|

|

市場調査レポート

商品コード

1671378

電力品質機器の世界市場:相別、機器別、エンドユーザー別、地域別 - 2030年までの予測Power Quality Equipment Market by Equipment (UPS, Harmonic Filters, Surge Protection Devices, Voltage Regulators, Power Conditioner Units, Synchronous Condenser, Power Quality Meters), Phase (Single, Three), End User, Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 電力品質機器の世界市場:相別、機器別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年02月28日

発行: MarketsandMarkets

ページ情報: 英文 311 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の電力品質機器の市場規模は、予測期間中に劇的に拡大し、2025年の3,819万米ドルから2030年には5,247万米ドルに達し、CAGR6.6%で成長するとみられます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)および数量(台) |

| セグメント別 | 相別、機器別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、南米 |

世界の電力品質機器市場の成長は、工業化、都市化、インフラ整備の加速に伴う、信頼性が高く効率的な配電システムへの需要によって促進されています。電力品質機器は、エネルギー損失を削減し、停電を回避し、複数の用途で安定した電圧と周波数を提供する役割を果たします。世界の政府や産業界は、電気インフラをアップグレードし、代替エネルギー源に新たな投資を行っており、その結果、洗練された電力品質ソリューションへの需要がさらに高まっています。スマートグリッド技術、IoTベースの監視プラットフォーム、エネルギー効率の高いソリューションの統合も、電力網全体の信頼性と性能を向上させています。エネルギー効率と持続可能性が重視されるようになるにつれ、電力品質機器の採用は世界中の産業、商業、住宅用で拡大し、将来の電力インフラの重要な一部となる可能性が高いとみられています。

無停電電源装置(UPS)市場は、デジタルインフラ、産業オートメーション、安定した無停電電力を必要とするミッションクリティカルな用途への依存度の高まりにより、2025年から2030年にかけて電力品質機器業界で最も急成長すると予測されています。クラウド・コンピューティング、データ・センター、インダストリー4.0技術の成長により、電力途絶やデータ損失を回避するためのUPSシステムの需要がかなり高まっています。さらに、再生可能エネルギーのグリッドへの統合の増加は、さらなる変動を引き起こしているため、エネルギー貯蔵を備えた洗練されたUPSソリューションへの需要をさらに促進しています。政府や企業が電力信頼性、災害復旧、事業継続性を重視する中、産業、商業、住宅用におけるUPSシステムの使用は増加し、今後、電力品質機器市場の主要な成長要因として浮上すると予測されています。

商業ビル、データセンター、ヘルスケア機関、小売店向けの無停電電源装置や常時給電に対する需要の高まりに後押しされ、2025年から2030年にかけて電力品質機器の市場で最も急成長するのは商業産業です。スマート・ビル、オートメーション・システム、デジタル・インフラの設置が増加し、電圧変動、電力サージ、ハードウェアの故障を抑止するための高品位電力への要求が高まっています。これに加えて、電力効率の高いソリューションの使用の増加や、電力の信頼性に関する厳しい規制が、業務用における電力品質機器の需要をさらに押し上げています。特に新興国におけるITセンター、コワーキング・プレイス、銀行の急成長も市場を後押ししています。さらに、太陽光発電や蓄電池システムのようなクリーンエネルギー・ソリューションへの移行が、スムーズな電力供給と運用効率を実現するために、商業ビルへの高度な電力品質ソリューションの採用を促進しています。

当レポートでは、世界の電力品質機器市場について調査し、相別、機器別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- サプライチェーン分析

- 技術分析

- 価格分析

- 2024年~2025年の主な会議とイベント

- 関税と規制状況

- 貿易分析

- 特許分析

- 投資と資金調達のシナリオ

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 購入基準

- ケーススタディ分析

- 電力品質機器市場における生成AI/AIの影響

- 電力品質機器市場のマクロ経済見通し

第6章 電力品質機器市場(相別)

- イントロダクション

- 単相

- 三相

第7章 電力品質機器市場(機器別)

- イントロダクション

- サージアレスター

- サージ保護装置

- 静止型無効電力補償装置

- 同期コンデンサー

- 電圧レギュレータ

- 電力品質メーター

- デジタルスタティックトランスファースイッチ

- 無停電電源装置

- 絶縁トランス

- ハーモニックフィルター

- パワーコンディショニングユニット

- 配電ユニット

第8章 電力品質機器市場(エンドユーザー別)

- イントロダクション

- 工業および製造

- 商業

- ユーティリティ

- 交通機関

- 住宅

第9章 電力品質機器市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- ベネズエラ

- その他

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 市場シェア分析、2024年

- 収益分析、2019年~2023年

- 企業価値評価と財務指標、2025年

- 製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- EATON

- SIEMENS

- ABB

- SCHNEIDER ELECTRIC

- GENERAL ELECTRIC

- TOSHIBA CORPORATION

- EMERSON

- LEGRAND

- HITACHI, LTD.

- FUJI ELECTRIC CO., LTD.

- MITSUBISHI ELECTRIC

- VERTIV GROUP CORPORATION

- DELTA ELECTRONICS

- PILLER POWER SYSTEMS

- AMETEK POWERVAR

- ACUMENTRICS

- LEVITON MANUFACTURING

- MTE

- SOCOMEC

- PANDUIT CORP

- その他の企業

- INFINITE ELECTRONICS

- CYBER POWER SYSTEMS

- CIRCUTOR

- LA MARCHE

- SATEC LTD.

第12章 付録

List of Tables

- TABLE 1 POWER QUALITY EQUIPMENT MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- TABLE 2 POWER QUALITY EQUIPMENT MARKET: RISK ANALYSIS

- TABLE 3 POWER QUALITY EQUIPMENT MARKET SNAPSHOT

- TABLE 4 POWER QUALITY EQUIPMENT MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 INDICATIVE PRICING OF POWER QUALITY EQUIPMENT, BY EQUIPMENT, 2024 (USD/UNIT)

- TABLE 6 AVERAGE SELLING PRICE TREND OF POWER QUALITY EQUIPMENT, BY REGION, 2021-2024 (USD/UNIT)

- TABLE 7 INDICATIVE PRICING TREND OF POWER QUALITY EQUIPMENT, BY REGION, 2024 (USD/UNIT)

- TABLE 8 LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 9 MFN TARIFF FOR HS 853540 CODE-COMPLIANT PRODUCTS, BY COUNTRY, 2023

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA AND SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 STANDARDS

- TABLE 16 IMPORT DATA FOR HS CODE 853540-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 17 EXPORT DATA FOR HS CODE 853540-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 18 LIST OF MAJOR PATENTS, 2021-2024

- TABLE 19 PORTER'S FIVE FORCES ANALYSIS: POWER QUALITY EQUIPMENT MARKET

- TABLE 20 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 22 POWER QUALITY EQUIPMENT MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 23 POWER QUALITY EQUIPMENT MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 24 SINGLE PHASE POWER QUALITY EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 25 SINGLE PHASE POWER QUALITY EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 THREE PHASE POWER QUALITY EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 27 THREE PHASE POWER QUALITY EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 29 POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 30 POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT, 2021-2024 (UNITS)

- TABLE 31 POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT, 2025-2030 (UNITS)

- TABLE 32 SURGE ARRESTER: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 SURGE ARRESTER: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 SURGE PROTECTION DEVICE: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 SURGE PROTECTION DEVICE: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 STATIC VAR COMPENSATOR: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 STATIC VAR COMPENSATOR: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 SYNCHRONOUS CONDENSER: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 SYNCHRONOUS CONDENSER: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 VOLTAGE REGULATOR: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 VOLTAGE REGULATOR: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 POWER QUALITY METER: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 POWER QUALITY METER: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 DIGITAL STATIC TRANSFER SWITCH: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 DIGITAL STATIC TRANSFER SWITCH: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 UNINTERRUPTABLE POWER SUPPLY: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 UNINTERRUPTABLE POWER SUPPLY: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 ISOLATION TRANSFORMER: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 ISOLATION TRANSFORMER: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 HARMONIC FILTER: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 HARMONIC FILTER: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 POWER CONDITIONING UNIT: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 POWER CONDITIONING UNIT: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 POWER DISTRIBUTION UNIT: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 POWER DISTRIBUTION UNIT: POWER QUALITY EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 57 POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 58 POWER QUALITY EQUIPMENT MARKET IN INDUSTRIAL & MANUFACTURING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 POWER QUALITY EQUIPMENT MARKET IN INDUSTRIAL & MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 POWER QUALITY EQUIPMENT MARKET IN COMMERCIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 POWER QUALITY EQUIPMENT MARKET IN COMMERCIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 POWER QUALITY EQUIPMENT MARKET IN UTILITIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 POWER QUALITY EQUIPMENT MARKET IN UTILITIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 POWER QUALITY EQUIPMENT MARKET IN TRANSPORTATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 POWER QUALITY EQUIPMENT MARKET IN TRANSPORTATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 POWER QUALITY EQUIPMENT MARKET IN RESIDENTIAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 POWER QUALITY EQUIPMENT MARKET IN RESIDENTIAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 POWER QUALITY EQUIPMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 POWER QUALITY EQUIPMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 71 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 72 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 73 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 74 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 75 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 76 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 77 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 78 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET IN INDUSTRIAL & MANUFACTURING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 79 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET IN INDUSTRIAL & MANUFACTURING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET IN COMMERCIAL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET IN COMMERCIAL, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 82 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET IN UTILITIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 83 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET IN UTILITIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 84 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET IN TRANSPORTATION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 85 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET IN TRANSPORTATION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 86 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET IN RESIDENTIAL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 87 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET IN RESIDENTIAL, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 88 CHINA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 89 CHINA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 90 INDIA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 91 INDIA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 92 JAPAN: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 93 JAPAN: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 95 REST OF ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 103 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 104 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN INDUSTRIAL & MANUFACTURING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 105 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN INDUSTRIAL & MANUFACTURING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN COMMERCIAL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 107 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN COMMERCIAL, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN UTILITIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 109 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN UTILITIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN TRANSPORTATION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 111 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN TRANSPORTATION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN RESIDENTIAL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 113 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN RESIDENTIAL, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 114 US: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 115 US: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 116 CANADA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 117 CANADA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 118 MEXICO: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 119 MEXICO: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 120 EUROPE: POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 121 EUROPE: POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 122 EUROPE: POWER QUALITY EQUIPMENT MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 123 EUROPE: POWER QUALITY EQUIPMENT MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 124 EUROPE: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 125 EUROPE: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 126 EUROPE: POWER QUALITY EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 127 EUROPE: POWER QUALITY EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 128 EUROPE: POWER QUALITY EQUIPMENT MARKET IN INDUSTRIAL & MANUFACTURING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 129 EUROPE: POWER QUALITY EQUIPMENT MARKET IN INDUSTRIAL & MANUFACTURING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: POWER QUALITY EQUIPMENT MARKET IN COMMERCIAL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 131 EUROPE: POWER QUALITY EQUIPMENT MARKET IN COMMERCIAL, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 132 EUROPE: POWER QUALITY EQUIPMENT MARKET IN UTILITIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 EUROPE: POWER QUALITY EQUIPMENT MARKET IN UTILITIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: POWER QUALITY EQUIPMENT MARKET IN TRANSPORTATION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 135 EUROPE: POWER QUALITY EQUIPMENT MARKET IN TRANSPORTATION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: POWER QUALITY EQUIPMENT MARKET IN RESIDENTIAL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 137 EUROPE: POWER QUALITY EQUIPMENT MARKET IN RESIDENTIAL, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 138 UK: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 139 UK: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 140 GERMANY: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 141 GERMANY: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 142 FRANCE: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 143 FRANCE: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 144 ITALY: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 145 ITALY: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 146 REST OF EUROPE: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 147 REST OF EUROPE: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 156 GCC COUNTRIES: POWER QUALITY EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 157 GCC COUNTRIES: POWER QUALITY EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET IN INDUSTRIAL & MANUFACTURING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET IN INDUSTRIAL & MANUFACTURING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET IN COMMERCIAL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET IN COMMERCIAL, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET IN UTILITIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET IN UTILITIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET IN TRANSPORTATION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET IN TRANSPORTATION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET IN RESIDENTIAL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET IN RESIDENTIAL, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 168 SAUDI ARABIA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 169 SAUDI ARABIA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 170 UAE: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 171 UAE: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 172 QATAR: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 173 QATAR: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 174 REST OF GCC: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 175 REST OF GCC: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 176 SOUTH AFRICA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 177 SOUTH AFRICA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 178 REST OF MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 179 REST OF MIDDLE EAST & AFRICA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 180 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT, 2021-2024 (USD MILLION)

- TABLE 181 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT, 2025-2030 (USD MILLION)

- TABLE 182 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY PHASE, 2021-2024 (USD MILLION)

- TABLE 183 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY PHASE, 2025-2030 (USD MILLION)

- TABLE 184 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 185 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 186 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 187 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 188 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN INDUSTRIAL & MANUFACTURING, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 189 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN INDUSTRIAL & MANUFACTURING, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 190 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN COMMERCIAL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 191 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN COMMERCIAL, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 192 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN UTILITIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 193 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN UTILITIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 194 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN TRANSPORTATION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 195 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN TRANSPORTATION, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 196 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN RESIDENTIAL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 197 SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET IN RESIDENTIAL, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 198 BRAZIL: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 199 BRAZIL: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 200 ARGENTINA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 201 ARGENTINA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 202 VENEZUELA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 203 VENEZUELA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 204 REST OF SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 205 REST OF SOUTH AMERICA: POWER QUALITY EQUIPMENT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 206 POWER QUALITY EQUIPMENT MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 207 POWER QUALITY EQUIPMENT MARKET: DEGREE OF COMPETITION, 2024

- TABLE 208 POWER QUALITY EQUIPMENT MARKET: REGION FOOTPRINT

- TABLE 209 POWER QUALITY EQUIPMENT MARKET: PHASE FOOTPRINT

- TABLE 210 POWER QUALITY EQUIPMENT MARKET: EQUIPMENT FOOTPRINT

- TABLE 211 POWER QUALITY EQUIPMENT MARKET: END USER FOOTPRINT

- TABLE 212 POWER QUALITY EQUIPMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 213 POWER QUALITY EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 214 POWER QUALITY EQUIPMENT MARKET: PRODUCT LAUNCHES, JANUARY 2020-DECEMBER 2024

- TABLE 215 POWER QUALITY EQUIPMENT MARKET: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 216 POWER QUALITY EQUIPMENT MARKET: EXPANSIONS, JANUARY 2020-DECEMBER 2024

- TABLE 217 EATON: COMPANY OVERVIEW

- TABLE 218 EATON: PRODUCTS OFFERED

- TABLE 219 EATON: PRODUCT LAUNCHES

- TABLE 220 EATON: DEALS

- TABLE 221 EATON: EXPANSIONS

- TABLE 222 SIEMENS: COMPANY OVERVIEW

- TABLE 223 SIEMENS: PRODUCTS OFFERED

- TABLE 224 SIEMENS: PRODUCT LAUNCHES

- TABLE 225 SIEMENS: DEALS

- TABLE 226 ABB: COMPANY OVERVIEW

- TABLE 227 ABB: PRODUCTS OFFERED

- TABLE 228 ABB: PRODUCT LAUNCHES

- TABLE 229 ABB: DEALS

- TABLE 230 ABB: OTHER DEVELOPMENTS

- TABLE 231 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 232 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

- TABLE 233 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 234 SCHNEIDER ELECTRIC: DEALS

- TABLE 235 GENERAL ELECTRIC: COMPANY OVERVIEW

- TABLE 236 GENERAL ELECTRIC: PRODUCTS OFFERED

- TABLE 237 TOSHIBA: COMPANY OVERVIEW

- TABLE 238 TOSHIBA: PRODUCTS OFFERED

- TABLE 239 EMERSON: COMPANY OVERVIEW

- TABLE 240 EMERSON: PRODUCTS OFFERED

- TABLE 241 LEGRAND: COMPANY OVERVIEW

- TABLE 242 LEGRAND: PRODUCTS OFFERED

- TABLE 243 HITACHI, LTD.: COMPANY OVERVIEW

- TABLE 244 HITACHI, LTD.: PRODUCTS OFFERED

- TABLE 245 HITACHI, LTD.: EXPANSIONS

- TABLE 246 FUJI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 247 FUJI ELECTRIC CO., LTD.: PRODUCTS OFFERED

- TABLE 248 MITSUBISHI ELECTRIC: COMPANY OVERVIEW

- TABLE 249 MITSUBISHI ELECTRIC: PRODUCTS OFFERED

- TABLE 250 MITSUBISHI ELECTRIC: PRODUCT LAUNCHES

- TABLE 251 MITSUBISHI ELECTRIC: DEALS

- TABLE 252 VERTIV GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 253 VERTIV GROUP CORPORATION: PRODUCTS OFFERED

- TABLE 254 VERTIV GROUP CORPORATION: PRODUCT LAUNCHES

- TABLE 255 VERTIV GROUP CORPORATION: DEALS

- TABLE 256 DELTA ELECTRONICS: COMPANY OVERVIEW

- TABLE 257 DELTA ELECTRONICS: PRODUCTS OFFERED

- TABLE 258 PILLER POWER SYSTEMS: COMPANY OVERVIEW

- TABLE 259 PILLER POWER SYSTEMS: PRODUCTS OFFERED

- TABLE 260 PILLER POWER SYSTEMS: PRODUCT LAUNCHES

- TABLE 261 PILLER POWER SYSTEMS: OTHER DEVELOPMENTS

- TABLE 262 AMETEK POWERVAR: COMPANY OVERVIEW

- TABLE 263 AMETEK POWERVAR: PRODUCTS OFFERED

- TABLE 264 AMETEK POWERVAR: DEALS

- TABLE 265 ACUMENTRICS: COMPANY OVERVIEW

- TABLE 266 ACUMENTRICS: PRODUCTS OFFERED

- TABLE 267 ACUMENTRICS: PRODUCT LAUNCHES

- TABLE 268 ACUMENTRICS: DEALS

- TABLE 269 ACUMENTRICS: EXPANSIONS

- TABLE 270 LEVITON MANUFACTURING: COMPANY OVERVIEW

- TABLE 271 LEVITON MANUFACTURING: PRODUCTS OFFERED

- TABLE 272 LEVITON MANUFACTURING: PRODUCT LAUNCHES

- TABLE 273 LEVITON MANUFACTURING: DEALS

- TABLE 274 MTE: COMPANY OVERVIEW

- TABLE 275 MTE: PRODUCTS OFFERED

- TABLE 276 MTE: PRODUCT LAUNCHES

- TABLE 277 SOCOMEC: COMPANY OVERVIEW

- TABLE 278 SOCOMEC: PRODUCTS OFFERED

- TABLE 279 SOCOMEC: PRODUCT LAUNCHES

- TABLE 280 PANDUIT CORP: COMPANY OVERVIEW

- TABLE 281 PANDUIT CORP: PRODUCTS OFFERED

List of Figures

- FIGURE 1 POWER QUALITY EQUIPMENT MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARIES

- FIGURE 3 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR POWER QUALITY EQUIPMENT

- FIGURE 4 POWER QUALITY EQUIPMENT MARKET: BOTTOM-UP APPROACH

- FIGURE 5 REGIONAL ANALYSIS

- FIGURE 6 POWER QUALITY EQUIPMENT MARKET: TOP-DOWN APPROACH

- FIGURE 7 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF POWER QUALITY EQUIPMENT

- FIGURE 8 POWER QUALITY EQUIPMENT MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 9 POWER QUALITY EQUIPMENT MARKET: DATA TRIANGULATION

- FIGURE 10 UNINTERRUPTABLE POWER SUPPLY SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 INDUSTRIAL & MANUFACTURING SEGMENT TO DOMINATE POWER QUALITY EQUIPMENT MARKET FROM 2025 TO 2030

- FIGURE 12 THREE PHASE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC HELD LARGEST SHARE OF GLOBAL POWER QUALITY EQUIPMENT MARKET IN 2024

- FIGURE 14 RAPID INDUSTRIALIZATION, URBANIZATION, AND INCREASING INVESTMENTS IN ENERGY INFRASTRUCTURE TO DRIVE MARKET

- FIGURE 15 CHINA ACCOUNTED FOR LARGEST SHARE OF POWER QUALITY EQUIPMENT MARKET IN ASIA PACIFIC

- FIGURE 16 THREE PHASE SEGMENT TO CAPTURE LARGER MARKET SHARE IN 2030

- FIGURE 17 UNINTERRUPTABLE POWER SUPPLY SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 18 INDUSTRIAL & MANUFACTURING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 19 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN POWER QUALITY EQUIPMENT MARKET BETWEEN 2025 AND 2030

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 TOTAL ELECTRICITY GENERATION, BY REGION, 2010-2050

- FIGURE 22 TOTAL RENEWABLE ENERGY SUPPLY, 2020-2040

- FIGURE 23 GLOBAL RENEWABLE GENERATION, BY REGION

- FIGURE 24 GLOBAL ELECTRIC CAR SALES, 2018-2024

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 POWER QUALITY EQUIPMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 POWER QUALITY EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICE TREND OF POWER QUALITY EQUIPMENT, BY REGION, 2021-2024 (USD/UNIT)

- FIGURE 29 IMPORT DATA FOR HS CODE 853540-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 30 EXPORT DATA FOR HS CODE 853540-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 31 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 32 INVESTMENT AND FUNDING SCENARIO, 2024

- FIGURE 33 POWER QUALITY EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 36 IMPACT OF GEN AI/AI IN POWER QUALITY EQUIPMENT MARKET, BY REGION

- FIGURE 37 THREE PHASE SEGMENT ACCOUNTED FOR LARGER SHARE OF POWER QUALITY EQUIPMENT MARKET IN 2024

- FIGURE 38 POWER QUALITY EQUIPMENT MARKET SHARE, BY EQUIPMENT, 2024

- FIGURE 39 POWER QUALITY EQUIPMENT MARKET SHARE, BY END USER, 2024

- FIGURE 40 POWER QUALITY EQUIPMENT MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 41 POWER QUALITY EQUIPMENT MARKET SHARE, BY REGION, 2024

- FIGURE 42 ASIA PACIFIC: POWER QUALITY EQUIPMENT MARKET SNAPSHOT

- FIGURE 43 NORTH AMERICA: POWER QUALITY EQUIPMENT MARKET SNAPSHOT

- FIGURE 44 MARKET SHARE ANALYSIS OF COMPANIES OFFERING POWER QUALITY EQUIPMENT, 2024

- FIGURE 45 POWER QUALITY EQUIPMENT MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2019-2023

- FIGURE 46 COMPANY VALUATION, 2025

- FIGURE 47 FINANCIAL METRICS, 2025

- FIGURE 48 PRODUCT COMPARISON

- FIGURE 49 POWER QUALITY EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 POWER QUALITY EQUIPMENT MARKET: COMPANY FOOTPRINT

- FIGURE 51 POWER QUALITY EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 EATON: COMPANY SNAPSHOT

- FIGURE 53 SIEMENS: COMPANY SNAPSHOT

- FIGURE 54 ABB: COMPANY SNAPSHOT

- FIGURE 55 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 56 GENERAL ELECTRIC: COMPANY SNAPSHOT

- FIGURE 57 TOSHIBA: COMPANY SNAPSHOT

- FIGURE 58 EMERSON: COMPANY SNAPSHOT

- FIGURE 59 LEGRAND: COMPANY SNAPSHOT

- FIGURE 60 HITACHI, LTD.: COMPANY SNAPSHOT

- FIGURE 61 FUJI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

- FIGURE 63 VERTIV GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 DELTA ELECTRONICS: COMPANY SNAPSHOT

The global power quality equipment market is likely to expand dramatically during the forecast period and to grow from an estimated value of USD 38.19 million in 2025 to USD 52.47 million by 2030, with a compound annual growth rate of 6.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Unit) |

| Segments | Power quality equipment Market by equipment, phase, end user, and region. |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa and South America |

The growth of the worldwide power quality equipment market is fuelled by the demand for reliable and efficient power distribution systems with accelerated industrialization, urbanization, and infrastructure development. Power quality equipment serves to reduce energy losses, avert power interruption, and provide stable voltage and frequency in multiple applications. Global governments and industries are upgrading electrical infrastructure and making new investments in alternative energy sources, which is in turn driving demand for sophisticated power quality solutions even further. Integration of smart grid technologies, IoT-based monitoring platforms, and energy-efficient solutions is also improving overall power network reliability and performance. As energy efficiency and sustainability become the focus, power quality equipment adoption is likely to grow in industrial, commercial, and residential applications around the world and become an important part of the future power infrastructure.

"Uninterruptable power supply, by equipment, is expected to be the fastest-growing segment from 2025 to 2030."

The Uninterruptible Power Supply (UPS) market is projected to be the most rapidly growing in the power quality equipment industry between 2025 and 2030 due to the growing dependence on digital infrastructure, industrial automation, and mission-critical applications needing stable and uninterrupted power. The growth in cloud computing, data centers, and Industry 4.0 technologies has considerably heightened the demand for UPS systems to avoid power disruptions and data loss. Moreover, the growth of the integration of renewable energy into the grid has caused additional fluctuations, thus further propelling demand for sophisticated UPS solutions with energy storage. With governments and companies emphasizing power reliability, disaster recovery, and business continuity, the use of UPS systems in industrial, commercial, and residential applications is likely to increase, and henceforth, it would emerge as the prime growth driver for the market of power quality equipment.

"Commercial segment, by end user, is expected to be the fastest-growing market from 2025 to 2030"

The commercial industry will be the most rapidly increasing market for power quality equipment from 2025 to 2030, buoyed by escalating demand for uninterruptible power supply and constant power supply for commercial buildings, data centers, healthcare institutions, and retail. Growing installations of smart buildings, automation systems, and digital infrastructures have accentuated the requirements of high-grade power to deter voltage fluctuations, power surges, and hardware breakdowns. Besides this, the increased use of power-efficient solutions and strict regulations for power reliability are further driving demand for power quality equipment in commercial use. The fast growth of IT centers, co-working places, and banks, especially in emerging economies, is also helping to drive the market. Additionally, the transition to clean energy solutions like solar and battery storage systems is fueling the adoption of power quality solutions advanced in nature into commercial buildings in order to deliver smooth power supply and operational efficacy.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the power quality equipment market.

By Company Type: Tier 1- 30%, Tier 2- 55%, and Tier 3- 15%

By Designation: C-Level- 30%, Directors- 20%, and Others- 50%

By Region: Asia Pacific- 55%, North America- 20%, Europe- 10%, Middle East & Africa - 10%, and South America-5%

Note: "Others" include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: <USD 500 million

The power quality equipment market is dominated by a few major players that have an extensive regional presence. The leading players in the power quality equipment market are Eaton (Ireland), ABB (Switzerland), Siemens (Germany), Schneider Electric (France), and General Electric (US).

Research Coverage:

The report defines, describes, and forecasts the power quality equipment market by equipment, phase, end-user and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product launches, mergers and acquisitions, and recent developments associated with the power quality equipment market. Competitive analysis of upcoming startups in the power quality equipment market ecosystem is covered in this report.

Reasons to buy this report:

Reasons to buy this report The report will help the market leaders/new entrants power quality equipment market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing Demand for Uninterrupted Power Supply, Rising Penetration of Renewable Energy Sources, Increasing Industrial Automation & Electrification), restraints (High Initial Investment & Maintenance Costs, Competition from Alternative Technologies), opportunities (Surge in Battery Energy Storage Systems (BESS), Growing Demand for Modular & Scalable Solutions, Adoption of Hybrid & Renewable Energy Microgrids), and challenges (Interoperability Issues in Smart Grid Systems, Growing Preference for Cloud-Based Energy Management) influencing the growth.

- Product Development/ Innovation: The market for power quality equipment is experiencing constant innovation and product development, as the demand for efficient and effective power solutions is increasing. Firms are significantly investing in new technologies for creating better performance, efficiency, and longevity in power quality equipment. Developments like digital monitoring systems, AI-driven predictive maintenance, and modular UPS systems are enhancing power quality management, lowering downtime, and decreasing energy wastage. Also, smart inverters, harmonic filters, and sophisticated voltage regulators are being designed to aid smart grids and renewable energy integration. Market leaders like ABB, Schneider Electric, Siemens, and Eaton are concentrating on creating intelligent power quality solutions addressing industrial automation, data centers, and commercial infrastructure to ensure improved efficiency and sustainability.

- Market Development: The power quality equipment market is witnessing strong growth, driven by the rising need for reliable and efficient power supply in industries, commercial complexes, and households. The growth of industrial infrastructure, urbanization, and increasing electricity demand in developing economies is also driving the market forward. Government policies favoring energy efficiency, grid modernization, and renewable energy adoption are also providing new opportunities for power quality equipment manufacturers. The market is also gaining from the adoption of IoT-based monitoring solutions, enabling real-time diagnostics and predictive maintenance, lowering operational costs and enhancing efficiency. Firms are diversifying their product lines to meet the increasing demand for uninterruptible power supply in mission-critical applications like data centers, healthcare, and financial institutions.

- Market Diversification: The power quality equipment market is experiencing diversification in various industries such as power utilities, industrial automation, renewable energy, transportation, healthcare, and commercial buildings. The growing use of electric vehicles (EVs), solar and wind power systems, and smart grid technology is fueling demand for sophisticated power quality solutions. Firms are also increasing their foothold in the emerging economies of Asia-Pacific, the Middle East, and Latin America, where industrialization and infrastructure development at a rapid pace are creating high demand for smart power distribution solutions. The movement towards digitized energy management and cloud monitoring of power is also prompting enterprises to invest in future-proof power quality equipment.

- Competitive Assessment: The market for power quality equipment is extremely competitive, and major players are concentrating on market growth, product development, strategic collaborations, and acquisitions to enhance their position in the market. Major players like ABB (Switzerland), Schneider Electric (France), Eaton (Ireland), Siemens (Germany), and Legrand (France) are investing in smart grid technology, AI-based power monitoring solutions, and energy storage systems to improve power quality and efficiency.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.2.1 Power quality equipment market: Inclusions and exclusions, by Equipment

- 1.3.2.2 Power quality equipment market: Inclusions and exclusions, by phase

- 1.3.2.3 Power quality equipment market: Inclusions and exclusions, by end user

- 1.3.2.4 Power quality equipment market: Inclusions and exclusions, by region

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Regional analysis

- 2.2.1.2 Country-level analysis

- 2.2.1.3 Demand-side assumptions

- 2.2.1.4 Demand-side calculations

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Supply-side assumptions

- 2.2.2.2 Supply-side calculations

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POWER QUALITY EQUIPMENT MARKET

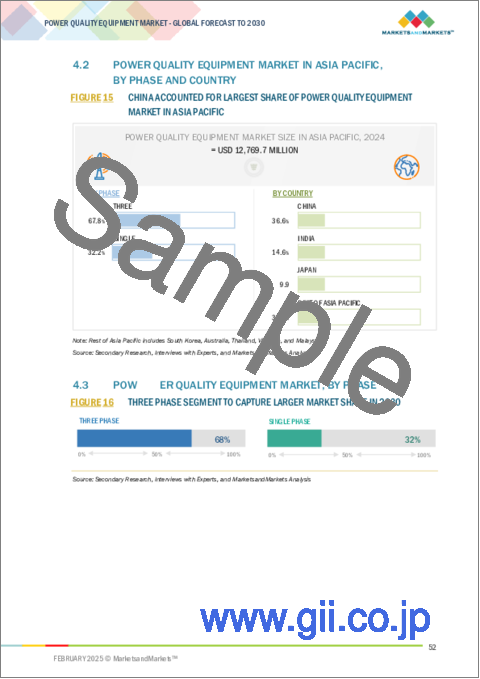

- 4.2 POWER QUALITY EQUIPMENT MARKET IN ASIA PACIFIC, BY PHASE AND COUNTRY

- 4.3 POWER QUALITY EQUIPMENT MARKET, BY PHASE

- 4.4 POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT

- 4.5 POWER QUALITY EQUIPMENT MARKET, BY END USER

- 4.6 POWER QUALITY EQUIPMENT MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for uninterrupted power supply

- 5.2.1.2 Increasing adoption of renewable energy sources

- 5.2.1.3 Increasing industrial automation & electrification

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment & maintenance costs

- 5.2.2.2 Competition from alternative technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Surge in battery energy storage systems

- 5.2.3.2 Growing demand for modular & scalable solutions

- 5.2.3.3 Adoption of hybrid & renewable energy microgrids

- 5.2.4 CHALLENGES

- 5.2.4.1 Interoperability issues in smart grid systems

- 5.2.4.2 Growing preference for cloud-based energy management

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 IoT-enabled monitoring systems

- 5.6.1.2 Modular UPS systems

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Energy storage systems (ESS)

- 5.6.2.2 Smart grid technology

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Power system simulation software

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 INDICATIVE PRICING OF POWER QUALITY EQUIPMENT, BY EQUIPMENT

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7.3 INDICATIVE PRICING OF POWER QUALITY EQUIPMENT, BY REGION

- 5.8 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.9 TARIFF AND REGULATORY LANDSCAPE

- 5.9.1 TARIFF ANALYSIS

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.3 STANDARDS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 853540)

- 5.10.2 EXPORT SCENARIO (HS CODE 853540)

- 5.11 PATENT ANALYSIS

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15 BUYING CRITERIA

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 ENSURING RELIABLE POWER IN HEALTHCARE: MODERNIZING EMERGENCY AND STANDBY POWER SYSTEMS

- 5.16.2 NEW HIGH-CAPACITY 2,000 KVA UPS FOR LARGE-SCALE DATA CENTERS SAVE BOTH ENERGY AND SPACE

- 5.16.3 BOURBON INTEGRATES POWER QUALITY SOLUTION FOR EVOLUTION SHIPS

- 5.16.4 SERVER TECHNOLOGY'S SWITCHED PDUS PROVIDE UPTIME AND REMOTE MANAGEMENT FOR 10,000 PICTUREMAXX CLIENTS

- 5.17 IMPACT OF GEN AI/AI IN POWER QUALITY EQUIPMENT MARKET

- 5.17.1 ADOPTION OF GEN AI/AI IN POWER QUALITY EQUIPMENT MARKET

- 5.17.2 IMPACT OF GEN AI/AI IN POWER QUALITY EQUIPMENT MARKET, BY REGION

- 5.18 MACROECONOMIC OUTLOOK FOR POWER QUALITY EQUIPMENT MARKET

6 POWER QUALITY EQUIPMENT MARKET, BY PHASE

- 6.1 INTRODUCTION

- 6.2 SINGLE PHASE

- 6.2.1 DEMAND IN RESIDENTIAL APPLICATIONS TO DRIVE MARKET

- 6.3 THREE PHASE

- 6.3.1 ADOPTION IN INDUSTRIAL AND LARGE-SCALE INFRASTRUCTURE APPLICATION TO FUEL MARKET GROWTH

7 POWER QUALITY EQUIPMENT MARKET, BY EQUIPMENT

- 7.1 INTRODUCTION

- 7.2 SURGE ARRESTER

- 7.2.1 NEED FOR RELIABILITY OF SMART GRID TO DRIVE DEMAND FOR SURGE ARRESTERS

- 7.3 SURGE PROTECTION DEVICE

- 7.3.1 GROWTH OF AUTOMATION, DIGITAL INFRASTRUCTURE, AND RENEWABLE ENERGY TO FUEL MARKET GROWTH

- 7.4 STATIC VAR COMPENSATOR

- 7.4.1 NEED FOR INCREASING EFFICIENCY OF ELECTRICAL GRIDS AND REDUCING TRANSMISSION LOSSES TO SUPPORT MARKET GROWTH

- 7.5 SYNCHRONOUS CONDENSER

- 7.5.1 SYNCHRONOUS CONDENSERS REDEFINING GRID MODERNIZATION IN HIGH-RENEWABLE REGIONS

- 7.6 VOLTAGE REGULATOR

- 7.6.1 ADOPTION OF SMART GRIDS DRIVING NEED FOR ADVANCED VOLTAGE CONTROL

- 7.7 POWER QUALITY METER

- 7.7.1 INCREASING ADOPTION IN SMART GRIDS TO SUPPORT MARKET GROWTH

- 7.8 DIGITAL STATIC TRANSFER SWITCH

- 7.8.1 GROWTH OF DIGITAL TECHNOLOGIES AND INCREASING COMPLEXITY OF ELECTRICAL GRIDS DRIVING ADOPTION

- 7.9 UNINTERRUPTABLE POWER SUPPLY

- 7.9.1 NEED FOR POWER STABILITY IN TELECOM, DATA CENTERS, HEALTHCARE, AND MANUFACTURING SECTORS TO DRIVE DEMAND

- 7.10 ISOLATION TRANSFORMER

- 7.10.1 NEED TO PROTECT SENSITIVE EQUIPMENT AND IMPROVE ELECTRICAL SAFETY TO FUEL DEMAND

- 7.11 HARMONIC FILTER

- 7.11.1 INCREASING PENETRATION OF WIND AND SOLAR POWER BOOSTING MARKET GROWTH

- 7.12 POWER CONDITIONING UNIT

- 7.12.1 DEMAND FOR HIGH-QUALITY POWER SUPPLY IN INDUSTRIES AND COMMERCIAL FACILITIES TO SUPPORT SEGMENTAL GROWTH

- 7.13 POWER DISTRIBUTION UNIT

- 7.13.1 GROWTH OF DATA CENTERS AND MANUFACTURING FACILITIES TO SUPPORT MARKET GROWTH

8 POWER QUALITY EQUIPMENT MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 INDUSTRIAL & MANUFACTURING

- 8.2.1 INDUSTRY 4.0 INTEGRATION AND SMART MANUFACTURING TO DRIVE DEMAND FOR POWER QUALITY EQUIPMENT

- 8.3 COMMERCIAL

- 8.3.1 NEED FOR POWER STABILITY IN SMART COMMERCIAL BUILDINGS DRIVING DEMAND FOR DIGITAL POWER QUALITY SOLUTIONS

- 8.4 UTILITIES

- 8.4.1 SURGE IN ELECTRIC VEHICLE CHARGING AND INCREASING ADOPTION OF RENEWABLE ENERGY TO DRIVE MARKET

- 8.5 TRANSPORTATION

- 8.5.1 ELECTRIFICATION OF TRANSPORTATION TO FUEL DEMAND FOR ADVANCED VOLTAGE REGULATION

- 8.6 RESIDENTIAL

- 8.6.1 ADOPTION OF SMART HOME TECHNOLOGIES TO SUPPORT MARKET GROWTH

9 POWER QUALITY EQUIPMENT MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Energy transition fueling demand for power quality solutions

- 9.2.2 INDIA

- 9.2.2.1 Growing industrialization and urbanization fueling demand for advanced power quality solutions

- 9.2.3 JAPAN

- 9.2.3.1 Advancement in industrial sector and growth of renewable energy integration to drive market

- 9.2.4 REST OF ASIA PACIFIC

- 9.2.1 CHINA

- 9.3 NORTH AMERICA

- 9.3.1 US

- 9.3.1.1 Expansion of data centers fueling demand for power quality equipment

- 9.3.2 CANADA

- 9.3.2.1 Renewable energy integration driving power quality investments in Canada

- 9.3.3 MEXICO

- 9.3.3.1 Industrial expansion fueling demand for power quality equipment

- 9.3.1 US

- 9.4 EUROPE

- 9.4.1 UK

- 9.4.1.1 Smart manufacturing and automation fueling demand for power stability

- 9.4.2 GERMANY

- 9.4.2.1 Increased reliance on renewable energy sources fueling demand for power quality equipment

- 9.4.3 FRANCE

- 9.4.3.1 Deployment of smart grid driving demand for power quality technologies

- 9.4.4 ITALY

- 9.4.4.1 Automotive industry leveraging power quality solutions for enhancing manufacturing efficiency

- 9.4.5 REST OF EUROPE

- 9.4.1 UK

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.5.1.1 Saudi Arabia

- 9.5.1.1.1 Rapid infrastructure development and renewable energy initiatives to fuel market

- 9.5.1.2 UAE

- 9.5.1.2.1 Strong push toward renewable energy integration to boost demand

- 9.5.1.3 Qatar

- 9.5.1.3.1 Emergence of smart grid systems fueling requirement for power quality equipment

- 9.5.1.4 Rest of GCC

- 9.5.1.1 Saudi Arabia

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 Increasing adoption in manufacturing sector to fuel demand during forecast period

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Industrial growth driving demand for voltage stabilization

- 9.6.2 ARGENTINA

- 9.6.2.1 Power sector reforms fueling demand for power quality equipment

- 9.6.3 VENEZUELA

- 9.6.3.1 Country witnessing demand for cost-effective power quality solutions for residential use

- 9.6.4 REST OF SOUTH AMERICA

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.4 REVENUE ANALYSIS, 2019-2023

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 10.6 PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Phase footprint

- 10.7.5.4 Equipment footprint

- 10.7.5.5 End user footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 EATON

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 SIEMENS

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 ABB

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Other developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 SCHNEIDER ELECTRIC

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 GENERAL ELECTRIC

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 TOSHIBA CORPORATION

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.7 EMERSON

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 LEGRAND

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 HITACHI, LTD.

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Expansions

- 11.1.10 FUJI ELECTRIC CO., LTD.

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.11 MITSUBISHI ELECTRIC

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches

- 11.1.11.3.2 Deals

- 11.1.12 VERTIV GROUP CORPORATION

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches

- 11.1.12.3.2 Deals

- 11.1.13 DELTA ELECTRONICS

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.14 PILLER POWER SYSTEMS

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches

- 11.1.14.3.2 Other developments

- 11.1.15 AMETEK POWERVAR

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Deals

- 11.1.16 ACUMENTRICS

- 11.1.16.1 Business overview

- 11.1.16.2 Products offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Product launches

- 11.1.16.3.2 Deals

- 11.1.16.3.3 Expansions

- 11.1.17 LEVITON MANUFACTURING

- 11.1.17.1 Business overview

- 11.1.17.2 Products offered

- 11.1.17.3 Recent developments

- 11.1.17.3.1 Product launches

- 11.1.17.3.2 Deals

- 11.1.18 MTE

- 11.1.18.1 Business overview

- 11.1.18.2 Products offered

- 11.1.18.3 Recent developments

- 11.1.18.3.1 Product launches

- 11.1.19 SOCOMEC

- 11.1.19.1 Business overview

- 11.1.19.2 Products offered

- 11.1.19.3 Recent developments

- 11.1.19.3.1 Product launches

- 11.1.20 PANDUIT CORP

- 11.1.20.1 Business overview

- 11.1.20.2 Products offered

- 11.1.1 EATON

- 11.2 OTHER PLAYERS

- 11.2.1 INFINITE ELECTRONICS

- 11.2.2 CYBER POWER SYSTEMS

- 11.2.3 CIRCUTOR

- 11.2.4 LA MARCHE

- 11.2.5 SATEC LTD.

12 APPENDIX

- 12.1 INSIGHTS OF INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS