|

|

市場調査レポート

商品コード

1659493

欧州のスマートホーム市場:プロトコル別、販売チャネル別、製品別、システムタイプ別、設置タイプ別、住宅タイプ別、国別 - 2029年までの予測European Smart Home Market by Lighting Controls, Smart Speakers, Entertainment Controls, HVAC Controls, Security & Access Controls, Smart Kitchen, Home Healthcare, Smart Furniture, Home Appliances, Wired, Behavioral, Proactive - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 欧州のスマートホーム市場:プロトコル別、販売チャネル別、製品別、システムタイプ別、設置タイプ別、住宅タイプ別、国別 - 2029年までの予測 |

|

出版日: 2025年02月01日

発行: MarketsandMarkets

ページ情報: 英文 303 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

欧州のスマートホームの市場規模は、2024年に221億1,000万米ドルとなりました。

同市場は、2029年には292億4,000万米ドルに達するとみられ、予測期間中のCAGRは5.7%と予測されています。一般消費者の安全、安心、利便性への関心が、欧州のスマートホーム市場の成長を促進しています。一方、現在のスマートホームデバイスのスイッチングコストが欧州のスマートホーム市場の成長を抑制しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | プロトコル別、販売チャネル別、製品別、システムタイプ別、設置タイプ別、住宅タイプ別、国別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

照明制御セグメントは予測期間中、2番目に高いCAGRで成長すると予測されています。スマート照明制御システムは、入力デバイスから情報を取得し、受信した情報を出力デバイスへの信号に変換する1つ以上の中央計算デバイスを介して送信することにより、住宅建物の照明を制御できる自動化デバイスです。

スマートホームの照明制御では、照明システムがエリア内の自然光だけでなく、居住状況のチェックも行うことができます。これらの要因を検知することで、自然光の量に応じて照度を調節したり、部屋に誰もいない場合はスイッチを切ったりすることができます。照明制御は省エネ照明の基本です。

行動システムタイプは、予測期間中に2番目に高いCAGRで成長すると予想されます。行動システムタイプは、AIと機械学習アルゴリズムを適用し、スマートハウス内の人の行動から研究します。センサー、カメラ、その他のスマートデバイスから取得したデータを使用して、家庭のルーチンや嗜好を起動・制御し、それらを実行します。行動システム型は、居住者の反応に基づいて様々な処理が行われる、消費者に合わせた快適なアプローチを提供することを目的としています。

ドイツの市場は、予測期間中に2番目に高いCAGRを示す見込みです。同国の成長は、政府がスマートソリューションを採用し、それによって建物の持続可能性を強化する取り組みを行ったことに起因しています。例えば、ドイツでは、経済・気候行動連邦省(BMWK)が支援する次世代メディアプログラムを通じてスマートホームが推進されています。スマートホーム技術は、生活の質とエネルギー効率を向上させ、ドイツのデジタル・アジェンダの一般目標に貢献する道筋のひとつと考えられています。次世代メディア・プログラムの支援を受けてスマートホーム・プロジェクトを実施することで、多くの産業にまたがるデジタル通信ネットワークとサービスを育成する、きわめて統合的なアプローチが実現します。

当レポートでは、欧州のスマートホーム市場について調査し、プロトコル別、販売チャネル別、製品別、システムタイプ別、設置タイプ別、住宅タイプ別、国別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2024年~2025年の主な会議とイベント

- ケーススタディ分析

- 関税と規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 欧州のスマートホーム市場におけるAI/生成AIの影響

第6章 欧州のスマートホーム市場、プロトコル別

- イントロダクション

- 有線

- 無線

第7章 欧州のスマートホーム市場、販売チャネル別

- イントロダクション

- 直接販売

- 間接販売

第8章 欧州のスマートホーム市場、製品別

- イントロダクション

- 照明制御

- セキュリティとアクセス制御

- HVACコントロール

- エンターテイメントとその他

- スマートスピーカー

- 家庭用ヘルスケア機器

- スマートキッチン家電

- 家庭用電化製品

- スマート家具

第9章 欧州のスマートホーム市場、システムタイプ別

- イントロダクション

- 行動システム

- プロアクティブシステム

第10章 欧州のスマートホーム市場、設置タイプ別

- イントロダクション

- 新設

- 改造設備

第11章 欧州のスマートホーム市場、住宅タイプ別

- イントロダクション

- 一戸建て住宅

- 集合住宅

第12章 欧州のスマートホーム市場、国別

- イントロダクション

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~20244年

- 市場シェア分析、2023年

- 収益分析、2019年~20234年

- 企業評価と財務指標、2024年

- ブランド比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競争シナリオ

第14章 企業プロファイル

- 主要参入企業

- JOHNSON CONTROLS

- SCHNEIDER ELECTRIC

- HONEYWELL INTERNATIONAL INC.

- ASSA ABLOY

- SIEMENS

- AMAZON.COM, INC.

- APPLE INC.

- RESIDEO TECHNOLOGIES INC.

- ROBERT BOSCH GMBH

- ABB

- その他の企業

- SAMSUNG

- SONY CORPORATION

- TRANE TECHNOLOGIES PLC

- GIRA

- AIRTHINGS

- LOXONE ELECTRONICS GMBH

- DELTA INTELLIGENT BUILDING TECHNOLOGIES(CANADA)INC.

- SNAP ONE, LLC.

- AXIS COMMUNICATIONS AB

- COMCAST

- ALARM.COM

- VIVINT, INC.

- SIMPLISAFE, INC.

- GENERAL ELECTRIC COMPANY

- NUKI HOME SOLUTIONS

- LG ELECTRONICS

- LUTRON ELECTRONICS CO., INC

- LEGRAND

第15章 付録

List of Tables

- TABLE 1 EUROPEAN SMART HOME MARKET: GROWTH FORECAST ASSUMPTIONS

- TABLE 2 EUROPEAN SMART HOME MARKET: RESEARCH ASSUMPTIONS

- TABLE 3 EUROPEAN SMART HOME MARKET: RISK ASSESSMENT

- TABLE 4 ENERGY-SAVING POTENTIAL OF LIGHTING CONTROL SYSTEMS

- TABLE 5 AVERAGE SELLING PRICING TREND OF SMART LOCKS OFFERED BY KEY PLAYERS, 2020-2023 (USD)

- TABLE 6 ROLE OF COMPANIES IN SMART HOME ECOSYSTEM

- TABLE 7 LIST OF MAJOR PATENTS, 2023-2024

- TABLE 8 IMPORT DATA FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 10 LIST OF CONFERENCES AND EVENTS, 2024-2025

- TABLE 11 MFN TARIFF FOR HS CODE 8517-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2023

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PORTER'S FIVE FORCES' IMPACT ON EUROPEAN SMART HOME MARKET

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SALES CHANNELS

- TABLE 15 KEY BUYING CRITERIA, BY SALES CHANNEL

- TABLE 16 EUROPEAN SMART HOME MARKET, BY PROTOCOL, 2020-2023 (USD MILLION)

- TABLE 17 EUROPEAN SMART HOME MARKET, BY PROTOCOL, 2024-2029 (USD MILLION)

- TABLE 18 EUROPEAN SMART HOME MARKET, BY SALES CHANNEL, 2020-2023 (USD MILLION)

- TABLE 19 EUROPEAN SMART HOME MARKET, BY SALES CHANNEL, 2024-2029 (USD MILLION)

- TABLE 20 EUROPEAN SMART HOME MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 21 EUROPEAN SMART HOME MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 22 EUROPEAN SMART HOME MARKET, BY PRODUCT, 2020-2023 (USD MILLION UNITS)

- TABLE 23 EUROPEAN SMART HOME MARKET, BY PRODUCT, 2024-2029 (USD MILLION UNITS)

- TABLE 24 LIGHTING CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 25 LIGHTING CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 26 LIGHTING CONTROLS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 27 LIGHTING CONTROLS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 28 RELAYS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 29 RELAYS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 30 OCCUPANCY SENSORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 31 OCCUPANCY SENSORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 32 DAYLIGHT SENSORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 33 DAYLIGHT SENSORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 34 TIMERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 35 TIMERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 36 DIMMERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 37 DIMMERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 38 SWITCHES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 39 SWITCHES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 40 ACCESSORIES & OTHER PRODUCTS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 41 ACCESSORIES & OTHER PRODUCTS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 42 SECURITY & ACCESS CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 43 SECURITY & ACCESS CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 44 SECURITY & ACCESS CONTROL: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 45 SECURITY & ACCESS CONTROL: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 46 VIDEO SURVEILLANCE: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 47 VIDEO SURVEILLANCE: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 48 ACCESS CONTROL: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 49 ACCESS CONTROL: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 50 HVAC CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 51 HVAC CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 52 HVAC CONTROLS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 53 HVAC CONTROLS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 54 SMART THERMOSTATS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 55 SMART THERMOSTATS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 56 SENSORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 57 SENSORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 58 CONTROL VALVES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 59 CONTROL VALVES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 60 HEATING & COOLING COILS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 61 HEATING & COOLING COILS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 62 DAMPERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 63 DAMPERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 64 ACTUATORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 65 ACTUATORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 66 PUMPS & FANS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 67 PUMPS & FANS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 68 SMART VENTS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 69 SMART VENTS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 70 ENTERTAINMENT & OTHER CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 71 ENTERTAINMENT & OTHER CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 72 ENTERTAINMENT & OTHER CONTROLS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 73 ENTERTAINMENT & OTHER CONTROLS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 74 ENTERTAINMENT CONTROLS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 75 ENTERTAINMENT CONTROLS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 76 ENTERTAINMENT CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 77 ENTERTAINMENT CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 78 ENTERTAINMENT CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2020-2023 (MILLION UNITS)

- TABLE 79 ENTERTAINMENT CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2024-2029 (MILLION UNITS)

- TABLE 80 AUDIO & VOLUME CONTROLS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 81 AUDIO & VOLUME CONTROLS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 82 HOME THEATER SYSTEM CONTROLS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 83 HOME THEATER SYSTEM CONTROLS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 84 TOUCHSCREENS & KEYPADS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 85 TOUCHSCREENS & KEYPADS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 86 OTHER CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 87 OTHER CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 88 OTHER CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2020-2023 (MILLION UNITS)

- TABLE 89 OTHER CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE, 2024-2029 (MILLION UNITS)

- TABLE 90 OTHER CONTROLS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 91 OTHER CONTROLS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 92 SMART METERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 93 SMART METERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 94 SMART PLUGS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 95 SMART PLUGS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 96 SMART HUBS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 97 SMART HUBS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 98 SMOKE DETECTORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 99 SMOKE DETECTORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 100 SMART SPEAKERS: EUROPEAN SMART HOME MARKET, 2020-2023 (USD MILLION)

- TABLE 101 SMART SPEAKERS: EUROPEAN SMART HOME MARKET, 2024-2029 (USD MILLION)

- TABLE 102 SMART SPEAKERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 103 SMART SPEAKERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 104 HOME HEALTHCARE APPLIANCES: EUROPEAN SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 105 HOME HEALTHCARE APPLIANCES: EUROPEAN SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 106 HOME HEALTHCARE APPLIANCES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 107 HOME HEALTHCARE APPLIANCES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 108 HEALTH STATUS MONITORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 109 HEALTH STATUS MONITORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 110 PHYSICAL ACTIVITY MONITORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 111 PHYSICAL ACTIVITY MONITORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 112 SMART KITCHEN APPLIANCES: EUROPEAN SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 113 SMART KITCHEN APPLIANCES: SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 114 SMART KITCHEN APPLIANCES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 115 SMART KITCHEN APPLIANCES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 116 SMART REFRIGERATORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 117 SMART REFRIGERATORS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 118 SMART COFFEE MAKERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 119 SMART COFFEE MAKERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 120 SMART KETTLES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 121 SMART KETTLES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 122 SMART DISHWASHERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 123 SMART DISHWASHERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 124 SMART OVENS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 125 SMART OVENS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 126 SMART COOKTOPS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 127 SMART COOKTOPS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 128 SMART COOKERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 129 SMART COOKERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 130 HOME APPLIANCES: EUROPEAN SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 131 HOME APPLIANCES: EUROPEAN SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 132 HOME APPLIANCES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 133 HOME APPLIANCES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 134 SMART WASHERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 135 SMART WASHERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 136 SMART DRYERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 137 SMART DRYERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 138 SMART WATER HEATERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 139 SMART WATER HEATERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 140 SMART VACUUM CLEANERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 141 SMART VACUUM CLEANERS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 142 SMART FURNITURE: EUROPEAN SMART HOME MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 143 SMART FURNITURE: EUROPEAN SMART HOME MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 144 SMART FURNITURE: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 145 SMART FURNITURE: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 146 SMART TABLES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 147 SMART TABLES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 148 SMART DESKS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 149 SMART DESKS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 150 SMART STOOLS & BENCHES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 151 SMART STOOLS & BENCHES: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 152 SMART SOFAS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 153 SMART SOFAS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 154 SMART CHAIRS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 155 SMART CHAIRS: EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 156 EUROPEAN SMART HOME MARKET, BY SYSTEM TYPE, 2020-2023 (USD MILLION)

- TABLE 157 EUROPEAN SMART HOME MARKET, BY SYSTEM TYPE, 2024-2029 (USD MILLION)

- TABLE 158 EUROPEAN SMART HOME MARKET, BY INSTALLATION TYPE, 2020-2023 (USD MILLION)

- TABLE 159 EUROPEAN SMART HOME MARKET, BY INSTALLATION TYPE, 2024-2029 (USD MILLION)

- TABLE 160 EUROPEAN SMART HOME MARKET, BY RESIDENCE TYPE, 2020-2023 (USD MILLION)

- TABLE 161 EUROPEAN SMART HOME MARKET, BY RESIDENCE TYPE, 2024-2029 (USD MILLION)

- TABLE 162 EUROPEAN SMART HOME MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 163 EUROPEAN SMART HOME MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 164 UK: EUROPEAN SMART HOME MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 165 UK: EUROPEAN SMART HOME MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 166 GERMANY: EUROPEAN SMART HOME MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 167 GERMANY: EUROPEAN SMART HOME MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 168 FRANCE: EUROPEAN SMART HOME MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 169 FRANCE: EUROPEAN SMART HOME MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 170 ITALY: EUROPEAN SMART HOME MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 171 ITALY: EUROPEAN SMART HOME MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 172 REST OF EUROPE: EUROPEAN SMART HOME MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 173 REST OF EUROPE: EUROPEAN SMART HOME MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 174 SMART CONTROLS/HUBS/PLATFORMS IN EUROPE

- TABLE 175 EUROPEAN SMART HOME MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 176 EUROPEAN SMART HOME MARKET: DEGREE OF COMPETITION, 2023

- TABLE 177 EUROPEAN SMART HOME MARKET: COUNTRY FOOTPRINT

- TABLE 178 EUROPEAN SMART HOME MARKET: PRODUCT FOOTPRINT

- TABLE 179 EUROPEAN SMART HOME MARKET: SYSTEM TYPE FOOTPRINT

- TABLE 180 EUROPEAN SMART HOME MARKET: SALES CHANNEL FOOTPRINT

- TABLE 181 EUROPEAN SMART HOME MARKET: INSTALLATION TYPE FOOTPRINT

- TABLE 182 EUROPEAN SMART HOME MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 183 EUROPEAN SMART HOME MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 184 EUROPEAN SMART HOME MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2020-JANUARY 2025

- TABLE 185 EUROPEAN SMART HOME MARKET: DEALS, JANUARY 2020-JANUARY 2025

- TABLE 186 EUROPEAN SMART HOME MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JANUARY 2025

- TABLE 187 JOHNSON CONTROLS: COMPANY OVERVIEW

- TABLE 188 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 JOHNSON CONTROLS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 190 JOHNSON CONTROLS: DEALS

- TABLE 191 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 192 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 194 SCHNEIDER ELECTRIC: DEALS

- TABLE 195 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 196 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 198 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 199 ASSA ABLOY: COMPANY OVERVIEW

- TABLE 200 ASSA ABLOY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 ASSA ABLOY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 202 ASSA ABLOY: DEALS

- TABLE 203 SIEMENS: COMPANY OVERVIEW

- TABLE 204 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 SIEMENS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 206 SIEMENS: DEALS

- TABLE 207 SIEMENS: OTHER DEVELOPMENTS

- TABLE 208 AMAZON.COM, INC.: COMPANY OVERVIEW

- TABLE 209 AMAZON.COM, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 AMAZON.COM, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 211 AMAZON.COM, INC.: DEALS

- TABLE 212 APPLE INC.: COMPANY OVERVIEW

- TABLE 213 APPLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 APPLE INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 215 APPLE INC.: DEALS

- TABLE 216 RESIDEO TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 217 RESIDEO TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 RESIDEO TECHNOLOGIES INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 219 RESIDEO TECHNOLOGIES INC.: DEALS

- TABLE 220 RESIDEO TECHNOLOGIES INC.: OTHER DEVELOPMENTS

- TABLE 221 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 222 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 ROBERT BOSCH GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 224 ROBERT BOSCH GMBH: DEALS

- TABLE 225 ABB: COMPANY OVERVIEW

- TABLE 226 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 ABB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 228 ABB: DEALS

List of Figures

- FIGURE 1 EUROPEAN SMART HOME MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 EUROPEAN SMART HOME MARKET: RESEARCH DESIGN

- FIGURE 3 EUROPEAN SMART HOME MARKET: RESEARCH APPROACH

- FIGURE 4 EUROPEAN SMART HOME MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 5 REVENUE GENERATED FROM SALES OF SMART HOME SOLUTIONS

- FIGURE 6 EUROPEAN SMART HOME MARKET: BOTTOM-UP APPROACH

- FIGURE 7 EUROPEAN SMART HOME MARKET: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 EUROPEAN SMART HOME MARKET, 2020-2029

- FIGURE 10 OCCUPANCY SENSORS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 11 MULTI-FAMILY RESIDENCE SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 12 SMART KITCHEN APPLIANCES SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 GROWING NEED FOR ENERGY-SAVING AND LOW CARBON EMISSION-ORIENTED SOLUTIONS TO DRIVE MARKET

- FIGURE 14 DAMPERS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 ACCESS CONTROL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

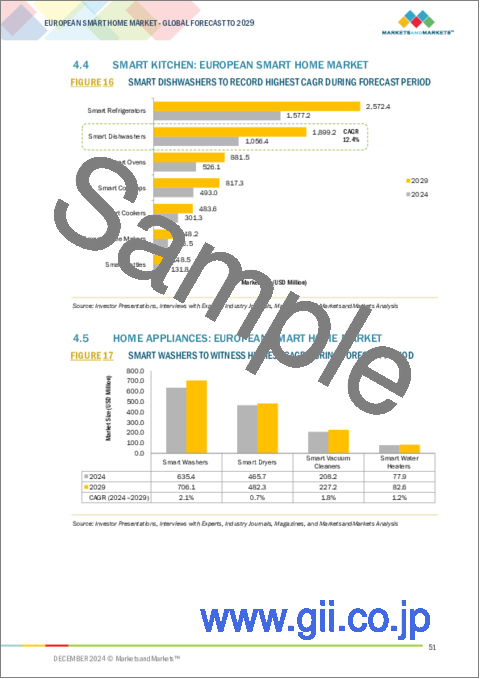

- FIGURE 16 SMART DISHWASHERS TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 SMART WASHERS TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 GERMANY TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 EUROPEAN SMART HOME MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 EUROPEAN SMART HOME MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 21 EUROPEAN SMART HOME MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 22 EUROPEAN SMART HOME MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 23 EUROPEAN SMART HOME MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 AVERAGE SELLING PRICE OF SMART LOCKS OFFERED BY KEY PLAYERS, 2023

- FIGURE 26 AVERAGE SELLING PRICE TREND OF SMART LOCKS, 2020-2023

- FIGURE 27 AVERAGE SELLING PRICE TREND OF LIGHTING CONTROL PRODUCTS FOR EUROPEAN COUNTRIES, 2020-2023

- FIGURE 28 EUROPEAN SMART HOME MARKET: VALUE CHAIN ANALYSIS

- FIGURE 29 ECOSYSTEM ANALYSIS

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2023

- FIGURE 31 PATENTS APPLIED AND GRANTED, 2015-2025

- FIGURE 32 IMPORT DATA FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 33 EXPORT DATA FOR HS CODE 8517-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 34 PORTER'S FIVE FORCES ANALYSIS: EUROPEAN SMART HOME MARKET

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SALES CHANNELS

- FIGURE 36 KEY BUYING CRITERIA FOR SALES CHANNELS

- FIGURE 37 IMPACT OF AI/GENERATIVE AI ON EUROPEAN SMART HOME MARKET

- FIGURE 38 WIRED SEGMENT TO CLAIM LARGER MARKET SHARE IN 2024

- FIGURE 39 WIRING FOR DALI FLUORESCENT DIMMING

- FIGURE 40 LONWORKS NETWORK SETUP

- FIGURE 41 TYPES OF WIRELESS COMMUNICATION TECHNOLOGIES

- FIGURE 42 INDIRECT SALES SEGMENT TO HOLD LARGER MARKET SHARE IN 2024

- FIGURE 43 ENTERTAINMENT & OTHER CONTROLS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 44 BEHAVIORAL SEGMENT TO CAPTURE MAJORITY OF MARKET SHARE IN 2029

- FIGURE 45 NEW INSTALLATIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 46 MULTI-FAMILY RESIDENCE SEGMENT TO SECURE LARGER MARKET SHARE IN 2024

- FIGURE 47 EUROPE: SMART HOME MARKET SNAPSHOT

- FIGURE 48 MARKET SHARE ANALYSIS OF EUROPEAN PLAYERS OFFERING SMART HOME SOLUTIONS, 2023

- FIGURE 49 EUROPEAN SMART HOME MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2023

- FIGURE 50 COMPANY VALUATION, 2024

- FIGURE 51 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 52 BRAND COMPARISON

- FIGURE 53 EUROPEAN SMART HOME MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 54 EUROPEAN SMART HOME MARKET: COMPANY FOOTPRINT

- FIGURE 55 EUROPEAN SMART HOME MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 56 JOHNSON CONTROLS: COMPANY SNAPSHOT

- FIGURE 57 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 58 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 59 ASSA ABLOY: COMPANY SNAPSHOT

- FIGURE 60 SIEMENS: COMPANY SNAPSHOT

- FIGURE 61 AMAZON.COM, INC.: COMPANY SNAPSHOT

- FIGURE 62 APPLE INC.: COMPANY SNAPSHOT

- FIGURE 63 RESIDEO TECHNOLOGIES INC.: COMPANY SNAPSHOT

- FIGURE 64 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 65 ABB: COMPANY SNAPSHOT

The European smart home market was valued at USD 22.11 billion in 2024 and is projected to reach USD 29.24 billion by 2029; it is expected to register a CAGR of 5.7% during the forecast period. Concerns about safety, security, and convenience among general population is driving the growth of the European smart home market. Whereas the switching cost of the present smart home devices is restraining the growth of the European smart home market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Product, Software, Service and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The lighting control segment is expected to grow at the second highest CAGR during the forecast period."

The lighting control segment is projected to grow at the second highest CAGR during the forecast. A smart lighting control system is an automated device that allows the control of lighting in a residential building through acquiring information from the input devices and transmitting it through one or more central computation devices which transform the received information into signals to the output devices.

Smart home lighting controls can allow a lighting system to perform checks on occupancy as well as natural lighting in an area. It can detect these factors and, therefore, it can regulate its illumination with regard to the amount of natural light, or switch off if the room is empty. Lighting control is a foundation of lighting for energy conservation.

The behavioral system type is likely to grow at the second higher CAGR during the forecast period

The behavioral system type is expected to grow at second higher CAGR during the forecast period. The behavioral system type applies AI and machine learning algorithms to study from the behaviors of persons in a smart house. It activates and controls routines and preferences of the home and implements them using data acquired from the sensors, cameras and other smart devices. The behavioral system type aims to offer consumers a tailored and comfort approach where various processes are conducted based on the occupant response.

"Germany is likely to grow at the second highest CAGR during the forecast period."

The market in Germany is expected to witness the second highest CAGR during the forecast period. The growth in the country is attributed to the initiatives undertaken by the government to adopt smart solutions thereby enhancing building sustainability. For instance, in Germany, the smart home is promoted through Next Generation Media Programme supported by the Federal Ministry for Economic Affairs and Climate Action (BMWK). Smart home technologies are considered as one of the pathways to enhance the quality of life and energy efficiency thus contributing to general objectives of the Digital Agenda for Germany. Implementing smart home projects with the assistance of Next Generation Media Programme, there is quite integrated approach to foster digital communications networks and services across many industries.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 35%, Tier 2 - 45%, Tier 3 - 20%

- By Designation- C-level Executives - 40%, Directors - 30%, Others - 30%

The European smart home market is dominated by a few globally established players such as Johnson Controls Inc. (Ireland), Honeywell International Inc. (US), Schneider Electric (France), Siemens (Germany), ASSA ABLOY (Sweden), Amazon.com, Inc. (US), Apple Inc. (US), Resideo Technologies Inc. (US), Robert Bosch (Germany), ABB (Switzerland). The study includes an in-depth competitive analysis of these key players in the European smart home market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the European smart home market and forecasts its size by product, system type, sales channel, protocol, residence type, installation type, country. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across a main region-Europe. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the smart home ecosystem.

Key Benefits to Buy the Report:

- Analysis of key drivers (Rising need for energy saving and low carbon emission-oriented solutions, Ongoing proliferation of smartphones and smart gadgets are driving need for them). Restraint (High switching cost for existing smart device consumers, More convenience driven market than being necessity driven market, High up front cost, Complexity and glitches in setting up of smart homes), Opportunity (Favorable government regulations, Expected incorporation of lighting controllers with inbuild data connectivity technology, Use of Smart Home product for geriatric applications), Challenges (Linking disparate systems, limited functionalities, and lack of open standards, Cybersecurity concerns of smart homes, Retrofitting existing homes, Compatibility Issues of smart home products)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the European smart home market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the European smart home market across varied countries.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the European smart home market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and system types of leading players like Johnson Controls Inc. (Ireland), Honeywell International Inc. (US), Schneider Electric (France), Siemens (Germany), ASSA ABLOY (Sweden), Amazon.com, Inc. (US), Apple Inc. (US), Resideo Technologies Inc. (US), Robert Bosch (Germany), ABB (Switzerland) among others in the European smart home market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.3.2 List of primary interview participants

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 FACTOR ANALYSIS

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.2.3 GROWTH FORECAST ASSUMPTIONS

- 2.3 MARKET SIZE ESTIMATION METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN EUROPEAN SMART HOME MARKET

- 4.2 HVAC CONTROLS: EUROPEAN SMART HOME MARKET, BY TYPE

- 4.3 SECURITY & ACCESS CONTROLS: EUROPEAN SMART HOME MARKET

- 4.4 SMART KITCHEN: EUROPEAN SMART HOME MARKET

- 4.5 HOME APPLIANCES: EUROPEAN SMART HOME MARKET

- 4.6 EUROPEAN SMART HOME MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising need for energy-saving and low-carbon emission-oriented solutions

- 5.2.1.2 Proliferation of smartphones and smart gadgets

- 5.2.1.3 Growing adoption of DIY home monitoring systems

- 5.2.1.4 Rising safety concerns due to urbanization and globalization

- 5.2.2 RESTRAINTS

- 5.2.2.1 Expenses associated with smart gadgets

- 5.2.2.2 High cost of ownership of home automation systems

- 5.2.2.3 Complexities in installing smart home devices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Implementation of energy efficiency measures

- 5.2.3.2 Rising adoption of smart lighting systems

- 5.2.3.3 Development of ambient assistant living-friendly solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of developments in common standards and communication protocols

- 5.2.4.2 Prone to hacking

- 5.2.4.3 Retrofitting existing homes

- 5.2.4.4 Fragmentation of smart home industry

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF SMART LOCKS, BY KEY PLAYER, 2019-2023

- 5.4.2 AVERAGE SELLING PRICE TREND OF SMART HOMES, BY PRODUCT, 2020-2023

- 5.4.3 AVERAGE SELLING PRICE TREND OF LIGHTING CONTROL PRODUCTS, BY COUNTRY, 2020-2023

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Voice assistants

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Big data analytics

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Biometric authentication

- 5.8.3.2 AR and VR

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA (HS CODE 8517)

- 5.10.2 EXPORT DATA (HS CODE 8517)

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 ASSA ABLOY'S REMOTE ACCESS DELEGATION REVOLUTIONIZES EMERGENCY SERVICES GLOBALLY

- 5.12.2 JOHNSON CONTROLS' COOLING SOLUTION ENABLES FISERV TO OVERCOME MAINTENANCE ISSUES AND SAVE ENERGY

- 5.12.3 FUNCTION CONTROL LTD OFFERS HOMEOWNERS IN SCOTLAND INTEGRATED SMART HOME SOLUTIONS FOR SEAMLESS USER EXPERIENCES

- 5.12.4 LEGRAND'S SMART HOME SOLUTION TRANSFORMS UNIQUE PROPERTY INTO AUTOMATED LIVING SPACE

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS (HS CODE 8517)

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 STANDARDS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GENERATIVE AI ON EUROPEAN SMART HOME MARKET

6 EUROPEAN SMART HOME MARKET, BY PROTOCOL

- 6.1 INTRODUCTION

- 6.2 WIRED

- 6.2.1 INCREASING IMPLEMENTATION IN HIGH-BANDWIDTH APPLICATIONS TO DRIVE MARKET

- 6.2.2 DALI

- 6.2.3 NEMA

- 6.2.4 KNX

- 6.2.5 DMX

- 6.2.6 LONWORKS

- 6.2.7 ETHERNET

- 6.2.8 MODBUS

- 6.2.9 BACNET

- 6.2.10 BLACK BOX

- 6.2.11 PLC

- 6.3 WIRELESS

- 6.3.1 RISING DEMAND FOR SECURED AND HIGH-SPEED SOLUTIONS TO FOSTER MARKET GROWTH

- 6.3.2 ZIGBEE

- 6.3.3 Z-WAVE

- 6.3.4 WI-FI

- 6.3.5 BLUETOOTH

- 6.3.6 ENOCEAN

- 6.3.7 THREAD

- 6.3.8 INFRARED

- 6.3.9 MQTT

7 EUROPEAN SMART HOME MARKET, BY SALES CHANNEL

- 7.1 INTRODUCTION

- 7.2 DIRECT SALES

- 7.2.1 GROWING DEMAND FOR PERSONALIZED SMART SOLUTIONS TO FOSTER MARKET GROWTH

- 7.3 INDIRECT SALES

- 7.3.1 RISING ADOPTION OF E-COMMERCE PLATFORMS TO DRIVE MARKET

8 EUROPEAN SMART HOME MARKET, BY PRODUCT

- 8.1 INTRODUCTION

- 8.2 LIGHTING CONTROLS

- 8.2.1 RELAYS

- 8.2.1.1 Rising adoption of IoT-enabled appliances and systems to support market growth

- 8.2.2 OCCUPANCY SENSORS

- 8.2.2.1 Growing need to minimize energy consumption and improve usability and control to foster market growth

- 8.2.3 DAYLIGHT SENSORS

- 8.2.3.1 Pressing need for efficient electricity usage to fuel market growth

- 8.2.4 TIMERS

- 8.2.4.1 Increasing use in indoor and outdoor lighting, heat lamps, and hot tubs to foster market growth

- 8.2.5 DIMMERS

- 8.2.5.1 Ability to increase operational lifespan of lamps to drive market

- 8.2.6 SWITCHES

- 8.2.6.1 Growing need to reduce cabling costs to fuel market growth

- 8.2.7 ACCESSORIES & OTHER PRODUCTS

- 8.2.1 RELAYS

- 8.3 SECURITY & ACCESS CONTROLS

- 8.3.1 VIDEO SURVEILLANCE

- 8.3.1.1 Rising emphasis on developing digital systems to foster market growth

- 8.3.2 ACCESS CONTROL

- 8.3.2.1 Increasing need to enhance security to accelerate demand

- 8.3.2.1.1 Hardware

- 8.3.2.1.1.1 Card-based readers

- 8.3.2.1.1.2 Multi-technology readers

- 8.3.2.1.1.3 Smart locks

- 8.3.2.1.1.4 Controllers

- 8.3.2.1.1.5 Biometric readers

- 8.3.2.1.2 Software

- 8.3.2.1.3 Services

- 8.3.2.1.1 Hardware

- 8.3.2.1 Increasing need to enhance security to accelerate demand

- 8.3.1 VIDEO SURVEILLANCE

- 8.4 HVAC CONTROLS

- 8.4.1 SMART THERMOSTATS

- 8.4.1.1 Ability to learn and adapt to behavior of end users to drive market

- 8.4.2 SENSORS

- 8.4.2.1 Rising need to facilitate ventilation for indoor air quality and temperature to fuel demand

- 8.4.3 CONTROL VALVES

- 8.4.3.1 Rising need to regulate flow of fluids to foster market growth

- 8.4.4 HEATING & COOLING COILS

- 8.4.4.1 Rising emphasis on achieving sustainable goals to fuel market growth

- 8.4.5 DAMPERS

- 8.4.5.1 Increasing need to regulate airflow inside air handling equipment to foster market growth

- 8.4.6 ACTUATORS

- 8.4.6.1 Rising application for controlling dampers and valves in HVAC systems to accelerate demand

- 8.4.7 PUMPS & FANS

- 8.4.7.1 Integration of IoT-enabled pumps and fans to offer lucrative growth opportunities

- 8.4.8 SMART VENTS

- 8.4.8.1 Rising demand for easy-to-install equipment to foster market growth

- 8.4.1 SMART THERMOSTATS

- 8.5 ENTERTAINMENT & OTHER CONTROLS

- 8.5.1 ENTERTAINMENT CONTROLS

- 8.5.1.1 Audio & volume controls

- 8.5.1.1.1 Ongoing technological advancements to offer lucrative growth opportunities

- 8.5.1.2 Home theater system controls

- 8.5.1.2.1 Increasing demand to eliminate wire installations to foster segmental growth

- 8.5.1.3 Touchscreens & keypads

- 8.5.1.3.1 Rising demand for customized devices to fuel market growth

- 8.5.1.1 Audio & volume controls

- 8.5.2 OTHER CONTROLS

- 8.5.2.1 Smart meters

- 8.5.2.1.1 Increasing awareness about environmental issues to foster market growth

- 8.5.2.2 Smart plugs

- 8.5.2.2.1 Growing need for efficient management of energy usage to offer lucrative growth opportunities

- 8.5.2.3 Smart hubs

- 8.5.2.3.1 Rising applications of unifying connected gadgets in smart homes to drive market

- 8.5.2.4 Smoke detectors

- 8.5.2.4.1 Stringent fire safety regulations to accelerate demand

- 8.5.2.1 Smart meters

- 8.5.1 ENTERTAINMENT CONTROLS

- 8.6 SMART SPEAKERS

- 8.6.1 ABILITY TO REGULATE SMART DEVICES THROUGH USER VOICE CONTROL TO DRIVE MARKET

- 8.7 HOME HEALTHCARE APPLIANCES

- 8.7.1 HEALTH STATUS MONITORS

- 8.7.1.1 Growing emphasis on preventive healthcare to boost demand

- 8.7.1.2 Fitness and heart rate monitors

- 8.7.1.3 Blood pressure monitors

- 8.7.1.4 Blood glucose meters

- 8.7.1.5 Continuous glucose monitors

- 8.7.1.6 Pulse oximeters

- 8.7.1.7 Fall detectors

- 8.7.2 PHYSICAL ACTIVITY MONITORS

- 8.7.2.1 Increasing significance of physical activity and overall health to drive market

- 8.7.1 HEALTH STATUS MONITORS

- 8.8 SMART KITCHEN APPLIANCES

- 8.8.1 SMART REFRIGERATORS

- 8.8.1.1 Advent of Wi-Fi-enabled touchscreen refrigerators to offer lucrative market growth

- 8.8.2 SMART COFFEE MAKERS

- 8.8.2.1 Increasing demand for Bluetooth-enabled coffee makers to fuel market growth

- 8.8.3 SMART KETTLES

- 8.8.3.1 Rising demand for Wi-Fi kettles to segmental growth

- 8.8.4 SMART DISHWASHERS

- 8.8.4.1 Ability to provide real-time information on energy consumption and energy efficiency to boost demand

- 8.8.5 SMART OVENS

- 8.8.5.1 Ability to control cooking time and temperature remotely to accelerate demand

- 8.8.6 SMART COOKTOPS

- 8.8.6.1 Rising consumer preference for convenience and time-saving solutions to spur demand

- 8.8.7 SMART COOKERS

- 8.8.7.1 Ability to adjust temperature remotely to accelerate demand

- 8.8.1 SMART REFRIGERATORS

- 8.9 HOME APPLIANCES

- 8.9.1 SMART WASHERS

- 8.9.1.1 Increasing demand for smart stats, smart assistants, and smart dispensers to fuel market growth

- 8.9.2 SMART DRYERS

- 8.9.2.1 Advent of smart alert systems to offer lucrative growth opportunities

- 8.9.3 SMART WATER HEATERS

- 8.9.3.1 Surging demand for cost -and energy-efficient devices to drive market

- 8.9.4 SMART VACUUM CLEANERS

- 8.9.4.1 Rising integration of cameras and microphones into smart vacuum cleaners to offer lucrative growth opportunities

- 8.9.1 SMART WASHERS

- 8.10 SMART FURNITURE

- 8.10.1 SMART TABLES

- 8.10.1.1 Ability to offer easy online access to users to drive market

- 8.10.2 SMART DESKS

- 8.10.2.1 Growing need to tackle backaches and eye strains to fuel market growth

- 8.10.3 SMART STOOLS & BENCHES

- 8.10.3.1 Rising demand for user-friendly environments to fuel market growth

- 8.10.4 SMART SOFAS

- 8.10.4.1 Ability to interact with different smart devices at home to foster market growth

- 8.10.5 SMART CHAIRS

- 8.10.5.1 Ability to monitor sitting posture accurately and non-invasively to foster market growth

- 8.10.1 SMART TABLES

9 EUROPEAN SMART HOME MARKET, BY SYSTEM TYPE

- 9.1 INTRODUCTION

- 9.2 BEHAVIORAL

- 9.2.1 INCREASING CONNECTIVITY BETWEEN MACHINE-TO-MACHINE SOLUTIONS AND IOT TO FOSTER MARKET GROWTH

- 9.3 PROACTIVE

- 9.3.1 EFFICIENT TRANSMISSION OF ENERGY CONSUMPTION DATA TO END USERS TO FUEL MARKET GROWTH

10 EUROPEAN SMART HOME MARKET, BY INSTALLATION TYPE

- 10.1 INTRODUCTION

- 10.2 NEW INSTALLATIONS

- 10.2.1 SUITABILITY FOR OUTDOOR ENVIRONMENTS TO FOSTER MARKET GROWTH

- 10.3 RETROFIT INSTALLATIONS

- 10.3.1 RISING NEED TO DECREASE HEAT EMISSIONS AND LOWER ENERGY USAGE TO DRIVE MARKET

11 EUROPEAN SMART HOME MARKET, BY RESIDENCE TYPE

- 11.1 INTRODUCTION

- 11.2 SINGLE-FAMILY RESIDENCE

- 11.2.1 RISING EMPHASIS ON REDUCING CARBON FOOTPRINTS TO DRIVE MARKET

- 11.3 MULTI-FAMILY RESIDENCE

- 11.3.1 ENHANCED OWNER EXPERIENCE TO FUEL MARKET GROWTH

12 EUROPEAN SMART HOME MARKET, BY COUNTRY

- 12.1 INTRODUCTION

- 12.2 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3 UK

- 12.3.1 MANDATORY COMPLIANCE WITH BUILDING SAFETY REGULATIONS TO FUEL MARKET GROWTH

- 12.4 GERMANY

- 12.4.1 ADOPTION OF ZERO-ENERGY SYSTEMS AND DEVELOPMENT OF SMART CITIES TO DRIVE MARKET

- 12.5 FRANCE

- 12.5.1 RISING INSTALLATION OF SECURITY SYSTEMS IN CONVENTIONAL BUILDINGS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 12.6 ITALY

- 12.6.1 GOVERNMENT-LED INITIATIVES TO PROMOTE IMPROVED DESIGNS AND MANAGEMENT OF LIGHTING SYSTEMS TO FUEL MARKET GROWTH

- 12.7 REST OF EUROPE

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 13.3 MARKET SHARE ANALYSIS, 2023

- 13.4 REVENUE ANALYSIS, 2019-2023

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 13.6 BRAND COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.7.5.1 Company footprint

- 13.7.5.2 Country footprint

- 13.7.5.3 Product footprint

- 13.7.5.4 System type footprint

- 13.7.5.5 Sales channel footprint

- 13.7.5.6 Installation type footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIOS

- 13.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 13.9.2 DEALS

- 13.9.3 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 JOHNSON CONTROLS

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches/Developments

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 SCHNEIDER ELECTRIC

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches/Developments

- 14.1.2.3.2 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 HONEYWELL INTERNATIONAL INC.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches/Developments

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 ASSA ABLOY

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches/Developments

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 SIEMENS

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches/Developments

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Other developments

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses/Competitive threats

- 14.1.6 AMAZON.COM, INC.

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches/Developments

- 14.1.6.3.2 Deals

- 14.1.7 APPLE INC.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches/Developments

- 14.1.7.3.2 Deals

- 14.1.8 RESIDEO TECHNOLOGIES INC.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches/Developments

- 14.1.8.3.2 Deals

- 14.1.8.3.3 Other developments

- 14.1.9 ROBERT BOSCH GMBH

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches/Developments

- 14.1.9.3.2 Deals

- 14.1.10 ABB

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches/Developments

- 14.1.10.3.2 Deals

- 14.1.1 JOHNSON CONTROLS

- 14.2 OTHER PLAYERS

- 14.2.1 SAMSUNG

- 14.2.2 SONY CORPORATION

- 14.2.3 TRANE TECHNOLOGIES PLC

- 14.2.4 GIRA

- 14.2.5 AIRTHINGS

- 14.2.6 LOXONE ELECTRONICS GMBH

- 14.2.7 DELTA INTELLIGENT BUILDING TECHNOLOGIES (CANADA) INC.

- 14.2.8 SNAP ONE, LLC.

- 14.2.9 AXIS COMMUNICATIONS AB

- 14.2.10 COMCAST

- 14.2.11 ALARM.COM

- 14.2.12 VIVINT, INC.

- 14.2.13 SIMPLISAFE, INC.

- 14.2.14 GENERAL ELECTRIC COMPANY

- 14.2.15 NUKI HOME SOLUTIONS

- 14.2.16 LG ELECTRONICS

- 14.2.17 LUTRON ELECTRONICS CO., INC

- 14.2.18 LEGRAND

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS