|

|

市場調査レポート

商品コード

1652609

リタイマー市場:インターフェース別、用途別、エンドユーザー別、地域別 - 2029年までの予測Retimer Market by PCIe (PCIe 1.0, PCIe 2.0, PCIe 3.0, PCIe 4.0, PCIe 5.0, PCIe 6.0), CXL, USB, SATA, HDMI, ThunderBolt, Ethernet, DisplayPort Interfaces, Servers, Storage Devices, Accelerators, Workstations, Routers, Gaming PCs - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| リタイマー市場:インターフェース別、用途別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2025年02月01日

発行: MarketsandMarkets

ページ情報: 英文 270 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のリタイマーの市場規模は、2024年の6億1,360万米ドルから2029年には10億2,220万米ドルに成長すると予測され、予測期間中のCAGRは10.7%になるとみられています。

リタイマー市場は、高速データトランスミッションの需要の高まり、シグナルインテグリティ品質の向上に対する要求の急増、データセンターの急速な拡張によるクラウドコンピューティングの採用拡大など、いくつかの要因によって有望な成長の可能性を秘めています。自動車や産業用IoTアプリケーションにおけるリタイマー技術の利用の拡大、生成AIの進化、エッジコンピューティングの導入の増加は、リタイマー市場に成長機会をもたらすと期待されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | インターフェース別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

データセンターの拡大に伴うクラウドコンピューティングの採用拡大が、リタイマー市場を大きく牽引しています。これらのインフラは、データトラフィックの増加や複雑な用途をサポートするために、高速で信頼性の高いデータ伝送を必要とするからです。クラウド・サービスの台頭により、企業は膨大な量の情報を効率的に処理するためにデータセンター機能に多額の投資を行っており、その結果、信号の完全性を維持し、より長距離の到達距離を伸ばすためにリタイマーの使用が必要となっています。さらに、人工知能や機械学習などにおける低遅延接続の需要は、サーバーとストレージ・デバイス間の正確かつ高速なデータ転送を保証することでパフォーマンスを向上させるリタイマーの必要性をさらに強調しています。組織がデジタル・インフラを拡大し続ける中、このような要因の集結により、リタイマー市場は大幅な成長を遂げます。

家電、ネットワーキング、通信などの業界では、高速データ・トランスミッションと安定した接続性への要求が高まっており、USBリタイマーの採用を促進しています。これらのデバイスはデータを復元し、信号内のノイズやジッターを除去し、信号の影響を強化するため、USB3.0/3.1/4技術においても非常に重要となっています。サーバーとデータセンターでは、大量のデータを効率的に処理したり保存したりするために、高速で低レイテンシの転送が必要です。世界のデータセンターの増加に伴い、マルチレベル・スイッチや他のシステムIC(このような高速リンクを必要としない)と比較して、USBリタイマーに対する需要が急激に高まっています。

最新のストレージシステムは、より長い距離にわたって信頼性の高いデータ転送とシグナルインテグリティを確保するために、リタイマーの機能に依存しています。ストレージ用途では、リタイマーはストレージコントローラ、メディア、バックエンドインターフェース間の高速データ転送を可能にします。

リアルタイムのデータ分析に対する需要は、BFSIエンドユーザーにおけるリタイマー採用を促進する重要な要因です。金融機関は、顧客行動、市場動向、リスク管理に関する洞察を得るためにビッグデータ分析を利用しています。これらの組織は、企業レベルのデータがシームレスに流れるために必要な接続性と処理能力に対する高い要求に対応しています。リタイマーは、長距離でも信号がクリアであることを保証することで、これらの高速信号をサポートします。特に、ミリ秒単位が業績に影響を与える高頻度取引では、データのクリアなトランスミッションが極めて重要です。

欧州のレタイマー市場は、ドイツ、英国、フランス、その他の欧州諸国にさらに分類されます。ドイツでは盛んな輸送産業でリタイマーの採用が増加していること、英国ではデータセンターの設立が増加していること、高速データトランスミッションの需要が高まっていること、フランスではデータセンターへの政府・民間投資がリタイマーの採用を促進していることなどが、欧州のリタイマー市場の成長を後押ししています。欧州のリタイマー市場は、AI&ML技術の技術革新、データ消費の増加、地域全体のデータセンターの設立などの要因によって、かなりの成長が見込まれています。欧州全域のリタイマーのエンドユーザー産業が業務をデジタル化するにつれて、高速データトランスミッションとシグナルインテグリティの需要が高まっています。

当レポートでは、世界のリタイマー市場について調査し、インターフェース別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 投資と資金調達のシナリオ

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 貿易分析

- 特許分析

- 規制状況

- 2024年~2025年の主な会議とイベント

- リタイマー市場へのAIの影響

第6章 リタイマー市場(インターフェース別)

- イントロダクション

- PCIE

- CXL

- USB

- その他

第7章 リタイマー市場(用途別)

- イントロダクション

- サーバー

- ストレージデバイス

- ハードウェアアクセサリ

- その他

第8章 リタイマー市場(エンドユーザー別)

- イントロダクション

- IT・通信

- BFSI

- 政府

- ヘルスケア

- 輸送

- 教育

- 小売

- その他

第9章 リタイマー市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- インド

- 日本

- 韓国

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- ASTERA LABS, INC.

- BROADCOM

- MARVELL

- RENESAS ELECTRONICS CORPORATION

- TEXAS INSTRUMENTS INCORPORATED

- PARADE TECHNOLOGIES, LTD.

- INTEL CORPORATION

- DIODES INCORPORATED

- MICROCHIP TECHNOLOGY INC.

- MONTAGE TECHNOLOGY

- RAMBUS

- SEMTECH CORPORATION

- PHISON ELECTRONICS

- NUVOTON TECHNOLOGY CORPORATION

- KANDOU BUS SA

- その他の企業

- ANALOGIX SEMICONDUCTOR, INC.

- ASMEDIA TECHNOLOGY INC.

- CHENGDU DIANKE XINGTUO TECHNOLOGY CO., LTD.

- CREDO, INC.

- INDIE SEMICONDUCTOR

- LINKREAL CO., LTD.

- MOSCHIP TECHNOLOGIES LIMITED

- SAIDI SEMICONDUCTOR(SHENZHEN)CO., LTD.

- TRUECHIP

- WIWYNN CORPORATION

- THINE ELECTRONICS, INC.

第12章 隣接市場と関連市場

第13章 付録

List of Tables

- TABLE 1 ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 2 INDICATIVE PRICING TREND OF USB RETIMERS, BY KEY PLAYER, 2020-2023 (USD)

- TABLE 3 INDICATIVE PRICING TREND OF RETIMERS, BY INTERFACE, 2020-2023 (USD)

- TABLE 4 INDICATIVE PRICING TREND OF RETIMERS, BY REGION, 2020-2023 (USD)

- TABLE 5 RETIMER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END USERS (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP END USERS

- TABLE 8 IMPORT DATA FOR HS CODE 854231-COMPLIANT PRODUCTS, BY COUNTRY (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 854231-COMPLIANT PRODUCTS, BY COUNTY, 2019-2023 (USD MILLION)

- TABLE 10 LIST OF KEY PATENTS IN RETIMER MARKET, 2020-2024

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 RETIMER MARKET: LIST OF CONFERENCES AND EVENTS, 2024-2025

- TABLE 16 RETIMER MARKET, BY INTERFACE, 2020-2023 (USD MILLION)

- TABLE 17 RETIMER MARKET, BY INTERFACE, 2024-2029 (USD MILLION)

- TABLE 18 RETIMER MARKET, IN TERMS OF VOLUME, 2020-2023 (MILLION UNITS)

- TABLE 19 RETIMER MARKET, IN TERMS OF VOLUME, 2024-2029 (MILLION UNITS)

- TABLE 20 COMPARISON OF PCIE GENERATIONS

- TABLE 21 PCIE: RETIMER MARKET, BY GENERATION, 2020-2023 (USD MILLION)

- TABLE 22 PCIE: RETIMER MARKET, BY GENERATION, 2024-2029 (USD MILLION)

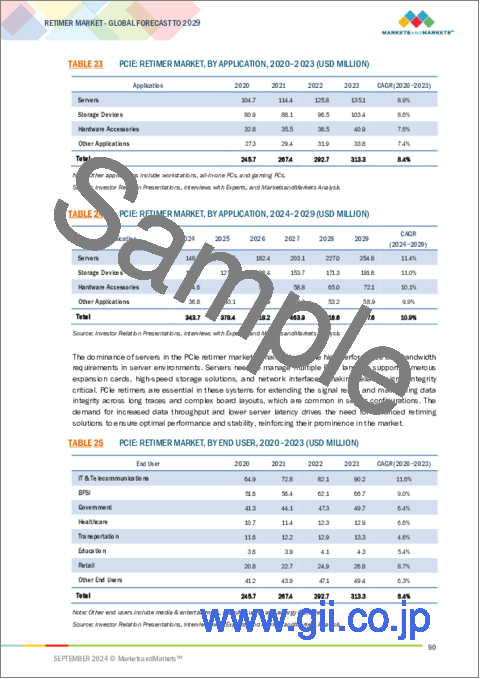

- TABLE 23 PCIE: RETIMER MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 24 PCIE: RETIMER MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 25 PCIE: RETIMER MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 26 PCIE: RETIMER MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 27 CXL: RETIMER MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 28 CXL: RETIMER MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 29 CXL: RETIMER MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 30 CXL: RETIMER MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 31 USB: RETIMER MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 32 USB: RETIMER MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 33 USB: RETIMER MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 34 USB: RETIMER MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 35 OTHER INTERFACES: RETIMER MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 36 OTHER INTERFACES: RETIMER MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 37 OTHER INTERFACES: RETIMER MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 38 OTHER INTERFACES: RETIMER MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 39 RETIMER MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 40 RETIMER MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 41 SERVERS: RETIMER MARKET, BY INTERFACE, 2020-2023 (USD MILLION)

- TABLE 42 SERVERS: RETIMER MARKET, BY INTERFACE, 2024-2029 (USD MILLION)

- TABLE 43 SERVERS: RETIMER MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 44 SERVERS: RETIMER MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 45 STORAGE DEVICES: RETIMER MARKET, BY INTERFACE, 2020-2023 (USD MILLION)

- TABLE 46 STORAGE DEVICES: RETIMER MARKET, BY INTERFACE, 2024-2029 (USD MILLION)

- TABLE 47 STORAGE DEVICES: RETIMER MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 48 STORAGE DEVICES: RETIMER MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 49 HARDWARE ACCESSORIES: RETIMER MARKET, BY INTERFACE, 2020-2023 (USD MILLION)

- TABLE 50 HARDWARE ACCESSORIES: RETIMER MARKET, BY INTERFACE, 2024-2029 (USD MILLION)

- TABLE 51 HARDWARE ACCESSORIES: RETIMER MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 52 HARDWARE ACCESSORIES: RETIMER MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 53 OTHER APPLICATIONS: RETIMER MARKET, BY INTERFACE, 2020-2023 (USD MILLION)

- TABLE 54 OTHER APPLICATIONS: RETIMER MARKET, BY INTERFACE, 2024-2029 (USD MILLION)

- TABLE 55 OTHER APPLICATIONS: RETIMER MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 56 OTHER APPLICATIONS: RETIMER MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 57 RETIMER MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 58 RETIMER MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 59 IT & TELECOMMUNICATIONS: RETIMER MARKET, BY INTERFACE, 2020-2023 (USD MILLION)

- TABLE 60 IT & TELECOMMUNICATIONS: RETIMER MARKET, BY INTERFACE, 2024-2029 (USD MILLION)

- TABLE 61 IT & TELECOMMUNICATIONS: RETIMER MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 62 IT & TELECOMMUNICATIONS: RETIMER MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 63 IT & TELECOMMUNICATIONS: RETIMER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 IT & TELECOMMUNICATIONS: RETIMER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 65 BFSI: RETIMER MARKET, BY INTERFACE, 2020-2023 (USD MILLION)

- TABLE 66 BFSI: RETIMER MARKET, BY INTERFACE, 2024-2029 (USD MILLION)

- TABLE 67 BFSI: RETIMER MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 68 BFSI: RETIMER MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 69 BFSI: RETIMER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 70 BFSI: RETIMER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 71 GOVERNMENT: RETIMER MARKET, BY INTERFACE, 2020-2023 (USD MILLION)

- TABLE 72 GOVERNMENT: RETIMER MARKET, BY INTERFACE, 2024-2029 (USD MILLION)

- TABLE 73 GOVERNMENT: RETIMER MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 74 GOVERNMENT: RETIMER MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 75 GOVERNMENT: RETIMER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 76 GOVERNMENT: RETIMER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 77 HEALTHCARE: RETIMER MARKET, BY INTERFACE, 2020-2023 (USD MILLION)

- TABLE 78 HEALTHCARE: RETIMER MARKET, BY INTERFACE, 2024-2029 (USD MILLION)

- TABLE 79 HEALTHCARE: RETIMER MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 80 HEALTHCARE: RETIMER MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 81 HEALTHCARE: RETIMER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 82 HEALTHCARE: RETIMER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 83 TRANSPORTATION: RETIMER MARKET, BY INTERFACE, 2020-2023 (USD MILLION)

- TABLE 84 TRANSPORTATION: RETIMER MARKET, BY INTERFACE, 2024-2029 (USD MILLION)

- TABLE 85 TRANSPORTATION: RETIMER MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 86 TRANSPORTATION: RETIMER MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 87 TRANSPORTATION: RETIMER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 88 TRANSPORTATION: RETIMER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 89 EDUCATION: RETIMER MARKET, BY INTERFACE, 2020-2023 (USD MILLION)

- TABLE 90 EDUCATION: RETIMER MARKET, BY INTERFACE, 2024-2029 (USD MILLION)

- TABLE 91 EDUCATION: RETIMER MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 92 EDUCATION: RETIMER MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 93 EDUCATION: RETIMER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 94 EDUCATION: RETIMER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 95 RETAIL: RETIMER MARKET, BY INTERFACE, 2020-2023 (USD MILLION)

- TABLE 96 RETAIL: RETIMER MARKET, BY INTERFACE, 2024-2029 (USD MILLION)

- TABLE 97 RETAIL: RETIMER MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 98 RETAIL: RETIMER MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 99 RETAIL: RETIMER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 100 RETAIL: RETIMER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 101 OTHER END USERS: RETIMER MARKET, BY INTERFACE, 2020-2023 (USD MILLION)

- TABLE 102 OTHER END USERS: RETIMER MARKET, BY INTERFACE, 2024-2029 (USD MILLION)

- TABLE 103 OTHER END USERS: RETIMER MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 104 OTHER END USERS: RETIMER MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 105 OTHER END USERS: RETIMER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 106 OTHER END USERS: RETIMER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 107 RETIMER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 108 RETIMER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 109 NORTH AMERICA: RETIMER MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 110 NORTH AMERICA: RETIMER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 111 NORTH AMERICA: RETIMER MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 112 NORTH AMERICA: RETIMER MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 113 EUROPE: RETIMER MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 114 EUROPE: RETIMER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 115 EUROPE: RETIMER MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 116 EUROPE: RETIMER MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 117 ASIA PACIFIC: RETIMER MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 118 ASIA PACIFIC: RETIMER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 119 ASIA PACIFIC: RETIMER MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 120 ASIA PACIFIC: RETIMER MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 121 ROW: RETIMER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 122 ROW: RETIMER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 123 ROW: RETIMER MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 124 ROW: RETIMER MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 125 MIDDLE EAST: RETIMER MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 126 MIDDLE EAST: RETIMER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 127 RETIMER MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 128 RETIMER MARKET: DEGREE OF COMPETITION, 2023

- TABLE 129 RETIMER MARKET: INTERFACE FOOTPRINT

- TABLE 130 RETIMER MARKET: APPLICATION FOOTPRINT

- TABLE 131 RETIMER MARKET: END USER FOOTPRINT

- TABLE 132 RETIMER MARKET: REGION FOOTPRINT

- TABLE 133 RETIMER MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 134 RETIMER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 135 RETIMER MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2020-DECEMBER 2024

- TABLE 136 RETIMER MARKET: DEALS, JANUARY 2020-DECEMBER 2024

- TABLE 137 RETIMER MARKET: OTHER DEVELOPMENTS, JANUARY 2020-DECEMBER 2024

- TABLE 138 RETIMER MARKET: OTHER DEVELOPMENTS, JANUARY 2020-DECEMBER 2024

- TABLE 139 ASTERA LABS, INC.: COMPANY OVERVIEW

- TABLE 140 ASTERA LABS, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 ASTERA LABS, INC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 142 ASTERA LABS, INC: DEALS

- TABLE 143 ASTERA LABS, INC.: EXPANSIONS

- TABLE 144 ASTERA LABS, INC.: OTHER DEVELOPMENTS

- TABLE 145 BROADCOM: COMPANY OVERVIEW

- TABLE 146 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 BROADCOM: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 148 MARVELL: COMPANY OVERVIEW

- TABLE 149 MARVELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 MARVELL: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 151 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 152 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 154 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 PARADE TECHNOLOGIES, LTD.: COMPANY OVERVIEW

- TABLE 156 PARADE TECHNOLOGIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 PARADE TECHNOLOGIES, LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 158 PARADE TECHNOLOGIES, LTD.: DEALS

- TABLE 159 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 160 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 DIODES INCORPORATED: COMPANY OVERVIEW

- TABLE 162 DIODES INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 DIODES INCORPORATED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 164 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 165 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 167 MONTAGE TECHNOLOGY: COMPANY OVERVIEW

- TABLE 168 MONTAGE TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 MONTAGE TECHNOLOGY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 170 RAMBUS: COMPANY OVERVIEW

- TABLE 171 RAMBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 RAMBUS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 173 SEMTECH CORPORATION: COMPANY OVERVIEW

- TABLE 174 SEMTECH CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 PHISON ELECTRONICS: COMPANY OVERVIEW

- TABLE 176 PHISON ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 PHISON ELECTRONICS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 178 PHISON ELECTRONICS: OTHER DEVELOPMENTS

- TABLE 179 NUVOTON TECHNOLOGY CORPORATION: COMPANY OVERVIEW

- TABLE 180 NUVOTON TECHNOLOGY CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 NUVOTON TECHNOLOGY CORPORATION: DEVELOPMENTS

- TABLE 182 KANDOU BUS SA: COMPANY OVERVIEW

- TABLE 183 KANDOU BUS SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 KANDOU BUS SA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 185 KANDOU BUS SA: EXPANSIONS

- TABLE 186 KANDOU BUS SA: OTHER DEVELOPMENTS

- TABLE 187 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2020-2023 (USD MILLION)

- TABLE 188 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2024-2029 (USD MILLION)

- TABLE 189 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 190 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 191 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP SOURCE, 2020-2023 (USD MILLION)

- TABLE 192 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP SOURCE, 2024-2029 (USD MILLION)

- TABLE 193 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 194 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 195 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR TELECOMMUNICATIONS & DATA CENTER VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 196 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR TELECOMMUNICATIONS & DATA CENTER VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 197 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) FOR INDUSTRIAL VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 198 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 199 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 200 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 201 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 202 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 203 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR OTHER VERTICALS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 204 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) FOR OTHER VERTICALS, BY REGION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 RETIMER MARKET SEGMENTATION

- FIGURE 2 RETIMER MARKET: RESEARCH DESIGN

- FIGURE 3 RETIMER MARKET: RESEARCH APPROACH

- FIGURE 4 RETIMER MARKET: BOTTOM-UP APPROACH

- FIGURE 5 RETIMER MARKET: TOP-DOWN APPROACH

- FIGURE 6 RETIMER MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 7 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 RESEARCH ASSUMPTIONS

- FIGURE 9 RETIMER MARKET SIZE SNAPSHOT, 2020-2029

- FIGURE 10 CXL INTERFACE TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 SERVERS SEGMENT TO DOMINATE RETIMER MARKET, BY APPLICATION, THROUGHOUT FORECAST PERIOD

- FIGURE 12 IT & TELECOMMUNICATIONS SEGMENT TO LEAD RETIMER MARKET FROM 2024 TO 2029

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 RISING ADOPTION OF AI AND CLOUD COMPUTING TO DRIVE MARKET

- FIGURE 15 PCIE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF RETIMER MARKET, BY INTERFACE, IN 2029

- FIGURE 16 SERVERS SEGMENT TO GAIN LARGEST SHARE OF RETIMER MARKET, BY APPLICATION, IN 2029

- FIGURE 17 IT & TELECOMMUNICATIONS SEGMENT TO CAPTURE LARGEST SHARE OF RETIMER MARKET, BY END USER, IN 2029

- FIGURE 18 IT & TELECOMMUNICATIONS SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2029

- FIGURE 19 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL RETIMER MARKET FROM 2024 TO 2029

- FIGURE 20 RETIMER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 HOUSEHOLD VIDEO STREAMING SUBSCRIPTION GROWTH, 2019-2023

- FIGURE 22 INCREASE IN DATA VOLUMES, 2010-2025

- FIGURE 23 TOP 5 COUNTRIES WITH HIGHEST NUMBER OF DATA CENTERS, 2023

- FIGURE 24 RETIMER MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 25 RETIMER MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 26 RETIMER MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 27 RETIMER MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 28 VALUE CHAIN ANALYSIS

- FIGURE 29 RETIMER MARKET: ECOSYSTEM ANALYSIS

- FIGURE 30 AVERAGE PRICING TREND OF RETIMERS, 2020-2023

- FIGURE 31 AVERAGE SELLING PRICING TREND OF USB RETIMERS OFFERED BY KEY PLAYERS

- FIGURE 32 INDICATIVE PRICING TREND OF RETIMERS, BY REGION, 2020-2023

- FIGURE 33 INVESTMENT AND FUNDING SCENARIO

- FIGURE 34 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 35 RETIMER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END USERS

- FIGURE 37 KEY BUYING CRITERIA FOR MAJOR END USERS

- FIGURE 38 IMPORT SCENARIO FOR HS CODE 854231-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 39 EXPORT SCENARIO FOR HS CODE 854231-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 40 PATENTS APPLIED AND GRANTED, 2014-2023

- FIGURE 41 RETIMER MARKET: USE CASES OF AI

- FIGURE 42 RETIMER MARKET, BY INTERFACE

- FIGURE 43 PCIE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 44 RETIMER MARKET, BY APPLICATION

- FIGURE 45 SERVERS SEGMENT TO DOMINATE RETIMER MARKET IN 2029

- FIGURE 46 RETIMER MARKET, BY END USER

- FIGURE 47 IT & TELECOMMUNICATIONS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 48 RETIMER MARKET, BY REGION

- FIGURE 49 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL RETIMER MARKET FROM 2024 TO 2029

- FIGURE 50 NORTH AMERICA: RETIMER MARKET SNAPSHOT

- FIGURE 51 US TO DOMINATE NORTH AMERICAN MARKET FROM 2024 TO 2029

- FIGURE 52 EUROPE: RETIMER MARKET SNAPSHOT

- FIGURE 53 GERMANY TO RECORD HIGHEST CAGR IN EUROPEAN RETIMER MARKET DURING FORECAST PERIOD

- FIGURE 54 ASIA PACIFIC: RETIMER MARKET SNAPSHOT

- FIGURE 55 CHINA TO CAPTURE LARGEST SHARE OF ASIA PACIFIC RETIMER MARKET IN 2029

- FIGURE 56 SOUTH AMERICA TO HOLD MAJOR MARKET SHARE OF RETIMER MARKET IN ROW IN 2029

- FIGURE 57 REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023

- FIGURE 58 RETIMER MARKET SHARE ANALYSIS, 2023

- FIGURE 59 COMPANY VALUATION

- FIGURE 60 FINANCIAL METRICS

- FIGURE 61 BRAND/PRODUCT COMPARISON

- FIGURE 62 RETIMER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 63 RETIMER MARKET: COMPANY FOOTPRINT

- FIGURE 64 RETIMER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 65 BROADCOM: COMPANY SNAPSHOT

- FIGURE 66 MARVELL: COMPANY SNAPSHOT

- FIGURE 67 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 69 PARADE TECHNOLOGIES, LTD.: COMPANY SNAPSHOT

- FIGURE 70 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 71 DIODES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 72 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- FIGURE 73 RAMBUS: COMPANY SNAPSHOT

- FIGURE 74 SEMTECH CORPORATION: COMPANY SNAPSHOT

- FIGURE 75 PHISON ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 76 NUVOTON TECHNOLOGY CORPORATION: COMPANY SNAPSHOT

The global retimer market is estimated to grow from USD 613.6 million in 2024 to USD 1,022.2 million in 2029; it is expected to grow at a CAGR of 10.7% during the forecast period. The retimer market has a promising growth potential due to several factors such as the rising demand for high-speed data transmission, the surging requirement for improved signal integrity quality, and the growing adoption of cloud computing owing to rapid data center expansion. The growing use of retimer technology in automotive and industrial IoT applications, the evolution of generative AI, and the increasing implementation of edge computing are expected to create growth opportunities for the retimer market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Interface, Application, End User and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Growing adoption of cloud computing owing to rapid data centers expansion to drive the retimer market"

The growing adoption of cloud computing owing to data centers expansion is significantly driving the retimer market, as these infrastructures require high-speed, reliable data transmission to support increasing data traffic and complex applications. With the rise of cloud services, businesses are investing heavily in data center capabilities to handle vast amounts of information efficiently, which in turn necessitates the use of retimers to maintain signal integrity and extend reach over longer distances. Additionally, the demand for low-latency connections in applications such as artificial intelligence and machine learning further emphasizes the need for retimers, which enhance performance by ensuring accurate and high-speed data transfer between servers and storage devices. This convergence of factors positions the retimer market for substantial growth as organizations continue to expand their digital infrastructure.

"USB interface retimer segment is projected to hold majority market share by 2029"

An increasing requirement for high-speed data transmission and stable connectivity in industries such as consumer electronics, networking & telecommunication is driving the adoption of USB retimer. These devices recuperate the data, clean noise & jitter within signals, enhance signal affectation and so have become very important in USB3.0/ 3.1 / 4 technology art as well. Servers and data centers: These computing applications require high-speed, low-latency transfers of large amounts of data in order to efficiently process or store it. With the growth of data centers worldwide, there will be an exponential demand for USB retimers to as compared with multi-level switches or other system ICs (which do not require such a high-speed link), in order to finely tune and optimize data flow within servers between them and their endpoints leading increased network performance.

"Storage application segment set to hold second largest market share during the forecast period"

Modern storage systems rely on the functionalities of a retimer to help ensure reliable data transfer and signal integrity over longer distances. In storage applications, the use of a retimer is to enable high-speed data transfer between storage controllers, media, and back-end interfaces. Some of the critical storage applications of retimers in enterprise storage arrays, SSDs, and tape libraries are discussed here. In enterprise storage arrays, for multi-controller arrays, retimers make sure that communication between controllers is reliably carried out. SSDs are also gaining more momentum as a form of storage device and retimer technology is being used in high-performance SSDs. Tape libraries are usually utilized for long-term data storage or archiving. For reliable data transfer between these tape libraries, there is a great need for a retimer.

"BFSI end user set to hold second largest market share by 2029"

The demand for real-time data analytics is an important factor driving retimer adoption in the BFSI end user. Financial organizations are using big data analytics to gain insights into customer behavior, trends in the market, and risk management. These organizations are addressing the high demand for connectivity and the processing capabilities needed for enterprise-level data to flow seamlessly. Retimers support these high-speed signals by ensuring that signals remain clear over long distances. The clearest transmission of data is crucial, especially in high-frequency trading, where milliseconds can affect financial results. Firms will continue to demand more speed and reliability to process data as faster and more reliable alternatives emerge, facilitating retimer applications and continued demand from support industries.

"Europe is likely to hold second largest market share by 2029"

The retimer market in Europe is categorized further into Germany, the UK, France, and the Rest of Europe. Factors such as the growing adoption of retimers in the thriving transportation industry in Germany, increasing establishment of data centers, the demand for high-speed data transmission in the UK, and the government and private investments in data centers fueling retimers adoption in France are driving the retimer market growth in Europe. The retimer market in Europe is expected to witness considerable growth owing to factors like technological innovations in AI & ML technologies, growing data consumption, and the establishment of data centers across the region. As end-user industries of retimers across the continent, digitize their operations, the demand for high-speed data transmission and signal integrity rises.

Breakdown of primaries

A variety of executives from key organizations operating in the retimer market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 = 50%, Tier 2 = 30%, and Tier 3 = 20%

- By Designation: C-level Executives = 35%, Directors = 30%, and Others (sales, marketing, and product managers, as well as members of various organizations) = 35%

- By Region: North America =40%, Europe = 25%, Asia Pacific =20%, and RoW = 15%

Key players profiled in this report

Astera Labs, Inc. (US), Broadcom (US), Marvell (US), Renesas Electronics Corporation (Japan), Texas Instruments Incorporated (US), Parade Technologies, Ltd. (Taiwan), Intel Corporation (US), Diodes Incorporated (US), Microchip Technology Inc. (US), Montage Technology (China), Rambus (US), Semtech Corporation (US), Phison Electronics (Taiwan), Nuvoton Technology Corporation (Taiwan) and Kandou Bus SA (Switzerland) are the some of the key players in the retimer market. These companies possess a wide portfolio of retimers, establishing a prominent presence in established as well as emerging markets. The study provides a detailed competitive analysis of these key players in the retimer market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report offers detailed insights into the retimer market based on Interface (PCIe, CXL, USB, and other interfaces), Application (servers, storage, hardware accessories, and other applications), End User (IT & telecommunications, BFSI, government, healthcare, transportation, education, retail, and other end users (media & entertainment, manufacturing, and energy & utilities), and region (North America, Europe, Asia Pacific, and RoW (includes the Middle East, South America, and Africa)

The report also comprehensively reviews the retimer market drivers, restraints, opportunities, and challenges. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Reasons to buy the report:

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenues for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the retimer market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (rising demand for high-speed data transmission, improved signal integrity requirements, and growing adoption of data centers and cloud computing), restraints (technological complexity, compatibility issues with retimers) opportunities (emerging applications in automotive and industrial IoT, and rise of edge computing) and challenges (availability of alternatives and regulatory and compliance challenges).

Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the retimer market

Market Development: Comprehensive information about lucrative markets - the report analyses the retimer market across varied regions

Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the retimer market

Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of key players like Astera Labs, Inc. (US), Broadcom (US), Marvell (US), Renesas Electronics Corporation (Japan), Texas Instruments Incorporated (US), Parade Technologies, Ltd. (Taiwan), Intel Corporation (US), Diodes Incorporated (US), Microchip Technology Inc. (US), Montage Technology (China), Rambus (US), Semtech Corporation (US), Phison Electronics (Taiwan), Nuvoton Technology Corporation (Taiwan) and Kandou Bus SA (Switzerland) among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 PRIMARY AND SECONDARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Intended participants in primary interview participants

- 2.1.3.2 List of primary interview participants

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.1.3.5 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RETIMER MARKET

- 4.2 RETIMER MARKET, BY INTERFACE

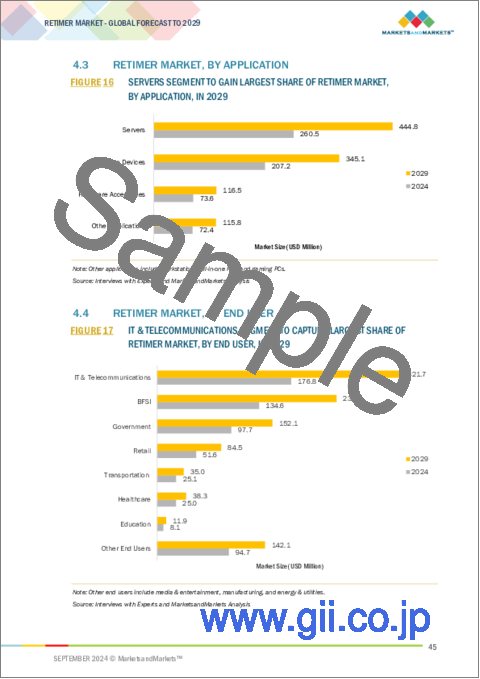

- 4.3 RETIMER MARKET, BY APPLICATION

- 4.4 RETIMER MARKET, BY END USER

- 4.5 RETIMER MARKET IN NORTH AMERICA, BY END USER AND COUNTRY

- 4.6 RETIMER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for high-speed data transmission

- 5.2.1.2 Surging requirement for improved signal quality

- 5.2.1.3 Growing adoption of cloud computing owing to rapid data center expansion

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technical hurdles in retimer deployment across high-speed data environments

- 5.2.2.2 Performance degradation due to compatibility issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing use of retimer technology in automotive and industrial IoT applications

- 5.2.3.2 Evolution of Generative AI

- 5.2.3.3 Increasing implementation of edge computing

- 5.2.4 CHALLENGES

- 5.2.4.1 Availability of alternative solutions

- 5.2.4.2 Regulatory and compliance-related challenges

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF RETIMERS

- 5.5.2 AVERAGE SELLING PRICING TREND OF USB RETIMERS, BY KEY PLAYER

- 5.5.3 INDICATIVE PRICING TREND OF RETIMERS, BY INTERFACE

- 5.5.4 INDICATIVE PRICING TREND OF RETIMERS, BY REGION

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Cloud computing

- 5.8.1.2 Edge computing

- 5.8.1.3 Artificial intelligence (AI)

- 5.8.2 COMPLIMENTARY TECHNOLOGIES

- 5.8.2.1 5G and 6G

- 5.8.2.2 IoT

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 BARGAINING POWER OF SUPPLIERS

- 5.9.2 BARGAINING POWER OF BUYERS

- 5.9.3 THREAT OF NEW ENTRANTS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 854231)

- 5.11.2 EXPORT SCENARIO (HS CODE 854231)

- 5.12 PATENT ANALYSIS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 GLOBAL REGULATIONS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.15 AI IMPACT ON RETIMER MARKET

- 5.15.1 USE CASES FOR AI IN RETIMER MARKET

- 5.15.2 BEST PRACTICES FOLLOWED BY COMPANIES IN RETIMER MARKET

- 5.15.3 INTERCONNECTED ADJACENT ECOSYSTEM WORKING ON AI AND ITS IMPACT ON MARKET PLAYERS

- 5.15.4 COMPANIES IN RETIMERS ADAPTING AI

6 RETIMER MARKET, BY INTERFACE

- 6.1 INTRODUCTION

- 6.2 PCIE

- 6.2.1 PCIE 1.0

- 6.2.1.1 Ability to add or remove components without need for system shut down to boost adoption

- 6.2.2 PCIE 2.0

- 6.2.2.1 Improved graphics processing speed and data storage performance to drive market

- 6.2.3 PCIE 3.0

- 6.2.3.1 Significant adoption in data center and gaming applications to fuel segmental growth

- 6.2.4 PCIE 4.0

- 6.2.4.1 Rising use in enterprise-grade applications requiring rapid data processing to boost segmental growth

- 6.2.5 PCIE 5.0

- 6.2.5.1 ML, advanced gaming, and HPC applications to contribute to segmental growth

- 6.2.6 PCIE 6.0

- 6.2.6.1 Higher data handling and processing efficiencies to foster segmental growth

- 6.2.1 PCIE 1.0

- 6.3 CXL

- 6.3.1 FLEXIBILITY AND MODULAR ARCHITECTURE ACCOMMODATING VARIOUS CONFIGURATIONS TO ACCELERATE SEGMENTAL GROWTH

- 6.4 USB

- 6.4.1 PROLIFERATION OF IOT DEVICES, SMART HOMES, AND CONNECTED VEHICLES TO SUPPORT MARKET GROWTH

- 6.5 OTHER INTERFACES

7 RETIMER MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 SERVERS

- 7.2.1 URGENT NEED TO IMPROVE SIGNAL INTEGRITY AND ENSURE HIGH-SPEED DATA TRANSFER TO DRIVE MARKET

- 7.3 STORAGE DEVICES

- 7.3.1 REQUIREMENT TO ENHANCE RELIABILITY AND LONGEVITY OF STORAGE SYSTEMS BY PREVENTING DATA CORRUPTION TO FACILITATE DEMAND

- 7.4 HARDWARE ACCESSORIES

- 7.4.1 RISING DEMAND FROM INDUSTRIES FOR HIGH-SPEED CONNECTIVITY AND DATA PROCESSING CAPABILITIES TO DRIVE MARKET

- 7.5 OTHER APPLICATIONS

8 RETIMER MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 IT & TELECOMMUNICATIONS

- 8.2.1 RISING DEMAND FROM DATA CENTERS TO BOOST SEGMENTAL GROWTH

- 8.3 BFSI

- 8.3.1 SURGING ADOPTION OF CLOUD-BASED SERVICES AND DIGITAL TECHNOLOGIES TO FUEL MARKET GROWTH

- 8.4 GOVERNMENT

- 8.4.1 GROWING FOCUS ON NATIONAL SECURITY AND SMART CITY INITIATIVES TO CREATE OPPORTUNITIES

- 8.5 HEALTHCARE

- 8.5.1 INCREASING TREND OF TELEMEDICINE AND REMOTE PATIENT MONITORING TO FOSTER MARKET GROWTH

- 8.6 TRANSPORTATION

- 8.6.1 ELEVATING DEPLOYMENT OF V2V AND V2X COMMUNICATION NETWORKS, ADAS, AND TRAFFIC MANAGEMENT SYSTEMS TO SUPPORT MARKET GROWTH

- 8.7 EDUCATION

- 8.7.1 ESCALATING USE OF CLOUD-BASED LMS AND AI-POWERED EDUCATIONAL TECHNOLOGIES TO PROPEL MARKET

- 8.8 RETAIL

- 8.8.1 RISING IMPLEMENTATION OF POS SYSTEMS, DIGITAL SIGNAGE, AND MOBILE PAYMENT SYSTEMS TO ACCELERATE MARKET GROWTH

- 8.9 OTHER END USERS

9 RETIMER MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Prominent presence of retimer manufacturers and adoption of 5G and IoT technologies to drive market

- 9.2.3 CANADA

- 9.2.3.1 Significant demand from IT & telecommunications and government sectors to contribute to market growth

- 9.2.4 MEXICO

- 9.2.4.1 Rapid expansion of data centers to accelerate market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Thriving transportation industry to boost market growth

- 9.3.3 UK

- 9.3.3.1 Increasing demand for high-speed data transmission networks to support market growth

- 9.3.4 FRANCE

- 9.3.4.1 Government and private sector investments in establishing data centers and AI hubs to fuel market growth

- 9.3.5 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Presence of numerous retimer manufacturers to drive market

- 9.4.3 INDIA

- 9.4.3.1 Rising demand for robust data centers due to booming e-commerce industry to drive market

- 9.4.4 JAPAN

- 9.4.4.1 Widespread adoption of 5G technology to create opportunities

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Significant presence of semiconductor manufacturers to support market growth

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 ROW

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Increasing investments in digital infrastructure to contribute to market growth

- 9.5.2.2 GCC countries

- 9.5.2.3 Rest of Middle East

- 9.5.3 AFRICA

- 9.5.3.1 Expanding telecom and 5G networks to create growth opportunities

- 9.5.4 SOUTH AMERICA

- 9.5.4.1 Digital transformation across telecom, healthcare, and education sectors to drive market

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 10.3 REVENUE ANALYSIS, 2019-2023

- 10.4 MARKET SHARE ANALYSIS, 2023

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.7.5.1 Company footprint

- 10.7.5.2 Interface footprint

- 10.7.5.3 Application footprint

- 10.7.5.4 End user footprint

- 10.7.5.5 Region footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 10.9.2 DEALS

- 10.9.3 OTHER DEVELOPMENTS

- 10.9.4 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ASTERA LABS, INC.

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches/Developments

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.3.4 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 BROADCOM

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches/Developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 MARVELL

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches/Developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 RENESAS ELECTRONICS CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths/Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses/Competitive threats

- 11.1.5 TEXAS INSTRUMENTS INCORPORATED

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths/Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses/Competitive threats

- 11.1.6 PARADE TECHNOLOGIES, LTD.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches/Developments

- 11.1.6.3.2 Deals

- 11.1.7 INTEL CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.8 DIODES INCORPORATED

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches/Developments

- 11.1.9 MICROCHIP TECHNOLOGY INC.

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches/Developments

- 11.1.10 MONTAGE TECHNOLOGY

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches/Developments

- 11.1.11 RAMBUS

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches/Developments

- 11.1.12 SEMTECH CORPORATION

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.13 PHISON ELECTRONICS

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product launches/Developments

- 11.1.13.3.2 Other developments

- 11.1.14 NUVOTON TECHNOLOGY CORPORATION

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Developments

- 11.1.15 KANDOU BUS SA

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches/Developments

- 11.1.15.3.2 Expansions

- 11.1.15.3.3 Other developments

- 11.1.1 ASTERA LABS, INC.

- 11.2 OTHER PLAYERS

- 11.2.1 ANALOGIX SEMICONDUCTOR, INC.

- 11.2.2 ASMEDIA TECHNOLOGY INC.

- 11.2.3 CHENGDU DIANKE XINGTUO TECHNOLOGY CO., LTD.

- 11.2.4 CREDO, INC.

- 11.2.5 INDIE SEMICONDUCTOR

- 11.2.6 LINKREAL CO., LTD.

- 11.2.7 MOSCHIP TECHNOLOGIES LIMITED

- 11.2.8 SAIDI SEMICONDUCTOR (SHENZHEN) CO., LTD.

- 11.2.9 TRUECHIP

- 11.2.10 WIWYNN CORPORATION

- 11.2.11 THINE ELECTRONICS, INC.

12 ADJACENT AND RELEVANT MARKETS

- 12.1 INTRODUCTION

- 12.2 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP

- 12.3 INTERFACE IP

- 12.3.1 RISING USE IN HDMI, USB, IP SYSTEM APPLICATIONS TO FUEL MARKET

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS