|

|

市場調査レポート

商品コード

1650862

サービスとしての暗号化市場:サービスタイプ別、組織規模別、業界別、地域別 - 2030年までの予測Encryption as a Service Market by Service Type (Data Encryption as a Service, Key Management as a Service, Email Encryption as a Service, Application-Level Encryption as a Service), Organization Size, Vertical, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| サービスとしての暗号化市場:サービスタイプ別、組織規模別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年02月05日

発行: MarketsandMarkets

ページ情報: 英文 240 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のサービスとしての暗号化(EaaS)の市場規模は、2024年の15億7,000万米ドルから2030年には59億8,000万米ドルに成長し、予測期間中の年間平均成長率(CAGR)は24.9%になると予測されています。

サービスとしての暗号化市場は、クラウド導入の増加と、データ保護規制への準拠を求めるユーザーからの要求の高まりが大きな原動力となっています。組織はクラウド環境に急速に移行しているため、高度なEaaSソリューションを通じて機密データを保護する必要性が高まっています。主要なクラウドプロバイダーは、利用を容易にするために、自社のクラウドプラットフォームに暗号化機能を統合することを求めています。GDPRとAESのコンプライアンス要求を満たす必要性が、EaaS市場をさらに加速させています。組織は、暗号化を含めなければならない厳格なデータ取り扱い慣行の下にあり、失敗は法的影響だけでなく、消費者の不信にもつながります。このような状況の中、企業は潜在的な金銭的損害や風評被害に直面しており、これに伴い暗号化サービスに対する需要も高まるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2030 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント | サービスタイプ別、組織規模別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

サービスとしての暗号化市場におけるヘルスケア分野は、機密性の高い患者データの増加や安全な通信に対する需要に牽引されて急成長しています。遠隔医療や遠隔診療の増加に伴い、ヘルスケア組織はHIPAAなどの要件を満たすためにデータ保護に注力しています。クラウドベースの暗号化ソリューションへの移行は、患者情報への不正アクセスのリスクを冒すことなく、広い地域でのアクセスを保護できることを意味します。アプリケーションレベルの暗号化は、個々の記録を固有のキーで暗号化するという意味で、現在人気を集めており、これにより医療提供者と患者間の電子通信時のセキュリティが強化されます。ヘルスケア機関に対するサイバー攻撃の脅威が高まっているため、暗号化対策を強化する必要があります。こうしたソリューションにAIやMLを組み込むことで、データ保護戦略が向上します。この成長は、デジタル脅威の変化と、高度にデジタル化されたヘルスケア環境において患者データの安全を確保する規制上の要求を反映しています。

カナダは、北米のサービスとしての暗号化市場で最も速い成長率が見込まれています。サイバーセキュリティ攻撃に対する懸念が高まっているため、企業は暗号化技術を採用し、機密データの保護により多く利用しています。中小企業はクラウド環境を採用する一方で、低コストの暗号化ソリューションを求めており、これが市場の需要を促進しています。技術の進歩、特にIoT機器と暗号化の統合は、セキュリティの状況を改善すると思われます。同国は、優れた規制支援、技術革新、サイバーセキュリティの課題に対する意識の高まりがあり、EaaS市場の大幅な成長に向けた好位置にあります。

当レポートでは、世界のサービスとしての暗号化市場について調査し、サービスタイプ別、組織規模別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- ポーターのファイブフォース分析

- バリューチェーン分析

- エコシステム分析

- 特許分析

- 価格分析

- 技術分析

- 生成AIがサービスとしての暗号化市場に与える影響

- 顧客ビジネスに影響を与える動向/混乱

- 主な利害関係者と購入基準

- 規制状況

- 規制機関、政府機関、その他の組織

- 2025年の主な会議とイベント

- 投資と資金調達のシナリオ

第6章 サービスとしての暗号化市場(サービスタイプ別)

- イントロダクション

- サービスとしてのデータ暗号化

- キー管理暗号化サービス

- サービスとしての電子メール暗号化

- アプリケーションレベルの暗号化サービス

- その他

第7章 サービスとしての暗号化市場(組織規模別)

- イントロダクション

- 大企業

- 中小企業

第8章 サービスとしての暗号化市場(業界別)

- イントロダクション

- BFSI

- 航空宇宙・防衛

- 政府・公共事業

- IT・通信

- ヘルスケア

- 小売

- その他

第9章 サービスとしての暗号化市場(地域別)

- イントロダクション

- 北米

- 北米:サービスとしての暗号化市場促進要因

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:サービスとしての暗号化市場促進要因

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- アジア太平洋:サービスとしての暗号化市場促進要因

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- インド

- その他

- 中東・アフリカ

- 中東・アフリカ:サービスとしての暗号市場促進要因

- 中東・アフリカ:マクロ経済見通し

- GCC諸国

- 南アフリカ

- その他

- ラテンアメリカ

- ラテンアメリカ:サービスとしての暗号化市場促進要因

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2024年

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- ブランド比較

- 企業価値評価と財務指標、2025年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- AWS

- CISCO

- HASHICORP

- BOX

- IBM

- MICROSOFT

- UTIMACO

- CLAI PAYMENTS TECHNOLOGIES

- RETARUS

- INTERMEDIA

- THALES

- NETWORK FISH

- STORMAGIC

- BLUEFIN

- COGITO GROUP

- KLOCH

- TENCENT CLOUD

- DELINEA

- その他の企業

- VIRTRU

- GARBLECLOUD

- PROTON

- FORTNAIX

- AKEYLESS

- NORDLOCKER

- PIIANO

第12章 隣接市場

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2023

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 ENCRYPTION AS A SERVICE MARKET SIZE AND GROWTH RATE, 2018-2023 (USD MILLION, Y-O-Y %)

- TABLE 4 ENCRYPTION AS A SERVICE MARKET SIZE AND GROWTH RATE, 2024-2030 (USD MILLION, Y-O-Y %)

- TABLE 5 IMPACT OF PORTER'S FIVE FORCES ON ENCRYPTION AS A SERVICE MARKET

- TABLE 6 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SERVICE TYPE

- TABLE 8 ENCRYPTION AS A SERVICE MARKET: INDICATIVE PRICING MODEL, BY SERVICE TYPE

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ENCRYPTION AS A SERVICE MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 16 ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 17 ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 18 DATA ENCRYPTION AS A SERVICE: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 19 DATA ENCRYPTION AS A SERVICE: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 20 KEY MANAGEMENT AS A SERVICE: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 21 KEY MANAGEMENT AS A SERVICE: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 22 EMAIL ENCRYPTION AS A SERVICE: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 23 EMAIL ENCRYPTION AS A SERVICE: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

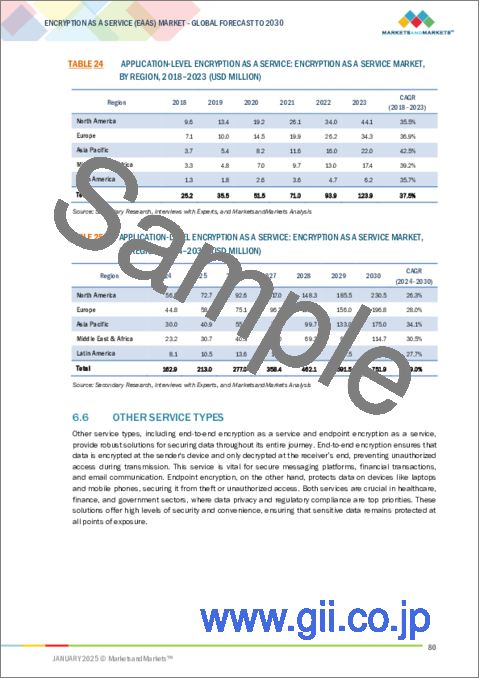

- TABLE 24 APPLICATION-LEVEL ENCRYPTION AS A SERVICE: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 25 APPLICATION-LEVEL ENCRYPTION AS A SERVICE: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 26 OTHER SERVICE TYPES: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 27 OTHER SERVICE TYPES: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 28 ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 29 ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 30 LARGE ENTERPRISES: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 31 LARGE ENTERPRISES: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 32 SMES: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 33 SMES: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 34 ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 35 ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 36 BFSI: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 37 BFSI: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 38 AEROSPACE & DEFENSE: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 39 AEROSPACE & DEFENSE: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 40 GOVERNMENT & PUBLIC UTILITIES: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 41 GOVERNMENT & PUBLIC UTILITIES: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 42 IT & TELECOMMUNICATIONS: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 43 IT & TELECOMMUNICATIONS: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 44 HEALTHCARE: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 45 HEALTHCARE: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 46 RETAIL: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 47 RETAIL: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 48 OTHER VERTICALS: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 49 OTHER VERTICALS: ENCRYPTION AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 50 ENCRYPTION AS A SERVICE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 51 ENCRYPTION AS A SERVICE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 53 NORTH AMERICA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 55 NORTH AMERICA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 57 NORTH AMERICA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: ENCRYPTION AS A SERVICE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 59 NORTH AMERICA: ENCRYPTION AS A SERVICE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 60 US: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 61 US: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 62 US: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 63 US: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 64 US: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 65 US: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 66 CANADA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 67 CANADA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 68 CANADA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 69 CANADA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 70 CANADA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 71 CANADA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 72 EUROPE: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 73 EUROPE: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 74 EUROPE: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 75 EUROPE: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 76 EUROPE: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 77 EUROPE: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 78 EUROPE: ENCRYPTION AS A SERVICE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 79 EUROPE: ENCRYPTION AS A SERVICE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 80 UK: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 81 UK: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 82 UK: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 83 UK: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 84 UK: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 85 UK: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 86 GERMANY: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 87 GERMANY: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 88 GERMANY: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 89 GERMANY: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 90 GERMANY: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 91 GERMANY: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 92 FRANCE: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 93 FRANCE: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 94 FRANCE: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 95 FRANCE: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 96 FRANCE: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 97 FRANCE: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 98 ITALY: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 99 ITALY: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 100 ITALY: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 101 ITALY: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 102 ITALY: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 103 ITALY: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 104 REST OF EUROPE: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 105 REST OF EUROPE: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 106 REST OF EUROPE: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 107 REST OF EUROPE: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 108 REST OF EUROPE: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 109 REST OF EUROPE: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 111 ASIA PACIFIC: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 113 ASIA PACIFIC: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 115 ASIA PACIFIC: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ENCRYPTION AS A SERVICE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ENCRYPTION AS A SERVICE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 118 CHINA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 119 CHINA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 120 CHINA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 121 CHINA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 122 CHINA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 123 CHINA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 124 JAPAN: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 125 JAPAN: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 126 JAPAN: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 127 JAPAN: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 128 JAPAN: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 129 JAPAN: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 130 INDIA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 131 INDIA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 132 INDIA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 133 INDIA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 134 INDIA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 135 INDIA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: ENCRYPTION AS A SERVICE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: ENCRYPTION AS A SERVICE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 150 GCC COUNTRIES: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 151 GCC COUNTRIES: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 152 GCC COUNTRIES: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 153 GCC COUNTRIES: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 154 GCC COUNTRIES: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 155 GCC COUNTRIES: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 156 GCC COUNTRIES: ENCRYPTION AS A SERVICE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 157 GCC COUNTRIES: ENCRYPTION AS A SERVICE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 158 KSA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 159 KSA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 160 KSA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 161 KSA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 162 KSA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 163 KSA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 164 UAE: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 165 UAE: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 166 UAE: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 167 UAE: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 168 UAE: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 169 UAE: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 170 REST OF GCC COUNTRIES: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 171 REST OF GCC COUNTRIES: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 172 REST OF GCC COUNTRIES: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 173 REST OF GCC COUNTRIES: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 174 REST OF GCC COUNTRIES: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 175 REST OF GCC COUNTRIES: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 176 SOUTH AFRICA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 177 SOUTH AFRICA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 178 SOUTH AFRICA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 179 SOUTH AFRICA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 180 SOUTH AFRICA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 181 SOUTH AFRICA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 187 REST OF MIDDLE EAST & AFRICA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 188 LATIN AMERICA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 189 LATIN AMERICA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 190 LATIN AMERICA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 191 LATIN AMERICA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 192 LATIN AMERICA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 193 LATIN AMERICA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 194 LATIN AMERICA: ENCRYPTION AS A SERVICE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 195 LATIN AMERICA: ENCRYPTION AS A SERVICE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 196 BRAZIL: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 197 BRAZIL: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 198 BRAZIL: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 199 BRAZIL: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 200 BRAZIL: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 201 BRAZIL: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 202 MEXICO: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 203 MEXICO: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 204 MEXICO: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 205 MEXICO: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 206 MEXICO: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 207 MEXICO: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 208 REST OF LATIN AMERICA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2018-2023 (USD MILLION)

- TABLE 209 REST OF LATIN AMERICA: ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030 (USD MILLION)

- TABLE 210 REST OF LATIN AMERICA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 211 REST OF LATIN AMERICA: ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 212 REST OF LATIN AMERICA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 213 REST OF LATIN AMERICA: ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 214 OVERVIEW OF STRATEGIES ADOPTED BY KEY ENCRYPTION AS A SERVICE VENDORS

- TABLE 215 ENCRYPTION AS A SERVICE MARKET: DEGREE OF COMPETITION

- TABLE 216 ENCRYPTION AS A SERVICE MARKET: REGIONAL FOOTPRINT

- TABLE 217 ENCRYPTION AS A SERVICE MARKET: SERVICE TYPE FOOTPRINT

- TABLE 218 ENCRYPTION AS A SERVICE MARKET: VERTICAL FOOTPRINT

- TABLE 219 ENCRYPTION AS A SERVICE MARKET: KEY STARTUPS/SMES

- TABLE 220 ENCRYPTION AS A SERVICE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY SERVICE TYPE

- TABLE 221 ENCRYPTION AS A SERVICE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY VERTICAL

- TABLE 222 ENCRYPTION AS A SERVICE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- TABLE 223 ENCRYPTION AS A SERVICE MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2022-DECEMBER 2024

- TABLE 224 ENCRYPTION AS A SERVICE MARKET: DEALS, JANUARY 2022-DECEMBER 2024

- TABLE 225 AWS: BUSINESS OVERVIEW

- TABLE 226 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 CISCO: BUSINESS OVERVIEW

- TABLE 228 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 HASHICORP: BUSINESS OVERVIEW

- TABLE 230 HASHICORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 HASHICORP: DEALS

- TABLE 232 GOOGLE: BUSINESS OVERVIEW

- TABLE 233 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 BOX: BUSINESS OVERVIEW

- TABLE 235 BOX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 IBM: BUSINESS OVERVIEW

- TABLE 237 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 MICROSOFT: BUSINESS OVERVIEW

- TABLE 239 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 MICROSOFT: DEALS

- TABLE 241 UTIMACO: BUSINESS OVERVIEW

- TABLE 242 UTIMACO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 UTIMACO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 244 CLAI PAYMENTS TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 245 CLAI PAYMENTS TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 RETARUS: BUSINESS OVERVIEW

- TABLE 247 RETARUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 RETARUS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 249 INTERMEDIA: BUSINESS OVERVIEW

- TABLE 250 INTERMEDIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 THALES: BUSINESS OVERVIEW

- TABLE 252 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 THALES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 254 NETWORK FISH: BUSINESS OVERVIEW

- TABLE 255 NETWORK FISH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 STORMAGIC: BUSINESS OVERVIEW

- TABLE 257 STORMAGIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 BLUEFIN: BUSINESS OVERVIEW

- TABLE 259 BLUEFIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 BLUEFIN: DEALS

- TABLE 261 COGITO GROUP: BUSINESS OVERVIEW

- TABLE 262 COGITO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 KLOCH: BUSINESS OVERVIEW

- TABLE 264 KLOCH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 ADJACENT MARKETS AND FORECASTS

- TABLE 266 ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2015-2020 (USD MILLION)

- TABLE 267 ENCRYPTION SOFTWARE MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- TABLE 268 ENCRYPTION SOFTWARE MARKET, BY APPLICATION, 2015-2020 (USD MILLION)

- TABLE 269 ENCRYPTION SOFTWARE MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- TABLE 270 ENCRYPTION SOFTWARE MARKET, BY DEPLOYMENT MODE, 2015-2020 (USD MILLION)

- TABLE 271 ENCRYPTION SOFTWARE MARKET, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- TABLE 272 ENCRYPTION SOFTWARE MARKET, BY ORGANIZATION SIZE, 2015-2020 (USD MILLION)

- TABLE 273 ENCRYPTION SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- TABLE 274 ENCRYPTION SOFTWARE MARKET, BY VERTICAL, 2015-2020 (USD MILLION)

- TABLE 275 ENCRYPTION SOFTWARE MARKET, BY VERTICAL, 2021-2026 (USD MILLION)

- TABLE 276 KEY MANAGEMENT AS A SERVICE MARKET, BY COMPONENT, 2016-2023 (USD MILLION)

- TABLE 277 KEY MANAGEMENT AS A SERVICE MARKET, BY APPLICATION, 2016-2023 (USD MILLION)

- TABLE 278 KEY MANAGEMENT AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016-2023 (USD MILLION)

- TABLE 279 KEY MANAGEMENT AS A SERVICE MARKET, BY VERTICAL, 2016-2023 (USD MILLION)

List of Figures

- FIGURE 1 ENCRYPTION AS A SERVICE MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 ENCRYPTION AS A SERVICE MARKET: DATA TRIANGULATION

- FIGURE 4 ENCRYPTION AS A SERVICE MARKET ESTIMATION: RESEARCH FLOW

- FIGURE 5 APPROACH 1 (SUPPLY SIDE): REVENUE FROM ENCRYPTION AS A SERVICE VENDORS

- FIGURE 6 APPROACH 1 (SUPPLY-SIDE ANALYSIS)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM-UP (DEMAND SIDE)

- FIGURE 8 GLOBAL ENCRYPTION AS A SERVICE MARKET SIZE AND Y-O-Y GROWTH RATE, 2022-2030

- FIGURE 9 SEGMENTS WITH SIGNIFICANT MARKET SHARE AND GROWTH RATE, 2024-2030

- FIGURE 10 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 11 GROWING ADOPTION OF CLOUD SERVICES TO DRIVE MARKET

- FIGURE 12 KEY MANAGEMENT AS A SERVICE SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 13 SMES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 14 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ENCRYPTION AS A SERVICE MARKET

- FIGURE 17 ENCRYPTION AS A SERVICE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 ENCRYPTION AS A SERVICE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 19 ENCRYPTION AS A SERVICE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 20 NUMBER OF PATENTS GRANTED FOR ENCRYPTION AS A SERVICE MARKET, 2014-2024

- FIGURE 21 ENCRYPTION AS A SERVICE MARKET: REGIONAL ANALYSIS OF PATENTS GRANTED

- FIGURE 22 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SERVICE TYPE

- FIGURE 23 MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING ENCRYPTION AS A SERVICE MARKET ACROSS INDUSTRIES

- FIGURE 24 IMPACT OF GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEM

- FIGURE 25 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 28 LEADING GLOBAL ENCRYPTION AS A SERVICE STARTUPS AND SMES, BY NUMBER OF INVESTORS AND FUNDING ROUNDS, 2021-2023

- FIGURE 29 APPLICATION-LEVEL ENCRYPTION AS A SERVICE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 SMES SEGMENT TO REGISTER HIGHER CAGR DURING THE FORECAST PERIOD

- FIGURE 31 IT & TELECOMMUNICATIONS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 35 SEGMENTAL REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2019-2023 (USD MILLION)

- FIGURE 36 SHARE OF LEADING COMPANIES IN ENCRYPTION AS A SERVICE MARKET

- FIGURE 37 ENCRYPTION AS A SERVICE MARKET: COMPARISON OF VENDORS' BRANDS

- FIGURE 38 ENCRYPTION AS A SERVICE MARKET: COMPANY VALUATION OF KEY VENDORS, 2025 (USD BILLION)

- FIGURE 39 ENCRYPTION AS A SERVICE MARKET: FINANCIAL METRICS OF KEY VENDORS, 2025

- FIGURE 40 ENCRYPTION AS A SERVICE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 41 ENCRYPTION AS A SERVICE MARKET: COMPANY FOOTPRINT

- FIGURE 42 ENCRYPTION AS A SERVICE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 43 AWS: COMPANY SNAPSHOT

- FIGURE 44 CISCO: COMPANY SNAPSHOT

- FIGURE 45 HASHICORP: COMPANY SNAPSHOT

- FIGURE 46 GOOGLE: COMPANY SNAPSHOT

- FIGURE 47 BOX: COMPANY SNAPSHOT

- FIGURE 48 IBM: COMPANY SNAPSHOT

- FIGURE 49 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 50 THALES: COMPANY SNAPSHOT

The global encryption as a service market size is projected to grow from USD 1.57 billion in 2024 to USD 5.98 billion by 2030 at a Compound Annual Growth Rate (CAGR) of 24.9% during the forecast period. The market for encryption as a service is largely driven by the rise in cloud adoption and increasing demand from users to comply with data protection regulations. Organizations are shifting very fast towards the cloud environment, hence, a strong need for protecting sensitive data through advanced EaaS solutions. Major cloud providers look for integration of encryption capabilities with their cloud platforms for ease in usage. The need to meet GDPR and AES compliance demands is further accelerating the market for EaaS. Organizations are under strict data handling practices that must include encryption, with failure leading to legal consequences as well as consumer distrust. In this context, companies face potential financial and reputational damage, and with this, there will be increased demand for encryption services.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | USD (Billion) |

| Segments | Service Type, Organization Size, Vertical and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

"By vertical, the healthcare segment is expected to grow at the second highest CAGR during the forecast period."

The healthcare segment in the encryption as a service market is growing rapidly, driven by the growth in sensitive patient data and demand for secure communication. As telemedicine and remote care are growing, healthcare organizations are largely concentrating on data protection to meet requirements such as those set by HIPAA. Migration to cloud-based encryption solutions means that access can be secured in a wide geographic area without risking unauthorized access to patient information. Application-level encryption is now gaining popularity in the sense that individual records are encrypted with unique keys, and this enhances security during electronic communications between providers and patients. The growing threats of cyberattacks on healthcare institutions necessitate stronger encryption measures. Incorporation of AI and ML in such solutions improves the data protection strategies. This growth reflects the changing digital threats and regulatory demands that ensure patient data is safe in a highly digital healthcare environment.

Canada is expected to grow at the highest CAGR in the North American region during the forecast period.

Canada is expected to grow at the fastest rate in the North American encryption as a service market. Due to growing concern about cybersecurity attacks, organizations embrace encryption technologies and use them more for securing confidential data. SMEs are very much in search of low-cost encryption solutions while they are adopting cloud environments, hence driving the market demand. Technological advancements particularly the integration of encryption with the IoT devices will improve the security landscape. The country has good regulatory support, technological innovation, and increased awareness of cybersecurity challenges, making it well positioned for significant growth in the EaaS market.

Breakdown of primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-Level Executives - 45%, Directors - 35%, Managers- 20%

- By Region: North America - 35%, Europe - 30%, Asia Pacific - 25%, Middle East and Africa - 5%, Latin America - 5%

Major vendors in the global encryption as a service market include AWS (US), Cisco (US), HashiCorp (US), Google (US), Box (US), IBM (US), Microsoft (US), Utimaco (Germany), CLAI PAYMENTS (US), Retarus (Germany), Intermedia (US), Thales (France), Network Fish (UK), StorMagic (UK), Bluefin (Georgia), Cogito Group (Australia), Kloch (US), Virtru (US), Tencent Cloud (China), GarbleCloud (US), Proton (Switzerland), Fortanix (US), Akeyless (US), NordLocker (Netherlands), Piiano (Israel), and Delinea (US).

The study includes an in-depth competitive analysis of the key players in the encryption as a service market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the encryption as a service market and forecasts its size by Service Type (data encryption as a service, key management as a service, email encryption as a service, and application-level encryption as a service), Organization Size (small and medium-sized enterprises, and large enterprises), Verticals (BFSI, aerospace & defense, government & public utilities, IT & telecommunications, healthcare, retail, and others).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall encryption as a service market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increase in cloud adoption, need for compliance with regulations regarding data protection, rising concerns to related to critical data loss), restraints (Limited control over data, and downtime in data accessing and processing), opportunities (Rise in IoT and BYOD adoption, and rising demand for integrated data protection solutions among SMEs), and challenges (Complexities in key management across diverse environments, difficulties in integrating encryption services with existing infrastructure, and vendor lock-in limits flexibility in EaaS adoption)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the encryption as a service market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the encryption as a service market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the encryption as a service market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in Encryption as a Service market strategies, including include AWS (US), Cisco (US), HashiCorp (US), Google (US), Box (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary profiles

- 2.1.2.2 Key insights from industry experts

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN ENCRYPTION AS A SERVICE MARKET

- 4.2 ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE, 2024-2030

- 4.3 ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2024-2030

- 4.4 ENCRYPTION AS A SERVICE MARKET, BY VERTICAL, 2024-2030

- 4.5 MARKET INVESTMENT SCENARIO, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in cloud adoption

- 5.2.1.2 Need for compliance with data protection regulations

- 5.2.1.3 Rising concerns related to critical data loss

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited control over data

- 5.2.2.2 Downtime in data accessing and processing

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise in IoT and BYoD adoption

- 5.2.3.2 Rising demand for integrated data protection solutions among SMEs

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities in key management across diverse environments

- 5.2.4.2 Difficulties in integrating encryption services with existing infrastructure

- 5.2.4.3 Vendor lock-in limits flexibility in EaaS adoption

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 THALES ENHANCED DATA SECURITY FOR MAJOR EUROPEAN ENERGY PROVIDER WITH ITS INTEGRATED SUITE OF SOLUTIONS

- 5.3.2 SENETAS CORPORATION HELPED SECURE CRITICAL INFRASTRUCTURE WITH HIGH-ASSURANCE ENCRYPTION SOLUTIONS

- 5.3.3 PERCEPTION POINT HELPED GLOBAL FOOD DISTRIBUTOR ENHANCE EMAIL SECURITY AND REDUCE OVERHEAD

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREAT OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 ENCRYPTION AS A SERVICE PROVIDERS

- 5.5.2 TECHNOLOGY PROVIDERS

- 5.5.3 INTEGRATION AND DEPLOYMENT

- 5.5.4 SALES AND DISTRIBUTION

- 5.5.5 END USERS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 PATENT ANALYSIS

- 5.7.1 LIST OF TOP PATENTS IN ENCRYPTION AS A SERVICE MARKET, 2022-2024

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE/PRICING MODEL OF ENCRYPTION AS A SERVICE MARKET

- 5.8.2 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SERVICE TYPE

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 AI/ML

- 5.9.1.2 Blockchain

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Zero trust

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Cloud computing

- 5.9.1 KEY TECHNOLOGIES

- 5.10 IMPACT OF GENERATIVE AI ON ENCRYPTION AS A SERVICE MARKET

- 5.10.1 TOP USE CASES & MARKET POTENTIAL

- 5.10.1.1 Key use cases

- 5.10.2 IMPACT OF GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEM

- 5.10.2.1 Cloud computing

- 5.10.2.2 Blockchain

- 5.10.2.3 Digital signature

- 5.10.2.4 Zero trust

- 5.10.1 TOP USE CASES & MARKET POTENTIAL

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 ADVANCED ENCRYPTION STANDARD (AES)

- 5.13.2 GENERAL DATA PROTECTION REGULATION

- 5.13.3 GRAMM-LEACH-BLILEY ACT

- 5.13.4 FEDERAL INFORMATION SECURITY MANAGEMENT ACT

- 5.13.5 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

- 5.13.6 SARBANES-OXLEY ACT

- 5.13.7 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

- 5.13.8 FEDERAL INFORMATION PROCESSING STANDARDS

- 5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 KEY CONFERENCES & EVENTS IN 2025

- 5.16 INVESTMENT AND FUNDING SCENARIO

6 ENCRYPTION AS A SERVICE MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- 6.1.1 SERVICE TYPE: ENCRYPTION AS A SERVICE MARKET DRIVERS

- 6.2 DATA ENCRYPTION AS A SERVICE

- 6.2.1 SIMPLIFYING DATA SECURITY BY ELIMINATING NEED FOR EXPENSIVE CRYPTOGRAPHIC HARDWARE

- 6.3 KEY MANAGEMENT ENCRYPTION AS A SERVICE

- 6.3.1 REDUCED COMPLEXITY OF KEY MANAGEMENT AND LOWER OPERATIONAL COSTS TO FUEL MARKET GROWTH

- 6.4 EMAIL ENCRYPTION AS A SERVICE

- 6.4.1 RISING PHISHING AND RANSOMWARE ATTACKS TO DRIVE DEMAND FOR EMAIL ENCRYPTION AS A SERVICE

- 6.5 APPLICATION-LEVEL ENCRYPTION AS A SERVICE

- 6.5.1 GRANULAR CONTROL AND TARGETED PROTECTION TO SAFEGUARD DATA THROUGHOUT ITS LIFECYCLE

- 6.6 OTHER SERVICE TYPES

7 ENCRYPTION AS A SERVICE MARKET, BY ORGANIZATION SIZE

- 7.1 INTRODUCTION

- 7.1.1 ORGANIZATION SIZE: ENCRYPTION AS A SERVICE MARKET DRIVERS

- 7.2 LARGE ENTERPRISES

- 7.2.1 SIMPLIFIED OPERATIONS AND REDUCED ADMINISTRATIVE OVERHEAD TO ACCELERATE MARKET GROWTH

- 7.3 SMES

- 7.3.1 SCALABILITY AND FLEXIBILITY OF CLOUD-BASED ENCRYPTION SERVICES TO DRIVE MARKET

8 ENCRYPTION AS A SERVICE MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.1.1 VERTICAL: ENCRYPTION AS A SERVICE MARKET DRIVERS

- 8.2 BFSI

- 8.2.1 EFFICIENT MANAGEMENT OF ENCRYPTION PROCESSES AND REDUCED OPERATIONAL COMPLEXITIES TO PROPEL MARKET GROWTH

- 8.3 AEROSPACE & DEFENSE

- 8.3.1 SECURE DATA HANDLING AND MITIGATION OF CYBER THREAT RISKS TO FOSTER MARKET GROWTH

- 8.4 GOVERNMENT & PUBLIC UTILITIES

- 8.4.1 STRINGENT CYBER LAWS AND COMPLIANCE REQUIREMENTS TO DRIVE ADOPTION OF ENCRYPTION SERVICES

- 8.5 IT & TELECOMMUNICATIONS

- 8.5.1 INCREASING NEED FOR SECURING VAST AMOUNTS OF PERSONAL AND SENSITIVE DATA TO BOOST MARKET

- 8.6 HEALTHCARE

- 8.6.1 INCREASING DIGITIZATION OF HEALTH RECORDS AND ADOPTION OF MOBILE HEALTH APPLICATIONS TO AID MARKET GROWTH

- 8.7 RETAIL

- 8.7.1 PROTECTING CUSTOMER DATA WITH ENCRYPTION AS A SERVICE IN RETAIL

- 8.8 OTHER VERTICALS

9 ENCRYPTION AS A SERVICE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: ENCRYPTION AS A SERVICE MARKET DRIVERS

- 9.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.3 US

- 9.2.3.1 Rising need for data security and secure communication channels to drive market

- 9.2.4 CANADA

- 9.2.4.1 Increasing cybersecurity awareness, regulatory pressures, and technological advancements to support market growth

- 9.3 EUROPE

- 9.3.1 EUROPE: ENCRYPTION AS A SERVICE MARKET DRIVERS

- 9.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.3 UK

- 9.3.3.1 Growing prevalence of digital transactions and online services to intensify need for advanced encryption

- 9.3.4 GERMANY

- 9.3.4.1 Heightened data privacy concerns and strict regulatory requirements to boost market

- 9.3.5 FRANCE

- 9.3.5.1 Surging demand for reliable encryption solutions to encourage market expansion

- 9.3.6 ITALY

- 9.3.6.1 Stringent regulatory compliance requirements and cybersecurity initiatives to boost market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: ENCRYPTION AS A SERVICE MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.3 CHINA

- 9.4.3.1 Industry developments and evolving regulatory frameworks to propel market growth

- 9.4.4 JAPAN

- 9.4.4.1 Rising investments in national cybersecurity strategies and proactive government initiatives to bolster market growth

- 9.4.5 INDIA

- 9.4.5.1 Surging need for strong encryption to protect personal data in centralized databases to enhance market growth

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: ENCRYPTION AS A SERVICE MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.3 GCC COUNTRIES

- 9.5.3.1 Increasing cybersecurity threats and government initiatives aimed at enhancing digital security to aid market growth

- 9.5.3.2 KSA

- 9.5.3.2.1 Stringent data protection regulations to drive continued investments in EaaS

- 9.5.3.3 UAE

- 9.5.3.3.1 Increasing digitalization and heightened focus on cybersecurity to accelerate market growth

- 9.5.3.4 Rest of GCC countries

- 9.5.4 SOUTH AFRICA

- 9.5.4.1 Growing integration of encryption within digital services aimed at improving urban management to foster market growth

- 9.5.5 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: ENCRYPTION AS A SERVICE MARKET DRIVERS

- 9.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.3 BRAZIL

- 9.6.3.1 Government's initiatives for enhancing cybersecurity frameworks to propel market growth

- 9.6.4 MEXICO

- 9.6.4.1 Increasing awareness regarding necessity of robust cybersecurity measures to drive market

- 9.6.5 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2024

- 10.3 REVENUE ANALYSIS, 2019-2023

- 10.4 MARKET SHARE ANALYSIS, 2023

- 10.5 BRAND COMPARISON

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 10.6.1 COMPANY VALUATION, 2025

- 10.6.2 FINANCIAL METRICS USING EV/EBIDTA, 2025

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Regional footprint

- 10.7.5.3 Service type footprint

- 10.7.5.4 Vertical footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 AWS

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 MnM view

- 11.1.1.3.1 Key strengths

- 11.1.1.3.2 Strategic choices

- 11.1.1.3.3 Weaknesses and competitive threats

- 11.1.2 CISCO

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 MnM view

- 11.1.2.3.1 Key strengths

- 11.1.2.3.2 Strategic choices

- 11.1.2.3.3 Weaknesses and competitive threats

- 11.1.3 HASHICORP

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 GOOGLE

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses and competitive threats

- 11.1.5 BOX

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 IBM

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.7 MICROSOFT

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.8 UTIMACO

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches and enhancements

- 11.1.9 CLAI PAYMENTS TECHNOLOGIES

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.10 RETARUS

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches and enhancements

- 11.1.11 INTERMEDIA

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.12 THALES

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches and enhancements

- 11.1.13 NETWORK FISH

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.14 STORMAGIC

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.15 BLUEFIN

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Deals

- 11.1.16 COGITO GROUP

- 11.1.16.1 Business overview

- 11.1.16.2 Products/Solutions/Services offered

- 11.1.17 KLOCH

- 11.1.17.1 Business overview

- 11.1.17.2 Products/Solutions/Services offered

- 11.1.18 TENCENT CLOUD

- 11.1.19 DELINEA

- 11.1.1 AWS

- 11.2 OTHER PLAYERS

- 11.2.1 VIRTRU

- 11.2.2 GARBLECLOUD

- 11.2.3 PROTON

- 11.2.4 FORTNAIX

- 11.2.5 AKEYLESS

- 11.2.6 NORDLOCKER

- 11.2.7 PIIANO

12 ADJACENT MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 ENCRYPTION AS A SERVICE ECOSYSTEM AND ADJACENT MARKETS

- 12.4 ENCRYPTION SOFTWARE MARKET

- 12.4.1 ENCRYPTION SOFTWARE MARKET, BY COMPONENT

- 12.4.2 ENCRYPTION SOFTWARE MARKET, BY APPLICATION

- 12.4.3 ENCRYPTION SOFTWARE MARKET, BY DEPLOYMENT MODE

- 12.4.4 ENCRYPTION SOFTWARE MARKET, BY ORGANIZATION SIZE

- 12.5 KEY MANAGEMENT AS A SERVICE MARKET

- 12.5.1 KEY MANAGEMENT AS A SERVICE MARKET, BY COMPONENT

- 12.5.2 KEY MANAGEMENT AS A SERVICE MARKET, BY APPLICATION

- 12.5.3 KEY MANAGEMENT AS A SERVICE MARKET, BY ORGANIZATION SIZE

- 12.5.4 KEY MANAGEMENT AS A SERVICE MARKET, BY VERTICAL

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS