|

|

市場調査レポート

商品コード

1650860

デジタルプロダクトパスポート(DPP)の世界市場:焦点分野別、ライフサイクルステージ別 - 予測(~2030年)Digital Product Passport (DPP) Market by Focus Area (Supply Chain Management, Circular Economy, Customer Engagement, Environmental Impact Assessment), Lifecycle Stage (Product Design, Production, Distribution, End of Life) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| デジタルプロダクトパスポート(DPP)の世界市場:焦点分野別、ライフサイクルステージ別 - 予測(~2030年) |

|

出版日: 2025年02月04日

発行: MarketsandMarkets

ページ情報: 英文 214 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のデジタルプロダクトパスポート(DPP)の市場規模は、2024年の1億8,590万米ドルから2030年までに17億8,050万米ドルに拡大し、予測期間にCAGRで45.7%の大幅な成長が見込まれます。

市場の主な促進要因は、持続可能性と循環型経済への取り組みです。DPPによってステークホルダーは詳細な製品情報を入手できるようになり、リサイクルとリユースが促進され、それによって国際的な持続可能性目標が支援されます。とはいえ、標準化と相互運用性の実現が難しいことが大きな制約となっています。普遍的に認知された枠組みが存在せず、産業内の技術基盤も多様であるため、シームレスなデータの統合と共有が困難です。これにより、企業が多様な標準に適応するための費用や複雑性といった課題に直面し、幅広い採用が妨げられる可能性があります。DPPを成功させ、製品ライフサイクル管理に革命をもたらすDPPの能力を実現するには、こうした障害に対処することが不可欠です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 100万米ドル |

| セグメント | 提供、焦点分野、ライフサイクルステージ、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「提供別では、ソフトウェアセグメントが予測期間に最大の市場シェアを占める見込みです。」

必要な製品の情報への容易なアクセスやサプライチェーン全体の統合とモニタリングにおいて大きな役割を担っていることから、予測期間にソフトウェアセグメントがデジタルプロダクトパスポート(DPP)市場をリードする見込みです。デジタルプロダクトパスポート(DPP)ソフトウェアソリューションは、原産地、組成、持続可能性指標、コンプライアンス要件などの基本的な製品情報の収集、保存、共有を可能にします。さらに、ブロックチェーン、AI、クラウドコンピューティングなどの技術の進歩により、これらのソフトウェアプラットフォームの機能性と拡張性が向上し、その魅力がさらに強まっています。組織が持続可能性とトレーサビリティを重視する中、徹底的で適応性の高いソリューションを提供するソフトウェア部門の能力は、市場の拡大に大きく寄与する重要な促進要因としての地位を確立しています。

「エンドユーザータイプ別では、バッテリーが予測期間にもっとも速い市場成長率を記録する見込みです。」

これは主に、再生可能エネルギー貯蔵用のバッテリーで動作するデバイスやソリューションに対する世界の需要が高まっているためです。電気自動車(EV)、ポータブルデバイス、エネルギー効率の高い技術の利用の向上が、バッテリーの製造とライフサイクル管理におけるトレーサビリティと持続可能性への需要を押し上げています。デジタルプロダクトパスポート(DPP)は、原材料のモニタリングの改善、環境規制の遵守、リサイクル活動を促進し、資源の枯渇や廃棄物に関する問題に取り組みます。欧州連合(EU)などの規制は、循環型経済の推進を重視しており、こうしたデジタルツールの利用を促進しています。産業と消費者が透明性と環境にやさしい活動を重視する中、デジタルプロダクトパスポート(DPP)は重要な進歩を推進し、市場の力強い拡大を促すことから、多くの用途で不可欠なバッテリーは重要です。

当レポートでは、世界のデジタルプロダクトパスポート(DPP)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- デジタルプロダクトパスポート(DPP)市場の魅力的な機会

- デジタルプロダクトパスポート(DPP)市場:上位3つの焦点分野

- 欧州のデジタルプロダクトパスポート(DPP)市場:提供別、ライフサイクルステージ別

- デジタルプロダクトパスポート(DPP)市場:地域別

第5章 市場の概要と産業動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 価格データ:オファー別

- 価格データ:焦点分野別

- サプライチェーン分析

- エコシステム

- デジタルプロダクトパスポート(DPP)プラットフォームプロバイダー

- デジタルプロダクトパスポート(DPP)ソフトウェアプロバイダー

- デジタルプロダクトパスポート(DPP)サービスプロバイダー

- エンドユーザー

- 政府と規制機関

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 調査手法

- 特許出願件数:文書タイプ別

- 主な会議とイベント(2024年~2025年)

- 投資情勢と資金調達シナリオ

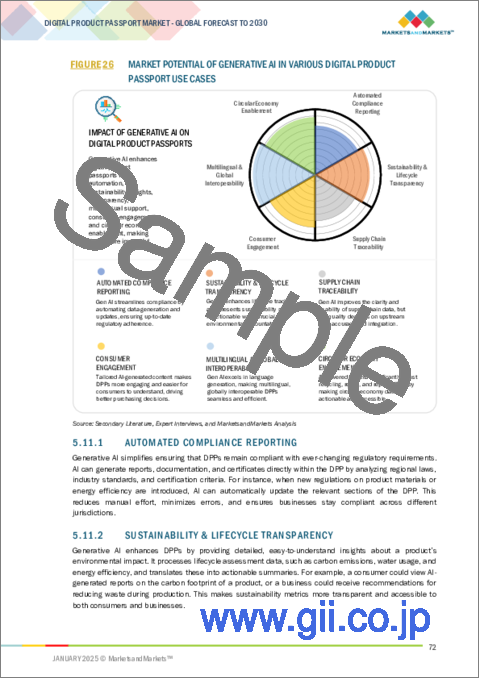

- デジタルプロダクトパスポート(DPP)市場に対する生成AIの影響

- 自動コンプライアンス報告

- 持続可能性・ライフサイクルの透明性

- サプライチェーンのトレーサビリティ

- 消費者エンゲージメント・教育

- 多言語・世界的相互運用性

- 循環型経済の実現

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制枠組み

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- デジタルプロダクトパスポート(DPP)の進化

- ケーススタディ分析

第6章 デジタルプロダクトパスポート(DPP)市場:提供別

- イントロダクション

- ソフトウェア

- サービス

第7章 デジタルプロダクトパスポート(DPP)市場:焦点分野別

- イントロダクション

- サプライチェーンマネジメント

- 環境影響の評価

- 循環型経済

- 規制遵守・報告

- 顧客エンゲージメント

- その他の焦点分野

第8章 デジタルプロダクトパスポート(DPP)市場:ライフサイクルステージ別

- イントロダクション

- 製品設計

- 生産

- 流通

- EOL

第9章 デジタルプロダクトパスポート(DPP)市場:エンドユーザー別

- イントロダクション

- エンドユーザー:規模別

- 大企業

- 中小企業

- エンドユーザー:タイプ別

- 電子・半導体

- 自動車

- バッテリー

- 医療・ライフサイエンス

- 化学品・材料

- ファッション・テキスタイル

- 建設

- その他のエンドユーザー

第10章 デジタルプロダクトパスポート(DPP)市場:地域別

- イントロダクション

- 北米

- 北米のデジタルプロダクトパスポート(DPP)市場の促進要因

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のデジタルプロダクトパスポート(DPP)市場の促進要因

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- アジア太平洋のデジタルプロダクトパスポート(DPP)市場の促進要因

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- 韓国

- その他のアジア太平洋

- その他の地域

- その他の地域のデジタルプロダクトパスポート(DPP)市場の促進要因

- その他の地域のマクロ経済の見通し

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 市場シェア分析

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- ブランド/製品の比較

- 企業の評価と財務指標

- 競合シナリオと動向

第12章 企業プロファイル

- イントロダクション

- 主要企業

- SIEMENS

- 3E

- DNV

- OPTEL GROUP

- AVL

- EVIDEN

- CIRCULOR

- PSQR

- BILLON GROUP

- NARRAVERO

- EON

- PROTOKOL

- その他の著名な企業

- CIRCULARISE

- THE ID FACTORY

- SPHERITY

- RENOON

- KEZZLER

- ASM GLOBAL

- QLIKTAG

- IPOINT-SYSTEMS

- CARBOLEDGER

- SCANTRUST

- PATHWAY DIGITAL PRODUCTS

- MINESPIDER

- PICONEXT

- ARIANEE

- 概念実証/研究段階

- LYONDELLBASELL

- CIRPASS

第13章 隣接市場と関連市場

- イントロダクション

- デジタル循環型経済市場 - 世界の予測(~2028年)

- 市場の定義

- 市場の概要

- ESG報告ソフトウェア市場 - 世界の予測(~2029年)

- 市場の定義

- 市場の概要

第14章 付録

List of Tables

- TABLE 1 US DOLLAR EXCHANGE RATE, 2023

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 GLOBAL DIGITAL PRODUCT PASSPORT MARKET SIZE AND GROWTH RATE, 2023-2030 (USD MILLION, Y-O-Y)

- TABLE 5 PRICING DATA OF DIGITAL PRODUCT PASSPORT, BY OFFERING

- TABLE 6 PRICING DATA OF DIGITAL PRODUCT PASSPORT, BY FOCUS AREA

- TABLE 7 DIGITAL PRODUCT PASSPORT MARKET: ECOSYSTEM

- TABLE 8 PATENTS FILED, 2015-2024

- TABLE 9 DIGITAL PRODUCT PASSPORT MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- TABLE 10 LIST OF FEW PATENTS IN DIGITAL PRODUCT PASSPORT MARKET, 2023-2024

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 PORTERS' FIVE FORCES' IMPACT ON DIGITAL PRODUCT PASSPORT MARKET

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 19 DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 20 SOFTWARE: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 21 SERVICES: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 22 DIGITAL PRODUCT PASSPORT MARKET, BY FOCUS AREA, 2023-2030 (USD MILLION)

- TABLE 23 SUPPLY CHAIN MANAGEMENT: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 24 ENVIRONMENTAL IMPACT ASSESSMENT: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 25 CIRCULAR ECONOMY: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 26 REGULATORY COMPLIANCE & REPORTING: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 27 CUSTOMER ENGAGEMENT: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 OTHER FOCUS AREAS: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 DIGITAL PRODUCT PASSPORT MARKET, BY LIFECYCLE STAGE, 2023-2030 (USD MILLION)

- TABLE 30 PRODUCT DESIGN: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 PRODUCTION: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 DISTRIBUTION: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 END OF LIFE: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 DIGITAL PRODUCT PASSPORT MARKET, BY END-USER SIZE, 2023-2030 (USD MILLION)

- TABLE 35 LARGE ENTERPRISES: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 SMALL AND MEDIUM-SIZED ENTERPRISES: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 DIGITAL PRODUCT PASSPORT MARKET, BY END-USER TYPE, 2023-2030 (USD MILLION)

- TABLE 38 ELECTRONICS & SEMICONDUCTORS: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 AUTOMOTIVE: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 BATTERIES: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 HEALTHCARE & LIFE SCIENCES: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 CHEMICALS & MATERIALS: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 FASHION & TEXTILES: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 CONSTRUCTION: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 OTHER END USERS: DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 DIGITAL PRODUCT PASSPORT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: DIGITAL PRODUCT PASSPORT MARKET, BY FOCUS AREA, 2023-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: DIGITAL PRODUCT PASSPORT MARKET, BY LIFECYCLE STAGE, 2023-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: DIGITAL PRODUCT PASSPORT MARKET, BY END-USER SIZE, 2023-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: DIGITAL PRODUCT PASSPORT MARKET, BY END-USER TYPE, 2023-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: DIGITAL PRODUCT PASSPORT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 US: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 54 CANADA: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 55 EUROPE: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 56 EUROPE: DIGITAL PRODUCT PASSPORT MARKET, BY FOCUS AREA, 2023-2030 (USD MILLION)

- TABLE 57 EUROPE: DIGITAL PRODUCT PASSPORT MARKET, BY LIFECYCLE STAGE, 2023-2030 (USD MILLION)

- TABLE 58 EUROPE: DIGITAL PRODUCT PASSPORT MARKET, BY END-USER SIZE, 2023-2030 (USD MILLION)

- TABLE 59 EUROPE: DIGITAL PRODUCT PASSPORT MARKET, BY END-USER TYPE, 2023-2030 (USD MILLION)

- TABLE 60 EUROPE: DIGITAL PRODUCT PASSPORT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 UK: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 62 GERMANY: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 63 FRANCE: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 64 REST OF EUROPE: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 66 ASIA PACIFIC: DIGITAL PRODUCT PASSPORT MARKET, BY FOCUS AREA, 2023-2030 (USD MILLION)

- TABLE 67 ASIA PACIFIC: DIGITAL PRODUCT PASSPORT MARKET, BY LIFECYCLE STAGE, 2023-2030 (USD MILLION)

- TABLE 68 ASIA PACIFIC: DIGITAL PRODUCT PASSPORT MARKET, BY END-USER SIZE, 2023-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: DIGITAL PRODUCT PASSPORT MARKET, BY END-USER TYPE, 2023-2030 (USD MILLION)

- TABLE 70 ASIA PACIFIC: DIGITAL PRODUCT PASSPORT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 CHINA: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 72 JAPAN: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 73 SOUTH KOREA: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 74 REST OF ASIA PACIFIC: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 75 REST OF WORLD: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 76 REST OF WORLD: DIGITAL PRODUCT PASSPORT MARKET, BY FOCUS AREA, 2023-2030 (USD MILLION)

- TABLE 77 REST OF WORLD: DIGITAL PRODUCT PASSPORT MARKET, BY LIFECYCLE STAGE, 2023-2030 (USD MILLION)

- TABLE 78 REST OF WORLD: DIGITAL PRODUCT PASSPORT MARKET, BY END-USER SIZE, 2023-2030 (USD MILLION)

- TABLE 79 REST OF WORLD: DIGITAL PRODUCT PASSPORT MARKET, BY END-USER TYPE, 2023-2030 (USD MILLION)

- TABLE 80 REST OF WORLD: DIGITAL PRODUCT PASSPORT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 LATIN AMERICA: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 82 MIDDLE EAST & AFRICA: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 83 OVERVIEW OF STRATEGIES ADOPTED BY KEY DIGITAL PRODUCT PASSPORT VENDORS

- TABLE 84 DIGITAL PRODUCT PASSPORT MARKET: DEGREE OF COMPETITION

- TABLE 85 OFFERING FOOTPRINT (13 COMPANIES)

- TABLE 86 FOCUS AREA FOOTPRINT (13 COMPANIES)

- TABLE 87 END-USER FOOTPRINT (13 COMPANIES)

- TABLE 88 REGIONAL FOOTPRINT (13 COMPANIES)

- TABLE 89 DIGITAL PRODUCT PASSPORT MARKET: KEY START-UPS/SMES

- TABLE 90 DIGITAL PRODUCT PASSPORT MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 91 DIGITAL PRODUCT PASSPORT MARKET: PRODUCT LAUNCHES, DECEMBER 2022-NOVEMBER 2024

- TABLE 92 DIGITAL PRODUCT PASSPORT MARKET: DEALS, DECEMBER 2022-NOVEMBER 2024

- TABLE 93 SIEMENS: COMPANY OVERVIEW

- TABLE 94 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 95 SIEMENS: PRODUCT LAUNCHES

- TABLE 96 SIEMENS: DEALS

- TABLE 97 3E: COMPANY OVERVIEW

- TABLE 98 3E: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 99 3E: PRODUCT LAUNCHES

- TABLE 100 3E: DEALS

- TABLE 101 DNV: COMPANY OVERVIEW

- TABLE 102 DNV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 103 OPTEL GROUP: COMPANY OVERVIEW

- TABLE 104 OPTEL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 105 OPTEL GROUP: PRODUCT LAUNCHES

- TABLE 106 OPTEL GROUP: DEALS

- TABLE 107 AVL: COMPANY OVERVIEW

- TABLE 108 AVL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 109 AVL: PRODUCT LAUNCHES

- TABLE 110 EVIDEN: COMPANY OVERVIEW

- TABLE 111 EVIDEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 112 EVIDEN: PRODUCT LAUNCHES

- TABLE 113 EVIDEN: DEALS

- TABLE 114 LYONDELLBASELL: COMPANY OVERVIEW

- TABLE 115 LYONDELLBASELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 116 DIGITAL CIRCULAR ECONOMY MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 117 DIGITAL CIRCULAR ECONOMY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 118 DIGITAL CIRCULAR ECONOMY MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 119 DIGITAL CIRCULAR ECONOMY MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 120 DIGITAL CIRCULAR ECONOMY MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 121 DIGITAL CIRCULAR ECONOMY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 122 DIGITAL CIRCULAR ECONOMY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 123 DIGITAL CIRCULAR ECONOMY MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 124 ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 125 ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 126 ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 127 ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 128 ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 129 ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 130 ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 131 ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 132 ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 133 ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 DIGITAL PRODUCT PASSPORT MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 DIGITAL PRODUCT PASSPORT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM OFFERINGS IN DIGITAL PRODUCT PASSPORT MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL OFFERINGS IN DIGITAL PRODUCT PASSPORT MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM OFFERINGS IN DIGITAL PRODUCT PASSPORT MARKET

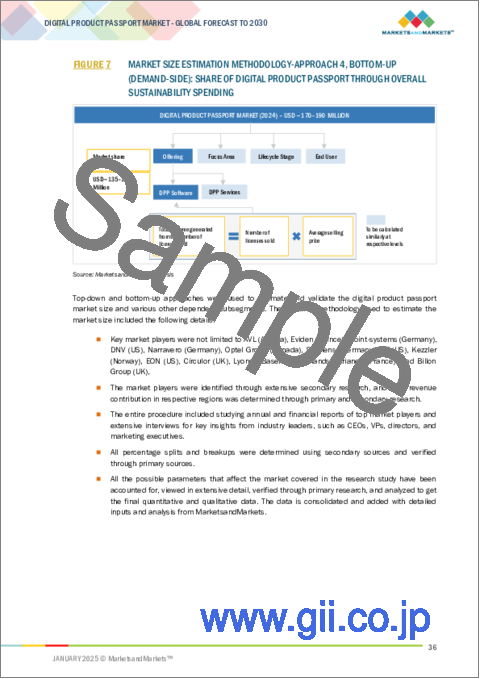

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF DIGITAL PRODUCT PASSPORT THROUGH OVERALL SUSTAINABILITY SPENDING

- FIGURE 8 DIGITAL PRODUCT PASSPORT SOFTWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2024

- FIGURE 9 SUPPLY CHAIN MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET BY FOCUS AREA IN 2024

- FIGURE 10 PRODUCTION SEGMENT TO HOLD LARGEST MARKET BY LIFECYCLE STAGE IN 2024

- FIGURE 11 LARGE ENTERPRISES SEGMENT TO REGISTER LARGER MARKET SHARE IN 2024

- FIGURE 12 BATTERIES SEGMENT TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 13 EUROPE TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 14 STRICTER GLOBAL REGULATIONS FOR CIRCULAR ECONOMY AND RISING CONSUMER DEMAND FOR TRANSPARENCY TO PROPEL MARKET

- FIGURE 15 CIRCULAR ECONOMY SEGMENT TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 16 DPP SOFTWARE AND PRODUCTION STAGE TO HOLD LARGEST MARKET SHARE IN EUROPE IN 2024

- FIGURE 17 EUROPE TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DIGITAL PRODUCT PASSPORT MARKET

- FIGURE 19 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 20 DIGITAL PRODUCT PASSPORT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 KEY PLAYERS IN DIGITAL PRODUCT PASSPORT MARKET ECOSYSTEM

- FIGURE 22 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2015-2024

- FIGURE 23 REGIONAL ANALYSIS OF PATENTS GRANTED, 2015-2024

- FIGURE 24 DIGITAL PRODUCT PASSPORT MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- FIGURE 25 CIRCULAR ECONOMY START-UP FUNDING, BY CATEGORY

- FIGURE 26 MARKET POTENTIAL OF GENERATIVE AI IN VARIOUS DIGITAL PRODUCT PASSPORT USE CASES

- FIGURE 27 DIGITAL PRODUCT PASSPORT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 30 EVOLUTION OF DIGITAL PRODUCT PASSPORTS

- FIGURE 31 SOFTWARE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 CIRCULAR ECONOMY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 DISTRIBUTION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 SMALL AND MEDIUM ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 BATTERIES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 FRANCE TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 EUROPE TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 EUROPE: MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 40 SHARE OF LEADING COMPANIES IN DIGITAL PRODUCT PASSPORT MARKET, 2023

- FIGURE 41 DIGITAL PRODUCT PASSPORT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 42 COMPANY FOOTPRINT (13 COMPANIES)

- FIGURE 43 DIGITAL PRODUCT PASSPORT MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 44 BRAND/PRODUCT COMPARISON

- FIGURE 45 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 46 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 47 SIEMENS: COMPANY SNAPSHOT

- FIGURE 48 LYONDELLBASELL: COMPANY SNAPSHOT

It is anticipated that the Digital Product Passport (DPP) market will experience substantial growth, increasing from USD 185.9 million in 2024 to USD 1,780.5 million by 2030, with a strong CAGR of 45.7% throughout the forecast period. A key factor driving the market for Digital Product Passport is sustainability and circular economy efforts. DPPs allow stakeholders to obtain detailed product information, promoting recycling and reuse, and thereby supporting international sustainability objectives. Nonetheless, a major limitation is the difficulty of achieving standardization and interoperability. The absence of universally recognized frameworks and varied technological infrastructures within industries makes seamless data integration and sharing challenging. This may impede broad adoption as companies face challenges with the expenses and intricacies of adjusting to diverse standards. Addressing these obstacles is essential for the successful execution of DPPs and realizing their ability to revolutionize product lifecycle management.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | USD (Million) |

| Segments | Offering, Focus Area, Lifecycle Stage, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, and Rest of World |

"By offering, software segment is expected to have the largest market share during the forecast period"

During the forecast period, it is estimated that the software segment will lead the digital product passport market as that industry holds a big deal in integration and monitoring across the supply chain with ease and access to the required information of the product. Digital product passport software solutions can enable the collection, storage, and sharing of fundamental product information like origin, composition, sustainability metrics, and compliance requirements. Additionally, progress in technologies such as blockchain, AI, and cloud computing improves the functionality and scalability of these software platforms, further reinforcing their attractiveness. With organizations placing greater emphasis on sustainability and traceability, the software sector's capability to deliver thorough and adaptable solutions establishes it as a crucial facilitator, significantly aiding in market expansion.

"By end user type, batteries are expected to register the fastest market growth rate during the forecast period."

In the digital product passport market, the battery segment by end user type is projected to experience the fastest growth rate in the forecast period. It is mainly because of the growing global demand for devices and solutions running on batteries for renewable energy storage. The rising application of electric vehicles (EVs), portable devices, and energy-efficient technologies has boosted the demand for traceability and sustainability in the manufacturing and lifecycle management of the battery. Digital product passports facilitate improved monitoring of raw materials, adherence to environmental regulations, and recycling initiatives, tackling issues related to resource exhaustion and waste. Regulations such as those from the European Union emphasize the promotion of circular economies, which enhances the use of these digital tools. With industries and consumers emphasizing transparency and environmentally friendly practices, batteries, essential in many uses, are crucial as digital product passports propel notable progress and encourage strong market expansion.

"By region, Europe to have the largest market share in 2024 and will also account for fastest growth rate between 2024 to 2030. North America to follow as the second fastest growing region over the forecast period"

Europe is expected to dominate the Digital Product Passport (DPP) market in 2024 and experience the fastest growth rate through 2030 due to several factors. The European Union's strong focus on sustainability and circular economy initiatives, such as the European Green Deal and the Circular Economy Action Plan, promotes the widespread adoption of DPPs. These digital solutions enable efficient tracking, recycling, and reuse of products, aligning with Europe's environmental goals. Additionally, stringent regulations, including the extended producer responsibility (EPR) laws, encourage the integration of DPPs across industries.

North America follows closely, driven by increasing demand for transparency in supply chains and consumer preferences for sustainable products. The region's advanced technological infrastructure and robust corporate support for digital solutions will fuel rapid adoption, making it the second-fastest-growing market for DPPs over the forecast period.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the Digital product passport market.

- By Company: Tier I - 14%, Tier II - 33%, and Tier III - 53%

- By Designation: Directors- 57%, Managers - 26%, and others - 17%

- By Region: North America - 22%, Europe - 59%, Asia Pacific - 14%, and Rest of World- 5%

The report includes the study of key players offering Digital product passport solutions. It profiles major vendors in the Digital product passport market. The major players in the Digital product passport market include AVL (Austria), Eviden (France), iPoint-systems (Germany), DNV (US), Narravero (Germany), Optel Group (Canada), Siemens (Germany), 3E (US), Kezzler (Norway), EON (US), Circulor (UK), LyondellBasell (Netherlands), Arianee (France), Billon Group (UK), Qliktag (US), Protokol (Netherlands), Circularise (Netherlands), The ID Factory (Italy), Renoon (Netherlands), Spherity (Germany), ASM Global (India), Carboledger (US), Scantrust (Switzerland), Pathway Digital Products (UK), Minespider (Germany), Cirpass (France), Piconext (US), and PSQR (Denmark).

Research coverage

This research report categorizes the Digital product passport Market by offering (software and services), by focus area (supply chain management, environmental impact assessment, circular economy, regulatory compliance & reporting, customer engagement, and other focus areas), by product lifecycle stage (product design, production, distribution and end of life) by end user (end user by size and end user by type) and by Region (North America, Europe, Asia Pacific, and rest of the world). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the Digital product passport market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the Digital product passport market. Competitive analysis of upcoming startups in the Digital product passport market ecosystem is covered in this report.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Digital product passport market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increased consumer demand for transparency, Growing importance of battery passports in advancing sustainability goals, EU regulations for sustainable circular economy), restraints (High implementation costs in budget-constrained industries, Privacy and security concerns in collecting and sharing sensitive product data), opportunities (Digital product passport in precision healthcare and drug discovery, Technological advancements in blockchain, IoT, and AI driving efficient DPP implementation ), and challenges (Slow adoption due to lack of education and industry resistance, Legacy system compatibility and lack of standardized frameworks).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Digital product passport market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Digital product passport market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Digital product passport market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like AVL (Austria), Eviden (France), iPoint-systems (Germany), DNV (US), Narravero (Germany), Optel Group (Canada), Siemens (Germany), 3E (US), Kezzler (Norway), EON (US), Circulor (UK), LyondellBasell (Netherlands), Arianee (France), Billon Group (UK), Qliktag (US), Protokol (Netherlands), Circularise (Netherlands), The ID Factory (Italy), Renoon (Netherlands), Spherity (Germany), ASM Global (India), Carboledger (US), Scantrust (Switzerland), Pathway Digital Products (UK), Minespider (Germany), Cirpass (France), Piconext (US), and PSQR (Denmark) among others in the Digital product passport market. The report also helps stakeholders understand the pulse of the Digital product passport market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key insights from industry experts

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN DIGITAL PRODUCT PASSPORT MARKET

- 4.2 DIGITAL PRODUCT PASSPORT MARKET: TOP THREE FOCUS AREAS

- 4.3 EUROPE: DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING AND LIFECYCLE STAGE

- 4.4 DIGITAL PRODUCT PASSPORT MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased consumer demand for transparency

- 5.2.1.2 Growing importance of battery passports in advancing sustainability goals

- 5.2.1.3 EU regulations for sustainable circular economy

- 5.2.2 RESTRAINTS

- 5.2.2.1 High implementation costs in budget-constrained industries

- 5.2.2.2 Privacy and security concerns in collecting and sharing sensitive product data

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Digital product passport in precision healthcare and drug discovery

- 5.2.3.2 Technological advancements in blockchain, IoT, and AI driving efficient DPP implementation

- 5.2.4 CHALLENGES

- 5.2.4.1 Slow adoption due to lack of education and industry resistance

- 5.2.4.2 Legacy system compatibility and lack of standardized frameworks

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING DATA, BY OFFERING

- 5.4.2 PRICING DATA, BY FOCUS AREA

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM

- 5.6.1 DIGITAL PRODUCT PASSPORT PLATFORM PROVIDERS

- 5.6.2 DIGITAL PRODUCT PASSPORT SOFTWARE PROVIDERS

- 5.6.3 DIGITAL PRODUCT PASSPORT SERVICE PROVIDERS

- 5.6.4 END USERS

- 5.6.5 GOVERNMENT & REGULATORY BODIES

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Blockchain and Distributed Ledger Technology (DLT)

- 5.7.1.2 Internet of Things (IoT)

- 5.7.1.3 RFID/NFC tags/QR codes

- 5.7.1.4 Cloud computing

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 AR/VR

- 5.7.2.2 Natural Language Processing (NLP)

- 5.7.2.3 Digital watermarking

- 5.7.2.4 Active packaging

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Machine Learning (ML)

- 5.7.3.2 Digital twin

- 5.7.3.3 Edge computing

- 5.7.3.4 Data encryption

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.8.1 METHODOLOGY

- 5.8.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.9 KEY CONFERENCES AND EVENTS (2024-2025)

- 5.9.1 INNOVATION AND PATENT APPLICATIONS

- 5.10 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.11 IMPACT OF GENERATIVE AI ON DIGITAL PRODUCT PASSPORT MARKET

- 5.11.1 AUTOMATED COMPLIANCE REPORTING

- 5.11.2 SUSTAINABILITY & LIFECYCLE TRANSPARENCY

- 5.11.3 SUPPLY CHAIN TRACEABILITY

- 5.11.4 CONSUMER ENGAGEMENT & EDUCATION

- 5.11.5 MULTILINGUAL & GLOBAL INTEROPERABILITY

- 5.11.6 CIRCULAR ECONOMY ENABLEMENT

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATORY FRAMEWORK

- 5.12.2.1 North America

- 5.12.2.1.1 The Consumer Product Safety Improvement Act (CPSIA) (US)

- 5.12.2.1.2 Directive on Automated Decision-Making (Canada)

- 5.12.2.2 Europe

- 5.12.2.2.1 Ecodesign for Sustainable Products Regulation (ESPR) (Europe Union)

- 5.12.2.2.2 Battery Regulation (EU 2023/1542) (European Union)

- 5.12.2.2.3 Waste Framework Directive (2008/98/EC) (European Union)

- 5.12.2.2.4 The European Green Deal (European Union)

- 5.12.2.3 Asia Pacific

- 5.12.2.3.1 National Waste Policy Action Plan (2019) (Australia)

- 5.12.2.3.2 Act on the Promotion of Recycling of Used Consumer Electrical Appliances (Japan)

- 5.12.2.3.3 Law on the Prevention and Control of Environmental Pollution by Solid Waste (2016) (China)

- 5.12.2.3.4 Extended Producer Responsibility (EPR) for Electronics and Batteries (South Korea)

- 5.12.2.4 Middle East & Africa

- 5.12.2.4.1 The Federal Decree-Law No. 14/2023 (UAE)

- 5.12.2.4.2 Saudi Arabia Personal Data Protection Law (PDPL) (Saudi Arabia)

- 5.12.2.4.3 Qatari Law No. 13 of 2016 (Qatar)

- 5.12.2.5 Latin America

- 5.12.2.5.1 Brazilian General Data Protection Law (LGPD) (Brazil)

- 5.12.2.5.2 Chile's Data Protection Law (Ley 19.496) (Chile)

- 5.12.2.1 North America

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 EVOLUTION OF DIGITAL PRODUCT PASSPORT

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 CASE STUDY 1: STEFANO BEMER AND NARRAVERO REVOLUTIONIZED CUSTOMER EXPERIENCE WITH DPP TO ENHANCE TRANSPARENCY AND SUSTAINABILITY

- 5.16.2 CASE STUDY 2: PORSCHE ADVANCED SUSTAINABLE AUTOMOTIVE PRACTICES WITH BLOCKCHAIN-ENABLED SUPPLY CHAIN TRANSPARENCY OF CIRCULARISE

- 5.16.3 CASE STUDY 3: HOLZWEILER ACCELERATED FAULT DETECTION WITH TRIMCO GROUP AND KEZZLER'S DIGITAL PRODUCT PASSPORT FOR ENHANCED PRODUCT RELIABILITY IN MANUFACTURING

- 5.16.4 CASE STUDY 4: TOMMY HILFIGER AND ID FACTORY REVOLUTIONIZED SUPPLY CHAIN TRANSPARENCY WITH TRACEABILITY SYSTEMS AND DIGITAL PRODUCT PASSPORTS

- 5.16.5 CASE STUDY 5: FIBRE FOR GOOD ACCELERATED ITS JOURNEY TO SUSTAINABLE APPAREL WITH PICONEXT DIGITAL PRODUCT PASSPORTS

6 DIGITAL PRODUCT PASSPORT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: DIGITAL PRODUCT PASSPORT MARKET DRIVERS

- 6.2 SOFTWARE

- 6.2.1 DPP SOFTWARE TO PROVIDE CENTRALIZED DATA MANAGEMENT AND ENABLE STAKEHOLDERS TO ACCESS CRITICAL LIFECYCLE DATA SEAMLESSLY

- 6.3 SERVICES

- 6.3.1 NEED TO DRIVE TRANSPARENCY AND COMPLIANCE TO FUEL DEMAND FOR DIGITAL PRODUCT PASSPORT SERVICES

7 DIGITAL PRODUCT PASSPORT MARKET, BY FOCUS AREA

- 7.1 INTRODUCTION

- 7.1.1 FOCUS AREAS: DIGITAL PRODUCT PASSPORT MARKET DRIVERS

- 7.2 SUPPLY CHAIN MANAGEMENT

- 7.2.1 AI-POWERED ANALYTICS TO EXTRACT INSIGHTS FROM DPP DATA TO ENABLE COMPANIES TO OPTIMIZE PROCESSES, FORECAST DISRUPTIONS, AND ENSURE SUPPLY CHAIN RESILIENCE

- 7.3 ENVIRONMENTAL IMPACT ASSESSMENT

- 7.3.1 NEED TO INCORPORATE ENVIRONMENTAL IMPACT ASSESSMENT TO ENSURE TRANSPARENCY REGARDING ECOLOGICAL EFFECTS OF MANUFACTURING AND DISPOSAL

- 7.4 CIRCULAR ECONOMY

- 7.4.1 DPPS TO HELP COMPANIES MEET REGULATORY REQUIREMENTS AND STRENGTHEN CONSUMER TRUST IN SUSTAINABLE PRODUCTS

- 7.5 REGULATORY COMPLIANCE & REPORTING

- 7.5.1 NEED TO STREAMLINE REPORTING PROCESS BY CONSOLIDATING LIFECYCLE DATA IN REAL-TIME TO ENABLE BUSINESSES TO MEET COMPLIANCE DEADLINES EFFICIENTLY

- 7.6 CUSTOMER ENGAGEMENT

- 7.6.1 BRANDS TO OFFER TAILORED RECOMMENDATIONS AND SERVICES WITH DPPS CONTAINING PRODUCT-SPECIFIC AND POTENTIALLY CUSTOMER-CENTRIC DATA

- 7.7 OTHER FOCUS AREAS

8 DIGITAL PRODUCT PASSPORT MARKET, BY LIFECYCLE STAGE

- 8.1 INTRODUCTION

- 8.1.1 LIFECYCLE STAGES: DIGITAL PRODUCT PASSPORT MARKET DRIVERS

- 8.2 PRODUCT DESIGN

- 8.2.1 GROWING EMPHASIS ON SUSTAINABLE AND CIRCULAR PRODUCT DESIGN, DRIVEN BY REGULATORY MANDATES AND CONSUMER DEMAND FOR TRANSPARENCY TO ACCELERATE MARKET GROWTH

- 8.3 PRODUCTION

- 8.3.1 INCREASING NEED FOR REAL-TIME TRACKING OF MATERIALS AND PROCESSES IN PRODUCTION STAGE TO ENSURE ETHICAL SOURCING TO DRIVE MARKET

- 8.4 DISTRIBUTION

- 8.4.1 DPP TO ENABLE GLOBAL SUPPLY CHAINS TRACEABILITY AND COUNTERFEIT PREVENTION IN DISTRIBUTION STAGE

- 8.5 END OF LIFE

- 8.5.1 GROWING EMPHASIS ON WASTE REDUCTION, EFFICIENT RECYCLING, AND RESOURCE RECOVERY DURING END-OF-LIFE STAGE TO PROPEL MARKET

9 DIGITAL PRODUCT PASSPORT MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.1.1 END USERS: DIGITAL PRODUCT PASSPORT MARKET DRIVERS

- 9.2 END USER, BY SIZE

- 9.2.1 LARGE ENTERPRISES

- 9.2.1.1 DPPs to be critical tool for large enterprises to meet environmental regulations and drive sustainability goals

- 9.2.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 9.2.2.1 Need to leverage digital product passports to boost SME compliance and market competitiveness to drive its demand in SMEs

- 9.2.1 LARGE ENTERPRISES

- 9.3 END USER, BY TYPE

- 9.3.1 ELECTRONICS & SEMICONDUCTORS

- 9.3.1.1 Organizations to develop blockchain-based DPP solutions and ensure data security and interoperability in electronics & semiconductors sector

- 9.3.2 AUTOMOTIVE

- 9.3.2.1 Automotive industry-leading circularity through digital product passports and digital transformation to foster market growth

- 9.3.3 BATTERIES

- 9.3.3.1 DPPs to enhance battery lifecycle management and sustainability

- 9.3.4 HEALTHCARE & LIFE SCIENCES

- 9.3.4.1 DPPs to ensure safety, effectiveness, and compliance with regulations of medical devices by enabling detailed tracking throughout product lifecycle

- 9.3.5 CHEMICALS & MATERIALS

- 9.3.5.1 Need to leverage digital product passports to enhance traceability and compliance in chemicals industry to fuel demand for DPPs

- 9.3.6 FASHION & TEXTILES

- 9.3.6.1 Increasing concerns around sustainability and transparency to boost demand for DPPs

- 9.3.7 CONSTRUCTION

- 9.3.7.1 Driving sustainability and compliance in construction with digital product passports to drive market

- 9.3.1 ELECTRONICS & SEMICONDUCTORS

- 9.4 OTHER END USERS

10 DIGITAL PRODUCT PASSPORT MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: DIGITAL PRODUCT PASSPORT MARKET DRIVERS

- 10.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.3 US

- 10.2.3.1 Digital product passports to leverage technologies to provide detailed product information across its lifecycle, enhance product traceability, and enable real-time data sharing

- 10.2.4 CANADA

- 10.2.4.1 Need to embrace sustainability practices and adhere to global regulatory trends to drive market

- 10.3 EUROPE

- 10.3.1 EUROPE: DIGITAL PRODUCT PASSPORT MARKET DRIVERS

- 10.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.3 UK

- 10.3.3.1 Need to enhance supply chain transparency, enable better recycling, and reuse practices to accelerate market growth

- 10.3.4 GERMANY

- 10.3.4.1 Need to enhance supply chain efficiency, meet sustainability targets, and respond to consumer demands to accelerate market growth

- 10.3.5 FRANCE

- 10.3.5.1 DPPs to enhance transparency in product sustainability, lifecycle management, and compliance, fostering circular economy

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: DIGITAL PRODUCT PASSPORT MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.3 CHINA

- 10.4.3.1 Presence of major eCommerce players, need to modernize trade, and enhance sustainability to propel market

- 10.4.4 JAPAN

- 10.4.4.1 Japan to pioneer digital product passports to revolutionize recycling and sustainability

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Need for sustainability and regulatory compliance to drive adoption of DPP technologies

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 REST OF WORLD

- 10.5.1 REST OF WORLD: DIGITAL PRODUCT PASSPORT MARKET DRIVERS

- 10.5.2 REST OF WORLD: MACROECONOMIC OUTLOOK

- 10.5.3 LATIN AMERICA

- 10.5.3.1 Partnerships between local tech companies and sustainability leaders to implement DPPs

- 10.5.4 MIDDLE EAST & AFRICA

- 10.5.4.1 Increasing adoption of circular economy models into smart manufacturing and sustainability initiatives to foster market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.3.1 MARKET SHARE OF KEY PLAYERS OFFERING DIGITAL PRODUCT PASSPORT

- 11.3.1.1 Market ranking analysis

- 11.3.1 MARKET SHARE OF KEY PLAYERS OFFERING DIGITAL PRODUCT PASSPORT

- 11.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- 11.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.4.5.1 Company footprint

- 11.4.5.2 Offering footprint

- 11.4.5.3 Focus area footprint

- 11.4.5.4 End-user footprint

- 11.4.5.5 Regional footprint

- 11.5 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- 11.5.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- 11.5.5.1 Detailed list of key start-ups/SMEs

- 11.5.5.2 Competitive benchmarking of key start-ups/SMEs

- 11.6 BRAND/PRODUCT COMPARISON

- 11.6.1 BRAND/PRODUCT COMPARISON

- 11.6.1.1 3E Digital Product Passports (3E)

- 11.6.1.2 Optchain Digital Product Passport (Optel Group)

- 11.6.1.3 Eviden Digital Passport Solution (Eviden)

- 11.6.1.4 Circulor Digital Product Passport Platform (Circulor)

- 11.6.1.5 Eon Digital Product Passport (Eon)

- 11.6.1 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.8 COMPETITIVE SCENARIO AND TRENDS

- 11.8.1 PRODUCT LAUNCHES

- 11.8.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 SIEMENS

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Product launches

- 12.2.1.3.2 Deals

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 3E

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Product launches

- 12.2.2.3.2 Deals

- 12.2.2.4 MnM view

- 12.2.2.4.1 Key strengths

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses and competitive threats

- 12.2.3 DNV

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 MnM view

- 12.2.3.3.1 Key strengths

- 12.2.3.3.2 Strategic choices

- 12.2.3.3.3 Weaknesses and competitive threats

- 12.2.4 OPTEL GROUP

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 Recent developments

- 12.2.4.3.1 Product launches

- 12.2.4.3.2 Deals

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses and competitive threats

- 12.2.5 AVL

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 Recent developments

- 12.2.5.3.1 Product launches

- 12.2.5.4 MnM view

- 12.2.5.4.1 Key strengths

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses and competitive threats

- 12.2.6 EVIDEN

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Product launches

- 12.2.6.3.2 Deals

- 12.2.7 CIRCULOR

- 12.2.8 PSQR

- 12.2.9 BILLON GROUP

- 12.2.10 NARRAVERO

- 12.2.11 EON

- 12.2.12 PROTOKOL

- 12.2.1 SIEMENS

- 12.3 OTHER PROMINENT PLAYERS

- 12.3.1 CIRCULARISE

- 12.3.2 THE ID FACTORY

- 12.3.3 SPHERITY

- 12.3.4 RENOON

- 12.3.5 KEZZLER

- 12.3.6 ASM GLOBAL

- 12.3.7 QLIKTAG

- 12.3.8 IPOINT-SYSTEMS

- 12.3.9 CARBOLEDGER

- 12.3.10 SCANTRUST

- 12.3.11 PATHWAY DIGITAL PRODUCTS

- 12.3.12 MINESPIDER

- 12.3.13 PICONEXT

- 12.3.14 ARIANEE

- 12.4 PROOF OF CONCEPT/RESEARCH STAGE

- 12.4.1 LYONDELLBASELL

- 12.4.1.1 Business overview

- 12.4.1.2 Products/Solutions/Services offered

- 12.4.2 CIRPASS

- 12.4.1 LYONDELLBASELL

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 DIGITAL CIRCULAR ECONOMY MARKET - GLOBAL FORECAST TO 2028

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.2.1 Digital circular economy market, by application

- 13.2.2.2 Digital circular economy market, by technology

- 13.2.2.3 Digital circular economy market, by vertical

- 13.2.2.4 Digital circular economy market, by region

- 13.3 ESG REPORTING SOFTWARE MARKET - GLOBAL FORECAST TO 2029

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.2.1 ESG reporting software market, by deployment type

- 13.3.2.2 ESG reporting software market, by organization size

- 13.3.2.3 ESG reporting software market, by vertical

- 13.3.2.4 ESG reporting software market, by region

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS