|

|

市場調査レポート

商品コード

1650849

有機金属構造体(MOF)の世界市場:タイプ別、合成法別、地域別 - 予測(~2030年)Metal Organic Frameworks Market by Type (Zinc-based, Copper-based, Iron-based, Aluminium-based, Chromium-based), Synthesis Method (Solvothermal/Hydrothermal, Microwave-assisted, Mechanochemical), and Region - Global forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 有機金属構造体(MOF)の世界市場:タイプ別、合成法別、地域別 - 予測(~2030年) |

|

出版日: 2025年02月01日

発行: MarketsandMarkets

ページ情報: 英文 217 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の有機金属構造体(MOF)の市場規模は、2024年に推定5億1,000万米ドルであり、2030年までに17億米ドルに達すると予測され、2024年~2030年にCAGRで22.1%の成長が見込まれます。

亜鉛ベースの有機金属構造体(MOF)は無毒性で生分解性があり、生物医学用途の薬物担体としてもっとも多く使用されています。表面積が大きく、多孔性が高く、熱的・化学的安定性に優れています。これらの有機金属構造体(MOF)は、ソルボサーマル/ハイドロサーマル、ソノケミカル、マイクロ波アシスト、メカノケミカルなどのさまざまな合成技術を用いて合成されます。ZIF-8、ZIF-67、MOF-5は、亜鉛ベースの有機金属構造体(MOF)の一部であり、ガス貯蔵、ガス吸着/分離、センシング・検出などの幅広い用途で使用されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 金額(100万/10億米ドル)数量(キログラム) |

| セグメント | タイプ、合成法、用途、地域 |

| 対象地域 | 北米、アジア太平洋、ラテンアメリカ、中東・アフリカ |

「金額ベースでは、ソルボサーマル/ハイドロサーマルセグメントが有機金属構造体(MOF)市場全体で最大のシェアを占めました。」

2023年、ソルボサーマル/ハイドロサーマル合成法が金額ベースで有機金属構造体(MOF)市場で最大のシェアを占めました。その費用対効果、優れた触媒活性、電気化学的特性から、有機金属構造体(MOF)の調製にもっとも広く使われている合成経路の1つです。これは有機金属構造体(MOF)の合成を可能にする高圧高温での反応混合物の長期加熱を伴います。ソルボサーマル/ハイドロサーマル合成法は収率が高く、高品質な結晶が成長します。

「金額ベースでは、触媒セグメントが有機金属構造体(MOF)市場全体で第3位のシェアを占めました。」

2023年、触媒セグメントが金額ベースで有機金属構造体(MOF)市場で第3位のシェアを占めました。有機金属構造体(MOF)の高い結晶性と均一な多孔性は、活性サイトの効率的な利用を保証し、不均一系触媒の理想的な候補となります。活性サイトの数が多いため、反応速度と選択性が向上します。有機金属構造体(MOF)は、反応物質に対する親和性を高めるためにリンカーの置換基を変えたり、活性触媒サイトの数を増やしたりすることで、容易に修飾することができます。さらに、有機金属構造体(MOF)は、そのユニークな特性により、電極触媒や光触媒用途の有望な候補として機能します。

「予測期間にアジア太平洋の有機金属構造体(MOF)市場が2番目に大きな地域になる見込みです。」

アジア太平洋の有機金属構造体(MOF)の成長は、急速な工業化、研究開発への投資の増加、技術の進歩、持続可能性目標によって促進されています。エネルギー貯蔵と水素経済への関心の高まりが、高品質な有機金属構造体(MOF)の需要を促進しています。中国は、大規模な製造拠点、豊富な原材料、安価な労働力、低い生産コストにより、有機金属構造体(MOF)市場を独占しています。日本、韓国、インドは、幅広い用途向けに有機金属構造体(MOF)の効率を向上させる研究開発活動に大いに取り組んでいます。

当レポートでは、世界の有機金属構造体(MOF)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 有機金属構造体(MOF)市場の企業にとって魅力的な機会

- 有機金属構造体(MOF)の市場シェア:タイプ別(2023年)

- 有機金属構造体(MOF)の市場シェア:合成法別(2023年)

- 有機金属構造体(MOF)市場:用途別、地域別(2023年)

- 有機金属構造体(MOF)市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- サプライチェーン分析

- 原材料

- 製造工程

- 最終製品

- エコシステム

- 価格分析

- 主要企業の平均販売価格の動向:タイプ別

- 平均販売価格の動向:タイプ別

- 平均販売価格の動向:合成法別

- 平均販売価格の動向:用途別

- 平均販売価格の動向:地域別

- バリューチェーン分析

- 技術分析

- ソルボサーマル/ハイドロサーマル有機金属構造体(MOF)の技術分析

- メカノケミカル有機金属構造体(MOF)の技術分析

- 有機金属構造体(MOF)の最新製造プロセスの補完技術

- 有機金属構造体(MOF)市場に対するAI/生成AIの影響

- 主なユースケースと市場の可能性

- 有機金属構造体(MOF)市場におけるベストプラクティス

- 有機金属構造体(MOF)市場におけるAI導入のケーススタディ

- 有機金属構造体(MOF)市場における生成AI採用に対する顧客の準備度

- 主なステークホルダーと購入基準

- 特許分析

- イントロダクション

- 調査手法

- 文献の種類

- 考察

- 法的地位

- 管轄分析

- 主な出願者

- 過去10年間の特許保有者上位10社(米国)

- 規制情勢

- 主な会議とイベント(2024年~2025年)

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

第6章 有機金属構造体(MOF)市場:タイプ別

- イントロダクション

- 亜鉛ベース

- 銅ベース

- 鉄ベース

- アルミニウムベース

- クロムベース

- その他のタイプ

第7章 有機金属構造体(MOF)市場:合成法別

- イントロダクション

- ソルボサーマル/ハイドロサーマル

- ソノケミカル

- マイクロ波アシスト

- メカノケミカル

- エレクトロケミカル

- その他の合成法

第8章 有機金属構造体(MOF)市場:用途別

- イントロダクション

- ガス・液体の吸収/分離

- 取水

- ガス貯蔵

- センシング・検出

- 触媒

- その他の用途

第9章 有機金属構造体(MOF)市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- メキシコ

- ブラジル

- その他のラテンアメリカ

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 市場シェア分析

- ブランド/製品の比較分析

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 企業の評価と財務指標

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- NANORH

- FRAMERGY, INC.

- NOVOMOF

- BASF SE

- NUMAT TECHNOLOGIES, INC.

- MOFAPPS

- NUADA

- PROFMOF

- ACSYNAM

- PROMETHEAN PARTICLES LTD.

- その他の企業

- ACMOFS

- GS ALLIANCE CO., LTD.

- PHYSICAL SCIENCES INC.

- MAJD ONSOR FARTAK

- SYNCMOF INC.

- IMMATERIAL LTD.

- ATOMIS INC.

- CD BIOPARTICLES

- NANOWIZ TECH

- KERONE ENGINEERING SOLUTIONS LTD.

- NANOSHEL LLC

- JIANGSU XIANFENG NANOMATERIAL TECHNOLOGY CO., LTD.

- DECARBONTEK, INC.

- SVANTE TECHNOLOGIES INC.

- NANOCHEMAZONE

第12章 付録

List of Tables

- TABLE 1 METAL ORGANIC FRAMEWORKS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 METAL ORGANIC FRAMEWORKS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 4 COMPARATIVE STUDY OF METAL ORGANIC FRAMEWORK MANUFACTURING PROCESSES

- TABLE 5 TOP USE CASES AND MARKET POTENTIAL

- TABLE 6 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 7 CASE STUDIES OF GEN AI IMPLEMENTATION IN METAL ORGANIC FRAMEWORKS MARKET

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS IN METAL ORGANIC FRAMEWORKS MARKET

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS IN METAL ORGANIC FRAMEWORKS MARKET

- TABLE 10 METAL ORGANIC FRAMEWORKS MARKET: TOTAL NUMBER OF PATENTS

- TABLE 11 LIST OF PATENTS BY ZHEJIANG UNIVERSITY

- TABLE 12 LIST OF PATENTS BY KING ABDULLAH UNIVERSITY OF SCIENCE & TECHNOLOGY

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 METAL ORGANIC FRAMEWORKS MARKET: KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 17 METAL ORGANIC FRAMEWORKS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 18 METAL ORGANIC FRAMEWORKS MARKET, BY TYPE, 2022-2030 (KILOGRAM)

- TABLE 19 ZINC-BASED METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 20 ZINC-BASED METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 21 COPPER-BASED METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 22 COPPER-BASED METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 23 IRON-BASED METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 24 IRON-BASED METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 25 ALUMINUM-BASED METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 26 ALUMINUM-BASED METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 27 CHROMIUM-BASED METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 28 CHROMIUM-BASED METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 29 OTHER TYPES: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 30 OTHER TYPES: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 31 METAL ORGANIC FRAMEWORKS MARKET, BY SYNTHESIS METHOD, 2022-2030 (USD MILLION)

- TABLE 32 METAL ORGANIC FRAMEWORKS MARKET, BY SYNTHESIS METHOD, 2022-2030 (KILOGRAM)

- TABLE 33 SOLVOTHERMAL/HYDROTHERMAL: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 34 SOLVOTHERMAL/HYDROTHERMAL: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 35 SONOCHEMICAL: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 36 SONOCHEMICAL: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 37 MICROWAVE-ASSISTED: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 38 MICROWAVE-ASSISTED: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 39 MECHANOCHEMICAL: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 40 MECHANOCHEMICAL: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 41 ELECTROCHEMICAL: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 42 ELECTROCHEMICAL: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 43 OTHER SYNTHESIS METHODS: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 44 OTHER SYNTHESIS METHODS: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 45 METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 46 METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 47 GAS & LIQUID ABSORPTION/SEPARATION: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 48 GAS & LIQUID ABSORPTION/SEPARATION: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 49 WATER HARVESTING: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 50 WATER HARVESTING: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 51 GAS STORAGE: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 52 GAS STORAGE: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 53 SENSING & DETECTING: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 54 SENSING & DETECTING: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 55 CATALYSIS: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 56 CATALYSIS: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 57 OTHER APPLICATIONS: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 58 OTHER APPLICATIONS: METAL ORGANIC FRAMEWORKS MARKET, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 59 METAL ORGANIC FRAMEWORKS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 60 METAL ORGANIC FRAMEWORKS, BY REGION, 2022-2030 (KILOGRAM)

- TABLE 61 NORTH AMERICA: METAL ORGANIC FRAMEWORKS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: METAL ORGANIC FRAMEWORKS, BY COUNTRY, 2022-2030 (KILOGRAM)

- TABLE 63 NORTH AMERICA: METAL ORGANIC FRAMEWORKS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: METAL ORGANIC FRAMEWORKS, BY TYPE, 2022-2030 (KILOGRAM)

- TABLE 65 NORTH AMERICA: METAL ORGANIC FRAMEWORKS, BY SYNTHESIS METHOD, 2022-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: METAL ORGANIC FRAMEWORKS, BY SYNTHESIS METHOD, 2022-2030 (KILOGRAM)

- TABLE 67 NORTH AMERICA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 69 US: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 70 US: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 71 CANADA: METAL ORGANIC FRAMEWORKS, BY END-USE INDUSTRY, 2022-2030 (USD MILLION)

- TABLE 72 CANADA: METAL ORGANIC FRAMEWORKS, BY END-USE INDUSTRY, 2022-2030 (KILOGRAM)

- TABLE 73 EUROPE: METAL ORGANIC FRAMEWORKS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 74 EUROPE: METAL ORGANIC FRAMEWORKS MARKET, BY TYPE, 2022-2030 (KILOGRAM)

- TABLE 75 EUROPE: METAL ORGANIC FRAMEWORKS MARKET, BY SYNTHESIS METHOD, 2022-2030 (USD MILLION)

- TABLE 76 EUROPE: METAL ORGANIC FRAMEWORKS MARKET, BY SYNTHESIS METHOD, 2022-2030 (KILOGRAM)

- TABLE 77 EUROPE: METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 78 EUROPE: METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 79 EUROPE: METAL ORGANIC FRAMEWORKS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 80 EUROPE: METAL ORGANIC FRAMEWORKS MARKET, BY COUNTRY, 2022-2030 (KILOGRAM)

- TABLE 81 GERMANY: METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 82 GERMANY: METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 83 FRANCE: METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 84 FRANCE: METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 85 UK: METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 86 UK: METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 87 ITALY: METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 88 ITALY: METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 89 SPAIN: METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 90 SPAIN: METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 91 REST OF EUROPE: METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 92 REST OF EUROPE: METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 93 ASIA PACIFIC: METAL ORGANIC FRAMEWORKS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: METAL ORGANIC FRAMEWORKS, BY COUNTRY, 2022-2030 (KILOGRAM)

- TABLE 95 ASIA PACIFIC: METAL ORGANIC FRAMEWORKS, BY SYNTHESIS METHOD, 2022-2030 (USD MILLION)

- TABLE 96 ASIA PACIFIC: METAL ORGANIC FRAMEWORKS, BY SYNTHESIS METHOD, 2022-2030 (KILOGRAM)

- TABLE 97 ASIA PACIFIC: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 98 ASIA PACIFIC: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 99 ASIA PACIFIC: METAL ORGANIC FRAMEWORKS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 100 ASIA PACIFIC: METAL ORGANIC FRAMEWORKS, BY TYPE, 2022-2030 (KILOGRAM)

- TABLE 101 CHINA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 102 CHINA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 103 INDIA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 104 INDIA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 105 JAPAN: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 106 JAPAN: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 107 SOUTH KOREA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 108 SOUTH KOREA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 109 REST OF ASIA PACIFIC: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 111 LATIN AMERICA: METAL ORGANIC FRAMEWORKS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 112 LATIN AMERICA: METAL ORGANIC FRAMEWORKS, BY COUNTRY, 2022-2030 (KILOGRAM)

- TABLE 113 LATIN AMERICA: METAL ORGANIC FRAMEWORKS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 114 LATIN AMERICA: METAL ORGANIC FRAMEWORKS, BY TYPE, 2022-2030 (KILOGRAM)

- TABLE 115 LATIN AMERICA: METAL ORGANIC FRAMEWORKS, BY SYNTHESIS METHOD, 2022-2030 (USD MILLION)

- TABLE 116 LATIN AMERICA: METAL ORGANIC FRAMEWORKS, BY SYNTHESIS METHOD, 2022-2030 (KILOGRAM)

- TABLE 117 LATIN AMERICA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 118 LATIN AMERICA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 119 MEXICO: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 120 MEXICO: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 121 BRAZIL: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 122 BRAZIL: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 123 REST OF LATIN AMERICA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 124 REST OF LATIN AMERICA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 125 MIDDLE EAST & AFRICA: METAL ORGANIC FRAMEWORKS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: METAL ORGANIC FRAMEWORKS, BY TYPE, 2022-2030 (KILOGRAM)

- TABLE 127 MIDDLE EAST & AFRICA: METAL ORGANIC FRAMEWORKS, BY SYNTHESIS METHOD, 2022-2030 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: METAL ORGANIC FRAMEWORKS, BY SYNTHESIS METHOD, 2022-2030 (KILOGRAM)

- TABLE 129 MIDDLE EAST & AFRICA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 131 MIDDLE EAST & AFRICA: METAL ORGANIC FRAMEWORKS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: METAL ORGANIC FRAMEWORKS, BY COUNTRY, 2022-2030 (KILOGRAM)

- TABLE 133 UAE: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 134 UAE: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 135 SAUDI ARABIA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 136 SAUDI ARABIA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 137 REST OF GCC COUNTRIES: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 138 REST OF GCC COUNTRIES: METAL ORGANIC FRAMEWORKS, BY END-USE INDUSTRY, 2022-2030 (KILOGRAM)

- TABLE 139 SOUTH AFRICA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 140 SOUTH AFRICA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 141 REST OF MIDDLE EAST AND AFRICA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 142 REST OF MIDDLE EAST AND AFRICA: METAL ORGANIC FRAMEWORKS, BY APPLICATION, 2022-2030 (KILOGRAM)

- TABLE 143 METAL ORGANIC FRAMEWORKS MARKET: KEY STRATEGIES ADOPTED BY MAJOR METAL ORGANIC FRAMEWORKS MANUFACTURERS

- TABLE 144 METAL ORGANIC FRAMEWORKS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 145 METAL ORGANIC FRAMEWORKS MARKET: TYPE FOOTPRINT

- TABLE 146 METAL ORGANIC FRAMEWORKS MARKET: SYNTHESIS METHOD FOOTPRINT

- TABLE 147 METAL ORGANIC FRAMEWORKS MARKET: APPLICATION FOOTPRINT

- TABLE 148 METAL ORGANIC FRAMEWORKS MARKET: REGION FOOTPRINT

- TABLE 149 METAL ORGANIC FRAMEWORKS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 150 METAL ORGANIC FRAMEWORKS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 151 METAL ORGANIC FRAMEWORKS MARKET: PRODUCT LAUNCHES, JANUARY 2018-DECEMBER 2024

- TABLE 152 METAL ORGANIC FRAMEWORKS MARKET: DEALS, JANUARY 2018-DECEMBER 2024

- TABLE 153 METAL ORGANIC FRAMEWORKS MARKET: EXPANSIONS, JANUARY 2018-DECEMBER 2024

- TABLE 154 NANORH: COMPANY OVERVIEW

- TABLE 155 NANORH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 FRAMERGY, INC.: COMPANY OVERVIEW

- TABLE 157 FRAMERGY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 NOVOMOF: COMPANY OVERVIEW

- TABLE 159 NOVOMOF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 BASF SE: COMPANY OVERVIEW

- TABLE 161 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 BASF SE: DEALS, JANUARY 2018-DECEMBER 2024

- TABLE 163 NUMAT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 164 NUMAT TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 NUMAT TECHNOLOGIES, INC.: PRODUCT LAUNCHES, JANUARY 2018-DECEMBER 2024

- TABLE 166 NUMAT TECHNOLOGIES, INC.: EXPANSIONS, JANUARY 2018-DECEMBER 2024

- TABLE 167 MOFAPPS: COMPANY OVERVIEW

- TABLE 168 MOFAPPS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 NUADA: COMPANY OVERVIEW

- TABLE 170 NUADA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 NUADA: DEALS, JANUARY 2018-DECEMBER 2024

- TABLE 172 NUADA: EXPANSIONS, JANUARY 2018-DECEMBER 2024

- TABLE 173 PROFMOF: COMPANY OVERVIEW

- TABLE 174 PROFMOF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 PROFMOF: DEALS, JANUARY 2018-DECEMBER 2024

- TABLE 176 ACSYNAM: COMPANY OVERVIEW

- TABLE 177 ACSYNAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 ACSYNAM: DEALS, JANUARY 2018-DECEMBER 2024

- TABLE 179 PROMETHEAN PARTICLES LTD.: COMPANY OVERVIEW

- TABLE 180 PROMETHEAN PARTICLES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 PROMETHEAN PARTICLES LTD.: DEALS, JANUARY 2018-DECEMBER 2024

- TABLE 182 PROMETHEAN PARTICLES LTD.: EXPANSIONS, JANUARY 2018-DECEMBER 2024

- TABLE 183 ACMOFS: COMPANY OVERVIEW

- TABLE 184 GS ALLIANCE CO., LTD.: COMPANY OVERVIEW

- TABLE 185 PHYSICAL SCIENCES INC.: COMPANY OVERVIEW

- TABLE 186 MAJD ONSOR FARTAK: COMPANY OVERVIEW

- TABLE 187 SYNCMOF INC.: COMPANY OVERVIEW

- TABLE 188 IMMATERIAL LTD.: COMPANY OVERVIEW

- TABLE 189 ATOMIS INC.: COMPANY OVERVIEW

- TABLE 190 CD BIOPARTICLES: COMPANY OVERVIEW

- TABLE 191 NANOWIZ TECH: COMPANY OVERVIEW

- TABLE 192 KERONE ENGINEERING SOLUTIONS LTD.: COMPANY OVERVIEW

- TABLE 193 NANOSHEL LLC: COMPANY OVERVIEW

- TABLE 194 JIANGSU XIANFENG NANOMATERIAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 195 DECARBONTEK, INC.: COMPANY OVERVIEW

- TABLE 196 SVANTE TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 197 NANOCHEMAZONE: COMPANY OVERVIEW

List of Figures

- FIGURE 1 METAL ORGANIC FRAMEWORKS MARKET SEGMENTATION

- FIGURE 2 METAL ORGANIC FRAMEWORKS MARKET: RESEARCH DESIGN

- FIGURE 3 METAL ORGANIC FRAMEWORKS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 METAL ORGANIC FRAMEWORKS MARKET: TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

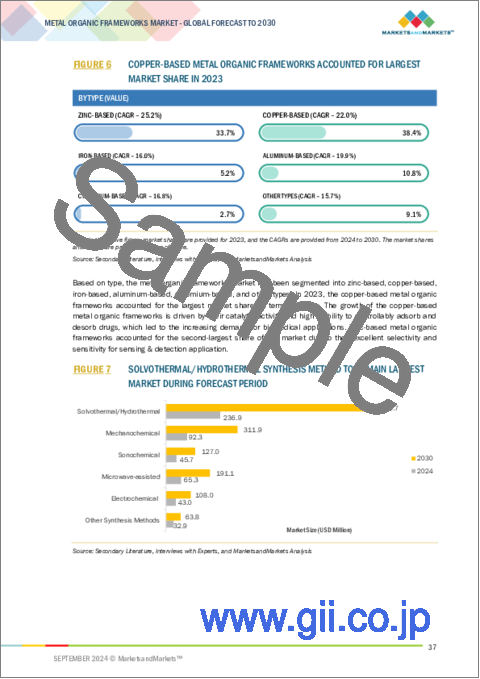

- FIGURE 6 COPPER-BASED METAL ORGANIC FRAMEWORKS ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 7 SOLVOTHERMAL/HYDROTHERMAL SYNTHESIS METHOD TO REMAIN LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 8 GAS STORAGE APPLICATION SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 9 NORTH AMERICA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 10 EMERGING APPLICATIONS FOR METAL ORGANIC FRAMEWORKS TO DRIVE MARKET

- FIGURE 11 COPPER-BASED SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 12 SOLVOTHERMAL/HYDROTHERMAL SYNTHESIS METHOD ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE IN 2023

- FIGURE 14 US TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN METAL ORGANIC FRAMEWORKS MARKET

- FIGURE 16 METAL ORGANIC FRAMEWORKS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 METAL ORGANIC FRAMEWORKS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 18 METAL ORGANIC FRAMEWORKS MARKET: KEY STAKEHOLDERS IN ECOSYSTEM

- FIGURE 19 METAL ORGANIC FRAMEWORKS MARKET: ECOSYSTEM

- FIGURE 20 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2023

- FIGURE 21 AVERAGE SELLING PRICE OF METAL ORGANIC FRAMEWORKS, BY TYPE (USD/KG), 2023

- FIGURE 22 AVERAGE SELLING PRICE OF METAL ORGANIC FRAMEWORKS, BY SYNTHESIS METHOD (USD/KG), 2023

- FIGURE 23 AVERAGE SELLING PRICE OF METAL ORGANIC FRAMEWORKS, BY APPLICATION (USD/KG), 2023

- FIGURE 24 METAL ORGANIC FRAMEWORKS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 27 PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 28 PATENT PUBLICATION TREND, 2014-2024

- FIGURE 29 METAL ORGANIC FRAMEWORKS MARKET: LEGAL STATUS OF PATENTS

- FIGURE 30 CHINESE JURISDICTION REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 31 UNIVERSITY OF CALIFORNIA REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 32 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN METAL ORGANIC FRAMEWORKS MARKET

- FIGURE 33 DEALS AND FUNDING IN METAL ORGANIC FRAMEWORKS MARKET SOARED IN 2022

- FIGURE 34 PROMINENT METAL ORGANIC FRAMEWORKS MANUFACTURING FIRMS IN 2025 (USD BILLION)

- FIGURE 35 COPPER-BASED SEGMENT TO HOLD LARGEST SHARE OF METAL ORGANIC FRAMEWORKS MARKET

- FIGURE 36 SOLVOTHERMAL/HYDROTHERMAL SEGMENT TO DOMINATE METAL ORGANIC FRAMEWORKS MARKET DURING FORECAST PERIOD

- FIGURE 37 GAS & LIQUID ABSORPTION/SEPARATION SEGMENT TO DOMINATE METAL ORGANIC FRAMEWORKS MARKET DURING FORECAST PERIOD

- FIGURE 38 US TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: METAL ORGANIC FRAMEWORKS MARKET SNAPSHOT

- FIGURE 40 EUROPE: METAL ORGANIC FRAMEWORKS MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: METAL ORGANIC FRAMEWORKS MARKET SNAPSHOT

- FIGURE 42 METAL ORGANIC FRAMEWORKS MARKET SHARE ANALYSIS, 2023

- FIGURE 43 METAL ORGANIC FRAMEWORKS MARKET: RANKING OF TOP FIVE PLAYERS

- FIGURE 44 METAL ORGANIC FRAMEWORKS MARKET: TOP TRENDING BRAND/PRODUCTS

- FIGURE 45 METAL ORGANIC FRAMEWORKS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 46 METAL ORGANIC FRAMEWORKS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 47 METAL ORGANIC FRAMEWORKS MARKET: COMPANY FOOTPRINT (10 COMPANIES)

- FIGURE 48 METAL ORGANIC FRAMEWORKS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 49 METAL ORGANIC FRAMEWORKS MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 50 METAL ORGANIC FRAMEWORKS MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY MARKET PLAYERS

- FIGURE 51 BASF SE: COMPANY SNAPSHOT

The metal organic frameworks market is estimated at USD 0.51 billion in 2024 and is projected to reach USD 1.70 billion by 2030, at a CAGR of 22.1% from 2024 to 2030. Zinc-based metal organic frameworks are non-toxic and biodegradable that are most prominently used as a drug carrier for biomedical applications. They exhibit larger surface area, high porosity, and better thermal and chemical stability. These metal organic frameworks are synthesized using different synthesis techniques including solvothermal/hydrothermal, sonochemical, microwave-assisted, and mechanochemical. ZIF-8, ZIF-67, MOF-5 are some of the zinc-based metal organic frameworks that are used in wide range of applications such as gas storage, gas adsorption/separation, sensing & detection.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million/Billion), and Volume (Kilogram) |

| Segments | By Type, Synthesis method, Application, and Region |

| Regions covered | Europe, North America, Asia Pacific, Latin America, Middle East, and Africa |

''In terms of value, solvothermal/hydrothermal segment accounted for the largest share of the overall metal organic frameworks market.''

In 2023, the solvothermal/hydrothermal synthesis method accounted for the largest share of the metal organic frameworks market, in terms of value. Due to its cost effectiveness, superior catalytic activity, and electrochemical characteristics, it is one of the most widely used synthesis route for the preparation of metal organic frameworks. It involves long-term heating of the reaction mixture at high pressure and temperature which enables the synthesis of metal organic frameworks. Solvothermal/hydrothermal synthesis method offers higher yields and results in the growth of high quality crystals.

''In terms of value, Catalysis segment accounted for the third largest share of the overall metal organic frameworks market.''

In 2023, Catalysis segment accounted for the third largest share of the metal organic frameworks market, in terms of value. The high degree of crystallinity and uniform porosity of metal organic frameworks ensures efficient use of active sites making them an ideal candidate for heterogeneous catalysis. Large number of active sites enhances the reaction rates and improved selectivity. Metal organic frameworks can be easily modified by changing linkers substituents to increase affinity for reactants, or by growing the number of active catalytic sites. Additionally, metal organic frameworks act as a promising candidate for electrocatalytic and photocatalytic applications due to its unique properties.

"During the forecast period, the metal organic frameworks market in Asia Pacific region is projected to be the second largest region."

The growth of metal organic frameworks in Asia Pacific is fuelled by rapid industrialization, increasing investments in research & development, technological advancements, and sustainability goals. Rising focus towards energy storage and hydrogen economy is fuelling the demand for high quality metal organic frameworks. China dominates the metal organic frameworks market due to large manufacturing base, abundant raw materials, cheap labour, and low production costs. Japan, South Korea, and India are significantly working on research and development activities to improve the efficiency of metal organic frameworks for wide range of applications.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 60%, Tier 2- 20%, and Tier 3- 20%

- By Designation- C Level- 33%, Director Level- 33%, and Others- 34%

- By Region- North America- 30%, Europe- 25%, Asia Pacific- 25%, Latin America- 10%, Middle East & Africa (MEA)-10%.

The report provides a comprehensive analysis of company profiles:

Prominent companies include Nanorh (US), Framergy, Inc. (US), novoMOF (Switzerland), BASF SE (Germany), Numat Technologies, Inc. (US), MOFapps (Norway), Nuada (UK), ProfMOF (Norway), ACSYNAM (Canada), Promethean Particles Ltd. (UK).

Research Coverage

This research report categorizes the metal organic frameworks market By Type (Zinc-based, Copper-based, Iron-based, Aluminium-based, Chromium-based, and Others), By Synthesis method (Solvothermal/hydrothermal, Sonochemical, Microwave-assisted, Mechanochemical, Electrochemical, and Others), Application (Gas and liquid adsorption/separation, Water harvesting, Gas storage, Sensing & detection, Catalysis, and Others), Region (North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America). The scope of the report includes detailed information about the major factors influencing the growth of the metal organic frameworks market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions, and services, key strategies, contracts, partnerships, and agreements. New product and service launches, mergers and acquisitions, and recent developments in the metal organic frameworks market are all covered. This report includes a competitive analysis of upcoming startups in the metal organic frameworks market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall metal organic frameworks market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Higher operational yield of metal organic frameworks for efficient gas storage, growing demand for metal organic frameworks to curb down carbon emissions),

restraints (Stability issues of metal organic frameworks, High cost of metal organic frameworks), opportunities (Growing investments in green hydrogen projects to boost the market, Innovative water harvesting technologies), and challenges (Overcoming scalability challenges in metal organic framework production, Toxicity concerns in metal organic frameworks) influencing the growth of the metal organic frameworks market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the metal organic frameworks market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the metal organic frameworks market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the metal organic frameworks market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Nanorh (US), Framergy, Inc. (US), novoMOF (Switzerland), BASF SE (Germany), Numat Technologies, Inc. (US), MOFapps (Norway), Nuada (UK), ProfMOF (Norway), ACSYNAM (Canada), Promethean Particles Ltd. (UK), ACMOFS (China), GS Alliance Co., Ltd. (Japan), Physical Sciences Inc. (US), Majd Onsor Fartak (Iran), SyncMOF Inc. (Japan), Immaterial Ltd. (UK), Atomis Inc. (Japan), CD Bioparticles (US), Nanowiz Tech (India), Kerone Engineering Solutions Ltd. (India), Nanoshel LLC (US), Jiangsu Xianfeng Nanomaterial Technology Co., Ltd. (China), Decarbontek, Inc. (US), Svante Technologies Inc. (Canada), Nanochemazone (India) among others in the metal organic frameworks market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key primary interview participants

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.4 MARKET FORECAST

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN METAL ORGANIC FRAMEWORKS MARKET

- 4.2 METAL ORGANIC FRAMEWORKS MARKET SHARE, BY TYPE, 2023

- 4.3 METAL ORGANIC FRAMEWORKS MARKET SHARE, BY SYNTHESIS METHOD, 2023

- 4.4 METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION AND REGION, 2023

- 4.5 METAL ORGANIC FRAMEWORKS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Higher operational yield of metal organic frameworks for efficient gas storage

- 5.2.1.2 Growing demand for metal organic frameworks to curb carbon emissions

- 5.2.1.3 Increasing government initiatives and funding for R&D

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stability issues of metal organic frameworks

- 5.2.2.2 High cost of metal organic frameworks

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing investments in green hydrogen projects

- 5.2.3.2 Innovative water harvesting technologies

- 5.2.3.3 Cost-effective and sustainable metal organic frameworks

- 5.2.4 CHALLENGES

- 5.2.4.1 Scalability issues in metal organic framework production

- 5.2.4.2 Toxicity concerns in metal organic frameworks

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.4.1 RAW MATERIAL

- 5.4.2 MANUFACTURING PROCESS

- 5.4.3 FINAL PRODUCT

- 5.5 ECOSYSTEM

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- 5.6.2 AVERAGE SELLING PRICE TREND, BY TYPE

- 5.6.3 AVERAGE SELLING PRICE TREND, BY SYNTHESIS METHOD

- 5.6.4 AVERAGE SELLING PRICE TREND, BY APPLICATION

- 5.6.5 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 TECHNOLOGY ANALYSIS FOR SOLVOTHERMAL/HYDROTHERMAL METAL ORGANIC FRAMEWORKS

- 5.8.2 TECHNOLOGY ANALYSIS FOR MECHANOCHEMICAL METAL ORGANIC FRAMEWORKS

- 5.8.3 COMPLEMENTARY TECHNOLOGIES FOR LATEST MANUFACTURING PROCESS OF METAL ORGANIC FRAMEWORKS

- 5.9 IMPACT OF AI/GEN AI ON METAL ORGANIC FRAMEWORKS MARKET

- 5.9.1 TOP USE CASES AND MARKET POTENTIAL

- 5.9.2 BEST PRACTICES IN METAL ORGANIC FRAMEWORKS MARKET

- 5.9.3 CASE STUDIES OF AI IMPLEMENTATION IN METAL ORGANIC FRAMEWORKS MARKET

- 5.9.4 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN METAL ORGANIC FRAMEWORKS MARKET

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 PATENT ANALYSIS

- 5.11.1 INTRODUCTION

- 5.11.2 METHODOLOGY

- 5.11.3 DOCUMENT TYPES

- 5.11.4 INSIGHTS

- 5.11.5 LEGAL STATUS

- 5.11.6 JURISDICTION ANALYSIS

- 5.11.7 TOP APPLICANTS

- 5.11.8 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES AND EVENTS IN 2024-2025

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 CALF-20: GAME-CHANGING METAL ORGANIC FRAMEWORK FOR CARBON CAPTURE

- 5.14.2 FRAMERGY, INC. COLLABORATED WITH ALICAT SCIENTIFIC, INC. FOR NATURAL GAS PURIFICATION

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 INVESTMENT AND FUNDING SCENARIO

6 METAL ORGANIC FRAMEWORKS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 ZINC-BASED

- 6.2.1 RISING DEMAND IN GAS STORAGE AND DRUG DELIVERY

- 6.3 COPPER-BASED

- 6.3.1 SURGE IN DEMAND IN CATALYTIC APPLICATIONS AND CO2 REDUCTION EFFORTS

- 6.4 IRON-BASED

- 6.4.1 INCREASING DEMAND IN CATALYTIC ACTIVITIES TO FUEL DEMAND

- 6.5 ALUMINUM-BASED

- 6.5.1 GROWING APPLICATION IN SUSTAINABLE GAS STORAGE AND CATALYSIS

- 6.6 CHROMIUM-BASED

- 6.6.1 HIGH USAGE IN CATALYTIC PERFORMANCE AND ADVANCED ELECTRONIC APPLICATIONS

- 6.7 OTHER TYPES

7 METAL ORGANIC FRAMEWORKS MARKET, BY SYNTHESIS METHOD

- 7.1 INTRODUCTION

- 7.2 SOLVOTHERMAL/HYDROTHERMAL

- 7.2.1 OFFERS CRYSTAL SYNTHESIS AT HIGH TEMPERATURES AND PRESSURES

- 7.3 SONOCHEMICAL

- 7.3.1 ENVIRONMENT-FRIENDLY METHOD IDEAL FOR NANOSIZED METAL ORGANIC FRAMEWORKS

- 7.4 MICROWAVE-ASSISTED

- 7.4.1 ENABLES RAPID SYNTHESIS OF METAL ORGANIC FRAMEWORKS

- 7.5 MECHANOCHEMICAL

- 7.5.1 AFFORDABLE AND SOLVENT-FREE ALTERNATIVE FOR SYNTHESIS

- 7.6 ELECTROCHEMICAL

- 7.6.1 HIGH YIELD AND LOW ENERGY CONSUMPTION

- 7.7 OTHER SYNTHESIS METHODS

8 METAL ORGANIC FRAMEWORKS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 GAS & LIQUID ABSORPTION/SEPARATION

- 8.2.1 HIGH DEMAND DUE TO CARBON DIOXIDE CAPTURE AND GAS SEPARATION

- 8.3 WATER HARVESTING

- 8.3.1 SOLUTION FOR WATER SCARCITY AMID RISING FRESHWATER DEMAND

- 8.4 GAS STORAGE

- 8.4.1 EFFICIENT GAS STORAGE FOR CLEAN ENERGY TRANSITION

- 8.5 SENSING & DETECTION

- 8.5.1 ENHANCED SENSING AND DETECTION WITH ADVANCED SENSITIVITY AND SELECTIVITY

- 8.6 CATALYSIS

- 8.6.1 SUSTAINABLE CATALYSIS WITH HIGH EFFICIENCY AND CUSTOMIZABLE PROPERTIES

- 8.7 OTHER APPLICATIONS

9 METAL ORGANIC FRAMEWORKS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Advancements in synthesis technology

- 9.2.2 CANADA

- 9.2.2.1 Advancements in clean energy solutions

- 9.2.1 US

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Target of net greenhouse gas neutrality by 2045

- 9.3.2 FRANCE

- 9.3.2.1 Increasing focus on R&D

- 9.3.3 UK

- 9.3.3.1 Government initiatives and funding programs

- 9.3.4 ITALY

- 9.3.4.1 Demand for clean energy solutions and R&D activities

- 9.3.5 SPAIN

- 9.3.5.1 Growing R&D activities related to metal organic frameworks

- 9.3.6 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 ASIA PACIFIC

- 9.4.1 CHINA

- 9.4.1.1 Rising R&D activities

- 9.4.2 INDIA

- 9.4.2.1 Demand for clean energy and environmental sustainability

- 9.4.3 JAPAN

- 9.4.3.1 Environmental regulations and technological advancements

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Rising demand in catalytic applications and advancements in synthesis methods

- 9.4.5 REST OF ASIA PACIFIC

- 9.4.1 CHINA

- 9.5 LATIN AMERICA

- 9.5.1 MEXICO

- 9.5.1.1 Expanding metal organic frameworks application to drive market

- 9.5.2 BRAZIL

- 9.5.2.1 Carbon capture and gas storage to drive market

- 9.5.3 REST OF LATIN AMERICA

- 9.5.1 MEXICO

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

- 9.6.1.1 UAE

- 9.6.1.1.1 Industrial Initiatives and R&D to boost market growth

- 9.6.1.2 Saudi Arabia

- 9.6.1.2.1 Government-led clean energy initiatives to drive market

- 9.6.1.3 Rest of GCC countries

- 9.6.1.1 UAE

- 9.6.2 SOUTH AFRICA

- 9.6.2.1 Increasing demand for clean energy solutions and environmental sustainability initiatives

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 MARKET SHARE ANALYSIS

- 10.3.1 RANKING ANALYSIS

- 10.4 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.4.1 METAL ORGANIC FRAMEWORKS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.5.5.1 Company footprint

- 10.5.5.2 Type footprint

- 10.5.5.3 Synthesis method footprint

- 10.5.5.4 Application footprint

- 10.5.5.5 Region footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION AND FINANCIAL METRICS

- 10.8 COMPETITIVE SCENARIOS

- 10.8.1 PRODUCT LAUNCHES

- 10.8.2 DEALS

- 10.8.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY COMPANIES

- 11.1.1 NANORH

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 MnM view

- 11.1.1.3.1 Right to win

- 11.1.1.3.2 Strategic choices

- 11.1.1.3.3 Weaknesses and competitive threats

- 11.1.2 FRAMERGY, INC.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 MnM view

- 11.1.2.3.1 Right to win

- 11.1.2.3.2 Strategic choices

- 11.1.2.3.3 Weaknesses and competitive threats

- 11.1.3 NOVOMOF

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 MnM view

- 11.1.3.3.1 Right to win

- 11.1.3.3.2 Strategic choices

- 11.1.3.3.3 Weaknesses and competitive threats

- 11.1.4 BASF SE

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 NUMAT TECHNOLOGIES, INC.

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 MOFAPPS

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 MnM view

- 11.1.6.3.1 Right to win

- 11.1.6.3.2 Strategic choices

- 11.1.6.3.3 Weaknesses and competitive threats

- 11.1.7 NUADA

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.7.3.2 Expansions

- 11.1.7.4 MnM view

- 11.1.7.4.1 Right to win

- 11.1.7.4.2 Strategic choices

- 11.1.7.4.3 Weaknesses and competitive threats

- 11.1.8 PROFMOF

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.8.4 MnM view

- 11.1.8.4.1 Right to win

- 11.1.8.4.2 Strategic choices

- 11.1.8.4.3 Weaknesses and competitive threats

- 11.1.9 ACSYNAM

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.4 MnM view

- 11.1.9.4.1 Right to win

- 11.1.9.4.2 Strategic choices

- 11.1.9.4.3 Weaknesses and competitive threats

- 11.1.10 PROMETHEAN PARTICLES LTD.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.10.3.2 Expansions

- 11.1.10.4 MnM view

- 11.1.10.4.1 Right to win

- 11.1.10.4.2 Strategic choices

- 11.1.10.4.3 Weaknesses and competitive threats

- 11.1.1 NANORH

- 11.2 OTHER PLAYERS

- 11.2.1 ACMOFS

- 11.2.2 GS ALLIANCE CO., LTD.

- 11.2.3 PHYSICAL SCIENCES INC.

- 11.2.4 MAJD ONSOR FARTAK

- 11.2.5 SYNCMOF INC.

- 11.2.6 IMMATERIAL LTD.

- 11.2.7 ATOMIS INC.

- 11.2.8 CD BIOPARTICLES

- 11.2.9 NANOWIZ TECH

- 11.2.10 KERONE ENGINEERING SOLUTIONS LTD.

- 11.2.11 NANOSHEL LLC

- 11.2.12 JIANGSU XIANFENG NANOMATERIAL TECHNOLOGY CO., LTD.

- 11.2.13 DECARBONTEK, INC.

- 11.2.14 SVANTE TECHNOLOGIES INC.

- 11.2.15 NANOCHEMAZONE

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS