|

|

市場調査レポート

商品コード

1647380

世界の電気自動車製造エコシステムへの戦略的洞察:OEM戦略、自動化とAI統合の進展、サーキュラー・エコノミーの原則 - 2035年までの予測Strategic Insights Into The Global EV Manufacturing Ecosystem OEM Strategies, Advancements in Automation and AI Integration, and Circular Economy Principles - Global Forecast To 2035 |

||||||

カスタマイズ可能

|

|||||||

| 世界の電気自動車製造エコシステムへの戦略的洞察:OEM戦略、自動化とAI統合の進展、サーキュラー・エコノミーの原則 - 2035年までの予測 |

|

出版日: 2024年11月27日

発行: MarketsandMarkets

ページ情報: 英文 125 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

電気自動車の市場規模は、2024年の1,570万7,000台から2035年には4,631万5,000台に、CAGR10.3%で成長すると予測されています。

EVメーカーの将来は、より迅速な生産とカスタマイズを可能にするモジュール式でスケーラブルな組立プラットフォームへのシフトによって形作られると思われます。テスラは、コードネーム"Redwood"と呼ばれる次世代車のために、"NV9X"と呼ばれる電気自動車プラットフォームを開発しており、社内でこのアーキテクチャを使用する予定です。さらに、オートメーションと人工知能を駆使した製造工程が主流となり、効率を高めてコストを削減します。メーカー各社は、バッテリーのリサイクルと持続可能な素材を重視し、循環型経済の実践をますます取り入れるようになると予測されます。特に固体電池やナトリウムイオン電池の進歩のためには、電池メーカーとの協力がカギとなります。さらに、EVメーカーは、高度なコネクティビティと自律走行機能を備えたプレミアム製品とともに、大量普及を達成するために手頃な価格のモデルに注力します。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2035年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2035年 |

| 対象台数 | 台数(1,000台) |

| セグメント別 | 車種別(乗用車、商用車)、地域別 |

| 対象地域 | 中国、アジア太平洋(中国を除く)、北米、欧州 |

乗用車セグメントは、政府のインセンティブ、厳しい排ガス規制、電気自動車に対する消費者の嗜好の高まりが相まって、中国での市場シェアを独占しています。中国政府は、免税、購入奨励金、インフラ投資を通じてEV導入に多額の補助金を出しており、EVをより手頃な価格にしています。さらに、環境問題に対する意識の高まりとバッテリー技術の進歩により、電気自動車は消費者にとってますます魅力的なものとなっています。この動向を活用するため、BYD、NIO、Geely、SAICなどの中国OEMは、意欲的な取り組みでEV生産を強化しています。これには、ソリッドステート・バッテリーやリン酸鉄リチウム(LFP)バッテリーなどの先進バッテリー技術の開発、世界展開の拡大、スマート製造施設への投資などが含まれます。

各社はまた、競争の激しい電気自動車市場で差別化を図るため、自律走行やコネクティッドカー技術などのソフトウェアの統合を模索しています。さらに、リチウムやコバルトなどの原材料を確保するための世界的サプライヤーや国内サプライヤーとの提携は、持続可能なサプライチェーンへのコミットメントを強調しています。今後、中国のOEMは、革新的なモデルを導入し、生産能力を拡大し、国内外における手頃な価格のプレミアムEVの需要増に対応することで、世界のEV市場をリードしようと努力しています。

プラットフォーム化とプラットフォーム共有は、電気自動車メーカーが拡張性、コストパフォーマンス、市場投入までの時間短縮を獲得するための重要な技術として浮上しています。VolkswagenのMEBプラットフォーム、HyundaiのE-GMP、RenaultのCMF-EVなど、モジュール化された屈曲性のあるEVアーキテクチャを開発することで、自動車メーカーは複数のモデルやブランドを通じてコンポーネントを標準化し、生産の複雑さを軽減し、規模の経済を達成することができます。現代自動車と起亜自動車の社内プラットフォーム共有戦略は、主流車種から高級車まで、セグメントを超えたスケールメリットを最大化します。

欧州は、野心的な気候政策、政府による多額のインセンティブ、厳しい排出ガス規制によって、電気自動車製造において最も急成長する市場のひとつとなる見込みです。欧州のOEMは、カーボンニュートラルの達成と急増する需要への対応に重点を置いた主要な取り組みにより、電気自動車の生産能力を増強しています。Volkswagenは「アクセラレート」戦略で先頭に立ち、2030年までに欧州で80%のEV販売を目標に掲げ、PowerCo部門傘下のバッテリー・ギガ工場に多額の投資を行っています。BMWは、2030年までに販売台数の少なくとも50%を電気自動車にすることを約束しており、「ノイエクラッセ」プラットフォームが次世代EVを支えることになります。Mercedes-Benzは、電動化された生産設備とバッテリー開発のためのパートナーシップに支えられ、条件の許す市場で2030年までにオール電化に移行しようとしています。一方、PolestarやFiskeのような小規模OEMは、ニッチな需要を満たすために最先端のEVモデルを投入しています。この地域はまた、欧州バッテリー・アライアンスのようなイニシアティブに支えられたバッテリー・サプライチェーンの強固なエコシステムと、持続可能なEV製造のための再生可能エネルギー統合への投資からも恩恵を受けています。

当レポートでは、世界の電気自動車市場について調査し、電気自動車製造動向、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 電気自動車市場情勢

- イントロダクション

- 地域別電気自動車販売台数

- 電気自動車の販売台数(車両タイプ別)

- ICEおよび電動モビリティの販売予測

- 政府規制

- 政府のインセンティブと補助金

- ゼロエミッション車に関する主要政策と開発目標

- ゼロエミッション車への主な投資と開発目標

- 自社生産とOEM別アウトソーシング

- 電気自動車用バッテリー製造能力

第4章 電気自動車製造の現状と将来動向

- イントロダクション

- デザイン

- プロトタイピング

- 主要部品の製造

- 組み立て

- ギガファクトリーの主な発展

- ギガキャスティングの主な発展

第5章 企業プロファイル

- TESLA

- BYD AUTO CO., LTD

- VOLKSWAGEN AG

- ZHEJIANG GEELY HOLDING GROUP

- SAIC MOTOR

- STELLANTIS NV

- BMW GROUP

- HYUNDAI GROUP

- FORD MOTOR COMPANY

- GENERAL MOTORS

- RENAULT GROUP

- TATA MOTORS LIMITED

- MAHINDRA & MAHINDRA LTD.

- TOYOTA MOTOR CORPORATION

第6章 重要なポイントと推奨事項

第7章 付録

List of Tables

- TABLE 1 MARKET DEFINITION, BY PROCESS

- TABLE 2 ANNUAL COST COMPARISON: ICE VEHICLE VS. ELECTRIC VEHICLE MODELS

- TABLE 3 ELECTRIC VEHICLE MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 4 ELECTRIC VEHICLE MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 5 ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 6 ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2031-2035 (THOUSAND UNITS)

- TABLE 7 UPCOMING ELECTRIC PASSENGER CAR MODELS, 2025-2027

- TABLE 8 ELECTRIC PASSENGER CARS MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 9 ELECTRIC PASSENGER CARS MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 10 UPCOMING ELECTRIC COMMERCIAL VEHICLE MODELS, 2025-2026

- TABLE 11 ELECTRIC COMMERCIAL VEHICLES MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 12 ELECTRIC COMMERCIAL VEHICLES MARKET, BY REGION, 2031-2035 (THOUSAND UNITS)

- TABLE 13 GOVERNMENT REGULATIONS ON ELECTRIC VEHICLE MANUFACTURING, BY KEY COUNTRY

- TABLE 14 GOVERNMENT INCENTIVES AND SUBSIDIES BY KEY COUNTRIES

- TABLE 15 KEY POLICIES AND PRODUCTION TARGETS FOR ZERO-EMISSION VEHICLES BY KEY COUNTRIES

- TABLE 16 INVESTMENT AND DEVELOPMENT TARGETS FOR ZERO-EMISSION VEHICLES BY KEY OEMS

- TABLE 17 IN-HOUSE AND OUTSOURCING STRATEGIES ADOPTED BY OEMS ACROSS FUNCTIONS

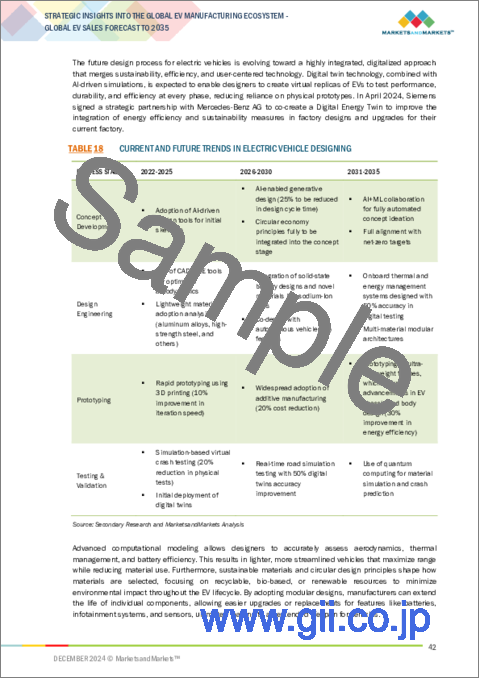

- TABLE 18 CURRENT AND FUTURE TRENDS IN ELECTRIC VEHICLE DESIGNING

- TABLE 19 BENEFITS OF DIGITAL TWINS IN ELECTRIC VEHICLE POWERTRAIN DESIGN

- TABLE 20 CURRENT AND FUTURE TRENDS IN ELECTRIC VEHICLE PROTOTYPING

- TABLE 21 BENEFITS OF ELECTRIC VEHICLE PROTOTYPING

- TABLE 22 CURRENT AND FUTURE TRENDS IN BATTERY MANUFACTURING

- TABLE 23 CURRENT AND FUTURE TRENDS IN ELECTRIC VEHICLE MOTOR MANUFACTURING

- TABLE 24 CURRENT AND FUTURE TRENDS IN ELECTRIC VEHICLE ASSEMBLY

- TABLE 25 ELECTRIC VEHICLE ASSEMBLY TRENDS AND STRATEGIES ADOPTED BY OEMS

- TABLE 26 TESLA: UPCOMING GIGAFACTORIES

- TABLE 27 BYD: UPCOMING GIGAFACTORIES

- TABLE 28 CATL: UPCOMING GIGAFACTORIES

- TABLE 29 UPCOMING GIGAFACTORIES IN EUROPE

- TABLE 30 UPCOMING GIGAFACTORIES IN NORTH AMERICA

- TABLE 31 UPCOMING GIGAFACTORIES IN ASIA PACIFIC

- TABLE 32 LIST OF GIGA CAST ADOPTION PLANS BY KEY AUTOMAKERS

- TABLE 33 TESLA: COMPANY OVERVIEW

- TABLE 34 TESLA: FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- TABLE 35 TESLA: PLATFORMS USED IN ELECTRIC VEHICLE MODELS

- TABLE 36 BYD AUTO CO., LTD: COMPANY OVERVIEW

- TABLE 37 BYD AUTO CO., LTD: FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- TABLE 38 BYD AUTO CO., LTD: FUTURE PLATFORMS FOR ELECTRIC VEHICLE MODELS

- TABLE 39 VOLKSWAGEN AG: COMPANY OVERVIEW

- TABLE 40 VOLKSWAGEN AG: FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- TABLE 41 VOLKSWAGEN AG: FUTURE PLATFORMS FOR ELECTRIC VEHICLE MODELS

- TABLE 42 ZHEJIANG GEELY HOLDING GROUP: COMPANY OVERVIEW

- TABLE 43 ZHEJIANG GEELY HOLDING GROUP: FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- TABLE 44 ZHEJIANG GEELY HOLDING GROUP: PLATFORMS USED IN ELECTRIC VEHICLE MODELS

- TABLE 45 SAIC MOTOR: COMPANY OVERVIEW

- TABLE 46 SAIC MOTOR: FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- TABLE 47 SAIC MOTOR: PLATFORMS USED IN ELECTRIC VEHICLE MODELS

- TABLE 48 STELLANTIS NV: COMPANY OVERVIEW

- TABLE 49 STELLANTIS NV: FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- TABLE 50 STELLANTIS NV: PLATFORMS USED IN ELECTRIC VEHICLE MODELS

- TABLE 51 BMW GROUP: COMPANY OVERVIEW

- TABLE 52 BMW GROUP: RESOURCE EFFICIENCY

- TABLE 53 BMW GROUP: FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- TABLE 54 BMW GROUP: PLATFORMS USED IN ELECTRIC VEHICLE MODELS

- TABLE 55 BMW GROUP: CURRENT AND UPCOMING MODELS, BY ELECTRIC VEHICLE PLATFORMS

- TABLE 56 HYUNDAI GROUP: COMPANY OVERVIEW

- TABLE 57 HYUNDAI GROUP: FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- TABLE 58 HYUNDAI GROUP: PLATFORMS USED IN ELECTRIC VEHICLE MODELS

- TABLE 59 HYUNDAI GROUP: CURRENT AND UPCOMING MODELS, BY EV PLATFORMS

- TABLE 60 FORD MOTOR COMPANY: COMPANY OVERVIEW

- TABLE 61 FORD MOTOR COMPANY: FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- TABLE 62 FORD MOTOR COMPANY: PLATFORMS USED IN ELECTRIC VEHICLE MODELS

- TABLE 63 FORD MOTOR COMPANY: CURRENT AND UPCOMING MODELS, BY EV PLATFORMS

- TABLE 64 GENERAL MOTORS: COMPANY OVERVIEW

- TABLE 65 GENERAL MOTORS: FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- TABLE 66 GENERAL MOTORS: PLATFORMS USED IN ELECTRIC VEHICLE MODELS

- TABLE 67 GENERAL MOTORS: CURRENT AND UPCOMING MODELS, BY EV PLATFORMS

- TABLE 68 RENAULT GROUP: COMPANY OVERVIEW

- TABLE 69 RENAULT GROUP: FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- TABLE 70 RENAULT GROUP: PLATFORMS USED IN ELECTRIC VEHICLE MODELS

- TABLE 71 RENAULT GROUP: CURRENT AND UPCOMING MODELS, BY ELECTRIC VEHICLE PLATFORMS

- TABLE 72 TATA MOTORS LIMITED: COMPANY OVERVIEW

- TABLE 73 TATA MOTORS LIMITED: FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- TABLE 74 MAHINDRA & MAHINDRA LTD.: COMPANY OVERVIEW

- TABLE 75 MAHINDRA & MAHINDRA LTD.: FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- TABLE 76 MAHINDRA & MAHINDRA LTD.: PLATFORMIZATION DEVELOPMENTS

- TABLE 77 TOYOTA MOTOR CORPORATION: COMPANY OVERVIEW

- TABLE 78 TOYOTA MOTOR CORPORATION: NEXT-GENERATION BEV BATTERY DEVELOPMENT

- TABLE 79 TOYOTA MOTOR CORPORATION: FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- TABLE 80 TOYOTA MOTOR CORPORATION: PLATFORMS USED IN ELECTRIC VEHICLE MODELS

- TABLE 81 TOYOTA MOTOR CORPORATION: CURRENT AND UPCOMING MODELS, BY EV PLATFORMS

List of Figures

- FIGURE 1 RESEARCH METHODOLOGY MODEL

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 3 ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE

- FIGURE 4 ELECTRIC VEHICLE MARKET, BY REGION

- FIGURE 5 US: BREAKDOWN OF TOTAL COST OF OWNERSHIP FOR KEY ELECTRIC VEHICLE MODELS

- FIGURE 6 BILL OF MATERIALS FOR ICE AND ELECTRIC VEHICLES, 2024 VS. 2030 (USD THOUSAND)

- FIGURE 7 ELECTRIFICATION AND SALES TARGETS BY KEY OEMS

- FIGURE 8 ELECTRIC VEHICLE MARKET, BY REGION, 2024 VS. 2035 (THOUSAND UNITS)

- FIGURE 9 ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2024 VS. 2035 (THOUSAND UNITS)

- FIGURE 10 CHINA: ICE AND ELECTRIC VEHICLE SALES, 2024-2035 (MILLION UNITS)

- FIGURE 11 ASIA PACIFIC (EXCLUDING CHINA): ICE VS. ELECTRIC VEHICLE SALES, 2024-2035 (MILLION UNITS)

- FIGURE 12 EUROPE: ICE VS. ELECTRIC VEHICLE SALES, 2024-2035 (MILLION UNITS)

- FIGURE 13 NORTH AMERICA: ICE VS. ELECTRIC VEHICLE SALES, 2024-2035 (MILLION UNITS)

- FIGURE 14 ELECTRIC VEHICLE BATTERY MANUFACTURING CAPACITY, BY COUNTRY, 2021-2025

- FIGURE 15 ELECTRIC VEHICLE BATTERY MANUFACTURING CAPACITY OF KEY PLAYERS, 2030

- FIGURE 16 USE OF MODULAR BODY CONSTRUCTION FOR ELECTRIC VEHICLES

- FIGURE 17 BATTERY TECHNOLOGY ROADMAP, 2022-2035

- FIGURE 18 TECHNOLOGY TRENDS FOR E-MOTORS, 2022-2035

- FIGURE 19 ARCHITECTURES OF WIRED AND WIRELESS BMS

- FIGURE 20 ELECTRIC VEHICLE ASSEMBLY PROCESS

- FIGURE 21 TESLA: MANUFACTURING LOCATION

- FIGURE 22 BYD E4 PLATFORM

- FIGURE 23 VOLKSWAGEN SCALABLE SYSTEM PLATFORM

- FIGURE 24 STELLANTIS NV: CIRCULAR ECONOMY MODEL

- FIGURE 25 STELLANTIS: TECHNOLOGICAL PLATFORM

- FIGURE 26 BMW GROUP: AVERAGE DISTRIBUTION OF MATERIALS

- FIGURE 27 TATA MOTORS LIMITED: CIRCULAR ECONOMY FOCUS AREA

- FIGURE 28 TOYOTA MOTOR CORPORATION: CIRCULAR ECONOMY STRATEGY

The Electric Vehicle market size is projected to grow from 15,707 thousand units in 2024 to 46,315 thousand units by 2035, at a CAGR of 10.3%. The future of EV manufacturers will be shaped by a shift to modular and scalable assembly platforms that enable faster production and customization. Tesla is developing an electric car platform called "NV9X" for their next-generation vehicle, codenamed "Redwood," which will use this architecture internally. Further, Automation and artificial intelligence-driven manufacturing processes will dominate, increasing efficiency and reducing costs. Manufacturers will increasingly integrate circular economy practices, emphasizing battery recycling and sustainable materials. Collaboration with battery manufacturers will be key, especially for the advancement of solid-state and sodium-ion batteries. In addition, EV manufacturers will focus on affordable models to achieve mass adoption, alongside premium offerings with advanced connectivity and autonomous driving capabilities.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2035 |

| Base Year | 2024 |

| Forecast Period | 2024-2035 |

| Units Considered | Volume (Thousand Units) |

| Segments | by Vehicle type (Passenger Cars and Commercial Vehicles), and Region |

| Regions covered | China, Asia Pacific (excl. China), North America, and Europe |

"Passenger cars segment is estimated to hold the largest market share during the forecast period."

The passenger car segment dominates market share in China thanks to a combination of government incentives, strict emissions regulations and growing consumer preference for electric vehicles. The Chinese government has heavily subsidized EV adoption through tax exemptions, purchase incentives and infrastructure investment, making EVs more affordable. Further, rising awareness of environmental issues and advances in battery technology have made electric vehicle increasingly attractive to consumers. To capitalize on this trend, Chinese OEMs such as BYD, NIO, Geely and SAIC are ramping up EV production with ambitious initiatives. These include developing advanced battery technologies such as solid-state and lithium iron phosphate (LFP) batteries, expanding global footprints and investing in smart manufacturing facilities. Companies are also looking to integrate software such as autonomous driving and connected car technology to differentiate themselves in the competitive electric vehicle market. Additionally, partnerships with global and domestic suppliers to secure raw materials such as lithium and cobalt underline their commitment to a sustainable supply chain. Looking ahead, Chinese OEMs are striving to lead the global EV market by introducing innovative models, expanding production capacity, and meeting the growing demand for affordable and premium EVs at domestically and internationally.

"Development in EV platformization and platform sharing boosting the EV manufacturing process"

Platformization and platform sharing have emerged as important techniques for electric vehicle manufacturers to acquire scalability, cost performance, and faster time-to-market. By developing modular and bendy EV architectures, inclusive of Volkswagen's MEB platform, Hyundai's E-GMP, and Renault's CMF-EV, automakers can standardize components throughout multiple models and brands, decreasing production complexity and achieving economies of scale. Hyundai and Kia's internal platform-sharing strategy maximizes economies of scale across segments, from mainstream to luxury vehicles. The Electric Global Modular Platform (E-GMP) underpins models like Hyundai Ioniq 5/6/7, Kia EV6, and Genesis GV60. Further, These systems assist various automobile types, together with sedans, SUVs, and even business vehicles, enabling producers to cater to diverse market segments with minimum layout modifications. In May 2024, SAIC Motor and Audi officially signed a cooperation agreement to jointly expand the Advanced Digitized Platform, following a memorandum of information signed in July 2023. This trend not only lowers production costs but also facilitates advancements in battery technology, software integration, and autonomous driving systems, as shared platforms provide a consistent foundation for implementing new features across a wider vehicle lineup. As an end result, platform sharing is poised to accelerate the transition to electrification at the same time as improving profitability and sustainability for producers globally.

"Europe is anticipated to be one of the fastest markets over the forecast period."

Europe is poised to be one of the fastest-growing market for electric vehicle manufacturing, driven by ambitious climate policies, significant government incentives, and stringent emissions regulations. European OEMs are ramping up their EV production capacities, with major initiatives focused on achieving carbon neutrality and meeting surging demand. Volkswagen is leading the charge with its "Accelerate" strategy, targeting 80% EV sales in Europe by 2030 and investing heavily in battery gigafactories under its PowerCo division. BMW is committed to making at least 50% of its sales electric by 2030, with its "Neue Klasse" platform set to underpin its next-generation EVs. Mercedes-Benz is transitioning to an all-electric future by 2030 in markets where conditions allow, supported by its electrified production facilities and partnerships for battery development. Meanwhile, smaller OEMs like Polestar and Fisker are introducing cutting-edge EV models to meet niche demands. The region also benefits from a robust ecosystem of battery supply chains, supported by initiatives like the European Battery Alliance, and investments in renewable energy integration for sustainable EV manufacturing.

- By Company Type: Tier 1 - 60%, OEM - 40%.

- By Designation: C Level - 40%, D Level - 35%, and Others - 25%

- By Region: North America - 20%, Europe - 30%, Asia Pacific (excl. China) - 35%, and China- 15%

Research Coverage:

Future of EV manufacturing market is segmented by vehicle type (Passenger Cars and Commercial Vehicles) and region (China, Asia Pacific (excl. China), Europe, and North America). The market study includes future strategies by OEMs, EV Ecosystem, Current and Future Trends in EV manufacturing and Regulatory Framework.

Reasons to buy this report:

The report will provide market leaders and new entrants with information on the closest approximations of the sales numbers for the EV market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies.

The report provides insights on the following pointers:

Technology Analysis: Insights on current and upcoming technologies, future investments, and critical OEMs and supplier strategies. Covered major electric components, technological trends such as the platform sharing, and market players providing these.

- Market Landscape by vehicle type (Passenger Cars and Commercial Vehicles), by region (China, Asia Pacific (excl. China), Europe, and North America).

- Supplier Analysis: The report analyzes market players, growth strategies, and product offerings of leading players. It also helps stakeholders understand the strategy of the EV manufacturers and provides information on their recent developments and investments in the market. OEM-wise decarbonization targets are also covered.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 MARKET DEFINITION

- 1.2 STUDY SCOPE

- 1.2.1 MARKET SEGMENTATION

- 1.2.2 INCLUSIONS AND EXCLUSIONS

- 1.3 RESEARCH METHODOLOGY

- 1.4 RESEARCH DATA

- 1.4.1 SECONDARY DATA

- 1.4.1.1 Secondary sources

- 1.4.2 PRIMARY DATA

- 1.4.3 RESEARCH LIMITATIONS

- 1.4.1 SECONDARY DATA

2 EXECUTIVE SUMMARY

- 2.1 ELECTRIC VEHICLE PLATFORMIZATION

- 2.2 CIRCULAR ECONOMY STRATEGIES

- 2.3 ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE

- 2.4 ELECTRIC VEHICLE MARKET, BY REGION

- 2.5 CONCLUSION

3 ELECTRIC VEHICLE MARKET LANDSCAPE

- 3.1 INTRODUCTION

- 3.2 ELECTRIC VEHICLE SALES, BY REGION

- 3.3 ELECTRIC VEHICLE SALES, BY VEHICLE TYPE

- 3.3.1 PASSENGER CARS

- 3.3.1.1 Availability of subsidies and tax rebates to drive growth

- 3.3.2 COMMERCIAL VEHICLES

- 3.3.2.1 Rising demand for efficient long-haul transportation to drive market

- 3.3.1 PASSENGER CARS

- 3.4 SALES FORECAST FOR ICE AND ELECTRIC MOBILITY

- 3.4.1 CHINA

- 3.4.2 ASIA PACIFIC (EXCLUDING CHINA)

- 3.4.3 EUROPE

- 3.4.4 NORTH AMERICA

- 3.5 GOVERNMENT REGULATIONS

- 3.6 GOVERNMENT INCENTIVES AND SUBSIDIES

- 3.7 KEY POLICIES AND DEVELOPMENT TARGETS FOR ZERO-EMISSION VEHICLES

- 3.8 KEY INVESTMENT AND DEVELOPMENT TARGETS FOR ZERO-EMISSION VEHICLES

- 3.9 IN-HOUSE PRODUCTION VS. OUTSOURCING, BY OEMS

- 3.10 ELECTRIC VEHICLE BATTERY MANUFACTURING CAPACITY

- 3.10.1 ELECTRIC VEHICLE BATTERY MANUFACTURING CAPACITY, BY COUNTRY, 2021-2025

- 3.10.2 ELECTRIC VEHICLE BATTERY MANUFACTURING CAPACITY OF KEY PLAYERS, 2030

4 CURRENT AND FUTURE TRENDS IN ELECTRIC VEHICLE MANUFACTURING

- 4.1 INTRODUCTION

- 4.2 DESIGN

- 4.3 PROTOTYPING

- 4.4 MANUFACTURING OF KEY COMPONENTS

- 4.4.1 BATTERY

- 4.4.2 MOTOR

- 4.4.3 BATTERY MANAGEMENT SYSTEM

- 4.5 ASSEMBLY

- 4.6 KEY DEVELOPMENTS IN GIGAFACTORIES

- 4.6.1 UPCOMING GIGAFACTORIES BY KEY OEMS

- 4.6.1.1 Tesla

- 4.6.1.2 BYD

- 4.6.1.3 CATL

- 4.6.2 UPCOMING GIGAFACTORIES, BY REGION

- 4.6.2.1 Europe

- 4.6.2.1.1 Upcoming gigafactories in Europe, 2027

- 4.6.2.2 North America

- 4.6.2.2.1 Upcoming gigafactories in North America, 2027

- 4.6.2.3 Asia Pacific

- 4.6.2.3.1 Upcoming gigafactories in Asia Pacific, 2027

- 4.6.2.1 Europe

- 4.6.1 UPCOMING GIGAFACTORIES BY KEY OEMS

- 4.7 KEY DEVELOPMENTS IN GIGA CASTING

- 4.7.1 INTRODUCTION

- 4.7.2 LIST OF GIGA CASTING ADOPTION PLANS BY KEY AUTOMAKERS

5 COMPANY PROFILES

- 5.1 TESLA

- 5.1.1 COMPANY OVERVIEW

- 5.1.2 CIRCULAR ECONOMY STRATEGY

- 5.1.2.1 Recycled materials/components

- 5.1.3 FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- 5.1.3.1 Role of AI

- 5.1.3.2 Digitization/Smart manufacturing factory

- 5.1.4 PLATFORMIZATION

- 5.2 BYD AUTO CO., LTD

- 5.2.1 COMPANY OVERVIEW

- 5.2.2 CIRCULAR ECONOMY STRATEGY

- 5.2.2.1 Recycled materials/components

- 5.2.3 FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- 5.2.3.1 Role of AI

- 5.2.3.2 Digitization/Smart manufacturing factory

- 5.2.4 PLATFORMIZATION

- 5.3 VOLKSWAGEN AG

- 5.3.1 COMPANY OVERVIEW

- 5.3.2 CIRCULAR ECONOMY STRATEGY

- 5.3.2.1 Recycled materials/components

- 5.3.3 FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- 5.3.3.1 Role of AI

- 5.3.3.2 Digitization/Smart manufacturing factory

- 5.3.4 PLATFORMIZATION

- 5.4 ZHEJIANG GEELY HOLDING GROUP

- 5.4.1 COMPANY OVERVIEW

- 5.4.2 CIRCULAR ECONOMY STRATEGY

- 5.4.2.1 Recycled materials/components

- 5.4.3 FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- 5.4.3.1 Role of AI

- 5.4.3.2 Digitization/Smart manufacturing factory

- 5.4.4 PLATFORMIZATION

- 5.5 SAIC MOTOR

- 5.5.1 COMPANY OVERVIEW

- 5.5.2 CIRCULAR ECONOMY STRATEGY

- 5.5.2.1 Recycled materials/components

- 5.5.3 FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- 5.5.3.1 Role of AI

- 5.5.3.2 Digitization/Smart manufacturing factory

- 5.5.4 PLATFORMIZATION

- 5.6 STELLANTIS NV

- 5.6.1 COMPANY OVERVIEW

- 5.6.2 CIRCULAR ECONOMY STRATEGY

- 5.6.2.1 Recycled materials/components

- 5.6.3 FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- 5.6.3.1 Role of AI

- 5.6.3.2 Digitization/Smart manufacturing factory

- 5.6.4 PLATFORMIZATION

- 5.7 BMW GROUP

- 5.7.1 COMPANY OVERVIEW

- 5.7.2 CIRCULAR ECONOMY STRATEGY

- 5.7.2.1 Recycled materials/components

- 5.7.3 FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- 5.7.3.1 Role of AI

- 5.7.3.2 Digitization/Smart manufacturing factory

- 5.7.4 PLATFORMIZATION

- 5.8 HYUNDAI GROUP

- 5.8.1 COMPANY OVERVIEW

- 5.8.2 CIRCULAR ECONOMY STRATEGY

- 5.8.2.1 Recycled materials/components

- 5.8.3 FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- 5.8.3.1 Role of AI

- 5.8.3.2 Digitization/Smart manufacturing factory

- 5.8.4 PLATFORMIZATION

- 5.9 FORD MOTOR COMPANY

- 5.9.1 COMPANY OVERVIEW

- 5.9.2 CIRCULAR ECONOMY STRATEGY

- 5.9.2.1 Recycled materials/components

- 5.9.3 FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- 5.9.3.1 Role of AI

- 5.9.3.2 Digitization/Smart manufacturing factory

- 5.9.4 PLATFORMIZATION

- 5.10 GENERAL MOTORS

- 5.10.1 COMPANY OVERVIEW

- 5.10.2 CIRCULAR ECONOMY STRATEGY

- 5.10.2.1 Recycled materials/components

- 5.10.3 FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- 5.10.3.1 Role of AI

- 5.10.3.2 Digitization/Smart manufacturing factory

- 5.10.4 PLATFORMIZATION

- 5.11 RENAULT GROUP

- 5.11.1 COMPANY OVERVIEW

- 5.11.2 CIRCULAR ECONOMY STRATEGY

- 5.11.2.1 Recycled materials/components

- 5.11.3 FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- 5.11.3.1 Role of AI

- 5.11.3.2 Digitization/Smart manufacturing factory

- 5.11.4 PLATFORMIZATION

- 5.12 TATA MOTORS LIMITED

- 5.12.1 COMPANY OVERVIEW

- 5.12.2 CIRCULAR ECONOMY STRATEGY

- 5.12.2.1 Recycled materials/components

- 5.12.3 FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- 5.12.3.1 Role of AI

- 5.12.3.2 Digitization/Smart manufacturing factory

- 5.12.4 PLATFORMIZATION

- 5.13 MAHINDRA & MAHINDRA LTD.

- 5.13.1 COMPANY OVERVIEW

- 5.13.2 CIRCULAR ECONOMY STRATEGY

- 5.13.2.1 Recycled materials/components

- 5.13.3 FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- 5.13.3.1 Digitization/Smart manufacturing factory

- 5.13.4 PLATFORMIZATION

- 5.14 TOYOTA MOTOR CORPORATION

- 5.14.1 COMPANY OVERVIEW

- 5.14.2 CIRCULAR ECONOMY STRATEGY

- 5.14.2.1 Recycled materials/components

- 5.14.3 FUTURE PLANS FOR ELECTRIC VEHICLE PRODUCTION

- 5.14.3.1 Role of AI

- 5.14.3.2 Digitization/Smart manufacturing factory

- 5.14.4 PLATFORMIZATION

6 KEY TAKEAWAYS AND RECOMMENDATIONS

- 6.1 KEY TAKEAWAYS

- 6.2 ADVANCEMENTS IN ELECTRIC VEHICLE MANUFACTURING

- 6.3 DEVELOPMENT OF SMART MANUFACTURING FACILITIES

- 6.4 SHIFT TOWARD CIRCULAR ECONOMY

- 6.5 CHINA'S DOMINANCE IN GLOBAL ELECTRIC VEHICLE MARKET

7 APPENDIX

- 7.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 7.2 DISCUSSION GUIDE

- 7.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 7.4 CUSTOMIZATION OPTIONS

- 7.4.1 ADDITIONAL COMPANY PROFILES (UP TO 5)

- 7.4.2 COUNTRY-LEVEL ELECTRIC VEHICLE MARKET, BY PROPULSION (FOR COUNTRIES COVERED IN THE REPORT)

- 7.4.3 COUNTRY-LEVEL ELECTRIC VEHICLE MARKET, BY BATTERY TYPE (FOR COUNTRIES COVERED IN THE REPORT)

- 7.5 RELATED REPORTS

- 7.6 AUTHOR DETAILS