|

|

市場調査レポート

商品コード

1638715

電気ブッシング市場:タイプ別、絶縁材料別、電圧別、用途別、エンドユーザー別、地域別 - 2029年までの予測Electrical Bushings Market by Type (Oil Impregnated Paper, Resin Impregnated Paper, Others), Insulation Material (Porcelain, Polymer, Glass), Application (Transformer, Switchger), Voltage, End User, and Region - Global Forecast 2029 |

||||||

カスタマイズ可能

|

|||||||

| 電気ブッシング市場:タイプ別、絶縁材料別、電圧別、用途別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2025年01月15日

発行: MarketsandMarkets

ページ情報: 英文 291 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の電気ブッシングの市場規模は、2024年定36億7,000万米ドルから2029年には47億7,000万米ドルへと、予測期間中のCAGR 5.4%で大きく成長する見込みです。

電気ブッシングの成長は、急速な都市化と工業化に伴う効率的な送配電の需要に牽引され、世界中で主に見られます。送電網の近代化に伴う再生可能エネルギー・プロジェクトへの大規模な投資は、より長期的なシステム性能を実現するための耐電圧性能を備えた、高性能で信頼性の高い高度なブッシングへの需要を高めています。樹脂含浸ブッシングや合成ブッシングは、従来の磁器に代わってエネルギー損失を減らし、電気的安全性を向上させます。さらに、厳しい政府規制や環境規制が、より持続可能で高性能なブッシング・ソリューションの採用に業界を駆り立てています。これらの促進要因は、世界の老朽化した電力インフラのアップグレードに対する需要の高まりとともに、市場の積極的な成長を後押ししています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年/td> |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | タイプ別、絶縁材料別、電圧別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、南米 |

230kV超サブセグメントは、高圧送電における重要性から、世界の電気ブッシング市場において第3位のシェアを占めています。この範囲は、送電網の安定化や再生可能エネルギーの統合に不可欠とされる地域間・国境を越えた送電網を含む大規模インフラプロジェクトで最も一般的に使用されています。特にアジア太平洋や中東の新興経済圏で超高圧直流(UHVDC)システムの採用が増加しており、需要をさらに押し上げています。また、北米や欧州などの先進地域では、老朽化した送電網インフラを改良するための投資が、このサブセグメントの成長を促進しています。実際、これらのブッシングは動作の信頼性を維持し、電力損失を低減し、長距離送電を維持するためにかけがえのないものです。

スイッチギアは、電気システムの安全性と信頼性を確保する上で重要な役割を果たしているため、用途別セグメントのスイッチギアサブセグメントは、世界の電気ブッシング市場で2番目に大きな市場シェアを占めています。スイッチギアの電気ブッシングは、高ストレス条件下でもシームレスな絶縁で電流を簡単かつ確実に流すことができます。先進的でコンパクトな開閉器ソリューションに対する需要は、世界中の都市化プロジェクト、再生可能エネルギー統合、産業拡張で浮上しています。欧州や北米などの地域で進められている送電網の近代化構想や、アジア太平洋地域における急速な電化や工業化は、中高圧スイッチギア用ブッシングの採用にプラスの影響を与えるとみられています。これらの要因は、運転効率とシステム保護を確保するためにブッシングが不可欠である理由を説明しています。

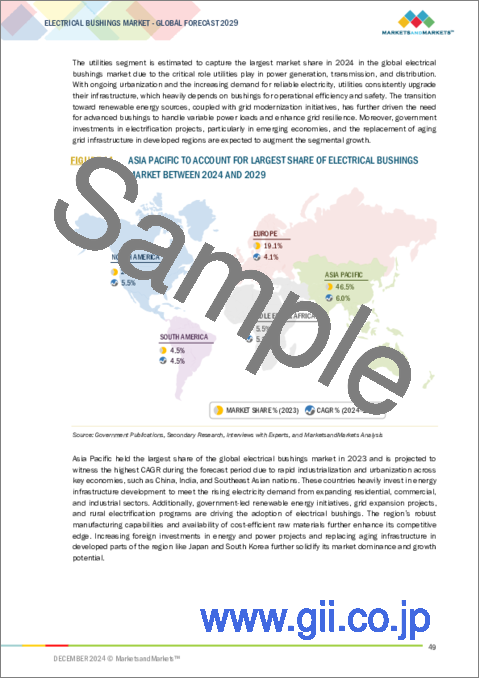

南米は、様々な制限要因により、世界の電気ブッシング市場で最も低い市場シェアを占めています。他の地域と比べて電力インフラへの投資水準が低いこと、最新の送電網技術への対応が遅れていることなどです。同地域はまだ農村部の基本的な電化活動に重点を置いており、電気ブッシングのような先進的な機器でトランスミッションや配電網をアップグレードする予算は限られています。他国の経済的不安定や政治的不安は、大規模なインフラ開発をさらに複雑にしています。ブラジルやチリなどでは再生可能エネルギー・プロジェクトが進行中であり、工業化や送電網の近代化がこの地域の他の地域よりも遅れているため、ブッシングのような高圧機器の需要全体は引き続きごくわずかなものにとどまると予測されます。

当レポートでは、世界の電気ブッシング市場について調査し、タイプ別、絶縁材料別、電圧別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 価格分析

- 投資と資金調達のシナリオ

- サプライチェーン分析

- 技術分析

- 2025年~2026年の主な会議とイベント

- 関税と規制状況

- 貿易分析

- 特許分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 生成AI/AIが電気ブッシング市場に与える影響

- マクロ経済見通し

第6章 電気ブッシング市場、用途別

- イントロダクション

- トランスフォーマー

- スイッチギア

- その他

第7章 電気ブッシング市場、エンドユーザー別

- イントロダクション

- ユーティリティ

- 工業用

- 商業用

- データセンター

- 再生可能エネルギー

- その他

第8章 電気ブッシング市場、絶縁材料別

- イントロダクション

- 磁器

- ポリマー

- ガラス

第9章 電気ブッシング市場、タイプ別

- イントロダクション

- オイル含浸紙ブッシング

- 樹脂含浸紙ブッシング

- その他

第10章 電気ブッシング市場、電圧別

- イントロダクション

- 36KV以下

- 37年~230KV

- 230KV以上

第11章 電気ブッシング市場、地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- その他

- 中東・アフリカ

- 湾岸協力会議

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第12章 競合情勢

- イントロダクション

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 企業評価と財務指標、2024年

- 製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- ABB

- SIEMENS

- HITACHI ENERGY LTD

- EATON

- GENERAL ELECTRIC COMPANY

- SCHNEIDER ELECTRIC

- CG POWER & INDUSTRIAL SOLUTIONS LTD.

- TRENCH GROUP

- HUBBELL

- POLYCAST INTERNATIONAL

- RHM INTERNATIONAL, LLC

- RELIANCE POTTERIES

- PFISTERER HOLDING SE

- WEBSTER WILKINSON LTD.

- BUSHING(BEIJING)HV ELECTRIC CO., LTD

- NEXANS

- YASH HIGHVOLTAGE INSULATORS PVT. LTD.

- NU-CORK PRODUCTS PVT LTD

- CHINSUN

- AMMA INSULATORS

- その他の企業

- DALIAN HIVOLT POWER SYSTEM CO., LTD.

- NANJING ELECTRIC HV BUSHING CO., LTD

- BAODING HEWEI POWER TECHNOLOGY CO., LTD

- MASSA IZOLYATOR MEHRU PVT. LTD.(MIM PVT. LTD.)

- POINSA

第14章 付録

List of Tables

- TABLE 1 ELECTRICAL BUSHINGS MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- TABLE 2 ELECTRICAL BUSHINGS MARKET: RISK ANALYSIS

- TABLE 3 ELECTRICAL BUSHINGS MARKET SNAPSHOT

- TABLE 4 ROLE OF COMPANIES IN ELECTRICAL BUSHINGS ECOSYSTEM

- TABLE 5 INDICATIVE PRICING OF ELECTRICAL BUSHINGS, BY INSULATION MATERIAL, 2023

- TABLE 6 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 7 MFN TARIFF FOR HS CODE 854620-COMPLIANT PRODUCTS, BY COUNTRY, 2023

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 CODES AND REGULATIONS

- TABLE 14 IMPORT DATA FOR HS CODE 854620-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 15 EXPORT DATA FOR HS CODE 854620-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 16 LIST OF KEY PATENTS, 2020-2023

- TABLE 17 PORTER'S FIVE FORCES ANALYSIS

- TABLE 18 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 20 ELECTRICAL BUSHINGS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 21 ELECTRICAL BUSHINGS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 22 TRANSFORMERS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 23 TRANSFORMERS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 24 SWITCHGEARS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 25 SWITCHGEARS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 26 OTHER APPLICATIONS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 27 OTHER APPLICATIONS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 28 ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 29 ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 30 UTILITIES: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 31 UTILITIES: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 32 INDUSTRIAL: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 33 INDUSTRIAL: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 34 COMMERCIAL: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 35 COMMERCIAL: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 36 DATA CENTERS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 37 DATA CENTERS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 38 RENEWABLES: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 39 RENEWABLES: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 40 OTHER END USERS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 41 OTHER END USERS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 42 ELECTRICAL BUSHINGS MARKET, BY INSULATION MATERIAL, 2021-2023 (USD MILLION)

- TABLE 43 ELECTRICAL BUSHINGS MARKET, BY INSULATION MATERIAL, 2024-2029 (USD MILLION)

- TABLE 44 PORCELAIN: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 45 PORCELAIN: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 46 POLYMER: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 47 POLYMER: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 48 GLASS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 49 GLASS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 50 ELECTRICAL BUSHINGS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 51 ELECTRICAL BUSHINGS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 52 OIL IMPREGNATED PAPER BUSHINGS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 53 OIL IMPREGNATED PAPER BUSHINGS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 54 RESIN IMPREGNATED PAPER BUSHINGS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 55 RESIN IMPREGNATED PAPER BUSHINGS: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 OTHER TYPES: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 57 OTHER TYPES: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 58 ELECTRICAL BUSHINGS MARKET, BY VOLTAGE, 2021-2023 (USD MILLION)

- TABLE 59 ELECTRICAL BUSHINGS MARKET, BY VOLTAGE, 2024-2029 (USD MILLION)

- TABLE 60 UP TO 36 KV: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 61 UP TO 36 KV: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 62 37-230 KV: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 63 37-230 KV: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 64 ABOVE 230 KV: ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 65 ABOVE 230 KV: ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 66 ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 67 ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 68 ELECTRICAL BUSHINGS MARKET, BY REGION, 2021-2023 (UNITS)

- TABLE 69 ELECTRICAL BUSHINGS MARKET, BY REGION, 2024-2029 (UNITS)

- TABLE 70 ASIA PACIFIC: ELECTRICAL BUSHINGS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 71 ASIA PACIFIC: ELECTRICAL BUSHINGS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 72 ASIA PACIFIC: ELECTRICAL BUSHINGS MARKET, BY INSULATION MATERIAL, 2021-2023 (USD MILLION)

- TABLE 73 ASIA PACIFIC: ELECTRICAL BUSHINGS MARKET, BY INSULATION MATERIAL, 2024-2029 (USD MILLION)

- TABLE 74 ASIA PACIFIC: ELECTRICAL BUSHINGS MARKET, BY VOLTAGE, 2021-2023 (USD MILLION)

- TABLE 75 ASIA PACIFIC: ELECTRICAL BUSHINGS MARKET, BY VOLTAGE, 2024-2029 (USD MILLION)

- TABLE 76 ASIA PACIFIC: ELECTRICAL BUSHINGS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 77 ASIA PACIFIC: ELECTRICAL BUSHINGS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 78 ASIA PACIFIC: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 79 ASIA PACIFIC: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 80 ASIA PACIFIC: ELECTRICAL BUSHINGS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 81 ASIA PACIFIC: ELECTRICAL BUSHINGS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 82 CHINA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 83 CHINA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 84 INDIA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 85 INDIA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 86 JAPAN: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 87 JAPAN: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 88 AUSTRALIA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 89 AUSTRALIA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 92 NORTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 93 NORTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 94 NORTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY INSULATION MATERIAL, 2021-2023 (USD MILLION)

- TABLE 95 NORTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY INSULATION MATERIAL, 2024-2029 (USD MILLION)

- TABLE 96 NORTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY VOLTAGE, 2021-2023 (USD MILLION)

- TABLE 97 NORTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY VOLTAGE, 2024-2029 (USD MILLION)

- TABLE 98 NORTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 99 NORTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 100 NORTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 101 NORTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 102 NORTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 103 NORTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 104 US: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 105 US: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 106 CANADA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 107 CANADA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 108 MEXICO: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 109 MEXICO: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 110 EUROPE: ELECTRICAL BUSHINGS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 111 EUROPE: ELECTRICAL BUSHINGS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 112 EUROPE: ELECTRICAL BUSHINGS MARKET, BY INSULATION MATERIAL, 2021-2023 (USD MILLION)

- TABLE 113 EUROPE: ELECTRICAL BUSHINGS MARKET, BY INSULATION MATERIAL, 2024-2029 (USD MILLION)

- TABLE 114 EUROPE: ELECTRICAL BUSHINGS MARKET, BY VOLTAGE, 2021-2023 (USD MILLION)

- TABLE 115 EUROPE: ELECTRICAL BUSHINGS MARKET, BY VOLTAGE, 2024-2029 (USD MILLION)

- TABLE 116 EUROPE: ELECTRICAL BUSHINGS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 117 EUROPE: ELECTRICAL BUSHINGS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 118 EUROPE: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 119 EUROPE: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 120 EUROPE: ELECTRICAL BUSHINGS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 121 EUROPE: ELECTRICAL BUSHINGS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 122 GERMANY: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 123 GERMANY: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 124 UK: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 125 UK: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 126 FRANCE: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 127 FRANCE: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 128 REST OF EUROPE: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 129 REST OF EUROPE: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: ELECTRICAL BUSHINGS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: ELECTRICAL BUSHINGS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: ELECTRICAL BUSHINGS MARKET, BY INSULATION MATERIAL, 2021-2023 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: ELECTRICAL BUSHINGS MARKET, BY INSULATION MATERIAL, 2024-2029 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: ELECTRICAL BUSHINGS MARKET, BY VOLTAGE, 2021-2023 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: ELECTRICAL BUSHINGS MARKET, BY VOLTAGE, 2024-2029 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: ELECTRICAL BUSHINGS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: ELECTRICAL BUSHINGS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: ELECTRICAL BUSHINGS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: ELECTRICAL BUSHINGS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 142 GCC: ELECTRICAL BUSHINGS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 143 GCC: ELECTRICAL BUSHINGS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 144 SAUDI ARABIA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 145 SAUDI ARABIA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 146 UAE: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 147 UAE: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 148 REST OF GCC: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 149 REST OF GCC: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 150 SOUTH AFRICA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 151 SOUTH AFRICA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 152 REST OF MIDDLE EAST & AFRICA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 153 REST OF MIDDLE EAST & AFRICA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 154 SOUTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 155 SOUTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 156 SOUTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY INSULATION MATERIAL, 2021-2023 (USD MILLION)

- TABLE 157 SOUTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY INSULATION MATERIAL, 2024-2029 (USD MILLION)

- TABLE 158 SOUTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY VOLTAGE, 2021-2023 (USD MILLION)

- TABLE 159 SOUTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY VOLTAGE, 2024-2029 (USD MILLION)

- TABLE 160 SOUTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 161 SOUTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 162 SOUTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 163 SOUTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 164 SOUTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 165 SOUTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 166 BRAZIL: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 167 BRAZIL: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 168 ARGENTINA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 169 ARGENTINA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 170 REST OF SOUTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2021-2023 (USD MILLION)

- TABLE 171 REST OF SOUTH AMERICA: ELECTRICAL BUSHINGS MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 172 ELECTRICAL BUSHINGS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 173 ELECTRICAL BUSHINGS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 174 ELECTRICAL BUSHINGS MARKET: REGION FOOTPRINT

- TABLE 175 ELECTRICAL BUSHINGS MARKET: TYPE FOOTPRINT

- TABLE 176 ELECTRICAL BUSHINGS MARKET: APPLICATION FOOTPRINT

- TABLE 177 ELECTRICAL BUSHINGS MARKET: VOLTAGE FOOTPRINT

- TABLE 178 ELECTRICAL BUSHINGS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 179 ELECTRICAL BUSHINGS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 180 ELECTRICAL BUSHINGS MARKET: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2024

- TABLE 181 ELECTRICAL BUSHINGS MARKET: DEALS, JANUARY 2021-NOVEMBER 2024

- TABLE 182 ELECTRICAL BUSHINGS MARKET: EXPANSIONS, JANUARY 2021-NOVEMBER 2024

- TABLE 183 ABB: COMPANY OVERVIEW

- TABLE 184 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 ABB: DEALS

- TABLE 186 ABB: EXPANSIONS

- TABLE 187 ABB: OTHER DEVELOPMENTS

- TABLE 188 SIEMENS: COMPANY OVERVIEW

- TABLE 189 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 SIEMENS: PRODUCT LAUNCHES

- TABLE 191 SIEMENS: DEALS

- TABLE 192 HITACHI ENERGY LTD: COMPANY OVERVIEW

- TABLE 193 HITACHI ENERGY LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 HITACHI ENERGY LTD: DEVELOPMENTS

- TABLE 195 EATON: COMPANY OVERVIEW

- TABLE 196 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 EATON: DEALS

- TABLE 198 EATON: EXPANSIONS

- TABLE 199 GENERAL ELECTRIC COMPANY: COMPANY OVERVIEW

- TABLE 200 GENERAL ELECTRIC COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 GENERAL ELECTRIC COMPANY: DEALS

- TABLE 202 GENERAL ELECTRIC COMPANY: OTHER DEVELOPMENTS

- TABLE 203 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 204 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 SCHNEIDER ELECTRIC: EXPANSIONS

- TABLE 206 CG POWER & INDUSTRIAL SOLUTIONS LTD.: COMPANY OVERVIEW

- TABLE 207 CG POWER & INDUSTRIAL SOLUTIONS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 TRENCH GROUP: COMPANY OVERVIEW

- TABLE 209 TRENCH GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 TRENCH GROUP: DEALS

- TABLE 211 HUBBELL: COMPANY OVERVIEW

- TABLE 212 HUBBELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 POLYCAST INTERNATIONAL: COMPANY OVERVIEW

- TABLE 214 POLYCAST INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 RHM INTERNATIONAL, LLC: COMPANY OVERVIEW

- TABLE 216 RHM INTERNATIONAL, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 RELIANCE POTTERIES: COMPANY OVERVIEW

- TABLE 218 RELIANCE POTTERIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 PFISTERER HOLDING SE: COMPANY OVERVIEW

- TABLE 220 PFISTERER HOLDING SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 WEBSTER WILKINSON LTD.: COMPANY OVERVIEW

- TABLE 222 WEBSTER WILKINSON LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 BUSHING (BEIJING) HV ELECTRIC CO., LTD: COMPANY OVERVIEW

- TABLE 224 BUSHING (BEIJING) HV ELECTRIC CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 NEXANS: COMPANY OVERVIEW

- TABLE 226 NEXANS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 NEXANS: DEALS

- TABLE 228 YASH HIGHVOLTAGE INSULATORS PVT. LTD.: COMPANY OVERVIEW

- TABLE 229 YASH HIGHVOLTAGE INSULATORS PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 YASH HIGHVOLTAGE INSULATORS PVT. LTD.: PRODUCT LAUNCHES

- TABLE 231 NU-CORK PRODUCTS PVT LTD: COMPANY OVERVIEW

- TABLE 232 NU-CORK PRODUCTS PVT LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 CHINSUN: COMPANY OVERVIEW

- TABLE 234 CHINSUN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 GAMMA INSULATORS: COMPANY OVERVIEW

- TABLE 236 GAMMA INSULATORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 ELECTRICAL BUSHINGS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 ELECTRICAL BUSHINGS MARKET: RESEARCH DESIGN

- FIGURE 3 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR ELECTRICAL BUSHINGS

- FIGURE 4 ELECTRICAL BUSHINGS MARKET: BOTTOM-UP APPROACH

- FIGURE 5 ELECTRICAL BUSHINGS MARKET: TOP-DOWN APPROACH

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF ELECTRICAL BUSHINGS

- FIGURE 7 ELECTRICAL BUSHINGS MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 8 ELECTRICAL BUSHINGS MARKET: DATA TRIANGULATION

- FIGURE 9 OIL IMPREGNATED PAPER BUSHINGS SEGMENT TO DOMINATE ELECTRICAL BUSHINGS MARKET DURING FORECAST PERIOD

- FIGURE 10 PORCELAIN SEGMENT TO HOLD LARGEST SHARE OF ELECTRICAL BUSHINGS MARKET IN 2029

- FIGURE 11 UP TO 36 KV SEGMENT TO DOMINATE ELECTRICAL BUSHINGS MARKET FROM 2024 TO 2029

- FIGURE 12 TRANSFORMERS SEGMENT TO CAPTURE LARGEST SHARE OF ELECTRICAL BUSHINGS MARKET IN 2024

- FIGURE 13 UTILITIES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 14 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF ELECTRICAL BUSHINGS MARKET BETWEEN 2024 AND 2029

- FIGURE 15 RISING EMPHASIS ON GRID MODERNIZATION TO ENHANCE POWER TRANSMISSION EFFICIENCY TO DRIVE MARKET

- FIGURE 16 OIL IMPREGNATED PAPER BUSHINGS SEGMENT AND CHINA CAPTURED LARGEST SHARES OF ELECTRICAL BUSHINGS MARKET IN ASIA PACIFIC IN 2023

- FIGURE 17 OIL IMPREGNATED PAPER BUSHINGS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 18 PORCELAIN SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 19 UP TO 36 KV SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 20 TRANSFORMERS SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2029

- FIGURE 21 UTILITIES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 22 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN ELECTRICAL BUSHINGS MARKET DURING FORECAST PERIOD

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 GLOBAL INVESTMENT IN POWER SECTOR, 2019-2023

- FIGURE 25 GLOBAL ANNUAL INVESTMENT IN GRID INFRASTRUCTURE, 2017-2023

- FIGURE 26 GLOBAL INVESTMENT IN CLEAN ENERGY, 2017-2023

- FIGURE 27 INCREASE IN ANNUAL CLEAN ENERGY INVESTMENT IN SELECTED COUNTRIES AND REGIONS, 2019-2023

- FIGURE 28 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 29 ECOSYSTEM ANALYSIS

- FIGURE 30 AVERAGE SELLING PRICE TREND OF ELECTRICAL BUSHINGS, BY REGION, 2021-2023

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO, 2023

- FIGURE 32 SUPPLY CHAIN ANALYSIS

- FIGURE 33 IMPORT DATA FOR HS CODE 854620-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023

- FIGURE 34 EXPORT DATA FOR HS CODE 854620-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023

- FIGURE 35 PATENTS APPLIED AND GRANTED, 2014-2023

- FIGURE 36 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 38 BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 39 IMPACT OF GEN AI/AI ON ELECTRICAL BUSHINGS MARKET, BY REGION

- FIGURE 40 ELECTRICAL BUSHINGS MARKET SHARE, BY APPLICATION, 2023

- FIGURE 41 ELECTRICAL BUSHINGS MARKET SHARE, BY END USER, 2023

- FIGURE 42 ELECTRICAL BUSHINGS MARKET SHARE, BY INSULATION MATERIAL, 2023

- FIGURE 43 ELECTRICAL BUSHINGS MARKET SHARE, BY TYPE, 2023

- FIGURE 44 ELECTRICAL BUSHINGS MARKET SHARE, BY VOLTAGE, 2023

- FIGURE 45 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN ELECTRICAL BUSHINGS MARKET FROM 2024 TO 2029

- FIGURE 46 ELECTRICAL BUSHINGS MARKET SHARE, BY REGION, 2023

- FIGURE 47 ASIA PACIFIC ELECTRICAL BUSHINGS MARKET SNAPSHOT

- FIGURE 48 NORTH AMERICA ELECTRICAL BUSHINGS MARKET SNAPSHOT

- FIGURE 49 ELECTRICAL BUSHINGS MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2019-2023

- FIGURE 50 MARKET SHARE ANALYSIS OF COMPANIES OFFERING ELECTRICAL BUSHINGS, 2023

- FIGURE 51 COMPANY VALUATION, 2024

- FIGURE 52 FINANCIAL METRICS, 2024

- FIGURE 53 PRODUCT COMPARISON

- FIGURE 54 ELECTRICAL BUSHINGS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 55 ELECTRICAL BUSHINGS MARKET: COMPANY FOOTPRINT

- FIGURE 56 ELECTRICAL BUSHINGS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 57 ABB: COMPANY SNAPSHOT

- FIGURE 58 SIEMENS: COMPANY SNAPSHOT

- FIGURE 59 HITACHI ENERGY LTD: COMPANY SNAPSHOT

- FIGURE 60 EATON: COMPANY SNAPSHOT

- FIGURE 61 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

- FIGURE 62 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 63 CG POWER & INDUSTRIAL SOLUTIONS LTD.: COMPANY SNAPSHOT

- FIGURE 64 HUBBELL: COMPANY SNAPSHOT

- FIGURE 65 NEXANS: COMPANY SNAPSHOT

The global electrical bushings market is expected to grow significantly from an estimated USD 3.67 billion in 2024 to USD 4.77 billion by 2029, at a CAGR of 5.4% during the forecast period. Growth in electrical bushings is predominantly seen worldwide, led by demand in effective transmission and distribution of electricity triggered by rapid urbanization and industrialization. Major investment in renewable energy projects along with the modernization of grid helps escalate demand for high-performance, reliable advanced bushings that may have withstanding voltage capability for more prolonged system performance. Resin-impregnated and synthetic bushings replace the traditional porcelain to reduce energy losses and improve electrical safety. Furthermore, stringent government regulations and environmental mandates drive the industries toward the adoption of more sustainable and high-performance bushing solutions. These drivers along with a growing demand for the upgradation of aging power infrastructure worldwide propel the market growth at an aggressive rate.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | Electrical Bushings Market by type, insulation material, voltage, application, end user, and region. |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa and South America |

"Above 230 segment, by voltage, is expected to hold third largest market share during forecast period"

The Above 230 kV subsegment of the By Voltage segment is the third-largest in the global electrical bushings market, given its importance in high-voltage power transmission applications. This range is most commonly used in large-scale infrastructure projects, including inter-regional and cross-border transmission networks, which are considered essential for stabilizing grids and integrating renewable energy sources. The increasing adoption of ultra-high-voltage direct current (UHVDC) systems, especially in emerging economies in the Asia Pacific and the Middle East, is further fuelling demand. Also, investments in upgrading aging grid infrastructure in developed regions like North America and Europe have fueled growth in this subsegment. In fact, these bushings are irreplaceable for maintaining the reliability of operation, reducing losses in power, and sustaining the long-distance transmission of electricity.

"Switchgear segment, by Application, is expected to hold second-largest market share during forecast period"

The Switchgear subsegment of the By Application segment is the second-largest market share in the global electrical bushings market because switchgear plays a critical role in ensuring that electrical systems are safe and reliable. Electrical bushings in switchgear provide an easy, secure passage for current with seamless insulation, even in high-stress conditions. Demand for advanced and compact switchgear solutions has emerged in urbanization projects, renewable energy integration, and industrial expansions across the globe. The grid modernization initiatives pursued by regions such as Europe and North America along with rapid electrification and industrialization in Asia Pacific will positively impact the adoption of bushings for medium- and high-voltage switchgear. These factors explain why, to ensure operational efficiency and system protection, bushings are indispensable.

"South Amrica is expected to hold the least market share during forecast period."

South America has the lowest market share in the global electrical bushings market due to various limiting factors. These include a lower level of investment in power infrastructure compared to other regions, and slower adaptation of the latest grid technologies. It is still more focused on basic electrification efforts for rural areas and has only limited budgets for upgrading its transmission and distribution networks with advanced equipment such as electrical bushings. Economic instability and political insecurity in other countries further compound large infrastructure development. Ongoing renewable projects in countries such as Brazil and Chile will continue to keep the overall demand for high-voltage equipment like bushings very modest with limited industrialization and grid modernization progressing at a slower rate than elsewhere in the region.

By Company Type: Tier 1- 30%, Tier 2- 55%, and Tier 3- 15%

By Designation: C-level Executives - 30%, Director Level- 20%, and Others- 50%

By Region: North America - 18%, Europe - 8%, Asia Pacific - 60%, South America - 4%, Middle East & Africa - 10%

Note: Other designations include sales managers, marketing managers, product managers, and product engineers.

The tier of the companies is defined based on their total revenue as of 2023. Tier 1: USD 1 billion and above, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: <USD 500 million.

The global electrical bushings market is dominated by key players that hold a wide regional presence and offer a diverse range of products. Leading companies in the electrical bushings market include ABB (Switzerland), Siemens (Germnay), Trench Group (Germany), General Electric Company (US), Schneider Electric (France), Eaton (Ireland) among others. These players focus on strategies such as product innovations, acquisitions, agreements, partnerships, and expansions to strengthen their market position. New product launches, coupled with strategic investments in power infrastructure and energy-efficient technologies, are key approaches adopted by these companies to maintain competitive advantages in the evolving market landscape.

Research Coverage:

The report defines, describes, and forecasts the electrical bushings market by type, insulation material, voltage, application, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product launches, acquisitions, and recent developments associated with the electrical bushings market. Competitive analysis of upcoming startups in the electrical bushings market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants electrical bushings market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing global reliable power demand, Modernization of aging infrastructure, Increasing adoption of high-voltage and extra high-voltage networks), restraints (High initial costs associated with electrical bushings, Availability of low-cost alternatives) opportunities (Integration of renewable energy into power grids, Increasing adoption of smart grid infrastructure, Industrial growth in emerging economies), and challenges (Complex manufacturing and customization requirements of electrical bushings, Maintenance and replacement challenges associated with electrical bushings) influencing the growth.

- Product Development/ Innovation: Advancements in the use of insulation materials and digital monitoring capabilities and improving energy efficiency are driving the developments in product innovation within the global electrical bushings market. The leading players ABB, Siemens, and Hitachi Energy are focusing on the production of next-generation bushings, such as Resin-Impregnated Paper (RIP) and Resin-Impregnated Synthetic (RIS), promising better thermal performance, lower environmental effects, and safety than the traditional oil-impregnated bushing (OIP). Innovations also include smart bushings with sensors and real-time monitoring systems for predictive maintenance, which are critical to ensuring grid reliability and minimizing downtime. In addition, there is an increasing emphasis on sustainable solutions, and hence designs that are eco-friendly, minimize oil usage, and maximize recyclability. These developments address the changing needs of modern power infrastructure, renewable energy integration, and the global push toward grid modernization, all set to propel the market for healthy growth through technological advancements.

- Market Development: Increasing the extension of T&D networks is currently driving the market for electrical bushings across the world. This development is occurring mostly in the developing economies of Asia Pacific, Africa, and Latin America. The governments and utilities are investing highly in modernization projects related to the grid, renewable energy integration, and cross-border power transmission as a way of increasing grid reliability and answering the increase in demand for electricity. Developed countries like North America and Europe are upgrading ageing infrastructure, replacing old obsolete bushings with modern technologies like RIP and RIS for safety improvements and efficiency. In emerging countries, growth is seen because of rapid urbanization and industrialization and also due to increased electrification initiatives. Use of smart grid technology and also digital substations further creates newer opportunities for bushings along with monitoring systems. Market players expand presence in untapped geographies through strategic collaborations and partnerships and new product launches that make the most of opportunities driven by rising demand for safe and efficient power delivery systems.

- Market Diversification: Market diversification in the global electrical bushings market comes from regional expansion, innovation in technology, and new verticals. Major manufacturers look to tap opportunities through the growing economies of Asia Pacific, Africa, and South America with a focus on emerging markets related to infrastructure development, grid expansions, and renewable projects. Companies are also expanding their product lines by introducing higher level of insulation technologies such as RIP and RIS bushings that are gaining traction as more consumers seek sustainable and efficient energy solutions. In addition, new applications are being found for this technology in rail transportation, offshore wind energy, and industrial power systems, well beyond traditional utilities and substations. Strategic alliances, mergers, and acquisitions further enable companies to enter untapped markets, strengthen supply chains, and leverage regional expertise. This diversification approach helps market players reduce dependency on a single market segment, thus ensuring long-term growth and resilience amidst evolving global energy needs.

- Competitive Assessment: In-depth analysis of market share, growth plans, and service offerings of top companies in the global electrical bushings market, including ABB (Switzerland), Siemens (Germnay), Trench Group (Germany), General Electric Company (US), Schneider Electric (France), Eaton (Ireland), RHM International LLC (US), Hitachi Energy Ltd. (Japan), Hubbell (US), Polycast International (US), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Regional analysis

- 2.2.1.2 Country-level analysis

- 2.2.1.3 Demand-side assumptions

- 2.2.1.4 Demand-side calculations

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Supply-side assumptions

- 2.2.2.2 Supply-side calculations

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTRICAL BUSHINGS MARKET

- 4.2 ELECTRICAL BUSHINGS MARKET IN ASIA PACIFIC, BY TYPE AND COUNTRY

- 4.3 ELECTRICAL BUSHINGS MARKET, BY TYPE

- 4.4 ELECTRICAL BUSHINGS MARKET, BY INSULATION MATERIAL

- 4.5 ELECTRICAL BUSHINGS MARKET, BY VOLTAGE

- 4.6 ELECTRICAL BUSHINGS MARKET, BY APPLICATION

- 4.7 ELECTRICAL BUSHINGS MARKET, BY END USER

- 4.8 ELECTRICAL BUSHINGS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Mounting demand for reliable power due to industrialization

- 5.2.1.2 Rapid modernization of aging grid infrastructure

- 5.2.1.3 Increasing focus on high-voltage and ultra-high-voltage transmission projects

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial and upfront costs

- 5.2.2.2 Availability of low-cost alternatives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing integration of renewable energy into power grids

- 5.2.3.2 Rising emphasis on expansion of smart grid infrastructure

- 5.2.3.3 Rapid industrial growth in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex manufacturing and customization requirements

- 5.2.4.2 Challenges associated with maintenance and replacement

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING OF ELECTRICAL BUSHINGS, BY INSULATION MATERIAL, 2023

- 5.5.2 AVERAGE SELLING PRICE TREND OF ELECTRICAL BUSHINGS, BY REGION, 2021-2023

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Advanced insulation technologies

- 5.8.1.2 Smart bushings

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 Additive manufacturing

- 5.8.1 KEY TECHNOLOGIES

- 5.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.10.1 TARIFF ANALYSIS (HS CODE 854620)

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.3 CODES AND REGULATIONS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 854620)

- 5.11.2 EXPORT SCENARIO (HS CODE 854620)

- 5.12 PATENT ANALYSIS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 UTILITY COMPANY IN EUROPE IMPLEMENTS BIIT BUSHING TO ENHANCE OPERATIONAL EFFICIENCY OF HIGH-VOLTAGE SYSTEMS

- 5.15.2 SIEMENS' BUSHING ENABLES TECHNISCHE BETRIEBE GLARUS NORD TO ACHIEVE SECURE AND SUSTAINABLE POWER SUPPLY AND ENHANCE GRID TRANSPARENCY

- 5.16 IMPACT OF GEN AI/AI ON ELECTRICAL BUSHINGS MARKET

- 5.17 MACROECONOMIC OUTLOOK

- 5.17.1 GDP OUTLOOK

- 5.17.2 RESEARCH & DEVELOPMENT EXPENDITURE

- 5.17.3 INVESTMENTS BY END USERS

- 5.17.4 POWER SECTOR GROWTH

6 ELECTRICAL BUSHINGS MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 TRANSFORMERS

- 6.2.1 INCREASING DEVELOPMENT OF GRID INFRASTRUCTURE TO BOOST SEGMENTAL GROWTH

- 6.3 SWITCHGEARS

- 6.3.1 RAPID INDUSTRIALIZATION AND URBANIZATION TO AUGMENT SEGMENTAL GROWTH

- 6.4 OTHER APPLICATIONS

7 ELECTRICAL BUSHINGS MARKET, BY END USER

- 7.1 INTRODUCTION

- 7.2 UTILITIES

- 7.2.1 INCREASING PENETRATION OF RENEWABLE ENERGY SOURCES TO BOLSTER SEGMENTAL GROWTH

- 7.3 INDUSTRIAL

- 7.3.1 GROWING EMPHASIS ON AUTOMATION AND DIGITALIZATION TO FUEL MARKET GROWTH

- 7.4 COMMERCIAL

- 7.4.1 INCREASING CONSTRUCTION OF ENERGY-EFFICIENT AND SUSTAINABLE BUILDINGS TO SPUR DEMAND

- 7.5 DATA CENTERS

- 7.5.1 RISING NEED FOR UNINTERRUPTED AND EFFICIENT POWER SUPPLY SYSTEMS TO DRIVE MARKET

- 7.6 RENEWABLES

- 7.6.1 INCREASING RELIANCE ON CLEAN ENERGY SOURCES FOR POWER GENERATION TO BOOST SEGMENTAL GROWTH

- 7.7 OTHER END USERS

8 ELECTRICAL BUSHINGS MARKET, BY INSULATION MATERIAL

- 8.1 INTRODUCTION

- 8.2 PORCELAIN

- 8.2.1 OPERATIONAL RELIABILITY IN POWER TRANSMISSION AND DISTRIBUTION SYSTEMS TO FUEL DEMAND

- 8.3 POLYMER

- 8.3.1 ENHANCED FLEXIBILITY AND LIGHTWEIGHT PROPERTIES TO FOSTER SEGMENTAL GROWTH

- 8.4 GLASS

- 8.4.1 DURABILITY, CHEMICAL RESISTANCE, AND DIELECTRIC PERFORMANCE TO FUEL SEGMENTAL GROWTH

9 ELECTRICAL BUSHINGS MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 OIL IMPREGNATED PAPER BUSHINGS

- 9.2.1 COST-EFFECTIVENESS AND LONGER OPERATIONAL LIFESPAN TO ACCELERATE SEGMENTAL GROWTH

- 9.3 RESIN IMPREGNATED PAPER BUSHINGS

- 9.3.1 INCREASING CONSUMPTION OF RENEWABLE ENERGY AND GRID MODERNIZATION TO BOOST DEMAND

- 9.4 OTHER TYPES

10 ELECTRICAL BUSHINGS MARKET, BY VOLTAGE

- 10.1 INTRODUCTION

- 10.2 UP TO 36 KV

- 10.2.1 GROWING EMPHASIS ON MODERNIZING URBAN INFRASTRUCTURE TO DRIVE MARKET

- 10.3 37-230 KV

- 10.3.1 INCREASING URBANIZATION, INDUSTRIALIZATION, AND CROSS-BORDER ENERGY TRADING TO AUGMENT SEGMENTAL GROWTH

- 10.4 ABOVE 230 KV

- 10.4.1 RISING NEED FOR LONG-DISTANCE POWER TRANSMISSION TO FACILITATE SEGMENTAL GROWTH

11 ELECTRICAL BUSHINGS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Strategic focus on grid modernization to accelerate demand

- 11.2.2 INDIA

- 11.2.2.1 Rapid urbanization and energy demand to support market growth

- 11.2.3 JAPAN

- 11.2.3.1 Energy transition and grid modernization to drive market

- 11.2.4 AUSTRALIA

- 11.2.4.1 Growing need for robust electrical infrastructure to foster market growth

- 11.2.5 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Investments in clean energy to accelerate market growth

- 11.3.2 CANADA

- 11.3.2.1 Deployment of advanced electrical bushings to support market growth

- 11.3.3 MEXICO

- 11.3.3.1 Rapid infrastructure development to drive market

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Rising investment in green energy to accelerate market growth

- 11.4.2 UK

- 11.4.2.1 Increasing focus on expanding power transmission networks to drive market

- 11.4.3 FRANCE

- 11.4.3.1 Growing consumption of renewable energy to meet decarbonization targets to spur demand

- 11.4.4 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Growing emphasis on renewable energy and infrastructure modernization to foster market growth

- 11.5.1.2 UAE

- 11.5.1.2.1 Rapid development of advanced electrical infrastructure to drive market

- 11.5.1.3 Rest of GCC

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Increasing generation of renewable energy to foster market growth

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Ambitious policy and investments in electricity infrastructure to fuel demand

- 11.6.2 ARGENTINA

- 11.6.2.1 Increasing reliance on renewable energy sources for power generation to fuel market growth

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 REVENUE ANALYSIS, 2019-2023

- 12.3 MARKET SHARE ANALYSIS, 2023

- 12.4 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 12.5 PRODUCT COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Type footprint

- 12.6.5.4 Application footprint

- 12.6.5.5 Voltage footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of key startups/SMEs

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 PRODUCT LAUNCHES

- 12.8.2 DEALS

- 12.8.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ABB

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SIEMENS

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 HITACHI ENERGY LTD

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 EATON

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 GENERAL ELECTRIC COMPANY

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 SCHNEIDER ELECTRIC

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Expansions

- 13.1.7 CG POWER & INDUSTRIAL SOLUTIONS LTD.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 TRENCH GROUP

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 HUBBELL

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 POLYCAST INTERNATIONAL

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.11 RHM INTERNATIONAL, LLC

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.12 RELIANCE POTTERIES

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.13 PFISTERER HOLDING SE

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.14 WEBSTER WILKINSON LTD.

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.15 BUSHING (BEIJING) HV ELECTRIC CO., LTD

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.16 NEXANS

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Deals

- 13.1.17 YASH HIGHVOLTAGE INSULATORS PVT. LTD.

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.17.3 Recent developments

- 13.1.17.3.1 Product launches

- 13.1.18 NU-CORK PRODUCTS PVT LTD

- 13.1.18.1 Business overview

- 13.1.18.2 Products/Solutions/Services offered

- 13.1.19 CHINSUN

- 13.1.19.1 Business overview

- 13.1.19.2 Products/Solutions/Services offered

- 13.1.20 AMMA INSULATORS

- 13.1.20.1 Business overview

- 13.1.20.2 Products/Solutions/Services offered

- 13.1.1 ABB

- 13.2 OTHER PLAYERS

- 13.2.1 DALIAN HIVOLT POWER SYSTEM CO., LTD.

- 13.2.2 NANJING ELECTRIC HV BUSHING CO., LTD

- 13.2.3 BAODING HEWEI POWER TECHNOLOGY CO., LTD

- 13.2.4 MASSA IZOLYATOR MEHRU PVT. LTD. (MIM PVT. LTD.)

- 13.2.5 POINSA

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS