|

|

市場調査レポート

商品コード

1636633

HDPEパイプの世界市場 (~2029年):グレード (Pe 63・Pe 80・Pe 100)・直径 (50 mm未満・50-250 mm・250 mm超)・用途 (灌漑システム・下水&排水システム・化学処理・電融継手・その他)・エンドユーザー・地域別HDPE Pipes Market by Grade (Pe 63, Pe 80, Pe 100), Diameter (<50 Mm, 50-250 Mm, >250 Mm), Application (Irrigation System, Sewage & Drainage System, Chemical Processing, Electrofusion Fittings, Others), End-Use, & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| HDPEパイプの世界市場 (~2029年):グレード (Pe 63・Pe 80・Pe 100)・直径 (50 mm未満・50-250 mm・250 mm超)・用途 (灌漑システム・下水&排水システム・化学処理・電融継手・その他)・エンドユーザー・地域別 |

|

出版日: 2025年01月07日

発行: MarketsandMarkets

ページ情報: 英文 253 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

HDPEパイプの市場規模は、2024年の198億4,000万米ドルから、予測期間中は5.3%のCAGRで推移し、2029年には256億8,000万米ドルの規模に成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル)・数量 (キロトン) |

| セグメント | グレード・エンドユーザー・直径・用途・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・南米 |

世界各地でHDPEパイプの需要が伸びている最も大きな要因には、都市化やインフラ整備などが挙げられます。都市化率の上昇に伴い、より良い将来性を求めて農村部から都市部へ移り住む人が増え、都市部の規模が拡大し、適切なインフラに対する需要が高まっています。新興経済諸国では、速度の速い工業化と人口増加によって、既存のインフラシステムにストレスが生じています。

また、HDPEパイプの需要拡大は、都市化によって上下水道、排水、ガス配給システムといった基本的なユーティリティ事業への要求が高まっていることとも密接に関係しています。都市人口の増加は、質の高いインフラシステムを必要とします。HDPEパイプは、強度、柔軟性、設置の容易さから、このような重要なサービスにますます選ばれるようになっています。HDPEパイプは極端な環境条件や腐食に強く、高圧給水システムや廃水管理による応力にも強いものです。

政府は、急速に成長する都市部の需要を満たすため、インフラプロジェクトに投資しています。世界の多くの地域、特に新興諸国では、政府は旧式の非効率的な配管システムをアップグレードまたは交換するための大規模な取り組みを行っています。コンクリートや金属パイプのような従来の素材は、寿命やメンテナンスコストの点で限界があるのに対し、HDPEパイプはより持続可能で費用対効果の高いソリューションを提供します。HDPEパイプは軽量であるため、輸送や設置にかかるコストを削減できます。また、柔軟性があるため、人口密度の高い都市部のような複雑な環境でも設置しやすいです。

HDPEパイプの需要を牽引しているのは、民間部門、特に建設およびユーティリティ部門です。官民パートナーシップや大規模な開発プロジェクトに民間企業が関与することで、長期的な価値があり、メンテナンスが容易で、漏水や故障のリスクが少ない材料が求められています。HDPEパイプはこうした基準を満たしているため、住宅や商業ビルの開発、工業用パイプライン、水や廃棄物管理システムに高度な技術を統合するスマートシティプロジェクトなど、新しいインフラプロジェクトでの使用が増加しています。

当レポートでは、世界のHDPEパイプの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 生成AIの影響

- 業界動向

- バリューチェーン分析

- 価格分析

- 投資情勢と資金調達シナリオ

- エコシステム分析

- 代替製品分析

- 技術分析

- 特許分析

- 貿易分析

- 2025年の主な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- マクロ経済見通し

- ケーススタディ分析

第6章 HDPEパイプ市場:直径別

- 500mm未満

- 500~1,000mm

- 1,000~2,000mm

- 2,000~3,000mm

- 3,000mm超

第7章 HDPEパイプ市場:グレード別

- PE80

- PE100

第8章 HDPEパイプ市場:用途別

- 灌漑システム

- 下水・排水

- 化学処理

- 電気融着継手

- その他

- 光ファイバー・ケーブル

- 雨水管理システム

第9章 HDPEパイプ市場:エンドユーザー別

- 自治体

- 農業

- 石油・ガス

- 工業

- 建設

- その他

- 鉱業

- 再生可能エネルギー

第10章 HDPEパイプ市場:地域別

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 欧州

- ドイツ

- 英国

- ロシア

- イタリア

- フランス

- スペイン

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

第11章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- ブランド/製品比較

- 企業価値評価と財務指標

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- WL PLASTICS

- AGRU KUNSTSTOFFTECHNIK GMBH

- DYKA GROUP

- ALIAXIS HOLDINGS SA

- CHINA LESSO

- CHEVRON PHILLIPS CHEMICAL COMPANY LLC

- JM EAGLE, INC.

- SUPREME INDUSTRIES LTD.

- JAIN IRRIGATION SYSTEMS LTD.

- ASTRAL PIPES

- その他の企業

- ISCO INDUSTRIES

- AL-ROWAD COMPLEX

- COSMOPLAST INDUSTRIAL COMPANY LLC

- UNION PIPES INDUSTRIES

- FUTURE PIPE INDUSTRIES

- POLYFAB PLASTIC INDUSTRY LLC

- FLORENCE POLYTECH (FZE)

- SAUDI ARABIAN AMIANTIT CO.

- KRAH MISR

- MUNA NOOR

- PIPEX INFRASTRUCTURE SOLUTIONS

- AL WASIL INDUSTRIAL COMPANY

- ROYAL MAJESTIC

- NATIONAL PLASTIC INDUSTRIES LIMITED

- ALAMAL ALSHARIF PLASTICS

第13章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF HDPE PIPES, BY REGION, 2021-2024 (USD/TON)

- TABLE 2 AVERAGE SELLING PRICE TREND, BY GRADE, 2021-2024 (USD/TON)

- TABLE 3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY GRADE, 2021-2024 (USD/TON)

- TABLE 4 HDPE PIPES MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 5 KEY TECHNOLOGIES IN HDPE PIPES MARKET

- TABLE 6 COMPLEMENTARY TECHNOLOGIES IN HDPE PIPES MARKET

- TABLE 7 ADJACENT TECHNOLOGIES IN HDPE PIPES MARKET

- TABLE 8 HDPE PIPES MARKET: TOTAL NUMBER OF PATENTS

- TABLE 9 HDPE PIPES MARKET: LIST OF MAJOR PATENT OWNERS

- TABLE 10 HDPE PIPES MARKET: LIST OF MAJOR PATENTS, 2018-2024

- TABLE 11 IMPORT OF HS CODE 391721-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 12 EXPORT OF HS CODE 391721-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 13 HDPE PIPES MARKET: LIST OF KEY CONFERENCES & EVENTS, 2025

- TABLE 14 TARIFF RATES RELATED TO HDPE PIPES MARKET

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 LIST OF REGULATIONS FOR HDPE PIPES MARKET

- TABLE 21 HDPE PIPES MARKET: PORTER'S FIVE FORCES ANALYSIS

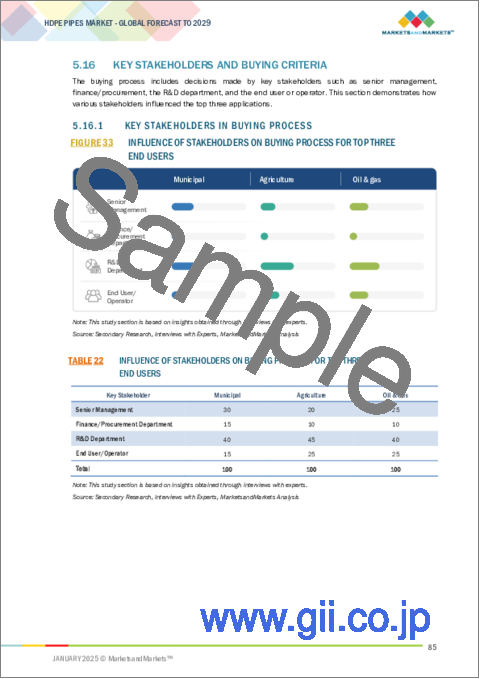

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 24 GDP TRENDS AND FORECAST, BY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 25 HDPE PIPES MARKET, BY DIAMETER, 2020-2023 (USD MILLION)

- TABLE 26 HDPE PIPES MARKET, BY DIAMETER, 2024-2029 (USD MILLION)

- TABLE 27 HDPE PIPES MARKET, BY GRADE, 2020-2023 (USD MILLION)

- TABLE 28 HDPE PIPES MARKET, BY GRADE, 2024-2029 (USD MILLION)

- TABLE 29 HDPE PIPES MARKET, BY GRADE, 2020-2023 (KILOTON)

- TABLE 30 HDPE PIPES MARKET, BY GRADE, 2024-2029 (KILOTON)

- TABLE 31 HDPE PIPES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 32 HDPE PIPES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 33 HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 34 HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 35 HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 36 HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 37 HDPE PIPES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 HDPE PIPES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 HDPE PIPES MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 40 HDPE PIPES MARKET, BY REGION, 2024-2029 (KILOTON)

- TABLE 41 ASIA PACIFIC: HDPE PIPES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 42 ASIA PACIFIC: HDPE PIPES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 43 ASIA PACIFIC: HDPE PIPES MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 44 ASIA PACIFIC: HDPE PIPES MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 45 ASIA PACIFIC: HDPE PIPES MARKET, BY GRADE, 2020-2023 (USD MILLION)

- TABLE 46 ASIA PACIFIC: HDPE PIPES MARKET, BY GRADE, 2024-2029 (USD MILLION)

- TABLE 47 ASIA PACIFIC: HDPE PIPES MARKET, BY GRADE, 2020-2023 (KILOTON)

- TABLE 48 ASIA PACIFIC: HDPE PIPES MARKET, BY GRADE, 2024-2029 (KILOTON)

- TABLE 49 ASIA PACIFIC: HDPE PIPES MARKET, BY DIAMETER, 2020-2023 (USD MILLION)

- TABLE 50 ASIA PACIFIC: HDPE PIPES MARKET, BY DIAMETER, 2024-2029 (USD MILLION)

- TABLE 51 ASIA PACIFIC: HDPE PIPES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 52 ASIA PACIFIC: HDPE PIPES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 53 ASIA PACIFIC: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 54 ASIA PACIFIC: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 55 ASIA PACIFIC: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 56 ASIA PACIFIC: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 57 CHINA: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 58 CHINA: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 59 CHINA: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 60 CHINA: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 61 JAPAN: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 62 JAPAN: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 63 JAPAN: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 64 JAPAN: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 65 INDIA: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 66 INDIA: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 67 INDIA: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 68 INDIA: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 69 SOUTH KOREA: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 70 SOUTH KOREA: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 71 SOUTH KOREA: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 72 SOUTH KOREA: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 73 REST OF ASIA PACIFIC: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 74 REST OF ASIA PACIFIC: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 75 REST OF ASIA PACIFIC: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 76 REST OF ASIA PACIFIC: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 77 EUROPE: HDPE PIPES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 78 EUROPE: HDPE PIPES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 79 EUROPE: HDPE PIPES MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 80 EUROPE: HDPE PIPES MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 81 EUROPE: HDPE PIPES MARKET, BY GRADE, 2020-2023 (USD MILLION)

- TABLE 82 EUROPE: HDPE PIPES MARKET, BY GRADE, 2024-2029 (USD MILLION)

- TABLE 83 EUROPE: HDPE PIPES MARKET, BY GRADE, 2020-2023 (KILOTON)

- TABLE 84 EUROPE: HDPE PIPES MARKET, BY GRADE, 2024-2029 (KILOTON)

- TABLE 85 EUROPE: HDPE PIPES MARKET, BY DIAMETER, 2020-2023 (USD MILLION)

- TABLE 86 EUROPE: HDPE PIPES MARKET, BY DIAMETER, 2024-2029 (USD MILLION)

- TABLE 87 EUROPE: HDPE PIPES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 88 EUROPE: HDPE PIPES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 89 EUROPE: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 90 EUROPE: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 91 EUROPE: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 92 EUROPE: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 93 GERMANY: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 94 GERMANY: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 95 GERMANY: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 96 GERMANY: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 97 UK: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 98 UK: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 99 UK: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 100 UK: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 101 RUSSIA: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 102 RUSSIA: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 103 RUSSIA: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 104 RUSSIA: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 105 ITALY: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 106 ITALY: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 107 ITALY: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 108 ITALY: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 109 FRANCE: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 110 FRANCE: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 111 FRANCE: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 112 FRANCE: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 113 SPAIN: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 114 SPAIN: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 115 SPAIN: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 116 SPAIN: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 117 REST OF EUROPE: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 118 REST OF EUROPE: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 119 REST OF EUROPE: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 120 REST OF EUROPE: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 121 NORTH AMERICA: HDPE PIPES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 122 NORTH AMERICA: HDPE PIPES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 123 NORTH AMERICA: HDPE PIPES MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 124 NORTH AMERICA: HDPE PIPES MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 125 NORTH AMERICA: HDPE PIPES MARKET, BY GRADE, 2020-2023 (USD MILLION)

- TABLE 126 NORTH AMERICA: HDPE PIPES MARKET, BY GRADE, 2024-2029 (USD MILLION)

- TABLE 127 NORTH AMERICA: HDPE PIPES MARKET, BY GRADE, 2020-2023 (KILOTON)

- TABLE 128 NORTH AMERICA: HDPE PIPES MARKET, BY GRADE, 2024-2029 (KILOTON)

- TABLE 129 NORTH AMERICA: HDPE PIPES MARKET, BY DIAMETER, 2020-2023 (USD MILLION)

- TABLE 130 NORTH AMERICA: HDPE PIPES MARKET, BY DIAMETER, 2024-2029 (USD MILLION)

- TABLE 131 NORTH AMERICA: HDPE PIPES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 132 NORTH AMERICA: HDPE PIPES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 133 NORTH AMERICA: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 134 NORTH AMERICA: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 135 NORTH AMERICA: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 136 NORTH AMERICA: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 137 US: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 138 US: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 139 US: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 140 US: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 141 CANADA: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 142 CANADA: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 143 CANADA: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 144 CANADA: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 145 MEXICO: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 146 MEXICO: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 147 MEXICO: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 148 MEXICO: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 149 SOUTH AMERICA: HDPE PIPES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 150 SOUTH AMERICA: HDPE PIPES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 151 SOUTH AMERICA: HDPE PIPES MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 152 SOUTH AMERICA: HDPE PIPES MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 153 SOUTH AMERICA: HDPE PIPES MARKET, BY GRADE, 2020-2023 (USD MILLION)

- TABLE 154 SOUTH AMERICA: HDPE PIPES MARKET, BY GRADE, 2024-2029 (USD MILLION)

- TABLE 155 SOUTH AMERICA: HDPE PIPES MARKET, BY GRADE, 2020-2023 (KILOTON)

- TABLE 156 SOUTH AMERICA: HDPE PIPES MARKET, BY GRADE, 2024-2029 (KILOTON)

- TABLE 157 SOUTH AMERICA: HDPE PIPES MARKET, BY DIAMETER, 2020-2023 (USD MILLION)

- TABLE 158 SOUTH AMERICA: HDPE PIPES MARKET, BY DIAMETER, 2024-2029 (USD MILLION)

- TABLE 159 SOUTH AMERICA: HDPE PIPES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 160 SOUTH AMERICA: HDPE PIPES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 161 SOUTH AMERICA: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 162 SOUTH AMERICA: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 163 SOUTH AMERICA: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 164 SOUTH AMERICA: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 165 BRAZIL: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 166 BRAZIL: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 167 BRAZIL: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 168 BRAZIL: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 169 ARGENTINA: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 170 ARGENTINA: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 171 ARGENTINA: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 172 ARGENTINA: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 173 REST OF SOUTH AMERICA: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 174 REST OF SOUTH AMERICA: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 175 REST OF SOUTH AMERICA: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 176 REST OF SOUTH AMERICA: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 177 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 180 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 181 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY GRADE, 2020-2023 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY GRADE, 2024-2029 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY GRADE, 2020-2023 (KILOTON)

- TABLE 184 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY GRADE, 2024-2029 (KILOTON)

- TABLE 185 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY DIAMETER, 2020-2023 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY DIAMETER, 2024-2029 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 192 MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 193 SAUDI ARABIA: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 194 SAUDI ARABIA: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 195 SAUDI ARABIA: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 196 SAUDI ARABIA: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 197 UAE: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 198 UAE: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 199 UAE: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 200 UAE: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 201 REST OF GCC COUNTRIES: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 202 REST OF GCC COUNTRIES: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 203 REST OF GCC COUNTRIES: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 204 REST OF GCC COUNTRIES: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 205 SOUTH AFRICA: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 206 SOUTH AFRICA: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 207 SOUTH AFRICA: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 208 SOUTH AFRICA: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 209 REST OF THE MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 210 REST OF THE MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 211 REST OF THE MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY END USER, 2020-2023 (KILOTON)

- TABLE 212 REST OF THE MIDDLE EAST & AFRICA: HDPE PIPES MARKET, BY END USER, 2024-2029 (KILOTON)

- TABLE 213 OVERVIEW OF STRATEGIES ADOPTED BY KEY HDPE PIPE MANUFACTURERS

- TABLE 214 HDPE PIPES MARKET: DEGREE OF COMPETITION

- TABLE 215 HDPE PIPES MARKET: REGION FOOTPRINT

- TABLE 216 HDPE PIPES MARKET: GRADE FOOTPRINT

- TABLE 217 HDPE PIPES MARKET: APPLICATION FOOTPRINT

- TABLE 218 HDPE PIPES MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 219 HDPE PIPES MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 220 HDPE PIPES MARKET: PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2024

- TABLE 221 HDPE PIPES MARKET: EXPANSIONS, JANUARY 2020-AUGUST 2024

- TABLE 222 HDPE PIPES MARKET: DEALS, JANUARY 2020-AUGUST 2024

- TABLE 223 WL PLASTICS: COMPANY OVERVIEW

- TABLE 224 WL PLASTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 WL PLASTICS: DEALS, JANUARY 2020-OCTOBER 2024

- TABLE 226 WL PLASTICS: EXPANSIONS, JANUARY 2020-OCTOBER 2024

- TABLE 227 AGRU KUNSTSTOFFTECHNIK GMBH: COMPANY OVERVIEW

- TABLE 228 AGRU KUNSTSTOFFTECHNIK GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 AGRU KUNSTSTOFFTECHNIK GMBH: PRODUCT LAUNCHES, JANUARY 2020-OCTOBER 2024

- TABLE 230 DYKA GROUP: COMPANY OVERVIEW

- TABLE 231 DYKA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 DYKA GROUP: DEALS, JANUARY 2020-OCTOBER 2024

- TABLE 233 DYKA GROUP: EXPANSIONS, JANUARY 2020-OCTOBER 2024

- TABLE 234 ALIAXIS HOLDINGS SA: COMPANY OVERVIEW

- TABLE 235 ALIAXIS HOLDINGS SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 ALIAXIS HOLDINGS SA: DEALS, JANUARY 2020-OCTOBER 2024

- TABLE 237 ALIAXIS HOLDINGS SA: EXPANSIONS, JANUARY 2020-OCTOBER 2024

- TABLE 238 CHINA LESSO: COMPANY OVERVIEW

- TABLE 239 CHINA LESSO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 CHEVRON PHILLIPS CHEMICAL COMPANY LLC: COMPANY OVERVIEW

- TABLE 241 CHEVRON PHILLIPS CHEMICAL COMPANY LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 CHEVRON PHILLIPS CHEMICAL COMPANY LLC: PRODUCT LAUNCHES, J ANUARY 2020-OCTOBER 2024

- TABLE 243 CHEVRON PHILLIPS CHEMICAL COMPANY LLC: DEALS, JANUARY 2020-OCTOBER 2024

- TABLE 244 CHEVRON PHILLIPS CHEMICAL COMPANY LLC: EXPANSIONS, JANUARY 2020-OCTOBER 2024

- TABLE 245 JM EAGLE, INC.: COMPANY OVERVIEW

- TABLE 246 JM EAGLE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 SUPREME INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 248 SUPREME INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 SUPREME INDUSTRIES LTD.: DEALS, JANUARY 2020-OCTOBER 2024

- TABLE 250 SUPREME INDUSTRIES LTD.: EXPANSIONS, JANUARY 2020-OCTOBER 2024

- TABLE 251 JAIN IRRIGATION SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 252 JAIN IRRIGATION SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 JAIN IRRIGATION SYSTEMS LTD.: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 254 ASTRAL PIPES: COMPANY OVERVIEW

- TABLE 255 ASTRAL PIPES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 ISCO INDUSTRIES: COMPANY OVERVIEW

- TABLE 257 AL-ROWAD COMPLEX: COMPANY OVERVIEW

- TABLE 258 COSMOPLAST INDUSTRIAL COMPANY LLC: COMPANY OVERVIEW

- TABLE 259 UNION PIPES INDUSTRIES: COMPANY OVERVIEW

- TABLE 260 FUTURE PIPE INDUSTRIES: COMPANY OVERVIEW

- TABLE 261 POLYFAB PLASTIC INDUSTRY LLC: COMPANY OVERVIEW

- TABLE 262 FLORENCE POLYTECH (FZE): COMPANY OVERVIEW

- TABLE 263 SAUDI ARABIAN AMIANTIT CO.: COMPANY OVERVIEW

- TABLE 264 KRAH MISR: COMPANY OVERVIEW

- TABLE 265 MUNA NOOR: COMPANY OVERVIEW

- TABLE 266 PIPEX INFRASTRUCTURE SOLUTIONS: COMPANY OVERVIEW

- TABLE 267 AL WASIL INDUSTRIAL COMPANY: COMPANY OVERVIEW

- TABLE 268 ROYAL MAJESTIC: COMPANY OVERVIEW

- TABLE 269 NATIONAL PLASTIC INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 270 ALAMAL ALSHARIF PLASTICS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HDPE PIPES MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HDPE PIPES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 HDPE PIPES MARKET: DATA TRIANGULATION

- FIGURE 9 PE 100 GRADE SEGMENT TO LEAD MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 10 >3,000 MM DIAMETER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

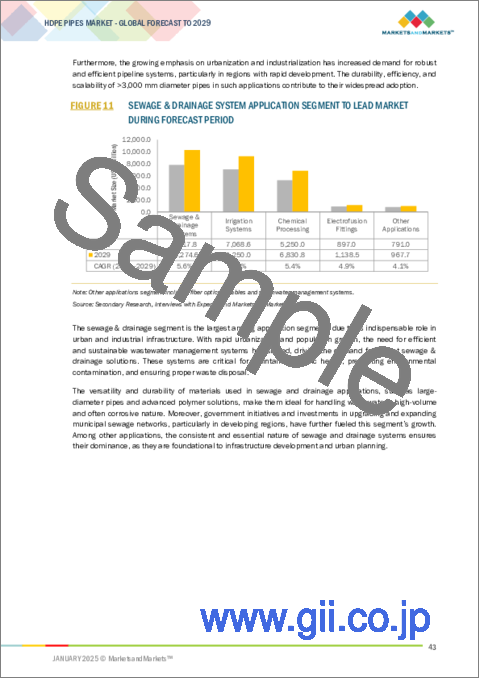

- FIGURE 11 SEWAGE & DRAINAGE SYSTEM APPLICATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 MUNICIPAL END USER SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO LEAD HDPE PIPES MARKET DURING FORECAST PERIOD

- FIGURE 14 GROWING INVESTMENTS IN CLEAN WATER AND SANITATION INITIATIVES TO BOOST DEMAND FOR HDPE PIPES

- FIGURE 15 PE 100 GRADE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 16 MUNICIPAL TO BE FASTEST-GROWING END USER DURING FORECAST PERIOD

- FIGURE 17 CHINA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, CHALLENGES, AND OPPORTUNITIES IN HDPE PIPES MARKET

- FIGURE 19 USE OF GENERATIVE AI IN HDPE PIPES MARKET

- FIGURE 20 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 VALUE CHAIN OF HDPE PIPES MARKET

- FIGURE 22 AVERAGE SELLING PRICE TREND OF HDPE PIPES, BY REGION, 2021-2024

- FIGURE 23 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY GRADE, 2021-2024

- FIGURE 24 HDPE PIPES MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 25 HDPE PIPES MARKET: ECOSYSTEM

- FIGURE 26 NUMBER OF PATENTS GRANTED, 2014-2023

- FIGURE 27 HDPE PIPES MARKET: LEGAL STATUS OF PATENTS

- FIGURE 28 PATENT ANALYSIS FOR HDPE PIPES, BY JURISDICTION, 2014-2023

- FIGURE 29 TOP 11 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 30 IMPORT OF HS CODE 391721-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 31 EXPORT OF HS CODE 391721-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 32 HDPE PIPES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 35 >3,000 MM DIAMETER TO LEAD HDPE PIPES MARKET DURING FORECAST PERIOD

- FIGURE 36 PE 100 GRADE TO LEAD HDPE PIPES MARKET DURING FORECAST PERIOD

- FIGURE 37 SEWAGE & DRAINAGE SYSTEM APPLICATION TO LEAD HDPE PIPES MARKET DURING FORECAST PERIOD

- FIGURE 38 MUNICIPAL END USER TO LEAD HDPE PIPES MARKET DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC: HDPE PIPES MARKET SNAPSHOT

- FIGURE 41 EUROPE: HDPE PIPES MARKET SNAPSHOT

- FIGURE 42 NORTH AMERICA: HDPE PIPES MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF KEY COMPANIES IN LAST FIVE YEARS, 2020-2024

- FIGURE 44 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- FIGURE 45 HDPE PIPES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 46 HDPE PIPES MARKET: COMPANY FOOTPRINT

- FIGURE 47 HDPE PIPES MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 48 BRAND/PRODUCT COMPARISON

- FIGURE 49 COMPANY VALUATION: EV/EBITDA OF KEY MANUFACTURERS OF HDPE PIPES

- FIGURE 50 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN

- FIGURE 51 CHEVRON PHILLIPS CHEMICAL COMPANY LLC: COMPANY SNAPSHOT

The HDPE pipes market is projected to reach USD 25.68 billion by 2029, at a CAGR of 5.3% from USD 19.84 billion in 2024.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/USD Billion), Volume (Kilotons) |

| Segments | Grade, End-use, diameter, Application and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, South America |

Some of the most significant factors contributing to the growing demand for HDPE pipes in various parts of the world include urbanization and infrastructure development. With the rate of urbanization on the rise, there are more people shifting from their rural homes to the urban cities in search of better prospects and thus increasing the size of the urban areas with increased demands for proper infrastructure. It can be seen to be largely reflected in developing economies with high-speed industrialization and population growth creating stresses in their existing infrastructure systems.

It goes with the increasing requirement for basic utilities such as water supply, sewage, drainage, and gas distribution system due to urbanization. Increasing the urban population needs supportive high-quality infrastructure systems. HDPE pipes are fast becoming the preferred choice for such critical services because of their strength, flexibility, and easy installation. They are resistant to extreme environmental conditions, corrosion, and stress from high-pressure water systems and wastewater management.

The Governments are investing in infrastructure projects to meet the demand of rapidly growing urban areas. In many parts of the world, especially in developing countries, governments are undertaking large-scale initiatives to upgrade or replace outdated and inefficient piping systems. Traditional materials, such as concrete or metal pipes, have limitations in terms of longevity and maintenance costs, whereas HDPE pipes offer a more sustainable, cost-effective solution. Their lightness decreases the cost of transportation and installation. Their flexibility also makes them easier to install in complex environments, like densely populated urban areas.

The private sector, particularly construction and utilities industries, is driving demand for HDPE pipes. With the involvement of private players in public-private partnerships or large-scale development projects, the requirements are for materials that would serve for long-term value, low maintenance, and less risk of leaks or failures. HDPE pipes meet these criteria, which is why they are increasingly used in new infrastructure projects, including residential and commercial building developments, industrial pipelines, and smart city projects that integrate advanced technologies into water and waste management systems.

As cities grow, new challenges have to be met in terms of increasing water scarcity and the better treatment of sewage and waste. Therefore, installation of HDPE pipes becomes a necessity to ensure that there are efficient and sustainable water management systems that can fulfill the demands of the ever-increasing needs of a huge population in an urban area. Not to mention, with all these environmental concerns being brought into the limelight, recycling capabilities and energy conservation further give HDPE pipes an attraction to green infrastructure initiatives.

"The unpredictability in raw material prices discourage long-term investments in HDPE infrastructure"

One of the major restraint factors for the HDPE pipes market is the fluctuation in raw material prices, mainly the cost of polyethylene, which is the raw material used in the manufacturing process of these pipes. Polyethylene is a product from petroleum-based products, so the pricing is very sensitive to the changes in global oil prices. When the price of oil is high, that of polyethylene also pushes the costs of HDPE pipes to produce, leading to a significant increase in cost and sometimes prices to the consumers, hence creating less stable markets. This makes HDPE pipes less competitive than other alternatives such as PVC or steel, particularly for those companies that have price-sensitive operations or are bound by tight budget allocations. It will also discourage long-term investment in the HDPE infrastructure since it is usually unpredictable especially in emerging economies where costs play a key role when it comes to infrastructure. This is, therefore one of the key challenges hindering the growth of this market.

"Integration of technologies toward smarter, more connected infrastructure represents a crucial opportunity for growth in the HDPE pipe"

One of the great opportunities in the HDPE pipes market is smart pipeline technology integration mainly through sensor-based monitoring and IoT connectivity. The sensors installed within the HDPE pipes would allow real-time collection of data on key parameters like pressure, temperature, flow rate, and leakage. This smart monitoring will let the operators know about any leakage, blockage, or pipe damage even before the condition develops into costly failure or system collapse. This provides enough time for maintenance to take action and thus reduce the proportion of interfering repairs, while most importantly minimizing the operation downtimes especially when talking of critical infrastructures like water distribution, wastewater management, and gas pipelines. This connectivity allows information to be transmitted from the other end, and therefore the operators will have a real-time view of it and decisions will be taken in a relatively short time. It raises levels of efficiency and reliability in HDPE piping systems besides enhancing sustainability levels in usage for infrastructure in ways that would decrease losses through water and ensure pipes have longer lives. Integration of these technologies, as cities and industries are increasingly opting for smarter and more connected infrastructure, forms a significant opportunity for market growth in HDPE pipes in cities, large-scale industrial applications, and future infrastructure projects.

"Alternative materials like PVC (Polyvinyl Chloride), steel, and other composite pipes, offer similar benefits"

One of the major challenges for the HDPE pipes market could be the competition from alternative materials such as PVC, steel, and other composite pipes, giving similar benefits and sometimes cost propositions more attractive. Substitution by these alternatives could limit the growth potential of the market and adoption levels of HDPE pipes in many applications.

PVC pipes are widely applied in plumbing and sewage systems. Their application is mainly because of their low initial costs and easy installation. In other areas, PVC has remained the most preferred piping system due to its long-standing existence in the market and well-established standards. HDPE pipes, while being stronger and more resistant to corrosion, can be costlier; therefore, they tend to be less price-competitive in sensitive markets or smaller projects. In addition, due to the strength and pressure resistance, steel pipes have been preferred for applications in the oil and gas industry. Since high-strength HDPE pipes have essentially the same applications, reputation within such highly pressurized environments with steel can make it the attractive choice for some consumers.

Other composite pipes, like fiberglass, may be more appropriate for other applications, such as industrial pipelines, where temperature resistance and chemical exposure are more critical. These alternatives may also have perceived or actual advantages over HDPE, such as better performance in extreme environments or longer operational lifespans in certain cases.

"PE 100 continues to dominate the HDPE pipes market, further solidifying its role as the leading grade for a wide range of applications"

With regard to outstanding strength, toughness, and performance, HDPE pipes PE 100 grade tend to dominate the HDPE pipes market. They are hence, the most demanded pipe materials for critical applications. In contrast to PE 63 and PE 80, which are specifically designed for applications in which pressures are relatively low, PE 100 is specifically designed to withstand greater pressures and is therefore highly versatile in its use in various applications like water supply, gas distribution, and industrial piping systems. The prime benefit of PE 100 lies in its superior mechanical properties that improve resistance to stress, cracking, and wear and ensure a longer service life. This increased durability reduces the frequency of maintenance and replacement, making PE 100 pipes more cost-effective in the long run. Moreover, PE 100 pipes have a better resistance to aggressive chemicals and environmental stress cracking; they can perform well even when exposed to harsh conditions such as fluctuating temperatures, UV, and soil movement. This means that they are suitable for long-term infrastructure projects where strength and sustainability of the material are of prime importance. Apart from this, PE 100 has a higher strength-to-weight ratio, easier installation, and greater compatibility with fusion welding techniques, which makes it increasingly adopted in industries where strength, eco-friendliness, and cost-effectiveness are all critical. As the global infrastructure projects demand higher-performance materials, PE 100 remains the dominant player in the HDPE pipes market, further strengthening its position as the leading grade for a wide range of applications.

"Based on region, asia pacific was the largest market in 2023."

Asia Pacific is the largest market for HDPE pipes, which is driven by several key factors connected with the rapid urbanization and infrastructure growth in the region along with industrial expansion. A growing population drives demand for essential infrastructure, including potable water systems, sewage networks, and industrial pipelines. There are rising urbanized populations who trigger heavy investment by government agencies and the private sectors for up-gradation and expansion of existing water and wastewater infrastructures and thereby making HDPE the preferred pipe material owing to its good strength, corrosion resistance properties, and low cost-effectiveness.

Industrialization is accelerating within the same region, such as agro-industry, construction, and manufacturing industry significantly relying on proper and functional piping systems. HDPE pipes, resistant to chemicals and abrasion, become especially appropriate for high demand applications like agricultural irrigation, process piping in industrial operations, among others. The region has also experienced increasing large-scale infrastructure projects like large water treatment plants, storm water management systems, and the gas distribution network that leverage the strength and longevity benefits of HDPE pipes.

More focus on sustainability and environmental factors is promoting the penetration of HDPE pipes in Asia Pacific because HDPE is a material that is lightweight, recyclable, and more environment-friendly compared to metal or concrete materials. This can be specifically seen in countries like China, India, and Southeast Asia, where growing environmental regulations and increasing demand for green infrastructure solutions drive the changeover towards HDPE pipes.

Asia Pacific would maintain pole position in HDPE pipes market as the governments encourage such investments. Further foreign investments will also lead to even higher market demands and longer-term advantages associated with the utilization of HDPE pipes; thus, Asia Pacific emerges at a distinct market leading position. Its unyielding demand for advanced infrastructural needs can guarantee a continued market dominance over the years ahead.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: Manger-Level - 30%, Director Level - 20%, and Others - 50%

- By Region: North America - 20%, Europe -30%, Asia Pacific - 30%, Middle East & Africa - 10%, and South America-10%

The key players in this market are JM EAGLE, INC. (US), CHINA LESSO (China), Supreme Industries Ltd. (India), Chevron Phillips Chemical Company LLC (US), AGRU (US), Dyka Group (Netherlands), Jain Irrigation Systems Ltd. (India), Astral Pipes (India), Advanced Drainage Systems (US) etc.

Research Coverage

This report segments the market for the HDPE pipes on the basis of type, application and region. It provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and partnerships associated with the market for the HDPE pipes market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the HDPE pipes market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers: HDPE pipes being ideal for water and wastewater management, irrigation, and gas distribution systems thus and most suitable for the construction.

- Market Penetration: Comprehensive information on the HDPE pipes offered by top players in the global HDPE Pipes market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the HDPE pipes market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for the HDPE pipes across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global HDPE pipes market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the HDPE pipes market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HDPE PIPES MARKET

- 4.2 HDPE PIPES MARKET, BY GRADE

- 4.3 HDPE PIPES MARKET, BY END USER

- 4.4 HDPE PIPES MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Government initiatives driving infrastructure development in emerging economies

- 5.2.1.2 Advancements in manufacturing technology and industrial modernization

- 5.2.1.3 Exceptional corrosion and chemical resistance of HDPE pipes

- 5.2.1.4 Stability and high strain capacity of HDPE pipes in dynamic water projects

- 5.2.2 RESTRAINTS

- 5.2.2.1 Temperature limitations and chemical contamination in pipes

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Alignment of HDPE pipes with sustainability standards and green building certifications

- 5.2.4 CHALLENGES

- 5.2.4.1 Price volatility of raw materials

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.3.2 IMPACT OF AI ON HDPE PIPES MARKET

- 5.4 INDUSTRY TRENDS

- 5.4.1 INTRODUCTION

- 5.4.2 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIERS

- 5.5.2 MANUFACTURERS

- 5.5.3 PIPE DISTRIBUTORS AND RETAILERS

- 5.5.4 END-USE INDUSTRIES

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 5.6.2 AVERAGE SELLING PRICE TREND, BY GRADE, 2021-2024

- 5.6.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY GRADE, 2021-2024

- 5.7 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 SUBSTITUTE PRODUCT ANALYSIS

- 5.9.1 SUBSTITUTE PIPES MARKET

- 5.9.1.1 Substitute product identification

- 5.9.1.1.1 Fiberglass

- 5.9.1.1.2 Unplasticized polyvinyl chloride

- 5.9.1.1.3 Concrete pipes

- 5.9.1.1 Substitute product identification

- 5.9.1 SUBSTITUTE PIPES MARKET

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 PATENTS GRANTED WORLDWIDE

- 5.11.3 PATENT PUBLICATION TRENDS

- 5.11.4 INSIGHTS

- 5.11.5 LEGAL STATUS OF PATENTS

- 5.11.6 JURISDICTION ANALYSIS

- 5.11.7 TOP APPLICANTS

- 5.11.8 LIST OF MAJOR PATENTS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 391721)

- 5.12.2 EXPORT SCENARIO (HS CODE 391721)

- 5.13 KEY CONFERENCES AND EVENTS, 2025

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF AND REGULATIONS RELATED TO HDPE PIPES

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.3 REGULATIONS RELATED TO HDPE PIPES MARKET

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF NEW ENTRANTS

- 5.15.2 THREAT OF SUBSTITUTES

- 5.15.3 BARGAINING POWER OF SUPPLIERS

- 5.15.4 BARGAINING POWER OF BUYERS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 MACROECONOMIC OUTLOOK

- 5.17.1 GDP TRENDS AND FORECAST, BY COUNTRY

- 5.18 CASE STUDY ANALYSIS

- 5.18.1 OPTIMIZING WASTEWATER INFRASTRUCTURE: KERR WOOD LEIDAL ENGINEERING'S HDPE FORCE-MAIN PROJECT

- 5.18.2 ENSURING SUSTAINABLE WATER SUPPLY: WL PLASTICS' ROLE IN WAUKESHA'S GREAT WATER ALLIANCE PROJECT

- 5.18.3 SAN RAFAEL SANITATION DISTRICT'S INNOVATIVE HDPE PIPELINE FOR ENVIRONMENTAL PROTECTION IN CALIFORNIA

6 HDPE PIPES MARKET, BY DIAMETER

- 6.1 INTRODUCTION

- 6.2 <500 MM

- 6.2.1 KEY APPLICATIONS IN LARGE-SCALE WATER AND WASTEWATER MANAGEMENT SYSTEMS

- 6.3 500-1,000 MM

- 6.3.1 LOW INSTALLATION AND MAINTENANCE COSTS WITH SUITABILITY FOR MEDIUM-CAPACITY FLUID HANDLING PROJECTS

- 6.4 1,000-2,000 MM

- 6.4.1 INCREASING DEMAND IN INDUSTRIAL FLUID TRANSPORT APPLICATIONS

- 6.5 2,000-3,000 MM

- 6.5.1 IDEAL FOR INSTALLATION IN AREAS PRONE TO GROUND MOVEMENT OR SEISMIC ACTIVITY

- 6.6 >3,000 MM

- 6.6.1 OFFER REDUCED MAINTENANCE AND LONGER SERVICE LIFE COMPARED TO CONCRETE AND STEEL

7 HDPE PIPES MARKET, BY GRADE

- 7.1 INTRODUCTION

- 7.2 PE 80

- 7.2.1 INCREASING DEMAND IN SEWER SYSTEMS AND IRRIGATION PROJECTS TO REDUCE ENVIRONMENTAL STRESS

- 7.3 PE 100

- 7.3.1 RISING USE OF HIGH-END WATER AND GAS DISTRIBUTION SYSTEMS TO ENDURE EXTERNAL LOADS AND RESIST DEGRADATION

8 HDPE PIPES MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 IRRIGATION SYSTEM

- 8.2.1 REDUCED LABOR COSTS AND DURABILITY OF HDPE PIPES WITH MINIMAL MAINTENANCE IN AGRICULTURAL ENVIRONMENT

- 8.3 SEWAGE & DRAINAGE

- 8.3.1 LEAK-PROOF PIPES WITH ADVANCED BUTT FUSION AND ELECTROFUSION CAPABILITIES

- 8.4 CHEMICAL PROCESSING

- 8.4.1 EXCEPTIONAL RESISTANCE TO CHEMICALS AND HARSH ENVIRONMENTS

- 8.5 ELECTROFUSION FITTINGS

- 8.5.1 HANDLE CORROSIVE CHEMICALS AND HIGH-PRESSURE FLUIDS WITHOUT COMPROMISING DURABILITY OR PERFORMANCE

- 8.6 OTHER APPLICATIONS

- 8.6.1 FIBER OPTICS AND CABLES

- 8.6.2 STORMWATER MANAGEMENT SYSTEM

9 HDPE PIPES MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 MUNICIPAL

- 9.2.1 WIDE APPLICATION OF HDPE PIPES IN STORMWATER MANAGEMENT TO HANDLE HEAVY RAINWATER FLOW

- 9.3 AGRICULTURE

- 9.3.1 ABILITY TO WITHSTAND EXPOSURE TO UV RADIATION, CHEMICALS, AND HARSH ENVIRONMENTAL CONDITIONS

- 9.4 OIL & GAS

- 9.4.1 RISING DEMAND FOR HDPE PIPES IN FLUID TRANSPORT AND CHEMICAL OPERATIONS

- 9.5 INDUSTRIAL

- 9.5.1 LIGHTWEIGHT DESIGN OF PIPES TO FACILITATE EASY INSTALLATION AND REDUCE TRANSPORTATION COSTS

- 9.6 CONSTRUCTION

- 9.6.1 LEAK-PROOF AND EFFICIENT DISTRIBUTION NETWORK AND ABILITY TO HANDLE HEAVY LOADS

- 9.7 OTHER END USERS

- 9.7.1 MINING

- 9.7.2 RENEWABLE ENERGY

10 HDPE PIPES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Availability of low-cost labor and cheap raw materials to drive market

- 10.2.2 JAPAN

- 10.2.2.1 Modernization of water supply and sewage systems to drive market

- 10.2.3 INDIA

- 10.2.3.1 Rapid urbanization and industrialization to fuel growth

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Commencement of smart city development projects to drive market

- 10.2.5 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Risk of flood and natural calamities to drive demand for HDPE pipes in water management systems

- 10.3.2 UK

- 10.3.2.1 Green infrastructure plan to create huge demand for HDPE pipes

- 10.3.3 RUSSIA

- 10.3.3.1 Resilience of domestic industries and government investments to drive market

- 10.3.4 ITALY

- 10.3.4.1 Versatility and advantages of HDPE pipes in addressing water supply challenges to boost demand

- 10.3.5 FRANCE

- 10.3.5.1 Need to address water scarcity and enhance resilience of water supply systems to drive market

- 10.3.6 SPAIN

- 10.3.6.1 Need to modernize water supply systems to boost demand for HDPE pipes

- 10.3.7 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Increasing investment in water infrastructure projects to drive market

- 10.4.2 CANADA

- 10.4.2.1 Government investments in power industry to foster growth

- 10.4.3 MEXICO

- 10.4.3.1 Rising population to drive demand for electricity

- 10.4.1 US

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Key infrastructure projects to drive adoption of HDPE pipes

- 10.5.2 ARGENTINA

- 10.5.2.1 Water supply and sanitation projects to boost demand for HDPE pipes

- 10.5.3 REST OF SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

- 10.6.1.1 Saudi Arabia

- 10.6.1.1.1 Economic diversification and public service enhancement to boost demand for HDPE pipes

- 10.6.1.2 UAE

- 10.6.1.2.1 Increasing demand for pipes in potable water distribution and irrigation systems to drive market

- 10.6.1.3 REST OF GCC COUNTRIES

- 10.6.1.1 Saudi Arabia

- 10.6.2 SOUTH AFRICA

- 10.6.2.1 Rural water supply initiatives to boost demand for HDPE pipes

- 10.6.3 REST OF MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Grade footprint

- 11.5.5.4 Application footprint

- 11.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING

- 11.6.5.1 Detailed list of key start-ups/SMES

- 11.6.5.2 Competitive benchmarking of key start-ups/SMEs

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 EXPANSIONS

- 11.9.3 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 WL PLASTICS

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 AGRU KUNSTSTOFFTECHNIK GMBH

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 DYKA GROUP

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 ALIAXIS HOLDINGS SA

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.2.1 Deals

- 12.1.4.2.2 Expansions

- 12.1.4.3 MnM view

- 12.1.4.3.1 Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 CHINA LESSO

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 CHEVRON PHILLIPS CHEMICAL COMPANY LLC

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Expansions

- 12.1.6.4 MnM view

- 12.1.6.4.1 Right to win

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses and competitive threats

- 12.1.7 JM EAGLE, INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 MnM view

- 12.1.7.3.1 Right to win

- 12.1.7.3.2 Strategic choices

- 12.1.7.3.3 Weaknesses and competitive threats

- 12.1.8 SUPREME INDUSTRIES LTD.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Expansions

- 12.1.8.4 MnM view

- 12.1.8.4.1 Right to win

- 12.1.8.4.2 Strategic choices

- 12.1.8.4.3 Weaknesses and competitive threats

- 12.1.9 JAIN IRRIGATION SYSTEMS LTD.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.4 MnM view

- 12.1.9.4.1 Right to win

- 12.1.9.4.2 Strategic choices

- 12.1.9.4.3 Weaknesses and competitive threats

- 12.1.10 ASTRAL PIPES

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.10.3.1 Right to win

- 12.1.10.3.2 Strategic choices

- 12.1.10.3.3 Weaknesses and competitive threats

- 12.1.1 WL PLASTICS

- 12.2 OTHER PLAYERS

- 12.2.1 ISCO INDUSTRIES

- 12.2.2 AL-ROWAD COMPLEX

- 12.2.3 COSMOPLAST INDUSTRIAL COMPANY LLC

- 12.2.4 UNION PIPES INDUSTRIES

- 12.2.5 FUTURE PIPE INDUSTRIES

- 12.2.6 POLYFAB PLASTIC INDUSTRY LLC

- 12.2.7 FLORENCE POLYTECH (FZE)

- 12.2.8 SAUDI ARABIAN AMIANTIT CO.

- 12.2.9 KRAH MISR

- 12.2.10 MUNA NOOR

- 12.2.11 PIPEX INFRASTRUCTURE SOLUTIONS

- 12.2.12 AL WASIL INDUSTRIAL COMPANY

- 12.2.13 ROYAL MAJESTIC

- 12.2.14 NATIONAL PLASTIC INDUSTRIES LIMITED

- 12.2.15 ALAMAL ALSHARIF PLASTICS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS