|

|

市場調査レポート

商品コード

1622841

排煙システムの世界市場:製品別、用途別、エンドユーザー別 - 予測(~2029年)Smoke Evacuation Systems Market by Product (Pencils & Wands, Systems (Portable, Stationary), Filter, Accessories), Application (General Surgery, Laproscopic, Orthopedic, Aesthetics), End User (Hospitals, ASC, Dental Clinics) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 排煙システムの世界市場:製品別、用途別、エンドユーザー別 - 予測(~2029年) |

|

出版日: 2024年12月19日

発行: MarketsandMarkets

ページ情報: 英文 398 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の排煙システムの市場規模は、2024年の1億8,760万米ドルから2029年までに2億6,640万米ドルに達すると予測され、予測期間にCAGRで7.3%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2032年 |

| 単位 | 米ドル |

| セグメント | 製品、用途、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

低侵襲手術は、回復の早さ、切開創の小ささ、合併症の少なさ、入院期間の短縮といった利点から、大きな需要があります。これは、近年患者数が大幅に増加しているという事実によるものです。このような需要の高まりは、運動不足や食生活の乱れといったライフスタイルの要因と密接に結びついており、さらに高齢化によって、関節炎や心血管疾患のような慢性疾患の増加が説明できます。

また、技術の進歩、研究開発費の増加、サージカルスモークの危険性に対する意識の高まり、新興経済国の経済拡大などの複数の要因も市場を牽引しています。

「予測期間に排煙ペンシル・ワンドセグメントが排煙システム市場で最大のシェアを占めます。」

排煙ペンシル・ワンドセグメントは、手頃な価格設定、さまざまな用途に適したペンシルの多様性、デザインと排煙機能を強化する技術の進歩により、予測期間に最大のシェアを占める見込みです。

「腹腔鏡手術セグメントが予測期間に用途別で最大のシェアを占めます。」

腹腔鏡手術は2023年に排煙システム市場で最大のシェアを占めました。肥満、肝疾患、骨盤内感染症、卵管結紮、腎結石などのさまざまな症状は、腹腔鏡手術で治療することができます。これは、高い費用対効果、低侵襲性、患者数の増加、世界中での技術の進歩などの数多くの要因によるものです。

「地域別では、北米が最大のシェアを占め、アジア太平洋が予測期間にもっとも高いCAGRを記録する見込みです。」

複数の重要な考慮事項のために、北米が排煙システム市場で最大のシェアを占めています。その先進の医療システムと、多種多様な手術に対する強固な償還制度は、先進の排煙システムの普及を支えています。米国の強固な規制システムは、高品質な排煙システムの開発と導入を促進し、これらの機器が最適な患者ケアに向け厳格な安全性と有効性の基準を満たしていることを保証します。また、大衆の可処分所得が高いことも、肥満手術、美容手術、形成手術などの選択的手術の旺盛な需要につながっています。

アジア太平洋は予測期間にもっとも高いCAGRを持つと見られます。日本、韓国、中国を含むアジア太平洋の多くの国々は、形成外科手術や美容手術の莫大な需要を示しています。また、インド、タイ、マレーシアなどの新興経済国では医療費が増加しています。また、この地域では急速に老年人口が増加しており、手術が必要なさまざまな慢性疾患を経験しています。

当レポートでは、世界の排煙システム市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 排煙システム市場の概要

- アジア太平洋の排煙システム市場:エンドユーザー別、国別(2023年)

- 排煙システム市場:地理的成長機会

- 排煙システム市場:地域別(2024年~2029年)

- 排煙システム市場:先進国市場 vs. 新興国市場

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 産業動向

- 排煙ペンシルのデザインの進歩

- 意識向上のに向けたメーカーと団体の協力

- バリューチェーン分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- ポーターのファイブフォース分析

- 規制分析

- 規制機関、政府機関、その他の組織

- 規制情勢

- 特許分析

- 排煙システムに関する特許公報の動向

- 考察:管轄と上位出願者の分析

- 排煙システム特許の主要出願国/地域(2014年1月~2024年11月)

- 貿易分析

- 輸入データ

- 輸出データ

- 価格分析

- 排煙システムの平均販売価格の推移:地域別

- 排煙システムの平均販売価格の動向:企業別(2023年)

- 主な会議とイベント(2024年~2025年)

- 主なステークホルダーと購入基準

- アンメットニーズ/エンドユーザーの期待

- 隣接市場の分析

- エコシステム分析

- ケーススタディ分析

- サプライチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- 償還シナリオ

- 排煙システム市場に対するAI/生成AIの影響

第6章 排煙システム市場:製品別

- イントロダクション

- 排煙ペンシル・ワンド

- 排煙フィルター

- 超低浸透エアフィルター

- 活性炭フィルター

- インラインフィルター

- プレフィルター

- 排煙システム

- 固定式システム

- ポータブルシステム

- 排煙融合製品

- 排煙チューブ

- アクセサリ

第7章 排煙システム市場:用途別

- イントロダクション

- 腹腔鏡手術

- 一般手術

- 消化器手術

- 婦人科手術

- その他の一般手術

- 整形外科手術

- 医療美容手術

第8章 排煙システム市場:エンドユーザー別

- イントロダクション

- 病院

- 外来手術センター

- 美容手術センター

- 歯科医院

- 動物医療提供者

第9章 排煙システム市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- 中東・アフリカのマクロ経済の見通し

- GCC諸国

- その他の中東・アフリカ

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析(2021年~2023年)

- 市場シェア分析(2023年)

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- ブランド/製品の比較

- 主要企業の研究開発の評価

- 企業の評価と財務指標

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- CONMED CORPORATION

- MEDTRONIC

- STRYKER

- JOHNSON & JOHNSON SERVICES, INC. (ETHICON, INC.)

- OLYMPUS CORPORATION

- DANAHER CORPORATION (PALL CORPORATION)

- ECOLAB

- ZIMMER BIOMET

- THE COOPER COMPANIES, INC. (COOPERSURGICAL INC.)

- UTAH MEDICAL PRODUCTS, INC.

- DEROYAL INDUSTRIES, INC.

- ERBE ELEKTROMEDIZIN GMBH

- KLS MARTIN GROUP

- I.C. MEDICAL, INC.

- ASPEN SURGICAL PRODUCTS, INC.

- BOWA-ELECTRONIC GMBH & CO. KG

- KARL STORZ

- SURGIFORM INNOVATIVE SURGICAL PRODUCTS

- ALESI SURGICAL

- MEYER-HAAKE GMBH

- その他の企業

- STERIS

- CIMPAX A/S

- CLS SURGIMEDICS

- ATMOS MEDIZINTECHNIK GMBH & CO. KG

- WALKER FILTRATION

第12章 付録

List of Tables

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 RISK ASSESSMENT: SMOKE EVACUATION SYSTEMS MARKET

- TABLE 3 GERIATRIC POPULATION, BY REGION, 2016 VS. 2023

- TABLE 4 STATES ENACTING SURGICAL SMOKE-FREE LEGISLATION, AS OF SEPTEMBER 1, 2024

- TABLE 5 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 US: REGULATORY PROCESS FOR MEDICAL DEVICES

- TABLE 12 JAPAN: CLASSIFICATION OF MEDICAL DEVICES AND REVIEWING BODIES

- TABLE 13 NMPA MEDICAL DEVICES CLASSIFICATION

- TABLE 14 LIST OF PATENTS IN SMOKE EVACUATION SYSTEMS MARKET (2022-2024)

- TABLE 15 IMPORT DATA FOR SMOKE EVACUATION SYSTEMS (HS CODE: 842139), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 16 EXPORT DATA FOR SMOKE EVACUATION SYSTEMS (HS CODE: 842139), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 17 AVERAGE SELLING PRICE TREND OF SMOKE EVACUATION SYSTEMS, BY REGION, 2022-2024 (USD)

- TABLE 18 AVERAGE SELLING PRICE TREND OF SMOKE EVACUATION SYSTEMS, BY COMPANY, 2023 (USD)

- TABLE 19 SMOKE EVACUATION SYSTEMS MARKET: KEY CONFERENCES & EVENTS, 2024-2025

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP 3 END USERS

- TABLE 21 KEY BUYING CRITERIA FOR TOP 3 END USERS

- TABLE 22 SMOKE EVACUATION SYSTEMS MARKET: UNMET NEEDS

- TABLE 23 SMOKE EVACUATION SYSTEMS MARKET: END-USER EXPECTATIONS

- TABLE 24 SMOKE EVACUATION SYSTEMS MARKET: ECOSYSTEM ANALYSIS

- TABLE 25 SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 26 SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 27 SMOKE EVACUATION PENCILS & WANDS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 28 SMOKE EVACUATION PENCILS & WANDS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 29 SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 30 SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 31 SMOKE EVACUATION FILTERS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 32 SMOKE EVACUATION FILTERS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 33 ULPA FILTERS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 34 ULPA FILTERS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 35 CHARCOAL FILTERS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 36 CHARCOAL FILTERS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 37 IN-LINE FILTERS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 38 IN-LINE FILTERS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 39 PRE-FILTERS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 40 PRE-FILTERS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 41 SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 42 SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 43 SMOKE EVACUATION SYSTEMS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 44 SMOKE EVACUATION SYSTEMS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 45 SMOKE EVACUATION SYSTEMS MARKET, BY REGION, 2023-2029 (THOUSAND UNITS)

- TABLE 46 STATIONARY SMOKE EVACUATION SYSTEMS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 47 STATIONARY SMOKE EVACUATION SYSTEMS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 48 PORTABLE SMOKE EVACUATION SYSTEMS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 49 PORTABLE SMOKE EVACUATION SYSTEMS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

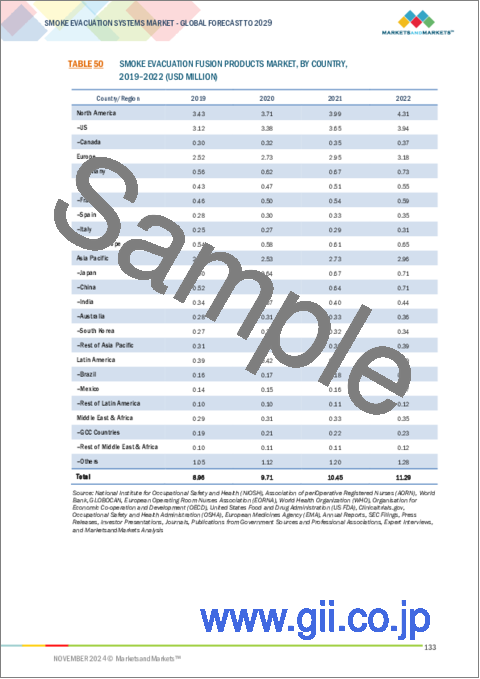

- TABLE 50 SMOKE EVACUATION FUSION PRODUCTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 51 SMOKE EVACUATION FUSION PRODUCTS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 52 SMOKE EVACUATION TUBING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 53 SMOKE EVACUATION TUBING MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 54 SMOKE EVACUATION ACCESSORIES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 55 SMOKE EVACUATION ACCESSORIES MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 56 SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 57 SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 58 SMOKE EVACUATION SYSTEMS MARKET FOR LAPAROSCOPIC SURGERIES, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 59 SMOKE EVACUATION SYSTEMS MARKET FOR LAPAROSCOPIC SURGERIES, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 60 SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE 2019-2022 (USD MILLION)

- TABLE 61 SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE 2023-2029 (USD MILLION)

- TABLE 62 SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 63 SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 64 SMOKE EVACUATION SYSTEMS MARKET FOR GASTROINTESTINAL SURGERIES, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 65 SMOKE EVACUATION SYSTEMS MARKET FOR GASTROINTESTINAL SURGERIES, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 66 SMOKE EVACUATION SYSTEMS MARKET FOR GYNECOLOGY SURGERIES, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 67 SMOKE EVACUATION SYSTEMS MARKET FOR GYNECOLOGY SURGERIES, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 68 SMOKE EVACUATION SYSTEMS MARKET FOR OTHER GENERAL SURGERIES, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 69 SMOKE EVACUATION SYSTEMS MARKET FOR OTHER GENERAL SURGERIES, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 70 SMOKE EVACUATION SYSTEMS MARKET FOR ORTHOPEDIC SURGERIES, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 71 SMOKE EVACUATION SYSTEMS MARKET FOR ORTHOPEDIC SURGERIES, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 72 SMOKE EVACUATION SYSTEMS MARKET FOR MEDICAL AESTHETICS SURGERIES, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 73 SMOKE EVACUATION SYSTEMS MARKET FOR MEDICAL AESTHETICS SURGERIES, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 74 SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 75 SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 76 SMOKE EVACUATION SYSTEMS MARKET FOR HOSPITALS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 77 SMOKE EVACUATION SYSTEMS MARKET FOR HOSPITALS, BY REGION, 2023-2029 (USD MILLION)

- TABLE 78 SMOKE EVACUATION SYSTEMS MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 79 SMOKE EVACUATION SYSTEMS MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2023-2029 (USD MILLION)

- TABLE 80 SMOKE EVACUATION SYSTEMS MARKET FOR COSMETIC SURGERY CENTERS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 81 SMOKE EVACUATION SYSTEMS MARKET FOR COSMETIC SURGERY CENTERS, BY REGION, 2023-2029 (USD MILLION)

- TABLE 82 SMOKE EVACUATION SYSTEMS MARKET FOR DENTAL CLINICS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 83 SMOKE EVACUATION SYSTEMS MARKET FOR DENTAL CLINICS, BY REGION, 2023-2029 (USD MILLION)

- TABLE 84 SMOKE EVACUATION SYSTEMS MARKET FOR VETERINARY HEALTHCARE PROVIDERS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 85 SMOKE EVACUATION SYSTEMS MARKET FOR VETERINARY HEALTHCARE PROVIDERS, BY REGION, 2023-2029 (USD MILLION)

- TABLE 86 SMOKE EVACUATION SYSTEMS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 87 SMOKE EVACUATION SYSTEMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 88 NORTH AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 90 NORTH AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 92 NORTH AMERICA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 94 NORTH AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 96 NORTH AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 98 NORTH AMERICA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 99 NORTH AMERICA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 100 NORTH AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 102 US: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 103 US: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 104 US: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 105 US: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 106 US: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 107 US: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 108 US: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 109 US: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 110 US: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 111 US: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE 2023-2029 (USD MILLION)

- TABLE 112 US: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 113 US: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 114 CANADA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 115 CANADA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 116 CANADA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 117 CANADA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 118 CANADA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 119 CANADA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 120 CANADA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 121 CANADA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 122 CANADA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 123 CANADA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 124 CANADA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 125 CANADA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 126 EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 127 EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 128 EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 129 EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 130 EUROPE: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 131 EUROPE: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 132 EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 133 EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 134 EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 135 EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 136 EUROPE: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 137 EUROPE: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 138 EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 139 EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 140 GERMANY: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 141 GERMANY: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 142 GERMANY: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 143 GERMANY: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 144 GERMANY: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 145 GERMANY: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 146 GERMANY: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 147 GERMANY: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 148 GERMANY: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 149 GERMANY: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 150 GERMANY: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 151 GERMANY: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 152 UK: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 153 UK: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 154 UK: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 155 UK: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 156 UK: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 157 UK: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 158 UK: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 159 UK: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 160 UK: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 161 UK: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 162 UK: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 163 UK: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 164 FRANCE: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 165 FRANCE: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 166 FRANCE: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 167 FRANCE: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 168 FRANCE: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 169 FRANCE: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 170 FRANCE: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 171 FRANCE: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 172 FRANCE: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE 2019-2022 (USD MILLION)

- TABLE 173 FRANCE: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 174 FRANCE: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 175 FRANCE: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 176 ITALY: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 177 ITALY: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 178 ITALY: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 179 ITALY: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 180 ITALY: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 181 ITALY: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 182 ITALY: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 183 ITALY: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 184 ITALY: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 185 ITALY: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE 2023-2029 (USD MILLION)

- TABLE 186 ITALY: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 187 ITALY: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 188 SPAIN: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 189 SPAIN: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 190 SPAIN: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 191 SPAIN: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 192 SPAIN: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 193 SPAIN: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 194 SPAIN: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 195 SPAIN: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 196 SPAIN: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 197 SPAIN: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 198 SPAIN: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 199 SPAIN: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 200 REST OF EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 201 REST OF EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 202 REST OF EUROPE: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 203 REST OF EUROPE: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 204 REST OF EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 205 REST OF EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 206 REST OF EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 207 REST OF EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 208 REST OF EUROPE: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 209 REST OF EUROPE: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 210 REST OF EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 211 REST OF EUROPE: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 212 ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 213 ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 214 ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 215 ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 216 ASIA PACIFIC: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 217 ASIA PACIFIC: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 218 ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 219 ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 220 ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 221 ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 222 ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 223 ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 224 ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 225 ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 226 JAPAN: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 227 JAPAN: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 228 JAPAN: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 229 JAPAN: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 230 JAPAN: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 231 JAPAN: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 232 JAPAN: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 233 JAPAN: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 234 JAPAN: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 235 JAPAN: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 236 JAPAN: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 237 JAPAN: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 238 CHINA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 239 CHINA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 240 CHINA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 241 CHINA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 242 CHINA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 243 CHINA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 244 CHINA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 245 CHINA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 246 CHINA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 247 CHINA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 248 CHINA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 249 CHINA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 250 INDIA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 251 INDIA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 252 INDIA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 253 INDIA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 254 INDIA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 255 INDIA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 256 INDIA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 257 INDIA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 258 INDIA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 259 INDIA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 260 INDIA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 261 INDIA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 262 AUSTRALIA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 263 AUSTRALIA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 264 AUSTRALIA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 265 AUSTRALIA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 266 AUSTRALIA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 267 AUSTRALIA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 268 AUSTRALIA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 269 AUSTRALIA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 270 AUSTRALIA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 271 AUSTRALIA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 272 AUSTRALIA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 273 AUSTRALIA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 274 SOUTH KOREA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 275 SOUTH KOREA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 276 SOUTH KOREA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 277 SOUTH KOREA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 278 SOUTH KOREA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 279 SOUTH KOREA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 280 SOUTH KOREA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 281 SOUTH KOREA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 282 SOUTH KOREA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 283 SOUTH KOREA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 284 SOUTH KOREA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 285 SOUTH KOREA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 286 REST OF ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 287 REST OF ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 288 REST OF ASIA PACIFIC: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 289 REST OF ASIA PACIFIC: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 290 REST OF ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 291 REST OF ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 292 REST OF ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 293 REST OF ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 294 REST OF ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 295 REST OF ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 296 REST OF ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 297 REST OF ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 298 LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 299 LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- TABLE 300 LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 301 LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 302 LATIN AMERICA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 303 LATIN AMERICA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 304 LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 305 LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 306 LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 307 LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 308 LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 309 LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 310 LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 311 LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 312 BRAZIL: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 313 BRAZIL: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 314 BRAZIL: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 315 BRAZIL: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 316 BRAZIL: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 317 BRAZIL: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 318 BRAZIL: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 319 BRAZIL: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 320 BRAZIL: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 321 BRAZIL: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 322 BRAZIL: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 323 BRAZIL: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 324 MEXICO: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 325 MEXICO: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 326 MEXICO: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 327 MEXICO: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 328 MEXICO: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 329 MEXICO: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 330 MEXICO: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 331 MEXICO: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 332 MEXICO: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 333 MEXICO: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 334 MEXICO: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 335 MEXICO: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 336 REST OF LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 337 REST OF LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 338 REST OF LATIN AMERICA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 339 REST OF LATIN AMERICA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 340 REST OF LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 341 REST OF LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 342 REST OF LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 343 REST OF LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 344 REST OF LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 345 REST OF LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 346 REST OF LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 347 REST OF LATIN AMERICA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 348 MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 349 MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 350 MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 351 MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 352 MIDDLE EAST & AFRICA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 353 MIDDLE EAST & AFRICA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 354 MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 355 MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 356 MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 357 MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 358 MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 359 MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 360 MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 361 MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 362 GCC COUNTRIES: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 363 GCC COUNTRIES: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 364 GCC COUNTRIES: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 365 GCC COUNTRIES: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 366 GCC COUNTRIES: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 367 GCC COUNTRIES: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 368 GCC COUNTRIES: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 369 GCC COUNTRIES: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 370 GCC COUNTRIES: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 371 GCC COUNTRIES: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 372 GCC COUNTRIES: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 373 GCC COUNTRIES: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 374 REST OF MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2019-2022 (USD MILLION)

- TABLE 375 REST OF MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2023-2029 (USD MILLION)

- TABLE 376 REST OF MIDDLE EAST & AFRICA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 377 REST OF MIDDLE EAST & AFRICA: SMOKE EVACUATION FILTERS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 378 REST OF MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 379 REST OF MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 380 REST OF MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 381 REST OF MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2023-2029 (USD MILLION)

- TABLE 382 REST OF MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 383 REST OF MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET FOR GENERAL SURGERIES, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 384 REST OF MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 385 REST OF MIDDLE EAST & AFRICA: SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2023-2029 (USD MILLION)

- TABLE 386 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN SMOKE EVACUATION SYSTEMS MARKET

- TABLE 387 SMOKE EVACUATION SYSTEMS MARKET: PRODUCT FOOTPRINT

- TABLE 388 SMOKE EVACUATION SYSTEMS MARKET: APPLICATION FOOTPRINT

- TABLE 389 SMOKE EVACUATION SYSTEMS MARKET: END-USER FOOTPRINT

- TABLE 390 SMOKE EVACUATION SYSTEMS MARKET: REGION FOOTPRINT

- TABLE 391 SMOKE EVACUATION SYSTEMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2023

- TABLE 392 SMOKE EVACUATION SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 393 SMOKE EVACUATION SYSTEMS MARKET: PRODUCT APPROVALS, JANUARY 2021-OCTOBER 2024

- TABLE 394 SMOKE EVACUATION SYSTEMS MARKET: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 395 SMOKE EVACUATION SYSTEMS MARKET: EXPANSIONS, JANUARY 2021- OCTOBER 2024

- TABLE 396 CONMED CORPORATION: COMPANY OVERVIEW

- TABLE 397 CONMED CORPORATION: PRODUCTS OFFERED

- TABLE 398 CONMED CORPORATION: PRODUCT APPROVALS, JANUARY 2021-OCTOBER 2024

- TABLE 399 MEDTRONIC: COMPANY OVERVIEW

- TABLE 400 MEDTRONIC: PRODUCTS OFFERED

- TABLE 401 MEDTRONIC: PRODUCT APPROVALS, JANUARY 2021-OCTOBER 2024

- TABLE 402 MEDTRONIC: EXPANSIONS, JANUARY 2021-OCTOBER 2024

- TABLE 403 STRYKER: COMPANY OVERVIEW

- TABLE 404 STRYKER: PRODUCTS OFFERED

- TABLE 405 STRYKER: PRODUCT APPROVALS, JANUARY 2021-OCTOBER 2024

- TABLE 406 STRYKER: EXPANSIONS, JANUARY 2021-OCTOBER 2024

- TABLE 407 JOHNSON & JOHNSON SERVICES, INC. (ETHICON, INC.): COMPANY OVERVIEW

- TABLE 408 JOHNSON & JOHNSON SERVICES, INC. (ETHICON, INC.): PRODUCTS OFFERED

- TABLE 409 OLYMPUS CORPORATION: COMPANY OVERVIEW

- TABLE 410 OLYMPUS CORPORATION: PRODUCTS OFFERED

- TABLE 411 OLYMPUS CORPORATION: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 412 OLYMPUS CORPORATION, EXPANSIONS, JANUARY 2021-OCTOBER 2024

- TABLE 413 DANAHER CORPORATION (PALL CORPORATION): COMPANY OVERVIEW

- TABLE 414 DANAHER CORPORATION (PALL CORPORATION): PRODUCTS OFFERED

- TABLE 415 DANAHER CORPORATION (PALL CORPORATION): DEALS, JANUARY 2021- OCTOBER 2024

- TABLE 416 ECOLAB: COMPANY OVERVIEW

- TABLE 417 ECOLAB: PRODUCTS OFFERED

- TABLE 418 ZIMMER BIOMET: COMPANY OVERVIEW

- TABLE 419 ZIMMER BIOMET: PRODUCTS OFFERED

- TABLE 420 THE COOPER COMPANIES, INC. (COOPERSURGICAL INC.): COMPANY OVERVIEW

- TABLE 421 THE COOPER COMPANIES, INC. (COOPERSURGICAL INC.): PRODUCTS OFFERED

- TABLE 422 UTAH MEDICAL PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 423 UTAH MEDICAL PRODUCTS, INC.: PRODUCTS OFFERED

- TABLE 424 DEROYAL INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 425 DEROYAL INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 426 ERBE ELEKTROMEDIZIN GMBH: COMPANY OVERVIEW

- TABLE 427 ERBE ELEKTROMEDIZIN GMBH.: PRODUCTS OFFERED

- TABLE 428 KLS MARTIN GROUP: COMPANY OVERVIEW

- TABLE 429 KLS MARTIN GROUP: PRODUCTS OFFERED

- TABLE 430 KLS MARTIN GROUP: EXPANSIONS, JANUARY 2021- OCTOBER 2024

- TABLE 431 I.C. MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 432 I.C. MEDICAL, INC.: PRODUCTS OFFERED

- TABLE 433 ASPEN SURGICAL PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 434 ASPEN SURGICAL PRODUCTS, INC.: PRODUCTS OFFERED

- TABLE 435 ASPEN SURGICAL PRODUCTS, INC.: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 436 BOWA-ELECTRONIC GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 437 BOWA-ELECTRONIC GMBH & CO. KG.: PRODUCTS OFFERED

- TABLE 438 BOWA-ELECTRONIC GMBH & CO. KG: EXPANSIONS, JANUARY 2021- OCTOBER 2024

- TABLE 439 KARL STORZ.: COMPANY OVERVIEW

- TABLE 440 KARL STORZ: PRODUCTS OFFERED

- TABLE 441 KARL STORZ: DEALS, JANUARY 2021- OCTOBER 2024

- TABLE 442 KARL STORZ: EXPANSIONS, JANUARY 2021- OCTOBER 2024

- TABLE 443 SURGIFORM INNOVATIVE SURGICAL PRODUCTS: COMPANY OVERVIEW

- TABLE 444 SURGIFORM INNOVATIVE SURGICAL PRODUCTS: PRODUCTS OFFERED

- TABLE 445 ALESI SURGICAL: COMPANY OVERVIEW

- TABLE 446 ALESI SURGICAL: PRODUCTS OFFERED

- TABLE 447 ALESI SURGICAL: PRODUCT APPROVALS, JANUARY 2021- OCTOBER 2024

- TABLE 448 ALESI SURGICAL: DEALS, JANUARY 2021- OCTOBER 2024

- TABLE 449 MEYER-HAAKE GMBH: COMPANY OVERVIEW

- TABLE 450 MEYER-HAAKE GMBH: PRODUCTS OFFERED

- TABLE 451 STERIS: COMPANY OVERVIEW

- TABLE 452 CIMPAX A/S: COMPANY OVERVIEW

- TABLE 453 CLS SURGIMEDICS: COMPANY OVERVIEW

- TABLE 454 ATMOS MEDIZINTECHNIK GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 455 WALKER FILTRATION: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY-SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND-SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION: CONMED CORP. (2023)

- FIGURE 8 SUPPLY-SIDE MARKET SIZE ESTIMATION: SMOKE EVACUATION SYSTEMS MARKET (2023)

- FIGURE 9 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 10 CAGR PROJECTIONS FROM DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES ANALYSIS (2024-2029)

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 MARKET DATA TRIANGULATION METHODOLOGY

- FIGURE 13 SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT, 2024 VS. 2029 (USD MILLION)

- FIGURE 14 SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 15 SMOKE EVACUATION SYSTEMS MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 16 GEOGRAPHIC SNAPSHOT OF SMOKE EVACUATION SYSTEMS MARKET (2023)

- FIGURE 17 RISING ADOPTION OF MINIMALLY INVASIVE SURGICAL PROCEDURES TO DRIVE MARKET GROWTH

- FIGURE 18 HOSPITALS SEGMENT TO DOMINATE ASIA PACIFIC MARKET IN 2023

- FIGURE 19 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 NORTH AMERICA TO DOMINATE MARKET IN 2029

- FIGURE 21 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 22 SMOKE EVACUATION SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

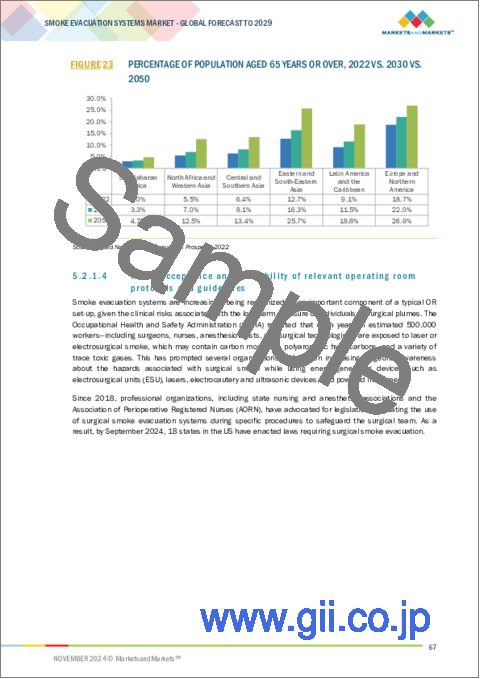

- FIGURE 23 PERCENTAGE OF POPULATION AGED 65 YEARS OR OVER, 2022 VS. 2030 VS. 2050

- FIGURE 24 SMOKE EVACUATION SYSTEMS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 SMOKE EVACUATION SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR SMOKE EVACUATION SYSTEM PATENTS (JANUARY 2014-NOVEMBER 2024)

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP 3 END USERS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 29 SMOKE EVACUATION SYSTEMS MARKET: ADJACENT MARKET ANALYSIS

- FIGURE 30 SMOKE EVACUATION SYSTEMS MARKET: MARKET MAP

- FIGURE 31 SMOKE EVACUATION SYSTEMS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 32 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 33 INVESTMENT/VENTURE CAPITAL SCENARIO IN SMOKE EVACUATION SYSTEMS MARKET, 2015-2018

- FIGURE 34 SMOKE EVACUATION SYSTEMS MARKET: GEOGRAPHIC SNAPSHOT, 2024-2029

- FIGURE 35 NORTH AMERICA: SMOKE EVACUATION SYSTEMS MARKET SNAPSHOT

- FIGURE 36 EUROPE: SMOKE EVACUATION SYSTEMS MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET SNAPSHOT

- FIGURE 38 REVENUE SHARE ANALYSIS OF KEY PLAYERS (2021-2023)

- FIGURE 39 MARKET SHARE ANALYSIS OF KEY PLAYERS (2023)

- FIGURE 40 SMOKE EVACUATION SYSTEMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 41 SMOKE EVACUATION SYSTEMS MARKET: COMPANY FOOTPRINT

- FIGURE 42 SMOKE EVACUATION SYSTEMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 43 SMOKE EVACUATION SYSTEMS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 44 R&D EXPENDITURE OF KEY PLAYERS IN SMOKE EVACUATION SYSTEMS MARKET, 2022 VS. 2023

- FIGURE 45 EV/EBITDA OF KEY VENDORS

- FIGURE 46 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 47 CONMED CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 MEDTRONIC: COMPANY SNAPSHOT

- FIGURE 49 STRYKER: COMPANY SNAPSHOT

- FIGURE 50 JOHNSON & JOHNSON SERVICES, INC. (ETHICON, INC.): COMPANY SNAPSHOT

- FIGURE 51 OLYMPUS CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 DANAHER CORPORATION (PALL CORPORATION): COMPANY SNAPSHOT

- FIGURE 53 ECOLAB: COMPANY SNAPSHOT

- FIGURE 54 ZIMMER BIOMET: COMPANY SNAPSHOT

- FIGURE 55 THE COOPER COMPANIES, INC. (COOPERSURGICAL INC.): COMPANY SNAPSHOT

- FIGURE 56 UTAH MEDICAL PRODUCTS, INC: COMPANY SNAPSHOT

The smoke evacuation systems market is projected to reach USD 266.4 million by 2029 from USD 187.6 million in 2024, at a CAGR of 7.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Units Considered | Value (USD) |

| Segments | By Product, Application, End User and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Minimally invasive procedures are witnessing a huge demand due to benefits such as quicker recovery, smaller incisions, fewer complications, and reduced hospitalisation periods. This is due to the fact that their patient base is increasing significantly in recent years. This growing demand is closely tied to lifestyle factors, such as lack of exercise and poor dieting, compounded by an ageing population, which explain the rise in chronic illnesses like arthritis and cardiovascular diseases.

The market is also driven by several other factors such as rise in technological advancements, rising R&D spending, increased awareness of dangers of surgical smoke, and expansion in economy of emerging countries.

"The smoke evacuation pencils & wands segment accounted for largest share of the smoke evacuation systems market during the forecast period."

On the basis of product type, the smoke evacuation systems market is segmented into smoke evacuation systems, smoke evacuation filters, smoke evacuation pencils & wands, smoke-evac fusion products (shrouds), smoke evacuation tubings, and accessories. The smoke evacuation pencils & wands segment is estimated to account for the largest share during the forecast period due to it's affordable pricing, wide variety affordable pricing, a variety of pencils suitable for various applications, and technological advancements enhancing their designs and smoke evacuation capabilities.

"The Laparoscopic surgeries segment accounted for the largest share, by application during the forecast period.

On the basis of applications, the smoke evacuation systems market is segmented into laparoscopic surgeries, general surgeries, orthopedic surgeries, and medical aesthetics surgeries

Laparoscopic surgeries accounted for largest share of the smoke evacuation systems market in 2023. Various conditions such as obesity, liver disease, pelvic infections, tubal ligation, kidney stones etc can be treated with Laparoscopic surgeries. This is due to the numerous factors such as being cost-effective, minimally invasive in nature and an elevated population of patients, advancement in technology around the world.

"North America accounted for the largest share, by region and APAC is estimated to register the highest CAGR during the forecast period."

The smoke evacuation systems market is segmented into five major regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa. North America had largest share in the smoke evacuation systems market for a number of key considerations. Its advanced healthcare system, compounded by a robust reimbursement system for multiple kind of surgeries, supports the deployment of advanced smoke evacuation systems for the population. Robust regulatory systems in the US facilitate the development and introduction of high-quality smoke evacuation systems, ensuring that these devices meet stringent safety and efficacy standards for optimal patient care. Also, the high disposable income of general population has contributed to strong demand for elective surgeries, including bariatric, cosmetic, and plastic procedures

The Asia Pacific is witnessed to have the highest CAGR during the forecast period. Many APAC countries, including Japan, South Korea, and China, are witnessing huge demand for plastic and cosmetic surgeries. Also, there is increased healthcare expenditure in rising economies such as India, Thailand and Malaysia. Also, the fast increasing ageing population in the region experience various chronic illnesses for which surgeries needs to be performed.

A breakdown of the primary participants (supply-side) for the Smoke Evacuation Systems market referred to for this report is provided below:

- By Company Type: Tier 1-35%, Tier 2-40%, and Tier 3-25%

- By Designation: C-level-20%, Director Level-35%, and Others-45%

- By Region: North America-27%, Europe-25%, Asia Pacific-30%, Others- 18% .

The prominent players in the Smoke evacuation systems market are Conmed Corporation (US), Medtronic (Ireland), Stryker (US), Johnson & Johnson (USA), Olympus Corporation (Japan), Danaher Corporation (US), Ecolab (USA), Zimmer Biomet (USA), CooperCompanies (USA), Utah Medical Products (USA), DeRoyal Industries (USA), ERBE Elektromedizin GmbH (Germany), KLS Martin (Germany), I.C. Medical (USA), Aspen Surgical (US), BOWA-electronic GmbH & Co. KG (Germany), Karl Storz (Germany), Surgiform Technology (US), Alesi Surgical (UK), Meyer Haake (Germany), Steris (US), Cimpax A/S (Denmark), CLS Surgimedics (US), ATMOS MedizinTechnik GmbH & Co. KG (Germany) and Walker Filtration (USA).

Research Coverage

This report studies the Smoke Evacuation Systems Market based on products, applications, end-users and region. The report also analyses factors (such as drivers, restraints, opportunities and challenges) affecting market growth. It evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders. The report also studies micro markets concerning their growth trends, prospects, and contributions to the total Smoke Evacuation Systems Market. The report forecasts the revenue of the market segments to five major regions.

Reasons to Buy the Report

This report also includes.

- Analysis of key drivers (increased product availability, rising patient preference for minimally invasive surgeries), restraints (lack of uniform regulatory guidelines across the world regarding surgical smoke evacuation), challenges (surgeons' resistance to adopt smoke evacuators), and opportunities (rising technological advancements) contributing to the growth of the Smoke Evacuation Systems Market.

- Product Development/Innovation: Detailed insights on upcoming trends, research & development activities, in the Smoke Evacuation Systems Market.

- Market Development: Comprehensive information on the lucrative emerging markets by products, applications, end-users and region.

- Market Diversification: Exhaustive information about the growing geographies, recent developments, and investments in the Smoke Evacuation Systems Market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, company evaluation quadrant, and capabilities of leading players in the global Smoke Evacuation Systems Market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 SMOKE EVACUATION SYSTEMS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: SMOKE EVACUATION SYSTEMS MARKET, BY END USER AND COUNTRY (2023)

- 4.3 SMOKE EVACUATION SYSTEMS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 SMOKE EVACUATION SYSTEMS MARKET, BY REGION (2024-2029)

- 4.5 SMOKE EVACUATION SYSTEMS MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased product availability

- 5.2.1.2 Rising patient preference for minimally invasive surgeries

- 5.2.1.3 Growing target patient population

- 5.2.1.4 Wider acceptance and availability of relevant operating room protocols and guidelines

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of uniform regulatory guidelines regarding surgical smoke evacuation

- 5.2.2.2 High cost associated with procurement and installation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging markets

- 5.2.3.2 Rising technological advancements

- 5.2.4 CHALLENGES

- 5.2.4.1 Resistance of surgeons to adopt smoke evacuators

- 5.2.4.2 Safety concerns regarding smoke evacuation systems

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 ADVANCEMENTS IN DESIGN SMOKE EVACUATION PENCILS

- 5.3.2 COLLABORATIONS BETWEEN MANUFACTURERS AND ORGANIZATIONS TO RAISE AWARENESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGIES

- 5.5.1.1 ULPA filters

- 5.5.1.2 Electrosurgical unit (ESU) pencils

- 5.5.2 COMPLEMENTARY TECHNOLOGIES

- 5.5.2.1 RF sensors

- 5.5.2.2 Smoke evacuation tubing

- 5.5.3 ADJACENT TECHNOLOGIES

- 5.5.3.1 Ultrasonic electrosurgery

- 5.5.1 KEY TECHNOLOGIES

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 REGULATORY ANALYSIS

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.2 REGULATORY LANDSCAPE

- 5.7.2.1 North America

- 5.7.2.1.1 US

- 5.7.2.1.2 Canada

- 5.7.2.2 Europe

- 5.7.2.3 Asia Pacific

- 5.7.2.3.1 Japan

- 5.7.2.3.2 China

- 5.7.2.3.3 India

- 5.7.2.4 Latin America

- 5.7.2.4.1 Brazil

- 5.7.2.4.2 Mexico

- 5.7.2.5 GCC Countries

- 5.7.2.1 North America

- 5.8 PATENT ANALYSIS

- 5.8.1 PATENT PUBLICATION TRENDS FOR SMOKE EVACUATION SYSTEMS

- 5.8.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.8.3 TOP APPLICANT COUNTRIES/REGIONS PATENTS FOR SMOKE EVACUATION SYSTEM PATENTS (JANUARY 2014-NOVEMBER 2024)

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT DATA

- 5.9.2 EXPORT DATA

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE TREND OF SMOKE EVACUATION SYSTEMS, BY REGION

- 5.10.2 AVERAGE SELLING PRICE TREND OF SMOKE EVACUATION SYSTEMS, BY COMPANY, 2023

- 5.11 KEY CONFERENCES & EVENTS, 2024-2025

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 UNMET NEEDS/END-USER EXPECTATIONS

- 5.13.1 UNMET NEEDS

- 5.13.2 END-USER EXPECTATIONS

- 5.14 ADJACENT MARKET ANALYSIS

- 5.15 ECOSYSTEM ANALYSIS

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 CASE STUDY 1: MASSACHUSETTS GENERAL HOSPITAL AIMS TO ACHIEVE 100% SMOKE-FREE STANDARD BY 2024

- 5.16.2 CASE STUDY 2: THE PIH HEALTH DOWNEY HOSPITAL HAS BEEN SMOKE-FREE FOR THE LAST THREE YEARS

- 5.16.3 CASE STUDY 3: THE DOERNBECHER CHILDREN'S HOSPITAL WON THE AORN GO CLEAR AWARD IN APRIL 2023

- 5.17 SUPPLY CHAIN ANALYSIS

- 5.18 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.19 INVESTMENT & FUNDING SCENARIO

- 5.20 REIMBURSEMENT SCENARIO

- 5.21 IMPACT OF AI/GEN AI ON SMOKE EVACUATION SYSTEMS MARKET

6 SMOKE EVACUATION SYSTEMS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 SMOKE EVACUATION PENCILS & WANDS

- 6.2.1 INCREASING NUMBER OF ELECTROSURGERIES TO DRIVE MARKET

- 6.3 SMOKE EVACUATION FILTERS

- 6.3.1 ULTRALOW PENETRATION AIR FILTERS

- 6.3.1.1 High efficiency and longer running ability to fuel uptake

- 6.3.2 CHARCOAL FILTERS

- 6.3.2.1 Simplified usage for removal of toxins to drive market

- 6.3.3 IN-LINE FILTERS

- 6.3.3.1 Decreased efficiency with time to limit market growth

- 6.3.4 PRE-FILTERS

- 6.3.4.1 Low maintenance cost and long product life to boost demand

- 6.3.1 ULTRALOW PENETRATION AIR FILTERS

- 6.4 SMOKE EVACUATION SYSTEMS

- 6.4.1 STATIONARY SYSTEMS

- 6.4.1.1 One-time installation and minimal user maintenance to drive market

- 6.4.2 PORTABLE SYSTEMS

- 6.4.2.1 Convenient transportation and remote efficiency to fuel uptake

- 6.4.1 STATIONARY SYSTEMS

- 6.5 SMOKE EVACUATION FUSION PRODUCTS

- 6.5.1 INCREASING DEMAND FOR MINIMALLY INVASIVE SURGERIES TO DRIVE MARKET

- 6.6 SMOKE EVACUATION TUBING

- 6.6.1 EASY AVAILABILITY TO SUPPORT MARKET GROWTH

- 6.7 ACCESSORIES

- 6.7.1 ENHANCED EFFICIENCY TO FUEL ADOPTION

7 SMOKE EVACUATION SYSTEMS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 LAPAROSCOPIC SURGERIES

- 7.2.1 GROWING ADOPTION OF BARIATRIC SURGERIES TO FUEL MARKET

- 7.3 GENERAL SURGERIES

- 7.3.1 GASTROINTESTINAL SURGERIES

- 7.3.1.1 Increasing number of open surgical procedures to drive market

- 7.3.2 GYNECOLOGY SURGERIES

- 7.3.2.1 Lifestyle changes and growing demand for permanent birth control procedures to propel market

- 7.3.3 OTHER GENERAL SURGERIES

- 7.3.1 GASTROINTESTINAL SURGERIES

- 7.4 ORTHOPEDIC SURGERIES

- 7.4.1 RISING GERIATRIC POPULATION AND INCREASING RISK OF BONE DEGENERATION DISORDERS TO FUEL UPTAKE

- 7.5 MEDICAL AESTHETICS SURGERIES

- 7.5.1 RISING UPTAKE OF LASER SURGERIES TO SUPPORT MARKET GROWTH

8 SMOKE EVACUATION SYSTEMS MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 HIGH UPTAKE OF SURGICAL PROCEDURES TO DRIVE MARKET

- 8.3 AMBULATORY SURGERY CENTERS

- 8.3.1 REMOTE CARE AND HIGH EFFICIENCY TO PROPEL MARKET

- 8.4 COSMETIC SURGERY CENTERS

- 8.4.1 GROWING NUMBER OF RECONSTRUCTION PROCEDURES TO FUEL UPTAKE

- 8.5 DENTAL CLINICS

- 8.5.1 INCREASING AWARENESS ABOUT ORAL HEALTH TO SUPPORT MARKET GROWTH

- 8.6 VETERINARY HEALTHCARE PROVIDERS

- 8.6.1 GROWING FOCUS ON IMPROVING AIR QUALITY IN VET SETTINGS TO DRIVE MARKET

9 SMOKE EVACUATION SYSTEMS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Large volume of surgical procedures in orthopedics and laser treatments to propel market

- 9.2.3 CANADA

- 9.2.3.1 Rising obesity level to expedite growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Favorable reimbursement scenario to contribute to growth

- 9.3.3 UK

- 9.3.3.1 Increasing cases of heart and circulatory diseases to promote growth

- 9.3.4 FRANCE

- 9.3.4.1 Increasing adoption of minimally invasive surgical procedures to encourage growth

- 9.3.5 ITALY

- 9.3.5.1 Growing adoption of advanced surgical techniques to drive market

- 9.3.6 SPAIN

- 9.3.6.1 Rising prevalence of chronic conditions and aging population to propel market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 Decreasing birth rate to support growth

- 9.4.3 CHINA

- 9.4.3.1 Growing proportion of elderly population to boost market

- 9.4.4 INDIA

- 9.4.4.1 Expanding healthcare infrastructure to stimulate growth

- 9.4.5 AUSTRALIA

- 9.4.5.1 Growing cases of chronic and degenerative conditions to fuel market

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Increasing preference for cosmetic surgery to boost market

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Thriving cosmetic surgery industry to augment growth

- 9.5.3 MEXICO

- 9.5.3.1 High prevalence of obesity to facilitate growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Growing modernization efforts across healthcare industry to drive market

- 9.6.3 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SMOKE EVACUATION SYSTEMS MARKET

- 10.3 REVENUE ANALYSIS, 2021-2023

- 10.4 MARKET SHARE ANALYSIS, 2023

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.5.5.1 Company footprint

- 10.5.5.2 Product footprint

- 10.5.5.3 Application footprint

- 10.5.5.4 End-user footprint

- 10.5.5.5 Region footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 10.7 BRAND/PRODUCT COMPARISON

- 10.8 R&D ASSESSMENT OF KEY PLAYERS

- 10.9 COMPANY VALUATION & FINANCIAL METRICS

- 10.9.1 FINANCIAL METRICS

- 10.9.2 COMPANY VALUATION

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 PRODUCT APPROVALS

- 10.10.2 DEALS

- 10.10.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 CONMED CORPORATION

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product approvals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 MEDTRONIC

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product approvals

- 11.1.2.3.2 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 STRYKER

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product approvals

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 JOHNSON & JOHNSON SERVICES, INC. (ETHICON, INC.)

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses & competitive threats

- 11.1.5 OLYMPUS CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.3.2 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 DANAHER CORPORATION (PALL CORPORATION)

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.7 ECOLAB

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 ZIMMER BIOMET

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 THE COOPER COMPANIES, INC. (COOPERSURGICAL INC.)

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.10 UTAH MEDICAL PRODUCTS, INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.11 DEROYAL INDUSTRIES, INC.

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.12 ERBE ELEKTROMEDIZIN GMBH

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.13 KLS MARTIN GROUP

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Expansions

- 11.1.14 I.C. MEDICAL, INC.

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.15 ASPEN SURGICAL PRODUCTS, INC.

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Deals

- 11.1.16 BOWA-ELECTRONIC GMBH & CO. KG

- 11.1.16.1 Business overview

- 11.1.16.2 Products offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Expansions

- 11.1.17 KARL STORZ

- 11.1.17.1 Business overview

- 11.1.17.2 Products offered

- 11.1.17.3 Recent developments

- 11.1.17.3.1 Deals

- 11.1.17.3.2 Expansions

- 11.1.18 SURGIFORM INNOVATIVE SURGICAL PRODUCTS

- 11.1.18.1 Business overview

- 11.1.18.2 Products offered

- 11.1.19 ALESI SURGICAL

- 11.1.19.1 Business overview

- 11.1.19.2 Products offered

- 11.1.19.3 Recent developments

- 11.1.19.3.1 Product approvals

- 11.1.19.3.2 Deals

- 11.1.20 MEYER-HAAKE GMBH

- 11.1.20.1 Business overview

- 11.1.20.2 Products offered

- 11.1.1 CONMED CORPORATION

- 11.2 OTHER PLAYERS

- 11.2.1 STERIS

- 11.2.2 CIMPAX A/S

- 11.2.3 CLS SURGIMEDICS

- 11.2.4 ATMOS MEDIZINTECHNIK GMBH & CO. KG

- 11.2.5 WALKER FILTRATION

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS