|

|

市場調査レポート

商品コード

1622839

EMIシールドの世界市場:タイプ別、方法別、材料別、周波数別 - 予測(~2029年)EMI Shielding Market by Type (Narrowband EMI, Broadband EMI), Method (Radiation, Conduction), Material (Coatings & Paints, Polymers, Elastomers, Metal Shielding, EMI/EMC Filters, EMI Tapes & Laminates), Frequency (Low, High) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| EMIシールドの世界市場:タイプ別、方法別、材料別、周波数別 - 予測(~2029年) |

|

出版日: 2024年12月18日

発行: MarketsandMarkets

ページ情報: 英文 263 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のEMIシールドの市場規模は、2024年の73億4,000万米ドルから2029年までに96億9,000万米ドルに達すると予測され、予測期間にCAGRで5.7%の成長が見込まれます。

EMIシールドの需要の増加は、コンシューマーエレクトロニクス、自動車、医療、通信などのさまざまな産業で近年加速している電子製品の小型化と密接な関係があります。デバイスが小型化、コンパクト化、高密度化するにつれて、デバイス内部のコンポーネントはより近い距離に集中するようになり、電磁放射が増加します。そのため、メーカーは先進のEMIシールド材料の使用に切り替え、非常にコンパクトな設計でも性能を損なわない薄い導電性コーティング、フレキシブルフィルム、軽量な導電性フォームの使用に重点を置いています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | タイプ、方法、材料、周波数、産業、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「ブロードバンドEMIセグメントが予測期間に優位を占める見込みです。」

ブロードバンドEMIがEMIシールド市場を独占しているのは、広範囲の周波数で動作を行う高速広帯域電子システムの普及が進んでいるためです。5G、Wi-Fi 6、その他の無線通信規格の普及により、近年の電子機器はより広い周波数帯域でデータを送信するようになっています。このため、多くの周波数で電磁干渉(EMI)が急増し、広帯域EMIシールドソリューションが非常に重要になっています。狭い範囲の周波数で動作するナローバンドEMIとは異なり、ブロードバンドEMIは、さまざまな周波数で動作する多数の機器に同時に干渉し、より包括的な混乱を引き起こす可能性があります。

「EMIシールドテープ・ラミネートセグメントがEMIシールド市場でもっとも高いCAGRで成長する見込みです。」

EMIシールドテープ・ラミネートは、幅広い用途に理想的なソリューションとなる複数の重要な利点により、EMIシールド市場でもっとも急成長しているセグメントです。電子機器の小型化、多機能化に伴い、複雑な形状や狭いスペースにも対応できる効果的なシールドソリューションの必要性が高まっており、EMIシールドテープ・ラミネートはこのようなニーズに最適です。ケーブル、コネクター、回路基板などのさまざまなコンポーネントと簡単に統合できるその能力は、コンシューマーエレクトロニクス、自動車、通信、航空宇宙部門でのそれらの使用に拍車をかけています。

「アジア太平洋はEMIシールド市場でもっとも高い成長率が見込まれます。」

アジア太平洋は、複数の重大な要因により、EMIシールド市場でもっとも高い成長が見込まれます。同地域には、最大かつもっとも影響力のある電子メーカーが存在し、中国、日本、韓国、台湾といった国々が世界の電子生産市場を独占しています。成長を続ける通信機器、コンシューマーエレクトロニクス、自動車産業は、これらの機器の電磁適合性を確保するEMIシールドソリューションへの需要を高めています。また、アジア太平洋ではスマートシティやオートメーションの動向も高まっており、EMIシールドの需要が高まっています。

当レポートでは、世界のEMIシールド市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- EMIシールド市場の企業にとって魅力的な機会

- EMIシールド市場:材料別

- EMIシールド市場:周波数別

- EMIシールド市場:地域別、産業別

- EMIシールド市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 価格分析

- 主要企業が提供するEMIシールドの参考価格:材料別(2023年)

- EMIシールドの平均販売価格の動向:材料別(2019年~2023年)

- EMIシールドの平均販売価格の動向:地域別(2019年~2023年)

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 輸入シナリオ(HSコード853630)

- 輸出シナリオ(HSコード853630)

- 特許分析

- 主な会議とイベント(2025年~2026年)

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- 標準

- EMIシールド市場に対するAIの影響

第6章 EMIシールドの形成

- イントロダクション

- EMIシールドガスケット、Oリング

- EMIシールドガスケット

- EMIシールドOリング

- 固体エンクロージャ

- 金網・スクリーン

- ケーブルシールド

- コーティング

第7章 最新のEMIシールド技術と有効性テスト

- 最新のEMIシールド技術

- 透明EMIシールド材料

- EMIシールドの有効性テスト

- シールドボックステスト

- シールドルームテスト

- オープンフィールドテスト

- 同軸伝送線テスト

第8章 EMIシールド戦略

- イントロダクション

- 導電性EMIシールド

- 磁性EMIシールド

- 吸収性EMIシールド

第9章 EMIシールド市場:タイプ別

- イントロダクション

- ナローバンドEMI

- ブロードバンドEMI

第10章 EMIシールド市場:方法別

- イントロダクション

- 放射

- 伝導

第11章 EMIシールド市場:材料別

- イントロダクション

- 導電性コーティング・塗料

- 導電性ポリマー

- 導電性エラストマー

- 導電性プラスチック

- 金属シールド

- EMI/EMCフィルター

- EMIシールドテープ・ラミネート

第12章 EMIシールド市場:周波数別

- イントロダクション

- 100MHz未満

- 100MHz超

第13章 EMIシールド市場:産業別

- イントロダクション

- コンシューマーエレクトロニクス

- 通信

- 自動車

- 医療

- 航空宇宙

- エネルギー・電力

- 工業

- 輸送

第14章 EMIシールド市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 中東

- アフリカ

- 南米

第15章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2021年~2024年)

- 収益分析(2019年~2023年)

- 市場シェア分析(2023年)

- 企業の評価と財務指標(2024年)

- カバー範囲/応答時間の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第16章 企業プロファイル

- 主要企業

- PARKER HANNIFIN CORP

- PPG INDUSTRIES, INC.

- 3M

- HENKEL AG & CO. KGAA

- LAIRD TECHNOLOGIES, INC.

- LEADER TECH INC.

- MG CHEMICALS

- NOLATO AB

- TECH ETCH, INC.

- RTP COMPANY

- SCHAFFNER HOLDING AG

- TE CONNECTIVITY

- KITAGAWA INDUSTRIES AMERICA, INC.

- ETS LINDGREN

- SEAL SCIENCE, INC.

- その他の企業

- E SONG EMC CO., LTD

- EAST COAST SHIELDING

- EFFECTIVE SHIELDING CO. INC.

- ATLANTA METAL COATING, INC.

- HOLLAND SHIELDING SYSTEMS BV

- ICOTEK

- INTEGRATED POLYMER SOLUTIONS

- INTERSTATE SPECIALTY PRODUCTS

- MARIAN, INC.

- NTRIUM CO., LTD

- OMEGA SHIELDING PRODUCTS

- SPIRA MANUFACTURING

第17章 付録

List of Tables

- TABLE 1 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 2 INDICATIVE PRICING OF EMI SHIELDING MATERIALS OFFERED BY KEY PLAYERS, 2023 (USD)

- TABLE 3 EMI SHIELDING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- TABLE 6 IMPORT SCENARIO FOR HS CODE 853630-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 7 EXPORT SCENARIO FOR HS CODE 853630-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 8 MAJOR PATENTS IN EMI SHIELDING MARKET

- TABLE 9 EMI SHIELDING MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 10 MFN TARIFF FOR HS CODE 853630-COMPLIANT PRODUCTS EXPORTED BY US, 2023

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- TABLE 15 SAFETY STANDARDS FOR EMI SHIELDING SOLUTIONS

- TABLE 16 EMI SHIELDING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 17 EMI SHIELDING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 18 EMI SHIELDING MARKET, BY METHOD, 2020-2023 (USD MILLION)

- TABLE 19 EMI SHIELDING MARKET, BY METHOD, 2024-2029 (USD MILLION)

- TABLE 20 RADIATION: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 21 RADIATION: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 22 CONDUCTION: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 23 CONDUCTION: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 24 EMI SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 25 EMI SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 26 EMI SHIELDING MARKET, BY MATERIAL, 2020-2023 (THOUSAND UNITS)

- TABLE 27 EMI SHIELDING MARKET, BY MATERIAL, 2024-2029 (THOUSAND UNITS)

- TABLE 28 CONDUCTIVE COATINGS & PAINTS: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 29 CONDUCTIVE COATINGS & PAINTS: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 30 CONDUCTIVE POLYMERS: EMI SHIELDING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 31 CONDUCTIVE POLYMERS: EMI SHIELDING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 32 CONDUCTIVE POLYMERS: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 33 CONDUCTIVE POLYMERS: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 34 CONDUCTIVE ELASTOMERS: EMI SHIELDING MARKET, BY CHEMISTRY, 2020-2023 (USD MILLION)

- TABLE 35 CONDUCTIVE ELASTOMERS: EMI SHIELDING MARKET, BY CHEMISTRY, 2024-2029 (USD MILLION)

- TABLE 36 CONDUCTIVE ELASTOMERS: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 37 CONDUCTIVE ELASTOMERS: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 38 SILICONE AND FLUROSILICONE: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 39 SILICONE AND FLUROSILICONE: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 40 EPDM: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 41 EPDM: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 42 CONDUCTIVE PLASTICS: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 43 CONDUCTIVE PLASTICS: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 44 METAL SHIELDING: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 45 METAL SHIELDING: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 46 EMI/EMC FILTERS: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 47 EMI/EMC FILTERS: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 48 EMI/EMC FILTERS: EMI SHIELDING MARKET, BY LOAD TYPE, 2020-2023 (USD MILLION)

- TABLE 49 EMI/EMC FILTERS: EMI SHIELDING MARKET, BY LOAD TYPE, 2024-2029 (USD MILLION)

- TABLE 50 AC FILTERS: EMI SHIELDING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 51 AC FILTERS: EMI SHIELDING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 52 AC FILTERS: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 53 AC FILTERS: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 54 DC FILTERS: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 55 DC FILTERS: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 56 EMI/EMC FILTERS: EMI SHIELDING MARKET, BY INSERTION LOSS, 2020-2023 (USD MILLION)

- TABLE 57 EMI/EMC FILTERS: EMI SHIELDING MARKET, BY INSERTION LOSS, 2024-2029 (USD MILLION)

- TABLE 58 EMI SHIELDING TAPES & LAMINATES: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 59 EMI SHIELDING TAPES & LAMINATES: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 60 EMI SHIELDING MARKET, BY FREQUENCY, 2020-2023 (USD MILLION)

- TABLE 61 EMI SHIELDING MARKET, BY FREQUENCY, 2024-2029 (USD MILLION)

- TABLE 62 EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 63 EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 64 CONSUMER ELECTRONICS: EMI SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 65 CONSUMER ELECTRONICS: EMI SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 66 CONSUMER ELECTRONICS: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 67 CONSUMER ELECTRONICS: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 68 CONSUMER ELECTRONICS: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2020-2023 (USD MILLION)

- TABLE 69 CONSUMER ELECTRONICS: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2024-2029 (USD MILLION)

- TABLE 70 CONSUMER ELECTRONICS: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2020-2023 (USD MILLION)

- TABLE 71 CONSUMER ELECTRONICS: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2024-2029 (USD MILLION)

- TABLE 72 CONSUMER ELECTRONICS: EMI SHIELDING MARKET, BY METHOD, 2020-2023 (USD MILLION)

- TABLE 73 CONSUMER ELECTRONICS: EMI SHIELDING MARKET, BY METHOD, 2024-2029 (USD MILLION)

- TABLE 74 CONSUMER ELECTRONICS: EMI SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 75 CONSUMER ELECTRONICS: EMI SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 76 TELECOMMUNICATIONS: EMI SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 77 TELECOMMUNICATIONS: EMI SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 78 TELECOMMUNICATIONS: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 79 TELECOMMUNICATIONS: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 80 TELECOMMUNICATIONS: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2020-2023 (USD MILLION)

- TABLE 81 TELECOMMUNICATIONS: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2024-2029 (USD MILLION)

- TABLE 82 TELECOMMUNICATIONS: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2020-2023 (USD MILLION)

- TABLE 83 TELECOMMUNICATIONS: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2024-2029 (USD MILLION)

- TABLE 84 TELECOMMUNICATIONS: EMI SHIELDING MARKET, BY METHOD, 2020-2023 (USD MILLION)

- TABLE 85 TELECOMMUNICATIONS: EMI SHIELDING MARKET, BY METHOD, 2024-2029 (USD MILLION)

- TABLE 86 TELECOMMUNICATIONS: EMI SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 87 TELECOMMUNICATIONS: EMI SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 88 AUTOMOTIVE: EMI SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 89 AUTOMOTIVE: EMI SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 90 AUTOMOTIVE: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 91 AUTOMOTIVE: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 92 AUTOMOTIVE: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2020-2023 (USD MILLION)

- TABLE 93 AUTOMOTIVE: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2024-2029 (USD MILLION)

- TABLE 94 AUTOMOTIVE: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2020-2023 (USD MILLION)

- TABLE 95 AUTOMOTIVE: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2024-2029 (USD MILLION)

- TABLE 96 AUTOMOTIVE: EMI SHIELDING MARKET, BY METHOD, 2020-2023 (USD MILLION)

- TABLE 97 AUTOMOTIVE: EMI SHIELDING MARKET, BY METHOD, 2024-2029 (USD MILLION)

- TABLE 98 AUTOMOTIVE: EMI SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 99 AUTOMOTIVE: EMI SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 100 HEALTHCARE: EMI SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 101 HEALTHCARE: EMI SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 102 HEALTHCARE: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 103 HEALTHCARE: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 104 HEALTHCARE: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2020-2023 (USD MILLION)

- TABLE 105 HEALTHCARE: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2024-2029 (USD MILLION)

- TABLE 106 HEALTHCARE: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2020-2023 (USD MILLION)

- TABLE 107 HEALTHCARE: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2024-2029 (USD MILLION)

- TABLE 108 HEALTHCARE: EMI SHIELDING MARKET, BY METHOD, 2020-2023 (USD MILLION)

- TABLE 109 HEALTHCARE: EMI SHIELDING MARKET, BY METHOD, 2024-2029 (USD MILLION)

- TABLE 110 HEALTHCARE: EMI SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 111 HEALTHCARE: EMI SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 112 AEROSPACE: EMI SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 113 AEROSPACE: EMI SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 114 AEROSPACE: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 115 AEROSPACE: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 116 AEROSPACE: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2020-2023 (USD MILLION)

- TABLE 117 AEROSPACE: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2024-2029 (USD MILLION)

- TABLE 118 AEROSPACE: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2020-2023 (USD MILLION)

- TABLE 119 AEROSPACE: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2024-2029 (USD MILLION)

- TABLE 120 AEROSPACE: EMI SHIELDING MARKET, BY METHOD, 2020-2023 (USD MILLION)

- TABLE 121 AEROSPACE: EMI SHIELDING MARKET, BY METHOD, 2024-2029 (USD MILLION)

- TABLE 122 AEROSPACE: EMI SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 123 AEROSPACE: EMI SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 124 ENERGY & POWER: EMI SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 125 ENERGY & POWER: EMI SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 126 ENERGY & POWER: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 127 ENERGY & POWER: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 128 ENERGY & POWER: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2020-2023 (USD MILLION)

- TABLE 129 ENERGY & POWER: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2024-2029 (USD MILLION)

- TABLE 130 ENERGY & POWER: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2020-2023 (USD MILLION)

- TABLE 131 ENERGY & POWER: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2024-2029 (USD MILLION)

- TABLE 132 ENERGY & POWER: EMI SHIELDING MARKET, BY METHOD, 2020-2023 (USD MILLION)

- TABLE 133 ENERGY & POWER: EMI SHIELDING MARKET, BY METHOD, 2024-2029 (USD MILLION)

- TABLE 134 ENERGY & POWER: EMI SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 135 ENERGY & POWER: EMI SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 136 INDUSTRIAL: EMI SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 137 INDUSTRIAL: EMI SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 138 INDUSTRIAL: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 139 INDUSTRIAL: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 140 INDUSTRIAL: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2020-2023 (USD MILLION)

- TABLE 141 INDUSTRIAL: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2024-2029 (USD MILLION)

- TABLE 142 INDUSTRIAL: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2020-2023 (USD MILLION)

- TABLE 143 INDUSTRIAL: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2024-2029 (USD MILLION)

- TABLE 144 INDUSTRIAL: EMI SHIELDING MARKET, BY METHOD, 2020-2023 (USD MILLION)

- TABLE 145 INDUSTRIAL: EMI SHIELDING MARKET, BY METHOD, 2024-2029 (USD MILLION)

- TABLE 146 INDUSTRIAL: EMI SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 147 INDUSTRIAL: EMI SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 148 TRANSPORTATION: EMI SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 149 TRANSPORTATION: EMI SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 150 TRANSPORTATION: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 151 TRANSPORTATION: EMI SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 152 TRANSPORTATION: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2020-2023 (USD MILLION)

- TABLE 153 TRANSPORTATION: EMI SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2024-2029 (USD MILLION)

- TABLE 154 TRANSPORTATION: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2020-2023 (USD MILLION)

- TABLE 155 TRANSPORTATION: EMI SHIELDING MARKET FOR EMI/EMC FILTERS, BY LOAD TYPE, 2024-2029 (USD MILLION)

- TABLE 156 TRANSPORTATION: EMI SHIELDING MARKET, BY METHOD, 2020-2023 (USD MILLION)

- TABLE 157 TRANSPORTATION: EMI SHIELDING MARKET, BY METHOD, 2024-2029 (USD MILLION)

- TABLE 158 TRANSPORTATION: EMI SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 159 TRANSPORTATION: EMI SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 160 EMI SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 161 EMI SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 162 NORTH AMERICA: EMI SHIELDING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 163 NORTH AMERICA: EMI SHIELDING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 164 NORTH AMERICA: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 165 NORTH AMERICA: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 166 EUROPE: EMI SHIELDING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 167 EUROPE: EMI SHIELDING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 168 EUROPE: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 169 EUROPE: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 170 ASIA PACIFIC: EMI SHIELDING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 171 ASIA PACIFIC: EMI SHIELDING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 172 ASIA PACIFIC: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 173 ASIA PACIFIC: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 174 ROW: EMI SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 175 ROW: EMI SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 176 ROW: EMI SHIELDING MARKET, BY INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 177 ROW: EMI SHIELDING MARKET, BY INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 178 MIDDLE EAST: EMI SHIELDING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 179 MIDDLE EAST: EMI SHIELDING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 180 SOUTH AMERICA: EMI SHIELDING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 181 SOUTH AMERICA: EMI SHIELDING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 182 EMI SHIELDING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 183 EMI SHIELDING MARKET: DEGREE OF COMPETITION, 2023

- TABLE 184 EMI SHIELDING MARKET: REGION FOOTPRINT

- TABLE 185 EMI SHIELDING MARKET: METHOD FOOTPRINT

- TABLE 186 EMI SHIELDING MARKET: MATERIAL FOOTPRINT

- TABLE 187 EMI SHIELDING MARKET: INDUSTRY FOOTPRINT

- TABLE 188 EMI SHIELDING MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 189 EMI SHIELDING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 190 EMI SHIELDING MARKET: PRODUCT LAUNCHES, JANUARY 2020-SEPTEMBER 2024

- TABLE 191 EMI SHIELDING MARKET: DEALS, JANUARY 2020-SEPTEMBER 2024

- TABLE 192 EMI SHIELDING MARKET: EXPANSIONS, JANUARY 2020-SEPTEMBER 2024

- TABLE 193 EMI SHIELDING MARKET: OTHER DEVELOPMENTS, JANUARY 2020-SEPTEMBER 2024

- TABLE 194 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 195 PARKER HANNIFIN CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 PARKER HANNIFIN CORP: PRODUCT LAUNCHES

- TABLE 197 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 198 PPG INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 PPG INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 200 PPG INDUSTRIES, INC..: DEALS

- TABLE 201 PPG INDUSTRIES, INC.: EXPANSIONS

- TABLE 202 PPG INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 203 3M: COMPANY OVERVIEW

- TABLE 204 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 3M: EXPANSIONS

- TABLE 206 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 207 HENKEL AG & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 HENKEL AG & CO. KGAA: PRODUCT LAUNCHES

- TABLE 209 HENKEL AG & CO. KGAA: DEALS

- TABLE 210 HENKEL AG & CO. KGAA: EXPANSIONS

- TABLE 211 HENKEL AG & CO. KGAA: OTHER DEVELOPMENTS

- TABLE 212 LAIRD TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 213 LAIRD TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 LAIRD TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 215 LAIRD TECHNOLOGIES, INC.: OTHER DEVELOPMENTS

- TABLE 216 LEADER TECH INC: COMPANY OVERVIEW

- TABLE 217 LEADER TECH INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 MG CHEMICALS: COMPANY OVERVIEW

- TABLE 219 MG CHEMICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 NOLATO AB: COMPANY OVERVIEW

- TABLE 221 NOLATO AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 NOLATO AB: DEALS

- TABLE 223 TECH ETCH INC.: COMPANY OVERVIEW

- TABLE 224 TECH ETCH INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 TECH ETCH INC.: PRODUCT LAUNCHES

- TABLE 226 TECH ETCH INC.: DEALS

- TABLE 227 RTP COMPANY: COMPANY OVERVIEW

- TABLE 228 RTP COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 RTP COMPANY: DEALS

- TABLE 230 SCHAFFNER HOLDING AG: COMPANY OVERVIEW

- TABLE 231 SCHAFFNER HOLDING AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 SCHAFFNER HOLDING AG: PRODUCT LAUNCHES

- TABLE 233 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 234 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 KITAGAWA INDUSTRIES AMERICA, INC: COMPANY OVERVIEW

- TABLE 236 KITAGAWA INDUSTRIES AMERICA, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 ETS-LINDGREN: COMPANY OVERVIEW

- TABLE 238 ETS-LINDGREN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 SEAL SCIENCE, INC.: COMPANY OVERVIEW

- TABLE 240 SEAL SCIENCE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 EMI SHIELDING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 EMI SHIELDING MARKET: RESEARCH DESIGN

- FIGURE 3 REVENUE GENERATED BY COMPANIES FROM SALES OF EMI SHIELDING

- FIGURE 4 EMI SHIELDING MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 NARROWBAND EMI SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 8 RADIATION SEGMENT TO EXHIBIT HIGHER CAGR IN 2024

- FIGURE 9 CONSUMER ELECTRONICS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN EMI SHIELDING MARKET BETWEEN 2024 AND 2029

- FIGURE 11 INCREASING RELIANCE ON ELECTRONIC DEVICES IN VARIOUS INDUSTRIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- FIGURE 12 CONDUCTIVE COATINGS & PAINTS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 13 ABOVE 100 MHZ SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 14 CONSUMER ELECTRONICS AND ASIA PACIFIC TO SECURE LARGEST MARKET SHARES IN 2029

- FIGURE 15 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL EMI SHIELDING MARKET DURING FORECAST PERIOD

- FIGURE 16 EMI SHIELDING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 IMPACT OF DRIVERS ON EMI SHIELDING MARKET

- FIGURE 18 IMPACT OF RESTRAINTS ON EMI SHIELDING MARKET

- FIGURE 19 IMPACT OF OPPORTUNITIES ON EMI SHIELDING MARKET

- FIGURE 20 IMPACT OF CHALLENGES ON EMI SHIELDING MARKET

- FIGURE 21 SUPPLY CHAIN ANALYSIS: EMI SHIELDING MARKET

- FIGURE 22 EMI SHIELDING ECOSYSTEM

- FIGURE 23 CONSUMER ELECTRONICS FUNDING TO US STARTUPS, 2019-2023

- FIGURE 24 INDICATIVE PRICING OF EMI SHIELDING MATERIALS OFFERED BY KEY PLAYERS, 2023

- FIGURE 25 AVERAGE SELLING PRICE TREND OF EMI SHIELDING, BY MATERIAL, 2019-2023

- FIGURE 26 AVERAGE SELLING PRICE TREND OF EMI SHIELDING, BY REGION, 2019-2023

- FIGURE 27 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 28 EMI SHIELDING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 INDUSTRIES

- FIGURE 30 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- FIGURE 31 IMPORT DATA FOR HS CODE 853630-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023

- FIGURE 32 EXPORT DATA FOR HS CODE 853630-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023

- FIGURE 33 EMI SHIELDING MARKET: PATENT ANALYSIS, 2014-2023

- FIGURE 34 USE CASES OF AI IN EMI SHIELDING

- FIGURE 35 FORMATIONS OF EMI SHIELDING

- FIGURE 36 EMI SHIELDING MARKET: APPLICATIONS OF EMI GASKETS

- FIGURE 37 KEY PROPERTIES OF LIQUID GASKETS

- FIGURE 38 APPLICATIONS OF SOLID ENCLOSURES

- FIGURE 39 EMI SHIELDING MARKET: APPLICATIONS OF COATINGS

- FIGURE 40 EMI SHIELDING MARKET: EMI SHIELDING EFFECTIVENESS TESTS

- FIGURE 41 BROADBAND EMI TO SECURE LARGER MARKET SHARE IN 2029

- FIGURE 42 RADIATION SEGMENT TO SECURE LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 43 TAPES & LAMINATES TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 ABOVE 100 MHZ TO SECURE LARGER MARKET SHARE IN 2029

- FIGURE 45 AUTOMOTIVE INDUSTRY TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 ASIA PACIFIC TO DOMINATE EMI SHIELDING MARKET DURING FORECAST PERIOD

- FIGURE 47 NORTH AMERICA: EMI SHIELDING MARKET SNAPSHOT

- FIGURE 48 EUROPE: EMI SHIELDING MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: EMI SHIELDING MARKET SNAPSHOT

- FIGURE 50 EMI SHIELDING MARKET: REVENUE ANALYSIS OF TOP FOUR PLAYERS, 2019-2023

- FIGURE 51 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 52 COMPANY VALUATION, 2024

- FIGURE 53 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 54 COVERAGE AREA/RESPONSE TIME COMPARISON

- FIGURE 55 EMI SHIELDING MARKET: EVALUATION MATRIX (KEY COMPANIES), 2023

- FIGURE 56 EMI SHIELDING MARKET: COMPANY FOOTPRINT

- FIGURE 57 EMI SHIELDING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 58 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- FIGURE 59 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 60 3M: COMPANY SNAPSHOT

- FIGURE 61 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 62 NOLATO AB: COMPANY SNAPSHOT

- FIGURE 63 TE CONNECTIVITY: COMPANY SNAPSHOT

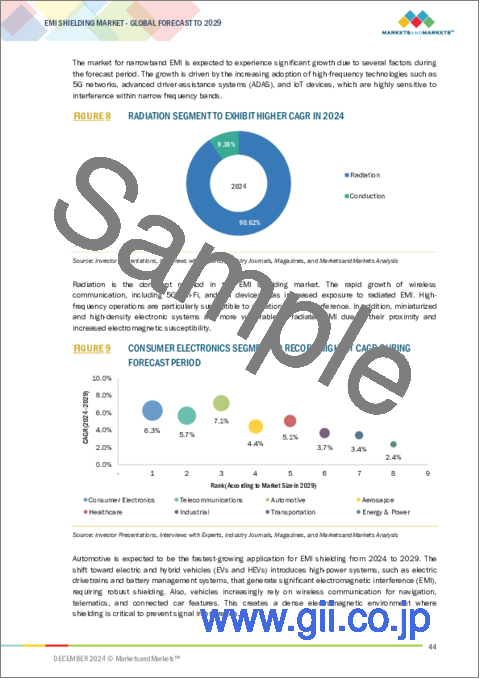

The global EMI shielding market is expected to reach USD 9.69 billion in 2029 from USD 7.34 billion in 2024, at a CAGR of 5.7% during the forecast period. The increasing demand for EMI shielding is closely linked to the miniaturization of electronic products, a process that has speeded up in recent years in industries as disparate as consumer electronics, automotive, healthcare, and telecommunications. As devices become smaller, more compact, and feature-dense, the components inside these devices can converge at closer distances, increasing electromagnetic emissions. Manufacturers are, therefore, switching to the use of advanced EMI shielding materials and have a focus on using thin conductive coatings, flexible films, and lightweight conductive foams that do not compromise with performances in highly compact designs.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Method, Material, Frequency, Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Broadband EMI segment is expected to dominate during the forecast period."

Broadband EMI is dominating the EMI shielding market as there is a rising prevalence of high-speed, wide-bandwidth electronic systems performing operations across a large range of frequencies. With the proliferation of 5G, Wi-Fi 6, and other wireless communication standards, nowadays electronics devices transmit data across larger frequency ranges. This led to a tremendous rise in electromagnetic interference (EMI) on many frequencies, rendering broadband EMI shielding solutions far more crucial. Unlike narrowband EMI, which operates in a confined range of frequencies, broadband EMI can interfere with numerous pieces of equipment operating in various frequencies at the same time, creating more comprehensive disruption.

"EMI shielding Tapes & Laminates segment is expected to grow at highest CAGR in EMI shielding market."

EMI shielding tapes and laminates are the fastest-growing segment in the EMI shielding market due to several key advantages that render them an ideal solution for a wide range of applications. As electronics get smaller and more feature-rich, the need for effective shielding solutions capable of conforming to complex shapes and tight spaces has grown, and EMI shielding tapes and laminates are just right for the requirements. Their ability to easily integrate with a range of components, such as cables, connectors, and circuit boards, continues to fuel their use in the consumer electronics, automotive, telecommunication, and aerospace sectors.

"The Asia Pacific is expected to have highest growth rate in the EMI shielding market."

The Asia-Pacific region expected to see the highest growth in the EMI shielding market, for several critical key factors. The region hosts some of the largest and most influential electronics manufacturers; countries like China, Japan, South Korea, and Taiwan dominate global electronics production markets. Ever-growing telecommunication equipment, consumer electronics, and automotive industries have increased demand for EMI shielding solutions to ensure electromagnetic compatibility of these devices. Asia-Pacific also experiences a growing trend in smart cities and automation, thereby boosting the demand for EMI shielding.

- By Company Type: Tier 1 - 45%, Tier 2 - 30%, and Tier 3 - 25%

- By Designation: Directors - 40%, Managers - 35%, and Others - 25%

- By Region: North America- 45%, Europe - 25%, Asia Pacific- 20% and RoW- 10%

Parker Hannifin Corp (US), PPG Industries Inc (US), 3M (US), Henkel AG & CO. KGAA (Germany), Laird Technologies, Inc. (US), Leader Tech Inc.(US), MG Chemicals (Canada), Nolato AB (Sweden), Tech Etch, Inc. (US), RTP Company (US), are some of the key players in the EMI shielding market.

The study includes an in-depth competitive analysis of these key players in the EMI shielding market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the EMI shielding market by type (Narrowband EMI, Broadband EMI), by method (Radiation, Conduction), by materials (Conductive Coatings & Paints, Conductive Polymers (Conductive Elastomers (Silicone and Flurosilicone, EPDM), Conductive Plastics), Metal Shielding, EMI Filters (By Load Type (AC (Single Phase, Three Phase), DC), By Insertion Loss(Differential Mode, Common Mode)) , EMI Shielding Tapes & Laminates), by frequency (Below 100 MHz, Above 100 MHz), by industry (Consumer Electronics, Telecommunications, Automotive, Healthcare, Aerospace, Energy & Power, Industrial, Transportation) and by region (North America, Europe, Asia Pacific, and RoW). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the EMI shielding market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements, new product & service launches, mergers and acquisitions; and recent developments associated with the EMI shielding market. This report covers the competitive analysis of upcoming startups in the EMI shielding market ecosystem.

Reasons to buy this report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall EMI shielding market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (miniaturization of electronic devices, enforcement of stringent regulations to prevent electronic equipment malfunctions, increasing proliferation of wireless communication technologies, rapid industrialization and deployment of automation technologies), restraints (environmental hazards and high costs of EMI shielding metals, low effectiveness of traditional EMI shielding materials), opportunities (shifting preference toward electric vehicles to mitigate carbon emissions, increasing adoption of digital healthcare solutions, rising consumer awareness for effects of EMI shielding), and challenges (high complexity in reducing electromagnetic interference in miniaturized devices) influencing the growth of the EMI shielding market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the EMI shielding market

- Market Development: Comprehensive information about lucrative markets - the report analyses the EMI shielding market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the EMI shielding market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Parker Hannifin Corp (US), PPG Industries Inc (US), 3M (US), Henkel AG & CO. KGAA (Germany), Laird Technologies, Inc. (US), among others in the EMI shielding market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 FACTOR ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EMI SHIELDING MARKET

- 4.2 EMI SHIELDING MARKET, BY MATERIAL

- 4.3 EMI SHIELDING MARKET, BY FREQUENCY

- 4.4 EMI SHIELDING MARKET, BY REGION AND INDUSTRY

- 4.5 EMI SHIELDING MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for high-speed and high-frequency devices

- 5.2.1.2 Enforcement of stringent regulations to prevent electronic equipment malfunctions

- 5.2.1.3 Increasing proliferation of wireless communication technologies

- 5.2.1.4 Rapid industrialization and deployment of automation technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Environmental hazards and high costs of EMI shielding metals

- 5.2.2.2 Low effectiveness of traditional EMI shielding materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Shifting preference toward electric vehicles to mitigate carbon emissions

- 5.2.3.2 Growing adoption of digital healthcare solutions

- 5.2.3.3 Rising consumer awareness of effects of EMI shielding

- 5.2.4 CHALLENGES

- 5.2.4.1 High complexity in reducing electromagnetic interference in miniaturized devices

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 PRICING ANALYSIS

- 5.6.1 INDICATIVE PRICING OF EMI SHIELDING OFFERED BY KEY PLAYERS, BY MATERIAL, 2023

- 5.6.2 AVERAGE SELLING PRICE TREND OF EMI SHIELDING, BY MATERIAL, 2019-2023

- 5.6.3 AVERAGE SELLING PRICE TREND OF EMI SHIELDING, BY REGION, 2019-2023

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Active EMI cancellation

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Grounding and bonding techniques

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 RFID interference management

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 THREAT OF NEW ENTRANTS

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 PARKER CHOMERICS OFFERS ELECTRICALLY CONDUCTIVE PLASTIC TO SHIELD PRINTED CIRCUIT BOARDS

- 5.11.2 SSD POLYMERS RECOMMENDS USE OF CONDUCTIVE GASKETS TO INCREASE EMI SHIELDING EFFECTIVENESS

- 5.11.3 SSD POLYMERS FORMULATES EMI SHIELDING MATERIALS FOR GENERATORS

- 5.11.4 PARKER CHOMERICS PRODUCES MICROWAVE ABSORBERS TO ENSURE RELIABLE PERFORMANCE FOR ADAS APPLICATIONS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 853630)

- 5.12.2 EXPORT SCENARIO (HS CODE 853630)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 TARIFF ANALYSIS

- 5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.3 STANDARDS

- 5.16 IMPACT OF AI ON EMI SHIELDING MARKET

- 5.16.1 INTRODUCTION

6 FORMATIONS OF EMI SHIELDING

- 6.1 INTRODUCTION

- 6.2 EMI SHIELDING GASKETS AND O-RINGS

- 6.2.1 EMI SHIELDING GASKETS

- 6.2.2 EMI SHIELDING O-RINGS

- 6.3 SOLID ENCLOSURES

- 6.4 WIRE MESH & SCREENS

- 6.5 CABLE SHIELDING

- 6.6 COATINGS

7 LATEST EMI SHIELDING TECHNOLOGIES AND EFFECTIVENESS TESTS

- 7.1 LATEST EMI SHIELDING TECHNOLOGIES

- 7.1.1 TRANSPARENT EMI SHIELDING MATERIALS

- 7.2 EMI SHIELDING EFFECTIVENESS TESTS

- 7.2.1 SHIELDED BOX TESTS

- 7.2.2 SHIELDED ROOM TESTS

- 7.2.3 OPEN FIELD TESTS

- 7.2.4 COAXIAL TRANSMISSION LINE TESTS

8 EMI SHIELDING STRATEGIES

- 8.1 INTRODUCTION

- 8.2 CONDUCTIVE EMI SHIELDING

- 8.3 MAGNETIC EMI SHIELDING

- 8.4 ABSORPTIVE EMI SHIELDING

9 EMI SHIELDING MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 NARROWBAND EMI

- 9.2.1 RISING COMPLEXITY OF ELECTRONIC DEVICES TO FUEL DEMAND

- 9.3 BROADBAND EMI

- 9.3.1 INCREASING ADOPTION OF HIGH-SPEED NETWORKS TO FOSTER MARKET GROWTH

10 EMI SHIELDING MARKET, BY METHOD

- 10.1 INTRODUCTION

- 10.2 RADIATION

- 10.2.1 ADVANCEMENTS IN SHIELDING MATERIALS OFFERING LIGHTWEIGHT SOLUTIONS TO FOSTER MARKET GROWTH

- 10.3 CONDUCTION

- 10.3.1 RISING ADOPTION OF ELECTRONIC DEVICES ACROSS CONSUMER AND AUTOMOTIVE SECTORS TO SPIKE DEMAND

11 EMI SHIELDING MARKET, BY MATERIAL

- 11.1 INTRODUCTION

- 11.2 CONDUCTIVE COATINGS & PAINTS

- 11.2.1 INCREASING DEMAND FOR LIGHTWEIGHT SHIELDING SOLUTIONS TO DRIVE MARKET

- 11.3 CONDUCTIVE POLYMERS

- 11.3.1 CONDUCTIVE ELASTOMERS

- 11.3.1.1 Silicone and flurosilicone

- 11.3.1.1.1 Rising demand for electric vehicles to fuel market growth

- 11.3.1.2 EPDM

- 11.3.1.2.1 Expansion of high-speed internet networks to boost demand

- 11.3.1.1 Silicone and flurosilicone

- 11.3.2 CONDUCTIVE PLASTICS

- 11.3.2.1 Increasing demand for lightweight and versatile conductive plastics to augment market growth

- 11.3.1 CONDUCTIVE ELASTOMERS

- 11.4 METAL SHIELDING

- 11.4.1 DURABILITY AND RELIABILITY OF METAL SHIELDING TO DRIVE SEGMENTAL GROWTH

- 11.5 EMI/EMC FILTERS

- 11.5.1 EMI/EMC FILTERS, BY LOAD TYPE

- 11.5.1.1 AC filters

- 11.5.1.1.1 Single phase

- 11.5.1.1.1.1 Rising demand for household appliances and personal devices to fuel segmental growth

- 11.5.1.1.2 Three phase

- 11.5.1.1.2.1 Increasing use of VFDs in motor control applications to boost market growth

- 11.5.1.1.1 Single phase

- 11.5.1.2 DC filters

- 11.5.1.2.1 Compliance with stringent electromagnetic compatibility standards to fuel market growth

- 11.5.1.1 AC filters

- 11.5.2 EMI/EMC FILTERS, BY INSERTION LOSS

- 11.5.2.1 Common mode

- 11.5.2.1.1 Increasing demand for networking equipment from data centers and telecommunication firms to drive market

- 11.5.2.2 Differential mode

- 11.5.2.2.1 Increasing demand for high-speed data transmission to accelerate market growth

- 11.5.2.1 Common mode

- 11.5.1 EMI/EMC FILTERS, BY LOAD TYPE

- 11.6 EMI SHIELDING TAPES & LAMINATES

- 11.6.1 SURGING USE OF EMI SHIELDING IN 5G INFRASTRUCTURE TO AUGMENT MARKET GROWTH

12 EMI SHIELDING MARKET, BY FREQUENCY

- 12.1 INTRODUCTION

- 12.2 BELOW 100 MHZ

- 12.2.1 GROWING ADOPTION OF EMI SHIELDING TECHNOLOGY IN HEALTHCARE AND MEDICAL DEVICES TO SUPPORT MARKET GROWTH

- 12.3 ABOVE 100 MHZ

- 12.3.1 ELEVATING ADOPTION OF WIRELESS NETWORKS AND IOT DEVICES TO CREATE OPPORTUNITIES

13 EMI SHIELDING MARKET, BY INDUSTRY

- 13.1 INTRODUCTION

- 13.2 CONSUMER ELECTRONICS

- 13.2.1 STRINGENT REGULATORY REQUIREMENTS FOR ELECTROMAGNETIC COMPATIBILITY TO FUEL MARKET GROWTH

- 13.2.2 SMARTPHONES

- 13.2.3 LAPTOPS AND COMPUTERS

- 13.2.4 SMART HOME DEVICES

- 13.2.5 GAMING CONSOLES

- 13.3 TELECOMMUNICATIONS

- 13.3.1 GOVERNMENT-LED INVESTMENTS AND POLICIES AIMED AT DEVELOPING NEXT-GENERATION NETWORK INFRASTRUCTURE TO ENHANCE MARKET GROWTH

- 13.3.2 BASE STATIONS AND SMALL CELLS

- 13.3.3 STORAGE DEVICES

- 13.3.4 OPTICAL TRANSCEIVERS

- 13.4 AUTOMOTIVE

- 13.4.1 INCREASING USE OF ADVANCED ELECTRONICS IN VEHICLES TO DRIVE SEGMENTAL GROWTH

- 13.4.2 ADVANCED DRIVER-ASSISTANCE SYSTEMS

- 13.4.3 INFOTAINMENT AND COMMUNICATION SYSTEMS

- 13.4.4 ENGINE CONTROL UNITS

- 13.5 HEALTHCARE

- 13.5.1 MINIATURIZATION OF MEDICAL DEVICES TO DRIVE MARKET GROWTH

- 13.5.2 MEDICAL DEVICES

- 13.5.3 DIAGNOSTIC EQUIPMENT

- 13.6 AEROSPACE

- 13.6.1 INCREASING ADOPTION OF SOPHISTICATED ELECTRONIC SYSTEMS IN AIRCRAFT TO DRIVE MARKET

- 13.6.2 NAVIGATION AND COMMUNICATION SYSTEMS

- 13.6.3 RADAR AND SURVEILLANCE SYSTEMS

- 13.7 ENERGY & POWER

- 13.7.1 RISING ADOPTION OF RENEWABLE ENERGY SOURCES TO SPUR DEMAND

- 13.7.2 POWER DISTRIBUTION SYSTEMS

- 13.8 INDUSTRIAL

- 13.8.1 INCREASING DEMAND FOR ADVANCED ROBOTICS AND AUTOMATION SYSTEMS TO AUGMENT MARKET GROWTH

- 13.8.2 LOGIC CONTROLLERS

- 13.8.3 ROBOTICS

- 13.8.4 INDUSTRIAL IOT DEVICES

- 13.9 TRANSPORTATION

- 13.9.1 ADVANCEMENTS IN SPECTROSCOPY TO ACCELERATE MARKET GROWTH

- 13.9.2 TRAIN CONTROL AND PROPULSION

14 EMI SHIELDING MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 14.2.2 US

- 14.2.2.1 Increasing adoption of electric vehicles to augment market growth

- 14.2.3 CANADA

- 14.2.3.1 Stringent government regulations and industry compliances to boost demand

- 14.2.4 MEXICO

- 14.2.4.1 Rapid expansion of manufacturing industry to drive market

- 14.3 EUROPE

- 14.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 14.3.2 GERMANY

- 14.3.2.1 Increasing demand for electronic components in various industries to stimulate market growth

- 14.3.3 UK

- 14.3.3.1 Growing demand for sophisticated electronic devices in healthcare industry to drive market

- 14.3.4 FRANCE

- 14.3.4.1 Adoption of advanced technologies in aerospace and defense to increase demand

- 14.3.5 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 14.4.2 CHINA

- 14.4.2.1 Excellence in electronics production to foster market growth

- 14.4.3 JAPAN

- 14.4.3.1 Surging developments in various industries to stimulate market growth

- 14.4.4 INDIA

- 14.4.4.1 Rapidly growing EV industry to spike demand

- 14.4.5 REST OF ASIA PACIFIC

- 14.5 ROW

- 14.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 14.5.2 MIDDLE EAST

- 14.5.2.1 Saudi Arabia

- 14.5.2.1.1 Rising investments in semiconductor sector to accelerate market growth

- 14.5.2.2 UAE

- 14.5.2.2.1 Increasing investments in manufacturing sector to drive market

- 14.5.2.3 Rest of Middle East

- 14.5.2.1 Saudi Arabia

- 14.5.3 AFRICA

- 14.5.3.1 Rising demand for fast and reliable internet access to fuel market growth

- 14.5.4 SOUTH AMERICA

- 14.5.4.1 Brazil

- 14.5.4.1.1 Growing automotive industry to boost demand

- 14.5.4.2 Argentina

- 14.5.4.2.1 Escalating adoption of modern technologies in manufacturing processes to stimulate market growth

- 14.5.4.3 Rest of South America

- 14.5.4.1 Brazil

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 15.3 REVENUE ANALYSIS, 2019-2023

- 15.4 MARKET SHARE ANALYSIS, 2O23

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 15.6 COVERAGE AREA/RESPONSE TIME COMPARISON

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Method footprint

- 15.7.5.4 Material footprint

- 15.7.5.5 Industry footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 15.8.5.1 Detailed list of key startups/SMEs

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

- 15.9.4 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 PARKER HANNIFIN CORP

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 PPG INDUSTRIES, INC.

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches

- 16.1.2.3.2 Deals

- 16.1.2.3.3 Expansions

- 16.1.2.3.4 Other developments

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 3M

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Expansions

- 16.1.3.4 MnM view

- 16.1.3.4.1 Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 HENKEL AG & CO. KGAA

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Expansions

- 16.1.4.3.4 Other developments

- 16.1.4.4 MnM view

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 LAIRD TECHNOLOGIES, INC.

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches

- 16.1.5.3.2 Other developments

- 16.1.5.4 MnM view

- 16.1.5.4.1 Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 LEADER TECH INC.

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.7 MG CHEMICALS

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.8 NOLATO AB

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Deals

- 16.1.9 TECH ETCH, INC.

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Product launches

- 16.1.9.3.2 Deals

- 16.1.10 RTP COMPANY

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Deals

- 16.1.11 SCHAFFNER HOLDING AG

- 16.1.11.1 Business overview

- 16.1.11.2 Products/Solutions/Services offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Product launches

- 16.1.12 TE CONNECTIVITY

- 16.1.12.1 Business overview

- 16.1.12.2 Products/Solutions/Services offered

- 16.1.13 KITAGAWA INDUSTRIES AMERICA, INC.

- 16.1.13.1 Business overview

- 16.1.13.2 Products/Solutions/Services offered

- 16.1.14 ETS LINDGREN

- 16.1.14.1 Business overview

- 16.1.14.2 Products/Solutions/Services offered

- 16.1.15 SEAL SCIENCE, INC.

- 16.1.15.1 Business overview

- 16.1.15.2 Products/Solutions/Services offered

- 16.1.1 PARKER HANNIFIN CORP

- 16.2 OTHER PLAYERS

- 16.2.1 E SONG EMC CO., LTD

- 16.2.2 EAST COAST SHIELDING

- 16.2.3 EFFECTIVE SHIELDING CO. INC.

- 16.2.4 ATLANTA METAL COATING, INC.

- 16.2.5 HOLLAND SHIELDING SYSTEMS BV

- 16.2.6 ICOTEK

- 16.2.7 INTEGRATED POLYMER SOLUTIONS

- 16.2.8 INTERSTATE SPECIALTY PRODUCTS

- 16.2.9 MARIAN, INC.

- 16.2.10 NTRIUM CO., LTD

- 16.2.11 OMEGA SHIELDING PRODUCTS

- 16.2.12 SPIRA MANUFACTURING

17 APPENDIX

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS