|

|

市場調査レポート

商品コード

1621137

住宅エネルギー貯蔵の世界市場 - 技術別、接続タイプ別、所有権タイプ別、システムタイプ別、電力定格別、地域別 - 2030年までの予測Residential Energy Storage Market by Technology (Lithium-Ion, Lead-Acid), Connectivity Type (On-Grid, Off-Grid), Operation Type (Standalone Systems, Solar and Storage Systems), Ownership Type, Power rating and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 住宅エネルギー貯蔵の世界市場 - 技術別、接続タイプ別、所有権タイプ別、システムタイプ別、電力定格別、地域別 - 2030年までの予測 |

|

出版日: 2024年12月17日

発行: MarketsandMarkets

ページ情報: 英文 213 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

住宅エネルギー貯蔵の市場規模は、2024年の26億7,000万米ドルから2030年には43億米ドルに成長し、予測期間中に8.2%のCAGRで成長すると予想されています。

最新のエネルギー管理システムは、住宅エネルギー貯蔵を変革しています。これらのシステムは、住宅所有者のエネルギー消費に関するリアルタイムの洞察と制御を取得することで、エネルギーの効率的で正確な使用をサポートし、それによって、家庭のニーズを満たすために可能な限り最大限に貯蔵されたエネルギーを展開します。最新のテクノロジーは、自動負荷最適化、予測エネルギー分析、および時間帯別料金との統合を特徴としており、それぞれのエネルギーコストと無駄を最小限に抑えます。さらに、再生可能エネルギーやスマートホームデバイスとの完全な統合により、使いやすさが向上し、住宅所有者がエネルギー効率と持続可能性をより簡単に管理できるようになります。

| 調査範囲 | |

|---|---|

| 調査対象年数 | 2019年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 価値(100万/10億米ドル) |

| セグメント | 技術別、接続タイプ別、所有権タイプ別、システムタイプ別、電力定格別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

オングリッドエネルギー貯蔵システムは、ピークシェービングと需要応答サービスを提供することで、グリッドの信頼性を大幅に向上させます。このシステムにより、住宅所有者はオフピーク時に生成されたエネルギーを捕捉してピーク時に供給できるため、グリッドの負担が軽減され、電気料金が下がります。この機能は、エネルギー価格が需要に応じて変動する時間帯別料金の地域では非常に価値があります。グリッド条件が不安定な地域や停電が頻繁に発生する可能性がある地域では、オングリッド貯蔵システムがシステムをバッファリングして安定した電力供給を実現します。これらは実際にエネルギーフローの安定化ポイントをすべて提供し、より差し迫ったグリッドインフラストラクチャのサポートに役立つため、個別にもマクロレベルでもコストを節約できます。そのため、住宅ユーザーにとって魅力的です。

リースやPPAなどのサードパーティ所有モデルがあります。住宅ESSの導入に対する経済的障壁を減らすという点では、これらのモデルは大きな違いをもたらします。多額の先行資本投資をする必要がなくなるため、他の方法では購入できないような幅広い住宅所有者が、この技術を利用できるようになります。特に、この手頃な価格により、予測可能で管理しやすい月々の支払いを提供することで市場導入のスピードが上がり、エネルギー貯蔵へのアクセスが民主化されます。サードパーティ所有モデルには、メンテナンスと運用サポートが付属していることが多く、財務リスクが軽減され、ユーザーに長期的なコスト効率をもたらす可能性があります。

当レポートでは、世界の住宅エネルギー貯蔵市場について調査し、技術別、接続タイプ別、所有権タイプ別、システムタイプ別、電力定格別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 顧客ビジネスに影響を与える動向/混乱

- サプライチェーン分析

- エコシステム分析

- 価格分析

- 技術分析

- ケーススタディ分析

- 規制状況

- 特許分析

- 貿易分析

- 2024年~2025年の主な会議とイベント

- 主な利害関係者と購入基準

- ポーターのファイブフォース分析

第6章 住宅エネルギー貯蔵市場、技術別(100万米ドル)- (2020年~2022年、2023年、2024年~2030年)

- イントロダクション

- リチウムイオン

- 鉛蓄電池

第7章 住宅エネルギー貯蔵市場、接続タイプ別(100万米ドル)- (2020年~2022年、2023年、2024年~2030年)

- イントロダクション

- オングリッド

- オフグリッド

第8章 住宅エネルギー貯蔵市場、所有権タイプ別(100万米ドル)- (2020年~2022年、2023年、2024年~2030年)

- イントロダクション

- 顧客所有

- ユーティリティ所有

- サードパーティ所有

第9章 住宅エネルギー貯蔵市場、システムタイプ別(100万米ドル)- (2020年~2022年、2023年、2024年~2030年)

- イントロダクション

- スタンドアロンシステム

- 太陽光発電および蓄電システム

第10章 住宅エネルギー貯蔵市場、電力定格別、容量(MW)および金額(100万米ドル)- (2020年~2022年、2023年、2024年~2030年)

- イントロダクション

- 3~6KW未満

- 6~10KW未満

- 10~20KW

第11章 住宅エネルギー貯蔵市場、地域別、数量(MW)および金額(100万米ドル)- (2020年~2022年、2023年、2024年~2030年)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- 南米

第12章 競合情勢

- 主要参入企業により採用された戦略、2019年~2024年

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

第13章 企業プロファイル

- TESLA

- PANASONIC HOLDINGS CORPORATION

- BYD COMPANY LTD.

- ENPHASE ENERGY

- SONNEN GMBH

- EATON

- LG ENERGY SOLUTION

- VARTA AG

- DELTA ELECTRONICS, INC

- HUAWEI TECHNOLOGIES CO., LTD.

- SMA SOLAR TECHNOLOGY AG

- SAMSUUNG SDI

- JINKO SOLAR

- ALPHA ESS CO., LTD

- E3/DC

- RCT-POWER

- SENEC

- SHANGHAI PYTES ENERGY CO., LTD.

- その他の企業

- PYLON TECHNOLOGIES CO., LTD.

- POWERVAULT

- TURBO ENERGY-SOLAR INNOVATION

- BST POWER(SHENZHEN)LIMITED

- WECO SRL

- DYNESS DIGITAL ENERGY TECHNOLOGY CO.,LTD.

- JA SOLAR TECHNOLOGY CO.,LTD

- SCHNEIDER ELECTRIC

第14章 付録

List of Tables

- TABLE 1 RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 2 LITHIUM-ION: RESIDENTIAL ENERGY STORAGE MARKET, BY REGION, 2019–2030 (USD MILLION)

- TABLE 3 LEAD-ACID: RESIDENTIAL ENERGY STORAGE MARKET, BY REGION, 2019–2030 (USD MILLION)

- TABLE 4 RESIDENTIAL ENERGY STORAGE MARKET, BY POWER RATING, 2019–2030 (USD MILLION)

- TABLE 5 3 TO <6 KW: RESIDENTIAL ENERGY STORAGE MARKET, BY REGION, 2019–2030 (USD MILLION)

- TABLE 6 6 TO <10 KW: RESIDENTIAL ENERGY STORAGE MARKET, BY REGION, 2019–2030 (USD MILLION)

- TABLE 7 10 TO 20 KW: RESIDENTIAL ENERGY STORAGE MARKET, BY REGION, 2019–2030 (USD MILLION)

- TABLE 8 RESIDENTIAL ENERGY STORAGE MARKET, BY OWNERSHIP TYPE, 2019–2030 (USD MILLION)

- TABLE 9 CUSTOMER-OWNED: RESIDENTIAL ENERGY STORAGE MARKET, BY REGION, 2019–2030 (USD MILLION)

- TABLE 10 UTILITY-OWNED: RESIDENTIAL ENERGY STORAGE MARKET, BY REGION, 2019–2030 (USD MILLION)

- TABLE 11 THIRD-PARTY-OWNED: RESIDENTIAL ENERGY STORAGE MARKET, BY REGION, 2019–2030 (USD MILLION)

- TABLE 12 RESIDENTIAL ENERGY STORAGE MARKET, BY SYSTEM TYPE, 2019–2030 (USD MILLION)

- TABLE 13 STANDALONE SYSTEMS: RESIDENTIAL ENERGY STORAGE MARKET, BY REGION, 2019–2030 (USD MILLION)

- TABLE 14 SOLAR AND STORAGE SYSTEMS: RESIDENTIAL ENERGY STORAGE MARKET, BY REGION, 2019–2030 (USD MILLION)

- TABLE 15 RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 16 ON-GRID: RESIDENTIAL ENERGY STORAGE MARKET, BY REGION, 2019–2030 (USD MILLION)

- TABLE 17 OFF-GRID: RESIDENTIAL ENERGY STORAGE MARKET, BY REGION, 2019–2030 (USD MILLION)

- TABLE 18 RESIDENTIAL ENERGY STORAGE MARKET, BY REGION, 2019–2030 (MW)

- TABLE 19 RESIDENTIAL ENERGY STORAGE MARKET, BY REGION, 2019–2030 (USD MILLION)

- TABLE 20 NORTH AMERICA: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 21 NORTH AMERICA: RESIDENTIAL ENERGY STORAGE MARKET, BY POWER RATING, 2019–2030 (USD MILLION)

- TABLE 22 NORTH AMERICA: RESIDENTIAL ENERGY STORAGE MARKET, BY OWNERSHIP TYPE, 2019–2030 (USD MILLION)

- TABLE 23 NORTH AMERICA: RESIDENTIAL ENERGY STORAGE MARKET, BY SYSTEM TYPE, 2019–2030 (USD MILLION)

- TABLE 24 NORTH AMERICA: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 25 NORTH AMERICA: RESIDENTIAL ENERGY STORAGE MARKET, BY COUNTRY, 2019–2030 (MW)

- TABLE 26 NORTH AMERICA: RESIDENTIAL ENERGY STORAGE MARKET, BY COUNTRY, 2019–2030 (USD MILLION)

- TABLE 27 US: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 28 US: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 29 CANADA: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 30 RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 31 MEXICO: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 32 MEXICO: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 33 ASIA PACIFIC: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 34 ASIA PACIFIC: RESIDENTIAL ENERGY STORAGE MARKET, BY POWER RATING, 2019–2030 (USD MILLION)

- TABLE 35 ASIA PACIFIC: RESIDENTIAL ENERGY STORAGE MARKET, BY OWNERSHIP TYPE, 2019–2030 (USD MILLION)

- TABLE 36 ASIA PACIFIC: RESIDENTIAL ENERGY STORAGE MARKET, BY SYSTEM TYPE, 2019–2030 (USD MILLION)

- TABLE 37 ASIA PACIFIC: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 38 ASIA PACIFIC: RESIDENTIAL ENERGY STORAGE MARKET, BY COUNTRY, 2019–2030 (MW)

- TABLE 39 ASIA PACIFIC: RESIDENTIAL ENERGY STORAGE MARKET, BY COUNTRY, 2019–2030 (USD MILLION)

- TABLE 40 CHINA: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 41 CHINA: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 42 INDIA: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 43 INDIA: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 44 JAPAN: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 45 JAPAN: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY 2019–2030 (USD MILLION)

- TABLE 46 SOUTH KOREA: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 47 SOUTH KOREA: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 48 AUSTRALIA: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 49 AUSTRALIA: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 50 REST OF ASIA PACIFIC: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 51 REST OF ASIA PACIFIC: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 52 EUROPE: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 53 EUROPE: RESIDENTIAL ENERGY STORAGE MARKET, BY POWER RATING, 2019–2030 (USD MILLION)

- TABLE 54 EUROPE: RESIDENTIAL ENERGY STORAGE MARKET, BY OWNERSHIP TYPE, 2019–2030 (USD MILLION)

- TABLE 55 EUROPE: RESIDENTIAL ENERGY STORAGE MARKET, BY SYSTEM TYPE, 2019–2030 (USD MILLION)

- TABLE 56 EUROPE: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 57 EUROPE: RESIDENTIAL ENERGY STORAGE MARKET, BY COUNTRY, 2019–2030 (KW)

- TABLE 58 EUROPE: RESIDENTIAL ENERGY STORAGE MARKET, BY COUNTRY, 2019–2030 (USD MILLION)

- TABLE 59 GERMANY: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 60 GERMANY: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 61 ITALY: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 62 ITALY: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 63 UK: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 64 UK: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 65 AUSTRIA: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 66 AUSTRIA: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 67 FRANCE: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 68 FRANCE: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 69 NETHERLANDS: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 70 NETHERLANDS: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 71 SWITZERLAND: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 72 SWITZERLAND: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 73 SPAIN: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 74 SPAIN: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 75 BELGIUM: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 76 BELGIUM: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 77 POLAND: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 78 POLAND: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 79 CZECH REPUBLIC: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 80 CZECH REPUBLIC: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 81 BULGARIA: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 82 BULGARIA: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 83 HUNGARY: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 84 HUNGARY: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 85 ROMANIA: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 86 ROMANIA: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 87 MIDDLE EAST & AFRICA: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION

- TABLE 88 MIDDLE EAST & AFRICA: RESIDENTIAL ENERGY STORAGE MARKET, BY POWER RATING, 2019–2030 (USD MILLION)

- TABLE 89 MIDDLE EAST & AFRICA: RESIDENTIAL ENERGY STORAGE MARKET, BY OWNERSHIP TYPE, 2019–2030 (USD MILLION)

- TABLE 90 MIDDLE EAST & AFRICA: RESIDENTIAL ENERGY STORAGE MARKET, BY SYSTEM TYPE, 2019–2030 (USD MILLION)

- TABLE 91 MIDDLE EAST & AFRICA: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 92 MIDDLE EAST & AFRICA: RESIDENTIAL ENERGY STORAGE MARKET, BY COUNTRY, 2019–2030 (MW)

- TABLE 93 MIDDLE EAST & AFRICA: RESIDENTIAL ENERGY STORAGE MARKET, BY COUNTRY, 2019–2030 (USD MILLION)

- TABLE 94 SAUDI ARABIA: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 95 SAUDI ARABIA: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 96 UAE: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 97 UAE: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 98 SOUTH AFRICA: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 99 SOUTH AFRICA: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 100 REST OF MIDDLE EAST & AFRICA: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 101 REST OF MIDDLE EAST & AFRICA: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 102 SOUTH AMERICA: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 103 SOUTH AMERICA: RESIDENTIAL ENERGY STORAGE MARKET, BY OWNERSHIP TYPE, 2019–2030 (USD MILLION)

- TABLE 104 SOUTH AMERICA: RESIDENTIAL ENERGY STORAGE MARKET, BY SYSTEM TYPE, 2019–2030 (USD MILLION)

- TABLE 105 SOUTH AMERICA: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 106 SOUTH AMERICA: RESIDENTIAL ENERGY STORAGE MARKET, BY COUNTRY, 2019–2030 (MW)

- TABLE 107 SOUTH AMERICA: RESIDENTIAL ENERGY STORAGE MARKET, BY COUNTRY, 2019–2030 (USD MILLION)

- TABLE 108 BRAZIL: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 109 BRAZIL: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 110 CHILE: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 111 CHILE: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

- TABLE 112 REST OF SOUTH AMERICA: RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY, 2019–2030 (USD MILLION)

- TABLE 113 REST OF SOUTH AMERICA: RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY, 2019–2030 (USD MILLION)

The residential energy storage market is expected to grow from an estimated USD 2.67 billion in 2024 to USD 4.30 billion by 2030, at a CAGR of 8.2% during the forecast period. Modern energy management systems are transforming residential energy storage. They support efficient and accurate usage of energy by capturing real-time insights and control for the homeowner on their energy consumption, thereby deploying the stored energy to the maximum extent possible for meeting the needs of the household. The modern technologies feature automated load optimization, predictive energy analytics, and integration with time-of-use tariffs to minimize the respective energy costs and waste. Moreover, their full integration with renewable energy and smart home devices increases usability and adds more appeal for homeowners to manage energy efficiency and sustainability easier.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | by technology, power rating, ownership type, operation type, connectivity type, and region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

"On-grid, by connectivity type, is expected to be the largest segment from 2024 to 2030."

On-grid energy storage systems greatly improve the reliability of the grid by offering peak shaving and demand response services. The systems allow homeowners to capture the energy generated during off-peak hours, which is served during peak hours, thus reducing strain on the grid and lowering electricity costs. This capability is of a lot of value in regions with time-of-use pricing; energy prices vary with demand. In areas with unstable grid conditions or where there is a likelihood of frequent power outages, on-grid storage systems buffer the system for a stable power supply. They actually provide all points of stabilization in energy flow and help support more imminent grid infrastructure, thus saving cost individually and at the aggregate macro level; hence the appeal for residential users.

"Third-party owned, by ownership type, is expected to be the fastest-growing market from 2024 to 2030"

There are third-party ownership models, for example leasing and PPAs. In terms of reducing financial barriers to the adoption of residential ESS, these models really make a difference. By allowing people to bypass the need to raise a significant upfront capital investment, they make it possible for a wider range of home owners than would be able to afford the technology otherwise. This affordability, in particular, democratises access to energy storage, as it increases the speed of market adoption by helping in offering predictable and manageable monthly payments. Third-party ownership models also often come with maintenance and operational support, reducing financial risk and providing potential long-term cost-effectiveness for users.

"US to grow at a highest CAGR for North America residential energy storage market."

Utilities around North America gradually move towards time-of-use pricing schemes, where electricity costs are charged at different prices depending on the time of the day it is consumed. The price of electricity is rather high when peak demand occurs during the evening when energy consumption in homes is at its peak. This situation creates an excellent reason for homeowners to make a significant investment in residential energy storage systems. An efficient technique for cost savings: the homeowner stores energy during off-peak hours, when electricity is cheaper, and uses it during peak periods. Advanced energy storage systems with intelligent energy management software automate the process, offering maximum convenience to the user and thereby optimizing energy usage to the best extent. This shift goes one step further in promoting energy efficiency and helps utilities properly balance grid load, making TOU pricing a great deal of the reason for the installation of home energy storage units.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the residential energy storage market.

By Company Type: Tier 1- 60%, Tier 2- 25%, and Tier 3- 15%

By Designation: C-level Executives - 35%, Director Level- 25%, and Others- 40%

By Region: North America - 20%, Europe - 30%, Asia Pacific - 20%, South America - 10%, Middle East & Africa- 10%

Note: Other designations include sales managers, marketing managers, product managers, and product engineers.

The tier of the companies is defined based on their total revenue as of 2023. Tier 1: USD 1 billion and above, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: <USD 500 million.

The residential energy storage market is dominated by a few major players that have a wide regional presence. The leading players in the residential energy storage market Panasonic Holdings Corporation (Japan), Tesla (US), Sonnen GmbH (Germany), BYD Company Ltd. (China), and Enphase Energy (US), among others. The major strategy adopted by the players includes new product launches, joint ventures, acquisitions, and expansions.

Research Coverage:

The report defines, describes, and forecasts the residential energy storage market by technology, power rating, ownership type, operation type, connectivity type, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product launches, mergers and acquisitions, and recent developments associated with the residential energy storage market. Competitive analysis of upcoming startups in the residential energy storage market ecosystem is covered in this report.

Reasons to buy this report:

Reasons to buy this report The report will help the market leaders/new entrants residential energy storage market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing industrialization, stringent government regulations and increasing need for sustainability in the residential energy storage are just a few of the primary drivers propelling the residential energy storage market), restraints (high operation and maintenance cost of residential energy storage system and high initial investment, limit the market's expansion), opportunities (advancement in residential energy storage technologies and development of sustainable residential energy storage solutions), and challenges (limited awareness in the emerging markets) influencing the growth.

- Product Development/ Innovation: The residential energy storage market is seeing substantial product development and innovation, driven by rising environmental concerns. Companies are investing in improved residential energy storage technology to manufacture advanced residential energy storage technologies.

- Market Development: In Septemeber 2024, Tesla is collaborating with Eaton to enhance home energy storage and solar installations in North America by early 2025. Tesla's Powerwall will integrate with Eaton's AbleEdge smart breakers, enabling smarter load management to optimize energy use and extend battery backup during outages. This partnership aims to simplify installation for both new and retrofit systems, aligning with Eaton's strategy to create efficient, flexible home energy solutions.

- Market Diversification: In August 2022, Tesla has expanded its Virtual Power Plant (VPP) program to Southern California Edison's (SCE) service area, following its successful trial and launch in Pacific Gas and Electric's (PG&E) area. The program allows Powerwall owners to earn $2 for each kilowatt-hour of energy they contribute during "load management events" called by the utility. SCE anticipates 3,000 Powerwall owners will sign up, potentially reducing energy demand by 10 to 15 megawatts, which could power approximately 11,250 homes. This expansion brings Tesla's VPP program close to covering California's entire electrical grid.

- Competitive Assessment: In-depth analysis of market share, growth plans, and service offerings of top companies in the residential energy storage market, including Panasonic Holdings Corporation (Japan), Tesla (US), Sonnen GmbH (Germany), BYD Company Ltd. (China), and Enphase Energy (US), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 MARKET DEFINITION

- 1.2 MARKETS COVERED

- 1.3 REGIONAL SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 RESEARCH LIMITATIONS

2 RESEARCH METHODOLOGY

- 2.1 SECONDARY DATA

- 2.1.1 KEY DATA FROM SECONDARY SOURCES

- 2.2 PRIMARY DATA

- 2.2.1 KEY DATA FROM PRIMARY SOURCES

- 2.3 BOTTOM-UP APPROACH

- 2.4 TOP-DOWN APPROACH

- 2.5 DEMAND-SIDE ANALYSIS

- 2.5.1 QUANTITATIVE DATA

- 2.5.2 QUALITATIVE PARAMETERS

- 2.5.3 RESEARCH ASSUMPTIONS FOR DEMAND-SIDE METRICS

- 2.5.4 CALCULATIONS FOR DEMAND-SIDE METRICS

- 2.6 SUPPLY-SIDE ANALYSIS

- 2.6.1 KEY SOURCES OF INFORMATION

- 2.7 MARKET SHARE OF KEY PLAYERS, 2023

- 2.8 NARRATIVE ON SCENARIO-BASED ANALYSIS FOR 2030

- 2.8.1 FORECAST ANALYSIS

- 2.9 MARKET BREAKDOWN AND DATA TRANGULATION

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 DECLINING COSTS OF LITHIUM-ION BATTERIES TO DRIVE RESIDENTIAL ENERGY STORAGE MARKET OVER COMING YEARS

- 4.2 RESIDENTIAL ENERGY STORAGE MARKET, BY POWER RATING

- 4.3 RESIDENTIAL ENERGY STORAGE MARKET, BY OWNERSHIP TYPE

- 4.4 RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY

- 4.5 RESIDENTIAL ENERGY STORAGE MARKET, BY SYSTEM TYPE

- 4.6 RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.1.1 DRIVERS

- 5.1.1.1 INCREASING DEMAND FOR RENEWABLE ENERGY

- 5.1.1.2 RISING EMPHASIS ON ENERGY INDEPENDENCE AND SELF-SUFFICIENCY

- 5.1.1.3 GROWING FOCUS ON MEETING NET-ZERO EMISSION TARGETS

- 5.1.2 RESTRAINTS

- 5.1.2.1 HIGH INITIAL INSTALLATION COSTS

- 5.1.2.2 LIMITED LIFESPAN OF BATTERIES AND STORAGE CAPACITY

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 INCREASING INSTALLATION OF SOLAR PANELS

- 5.1.3.2 MOUNTING DEMAND FOR GRID ENERGY STORAGE SYSTEMS

- 5.1.4 CHALLENGES

- 5.1.4.1 SAFETY CONCERNS OF LITHIUM-ION BATTERIES

- 5.1.4.2 ENVIRONMENTAL IMPACT OF BATTERY MATERIALS

- 5.1.1 DRIVERS

- 5.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

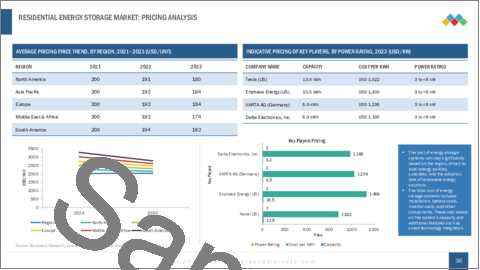

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2023

- 5.5.2 INDICATIVE PRICING OF KEY PLAYERS, BY POWER RATING, 2023

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 LITHIUM-ION

- 5.6.1.2 LEAD-ACID

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 SMART INVERTERS

- 5.6.2.2 ENERGY MANAGEMENT SYSTEMS

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 COMPRESSED AIR ENERGY STORAGE (CAES)

- 5.6.3.2 PUMPED HYDRO STORAGE

- 5.6.1 KEY TECHNOLOGIES

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 TESLA AND SOLARCITY PARTNER WITH BRIGHTFIELDS DEVELOPMENT TO PROVIDE LOW-COST ENERGY SOLUTIONS TO CONNECTICUT MUNICIPAL UTILITIES

- 5.7.2 BYD COMPANY LTD. HELPS END USERS BUILD EFFICIENT SYSTEM COMPATIBLE WITH PV SOLAR INVERTERS WITH BATTERY MAX LITE

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 REGULATORY FRAMEWORK

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13 PORTER'S FIVE FORCES ANALYSIS

6 RESIDENTIAL ENERGY STORAGE MARKET, BY TECHNOLOGY Value (USD Million) - (2020-2022, 2023, 2024-2030)

- 6.1 INTRODUCTION

- 6.2 LITHIUM-ION

- 6.2.1 GLOBAL MARKET DYNAMICS AND THEIR INFLUENCE ON BATTERY PRICES TO STIMULATE MARKET GROWTH

- 6.3 LEAD-ACID

- 6.3.1 INCREASING CUSTOMIZATION OF BATTERIES FOR ENERGY EFFICIENCY TO DRIVE MARKET

7 RESIDENTIAL ENERGY STORAGE MARKET, BY CONNECTIVITY TYPE Value (USD Million) -(2020-2022, 2023, 2024-2030)

- 7.1 INTRODUCTION

- 7.2 ON-GRID

- 7.2.1 RISING FOCUS ON REDUCING ENERGY BILLS TO BOOST MARKET GROWTH

- 7.3 OFF-GRID

- 7.3.1 STRONG FOCUS ON ENVIRONMENTAL CONSERVATION TO PROMOTE USE OF OFF-GRID SYSTEMS

8 RESIDENTIAL ENERGY STORAGE MARKET, BY OWNERSHIP TYPE Value (USD Million) -(2020-2022, 2023, 2024-2030)

- 8.1 INTRODUCTION

- 8.2 CUSTOMER-OWNED

- 8.2.1 ABILITY TO RESOLVE ISSUES OF OVERVOLTAGE AND IMBALANCE OF ENERGY SUPPLY AND DEMAND TO DRIVE MARKET

- 8.3 UTILITY-OWNED

- 8.3.1 GLOBAL RENEWABLE ENERGY GENERATION INITIATIVES TO BOOST INSTALLATION OF UTILITY-OWNED ESS

- 8.4 THIRD-PARTY-OWNED

- 8.4.1 HIGH UPFRONT COSTS AND LOW PER CAPITA INCOME TO BOOST DEMAND FOR THIRD-PARTY-OWNED ESS

9 RESIDENTIAL ENERGY STORAGE MARKET, BY SYSTEM TYPE Value (USD Million) -(2020-2022, 2023, 2024-2030)

- 9.1 INTRODUCTION

- 9.2 STANDALONE SYSTEMS

- 9.2.1 LOW UPFRONT COSTS OF STANDALONE SYSTEMS TO DRIVE MARKET

- 9.3 SOLAR AND STORAGE SYSTEMS

- 9.3.1 HIGH REQUIREMENT FOR ENERGY SELF-SUFFICIENCY TO BOOST DEMAND FOR SOLAR AND STORAGE SYSTEMS

10 RESIDENTIAL ENERGY STORAGE MARKET, BY POWER RATING Volume (MW) and Value (USD Million) -(2020-2022, 2023, 2024-2030)

- 10.1 INTRODUCTION

- 10.2 3 TO <6 KW

- 10.2.1 ROLE OF 3 TO <6 KW STORAGE SOLUTIONS IN SOLAR POWER ADOPTION TO FUEL MARKET GROWTH

- 10.3 6 TO <10 KW

- 10.3.1 ABILITY TO MAXIMIZE SOLAR POWER EFFICIENCY WITH 6 TO <10 KW STORAGE SOLUTIONS TO BOOST MARKET GROWTH

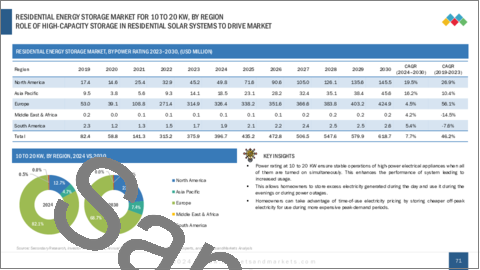

- 10.4 10 TO 20 KW

- 10.4.1 ROLE OF HIGH-CAPACITY STORAGE IN RESIDENTIAL SOLAR SYSTEMS TO DRIVE MARKET

11 RESIDENTIAL ENERGY STORAGE MARKET, BY REGION Volume (MW) and Value (USD Million) -(2020-2022, 2023, 2024-2030)

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 RISING IMPLEMENTATION OF SUBSIDIES, TAX CREDITS, AND FAVORABLE POLICIES TO AUGMENT MARKET GROWTH

- 11.2.2 BY TECHNOLOGY

- 11.2.3 BY POWER RATING

- 11.2.4 BY OWNERSHIP TYPE

- 11.2.5 BY SYSTEM TYPE

- 11.2.6 BY CONNECTIVITY

- 11.2.7 BY COUNTRY

- 11.2.7.1 US

- 11.2.7.1.1 BY TECHNOLOGY

- 11.2.7.1.2 BY CONNECTIVITY

- 11.2.7.2 CANADA

- 11.2.7.3 MEXICO

- 11.2.7.1 US

- 11.3 EUROPE

- 11.3.1 AMBITIOUS NET-ZERO EMISSION GOALS TO DRIVE MARKET

- 11.3.2 BY TECHNOLOGY

- 11.3.3 BY POWER RATING

- 11.3.4 BY OWNERSHIP TYPE

- 11.3.5 BY SYSTEM TYPE

- 11.3.6 BY CONNECTIVITY

- 11.3.7 BY COUNTRY

- 11.3.7.1 GERMANY

- 11.3.7.1.1 BY TECHNOLOGY

- 11.3.7.1.2 BY CONNECTIVITY

- 11.3.7.2 Italy

- 11.3.7.3 UK

- 11.3.7.4 Austria

- 11.3.7.5 France

- 11.3.7.6 Netherlands

- 11.3.7.7 Switzerland

- 11.3.7.8 Spain

- 11.3.7.9 Belgium

- 11.3.7.10 Poland

- 11.3.7.11 Czech Republic

- 11.3.7.12 Bulgaria

- 11.3.7.13 Hungary

- 11.3.7.14 Romania

- 11.3.7.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 RAPID TECHNOLOGICAL ADVANCES AND GROWING DEMAND FOR NATURAL GAS PRODUCTION TO BOOST MARKET GROWTH

- 11.4.2 BY TECHNOLOGY

- 11.4.3 BY POWER RATING

- 11.4.4 BY OWNERSHIP TYPE

- 11.4.5 BY SYSTEM TYPE

- 11.4.6 BY CONNECTIVITY

- 11.4.7 BY COUNTRY

- 11.4.7.1 China

- 11.4.7.1.1 By Technology

- 11.4.7.1.2 By Connectivity

- 11.4.7.2 India

- 11.4.7.3 Australia

- 11.4.7.4 Japan

- 11.4.7.5 South Korea

- 11.4.7.6 Rest of Asia Pacific

- 11.4.7.1 China

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 FAVORABLE GOVERNMENT POLICIES TO CONTRIBUTE TO MARKET GROWTH

- 11.5.2 BY TECHNOLOGY

- 11.5.3 BY POWER RATING

- 11.5.4 BY OWNERSHIP TYPE

- 11.5.5 BY SYSTEM TYPE

- 11.5.6 BY CONNECTIVITY

- 11.5.7 BY COUNTRY

- 11.5.7.1 GCC countries

- 11.5.7.1.1 Saudi Arabia

- 11.5.7.1.1.1 By Technology

- 11.5.7.1.1.2 By Connectivity

- 11.5.7.1.2 UAE

- 11.5.7.1.1 Saudi Arabia

- 11.5.7.2 South Africa

- 11.5.7.3 Rest of Middle East & Africa

- 11.5.7.1 GCC countries

- 11.6 SOUTH AMERICA

- 11.6.1 INCREASING NEED FOR ENERGY STORAGE SOLUTIONS TO FOSTER MARKET GROWTH

- 11.6.2 BY TECHNOLOGY

- 11.6.3 BY POWER RATING

- 11.6.4 BY OWNERSHIP TYPE

- 11.6.5 BY SYSTEM TYPE

- 11.6.6 BY CONNECTIVITY TYPE

- 11.6.7 BY COUNTRY

- 11.6.7.1 Brazil

- 11.6.7.1.1 By Technology

- 11.6.7.1.2 By Connectivity

- 11.6.7.2 Chile

- 11.6.7.3 Rest of South America

- 11.6.7.1 Brazil

12 COMPETITIVE LANDSCAPE

- 12.1 STRATEGIES ADOPTED KEY PLAYERS, 2019-2024

- 12.2 REVENUE ANALYSIS, 2019-2023

- 12.3 MARKET SHARE ANALYSIS, 2023

- 12.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 PARTICIPANTS

- 12.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.4.5.1 Technology footprint

- 12.4.5.2 Power rating footprint

- 12.4.5.3 Ownership type footprint

- 12.4.5.4 System type footprint

- 12.4.5.5 Connectivity footprint

- 12.5 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.5.1 PROGRESSIVE COMPANIES

- 12.5.2 RESPONSIVE COMPANIES

- 12.5.3 DYNAMIC COMPANIES

- 12.5.4 STARTING BLOCKS

- 12.5.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.5.5.1 Detailed list of key startups/SMEs

- 12.5.5.2 Competitive benchmaring of key startups/SMEs

13 COMPANY PROFILES

- 13.1 TESLA

- 13.1.1.1 Business Overview

- 13.1.1.2 Products/Services/Solutions Offered

- 13.1.1.3 Recent developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive Threats

- 13.2 PANASONIC HOLDINGS CORPORATION

- 13.3 BYD COMPANY LTD.

- 13.4 ENPHASE ENERGY

- 13.5 SONNEN GMBH

- 13.6 EATON

- 13.7 LG ENERGY SOLUTION

- 13.8 VARTA AG

- 13.9 DELTA ELECTRONICS, INC

- 13.10 HUAWEI TECHNOLOGIES CO., LTD.

- 13.11 SMA SOLAR TECHNOLOGY AG

- 13.12 SAMSUUNG SDI

- 13.13 JINKO SOLAR

- 13.14 ALPHA ESS CO., LTD

- 13.15 E3/DC

- 13.16 RCT-POWER

- 13.17 SENEC

- 13.18 SHANGHAI PYTES ENERGY CO., LTD.

- 13.19 OTHER PLAYERS

- 13.19.1 PYLON TECHNOLOGIES CO., LTD.

- 13.19.2 POWERVAULT

- 13.19.3 TURBO ENERGY - SOLAR INNOVATION

- 13.19.4 BST POWER (SHENZHEN) LIMITED

- 13.19.5 WECO SRL

- 13.19.6 DYNESS DIGITAL ENERGY TECHNOLOGY CO.,LTD.

- 13.19.7 JA SOLAR TECHNOLOGY CO.,LTD

- 13.19.8 SCHNEIDER ELECTRIC

14 APPENDIX

- 14.1 INSIGHTS OF INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORT

- 14.6 AUTHOR DETAILS"