|

|

市場調査レポート

商品コード

1606238

CAMソフトウェアの世界市場:用途別、2D、3D - 予測 (~2030年)CAM Software Market by Application (Machining & Production (CNC Machining, Sheet Metal Fabrication), Product Design & Prototyping (Additive/3D Printing, Tool & Die Manufacturing), Quality Control & Inspection), 2D, and 3D - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| CAMソフトウェアの世界市場:用途別、2D、3D - 予測 (~2030年) |

|

出版日: 2024年12月02日

発行: MarketsandMarkets

ページ情報: 英文 338 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のCAMの市場規模は、2024年の33億9,000万米ドルから2030年までに56億9,000万米ドルに達し、予測期間にCAGRで9.0%の成長が見込まれます。

CAM(コンピューター支援製造)の動向と発展は、生産性を向上させ企業に利益をもたらすことで、製造の様相を変えつつあります。CADとの統合により、メーカーは最小の手作業でプロセスを最適化できるようになります。最新のCAMツールには、ツールパスの品質と加工戦略を向上させる機械学習機能が搭載されており、納期の短縮と材料の無駄の削減につながります。さらに、先進のアナリティクスとシミュレーション機能もCAMパッケージの一部であり、メーカーは機械の挙動を予測し、製造中の手作業を減らすことができます。自動化は、作業のスケジューリング、品質保証、予知保全など、業務のあらゆる側面に適用されており、人員はより付加価値の高い創造的な活動に力を注ぐことができます。このような技術的変化は、航空宇宙、自動車、医療機器製造の発展を促すと同時に、産業が変化する市場要件に対応することを可能にします。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 提供、機能、用途、展開方式、組織規模、業界 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

「提供タイプ別では、ソフトウェアセグメントが予測期間に最大の市場シェアを占めます。」

ソフトウェアセグメントは、製造プロセスの最適化において極めて重要な役割を果たすため、予測期間にCAM市場で最大のシェアを占める見込みです。CAMソフトウェアを使えば、CNCマシンの操作を最適化することができ、それによって生産プロセスの効率、精度、柔軟性を高めることができます。近年、企業が製品の急激な変化やカスタマイズに対応していることから、その他の設計や製造プロセスと互換性のある先進のCAMソリューションが求められています。さらに、需要の高まりは、クラウドベースCAMのイノベーションと、ソフトウェアにおけるAIと機械学習の応用にも起因していると考えられます。これらの改良により、メーカーは生産性を向上させ、製造サイクルを短縮し、製造コストを削減することができます。そのため、企業がデジタルトランスフォーメーションを進め、自動化を取り入れる必要性が高まる中、CAMソフトウェアセグメントの拡大は上昇の波に乗り、予測期間に市場で最大のセグメントとなります。

「機能別では、多軸セグメントが予測期間にもっとも高いCAGRで成長する見込みです。」

CAM市場における多軸セグメントは、複雑な形状や入り組んだ設計を処理する優れた機能により、予測期間にもっとも高いCAGRで成長する見込みです。4軸および5軸の加工機を含む多軸システムは、複数の平面を同時に動かすことができるため、複雑な形状の細部をより簡単に製造できるという利点があります。これは特に、特定の寸法に準拠する必要がある複雑な形状の部品を製造する航空宇宙、自動車、医療産業に恩恵をもたらしています。さらに、多軸加工は手作業の介入を減らし、製造時間を短縮し、材料費を削減するのに役立つため、あらゆるビジネスに利益をもたらします。さらに、多軸加工機と連動したCAMソフトウェアシステムは、さらなる自動化と精度を促進し、人気を集めています。急速に変化するCAM市場は、消費者がユニークで高級な製品や新しい技術的ソリューションを求めるにつれて成長しています。

当レポートでは、世界のCAMソフトウェア市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- CAM市場における主要企業の機会

- CAM市場:提供別(2024年・2030年)

- CAM市場:用途別(2024年・2030年)

- CAM市場:機能別(2024年・2030年)

- CAM市場:組織規模別(2024年・2030年)

- CAM市場:展開方式別(2024年・2030年)

- CAM市場:業界別(2024年・2030年)

- CAM市場:地域のシナリオ(2024年~2030年)

第5章 市場の概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- サプライチェーン分析

- エコシステム

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 主な会議とイベント(2024年~2025年)

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制:地域別

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ビジネスモデル分析

- ライセンスベースモデル

- クラウドベースSaaS

- フリーミアム、段階的価格設定

- 消費に基づく価格設定

- CAM市場に対するAI/生成AIの影響

- 産業動向:ユースケース

- AI/生成AIを採用している上位顧客

- 投資と資金調達のシナリオ

- ケーススタディ分析

第6章 CAM市場:提供別

- イントロダクション

- ソフトウェア

- サービス

第7章 CAM市場:用途別

- イントロダクション

- 製品設計・プロトタイピング

- 機械加工・生産

- 品質管理・検査

第8章 CAM市場:機能別

- イントロダクション

- 2D

- 3D

- 多軸

第9章 CAM市場:展開方式別

- イントロダクション

- オンプレミス

- クラウド

第10章 CAM市場:組織規模別

- イントロダクション

- 大企業

- 中小企業

第11章 CAM市場:業界別

- イントロダクション

- 石油・ガス

- 食品・飲料

- 医療機器・医薬品

- 化学品

- エネルギー・電力

- 金属・鉱業

- パルプ・紙

- 自動車

- 航空宇宙

- 電子・半導体

- 重機

- その他の業界

第12章 CAM市場:地域別

- イントロダクション

- 北米

- 北米のCAM市場の促進要因

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のCAM市場の促進要因

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋のCAM市場の促進要因

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカのCAM市場の促進要因

- 中東・アフリカのマクロ経済の見通し

- 湾岸協力会議(GCC)諸国

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカのCAM市場の促進要因

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み(2021年~2024年)

- 収益分析

- 市場シェア分析

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 企業の評価と財務指標

- ブランド/製品の比較

- AUTODESK - FUSION 360

- SIEMENS - NX CAM

- HEXAGON - ALPHACAM

- DASSAULT SYSTEMES - 3DEXPIERENCE PLATFORM

- HYPERTHERM - PRONEST

- 競合シナリオと動向

第14章 企業プロファイル

- イントロダクション

- 主要企業

- AUTODESK

- SIEMENS

- HEXAGON

- DASSAULT SYSTEMES

- HYPERTHERM

- PTC

- SOLIDCAM

- TOPSOLID

- CAMWORKS

- MASTERCAM

- その他の企業

- SIGMANEST

- NTT DATA ENGINEERING SYSTEMS

- ZWSOFT

- LANTEK

- BOBCAD-CAM

- MECSOFT CORPORATION

- GIBBSCAM

- EZCAM

- OPEN MIND TECHNOLOGIES

- TEBIS

- NCG CAM SOLUTIONS

- SMARTCAM

- CARBIDE

- METAMATION

- VAYO TECHNOLOGY

- ONG SOLUTIONS

- MAXXCAM

第15章 隣接/関連市場

- イントロダクション

- 関連市場

- 制限

- 製品ライフサイクル管理市場

- シミュレーションソフトウェア市場

第16章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2023

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 AVERAGE PRICING ANALYSIS, BY REGION

- TABLE 4 INDICATIVE PRICING ANALYSIS, BY SOFTWARE

- TABLE 5 COMPUTER-AIDED MANUFACTURING MARKET: ECOSYSTEM

- TABLE 6 LIST OF MAJOR PATENTS FOR COMPUTER-AIDED MANUFACTURING MARKET

- TABLE 7 COMPUTER-AIDED MANUFACTURING MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 PORTER'S FIVE FORCES' IMPACT ON COMPUTER-AIDED MANUFACTURING MARKET

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP VERTICALS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 15 COMPUTER-AIDED MANUFACTURING MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 16 COMPUTER-AIDED MANUFACTURING MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 17 COMPUTER-AIDED MANUFACTURING MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 18 COMPUTER-AIDED MANUFACTURING MARKET, BY SOFTWARE, 2024-2030 (USD MILLION)

- TABLE 19 CAD-EMBEDDED CAM SOFTWARE: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 20 CAD-EMBEDDED CAM SOFTWARE: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 21 INDEPENDENT CAM SOFTWARE: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 22 INDEPENDENT CAM SOFTWARE: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 23 COMPUTER-AIDED MANUFACTURING MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 24 COMPUTER-AIDED MANUFACTURING MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 25 SERVICES: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 26 SERVICES: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 27 IMPLEMENTATION & INTEGRATION: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 28 IMPLEMENTATION & INTEGRATION: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 29 CONSULTING: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 30 CONSULTING: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 31 TRAINING, SUPPORT, AND MAINTENANCE: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 32 TRAINING, SUPPORT, AND MAINTENANCE: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 33 COMPUTER-AIDED MANUFACTURING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 34 COMPUTER-AIDED MANUFACTURING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 35 COMPUTER-AIDED MANUFACTURING MARKET, BY PRODUCT DESIGN & PROTOTYPING, 2019-2023 (USD MILLION)

- TABLE 36 COMPUTER-AIDED MANUFACTURING MARKET, BY PRODUCT DESIGN & PROTOTYPING, 2024-2030 (USD MILLION)

- TABLE 37 SIMULATION: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 38 SIMULATION: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

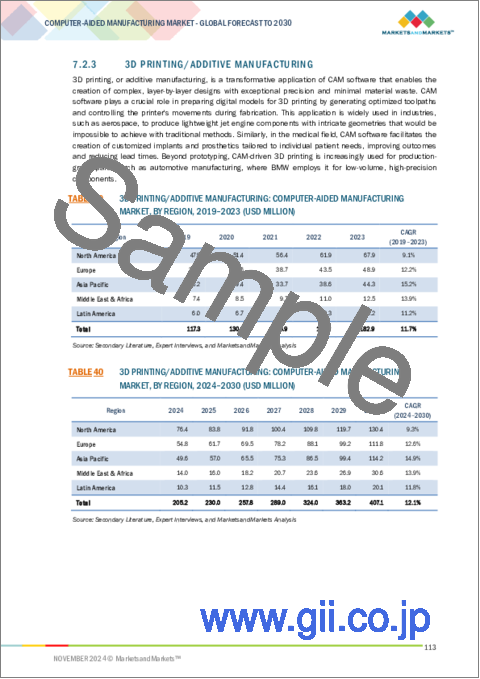

- TABLE 39 3D PRINTING/ADDITIVE MANUFACTURING: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 40 3D PRINTING/ADDITIVE MANUFACTURING: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 41 TOOL & DIE MANUFACTURING: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 42 TOOL & DIE MANUFACTURING: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 43 COMPUTER-AIDED MANUFACTURING MARKET, BY MACHINING & PRODUCTION, 2019-2023 (USD MILLION)

- TABLE 44 COMPUTER-AIDED MANUFACTURING MARKET, BY MACHINING & PRODUCTION, 2024-2030 (USD MILLION)

- TABLE 45 MACHINING & PRODUCTION: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 46 MACHINING & PRODUCTION: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 47 CNC MACHINING: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 48 CNC MACHINING: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 49 SHEET METAL FABRICATION: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 50 SHEET METAL FABRICATION: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 51 QUALITY CONTROL & INSPECTION: COMPUTER-AIDED MANUFACTURING MARKET, REGION, 2019-2023 (USD MILLION)

- TABLE 52 QUALITY CONTROL & INSPECTION: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 53 COMPUTER-AIDED MANUFACTURING MARKET, BY CAPABILITY, 2019-2023 (USD MILLION)

- TABLE 54 COMPUTER-AIDED MANUFACTURING MARKET, BY CAPABILITY, 2024-2030 (USD MILLION)

- TABLE 55 2D: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 56 2D: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 57 3D: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 58 3D: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 59 MULTI-AXIS: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 60 MULTI-AXIS: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 61 COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 62 COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 63 ON-PREMISES: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 64 ON-PREMISES: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 65 CLOUD: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 66 CLOUD: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 67 COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 68 COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 69 LARGE ENTERPRISES: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 70 LARGE ENTERPRISES: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 71 SMALL AND MEDIUM-SIZED ENTERPRISES: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 72 SMALL AND MEDIUM-SIZED ENTERPRISES: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 73 COMPUTER-AIDED MANUFACTURING MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 74 COMPUTER-AIDED MANUFACTURING MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 75 OIL & GAS: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 76 OIL & GAS: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 77 FOOD & BEVERAGES: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 78 FOOD & BEVERAGES: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 79 MEDICAL DEVICES & PHARMACEUTICALS: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 80 MEDICAL DEVICES & PHARMACEUTICALS: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 81 CHEMICALS: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 82 CHEMICALS: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 83 ENERGY & POWER: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 84 ENERGY & POWER: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 85 METALS & MINING: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 86 METALS & MINING: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 87 PULP & PAPER: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 88 PULP & PAPER: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 89 AUTOMOTIVE: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 90 AUTOMOTIVE: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 91 AEROSPACE: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 92 AEROSPACE: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 93 ELECTRONICS & SEMICONDUCTORS: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 94 ELECTRONICS & SEMICONDUCTORS: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 95 HEAVY MACHINERY: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 96 HEAVY MACHINERY: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 97 OTHER VERTICALS: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 98 OTHER VERTICALS: COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 99 COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 100 COMPUTER-AIDED MANUFACTURING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 102 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 104 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY SOFTWARE, 2024-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 106 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY CAPABILITY, 2019-2023 (USD MILLION)

- TABLE 108 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY CAPABILITY, 2024-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY APPLICATION, 2019-2023 (USD MILLION

- TABLE 110 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY PRODUCT DESIGN & PROTOTYPING, 2019-2023 (USD MILLION)

- TABLE 112 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY PRODUCT DESIGN & PROTOTYPING, 2024-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY MACHINING & PRODUCTION, 2019-2023 (USD MILLION)

- TABLE 114 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY MACHINING & PRODUCTION, 2024-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 116 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 118 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 120 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 122 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 123 US: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 124 US: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 125 US: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 126 US: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 127 CANADA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 128 CANADA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 129 CANADA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 130 CANADA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 131 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 132 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 133 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 134 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY SOFTWARE, 2024-2030 (USD MILLION)

- TABLE 135 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 136 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 137 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY CAPABILITY, 2019-2023 (USD MILLION)

- TABLE 138 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY CAPABILITY, 2024-2030 (USD MILLION)

- TABLE 139 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY APPLICATION, 2019-2023 (USD MILLION

- TABLE 140 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 141 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY PRODUCT DESIGN & PROTOTYPING, 2019-2023 (USD MILLION)

- TABLE 142 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY PRODUCT DESIGN & PROTOTYPING, 2024-2030 (USD MILLION)

- TABLE 143 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY MACHINING & PRODUCTION, 2019-2023 (USD MILLION)

- TABLE 144 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY MACHINING & PRODUCTION, 2024-2030 (USD MILLION)

- TABLE 145 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 146 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 147 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 148 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 149 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 150 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 151 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 152 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 153 UK: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 154 UK: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 155 UK: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 156 UK: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 157 GERMANY: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 158 GERMANY: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 159 GERMANY: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 160 GERMANY: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 161 FRANCE: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 162 FRANCE: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 163 FRANCE: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 164 FRANCE: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 165 ITALY: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 166 ITALY: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 167 ITALY: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 168 ITALY: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 169 REST OF EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 170 REST OF EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 171 REST OF EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 172 REST OF EUROPE: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 174 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 175 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 176 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY SOFTWARE, 2024-2030 (USD MILLION)

- TABLE 177 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 178 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 179 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY CAPABILITY, 2019-2023 (USD MILLION)

- TABLE 180 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY CAPABILITY, 2024-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY APPLICATION, 2019-2023 (USD MILLION

- TABLE 182 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 183 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY PRODUCT DESIGN & PROTOTYPING, 2019-2023 (USD MILLION)

- TABLE 184 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY PRODUCT DESIGN & PROTOTYPING, 2024-2030 (USD MILLION)

- TABLE 185 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY MACHINING & PRODUCTION, 2019-2023 (USD MILLION)

- TABLE 186 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY MACHINING & PRODUCTION, 2024-2030 (USD MILLION)

- TABLE 187 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 188 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 190 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 191 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 192 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 193 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 194 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 195 CHINA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 196 CHINA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 197 CHINA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 198 CHINA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 199 JAPAN: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 200 JAPAN: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 201 JAPAN: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 202 JAPAN: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 203 INDIA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 204 INDIA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 205 INDIA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 206 INDIA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY SOFTWARE, 2024-2030 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY CAPABILITY, 2019-2023 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY CAPABILITY, 2024-2030 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY APPLICATION, 2019-2023 (USD MILLION

- TABLE 220 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY PRODUCT DESIGN & PROTOTYPING, 2019-2023 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY PRODUCT DESIGN & PROTOTYPING, 2024-2030 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY MACHINING & PRODUCTION, 2019-2023 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY MACHINING & PRODUCTION, 2024-2030 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY COUNTRY/SUBREGION, 2019-2023 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY COUNTRY/SUBREGION, 2024-2030 (USD MILLION)

- TABLE 233 GCC COUNTRIES: COMPUTER-AIDED MANUFACTURING MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 234 GCC COUNTRIES: COMPUTER-AIDED MANUFACTURING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 235 GCC COUNTRIES: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 236 GCC COUNTRIES: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 237 GCC COUNTRIES: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 238 GCC COUNTRIES: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 239 SOUTH AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 240 SOUTH AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 241 SOUTH AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 242 SOUTH AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 243 REST OF MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 244 REST OF MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 245 REST OF MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 246 REST OF MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 247 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 248 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 249 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY SOFTWARE, 2019-2023 (USD MILLION)

- TABLE 250 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY SOFTWARE, 2024-2030 (USD MILLION)

- TABLE 251 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY SERVICE, 2019-2023 (USD MILLION)

- TABLE 252 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 253 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY CAPABILITY, 2019-2023 (USD MILLION)

- TABLE 254 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY CAPABILITY, 2024-2030 (USD MILLION)

- TABLE 255 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY APPLICATION, 2019-2023 (USD MILLION

- TABLE 256 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 257 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY PRODUCT DESIGN & PROTOTYPING, 2019-2023 (USD MILLION)

- TABLE 258 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY PRODUCT DESIGN & PROTOTYPING, 2024-2030 (USD MILLION)

- TABLE 259 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY MACHINING & PRODUCTION, 2019-2023 (USD MILLION)

- TABLE 260 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY MACHINING & PRODUCTION, 2024-2030 (USD MILLION)

- TABLE 261 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 262 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 263 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 264 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 265 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 266 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 267 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 268 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 269 BRAZIL: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 270 BRAZIL: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 271 BRAZIL: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 272 BRAZIL: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 273 MEXICO: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 274 MEXICO: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 275 MEXICO: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 276 MEXICO: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 277 REST OF LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 278 REST OF LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 279 REST OF LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 280 REST OF LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 281 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS OF COMPUTER-AIDED MANUFACTURING MARKET

- TABLE 282 COMPUTER-AIDED MANUFACTURING MARKET: DEGREE OF COMPETITION, 2023

- TABLE 283 COMPUTER-AIDED MANUFACTURING MARKET: OFFERING FOOTPRINT

- TABLE 284 COMPUTER-AIDED MANUFACTURING MARKET: ORGANIZATION SIZE FOOTPRINT

- TABLE 285 COMPUTER-AIDED MANUFACTURING MARKET: VERTICAL FOOTPRINT

- TABLE 286 COMPUTER-AIDED MANUFACTURING MARKET: REGIONAL FOOTPRINT

- TABLE 287 DETAILED LIST OF KEY START-UPS/SMES

- TABLE 288 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 289 COMPUTER-AIDED MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2023-OCTOBER 2024

- TABLE 290 COMPUTER-AIDED MARKET: DEALS, JANUARY 2023-OCTOBER 2024

- TABLE 291 AUTODESK: COMPANY OVERVIEW

- TABLE 292 AUTODESK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 AUTODESK: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 294 AUTODESK: DEALS

- TABLE 295 SIEMENS: COMPANY OVERVIEW

- TABLE 296 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 SIEMENS: PRODUCT ENHANCEMENTS

- TABLE 298 SIEMENS: DEALS

- TABLE 299 HEXAGON: COMPANY OVERVIEW

- TABLE 300 HEXAGON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 HEXAGON: PRODUCT ENHANCEMENTS

- TABLE 302 HEXAGON: DEALS

- TABLE 303 DASSAULT SYSTEMES: COMPANY OVERVIEW

- TABLE 304 DASSAULT SYSTEMES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 DASSAULT SYSTEMES: DEALS

- TABLE 306 HYPERTHERM: COMPANY OVERVIEW

- TABLE 307 HYPERTHERM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 HYPERTHERM: PRODUCT ENHANCEMENTS

- TABLE 309 HYPERTHERM: DEALS

- TABLE 310 PTC: COMPANY OVERVIEW

- TABLE 311 PTC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 PTC: PRODUCT ENHANCEMENTS

- TABLE 313 PTC: DEALS

- TABLE 314 SOLIDCAM: COMPANY OVERVIEW

- TABLE 315 SOLIDCAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 316 SOLIDCAM: DEALS

- TABLE 317 TOPSOLID: COMPANY OVERVIEW

- TABLE 318 TOPSOLID: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 TOPSOLID: DEALS

- TABLE 320 CAMWORKS: COMPANY OVERVIEW

- TABLE 321 CAMWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 CAMWORKS: PRODUCT ENHANCEMENTS

- TABLE 323 MASTERCAM: COMPANY OVERVIEW

- TABLE 324 MASTERCAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 325 MASTERCAM: PRODUCT ENHANCEMENTS

- TABLE 326 MASTERCAM: DEALS

- TABLE 327 PRODUCT LIFECYCLE MANAGEMENT MARKET, BY COMPONENT, 2017-2024 (USD MILLION)

- TABLE 328 PRODUCT LIFECYCLE MANAGEMENT MARKET, BY SERVICE TYPE, 2017-2024 (USD MILLION)

- TABLE 329 PRODUCT LIFECYCLE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2017-2024 (USD MILLION)

- TABLE 330 PRODUCT LIFECYCLE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2017-2024 (USD MILLION)

- TABLE 331 PRODUCT LIFECYCLE MANAGEMENT MARKET, BY VERTICAL, 2017-2024 (USD MILLION)

- TABLE 332 PRODUCT LIFECYCLE MANAGEMENT MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 333 SIMULATION SOFTWARE MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 334 SIMULATION SOFTWARE MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 335 SIMULATION SOFTWARE MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 336 SIMULATION SOFTWARE MARKET, BY SOFTWARE TYPE, 2024-2030 (USD MILLION)

- TABLE 337 SIMULATION SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 338 SIMULATION SOFTWARE MARKET, BY DEPLOYMENT MODE, 2024-2030 (USD MILLION)

- TABLE 339 SIMULATION SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 340 SIMULATION SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2030 (USD MILLION)

- TABLE 341 SIMULATION SOFTWARE MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 342 SIMULATION SOFTWARE MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 343 SIMULATION SOFTWARE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 344 SIMULATION SOFTWARE MARKET, BY VERTICAL, 2024-2030 (USD MILLION)

- TABLE 345 SIMULATION SOFTWARE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 346 SIMULATION SOFTWARE MARKET, BY REGION, 2024-2030 (USD MILLION)

List of Figures

- FIGURE 1 COMPUTER-AIDED MANUFACTURING MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 COMPUTER-AIDED MANUFACTURING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF COMPUTER-AIDED MANUFACTURING VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM OFFERINGS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): COMPUTER-AIDED MANUFACTURING MARKET

- FIGURE 9 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 FASTEST-GROWING SEGMENTS OF COMPUTER-AIDED MANUFACTURING MARKET

- FIGURE 11 SHIFT TOWARD SMART MANUFACTURING AND ADVANCEMENTS IN MACHINING TO DRIVE MARKET

- FIGURE 12 SOFTWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

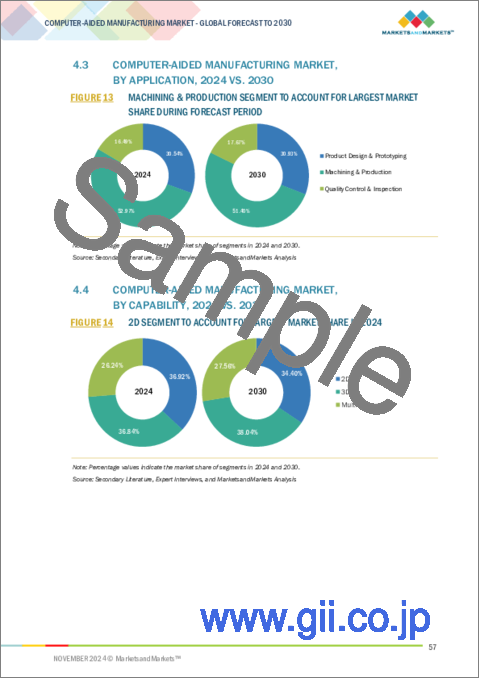

- FIGURE 13 MACHINING & PRODUCTION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 2D SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 15 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 AUTOMOTIVE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: COMPUTER-AIDED MANUFACTURING MARKET

- FIGURE 20 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 COMPUTER-AIDED MANUFACTURING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 KEY PLAYERS IN COMPUTER-AIDED MANUFACTURING MARKET ECOSYSTEM

- FIGURE 23 LIST OF MAJOR PATENTS FOR COMPUTER-AIDED MANUFACTURING MARKET

- FIGURE 24 PORTER'S FIVE FORCES ANALYSIS: COMPUTER-AIDED MANUFACTURING MARKET

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VERTICALS

- FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 27 COMPUTER-AIDED MANUFACTURING MARKET: BUSINESS MODELS

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO OF COMPUTER-AIDED MANUFACTURING COMPANIES

- FIGURE 29 SOFTWARE SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 30 CAD-EMBEDDED CAM SOFTWARE SEGMENT TO HOLD LARGER MARKET DURING FORECAST PERIOD

- FIGURE 31 TRAINING, SUPPORT, AND MAINTENANCE SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 QUALITY CONTROL & INSPECTION SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 CLOUD DEPLOYMENT MODE TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 40 HISTORICAL REVENUE ANALYSIS, 2021-2023 (USD MILLION)

- FIGURE 41 COMPUTER-AIDED MANUFACTURING MARKET: MARKET SHARE ANALYSIS, 2023

- FIGURE 42 BRAND/PRODUCT COMPARISON

- FIGURE 43 COMPUTER-AIDED MANUFACTURING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 44 COMPUTER-AIDED MANUFACTURING MARKET: COMPANY FOOTPRINT

- FIGURE 45 COMPUTER-AIDED MANUFACTURING MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 46 COMPANY VALUATION OF KEY VENDORS

- FIGURE 47 FINANCIAL METRICS OF KEY VENDORS

- FIGURE 48 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 49 AUTODESK: COMPANY SNAPSHOT

- FIGURE 50 SIEMENS: COMPANY SNAPSHOT

- FIGURE 51 HEXAGON: COMPANY SNAPSHOT

- FIGURE 52 DASSAULT SYSTEMES: COMPANY SNAPSHOT

- FIGURE 53 PTC: COMPANY SNAPSHOT

The global computer-aided manufacturing market will grow from USD 3.39 billion in 2024 to USD 5.69 billion by 2030 at a compounded annual growth rate (CAGR) of 9.0% during the forecast period. Trends and developments in computer-aided manufacturing (CAM) are reshaping the face of manufacturing by improving productivity and providing benefits to businesses. With CAD integration, such possibilities enable manufacturers to optimize processes with minimal manual work. Modern CAM tools include machine learning-powered features that enhance the quality of toolpathing and machining strategies, leading to quicker turnaround and lower material wastage. Moreover, advanced analytics offerings and simulation capabilities are also part of the package CAM, making it possible for manufacturers to foresee the behavior of machines and reduce manual interventions during manufacturing. Automation is being applied to all aspects of the business, including job scheduling, quality assurance, and predictive maintenance, allowing personnel to channel efforts into more value-adding and creative activities. Such technological changes enable industries to meet changing market requirements while encouraging aerospace, automotive, and medical device manufacturing development.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | USD (Billion) |

| Segments | Offering, Capability, Application, Deployment Mode, Organization Size, and Vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"The software segment holds the largest market share by offering type during the forecast period."

The software segment is expected to hold the largest market share in the CAM market during the forecast period due to its pivotal role in optimizing manufacturing processes. With CAM software, the operation of a CNC machine can be optimized; thereby enhancing the production processes' efficiency, accuracy, and flexibility. In recent years, as businesses have adapted to radical changes and customizations in products, advanced CAM solutions compatible with other design and manufacturing processes have become increasingly needed. In addition, the growing demand can also be attributed to cloud-based CAM innovations and the application of artificial intelligence and machine learning in software. With these improvements, manufacturers can improve productivity, shorten manufacturing cycles, and cut production costs. Therefore, with the increasing need for businesses to transform digitally and embrace automation, the expansion of the CAM software segment is expected to boost in an upward wave, making it the largest segment in the market during the forecast period.

"Based on capability, the multi-axis segment is expected to grow at highest CAGR during the forecast period."

The multi-axis segment in the CAM market is expected to grow at the highest CAGR during the forecast period due to its superior capability to handle complex geometries and intricate designs. Multi-axis systems, which include 4-axis and 5-axis machines, offer the benefit of concurrent motion across multiple planes, hence facilitating the manufacture of complex shape details more easily. This has particularly benefited the aerospace, automotive, and medical industries, which manufacture parts with complex shapes that must comply with particular dimensions. Additionally, multi-axis machining reduces manual labor intervention, speeds up manufacturing times, and helps decrease material costs, benefiting any business. Additionally, CAM software systems linked to multi-axis machines promote further automation and precision, resulting in their popularity. The rapidly changing CAM market is growing as consumers want unique, high-class products and new technological solutions.

"Based on the services, the training, support & maintenance segment holds the largest share during the forecast period."

The training, support, and maintenance segment holds the largest share in the computer-aided manufacturing (CAM) market due to its essential role in ensuring the seamless operation of CAM systems. With manufacturers moving towards more complex software, there is an imperative need for effective training programs to train the staff on using sophisticated tools. In addition, there are also support services that provide solutions for problems encountered during the day-to-day running of the organization so that there is little or no wasted time in business operations. Maintenance ensures the availability of CAM tools per current and future manufacturing demands and technologies by providing services such as system enhancement and software installation. Implementing ideas constituting Industry 4.0 and smart manufacturing systems has increased these services since organizations need to ensure the reliability and efficient operations of their systems. The growth of this segment is also supported by the prolonged sustained interactions with existing customers, which entail the provision of constant assistance to guarantee their satisfaction and efficiency in operations, cementing its status in the CAM performed forecasts.

Breakdown of primaries

We interviewed Chief Executive Officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant computer-aided manufacturing market companies.

- By Company: Tier I: 30%, Tier II: 45%, and Tier III: 25%

- By Designation: C-Level Executives: 50%, Director Level: 35%, and Others: 15%

- By Region: North America: 50%, Europe: 30%, Asia Pacific: 15%, Rest of World: 5%

Some of the significant computer-aided manufacturing market vendors are Autodesk (US), Siemens (Germany), Hexagon (Sweden), Dassault Systemes (France), Hypertherm (US), PTC (US), SolidCAM (US), TopSolid (France), CAMWorks (US) and MasterCAM (US).

Research coverage:

The market report covered the computer-aided manufacturing market across segments. We estimated the market size and growth potential for many segments based on offering, capability, application, deployment mode, organization size, vertical, and region. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product and service offerings, current trends, and critical market strategies.

Reasons to buy this report:

With information on the most accurate revenue estimates for the whole computer-aided manufacturing industry and its subsegments, the research will benefit market leaders and recent newcomers. Stakeholders will benefit from this report's increased understanding of the competitive environment, which will help them better position their companies and develop go-to-market strategies. The research offers information on the main market drivers, constraints, opportunities, and challenges, as well as aids players in understanding the pulse of the industry.

The report provides insights on the following pointers:

Analysis of key drivers (Increasing demand for cloud-based and SaaS solutions, Growing adoption of smart manufacturing and industry 4.0 initiatives, Addressing Complex Supply Chain Demands with Agile Production, Emphasis on sustainability and resource efficiency, Improving Traceability for End-to-End Product Lifecycle Management, Enhancing worker safety in hazardous manufacturing environments), restraints (Integration of CAM software with legacy systems), opportunities (Adoption of precision manufacturing for specialized high-performance parts, Increasing demand for shorter product development cycle, Increasing demand for additive manufacturing, Increasing investment in digital twin and simulation technologies), and challenges (Lack of skilled workforce, Limited customization options for complex manufacturing process) influencing the growth of the computer-aided manufacturing market.

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and new service and product introductions in the computer-aided manufacturing market.

- Market Development: In-depth details regarding profitable markets: the paper examines the global computer-aided manufacturing market.

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, new goods and services, and the computer-aided manufacturing market.

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, and service portfolios of the top competitors in the computer-aided manufacturing industry, such as Autodesk (US), Siemens (Germany), Hexagon (Sweden), Dassault Systemes (France) and Hypertherm (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key insights from industry experts

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR KEY PLAYERS IN COMPUTER-AIDED MANUFACTURING MARKET

- 4.2 COMPUTER-AIDED MANUFACTURING MARKET, BY OFFERING, 2024 VS. 2030

- 4.3 COMPUTER-AIDED MANUFACTURING MARKET, BY APPLICATION, 2024 VS. 2030

- 4.4 COMPUTER-AIDED MANUFACTURING MARKET, BY CAPABILITY, 2024 VS. 2030

- 4.5 COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE, 2024 VS. 2030

- 4.6 COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE, 2024 VS. 2030

- 4.7 COMPUTER-AIDED MANUFACTURING MARKET, BY VERTICAL, 2024 VS. 2030

- 4.8 COMPUTER-AIDED MANUFACTURING MARKET: REGIONAL SCENARIO, 2024-2030

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for cloud-based and SaaS solutions

- 5.2.1.2 Growing adoption of smart manufacturing and industry 4.0 initiatives

- 5.2.1.3 Addressing complex supply chain demands with agile production

- 5.2.1.4 Emphasis on sustainability and resource efficiency

- 5.2.1.5 Improving traceability for end-to-end product lifecycle management

- 5.2.1.6 Enhancing worker safety in hazardous manufacturing environments

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of awareness regarding integration of CAM software with legacy systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of precision manufacturing for specialized high-performance components

- 5.2.3.2 Increasing demand for shorter product development cycle

- 5.2.3.3 Rising demand for additive manufacturing

- 5.2.3.4 Growing investment in digital twin and simulation technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of skilled workforce

- 5.2.4.2 Limited customization options for complex manufacturing processes

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY REGION

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Artificial Intelligence (AI) & Machine Learning (ML)

- 5.7.1.2 Cloud computing

- 5.7.1.3 Simulation and virtual machining

- 5.7.1.4 Multi-axis machining

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Computer-Aided Design (CAD)

- 5.7.2.2 Product Lifecycle Management (PLM)

- 5.7.2.3 Manufacturing Execution Systems (MES)

- 5.7.2.4 Computer Numerical Control (CNC) systems

- 5.7.2.5 Robotics

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Computer-Aided Engineering (CAE)

- 5.7.3.2 Digital twin

- 5.7.3.3 AR/VR

- 5.7.3.4 Industrial Internet of Things (IIoT)

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 KEY CONFERENCES AND EVENTS (2024-2025)

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATIONS, BY REGION

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 BARGAINING POWER OF SUPPLIERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 BUSINESS MODEL ANALYSIS

- 5.13.1 LICENSE-BASED MODEL

- 5.13.2 CLOUD-BASED SOFTWARE-AS-A-SERVICE (SAAS)

- 5.13.3 FREEMIUM AND TIERED PRICING

- 5.13.4 CONSUMPTION-BASED PRICING

- 5.14 IMPACT OF AI/GEN AI IN COMPUTER-AIDED MANUFACTURING MARKET

- 5.14.1 INDUSTRY TRENDS: USE CASES

- 5.14.1.1 Toyota revolutionized its automotive comfort with AI-enhanced seat frames with help of Autodesk Fusion 360

- 5.14.1.2 HPE broke barriers in motorsport design with PTC's Creo AI-powered solution

- 5.14.2 TOP CLIENTS ADAPTING AI/GEN AI

- 5.14.2.1 Autodesk

- 5.14.2.2 Siemens

- 5.14.1 INDUSTRY TRENDS: USE CASES

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 WESTERN SAW INC TRANSFORMED CONSTRUCTION SAFETY BY DEVELOPING WSX-1 WITH HCL CAMWORKS

- 5.16.2 ROLLS-ROYCE DEFENSE OPTIMIZED MACHINING PROCESSES THROUGH SIEMENS NX CAM INTEGRATED SOLUTION

- 5.16.3 EDWARDS CENTRALIZED CAM DATA BY DEPLOYING 3DEXPERIENCE PLATFORM BY DASSAULT SYSTEMES

- 5.16.4 AUTODESK DEPLOYED ITS AUTODESK FUSION TO TRANSFORM DECATHLON'S FIN DESIGN

- 5.16.5 BRASSELER ACHIEVED PRECISION ENGINEERING IN DENTISTRY WITH PTC'S CREO NC

- 5.16.6 ROBEY TOOL & MACHINE UNLOCKED 5-AXIS CAPABILITY WITH BOBCAD-CAM CNC SOFTWARE

6 COMPUTER-AIDED MANUFACTURING MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: COMPUTER-AIDED MANUFACTURING MARKET DRIVERS

- 6.2 SOFTWARE

- 6.2.1 NEED TO AUTOMATE AND OPTIMIZE MANUFACTURING PROCESSES TO DRIVE MARKET

- 6.2.2 CAD-EMBEDDED CAM SOFTWARE

- 6.2.3 INDEPENDENT CAM SOFTWARE

- 6.3 SERVICES

- 6.3.1 GROWING DEMAND FOR SMART MANUFACTURING TO PROPEL MARKET

- 6.3.2 IMPLEMENTATION & INTEGRATION

- 6.3.3 CONSULTING

- 6.3.4 TRAINING, SUPPORT, AND MAINTENANCE

7 COMPUTER-AIDED MANUFACTURING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 APPLICATIONS: COMPUTER-AIDED MANUFACTURING MARKET DRIVERS

- 7.2 PRODUCT DESIGN & PROTOTYPING

- 7.2.1 GROWING COMPLEXITY IN DESIGNING PROCESS TO FUEL MARKET GROWTH

- 7.2.2 SIMULATION

- 7.2.3 3D PRINTING/ADDITIVE MANUFACTURING

- 7.2.4 TOOL & DIE MANUFACTURING

- 7.3 MACHINING & PRODUCTION

- 7.3.1 NEED FOR OPTIMIZING PRECISION AND EFFICIENCY TO BOOST MARKET GROWTH

- 7.3.2 CNC MACHINING

- 7.3.3 SHEET METAL FABRICATION

- 7.4 QUALITY CONTROL & INSPECTION

- 7.4.1 NEED TO MEET INDUSTRY STANDARDS AND DESIGN SPECIFICATIONS TO BOLSTER MARKET GROWTH

8 COMPUTER-AIDED MANUFACTURING MARKET, BY CAPABILITY

- 8.1 INTRODUCTION

- 8.1.1 CAPABILITIES: COMPUTER-AIDED MANUFACTURING MARKET DRIVERS

- 8.2 2D

- 8.2.1 NEED FOR PRECISE AND COST-EFFECTIVE TOOLPATHING TO FOSTER MARKET GROWTH

- 8.3 3D

- 8.3.1 3D CAPABILITY OF COMPUTER-AIDED MANUFACTURING TO REPRESENT SIGNIFICANT ADVANCEMENT IN MANUFACTURING TECHNOLOGY

- 8.4 MULTI-AXIS

- 8.4.1 ADVANCEMENTS IN DESIGNING MODELS TO ACCELERATE MARKET GROWTH

9 COMPUTER-AIDED MANUFACTURING MARKET, BY DEPLOYMENT MODE

- 9.1 INTRODUCTION

- 9.1.1 DEPLOYMENT MODES: COMPUTER-AIDED MANUFACTURING MARKET DRIVERS

- 9.2 ON-PREMISES

- 9.2.1 NEED FOR SPECIALIZED ENVIRONMENT FOR HANDLING SENSITIVE DATA TO DRIVE MARKET

- 9.3 CLOUD

- 9.3.1 COST-EFFECTIVENESS AND SCALABILITY TO BOOST DEMAND FOR COMPUTER-AIDED MANUFACTURING SOLUTIONS

10 COMPUTER-AIDED MANUFACTURING MARKET, BY ORGANIZATION SIZE

- 10.1 INTRODUCTION

- 10.1.1 ORGANIZATION SIZES: COMPUTER-AIDED MANUFACTURING MARKET DRIVERS

- 10.2 LARGE ENTERPRISES

- 10.2.1 NEED TO HANDLE HIGH PRODUCTION VOLUMES TO DRIVE MARKET

- 10.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 10.3.1 NEED TO DRIVE EFFICIENCY, CUSTOMIZATION, AND GROWTH IN COMPETITIVE MARKETS TO BOOST MARKET GROWTH

11 COMPUTER-AIDED MANUFACTURING MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.1.1 VERTICALS: COMPUTER-AIDED MANUFACTURING MARKET DRIVERS

- 11.2 OIL & GAS

- 11.2.1 NEED FOR OPTIMIZING DESIGNING PROCESS AND PRODUCING COMPLEX COMPONENTS TO FOSTER MARKET GROWTH

- 11.2.2 OIL & GAS: APPLICATION AREAS

- 11.2.2.1 Exploration & drilling

- 11.2.2.2 Pipeline manufacturing

- 11.2.2.3 Refining and petrochemical processing

- 11.2.2.4 Other oil & gas application areas

- 11.3 FOOD & BEVERAGES

- 11.3.1 NEED TO ENHANCE OPERATIONAL SAFETY AND REDUCE COSTS TO BOLSTER MARKET GROWTH

- 11.3.2 FOOD & BEVERAGES: APPLICATION AREAS

- 11.3.2.1 Food machinery and equipment

- 11.3.2.2 Dairy processing

- 11.3.2.3 Bakery & confectionary

- 11.3.2.4 Other food & beverage application areas

- 11.4 MEDICAL DEVICES & PHARMACEUTICALS

- 11.4.1 INCREASING DEMAND FOR IMPROVED PRODUCT QUALITY AND COMPLIANCE OF REGULATIONS TO BOOST MARKET GROWTH

- 11.4.2 MEDICAL DEVICES & PHARMACEUTICALS: APPLICATION AREAS

- 11.4.2.1 Drug manufacturing

- 11.4.2.2 Packaging and labeling

- 11.4.2.3 Heavy manufacturing

- 11.4.2.4 Other medical device & pharmaceutical application areas

- 11.5 CHEMICALS

- 11.5.1 NEED TO ENSURE SAFER, MORE EFFICIENT CHEMICAL MANUFACTURING OPERATIONS TO BOLSTER MARKET GROWTH

- 11.5.2 CHEMICALS: APPLICATION AREAS

- 11.5.2.1 Petrochemicals

- 11.5.2.2 Agrochemicals

- 11.5.2.3 Polymers & plastics

- 11.5.2.4 Other chemical application areas

- 11.6 ENERGY & POWER

- 11.6.1 NEED TO OPTIMIZE MAINTENANCE AND EFICIENCY OF ENERGY & POWER SECTOR TO DRIVE MARKET

- 11.6.2 ENERGY & POWER: APPLICATION AREAS

- 11.6.2.1 Renewable energy

- 11.6.2.2 Power generation equipment

- 11.6.2.3 Consumer chemicals

- 11.6.2.4 Other energy & power application areas

- 11.7 METALS & MINING

- 11.7.1 NEED FOR HIGH PRECISION & EFFICIENCY FOR PRODUCTION TO PROPEL MARKET

- 11.7.2 METALS & MINING: APPLICATION AREAS

- 11.7.2.1 Metal extraction

- 11.7.2.2 Mineral processing

- 11.7.2.3 Steel manufacturing

- 11.7.2.4 Other metals & mining application areas

- 11.8 PULP & PAPER

- 11.8.1 NEED TO REDUCE WASTE AND ENERGY CONSUMPTION TO DRIVE MARKET

- 11.8.2 PULP & PAPER: APPLICATION AREAS

- 11.8.2.1 Paper manufacturing

- 11.8.2.2 Chemical pulping

- 11.8.2.3 Packaging paper & board

- 11.8.2.4 Other pulp & paper application areas

- 11.9 AUTOMOTIVE

- 11.9.1 GROWING DEMAND FOR COMPONENT DESIGNING TO BOOST MARKET GROWTH

- 11.9.2 AUTOMOTIVE: APPLICATION AREAS

- 11.9.2.1 Passenger vehicles

- 11.9.2.2 Commercial vehicles

- 11.9.2.3 Automotive electronics

- 11.9.2.4 Other automotive application areas

- 11.10 AEROSPACE

- 11.10.1 NEED TO HANDLE COMPLEX GEOMETRIES TO ACCELERATE MARKET GROWTH

- 11.10.2 AEROSPACE: APPLICATION AREAS

- 11.10.2.1 Commercial aviation

- 11.10.2.2 Military & defense

- 11.10.2.3 Space exploration

- 11.10.2.4 Other aerospace application areas

- 11.11 ELECTRONICS & SEMICONDUCTORS

- 11.11.1 NEED TO MANUFACTURE INTRICATE CIRCUIT COMPONENTS TO FUEL MARKET GROWTH

- 11.11.2 ELECTRONICS & SEMICONDUCTORS: APPLICATION AREAS

- 11.11.2.1 Printed Circuit Board (PCB)

- 11.11.2.2 Consumer electronics

- 11.11.2.3 Industry electronics

- 11.11.2.4 Other electronics & semiconductor application areas

- 11.12 HEAVY MACHINERY

- 11.12.1 NEED TO EXCEPTIONAL ACCURACY, MINIMIZING MANUAL LABOR, REDUCING HUMAN ERROR, AND OPTIMIZING MATERIAL USAGE TO AUGMENT MARKET GROWTH

- 11.12.2 HEAVY MACHINERY: APPLICATION AREAS

- 11.12.2.1 Construction machinery

- 11.12.2.2 Industrial machinery

- 11.12.2.3 Material handling

- 11.12.2.4 Other heavy machinery application areas

- 11.13 OTHER VERTICALS

12 COMPUTER-AIDED MANUFACTURING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: COMPUTER-AIDED MANUFACTURING MARKET DRIVERS

- 12.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 12.2.3 US

- 12.2.3.1 Government initiatives and technological advancements to drive demand for CAM solutions

- 12.2.4 CANADA

- 12.2.4.1 CAM solutions to transform manufacturing sector with advanced technologies

- 12.3 EUROPE

- 12.3.1 EUROPE: COMPUTER-AIDED MANUFACTURING MARKET DRIVERS

- 12.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 12.3.3 UK

- 12.3.3.1 Adoption of automation and digital technologies and implementation of Industry 4.0 to propel market

- 12.3.4 GERMANY

- 12.3.4.1 Strong industrial foundation, commitment to Industry 4.0, and focus on sustainability to fuel market growth

- 12.3.5 FRANCE

- 12.3.5.1 Need to improve production efficiency, precision, and flexibility to accelerate market growth

- 12.3.6 ITALY

- 12.3.6.1 Piano Transizione 4.0 and advancements in digital technologies and automation across automotive, aerospace, and machinery industries to foster market growth

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: COMPUTER-AIDED MANUFACTURING MARKET DRIVERS

- 12.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 12.4.3 CHINA

- 12.4.3.1 Increased adoption of new technologies in automation, AI, and digital manufacturing to boost market growth

- 12.4.4 JAPAN

- 12.4.4.1 Rising government investments, forward-looking initiatives, and implementation of Society 5.0 to bolster market growth

- 12.4.5 INDIA

- 12.4.5.1 SAMARTH Udyog Bharat 4.0 and adoption of automation and precision technologies to drive market

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MIDDLE EAST & AFRICA: COMPUTER-AIDED MANUFACTURING MARKET DRIVERS

- 12.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 12.5.3 GULF COOPERATION COUNCIL (GCC) COUNTRIES

- 12.5.3.1 UAE

- 12.5.3.1.1 Industrial modernization, technological advancement, and government regulations to boost market growth

- 12.5.3.2 Saudi Arabia

- 12.5.3.2.1 Implementation of Vision 2030 and advanced manufacturing technologies to drive market

- 12.5.3.3 Rest of GCC countries

- 12.5.3.1 UAE

- 12.5.4 SOUTH AFRICA

- 12.5.4.1 Rising demand for automation and Industry 4.0 to boost market growth

- 12.5.5 REST OF MIDDLE EAST & AFRICA

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: COMPUTER-AIDED MANUFACTURING MARKET DRIVERS

- 12.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 12.6.3 BRAZIL

- 12.6.3.1 CAM technologies to enhance precision, optimize production, and reduce waste

- 12.6.4 MEXICO

- 12.6.4.1 Need to improve precision, reduce costs, and speed up production to boost market growth

- 12.6.5 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 13.3 REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.5.5.1 Company footprint

- 13.5.5.2 Offering footprint

- 13.5.5.3 Organization size footprint

- 13.5.5.4 Vertical footprint

- 13.5.5.5 Regional footprint

- 13.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: START-UP/SMES, 2023

- 13.6.5.1 Detailed list of key start-ups/SMEs

- 13.6.5.2 Competitive benchmarking of start-ups/SMEs

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- 13.8 BRAND/PRODUCT COMPARISON

- 13.8.1 AUTODESK - FUSION 360

- 13.8.2 SIEMENS - NX CAM

- 13.8.3 HEXAGON - ALPHACAM

- 13.8.4 DASSAULT SYSTEMES - 3DEXPIERENCE PLATFORM

- 13.8.5 HYPERTHERM - PRONEST

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 MAJOR PLAYERS

- 14.2.1 AUTODESK

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product launches and enhancements

- 14.2.1.3.2 Deals

- 14.2.1.4 MnM view

- 14.2.1.4.1 Right to win

- 14.2.1.4.2 Strategic choices

- 14.2.1.4.3 Weaknesses and competitive threats

- 14.2.2 SIEMENS

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered.

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Product enhancements

- 14.2.2.3.2 Deals

- 14.2.2.4 MnM view

- 14.2.2.4.1 Right to win

- 14.2.2.4.2 Strategic choices

- 14.2.2.4.3 Weaknesses and competitive threats

- 14.2.3 HEXAGON

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Product enhancements

- 14.2.3.3.2 Deals

- 14.2.3.4 MnM view

- 14.2.3.4.1 Right to win

- 14.2.3.4.2 Strategic choices

- 14.2.3.4.3 Weaknesses and competitive threats

- 14.2.4 DASSAULT SYSTEMES

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.4.3 Recent developments

- 14.2.4.3.1 Deals

- 14.2.4.4 MnM view

- 14.2.4.4.1 Right to win

- 14.2.4.4.2 Strategic choices

- 14.2.4.4.3 Weaknesses and competitive threats

- 14.2.5 HYPERTHERM

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.5.3 Recent developments

- 14.2.5.3.1 Product enhancements

- 14.2.5.3.2 Deals

- 14.2.5.4 MnM view

- 14.2.5.4.1 Right to win

- 14.2.5.4.2 Strategic choices

- 14.2.5.4.3 Weaknesses and competitive threats

- 14.2.6 PTC

- 14.2.6.1 Business overview

- 14.2.6.2 Products/Solutions/Services offered

- 14.2.6.3 Recent developments

- 14.2.6.3.1 Product enhancements

- 14.2.6.3.2 Deals

- 14.2.7 SOLIDCAM

- 14.2.7.1 Business overview

- 14.2.7.2 Products/Solutions/Services offered

- 14.2.7.3 Recent developments

- 14.2.7.3.1 Deals

- 14.2.8 TOPSOLID

- 14.2.8.1 Business overview

- 14.2.8.2 Products/Solutions/Services offered

- 14.2.8.3 Recent developments

- 14.2.8.3.1 Deals

- 14.2.9 CAMWORKS

- 14.2.9.1 Business overview

- 14.2.9.2 Products/Solutions/Services offered

- 14.2.9.3 Recent developments

- 14.2.9.3.1 Product enhancements

- 14.2.10 MASTERCAM

- 14.2.10.1 Business overview

- 14.2.10.2 Products/Solutions/Services offered

- 14.2.10.3 Recent developments

- 14.2.10.3.1 Product enhancements

- 14.2.10.3.2 Deals

- 14.2.1 AUTODESK

- 14.3 OTHER PLAYERS

- 14.3.1 SIGMANEST

- 14.3.2 NTT DATA ENGINEERING SYSTEMS

- 14.3.3 ZWSOFT

- 14.3.4 LANTEK

- 14.3.5 BOBCAD-CAM

- 14.3.6 MECSOFT CORPORATION

- 14.3.7 GIBBSCAM

- 14.3.8 EZCAM

- 14.3.9 OPEN MIND TECHNOLOGIES

- 14.3.10 TEBIS

- 14.3.11 NCG CAM SOLUTIONS

- 14.3.12 SMARTCAM

- 14.3.13 CARBIDE

- 14.3.14 METAMATION

- 14.3.15 VAYO TECHNOLOGY

- 14.3.16 ONG SOLUTIONS

- 14.3.17 MAXXCAM

15 ADJACENT/RELATED MARKETS

- 15.1 INTRODUCTION

- 15.1.1 RELATED MARKETS

- 15.1.2 LIMITATIONS

- 15.2 PRODUCT LIFECYCLE MANAGEMENT MARKET

- 15.3 SIMULATION SOFTWARE MARKET

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS