|

|

市場調査レポート

商品コード

1603241

外科用ステープラーの世界市場:タイプ別、技術別、使用法別、用途別、エンドユーザー別、地域別 - 2029年までの予測Surgical Staplers Market by Type, Technology, Usability, Application, End User - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 外科用ステープラーの世界市場:タイプ別、技術別、使用法別、用途別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2024年11月26日

発行: MarketsandMarkets

ページ情報: 英文 260 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

外科用ステープラーの市場規模は、予測期間中に7.2%のCAGRで拡大し、2024年の51億5,000万米ドルから2029年には72億9,000万米ドルに達すると予測されています。

低侵襲手技に対する需要の高まりが、手術、特に腹腔鏡手術や内視鏡手術の際に外科用ステープラーの採用が増加している主な要因です。低侵襲手技が支持されるのは、開腹手術に比べていくつかの利点があるからです。これらには、切開創の縮小、痛みの最小化、入院期間の短縮、回復時間の短縮などが含まれます。患者の治療成績の向上、合併症や感染率の減少、瘢痕の減少などがその特徴です。外科用ステープラー、特に直線状ステープラーと円形ステープラーは、説明した手技に非常に有用です。

ステープラーは、迅速、確実、かつ均一な組織閉鎖が可能であり、周囲組織の破壊はほとんどありません。ステープリングは従来の縫合のように段階的に縫合する必要がなく、手術へのアプローチを短縮し、時間を節約し、組織の整列を容易にします。例えば腹腔鏡手術では、視界や操作性が制限されるため、限られたスペースで安全に閉鎖できるステープラーは非常に人気があります。肥満手術、大腸手術、婦人科手術はその数を増やしており、低侵襲手技の助けを借りて行われることが多くなっているため、外科用ステープラーが必要とされています。医療関係者は、患者への最大限のケアと、比較的長い回復期間によるコストの管理を推し進め続けているため、ステープラーは徐々に、近代的な外科手術での大量採用を促進する縫合糸に道を譲ることになりそうです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | タイプ別、技術別、使用法別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

リニアステープラーは、その精度と制御性が高く評価され、精度が最優先されなければならないデリケートな組織を含む処置において非常に有用です。このアプローチでは、確実な組織閉鎖が可能であり、出血、漏出、感染などの合併症のため肘にスペースはほとんどありません。したがって、消化器、胸部、肥満手術など、優れた結果を得るためには細かいコントロールが不可欠な手術では、専門的な技術となります。縫合医は、そのスピード、シンプルさ、効率の良さからリニアステープラーを好みます。吻合は、熟練した外科医の手元で、漏れることなく瞬時に行われるため、時間的にもリスク的にも効率的です。

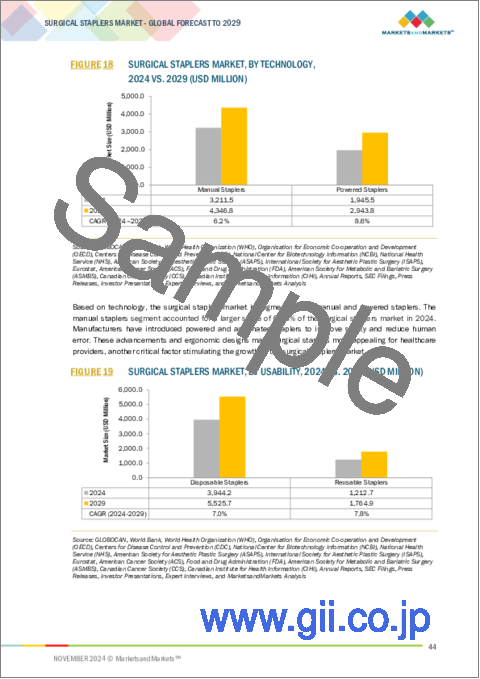

手動ステープラーは、精密さ、簡便さ、親しみやすさを提供するため、外科医に好まれています。組織近似時に即座に触覚フィードバックが得られるため、外科医は緊張感を得ることができ、特にデリケートな症例では、ステープルの配置を最適化するために適切な手技調整を行うことができます。このようなハンズオンコントロールにより、組織の完璧な整列と緊密な閉鎖が保証され、組織の不適切な治癒や漏れに関連する合併症が少なくなります。外科医は、手動ステープラーの直感的な操作感が好きで、動力式機器のような複雑さはなく、安定した性能を発揮します。手軽さと正確さが相まって、多くの外科医が手術のステープルとして手動ステープラーに自信を持って頼るようになっています。

当レポートでは、世界の外科用ステープラー市場について調査し、タイプ別、技術別、使用法別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界動向

- 技術分析

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 規制状況

- 特許分析

- 価格分析

- 2024年~2025年の主な会議とイベント

- エコシステム分析

- 顧客のビジネスに影響を与える動向/混乱

- AI/生成AIが外科用ステープラー市場に与える影響

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 隣接市場分析

第6章 外科用ステープラー市場(タイプ別)

- イントロダクション

- リニアステープラー

- 円形ステープラー

- スキンステープラー

- その他

第7章 外科用ステープラー市場(技術別)

- イントロダクション

- 手動ステープラー

- 電動ステープラー

第8章 外科用ステープラー市場(使用法別)

- イントロダクション

- ディスポーザブルステープラー

- 再利用ステープラー

第9章 外科用ステープラー市場(用途別)

- イントロダクション

- 腹部・骨盤外科手術

- 一般外科

- 心臓・胸部外科

- 整形外科

- その他

第10章 外科用ステープラー市場(エンドユーザー別)

- イントロダクション

- 病院

- 外来手術センター

- その他

第11章 外科用ステープラー市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- GCC諸国

第12章 競合情勢

- イントロダクション

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業評価と財務指標

- ブランド/製品比較

- 外科用ステープラー市場:研究開発費

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- MEDTRONIC

- JOHNSON & JOHNSON SERVICES, INC.(ETHICON, INC.)

- LEPU MEDICAL TECHNOLOGY(BEIJING)CO., LTD.

- INTUITIVE SURGICAL OPERATIONS, INC.

- 3M

- CONMED CORPORATION

- B. BRAUN SE

- SMITH+NEPHEW

- WELFARE MEDICAL LTD.

- REACH SURGICAL

- MERIL LIFE SCIENCES PVT. LTD.

- XNY MEDICAL

- PURPLE SURGICAL

- FRANKENMAN INTERNATIONAL LTD.

- LEXINGTON MEDICAL CENTER

- その他の企業

- NINGBO VERYKIND MEDICAL DEVICE CO., LTD.

- WASTON MEDICAL CORPORATION

- SUTURE PLANET

- DOLPHIN SUTURES

- TOUCHSTONE INTERNATIONAL MEDICAL SCIENCE CO., LTD.

- NEWGEN SURGICAL

- EDGES MEDICARE PRIVATE LIMITED

- GOLDEN STAPLER SURGICAL CO., LTD.

- VICTOR MEDICAL INSTRUMENTS CO., LTD.

- VOLKMANN MEDIZINTECHNIK GMBH

第14章 付録

List of Tables

- TABLE 1 SURGICAL STAPLERS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 STANDARD CURRENCY CONVERSION RATES, 2020-2023

- TABLE 3 SURGICAL STAPLERS MARKET: STUDY ASSUMPTIONS

- TABLE 4 SURGICAL STAPLERS MARKET: RISK ASSESSMENT

- TABLE 5 TRADE ANALYSIS OF MEDICAL DEVICE PRODUCTS, 2023 (USD MILLION)

- TABLE 6 EXPORT DATA FOR LINEAR, CIRCULAR, AND SKIN SURGICAL STAPLERS (HS CODE 9018), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 7 IMPORT DATA FOR LINEAR, CIRCULAR, AND SKIN SURGICAL STAPLERS (HS CODE 9018), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 8 SURGICAL STAPLERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF SURGICAL STAPLERS

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 AVERAGE SELLING PRICE OF SURGICAL STAPLERS, BY TYPE, 2021-2023 (USD)

- TABLE 17 AVERAGE SELLING PRICE OF SURGICAL STAPLERS, BY TECHNOLOGY, 2021-2023 (USD)

- TABLE 18 AVERAGE SELLING PRICE OF SURGICAL STAPLERS, BY KEY PLAYER, 2023

- TABLE 19 AVERAGE SELLING PRICE OF LINEAR STAPLERS, BY REGION, 2021-2023 (USD)

- TABLE 20 SURGICAL STAPLERS MARKET: LIST OF KEY CONFERENCES & EVENTS, JANUARY 2024-DECEMBER 2025

- TABLE 21 SURGICAL STAPLERS MARKET: ROLE IN ECOSYSTEM

- TABLE 22 SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 23 LINEAR SURGICAL STAPLERS MARKET, BY REGION, 2022-2029 (THOUSAND UNITS)

- TABLE 24 LINEAR SURGICAL STAPLERS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 25 CIRCULAR SURGICAL STAPLERS MARKET, BY REGION, 2022-2029 (THOUSAND UNITS)

- TABLE 26 CIRCULAR SURGICAL STAPLERS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 27 SURGICAL SKIN STAPLERS MARKET, BY REGION, 2022-2029 (THOUSAND UNITS)

- TABLE 28 SURGICAL SKIN STAPLERS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 29 OTHER SURGICAL STAPLERS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 30 SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 31 MANUAL SURGICAL STAPLERS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 32 POWERED SURGICAL STAPLERS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 33 SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 34 DISPOSABLE SURGICAL STAPLERS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 35 REUSABLE SURGICAL STAPLERS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 36 SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 37 SURGICAL STAPLERS MARKET FOR ABDOMINAL & PELVIC SURGERY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 38 SURGICAL STAPLERS MARKET FOR GENERAL SURGERY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 39 SURGICAL STAPLERS MARKET FOR CARDIAC & THORACIC SURGERY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 40 SURGICAL STAPLERS MARKET FOR ORTHOPEDIC SURGERY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 41 SURGICAL STAPLERS MARKET FOR OTHER SURGICAL APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 42 SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 43 SURGICAL STAPLERS MARKET FOR HOSPITALS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 44 SURGICAL STAPLERS MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 45 SURGICAL STAPLERS MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 46 SURGICAL STAPLERS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 47 NORTH AMERICA: SURGICAL STAPLERS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 48 NORTH AMERICA: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 49 NORTH AMERICA: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 50 NORTH AMERICA: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 51 NORTH AMERICA: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 52 NORTH AMERICA: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 53 US: MACROECONOMIC INDICATORS

- TABLE 54 US: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 55 US: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 56 US: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 57 US: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 58 US: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 59 CANADA: MACROECONOMIC INDICATORS

- TABLE 60 CANADA: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 61 CANADA: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 62 CANADA: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 63 CANADA: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 64 CANADA: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 65 EUROPE: SURGICAL STAPLERS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 66 EUROPE: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 67 EUROPE: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 68 EUROPE: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 69 EUROPE: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 70 EUROPE: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 71 GERMANY: PREVALENCE OF ADULT OBESITY BY 2030

- TABLE 72 GERMANY: MACROECONOMIC INDICATORS

- TABLE 73 GERMANY: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 74 GERMANY: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 75 GERMANY: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 76 GERMANY: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 77 GERMANY: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 78 UK: MACROECONOMIC INDICATORS

- TABLE 79 UK: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 80 UK: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 81 UK: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 82 UK: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 83 UK: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 84 FRANCE: MACROECONOMIC INDICATORS

- TABLE 85 FRANCE: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 86 FRANCE: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 87 FRANCE: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 88 FRANCE: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 89 FRANCE: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 90 ITALY: PREVALENCE OF ADULT OBESITY BY 2030

- TABLE 91 ITALY: MACROECONOMIC INDICATORS

- TABLE 92 ITALY: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 93 ITALY: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 94 ITALY: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 95 ITALY: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 96 ITALY: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 97 SPAIN: MACROECONOMIC INDICATORS

- TABLE 98 SPAIN: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 99 SPAIN: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 100 SPAIN: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 101 SPAIN: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 102 SPAIN: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 103 REST OF EUROPE: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 104 REST OF EUROPE: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 105 REST OF EUROPE: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 106 REST OF EUROPE: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 107 REST OF EUROPE: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 108 ASIA PACIFIC: SURGICAL STAPLERS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 109 ASIA PACIFIC: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 110 ASIA PACIFIC: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 111 ASIA PACIFIC: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 112 ASIA PACIFIC: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 113 ASIA PACIFIC: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 114 CHINA: MACROECONOMIC INDICATORS

- TABLE 115 CHINA: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 116 CHINA: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 117 CHINA: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 118 CHINA: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 119 CHINA: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 120 JAPAN: MACROECONOMIC INDICATORS

- TABLE 121 JAPAN: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 122 JAPAN: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 123 JAPAN: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 124 JAPAN: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 125 JAPAN: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 126 INDIA: MACROECONOMIC INDICATORS

- TABLE 127 INDIA: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 128 INDIA: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 129 INDIA: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 130 INDIA: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 131 INDIA: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 132 AUSTRALIA: MACROECONOMIC INDICATORS

- TABLE 133 AUSTRALIA: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 134 AUSTRALIA: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 135 AUSTRALIA: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 136 AUSTRALIA: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 137 AUSTRALIA: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 138 SOUTH KOREA: MACROECONOMIC INDICATORS

- TABLE 139 SOUTH KOREA: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 140 SOUTH KOREA: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 141 SOUTH KOREA: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 142 SOUTH KOREA: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 143 SOUTH KOREA: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 149 LATIN AMERICA: SURGICAL STAPLERS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 150 LATIN AMERICA: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 151 LATIN AMERICA: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 152 LATIN AMERICA: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 153 LATIN AMERICA: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 154 LATIN AMERICA: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 155 BRAZIL: MACROECONOMIC INDICATORS

- TABLE 156 BRAZIL: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 157 BRAZIL: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 158 BRAZIL: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 159 BRAZIL: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 160 BRAZIL: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 161 MEXICO: MACROECONOMIC INDICATORS

- TABLE 162 MEXICO: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 163 MEXICO: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 164 MEXICO: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 165 MEXICO: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 166 MEXICO: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 167 REST OF LATIN AMERICA: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 168 REST OF LATIN AMERICA: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 169 REST OF LATIN AMERICA: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 170 REST OF LATIN AMERICA: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 171 REST OF LATIN AMERICA: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 177 GCC COUNTRIES: SURGICAL STAPLERS MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 178 GCC COUNTRIES: SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 179 GCC COUNTRIES: SURGICAL STAPLERS MARKET, BY USABILITY, 2022-2029 (USD MILLION)

- TABLE 180 GCC COUNTRIES: SURGICAL STAPLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 181 GCC COUNTRIES: SURGICAL STAPLERS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 182 SURGICAL STAPLERS MARKET: DEGREE OF COMPETITION

- TABLE 183 SURGICAL STAPLERS MARKET: TYPE FOOTPRINT

- TABLE 184 SURGICAL STAPLERS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 185 SURGICAL STAPLERS MARKET: USABILITY FOOTPRINT

- TABLE 186 SURGICAL STAPLERS MARKET: APPLICATION FOOTPRINT

- TABLE 187 SURGICAL STAPLERS MARKET: END-USER FOOTPRINT

- TABLE 188 SURGICAL STAPLERS MARKET: REGION FOOTPRINT

- TABLE 189 SURGICAL STAPLERS MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 190 SURGICAL STAPLERS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SME PLAYERS

- TABLE 191 SURGICAL STAPLERS MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-OCTOBER 2024

- TABLE 192 SURGICAL STAPLERS MARKET: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 193 SURGICAL STAPLERS MARKET: EXPANSIONS, JANUARY 2021-OCTOBER 2024

- TABLE 194 MEDTRONIC: COMPANY OVERVIEW

- TABLE 195 MEDTRONIC: PRODUCTS OFFERED

- TABLE 196 MEDTRONIC: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 197 JOHNSON & JOHNSON SERVICES, INC. (ETHICON, INC.): COMPANY OVERVIEW

- TABLE 198 JOHNSON & JOHNSON SERVICES, INC. (ETHICON, INC.): PRODUCTS OFFERED

- TABLE 199 JOHNSON & JOHNSON SERVICES, INC. (ETHICON, INC.): PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 200 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.: COMPANY OVERVIEW

- TABLE 201 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.: PRODUCTS OFFERED

- TABLE 202 INTUITIVE SURGICAL OPERATIONS, INC.: COMPANY OVERVIEW

- TABLE 203 INTUITIVE SURGICAL OPERATIONS, INC.: PRODUCTS OFFERED

- TABLE 204 INTUITIVE SURGICAL OPERATIONS, INC.: PRODUCT APPROVALS, JANUARY 2021-OCTOBER 2024

- TABLE 205 3M: COMPANY OVERVIEW

- TABLE 206 3M: PRODUCTS OFFERED

- TABLE 207 CONMED CORPORATION: COMPANY OVERVIEW

- TABLE 208 CONMED CORPORATION: PRODUCTS OFFERED

- TABLE 209 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 210 B BRAUN SE: PRODUCTS OFFERED

- TABLE 211 SMITH+NEPHEW: COMPANY OVERVIEW

- TABLE 212 SMITH+NEPHEW: PRODUCTS OFFERED

- TABLE 213 WELFARE MEDICAL LTD.: COMPANY OVERVIEW

- TABLE 214 WELFARE MEDICAL LTD.: PRODUCTS OFFERED

- TABLE 215 REACH SURGICAL: COMPANY OVERVIEW

- TABLE 216 REACH SURGICAL: PRODUCTS OFFERED

- TABLE 217 MERIL LIFE SCIENCES PVT. LTD.: COMPANY OVERVIEW

- TABLE 218 MERIL LIFE SCIENCES PVT. LTD.: PRODUCTS OFFERED

- TABLE 219 MERIL LIFE SCIENCES PVT LTD.: EXPANSIONS, JANUARY 2021-OCTOBER 2024

- TABLE 220 XNY MEDICAL: COMPANY OVERVIEW

- TABLE 221 XNY MEDICAL: PRODUCTS OFFERED

- TABLE 222 PURPLE SURGICAL: COMPANY OVERVIEW

- TABLE 223 PURPLE SURGICAL: PRODUCTS OFFERED

- TABLE 224 FRANKENMAN INTERNATIONAL LTD.: COMPANY OVERVIEW

- TABLE 225 FRANKENMAN INTERNATIONAL LTD.: PRODUCTS OFFERED

- TABLE 226 LEXINGTON MEDICAL CENTER: COMPANY OVERVIEW

- TABLE 227 LEXINGTON MEDICAL CENTER: PRODUCTS OFFERED

- TABLE 228 LEXINGTON MEDICAL CENTER: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 229 NINGBO VERYKIND MEDICAL DEVICE CO., LTD.: COMPANY OVERVIEW

- TABLE 230 WASTON MEDICAL CORPORATION: COMPANY OVERVIEW

- TABLE 231 SUTURE PLANET: COMPANY OVERVIEW

- TABLE 232 DOLPHIN SUTURES: COMPANY OVERVIEW

- TABLE 233 TOUCHSTONE INTERNATIONAL MEDICAL SCIENCE CO., LTD.: COMPANY OVERVIEW

- TABLE 234 NEWGEN SURGICAL: COMPANY OVERVIEW

- TABLE 235 EDGES MEDICARE PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 236 GOLDEN STAPLER SURGICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 237 VICTOR MEDICAL INSTRUMENTS CO., LTD.: COMPANY OVERVIEW

- TABLE 238 VOLKMANN MEDIZINTECHNIK GMBH: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SURGICAL STAPLERS MARKET: SEGMENTS CONSIDERED

- FIGURE 2 SURGICAL STAPLERS MARKET: YEARS CONSIDERED

- FIGURE 3 SURGICAL STAPLERS MARKET: RESEARCH DESIGN

- FIGURE 4 INDICATIVE LIST OF SECONDARY SOURCES

- FIGURE 5 LIST OF KEY PRIMARY SOURCES

- FIGURE 6 SURGICAL STAPLERS MARKET: KEY INDUSTRY INSIGHTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 9 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 10 SURGICAL STAPLERS MARKET: BOTTOM-UP APPROACH

- FIGURE 11 REVENUE SHARE ILLUSTRATION FOR MEDTRONIC (2023)

- FIGURE 12 SURGICAL STAPLERS MARKET: SUPPLY-SIDE MARKET SIZE ESTIMATION (2023)

- FIGURE 13 SURGICAL STAPLERS MARKET: TOP-DOWN APPROACH

- FIGURE 14 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2024-2029)

- FIGURE 15 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 16 SURGICAL STAPLERS MARKET: DATA TRIANGULATION

- FIGURE 17 SURGICAL STAPLERS MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 18 SURGICAL STAPLERS MARKET, BY TECHNOLOGY, 2024 VS. 2029 (USD MILLION)

- FIGURE 19 SURGICAL STAPLERS MARKET, BY USABILITY, 2024 VS. 2029 (USD MILLION)

- FIGURE 20 SURGICAL STAPLERS MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 21 SURGICAL STAPLERS MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 22 SURGICAL STAPLERS MARKET: REGIONAL SNAPSHOT

- FIGURE 23 INCREASING PREVALENCE OF CHRONIC DISEASES AND RISING HEALTHCARE EXPENDITURE TO DRIVE MARKET

- FIGURE 24 CHINA AND LINEAR STAPLERS TO ACCOUNT FOR LARGEST SHARE IN ASIA PACIFIC MARKET IN 2024

- FIGURE 25 INDIA TO REGISTER HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 26 NORTH AMERICA TO DOMINATE SURGICAL STAPLERS MARKET DURING FORECAST PERIOD

- FIGURE 27 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATES FROM 2024 TO 2029

- FIGURE 28 SURGICAL STAPLERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 29 NUMBER OF BARIATRIC OPERATIONS PER COUNTRY, PRIMARY AND REVISIONAL (2023)

- FIGURE 30 NUMBER OF DEALS AND HEALTH-TECH VENTURE CAPITAL FUNDING (2016-2022)

- FIGURE 31 SURGICAL STAPLERS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 32 SURGICAL STAPLERS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 33 SURGICAL STAPLERS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF SURGICAL STAPLERS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 36 NUMBER OF PATENT PUBLICATIONS IN SURGICAL STAPLERS MARKET (2014-2024)

- FIGURE 37 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR SURGICAL STAPLER PATENTS (JANUARY 2014-SEPTEMBER 2024)

- FIGURE 38 AVERAGE SELLING PRICE OF LINEAR STAPLERS, BY REGION, 2021-2023 (USD)

- FIGURE 39 SURGICAL STAPLERS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 40 SURGICAL STAPLERS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 41 SURGICAL STAPLERS MARKET: IMPACT OF AI/GEN AI

- FIGURE 42 FUNDING AND NUMBER OF DEALS IN SURGICAL STAPLERS MARKET, 2019-2023 (USD MILLION)

- FIGURE 43 NUMBER OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023

- FIGURE 44 VALUE OF INVESTOR DEALS, BY KEY PLAYER, 2019-2023 (USD MILLION)

- FIGURE 45 ANASTOMOSIS DEVICES MARKET OVERVIEW

- FIGURE 46 BARIATRIC SURGERY DEVICES MARKET OVERVIEW

- FIGURE 47 MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET OVERVIEW

- FIGURE 48 WOUND CARE MARKET OVERVIEW

- FIGURE 49 NORTH AMERICA: SURGICAL STAPLERS MARKET SNAPSHOT

- FIGURE 50 ASIA PACIFIC: SURGICAL STAPLERS MARKET SNAPSHOT

- FIGURE 51 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN SURGICAL STAPLERS MARKET

- FIGURE 52 REVENUE ANALYSIS OF TOP FIVE PLAYERS IN SURGICAL STAPLERS MARKET (2019-2023)

- FIGURE 53 MARKET SHARE ANALYSIS OF KEY PLAYERS IN SURGICAL STAPLERS MARKET (2023)

- FIGURE 54 SURGICAL STAPLERS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 55 SURGICAL STAPLERS MARKET: COMPANY FOOTPRINT

- FIGURE 56 SURGICAL STAPLERS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 57 EV/EBITDA OF KEY PLAYERS

- FIGURE 58 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 59 SURGICAL STAPLERS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 60 R&D EXPENDITURE OF KEY PLAYERS IN SURGICAL STAPLERS MARKET (2022 VS. 2023)

- FIGURE 61 MEDTRONIC: COMPANY SNAPSHOT

- FIGURE 62 JOHNSON & JOHNSON SERVICES, INC. (ETHICON, INC.): COMPANY SNAPSHOT

- FIGURE 63 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.: COMPANY SNAPSHOT

- FIGURE 64 INTUITIVE SURGICAL OPERATIONS, INC.: COMPANY SNAPSHOT

- FIGURE 65 3M: COMPANY SNAPSHOT

- FIGURE 66 CONMED CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 B BRAUN SE: COMPANY SNAPSHOT

- FIGURE 68 SMITH+NEPHEW: COMPANY SNAPSHOT

The surgical staplers market is projected to reach USD 7.29 Billion by 2029 from USD 5.15 Billion in 2024 at a CAGR of 7.2% during the forecast period. Increased demand for minimally invasive procedures is the leading factor for the growing adoption of surgical staplers during surgeries, especially laparoscopic and endoscopic ones. A minimally invasive technique is favored because it offers several advantages over open surgeries; these include smaller cuts, pain minimization, shorter periods of stay in hospitals, and quicker recovery times. Improved outcomes of patient care and reduced complication and infection rates as well as scarring characterize outcomes. Surgical staplers, particularly linear and circular staplers, are very useful for the procedures described. They offer fast, secure, and uniform tissue closure with almost minimal disruption to the surrounding tissues. Stapling does not have to be staged as in a conventional suture; it shortens the approach to surgery, saves time, and affords easier tissue alignment. For instance, in laparoscopic surgeries, visibility and maneuverability being limited, staplers are highly sought after because they enable safe closures within confined spaces. Bariatric, colorectal, and gynecologic procedures are being increased in number and are increasingly being performed with the aid of minimally invasive techniques and therefore, require surgical staplers. As medical professionals continue to push for maximum patient care and control of cost attributed to recovery periods, which are relatively long, staplers gradually give way to sutures that promote mass adoption in modern surgeries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Segments | By Type, Technology, Usability, Application, End User and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

"The linear surgical staplers segment is accounted for the largest share of surgical staplers market."

Linear staplers are valued highly for their precision and control and are very useful in procedures involving delicate tissues, where accuracy has to be at the top. With this approach, there is reliable tissue closure, and little elbow space for complications like bleeding, leakage, or infection.It is thus a specialty bonus for procedures like gastrointestinal, thoracic, and bariatric surgeries, where fine control is vital for excellent outcomes. Suturers like linear staplers for their speed, simplicity, and efficiency. Anastomoses are accomplished in the jiffy-with no leaks-under the fingers of the skilled surgeon, hence making their procedures both time and risk-effective.

"Manual segment holds the largest market share of surgical staplers market."

Manual staplers are favorites of surgeons because they provide precision, simplicity, and familiarity. The immediate tactile feedback made during tissue approximation allows the surgeon to achieve the sense of tension, which will allow him to make the appropriate adjustment of technique on optimizing staple placement, especially in delicate cases. These hands-on controls guarantee perfect alignment of tissues and tight closure for fewer complications associated with improper healing of tissues or leakage. Surgeons like the intuitive feel of manual staplers, with consistent performance that is not so complex as powered devices. Ease combined with precision has convinced many surgeons to rely confidently on manual staplers as their staple for operations.

"Disposable segment holds the largest market share in the global surgical staplers market"

Although the initial cost of disposable staplers happens to be higher than that of re-usable staplers, the latter could actually save the facility quite a good sum in the long term by eliminating the costs incurred on sterilization and maintenance. Reusable staplers need to be cleaned and sterilized quite frequently and even serviced at regular intervals so that they remain in a functional and safe condition, increasing the operational expenses of healthcare facilities. Disposable staplers, on the other hand, come presterilized and ready for use: that is less labor, fewer resources are required for cleaning and maintenance. This approach may save more time and even cross-contamination, thereby justifying more expensive costs at the outset, improving overall efficiency and safety.

"Abdominal & pelvic surgery segment accounted for the largest market share in the global surgical staplers market and expected to grow at the highest CAGR during the forecast period."

The volume of abdominal surgeries, among them appendectomies, bowel resections, and pelvic surgery, is creating high demand for surgical staplers. Such procedures require accurate and efficient closure of tissues to ensure the desired outcome without any complications. Surgical staplers ensure uniform and secure closures and are essential instruments in such abdominal surgeries. This will be greatly prized in high-pressurized surgery environments due to their ability to diminish operative time and advance surgical accuracy. Growing cases of appendicitis and colorectal diseases, as well as gynecological disorders, are also bound to heighten further the demand for reliable operative stapling devices.

"Hospitals segment accounted for the largest market share in the global surgical staplers"

With expanding hospitals networks around the world, particularly in emerging markets, surgical volumes are increasing steeply along with demand for surgical staplers. It is primarily now that healthcare infrastructure is being improved and access to care is being expanded for a larger population that is forcing more patients into surgical treatments, and the need for reliable and effective surgical tools increases with them. As such, the emerging markets are also witnessing investments in advanced medical technologies to assist in complicated procedures. These would, therefore, further fuel the adoption of surgical staplers. Staplers have been considered to improve surgical accuracy, reduce operative time, and enhance outcomes for patients; thus, they form an essential part of modern surgical practice the world over.

"North America to witness the substantial growth rate during the forecast period."

The surgical staplers market is segmented into North America, Europe, Asia Pacific, Latin America, the Middle East & Africa and GCC Countries based on the region type. In 2023, the Asia Pacific region is projected to exhibit the highest CAGR during the forecast period. However, North America accounts for the largest market share of the surgical staplers market in 2023. North America specifically has high volumes of surgery in specialties like general surgery, orthopedics, and bariatric surgery, which are among the biggest drivers for surgical staplers. Overall advanced healthcare infrastructure and stress on state-of-art medical practices in the region also well support broad-scale adoption of the products. With such innovative houses as Medtronic and Johnson & Johnson that are persistently working on designing newer surgical stapling variants with characteristic properties like the introduction of powered mechanisms with real-time feedback systems that would still enhance precision and safety further, this type of development remains in line with the highest demand for minimal invasiveness, and that leads to the market growth with more adoption. North America will always remain on top as it has kept its focus on technologically outperforming surgical stapler application.

A breakdown of the primary participants (supply-side) for the surgical staplers market referred to for this report is provided below:

- By Company Type: Tier 1-45%, Tier 2-30%, and Tier 3-25%

- By Designation: C-level-35%, Director Level-25%, and Others-40%

- By Region: North America-40%, Europe-20%, Asia Pacific-25%, Latin America- 10%, and Middle East and Africa- 3% and GCC Countries- 2%

Prominent players in this market include Medtronic Plc (Ireland), Johnson & Johnson (Ethicon, Inc.) (US), Lepu Medical Technology (Beijing) Co.,Ltd. (China), Intuitive Surgical Inc (US), 3M Company (US), CONMED Corporation (US), B. Braun SE (Germany), Smith+Nephew (UK), Welfare Medical Ltd. (UK), Reach Surgical (China), Meril Life Sciences Pvt Ltd. (India), XNY Medical (China), Purple Surgical (UK), Frankenman International Ltd. (China), Lexington Medical (US), Ningbo Verykind Medical Device Co., Ltd (China), Waston Medical Corporation (China), Suture Planet (India), Dolphin Suture (India), Touchstone International Medical Science Co. Ltd. (China), NewGen Surgical (US), Edges Medicare Private Limited (India), Golden Stapler Surgical Co., Ltd., (China), Victor Medical Instruments Co., Ltd. (China), and Volkmann Medizintechnik GmbH (Germany).

Research Coverage:

The market study covers the surgical staplers market across various segments. It aims at estimating the market size and the growth potential of this market across different segments by type, technology, usability, application, end user and region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights on:

- Analysis of Market Dynamics: Drivers (technological advancements in surgical staplers, expansion of minimally invasive surgery (mis), rising surgical demand due to chronic diseases and healthcare expansion in emerging markets) restraints (high cost of advanced surgical staplers, risk of complications and device failures, limited adoption in emerging markets) opportunities (integration of surgical staplers with robotic surgery systems, expansion into low-resource settings and development of customizable and smart stapling solutions), and challenges (integration with existing surgical protocols, and navigating diverse regulatory environments)

- Services/Innovations: Detailed insights on upcoming technologies, research & development activities, and new product launches in the surgical staplers market.

- Market Development: Comprehensive information on the lucrative emerging markets, components, demographics, end-user, and region.

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the surgical staplers market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the surgical staplers market like Medtronic Plc (Ireland), Johnson & Johnson (Ethicon, Inc.) (US), Lepu Medical Technology (Beijing) Co.,Ltd. (China), Intuitive Surgical Inc (US), and 3M Company (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 SEGMENTS CONSIDERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

- 1.5.1 IMPACT OF AI/GEN AI

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 COMPANY PRESENTATIONS AND PRIMARY INTERVIEWS

- 2.2.4 TOP-DOWN APPROACH

- 2.2.5 PRIMARY RESEARCH VALIDATION

- 2.3 GROWTH FORECAST ESTIMATION

- 2.4 DATA TRIANGULATION

- 2.5 MARKET RANKING ANALYSIS

- 2.6 STUDY ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- 2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 SURGICAL STAPLERS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: SURGICAL STAPLERS MARKET, BY TYPE AND COUNTRY (2024)

- 4.3 SURGICAL STAPLERS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 SURGICAL STAPLERS MARKET: REGIONAL MIX, 2024-2029

- 4.5 SURGICAL STAPLERS MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements in surgical staplers

- 5.2.1.2 Increased adoption of minimally invasive surgical techniques over traditional open surgeries

- 5.2.1.3 Rising incidence of chronic lifestyle-related diseases

- 5.2.1.4 Growing healthcare sector in emerging economies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of advanced surgical staplers

- 5.2.2.2 Risk of complications and device failures

- 5.2.2.3 Limited adoption of surgical staplers in emerging markets

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of surgical staplers with robotic surgery systems

- 5.2.3.2 Increasing availability in low-resource settings

- 5.2.3.3 Development of customizable and smart stapling solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration with conventional surgical protocols and medical practices

- 5.2.4.2 Presence of diverse regulatory environments across regions

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 SHIFT TOWARD DISPOSABLE STAPLERS FOR INFECTION CONTROL

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Powered surgical staplers

- 5.4.1.2 Endoscopic staplers

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Tissue sealing and hemostasis

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Laser-based tissue welding

- 5.4.1 KEY TECHNOLOGIES

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 TRADE ANALYSIS OF MEDICAL DEVICE PRODUCTS (HS CODE 9018)

- 5.7.2 EXPORT DATA FOR LINEAR, CIRCULAR, AND SKIN SURGICAL STAPLERS (HS CODE 9018)

- 5.7.3 IMPORT DATA FOR LINEAR, CIRCULAR, AND SKIN SURGICAL STAPLERS (HS CODE 9018)

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 KEY BUYING CRITERIA

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATORY FRAMEWORK

- 5.10.2.1 North America

- 5.10.2.1.1 US

- 5.10.2.1.2 Canada

- 5.10.2.2 Europe

- 5.10.2.3 Asia Pacific

- 5.10.2.3.1 China

- 5.10.2.3.2 Japan

- 5.10.2.3.3 India

- 5.10.2.4 Latin America

- 5.10.2.4.1 Brazil

- 5.10.2.4.2 Mexico

- 5.10.2.5 Middle East

- 5.10.2.6 Africa

- 5.10.2.1 North America

- 5.11 PATENT ANALYSIS

- 5.11.1 PATENT PUBLICATION TRENDS FOR SURGICAL STAPLERS MARKET

- 5.11.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE OF LINEAR STAPLERS, BY REGION, 2021-2023 (USD)

- 5.13 KEY CONFERENCES & EVENTS, 2024-2025

- 5.14 ECOSYSTEM ANALYSIS

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.16 IMPACT OF AI/GEN AI ON SURGICAL STAPLERS MARKET

- 5.17 INVESTMENT & FUNDING SCENARIO

- 5.18 CASE STUDY ANALYSIS

- 5.18.1 CASE STUDY 1: 50 CASES OF LAPAROSCOPIC INTESTINAL ANASTOMOSIS BY ENDO GIA UNIVERSAL LOADING STAPLERS

- 5.18.2 CASE STUDY 2: COMPARISON OF SKIN STAPLERS AND SUTURES

- 5.18.3 CASE STUDY 3: EFFECTIVENESS OF STAPLE LINE REINFORCEMENT

- 5.19 ADJACENT MARKET ANALYSIS

- 5.19.1 ANASTOMOSIS DEVICES MARKET

- 5.19.2 BARIATRIC SURGERY DEVICES MARKET

- 5.19.3 MINIMALLY INVASIVE SURGICAL INSTRUMENTS MARKET

- 5.19.4 WOUND CARE MARKET

6 SURGICAL STAPLERS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 LINEAR STAPLERS

- 6.2.1 PREFERENCE FOR MINIMALLY INVASIVE SURGICAL PROCEDURES TO DRIVE ADOPTION

- 6.3 CIRCULAR STAPLERS

- 6.3.1 INCREASING PREVALENCE OF COLORECTAL CANCER AND CHRONIC GASTROINTESTINAL DISORDERS TO PROPEL MARKET GROWTH

- 6.4 SKIN STAPLERS

- 6.4.1 NEED FOR QUICK WOUND CLOSURE IN EMERGENCY ROOMS AND TRAUMA CENTERS TO SPUR MARKET GROWTH

- 6.5 OTHER STAPLERS

7 SURGICAL STAPLERS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 MANUAL STAPLERS

- 7.2.1 LOW TISSUE REACTIVITY AND REDUCED OPERATING TIME TO DRIVE ADOPTION IN SURGERIES

- 7.3 POWERED STAPLERS

- 7.3.1 TECHNOLOGICAL ADVANCEMENTS AND PREFERENCE FOR MINIMALLY INVASIVE SURGERIES TO SUPPORT MARKET GROWTH

8 SURGICAL STAPLERS MARKET, BY USABILITY

- 8.1 INTRODUCTION

- 8.2 DISPOSABLE STAPLERS

- 8.2.1 REDUCED CHANCE OF INFECTION AND NEED FOR MINIMAL MAINTENANCE TO BOOST MARKET GROWTH

- 8.3 REUSABLE STAPLERS

- 8.3.1 FOCUS ON REDUCING SURGICAL WASTES AND MAXIMIZING CLEANLINESS TO PROPEL MARKET GROWTH

9 SURGICAL STAPLERS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 ABDOMINAL & PELVIC SURGERY

- 9.2.1 RISING PREVALENCE OF OBESITY AND INCREASING COLORECTAL SURGERIES TO FUEL MARKET GROWTH

- 9.3 GENERAL SURGERY

- 9.3.1 RISING NUMBER OF GENERAL AND HERNIA SURGERIES TO BOOST ADOPTION OF SURGICAL STAPLERS

- 9.4 CARDIAC & THORACIC SURGERY

- 9.4.1 INCREASED NEED FOR CARDIAC INTERVENTION, LOBECTOMY, AND WEDGE RESECTION PROCEDURES TO DRIVE MARKET

- 9.5 ORTHOPEDIC SURGERY

- 9.5.1 FAVORABLE REIMBURSEMENT SCENARIO AND REDUCED POSTOPERATIVE COMPLICATIONS TO SUPPORT MARKET GROWTH

- 9.6 OTHER SURGICAL APPLICATIONS

10 SURGICAL STAPLERS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOSPITALS

- 10.2.1 RISE OF ROBOTIC-ASSISTED AND MINIMALLY INVASIVE SURGERIES TO FUEL MARKET GROWTH

- 10.3 AMBULATORY SURGERY CENTERS

- 10.3.1 COST-EFFECTIVENESS AND SHORTER PATIENT STAYS TO PROPEL MARKET GROWTH

- 10.4 OTHER END USERS

11 SURGICAL STAPLERS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 US to dominate North American surgical staplers market during study period

- 11.2.3 CANADA

- 11.2.3.1 Favorable government initiatives and high obesity rates to aid market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Low cost of surgeries and high healthcare expenditure to support adoption of advanced surgical staplers

- 11.3.3 UK

- 11.3.3.1 Growing incidence of cancer and rising geriatric population to boost market growth

- 11.3.4 FRANCE

- 11.3.4.1 Favorable reimbursement scenario for minimally invasive procedures to drive market

- 11.3.5 ITALY

- 11.3.5.1 Growing focus on research and increasing target patient population to fuel market growth

- 11.3.6 SPAIN

- 11.3.6.1 Increasing incidence of cardiovascular diseases to boost adoption of surgical staplers

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Increased incidence of obesity and rising geriatric population to drive market for advanced surgeries

- 11.4.3 JAPAN

- 11.4.3.1 Growing prevalence of lifestyle-related diseases and increasing geriatric population to spur market growth

- 11.4.4 INDIA

- 11.4.4.1 Better healthcare infrastructure and high government investments to propel market growth

- 11.4.5 AUSTRALIA

- 11.4.5.1 Increasing incidence of obesity and rising number of bariatric surgeries to aid market growth

- 11.4.6 SOUTH KOREA

- 11.4.6.1 High geriatric population and increased number of surgical procedures to fuel market growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 High diabetes rates and focus on private-public partnerships for better healthcare facilities to favor market growth

- 11.5.3 MEXICO

- 11.5.3.1 Increased focus on medical tourism and developed private healthcare sector to drive market

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 WELL-DEVELOPED HEALTHCARE INFRASTRUCTURE AND FAVORABLE GOVERNMENT INITIATIVES TO BOOST MARKET GROWTH

- 11.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.7 GCC COUNTRIES

- 11.7.1 HIGH DISPOSABLE INCOME AND INCREASED GOVERNMENT HEALTHCARE EXPENDITURE TO PROPEL MARKET GROWTH

- 11.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.1.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SURGICAL STAPLERS MARKET

- 12.2 REVENUE ANALYSIS, 2019-2023

- 12.3 MARKET SHARE ANALYSIS, 2023

- 12.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 PARTICIPANTS

- 12.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.4.5.1 Company footprint

- 12.4.5.2 Type footprint

- 12.4.5.3 Technology footprint

- 12.4.5.4 Usability footprint

- 12.4.5.5 Application footprint

- 12.4.5.6 End-user footprint

- 12.4.5.7 Region footprint

- 12.5 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.5.1 PROGRESSIVE COMPANIES

- 12.5.2 RESPONSIVE COMPANIES

- 12.5.3 DYNAMIC COMPANIES

- 12.5.4 STARTING BLOCKS

- 12.5.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.6 COMPANY VALUATION & FINANCIAL METRICS

- 12.7 BRAND/PRODUCT COMPARISON

- 12.8 SURGICAL STAPLERS MARKET: R&D EXPENDITURE

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES AND APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 MEDTRONIC

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 JOHNSON & JOHNSON SERVICES, INC. (ETHICON, INC.)

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD.

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Right to win

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses and competitive threats

- 13.1.4 INTUITIVE SURGICAL OPERATIONS, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product approvals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 3M

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 CONMED CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.7 B. BRAUN SE

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.8 SMITH+NEPHEW

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.9 WELFARE MEDICAL LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 REACH SURGICAL

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 MERIL LIFE SCIENCES PVT. LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Expansions

- 13.1.12 XNY MEDICAL

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 PURPLE SURGICAL

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.14 FRANKENMAN INTERNATIONAL LTD.

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.15 LEXINGTON MEDICAL CENTER

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product launches

- 13.1.1 MEDTRONIC

- 13.2 OTHER PLAYERS

- 13.2.1 NINGBO VERYKIND MEDICAL DEVICE CO., LTD.

- 13.2.2 WASTON MEDICAL CORPORATION

- 13.2.3 SUTURE PLANET

- 13.2.4 DOLPHIN SUTURES

- 13.2.5 TOUCHSTONE INTERNATIONAL MEDICAL SCIENCE CO., LTD.

- 13.2.6 NEWGEN SURGICAL

- 13.2.7 EDGES MEDICARE PRIVATE LIMITED

- 13.2.8 GOLDEN STAPLER SURGICAL CO., LTD.

- 13.2.9 VICTOR MEDICAL INSTRUMENTS CO., LTD.

- 13.2.10 VOLKMANN MEDIZINTECHNIK GMBH

14 APPENDIX

- 14.1 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.2 CUSTOMIZATION OPTIONS

- 14.3 RELATED REPORTS

- 14.4 AUTHOR DETAILS