|

|

市場調査レポート

商品コード

1590391

航空宇宙試験の世界市場:材料試験、環境試験、構造/コンポーネント試験、航空電子/飛行/電子試験、推進システム試験、インハウス、商業、軍事・防衛、宇宙探査 - 予測(~2029年)Aerospace Testing Market by Material Testing, Environmental Testing, Structural/Component Testing, Avionics/Flight & Electronics Testing, Propulsion System Testing, In-house, Commercial, Military & Defence, Space Exploration - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 航空宇宙試験の世界市場:材料試験、環境試験、構造/コンポーネント試験、航空電子/飛行/電子試験、推進システム試験、インハウス、商業、軍事・防衛、宇宙探査 - 予測(~2029年) |

|

出版日: 2024年11月05日

発行: MarketsandMarkets

ページ情報: 英文 271 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の航空宇宙試験の市場規模は、2024年に52億9,000万米ドルであり、2029年までに66億8,000万米ドルに達すると予測され、予測期間にCAGRで4.8%の成長が見込まれます。

市場の主な促進要因は、厳しい安全基準や規制基準、技術の進歩、世界の量産機や防衛機の保有機数の増加などです。FAAとEASAの規制機関は、厳格な試験と品質チェックを要求しています。したがって、先進の試験サービスが継続的に必要とされ、需要が確認されています。さらに、軽量材料、積層造形、デジタル化に向け航空宇宙産業が進歩し続けていることから、耐久性と性能を保証するための新材料や複雑なコンポーネントの専門的な試験に対する需要がますます高まっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 試験タイプ、ソーシングタイプ、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「航空宇宙試験市場のインハウスソーシングセグメントが予測期間に大きな市場シェアを獲得する見込みです。」

予測期間にインハウスソーシングセグメントが航空宇宙メーカーに試験プロセスの管理、カスタマイズ、機密性を提供するため、航空宇宙試験市場をリードする可能性が高いです。社内試験プロセスを利用する企業は、独自の技術や機密データも管理できます。これは、防衛・航空宇宙産業における重要な機能です。さらに、社内試験施設は、高度にカスタマイズされた試験プロトコルの開発を可能にし、社内試験施設に基づいて特定の製品設計の研究開発プロセスの効率を高めることができます。材料、推進システム、航空電子技術が発展するにつれて、メーカーの社内施設はリードタイムを増加させる第三者のスケジュールに依存することなく、迅速な進化と革新を可能にし、製品の品質管理を向上させます。

「環境試験サービスが予測期間に大幅な成長率を記録します。」

極端な温度や条件に耐えられるかどうかを調べるために試験される航空宇宙コンポーネントの数が増加しているため、航空宇宙試験市場は予測期間に環境試験サービスにおいて高い拡大率を記録する見通しです。航空機は、激しい温度変化、高い高度、湿度、振動などの過酷な環境にさらされ続けるため、航空機の安全性や性能を損なうことなく、コンポーネントがこれらの条件に耐えられるかどうかを確認するための試験が必要となっています。環境試験は、燃料消費を削減するために持続可能な航空への動きの一環として開発されている、可動式かつ革命的な新しい推進システムや燃料節約活動に関連する、新しく開発された材料や設計を検証するために必要です。

「欧州は予測期間に大きなCAGRで成長すると思われます。」

航空宇宙のイノベーション、防衛、民間航空への投資の増加により、航空宇宙試験市場は予測期間に大幅なCAGRで成長する見込みであり、中でも欧州は注目の地域です。フランス、ドイツ、英国などの国々は、次世代航空機、防衛システム、持続可能な航空技術の開発に依存する先進のサービスの需要がある主要な航空宇宙製造拠点です。さらに重要な点として、EASA(European Union Aviation Safety Agency)のような機関による厳格な規制基準が、広範な試験とコンプライアンスへのニーズを促進し、市場成長に弾みをつけています。また、欧州のグリーンアビエーションや低炭素排出に向けた取り組みも、燃料消費に利用される技術の効率性を検証する試験サービスへの需要を支える一助となっています。

当レポートでは、世界の航空宇宙試験市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 航空宇宙試験市場の企業にとって魅力的な機会

- 航空宇宙試験市場:ソーシングタイプ別

- 航空宇宙試験市場:エンドユーザー別

- 航空宇宙試験市場:試験タイプ別

- 航空宇宙試験市場:地域別

第5章 市場の概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- 輸入シナリオ

- 輸出シナリオ

- 主な会議とイベント(2024年~2025年)

- ケーススタディ分析

- 関税と規制情勢

- 関税分析

- 規制分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 航空宇宙試験市場に対するAI/生成AIの影響

- イントロダクション

- 航空宇宙試験における生成AIの活用

- 航空宇宙試験市場に対する生成AIの影響

第6章 航空宇宙試験市場:ソーシングタイプ別

- イントロダクション

- インハウス

- アウトソーシング

第7章 航空宇宙試験市場:試験タイプ別

- イントロダクション

- 材料試験

- 燃料試験

- 環境試験

- 構造/コンポーネント試験

- 航空電子/飛行・電子試験

- 推進システム試験

- その他の試験タイプ

第8章 航空宇宙試験市場:エンドユーザー別

- イントロダクション

- 商業

- 軍事・防衛

- 宇宙探査

- その他のエンドユーザー

第9章 航空宇宙試験市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 南米

- 中東・アフリカ

第10章 競合情勢

- 概要

- 主要企業戦略/有力企業(2020年~2024年)

- 収益分析(2020年~2023年)

- 市場シェア分析(2023年)

- 企業の評価と財務指標(2024年)

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオと動向

第11章 企業プロファイル

- 主な試験サービスプロバイダー

- ELEMENT MATERIALS TECHNOLOGY

- SGS SA

- INTERTEK GROUP PLC

- TUV SUD

- APPLUS+

- TUV RHEINLAND

- EUROFINS SCIENTIFIC

- BUREAU VERITAS

- DEKRA

- MISTRAS GROUP

- その他の試験サービスプロバイダー

- TESTEK SOLUTIONS

- TEKTRONIX, INC.

- ROHDE & SCHWARZ

- DAYTON T. BROWN, INC.

- MTS SYSTEMS

- APPLIED TECHNICAL SERVICES

- ALS

- 主な航空宇宙企業

- THE BOEING COMPANY

- AIRBUS

- LOCKHEED MARTIN CORPORATION

- NORTHROP GRUMMAN

- COLLINS AEROSPACE

- その他の試験装置プロバイダー

- GE AEROSPACE

- GENERAL DYNAMICS

- MOOG INC.

- LABORATORY TESTING INC.

第12章 付録

List of Tables

- TABLE 1 RISK ASSESSMENT: AEROSPACE TESTING MARKET

- TABLE 2 AEROSPACE TESTING MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 3 LIST OF PATENTS RELATED TO AEROSPACE TESTING, 2020-2023

- TABLE 4 IMPORT DATA FOR HS CODE 8807 (PARTS OF AIRCRAFT/SPACECRAFT)-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 5 EXPORT DATA FOR HS CODE 8807 (PARTS OF AIRCRAFT/SPACECRAFT)-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 6 AEROSPACE TESTING MARKET: DETAILED LIST OF RELATED CONFERENCES AND EVENTS, 2024-2025

- TABLE 7 US: EXPORT TARIFF FOR HS CODE 8807-COMPLIANT PRODUCTS, 2023

- TABLE 8 HONG KONG: EXPORT TARIFF FOR HS CODE 8807-COMPLIANT PRODUCTS, 2023

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 AEROSPACE TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 16 AEROSPACE TESTING MARKET, BY SOURCING TYPE, 2020-2023 (USD MILLION)

- TABLE 17 AEROSPACE TESTING MARKET, BY SOURCING TYPE, 2024-2029 (USD MILLION)

- TABLE 18 AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 19 AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 20 AEROSPACE MATERIAL TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 21 AEROSPACE MATERIAL TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 22 NORTH AMERICA: AEROSPACE MATERIAL TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 23 NORTH AMERICA: AEROSPACE MATERIAL TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 24 EUROPE: AEROSPACE MATERIAL TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 25 EUROPE: AEROSPACE MATERIAL TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 26 ASIA PACIFIC: AEROSPACE MATERIAL TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 27 ASIA PACIFIC: AEROSPACE MATERIAL TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 28 ROW: AEROSPACE MATERIAL TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 29 ROW: AEROSPACE MATERIAL TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 30 AEROSPACE FUEL TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 31 AEROSPACE FUEL TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 32 NORTH AMERICA: AEROSPACE FUEL TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

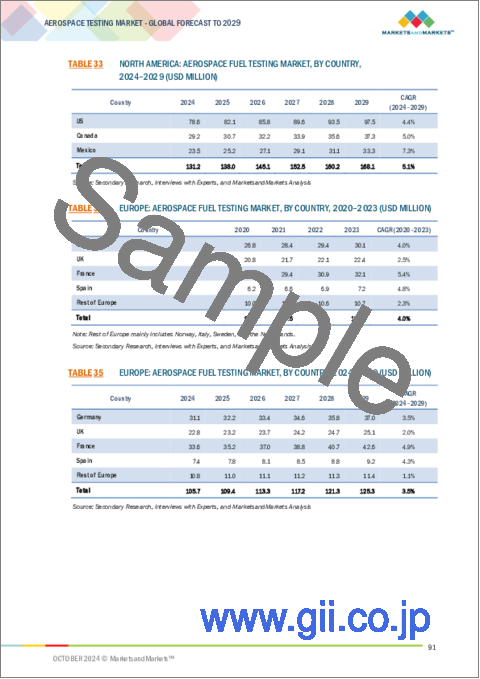

- TABLE 33 NORTH AMERICA: AEROSPACE FUEL TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 34 EUROPE: AEROSPACE FUEL TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 35 EUROPE: AEROSPACE FUEL TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 36 ASIA PACIFIC: AEROSPACE FUEL TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 37 ASIA PACIFIC: AEROSPACE FUEL TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 38 ROW: AEROSPACE FUEL TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 39 ROW: AEROSPACE FUEL TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 40 AEROSPACE ENVIRONMENTAL TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 41 AEROSPACE ENVIRONMENTAL TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 42 NORTH AMERICA: AEROSPACE ENVIRONMENTAL TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 43 NORTH AMERICA: AEROSPACE ENVIRONMENTAL TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 44 EUROPE: AEROSPACE ENVIRONMENTAL TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 45 EUROPE: AEROSPACE ENVIRONMENTAL TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 46 ASIA PACIFIC: AEROSPACE ENVIRONMENTAL TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 47 ASIA PACIFIC: AEROSPACE ENVIRONMENTAL TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 48 ROW: AEROSPACE ENVIRONMENTAL TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 49 ROW: AEROSPACE ENVIRONMENTAL TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 50 AEROSPACE STRUCTURAL/COMPONENT TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 51 AEROSPACE STRUCTURAL/COMPONENT TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 NORTH AMERICA: AEROSPACE STRUCTURAL/COMPONENT TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 53 NORTH AMERICA: AEROSPACE STRUCTURAL/COMPONENT TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 54 EUROPE: AEROSPACE STRUCTURAL/COMPONENT TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 55 EUROPE: AEROSPACE STRUCTURAL/COMPONENT TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 56 ASIA PACIFIC: AEROSPACE STRUCTURAL/COMPONENT TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 57 ASIA PACIFIC: AEROSPACE STRUCTURAL/COMPONENT TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 58 ROW: AEROSPACE STRUCTURAL/COMPONENT TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 59 ROW: AEROSPACE STRUCTURAL/COMPONENT TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 60 AEROSPACE AVIONICS/FLIGHT & ELECTRONICS TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 61 AEROSPACE AVIONICS/FLIGHT & ELECTRONICS TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 62 NORTH AMERICA: AEROSPACE AVIONICS/FLIGHT & ELECTRONICS TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 63 NORTH AMERICA: AEROSPACE AVIONICS/FLIGHT & ELECTRONICS TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 64 EUROPE: AEROSPACE AVIONICS/FLIGHT & ELECTRONICS TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 65 EUROPE: AEROSPACE AVIONICS/FLIGHT & ELECTRONICS TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 66 ASIA PACIFIC: AEROSPACE AVIONICS/FLIGHT & ELECTRONICS TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 67 ASIA PACIFIC: AEROSPACE AVIONICS/FLIGHT & ELECTRONICS TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 68 ROW: AEROSPACE AVIONICS/FLIGHT & ELECTRONICS TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 69 ROW: AEROSPACE AVIONICS/FLIGHT & ELECTRONICS TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 70 AEROSPACE PROPULSION SYSTEM TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 71 AEROSPACE PROPULSION SYSTEM TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 72 NORTH AMERICA: AEROSPACE PROPULSION SYSTEM TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 73 NORTH AMERICA: AEROSPACE PROPULSION SYSTEM TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 74 EUROPE: AEROSPACE PROPULSION SYSTEM TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 75 EUROPE: AEROSPACE PROPULSION SYSTEM TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 76 ASIA PACIFIC: AEROSPACE PROPULSION SYSTEM TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 77 ASIA PACIFIC: AEROSPACE PROPULSION SYSTEM TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 78 ROW: AEROSPACE PROPULSION SYSTEM TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 79 ROW: AEROSPACE PROPULSION SYSTEM TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 80 OTHER AEROSPACE TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 81 OTHER AEROSPACE TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 82 NORTH AMERICA: OTHER AEROSPACE TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 83 NORTH AMERICA: OTHER AEROSPACE TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 84 EUROPE: OTHER AEROSPACE TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 85 EUROPE: OTHER AEROSPACE TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 86 ASIA PACIFIC: OTHER AEROSPACE TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 87 ASIA PACIFIC: OTHER AEROSPACE TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 88 ROW: OTHER AEROSPACE TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 89 ROW: OTHER AEROSPACE TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 90 AEROSPACE TESTING MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 91 AEROSPACE TESTING MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 92 AEROSPACE TESTING MARKET IN COMMERCIAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 93 AEROSPACE TESTING MARKET IN COMMERCIAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 94 AEROSPACE TESTING MARKET IN MILITARY & DEFENSE, BY REGION, 2020-2023 (USD MILLION)

- TABLE 95 AEROSPACE TESTING MARKET IN MILITARY & DEFENSE, BY REGION, 2024-2029 (USD MILLION)

- TABLE 96 AEROSPACE TESTING MARKET IN SPACE EXPLORATION, BY REGION, 2020-2023 (USD MILLION)

- TABLE 97 AEROSPACE TESTING MARKET IN SPACE EXPLORATION, BY REGION, 2024-2029 (USD MILLION)

- TABLE 98 AEROSPACE TESTING MARKET IN OTHER END USERS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 99 AEROSPACE TESTING MARKET IN OTHER END USERS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 100 AEROSPACE TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 101 AEROSPACE TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 102 NORTH AMERICA: AEROSPACE TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 103 NORTH AMERICA: AEROSPACE TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 104 NORTH AMERICA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 105 NORTH AMERICA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 106 NORTH AMERICA: AEROSPACE TESTING MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 107 NORTH AMERICA: AEROSPACE TESTING MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 108 US: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 109 US: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 110 CANADA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 111 CANADA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 112 MEXICO: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 113 MEXICO: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 114 EUROPE: AEROSPACE TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 115 EUROPE: AEROSPACE TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 116 EUROPE: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 117 EUROPE: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 118 EUROPE: AEROSPACE TESTING MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 119 EUROPE: AEROSPACE TESTING MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 120 GERMANY: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 121 GERMANY: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 122 UK: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 123 UK: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 124 FRANCE: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 125 FRANCE: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 126 SPAIN: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 127 SPAIN: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 128 REST OF EUROPE: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 129 REST OF EUROPE: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 130 ASIA PACIFIC: AEROSPACE TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 131 ASIA PACIFIC: AEROSPACE TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 132 ASIA PACIFIC: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 133 ASIA PACIFIC: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 134 ASIA PACIFIC: AEROSPACE TESTING MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 135 ASIA PACIFIC: AEROSPACE TESTING MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 136 CHINA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 137 CHINA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 138 JAPAN: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 139 JAPAN: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 140 INDIA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 141 INDIA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 142 SOUTH KOREA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 143 SOUTH KOREA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 144 AUSTRALIA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 145 AUSTRALIA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 148 ROW: AEROSPACE TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 149 ROW: AEROSPACE TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 150 ROW: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 151 ROW: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 152 ROW: AEROSPACE TESTING MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 153 ROW: AEROSPACE TESTING MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 154 SOUTH AMERICA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 155 SOUTH AMERICA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 156 SOUTH AMERICA: AEROSPACE TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 157 SOUTH AMERICA: AEROSPACE TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: AEROSPACE TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: AEROSPACE TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 162 GCC: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 163 GCC: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 164 REST OF MIDDLE EAST & AFRICA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2020-2023 (USD MILLION)

- TABLE 165 REST OF MIDDLE EAST & AFRICA: AEROSPACE TESTING MARKET, BY TESTING TYPE, 2024-2029 (USD MILLION)

- TABLE 166 AEROSPACE TESTING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 167 AEROSPACE TESTING MARKET: DEGREE OF COMPETITION, 2023

- TABLE 168 AEROSPACE TESTING MARKET: TESTING TYPE FOOTPRINT

- TABLE 169 AEROSPACE TESTING MARKET: END USER FOOTPRINT

- TABLE 170 AEROSPACE TESTING MARKET: SOURCING TYPE FOOTPRINT

- TABLE 171 AEROSPACE TESTING MARKET: REGION FOOTPRINT

- TABLE 172 AEROSPACE TESTING MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 173 AEROSPACE TESTING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 174 AEROSPACE TESTING MARKET: DEALS, JULY 2020-OCTOBER 2024

- TABLE 175 AEROSPACE TESTING MARKET: EXPANSIONS, JULY 2020-OCTOBER 2024

- TABLE 176 AEROSPACE TESTING MARKET: OTHER DEVELOPMENTS, JULY 2020-OCTOBER 2024

- TABLE 177 ELEMENT MATERIALS TECHNOLOGY: COMPANY OVERVIEW

- TABLE 178 ELEMENT MATERIALS TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 ELEMENT MATERIALS TECHNOLOGY: DEALS

- TABLE 180 ELEMENT MATERIALS TECHNOLOGY: EXPANSIONS

- TABLE 181 ELEMENT MATERIALS TECHNOLOGY: OTHER DEVELOPMENTS

- TABLE 182 SGS SA: COMPANY OVERVIEW

- TABLE 183 SGS SA: PRODUCTS/PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 SGS SA: OTHER DEVELOPMENTS

- TABLE 185 INTERTEK GROUP PLC: COMPANY OVERVIEW

- TABLE 186 INTERTEK GROUP PLC: PRODUCT/SOLUTION/SERVICE OFFERED

- TABLE 187 INTERTEK GROUP PLC: DEALS

- TABLE 188 INTERTEK GROUP PLC: EXPANSIONS

- TABLE 189 TUV SUD: COMPANY OVERVIEW

- TABLE 190 TUV SUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 APPLUS+: COMPANY OVERVIEW

- TABLE 192 APPLUS+: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 APPLUS+: DEALS

- TABLE 194 TUV RHEINLAND: COMPANY OVERVIEW

- TABLE 195 TUV RHEINLAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 TUV RHEINLAND: DEALS

- TABLE 197 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- TABLE 198 EUROFINS SCIENTIFIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 BUREAU VERITAS: COMPANY OVERVIEW

- TABLE 200 BUREAU VERITAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 BUREAU VERITAS: DEALS

- TABLE 202 BUREAU VERITAS: OTHER DEVELOPMENTS

- TABLE 203 DEKRA: COMPANY OVERVIEW

- TABLE 204 DEKRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 MISTRAS GROUP: COMPANY OVERVIEW

- TABLE 206 MISTRAS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 THE BOEING COMPANY: COMPANY OVERVIEW

- TABLE 208 THE BOEING COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 THE BOEING COMPANY: DEALS

- TABLE 210 AIRBUS: COMPANY OVERVIEW

- TABLE 211 AIRBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 213 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 215 NORTHROP GRUMMAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 COLLINS AEROSPACE: COMPANY OVERVIEW

- TABLE 217 COLLINS AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 AEROSPACE TESTING MARKET SEGMENTATION

- FIGURE 2 AEROSPACE TESTING MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY AEROSPACE TESTING SERVICE PROVIDERS

- FIGURE 5 APPROACH 2 (DEMAND SIDE): BOTTOM-UP ESTIMATION BASED ON REGION

- FIGURE 6 AEROSPACE TESTING MARKET: BOTTOM-UP APPROACH

- FIGURE 7 AEROSPACE TESTING MARKET: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION: AEROSPACE TESTING MARKET

- FIGURE 9 AEROSPACE TESTING MARKET, 2020-2029

- FIGURE 10 AVIONICS/FLIGHT & ELECTRONICS TESTING TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 IN-HOUSE SOURCING TO ACCOUNT FOR LARGER SHARE OF AEROSPACE TESTING MARKET

- FIGURE 12 COMMERCIAL END USER TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 13 ASIA PACIFIC TO RECORD HIGHEST CAGR IN AEROSPACE TESTING MARKET

- FIGURE 14 INCREASE IN AIR TRAVEL AND INVESTMENT IN MILITARY AND SPACE EXPLORATION PROJECTS TO DRIVE MARKET

- FIGURE 15 IN-HOUSE TESTING TO GROW NOTABLY BETWEEN 2024 AND 2029

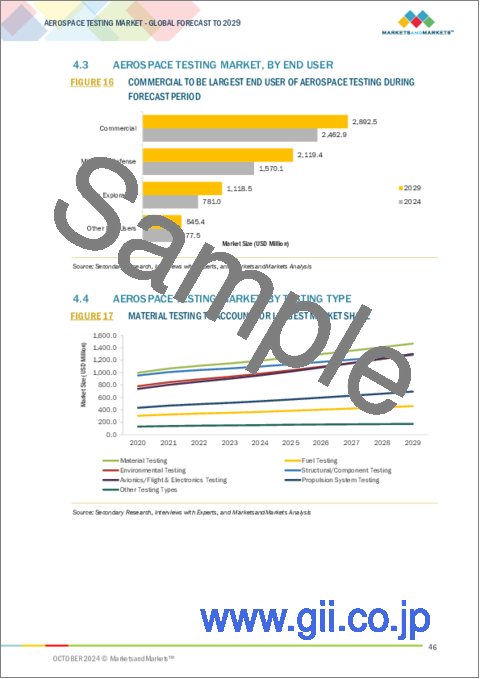

- FIGURE 16 COMMERCIAL TO BE LARGEST END USER OF AEROSPACE TESTING DURING FORECAST PERIOD

- FIGURE 17 MATERIAL TESTING TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 18 NORTH AMERICA TO DOMINATE AEROSPACE TESTING MARKET DURING FORECAST PERIOD

- FIGURE 19 AEROSPACE TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 AEROSPACE TESTING MARKET DRIVERS AND THEIR IMPACT

- FIGURE 21 AEROSPACE TESTING MARKET RESTRAINTS AND THEIR IMPACT

- FIGURE 22 AEROSPACE TESTING MARKET OPPORTUNITIES AND THEIR IMPACT

- FIGURE 23 AEROSPACE TESTING MARKET CHALLENGES AND THEIR IMPACT

- FIGURE 24 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AEROSPACE TESTING MARKET PLAYERS

- FIGURE 25 AEROSPACE TESTING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 AEROSPACE TESTING MARKET: KEY PLAYERS IN ECOSYSTEM

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO

- FIGURE 28 PATENTS GRANTED IN AEROSPACE MARKET

- FIGURE 29 IMPORT DATA FOR HS CODE 8807- PARTS OF AIRCRAFT/SPACECRAFT FOR KEY COUNTRIES, 2020-2023

- FIGURE 30 EXPORT DATA FOR HS CODE 8807- PARTS OF AIRCRAFT/SPACECRAFT FOR KEY COUNTRIES, 2020-2023

- FIGURE 31 AEROSPACE TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 33 BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 34 ADOPTION OF GEN AI IN AEROSPACE TESTING

- FIGURE 35 IN-HOUSE SOURCING TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 36 AVIONICS/FLIGHT & ELECTRONICS TESTING TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 COMMERCIAL END USER TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 38 AEROSPACE TESTING MARKET, BY REGION

- FIGURE 39 INDIA TO EXHIBIT HIGHEST CAGR IN AEROSPACE TESTING MARKET DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO RECORD HIGHEST CAGR IN AEROSPACE TESTING MARKET DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: AEROSPACE TESTING MARKET SNAPSHOT

- FIGURE 42 EUROPE: AEROSPACE TESTING MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: AEROSPACE TESTING MARKET SNAPSHOT

- FIGURE 44 AEROSPACE TESTING MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2023

- FIGURE 45 AEROSPACE TESTING MARKET SHARE ANALYSIS, 2023

- FIGURE 46 AEROSPACE TESTING MARKET: COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 47 AEROSPACE TESTING MARKET: FINANCIAL METRICS, 2024 (EV/EBITDA)

- FIGURE 48 BRAND/PRODUCT COMPARISON

- FIGURE 49 AEROSPACE TESTING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 50 AEROSPACE TESTING MARKET: COMPANY FOOTPRINT

- FIGURE 51 AEROSPACE TESTING: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 52 ELEMENT MATERIALS TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 53 SGS SA: COMPANY SNAPSHOT

- FIGURE 54 INTERTEK GROUP PLC: COMPANY SNAPSHOT

- FIGURE 55 TUV SUD: COMPANY SNAPSHOT

- FIGURE 56 APPLUS+: COMPANY SNAPSHOT

- FIGURE 57 TUV RHEINLAND: COMPANY SNAPSHOT

- FIGURE 58 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- FIGURE 59 BUREAU VERITAS: COMPANY SNAPSHOT

- FIGURE 60 DEKRA: COMPANY SNAPSHOT

- FIGURE 61 MISTRAS GROUP: COMPANY SNAPSHOT

- FIGURE 62 THE BOEING COMPANY: COMPANY SNAPSHOT

- FIGURE 63 AIRBUS: COMPANY SNAPSHOT

- FIGURE 64 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 NORTHROP GRUMMAN: COMPANY SNAPSHOT

The global aerospace testing was valued at USD 5.29 billion in 2024 and is projected to reach USD 6.68 billion by 2029; it is expected to register a CAGR of 4.8% during the forecast period. Several key factors that drive the aerospace testing market include stringent safety and regulatory standards, technological advancements and the growing global fleet of production and defence aircraft. The FAA and EASA regulatory bodies demand rigorous testing and quality checks; thus, advanced testing services are needed to continue and the demand is confirmed. Furthermore, given the ongoing advancement of the aerospace industry toward lightweight materials, additive manufacturing, and digitalization, more and more demand is being created for the specialized testing of new materials and complex components to assure durability and performance.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Testing Type, Sourcing Type, End-user, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The in-house sourcing segment of aerospace testing market is expected to have significant market share during the forecast period."

During the forecast period, it is probable that the in-house sourcing segment will lead the market for aerospace testing as it provides aerospace manufacturers with control, customization, and confidentiality in the testing process. Companies utilizing in-house testing processes will also control their proprietary technology and sensitive data. This is a key function in the defense and aerospace industries. Additionally, in-house testing facilities enable the development of highly customized testing protocols that can enhance the efficiency of the R&D process for a specific product design based on the in-house testing facilities. As materials, propulsion systems, and avionics technology develop, the in-house facilities of manufacturers enable them to rapidly evolve and innovate with no reliance on third parties schedules, which increases lead times, and improves the quality control of their products.

"The Environmental Testing services to record significant growth rate during the forecast period"

During the forecast period, the aerospace testing market is poised to have a high expansion rate for environmental testing services, as an increasing number of aerospace components are being tested to find out if they will be able to withstand extreme temperatures and conditions. Due to the continued exposure of the aircraft to harsh environments, such as violent changes in temperature, high altitudes, humidity, and vibration, it has been necessary to test the components to ensure that they are able to stand up to these conditions without compromising the aircraft's safety or performance. Environmental tests are needed in order to validate newly developed materials and designs associated with portable, but revolutionary, new propulsion systems and fuel-saving efforts that are being developed as part of the move toward sustainable aviation in order to reduce fuel consumption.

"The Europe is likely to grow at the significant CAGR during the forecast period."

Due to the increasing investments in aerospace innovation, defense, and commercial aviation, the aerospace testing market is poised to grow at a significant CAGR during the forecast period, with Europe being an area in focus. Countries such as France, Germany, and the UK are main leading aerospace manufacturing hubs whose demand for advanced services relies on the development of next generation aircraft, defense systems, and sustainable aviation technologies. More importantly, strict regulatory standards of agencies such as the EASA-European Union Aviation Safety Agency facilitate the need for extensive testing and compliance, thereby giving an impetus to market growth. Also, European green aviation and efforts toward low carbon emissions also help in supporting the demand for testing services that validate efficiency in technologies applied to fuel consumption.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 55%, Tier 2 - 25%, Tier 3 - 20%

- By Designation-Directors - 50%, Managers - 30%, Others - 20%

- By Region- Asia Pacific - 20%, Europe - 30%, , North America - 45%, RoW - 5%

The aerospace testing market is dominated by a few globally established players such as Element Materials Technology (UK), SGS SA (Switzerland), Intertek Group plc (UK), Applus+ (Spain), TUV SUD (Germany), TUV Rheinland (Germany), TUV NORD Group (Germany), Rohde & Schwarz (Germany), Eurofins Scientific (Luxembourg), The Boeing Company (US), Airbus (Netherlands), MISTRAS Group (US), Lockheed Martin Corporation (US), Bureau Veritas (France), and DEKRA (Germany). The study includes an in-depth competitive analysis of these key players in the aerospace testing market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the aerospace testing market and forecasts its size by testing type, sourcing type, and vertical. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the aerospace testing ecosystem.

Key Benefits to Buy the Report:

- Analysis of key drivers (Rising demand for commercial aircraft necessitates both initial and ongoing testing of new aircraft and their components, governments are investing heavily in military and defense aircraft, requiring rigorous testing, the advancement in new technology is evolving demand for specialized aerospace testing), restraint (The rapid advancement of aerospace technologies requires ongoing updates in testing methodologies and equipment), opportunity (Increased use of UAVs in commercial and defense applications drives demand for specialized testing, the shift toward sustainable aviation with alternative fuels, lightweight materials, and energy-efficient designs creates demand for testing, the development of advanced aircraft technologies creates a growing need for specialized testing.), challenges (the rapid advancement of aerospace technologies requires ongoing updates in testing methodologies and equipment)

- Service Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the aerospace testing market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the aerospace testing market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the aerospace testing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Element Materials Technology (UK), SGS SA (Switzerland), Intertek Group plc (UK), Applus+ (Spain), TUV SUD (Germany), TUV Rheinland (Germany), TUV NORD Group (Germany), Rohde & Schwarz (Germany), Eurofins Scientific (Luxembourg), The Boeing Company (US), Airbus (Netherlands), MISTRAS Group (US), Lockheed Martin Corporation (US), Bureau Veritas (France), and DEKRA (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Intended participants and key opinion leaders in primary interviews

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size by bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market share by top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AEROSPACE TESTING MARKET

- 4.2 AEROSPACE TESTING MARKET, BY SOURCING TYPE

- 4.3 AEROSPACE TESTING MARKET, BY END USER

- 4.4 AEROSPACE TESTING MARKET, BY TESTING TYPE

- 4.5 AEROSPACE TESTING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 DRIVERS

- 5.1.1.1 Rising demand for commercial aircraft in developing economies

- 5.1.1.2 Growing use of UAVs in military and commercial applications

- 5.1.1.3 Significant investments by governments in military and defense aircraft

- 5.1.2 RESTRAINTS

- 5.1.2.1 Complex and time-consuming testing process due to stringent regulations

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Development of advanced aircraft technologies creating need for specialized testing

- 5.1.3.2 Need for new testing methodologies to cater to evolving aerospace technologies

- 5.1.4 CHALLENGES

- 5.1.4.1 Budget constraints necessitating aerospace companies to cut testing costs

- 5.1.1 DRIVERS

- 5.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Additive manufacturing and robotics

- 5.6.1.2 Traditional molding

- 5.6.1.3 Automated lay-up

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Advanced placed ply

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Automated test equipment (ATE)

- 5.6.3.2 Data acquisition and control (DAQ) systems

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PATENT ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO

- 5.8.2 EXPORT SCENARIO

- 5.9 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 CASE STUDY 1: VELOCITY COMPOSITES EXPANDS INTO US MARKET AND SUPPORTS GKN AEROSTRUCTURES

- 5.10.2 CASE STUDY 2: GKN AEROSPACE AND GE AEROSPACE EXTEND PARTNERSHIP FOR AEROENGINE DEVELOPMENT AND PRODUCTION

- 5.10.3 CASE STUDY 3: HEXCEL INTRODUCES LATEST HEXTOW CARBON FIBER INNOVATION

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 TARIFF ANALYSIS

- 5.11.2 REGULATORY ANALYSIS

- 5.11.2.1 Regulatory bodies, government agencies, and other organizations

- 5.11.2.2 Standards

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 IMPACT OF AI/GEN AI ON AEROSPACE TESTING MARKET

- 5.14.1 INTRODUCTION

- 5.14.2 USE OF GEN AI IN AEROSPACE TESTING

- 5.14.3 IMPACT OF GEN AI ON AEROSPACE TESTING MARKET

6 AEROSPACE TESTING MARKET, BY SOURCING TYPE

- 6.1 INTRODUCTION

- 6.2 IN-HOUSE

- 6.2.1 IN-HOUSE TESTING ENABLES MAINTAINING CONTROL OVER PROPRIETARY DESIGNS, TECHNOLOGY, AND CLASSIFIED DATA

- 6.3 OUTSOURCED

- 6.3.1 OUTSOURCING ALLOWS AEROSPACE COMPANIES TO REDUCE TESTING COSTS

7 AEROSPACE TESTING MARKET, BY TESTING TYPE

- 7.1 INTRODUCTION

- 7.2 MATERIAL TESTING

- 7.2.1 INCREASED DEMAND FOR LIGHTWEIGHT MATERIALS TO DRIVE MARKET

- 7.3 FUEL TESTING

- 7.3.1 INCREASING GLOBAL REGULATIONS ON EMISSIONS AND FUEL EFFICIENCY DRIVING NEED FOR FUEL TESTING

- 7.4 ENVIRONMENTAL TESTING

- 7.4.1 ADOPTION OF NEW LIGHTWEIGHT, HIGH-STRENGTH MATERIALS NECESSITATING RIGOROUS ENVIRONMENTAL TESTING

- 7.5 STRUCTURAL/COMPONENT TESTING

- 7.5.1 RISING DEMAND FOR COMMERCIAL AND MILITARY AIRCRAFT FUELING STRUCTURAL AND COMPONENT TESTING

- 7.6 AVIONICS/FLIGHT & ELECTRONICS TESTING

- 7.6.1 DEVELOPMENT OF AUTONOMOUS FLYING SYSTEMS AND ELECTRIC AIRCRAFT FUELING DEMAND FOR INNOVATIVE TESTING METHODS

- 7.7 PROPULSION SYSTEM TESTING

- 7.7.1 GROWING INTEREST IN SPACE TRAVEL FUELING DEMAND FOR THOROUGH TESTING OF ROCKET PROPULSION SYSTEMS

- 7.8 OTHER TESTING TYPES

8 AEROSPACE TESTING MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 COMMERCIAL

- 8.2.1 GROWING DEMAND FOR AIR TRAVEL NECESSITATING AIRLINES TO EXPAND THEIR FLEETS

- 8.3 MILITARY & DEFENSE

- 8.3.1 GROWING DEFENSE SPENDING ACROSS MAJOR COUNTRIES SUPPORTING MARKET GROWTH

- 8.4 SPACE EXPLORATION

- 8.4.1 INCREASING INVESTMENTS IN SPACE PROGRAMS TO DRIVE MARKET

- 8.5 OTHER END USERS

9 AEROSPACE TESTING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Presence of strong aviation sector fueling demand for aerospace testing

- 9.2.3 CANADA

- 9.2.3.1 Increasing investments in aerospace and defense sector to drive market

- 9.2.4 MEXICO

- 9.2.4.1 Expanding aerospace manufacturing sector to support market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Focus on hydrogen and electric propulsion systems to drive testing needs for new aircraft technologies

- 9.3.3 UK

- 9.3.3.1 Advancements in drones and advanced fighter jets development driving aerospace testing market

- 9.3.4 FRANCE

- 9.3.4.1 Robust space sector fueling demand for aerospace testing

- 9.3.5 SPAIN

- 9.3.5.1 Presence of strong aircraft components manufacturing driving testing market

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Rapidly increasing air travel demand driving production of commercial aircraft

- 9.4.3 JAPAN

- 9.4.3.1 Increasing focus on cutting emissions and noise to drive testing for cleaner aerospace technologies

- 9.4.4 INDIA

- 9.4.4.1 Significant defense budget and emphasis on modernizing air capabilities to drive market

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Focus on UAVs and autonomous systems for defense and commercial applications to drive market

- 9.4.6 AUSTRALIA

- 9.4.6.1 Rebound of commercial aviation industry and expansion of defense aircraft fleets to drive demand

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 ROW

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 SOUTH AMERICA

- 9.5.2.1 Rising passenger traffic and fleet expansion to drive demand for testing and certification

- 9.5.3 MIDDLE EAST & AFRICA

- 9.5.3.1 GCC

- 9.5.3.1.1 Investments in defense to enhance military capabilities and maintain regional security to support market growth

- 9.5.3.2 Rest of Middle East & Africa

- 9.5.3.1 GCC

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 10.3 REVENUE ANALYSIS, 2020-2023

- 10.4 MARKET SHARE ANALYSIS, 2023

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.7.5.1 Company footprint

- 10.7.5.2 Testing type footprint

- 10.7.5.3 End user footprint

- 10.7.5.4 Sourcing type footprint

- 10.7.5.5 Region footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO AND TRENDS

- 10.9.1 DEALS

- 10.9.2 EXPANSIONS

- 10.9.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY TESTING SERVICE PROVIDERS

- 11.1.1 ELEMENT MATERIALS TECHNOLOGY

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.3.2 Expansions

- 11.1.1.3.3 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 SGS SA

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 INTERTEK GROUP PLC

- 11.1.3.1 Business overview

- 11.1.3.2 Product/Solution/Service offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 TUV SUD

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses and competitive threats

- 11.1.5 APPLUS+

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 TUV RHEINLAND

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.7 EUROFINS SCIENTIFIC

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.8 BUREAU VERITAS

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.8.3.2 Other developments

- 11.1.9 DEKRA

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.10 MISTRAS GROUP

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.1 ELEMENT MATERIALS TECHNOLOGY

- 11.2 OTHER TESTING SERVICE PROVIDERS

- 11.2.1 TESTEK SOLUTIONS

- 11.2.2 TEKTRONIX, INC.

- 11.2.3 ROHDE & SCHWARZ

- 11.2.4 DAYTON T. BROWN, INC.

- 11.2.5 MTS SYSTEMS

- 11.2.6 APPLIED TECHNICAL SERVICES

- 11.2.7 ALS

- 11.3 KEY AEROSPACE COMPANIES

- 11.3.1 THE BOEING COMPANY

- 11.3.1.1 Business overview

- 11.3.1.2 Products/Solutions/Services offered

- 11.3.1.3 Recent developments

- 11.3.1.3.1 Deals

- 11.3.2 AIRBUS

- 11.3.2.1 Business overview

- 11.3.2.2 Products/Solutions/Services offered

- 11.3.3 LOCKHEED MARTIN CORPORATION

- 11.3.3.1 Business overview

- 11.3.3.2 Products/Solutions/Services offered

- 11.3.4 NORTHROP GRUMMAN

- 11.3.4.1 Business overview

- 11.3.4.2 Products/Solutions/Services offered

- 11.3.5 COLLINS AEROSPACE

- 11.3.5.1 Business overview

- 11.3.5.2 Products/Solutions/Services offered

- 11.3.1 THE BOEING COMPANY

- 11.4 OTHER TESTING EQUIPMENT PROVIDERS

- 11.4.1 GE AEROSPACE

- 11.4.2 GENERAL DYNAMICS

- 11.4.3 MOOG INC.

- 11.4.4 LABORATORY TESTING INC.

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS