|

|

市場調査レポート

商品コード

1572690

マイクロプラスチック検出の世界市場 (~2029年):タイプ (ポリエチレン・ポリテトラフルオロエチレン)・技術 (マイクロラマン分光法・Ftir分光法)・媒体 (水・土壌)・サイズ (1mm未満・1-3mm)・エンドユーザー産業 (水処理・FnB) 別Microplastic Detection Market by Type (Polyethylene, Polytetrafluoroethylene), technology (Micro-Raman Spectroscopy, Ftir Spectroscopy), Medium (Water, Soil), Size ( < 1mm, 1-3mm), End-Use Industry (Water Treatment, FnB) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| マイクロプラスチック検出の世界市場 (~2029年):タイプ (ポリエチレン・ポリテトラフルオロエチレン)・技術 (マイクロラマン分光法・Ftir分光法)・媒体 (水・土壌)・サイズ (1mm未満・1-3mm)・エンドユーザー産業 (水処理・FnB) 別 |

|

出版日: 2024年10月14日

発行: MarketsandMarkets

ページ情報: 英文 265 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

マイクロプラスチック検出の市場規模は、2024年の47億6,000万米ドルから、予測期間中は6.4%のCAGRで推移し、2029年には64億9,000万米ドルの規模に成長すると予測されています。

マイクロプラスチック検出市場の成長は、多くの要因に起因しています。例えば、ラマンやFTIRなどの分光法や顕微鏡法、その他の分析法の新たな開発により、もっとも複雑な環境サンプルの中でもマイクロプラスチックを監視・分析する能力が向上し、市場成長につながっています。多くの地域で、プラスチック製造業者やその他の廃棄物管理会社は、マイクロプラスチックの排出量の追跡と報告を義務付けられており、それによって信頼性の高い検出技術に対する直接的な需要が生まれています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント | タイプ・技術・媒体・サイズ・エンドユーザー産業・地域別 |

| 対象地域 | アジア太平洋・北米・欧州・中東&アフリカ・南米 |

"タイプ別では、ポリテトラフルオロエチレンの部門が金額ベースで第2位のシェアを占めています"

ポリテトラフルオロエチレンは、その広範な使用と長期的な環境残留性から、2番目に大きなタイプです。ポリテトラフルオロエチレンは、自動車、建築、調理器具、電子機器など多くの産業で使用されている汎用性の高いポリマーです。また、有害な化学物質を吸着し、食物連鎖を通じて移行する可能性もあり、野生生物や人間の健康に潜在的なリスクをもたらします。このため、ポリテトラフルオロエチレン粒子を対象とした効果的な検出・監視ソリューションの必要性が高まっています。

"技術別では、FTIR分光法の部門が金額ベースで2番目に大きなシェアを占めています"

フーリエ変換赤外分光法 (FTIR) は、マイクロプラスチックに含まれる多種多様なポリマータイプを識別・検出できるため、金額ベースで2番目に大きなシェアを占めました。FTIR分光法には高い特異性があり、環境の異なるサンプルに含まれるポリエチレン、ポリプロピレン、ポリスチレンなどのプラスチックを区別することができます。これは、マイクロプラスチック汚染の組成と発生源を理解するために不可欠です。この技術はマクロサイズとマイクロサイズの粒子の両方に適用できるため、マイクロプラスチックの全スペクトルモニタリングのための非常に価値あるツールとして使用できます。顕微鏡と分光法を統合したFTIR顕微鏡は、マイクロメートルスケールの微小粒子を検査し、マイクロプラスチックのサイズ、形状、化学組成に関する詳細な情報を得るのに有用です。

”地域別では、アジア太平洋地域が最大の市場です”

アジア太平洋地域は、重工業化、人口の多さ、プラスチックの製造・使用の増加など、多くの相互に関連する要因から、最大規模の市場となっています。この地域の中国、インド、日本、韓国は、プラスチック製品の世界最大の生産国と消費国のひとつであり、膨大なプラスチック廃棄物が発生しています。これは、主にこの地域の多くの地域で廃棄物管理インフラが整備されていないことが原因であり、著しいプラスチック汚染につながっています。広大な海岸線と漁業・農業への依存度の高さは、マイクロプラスチック汚染による環境的・経済的リスクを増幅させるため、高度な検出・監視ソリューションへの高い需要をもたらしています。

当レポートでは、世界のマイクロプラスチック検出の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 生成AI

第6章 業界の動向

- 顧客の事業に影響を与える動向/ディスラプション

- バリューチェーン分析

- 投資と資金調達のシナリオ

- 価格分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 主な会議とイベント

- 基準と規制状況

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- マクロ経済見通し

- ケーススタディ分析

第7章 マイクロプラスチック検出市場:タイプ別

- ポリエチレン

- ポリスチレン

- ポリプロピレン

- ポリテトラフルオロエチレン

- その他

- ポリエチレンテレフタレート

- ポリウレタン

第8章 マイクロプラスチック検出市場:媒体別

- 水

- 土壌

- 空気

第9章 マイクロプラスチック検出市場:サイズ別

- 1ミリメートル未満

- 1-3ミリメートル

- 3-5ミリメートル

第10章 マイクロプラスチック検出市場:技術別

- FTIR分光法

- 顕微ラマン分光法

- 熱分解ガスクロマトグラフィー質量分析法 (PY-GC-MS)

- 液体クロマトグラフィー (LC) と質量分析 (MS)

- フローサイトメトリー

- 走査型電子顕微鏡 (SEM)

- その他

- ハイパースペクトルイメージング

- 熱重量分析

第11章 マイクロプラスチック検出市場:エンドユーザー産業別

- 水処理

- 包装

- 化粧品・パーソナルケア

- 食品・飲料

- テキスタイル

- その他

- 農業

- 建設

第12章 マイクロプラスチック検出市場:地域別

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- 南米

第13章 競合情勢

- 主要企業の戦略/有力企業

- 市場シェア分析

- 収益分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- ブランド/製品比較分析

- 企業価値評価と財務指標

- 競合シナリオと動向

第14章 企業プロファイル

- 主要企業

- THERMO FISHER SCIENTIFIC INC.

- AGILENT TECHNOLOGIES, INC.

- BRUKER

- SHIMADZU CORPORATION

- JEOL LTD.

- METTLER TOLEDO

- OXFORD INSTRUMENTS

- ZEISS GROUP

- DANAHER CORPORATION

- PERKINELMER

- ENDRESS+HAUSER GROUP SERVICES AG

- その他の企業

- RENISHAW PLC

- MALVERN PANALYTICAL LTD

- JASCO

- TESCAN GROUP, A.S.

- LAMBDA SCIENTIFIC PTY LTD

- OCEAN OPTICS

- EDINBURGH INSTRUMENTS

- LIGHTNOVO APS

- HANGZHOU TIETAI AUTOMATION TECHNOLOGY CO., LTD.

- TECHNOS INSTRUMENTS

- TOKYO INSTRUMENTS, INC.

第15章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF MICROPLASTIC DETECTION, BY REGION, 2020-2023 (USD/TON)

- TABLE 2 AVERAGE SELLING PRICE TREND OF MICROPLASTIC DETECTION, BY TYPE, 2020-2023 (USD/KILOTON)

- TABLE 3 AVERAGE SELLING PRICE TREND OF MICROPLASTIC DETECTION OFFERED BY KEY PLAYERS, BY TYPE, 2023 (USD/KILOTON)

- TABLE 4 ROLES OF COMPANIES IN MICROPLASTIC DETECTION ECOSYSTEM

- TABLE 5 KEY TECHNOLOGIES

- TABLE 6 COMPLEMENTARY TECHNOLOGIES

- TABLE 7 ADJACENT TECHNOLOGIES

- TABLE 8 TOTAL NUMBER OF PATENTS, 2014-2024

- TABLE 9 TOP OWNERS OF PATENTS RELATED TO MICROPLASTIC DETECTION, 2014-2024

- TABLE 10 LIST OF KEY PATENTS RELATED TO MICROPLASTIC DETECTION, 2014-2022

- TABLE 11 MICROPLASTIC DETECTION MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 STANDARDS AND REGULATIONS FOR PLAYERS IN MICROPLASTIC DETECTION MARKET

- TABLE 18 IMPACT OF PORTER'S FIVE FORCES ON MICROPLASTIC DETECTION MARKET

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 20 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 21 GDP TRENDS AND FORECAST, BY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 22 MICROPLASTIC DETECTION MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 23 MICROPLASTIC DETECTION MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 24 MICROPLASTIC DETECTION MARKET, BY TYPE, 2020-2023 (KILOTON)

- TABLE 25 MICROPLASTIC DETECTION MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 26 MICROPLASTIC DETECTION MARKET, BY MEDIUM, 2020-2023 (USD MILLION)

- TABLE 27 MICROPLASTIC DETECTION MARKET, BY MEDIUM, 2024-2029 (USD MILLION)

- TABLE 28 MICROPLASTIC DETECTION MARKET, BY SIZE, 2020-2023 (USD MILLION)

- TABLE 29 MICROPLASTIC DETECTION MARKET, BY SIZE, 2024-2029 (USD MILLION)

- TABLE 30 MICROPLASTIC DETECTION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 31 MICROPLASTIC DETECTION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 32 MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 33 MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 34 MICROPLASTIC DETECTION MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 35 MICROPLASTIC DETECTION MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 36 MICROPLASTIC DETECTION MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 37 MICROPLASTIC DETECTION MARKET, BY REGION, 2024-2029 (KILOTON)

- TABLE 38 MICROPLASTIC DETECTION MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 39 MICROPLASTIC DETECTION MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 40 MICROPLASTIC DETECTION MARKET, BY TYPE, 2020-2023 (KILOTON)

- TABLE 41 MICROPLASTIC DETECTION MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 42 MICROPLASTIC DETECTION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 43 MICROPLASTIC DETECTION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 44 MICROPLASTIC DETECTION MARKET, BY MEDIUM, 2020-2023 (USD MILLION)

- TABLE 45 MICROPLASTIC DETECTION MARKET, BY MEDIUM, 2024-2029 (USD MILLION)

- TABLE 46 MICROPLASTIC DETECTION MARKET, BY SIZE, 2020-2023 (USD MILLION)

- TABLE 47 MICROPLASTIC DETECTION MARKET, BY SIZE, 2024-2029 (USD MILLION)

- TABLE 48 MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 49 MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 50 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 51 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 52 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 53 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 54 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 55 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 56 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY TYPE, 2020-2023 (KILOTON)

- TABLE 57 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 58 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 59 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 60 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY MEDIUM, 2020-2023 (USD MILLION)

- TABLE 61 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY MEDIUM, 2024-2029 (USD MILLION)

- TABLE 62 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY SIZE, 2020-2023 (USD MILLION)

- TABLE 63 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY SIZE, 2024-2029 (USD MILLION)

- TABLE 64 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 65 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 66 CHINA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 67 CHINA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 68 JAPAN: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 69 JAPAN: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 70 INDIA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 71 INDIA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 72 SOUTH KOREA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 73 SOUTH KOREA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 74 REST OF ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 75 REST OF ASIA PACIFIC: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 76 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 77 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 78 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 79 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 80 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 81 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 82 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY TYPE, 2020-2023 (KILOTON)

- TABLE 83 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 84 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 85 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 86 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY MEDIUM, 2020-2023 (USD MILLION)

- TABLE 87 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY MEDIUM, 2024-2029 (USD MILLION)

- TABLE 88 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY SIZE, 2020-2023 (USD MILLION)

- TABLE 89 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY SIZE, 2024-2029 (USD MILLION)

- TABLE 90 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 91 NORTH AMERICA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 92 US: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 93 US: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 94 CANADA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 95 CANADA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 96 MEXICO: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 97 MEXICO: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 98 EUROPE: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 99 EUROPE: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 100 EUROPE: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 101 EUROPE: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 102 EUROPE: MICROPLASTIC DETECTION MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 103 EUROPE: MICROPLASTIC DETECTION MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 104 EUROPE: MICROPLASTIC DETECTION MARKET, BY TYPE, 2020-2023 (KILOTON)

- TABLE 105 EUROPE: MICROPLASTIC DETECTION MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 106 EUROPE: MICROPLASTIC DETECTION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 107 EUROPE: MICROPLASTIC DETECTION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 108 EUROPE: MICROPLASTIC DETECTION MARKET, BY MEDIUM, 2020-2023 (USD MILLION)

- TABLE 109 EUROPE: MICROPLASTIC DETECTION MARKET, BY MEDIUM, 2024-2029 (USD MILLION)

- TABLE 110 EUROPE: MICROPLASTIC DETECTION MARKET, BY SIZE, 2020-2023 (USD MILLION)

- TABLE 111 EUROPE: MICROPLASTIC DETECTION MARKET, BY SIZE, 2024-2029 (USD MILLION)

- TABLE 112 EUROPE: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 113 EUROPE: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 114 GERMANY: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 115 GERMANY: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 116 ITALY: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 117 ITALY: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 118 FRANCE: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 119 FRANCE: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 120 UK: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 121 UK: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 122 SPAIN: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 123 SPAIN: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 124 RUSSIA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 125 RUSSIA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 126 REST OF EUROPE: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 127 REST OF EUROPE: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 131 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 132 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY TYPE, 2020-2023 (KILOTON)

- TABLE 135 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 136 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY MEDIUM, 2020-2023 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY MEDIUM, 2024-2029 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY SIZE, 2020-2023 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY SIZE, 2024-2029 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY 2020-2023 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 144 SAUDI ARABIA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 145 SAUDI ARABIA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 146 UAE: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 147 UAE: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 148 REST OF GCC COUNTRIES: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 149 REST OF GCC COUNTRIES: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 150 SOUTH AFRICA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 151 SOUTH AFRICA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 152 REST OF MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 153 REST OF MIDDLE EAST & AFRICA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 154 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 155 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 156 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 157 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 158 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 159 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 160 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY TYPE, 2020-2023 (KILOTON)

- TABLE 161 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY TYPE, 2024-2029 (KILOTON)

- TABLE 162 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 163 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 164 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY MEDIUM, 2020-2023 (USD MILLION)

- TABLE 165 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY MEDIUM, 2024-2029 (USD MILLION)

- TABLE 166 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY SIZE, 2020-2023 (USD MILLION)

- TABLE 167 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY SIZE, 2024-2029 (USD MILLION)

- TABLE 168 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 169 SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 170 ARGENTINA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 171 ARGENTINA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 172 BRAZIL: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 173 BRAZIL: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 174 REST OF SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 175 REST OF SOUTH AMERICA: MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 176 MICROPLASTIC DETECTION MARKET: DEGREE OF COMPETITION

- TABLE 177 MICROPLASTIC DETECTION MARKET: TYPE FOOTPRINT

- TABLE 178 MICROPLASTIC DETECTION MARKET: TECHNOLOGY FOOTPRINT

- TABLE 179 MICROPLASTIC DETECTION MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 180 MICROPLASTIC DETECTION MARKET: REGION FOOTPRINT

- TABLE 181 MICROPLASTIC DETECTION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 182 MICROPLASTIC DETECTION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 183 MICROPLASTIC DETECTION MARKET: PRODUCT LAUNCHES, JANUARY 2020-JULY 2024

- TABLE 184 MICROPLASTIC DETECTION MARKET: EXPANSIONS, JANUARY 2020-JULY 2024

- TABLE 185 MICROPLASTIC DETECTION MARKET: DEALS, JANUARY 2020-JULY 2024

- TABLE 186 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 187 THERMO FISHER SCIENTIFIC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2024

- TABLE 189 THERMO FISHER SCIENTIFIC INC.: OTHERS, JANUARY 2021-AUGUST 2024

- TABLE 190 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 191 AGILENT TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 AGILENT TECHNOLOGIES, INC.: EXPANSIONS, JANUARY 2021-AUGUST 2024

- TABLE 193 AGILENT TECHNOLOGIES, INC.: OTHERS, JANUARY 2021-AUGUST 2024

- TABLE 194 BRUKER: COMPANY OVERVIEW

- TABLE 195 BRUKER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 BRUKER: DEALS, JANUARY 2021-AUGUST 2024

- TABLE 197 BRUKER: OTHERS, JANUARY 2021-AUGUST 2024

- TABLE 198 SHIMADZU CORPORATION: COMPANY OVERVIEW

- TABLE 199 SHIMADZU CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 SHIMADZU CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2024

- TABLE 201 SHIMADZU CORPORATION: DEALS, JANUARY 2021-AUGUST 2024

- TABLE 202 SHIMADZU CORPORATION: OTHERS, JANUARY 2021-AUGUST 2024

- TABLE 203 JEOL LTD.: COMPANY OVERVIEW

- TABLE 204 JEOL LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 JEOL LTD.: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2024

- TABLE 206 METTLER TOLEDO: COMPANY OVERVIEW

- TABLE 207 METTLER TOLEDO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 OXFORD INSTRUMENTS: COMPANY OVERVIEW

- TABLE 209 OXFORD INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 OXFORD INSTRUMENTS: DEALS, JANUARY 2020-AUGUST 2024

- TABLE 211 OXFORD INSTRUMENTS: OTHERS, JANUARY 2021-AUGUST 2024

- TABLE 212 ZEISS GROUP: COMPANY OVERVIEW

- TABLE 213 ZEISS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 ZEISS GROUP: OTHERS, JANUARY 2021-AUGUST 2024

- TABLE 215 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 216 DANAHER CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 DANAHER CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-AUGUST 2024

- TABLE 218 PERKINELMER: COMPANY OVERVIEW

- TABLE 219 PERKINELMER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY OVERVIEW

- TABLE 221 ENDRESS+HAUSER GROUP SERVICES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 ENDRESS+HAUSER GROUP SERVICES AG: OTHERS, JANUARY 2021-AUGUST 2024

- TABLE 223 RENISHAW PLC: COMPANY OVERVIEW

- TABLE 224 MALVERN PANALYTICAL LTD: COMPANY OVERVIEW

- TABLE 225 JASCO: COMPANY OVERVIEW

- TABLE 226 TESCAN GROUP, A.S.: COMPANY OVERVIEW

- TABLE 227 LAMBDA SCIENTIFIC PTY LTD: COMPANY OVERVIEW

- TABLE 228 OCEAN OPTICS: COMPANY OVERVIEW

- TABLE 229 EDINBURGH INSTRUMENTS: COMPANY OVERVIEW

- TABLE 230 LIGHTNOVO APS: COMPANY OVERVIEW

- TABLE 231 HANGZHOU TIETAI AUTOMATION TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 232 TECHNOS INSTRUMENTS: COMPANY OVERVIEW

- TABLE 233 TOKYO INSTRUMENTS, INC.: COMPANY OVERVIEW

_

List of Figures

- FIGURE 1 MICROPLASTIC DETECTION MARKET SEGMENTATION

- FIGURE 2 MICROPLASTIC DETECTION MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 MICROPLASTIC DETECTION MARKET: DATA TRIANGULATION

- FIGURE 9 POLYETHYLENE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 MICRO-RAMAN SPECTROSCOPY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 WATER TREATMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 WATER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 <1 MM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO LEAD MICROPLASTIC DETECTION MARKET DURING FORECAST PERIOD

- FIGURE 15 GROWING USE OF MICROPLASTIC DETECTION TECHNOLOGY IN WATER TREATMENT TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 16 POLYTETRAFLUOROETHYLENE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 17 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MICROPLASTIC DETECTION MARKET

- FIGURE 19 USE OF GENERATIVE AI IN MICROPLASTIC DETECTION MARKET

- FIGURE 20 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 21 MICROPLASTIC DETECTION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 MICROPLASTIC DETECTION MARKET: INVESTMENT AND FUNDING SCENARIO, 2021, 2023, AND 2024 (USD MILLION)

- FIGURE 23 AVERAGE SELLING PRICE TREND OF MICROPLASTIC DETECTION, BY REGION, 2020-2023 (USD/TON)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF MICROPLASTIC DETECTION OFFERED BY KEY PLAYERS, BY TYPE, 2023 (USD/KILOTON)

- FIGURE 25 MICROPLASTIC DETECTION MARKET: ECOSYSTEM

- FIGURE 26 PATENTS GRANTED OVER LAST 11 YEARS, 2014-2024

- FIGURE 27 PATENT ANALYSIS, BY LEGAL STATUS, 2014-2024

- FIGURE 28 REGIONAL ANALYSIS OF PATENTS GRANTED RELATED TO MICROPLASTIC DETECTION, 2014-2024

- FIGURE 29 TOP 5 COMPANIES WITH SUBSTANTIAL NUMBER OF PATENTS, 2014-2024

- FIGURE 30 IMPORT DATA RELATED TO HS CODE 902730-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 31 EXPORT DATA RELATED TO HS CODE 902730-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 32 MICROPLASTIC DETECTION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 34 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 35 POLYETHYLENE SEGMENT TO LEAD MICROPLASTIC DETECTION MARKET IN 2024

- FIGURE 36 WATER SEGMENT TO LEAD MICROPLASTIC DETECTION MARKET IN 2024

- FIGURE 37 <1 MM TO BE LARGEST SEGMENT OF MICROPLASTIC DETECTION MARKET DURING FORECAST PERIOD

- FIGURE 38 MICRO-RAMAN SPECTROSCOPY SEGMENT TO LEAD MICROPLASTIC DETECTION MARKET IN 2024

- FIGURE 39 WATER TREATMENT SEGMENT TO HOLD LARGEST SHARE OF MICROPLASTIC DETECTION MARKET IN 2024

- FIGURE 40 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC: MICROPLASTIC DETECTION MARKET SNAPSHOT

- FIGURE 42 NORTH AMERICA: MICROPLASTIC DETECTION MARKET SNAPSHOT

- FIGURE 43 EUROPE: MICROPLASTIC DETECTION MARKET SNAPSHOT

- FIGURE 44 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- FIGURE 45 REVENUE ANALYSIS OF KEY COMPANIES IN LAST FIVE YEARS

- FIGURE 46 MICROPLASTIC DETECTIONS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 47 MICROPLASTIC DETECTION MARKET: COMPANY FOOTPRINT

- FIGURE 48 MICROPLASTIC DETECTION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 49 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY MICROPLASTIC DETECTION PRODUCTS

- FIGURE 50 EV/EBITDA OF KEY MANUFACTURERS OF MICROPLASTIC DETECTION

- FIGURE 51 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN

- FIGURE 52 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 53 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 54 BRUKER: COMPANY SNAPSHOT

- FIGURE 55 SHIMADZU CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 JEOL LTD.: COMPANY SNAPSHOT

- FIGURE 57 METTLER TOLEDO: COMPANY SNAPSHOT

- FIGURE 58 OXFORD INSTRUMENTS: COMPANY SNAPSHOT

- FIGURE 59 ZEISS GROUP: COMPANY SNAPSHOT

- FIGURE 60 DANAHER CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 PERKINELMER: COMPANY SNAPSHOT

- FIGURE 62 ENDRESS+HAUSER GROUP SERVICES AG: COMPANY SNAPSHOT

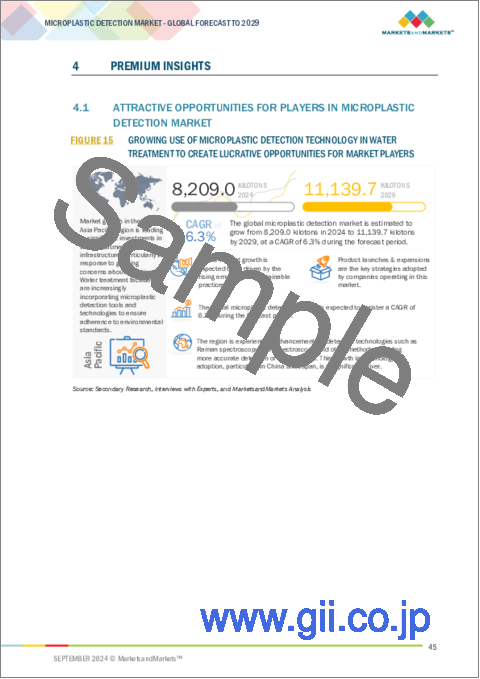

The Microplastic Detection market size is projected to grow from USD 4.76 billion in 2024 to USD 6.49 billion by 2029, registering a CAGR of 6.4% during the forecast period. The growth in the market for Microplastic Detection is attributed to a number of factors. New developments in spectroscopy, for example, Raman and FTIR as well as microscopy, and other analytics have now increased the ability to monitor and analyze microplastics even within the most complex environmental samples, leading to growth in the market. In many regions, plastic manufacturers and other waste management companies are mandated to track and report on their microplastic emissions, thereby creating a direct demand for reliable detection technologies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Type, Technology, Medium, Size, End-Use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

" Polytetrafluoroethylene accounted for the second largest share in type segment of Microplastic Detection market in terms of value."

Polytetrafluoroethylene is the second largest type segment in the microplastic detection market, owing to its extensive use and long-term environmental persistence. IT is a versatile polymer used in many industries, including automotive, construction, cookware and electronics. Non-stick coatings on cookware, or gaskets and seals in industrial machines, can hence be seen as the causes of microplastics in the environment. Therefore, microplastics are most likely to be formed from the degradation of polytetrafluoroethylene products due to time-dependent factors including physical abrasion, chemical reactions, or environmental exposure. They can also adsorb harmful chemicals, which may be transferred through the food chain, and pose potential risks to wildlife and human health. This has increased the requirement for effective detection and monitoring solutions that target polytetrafluoroethylene particles.

"FTIR Spectroscopy accounted for the second largest share in technology industry segment of Microplastic Detection market in terms of value."

Fourier Transform Infrared (FTIR) spectroscopy accounted for the second largest share in the technology segment towards the detection of microplastic because it can identify and detect a wide variety of polymer types that are found in the sample of microplastic. FTIR spectroscopy has high specificity that allows a researcher to distinguish the different kinds of plastics, such as polyethylene, polypropylene, and polystyrene, found in different samples of the environment. This is essential to understand the composition and sources of microplastic pollution. Since this technology can be applied to both macro and micro-sized particles, it can be used as a highly valuable tool for the full spectre monitoring of microplastics. FTIR microscopes, integrating microscopy and spectroscopy, are useful for examining microscopic particle at micrometer scale to obtain detailed information on the size, shape, and chemical composition of microplastics.

"Soil accounted for the second largest share in medium segment of Microplastic Detection market in terms of value."

Soil accounted for the second largest share in the medium segment of the microplastic detection market due to several key factors that highlight its significance as a critical area for monitoring and analysis. Sources of microplastics in soil are agricultural activities, urban runoff, decomposition of plastic wastes, and the use of biosolids and fertilizers containing plastic particles. Agricultural industries remain one of the leading causes of microplastic contamination of soils, including those manufactured from plastic mulch films, irrigation systems, and plastic-coated fertilizers. Slow decomposition of such materials tends to lead to microplastics, which are retained in the soil. This may influence both the fertility and health of the soil and its microbial communities. There is a potential pathway for their transfer to the food chain through crop uptake.

Microplastic size with 1mm-3mm accounted for the second largest share in size segment of Microplastic Detection market in terms of value."

The Microplastics of sizes less than 1mm-3mm is the second most significant contributor in size segment for the detection of microplastics. These particles are primarily produced from the fragmentation of large pieces of plastics such as packaging materials, plastic carrier bags, and bottles. Since these particles have a larger size as compared to nano-sized microplastics, therefore it is easier to detect and quantify these microplastics through conventional methods including visual microscopy and spectroscopic methods.This size range also is important due to the significant threat it poses to marine and terrestrial wildlife; a large quantity of the particles are ingested as food by many organisms, such as fish and birds. This can lead to a blocking effect on organisms through the physical blocking of their digestive tracts, reduced nutrient intake, and even bioaccumulation of harmful chemicals, leading to effects cascading through the food chain that have an impact upon human health.

Food & beverages accounted for the second largest share in end-use industries segment of Microplastic Detection market in terms of value."

The food and beverage industry is the second largest in the end-use segment of the microplastic detection market, due to growing concerns regarding food safety and human health risks from the presence of microplastics in foods. Microplastics have been detected in food products such as seafood, salt, honey, and even drinking water and have alerted consumers and authorities for possible ingestion and accumulation in the human body. Microplastics penetrate foodstuffs through several pathways such as plastic packaging, processing machinery and environmental factors.This widespread issue associated with the food supply chain compels major concern from the consumer towards the product safety and purity, compelling the manufacturers to address these worries and ensure integrity in their offerings.

"Asia pacific is the largest market for Microplastic Detection."

Asia-Pacific has been the largest market for the detection of microplastics for a number of interrelated reasons, primarily its heavy industrialization, high population, and increased production and usage of plastics. China, India, Japan, and South Korea-the countries of this region-are among the world's largest producers and consumers of plastic products. Generation of enormous plastic wastes follows suit. This has led to significant plastic pollution, including microplastic contamination of marine and terrestrial habitats, mainly due to lack of waste management infrastructure in many parts of the region. The vast coastlines and high reliance on fisheries and agriculture amplify the environmental and economic risks due to microplastic pollution, thus leading to a high demand for advanced detection and monitoring solutions.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the Microplastic Detection market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 30%, Europe - 25%, APAC - 35%, the Middle East & Africa -5%, and South America- 5%

The Microplastic Detection market comprises major players Thermo Fisher Scientific Inc. (US), Agilent Technologies, Inc. (US), Bruker (US), PerkinElmer (US), JEOL Ltd. (Japan), Shimadzu Corporation (Japan), Oxford Instruments (UK), Endress+Hauser Group Services AG (Switzerland), Danaher Corporation (US), METTLER TOLEDO (Switzerland), ZEISS Group (Germany). The study includes in-depth competitive analysis of these key players in the Microplastic Detection market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for Microplastic Detection market on the basis of grade, function, application, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the market for Microplastic Detection market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the Microplastic Detection market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of drivers: (Rising concerns of plastic pollution and its effect on ecosystem and human health), restraints (Absence of standardized detection method), opportunities (Advancement in machine learning and AI to enhance accuracy and speed), and challenges (Quantifying microplastics due to diverse size and shapes remains a significant technical hurdle) influencing the growth of Microplastic Detection market.

- Market Penetration: Comprehensive information on the Microplastic Detection market offered by top players in the global Microplastic Detection market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, in the Microplastic Detection market.

- Market Development: Comprehensive information about lucrative emerging markets the report analyzes the markets for Microplastic Detection market across regions.

- Market Capacity: Production capacities of companies producing Microplastic Detection are provided wherever available with upcoming capacities for the Microplastic Detection market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the Microplastic Detection market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants for primary interviews

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MICROPLASTIC DETECTION MARKET

- 4.2 MICROPLASTIC DETECTION MARKET, BY TYPE

- 4.3 MICROPLASTIC DETECTION MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising public concerns over effects of plastic pollution on ecosystems and health

- 5.2.1.2 Advancements in spectroscopy, microscopy, and sensor technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Absence of standardized detection methods

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in machine learning and AI

- 5.2.3.2 Development of low-cost, portable detection systems for real-time monitoring and field studies

- 5.2.4 CHALLENGES

- 5.2.4.1 Achieving required sensitivity and resolution with single analytical technology

- 5.2.4.2 Inconsistencies in detection and arbitrary reporting due to diverse microplastics sizes and shapes

- 5.2.1 DRIVERS

- 5.3 GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.3.2 IMPACT ON MICROPLASTIC DETECTION MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 INVESTMENT AND FUNDING SCENARIO

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND, BY REGION

- 6.5.2 AVERAGE SELLING PRICE TREND, BY TYPE

- 6.5.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.3 ADJACENT TECHNOLOGIES

- 6.8 PATENT ANALYSIS

- 6.8.1 METHODOLOGY

- 6.8.2 GRANTED PATENTS

- 6.8.3 INSIGHTS

- 6.8.4 LEGAL STATUS

- 6.8.5 JURISDICTION ANALYSIS

- 6.8.6 TOP APPLICANTS

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO (HS CODE 902730)

- 6.9.2 EXPORT SCENARIO (HS CODE 902730)

- 6.10 KEY CONFERENCES AND EVENTS, 2024-2025

- 6.11 STANDARDS AND REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 STANDARDS

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 MACROECONOMIC OUTLOOK

- 6.14.1 GDP TRENDS AND FORECAST, BY COUNTRY

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 ADVANCEMENTS IN MICROPARTICLE ANALYSIS: LEVERAGING RAMAN MICROSCOPY FOR ENHANCED IDENTIFICATION AND CHARACTERIZATION

- 6.15.2 MICROPLASTIC DETECTION AND REMEDIATION THROUGH EFFICIENT INTERFACIAL SOLAR EVAPORATION FOR IMMACULATE WATER PRODUCTION

7 MICROPLASTIC DETECTION MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 POLYETHYLENE

- 7.2.1 INCREASING DEMAND FOR EFFECTIVE ENVIRONMENTAL POLLUTION CONTROL TO DRIVE MARKET

- 7.3 POLYSTYRENE

- 7.3.1 ADVANCED DETECTION AND MANAGEMENT STRATEGIES FOR POLYSTYRENE MICROPLASTICS TO DRIVE DEMAND

- 7.4 POLYPROPYLENE

- 7.4.1 PRESSING NEED FOR NON-DESTRUCTIVE EXAMINATION OF MICROPLASTICS TO DRIVE DEMAND

- 7.5 POLYTETRAFLUOROETHYLENE

- 7.5.1 ABILITY TO ENSURE RELIABLE AND RESILIENT CONNECTIONS IN CRITICAL SYSTEMS TO FUEL DEMAND

- 7.6 OTHER TYPES

- 7.6.1 POLYETHYLENE TEREPHTHALATE

- 7.6.2 POLYURETHANE

8 MICROPLASTIC DETECTION MARKET, BY MEDIUM

- 8.1 INTRODUCTION

- 8.2 WATER

- 8.2.1 URGENT NEED FOR BETTER DETECTION AND REGULATION OF PLASTIC WASTE IN WATER SYSTEMS TO DRIVE MARKET

- 8.3 SOIL

- 8.3.1 NEED TO CURB MICROPLASTIC CONTAMINATION IN AGRICULTURE TO DRIVE MARKET

- 8.4 AIR

- 8.4.1 PRESSING NEED TO CURB GROWTH OF AIRBORNE MICROPLASTICS TO DRIVE MARKET

9 MICROPLASTIC DETECTION MARKET, BY SIZE

- 9.1 INTRODUCTION

- 9.2 <1 MM

- 9.3 1-3 MM

- 9.4 3-5 MM

10 MICROPLASTIC DETECTION MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 FTIR SPECTROSCOPY

- 10.2.1 EFFECTIVE TECHNIQUE TO IDENTIFY AND QUANTIFY MICROPLASTICS

- 10.3 MICRO-RAMAN SPECTROSCOPY

- 10.3.1 EFFICIENT IN PRODUCING DISTINCT CHEMICAL FINGERPRINT FOR POLYMERS

- 10.4 PYROLYSIS-GAS CHROMATOGRAPHY-MASS SPECTROMETRY (PY-GC-MS)

- 10.4.1 SOPHISTICATED PROCEDURE FOR DETERMINING PYROLYSIS GAS IN SUSPENDED SOLID PARTICLES

- 10.5 LIQUID CHROMATOGRAPHY (LC) WITH MASS SPECTROMETRY (MS)

- 10.5.1 ADVANCED DETECTION OF MICROPLASTICS THROUGH DEPOLYMERIZATION ANALYSIS

- 10.6 FLOW CYTOMETRY

- 10.6.1 ACCURATE IDENTIFICATION OF MICROPLASTICS THROUGH UNIQUE POLYMER SIGNATURES

- 10.7 SCANNING ELECTRON MICROSCOPY (SEM)

- 10.7.1 PROVIDES HIGH-RESOLUTION IMAGES OF SURFACE STRUCTURES

- 10.8 OTHER TECHNOLOGIES

- 10.8.1 HYPERSPECTRAL IMAGING

- 10.8.2 THERMOGRAVIMETRIC ANALYSIS

11 MICROPLASTIC DETECTION MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 WATER TREATMENT

- 11.2.1 GROWING ADOPTION TO REVOLUTIONIZE HEAVY-DUTY MANUFACTURING TO DRIVE MARKET

- 11.3 PACKAGING

- 11.3.1 NEED FOR MONITORING USE OF BIODEGRADABLE MATERIAL TO DRIVE MARKET

- 11.4 COSMETICS & PERSONAL CARE

- 11.4.1 INCREASING DEMAND FOR NATURALLY EXFOLIATING SUBSTANCES TO DRIVE MARKET

- 11.5 FOOD & BEVERAGE

- 11.5.1 COMBATING MICROPLASTIC CONTAMINATION FOR SAFER CONSUMPTION TO BOOST DEMAND

- 11.6 TEXTILES

- 11.6.1 NEED FOR REDUCING MICROFIBER EMISSIONS IN FABRIC PRODUCTION TO DRIVE MARKET

- 11.7 OTHER END-USE INDUSTRIES

- 11.7.1 AGRICULTURE

- 11.7.2 CONSTRUCTION

12 MICROPLASTIC DETECTION MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Growing concerns over microplastics from textile industry to drive market

- 12.2.2 JAPAN

- 12.2.2.1 Wide adoption of advanced technologies in tackling emerging environmental challenges to drive market

- 12.2.3 INDIA

- 12.2.3.1 Emphasis on implementing technologies to measure and monitor microplastic pollution to boost market

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Significant investments in R&D in developing advanced technologies to drive market

- 12.2.5 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Stringent regulations on plastic use to drive market

- 12.3.2 CANADA

- 12.3.2.1 Commitment to water conservation to boost market

- 12.3.3 MEXICO

- 12.3.3.1 Increased plastic use and regulatory pressures to propel market

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Heightened consumer concerns over microplastics in food & beverages to drive market

- 12.4.2 ITALY

- 12.4.2.1 Prominent fashion industry to sustain market

- 12.4.3 FRANCE

- 12.4.3.1 Increasing awareness, regulatory compliance, and environmental protection efforts to drive market

- 12.4.4 UK

- 12.4.4.1 Increasing demand for detection technologies for cosmetics to drive market

- 12.4.5 SPAIN

- 12.4.5.1 Pressing need to curb industrial pollution to drive market

- 12.4.6 RUSSIA

- 12.4.6.1 Stringent regulations on plastic packaging and push for sustainable packaging to drive market

- 12.4.7 REST OF EUROPE

- 12.4.1 GERMANY

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.5.1.1 Saudi Arabia

- 12.5.1.1.1 Participation in international agreements and initiatives aimed at reducing plastic pollution to drive market

- 12.5.1.2 UAE

- 12.5.1.2.1 Strategic location and economic diversification to drive market

- 12.5.1.3 Rest of GCC countries

- 12.5.1.4 South Africa

- 12.5.1.4.1 Increased funding for research & development in environmental sciences and pollution control to boost market

- 12.5.1.5 Rest of Middle East & Africa

- 12.5.1.1 Saudi Arabia

- 12.5.1 GCC COUNTRIES

- 12.6 SOUTH AMERICA

- 12.6.1 ARGENTINA

- 12.6.1.1 Control of agricultural runoff to drive market

- 12.6.2 BRAZIL

- 12.6.2.1 Demand for exports of food products to boost market

- 12.6.3 REST OF SOUTH AMERICA

- 12.6.1 ARGENTINA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY MICROPLASTIC DETECTION MANUFACTURERS

- 13.3 MARKET SHARE ANALYSIS

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.5.5.1 Company footprint

- 13.5.5.2 Type footprint

- 13.5.5.3 Technology footprint

- 13.5.5.4 End-use industry footprint

- 13.5.5.5 Region footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 13.6.5.1 Detailed list of key startups/SMES

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 EXPANSIONS

- 13.9.3 DEALS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 THERMO FISHER SCIENTIFIC INC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Others

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 AGILENT TECHNOLOGIES, INC.

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Expansions

- 14.1.2.3.2 Others

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 BRUKER

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.3.2 Others

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 SHIMADZU CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Others

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 JEOL LTD.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 METTLER TOLEDO

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 MnM view

- 14.1.6.3.1 Right to win

- 14.1.6.3.2 Strategic choices

- 14.1.6.3.3 Weaknesses and competitive threats

- 14.1.7 OXFORD INSTRUMENTS

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.7.3.2 Others

- 14.1.7.4 MnM view

- 14.1.7.4.1 Right to win

- 14.1.7.4.2 Strategic choices

- 14.1.7.4.3 Weaknesses and competitive threats

- 14.1.8 ZEISS GROUP

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Others

- 14.1.8.4 MnM view

- 14.1.8.4.1 Right to win

- 14.1.8.4.2 Strategic choices

- 14.1.8.4.3 Weaknesses and competitive threats

- 14.1.9 DANAHER CORPORATION

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.4 MnM view

- 14.1.9.4.1 Right to win

- 14.1.9.4.2 Strategic choices

- 14.1.9.4.3 Weaknesses and competitive threats

- 14.1.10 PERKINELMER

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 MnM view

- 14.1.10.3.1 Right to win

- 14.1.10.3.2 Strategic choices

- 14.1.10.3.3 Weaknesses and competitive threats

- 14.1.11 ENDRESS+HAUSER GROUP SERVICES AG

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Others

- 14.1.11.4 MnM view

- 14.1.11.4.1 Right to win

- 14.1.11.4.2 Strategic choices

- 14.1.11.4.3 Weaknesses and competitive threats

- 14.1.1 THERMO FISHER SCIENTIFIC INC.

- 14.2 OTHER PLAYERS

- 14.2.1 RENISHAW PLC

- 14.2.2 MALVERN PANALYTICAL LTD

- 14.2.3 JASCO

- 14.2.4 TESCAN GROUP, A.S.

- 14.2.5 LAMBDA SCIENTIFIC PTY LTD

- 14.2.6 OCEAN OPTICS

- 14.2.7 EDINBURGH INSTRUMENTS

- 14.2.8 LIGHTNOVO APS

- 14.2.9 HANGZHOU TIETAI AUTOMATION TECHNOLOGY CO., LTD.

- 14.2.10 TECHNOS INSTRUMENTS

- 14.2.11 TOKYO INSTRUMENTS, INC.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS