|

|

市場調査レポート

商品コード

1563539

バイオリファイナリーの世界市場:技術別、製品別、タイプ別、地域別 - 予測(~2029年)Biorefinery Market by Technology, Product, Type (First Generation, Second Generation, Third Generation) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| バイオリファイナリーの世界市場:技術別、製品別、タイプ別、地域別 - 予測(~2029年) |

|

出版日: 2024年09月27日

発行: MarketsandMarkets

ページ情報: 英文 255 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

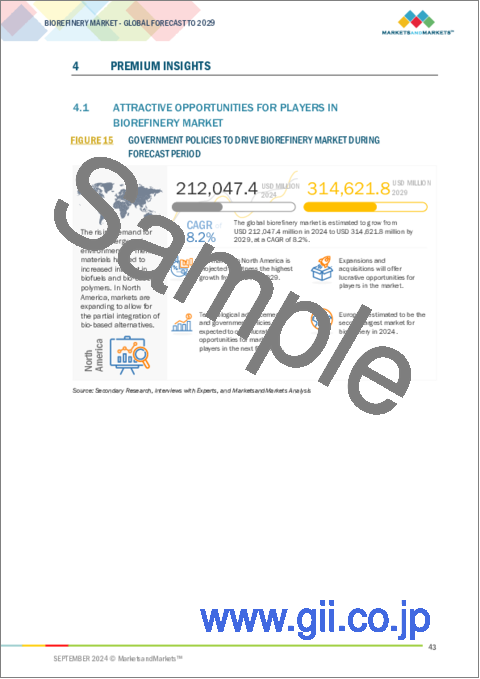

世界のバイオリファイナリーの市場規模は、2024年の推定2,120億5,000万米ドルから2029年までに3,146億2,000万米ドルに達すると予測され、予測期間にCAGRで8.2%の成長が見込まれます。

バイオリファイナリーは、再生可能なバイオマスをバイオ燃料やバイオベース製品に転換することで温室効果ガス(GHG)排出を削減する取り組みの最前線にあります。バイオリファイニングは、カーボンフットプリントを削減し、ネットゼロ排出目標を達成しようと活動する政府や企業が採用する方向性の1つです。化石燃料の使用が急速に減少し、エネルギー、化学品、材料の生産においてより持続可能な代替品が開発される中、バイオリファイナリーがこの開発の基幹をなすことが求められています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 金額(10億米ドル)、数量(100万リットル) |

| セグメント | バイオリファイナリー市場:製品別、技術別、タイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

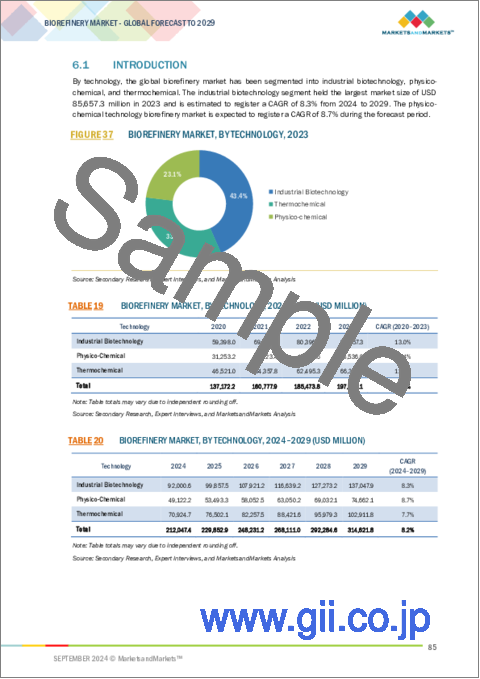

「技術別では、産業バイオテクノロジーが2024年~2029年にもっとも大きく成長するセグメントとなる見込みです。」

産業バイオテクノロジーの統合はバイオリファイナリーにおいて極めて重要であり、バイオマスの燃料、化学品、材料への持続可能かつ効率的な変換を促進します。バイオリファイナリーでは、酵素、微生物、生物学的プロセスを利用して、農業残渣、エネルギー作物、有機廃棄物などの複雑な有機物を、価値ある製品に変換できるより単純な化合物に分解します。例えば、酵素加水分解は、リグノセルロース系バイオマスを発酵可能な糖に変換するために用いられ、その後、人工微生物によって発酵させ、エタノールなどのバイオ燃料、バイオプラスチック、その他のバイオベースの化学品を生産することができます。合成生物学と代謝工学の進歩は、こうした微生物経路の最適化を可能にし、収量の増加とコストの削減を実現します。さらに、生体触媒作用は、従来の化学プロセスに代わる、より環境にやさしい選択肢を提供し、より選択的で環境にやさしい変換を可能にします。

「タイプ別では、第二世代が2024年~2029年にもっとも急成長する市場になると予測されます。」

第二世代バイオリファイナリーは、持続可能性を高め、燃料生産によるエコシステムに対する影響を最小限に抑えながら、将来のエネルギー需要の増加を満たすために極めて重要になると予測されています。米国のRenewable Fuel Standard(RFS2)や欧州連合のRenewable Energy Directive(RED II)のようなさまざまな政策は、第二世代バイオ燃料の割当量を設定することで、先進バイオ燃料のニッチ市場を促進しています。これは、非食料バイオマスへの転換技術への産業投資を奨励するものです。

「欧州がバイオリファイナリー市場でもっとも急成長する地域になると予測されます。」

ドイツ、フランス、オランダ、イタリア、スペイン、英国などの国々は、バイオリファイナリー技術を急速に進歩させ、バイオベースの化学品やバイオ燃料を開発しています。欧州がバイオリファイナリーの分野でもっとも急成長しているのは、EUのRenewable Energy Directive(RED II)のような、再生可能エネルギー目標やバイオ燃料の要件を含む強力な政府政策が主な理由です。この地域は、循環型経済の原則と同様に、二酸化炭素排出の削減に非常に力を入れており、バイオベースの化学品や燃料への投資を促進しています。欧州におけるバイオリファイナリー技術とバイオリファイナリー産業の発展の基盤の一部は、利用可能な農業残渣や林業バイオマス副産物が多く、また持続可能な実践を考慮した場合、世界のその他の地域と比較してインフラが比較的進んでいることです。例えば、フランス政府は、ガソリンやディーゼル燃料にバイオ燃料を混合することを企業に義務付けました。これは、フランス全土でバイオ燃料の混合使用を義務付ける具体的な指令です。これらの混合燃料に占めるバイオ燃料の割合は年々大幅に増加しており、2030年までの温室効果ガス排出削減目標に基づき、さらに増加すると見られます。

当レポートでは、世界のバイオリファイナリー市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- バイオリファイナリー市場の企業にとって魅力的な機会

- バイオリファイナリー市場:地域別

- バイオリファイナリー市場:技術別

- バイオリファイナリー市場:製品別

- バイオリファイナリー市場:タイプ別

- バイオリファイナリー市場:製品別、国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 平均販売価格の動向:地域別

- 参考価格分析:製品別(2020年~2023年)

- バリューチェーン分析

- 原料サプライヤー

- 技術プロバイダー

- バイオリファイナリーのオーナー/経営者

- 販売業者

- エンドユーザー

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- 輸入シナリオ(HSコード3826)

- 輸出シナリオ(HSコード3826)

- 主な会議とイベント(2024年~2025年)

- ケーススタディ分析

- 世界のマクロ経済の見通し

- 国内総生産

- 研究開発費

- バイオ精製技術への投資

- 規制情勢

- 規制機関、政府機関、その他の組織

- バイオリファイナリー市場:規制枠組み

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- バイオリファイナリー市場に対する生成AI/AIの影響

- イントロダクション

- バイオリファイナリー市場における生成AI/AIアプリケーションの採用

- 生成AI/AIの影響:製品/地域別

- バイオリファイナリー市場に対するAIの影響:地域別

第6章 バイオリファイナリー市場:技術別

- イントロダクション

- 産業バイオテクノロジー

- 熱化学

- 物理化学

第7章 バイオリファイナリー市場:製品別

- イントロダクション

- エネルギー駆動

- 材料駆動

第8章 バイオリファイナリー市場:タイプ別

- イントロダクション

- 第一世代

- 第二世代

- 第三世代

第9章 バイオリファイナリー市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- イタリア

- オランダ

- スペイン

- 英国

- ポーランド

- その他の欧州

- アジア太平洋

- 中国

- インドネシア

- タイ

- インド

- その他のアジア太平洋

- その他の地域

- ブラジル

- その他の国々

第10章 競合情勢

- イントロダクション

- 主要企業戦略/有力企業(2020年~2024年)

- 収益分析(2019年~2023年)

- 市場シェア分析(2023年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- CHEVRON

- ADM

- VALERO

- NESTE

- TOTALENERGIES

- BP P.L.C.

- HONEYWELL INTERNATIONAL INC.

- WILMAR INTERNATIONAL LTD.

- CLARIANT

- GREEN PLAINS INC.

- RAIZEN

- BORREGAARD AS

- VERSALIS S.P.A.

- GODAVARI BIOREFINERIES LTD.

- SEKAB

- CARGILL, INCORPORATED

- その他の企業

- COSUN

- NOVOZYMES A/S

- CHINA PETROCHEMICAL CORPORATION

- SGP BIOENERGY HOLDINGS, LLC

- AFYREN

- UPM

- VIVERGO FUELS

- CHEMPOLIS

- BTS BIOGAS SRL/GMBH

第12章 付録

List of Tables

- TABLE 1 BIOREFINERY MARKET SNAPSHOT

- TABLE 2 AVERAGE SELLING PRICE OF BIOFUELS, BY REGION (USD/LITER)

- TABLE 3 INDICATIVE PRICING ANALYSIS, BY PRODUCT, 2020-2023 (USD/LITER)

- TABLE 4 AVERAGE SELLING PRICE TREND OF BIOMETHANE, BY REGION, 2020-2023 (USD/CUBIC METER)

- TABLE 5 BIOREFINERY MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 LIST OF PATENTS, 2020-2024

- TABLE 7 IMPORT SCENARIO FOR HS CODE 3826-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD)

- TABLE 8 EXPORT SCENARIO FOR HS CODE 3826-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD)

- TABLE 9 BIOREFINERY MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 BIOREFINERY MARKET: REGULATIONS

- TABLE 16 BIOREFINERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP TWO PRODUCTS

- TABLE 18 KEY BUYING CRITERIA FOR TOP TWO PRODUCTS

- TABLE 19 BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 20 BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 21 INDUSTRIAL BIOTECHNOLOGY: BIOREFINERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 22 INDUSTRIAL BIOTECHNOLOGY: BIOREFINERY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 23 THERMOCHEMICAL TECHNOLOGY: BIOREFINERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 24 THERMOCHEMICAL TECHNOLOGY: BIOREFINERY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 25 PHYSICO-CHEMICAL TECHNOLOGY: BIOREFINERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 26 PHYSICO-CHEMICAL TECHNOLOGY: BIOREFINERY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 27 BIOREFINERY MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 28 BIOREFINERY MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 29 ENERGY DRIVEN: BIOREFINERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 30 ENERGY DRIVEN: BIOREFINERY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 31 ENERGY DRIVEN: BIOREFINERY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 32 ENERGY DRIVEN: BIOREFINERY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 33 ENERGY DRIVEN: BIOREFINERY MARKET, BY PRODUCT TYPE, 2020-2023 (MILLION LITERS)

- TABLE 34 ENERGY DRIVEN: BIOREFINERY MARKET, BY PRODUCT TYPE, 2024-2029 (MILLION LITERS)

- TABLE 35 BIOMETHANE: BIOREFINERY MARKET, BY REGION, 2020-2023 (BILLION CUBIC METER)

- TABLE 36 BIOMETHANE: BIOREFINERY MARKET, BY REGION, 2024-2029 (BILLION CUBIC METER)

- TABLE 37 BIOETHANOL: BIOREFINERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 BIOETHANOL: BIOREFINERY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 BIODIESEL: BIOREFINERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 40 BIODIESEL: BIOREFINERY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 41 RENEWABLE DIESEL: BIOREFINERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 42 RENEWABLE DIESEL: BIOREFINERY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 43 SUSTAINABLE AVIATION FUEL: BIOREFINERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 44 SUSTAINABLE AVIATION FUEL: BIOREFINERY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 45 BIOMETHANE: BIOREFINERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 46 BIOMETHANE: BIOREFINERY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 47 OTHERS: BIOREFINERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 48 OTHERS: BIOREFINERY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 49 MATERIAL DRIVEN: BIOREFINERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 50 MATERIAL DRIVEN: BIOREFINERY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 51 BIOREFINERY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 52 BIOREFINERY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 53 FIRST GENERATION: BIOREFINERY MARKET, BY FEEDSTOCK, 2020-2023 (USD MILLION)

- TABLE 54 FIRST GENERATION: BIOREFINERY MARKET, BY FEEDSTOCK, 2024-2029 (USD MILLION)

- TABLE 55 FIRST GENERATION: BIOREFINERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 FIRST GENERATION: BIOREFINERY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 57 SECOND GENERATION: BIOREFINERY MARKET, BY FEEDSTOCK, 2020-2023 (USD MILLION)

- TABLE 58 SECOND GENERATION: BIOREFINERY MARKET, BY FEEDSTOCK, 2024-2029 (USD MILLION)

- TABLE 59 SECOND GENERATION: BIOREFINERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 60 SECOND GENERATION: BIOREFINERY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 61 THIRD GENERATION: BIOREFINERY MARKET, BY FEEDSTOCK, 2020-2023 (USD MILLION)

- TABLE 62 THIRD GENERATION: BIOREFINERY MARKET, BY FEEDSTOCK, 2024-2029 (USD MILLION)

- TABLE 63 THIRD GENERATION: BIOREFINERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 THIRD GENERATION: BIOREFINERY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 65 BIOREFINERY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 66 BIOREFINERY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 67 NORTH AMERICA: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 68 NORTH AMERICA: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 69 NORTH AMERICA: BIOREFINERY MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 70 NORTH AMERICA: BIOREFINERY MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 71 NORTH AMERICA: BIOREFINERY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 72 NORTH AMERICA: BIOREFINERY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 73 NORTH AMERICA: BIOREFINERY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 74 NORTH AMERICA: BIOREFINERY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 75 US: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 76 US: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 77 CANADA: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 78 CANADA: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 79 EUROPE: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 80 EUROPE: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 81 EUROPE: BIOREFINERY MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 82 EUROPE: BIOREFINERY MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 83 EUROPE: BIOREFINERY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 84 EUROPE: BIOREFINERY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 85 EUROPE: BIOREFINERY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 86 EUROPE: BIOREFINERY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 87 GERMANY: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 88 GERMANY: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 89 FRANCE: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 90 FRANCE: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 91 ITALY: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 92 ITALY: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 93 NETHERLANDS: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 94 NETHERLANDS: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 95 SPAIN: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 96 SPAIN: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 97 UK: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 98 UK: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 99 POLAND: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 100 POLAND: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 101 REST OF EUROPE: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 102 REST OF EUROPE: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 103 ASIA PACIFIC: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 104 ASIA PACIFIC: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 105 ASIA PACIFIC: BIOREFINERY MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 106 ASIA PACIFIC: BIOREFINERY MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 107 ASIA PACIFIC: BIOREFINERY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 108 ASIA PACIFIC: BIOREFINERY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 109 ASIA PACIFIC: BIOREFINERY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 110 ASIA PACIFIC: BIOREFINERY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 111 CHINA: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 112 CHINA: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 113 INDONESIA: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 114 INDONESIA: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 115 THAILAND: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 116 THAILAND: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 117 INDIA: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 118 INDIA: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 121 ROW: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 122 ROW: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 123 ROW: BIOREFINERY MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 124 ROW: BIOREFINERY MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 125 ROW: BIOREFINERY MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 126 ROW: BIOREFINERY MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 127 ROW: BIOREFINERY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 128 ROW: BIOREFINERY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 129 BRAZIL: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 130 BRAZIL: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 131 OTHER COUNTRIES: BIOREFINERY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 132 OTHER COUNTRIES: BIOREFINERY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 133 BIOREFINERY MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 134 BIOREFINERY MARKET: DEGREE OF COMPETITION, 2023

- TABLE 135 BIOREFINERY MARKET: REGION FOOTPRINT

- TABLE 136 BIOREFINERY MARKET: PRODUCT FOOTPRINT

- TABLE 137 BIOREFINERY MARKET: TYPE FOOTPRINT

- TABLE 138 BIOREFINERY MARKET: TECHNOLOGY FOOTPRINT

- TABLE 139 BIOREFINERY MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 140 BIOREFINERY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 141 BIOREFINERY MARKET: PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2024

- TABLE 142 BIOREFINERY MARKET: DEALS, JANUARY 2020-AUGUST 2024

- TABLE 143 BIOREFINERY MARKET: EXPANSIONS, JANUARY 2020-AUGUST 2024

- TABLE 144 BIOREFINERY MARKET: OTHER DEVELOPMENTS, JANUARY 2020-AUGUST 2024

- TABLE 145 CHEVRON: COMPANY OVERVIEW

- TABLE 146 CHEVRON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 147 CHEVRON: PRODUCT LAUNCHES

- TABLE 148 CHEVRON: DEALS

- TABLE 149 CHEVRON: EXPANSIONS

- TABLE 150 ADM: COMPANY OVERVIEW

- TABLE 151 ADM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 152 ADM: DEALS

- TABLE 153 VALERO: COMPANY OVERVIEW

- TABLE 154 VALERO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 155 VALERO: DEALS

- TABLE 156 NESTE: COMPANY OVERVIEW

- TABLE 157 NESTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 NESTE: DEALS

- TABLE 159 TOTALENERGIES: COMPANY OVERVIEW

- TABLE 160 TOTALENERGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 161 TOTALENERGIES: DEALS

- TABLE 162 TOTALENERGIES: EXPANSIONS

- TABLE 163 TOTALENERGIES: OTHER DEVELOPMENTS

- TABLE 164 BP P.L.C.: COMPANY OVERVIEW

- TABLE 165 BP P.L.C.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 166 BP P.L.C.: DEALS

- TABLE 167 BP P.L.C.: OTHER DEVELOPMENTS

- TABLE 168 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 169 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 170 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 171 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 172 WILMAR INTERNATIONAL LTD.: COMPANY OVERVIEW

- TABLE 173 WILMAR INTERNATIONAL LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 174 CLARIANT: COMPANY OVERVIEW

- TABLE 175 CLARIANT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 176 CLARIANT: DEALS

- TABLE 177 CLARIANT: EXPANSIONS

- TABLE 178 CLARIANT: OTHER DEVELOPMENTS

- TABLE 179 GREEN PLAINS INC.: COMPANY OVERVIEW

- TABLE 180 GREEN PLAINS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 GREEN PLAINS INC.: PRODUCT LAUNCHES

- TABLE 182 GREEN PLAINS INC.: DEALS

- TABLE 183 GREEN PLAINS INC.: EXPANSIONS

- TABLE 184 GREEN PLAINS INC.: OTHER DEVELOPMENTS

- TABLE 185 RAIZEN: COMPANY OVERVIEW

- TABLE 186 RAIZEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 RAIZEN: EXPANSIONS

- TABLE 188 BORREGAARD AS: COMPANY OVERVIEW

- TABLE 189 BORREGAARD AS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 BORREGAARD AS: DEVELOPMENTS

- TABLE 191 VERSALIS S.P.A.: COMPANY OVERVIEW

- TABLE 192 VERSALIS S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 VERSALIS S.P.A.: PRODUCT LAUNCHES

- TABLE 194 VERSALIS S.P.A.: DEALS

- TABLE 195 VERSALIS S.P.A.: EXPANSIONS

- TABLE 196 GODAVARI BIOREFINERIES LTD.: COMPANY OVERVIEW

- TABLE 197 GODAVARI BIOREFINERIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 GODAVARI BIOREFINERIES LTD.: EXPANSIONS

- TABLE 199 SEKAB: COMPANY OVERVIEW

- TABLE 200 SEKAB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 SEKAB: DEALS

- TABLE 202 SEKAB: OTHER DEVELOPMENTS

- TABLE 203 CARGILL, INCORPORATED: COMPANY OVERVIEW

- TABLE 204 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 CARGILL, INCORPORATED: DEALS

- TABLE 206 CARGILL, INCORPORATED: EXPANSIONS

- TABLE 207 COSUN: BUSINESS OVERVIEW

- TABLE 208 NOVOZYMES A/S: BUSINESS OVERVIEW

- TABLE 209 CHINA PETROCHEMICAL CORPORATION: BUSINESS OVERVIEW

- TABLE 210 SGP BIOENERGY HOLDINGS, LLC: BUSINESS OVERVIEW

- TABLE 211 AFYREN: BUSINESS OVERVIEW

- TABLE 212 UPM: BUSINESS OVERVIEW

- TABLE 213 VIVERGO FUELS: BUSINESS OVERVIEW

- TABLE 214 CHEMPOLIS: BUSINESS OVERVIEW

- TABLE 215 BTS BIOGAS SRL/GMBH: BUSINESS OVERVIEW

List of Figures

- FIGURE 1 BIOREFINERY MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 BIOREFINERY MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 BIOREFINERY MARKET: DATA TRIANGULATION

- FIGURE 5 BIOREFINERY MARKET: BOTTOM-UP APPROACH

- FIGURE 6 BIOREFINERY MARKET: TOP-DOWN APPROACH

- FIGURE 7 METRICS CONSIDERED TO ASSESS DEMAND FOR BIOREFINERY

- FIGURE 8 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF BIOREFINERY

- FIGURE 9 BIOREFINERY MARKET: MARKET SHARE ANALYSIS

- FIGURE 10 BIOREFINERY MARKET: SUPPLY SIDE ANALYSIS

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF BIOREFINERY MARKET

- FIGURE 12 INDUSTRIAL BIOTECHNOLOGY TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 ENERGY DRIVEN SEGMENT TO DOMINATE BIOREFINERY MARKET DURING FORECAST PERIOD

- FIGURE 14 FIRST GENERATION SEGMENT TO LEAD BIOREFINERY MARKET DURING FORECAST PERIOD

- FIGURE 15 GOVERNMENT POLICIES TO DRIVE BIOREFINERY MARKET DURING FORECAST PERIOD

- FIGURE 16 EUROPE TO WITNESS FASTEST-GROWTH IN BIOREFINERY MARKET DURING FORECAST PERIOD

- FIGURE 17 INDUSTRIAL BIOTECHNOLOGY TO DOMINATE BIOREFINERY MARKET IN 2029

- FIGURE 18 ENERGY DRIVEN SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2029

- FIGURE 19 FIRST GENERATION SEGMENT TO ACCOUNT FOR DOMINANT SHARE OF BIOREFINERY MARKET

- FIGURE 20 US TO DOMINATE BIOREFINERY MARKET IN NORTH AMERICA

- FIGURE 21 BIOREFINERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 ANNUAL FINANCIAL COMMITMENTS IN BIOFUELS & BIOMASS

- FIGURE 23 BIOFUELS AND RENEWABLE ELECTRICITY AVOIDED OIL DEMAND IN TRANSPORT, MAIN CASE, 2022-2028

- FIGURE 24 OPERATING AND PLANNED PRODUCTION CAPACITY FOR RENEWABLE BIODIESEL AND BIOJET FUELS, BY COMPANY TYPE, 2022-2030

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 AVERAGE SELLING PRICE OF BIOFUELS, BY REGION (USD/LITER)

- FIGURE 27 BIOREFINERY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 BIOREFINERY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO

- FIGURE 30 PATENT APPLIED AND GRANTED, 2014-2023

- FIGURE 31 IMPORT DATA FOR HS CODE 3826-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2021-2023

- FIGURE 32 EXPORT DATA FOR HS CODE 3826-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2021-2023

- FIGURE 33 PORTER'S FIVE FORCES ANALYSIS FOR BIOREFINERY MARKET

- FIGURE 34 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP TWO PRODUCTS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP TWO PRODUCTS

- FIGURE 36 IMPACT OF GENERATIVE AI/AI IN BIOREFINERY PRODUCTS, BY REGION

- FIGURE 37 BIOREFINERY MARKET, BY TECHNOLOGY, 2023

- FIGURE 38 BIOREFINERY MARKET, BY PRODUCT, 2023

- FIGURE 39 BIOREFINERY MARKET, BY TYPE, 2023

- FIGURE 40 EUROPE TO BE FASTEST-GROWING BIOREFINERY MARKET DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: BIOREFINERY MARKET SNAPSHOT

- FIGURE 42 EUROPE: BIOREFINERY MARKET SNAPSHOT

- FIGURE 43 BIOREFINERY MARKET: REVENUE ANALYSIS, 2019-2023

- FIGURE 44 BIOREFINERY MARKET SHARE ANALYSIS, 2023

- FIGURE 45 COMPANY VALUATION, 2024

- FIGURE 46 FINANCIAL METRICS

- FIGURE 47 BRAND/PRODUCT COMPARISON

- FIGURE 48 BIOREFINERY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 49 BIOREFINERY MARKET: PRODUCT FOOTPRINT

- FIGURE 50 BIOREFINERY MARKET: MARKET FOOTPRINT

- FIGURE 51 BIOREFINERY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 52 CHEVRON: COMPANY SNAPSHOT

- FIGURE 53 ADM: COMPANY SNAPSHOT

- FIGURE 54 VALERO: COMPANY SNAPSHOT

- FIGURE 55 NESTE: COMPANY SNAPSHOT

- FIGURE 56 TOTALENERGIES: COMPANY SNAPSHOT

- FIGURE 57 BP P.L.C.: COMPANY SNAPSHOT

- FIGURE 58 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 59 WILMAR INTERNATIONAL LTD.: COMPANY SNAPSHOT

- FIGURE 60 CLARIANT: COMPANY SNAPSHOT

- FIGURE 61 GREEN PLAINS INC.: COMPANY SNAPSHOT

- FIGURE 62 BORREGAARD AS: COMPANY SNAPSHOT

- FIGURE 63 VERSALIS S.P.A.: COMPANY SNAPSHOT

- FIGURE 64 GODAVARI BIOREFINERIES LTD.: COMPANY SNAPSHOT

- FIGURE 65 CARGILL, INCORPORATED: COMPANY SNAPSHOT

The biorefinery market is expected to grow from an estimated USD 212.05 billion in 2024 to USD 314.62 billion by 2029, at a CAGR of 8.2% during the forecast period. Biorefineries are at the forefront of efforts to reduce greenhouse gas (GHG) emissions as renewable biomass is converted into biofuels and bio-based products. Biorefining is one of the directions adopted by governments and firms, which strive to reduce their carbon footprint and achieve net-zero emission targets. Rapid decreases in fossil fuel usage and the development of more sustainable alternatives for the production of energy, chemicals, and materials require biorefineries to form the backbone of much of this development.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) and Volume (million litres) |

| Segments | Biorefinery Market by technology, by type, by product and region. |

| Regions covered | North America, Europe, Asia Pacific, and Rest of the World |

"Industrial Biotechnology, by technology, is expected to be the largest-growing segment from 2024 to 2029."

The industrial biotechnology segment is expected to largest growing in the biorefinery market. Integration of industrial biotechnology is pivotal in biorefineries, facilitating the sustainable and efficient conversion of biomass into fuels, chemicals, and materials. It involves the use of enzymes, microorganisms, and biological processes to break down complex organic matter, such as agricultural residues, energy crops, and organic waste, into simpler compounds that can be transformed into valuable products. Enzymatic hydrolysis, for example, is employed to convert lignocellulosic biomass into fermentable sugars, which can then be fermented by engineered microbes to produce biofuels like ethanol, bioplastics, or other bio-based chemicals. Advances in synthetic biology and metabolic engineering allow for the optimization of these microbial pathways, increasing yield and reducing costs. Additionally, biocatalysis offers a greener alternative to traditional chemical processes, enabling more selective and environmentally friendly transformations.

"Second Generation, by type, is expected to be the fastest-growing market from 2024 to 2029"

It is anticipated that second-generation biorefineries will be pivotal to satisfy rising future energy demands, while enhancing sustainability and minimizing ecological impacts of fuel production. Various policy measures such as U.S. Renewable Fuel Standard (RFS2); European Union Renewable Energy Directive (RED II) develop promotional niche markets for advanced biofuels by establishing a quota for second-generation biofuels. This incentivizes industry investment into conversion technologies for non-food biomass.

"Europe is expected to be the fastest-growing region in the biorefinery market."

Germany, France, Netherlands, Italy, Spain, UK and other similar countries are rapidly advancing biorefinery technologies and developing bio-based chemicals and biofuels. Europe has the fastest growing market in the biorefinery domain mainly due to strong government policies such as the EU's Renewable Energy Directive (RED II), which contains requirements for renewable energy targets and biofuels. The region is very focused on reducing carbon emissions, as well as the principles of the circular economy, which has fostered investments in bio-based chemicals and fuels. Part of this foundation for the development of biorefinery technologies and biorefinery industries in Europe is that it has a lot of agricultural residues and forestry biomass byproducts that can be utilized, as well as relatively advanced infrastructure compared to other regions of the world when considering sustainable practices. For instance, also, the French Government initiated a blending mandate for companies to combine gasoline or diesel with biofuels. That is a specific directive requiring the use of biofuels in a blend throughout France. The proportion of biofuels in these blends has increased significantly over the years and will be further increased based on targets for reducing greenhouse gas emissions over time into the year 2030.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the biorefinery market.

By Company Type: Tier 1- 60%, Tier 2- 25%, and Tier 3- 15%

By Designation: C-level Executives - 35%, Director Level- 25%, and Others- 40%

By Region: North America - 35%, Europe - 25%, Asia Pacific - 30%, and Rest of the World - 10%

Note: Other designations include sales managers, marketing managers, product managers, and product engineers.

The tier of the companies is defined based on their total revenue as of 2023. Tier 1: USD 1 billion and above, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: <USD 500 million.

The biorefinery market is dominated by a few major players that have a wide regional presence. The leading players in the biorefinery market are Chevron (US), ADM (US), Valero (US), Neste (Finland), and TotalEnergies (France), among others. The major strategy adopted by the players includes new product launches, partnerships, collaboration, mergers, and investments & expansions.

Research Coverage:

The report defines, describes, and forecasts the biorefinery market by technology, type, product, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product launches, mergers and acquisitions, and recent developments associated with the biorefinery market. Competitive analysis of upcoming startups in the biorefinery market ecosystem is covered in this report.

Reasons to buy this report:

Reasons to buy this report The report will help the market leaders/new entrants biorefinery market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand for biofuels and bio-based products, government initiatives and increasing need for sustainability, and technological advancements in the biorefineries are just a few of the primary drivers propelling the biorefinery market), restraints (Lack of product uncertainties, as well as costly initial capital expenditure, limit the market's expansion), opportunities (development of advanced biofuels and circular economy initiatives), and challenges (variable and high cost of feedstock and competition from traditional fuels) influencing the growth.

- Product Development/ Innovation: The biorefinery market is seeing substantial product development and innovation, driven by rising environmental concerns. Companies are investing in improved biorefinery technology to produce advanced biofuels and bio-based products.

- Market Development: In February 2022, Versalis announced the beginning of the production of bioethanol from lignocellulosic biomass at Crescentino (Vercelli).

- Market Diversification: In July 2024, Neste and HELLENiQ ENERGY, one of Southeast Europe's leading energy groups, collaborated to deliver blended Neste MY Sustainable Aviation Fuel to HELLENiQ ENERGY's facilities in Thessaloniki.

- Competitive Assessment: In-depth analysis of market share, growth plans, and service offerings of top companies in the stations market, including Chevron (US), ADM (US), Valero (US), Neste (Finland), and TotalEnergies (France), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key primary insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 DEMAND-SIDE ANALYSIS

- 2.4.1 ASSUMPTIONS FOR DEMAND-SIDE ANALYSIS

- 2.4.2 CALCULATIONS FOR DEMAND-SIDE ANALYSIS

- 2.5 SUPPLY-SIDE ANALYSIS

- 2.5.1 ASSUMPTIONS FOR SUPPLY-SIDE ANALYSIS

- 2.5.2 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

- 2.6 MARKET GROWTH RATE FORECAST

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BIOREFINERY MARKET

- 4.2 BIOREFINERY MARKET, BY REGION

- 4.3 BIOREFINERY MARKET, BY TECHNOLOGY

- 4.4 BIOREFINERY MARKET, BY PRODUCT

- 4.5 BIOREFINERY MARKET, BY TYPE

- 4.6 BIOREFINERY MARKET, BY PRODUCT AND COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for bio-based products

- 5.2.1.2 Technological advancements

- 5.2.1.3 Government initiatives and increasing need for environmental sustainability

- 5.2.2 RESTRAINTS

- 5.2.2.1 Requirement of high initial capital investments

- 5.2.2.2 Lack of process efficiency and product consistency

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of advanced biofuels

- 5.2.3.2 Circular economy initiatives

- 5.2.4 CHALLENGES

- 5.2.4.1 Variable and high cost of feedstock

- 5.2.4.2 Competition from traditional fossil fuels

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN BIOREFINERY MARKET

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY REGION (USD/LITER)

- 5.4.2 INDICATIVE PRICING ANALYSIS, BY PRODUCT, 2020-2023

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 FEEDSTOCK SUPPLIERS

- 5.5.2 TECHNOLOGY PROVIDERS

- 5.5.3 BIOREFINERY OWNERS/OPERATORS

- 5.5.4 DISTRIBUTORS

- 5.5.5 END USERS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Hybrid biorefineries technology

- 5.8.1.2 Supercritical water gasification

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Advanced catalysts technology

- 5.8.2.2 Modular biorefineries technology

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Modular bioprocess intensification technology

- 5.8.3.2 Modular electro-fermentation technology

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 3826)

- 5.10.2 EXPORT SCENARIO (HS CODE 3826)

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 BIOENERGY PRODUCTION USING WASTE FROM INDUSTRIAL PROCESSING OF ORANGES

- 5.12.1.1 Problem statement

- 5.12.1.2 Solution

- 5.12.2 SUSTAINABILITY ASSESSMENT OF GREEN BIOREFINERIES IN DANISH AGRICULTURE

- 5.12.2.1 Problem Statement

- 5.12.2.2 Solution

- 5.12.3 FOOD WASTE (FW) MANAGEMENT ENHANCING EMERGING BIOECONOMY IN CHINA

- 5.12.3.1 Problem statement

- 5.12.3.2 Solution

- 5.12.1 BIOENERGY PRODUCTION USING WASTE FROM INDUSTRIAL PROCESSING OF ORANGES

- 5.13 GLOBAL MACROECONOMIC OUTLOOK

- 5.13.1 GDP

- 5.13.2 RESEARCH AND DEVELOPMENT EXPENDITURE

- 5.13.3 INVESTMENTS IN BIOREFINING TECHNOLOGY

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 BIOREFINERY MARKET: REGULATORY FRAMEWORK

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF SUBSTITUTES

- 5.15.2 BARGAINING POWER OF SUPPLIERS

- 5.15.3 BARGAINING POWER OF BUYERS

- 5.15.4 THREAT OF NEW ENTRANTS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 IMPACT OF GENERATIVE AI/AI IN BIOREFINERY MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 ADOPTION OF GENERATIVE AI/AI APPLICATIONS IN BIOREFINERY MARKET

- 5.17.3 IMPACT OF GENERATIVE AI/AI, BY PRODUCT/REGION

- 5.17.4 IMPACT OF AI IN BIOREFINERY MARKET, BY REGION

6 BIOREFINERY MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 INDUSTRIAL BIOTECHNOLOGY

- 6.2.1 OFFERS BETTER ECONOMIC VIABILITY AND WASTE MANAGEMENT PRACTICE

- 6.3 THERMOCHEMICAL

- 6.3.1 EUROPE TO BE FASTEST-GROWING MARKET FOR THERMOCHEMICAL TECHNOLOGY

- 6.4 PHYSICO-CHEMICAL

- 6.4.1 TECHNOLOGICAL MATURITY OF PHYSICO-CHEMICAL SEGMENT TO DRIVE MARKET

7 BIOREFINERY MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 ENERGY DRIVEN

- 7.2.1 CHANGES IN GOVERNMENT POLICIES LEADING TO INCREASED INVESTMENTS IN BIOREFINERY TO DRIVE DEMAND

- 7.2.1.1 Bioethanol

- 7.2.1.2 Biodiesel

- 7.2.1.3 Renewable diesel

- 7.2.1.4 Sustainable aviation fuel

- 7.2.1.5 Biomethane

- 7.2.1.6 Others

- 7.2.1 CHANGES IN GOVERNMENT POLICIES LEADING TO INCREASED INVESTMENTS IN BIOREFINERY TO DRIVE DEMAND

- 7.3 MATERIAL DRIVEN

- 7.3.1 RISING DEMAND FOR ANIMAL FEED AND INCREASING BIOBASED PRODUCT USAGE IN INDUSTRIAL AND COMMERCIAL SECTORS TO DRIVE MARKET

- 7.3.1.1 Chemicals

- 7.3.1.2 Bio-naphtha

- 7.3.1.3 Animal feed

- 7.3.1.4 Others

- 7.3.1 RISING DEMAND FOR ANIMAL FEED AND INCREASING BIOBASED PRODUCT USAGE IN INDUSTRIAL AND COMMERCIAL SECTORS TO DRIVE MARKET

8 BIOREFINERY MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 FIRST GENERATION

- 8.2.1 EASY AVAILABILITY OF RAW MATERIALS TO DRIVE DEMAND

- 8.2.1.1 Corn

- 8.2.1.2 Vegetable oils

- 8.2.1.3 Sugarcane

- 8.2.1.4 Others

- 8.2.1 EASY AVAILABILITY OF RAW MATERIALS TO DRIVE DEMAND

- 8.3 SECOND GENERATION

- 8.3.1 LOW PRODUCTION COST TO DRIVE DEMAND FOR SECOND-GENERATION BIOFUELS

- 8.3.1.1 Used cooking oil

- 8.3.1.2 Residues

- 8.3.1.3 Others

- 8.3.1 LOW PRODUCTION COST TO DRIVE DEMAND FOR SECOND-GENERATION BIOFUELS

- 8.4 THIRD GENERATION

- 8.4.1 RISE IN DEMAND FOR ALGAE-BASED BIOFUEL TO DRIVE MARKET

- 8.4.1.1 Algae

- 8.4.1.2 Others

- 8.4.1 RISE IN DEMAND FOR ALGAE-BASED BIOFUEL TO DRIVE MARKET

9 BIOREFINERY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Dominant market for biorefinery in North America

- 9.2.2 CANADA

- 9.2.2.1 Investments in biofuel and goals for reducing emissions to drive market

- 9.2.1 US

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Germany to leads European biorefinery during forecast period

- 9.3.2 FRANCE

- 9.3.2.1 Government policies and availability of biomass to drive market

- 9.3.3 ITALY

- 9.3.3.1 Abundant availability of agricultural wastes to support market growth

- 9.3.4 NETHERLANDS

- 9.3.4.1 Government policies on development of biofuels sector to drive market growth

- 9.3.5 SPAIN

- 9.3.5.1 Spain witnessing increasing number of biorefinery projects

- 9.3.6 UK

- 9.3.6.1 Increasing focus on circular economy to boost market growth

- 9.3.7 POLAND

- 9.3.7.1 Increasing demand for biofuel and implementation of renewable energy policies to drive market

- 9.3.8 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 ASIA PACIFIC

- 9.4.1 CHINA

- 9.4.1.1 Increasing biofuels and SAF production to drive market

- 9.4.2 INDONESIA

- 9.4.2.1 Availability of biomass resources and government incentives to drive market

- 9.4.3 THAILAND

- 9.4.3.1 Physico-chemical technology to be fastest-growing segment during forecast period

- 9.4.4 INDIA

- 9.4.4.1 Government initiatives and partnerships between key players to propel demand

- 9.4.5 REST OF ASIA PACIFIC

- 9.4.1 CHINA

- 9.5 ROW

- 9.5.1 BRAZIL

- 9.5.1.1 Implementation of new biorefinery projects to fuel demand

- 9.5.2 OTHER COUNTRIES

- 9.5.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 10.3 REVENUE ANALYSIS, 2019-2023

- 10.4 MARKET SHARE ANALYSIS, 2023

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT, KEY PLAYERS, 2023

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Product footprint

- 10.7.5.4 Type footprint

- 10.7.5.5 Technology footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 10.8.5.1 Detailed List of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 CHEVRON

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 ADM

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Services/Solutions offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 VALERO

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Services/Solutions offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 NESTE

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 TOTALENERGIES

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Services/Solutions offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.3.2 Expansions

- 11.1.5.3.3 Other developments

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 BP P.L.C.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Services/Solutions offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.6.3.2 Other developments

- 11.1.7 HONEYWELL INTERNATIONAL INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Services/Solutions offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.8 WILMAR INTERNATIONAL LTD.

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Services/Solutions offered

- 11.1.9 CLARIANT

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Services/Solutions offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.3.2 Expansions

- 11.1.9.3.3 Other developments

- 11.1.10 GREEN PLAINS INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Deals

- 11.1.10.3.3 Expansions

- 11.1.10.3.4 Other developments

- 11.1.11 RAIZEN

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Expansions

- 11.1.12 BORREGAARD AS

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Developments

- 11.1.13 VERSALIS S.P.A.

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product launches

- 11.1.13.3.2 Deals

- 11.1.13.3.3 Expansions

- 11.1.14 GODAVARI BIOREFINERIES LTD.

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Expansions

- 11.1.15 SEKAB

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Deals

- 11.1.15.3.2 Other developments

- 11.1.16 CARGILL, INCORPORATED

- 11.1.16.1 Business overview

- 11.1.16.2 Products/Solutions/Services offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Deals

- 11.1.16.3.2 Expansions

- 11.1.1 CHEVRON

- 11.2 OTHER PLAYERS

- 11.2.1 COSUN

- 11.2.2 NOVOZYMES A/S

- 11.2.3 CHINA PETROCHEMICAL CORPORATION

- 11.2.4 SGP BIOENERGY HOLDINGS, LLC

- 11.2.5 AFYREN

- 11.2.6 UPM

- 11.2.7 VIVERGO FUELS

- 11.2.8 CHEMPOLIS

- 11.2.9 BTS BIOGAS SRL/GMBH

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS