|

|

市場調査レポート

商品コード

1563535

OTA試験の世界市場:テストチャンバー、アンテナテストソリューション、ソフトウェア、サービス、5G、LTE、UMTS、GSM、CDMA、Wi-Fi、Bluetooth、スマートフォン、ラップトップ、ノートブック・タブレット、ウェアラブル、自動車・輸送、スマートシティ - 予測(~2029年)OTA Testing Market by Test Chambers, Antenna Testing Solutions, Software, Services, 5G, LTE, UMTS, GSM, CDMA, Wi-Fi, Bluetooth, Smartphones, Laptops, Notebooks & Tablets, Wearables, Automotive & Transportation and Smart Cities - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| OTA試験の世界市場:テストチャンバー、アンテナテストソリューション、ソフトウェア、サービス、5G、LTE、UMTS、GSM、CDMA、Wi-Fi、Bluetooth、スマートフォン、ラップトップ、ノートブック・タブレット、ウェアラブル、自動車・輸送、スマートシティ - 予測(~2029年) |

|

出版日: 2024年09月26日

発行: MarketsandMarkets

ページ情報: 英文 237 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

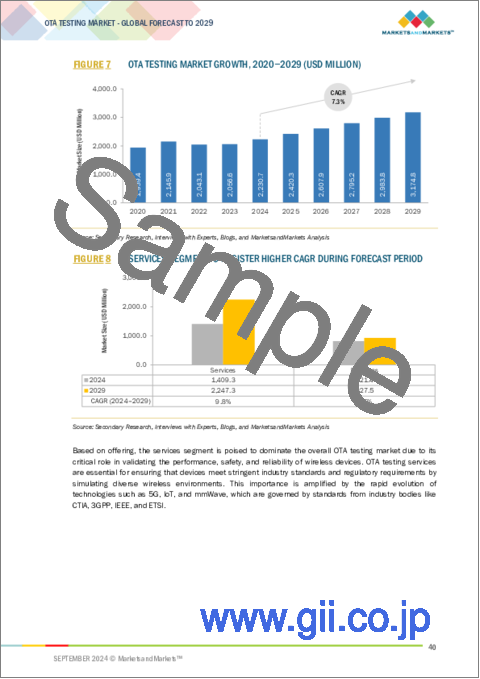

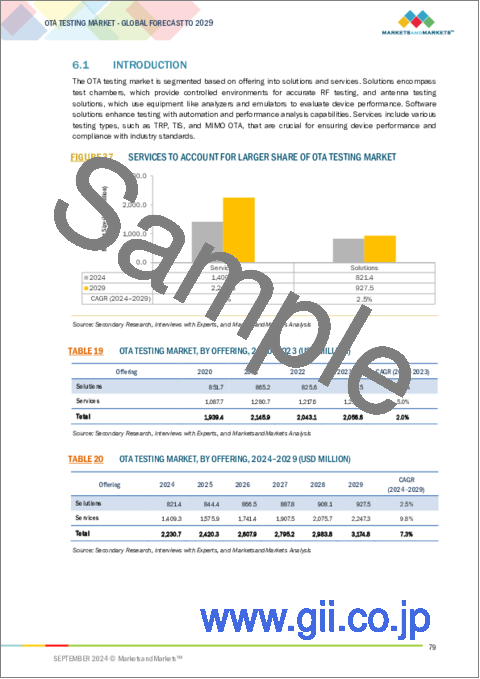

世界のOTA試験の市場規模は、2024年の22億3,000万米ドルから2029年までに31億7,000万米ドルに達すると予測され、予測期間にCAGRで7.3%の成長が見込まれます。

市場成長の主な促進要因は、無線消費者向け機器に対する需要の高まり、5G技術の採用の増加、IoTエコシステムの拡大、無線機器に対する厳しい規制要件などです。さらに、自動運転車の開発の進行や、インフラ開発に伴うスマートシティ活動の高まり、ミリ波(mmWave)技術やMIMO技術の進歩は、市場参入企業に新たな成長の道を開きます。OTA試験は、アンテナの効率、信号の品質、無線の性能に関する規格への準拠をチェックします。スマートフォン、loTデバイス、自動車システムなどのさまざまな無線通信プロトコルの運用において、実環境での性能を確保する上で非常に重要です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 技術別、提供別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「テストチャンバーが予測期間にOTA試験ソリューションセグメントで最大の市場シェアを記録します。」

テストチャンバーセグメントは、外部RF干渉から機器を隔離するために多く展開されているため、OTA試験のソリューション市場で最大のシェアを占めると予測されます。テストチャンバーまたは電波暗室は基本的に、制御された条件下でアンテナ性能、信号伝播、機器の挙動を正確に測定するために設計されており、厳しい産業標準への準拠を保証するために重要な機能です。高品質な電波暗室は、正確なRF試験を必要とする5GやmmWave技術などの先進の無線技術の利用がますます増加するのに伴い、需要も増加しています。テストチャンバーは、幅広い周波数、環境、ユースケースにわたる機器の試験に利用されています。

「セルラーネットワークが予測期間に技術セグメントで最大のシェアを占めます。」

セルラー技術、特に5G技術の大規模な拡大と幅広い利用により、セルラーネットワークセグメントがOTA試験市場で最大のシェアを占めます。セルラーネットワークは、5G用途向けのサブ6GHzやmmWaveのようなさまざまな周波数帯域で必要とされ、その最適な性能、信号の信頼性、幅広い規制への準拠を判断するために包括的なOTA試験が必要となります。その成長は、モバイルブロードバンド、IoT、車車間通信など多くのユースケースを持つセルラー通信の複雑な性質によって促進されています。さらに、セルラー規格はLTEから5G、そしてbeyond 5Gへと進化を続けており、デバイス、アンテナ、インフラに関する厳格な基準に従って試験が継続的に実施されています。

「アジア太平洋が予測期間にもっとも高い成長を記録します。」

複数の主な要因により、アジア太平洋が予測期間に最高のCAGRを記録します。中国、韓国、日本などの主要市場で5Gの展開が大幅に増加したことにより、ネットワーク性能と機器の先進規格への準拠を確認するためのOTA試験の需要が高まっています。近年のコネクテッドカーや自動運転車の開発では、複雑な自動車システムにおける接続性試験だけでなく、無線で実施される性能試験や安全性試験がますます厳しくなっています。また、世界の電子機器製造におけるその主導的な地位は、幅広い消費者向け機器と産業用機器にわたって高品質な標準を維持するための包括的なOTA試験の必要性を後押ししています。アジア太平洋における近年の政府の取り組みには、通信インフラへの大規模な投資計画や技術の進歩に対する規制支援が含まれ、アジア太平洋のOTA試験市場の急成長をさらに後押ししています。

当レポートでは、世界のOTA試験市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- OTA試験市場の企業にとって魅力的な機会

- OTA試験市場:セルラーネットワーク別

- OTA試験市場:提供別

- OTA試験市場:エンドユーザー別

- アジア太平洋のOTA試験市場:エンドユーザー別、国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 主要企業の平均販売価格の動向:提供別

- テストチャンバーの平均販売価格の推移:地域別

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- 輸出シナリオ(HSコード903180)

- 輸入シナリオ(HSコード903180)

- 主な会議とイベント(2024年~2025年)

- ケーススタディ分析

- 規制情勢

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- OTA試験市場に対するAI/生成AIの影響

第6章 OTA試験市場:提供別

- イントロダクション

- ソリューション

- サービス

第7章 OTA試験市場:技術別

- イントロダクション

- セルラーネットワーク

- 5G

- Wi-Fi

- Bluetooth

- その他の技術

第8章 OTA試験市場:エンドユーザー別

- イントロダクション

- 消費者向け機器

- スマートフォン

- 自動車・輸送

- 工業

- スマートシティ

- その他のエンドユーザー

第9章 OTA試験市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- 韓国

- 台湾

- シンガポール

- その他のアジア太平洋

- その他の地域

- 南米

- 中東

- アフリカ

第10章 競合情勢

- イントロダクション

- 主要企業戦略/有力企業(2021年~2024年)

- 有機的/無機的成長戦略

- 製品/サービスポートフォリオ

- 地理的プレゼンス

- 世界的フットプリント

- 収益分析

- 市場シェア分析

- 企業の評価と財務指標

- 製品/ブランドの比較

- 企業の評価マトリクス:主要企業(2023年)

- スタートアップ/中小企業の評価マトリクス(2023年)

- 競合シナリオ

第11章 企業プロファイル

- イントロダクション

- 主要企業

- ROHDE & SCHWARZ

- KEYSIGHT TECHNOLOGIES

- ANRITSU

- SGS SA

- INTERTEK GROUP PLC

- NATIONAL INSTRUMENTS

- UL LLC

- SPIRENT COMMUNICATIONS

- BUREAU VERITAS

- EUROFINS SCIENTIFIC

- DEKRA

- TUV RHEINLAND

- ELEMENT MATERIALS TECHNOLOGY

- TUV SUD

- TERADYNE INC.

- MICROWAVE VISION GROUP

- その他の企業

- TOYO CORPORATION

- ORBIS SYSTEMS OY

- DSPACE GMBH

- DVTEST INC.

- COPPER MOUNTAIN TECHNOLOGIES

- ETS-LINDGREN

- TESTILABS OY

- VERKOTAN

- CETECOM ADVANCED

第12章 付録

List of Tables

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- TABLE 2 RISK ASSESSMENT: OTA TESTING MARKET

- TABLE 3 AVERAGE SELLING PRICE OF KEY PLAYERS, BY OFFERING (USD)

- TABLE 4 AVERAGE SELLING PRICE OF TEST CHAMBER, BY KEY PLAYERS (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF TEST CHAMBER, BY REGION (USD)

- TABLE 6 OTA TESTING MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 7 PATENTS FILED FROM 2014 TO 2023

- TABLE 8 LIST OF MAJOR PATENTS RELATED TO OTA TESTING

- TABLE 9 EXPORT SCENARIO FOR HS CODE 903180-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 10 IMPORT SCENARIO FOR HS CODE 903180-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 11 OTA TESTING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2024-2025

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 OTA TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR OTA TESTING MARKET (%)

- TABLE 18 KEY BUYING CRITERIA FOR OTA TESTING

- TABLE 19 OTA TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 20 OTA TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 21 OTA TESTING MARKET, BY SOLUTIONS, 2020-2023 (USD MILLION)

- TABLE 22 OTA TESTING MARKET, BY SOLUTIONS, 2024-2029 (USD MILLION)

- TABLE 23 OTA TESTING MARKET, BY SOLUTIONS, 2020-2023 (UNITS)

- TABLE 24 OTA TESTING MARKET, BY SOLUTIONS, 2024-2029 (UNITS)

- TABLE 25 SOLUTIONS: OTA TESTING MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 26 SOLUTIONS: OTA TESTING MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 27 SOLUTIONS: OTA TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 28 SOLUTIONS: OTA TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 29 SOLUTIONS: OTA TESTING MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 30 SOLUTIONS: OTA TESTING MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 31 SOLUTIONS: OTA TESTING MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 32 SOLUTIONS: OTA TESTING MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 33 SOLUTIONS: OTA TESTING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 34 SOLUTIONS: OTA TESTING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 35 SOLUTIONS: OTA TESTING MARKET IN REST OF THE WORLD, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 SOLUTIONS: OTA TESTING MARKET IN REST OF THE WORLD, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 SOLUTIONS: OTA TESTING MARKET IN MIDDLE EAST, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 38 SOLUTIONS: OTA TESTING MARKET IN MIDDLE EAST, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 39 SERVICES: OTA TESTING MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 40 SERVICES: OTA TESTING MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 41 SERVICES: OTA TESTING MARKET, BY CONSUMER DEVICES, 2020-2023 (USD MILLION)

- TABLE 42 SERVICES: OTA TESTING MARKET, BY CONSUMER DEVICES, 2024-2029 (USD MILLION)

- TABLE 43 SERVICES: OTA TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 44 SERVICES: OTA TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 45 SERVICES: OTA TESTING MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 46 SERVICES: OTA TESTING MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 47 SERVICES: OTA TESTING MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 48 SERVICES: OTA TESTING MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 49 SERVICES: OTA TESTING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 50 SERVICES: OTA TESTING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 51 SERVICES: OTA TESTING MARKET IN REST OF THE WORLD, BY REGION, 2020-2023 (USD MILLION)

- TABLE 52 SERVICES: OTA TESTING MARKET IN REST OF THE WORLD, BY REGION, 2024-2029 (USD MILLION)

- TABLE 53 SERVICES: OTA TESTING MARKET IN MIDDLE EAST, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 54 SERVICES: OTA TESTING MARKET IN MIDDLE EAST, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 55 OTA TESTING MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 56 OTA TESTING MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 57 OTA TESTING MARKET, BY CELLULAR NETWORK, 2020-2023 (USD MILLION)

- TABLE 58 OTA TESTING MARKET, BY CELLULAR NETWORK, 2024-2029 (USD MILLION)

- TABLE 59 OTA TESTING MARKET, BY END USER, 2020-2023 (USD MILLION)

- TABLE 60 OTA TESTING MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 61 CONSUMER DEVICES: OTA TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 62 CONSUMER DEVICES: OTA TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 63 CONSUMER DEVICES: OTA TESTING MARKET FOR SERVICES, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 CONSUMER DEVICES: OTA TESTING MARKET FOR SERVICES, BY REGION, 2024-2029 (USD MILLION)

- TABLE 65 CONSUMER DEVICES: OTA TESTING MARKET FOR SOLUTIONS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 66 CONSUMER DEVICES: OTA TESTING MARKET FOR SOLUTIONS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 67 CONSUMER DEVICES: OTA TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 CONSUMER DEVICES: OTA TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 69 AUTOMOTIVE & TRANSPORTATION: OTA TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 70 AUTOMOTIVE & TRANSPORTATION: OTA TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 71 AUTOMOTIVE & TRANSPORTATION: OTA TESTING MARKET FOR SERVICES, BY REGION, 2020-2023 (USD MILLION)

- TABLE 72 AUTOMOTIVE & TRANSPORTATION: OTA TESTING MARKET FOR SERVICES, BY REGION, 2024-2029 (USD MILLION)

- TABLE 73 AUTOMOTIVE & TRANSPORTATION: OTA TESTING MARKET FOR SOLUTIONS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 74 AUTOMOTIVE & TRANSPORTATION: OTA TESTING MARKET FOR SOLUTIONS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 75 AUTOMOTIVE & TRANSPORTATION: OTA TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 76 AUTOMOTIVE & TRANSPORTATION: OTA TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 77 INDUSTRIAL: OTA TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 78 INDUSTRIAL: OTA TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 79 INDUSTRIAL: OTA TESTING MARKET FOR SERVICES, BY REGION, 2020-2023 (USD MILLION)

- TABLE 80 INDUSTRIAL: OTA TESTING MARKET FOR SERVICES, BY REGION, 2024-2029 (USD MILLION)

- TABLE 81 INDUSTRIAL: OTA TESTING MARKET FOR SOLUTIONS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 82 INDUSTRIAL: OTA TESTING MARKET FOR SOLUTIONS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 83 INDUSTRIAL: OTA TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 84 INDUSTRIAL: OTA TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 85 SMART CITIES: OTA TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 86 SMART CITIES: OTA TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 87 SMART CITIES: OTA TESTING MARKET FOR SERVICES, BY REGION, 2020-2023 (USD MILLION)

- TABLE 88 SMART CITIES: OTA TESTING MARKET FOR SERVICES, BY REGION, 2024-2029 (USD MILLION)

- TABLE 89 SMART CITIES: OTA TESTING MARKET FOR SOLUTIONS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 90 SMART CITIES: OTA TESTING MARKET FOR SOLUTIONS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 91 SMART CITIES: OTA TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 92 SMART CITIES: OTA TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 93 OTHER END USERS: OTA TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 94 OTHER END USERS: OTA TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 95 OTHER END USERS: OTA TESTING MARKET FOR SERVICES, BY REGION, 2020-2023 (USD MILLION)

- TABLE 96 OTHER END USERS: OTA TESTING MARKET FOR SERVICES, BY REGION, 2024-2029 (USD MILLION)

- TABLE 97 OTHER END USERS: OTA TESTING MARKET FOR SOLUTIONS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 98 OTHER END USERS: OTA TESTING MARKET FOR SOLUTIONS, BY REGION, 2024-2029 (USD MILLION)

- TABLE 99 OTHER END USERS: OTA TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 100 OTHER END USERS: OTA TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 101 OTA TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 102 OTA TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 103 NORTH AMERICA: OTA TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 104 NORTH AMERICA: OTA TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 105 NORTH AMERICA: OTA TESTING MARKET, BY END USER, 2020-2023 (USD MILLION )

- TABLE 106 NORTH AMERICA: OTA TESTING MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 107 NORTH AMERICA: OTA TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION )

- TABLE 108 NORTH AMERICA: OTA TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 109 EUROPE: OTA TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 110 EUROPE: OTA TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 111 EUROPE: OTA TESTING MARKET, BY END USER, 2020-2023 (USD MILLION )

- TABLE 112 EUROPE: OTA TESTING MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 113 EUROPE: OTA TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION )

- TABLE 114 EUROPE: OTA TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 115 ASIA PACIFIC: OTA TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 116 ASIA PACIFIC: OTA TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 117 ASIA PACIFIC: OTA TESTING MARKET, BY END USER, 2020-2023 (USD MILLION )

- TABLE 118 ASIA PACIFIC: OTA TESTING MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 119 ASIA PACIFIC: OTA TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION )

- TABLE 120 ASIA PACIFIC: OTA TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 121 REST OF THE WORLD: OTA TESTING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 122 REST OF THE WORLD: OTA TESTING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 123 REST OF THE WORLD: OTA TESTING MARKET, BY END USER, 2020-2023 (USD MILLION )

- TABLE 124 REST OF THE WORLD: OTA TESTING MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 125 REST OF THE WORLD: OTA TESTING MARKET, BY OFFERING, 2020-2023 (USD MILLION )

- TABLE 126 REST OF THE WORLD: OTA TESTING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 127 MIDDLE EAST: OTA TESTING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 128 MIDDLE EAST: OTA TESTING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 129 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 130 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN OTA TESTING MARKET, 2023

- TABLE 131 OTA TESTING MARKET: OFFERING FOOTPRINT

- TABLE 132 OTA TESTING MARKET: TECHNOLOGY FOOTPRINT

- TABLE 133 OTA TESTING MARKET: END USER FOOTPRINT

- TABLE 134 OTA TESTING MARKET: REGION FOOTPRINT

- TABLE 135 OTA TESTING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 136 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY OFFERING

- TABLE 137 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY TECHNOLOGY

- TABLE 138 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY END USER

- TABLE 139 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- TABLE 140 OTA TESTING MARKET: PRODUCT/SOLUTION/SERVICE LAUNCHES, MARCH 2021- JULY 2024

- TABLE 141 OTA TESTING MARKET, DEALS, MARCH 2021- JULY 2024

- TABLE 142 OTA TESTING MARKET, EXPANSIONS, MARCH 2021-JULY 2024

- TABLE 143 ROHDE & SCHWARZ: COMPANY OVERVIEW

- TABLE 144 ROHDE & SCHWARZ: PRODUCTS/SOLUTIONS/SERVICES 0FFERED

- TABLE 145 ROHDE & SCHWARZ: PRODUCT LAUNCHES

- TABLE 146 ROHDE & SCHWARZ: DEALS

- TABLE 147 KEYSIGHT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 148 KEYSIGHT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES 0FFERED

- TABLE 149 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 150 KEYSIGHT TECHNOLOGIES: DEALS

- TABLE 151 ANRITSU: COMPANY OVERVIEW

- TABLE 152 ANRITSU: PRODUCTS/SOLUTIONS/SERVICES 0FFERED

- TABLE 153 ANRITSU: PRODUCT LAUNCHES

- TABLE 154 ANRITSU: DEALS

- TABLE 155 SGS SA: COMPANY OVERVIEW

- TABLE 156 SGS SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 SGS SA: DEALS

- TABLE 158 SGS SA: EXPANSIONS

- TABLE 159 INTERTEK GROUP PLC: COMPANY OVERVIEW

- TABLE 160 INTERTEK GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES 0FFERED

- TABLE 161 INTERTEK GROUP PLC: DEALS

- TABLE 162 NATIONAL INSTRUMENTS: COMPANY OVERVIEW

- TABLE 163 NATIONAL INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 UL LLC: COMPANY OVERVIEW

- TABLE 165 UL LLC: PRODUCTS/SOLUTIONS/SERVICES 0FFERED

- TABLE 166 SPIRENT COMMUNICATIONS: COMPANY OVERVIEW

- TABLE 167 SPIRENT COMMUNICATIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 SPIRENT COMMUNICATIONS: PRODUCT LAUNCHES

- TABLE 169 SPIRENT COMMUNICATIONS: DEALS

- TABLE 170 BUREAU VERITAS: COMPANY OVERVIEW

- TABLE 171 BUREAU VERITAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 BUREAU VERITAS: EXPANSIONS

- TABLE 173 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- TABLE 174 EUROFINS SCIENTIFIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 EUROFINS SCIENTIFIC: DEALS

- TABLE 176 EUROFINS SCIENTIFIC: EXPANSIONS

- TABLE 177 DEKRA: COMPANY OVERVIEW

- TABLE 178 DEKRA: PRODUCTS/SOLUTIONS/SERVICES 0FFERED

- TABLE 179 DEKRA: EXPANSIONS

- TABLE 180 TUV RHEINLAND: COMPANY OVERVIEW

- TABLE 181 TUV RHEINLAND: PRODUCTS/SOLUTIONS/SERVICES 0FFERED

- TABLE 182 TUV RHEINLAND: PRODUCT LAUNCHES

- TABLE 183 ELEMENT MATERIALS TECHNOLOGY: COMPANY OVERVIEW

- TABLE 184 ELEMENT MATERIALS TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES 0FFERED

- TABLE 185 ELEMENT MATERIALS TECHNOLOGY: DEALS

- TABLE 186 TUV SUD: COMPANY OVERVIEW

- TABLE 187 TUV SUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 TUV SUD: EXPANSIONS

- TABLE 189 TERADYNE INC.: COMPANY OVERVIEW

- TABLE 190 TERADYNE INC.: PRODUCTS/SOLUTIONS/SERVICES 0FFERED

- TABLE 191 MICROWAVE VISION GROUP: COMPANY OVERVIEW

- TABLE 192 MICROWAVE VISION GROUP: PRODUCTS/SOLUTIONS/SERVICES 0FFERED

List of Figures

- FIGURE 1 OTA TESTING MARKET: SEGMENTATION & REGIONS COVERED

- FIGURE 2 OTA TESTING MARKET: RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 6 DATA TRIANGULATION: OTA TESTING MARKET

- FIGURE 7 OTA TESTING MARKET GROWTH, 2020-2029 (USD MILLION)

- FIGURE 8 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 9 CELLULAR NETWORK TECHNOLOGY TO DOMINATE OTA TESTING MARKET DURING FORECAST PERIOD

- FIGURE 10 CONSUMER DEVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN OTA TESTING MARKET FROM 2024 TO 2029

- FIGURE 12 EXTENSIVE 5G ROLLOUTS IN ASIA PACIFIC TO DRIVE MARKET GROWTH

- FIGURE 13 5G TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 SERVICES SEGMENT TO ACCOUNT FOR LARGER SHARE OF OTA TESTING MARKET DURING FORECAST PERIOD

- FIGURE 15 CONSUMER DEVICES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 CONSUMER DEVICES SEGMENT TO BE LARGEST END USER OF OTA TESTING IN ASIA PACIFIC

- FIGURE 17 OTA TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 IMPACT ANALYSIS OF DRIVERS ON OTA TESTING MARKET

- FIGURE 19 IMPACT ANALYSIS OF RESTRAINTS ON OTA TESTING MARKET

- FIGURE 20 IMPACT ANALYSIS OF OPPORTUNITIES ON OTA TESTING MARKET

- FIGURE 21 IMPACT ANALYSIS OF CHALLENGES ON OTA TESTING MARKET

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING (TEST CHAMBER)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING (ANTENNA TESTING SOLUTIONS)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF TEST CHAMBER, BY REGION

- FIGURE 26 OTA TESTING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 OTA TESTING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 FUNDS AUTHORIZED BY KEY PLAYERS IN OTA TESTING MARKET, 2020-2024

- FIGURE 29 PATENTS APPLIED AND GRANTED, 2014-2023

- FIGURE 30 EXPORT DATA FOR HS CODE 903180-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 31 IMPORT DATA FOR HS CODE 903180-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 32 OTA TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 IMPACT OF PORTER'S FIVE FORCES ON OTA TESTING MARKET

- FIGURE 34 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR OTA TESTING

- FIGURE 35 KEY BUYING CRITERIA FOR TOP 3 END USERS OF OTA TESTING

- FIGURE 36 IMPACT OF AI/GEN AI ON OTA TESTING MARKET

- FIGURE 37 SERVICES TO ACCOUNT FOR LARGER SHARE OF OTA TESTING MARKET

- FIGURE 38 CELLULAR NETWORK TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 39 CONSUMER DEVICES TO ACCOUNT FOR LARGEST SHARE OF OTA TESTING MARKET

- FIGURE 40 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: OTA TESTING MARKET SNAPSHOT

- FIGURE 42 EUROPE: OTA TESTING MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: OTA TESTING MARKET SNAPSHOT

- FIGURE 44 COMPANIES ADOPTED PARTNERSHIPS AS KEY GROWTH STRATEGY FROM 2021 TO 2024

- FIGURE 45 REVENUE ANALYSIS OF KEY PLAYER IN OTA TESTING MARKET, 2021-2023

- FIGURE 46 OTA TESTING MARKET SHARE ANALYSIS, 2023

- FIGURE 47 COMPANY VALUATION, 2024

- FIGURE 48 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 49 PRODUCT/BRAND COMPARISON

- FIGURE 50 OTA TESTING MARKET: COMPANY EVALUATION MATRIX (SOLUTIONS), 2023

- FIGURE 51 OTA TESTING MARKET: COMPANY EVALUATION MATRIX (SERVICES), 2023

- FIGURE 52 OTA TESTING MARKET: COMPANY FOOTPRINT

- FIGURE 53 OTA TESTING MARKET: STARTUPS/SMES EVALUATION MATRIX, 2023

- FIGURE 54 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 55 ANRITSU: COMPANY SNAPSHOT

- FIGURE 56 SGS SA: COMPANY SNAPSHOT

- FIGURE 57 INTERTEK GROUP PLC: COMPANY SNAPSHOT

- FIGURE 58 SPIRENT COMMUNICATIONS: COMPANY SNAPSHOT

- FIGURE 59 BUREAU VERITAS: COMPANY SNAPSHOT

- FIGURE 60 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- FIGURE 61 DEKRA: COMPANY SNAPSHOT

- FIGURE 62 TUV RHEINLAND: COMPANY SNAPSHOT

- FIGURE 63 TUV SUD: COMPANY SNAPSHOT

- FIGURE 64 TERADYNE INC.: COMPANY SNAPSHOT

The OTA testing market is projected to reach USD 3.17 billion by 2029 from USD 2.23 billion in 2024 at a CAGR of 7.3% during the forecast period. The major factors driving the growth of the market are rising demand for wireless consumer devices, growing adoption of 5G technology, expansion of the Internet of Things (IoT) ecosystem, and stringent regulatory requirements for wireless devices. Further, increasing development in autonomous vehicles, rising smart city initiatives along with infrastructure, and advancements in millimeter-wave (mmwave), as well as massive multiple-input multiple-output (MIMO) technologies open new growth avenues for market participants. OTA testing checks the efficiency of an antenna, the quality of the signal, and standards compliance regarding wireless performance. It is of prime importance in ensuring performance in a real environment, whether it be a smartphone, loT device, or automotive system in operation for various wireless communication protocols.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Offering, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Test chambers to register the largest market share in OTA testing solutions segment during the forecast period."

The test chambers segment is expected to constitute the largest share in the solutions market of OTA testing because it has been largely deployed for isolating a device from external RF interference. Test chambers or Anechoic chambers are basically designed for the accurate measurement of antenna performance, signal propagation, and device behavior under controlled conditions, which is a critical feature for ensuring compliance with stringent industry standards. High-quality anechoic chambers also received an increase in demand with the ever-increasing use of advanced wireless technologies such as 5G and mmWave technologies that demand precise RF testing. Test chambers are utilized in the testing of devices across a wide range of frequencies, environments, and use cases.

"Cellular Networks to account for the largest share in technology segment during the forecast period."

The cellular network segment to account for the largest share within the OTA Testing market, due to the high-scale expansion and wide usage of cellular technologies, particularly the 5G technology. Cellular networks will be required across various frequency bands like sub-6 GHz or mmWave for 5G applications, all of which will need comprehensive OTA testing to determine their optimal performance, signal reliability, and adherence to a wide range of regulations. The growth is driven by the complex nature of cellular communication, with a number of use cases that include mobile broadband, IoT, and vehicle-to-everything communication. Furthermore, cellular standards are ever-evolving from LTE to 5G and beyond, while testing is continually performed in accordance with strict norms on devices, antennas, and infrastructure.

" Asia Pacific to register the highest growth during the forecast period."

Asia Pacific to register the highest CAGR during the forecast period, due to several key factors. The significant rise in the rollout of 5G in leading markets such as China, South Korea, and Japan have driven the demand for OTA testing to ensure network performance and device compliance with advanced standards. The recent development of connected and autonomous vehicles requires increasingly rigorous performance and safety tests conducted over the air, as well as connectivity testing in complex automotive systems. Its leading position in global electronics manufacturing also propels the need for comprehensive OTA testing to keep high-quality standards across a wide range of consumer and industrial devices. Recent government initiatives in the region include heavy investment plans in telecommunication infrastructure and regulatory support for technological advancements, further helping the growth of the OTA testing market in the Asia Pacific at a rapid pace.

The break-up of the profile of primary participants in the OTA testing market-

- By Company Type: Tier 1 - 30%, Tier 2 - 50%, Tier 3 - 20%

- By Designation Type: C Level - 25%, Director Level - 35%, Others - 40%

- By Region Type: Europe - 35%, Asia Pacific - 30%, North America - 25%, Rest of the World - 10%

The major players in the OTA testing market with a significant global presence include Rhode & Schwarz (Germany), Keysight Technologies (US), Anritsu (Japan), SGS SA (Switzerland), Intertek Group plc (UK), and others.

Research Coverage

The report segments the OTA testing market and forecasts its size by offering, technology, end users, and region. It also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report covers qualitative aspects in addition to quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall OTA testing market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (rising demand for wireless consumer devices, growing adoption of 5G technology, expansion of internet of things (IoT) ecosystem, stringent regulatory requirements for wireless devices), restraints (High cost of OTA testing equipment, complexity of OTA testing procedures, and limited availability of testing facilities), opportunities (advancements in autonomous vehicles, growth in smart city initiatives and infrastructure, advancements in Millimeter wave (mmWave) and massive MIMO technologies), and challenges (rapidly evolving wireless standards and technologies, simulating real-world conditions in laboratory environments)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new solution and service launches in the OTA testing market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the OTA testing market across varied regions.

- Market Diversification: Exhaustive information about new solutions and services, untapped geographies, recent developments, and investments in the OTA testing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and solution and service offerings of leading players, including Rhode & Schwarz (Germany), Keysight Technologies (US), Anritsu (Japan), SGS SA (Switzerland), and Intertek Group plc (UK).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.2.1 Inclusions and exclusions, by company

- 1.3.2.2 Inclusions and exclusions, by offering

- 1.3.2.3 Inclusions and exclusions, by technology

- 1.3.2.4 Inclusions and exclusions, by end user

- 1.3.2.5 Inclusions and exclusions, by region

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 LIMITATIONS

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 SUPPLY-SIDE ANALYSIS

- 2.3.2 GROWTH FORECAST ASSUMPTIONS

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN OTA TESTING MARKET

- 4.2 OTA TESTING MARKET, BY CELLULAR NETWORK

- 4.3 OTA TESTING MARKET, BY OFFERING

- 4.4 OTA TESTING MARKET, BY END USER

- 4.5 ASIA PACIFIC: OTA TESTING MARKET, BY END USER AND COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for wireless consumer devices

- 5.2.1.2 Growing adoption of 5G technology

- 5.2.1.3 Expansion of Internet of Things (IoT) ecosystem

- 5.2.1.4 Stringent regulatory requirements for wireless devices

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of OTA testing equipment

- 5.2.2.2 Complexity of OTA testing procedures

- 5.2.2.3 Limited availability of testing facilities

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in autonomous vehicles

- 5.2.3.2 Growth in smart city initiatives and infrastructure

- 5.2.3.3 Advancements in mmWave and massive MIMO technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Rapidly evolving wireless standards and technologies

- 5.2.4.2 Simulating real-world conditions in laboratory environments

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

- 5.4.2 AVERAGE SELLING PRICE TREND OF TEST CHAMBER, BY REGION

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 OTA test chambers

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Massive MIMO

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Autonomous vehicles

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 EXPORT SCENARIO (HS CODE 903180)

- 5.10.2 IMPORT SCENARIO (HS CODE 903180)

- 5.11 KEY CONFERENCES & EVENTS, 2024-2025

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 OTA TESTING SOLUTION ENABLED XIAOMI TO VALIDATE PERFORMANCE OF ITS 5G DEVICES

- 5.12.2 OTA TESTING SOLUTIONS ENABLED BOSCH TO VALIDATE ITS UWB APPLICATIONS

- 5.12.3 OTA TEST SYSTEM HELPED TMYTEK ACCELERATE PRODUCT DEVELOPMENT CYCLE

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON OTA TESTING MARKET

6 OTA TESTING MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 SOLUTIONS

- 6.2.1 TEST CHAMBERS

- 6.2.1.1 Increasing complexity and demand for accurate testing of advanced wireless technologies to propel market growth

- 6.2.1.2 Compact antenna test ranges (CATRs)

- 6.2.1.3 Multi-probe anechoic chambers (MPAC)

- 6.2.1.4 Direct far-field (DFF) chambers

- 6.2.2 ANTENNA TESTING SOLUTIONS

- 6.2.2.1 Expansion of wireless technologies, particularly with advent of 5G and MIMO systems, to drive market growth

- 6.2.3 SOFTWARE

- 6.2.3.1 Growing demand for more advanced OTA testing software to support market growth

- 6.2.1 TEST CHAMBERS

- 6.3 SERVICES

- 6.3.1 RAPID ADVANCEMENT OF WIRELESS TECHNOLOGIES AND STRICTER REGULATIONS AND STANDARDS TO DRIVE GROWTH

- 6.3.2 TOTAL RADIATED POWER (TRP) TESTING

- 6.3.3 TOTAL ISOTROPIC SENSITIVITY (TIS) TESTING

- 6.3.4 A-GNSS RECEIVER SENSITIVITY TESTING

- 6.3.5 DESENSITIZATION TESTING FOR CONVERGED WI-FI AND 5G TECHNOLOGIES

7 OTA TESTING MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 CELLULAR NETWORK

- 7.3 5G

- 7.3.1 RAPID DEPLOYMENT OF 5G TECHNOLOGY TO DRIVE MARKET GROWTH

- 7.3.2 5G FR1/5G FR2

- 7.3.3 5G NR NSA/SA

- 7.3.4 LTE

- 7.3.5 UMTS

- 7.3.6 GSM

- 7.3.7 CDMA

- 7.4 WI-FI

- 7.4.1 EVOLUTION OF WI-FI TECHNOLOGIES, INCLUDING WI-FI 6E AND UPCOMING WI-FI 7, TO DRIVE MARKET GROWTH

- 7.4.2 WI-FI 6 (802.11AX)

- 7.4.3 WI-FI 7 (802.11BE)

- 7.5 BLUETOOTH

- 7.5.1 RAPID PROLIFERATION OF BLUETOOTH LOW ENERGY (BLE) DEVICES TO DRIVE DEMAND

- 7.5.2 BLUETOOTH CLASSIC

- 7.5.3 BLUETOOTH LOW ENERGY (BLE)

- 7.6 OTHER TECHNOLOGIES

8 OTA TESTING MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 CONSUMER DEVICES

- 8.2.1 GROWING INTEGRATION OF 5G TECHNOLOGIES WITH ADVANCED MULTI-ANTENNA SYSTEMS DRIVING GROWTH

- 8.3 SMARTPHONES

- 8.3.1 RAPID ADOPTION OF ADVANCED TECHNOLOGIES, INCLUDING 5G NR, WI-FI 6/6E, AND BLUETOOTH 5, TO DRIVE DEMAND

- 8.3.2 LAPTOPS, NOTEBOOKS & TABLETS

- 8.3.2.1 Increasing integration of 5G capabilities and advanced wireless technologies into laptops to drive demand

- 8.3.3 WEARABLES

- 8.3.3.1 Growing adoption of advanced wearable technologies to support market growth

- 8.3.4 OTHER CONSUMER DEVICES

- 8.4 AUTOMOTIVE & TRANSPORTATION

- 8.4.1 INCREASING INTEGRATION OF CONNECTED CAR TECHNOLOGIES AND AUTONOMOUS DRIVING SYSTEMS TO FUEL DEMAND

- 8.5 INDUSTRIAL

- 8.5.1 RAPID ADOPTION OF INDUSTRY 4.0 AND IOT TECHNOLOGIES TO SUPPORT MARKET GROWTH

- 8.6 SMART CITIES

- 8.6.1 PUSH TOWARD SMART CITY DEVELOPMENT TO SUPPORT MARKET GROWTH

- 8.7 OTHER END USERS

9 OTA TESTING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Rapid expansion of 5G networks to drive market growth

- 9.2.3 CANADA

- 9.2.3.1 Accelerating 5G rollout and government initiatives promoting innovation in wireless technologies to boost demand

- 9.2.4 MEXICO

- 9.2.4.1 Expanding electronics manufacturing sector to drive market growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Leadership in Industry 4.0 and advancements in connected and autonomous vehicles to drive market

- 9.3.3 UK

- 9.3.3.1 Growing adoption of IoT technologies in smart homes and smart city initiatives to propel growth

- 9.3.4 FRANCE

- 9.3.4.1 Automotive sector to contribute significantly to growth in demand for OTA testing

- 9.3.5 SPAIN

- 9.3.5.1 Significant investments in advanced wireless technologies and digital transformation to fuel demand

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Rapid deployment of 5G technology and significant investment in IoT infrastructure to drive growth

- 9.4.3 JAPAN

- 9.4.3.1 Focus on next-generation wireless technologies and developing connected and autonomous vehicles to support market growth

- 9.4.4 INDIA

- 9.4.4.1 Rapid 5G rollout and booming electronics manufacturing sector to drive growth

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Strong emphasis on developing and maintaining high-performance semiconductor manufacturing to drive growth

- 9.4.6 TAIWAN

- 9.4.6.1 Advancements in testing methodologies for 5G and beyond-5G technologies to drive market

- 9.4.7 SINGAPORE

- 9.4.7.1 Comprehensive 5G rollout plans and advanced smart nation initiatives to drive market growth

- 9.4.8 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD

- 9.5.1 SOUTH AMERICA

- 9.5.1.1 Growing adoption of wireless communication and networking technologies to drive market growth

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Advancements in telecommunications infrastructure and technology adoption to drive growth

- 9.5.2.2 GCC Countries

- 9.5.2.3 Rest of Middle East

- 9.5.3 AFRICA

- 9.5.3.1 Rapid mobile technology adoption and telecom infrastructure expansion to drive market

- 9.5.1 SOUTH AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 10.2.1 ORGANIC/INORGANIC GROWTH STRATEGIES

- 10.2.2 PRODUCT/SERVICE PORTFOLIO

- 10.2.3 GEOGRAPHICAL PRESENCE

- 10.2.4 GLOBAL FOOTPRINT

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 PRODUCT/BRAND COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.7.5.1 Company footprint

- 10.7.5.2 Offering footprint

- 10.7.5.3 Technology footprint

- 10.7.5.4 End user footprint

- 10.7.5.5 Region footprint

- 10.8 STARTUPS/SMES EVALUATION MATRIX, 2023

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT/SOLUTION/SERVICE LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS

- 11.2.1 ROHDE & SCHWARZ

- 11.2.1.1 Business overview

- 11.2.1.2 Products/Solutions/Services offered

- 11.2.1.3 Recent developments

- 11.2.1.3.1 Product launches

- 11.2.1.3.2 Deals

- 11.2.1.4 MnM View

- 11.2.1.4.1 Key strengths/Right to win

- 11.2.1.4.2 Strategic choices

- 11.2.1.4.3 Weaknesses and competitive threats

- 11.2.2 KEYSIGHT TECHNOLOGIES

- 11.2.2.1 Business overview

- 11.2.2.2 Products/Solutions/Services offered

- 11.2.2.3 Recent developments

- 11.2.2.3.1 Product launches

- 11.2.2.3.2 Deals

- 11.2.2.4 MnM View

- 11.2.2.4.1 Key strengths/Right to win

- 11.2.2.4.2 Strategic choices

- 11.2.2.4.3 Weaknesses and competitive threats

- 11.2.3 ANRITSU

- 11.2.3.1 Business overview

- 11.2.3.2 Products/Solutions/Services offered

- 11.2.3.3 Recent developments

- 11.2.3.3.1 Product launches

- 11.2.3.3.2 Deals

- 11.2.3.4 MnM View

- 11.2.3.4.1 Key strengths/Right to win

- 11.2.3.4.2 Strategic choices

- 11.2.3.4.3 Weaknesses and competitive threats

- 11.2.4 SGS SA

- 11.2.4.1 Business overview

- 11.2.4.2 Products/Solutions/Services offered

- 11.2.4.3 Recent developments

- 11.2.4.3.1 Deals

- 11.2.4.3.2 Expansions

- 11.2.4.4 MnM view

- 11.2.4.4.1 Key strengths/Right to win

- 11.2.4.4.2 Strategic choices

- 11.2.4.4.3 Weaknesses and competitive threats

- 11.2.5 INTERTEK GROUP PLC

- 11.2.5.1 Business overview

- 11.2.5.2 Products/Solutions/Services offered

- 11.2.5.3 Recent developments

- 11.2.5.3.1 Deals

- 11.2.5.4 MnM view

- 11.2.5.4.1 Key strengths/Right to win

- 11.2.5.4.2 Strategic choices

- 11.2.5.4.3 Weaknesses and competitive threats

- 11.2.6 NATIONAL INSTRUMENTS

- 11.2.6.1 Business overview

- 11.2.6.2 Products/Solutions/Services offered

- 11.2.7 UL LLC

- 11.2.7.1 Business overview

- 11.2.7.2 Products/Solutions/Services offered

- 11.2.8 SPIRENT COMMUNICATIONS

- 11.2.8.1 Business overview

- 11.2.8.2 Products/Solutions/Services offered

- 11.2.8.3 Recent developments

- 11.2.8.3.1 Product launches

- 11.2.8.3.2 Deals

- 11.2.9 BUREAU VERITAS

- 11.2.9.1 Business overview

- 11.2.9.2 Products/Solutions/Services offered

- 11.2.9.3 Recent developments

- 11.2.9.3.1 Expansions

- 11.2.10 EUROFINS SCIENTIFIC

- 11.2.10.1 Business overview

- 11.2.10.2 Products/Solutions/Services offered

- 11.2.10.3 Recent developments

- 11.2.10.3.1 Deals

- 11.2.10.3.2 Expansions

- 11.2.11 DEKRA

- 11.2.11.1 Products/Solutions/Services offered

- 11.2.11.2 Recent developments

- 11.2.11.2.1 Expansions

- 11.2.12 TUV RHEINLAND

- 11.2.12.1 Business overview

- 11.2.12.2 Products/Solutions/Services offered

- 11.2.12.3 Recent developments

- 11.2.12.3.1 Product launches

- 11.2.13 ELEMENT MATERIALS TECHNOLOGY

- 11.2.13.1 Business overview

- 11.2.13.2 Products/Solutions/Services offered

- 11.2.13.3 Recent developments

- 11.2.13.3.1 Deals

- 11.2.14 TUV SUD

- 11.2.14.1 Business overview

- 11.2.14.2 Products/Solutions/Services offered

- 11.2.14.3 Recent developments

- 11.2.14.3.1 Expansions

- 11.2.15 TERADYNE INC.

- 11.2.15.1 Business overview

- 11.2.15.2 Products/Solutions/Services offered

- 11.2.16 MICROWAVE VISION GROUP

- 11.2.16.1 Business overview

- 11.2.16.2 Products/Solutions/Services offered

- 11.2.1 ROHDE & SCHWARZ

- 11.3 OTHER PLAYERS

- 11.3.1 TOYO CORPORATION

- 11.3.2 ORBIS SYSTEMS OY

- 11.3.3 DSPACE GMBH

- 11.3.4 DVTEST INC.

- 11.3.5 COPPER MOUNTAIN TECHNOLOGIES

- 11.3.6 ETS-LINDGREN

- 11.3.7 TESTILABS OY

- 11.3.8 VERKOTAN

- 11.3.9 CETECOM ADVANCED

12 APPENDIX

- 12.1 INSIGHTS OF INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS