|

|

市場調査レポート

商品コード

1558952

量子ネットワーキング市場:オファリング別、エンドユーザー産業別、地域別 - 2029年までの予測Quantum Networking Market by Offering (Quantum Key Distribution, Quantum Random Number Generator, Quantum Repeater, Quantum Memory, Photon Detectors, Software), End User Industry - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 量子ネットワーキング市場:オファリング別、エンドユーザー産業別、地域別 - 2029年までの予測 |

|

出版日: 2024年09月05日

発行: MarketsandMarkets

ページ情報: 英文 273 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

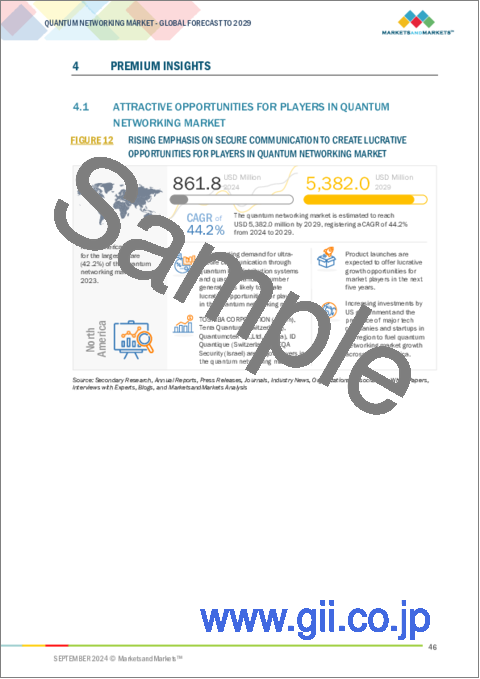

量子ネットワーキングの市場規模は、2024年には8億6,180万米ドル規模になると予想され、2029年には53億8,200万米ドルに達すると予測されており、2024年から2029年のCAGRは44.2%と見込まれています。

市場成長の原動力となっているのは、安全な通信、金融取引、防衛における使用事例の拡大です。また、金融機関や防衛機関がデータの保護やプライバシーの維持に注力するようになったことで、量子鍵配布装置などの需要が拡大します。さらに、政府や企業による量子技術への資金提供や取り組みが、量子ネットワーキング市場をさらに活性化させるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | オファリング別、エンドユーザー産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

量子鍵配布(QKD)システム分野が予測期間中に高い市場シェアを占めるとみられています。市場成長の背景には、データ・セキュリティに対する懸念の高まりと、従来のデータ暗号化手法に対する脅威があります。このため、銀行・金融、政府、防衛の各分野で量子ネットワーキングソリューションの採用が増加しています。市場参入企業はQKDシステムの実装に注力し、量子ネットワーキングのパイロットプロジェクトを実施することで、市場での競争力を高めています。

政府・防衛エンドユーザー産業は、予測期間中により大きなシェアを占めると予測されています。量子ネットワーキングは、政府や防衛分野における機密情報や国家安全保障の安全な通信のために行われています。量子ネットワーキングは、事実上、通信チャネルを盗聴されないようにすることができます。QKDは暗号鍵の生成を可能にし、物理法則そのものによって、将来の量子コンピューターからのものを含め、いかなる形の計算攻撃に対しても安全です。これにより、機密情報を保護し、軍事通信の完全性を保証し、国家機密を守る方法が開かれます。さらに、量子で保護された軍事通信は、高度なサイバー脅威に対して機密性を保持し、認証されることになっています。したがって、秘密防衛作戦や戦略立案にとって極めて重要になります。

米国には世界的に有名な研究機関やイノベーションハブがあり、量子ネットワーキング研究の最前線をリードしているため、予測期間中、北米が最大のシェアを占めると思われます。最近、米国エネルギー省は、量子ネットワーキングの研究を推進する3つのプロジェクトに対し、2,400万米ドルの資金提供を宣言しました。焦点はスケーラブルな量子ネットワーキング通信です。その目的は、分散型量子コンピューターの実現、高精度量子センサーの統合、量子情報の流れの改善とエラー緩和を実現する新しいネットワーク・アーキテクチャとプロトコルの開発です。

当レポートでは、世界の量子ネットワーキング市場について調査し、オファリング別、エンドユーザー産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- 2024年~2025年の主な会議とイベント

- ケーススタディ分析

- 規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 量子ネットワーキング市場におけるAIの影響

第6章 量子ネットワーキングの用途

- イントロダクション

- 安全な通信

- 分散量子コンピューティング

- 量子センシングと計測

- 量子クロック同期

- 安全な投票

- 安全な金融取引

第7章 量子ネットワーキング市場、オファリング別

- イントロダクション

- ハードウェア

- ソフトウェア

第8章 量子ネットワーキング市場、エンドユーザー産業別

- イントロダクション

- 銀行・金融

- 政府・防衛

- ヘルスケア・ライフサイエンス

- IT ・通信

- エネルギー・ユーティリティ

- 製造

- その他のエンドユーザー産業

第9章 量子ネットワーキング市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2024年

- 収益分析、2021年~2023年

- 市場シェア分析、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- TOSHIBA CORPORATION

- ID QUANTIQUE

- HEQA SECURITY

- QUANTUMCTEK CO., LTD.

- QUINTESSENCELABS

- TERRA QUANTUM

- MAGIQ TECHNOLOGIES

- CRYPTA LABS LIMITED

- QUANTUM XCHANGE

- QUNNECT INC.

- その他の企業

- QUBITEKK, INC.

- ALIRO TECHNOLOGIES, INC.

- QUNU LABS PRIVATE LIMITED

- ARQIT

- MIRAEX

- SPEQTRAL PTE LTD

- KETS QUANTUM SECURITY LTD.

- AEGIQ LTD.

- QUBALT GMBH

- SSH

- QUSECURE, INC.

- VERIQLOUD

- QRYPT

- QUSIDE TECHNOLOGIES

- LUXQUANTA TECHNOLOGIES S.L.

第12章 付録

List of Tables

- TABLE 1 QUANTUM NETWORKING MARKET: RISK ANALYSIS

- TABLE 2 INDICATIVE PRICING TREND OF QUANTUM NETWORKING TECHNOLOGIES OFFERED BY KEY PLAYERS, BY OFFERING (USD)

- TABLE 3 INDICATIVE PRICING TREND OF QUANTUM NETWORKING TECHNOLOGIES, BY OFFERING, 2020-2023 (USD)

- TABLE 4 AVERAGE SELLING PRICE TREND OF QUANTUM KEY DISTRIBUTION SYSTEMS, BY REGION, 2020-2023 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF QUANTUM RANDOM NUMBER GENERATORS, BY REGION, 2020-2023 (USD)

- TABLE 6 ROLE OF COMPANIES IN QUANTUM NETWORKING ECOSYSTEM

- TABLE 7 LIST OF PATENTS, 2022-2024

- TABLE 8 IMPORT SCENARIO FOR HS CODE 847180-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 9 EXPORT SCENARIO FOR HS CODE 847180-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 10 LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 17 QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 18 QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 19 HARDWARE: QUANTUM NETWORKING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 20 HARDWARE: QUANTUM NETWORKING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 21 HARDWARE: QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 22 HARDWARE: QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 23 HARDWARE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 24 HARDWARE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 25 HARDWARE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 26 HARDWARE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 27 HARDWARE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 28 HARDWARE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 29 HARDWARE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 30 HARDWARE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 31 QUANTUM KEY DISTRIBUTION SYSTEMS: QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 32 QUANTUM KEY DISTRIBUTION SYSTEMS: QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 33 QUANTUM RANDOM NUMBER GENERATORS: QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 34 QUANTUM RANDOM NUMBER GENERATORS: QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 35 QUANTUM MEMORY DEVICES: QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 QUANTUM MEMORY DEVICES: QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 QUANTUM REPEATERS: QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 QUANTUM REPEATERS: QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 OTHER HARDWARE TYPES: QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 40 OTHER HARDWARE TYPES: QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 41 SOFTWARE: QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 42 SOFTWARE: QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 43 SOFTWARE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 44 SOFTWARE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 45 SOFTWARE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 46 SOFTWARE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 47 SOFTWARE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 48 SOFTWARE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 49 SOFTWARE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 50 SOFTWARE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 51 QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 52 QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 53 BANKING & FINANCE: QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 54 BANKING & FINANCE: QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 55 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 56 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 57 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 58 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 59 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 60 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 61 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 62 BANKING & FINANCE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 63 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 65 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 66 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 67 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 68 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 69 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 70 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 71 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 72 GOVERNMENT & DEFENSE: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 73 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 74 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 75 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 76 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 77 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 78 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 79 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 80 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 81 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 82 HEALTHCARE & LIFE SCIENCES: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 83 IT & TELECOM: QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 84 IT & TELECOM: QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 85 IT & TELECOM: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 86 IT & TELECOM: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 87 IT & TELECOM: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 88 IT & TELECOM: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 89 IT & TELECOM: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 90 IT & TELECOM: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 91 IT & TELECOM: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 92 IT & TELECOM: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 93 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 94 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 95 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 96 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 97 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 98 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 99 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 100 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 101 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 102 ENERGY & UTILITIES: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 103 MANUFACTURING: QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 104 MANUFACTURING: QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 105 MANUFACTURING: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 106 MANUFACTURING: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 107 MANUFACTURING: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 108 MANUFACTURING: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 109 MANUFACTURING: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 110 MANUFACTURING: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 111 MANUFACTURING: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020-2023 (USD THOUSAND)

- TABLE 112 MANUFACTURING: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024-2029 (USD THOUSAND)

- TABLE 113 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 114 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 115 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 116 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD THOUSAND)

- TABLE 117 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 118 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD THOUSAND)

- TABLE 119 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 120 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD THOUSAND)

- TABLE 121 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2020-2023 (USD THOUSAND)

- TABLE 122 OTHER END-USE INDUSTRIES: QUANTUM NETWORKING MARKET IN ROW, BY REGION, 2024-2029 (USD THOUSAND)

- TABLE 123 QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 124 QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 125 NORTH AMERICA: QUANTUM NETWORKING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 126 NORTH AMERICA: QUANTUM NETWORKING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 127 NORTH AMERICA: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 128 NORTH AMERICA: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 129 NORTH AMERICA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 130 NORTH AMERICA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 131 US: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 132 US: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 133 US: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 134 US: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 135 CANADA: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 136 CANADA: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 137 CANADA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 138 CANADA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 139 MEXICO: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 140 MEXICO: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 141 MEXICO: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD THOUSAND)

- TABLE 142 MEXICO: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD THOUSAND)

- TABLE 143 EUROPE: QUANTUM NETWORKING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 144 EUROPE: QUANTUM NETWORKING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 145 EUROPE: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 146 EUROPE: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 147 EUROPE: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 148 EUROPE: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 149 UK: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 150 UK: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 151 UK: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 152 UK: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 153 GERMANY: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 154 GERMANY: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 155 GERMANY: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 156 GERMANY: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 157 FRANCE: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 158 FRANCE: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 159 FRANCE: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD THOUSAND)

- TABLE 160 FRANCE: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD THOUSAND)

- TABLE 161 REST OF EUROPE: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 162 REST OF EUROPE: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 163 REST OF EUROPE: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 164 REST OF EUROPE: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 165 ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 166 ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 167 ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 168 ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 169 ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 170 ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 171 CHINA: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 172 CHINA: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 173 CHINA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 174 CHINA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 175 JAPAN: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 176 JAPAN: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 177 JAPAN: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD THOUSAND)

- TABLE 178 JAPAN: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD THOUSAND)

- TABLE 179 SOUTH KOREA: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 180 SOUTH KOREA: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 181 SOUTH KOREA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD THOUSAND)

- TABLE 182 SOUTH KOREA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD THOUSAND)

- TABLE 183 REST OF ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 185 REST OF ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, BY OFFERING, 2020-2023 (USD THOUSAND)

- TABLE 186 REST OF ASIA PACIFIC: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, BY OFFERING, 2024-2029 (USD THOUSAND)

- TABLE 187 ROW: QUANTUM NETWORKING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 188 ROW: QUANTUM NETWORKING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 189 ROW: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 190 ROW: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 191 ROW: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 192 ROW: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 193 MIDDLE EAST: QUANTUM NETWORKING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 194 MIDDLE EAST: QUANTUM NETWORKING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 195 MIDDLE EAST: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 196 MIDDLE EAST: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 197 MIDDLE EAST: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD THOUSAND)

- TABLE 198 MIDDLE EAST: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD THOUSAND)

- TABLE 199 AFRICA: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 200 AFRICA: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 201 AFRICA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD THOUSAND)

- TABLE 202 AFRICA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD THOUSAND)

- TABLE 203 SOUTH AMERICA: QUANTUM NETWORKING MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 204 SOUTH AMERICA: QUANTUM NETWORKING MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 205 SOUTH AMERICA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2020-2023 (USD THOUSAND)

- TABLE 206 SOUTH AMERICA: QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY, 2024-2029 (USD THOUSAND)

- TABLE 207 QUANTUM NETWORKING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- TABLE 208 QUANTUM NETWORKING MARKET: DEGREE OF COMPETITION, 2023

- TABLE 209 QUANTUM NETWORKING MARKET: OFFERING FOOTPRINT

- TABLE 210 QUANTUM NETWORKING MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 211 QUANTUM NETWORKING MARKET: REGION FOOTPRINT

- TABLE 212 QUANTUM NETWORKING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 213 QUANTUM NETWORKING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 214 QUANTUM NETWORKING MARKET: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2024

- TABLE 215 QUANTUM NETWORKING MARKET: DEALS, JANUARY 2020-JUNE 2024

- TABLE 216 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 217 TOSHIBA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 TOSHIBA CORPORATION: PRODUCT LAUNCHES

- TABLE 219 TOSHIBA CORPORATION: DEALS

- TABLE 220 TOSHIBA CORPORATION: EXPANSIONS

- TABLE 221 ID QUANTIQUE: COMPANY OVERVIEW

- TABLE 222 ID QUANTIQUE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 ID QUANTIQUE: PRODUCT LAUNCHES

- TABLE 224 ID QUANTIQUE: DEALS

- TABLE 225 HEQA SECURITY: COMPANY OVERVIEW

- TABLE 226 HEQA SECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 HEQA SECURITY: DEALS

- TABLE 228 QUANTUMCTEK CO., LTD.: COMPANY OVERVIEW

- TABLE 229 QUANTUMCTEK CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 QUINTESSENCELABS: COMPANY OVERVIEW

- TABLE 231 QUINTESSENCELABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 QUINTESSENCELABS: PRODUCT LAUNCHES

- TABLE 233 QUINTESSENCELABS: DEALS

- TABLE 234 TERRA QUANTUM: COMPANY OVERVIEW

- TABLE 235 TERRA QUANTUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 TERRA QUANTUM: PRODUCT LAUNCHES

- TABLE 237 TERRA QUANTUM: DEALS

- TABLE 238 MAGIQ TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 239 MAGIQ TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 CRYPTA LABS LIMITED: COMPANY OVERVIEW

- TABLE 241 CRYPTA LABS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 CRYPTA LABS LIMITED: DEALS

- TABLE 243 QUANTUM XCHANGE: COMPANY OVERVIEW

- TABLE 244 QUANTUM XCHANGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 QUANTUM XCHANGE: PRODUCT LAUNCHES

- TABLE 246 QUANTUM XCHANGE: DEALS

- TABLE 247 QUNNECT INC.: COMPANY OVERVIEW

- TABLE 248 QUNNECT INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 QUNNECT INC.: EXPANSIONS

List of Figures

- FIGURE 1 QUANTUM NETWORKING MARKET SEGMENTATION

- FIGURE 2 QUANTUM NETWORKING MARKET: RESEARCH DESIGN

- FIGURE 3 QUANTUM NETWORKING MARKET: RESEARCH FLOW

- FIGURE 4 QUANTUM NETWORKING MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 5 QUANTUM NETWORKING MARKET: BOTTOM-UP APPROACH

- FIGURE 6 QUANTUM NETWORKING MARKET: TOP-DOWN APPROACH

- FIGURE 7 QUANTUM NETWORKING MARKET: DATA TRIANGULATION

- FIGURE 8 QUANTUM NETWORKING MARKET: RESEARCH ASSUMPTIONS

- FIGURE 9 HARDWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2029

- FIGURE 10 GOVERNMENT & DEFENSE SEGMENT TO DOMINATE QUANTUM NETWORKING MARKET FROM 2024 TO 2029

- FIGURE 11 NORTH AMERICA HELD LARGEST SHARE OF QUANTUM NETWORKING MARKET IN 2023

- FIGURE 12 RISING EMPHASIS ON SECURE COMMUNICATION TO CREATE LUCRATIVE OPPORTUNITIES FOR PLAYERS IN QUANTUM NETWORKING MARKET

- FIGURE 13 HARDWARE SEGMENT TO EXHIBIT HIGHER CAGR FROM 2024 TO 2029

- FIGURE 14 IT & TELECOM SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 CANADA TO EXHIBIT HIGHEST CAGR IN GLOBAL QUANTUM NETWORKING MARKET DURING FORECAST PERIOD

- FIGURE 16 NORTH AMERICA TO RECORD HIGHEST CAGR IN QUANTUM NETWORKING MARKET BETWEEN 2024 AND 2029

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 VOLUME OF DATA GENERATED WORLDWIDE, 2020-2025 (ZETTABYTES)

- FIGURE 19 IMPACT ANALYSIS: DRIVERS

- FIGURE 20 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 21 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 22 IMPACT ANALYSIS: CHALLENGES

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 AVERAGE SELLING PRICE TREND OF QUANTUM NETWORKING TECHNOLOGIES OFFERED BY KEY PLAYERS, BY OFFERING

- FIGURE 25 AVERAGE SELLING PRICE TREND OF QUANTUM KEY DISTRIBUTION SYSTEMS, BY REGION, 2020-2023

- FIGURE 26 AVERAGE SELLING PRICE TREND OF QUANTUM RANDOM NUMBER GENERATORS, BY REGION, 2020-2023

- FIGURE 27 VALUE CHAIN ANALYSIS

- FIGURE 28 QUANTUM NETWORKING ECOSYSTEM

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2020-2023

- FIGURE 30 INVESTMENTS IN QUANTUM TECHNOLOGY, 2015-2023

- FIGURE 31 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 32 IMPORT DATA FOR HS CODE 847180-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 33 EXPORT DATA FOR HS CODE 847180-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 34 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 37 IMPACT OF AI ON QUANTUM NETWORKING INDUSTRY

- FIGURE 38 HARDWARE SEGMENT TO HOLD LARGER MARKET SHARE IN 2029

- FIGURE 39 GOVERNMENT & DEFENSE SEGMENT TO DOMINATE QUANTUM NETWORKING MARKET DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA TO RECORD HIGHEST CAGR IN QUANTUM NETWORKING MARKET FROM 2024 TO 2029

- FIGURE 41 NORTH AMERICA: QUANTUM NETWORKING MARKET SNAPSHOT

- FIGURE 42 CANADA TO EXHIBIT HIGHEST CAGR IN NORTH AMERICAN QUANTUM NETWORKING MARKET FROM 2024 TO 2029

- FIGURE 43 EUROPE: QUANTUM NETWORKING MARKET SNAPSHOT

- FIGURE 44 GERMANY TO RECORD HIGHEST CAGR IN EUROPEAN QUANTUM NETWORKING MARKET BETWEEN 2024 AND 2029

- FIGURE 45 ASIA PACIFIC: QUANTUM NETWORKING MARKET SNAPSHOT

- FIGURE 46 CHINA TO DOMINATE ASIA PACIFIC QUANTUM NETWORKING MARKET DURING FORECAST PERIOD

- FIGURE 47 ROW: QUANTUM NETWORKING MARKET SNAPSHOT

- FIGURE 48 MIDDLE EAST TO RECORD HIGHEST CAGR IN ROW QUANTUM NETWORKING MARKET FROM 2024 TO 2029

- FIGURE 49 QUANTUM NETWORKING MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2021-2023

- FIGURE 50 MARKET SHARE ANALYSIS OF COMPANIES OFFERING QUANTUM NETWORKING TECHNOLOGIES, 2023

- FIGURE 51 COMPANY VALUATION

- FIGURE 52 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 53 BRAND/PRODUCT COMPARISON

- FIGURE 54 QUANTUM NETWORKING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 55 QUANTUM NETWORKING MARKET: COMPANY FOOTPRINT

- FIGURE 56 QUANTUM NETWORKING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 57 TOSHIBA CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 QUANTUMCTEK CO., LTD.: COMPANY SNAPSHOT

The quantum networking market is expected to be worth USD 861.8 million in 2024 and is estimated to reach USD 5,382.0 million by 2029, growing at a CAGR of 44.2% between 2024 and 2029. The market growth is driven by expanding use cases in secure communication, financial transactions, and defense. Also, with an increased focus of financial institutions and defense organizations toward protection and maintenance of privacy of data, demand will grow for devices such as quantum key distribution. Added to this is quantum technologies funding and initiatives by governments and corporations that further catapult the quantum networking market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Segments | By Offering, End-user Industry, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Quantum Key Distribution (QKD) system segment to hold the high market share during the forecast period."

Quantum Key Distribution (QKD) system segment will hold high market share during the forecast period. The market growth is credited to growing concerns over data security and threat towards traditional data encryption methods. This has let to increase in adoption of quantum networking solutions across banking and finance, government, and defense sectors. The industry participants are focusing on implementations of QKD systems and running quantum networking pilot projects to gain a competitive edge in the market. For instance, in March 2024, Toshiba Corporation (Japan) announced strategic partnership with SoftBank Corp. (Japan) to demonstrate QKD operations with optical wireless communication. The partnership aims to showcases that secure QKD networks can be deployed over wireless communication infrastructure. Such significant partnership activities will propel the QKD segment growth over the forecast timeframe.

"Market for Government & Defense segment is projected to hold for largest share during the forecast timeline."

Government and defense end user industry is projected to hold larger share during the forecast timeline. Quantum networking is done for the secure communication of classified information and national security in government and defense sectors. Quantum networks ensure that the communication channels can, in effect, be made immune to eavesdropping. QKD will enable the generation of cryptographic keys, which, by the very law of Physics itself, are safe against any form of computational attack, including those coming from the future quantum computers. This opens up a way to protect sensitive information, assure military communications integrity, and protect national secrets. In addition, quantum-secured military communications are supposed to be kept confidential and authenticated against advanced cyber threats; therefore, they become exceedingly important for secret defense operations and strategic planning.

"North America is expected to hold for largest share during the forecast timeline."

North America will occupy the largest share during the forecast period since The US is home to research institutions and innovation hubs of worldwide repute, leading from the forefront in quantum networking research. Universities like MIT, Stanford, and the University of Chicago, along with national laboratories such as Argonne and Los Alamos, are leading different cutting-edge researches in quantum communication and networking. Recently, The U.S. Department of Energy declared USD 24 million, in funding for three projects driving the research into quantum networks. The focus will be on scalable quantum network communications. The funding will go to three projects whose objectives are threefold: allowing distributed quantum computers, integrating precision quantum sensors, and giving rise to new network architectures and protocols that will realize improved quantum information flow and error mitigation.

Extensive primary interviews were conducted with key industry experts in the quantum networking market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The break-up of primary participants for the report has been shown below: The break-up of the profile of primary participants in the quantum networking market:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C Level - 45%, Director Level - 35%, Others-20%

- By Region: North America - 40%, Europe - 18%, Asia Pacific - 35%, ROW- 7%

The report profiles key players in the quantum networking market with their respective market ranking analysis. Prominent players profiled in this report are TOSHIBA CORPORATION (Japan), Terra Quantum (Switzerland), Quantumctek Co.,Ltd. (China), ID Quantique (Switzerland), HEQA Security (Israel), QuintessenceLabs (Australia), MagiQ Technologies (US), Crypta Labs Limited (UK), Quantum Xchange (US), Qunnect Inc. (US), among others.

Apart from this, Qubitekk, Inc. (US), Aliro Technologies, Inc. (US), QuNu Labs Private Limited. (India), Arqit Quantum Inc. (UK), Miraex (Switzerland), SpeQtral Pte Ltd (Singapore), KETS QUANTUM SECURITY LTD (UK), Aegiq Ltd. (Sheffield), QuBalt GmbH (Germany), SSH (Finland), QuSecure, Inc. (US), VeriQloud (France), Qrypt (New York), Quside Technologies. (Spain), LuxQuanta Technologies S.L. (Spain), are among a few emerging companies in the quantum networking market.

Research Coverage: This research report categorizes the quantum networking market based on offering, end user Industry, application, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the quantum networking market and forecasts the same till 2029. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the quantum networking ecosystem.

Key Benefits of Buying the Report The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall quantum networking market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (expanding cyber threats; the surge in data generation necessitating robust and scalable security solutions capable of handling large volumes of sensitive information) influencing the growth of the quantum networking market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the quantum networking market.

- Market Development: Comprehensive information about lucrative markets - the report analysis the quantum networking market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the quantum networking market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like TOSHIBA CORPORATION (Japan), Terra Quantum (Switzerland), Quantumctek Co.,Ltd. (China), ID Quantique (Switzerland), HEQA Security (Israel), among others in the quantum networking market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ANALYSIS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN QUANTUM NETWORKING MARKET

- 4.2 QUANTUM NETWORKING MARKET, BY OFFERING

- 4.3 QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY

- 4.4 QUANTUM NETWORKING MARKET, BY COUNTRY

- 4.5 QUANTUM NETWORKING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing complexity of cyber-attacks in digital era

- 5.2.1.2 Rising data generation from IoT and cloud computing devices

- 5.2.1.3 Mounting demand for secure communication channels

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs of quantum networking hardware

- 5.2.2.2 Standardization and interoperability issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising emphasis on data protection and privacy

- 5.2.3.2 Increasing allocation of funds for developing quantum technologies

- 5.2.3.3 Emergence of smart cities and industrial automation

- 5.2.4 CHALLENGES

- 5.2.4.1 Sensitivity of quantum systems to electromagnetic radiation

- 5.2.4.2 Technical compatibility issues

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Quantum sensing

- 5.8.1.2 Quantum computing

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Post-quantum cryptography

- 5.8.2.2 Integrated quantum circuits

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Photonics and optoelectronics

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 847180)

- 5.10.2 EXPORT SCENARIO (HS CODE 847180)

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 GLOBAL TECH SOLUTIONS ADOPTS QRNG-INTEGRATED EZQUANT SECURITY KEY TO ENABLE SECURE PASSWORDLESS AUTHENTICATION

- 5.12.2 HITACHI ENERGY AND ID QUANTIQUE PARTNER TO SECURE MISSION-CRITICAL NETWORKS WITH QUANTUM ENCRYPTION

- 5.12.3 EPB, QUBITEKK, AND ALIRO UNITE TO ENABLE SECURE AND SCALABLE COMMUNICATION WITH EPB QUANTUM NETWORK

- 5.12.4 QUANTUM COMMUNICATIONS HUB DEPLOYS QKD ACROSS UKQN AND UKQNTEL NETWORKS TO ESTABLISH SECURE QUANTUM COMMUNICATION

- 5.12.5 THALES TRUSTED CYBER TECHNOLOGIES ADOPTS LUNA T-SERIES HSMS WITH ID QUANTIQUE'S QRNG CHIP TO ADDRESS CYBER THREATS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

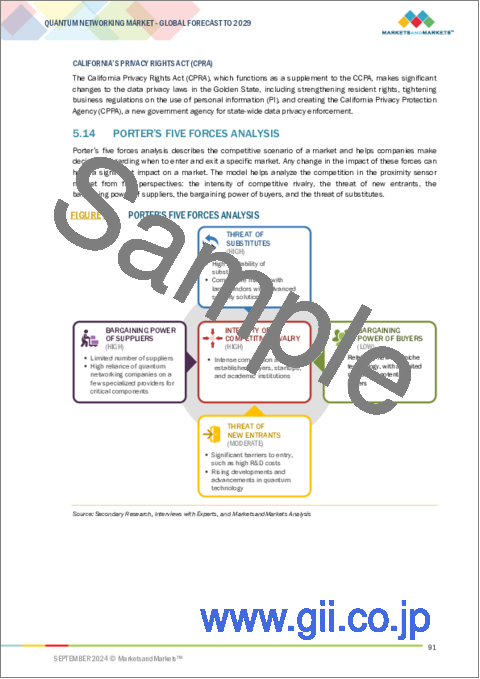

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI ON QUANTUM NETWORKING MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 CASE STUDY: APPLICATION OF AI IN MARL-BASED APPROACH FOR DECENTRALIZED RESOURCE ALLOCATION IN QUANTUM COMPUTING NETWORKS

6 QUANTUM NETWORKING APPLICATIONS

- 6.1 INTRODUCTION

- 6.2 SECURE COMMUNICATION

- 6.3 DISTRIBUTED QUANTUM COMPUTING

- 6.4 QUANTUM SENSING & METROLOGY

- 6.5 QUANTUM CLOCK SYNCHRONIZATION

- 6.6 SECURE VOTING

- 6.7 SECURE FINANCIAL TRANSACTION

7 QUANTUM NETWORKING MARKET, BY OFFERING

- 7.1 INTRODUCTION

- 7.2 HARDWARE

- 7.2.1 QUANTUM KEY DISTRIBUTION SYSTEMS

- 7.2.1.1 Increasing need for promising technology for long-term data security to expedite segmental growth

- 7.2.2 QUANTUM RANDOM NUMBER GENERATORS

- 7.2.2.1 Rising emphasis on secure financial transactions and communications to drive market

- 7.2.3 QUANTUM MEMORY DEVICES

- 7.2.3.1 Growing focus on efficient storage and management of quantum information for computation tasks to boost segmental growth

- 7.2.4 QUANTUM REPEATERS

- 7.2.4.1 Increasing integration with telecom infrastructure to transform communications to fuel segmental growth

- 7.2.5 OTHER HARDWARE TYPES

- 7.2.1 QUANTUM KEY DISTRIBUTION SYSTEMS

- 7.3 SOFTWARE

- 7.3.1 GROWING CONCERN ABOUT CYBER THREATS AND DATA BREACHES TO CONTRIBUTE TO SEGMENTAL GROWTH

8 QUANTUM NETWORKING MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 BANKING & FINANCE

- 8.2.1 INCREASING FREQUENCY OF CYBER-ATTACKS TO BOOST SEGMENTAL GROWTH

- 8.3 GOVERNMENT & DEFENSE

- 8.3.1 GROWING DEMAND FOR ROBUST ENCRYPTION SOLUTIONS TO SAFEGUARD CRITICAL INFRASTRUCTURE TO FOSTER SEGMENTAL GROWTH

- 8.4 HEALTHCARE & LIFE SCIENCES

- 8.4.1 RISING EMPHASIS ON SAFEGUARDING SENSITIVE PATIENT INFORMATION TO AUGMENT SEGMENTAL GROWTH

- 8.5 IT & TELECOM

- 8.5.1 INCREASING FOCUS ON PREVENTING SIGNAL LOSS AND INTERFERENCE TO BOLSTER SEGMENTAL GROWTH

- 8.6 ENERGY & UTILITIES

- 8.6.1 RISING FOCUS ON ACCURATE WEATHER FORECASTING AND SAFE DATA EXCHANGE TO BOOST SEGMENTAL GROWTH

- 8.7 MANUFACTURING

- 8.7.1 INCREASING DATA GENERATION AND NEED FOR ADVANCED SECURITY AND COMMUNICATION SOLUTIONS TO FUEL SEGMENTAL GROWTH

- 8.8 OTHER END-USE INDUSTRIES

9 QUANTUM NETWORKING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Mounting investment in advanced communication technologies to foster market growth

- 9.2.3 CANADA

- 9.2.3.1 Increasing development of algorithms to enhance telecom networks to expedite market growth

- 9.2.4 MEXICO

- 9.2.4.1 Rising allocation of funds to develop advanced information technologies to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 UK

- 9.3.2.1 Rising emphasis on addressing cybersecurity threats to accelerate market growth

- 9.3.3 GERMANY

- 9.3.3.1 Growing focus on enabling secure and efficient data exchange to augment market growth

- 9.3.4 FRANCE

- 9.3.4.1 Surging demand for advanced technologies for secure communication to contribute to market growth

- 9.3.5 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Rising investment in emerging technologies to accelerate market growth

- 9.4.3 JAPAN

- 9.4.3.1 Increasing focus on advancing high-tech sector to spur demand

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Growing focus on technological innovation to contribute to market growth

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 ROW

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Increasing need for robust and secure communication systems to boost market growth

- 9.5.2.2 GCC countries

- 9.5.2.3 Rest of Middle East

- 9.5.3 AFRICA

- 9.5.3.1 Growing interest in enhancing technological capabilities and securing communication infrastructure to augment market growth

- 9.5.4 SOUTH AMERICA

- 9.5.4.1 Rising emphasis on technology-driven economic growth to drive market

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 10.3 REVENUE ANALYSIS, 2021-2023

- 10.4 MARKET SHARE ANALYSIS, 2023

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.7.5.1 Company footprint

- 10.7.5.2 Offering footprint

- 10.7.5.3 End-use industry footprint

- 10.7.5.4 Region footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 TOSHIBA CORPORATION

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 ID QUANTIQUE

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 HEQA SECURITY

- 11.1.3.1 Products/Solutions/Services offered

- 11.1.3.2 Recent developments

- 11.1.3.2.1 Deals

- 11.1.3.3 MnM view

- 11.1.3.3.1 Key strengths/Right to win

- 11.1.3.3.2 Strategic choices

- 11.1.3.3.3 Weaknesses/Competitive threats

- 11.1.4 QUANTUMCTEK CO., LTD.

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths/Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses/Competitive threats

- 11.1.5 QUINTESSENCELABS

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses/Competitive threats

- 11.1.6 TERRA QUANTUM

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.7 MAGIQ TECHNOLOGIES

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.8 CRYPTA LABS LIMITED

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.9 QUANTUM XCHANGE

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.9.3.2 Deals

- 11.1.10 QUNNECT INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Expansions

- 11.1.1 TOSHIBA CORPORATION

- 11.2 OTHER PLAYERS

- 11.2.1 QUBITEKK, INC.

- 11.2.2 ALIRO TECHNOLOGIES, INC.

- 11.2.3 QUNU LABS PRIVATE LIMITED

- 11.2.4 ARQIT

- 11.2.5 MIRAEX

- 11.2.6 SPEQTRAL PTE LTD

- 11.2.7 KETS QUANTUM SECURITY LTD.

- 11.2.8 AEGIQ LTD.

- 11.2.9 QUBALT GMBH

- 11.2.10 SSH

- 11.2.11 QUSECURE, INC.

- 11.2.12 VERIQLOUD

- 11.2.13 QRYPT

- 11.2.14 QUSIDE TECHNOLOGIES

- 11.2.15 LUXQUANTA TECHNOLOGIES S.L.

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS