|

|

市場調査レポート

商品コード

1555086

呼吸回路市場:使用法別、患者タイプ別、回路タイプ別、用途別、エンドユーザー別、地域別 - 2029年までの予測Breathing Circuits Market by Circuit Type (Single Limb, Dual Limb), Usage (Disposable, Reusable), Application (Anesthesia, Respiratory Dysfunction), Patient Type (Adults, Pediatric & Neonatal), End User (Hospitals, Clinics) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 呼吸回路市場:使用法別、患者タイプ別、回路タイプ別、用途別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2024年09月10日

発行: MarketsandMarkets

ページ情報: 英文 282 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

呼吸回路の市場規模は、2024年の15億7,000万米ドルから2029年には21億6,000万米ドルに成長すると予測され、予測期間中のCAGRは6.5%になるとみられています。

呼吸回路技術の向上は市場の主要促進要因の一つです。過去2、3年の間に、安全性、快適性、効率重視の開発を強化するためにとられた新たな取り組みや努力によって、呼吸回路はますます洗練された効率的な形態になっています。例えば、内蔵加湿、抗菌フィルター、高度な人間工学的設計を特徴とする呼吸回路は、感染症や不快感を軽減しながら呼吸サポートを提供する上で、より大きな効果をもたらしています。さらに、生産に使用される高度な材料により、呼吸回路はより生体適合性と耐性を持つようになっています。さまざまな主要企業によるこのような技術的進歩は、呼吸回路の採用拡大につながり、したがって今後数年間の市場成長を促進します。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(米ドル) |

| セグメント別 | 使用法別、患者タイプ別、回路タイプ別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ、GCC諸国 |

患者タイプ別では、呼吸回路市場は成人患者と小児・新生児患者に二分されます。予測期間中にCAGRが最も高くなると予測されるのは成人患者セグメントです。この患者セグメントの成長は、成人外科手術、特に麻酔と呼吸サポートに呼吸回路を必要とする複雑でリスクの高い症例の割合が増加していることによるものです。さらに、人口の高齢化とCOPD、喘息、睡眠時無呼吸症候群などの慢性呼吸器疾患の有病率の上昇は、特に外科手術における高度な呼吸回路の使用としばしば関連しており、これがこのセグメントの成長をさらに後押ししています。さらに、座りっぱなしの生活、食生活の乱れ、喫煙もこのような症状の主な一因として作用するため、成人の呼吸器疾患の管理・治療における高度な呼吸回路の需要を増大させています。

呼吸回路市場は、回路タイプ別に片肢呼吸回路と両肢呼吸回路に区分されます。二重肢式呼吸回路は予測期間中に最も高いCAGRを占めると予測されています。二重手足呼吸回路は、重要で特殊な医療用途に数多くの利点を提供するため、大きな需要が見込まれます。主な要因の1つは、吸気と呼気のための2つの異なる制御されたチャンネルを提供することで、呼気二酸化炭素の再呼吸を防ぐことで換気効率を高めます。これは、患者の安全性と最適な呼吸サポートを確保するためにガス管理を正しく行うことが重要なICUやOTでは非常に重要になるとみられます。二重四肢回路のもう一つの利点は、加湿器、フィルター、モニター装置などの付属品を装着することで、患者への適切で包括的なケアを促進できることです。これに加えて、これらの回路はさまざまな患者やさまざまな医療介入に適応できるため、ヘルスケアにおける適用性がさらに高まるという事実もあります。

当レポートでは、世界の呼吸回路市場について調査し、使用法別、患者タイプ別、回路タイプ別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 価格分析

- 特許分析

- バリューチェーン分析

- サプライチェーン分析

- 貿易分析

- エコシステム分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 規制分析

- 技術分析

- 2024年~2025年の主な会議とイベント

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- AI/生成AIが呼吸回路市場に与える影響

第6章 呼吸回路市場(使用法別)

- イントロダクション

- 使い捨て型呼吸回路

- 再利用型呼吸回路

第7章 呼吸回路市場(患者タイプ別)

- イントロダクション

- 成人患者

- 小児および新生児患者

第8章 呼吸回路市場(回路タイプ別)

- イントロダクション

- 片肢呼吸回路

- 両肢呼吸回路

第9章 呼吸回路市場(用途別)

- イントロダクション

- 麻酔

- 呼吸機能障害

- その他

第10章 呼吸回路市場(エンドユーザー別)

- イントロダクション

- 病院

- 外来手術センター

- クリニック

- その他

第11章 呼吸回路市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- GCC諸国

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2021年~2023年

- 市場シェア分析、2023年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- DRAGERWERK AG & CO. KGAA

- MEDTRONIC

- CARDINAL HEALTH

- FISHER & PAYKEL HEALTHCARE LIMITED

- RESMED

- AMBU A/S

- GE HEALTHCARE

- KONINKLIJKE PHILIPS N.V.

- ICU MEDICAL, INC.

- HAMILTON MEDICAL

- MEDLINE INDUSTRIES, LP

- その他の企業

- FORCA HEALTHCARE

- BRAUN & CO. LIMITED

- INSPIRATION HEALTHCARE GROUP PLC

- BESMED HEALTH BUSINESS CORP.

- EAKIN HEALTHCARE

- BOMIMED

- FLEXICARE(GROUP)LIMITED

- BIO-MED DEVICES

- AIRLIFE

- MERCURY MEDICAL

- INTERSURGICAL LTD.

- FAIRMONT MEDICAL PRODUCTS PTY LTD.

- BREAS MEDICAL AB

- GPC MEDICAL LTD.

第14章 付録

List of Tables

- TABLE 1 BREATHING CIRCUITS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 BREATHING CIRCUITS MARKET: KEY DATA FROM PRIMARY SOURCES

- TABLE 3 BREATHING CIRCUITS MARKET: RISK ASSESSMENT

- TABLE 4 NUMBER OF SURGERIES PERFORMED GLOBALLY, BY COUNTRY, 2022

- TABLE 5 INDICATIVE SELLING PRICING OF BREATHING CIRCUITS, BY PRODUCT, 2022-2024

- TABLE 6 INDICATIVE SELLING PRICE OF BREATHING CIRCUITS, BY REGION, 2022-2024

- TABLE 7 BREATHING CIRCUITS MARKET: LIST OF MAJOR PATENTS, 2022-2023

- TABLE 8 IMPORT DATA FOR HS CODE 901920, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 901920, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 10 BREATHING CIRCUITS MARKET: ROLE IN ECOSYSTEM

- TABLE 11 BREATHING CIRCUITS MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 12 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS OF BREATHING CIRCUITS (%)

- TABLE 13 KEY BUYING CRITERIA FOR BREATHING CIRCUITS, BY CIRCUIT TYPE

- TABLE 14 CLASSIFICATION OF MEDICAL DEVICES BY US FDA

- TABLE 15 CHINA: MEDICAL DEVICES CLASSIFICATION BY NATIONAL MEDICAL PRODUCTS ADMINISTRATION (NMPA)

- TABLE 16 JAPAN: CLASSIFICATION OF MEDICAL DEVICES AND REVIEWING BODIES

- TABLE 17 NORTH AMERICA: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 LATIN AMERICA: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 REST OF THE WORLD: KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 BREATHING CIRCUITS MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS, JANUARY 2024-DECEMBER 2025

- TABLE 23 BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 24 KEY PRODUCTS IN DISPOSABLE BREATHING CIRCUITS MARKET

- TABLE 25 DISPOSABLE BREATHING CIRCUITS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 26 NORTH AMERICA: DISPOSABLE BREATHING CIRCUITS MARKET, BY COUNTRY 2022-2029 (USD MILLION)

- TABLE 27 EUROPE: DISPOSABLE BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 28 ASIA PACIFIC: DISPOSABLE BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 29 LATIN AMERICA: DISPOSABLE BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 30 KEY PRODUCTS IN REUSABLE BREATHING CIRCUITS MARKET

- TABLE 31 REUSABLE BREATHING CIRCUITS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 32 NORTH AMERICA: REUSABLE BREATHING CIRCUITS MARKET, BY COUNTRY 2022-2029 (USD MILLION)

- TABLE 33 EUROPE: REUSABLE BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

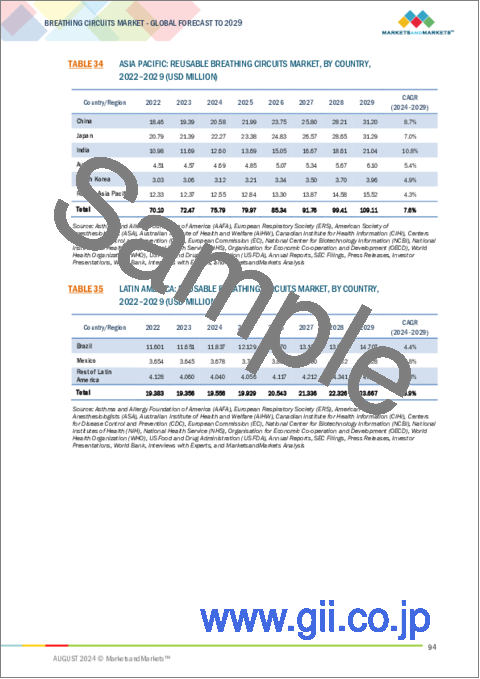

- TABLE 34 ASIA PACIFIC: REUSABLE BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 35 LATIN AMERICA: REUSABLE BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 36 BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 37 KEY PRODUCTS IN BREATHING CIRCUITS MARKET FOR ADULT PATIENTS

- TABLE 38 BREATHING CIRCUITS MARKET FOR ADULT PATIENTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 39 NORTH AMERICA: BREATHING CIRCUITS MARKET FOR ADULT PATIENTS, BY COUNTRY 2022-2029 (USD MILLION)

- TABLE 40 EUROPE: BREATHING CIRCUITS MARKET FOR ADULT PATIENTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 41 ASIA PACIFIC: BREATHING CIRCUITS MARKET FOR ADULT PATIENTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 42 LATIN AMERICA: BREATHING CIRCUITS MARKET FOR ADULT PATIENTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 43 KEY PRODUCTS IN BREATHING CIRCUITS MARKET FOR PEDIATRIC AND NEONATAL PATIENTS

- TABLE 44 BREATHING CIRCUITS MARKET FOR PEDIATRIC AND NEONATAL PATIENTS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 45 NORTH AMERICA: BREATHING CIRCUITS MARKET FOR PEDIATRIC AND NEONATAL PATIENTS, BY COUNTRY 2022-2029 (USD MILLION)

- TABLE 46 EUROPE: BREATHING CIRCUITS MARKET FOR PEDIATRIC AND NEONATAL PATIENTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 47 ASIA PACIFIC: BREATHING CIRCUITS MARKET FOR PEDIATRIC AND NEONATAL PATIENTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 48 LATIN AMERICA: BREATHING CIRCUITS MARKET FOR PEDIATRIC AND NEONATAL PATIENTS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 49 BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 50 KEY PRODUCTS IN SINGLE-LIMB BREATHING CIRCUITS MARKET

- TABLE 51 SINGLE-LIMB BREATHING CIRCUITS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 52 NORTH AMERICA: SINGLE-LIMB BREATHING CIRCUITS MARKET, BY COUNTRY 2022-2029 (USD MILLION)

- TABLE 53 EUROPE: SINGLE-LIMB BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 54 ASIA PACIFIC: SINGLE-LIMB BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 55 LATIN AMERICA: SINGLE-LIMB BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 56 KEY PRODUCTS IN DUAL-LIMB BREATHING CIRCUITS MARKET

- TABLE 57 DUAL-LIMB BREATHING CIRCUITS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 58 NORTH AMERICA: DUAL-LIMB BREATHING CIRCUITS MARKET, BY COUNTRY 2022-2029 (USD MILLION)

- TABLE 59 EUROPE: DUAL-LIMB BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 60 ASIA PACIFIC: DUAL-LIMB BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 61 LATIN AMERICA: DUAL-LIMB BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 62 BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 63 KEY PRODUCTS IN BREATHING CIRCUITS MARKET FOR ANESTHESIA

- TABLE 64 BREATHING CIRCUITS MARKET FOR ANESTHESIA, BY REGION, 2022-2029 (USD MILLION)

- TABLE 65 NORTH AMERICA: BREATHING CIRCUITS MARKET FOR ANESTHESIA, BY COUNTRY 2022-2029 (USD MILLION)

- TABLE 66 EUROPE: BREATHING CIRCUITS MARKET FOR ANESTHESIA, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 67 ASIA PACIFIC: BREATHING CIRCUITS MARKET FOR ANESTHESIA, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 68 LATIN AMERICA: BREATHING CIRCUITS MARKET FOR ANESTHESIA, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 69 KEY PRODUCTS IN BREATHING CIRCUITS MARKET FOR RESPIRATORY DYSFUNCTION

- TABLE 70 BREATHING CIRCUITS MARKET FOR RESPIRATORY DYSFUNCTION, BY REGION, 2022-2029 (USD MILLION)

- TABLE 71 NORTH AMERICA: BREATHING CIRCUITS MARKET FOR RESPIRATORY DYSFUNCTION, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 72 EUROPE: BREATHING CIRCUITS MARKET FOR RESPIRATORY DYSFUNCTION, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 73 ASIA PACIFIC: BREATHING CIRCUITS MARKET FOR RESPIRATORY DYSFUNCTION, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 74 LATIN AMERICA: BREATHING CIRCUITS MARKET FOR RESPIRATORY DYSFUNCTION, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 75 KEY PRODUCTS IN BREATHING CIRCUITS MARKET FOR OTHER APPLICATIONS

- TABLE 76 BREATHING CIRCUITS MARKET FOR OTHER APPLICATIONS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 77 NORTH AMERICA: BREATHING CIRCUITS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 78 EUROPE: BREATHING CIRCUITS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 79 ASIA PACIFIC: BREATHING CIRCUITS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 80 LATIN AMERICA: BREATHING CIRCUITS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 81 BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 82 BREATHING CIRCUITS MARKET FOR HOSPITALS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 83 NORTH AMERICA: BREATHING CIRCUITS MARKET FOR HOSPITALS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 84 EUROPE: BREATHING CIRCUITS MARKET FOR HOSPITALS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 85 ASIA PACIFIC: BREATHING CIRCUITS MARKET FOR HOSPITALS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 86 LATIN AMERICA: BREATHING CIRCUITS MARKET FOR HOSPITALS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 87 BREATHING CIRCUITS MARKET FOR AMBULATORY SURGERY CENTERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 88 NORTH AMERICA: BREATHING CIRCUITS MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY 2022-2029 (USD MILLION)

- TABLE 89 EUROPE: BREATHING CIRCUITS MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 90 ASIA PACIFIC: BREATHING CIRCUITS MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 91 LATIN AMERICA: BREATHING CIRCUITS MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 92 BREATHING CIRCUITS MARKET FOR CLINICS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 93 NORTH AMERICA: BREATHING CIRCUITS MARKET FOR CLINICS, BY COUNTRY 2022-2029 (USD MILLION)

- TABLE 94 EUROPE: BREATHING CIRCUITS MARKET FOR CLINICS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 95 ASIA PACIFIC: BREATHING CIRCUITS MARKET FOR CLINICS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 96 LATIN AMERICA: BREATHING CIRCUITS MARKET FOR CLINICS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 97 BREATHING CIRCUITS MARKET FOR OTHER END USERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 98 NORTH AMERICA: BREATHING CIRCUITS MARKET FOR OTHER END USERS, BY COUNTRY 2022-2029 (USD MILLION)

- TABLE 99 EUROPE: BREATHING CIRCUITS MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 100 ASIA PACIFIC: BREATHING CIRCUITS MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 101 LATIN AMERICA: BREATHING CIRCUITS MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 102 BREATHING CIRCUITS MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 103 NORTH AMERICA: BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 104 NORTH AMERICA: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 105 NORTH AMERICA: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 106 NORTH AMERICA: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 107 NORTH AMERICA: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 108 NORTH AMERICA: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 109 NORTH AMERICA: MACROINDICATORS FOR BREATHING CIRCUITS MARKET

- TABLE 110 US: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 111 US: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 112 US: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 113 US: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 114 US: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 115 CANADA: NUMBER OF SURGICAL PROCEDURES PERFORMED, 2022

- TABLE 116 CANADA: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 117 CANADA: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 118 CANADA: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 119 CANADA: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 120 CANADA: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 121 EUROPE: BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 122 EUROPE: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 123 EUROPE: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 124 EUROPE: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 125 EUROPE: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 126 EUROPE: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 127 EUROPE: MACROINDICATORS FOR BREATHING CIRCUITS MARKET

- TABLE 128 GERMANY: NUMBER OF SURGICAL PROCEDURES PERFORMED, 2011 VS. 2021 (PER 100,000 INHABITANTS)

- TABLE 129 GERMANY: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 130 GERMANY: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 131 GERMANY: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 132 GERMANY: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 133 GERMANY: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 134 FRANCE: NUMBER OF SURGICAL PROCEDURES PERFORMED, 2011 VS. 2021 (PER 100,000 INHABITANTS)

- TABLE 135 FRANCE: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 136 FRANCE: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 137 FRANCE: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 138 FRANCE: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 139 FRANCE: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 140 UK: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 141 UK: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 142 UK: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 143 UK: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 144 UK: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 145 ITALY: NUMBER OF SURGICAL PROCEDURES PERFORMED, 2011 VS. 2021 (PER 100,000 INHABITANTS)

- TABLE 146 ITALY: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 147 ITALY: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 148 ITALY: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 149 ITALY: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 150 ITALY: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 151 SPAIN: NUMBER OF SURGICAL PROCEDURES PERFORMED, 2011 VS. 2021 (PER 100,000 INHABITANTS)

- TABLE 152 SPAIN: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 153 SPAIN: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 154 SPAIN: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 155 SPAIN: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 156 SPAIN: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 157 REST OF EUROPE: SELECTED HIGH-GROWTH PROCEDURES PERFORMED IN HOSPITALS, 2011 VS. 2021 (PER 100,000 INHABITANTS)

- TABLE 158 REST OF EUROPE: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 159 REST OF EUROPE: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 160 REST OF EUROPE: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 161 REST OF EUROPE: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 162 REST OF EUROPE: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 163 ASIA PACIFIC: BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 164 ASIA PACIFIC: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 165 ASIA PACIFIC: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 166 ASIA PACIFIC: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 167 ASIA PACIFIC: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 168 ASIA PACIFIC: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 169 ASIA PACIFIC: MACROINDICATORS FOR BREATHING CIRCUITS MARKET

- TABLE 170 JAPAN: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 171 JAPAN: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 172 JAPAN: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 173 JAPAN: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 174 JAPAN: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 175 CHINA: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 176 CHINA: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 177 CHINA: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 178 CHINA: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 179 CHINA: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 180 INDIA: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 181 INDIA: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 182 INDIA: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 183 INDIA: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 184 INDIA: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 185 AUSTRALIA: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 186 AUSTRALIA: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 187 AUSTRALIA: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 188 AUSTRALIA: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 189 AUSTRALIA: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 190 SOUTH KOREA: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 191 SOUTH KOREA: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 192 SOUTH KOREA: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 193 SOUTH KOREA: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 194 SOUTH KOREA: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 195 REST OF ASIA PACIFIC: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 196 REST OF ASIA PACIFIC: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 200 LATIN AMERICA: BREATHING CIRCUITS MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 201 LATIN AMERICA: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 202 LATIN AMERICA: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 203 LATIN AMERICA: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 204 LATIN AMERICA: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 205 LATIN AMERICA: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 206 LATIN AMERICA: MACROINDICATORS FOR BREATHING CIRCUITS MARKET

- TABLE 207 BRAZIL: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 208 BRAZIL: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 209 BRAZIL: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 210 BRAZIL: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 211 BRAZIL: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 212 MEXICO: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 213 MEXICO: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 214 MEXICO: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 215 MEXICO: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 216 MEXICO: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 217 REST OF LATIN AMERICA: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 218 REST OF LATIN AMERICA: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 219 REST OF LATIN AMERICA: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 220 REST OF LATIN AMERICA: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 221 REST OF LATIN AMERICA: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 227 GCC COUNTRIES: BREATHING CIRCUITS MARKET, BY USAGE, 2022-2029 (USD MILLION)

- TABLE 228 GCC COUNTRIES: BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2022-2029 (USD MILLION)

- TABLE 229 GCC COUNTRIES: BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2022-2029 (USD MILLION)

- TABLE 230 GCC COUNTRIES: BREATHING CIRCUITS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

- TABLE 231 GCC COUNTRIES: BREATHING CIRCUITS MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 232 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN BREATHING CIRCUITS MARKET

- TABLE 233 BREATHING CIRCUITS MARKET: DEGREE OF COMPETITION

- TABLE 234 BREATHING CIRCUITS MARKET: USAGE FOOTPRINT

- TABLE 235 BREATHING CIRCUITS MARKET: APPLICATION FOOTPRINT

- TABLE 236 BREATHING CIRCUITS MARKET: REGION FOOTPRINT

- TABLE 237 BREATHING CIRCUITS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 238 BREATHING CIRCUITS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 239 BREATHING CIRCUITS MARKET: PRODUCT LAUNCHES, JANUARY 2021- JULY 2024

- TABLE 240 BREATHING CIRCUITS MARKET: DEALS, JANUARY 2021- JULY 2024

- TABLE 241 DRAGERWERK AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 242 DRAGERWERK AG & CO. KGAA: PRODUCTS OFFERED

- TABLE 243 DRAGERWERK AG & CO. KGAA: PRODUCT LAUNCHES, JANUARY 2021-JULY 2024

- TABLE 244 DRAGERWERK AG & CO. KGAA: DEALS, JANUARY 2021-JULY 2024

- TABLE 245 MEDTRONIC: COMPANY OVERVIEW

- TABLE 246 MEDTRONIC: PRODUCTS OFFERED

- TABLE 247 MEDTRONIC: DEALS, JANUARY 2021-JULY 2024

- TABLE 248 CARDINAL HEALTH.: COMPANY OVERVIEW

- TABLE 249 CARDINAL HEALTH: PRODUCTS OFFERED

- TABLE 250 CARDINAL HEALTH: EXPANSIONS, JANUARY 2021-JULY 2024

- TABLE 251 FISHER & PAYKEL HEALTHCARE LIMITED: COMPANY OVERVIEW

- TABLE 252 FISHER & PAYKEL HEALTHCARE LIMITED: PRODUCTS OFFERED

- TABLE 253 FISHER & PAYKEL HEALTHCARE LIMITED: EXPANSIONS, JANUARY 2021-JULY 2024

- TABLE 254 RESMED: COMPANY OVERVIEW

- TABLE 255 RESMED: PRODUCTS OFFERED

- TABLE 256 RESMED: EXPANSIONS, JANUARY 2021-JULY 2024

- TABLE 257 AMBU A/S: COMPANY OVERVIEW

- TABLE 258 AMBU A/S: PRODUCTS OFFERED

- TABLE 259 AMBU A/S: EXPANSIONS, JANUARY 2021-JULY 2024

- TABLE 260 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 261 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 262 GE HEALTHCARE: DEALS, JANUARY 2021-JULY 2024

- TABLE 263 GE HEALTHCARE: EXPANSIONS, JANUARY 2021-JULY 2024

- TABLE 264 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 265 KONINKLIJKE PHILIPS N.V.: PRODUCTS OFFERED

- TABLE 266 KONINKLIJKE PHILIPS N.V.: DEALS, JANUARY 2021-JULY 2024

- TABLE 267 ICU MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 268 ICU MEDICAL, INC.: PRODUCTS OFFERED

- TABLE 269 ICU MEDICAL, INC.: DEALS, JANUARY 2021-JULY 2024

- TABLE 270 HAMILTON MEDICAL: COMPANY OVERVIEW

- TABLE 271 HAMILTON MEDICAL: PRODUCTS OFFERED

- TABLE 272 MEDLINE INDUSTRIES, LP: COMPANY OVERVIEW

- TABLE 273 MEDLINE INDUSTRIES, LP: PRODUCTS OFFERED

- TABLE 274 MEDLINE INDUSTRIES, LP: DEALS, JANUARY 2021-JULY 2024

- TABLE 275 MEDLINE INDUSTRIES, LP: EXPANSIONS, JANUARY 2021-JULY 2024

- TABLE 276 FORCA HEALTHCARE: COMPANY OVERVIEW

- TABLE 277 BRAUN & CO. LIMITED: COMPANY OVERVIEW

- TABLE 278 INSPIRATION HEALTHCARE GROUP PLC: COMPANY OVERVIEW

- TABLE 279 BESMED HEALTH BUSINESS CORP.: COMPANY OVERVIEW

- TABLE 280 EAKIN HEALTHCARE: COMPANY OVERVIEW

- TABLE 281 BOMIMED: COMPANY OVERVIEW

- TABLE 282 FLEXICARE (GROUP) LIMITED: COMPANY OVERVIEW

- TABLE 283 BIO-MED DEVICES: COMPANY OVERVIEW

- TABLE 284 AIRLIFE: COMPANY OVERVIEW

- TABLE 285 MERCURY MEDICAL: COMPANY OVERVIEW

- TABLE 286 INTERSURGICAL LTD.: COMPANY OVERVIEW

- TABLE 287 FAIRMONT MEDICAL PRODUCTS PTY LTD.: COMPANY OVERVIEW

- TABLE 288 BREAS MEDICAL AB: COMPANY OVERVIEW

- TABLE 289 GPC MEDICAL LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 BREATHING CIRCUITS MARKET: SEGMENTS CONSIDERED

- FIGURE 2 BREATHING CIRCUITS MARKET: YEARS CONSIDERED

- FIGURE 3 BREATHING CIRCUITS MARKET: RESEARCH DESIGN

- FIGURE 4 BREATHING CIRCUITS MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 BREATHING CIRCUITS MARKET: KEY PRIMARY SOURCES

- FIGURE 6 BREATHING CIRCUITS MARKET: KEY INDUSTRY INSIGHTS

- FIGURE 7 BREAKDOWN OF PRIMARIES: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 8 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 9 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 11 BREATHING CIRCUITS MARKET: TOP-DOWN APPROACH

- FIGURE 12 DATA TRIANGULATION METHODOLOGY

- FIGURE 13 BREATHING CIRCUITS MARKET: STUDY ASSUMPTIONS

- FIGURE 14 BREATHING CIRCUITS MARKET, BY USAGE, 2024 VS. 2029 (USD MILLION)

- FIGURE 15 BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 16 BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 17 BREATHING CIRCUITS MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 18 BREATHING CIRCUITS MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 19 BREATHING CIRCUITS MARKET, BY REGION, 2024 VS. 2029 (USD MILLION)

- FIGURE 20 INCREASING NUMBER OF SURGERIES AND GROWING PREVALENCE OF CHRONIC RESPIRATORY DISORDERS TO DRIVE MARKET

- FIGURE 21 DISPOSABLE BREATHING CIRCUITS TO DOMINATE BREATHING CIRCUITS USAGE MARKET IN 2029

- FIGURE 22 ADULT PATIENTS SEGMENT TO COMMAND LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 23 SINGLE-LIMB BREATHING CIRCUITS TO ACCOUNT FOR LARGER MARKET SHARE BETWEEN 2024 AND 2029

- FIGURE 24 ANESTHESIA TO COMMAND LARGEST SHARE IN BREATHING CIRCUITS APPLICATION MARKET DURING STUDY PERIOD

- FIGURE 25 HOSPITALS TO DOMINATE END USER MARKET DURING FORECAST PERIOD

- FIGURE 26 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 27 BREATHING CIRCUITS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 US: NUMBER OF HOSPITAL EMERGENCY ROOM VISITS, 2012-2022 (PER 1,000 POPULATION)

- FIGURE 29 AVERAGE SELLING PRICE OF SINGLE-LIMB BREATHING CIRCUITS (2024)

- FIGURE 30 PATENT ANALYSIS FOR BREATHING CIRCUITS (JANUARY 2014- DECEMBER 2023)

- FIGURE 31 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

- FIGURE 32 BREATHING CIRCUITS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 33 BREATHING CIRCUITS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 34 BREATHING CIRCUITS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS OF BREATHING CIRCUITS

- FIGURE 36 KEY BUYING CRITERIA FOR BREATHING CIRCUITS

- FIGURE 37 BREATHING CIRCUITS MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 38 NUMBER OF DEALS AND FUNDING IN BREATHING CIRCUITS MARKET

- FIGURE 39 MARKET POTENTIAL OF AI TO ENHANCE USE OF BREATHING CIRCUITS ACROSS CLINICAL SETTINGS

- FIGURE 40 US: AGE-ADJUSTED PREVALENCE OF COPD AMONG ADULTS AGED >=18 YEARS (2011 VS. 2021)

- FIGURE 41 NORTH AMERICA: BREATHING CIRCUITS MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: BREATHING CIRCUITS MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS IN BREATHING CIRCUITS MARKET (2021-2023)

- FIGURE 44 MARKET SHARE ANALYSIS OF KEY PLAYERS IN BREATHING CIRCUITS MARKET (2023)

- FIGURE 45 BREATHING CIRCUITS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 46 BREATHING CIRCUITS MARKET: COMPANY FOOTPRINT

- FIGURE 47 BREATHING CIRCUITS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 48 EV/EBITDA OF KEY VENDORS

- FIGURE 49 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 50 BREATHING CIRCUITS MARKET: PRODUCT ANALYSIS FOR DUAL-LIMB BREATHING CIRCUITS

- FIGURE 51 DRAGERWERK AG & CO. KGAA: COMPANY SNAPSHOT (2023)

- FIGURE 52 MEDTRONIC: COMPANY SNAPSHOT (2023)

- FIGURE 53 CARDINAL HEALTH: COMPANY SNAPSHOT (2023)

- FIGURE 54 FISHER & PAYKEL HEALTHCARE LIMITED: COMPANY SNAPSHOT (2023)

- FIGURE 55 RESMED: COMPANY SNAPSHOT (2023)

- FIGURE 56 AMBU A/S: COMPANY SNAPSHOT (2023)

- FIGURE 57 GE HEALTHCARE: COMPANY SNAPSHOT (2023)

- FIGURE 58 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2023)

- FIGURE 59 ICU MEDICAL, INC.: COMPANY SNAPSHOT (2023)

The breathing circuits market is expected to grow to USD 2.16 billion by 2029 from an estimated USD 1.57 billion in 2024, at a CAGR of 6.5% during the forecast period. Improvements in breathing circuit technology is one of the major drivers of the market. Within the past couple of years, new initiatives and efforts taken towards enhancing safety, comfort, and efficiency-oriented development have resulted in increasingly sophisticated and efficient forms of breathing circuits. For instance, breathing circuits that feature inbuilt humidification, antimicrobial filters, and advanced ergonomic designs have added to a much greater effect in delivering respiratory support while reducing infections and discomfort. Moreover, with advanced materials used in production, breathing circuits become more biocompatible and resistant. Such technological advancements by different key players will lead to increased adoption of breathing circuits, thus driving the market growth in the coming years.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) |

| Segments | By Usage, Patient Type, Circuit Type, Application, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC countries |

"Adult patients segment accounted for the highest growth rate in the breathing circuits market, by patient type, during the forecast period."

Based on patient type, the breathing circuits market is bifurcated into adult patients and pediatric and neonatal patients. The adult patients segment expected to have the highest CAGR during the forecast period. The growth in this patient segment is driven by the increasing rate of adult surgical interventions, especially complex and high-risk cases needing breathing circuits for anesthesia and respiratory support. Furthermore, the aging population and rising prevalence of chronic respiratory disorders, such as COPD, asthma, and sleep apnea, are often associated with the use of advanced breathing circuits, especially in surgical procedures, which further support this segment's growth. Moreover, sedentary life, poor diet, and smoking act also as major contributory factors to such conditions and hence increase the demand for advanced breathing circuits in managing and treating respiratory diseases in adults.

"Dual-limb Breathing Circuits segment is expected to have the fastest growth rate in the breathing circuits market, by circuit type, during the forecast period."

The breathing circuits market is segmented into single-limb breathing circuits and dual-limb breathing circuits, based on circuit type. Dual-limb breathing circuits are projected to account for the highest CAGR during the forecast period. Dual-limb breathing circuits are likely to witness a huge demand, as they offer numerous advantages for critical and specialized medical applications. One major factor is that they provide two distinct and controlled channels for inhalation and exhalation, which increases the efficiency of ventilation by preventing rebreathing of exhaled carbon dioxide. This would be very important in ICUs and OTs, where it would be important to correct management of gases in order to ensure patient safety and optimum respiratory support. Another advantage of dual-limb circuits is that accessories, like humidifiers, filters, and monitoring equipment, can be fitted to facilitate appropriate and comprehensive care for the patient. Added to this is the fact that these circuits can adapt to different patients and different medical interventions that further increase their applicability in healthcare.

"Asia Pacific: The fastest-growing region in breathing circuits market."

The worldwide market for breathing circuits is categorized into North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC countries. Notably, the Asia Pacific region is anticipated to experience the most substantial growth in the forecast period. The Asia Pacific region, a hub for medical tourism, is rapidly emerging as a leader in the market for medical procedures and devices. Growth in this market is driven by several factors, that include the increased investment and modernization in the health care infrastructure, which improves the availability as well as the quality of medical services. Rising patient population and occurrences of chronic respiratory diseases further fuel the demand. Moreover, high economic growth in developing countries, including China, India, and others, has led to increases in health care expenditures and the demand for more modern medical devices, including breathing circuits.

The break-up of the profile of primary participants in the breathing circuits market:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America - 6%, and Middle East & Africa- 4%

The key players in this market are Dragerwerk AG & Co. KGaA (Germany), Medtronic (Ireland), Cardinal Health (US), Fisher & Paykel Healthcare Limited (New Zealand), ResMed (US), Ambu A/S (Denmark), GE Healthcare (US), ICU Medical, Inc. (US), Koninklijke Philips N.V. (Netherlands), Hamilton Medical (Switzerland), Medline Industries, LP (US), Forca Healthcare (India), Braun & Co. Limited (UK), Inspiration Healthcare Group PLC (UK), Besmed Health Business Corp. (Taiwan), Eakin Healthcare (UK), BOMIMED (Canada), Flexicare (Group) Limited (UK), Bio-Med Devices (US), Airlife (US), Mercury Medical (US), Intersurgical Ltd (UK), Fairmont Medical Products Pty Ltd. (Australia), Breas Medical AB (Sweden), and GPC Medical Ltd. (India).

Research Coverage:

This research report categorizes the breathing circuits market by usage (disposable breathing circuits and reusable breathing circuits), by patient type (adult patients and pediatric and neonatal patients), by circuit type (single-limb breathing circuits and dual-limb breathing circuits), by application (anesthesia, respiratory dysfunction, and other applications), by end user (hospitals, ambulatory surgical centers, clinics, and other end users), and region (North America, Europe, Asia Pacific, Latin America, the Middle East & Africa and GCC countries). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the breathing circuits market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, key strategies, acquisitions, and agreements. New product & service launches, and recent developments associated with the breathing circuits market. Competitive analysis of upcoming startups in the breathing circuits market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall breathing circuits market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (growing prevalence of respiratory diseases, rising number of emergency cases globally, increasing number of surgical procedures, and technological advancements), opportunities (Growth opportunities in emerging economies), restraints (Unfavorable reimbursement scenario and high risk of infection associated with reusable breathing circuits), and challenges (environmental concerns related to single-use and non-biodegradable breathing circuits) influencing the growth of the breathing circuits market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the breathing circuits market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the breathing circuits market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the breathing circuits market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings of leading players like Dragerwerk AG & Co. KGaA (Germany), Medtronic (Ireland), Cardinal Health (US), Fisher & Paykel Healthcare Limited (New Zealand), and ResMed (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 SEGMENTS CONSIDERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.1.3 Objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Company revenue estimation approach

- 2.2.1.2 Company presentations and primary interviews

- 2.2.1.3 Growth forecast

- 2.2.1.4 CAGR projections

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 GROWTH RATE ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 BREATHING CIRCUITS MARKET OVERVIEW

- 4.2 BREATHING CIRCUITS MARKET, BY USAGE, 2024 VS. 2029

- 4.3 BREATHING CIRCUITS MARKET, BY PATIENT TYPE, 2024 VS. 2029

- 4.4 BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE, 2024 VS. 2029

- 4.5 BREATHING CIRCUITS MARKET, BY APPLICATION, 2024 VS. 2029

- 4.6 BREATHING CIRCUITS MARKET, BY END USER, 2024 VS. 2029

- 4.7 BREATHING CIRCUITS MARKET: REGIONAL GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing prevalence of respiratory diseases

- 5.2.1.2 Rising number of emergency cases globally

- 5.2.1.3 Increasing number of surgical procedures

- 5.2.1.4 Technological advancements

- 5.2.2 RESTRAINTS

- 5.2.2.1 Unfavorable reimbursement scenario

- 5.2.2.2 High risk of infection associated with reusable breathing circuits

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth opportunities in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental concerns related to single-use and non-biodegradable breathing circuits

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.4 PATENT ANALYSIS

- 5.4.1 LIST OF MAJOR PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT DATA (HS CODE 901920)

- 5.7.2 EXPORT DATA (HS CODE 901920)

- 5.8 ECOSYSTEM ANALYSIS

- 5.8.1 ROLE IN ECOSYSTEM

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 KEY BUYING CRITERIA

- 5.11 REGULATORY ANALYSIS

- 5.11.1 REGULATORY LANDSCAPE

- 5.11.1.1 North America

- 5.11.1.1.1 US

- 5.11.1.1.2 Canada

- 5.11.1.2 Europe

- 5.11.1.3 Asia Pacific

- 5.11.1.3.1 China

- 5.11.1.3.2 Japan

- 5.11.1.3.3 India

- 5.11.1.4 Latin America

- 5.11.1.4.1 Brazil

- 5.11.1.4.2 Mexico

- 5.11.1.5 Middle East

- 5.11.1.6 Africa

- 5.11.1.1 North America

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1 REGULATORY LANDSCAPE

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Single-limb breathing circuits

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 Dual-limb breathing circuits

- 5.12.3 ADJACENT TECHNOLOGIES

- 5.12.3.1 Low dead space circuits

- 5.12.1 KEY TECHNOLOGIES

- 5.13 KEY CONFERENCES AND EVENTS IN 2024-2025

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 IMPACT OF AI/GEN AI ON BREATHING CIRCUITS MARKET

- 5.16.1 KEY USE CASES

6 BREATHING CIRCUITS MARKET, BY USAGE

- 6.1 INTRODUCTION

- 6.2 DISPOSABLE BREATHING CIRCUITS

- 6.2.1 GROWING EMPHASIS ON INFECTION CONTROL AND PATIENT SAFETY TO DRIVE MARKET

- 6.3 REUSABLE BREATHING CIRCUITS

- 6.3.1 COST-EFFECTIVENESS AND REDUCED ENVIRONMENTAL FOOTPRINT TO PROPEL MARKET GROWTH

7 BREATHING CIRCUITS MARKET, BY PATIENT TYPE

- 7.1 INTRODUCTION

- 7.2 ADULT PATIENTS

- 7.2.1 INCREASING SURGICAL PROCEDURES AND GROWING PREVALENCE OF LIFESTYLE-RELATED DISEASES TO BOOST MARKET GROWTH

- 7.3 PEDIATRIC AND NEONATAL PATIENTS

- 7.3.1 INCREASING TIMELY INTERVENTION AND TREATMENT IN PEDIATRIC CARE TO FUEL MARKET GROWTH

8 BREATHING CIRCUITS MARKET, BY CIRCUIT TYPE

- 8.1 INTRODUCTION

- 8.2 SINGLE-LIMB BREATHING CIRCUITS

- 8.2.1 SIMPLE DESIGN AND EASE OF USE TO AID MARKET GROWTH

- 8.3 DUAL-LIMB BREATHING CIRCUITS

- 8.3.1 HIGH DEMAND FOR ADVANCED VENTILATION SOLUTIONS AND INCREASED PATIENT COMFORT TO SPUR MARKET GROWTH

9 BREATHING CIRCUITS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 ANESTHESIA

- 9.2.1 INCREASING NUMBER OF SURGERIES AND MINIMALLY INVASIVE PROCEDURES TO AUGMENT MARKET GROWTH

- 9.3 RESPIRATORY DYSFUNCTION

- 9.3.1 RISING PREVALENCE OF CHRONIC PULMONARY DISEASES AND SLEEP APNEA TO FUEL MARKET GROWTH

- 9.4 OTHER APPLICATIONS

10 BREATHING CIRCUITS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOSPITALS

- 10.2.1 INCREASING NUMBER OF HOSPITALS AND RISING GOVERNMENT HEALTHCARE INVESTMENTS TO SUPPORT MARKET GROWTH

- 10.3 AMBULATORY SURGERY CENTERS

- 10.3.1 FOCUS ON COST-EFFECTIVE AND IMPROVED PATIENT EXPERIENCE TO DRIVE MARKET

- 10.4 CLINICS

- 10.4.1 RISING PREVALENCE OF TARGET DISEASES TO SUPPORT MARKET GROWTH

- 10.5 OTHER END USERS

11 BREATHING CIRCUITS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 US to dominate North American breathing circuits market during study period

- 11.2.3 CANADA

- 11.2.3.1 High geriatric population and improved healthcare infrastructure to propel market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 High healthcare spending and favorable government policies to favor market growth

- 11.3.3 FRANCE

- 11.3.3.1 Advanced healthcare system and increased number of surgeries to augment market growth

- 11.3.4 UK

- 11.3.4.1 Rising geriatric population and increasing initiatives by public and private organizations to aid market growth

- 11.3.5 ITALY

- 11.3.5.1 Improved quality of medical care and high geriatric population to spur market growth

- 11.3.6 SPAIN

- 11.3.6.1 Increased incidence of chronic diseases and improved healthcare infrastructure to drive demand

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Presence of universal healthcare reimbursement policy and high geriatric population to drive market

- 11.4.3 CHINA

- 11.4.3.1 Increasing number of hospitals and growing public access to modern healthcare to fuel market growth

- 11.4.4 INDIA

- 11.4.4.1 Large patient population and developed healthcare sector to boost market growth

- 11.4.5 AUSTRALIA

- 11.4.5.1 Increasing prevalence of chronic respiratory diseases to fuel market

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Increasing private hospitals and growing medical tourism to support market growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Developed public health systems and improved healthcare infrastructure to favor market growth

- 11.5.3 MEXICO

- 11.5.3.1 Modern healthcare infrastructure and availability of advanced surgical techniques to augment market growth

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 DEVELOPED HEALTHCARE INFRASTRUCTURE AND FAVORABLE GOVERNMENT HEALTH POLICIES TO PROPEL MARKET

- 11.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.7 GCC COUNTRIES

- 11.7.1 INCREASING GOVERNMENT HEALTHCARE SPENDING AND GROWING MEDICAL TOURISM TO AID MARKET GROWTH

- 11.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN BREATHING CIRCUITS MARKET

- 12.3 REVENUE ANALYSIS, 2021-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT, KEY PLAYERS, 2023

- 12.5.5.1 Company footprint

- 12.5.5.2 Usage footprint

- 12.5.5.3 Application footprint

- 12.5.5.4 Region footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING OF STARTUP/SME PLAYERS, 2023

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 DRAGERWERK AG & CO. KGAA

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 MEDTRONIC

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 CARDINAL HEALTH

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 FISHER & PAYKEL HEALTHCARE LIMITED

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 RESMED

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 AMBU A/S

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Expansions

- 13.1.7 GE HEALTHCARE

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.3.2 Expansions

- 13.1.8 KONINKLIJKE PHILIPS N.V.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 ICU MEDICAL, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 HAMILTON MEDICAL

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 MEDLINE INDUSTRIES, LP

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.3.2 Expansions

- 13.1.1 DRAGERWERK AG & CO. KGAA

- 13.2 OTHER PLAYERS

- 13.2.1 FORCA HEALTHCARE

- 13.2.2 BRAUN & CO. LIMITED

- 13.2.3 INSPIRATION HEALTHCARE GROUP PLC

- 13.2.4 BESMED HEALTH BUSINESS CORP.

- 13.2.5 EAKIN HEALTHCARE

- 13.2.6 BOMIMED

- 13.2.7 FLEXICARE (GROUP) LIMITED

- 13.2.8 BIO-MED DEVICES

- 13.2.9 AIRLIFE

- 13.2.10 MERCURY MEDICAL

- 13.2.11 INTERSURGICAL LTD.

- 13.2.12 FAIRMONT MEDICAL PRODUCTS PTY LTD.

- 13.2.13 BREAS MEDICAL AB

- 13.2.14 GPC MEDICAL LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS