|

|

市場調査レポート

商品コード

1546366

飼料産業市場の将来-2024年までの予測Future of Feed Industry Market - Global Forecast to 2024 |

||||||

カスタマイズ可能

|

|||||||

| 飼料産業市場の将来-2024年までの予測 |

|

出版日: 2024年08月27日

発行: MarketsandMarkets

ページ情報: 英文 105 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

動物の健康と生産性における栄養の重要性に対する理解が深まるにつれ、様々な動物種、さらには個々の動物の特定のニーズに合わせた飼料ソリューションに対する需要が高まっています。

バイオテクノロジー、データ分析、精密給餌技術における革新は、より効果的で個別化された飼料ソリューションの開発を可能にしています。例えば、ダブリンに本社を置くアグテック企業Cainthusは、24時間365日リアルタイムで牛を監視するAIを採用したALUS Nutritionシステムを開発しました。この技術には、牛の行動と摂食パターンを継続的に観察・分析するスマートカメラシステムが含まれています。この酪農家は、水道を流れる迷走電流が牛の乳量と健康全般に悪影響を及ぼしていることを発見しました。AIを活用したモニタリングシステムでこの問題を早期に発見したことで、酪農家は問題を解決し、乳量の減少を防ぎ、牛の健康を維持することができました。このケースは、AI技術が、すぐにはわからないような問題を特定し対処することで、生産性と動物福祉を向上させることができることを強調しています。

インドのeFeedは、人工知能を活用した高度な動物管理と栄養学に特化しています。同社は、動物の生産性を高め、メタン排出量を削減するために、パーソナライズされた飼料を推奨しています。AIを活用した飼料推奨の実施により、家畜の生産性が向上し、メタン排出量が削減されました。これは、より効率的な生産と環境の持続可能性に向けた業界の動きを示しています。

飼料業界は、技術の進歩と戦略的パートナーシップによって、変革的な変化を目の当たりにしています。このような協力関係は技術革新を促進するだけでなく、この分野における生産性、持続可能性、収益性を向上させています。Cargillとダブリンのマシンビジョン企業Cainthusとの戦略的パートナーシップは、この動向を例証するものです。Cainthusの顔認識技術を世界中の酪農場に組み込むことで、CargillはAIを活用して家畜の健康と福祉をより効果的に監視しています。この技術は、餌や水の摂取量、発情検知、行動パターンなどの重要なデータポイントを追跡し、乳生産、繁殖管理、家畜の健康全般を改善するデータ駆動型の意思決定を可能にします。

当レポートでは、世界の飼料産業市場について調査し、家畜別市場シナリオ、地域別の動向、および今後の市場見通しなどをまとめています。

目次

第1章 エグゼクティブサマリー

第2章 世界マクロ経済分析

第3章 飼料産業に影響を与える世界のメガトレンド

- 持続可能性、環境問題、動物福祉

- 抗生物質の削減

- 精密栄養

- パーソナライズされたフィードソリューション

- 代替タンパク質源

- 飼料添加物およびサプリメント

第4章 地域別の飼料産業の市場シナリオ

- 世界分析

- 地域分析

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 飼料産業の市場シナリオ、家畜別

- 養殖業

- 牛

- 豚

- 家禽

第6章 消費者の動向と嗜好

第7章 飼料における技術主導の進歩

- 飼料産業における自動化、ロボット工学、テクノロジーの役割

- 環境に優しい未来の促進:次世代飼料のための技術

第8章 飼料産業におけるイノベーションと技術進歩のロードマップ

第9章 飼料産業における主な発展

- 飼料加工技術の革新

- 飼料調査における協力

- 新たな飼料原料と配合

- 飼料産業における最先端のスタートアップ

第10章 市場力学

第11章 付録

With a growing understanding of the importance of nutrition in animal health and productivity, there is a rising demand for feed solutions tailored to the specific needs of different species and even individual animals. Innovations in biotechnology, data analytics, and precision feeding technologies are enabling the development of more effective and personalized feed solutions. For instance, Cainthus, an agtech firm based in Dublin, developed the ALUS Nutrition system, which employs AI to monitor cows in real-time, 24/7. This technology involves a smart camera system that continuously observes and analyzes cow behavior and feeding patterns. The farmer discovered a stray electric current running through the water supply, which was negatively impacting the cows' milk production and overall health. By identifying this issue early through the AI-driven monitoring system, the farmer rectified the problem, preventing a decline in milk production and maintaining the health of the cows. This case highlights how AI technology can identify and address issues that may not be immediately apparent, thereby enhancing productivity and animal welfare.

More and more startups are entering the feed industry. eFeed, an Indian company, specializes in advanced animal management and nutrition using artificial intelligence. They create personalized feed recommendations to enhance animal productivity and decrease methane emissions. The implementation of these AI-based feed recommendations has resulted in improved animal productivity and reduced methane emissions. This illustrates the industry's movement towards more efficient production and environmental sustainability.

Strategic Partnership Propel Growth in the Future of Feed Industry

The feed industry is witnessing a transformative shift driven by technological advancements and strategic partnerships. These collaborations are not only fostering innovation but also enhancing productivity, sustainability, and profitability within the sector. Cargill's strategic partnership with Cainthus, a Dublin-based machine vision company, exemplifies this trend. By integrating Cainthus' facial recognition technology into dairy farms worldwide, Cargill is leveraging AI to monitor livestock health and well-being more effectively. This technology tracks critical data points such as food and water intake, heat detection, and behavior patterns, enabling data-driven decisions that improve milk production, reproduction management, and overall animal health.

In addition to this, Cargill's launch of Micronutrition and Health Solutions (MHS) on February 1, 2024, highlights the company's commitment to a holistic approach to animal nutrition. MHS combines a broad portfolio of science-based products, services, and digital solutions to optimize animal performance and health. By considering all microelements-microorganisms, molecules, and micronutrients-impacting animal diets, MHS ensures precise and efficient nutrition management. These advancements underscore the critical role of strategic partnerships and cutting-edge technologies in shaping the future of the feed industry. Through collaborations like that of Cargill and Cainthus, the industry is moving towards more customized and effective feed solutions, ultimately enhancing animal health and farm profitability.

Alternative Protein options are gaining more attraction for animal feed.

The exploration of alternative protein sources such as insects, algae, and single-cell proteins is gaining traction. These alternatives are sustainable and offer high nutritional value, addressing environmental and economic challenges. According to the 2021 WWF Report, "The Future of Feed: A WWF Roadmap to Accelerating Insect Protein in UK Feeds," the demand for insect meal from the UK's pig, poultry, and salmon sectors could reach approximately 540,000 tonnes annually by 2050. Companies are increasingly considering these alternative proteins as sustainable options for animal nutrition, aiming to provide optimal nutrition from the best protein sources. Utilizing these alternatives in feed chains has significant potential to support the transition to a circular economy. Notably, these alternative proteins can convert surplus food, which would otherwise be waste, into high-quality protein, replacing soymeal and fishmeal in animal feed.

Research Coverage:

The Global Feed Industry Outlook for 2024 is poised to provide comprehensive projections on the feed industry's performance, encapsulating major trends such as Nutritional Innovations, Sustainable Feed Ingredients, Enhanced Feed Safety and Quality Standards, Precision Feeding Technologies, Automation and Industry 4.0 in Feed Production, and Ethical Sourcing. This report will scrutinize the feed industry's 2023 performance in comparison to 2022, emphasizing critical developments within the feed landscape during 2023. Additionally, it will explore the key trends in 2024 that are expected to influence the feed industry, including macro-economic shifts, global industry-agnostic trends, and sector-specific advancements. These identified trends will act as the driving forces and constraints shaping the feed industry's trajectory in 2024. By drawing insights from historical performance and forecasting the anticipated impact of these trends, the report will generate predictions for the feed industry in 2024.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Future of Feed Industry Outlook and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

The report will encompass statistical data and prognostications pertaining to the performance of the feed industry across various metrics, and specific breakdowns for key regions.

This comprehensive analysis will extend to various growing markets, encompassing overall figures, segmentation by types, regional variations, and specific insights into key countries. The major markets discussed in the study are the Plant-Based Protein Market, Precision Fermentation Ingredients Market, Animal Nutrition Market, Feed Additives Market, Feed Automation and Robotics Market, Probiotics Market, Personalized Animal Nutrition Market, Regenerative Agriculture Market, and among others.

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

- 1.1 TOP DEVELOPMENTS IN 2023

- 1.2 FUTURE PREDICTIONS FOR 2024

2. GLOBAL MACROECONOMIC ANALYSIS

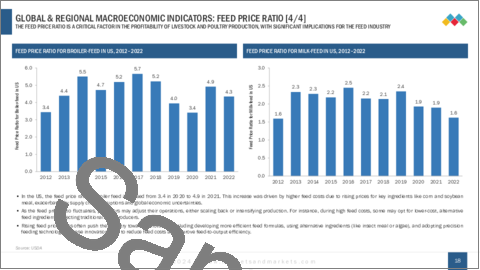

- 2.1 GLOBAL & REGIONAL MACROECONOMIC ANALYSIS

- 2.2 MACROECONOMICS KPIS

3. GLOBAL MEGATRENDS IMPACTING FEED INDUSTRY

- 3.1 SUSTAINABILITY, ENVIRONMENTAL CONCERNS AND ANIMAL WELFARE

- 3.2 ANTIBIOTIC REDUCTION

- 3.3 PRECISION NUTRITION

- 3.4 PERSONALIZED FEED SOLUTIONS

- 3.5 ALTERNATIVE PROTEIN SOURCES

- 3.6 FEED ADDITIVES AND SUPPLEMENTS

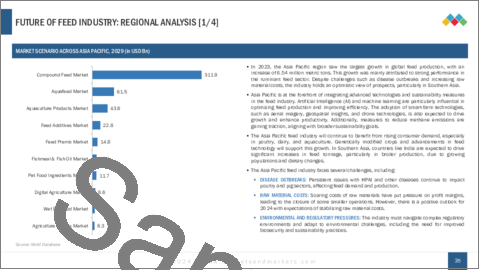

4. FEED INDUSTRY MARKET SCENARIO ACROSS REGIONS

- 4.1 GLOBAL ANALYSIS

- 4.1.1 LARGEST MARKETS

- 4.1.2 FASTEST GROWING MARKETS

- 4.2 REGIONAL ANALYSIS

- 4.2.1 NORTH AMERICA

- 4.2.2 EUROPE

- 4.2.3 ASIA PACIFIC

- 4.2.4 REST OF THE WORLD

5. FEED INDUSTRY MARKET SCENARIO BY LIVESTOCK

- 5.1.1 AQUACULTURE

- 5.1.2 CATTLE

- 5.1.3 SWINE

- 5.1.4 POULTRY

6. CONSUMER TRENDS AND PREFERENCES

- 6.1 SHIFTS IN CONSUMER DEMAND

- 6.2 NUTRITIONAL REQUIREMENTS: HOW DO WE FEED OUR LIVESTOCK?

- 6.3 IMPACT OF CONSUMER TRENDS ON FEED FORMULATION

- 6.4 FUTURE PRODUCT MAPPING

7. TECH-DRIVEN ADVANCEMENTS IN FEED

- 7.1 ROLE OF AUTOMATION, ROBOTICS AND TECHNOLOGY IN FEED

- 7.2 ENCOURAGING AN ECOLOGICAL FUTURE: TECHNOLOGIES FOR NEXT-GENERATION FEED

- 7.2.1 DATA-DRIVEN FEED MANAGEMENT

- 7.2.2 PRECISION NUTRITION

- 7.2.3 SMART FARMING SENSORS AND IOT

8. ROADMAP FOR INNOVATION AND TECHNOLOGY ADVANCEMENT IN FEED

9. KEY DEVELOPMENTS IN THE FEED INDUSTRY

- 9.1 INNOVATIONS IN FEED PROCESSING TECHNOLOGIES

- 9.2 COLLABORATION IN FEED RESEARCH

- 9.3 EMERGING FEED INGREDIENTS AND FORMULATIONS

- 9.4 CUTTING-EDGE STARTUPS IN FEED INDUSTRY

- 9.4.1 ANIMAL NUTRITION BASED COMPANIES

- 9.4.2 TECHNOLOGY-BASED COMPANIES

10. MARKET DYNAMICS

- 10.1 DRIVERS OF GROWTH

- 10.2 CHALLENGES AND RESTRAINTS

- 10.3 KEY GROWTH OPPORTUNITIES AND RECOMMENDATIONS

11. APPENDIX

- 11.1 ABOUT MARKETSANDMARKETS

- 11.2 LEGAL DISCLAIMER