|

|

市場調査レポート

商品コード

1546363

フォルダブルディスプレイの世界市場:技術別、パネルサイズ別、用途別、材料別、解像度別、タイプ別、地域別 - 予測(~2029年)Foldable Display Market by Technology (OLED, Direct-view LED), Panel Size (Up to 20", Above 20"), Application (Smartphones, Laptops and Tablets, Large Format Displays and Digital Signage), Material, Resolution, Type and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| フォルダブルディスプレイの世界市場:技術別、パネルサイズ別、用途別、材料別、解像度別、タイプ別、地域別 - 予測(~2029年) |

|

出版日: 2024年08月09日

発行: MarketsandMarkets

ページ情報: 英文 213 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のフォルダブルディスプレイの市場規模は、2024年の46億米ドルから2029年までに132億米ドルに達すると予測され、2024年~2029年にCAGRで23.6%の成長が見込まれます。

市場の主な成長促進要因は、スマートフォンの大きな画面への需要の高まり、5G展開の影響、消費者向けのイノベーションと多機能デバイスへの関心の高まり、応用分野の拡大などです。さらに、フォルダブルディスプレイの技術的進歩と新たな用途が、市場企業に複数の成長機会を提供すると予測されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 技術別、パネルサイズ別、用途別、材料別、解像度別、タイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

スマートフォン用途が予測期間に市場のシェアを独占する見込みです。

スマートフォンの大画面化に対する消費者の選好は、携帯性を損なうことなくこのデバイスの人気が高まっていることからも明らかです。ディスプレイ材料とヒンジ機構の技術の向上は、いずれも耐久性と信頼性を高め、消費者にとってフォルダブルスクリーンをより興味深いものにしています。マルチタスクからメディア消費に至るまで、ノートパソコンやタブレットには、複数のシナリオに対応するフォルダブルディスプレイが搭載されています。大型ディスプレイやデジタルサイネージとは異なり、フォルダブル技術は没入的なカスタマイズされた視界をもたらすことができ、公共空間、小売環境、広告用途に最適です。このように、比類のない柔軟性と機能性を提供することによる斬新な能力は、スマートフォン用途にフォルダブルディスプレイを採用する際の大きな燃料となります。

20インチ超のパネルサイズが予測期間に市場でもっとも高いCAGRとなる見込みです。

20インチ超のフォルダブルディスプレイの利用は、モニター、テレビ、デジタルサイネージなどの大規模環境で進んでいます。現在、より大きなフォルダブルディスプレイへのニーズや需要は基本的に、ホームエンターテインメントから企業環境、商業用ディスプレイに至るまでのこれらすべてのセグメントが、小さいエリアの管理に向けてそのようなデバイスを必要としているという事実に依存しています。これらのディスプレイは、その大きなインタラクティブな形から管理しやすい保管形式に変換することができ、その結果、より多くの生産性と効率性を会議環境に提供することができます。フォルダブルデジタルサイネージは、小売店や公共空間に利用されるダイナミックな広告ソリューションです。このようなディスプレイは折りたたみや巻き取りが可能であるため、設置やメンテナンスが容易で、スムーズな広告体験が可能です。また、製造や材料の改良も、さまざまな最終用途産業に対し、より大きなサイズのフォルダブルディスプレイの採用を後押ししています。

北米が予測期間に2番目に高いCAGRで成長する見込みです。

北米は、先進技術への旺盛な需要と大きな可処分所得を持つ強力な消費者層の存在により、フォルダブルディスプレイにおける主要市場の1つとなっています。大手テック企業や技術に精通した消費者層が存在するため、スマートフォン、ラップトップ、タブレットなどのフォルダブルデバイスの採用が加速し、高解像度のAMOLEDおよびPOLEDスクリーンに対する需要の増加を通じて、フォルダブルディスプレイ産業に安定した成長をもたらしています。また、規制機関が製品の安全性と効率性を保証することで、需要が高まっています。北米のフォルダブルディスプレイ市場で活動している企業には、Alphabet, Inc.(米国)、ViewSonic Corporation(米国)、Motorola Mobility LLC(米国)などがあり、高品質なフォルダブルデバイスの自社生産によって業界で優位を保っています。

当レポートでは、世界のフォルダブルディスプレイ市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- フォルダブルディスプレイ市場の企業にとって魅力的な機会

- フォルダブルディスプレイ市場:技術別

- フォルダブルディスプレイ市場:用途別

- フォルダブルディスプレイ市場:パネルサイズ別

- フォルダブルディスプレイ市場:地域別

- フォルダブルディスプレイ市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 価格分析

- 平均販売価格の動向:主要企業、技術別

- 平均販売価格の動向:地域別

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 輸入シナリオ(HSコード8524)

- 輸出シナリオ(HSコード8524)

- 特許分析

- 規制情勢

- 規制機関、政府機関、その他の組織

- 標準

- 規制

- 主な会議とイベント(2024年~2025年)

- フォルダブルディスプレイ市場に対するAI/生成AIの影響

第6章 フォルダブルディスプレイに使用される材料

- イントロダクション

- ガラス

- 金属

- プラスチック

- その他の材料

第7章 フォルダブルスクリーンのディスプレイ解像度

- イントロダクション

- HD未満

- HD

- HD超

第8章 フレキシブルディスプレイのタイプ

- イントロダクション

- 曲面ディスプレイ

- 曲げられるディスプレイ

- 巻き取れるディスプレイ

第9章 フォルダブルディスプレイ市場:技術別

- イントロダクション

- 有機EL

- その他の技術

- マイクロLED

- ダイレクトビューLED

第10章 フォルダブルディスプレイ市場:パネルサイズ別

- イントロダクション

- 20インチ以下

- 8インチ以下

- 8~20インチ

- 20インチ超

第11章 フォルダブルディスプレイ市場:用途別

- イントロダクション

- スマートフォン

- ノートパソコン、タブレット

- デジタルサイネージ、その他の大型ディスプレイデバイス

第12章 フォルダブルディスプレイ市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- 韓国

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 中東・アフリカ

- 南米

第13章 競合情勢

- 概要

- 主要企業戦略/有力企業(2019年~2024年)

- 市場シェア分析(2023年)

- 収益分析(2019年~2023年)

- 企業の評価と財務指標

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- ブランド/製品の比較

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- SAMSUNG ELECTRONICS CO., LTD.

- BOE TECHNOLOGY GROUP CO., LTD.

- VISIONOX COMPANY

- TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.

- TIANMA

- ROYOLE CORPORATION

- AUO CORPORATION

- HUAWEI TECHNOLOGIES CO., LTD.

- MOTOROLA MOBILITY LLC

- HONOR DEVICE CO., LTD.

- その他の企業

- ALPHABET, INC.

- LENOVO

- OPPO

- TECNO MOBILE

- VIVO MOBILE COMMUNICATION CO., LTD.

- XIAOMI

- VIEWSONIC CORPORATION

- ASUSTEK COMPUTER INC.

- E INK HOLDINGS INC.

- ONEPLUS

- CORNING INCORPORATED

- ONUMEN TECHNOLOGY CO., LTD.

- 3M

- SCHOTT GROUP

- APPLIED MATERIALS, INC.

第15章 付録

List of Tables

- TABLE 1 FOLDABLE DISPLAY MARKET: FORECAST ASSUMPTIONS

- TABLE 2 FOLDABLE DISPLAY MARKET: RESEARCH ASSUMPTIONS

- TABLE 3 FOLDABLE DISPLAY MARKET: RISK ASSESSMENT

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TECHNOLOGY, 2019-2023 (USD)

- TABLE 6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 8 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 9 LIST OF PATENTS, 2020-2022

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 15 FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 16 FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 17 OLED: FOLDABLE DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 18 OLED: FOLDABLE DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 19 OLED: FOLDABLE DISPLAY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 20 OLED: FOLDABLE DISPLAY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 21 OLED: FOLDABLE DISPLAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 22 OLED: FOLDABLE DISPLAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 23 OLED: FOLDABLE DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 24 OLED: FOLDABLE DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 25 OLED: FOLDABLE DISPLAY MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 26 OLED: FOLDABLE DISPLAY MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 27 OLED: FOLDABLE DISPLAY MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 28 OLED: FOLDABLE DISPLAY MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 29 OLED: FOLDABLE DISPLAY MARKET, BY APPLICATION, 2020-2023 (MILLION UNITS)

- TABLE 30 OLED: FOLDABLE DISPLAY MARKET, BY APPLICATION, 2024-2029 (MILLION UNITS)

- TABLE 31 OLED: FOLDABLE DISPLAY MARKET FOR SMARTPHONES, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 32 OLED: FOLDABLE DISPLAY MARKET FOR SMARTPHONES, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 33 OLED: FOLDABLE DISPLAY MARKET FOR LAPTOPS AND TABLETS, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 34 OLED: FOLDABLE DISPLAY MARKET FOR LAPTOPS AND TABLETS, BY REGION, 2024-2029 (THOUSAND UNITS)

- TABLE 35 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 38 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 39 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY TYPE, 2020-2023 (USD MILLION)

- TABLE 40 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY TYPE, 2024-2029 (USD MILLION)

- TABLE 41 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET, BY REGION, 2020-2023 (USD THOUSANDS)

- TABLE 42 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET, BY REGION, 2024-2029 (USD THOUSAND)

- TABLE 43 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 44 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD THOUSAND)

- TABLE 45 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 46 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD THOUSAND)

- TABLE 47 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 48 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD THOUSAND)

- TABLE 49 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET IN ROW, BY REGION, 2020-2023 (USD THOUSAND)

- TABLE 50 OTHER TECHNOLOGIES: FOLDABLE DISPLAY MARKET IN ROW, BY REGION, 2024-2029 (USD THOUSAND)

- TABLE 51 MICRO-LED: FOLDABLE DISPLAY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 52 MICRO-LED: FOLDABLE DISPLAY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 53 FOLDABLE DISPLAY MARKET, BY PANEL SIZE, 2020-2023 (USD MILLION)

- TABLE 54 FOLDABLE DISPLAY MARKET, BY PANEL SIZE, 2024-2029 (USD MILLION)

- TABLE 55 UP TO 20 INCHES: FOLDABLE DISPLAY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 56 UP TO 20 INCHES: FOLDABLE DISPLAY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 57 UP TO 20 INCHES: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 58 UP TO 20 INCHES: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 59 FOLDABLE DISPLAY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 60 FOLDABLE DISPLAY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 61 LAPTOPS AND TABLETS: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 62 LAPTOPS AND TABLETS: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 63 FOLDABLE DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 FOLDABLE DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 65 NORTH AMERICA: FOLDABLE DISPLAY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 66 NORTH AMERICA: FOLDABLE DISPLAY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 67 NORTH AMERICA: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 68 NORTH AMERICA: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 69 NORTH AMERICA: FOLDABLE DISPLAY MARKET FOR OLED, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 70 NORTH AMERICA: FOLDABLE DISPLAY MARKET FOR OLED, BY APPLICATION, 2024-2029 (THOUSAND UNITS)

- TABLE 71 US: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 72 US: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 73 CANADA: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 74 CANADA: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 75 MEXICO: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD THOUSAND)

- TABLE 76 MEXICO: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD THOUSAND)

- TABLE 77 EUROPE: FOLDABLE DISPLAY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 78 EUROPE: FOLDABLE DISPLAY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 79 EUROPE: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 80 EUROPE: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 81 EUROPE: FOLDABLE DISPLAY MARKET FOR OLED, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 82 EUROPE: FOLDABLE DISPLAY MARKET FOR OLED, BY APPLICATION, 2024-2029 (THOUSAND UNITS)

- TABLE 83 UK: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 84 UK: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 85 GERMANY: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 86 GERMANY: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 87 FRANCE: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 88 FRANCE: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 89 REST OF EUROPE: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 90 REST OF EUROPE: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 91 ASIA PACIFIC: FOLDABLE DISPLAY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 92 ASIA PACIFIC: FOLDABLE DISPLAY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 93 ASIA PACIFIC: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 94 ASIA PACIFIC: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 95 ASIA PACIFIC: FOLDABLE DISPLAY MARKET FOR OLED, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 96 ASIA PACIFIC: FOLDABLE DISPLAY MARKET FOR OLED, BY APPLICATION, 2024-2029 (THOUSAND UNITS)

- TABLE 97 CHINA: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 98 CHINA: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 99 JAPAN: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 100 JAPAN: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 101 SOUTH KOREA: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 102 SOUTH KOREA: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 105 ROW: FOLDABLE DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 106 ROW: FOLDABLE DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 107 ROW: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 108 ROW: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 109 ROW: FOLDABLE DISPLAY MARKET FOR OLED, BY APPLICATION, 2020-2023 (THOUSAND UNITS)

- TABLE 110 ROW: FOLDABLE DISPLAY MARKET FOR OLED, BY APPLICATION, 2024-2029 (THOUSAND UNITS)

- TABLE 111 MIDDLE EAST & AFRICA: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: FOLDABLE DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: FOLDABLE DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 115 SOUTH AMERICA: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 116 SOUTH AMERICA: FOLDABLE DISPLAY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 117 FOLDABLE DISPLAY MARKET: KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019-2024

- TABLE 118 FOLDABLE DISPLAY MARKET: MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- TABLE 119 FOLDABLE DISPLAY MARKET: TECHNOLOGY FOOTPRINT

- TABLE 120 FOLDABLE DISPLAY MARKET: PANEL SIZE FOOTPRINT

- TABLE 121 FOLDABLE DISPLAY MARKET: APPLICATION FOOTPRINT

- TABLE 122 FOLDABLE DISPLAY MARKET: REGION FOOTPRINT

- TABLE 123 FOLDABLE DISPLAY MARKET: LIST OF STARTUPS/SMES

- TABLE 124 FOLDABLE DISPLAY MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 125 FOLDABLE DISPLAY MARKET: PRODUCT LAUNCHES, MAY 2019- JUNE 2024

- TABLE 126 FOLDABLE DISPLAY MARKET: DEALS, MAY 2019-JUNE 2024

- TABLE 127 FOLDABLE DISPLAY MARKET: OTHER DEVELOPMENTS, MAY 2019-JUNE 2024

- TABLE 128 SAMSUNG ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 129 SAMSUNG ELECTRONICS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 SAMSUNG ELECTRONICS CO., LTD.: PRODUCT LAUNCHES

- TABLE 131 SAMSUNG ELECTRONICS CO., LTD.: DEALS

- TABLE 132 BOE TECHNOLOGY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 133 BOE TECHNOLOGY GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 BOE TECHNOLOGY GROUP CO., LTD.: DEALS

- TABLE 135 VISIONOX COMPANY: COMPANY OVERVIEW

- TABLE 136 VISIONOX COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 VISIONOX COMPANY: DEALS

- TABLE 138 VISIONOX COMPANY: OTHER DEVELOPMENTS

- TABLE 139 TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 140 TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 142 TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.: DEALS

- TABLE 143 TIANMA: COMPANY OVERVIEW

- TABLE 144 TIANMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 TIANMA: PRODUCT LAUNCHES

- TABLE 146 ROYOLE CORPORATION: COMPANY OVERVIEW

- TABLE 147 ROYOLE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 ROYOLE CORPORATION: PRODUCT LAUNCHES

- TABLE 149 ROYOLE CORPORATION: DEALS

- TABLE 150 AUO CORPORATION: COMPANY OVERVIEW

- TABLE 151 AUO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 AUO CORPORATION: PRODUCT LAUNCHES

- TABLE 153 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 154 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 156 MOTOROLA MOBILITY LLC: COMPANY OVERVIEW

- TABLE 157 MOTOROLA MOBILITY LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 MOTOROLA MOBILITY LLC: PRODUCT LAUNCHES

- TABLE 159 HONOR DEVICE CO., LTD.: COMPANY OVERVIEW

- TABLE 160 HONOR DEVICE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 HONOR DEVICE CO., LTD.: PRODUCT LAUNCHES

- TABLE 162 ALPHABET, INC.: COMPANY OVERVIEW

- TABLE 163 LENOVO: COMPANY OVERVIEW

- TABLE 164 OPPO: COMPANY OVERVIEW

- TABLE 165 TECNO MOBILE: COMPANY OVERVIEW

- TABLE 166 VIVO MOBILE COMMUNICATION CO., LTD.: COMPANY OVERVIEW

- TABLE 167 XIAOMI: COMPANY OVERVIEW

- TABLE 168 VIEWSONIC CORPORATION: COMPANY OVERVIEW

- TABLE 169 ASUSTEK COMPUTER INC.: COMPANY OVERVIEW

- TABLE 170 E INK HOLDINGS INC.: COMPANY OVERVIEW

- TABLE 171 ONEPLUS: COMPANY OVERVIEW

- TABLE 172 CORNING INCORPORATED: COMPANY OVERVIEW

- TABLE 173 ONUMEN TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 174 3M: COMPANY OVERVIEW

- TABLE 175 SCHOTT GROUP: COMPANY OVERVIEW

- TABLE 176 APPLIED MATERIALS, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 FOLDABLE DISPLAY MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 GLOBAL FOLDABLE DISPLAY MARKET SNAPSHOT

- FIGURE 9 OLED SEGMENT TO SECURE LARGER MARKET SHARE IN 2024

- FIGURE 10 UP TO 20 INCHES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 SMARTPHONES TO SECURE LARGEST MARKET SHARE IN 2029

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 13 RISING ADOPTION OF INNOVATIVE AND MULTIFUNCTIONAL DEVICES BY CONSUMERS TO DRIVE MARKET

- FIGURE 14 OLED SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 SMARTPHONES SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 FOLDABLE DISPLAYS UP TO 20 INCHES TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC TO BE LARGEST MARKET FOR FOLDABLE DISPLAYS BETWEEN 2024 AND 2029

- FIGURE 18 CHINA TO BE FASTEST-GROWING COUNTRY GLOBALLY DURING FORECAST PERIOD

- FIGURE 19 FOLDABLE DISPLAY MARKET DYNAMICS

- FIGURE 20 GLOBAL 5G SUBSCRIPTIONS FOR SMARTPHONES, 2020-2029,

- FIGURE 21 IMPACT ANALYSIS OF DRIVERS ON FOLDABLE DISPLAY MARKET

- FIGURE 22 IMPACT ANALYSIS OF RESTRAINTS ON FOLDABLE DISPLAY MARKET

- FIGURE 23 IMPACT ANALYSIS OF OPPORTUNITIES ON FOLDABLE DISPLAY MARKET

- FIGURE 24 IMPACT ANALYSIS OF CHALLENGES ON FOLDABLE DISPLAY MARKET

- FIGURE 25 SUPPLY CHAIN ANALYSIS

- FIGURE 26 ECOSYSTEM ANALYSIS

- FIGURE 27 DISPLAY ECOSYSTEM

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2018-2024

- FIGURE 29 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 30 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TECHNOLOGY, 2023

- FIGURE 31 AVERAGE SELLING PRICE TREND OF FOLDABLE DISPLAYS, BY REGION, 2019-2023

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 IMPACT OF PORTER'S FIVE FORCES

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 35 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 36 IMPORT DATA FOR HS CODE 8524-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2023

- FIGURE 37 EXPORT DATA FOR HS CODE 8524-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2023

- FIGURE 38 PATENT ANALYSIS

- FIGURE 39 IMPACT OF AI/GEN AI ON FOLDABLE DISPLAY MARKET

- FIGURE 40 OLED SEGMENT TO CAPTURE LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR OLED TECHNOLOGY DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC TO LEAD FOLDABLE DISPLAY MARKET FOR OTHER TECHNOLOGIES DURING FORECAST PERIOD

- FIGURE 43 ABOVE 20 INCHES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 44 SMARTPHONES SEGMENT TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA: FOLDABLE DISPLAY MARKET SNAPSHOT

- FIGURE 47 EUROPE: FOLDABLE DISPLAY MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: FOLDABLE DISPLAY MARKET SNAPSHOT

- FIGURE 49 FOLDABLE DISPLAY MARKET: MARKET SHARE ANALYSIS, 2023

- FIGURE 50 FOLDABLE DISPLAY MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023

- FIGURE 51 FOLDABLE DISPLAY MARKET: COMPANY VALUATION, 2024

- FIGURE 52 FOLDABLE DISPLAY MARKET: FINANCIAL METRICS, 2024

- FIGURE 53 FOLDABLE DISPLAY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 54 FOLDABLE DISPLAY MARKET: COMPANY FOOTPRINT

- FIGURE 55 FOLDABLE DISPLAY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 56 FOLDABLE DISPLAY MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 57 SAMSUNG ELECTRONICS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 58 BOE TECHNOLOGY GROUP CO., LTD.: COMPANY SNAPSHOT

- FIGURE 59 VISIONOX COMPANY: COMPANY SNAPSHOT

- FIGURE 60 TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 61 TIANMA: COMPANY SNAPSHOT

- FIGURE 62 AUO CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

The foldable display market is projected to reach USD 13.2 billion by 2029 from USD 4.6 billion in 2024, at a CAGR of 23.6% from 2024 to 2029. The major factors driving the market growth of the foldable display market include the rising demand for large screen in smartphones, impact of 5G rollout, increasing interest in consumer innovations and multifunctional devices, and expansion of applications areas. Moreover, technological advancement and emerging applications in foldable displays is expected to provide several growth opportunities for market players in the foldable display market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Panel Size, Application, Material, Resolution, Type and Region |

| Regions covered | North America, Europe, APAC, RoW |

Smartphone application are anticipated to dominate the market share of the foldable display market during the forecast period

The consumer preference for larger screens in smartphones is evident in the increasing popularity of this device without compromising on portability. Improvements to the technologies of both display materials and hinge mechanisms increase durability and reliability, making foldable screens more interesting for consumers. Starting from multitasking to media consumption, laptops and tablets are fitted with foldable displays for multiple scenarios. Unlike large format displays and digital signage, foldable technology can bring an immersive and customized view, perfect for public spaces, retail environments, and advertising applications. Thus, this transformative ability through the offer of unrivaled flexibility and functionality acts as a major fuel in the adoption foldable displays in smartphone applications.

Panels sized above 20 inches are projected to experience the highest CAGR in the foldable display market during the forecast period.

Applications of foldable displays greater than 20 inches are going ahead in large-scale environments like monitors, televisions, and digital signage. The need or demand of a larger foldable display currently basically relies on the fact that all these sectors, from home entertainment to corporate setups, and commercial displays, require such devices for compact area management. These displays could convert into manageable storage format from their large interactive figure, thus providing more productivity and efficiency to the meeting environments. Foldable digital signage is a dynamic advertising solution applied to retail and public spaces because it can be adapted to numerous promotional campaigns or spatial constraints. The foldable or rollable nature of such displays makes it easy to install and maintain them for a smooth advertising experience. Improvements in manufacturing and materials are also driving adoption of larger foldable display sizes for different end-use industries.

North America is expected to grow at the second highest CAGR during the forecast period.

North America is one of the major markets in terms of foldable displays due to the presence of a strong consumer class with a huge demand for advanced technology and large disposable incomes. The presence of tech giants and a technologically savvy consumer base, this accelerates the adoption in foldable devices of smartphones, laptops, and tablets, thereby adding consistent growth to the foldable display industry through increased demand for high-resolution AMOLED and POLED screens. Besides, the regulatory bodies ensure safety and efficiency of the products, thereby rising in demand. Some of the companies operating in the North American foldable display market are Alphabet, Inc. (US), ViewSonic Corporation (US), and Motorola Mobility LLC (US), which continue dominating the industry through in-house production of quality foldable devices.

The break-up of profile of primary participants in the foldable display market-

- By Company Type: Tier 1 - 10%, Tier 2 - 20%, Tier 3 - 70%

- By Designation Type: C Level - 40%, Director Level - 30%, Others - 30%

- By Region Type: North America - 30%, : Asia Pacific - 40%, Europe - 20%, Rest of the World (RoW) - 10%

The major players of foldable display market are Samsung Electronics Co., Ltd. (South Korea), BOE Technology Group Co., Ltd. (China), Visionox Company (China), Royole Corporation (China), and TCL China Star Optoelectronics Co., Ltd. (China), among others.

Research Coverage

The report segments the foldable display market and forecasts its size based on technology, panel size, application, material, resolution, type, and region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall foldable display market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (rising demand for large screens in smartphones, impact of 5G rollout, increasing consumer interest in innovations and multifunctional devices, and expansion of applications areas), restraints (high production costs of foldable displays, and long-term durability and reliability), opportunities (emerging applications in foldable displays, and advancements in technology), and challenges (design and engineering complexities, and limited use of foldable displays) influencing the growth of the foldable display market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the foldable display market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the foldable display market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the foldable display market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like Samsung Electronics Co., Ltd. (South Korea), BOE Technology Group Co., Ltd. (China), Visionox Company (China), Royole Corporation (China), and TCL China Star Optoelectronics Co., Ltd. (China).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

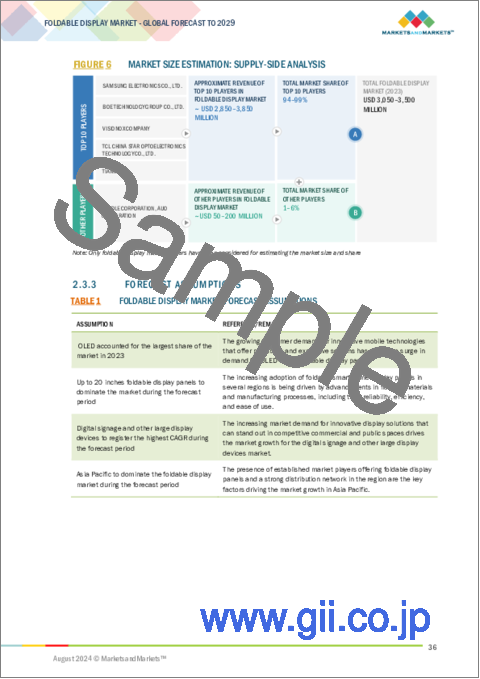

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.3.3 FORECAST ASSUMPTIONS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FOLDABLE DISPLAY MARKET

- 4.2 FOLDABLE DISPLAY MARKET, BY TECHNOLOGY

- 4.3 FOLDABLE DISPLAY MARKET, BY APPLICATION

- 4.4 FOLDABLE DISPLAY MARKET, BY PANEL SIZE

- 4.5 FOLDABLE DISPLAY MARKET, BY REGION

- 4.6 FOLDABLE DISPLAY MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Consumer preference for smartphones with larger screens

- 5.2.1.2 Widespread rollout of 5G networks

- 5.2.1.3 High adoption of innovative and multifunctional devices by consumers

- 5.2.1.4 Revolutionizing industries by extending foldable displays beyond smartphones

- 5.2.2 RESTRAINTS

- 5.2.2.1 High production costs and poor yields

- 5.2.2.2 Longevity and reliability issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for gaming, healthcare, and education applications

- 5.2.3.2 Enhancing quality through advanced technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities associated with display designing and fabrication

- 5.2.4.2 Limited use of foldable displays

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 AMOLED

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 5G

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Wearables

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TECHNOLOGY

- 5.8.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 SAMSUNG'S CAMPAIGN TO REIGNITE SMARTPHONE SALES WITH GALAXY FOLD 5G

- 5.11.2 UNIFIED INFOTECH STRATEGIES TO OVERCOME DESIGN AND FUNCTIONAL CHALLENGES

- 5.11.3 OWENS REVOLUTIONIZES FLEXIBLE OLED DISPLAY PRODUCTION THROUGH INNOVATIVE ENGINEERING AND PARTNERSHIP

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 8524)

- 5.12.2 EXPORT SCENARIO (HS CODE 8524)

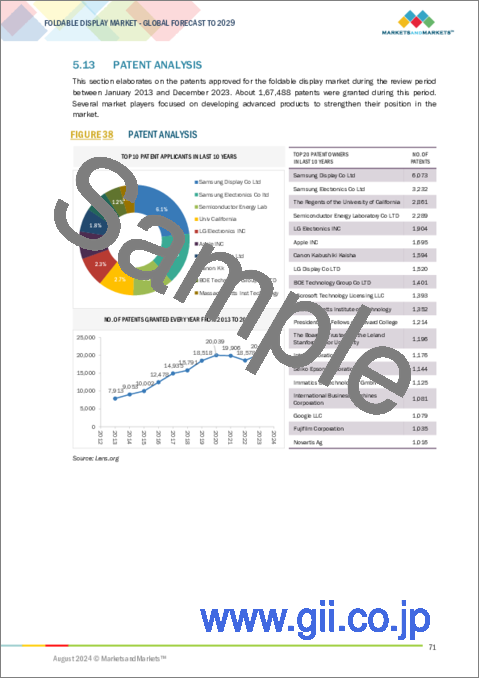

- 5.13 PATENT ANALYSIS

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS

- 5.14.3 REGULATIONS

- 5.15 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.16 IMPACT OF AI/GEN AI ON FOLDABLE DISPLAY MARKET

6 MATERIALS USED IN FOLDABLE DISPLAYS

- 6.1 INTRODUCTION

- 6.2 GLASS

- 6.3 METAL

- 6.4 PLASTIC

- 6.5 OTHER MATERIALS

7 DISPLAY RESOLUTION FOR FOLDABLE SCREENS

- 7.1 INTRODUCTION

- 7.2 LESS THAN HD

- 7.3 HD

- 7.4 MORE THAN HD

8 TYPES OF FLEXIBLE DISPLAYS

- 8.1 INTRODUCTION

- 8.2 CURVED DISPLAY

- 8.3 BENDABLE DISPLAY

- 8.4 ROLLABLE DISPLAY

9 FOLDABLE DISPLAY MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 OLED

- 9.2.1 CONTINUOUS INVESTMENTS IN RESEARCH & DEVELOPMENT TO SUPPORT MARKET GROWTH

- 9.3 OTHER TECHNOLOGIES

- 9.3.1 MICRO-LED

- 9.3.1.1 Overcoming manufacturing challenges and improving display durability to fuel market

- 9.3.2 DIRECT-VIEW LED

- 9.3.2.1 Increasing need for high-performance and large-format displays to spike demand

- 9.3.1 MICRO-LED

10 FOLDABLE DISPLAY MARKET, BY PANEL SIZE

- 10.1 INTRODUCTION

- 10.2 UP TO 20 INCHES

- 10.2.1 UP TO 8 INCHES

- 10.2.1.1 Improved functionality and user experience to foster market growth

- 10.2.2 8 - 20 INCHES

- 10.2.2.1 Surging demand for bigger workspaces and devices with flexible screens to drive segmental growth

- 10.2.1 UP TO 8 INCHES

- 10.3 ABOVE 20 INCHES

- 10.3.1 VERSATILE SOLUTIONS FOR OFFICES, PUBLIC SPACES, AND HOME ENTERTAINMENT TO SPUR DEMAND

11 FOLDABLE DISPLAY MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 SMARTPHONES

- 11.2.1 ENHANCED VERSATILITY AND MULTITASKING TO FOSTER MARKET GROWTH

- 11.3 LAPTOPS AND TABLETS

- 11.3.1 RISE OF REMOTE WORKING TRENDS, FLEXIBLE WORK ARRANGEMENTS, AND TELECOMMUTING TO SPUR DEMAND

- 11.4 DIGITAL SIGNAGE AND OTHER LARGE DISPLAY DEVICES

- 11.4.1 DYNAMIC AND ADAPTABLE INSTALLATION OPTIONS TO FUEL MARKET GROWTH

12 FOLDABLE DISPLAY MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Increasing demand for video streaming services with rising number of online gamers to accelerate market growth

- 12.2.3 CANADA

- 12.2.3.1 Digitally literate population and high standard of living to create growth opportunities

- 12.2.4 MEXICO

- 12.2.4.1 Growing inclination of youth toward adoption of innovative technology to boost demand

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 UK

- 12.3.2.1 Widespread availability of premium electronics due to strong retail infrastructure to support market growth

- 12.3.3 GERMANY

- 12.3.3.1 Significant presence of manufacturers and suppliers of key components and materials to foster market growth

- 12.3.4 FRANCE

- 12.3.4.1 Robust retail network to contribute to market growth

- 12.3.5 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Advanced manufacturing capabilities and supportive environment for innovation to accelerate market

- 12.4.3 JAPAN

- 12.4.3.1 Constant innovations in display technologies and robust consumer base to augment market growth

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Constant advancements in display technology by giant companies to create opportunities

- 12.4.5 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 MIDDLE EAST & AFRICA

- 12.5.2.1 Increasing demand for versatile and advanced electronic devices from educational institutions to drive market

- 12.5.2.2 Gulf cooperation council (GCC)

- 12.5.2.3 Rest of Middle East & Africa

- 12.5.3 SOUTH AMERICA

- 12.5.3.1 Growing middle-class and tech-savvy youth to boost demand

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019-2024

- 13.3 MARKET SHARE ANALYSIS, 2023

- 13.4 REVENUE ANALYSIS, 2019-2023

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.6.5.1 Company footprint

- 13.6.5.2 Technology footprint

- 13.6.5.3 Panel size footprint

- 13.6.5.4 Application footprint

- 13.6.5.5 Region footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 13.7.5.1 List of start-ups/SMEs

- 13.7.5.2 Competitive benchmarking of startups/SMEs

- 13.8 BRAND/PRODUCT COMPARISON

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 SAMSUNG ELECTRONICS CO., LTD.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 BOE TECHNOLOGY GROUP CO., LTD.

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 VISIONOX COMPANY

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.3.2 Other developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 TCL CHINA STAR OPTOELECTRONICS TECHNOLOGY CO., LTD.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 TIANMA

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 ROYOLE CORPORATION

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.4 MnM view

- 14.1.6.4.1 Key strengths

- 14.1.6.4.2 Strategic choices

- 14.1.6.4.3 Weaknesses and competitive threats

- 14.1.7 AUO CORPORATION

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.8 HUAWEI TECHNOLOGIES CO., LTD.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.9 MOTOROLA MOBILITY LLC

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.10 HONOR DEVICE CO., LTD.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.1 SAMSUNG ELECTRONICS CO., LTD.

- 14.2 OTHER PLAYERS

- 14.2.1 ALPHABET, INC.

- 14.2.2 LENOVO

- 14.2.3 OPPO

- 14.2.4 TECNO MOBILE

- 14.2.5 VIVO MOBILE COMMUNICATION CO., LTD.

- 14.2.6 XIAOMI

- 14.2.7 VIEWSONIC CORPORATION

- 14.2.8 ASUSTEK COMPUTER INC.

- 14.2.9 E INK HOLDINGS INC.

- 14.2.10 ONEPLUS

- 14.2.11 CORNING INCORPORATED

- 14.2.12 ONUMEN TECHNOLOGY CO., LTD.

- 14.2.13 3M

- 14.2.14 SCHOTT GROUP

- 14.2.15 APPLIED MATERIALS, INC.

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS