|

|

市場調査レポート

商品コード

1543644

エアサスペンション市場:コンポーネント別、技術別、キャブサスペンション別、車両タイプ別、アフターマーケット別、地域別 - 2030年までの予測Air Suspension Market by Component (Air Spring, Compressor, ECU, Tank, Solenoid Valve, Height & Pressure Sensor), Technology (Electric, Non-Electric), Cab Suspension, Vehicle Type (Rigid, Semi-trailers), Aftermarket & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| エアサスペンション市場:コンポーネント別、技術別、キャブサスペンション別、車両タイプ別、アフターマーケット別、地域別 - 2030年までの予測 |

|

出版日: 2024年08月23日

発行: MarketsandMarkets

ページ情報: 英文 282 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のエアサスペンションの市場規模は、2024年の100億米ドルから2030年には139億米ドルに成長すると予測され、予測期間のCAGRは5.6%になると予測されています。

アジア太平洋と北米市場では、経済成長、インフラ整備、eコマース活動により、大型車の需要が増加しています。OICAによると、北米のトラック生産台数は2020年の388,244台から2023年には562,244台に増加し、2020年から2023年までの成長率は45%です。このトラック生産台数の増加は、エアサスペンションシステムの需要に直接影響します。大型トラックの多くはエアサスペンションシステムを装備していますが、これはトラックが重量のある様々な荷物を運ぶことが多く、トラックの安定性とハンドリングに大きな影響を与える可能性があるためです。トラックのエアサスペンションシステムは、荷重に応じて車高と剛性を自動的に調整し、最適な性能と安全性を確保します。さらに、エアサスペンションシステムは十分なスペースを必要とするため、トラックはエアサスペンションシステムの設置に適しています。したがって、トラックやバスを含む大型商用車の需要は、今後数年間で高まるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | コンポーネント別、技術別、キャブサスペンション別、車両タイプ別、アフターマーケット別、地域別 |

| 対象地域 | アジア太平洋地域、北米、欧州、その他の地域 |

これに加えて、可処分所得の増加、インフラの改善、ブランド認知度の向上、機能強化を提供するためのOEM間の競合の激化に伴い、プレミアム車に対する需要は先進国および新興諸国において継続的に拡大しています。主にE&Fクラスのプレミアムカーの中には、乗り心地と快適性を向上させるためにエアサスペンションシステムを搭載しているものもあります。このことは、乗用車セグメントにおけるエアサスペンション市場の成長を促すと予測されます。

電子制御エアサスペンションは、エアサスペンション市場において急速な成長を遂げ、人気を博しています。欧州におけるトラック・バス用エアサスペンションの採用率は、2023年には80%以上に達しています。Volvo、Daimler AG、Scania、MANは、欧州市場でトラック・バス用の電子制御システムを提供しています。電子制御エアサスペンションは、道路状況、荷重、車速に基づいてサスペンション設定をリアルタイムで調整できる高度なソフトウェアとセンサーを備えています。その結果、スムーズで快適な乗り心地を実現し、高級車やプレミアムカー、長距離トラックで高く評価されています。これらのシステムは、理想的な車高を維持するようにエアサスペンションを調整し、コーナリング中の車体のロールの可能性を減らすことで、車両の安定性とハンドリングを最適化することができます。このリアルタイムのサスペンション高さ調整は、高速走行時には車高を下げ、低速走行時には車高を上げることで、車両のエアロダイナミクスも向上させる。エアロダイナミクスは、空気抵抗を減らすことで、車両全体のパフォーマンスと効率を向上させます。また、電子制御エアサスペンションは、 促進要因のニーズに応じて、より高度なカスタマイズ(コンフォート、スポーツ、オフロードなど)を可能にします。

当レポートでは、世界のエアサスペンション市場について調査し、コンポーネント別、技術別、キャブサスペンション別、車両タイプ別、アフターマーケット別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 消費者のビジネスに影響を与える動向と混乱

- エコシステム分析

- 技術分析

- サプライチェーン分析

- 価格分析

- 投資と資金調達のシナリオ

- 主な利害関係者と購入基準

- 特許分析

- ケーススタディ分析

- 貿易分析

- 規制状況

- 2024年~2025年の主な会議とイベント

- サプライヤー分析

第6章 エアサスペンション市場(車両タイプ別)

- イントロダクション

- 乗用車

- 小型商用車

- トラック

- バス

- 業界考察

第7章 エアサスペンション市場(技術別)

- イントロダクション

- 電子制御

- 非電子制御

- 業界考察

第8章 エアサスペンションOE市場(コンポーネント別)

- イントロダクション

- エアスプリング

- ショックアブソーバー

- エアコンプレッサー

- 電子制御ユニット

- 空気貯蔵庫

- 高さセンサー

- ソレノイドバルブ

- 圧力センサー

- 業界考察

第9章 エアサスペンションアフターマーケット(コンポーネント別)

- イントロダクション

- エアベローズ

- ショックアブソーバーブッシュ

- 業界考察

第10章 キャビンエアサスペンション市場(車両タイプ別)

- イントロダクション

- リジッドトラック

- セミトレーラー

- 業界考察

第11章 電気自動車およびハイブリッド車用エアサスペンション市場(技術別)

- イントロダクション

- 電子制御

- 非電子制御

- 業界考察

第12章 電気自動車およびハイブリッド車用エアサスペンション市場(車両タイプ別)

- イントロダクション

- 小型車両

- トラック

- バス

- 業界考察

第13章 エアサスペンション市場(地域別)

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- その他の地域

- 業界考察

第14章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 市場シェア分析、2023年

- 2019年~2023年のトップ5企業の収益分析

- エアサスペンション部品サプライヤー、2023年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- 製品/ブランド比較

- 競合シナリオと動向

第15章 企業プロファイル

- 主要参入企業

- ZF FRIEDRICHSHAFEN AG

- CONTINENTAL AG

- THYSSENKRUPP AG

- HL MANDO CORP.

- MERITOR, INC.

- SAF-HOLLAND SE

- HENDRICKSON USA, L.L.C.

- FIRESTONE INDUSTRIAL PRODUCTS COMPANY, LLC

- VIBRACOUSTIC SE

- BWI GROUP

- その他の企業

- ARNOTT LLC

- THYSSENKRUPP BILSTEIN

- AIR LIFT COMPANY

- INFINITY ENGINEERED PRODUCTS

- DUNLOP

- VB-AIRSUSPENSION

- LINK MANUFACTURING, LTD.

- UNIVERSAL AIR INC.

- LIFTMATIC

- STEMCOPRODUCTS INC.

- SHANGHAI KOMMAN VEHICLE PARTS SYSTEM CO., LTD.

- JAMNA AUTO INDUSTRIES LIMITED

- ACCUAIR SUSPENSION

- AEROSUS

- AIRTECH SYSTEMS

第16章 市場における提言

第17章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 CURRENCY EXCHANGE RATES

- TABLE 3 PRODUCTION VOLUME OF PASSENGER CAR MODELS WITH AIR SUSPENSION, 2023 (UNITS)

- TABLE 4 AVERAGE COST OF SUSPENSION TECHNOLOGIES

- TABLE 5 WEIGHT REDUCTION TARGETS FOR ICE LIGHT-DUTY VEHICLES IN US

- TABLE 6 LIST OF KEY AFTERMARKET PLAYERS

- TABLE 7 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 8 AVERAGE SELLING PRICE OF AIR SUSPENSION, BY VEHICLE TYPE, 2021-2023 (USD)

- TABLE 9 AVERAGE SELLING PRICE OF AIR SUSPENSION, BY TECHNOLOGY, 2021-2023 (USD)

- TABLE 10 AVERAGE SELLING PRICE OF AIR SUSPENSION FOR HEAVY-DUTY VEHICLES, BY REGION, 2021-2023 (USD)

- TABLE 11 LIST OF FUNDINGS, 2023-2024

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIR SUSPENSION

- TABLE 13 KEY BUYING CRITERIA FOR AIR SUSPENSION, BY TECHNOLOGY

- TABLE 14 PATENT ANALYSIS

- TABLE 15 US: IMPORT DATA, BY COUNTRY (USD)

- TABLE 16 CHINA: IMPORT DATA, BY COUNTRY (USD)

- TABLE 17 JAPAN: IMPORT DATA, BY COUNTRY (USD)

- TABLE 18 INDIA: IMPORT DATA, BY COUNTRY (USD)

- TABLE 19 US: EXPORT DATA, BY COUNTRY (USD)

- TABLE 20 CHINA: EXPORT DATA, BY COUNTRY (USD)

- TABLE 21 JAPAN: EXPORT DATA, BY COUNTRY (USD)

- TABLE 22 INDIA: EXPORT DATA, BY COUNTRY (USD)

- TABLE 23 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

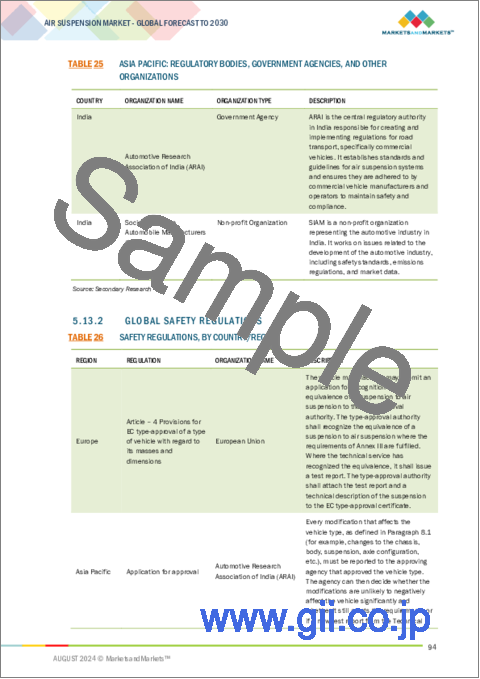

- TABLE 25 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 SAFETY REGULATIONS, BY COUNTRY/REGION

- TABLE 27 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 28 AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 29 AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 30 AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 31 AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 32 PASSENGER CARS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 33 PASSENGER CARS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 34 PASSENGER CARS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 35 PASSENGER CARS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 36 LIGHT COMMERCIAL VEHICLES: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 37 LIGHT COMMERCIAL VEHICLES: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 38 LIGHT COMMERCIAL VEHICLES: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 39 LIGHT COMMERCIAL VEHICLES: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 40 TRUCKS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 41 TRUCKS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 42 TRUCKS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 43 TRUCKS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 44 BUSES: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 45 BUSES: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 46 BUSES: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 47 BUSES: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 48 AIR SUSPENSION MARKET, BY TECHNOLOGY, 2019-2023 (THOUSAND UNITS)

- TABLE 49 AIR SUSPENSION MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 50 AIR SUSPENSION MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 51 AIR SUSPENSION MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 52 ELECTRONICALLY CONTROLLED: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 53 ELECTRONICALLY CONTROLLED: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 54 ELECTRONICALLY CONTROLLED: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 55 ELECTRONICALLY CONTROLLED: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 56 NON-ELECTRONICALLY CONTROLLED: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 57 NON-ELECTRONICALLY CONTROLLED: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 58 NON-ELECTRONICALLY CONTROLLED: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 59 NON-ELECTRONICALLY CONTROLLED: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 60 AIR SUSPENSION MARKET, BY COMPONENT, 2019-2023 (THOUSAND UNITS)

- TABLE 61 AIR SUSPENSION MARKET, BY COMPONENT, 2024-2030 (THOUSAND UNITS)

- TABLE 62 AIR SUSPENSION MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 63 AIR SUSPENSION MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 64 AIR SPRINGS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 65 AIR SPRINGS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 66 AIR SPRINGS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 67 AIR SPRINGS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 68 SHOCK ABSORBERS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 69 SHOCK ABSORBERS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 70 SHOCK ABSORBERS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 71 SHOCK ABSORBERS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 72 AIR COMPRESSORS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 73 AIR COMPRESSORS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 74 AIR COMPRESSORS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 75 AIR COMPRESSORS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 76 ELECTRONIC CONTROL UNITS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 77 ELECTRONIC CONTROL UNITS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 78 ELECTRONIC CONTROL UNITS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 79 ELECTRONIC CONTROL UNITS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 80 AIR RESERVOIRS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 81 AIR RESERVOIRS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 82 AIR RESERVOIRS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 83 AIR RESERVOIRS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 84 HEIGHT SENSORS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 85 HEIGHT SENSORS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 86 HEIGHT SENSORS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 87 HEIGHT SENSORS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 88 SOLENOID VALVES: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 89 SOLENOID VALVES: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 90 SOLENOID VALVES: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 91 SOLENOID VALVES: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 92 PRESSURE SENSORS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 93 PRESSURE SENSORS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 94 PRESSURE SENSORS: AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 95 PRESSURE SENSORS: AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 96 AIR SUSPENSION AFTERMARKET, BY COMPONENT, 2019-2023 (MILLION UNITS)

- TABLE 97 AIR SUSPENSION AFTERMARKET, BY COMPONENT, 2024-2030 (MILLION UNITS)

- TABLE 98 AIR SUSPENSION AFTERMARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 99 AIR SUSPENSION AFTERMARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 100 AIR BELLOWS AFTERMARKET, BY REGION, 2019-2023 (MILLION UNITS)

- TABLE 101 AIR BELLOWS AFTERMARKET, BY REGION, 2024-2030 (MILLION UNITS)

- TABLE 102 AIR BELLOWS AFTERMARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 103 AIR BELLOWS AFTERMARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 104 SHOCK ABSORBER BUSHES AFTERMARKET, BY REGION, 2019-2023 (MILLION UNITS)

- TABLE 105 SHOCK ABSORBER BUSHES AFTERMARKET, BY REGION, 2024-2030 (MILLION UNITS)

- TABLE 106 SHOCK ABSORBER BUSHES AFTERMARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 107 SHOCK ABSORBER BUSHES AFTERMARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 108 CABIN AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 109 CABIN AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 110 CABIN AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 111 CABIN AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 112 RIGID TRUCKS: CABIN AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 113 RIGID TRUCKS: CABIN AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 114 RIGID TRUCKS: CABIN AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 115 RIGID TRUCKS: CABIN AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 116 SEMI-TRAILERS: CABIN AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 117 SEMI-TRAILERS: CABIN AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 118 SEMI-TRAILERS: CABIN AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 119 SEMI-TRAILERS: CABIN AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 120 ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY TECHNOLOGY, 2019-2023 (THOUSAND UNITS)

- TABLE 121 ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 122 ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 123 ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 124 ELECTRONICALLY CONTROLLED: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 125 ELECTRONICALLY CONTROLLED: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 126 ELECTRONICALLY CONTROLLED: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 127 ELECTRONICALLY CONTROLLED: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 128 NON-ELECTRONICALLY CONTROLLED: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 129 NON-ELECTRONICALLY CONTROLLED: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 130 NON-ELECTRONICALLY CONTROLLED: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 131 NON-ELECTRONICALLY CONTROLLED: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 132 ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 133 ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 134 ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 135 ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 136 LIGHT-DUTY VEHICLES: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 137 LIGHT-DUTY VEHICLES: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 138 LIGHT-DUTY VEHICLES: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 139 LIGHT-DUTY VEHICLES: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 140 TRUCKS: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 141 TRUCKS: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 142 TRUCKS: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 143 TRUCKS: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 144 BUSES: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 145 BUSES: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 146 BUSES: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 147 BUSES: ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 148 AIR SUSPENSION MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 149 AIR SUSPENSION MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 150 AIR SUSPENSION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 151 AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: AIR SUSPENSION MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 153 ASIA PACIFIC: AIR SUSPENSION MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 154 ASIA PACIFIC: AIR SUSPENSION MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 155 ASIA PACIFIC: AIR SUSPENSION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 156 CHINA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 157 CHINA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 158 CHINA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 159 CHINA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 160 INDIA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 161 INDIA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 162 INDIA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 163 INDIA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 164 JAPAN: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 165 JAPAN: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 166 JAPAN: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 167 JAPAN: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 168 SOUTH KOREA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 169 SOUTH KOREA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 170 SOUTH KOREA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 171 SOUTH KOREA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 173 REST OF ASIA PACIFIC: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 174 REST OF ASIA PACIFIC: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 176 EUROPE: AIR SUSPENSION MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 177 EUROPE: AIR SUSPENSION MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 178 EUROPE: AIR SUSPENSION MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 179 EUROPE: AIR SUSPENSION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 180 GERMANY: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 181 GERMANY: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 182 GERMANY: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 183 GERMANY: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 184 FRANCE: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 185 FRANCE: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 186 FRANCE: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 187 FRANCE: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 188 SPAIN: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 189 SPAIN: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 190 SPAIN: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 191 SPAIN: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 192 ITALY: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 193 ITALY: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 194 ITALY: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 195 ITALY: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 196 UK: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 197 UK: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 198 UK: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 199 UK: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 200 RUSSIA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 201 RUSSIA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 202 RUSSIA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 203 RUSSIA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 204 REST OF EUROPE: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 205 REST OF EUROPE: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 206 REST OF EUROPE: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 207 REST OF EUROPE: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 208 NORTH AMERICA: AIR SUSPENSION MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 209 NORTH AMERICA: AIR SUSPENSION MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 210 NORTH AMERICA: AIR SUSPENSION MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 211 NORTH AMERICA: AIR SUSPENSION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 212 US: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 213 US: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 214 US: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 215 US: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 216 CANADA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 217 CANADA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 218 CANADA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 219 CANADA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 220 MEXICO: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 221 MEXICO: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 222 MEXICO: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 223 MEXICO: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 224 REST OF THE WORLD: AIR SUSPENSION MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 225 REST OF THE WORLD: AIR SUSPENSION MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 226 REST OF THE WORLD: AIR SUSPENSION MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 227 REST OF THE WORLD: AIR SUSPENSION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 228 BRAZIL: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 229 BRAZIL: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 230 BRAZIL: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 231 BRAZIL: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 232 SOUTH AFRICA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 233 SOUTH AFRICA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 234 SOUTH AFRICA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 235 SOUTH AFRICA: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 236 OTHERS: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 237 OTHERS: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 238 OTHERS: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 239 OTHERS: AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 240 AIR SUSPENSION MARKET: DEGREE OF COMPETITION, 2023

- TABLE 241 LIST OF AIR COMPRESSOR SUPPLIERS, 2023

- TABLE 242 LIST OF AIR SPRING SUPPLIERS, 2023

- TABLE 243 AIR SUSPENSION MARKET: TECHNOLOGY FOOTPRINT

- TABLE 244 AIR SUSPENSION MARKET: APPLICATION FOOTPRINT

- TABLE 245 AIR SUSPENSION MARKET: REGION FOOTPRINT

- TABLE 246 LIST OF START-UPS/SMES

- TABLE 247 COMPETITIVE BENCHMARKING OF START-UPS/SMES, 2023

- TABLE 248 AIR SUSPENSION MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2020-2024

- TABLE 249 AIR SUSPENSION MARKET: DEALS, 2020-2024

- TABLE 250 AIR SUSPENSION MARKET: EXPANSIONS, 2020-2024

- TABLE 251 AIR SUSPENSION MARKET: OTHERS, 2020-2024

- TABLE 252 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW

- TABLE 253 ZF FRIEDRICHSHAFEN AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 ZF FRIEDRICHSHAFEN AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 255 ZF FRIEDRICHSHAFEN AG: DEALS

- TABLE 256 ZF FRIEDRICHSHAFEN AG: EXPANSIONS

- TABLE 257 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 258 CONTINENTAL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 CONTINENTAL AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 260 CONTINENTAL AG: EXPANSIONS

- TABLE 261 THYSSENKRUPP AG: COMPANY OVERVIEW

- TABLE 262 THYSSENKRUPP AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 THYSSENKRUPP AG: EXPANSIONS

- TABLE 264 HL MANDO CORP.: COMPANY OVERVIEW

- TABLE 265 HL MANDO CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 MERITOR, INC.: COMPANY OVERVIEW

- TABLE 267 MERITOR, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 MERITOR, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 269 MERITOR, INC.: DEALS

- TABLE 270 SAF-HOLLAND SE: COMPANY OVERVIEW

- TABLE 271 SAF-HOLLAND SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 SAF-HOLLAND SE: DEALS

- TABLE 273 SAF-HOLLAND SE: EXPANSIONS

- TABLE 274 SAF-HOLLAND SE: OTHERS

- TABLE 275 HENDRICKSON USA, L.L.C.: COMPANY OVERVIEW

- TABLE 276 HENDRICKSON USA, L.L.C.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 HENDRICKSON USA, L.L.C.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 278 HENDRICKSON USA, L.L.C.: DEALS

- TABLE 279 HENDRIKSON USA, L.L.C.: OTHERS

- TABLE 281 FIRESTONE INDUSTRIAL PRODUCTS COMPANY, LLC: COMPANY OVERVIEW

- TABLE 282 FIRESTONE INDUSTRIAL PRODUCTS COMPANY, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 FIRESTONE INDUSTRIAL PRODUCTS COMPANY, LLC: EXPANSIONS

- TABLE 284 VIBRACOUSTIC SE: COMPANY OVERVIEW

- TABLE 285 VIBRACOUSTIC SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 286 VIBRACOUSTIC SE: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 287 VIBRACOUSTIC SE: DEALS

- TABLE 288 BWI GROUP: COMPANY OVERVIEW

- TABLE 289 BWI GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 290 BWI GROUP: DEALS

- TABLE 291 ARNOTT LLC: COMPANY OVERVIEW

- TABLE 292 THYSSENKRUPP BILSTEIN: COMPANY OVERVIEW

- TABLE 293 AIR LIFT COMPANY: COMPANY OVERVIEW

- TABLE 294 INFINITY ENGINEERED PRODUCTS: COMPANY OVERVIEW

- TABLE 295 DUNLOP: COMPANY OVERVIEW

- TABLE 296 VB-AIRSUSPENSION: COMPANY OVERVIEW

- TABLE 297 LINK MANUFACTURING, LTD.: COMPANY OVERVIEW

- TABLE 298 UNIVERSAL AIR INC.: COMPANY OVERVIEW

- TABLE 299 LIFTMATIC: COMPANY OVERVIEW

- TABLE 300 STEMCOPRODUCTS INC: COMPANY OVERVIEW

- TABLE 301 SHANGHAI KOMMAN VEHICLE PARTS SYSTEM CO., LTD.: COMPANY OVERVIEW

- TABLE 302 JAMNA AUTO INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 303 ACCUAIR SUSPENSION: COMPANY OVERVIEW

- TABLE 304 AEROSUS: COMPANY OVERVIEW

- TABLE 305 AIRTECH SYSTEMS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 AIR SUSPENSION MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 REPORT SUMMARY

- FIGURE 8 AIR SUSPENSION MARKET, BY REGION, 2024 VS. 2030

- FIGURE 9 RISING DEMAND FOR ENHANCED RIDE COMFORT AND TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

- FIGURE 10 TRUCKS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 11 AIR SPRINGS TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 12 ELECTRONICALLY CONTROLLED SEGMENT TO LEAD AIR SUSPENSION MARKET DURING FORECAST PERIOD

- FIGURE 13 SEMI-TRAILERS TO HOLD HIGHER SHARE THAN RIGID TRUCKS DURING FORECAST PERIOD

- FIGURE 14 AIR BELLOWS TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 15 TRUCKS TO BE FASTEST-GROWING ELECTRIC & HYBRID VEHICLE SEGMENT DURING FORECAST PERIOD

- FIGURE 16 ELECTRONICALLY CONTROLLED SEGMENT TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC TO BE LARGEST MARKET FOR AIR SUSPENSIONS DURING FORECAST PERIOD

- FIGURE 18 AIR SUSPENSION MARKET DYNAMICS

- FIGURE 19 GLOBAL COMMERCIAL VEHICLE PRODUCTION, 2021-2023 (THOUSAND UNITS)

- FIGURE 20 GLOBAL PREMIUM PASSENGER CAR PRODUCTION, 2020-2023 (THOUSAND UNITS)

- FIGURE 21 GLOBAL BEV AND PHEV PASSENGER CAR SALES, 2020-2030 (THOUSAND UNITS)

- FIGURE 22 GLOBAL ELECTRIC TRUCK AND BUS SALES, 2020-2030 (THOUSAND UNITS)

- FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING CONSUMERS' BUSINESSES

- FIGURE 24 ECOSYSTEM ANALYSIS

- FIGURE 25 SUPPLY CHAIN ANALYSIS

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIR SUSPENSION

- FIGURE 28 KEY BUYING CRITERIA FOR AIR SUSPENSION, BY TECHNOLOGY

- FIGURE 29 PATENT ANALYSIS

- FIGURE 30 AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- FIGURE 31 AIR SUSPENSION MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- FIGURE 32 AIR SUSPENSION MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- FIGURE 33 AIR SUSPENSION AFTERMARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- FIGURE 34 CABIN AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- FIGURE 35 ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- FIGURE 36 ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- FIGURE 37 AIR SUSPENSION MARKET, BY REGION, 2024-2030 (USD MILLION)

- FIGURE 38 ASIA PACIFIC: AIR SUSPENSION MARKET SNAPSHOT

- FIGURE 39 EUROPE: AIR SUSPENSION MARKET SNAPSHOT

- FIGURE 40 NORTH AMERICA: AIR SUSPENSION MARKET SNAPSHOT

- FIGURE 41 REST OF THE WORLD: AIR SUSPENSION MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- FIGURE 42 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- FIGURE 43 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 44 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019-2023

- FIGURE 45 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 46 AIR SUSPENSION MARKET: COMPANY FOOTPRINT

- FIGURE 47 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 48 VALUATION OF KEY PLAYERS, 2024

- FIGURE 49 FINANCIAL METRICS OF KEY PLAYERS, 2024

- FIGURE 50 PRODUCT/BRAND COMPARISON

- FIGURE 51 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

- FIGURE 52 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 53 THYSSENKRUPP AG: COMPANY SNAPSHOT

- FIGURE 54 HL MANDO CORP.: COMPANY SNAPSHOT

- FIGURE 55 MERITOR, INC.: COMPANY SNAPSHOT

- FIGURE 56 SAF-HOLLAND SE: COMPANY SNAPSHOT

The global Air Suspension Market is expected to grow from USD 10.0 billion in 2024 to 13.9 billion by 2030, it is projected to grow at a CAGR of 5.6% in the forecast period. There is a rise in demand for heavy vehicles in the APAC and North American markets owing to economic growth, infrastructural developments, and e-commerce activities. According to OICA, the production of trucks in North America has increased from 388,244 units in 2020 to 562,244 units in 2023, at a growth rate of 45% from 2020 to 2023. This growing production of trucks will directly impact the demand for air suspension systems. Most heavy trucks are equipped with air suspension systems because trucks often carry heavy and variable loads, which can significantly affect the truck's stability and handling. Air suspension systems in trucks automatically regulate the ride height and stiffness according to the load, ensuring optimal performance and safety. Further, air suspension systems require ample space, and trucks are well-suited for installing air suspension systems. Thus, the demand for heavy commercial vehicles, including trucks and buses, will rise in the coming years.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, By Technology, By Vehicle Type, Aftermarket, By Region |

| Regions covered | Asia Pacific, North America, Europe, and Rest of the World |

In addition to this, the demand for premium vehicles has continuously grown in developed and developing countries with increasing disposable income, improving infrastructure, rising brand awareness, and growing competition among OEMs to offer enhanced features. Some premium cars, mainly from Class E& F segments, are fitted with air suspension systems for better ride and comfort. This will subsequently prompt the growth of the air suspension market in the passenger vehicle segment.

"The Electronically controlled Air Suspension accounted for the largest and fastest in the technological segment in the air suspension market during the forecast period."

The electronically controlled air suspension is experiencing rapid growth and gaining popularity in the air suspension market. The adoption rate of air suspension in Europe for Trucks and buses stood at>80% in 2023. Volvo, Daimler AG, Scania, and MAN offer electronically controlled systems for trucks and buses in the European market. The electronically controlled air suspension has advanced software and sensors that allow real-time adjustments to the suspension settings based on the road conditions, load, and vehicle speed. This results in a smooth and comfortable ride, which is very much valued in luxury and premium cars and long-haul trucks. These systems can optimize vehicle stability and handling by adjusting the air suspension to maintain the ideal height and reducing the chances of body roll during cornering. This real-time suspension height adjustment also improves the vehicle's aerodynamics by reducing its height at fast speeds and increasing it at slower speeds. Aerodynamics, in turn, helps improve the overall performance and efficiency of the vehicle by reducing drag. The electronically controlled air suspension also provides drivers a higher degree of customization (e.g., comfort, sport, off-road) depending on their needs.

The demand for luxury passenger cars has grown significantly globally in recent years. The production of luxury passenger cars has grown from 3,758 thousand units in 2020 to 5,322 thousand units in 2023 at a growth rate of 12.3% from 2020 to 2023. As the cost of electronically controlled air suspension is higher than that of non-electronically air suspension systems, the usage of ECAS is found to have a higher installation rate in luxury vehicles. Thus, with the growing adoption of luxury vehicles in most developing Asian countries like China and India with higher populations, the market for passenger cars fitted with electronically controlled air suspension is likely to demonstrate a promising business in upcoming years.

"The passenger car segment is expected to be the fastest growing air suspension market."

The passenger car segment is estimated to be the fastest air suspension system market due to the maximum share across all vehicle types. The need for enhanced ride comfort in passenger cars has surged, primarily due to consumer expectations for a smoother and quieter ride. Innovations in vehicle design, suspension systems, and interior materials have significantly reduced noise, vibration, and harshness (NVH), improving overall comfort. Further, SUV cars have shown a noticeable shift in the passenger vehicles segment in the last few years. For instance, SUVs accounted for 48% of global car sales in 2023, and the production of SUVs in Asia Pacific increased from 15,998 units in 2020 to 22,956 units in 2023. The rise in SUV popularity, driven by their spaciousness and comfort, has led automakers to prioritize the development of suspension systems tailored to the specific dynamics and weight distribution of these larger vehicles. This focus aims to improve the overall ride comfort of SUVs. Some SUVs from Mercedes-Benz, BMW, and Range Rover have electronically controlled air suspension systems to enhance traction and stability, particularly in adverse weather or off-road situations. Asia Pacific region accounted for the largest demand for SUVs. This growing demand for SUVs will fuel the air suspension system market in the coming years. In addition to this, increasing sales of premium passenger cars is also expected to boost the demand for air suspension systems, as most premium cars are equipped with electronically controlled air suspension systems.

Furthermore, the rise of electric and hybrid vehicles, which often emphasize the use of advanced technology and comfort, has spurred the demand for electronically controlled air suspensions. These vehicles benefit from the weight management and weight-balancing capabilities of ECAS, which enhances the range and performance of the vehicle. Thus, with the rise in the production and sales of SUV categories, consumer focus on ride comfort, and growing premium car sales are expected to boost the demand for the air suspension systems market in the coming years.

"North America is the second largest market for air suspension."

During the forecast period, North America is expected to hold the 2nd largest market share in the air suspension system market. The North American automotive industry consists of developed economies in Canada, the US, and Mexico, dominated by established OEMs such as Tesla, Inc. (US), Ford Motor Company (US), and General Motors (GM) (United States). North America accounted for the largest market for heavy commercial vehicle demand. According to OICA, the sales of heavy commercial vehicles, including light commercial vehicles, buses & coaches, and trucks, increased from 13,192 thousand units in 2020 to 15,211 thousand units in 2023. General Motors, Ford Motor Company Ltd, Volvo Group, Freightliner Trucks, and PACCAR are some OEMs for North American heavy commercial trucks and buses. These OEMs offer premium vehicle models in the North American market, such as Volvo VNL and VNR Series, Volvo 9700 bus, Freightliner Cascadia, and Freightliner 122SD. These premium models from these OEMs are fitted with electronically controlled air suspension systems.

Moreover, North America is a hub of the markets for premium and luxury vehicles, majorly equipped with air suspension systems as consumers of this region prioritize comfort, performance, and technological advancement, which makes all desire air suspensions. Commercial vehicles-trucks and buses-are also exceedingly well connected in North America. Air suspensions on public transit buses will also include load management, improve ride quality, and increase vehicle stability and safety. North American automakers and suppliers are also state-of-the-art in the innovations of automotive technology; therefore, there is a strong integration of advanced systems such as electronic control over air suspension to make it better for the vehicle in terms of stability, comfort, and safety. Air suspensions are favored due to the variety of terrains across North America. These factors collectively boost the air suspension market in different vehicle segments.

The breakup of primary respondents

- By Company: Tier 1 - 70%, Tier 2 - 15%, OEMs -15%

- By Designation: C level Executives - 25%, Director Level - 50%, Others - 25%

- By Region: North America - 25% Europe - 30%, Asia Pacific - 45%

The automotive air suspension market is dominated by global players and comprises several regional players, including ZF Friedrichshafen AG (Germany), Continental AG (Germany), ThyssenKrupp AG (Germany), and Meritor, Inc. (US), SAF-Holland SE (Germany). The study includes an in-depth competitive analysis of these key players in the automotive suspension market with their company profiles, MnM view of the top five companies, recent developments, and key market strategies.

Research Coverage

The study's primary objective is to define, describe, and forecast the air suspension market by value and volume. The study segments the air suspension market by technology (electronically controlled and non-electronically controlled), component (air springs, shock absorber, compressor, electronic control unit, air reservoir, height sensors, solenoid valves, and pressure sensors), vehicle type (light-duty vehicles, trucks, and buses), cabin air suspension by vehicle type (rigid trucks and semi-trailers), electric and hybrid HDVs (trucks and buses) and region (North America, Europe, Asia Pacific, and RoW). The study also covers the aftermarket by component (air bellows and shock absorber bushes). It analyzes the opportunities offered by various market segments to the stakeholders. It tracks and analyzes competitive developments such as market ranking analysis, expansions, joint ventures, acquisitions, and other activities carried out by key industry participants.

Reasons to buy this report:

This report offers comprehensive analyses of market share and supply chains and detailed information on component manufacturers. It is designed to aid market leaders and new entrants by providing precise revenue estimates for the overall automotive Air suspension market. Additionally, the report helps stakeholders understand the market dynamics, highlighting key drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising global commercial vehicle sales, Demand for premium and luxury vehicles, Enhanced Ride Comfort and Stability, Technological Advancements), restraints (High development and adoption costs, High Installation, Maintenance and Repair Cost), opportunities (Increasing demand for lightweight air suspension systems, Aftermarket demand for air suspensions and related components, Expansion of Electric and Autonomous Vehicles), and challenges (Presence of local suppliers, Durability and Reliability Concerns, Limited Adoption in Certain Segments ) are fueling the demand of the Air Suspension systems.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive air suspension market, such as using various materials to design the components, such as plastics and carbon fiber.

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive air suspension market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive Air Suspension market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the automotive Air Suspension market, such as ZF Friedrichshafen (Germany), ThyssenKrupp (Germany), Continental AG (Germany), Mando Corporation (South Korea), and Cummins-Meritor INC (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources referred to for estimating vehicle production

- 2.1.1.2 Secondary sources referred to for estimating air suspension market size

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.3 SAMPLING TECHNIQUES AND DATA COLLECTION METHODS

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS AND ASSOCIATED RISKS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIR SUSPENSION MARKET

- 4.2 AIR SUSPENSION MARKET, BY VEHICLE TYPE

- 4.3 AIR SUSPENSION OE MARKET, BY COMPONENT

- 4.4 AIR SUSPENSION MARKET, BY TECHNOLOGY

- 4.5 CABIN AIR SUSPENSION MARKET, BY VEHICLE TYPE

- 4.6 AIR SUSPENSION AFTERMARKET, BY COMPONENT

- 4.7 ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY VEHICLE TYPE

- 4.8 ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY TECHNOLOGY

- 4.9 AIR SUSPENSION MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing commercial vehicle sales

- 5.2.1.2 Rising consumer demand for premium passenger cars

- 5.2.2 RESTRAINTS

- 5.2.2.1 High development cost of air suspension for mid-segment cars

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging trend of lightweight air suspension systems

- 5.2.3.2 Aftermarket demand for air suspensions and related components

- 5.2.3.3 Expansion of electric and hybrid vehicles

- 5.2.4 CHALLENGES

- 5.2.4.1 Significant presence of local suppliers

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CONSUMERS' BUSINESSES

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 AIR SUSPENSION SYSTEM MANUFACTURERS

- 5.4.2 AIR SUSPENSION COMPONENT SUPPLIERS

- 5.4.3 OEMS

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGY

- 5.5.1.1 Electronically controlled air suspension system

- 5.5.1.2 Electronic shock absorber control system

- 5.5.2 COMPLEMENTARY TECHNOLOGY

- 5.5.2.1 Electronic suspension system

- 5.5.3 ADJACENT TECHNOLOGY

- 5.5.3.1 By-wire system

- 5.5.1 KEY TECHNOLOGY

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE, BY VEHICLE TYPE

- 5.7.2 AVERAGE SELLING PRICE, BY TECHNOLOGY

- 5.7.3 AVERAGE SELLING PRICE, BY REGION

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 PATENT ANALYSIS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 HENDRICKSON'S CREO CAD SUSPENSION

- 5.11.2 VOLVO'S MODIFIED AXLE TRUCK CONFIGURATION

- 5.11.3 CONTINENTAL'S HITEMP AIR SPRING

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA OF (HARMONIZED SYSTEM CODE: 870880) AIR SUSPENSION SYSTEMS AND PARTS

- 5.12.2 EXPORT DATA OF (HARMONIZED SYSTEM CODE: 870880) AIR SUSPENSION SYSTEMS AND PARTS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 GLOBAL SAFETY REGULATIONS

- 5.14 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.15 SUPPLIER ANALYSIS

6 AIR SUSPENSION MARKET, BY VEHICLE TYPE

- 6.1 INTRODUCTION

- 6.2 PASSENGER CARS

- 6.2.1 INCREASING PRODUCTION IN EMERGING ECONOMIES TO DRIVE MARKET

- 6.3 LIGHT COMMERCIAL VEHICLES

- 6.3.1 PREDOMINANCE IN NORTH AMERICA TO DRIVE MARKET

- 6.4 TRUCKS

- 6.4.1 INNOVATIONS IN AIR SUSPENSION TECHNOLOGY TO DRIVE MARKET

- 6.5 BUSES

- 6.5.1 FOCUS ON PASSENGER COMFORT AND SAFETY TO DRIVE MARKET

- 6.6 INDUSTRY INSIGHTS

7 AIR SUSPENSION MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 ELECTRONICALLY CONTROLLED

- 7.2.1 BENEFITS OVER TRADITIONAL AIR SUSPENSION SYSTEMS TO DRIVE MARKET

- 7.3 NON-ELECTRONICALLY CONTROLLED

- 7.3.1 LOW COST AND MAINTENANCE REQUIREMENTS TO DRIVE MARKET

- 7.4 INDUSTRY INSIGHTS

8 AIR SUSPENSION OE MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 AIR SPRINGS

- 8.2.1 EXTENSIVE USE IN PREMIUM VEHICLES TO DRIVE MARKET

- 8.3 SHOCK ABSORBERS

- 8.3.1 SHIFT TOWARD ELECTRONICALLY ADJUSTABLE SHOCK ABSORBERS TO DRIVE MARKET

- 8.4 AIR COMPRESSORS

- 8.4.1 NEED FOR OPTIMAL AIR PRESSURE IN AIR SPRINGS TO DRIVE MARKET

- 8.5 ELECTRONIC CONTROL UNITS

- 8.5.1 RISING PENETRATION OF ELECTRONICALLY CONTROLLED AIR SUSPENSION SYSTEMS TO DRIVE MARKET

- 8.6 AIR RESERVOIRS

- 8.6.1 INCREASING DEMAND FOR IMPROVED AIR SUSPENSION PERFORMANCE TO DRIVE MARKET

- 8.7 HEIGHT SENSORS

- 8.7.1 NEED FOR PRECISE CONTROL OVER VEHICLE DYNAMICS TO DRIVE MARKET

- 8.8 SOLENOID VALVES

- 8.8.1 RISE OF ELECTRONICALLY CONTROLLED AIR SUSPENSION TECHNOLOGY TO DRIVE MARKET

- 8.9 PRESSURE SENSORS

- 8.9.1 GROWING PASSENGER DEMAND FOR CUSTOMIZABLE RIDE SETTINGS TO DRIVE MARKET

- 8.10 INDUSTRY INSIGHTS

9 AIR SUSPENSION AFTERMARKET, BY COMPONENT

- 9.1 INTRODUCTION

- 9.2 AIR BELLOWS

- 9.2.1 NEED FOR FREQUENT REPLACEMENTS IN HEAVY-DUTY TRUCKS TO DRIVE MARKET

- 9.3 SHOCK ABSORBER BUSHES

- 9.3.1 STRINGENT SAFETY AND PERFORMANCE REGULATIONS TO DRIVE MARKET

- 9.4 INDUSTRY INSIGHTS

10 CABIN AIR SUSPENSION MARKET, BY VEHICLE TYPE

- 10.1 INTRODUCTION

- 10.2 RIGID TRUCKS

- 10.2.1 SHIFT IN CONSUMER PREFERENCE TOWARD CABIN COMFORT TO DRIVE MARKET

- 10.3 SEMI-TRAILERS

- 10.3.1 REGULATIONS FOR IMPROVED CABIN AIR QUALITY TO DRIVE MARKET

- 10.4 INDUSTRY INSIGHTS

11 ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY TECHNOLOGY

- 11.1 INTRODUCTION

- 11.2 ELECTRONICALLY CONTROLLED

- 11.2.1 WIDE ACCEPTANCE OF ADVANCED TECHNOLOGIES TO DRIVE MARKET

- 11.3 NON-ELECTRONICALLY CONTROLLED

- 11.3.1 HIGH DEMAND FROM PRICE-SENSITIVE MARKETS IN ASIA PACIFIC TO DRIVE MARKET

- 11.4 INDUSTRY INSIGHTS

12 ELECTRIC & HYBRID VEHICLE AIR SUSPENSION MARKET, BY VEHICLE TYPE

- 12.1 INTRODUCTION

- 12.2 LIGHT-DUTY VEHICLES

- 12.2.1 ADVANCEMENTS IN AIR SUSPENSION TO ENHANCE RIDE QUALITY TO DRIVE MARKET

- 12.3 TRUCKS

- 12.3.1 RISING DEMAND FOR IMPROVED CONTROL AND MANEUVERABILITY TO DRIVE MARKET

- 12.4 BUSES

- 12.4.1 PASSENGERS' FOCUS ON RIDING COMFORT TO DRIVE MARKET

- 12.5 INDUSTRY INSIGHTS

13 AIR SUSPENSION MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 CHINA

- 13.2.1.1 Rapid adoption of air suspension in premium passenger cars to drive market

- 13.2.2 INDIA

- 13.2.2.1 High demand for air suspension from heavy commercial vehicle industry to drive market

- 13.2.3 JAPAN

- 13.2.3.1 Regulatory mandates for vehicle and passenger safety to drive market

- 13.2.4 SOUTH KOREA

- 13.2.4.1 Focus on enhancing vehicle performance and passenger comfort to drive market

- 13.2.5 REST OF ASIA PACIFIC

- 13.2.1 CHINA

- 13.3 EUROPE

- 13.3.1 GERMANY

- 13.3.1.1 Growing popularity of air suspension systems to drive market

- 13.3.2 FRANCE

- 13.3.2.1 Surge in demand for commercial vehicles to drive market

- 13.3.3 SPAIN

- 13.3.3.1 Rising passenger vehicle sales to drive market

- 13.3.4 ITALY

- 13.3.4.1 Booming automotive industry to drive market

- 13.3.5 UK

- 13.3.5.1 Expanding automobile production to drive market

- 13.3.6 RUSSIA

- 13.3.6.1 Increasing investments in infrastructure projects to drive market

- 13.3.7 REST OF EUROPE

- 13.3.1 GERMANY

- 13.4 NORTH AMERICA

- 13.4.1 US

- 13.4.1.1 Emphasis on high-performance vehicle development to drive market

- 13.4.2 CANADA

- 13.4.2.1 Improved awareness of safety features and government regulations to drive market

- 13.4.3 MEXICO

- 13.4.3.1 Significant presence of global automakers to drive market

- 13.4.1 US

- 13.5 REST OF THE WORLD

- 13.5.1 BRAZIL

- 13.5.1.1 Rising domestic vehicle production and sales to drive market

- 13.5.2 SOUTH AFRICA

- 13.5.2.1 Extensive use of trucks for transportation and logistics to drive market

- 13.5.3 OTHERS

- 13.5.1 BRAZIL

- 13.6 INDUSTRY INSIGHTS

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 14.3 MARKET SHARE ANALYSIS, 2023

- 14.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019-2023

- 14.5 AIR SUSPENSION COMPONENT SUPPLIERS, 2023

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT

- 14.7 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 STARTING BLOCKS

- 14.7.4 DYNAMIC COMPANIES

- 14.7.5 COMPETITIVE BENCHMARKING

- 14.8 COMPANY VALUATION AND FINANCIAL METRICS

- 14.8.1 COMPANY VALUATION

- 14.8.2 FINANCIAL METRICS

- 14.9 PRODUCT/BRAND COMPARISON

- 14.10 COMPETITIVE SCENARIO AND TRENDS

- 14.10.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 14.10.2 DEALS

- 14.10.3 EXPANSIONS

- 14.10.4 OTHERS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 ZF FRIEDRICHSHAFEN AG

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches/developments

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Expansions

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 CONTINENTAL AG

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches/developments

- 15.1.2.3.2 Expansions

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 THYSSENKRUPP AG

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Expansions

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 HL MANDO CORP.

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 MnM view

- 15.1.4.3.1 Key strengths

- 15.1.4.3.2 Strategic choices

- 15.1.4.3.3 Weaknesses and competitive threats

- 15.1.5 MERITOR, INC.

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches/developments

- 15.1.5.3.2 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 SAF-HOLLAND SE

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.6.3.2 Expansions

- 15.1.6.3.3 Others

- 15.1.6.4 MnM view

- 15.1.6.4.1 Key strengths

- 15.1.6.4.2 Strategic choices

- 15.1.6.4.3 Weaknesses and competitive threats

- 15.1.7 HENDRICKSON USA, L.L.C.

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches/developments

- 15.1.7.3.2 Deals

- 15.1.7.3.3 Others

- 15.1.8 FIRESTONE INDUSTRIAL PRODUCTS COMPANY, LLC

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.2.1 Expansions

- 15.1.9 VIBRACOUSTIC SE

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches/developments

- 15.1.9.3.2 Deals

- 15.1.10 BWI GROUP

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.1 ZF FRIEDRICHSHAFEN AG

- 15.2 OTHER PLAYERS

- 15.2.1 ARNOTT LLC

- 15.2.2 THYSSENKRUPP BILSTEIN

- 15.2.3 AIR LIFT COMPANY

- 15.2.4 INFINITY ENGINEERED PRODUCTS

- 15.2.5 DUNLOP

- 15.2.6 VB-AIRSUSPENSION

- 15.2.7 LINK MANUFACTURING, LTD.

- 15.2.8 UNIVERSAL AIR INC.

- 15.2.9 LIFTMATIC

- 15.2.10 STEMCOPRODUCTS INC.

- 15.2.11 SHANGHAI KOMMAN VEHICLE PARTS SYSTEM CO., LTD.

- 15.2.12 JAMNA AUTO INDUSTRIES LIMITED

- 15.2.13 ACCUAIR SUSPENSION

- 15.2.14 AEROSUS

- 15.2.15 AIRTECH SYSTEMS

16 RECOMMENDATIONS BY MARKETSANDMARKETS

- 16.1 ASIA PACIFIC TO LEAD AIR SUSPENSION MARKET

- 16.2 ELECTRONICALLY CONTROLLED AIR SUSPENSION TO BE KEY FOCUS AREA

- 16.3 CONCLUSION

17 APPENDIX

- 17.1 INSIGHTS FROM INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS