|

|

市場調査レポート

商品コード

1840079

水素ステーションの世界市場:ソリューション別、圧力別、ステーションサイズ別、ステーションタイプ別、供給タイプ別、地域別 - 2035年までの予測と動向Hydrogen Fueling Station Market by Supply Type (On-site, Off-site (Gas, Liquid)), Station Type (Fixed, Mobile), Station Size (Small, Mid-sized, Large), Pressure (High, Low), Solution (EPC, Components), Region - Global Forecast & Trends to 2035 |

||||||

カスタマイズ可能

|

|||||||

| 水素ステーションの世界市場:ソリューション別、圧力別、ステーションサイズ別、ステーションタイプ別、供給タイプ別、地域別 - 2035年までの予測と動向 |

|

出版日: 2025年08月25日

発行: MarketsandMarkets

ページ情報: 英文 323 Pages

納期: 即納可能

|

概要

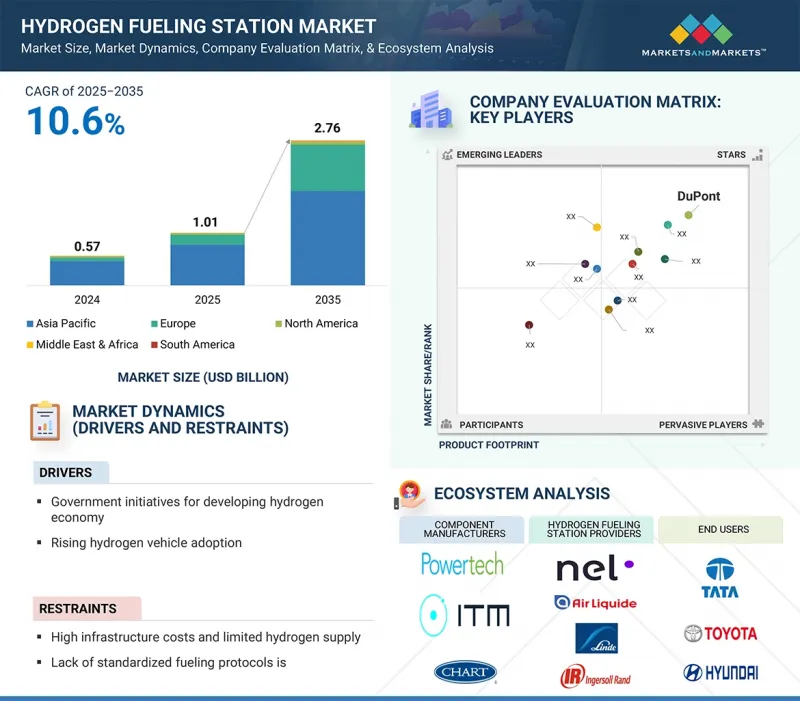

水素ステーションの市場規模は、2025年の10億1,000万米ドルから2035年には27億6,000万米ドルに成長すると予測され、予測期間中のCAGRは10.6%と見込まれています。

この市場を牽引しているのは、環境問題への関心と排出ガスに関する厳しい規制により、ゼロエミッション車の採用が増加していることです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2035年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2035年 |

| 対象台数 | 金額(100万米ドル)および数量(台) |

| セグメント別 | ソリューション別、圧力別、ステーションサイズ別、ステーションタイプ別、供給タイプ別、地域別 |

| 対象地域 | 欧州、アジア太平洋、北米、南米、中東・アフリカ |

水素燃料電池車を含むゼロ・エミッション車は、テールパイプから汚染物質を排出しないため、都市の大気汚染を減らし、気候目標を達成するための取り組みにおいて、実現可能な選択肢となっています。ゼロ・エミッション車市場の拡大は、水素補給ステーションのような支援インフラの需要を直接的に増大させる。市場拡大の原動力は、クリーンエネルギー源として水素を支持する規制政策です。

中型ステーションでは、リソースの最適利用やダウンタイムの削減により、運営効率が向上します。中型ステーションは、小型ステーションの利用不足と大型ステーションの過負荷のバランスをとり、より安定した性能を保証します。中規模ステーションに必要な技術は、大規模ステーションよりも成熟しており、広く利用可能です。この技術的成熟は開発リスクを軽減し、中型インフラへの投資を促進します。さらに、中型ステーションは、中程度から高い需要のある地域をターゲットにすることで、市場に浸透しやすいです。そのサイズは、多くの場所への展開に必要な汎用性を提供し、顧客へのアクセシビリティを高める。さらに、水素燃料電池車産業の拡大が予測される中、中型ステーションの建設、メンテナンス、運営は、全体的な経済性に優れています。

EPC企業は、設計から完成までのプロジェクト管理のために、エンド・ツー・エンドのターンキー・ソリューションを提供します。基本的に、これはエンド・ツー・エンドのソリューションであり、プロジェクトの複雑さから解放されるため、投資家や開発者の多くが非常に魅力的だと感じています。加えて、EPC企業は、大規模インフラ・プロジェクトにおける確かな専門知識と豊富な経験を有しており、業界標準に準拠した高品質な工事の実施を保証しています。さらに、EPC企業は、プロジェクトのフェーズを重複させ、リソースを管理することで、プロジェクト期間を短縮することができます。プロジェクト完了までの期間が短縮されれば、競争上有利になります。さらに、EPC企業が業界の規制やコンプライアンス要件を十分に理解していれば、複雑な規制環境にもうまく対応できます。

欧州は、強力な政策支援、大規模投資、野心的なゼロ・エミッションモビリティ目標に後押しされ、水素燃料ステーション(HRS)市場が急成長する態勢を整えています。この地域は、確立された水素戦略の恩恵を受けており、欧州連合(EU)といくつかの加盟国は、燃料電池車の導入を可能にするため、大規模なHRSネットワークの拡張を約束しています。ドイツ、フランス、オランダ、英国などの非公開会社は、官民一体となった大規模な取り組みでリードしており、自動車メーカーとエネルギー企業は主要な輸送ルート沿いに大容量のステーションを配備するために協力しています。大型輸送の脱炭素化と再生可能な水素製造の統合に向けた開発の高まりが、この地域のHRS開発をさらに加速させています。さらに欧州では、大型用途に対応するためのインフラ整備が進んでいます。2023年には、新設ステーションの92%が乗用車とバスやトラックのような大型車の両方に給油できるようになっており、全ステーションの40%近くがこのような用途をサポートしています。

Air Liquide(フランス)、Linde PLC(アイルランド)、Air Products and Chemicals, Inc.(米国)、Nel(ノルウェー)、MAXIMATOR Hydrogen GmbH(ドイツ)、HYDROGEN REFUELING SOLUTIONS SA(フランス)、Iwatani Corporation(日本)、Ingersoll Rand(米国)、Chart Industries(米国)、PERIC Hydrogen Technologies(中国)、H2 MOBILITY(ドイツ)、PDC Machines(米国)、sera GmbH(ドイツ)、Hydrogenious LOHC technology(ドイツ)、Powertech Labs Inc.(カナダ)、Resato Hydrogen Technology(オランダ)、Galileo Technologies S.A.(アルゼンチン)、Nikola Corporation(米国)、Humble Hydrogen(英国)、atawey(フランス)、OneH2(米国)、China Petrochemical Corporation(中国)、VIRYA ENERGY(ベルギー)、NUVERA FUEL CELLS, LLC(米国)、ANGI Energy Systems, Inc.などが同市場における主要参入企業となっています。本調査では、水素ステーション市場におけるこれら主要企業の企業プロファイル、最近の動向、主な市場戦略など、詳細な競合分析を掲載しています。

当レポートでは、水素市場を供給タイプ別(オンサイト、オフサイト[ガス、液体])、ステーションタイプ別(固定式、移動式)、ステーションサイズ別(小型、中型、大型)、圧力別(高圧、低圧)、ソリューション別(EPC、コンポーネント)、地域別(北米、欧州、アジア太平洋、中東・アフリカ、南米)に定義、記述、予測しています。当レポートの調査範囲は、水素燃料ステーション市場の成長に影響を与える促進要因・市場抑制要因・課題・機会などの主要な要因に関する詳細情報を網羅しています。主要業界参入企業の徹底的な分析により、事業概要、ソリューション、サービス、契約、パートナーシップ、協定、拡大、合弁事業、提携、買収などの主要戦略、水素燃料ステーション市場に関連する最近の動向に関する洞察を提供しています。本レポートは、水素ステーション市場のエコシステムにおける今後の新興企業の競合分析をカバーしています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- サプライチェーン分析

- エコシステム分析

- 市場マッピング

- 技術分析

- 特許分析

- 規制状況

- 2025年~2026年の主な会議とイベント

- 貿易分析

- 価格分析

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 投資と資金調達のシナリオ

- 充填プロトコル

- AI/生成AIが水素ステーション市場に与える影響

- 2025年の米国関税が水素ステーション市場に与える影響

第6章 水素ステーション市場(ソリューション別)

- イントロダクション

- EPC

- コンポーネント

第7章 水素ステーション市場(圧力別)

- イントロダクション

- 高

- 低

第8章 水素ステーション市場(ステーションサイズ別)

- イントロダクション

- 小型

- 中型

- 大型

第9章 水素ステーション市場(ステーションタイプ別)

- イントロダクション

- 固定式

- 可動式

第10章 水素ステーション市場(供給タイプ別)

- イントロダクション

- オンサイト

- オフサイト

第11章 水素ステーション市場(地域別)

- イントロダクション

- アジア太平洋

- 中国

- 日本

- 韓国

- ニュージーランド

- オーストラリア

- その他

- 欧州

- ドイツ

- フランス

- オランダ

- スイス

- 英国

- その他

- 北米

- 米国

- カナダ

- 中東・アフリカ

- GCC

- その他

- 南米

- ブラジル

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価と財務マトリックス

- ブランド比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- LINDE PLC

- AIR LIQUIDE

- AIR PRODUCTS AND CHEMICALS, INC.

- NEL

- MAXIMATOR HYDROGEN GMBH

- CHART INDUSTRIES

- HYDROGEN REFUELING SOLUTIONS SA

- IWATANI CORPORATION

- INGERSOLL RAND

- PERIC HYDROGEN TECHNOLOGIES CO., LTD

- H2 MOBILITY

- PDC MACHINES

- SERA GMBH

- HYDROGENIOUS LOHC TECHNOLOGIES

- POWERTECH LABS

- RESATO HYDROGEN TECHNOLOGY

- その他の企業

- GALILEO TECHNOLOGIES

- NIKOLA CORPORATION

- HUMBLE HYDROGEN

- ATAWEY

- ONEH2

- CHINA PETROCHEMICAL CORPORATION

- VIRYA ENERGY

- NUVERA FUEL CELLS, LLC

- ANGI ENERGY SYSTEMS, INC.