|

|

市場調査レポート

商品コード

1877353

IoTの世界市場:モジュールタイプ別、ハードウェア別、接続性別、ソフトウェア別、サービス別、注目領域別、地域別 - 2030年までの予測IoT Market by Module Type (Hardware, Connectivity, Software, Services), Focus Areas (Smart Manufacturing, Smart Transportation/Mobility, Smart Energy & Utilities, Smart Healthcare, Smart Buildings, Smart Retail) and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| IoTの世界市場:モジュールタイプ別、ハードウェア別、接続性別、ソフトウェア別、サービス別、注目領域別、地域別 - 2030年までの予測 |

|

出版日: 2025年11月06日

発行: MarketsandMarkets

ページ情報: 英文 362 Pages

納期: 即納可能

|

概要

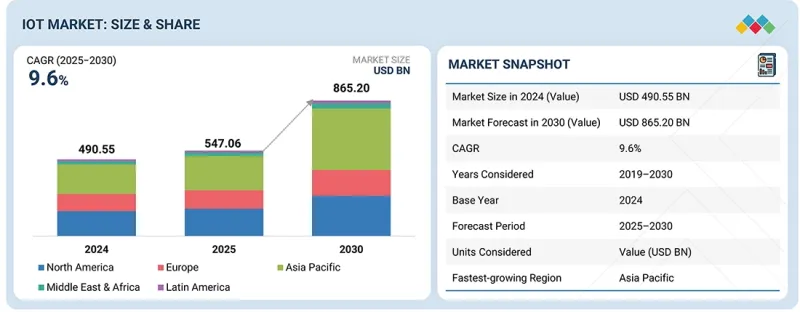

IoTの市場規模は2025年に5,470億6,000万米ドル規模と推定され、2030年までに8,652億米ドルに達すると予測されています。

CAGRは9.6%と見込まれています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030 |

| 対象単位 | 10億米ドル |

| セグメント | モジュールタイプ別、ハードウェア別、接続性別、ソフトウェア別、サービス別、注目領域別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

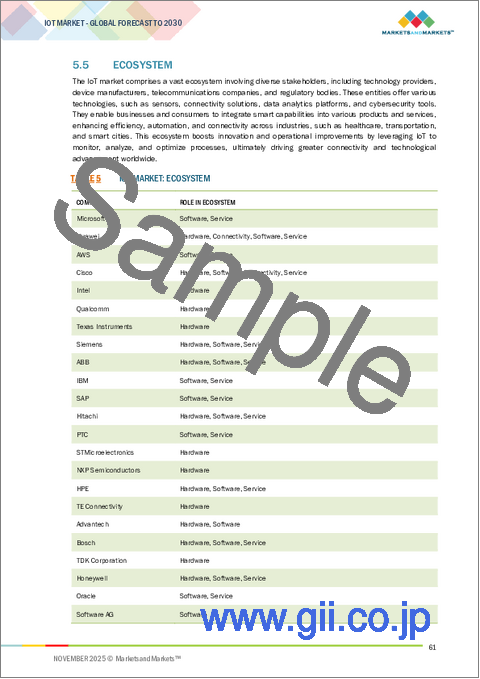

Cisco、IBM、Microsoft、AWSなどの主要テクノロジー企業は、堅牢なプラットフォーム、クラウドエコシステム、AI統合ソリューションを通じてIoTイノベーションを推進しています。これらの企業は、組織が多様な環境においてIoTアプリケーションを容易に導入、管理、拡張することを可能にしています。CiscoのIoTコントロールセンター、MicrosoftAzure IoTハブ、IBMワトソンIoTは、エンタープライズグレードのソリューションが接続性を簡素化し、セキュリティを強化し、実用的なインテリジェンスを提供する好例です。

IoTデータを機械学習や分析ツールと統合することで、これらの企業は業界がより深い洞察を得て意思決定を強化することを可能にしています。テクノロジー大手、通信事業者、ハードウェアベンダー間の戦略的提携は、相互運用性とイノベーションをさらに促進しています。その結果、企業は業務を最適化し、サイバーセキュリティを強化し、新たなビジネスモデルを開拓するエンドツーエンドのIoTエコシステムを導入できるようになっています。

衛星IoTは、地上ネットワークが利用できない、あるいは信頼性に欠ける農業、海事、鉱業、物流などの分野で勢いを増しています。低軌道(LEO)衛星コンステレーションの出現により、帯域幅、遅延、手頃な価格が大幅に改善され、衛星IoTの大規模展開が可能になりました。企業は資産追跡、環境監視、災害対応アプリケーション向けに衛星ベースのソリューションを活用しています。衛星ネットワークと5G、エッジコンピューティングの統合により、リアルタイムデータ処理とグローバル接続性がさらに強化されます。継続的で国境を越えた通信の必要性が高まる中、衛星IoTはユビキタス接続の重要な基盤となり、業界や地域を問わず市場の急速な拡大を推進するでしょう。

モジュールとセンサーは、スマートシティ、産業オートメーション、医療、物流など様々なアプリケーションにおけるリアルタイムデータ収集・監視を可能にします。低コストセンサーの普及とMEMS(微小電気機械システム)技術の進歩により、民生用・産業用デバイス双方へのセンサー統合が加速しています。Bluetooth、Wi-Fi、セルラー通信などの接続モジュールは、分散型ネットワーク全体でのシームレスなデバイス間通信を実現します。センサーはエッジAIとの統合により、データをローカルで分析し意思決定効率を高めるなど、ますます高度化しています。さらに、スマートインフラや自律システムにおける環境・動作・温度センサーの需要拡大が市場成長を牽引しています。IoT導入が世界的に拡大する中、モジュールおよびセンサー分野は相互接続システム内での正確かつ継続的なデータフロー実現の中核的役割を担い続けています。

アジア太平洋のモノのインターネット(IoT)市場は、大規模なデジタルトランスフォーメーション構想や政府主導のスマートインフラプロジェクトを原動力に、急速な拡大を遂げています。中国、日本、韓国、インドなどの国々は、強力な産業オートメーション、スマートシティソリューションの導入拡大、5G接続技術の進展により、地域成長を牽引しています。同地域の製造業および運輸部門は、接続されたセンサーとデータ分析を活用して効率性を高め、運用コストを削減するため、IoT導入の最前線に立っています。さらに、様々な産業における予知保全とリアルタイム監視への需要の高まりが、IoT導入の加速を推進しています。エッジコンピューティングとAI統合型IoTエコシステムへの継続的な投資に支えられ、アジア太平洋は今後も世界で最も成長の速いIoT市場の一つであり続けると予測されています。

当レポートでは、世界のIoT市場について調査し、モジュールタイプ別、ハードウェア別、接続性別、ソフトウェア別、サービス別、注目領域別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要考察

第4章 市場概要と業界動向

- イントロダクション

- 市場力学

- 相互接続された市場と分野横断的な機会

- ティア1/2/3企業の戦略的動き

第5章 業界動向

- ポーターのファイブフォースモデル分析

- マクロ経済見通し

- サプライチェーン分析

- バリューチェーン分析

- エコシステム

- 価格分析

- 貿易分析

- 主要な会議とイベント

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 2025年の米国関税の影響-IoT市場

第6章 戦略的破壊:特許、デジタル、AIの導入

- 主要な新興技術

- 補完的技術

- IoT市場向け技術・製品ロードマップ

- 特許分析

- AI/生成AIがIoT市場に与える影響

第7章 規制状況とコンプライアンス

- 規制状況

- 規制機関、政府機関、その他の組織

- 業界標準

第8章 顧客情勢と購買行動

- 意思決定プロセス

- 主要な利害関係者と購入基準

- 採用障壁と内部課題

- さまざまな最終用途分野におけるアンメットニーズ

第9章 IoT市場(モジュールタイプ別)

- イントロダクション

- ハードウェア

- 接続性

- ソフトウェア

- サービス

第10章 IoT市場(ハードウェア別)

- イントロダクション

- モジュール/センサー

- セキュリティハードウェア

- その他

第11章 IoT市場(接続性別)

- イントロダクション

- セルラー

- LP-WAN

- 衛星

- その他

第12章 IoT市場(ソフトウェア別)

- イントロダクション

- IoTプラットフォーム

- アプリケーションソフトウェア

- 分析ソフトウェア

- セキュリティと安全ソフトウェア

- その他

第13章 IoT市場(サービス別)

- イントロダクション

- 専門サービス

- マネージドサービス

第14章 IoT市場(注目領域別)

- イントロダクション

- スマート交通/モビリティ

- スマートビルディング

- スマートエネルギー&ユーティリティ

- スマートヘルスケア

- スマート農業

- スマート製造

- スマートリテール

- その他

第15章 IoT市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- その他

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

第16章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2023年~2025年

- 収益分析、2022年~2024年

- 市場シェア分析、2024年

- ブランド/製品比較

- 企業評価と財務指標

- 企業評価マトリックス:ハードウェア、2024年

- 企業評価マトリックス:ソフトウェア、2024年

- 競合シナリオ

第17章 企業プロファイル

- イントロダクション

- 主要参入企業

- MICROSOFT

- HUAWEI

- AMAZON WEB SERVICES, INC.

- CISCO SYSTEMS, INC.

- INTEL CORPORATION

- QUALCOMM TECHNOLOGIES, INC.

- TEXAS INSTRUMENTS INCORPORATED

- SIEMENS

- ABB

- IBM

- SAP

- HITACHI

- PTC

- STMICROELECTRONICS

- NXP SEMICONDUCTORS

- HPE

- TE CONNECTIVITY

- ADVANTECH

- BOSCH

- TDK CORPORATION

- OMRON CORPORATION

- HONEYWELL

- ORACLE

- SOFTWARE AG

- STC

- SAMSUNG

- ERICSSON

- AVNET

- ALIBABA CLOUD

- スタートアップ企業/中小企業

- HQSOFTWARE

- PARTICLE

- CLEARBLADE

- AYLA NETWORKS

- LOSANT IOT

- EMNIFY

- BLUES

- TELIT CINTERION