|

|

市場調査レポート

商品コード

1923693

塗料・コーティングの世界市場:樹脂タイプ別、技術別、最終用途産業別、地域別 - 予測(~2030年)Paints & Coatings Market by Resin Type (Acrylic, Alkyd, Epoxy, Polyurethane, Fluoropolymer), Technology (Waterborne Coatings, Solventborne Coatings, Powder Coatings), End-use Industry (Architectural, Industrial), Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 塗料・コーティングの世界市場:樹脂タイプ別、技術別、最終用途産業別、地域別 - 予測(~2030年) |

|

出版日: 2026年01月22日

発行: MarketsandMarkets

ページ情報: 英文 399 Pages

納期: 即納可能

|

概要

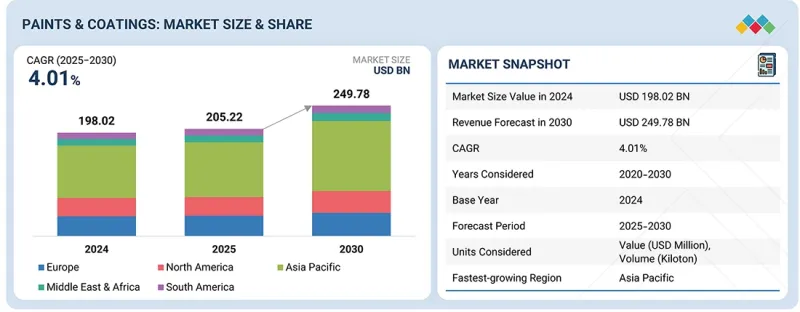

世界の塗料・コーティングの市場規模は、2025年の2,052億2,000万米ドルから2030年までに2,497億8,000万米ドルに達すると予測され、予測期間にCAGRで4.01%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル、キロトン |

| セグメント | 樹脂タイプ、技術、最終用途産業、地域 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

「塗料・コーティング市場の成長を加速させる、規制圧力と持続可能性の義務付け」

環境規制と持続可能性目標は、塗料・コーティング市場に大きな影響を与えています。排出物や有害物質に関する規制は厳格化しており、環境負荷の低い製品のみが世界的に選好されています。汚染が少なく作業者にとって安全な、水性でゼロVOCまたは低VOCのハイソリッドコーティングソリューションへの需要は、こうした変化する需要によって促進されています。また、企業は持続可能性目標を設定し、環境にやさしい経営を支援する企業との協業を選択しています。環境にやさしいコーティングが使用される建設・工業部門では、企業は規制要件を満たすだけでなく、ブランドイメージの向上も図っています。消費者も特に家庭、学校、病院において、室内空気質や表面の安全性に対する意識を高めています。したがって、メーカーは性能を提供すると同時に環境にやさしい製品を開発することで、このニーズに対応しています。規制や社会に後押しされたクリーンなソリューションへの移行は、現在も全セグメントにおいて塗料・コーティング市場の第一の成長促進要因となっています。

「エポキシ樹脂が予測期間にもっとも高いCAGRを記録する見込みです。」

エポキシ塗料は機械的ストレス、衝撃、摩耗に耐える特性を持つため、塗料・コーティング市場での採用が進んでいます。パイプライン、貯蔵タンク、重機の表面には、ひび割れや剥離を起こさずに持続的な摩耗に耐えるコーティングが求められます。エポキシ樹脂は高い硬度と優れた密着性を提供し、過酷な稼働条件下でも基材を保護します。この耐久性によりメンテナンス頻度とライフサイクルコストが削減され、このことは商業施設に隣接する工業施設において特に価値があります。資産所有者が短期的な節約よりも長期的な性能を優先する中、エポキシ樹脂は負荷の大きい保護用途で引き続き人気を集めています。

「フッ素樹脂が予測期間に塗料・コーティングセグメントにおいて2番目に成長率の高い樹脂タイプとなる見込みです。」

フッ素樹脂は、2025年~2030年に塗料・コーティングで2番目に成長率の高い樹脂タイプになると予測されています。フッ素樹脂は、日光、雨、熱、汚染に対する比類のない長期的な耐性を有することから高く評価されています。これらの樹脂から生産されたコーティングは、屋外環境で数十年経過した後でも、色調、光沢、表面強度を維持することが可能です。そのため、再塗装がコスト的にだけでなく技術的にも困難な、建物の外装、記念碑、橋梁、高級建築プロジェクトに適しています。したがって、不動産所有者や開発業者は、退色やチョーキングが少なく長期間持続するものを求めています。都市が成長し、より多くの構造物がランドマークとなる中、過酷な屋外環境下でも安定性を保つこのようなコーティングへの需要が、塗料・コーティング市場におけるフッ素樹脂のシェアの拡大を促進し続けています。

「2024年、北米が世界の塗料・コーティング市場において金額ベースで第3位のシェアを占めました。」

北米は2024年の塗料・コーティング市場全体において金額ベースで第3位のシェアを占めました。北米地域には、機械、機器、消費財、航空宇宙、重工業などの部門からなる工業の広大な基盤が存在します。これらの工業や工場では、床、機械、保管場所、完成品の保護にコーティングが広く使用されています。これらのコーティングは、摩耗、化学品、熱への曝露の影響に対抗することを可能にします。企業が施設の近代化を継続し、安全性と品質基準を高めるにつれて、コーティングの使用は増加しています。この強力な工業のプレゼンスにより、工業用塗料・コーティングはこの地域市場における重要な成長の柱となっています。

当レポートでは、世界の塗料・コーティング市場について調査分析し、主な促進要因と抑制要因、製品開発とイノベーション、競合情勢に関する知見を提供しています。

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要な知見

- 塗料・コーティング市場における魅力的な機会

- 塗料・コーティング市場:最終用途産業別、地域別

- 塗料・コーティング市場:技術別

- 塗料・コーティング市場:国別

第4章 市場の概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 相互接続された市場と部門横断的な機会

- 相互接続された市場

- 部門横断的な機会

- Tier 1/2/3企業の戦略的動き

第5章 業界動向

- ポーターのファイブフォース分析

- マクロ経済の見通し

- GDPの動向と予測

- 世界の自動車業界の動向

- サプライチェーン分析

- 原材料

- メーカー

- 流通ネットワーク

- エンドユーザー

- エコシステム分析

- 価格設定の分析

- 主要企業の平均販売価格:最終用途産業別(2024年)

- 塗料・コーティングの平均販売価格の動向:地域別(2022年~2025年)

- 貿易分析

- 輸入シナリオ(HSコード3209)

- 輸出シナリオ(HSコード3209)

- 主な会議とイベント(2025年~2026年)

- カスタマービジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 2025年の米国関税の影響 - 概要

- 主な関税率

- 価格の影響の分析

- 国/地域への影響

- 最終用途産業への影響

第6章 規制情勢と持続可能性に関する取り組み

- 地域の規制とコンプライアンス

- 規制機関、政府機関、その他の組織

- 業界標準

- 持続可能性への取り組み

- 炭素の影響の削減

- エコアプリケーションの有効化

- 持続可能性への影響と規制政策の取り組み

- 認証、ラベル、環境基準

第7章 顧客情勢と購買行動

- 意思決定プロセス

- バイヤーのステークホルダーと購入評価基準

- 購買プロセスにおける主なステークホルダー

- 購入基準

- 採用障壁と内部課題

- さまざまな最終用途産業におけるアンメットニーズ

第8章 技術の進歩、AIによる影響、特許、イノベーション、将来の用途

- 主な新技術

- 水性コーティング技術

- 溶剤系コーティング技術

- パウダーコーティング技術

- 補完技術

- 表面処理・前処理技術

- カラーマッチング・デジタル配合技術

- 技術/製品ロードマップ

- 短期|配合の精緻化・早期市場参入(2025年~2027年)

- 中期|パフォーマンスのスケールアップ・市場標準化(2027年~2030年)

- 長期|先進材料・持続可能な産業移行(2030年~2035年以降)

- 特許分析

- アプローチ

- 文献タイプ

- 主な出願者

- 管轄分析

- 塗料・コーティング市場に対するAI/生成AIの影響

- 主なユースケースと市場の将来性

- 塗料・コーティング処理におけるベストプラクティス

- 塗料・コーティング市場におけるAI導入のケーススタディ

- 相互接続された隣接エコシステムと市場企業への影響

- 塗料・コーティング市場における生成AIの採用に対する顧客の準備状況

第9章 塗料・コーティング市場:技術別

- 水性コーティング

- 溶剤系コーティング

- パウダーコーティング

- その他の技術

第10章 塗料・コーティング市場:樹脂タイプ別

- アクリル樹脂

- アルキド樹脂

- エポキシ樹脂

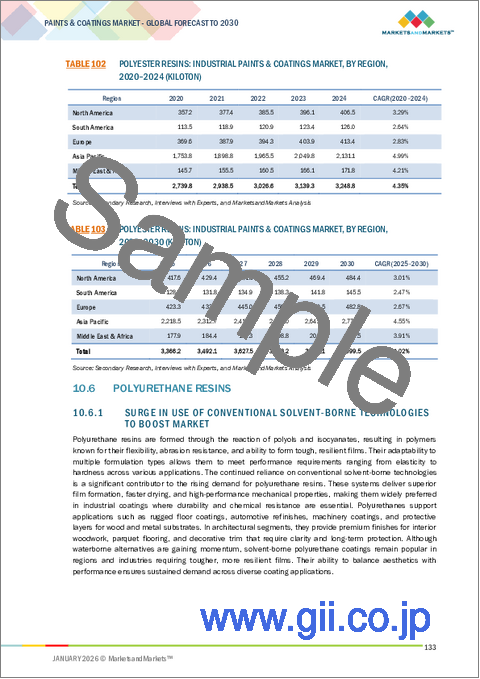

- ポリエステル樹脂

- ポリウレタン樹脂

- フッ素ポリマー樹脂

- ビニル樹脂

- その他の樹脂タイプ

第11章 塗料・コーティング市場:最終用途産業別

- 建築

- 住宅

- 非住宅

- 工業

- 一般工業

- 保護

- 自動車補修

- 自動車OEM

- 木材

- 船舶

- コイル

- 包装

- 航空宇宙

- レール

第12章 塗料・コーティング市場:地域別

- アジア太平洋

- 中国

- インド

- 日本

- インドネシア

- タイ

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- トルコ

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- エジプト

- 南米

- ブラジル

- アルゼンチン

第13章 競合情勢

- 主要参入企業の戦略/強み、2020年1月~2025年11月

- 市場シェア分析(2024年)

- 収益分析(2020年~2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 製品の比較分析

- 企業の評価と財務指標

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- THE SHERWIN-WILLIAMS COMPANY

- PPG INDUSTRIES, INC.

- AKZO NOBEL N.V.

- NIPPON PAINT HOLDINGS CO., LTD.

- AXALTA COATING SYSTEMS LLC

- ASIAN PAINTS LIMITED

- KANSAI PAINT CO., LTD.

- RPM INTERNATIONAL INC.

- BASF COATINGS GMBH

- JOTUN A/S

- スタートアップ/中小企業

- HEMPEL A/S

- BERGER PAINTS INDIA LIMITED

- SHALIMAR PAINTS

- MASCO CORPORATION

- S.K. KAKEN CO., LTD.

- BECKERS GROUP

- DUNN-EDWARDS CORPORATION

- TIGER COATINGS GMBH & CO. KG

- SACAL INTERNATIONAL GROUP LTD.

- DIAMOND VOGEL

- VISTA PAINT CORPORATION

- INDIGO PAINTS PVT. LTD.

- BENJAMIN MOORE & CO.

- DAW SE

- HIS PAINT MANUFACTURING COMPANY

第15章 隣接市場と関連市場

- 制限

- パウダーコーティング市場

- 市場定義

- 市場の概要

- パウダーコーティング市場:地域別

- アジア太平洋

- 欧州

- 北米

- 中東・アフリカ

- 南米