|

|

市場調査レポート

商品コード

1527781

単位用量包装の世界市場:形態別、素材タイプ別、製品タイプ別、最終用途産業別、地域別 - 2029年までの予測Unit Dose Packaging Market by Form (Liquid, Solid, Powder, Gel), Material Type (Plastic, Glass, Paper, Aluminium), Product Type, End-use industry (Pharmaceuticals, Cosmetic & Personal Care, Nutraceuticals), and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 単位用量包装の世界市場:形態別、素材タイプ別、製品タイプ別、最終用途産業別、地域別 - 2029年までの予測 |

|

出版日: 2024年08月02日

発行: MarketsandMarkets

ページ情報: 英文 230 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

単位用量包装の市場規模は、2024年の291億米ドルから2029年には438億米ドルに成長すると予測され、予測期間中のCAGRは8.5%になる見込みです。

薬剤の安全性、正確性、利便性を確保する上で重要な利点があるため、ブリスター包装に対する需要の高まりが単位用量包装市場の成長を大きく促進しています。プラスチックや箔のコンパートメントに個々の投薬量を封入するブリスター包装は、医薬品を湿気や光から保護し、効能を保持する能力があるため、製薬業界で広く使用されています。避妊用ピルや市販の鎮痛剤などの医薬品はブリスターパックに包装されることが多く、患者が服用量を容易に把握し、服薬スケジュールを守るのに役立ちます。この方法は、各投与量を明確に分け、ラベリングすることで、患者のコンプライアンスを向上させるだけでなく、投薬ミスも減らすことができます。ブリスターパックの利便性は、多忙なライフスタイルを送る人々にとって理想的であり、その人気はさらに高まっています。ヘルスケア部門は患者の安全性と服薬遵守を重視し、ブリスターパッケージングの実用的な利点とともに、さまざまな業界への導入を引き続き推進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント | 形態別、素材タイプ別、製品タイプ別、最終用途産業別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、南米、中東・アフリカ |

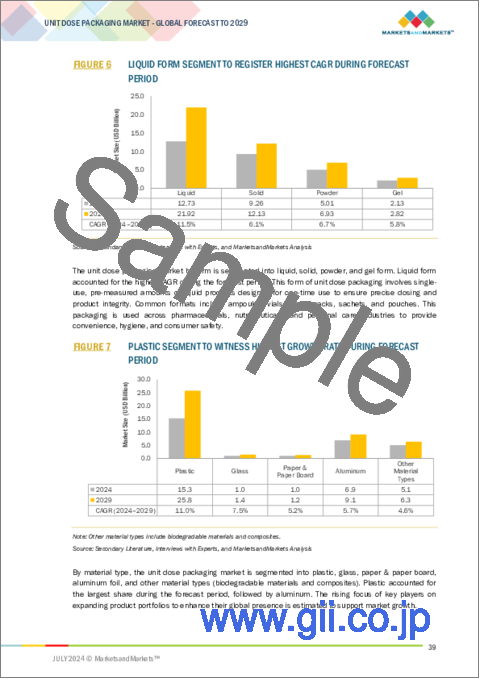

固形単位用量包装は、30~35%と推定されるかなりのシェアを占めています。この包装形態は、錠剤やカプセルのブリスターパックが一般的な医薬品で広く使用されています。イブプロフェン、抗ヒスタミン剤、マルチビタミン剤などの製品は、正確な服用と環境要因からの保護を確実にするため、この方法で包装されることが多いです。栄養補助食品分野では、ビタミンやオメガ3カプセルのような栄養補助食品に固形単位用量包装が採用され、利便性と正確な服用量を提供しています。化粧品もまた、スキンケアトリートメントやフェイスマスクの入った使い切りカプセルなどに固形単位用量包装を使用しています。固形単位用量包装の成長は、製薬業界における広範な用途によって大きく牽引されています。

プラスチックは、モノマーをさまざまな構成で連結して作られる合成材料で、柔軟性、耐久性、劣化への耐性といった独自の特性を備えています。単位用量包装業界では、ポリエチレン(PE)、ポリプロピレン(PP)、ポリ塩化ビニル(PVC)などのプラスチックが、湿気、光、ガス、汚染物質に対する効果的なバリアとして評価されています。これらの材料は、正確な投与能力、改ざん防止シール、イージーオープンの特徴により、ヘルスケアや医薬品において非常に重要であり、安全でユーザーフレンドリーな薬物送達を保証します。プラスチック包装はコスト効率に優れ、廃棄物を減らし、厳しい無菌基準や規制基準を満たすため、医薬品の安全性と有効性を維持することができます。ガラスやアルミニウムに比べ、プラスチックは軽量で耐衝撃性に優れ、設計の柔軟性があるため、様々な用途に合わせた特殊な形状やサイズに対応することができます。

ブリスターパックは、熱成形されたプラスチックの空洞と柔軟な上部で構成され、内容物を湿気、ガス、光、物理的損傷から保護し、それによって完全性を保ち、保存期間を延ばすように設計されています。医薬品、ビタミン剤、サプリメント、その他の製品を1回分ずつ安全に収納することができます。持続可能性への懸念に対応するため、最新のブリスターパックは環境に優しい素材と効率的な設計を採用し、医薬品、栄養補助食品、医療機器の市場ニーズを満たしながら環境への影響を最小限に抑えています。ブリスターパックは製品の保護を強化し、正確な投与を保証し、安全性を高めることで包装の効率化に貢献しています。

当レポートでは、世界の単位用量包装市場について調査し、形態別、素材タイプ別、製品タイプ別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 業界の動向

- ポーターのファイブフォース分析

- バリューチェーン分析

- 貿易分析

- 生成AIが単位用量包装に与える影響

- マクロ経済指標

- 技術分析

- 関税と規制状況

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向と混乱

- 2024年~2025年の主な会議とイベント

- 主な利害関係者と購入基準

- エコシステム分析

- 特許分析

- 価格分析

第7章 単位用量包装市場(形態別)

- イントロダクション

- 液体

- 固体

- 粉

- ゲル

第8章 単位用量包装市場(素材タイプ別)

- イントロダクション

- プラスチック

- ガラス

- 紙・板紙

- アルミニウム

- その他

第9章 単位用量包装市場(製品タイプ別)

- イントロダクション

- ブリスターパック

- サシェ・ストリップパック

- アンプル・バイアル

- その他

第10章 単位用量包装市場(最終用途産業別)

- イントロダクション

- 医薬品

- 化粧品・パーソナルケア

- 栄養補助食品

- その他

第11章 単位用量包装市場(地域別)

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- 南米

- 中東・アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業価値評価と財務指標

- 製品/ブランド比較分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオと動向

第13章 企業プロファイル

- 主要参入企業

- PFIZER INC.

- AMCOR PLC

- CORNING INCORPORATED

- WEST PHARMACEUTICAL SERVICES

- STEVANATO GROUP

- GERRESHEIMER AG

- SCHOTT

- NIPRO

- CONSTANTIA FLEXIBLES

- KLOCKNER PENTAPLAST

- その他の企業

- SONIC PACKAGING INDUSTRIES INC.

- SHARP SERVICES, LLC

- TEKNI-PLEX, INC.

- THERMO-PAK CO. INC.

- APHENA PHARMA SOLUTIONS

- PACIFIC VIAL MANUFACTURING INC.

- HEALTH CARE LOGISTICS, INC.

- ULTRA SEAL CORPORATION

- SAFECORE HEALTH

- UNIT PACK

- JONES HEALTHCARE GROUP

- ROPACK INC.

- RX SYSTEMS, INC.

- JAMES ALEXANDER CORPORATION

- PHARMACY AUTOMATION SUPPLIES

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 UNIT DOSE PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 WORLD GDP GROWTH PROJECTION, 2019-2026 (USD BILLION)

- TABLE 3 AVERAGE TARIFF BY COUNTRY

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 PFIZER-ENHANCING MEDICATION COMPLIANCE IN ELDERLY PATIENTS

- TABLE 10 WESTROCK COMPANY-IMPROVING OPERATIONAL EFFICIENCY IN UNIT DOSE PACKAGING PRODUCTION

- TABLE 11 SHARP PACKAGING SOLUTIONS-INTEGRATING SMART TECHNOLOGY TO IMPROVE PATIENT ADHERENCE

- TABLE 12 UNIT DOSE PACKAGING MARKET: KEY CONFERENCES & EVENTS, 2024-2025

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR UNIT DOSE PACKAGING MARKET

- TABLE 14 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 15 UNIT DOSE PACKAGING MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 16 PATENTS IN UNIT DOSE PACKAGING MARKET, 2022-2023

- TABLE 17 AVERAGE SELLING PRICE OF MATERIAL TYPE, BY KEY PLAYER, 2023 (USD/TON)

- TABLE 18 UNIT DOSE PACKAGING MARKET, BY FORM, 2022-2029 (USD BILLION)

- TABLE 19 UNIT DOSE PACKAGING MARKET, BY MATERIAL TYPE, 2022-2029 (USD BILLION)

- TABLE 20 UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 21 UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 22 UNIT DOSE PACKAGING MARKET, BY REGION, 2022-2029 (USD BILLION)

- TABLE 23 ASIA PACIFIC: UNIT DOSE PACKAGING MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 24 ASIA PACIFIC: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 25 ASIA PACIFIC: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 26 CHINA: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 27 CHINA: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 28 INDIA: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 29 INDIA: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 30 JAPAN: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 31 JAPAN: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 32 SOUTH KOREA: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 33 SOUTH KOREA: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 34 REST OF ASIA PACIFIC: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 35 REST OF ASIA PACIFIC: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 36 EUROPE: UNIT DOSE PACKAGING MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 37 EUROPE: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 38 EUROPE: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 39 GERMANY: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 40 GERMANY: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 41 FRANCE: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 42 FRANCE: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 43 ITALY: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 44 ITALY: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 45 UK: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 46 UK: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 47 SPAIN: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 48 SPAIN: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 49 REST OF EUROPE: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 50 REST OF EUROPE: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 51 NORTH AMERICA: UNIT DOSE PACKAGING MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 52 NORTH AMERICA: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 53 NORTH AMERICA: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 54 US: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 55 US: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 56 CANADA: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 57 CANADA: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 58 MEXICO: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 59 MEXICO: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 60 SOUTH AMERICA: UNIT DOSE PACKAGING MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 61 SOUTH AMERICA: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 62 SOUTH AMERICA: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 63 BRAZIL: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 64 BRAZIL: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 65 ARGENTINA: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 66 ARGENTINA: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 67 REST OF SOUTH AMERICA: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 68 REST OF SOUTH AMERICA: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 69 MIDDLE EAST & AFRICA: UNIT DOSE PACKAGING MARKET, BY COUNTRY, 2022-2029 (USD BILLION)

- TABLE 70 MIDDLE EAST & AFRICA: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 71 MIDDLE EAST & AFRICA: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 72 GCC COUNTRIES: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 73 GCC COUNTRIES: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 74 SAUDI ARABIA: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 75 SAUDI ARABIA: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 76 UAE: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 77 UAE: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 78 REST OF GCC COUNTRIES: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 79 REST OF GCC COUNTRIES: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 80 SOUTH AFRICA: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 81 SOUTH AFRICA: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 82 REST OF MIDDLE EAST & AFRICA: UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE, 2022-2029 (USD BILLION)

- TABLE 83 REST OF MIDDLE EAST & AFRICA: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY, 2022-2029 (USD BILLION)

- TABLE 84 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN UNIT DOSAGE PACKAGING MARKET

- TABLE 85 UNIT DOSE PACKAGING MARKET: DEGREE OF COMPETITION

- TABLE 86 UNIT DOSE PACKAGING MARKET: FORM FOOTPRINT

- TABLE 87 UNIT DOSE PACKAGING MARKET: MATERIAL TYPE FOOTPRINT

- TABLE 88 UNIT DOSE PACKAGING MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 89 UNIT DOSE PACKAGING MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 90 UNIT DOSE PACKAGING MARKET: REGION FOOTPRINT

- TABLE 91 UNIT DOSE PACKAGING MARKET: KEY STARTUPS/SMES

- TABLE 92 UNIT DOSE PACKAGING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 93 UNIT DOSE PACKAGING MARKET: PRODUCT LAUNCHES, JANUARY 2018-MAY 2024

- TABLE 94 UNIT DOSE PACKAGING MARKET: DEALS, JANUARY 2018-MAY 2024

- TABLE 95 UNIT DOSE PACKAGING MARKET: EXPANSIONS, JANUARY 2018-MAY 2024

- TABLE 96 PFIZER INC.: COMPANY OVERVIEW

- TABLE 97 PFIZER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 98 PFIZER INC.: PRODUCT LAUNCHES, JANUARY 2018-MAY 2024

- TABLE 99 PFIZER INC.: DEALS, JANUARY 2018-MAY 2024

- TABLE 100 AMCOR PLC: COMPANY OVERVIEW

- TABLE 101 AMCOR PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 102 AMCOR PLC: PRODUCT LAUNCHES, JANUARY 2018-MAY 2024

- TABLE 103 AMCOR PLC: EXPANSION, JANUARY 2018-MAY 2024

- TABLE 104 CORNING INCORPORATED: COMPANY OVERVIEW

- TABLE 105 CORNING INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 106 CORNING INCORPORATED: PRODUCT LAUNCHES, JANUARY 2018-MAY 2024

- TABLE 107 CORNING INCORPORATED: DEALS, JANUARY 2018-MAY 2024

- TABLE 108 WEST PHARMACEUTICAL SERVICES: COMPANY OVERVIEW

- TABLE 109 WEST PHARMACEUTICAL SERVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 110 WEST PHARMACEUTICAL SERVICES: PRODUCT LAUNCHES, JANUARY 2018-MAY 2024

- TABLE 111 WEST PHARMACEUTICAL SERVICES: DEALS, JANUARY 2018-MAY 2024

- TABLE 112 WEST PHARMACEUTICAL SERVICES: EXPANSION, JANUARY 2018-MAY 2024

- TABLE 113 STEVANATO GROUP: COMPANY OVERVIEW

- TABLE 114 STEVANATO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 115 STEVANATO GROUP: PRODUCT LAUNCHES, JANUARY 2018-MAY 2024

- TABLE 116 STEVANATO GROUP: DEALS, JANUARY 2018-MAY 2024

- TABLE 117 STEVANATO GROUP: EXPANSION, JANUARY 2018-MAY 2024

- TABLE 118 GERRESHEIMER AG: COMPANY OVERVIEW

- TABLE 119 GERRESHEIMER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 120 GERRESHEIMER AG: PRODUCT LAUNCHES, JANUARY 2018-MAY 2024

- TABLE 121 GERRESHEIMER AG: DEALS, JANUARY 2018-MAY 2024

- TABLE 122 GERRESHEIMER AG: EXPANSION, JANUARY 2018-MAY 2024

- TABLE 123 SCHOTT: COMPANY OVERVIEW

- TABLE 124 SCHOTT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 125 SCHOTT: PRODUCT LAUNCHES, JANUARY 2018-MAY 2024

- TABLE 126 SCHOTT: DEALS, JANUARY 2018-MAY 2024

- TABLE 127 SCHOTT: EXPANSION, JANUARY 2018-MAY 2024

- TABLE 128 NIPRO: COMPANY OVERVIEW

- TABLE 129 NIPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 NIPRO: PRODUCT LAUNCHES, JANUARY 2018-MAY 2024

- TABLE 131 CONSTANTIA FLEXIBLES: COMPANY OVERVIEW

- TABLE 132 CONSTANTIA FLEXIBLES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 CONSTANTIA FLEXIBLES: DEALS, JANUARY 2018-MAY 2024

- TABLE 134 CONSTANTIA FLEXIBLES: EXPANSION, JANUARY 2018-MAY 2024

- TABLE 135 KLOCKNER PENTAPLAST: COMPANY OVERVIEW

- TABLE 136 KLOCKNER PENTAPLAST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 KLOCKNER PENTAPLAST: EXPANSION, JANUARY 2018-MAY 2024

- TABLE 138 PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2020-2022 (USD MILLION)

- TABLE 139 PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2023-2028 (USD MILLION)

- TABLE 140 PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020-2022 (KILOTON)

- TABLE 141 PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2023-2028 (KILOTON)

- TABLE 142 PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020-2022 (USD MILLION)

- TABLE 143 PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2023-2028 (USD MILLION)

- TABLE 144 DRUG DELIVERY: PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 145 DRUG DELIVERY: PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 146 PHARMACEUTICAL PACKAGING MARKET, BY DRUG DELIVERY, 2020-2022 (USD MILLION)

- TABLE 147 PHARMACEUTICAL PACKAGING MARKET, BY DRUG DELIVERY, 2023-2028 (USD MILLION)

- TABLE 148 PHARMACEUTICAL PACKAGING MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 149 PHARMACEUTICAL PACKAGING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 150 PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 151 PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 152 NUTRACEUTICAL PACKAGING MARKET, BY PRODUCT FORM, 2019-2022 (USD MILLION)

- TABLE 153 NUTRACEUTICAL PACKAGING MARKET, BY PRODUCT FORM, 2023-2028 (USD MILLION)

- TABLE 154 NUTRACEUTICAL PACKAGING MARKET, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 155 NUTRACEUTICAL PACKAGING MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 156 NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2019-2022 (USD MILLION)

- TABLE 157 NUTRACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2023-2028 (USD MILLION)

- TABLE 158 NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2019-2022 (USD MILLION)

- TABLE 159 NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- TABLE 160 NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2019-2022 (KILOTON)

- TABLE 161 NUTRACEUTICAL PACKAGING MARKET, BY MATERIAL, 2023-2028 (KILOTON)

- TABLE 162 NUTRACEUTICAL PACKAGING MARKET, BY INGREDIENT, 2019-2022 (USD MILLION)

- TABLE 163 NUTRACEUTICAL PACKAGING MARKET, BY INGREDIENT, 2023-2028 (USD MILLION)

- TABLE 164 NUTRACEUTICAL PACKAGING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 165 NUTRACEUTICAL PACKAGING MARKET, BY REGION, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 UNIT DOSE PACKAGING: RESEARCH DESIGN

- FIGURE 2 UNIT DOSE PACKAGING MARKET: TOP-DOWN APPROACH

- FIGURE 3 UNIT DOSE PACKAGING MARKET: APPROACH 1

- FIGURE 4 UNIT DOSE PACKAGING MARKET: APPROACH 2

- FIGURE 5 UNIT DOSE PACKAGING MARKET: DATA TRIANGULATION

- FIGURE 6 LIQUID FORM SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 7 PLASTIC SEGMENT TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 8 BLISTER PACKS TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 PHARMACEUTICALS TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES IN UNIT DOSE PACKAGING MARKET

- FIGURE 12 US DOMINATED UNIT DOSE PACKAGING MARKET IN 2023

- FIGURE 13 BLISTER PACKS TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 14 PHARMACEUTICALS TO LEAD UNIT DOSE PACKAGING MARKET DURING FORECAST PERIOD

- FIGURE 15 CHINA PROJECTED TO GROW AT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 16 UNIT DOSE PACKAGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 VALUE FORECAST OF PHARMACEUTICAL EMPTY CAPSULES MARKET WORLDWIDE FROM 2021 TO 2032, BY RAW MATERIALS (USD MILLION)

- FIGURE 18 UNIT DOSE PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 UNIT DOSE PACKAGING: VALUE CHAIN ANALYSIS

- FIGURE 20 EXPORT OF "3923 ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; STOPPERS, LIDS, CAPS, AND OTHER CLOSURES, OF PLASTICS," BY KEY COUNTRY, 2019-2023

- FIGURE 21 IMPORT OF 280610 "3923 ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS; STOPPERS, LIDS, CAPS, AND OTHER CLOSURES, OF PLASTICS," BY KEY COUNTRY, 2019-2023

- FIGURE 22 EMERGING TRENDS AND ADVANCEMENTS IN TECHNOLOGY TO CHANGE FUTURE REVENUE MIX OF SUPPLIERS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- FIGURE 24 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- FIGURE 25 UNIT DOSE PACKAGING MARKET: ECOSYSTEM

- FIGURE 26 NUMBER OF PATENTS GRANTED FOR UNIT DOSE PACKAGING, 2013-2023

- FIGURE 27 REGIONAL ANALYSIS OF PATENTS GRANTED FOR UNIT DOSE PACKAGING, 2013-2023

- FIGURE 28 AVERAGE SELLING PRICE OF PHARMACEUTICAL PACKAGING, BY REGION (USD/KG)

- FIGURE 29 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY MATERIAL TYPE (USD/KG)

- FIGURE 30 INVESTOR DEALS AND FUNDING IN UNIT DOSE PACKAGING SOARED IN 2023

- FIGURE 31 LIQUID SEGMENT TO REGISTER HIGHEST GROWTH THROUGH 2029

- FIGURE 32 PLASTICS SEGMENT TO REGISTER HIGHEST CAGR THROUGH 2029

- FIGURE 33 BLISTER PACKS SEGMENT TO RECORD HIGHEST GROWTH THROUGH 2029

- FIGURE 34 PHARMACEUTICALS INDUSTRY TO BE LARGEST CONSUMER OF UNIT DOSE PACKAGING

- FIGURE 35 UNIT DOSE PACKAGING MARKET GROWTH RATE, BY COUNTRY, 2024-2029

- FIGURE 36 ASIA PACIFIC: UNIT DOSE PACKAGING MARKET SNAPSHOT

- FIGURE 37 EUROPE: UNIT DOSE PACKAGING MARKET SNAPSHOT

- FIGURE 38 NORTH AMERICA: UNIT DOSE PACKAGING MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF KEY COMPANIES IN LAST FIVE YEARS

- FIGURE 40 UNIT DOSE PACKAGING MARKET: MARKET SHARE ANALYSIS

- FIGURE 41 COMPANY VALUATION (USD BILLION)

- FIGURE 42 FINANCIAL MATRIX: EV/EBITDA RATIO

- FIGURE 43 PRODUCT COMPARISON

- FIGURE 44 UNIT DOSE PACKAGING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 45 UNIT DOSE PACKAGING MARKET: COMPANY FOOTPRINT

- FIGURE 46 UNIT DOSE PACKAGING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 47 PFIZER INC.: COMPANY SNAPSHOT

- FIGURE 48 AMCOR PLC: COMPANY SNAPSHOT

- FIGURE 49 CORNING INCORPORATED: COMPANY SNAPSHOT

- FIGURE 50 WEST PHARMACEUTICAL SERVICES: COMPANY SNAPSHOT

- FIGURE 51 STEVANATO GROUP: COMPANY SNAPSHOT

- FIGURE 52 GERRESHEIMER AG: COMPANY SNAPSHOT

- FIGURE 53 NIPRO: COMPANY SNAPSHOT

The unit dose packaging market is projected to grow from USD 29.1 Billion in 2024 to USD 43.8 Billion by 2029, at a CAGR of 8.5% during the forecast period. The rising demand for blister packaging is significantly driving the growth of the unit dose packaging market due to its key advantages in ensuring medication safety, accuracy, and convenience. Blister packaging, which encloses individual doses in plastic and foil compartments, is widely used in the pharmaceutical industry for its ability to protect medications from moisture and light, preserving their potency. Medications such as birth control pills and over-the-counter pain relievers are often packaged in blister packs, which help patients easily track doses and adhere to their medication schedules. This method not only improves patient compliance by clearly separating and labeling each dose but also reduces medication errors. The convenience of blister packaging makes it ideal for individuals with busy lifestyles, further boosting its popularity. The healthcare sector's emphasis on patient safety and adherence, along with the practical benefits of blister packaging, continues to drive its adoption across various industries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Segments | Form, Material Type, Product Type, End-Use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

"By Form, solid is the second largest market share for unit dose packaging during forecast period."

Solid unit dose packaging accounts for a substantial share, estimated at 30-35%. This packaging format is widely used in pharmaceuticals, where blister packs for tablets and capsules are common. Products such as ibuprofen, antihistamines, and multivitamins are frequently packaged in this way to ensure precise dosing and protection from environmental factors. In the nutraceutical sector, solid unit dose packaging is employed for vitamins and dietary supplements like Omega-3 capsules, providing convenience and accurate dosing. Cosmetics also use solid unit dose formats for items such as single-use capsules containing skincare treatments and face masks. The growth of solid unit dose packaging is largely driven by its extensive application in the pharmaceutical industry.

"By Material Type, plastic account for largest market share for unit dose packaging during forecast period."

Plastic, a synthetic material made by linking monomers in various configurations, offers unique properties like flexibility, durability, and resistance to degradation. In the unit dose packaging industry, plastics such as polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC) are valued for their effective barriers against moisture, light, gases, and contaminants. These materials are crucial in healthcare and pharmaceuticals due to their precise dosing capabilities, tamper-evident seals, and easy-open features, ensuring secure and user-friendly medication delivery. Plastic packaging is cost-effective, reducing waste and meeting stringent sterility and regulatory standards, thus maintaining medication safety and efficacy. Compared to glass and aluminum, plastics are preferred for their lightweight nature, impact resistance, and design flexibility, accommodating specialized forms and sizes for various applications.

"By Product Type, blister pack account for largest share during forecast period."

Blister packs consist of a thermoformed plastic cavity and a flexible top, designed to protect contents from moisture, gases, light, and physical damage, thereby preserving their integrity and extending shelf life. They securely house individual doses of medications, vitamins, supplements, and other products. To address sustainability concerns, modern blister packs use eco-friendly materials and efficient designs to minimize environmental impact while meeting market needs in pharmaceuticals, nutraceuticals, and medical devices. Blister packs contribute to packaging efficiency by enhancing product protection, ensuring precise dosing, and increasing safety. Leading companies such as Amcor plc, Constantia Flexibles, and West Pharmaceutical Services are incorporating smart technologies like RFID (Radio Frequency Identification) and NFC (Near Field Communication) into blister packs to improve tracking, authentication, and real-time monitoring. Additionally, Klockner Pentaplast offers advanced films with high clarity, autoclavable laminate, and robust barriers against moisture and package leaching. These films are ideal for hot-fill liquids and new dosage forms, providing customizable moisture protection, high heat stability, quick release, and excellent odor and flavor retention.

"By End-Use Industry, Pharmaceutical End-use Industry Segment Accounted For largest share during forecast period."

Unit dose packaging is crucial in the pharmaceutical industry for distributing precise doses of medications, vitamins, oral liquids, and injectables. It ensures that each dose is securely contained in a sealed package, such as vials, ampoules, or blister packs. Technologies like Blow-Fill-Seal (BFS) streamline the sterile packaging process, minimizing contamination risks and enhancing product safety. The trend towards prefilled syringes and auto-injectors provides accurate dosing and improved patient compliance with added safety features. Innovations in sensors and indicators monitor environmental conditions to maintain medication efficacy. The shift towards sustainable materials and optimized packaging sizes highlights the industry's commitment to reducing environmental impact while enhancing patient safety and dosing accuracy.

"North America is accounted larget market for Unit dose packaging in 2023."

The North America region is accounted larget in the unit dose packaging market. This growth encompasses countries like US, Canada, and Mexico.

The unit dose packaging market in North America is being propelled by various factors. In North America, the pharmaceutical industry heavily relies on unit dose packaging for its precision, patient compliance, and protection against contamination and tampering. This demand is driven by a focus on patient-centric solutions, the need for accurate dosing to reduce errors, and the convenience of use. The aging population and high prevalence of chronic diseases further boost the need for pharmaceuticals and healthcare services. According to pharma association, in 2023, the industry invested around USD 90 billion in R&D, reflecting its growth. Stringent regulations by the FDA and Health Canada ensure compliance with safety and quality standards, influencing packaging choices. Despite significant growth, challenges such as increased competition, innovation, and environmental regulations pose constraints to the market.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the unit dose packaging market.

- By Company Type: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Others: 35%

- By Region: North America: 25%, Europe: 20%, APAC: 45%, Middle East & Africa: 5%, and South America: 5%

Companies Covered: The global unit dose packaging market comprises major manufacturers, such as Pfizer Inc. (US), Amcor Plc (Switzerland), Corning Incorporated (US), West Pharmaceutical Services (US), Stevanato Group (Italy), Gerresheimer AG (Germany), SCHOTT (Germany), Nipro (Japan), Constantia Flexibles (Austria), and Klockner Pentaplast (UK), among others.

Research Coverage

The market study covers the unit dose packaging market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on form, material type, product type, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the unit dose packaging market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall unit dose packaging market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Thriving Pharmaceutical Sector and surge in healthcare expenditure, Rising demand for blister packaging, and Consumer preference for convenience and portability driving demand for unit dose packaging), restraints (The setup and maintenance of unit dose packaging machines and Environmental concerns), opportunities (Increasing demand for primary pharmaceutical packaging and Market expansion in nutraceuticals and cosmetics) and challenges (Technological challenges in the unit dose packaging market and High initial investment).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the unit dose packaging market

- Market Development: Comprehensive information about lucrative markets - the report analyses the unit dose packaging market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the unit dose packaging market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Pfizer Inc. (US), Amcor Plc (Switzerland), Corning Incorporated (US), West Pharmaceutical Services (US), Stevanato Group (Italy), Gerresheimer AG (Germany), SCHOTT (Germany), Nipro (Japan), Constantia Flexibles (Austria), and Klockner Pentaplast (UK), among others in the unit dose packaging market. The report also helps stakeholders understand the pulse of the unit dose packaging market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 UNIT DOSE PACKAGING MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.3.4 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN UNIT DOSE PACKAGING MARKET

- 4.2 NORTH AMERICA: UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.3 NORTH AMERICA UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE

- 4.4 NORTH AMERICA UNIT DOSE PACKAGING MARKET, BY END-USE INDUSTRY

- 4.5 UNIT DOSE PACKAGING MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Thriving pharmaceutical sector and surge in healthcare expenditure

- 5.2.1.2 Rising demand for blister packaging

- 5.2.1.3 Consumer preference for convenience and portability

- 5.2.2 RESTRAINTS

- 5.2.2.1 Substantial capital investment required for setup and maintenance of unit dose packaging machines

- 5.2.2.2 Environmental concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for primary pharmaceutical packaging

- 5.2.3.2 Market expansion in nutraceuticals and cosmetics

- 5.2.4 CHALLENGES

- 5.2.4.1 Technological challenges

- 5.2.4.2 High initial investment

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 THREAT OF SUBSTITUTES

- 6.1.3 BARGAINING POWER OF SUPPLIERS

- 6.1.4 BARGAINING POWER OF BUYERS

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 TRADE ANALYSIS

- 6.3.1 EXPORT SCENARIO

- 6.3.2 IMPORT SCENARIO

- 6.4 IMPACT OF GEN AI ON UNIT DOSE PACKAGING

- 6.4.1 INTEGRATING AI IN UNIT DOSE PACKAGING

- 6.4.2 BEST PRACTICES TO LEVERAGE AI FOR UNIT DOSE PACKAGING MARKET

- 6.4.3 USE CASES OF GENERATIVE AI IN UNIT DOSE PACKAGING MARKET

- 6.4.3.1 Future of generative AI in unit dose packaging market

- 6.5 MACROECONOMIC INDICATORS

- 6.5.1 GLOBAL GDP OUTLOOK

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Blister packaging

- 6.6.1.2 Strip packaging

- 6.6.1.3 Blow-Fill-Seal

- 6.6.2 COMPLEMENTARY TECHNOLOGIES

- 6.6.2.1 Smart packaging

- 6.6.2.2 Barrier and coating

- 6.6.1 KEY TECHNOLOGIES

- 6.7 TARIFF AND REGULATORY LANDSCAPE

- 6.7.1 TARIFF RELATED TO UNIT DOSE PACKAGING MARKET

- 6.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8 CASE STUDY ANALYSIS

- 6.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.10 KEY CONFERENCES & EVENTS IN 2024-2025

- 6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.11.2 BUYING CRITERIA

- 6.12 ECOSYSTEM ANALYSIS

- 6.13 PATENT ANALYSIS

- 6.13.1 INTRODUCTION

- 6.13.2 METHODOLOGY

- 6.14 PRICING ANALYSIS

- 6.14.1 AVERAGE SELLING PRICE OF PHARMACEUTICAL PACKAGING, BY REGION

- 6.14.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY MATERIAL TYPE

- 6.14.3 INVESTMENT AND FUNDING SCENARIO

7 UNIT DOSE PACKAGING MARKET, BY FORM

- 7.1 INTRODUCTION

- 7.2 LIQUID

- 7.3 SOLID

- 7.4 POWDER

- 7.5 GEL

8 UNIT DOSE PACKAGING MARKET, BY MATERIAL TYPE

- 8.1 INTRODUCTION

- 8.2 PLASTIC

- 8.2.1 POLYVINYL CHLORIDE

- 8.2.2 POLYETHYLENE

- 8.2.3 POLYPROPYLENE

- 8.2.4 POLYETHYLENE TEREPHTHALATE

- 8.2.5 OTHER PLASTIC FILMS

- 8.3 GLASS

- 8.4 PAPER & PAPERBOARD

- 8.5 ALUMINUM

- 8.6 OTHER MATERIAL TYPES

9 UNIT DOSE PACKAGING MARKET, BY PRODUCT TYPE

- 9.1 INTRODUCTION

- 9.2 BLISTER PACKS

- 9.2.1 ENSURE DRUG DOSING ACCURACY AND INCREASED SAFETY

- 9.3 SACHETS & STRIP PACKS

- 9.3.1 MAINTAIN PRODUCT FRESHNESS AND QUALITY

- 9.4 AMPOULES & VIALS

- 9.4.1 USED FOR STORING AND DISPENSING LIQUID PHARMACEUTICALS

- 9.5 OTHER PRODUCT TYPES

10 UNIT DOSE PACKAGING, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 PHARMACEUTICALS

- 10.2.1 INCREASED DEMAND FOR PREFILLED SYRINGES AND AUTO-INJECTORS

- 10.3 COSMETICS & PERSONAL CARE

- 10.3.1 EXTENDING SHELF LIFE OF BEAUTY PRODUCTS

- 10.4 NUTRACEUTICALS

- 10.4.1 ADMINISTRATION OF PRECISE DOSAGE AND CONSUMER COMPLIANCE

- 10.5 OTHER END-USE INDUSTRIES

11 UNIT DOSE PACKAGING MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Rising investments in biologics and biosimilar drug research to drive market

- 11.2.2 INDIA

- 11.2.2.1 Large domestic consumption and export of generic drugs to drive market

- 11.2.3 JAPAN

- 11.2.3.1 Surge in aging population to drive demand for medications

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Growth of cosmetic & personal care industries to drive market

- 11.2.5 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Advanced healthcare infrastructure and emphasis on patient-centric care to drive market

- 11.3.2 FRANCE

- 11.3.2.1 Surge in demand for generic drugs to drive market

- 11.3.3 ITALY

- 11.3.3.1 Growing exports of pharmaceutical products to boost market

- 11.3.4 UK

- 11.3.4.1 Innovations in drug manufacturing to drive market

- 11.3.5 SPAIN

- 11.3.5.1 Growth of cosmetic & personal care industry to drive market

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 NORTH AMERICA

- 11.4.1 US

- 11.4.1.1 Increasing demand for RFID integration and smart packaging to drive market

- 11.4.2 CANADA

- 11.4.2.1 Rising demand for precise packaging to drive market

- 11.4.3 MEXICO

- 11.4.3.1 Technological advancements and packaging innovations to boost market

- 11.4.1 US

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Increased healthcare awareness and substantial investment to drive market

- 11.5.2 ARGENTINA

- 11.5.2.1 Innovations in packaging to drive market

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

- 11.6.1.1 Saudi Arabia

- 11.6.1.1.1 Saudi Vision 2030 to boost demand for advanced medical packaging solutions

- 11.6.1.2 UAE

- 11.6.1.2.1 Increasing demand for dietary supplements and functional foods to drive market

- 11.6.1.3 Rest of GCC countries

- 11.6.1.1 Saudi Arabia

- 11.6.2 SOUTH AFRICA

- 11.6.2.1 Government initiatives upholding safety and efficacy standards to boost market

- 11.6.3 REST OF MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 PRODUCT/BRAND COMPARISON ANALYSIS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.7.5.1 Company footprint

- 12.7.5.2 Form footprint

- 12.7.5.3 Material type footprint

- 12.7.5.4 Product type footprint

- 12.7.5.5 End-use industry footprint

- 12.7.5.6 Region footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 PFIZER INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 AMCOR PLC

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Expansion

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 CORNING INCORPORATED

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 WEST PHARMACEUTICAL SERVICES

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansion

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 STEVANATO GROUP

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Expansion

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 GERRESHEIMER AG

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.6.3.3 Expansion

- 13.1.6.4 MnM view

- 13.1.7 SCHOTT

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.3.2 Deals

- 13.1.7.3.3 Expansion

- 13.1.7.4 MnM view

- 13.1.8 NIPRO

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.4 MnM view

- 13.1.9 CONSTANTIA FLEXIBLES

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Expansion

- 13.1.9.4 MnM view

- 13.1.10 KLOCKNER PENTAPLAST

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Expansion

- 13.1.10.4 MnM view

- 13.1.1 PFIZER INC.

- 13.2 OTHER PLAYERS

- 13.2.1 SONIC PACKAGING INDUSTRIES INC.

- 13.2.2 SHARP SERVICES, LLC

- 13.2.3 TEKNI-PLEX, INC.

- 13.2.4 THERMO-PAK CO. INC.

- 13.2.5 APHENA PHARMA SOLUTIONS

- 13.2.6 PACIFIC VIAL MANUFACTURING INC.

- 13.2.7 HEALTH CARE LOGISTICS, INC.

- 13.2.8 ULTRA SEAL CORPORATION

- 13.2.9 SAFECORE HEALTH

- 13.2.10 UNIT PACK

- 13.2.11 JONES HEALTHCARE GROUP

- 13.2.12 ROPACK INC.

- 13.2.13 RX SYSTEMS, INC.

- 13.2.14 JAMES ALEXANDER CORPORATION

- 13.2.15 PHARMACY AUTOMATION SUPPLIES

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.2.1 PHARMACEUTICAL PACKAGING MARKET

- 14.2.1.1 Market definition

- 14.2.1.2 Pharmaceutical packaging market, by packaging type

- 14.2.1.3 Pharmaceutical packaging market, by raw material

- 14.2.1.4 Pharmaceutical packaging market, by drug delivery

- 14.2.1.5 Pharmaceutical packaging market, by type

- 14.2.1.6 Pharmaceutical packaging market, by region

- 14.2.2 NUTRACEUTICAL PACKAGING MARKET

- 14.2.2.1 Market definition

- 14.2.2.2 Nutraceutical packaging market, by product form

- 14.2.2.3 Nutraceutical packaging market, by product type

- 14.2.2.4 Nutraceutical packaging market, by packaging type

- 14.2.2.5 Nutraceutical packaging market, by material

- 14.2.2.6 Nutraceutical packaging market, by ingredient

- 14.2.2.7 Nutraceutical packaging market, by region

- 14.2.1 PHARMACEUTICAL PACKAGING MARKET

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 CUSTOMIZATION OPTIONS

- 15.3 RELATED REPORTS

- 15.4 AUTHOR DETAILS