|

|

市場調査レポート

商品コード

1526814

地域冷房の世界市場:生産技術別、原料別、用途別、地域別 - 2029年までの予測District Cooling Market by Production Technique (Free Cooling, Absorption Cooling, & Electric Chillers), Source (Fossil Fuels, Renewables), Application (Residential, Commercial, & Industrial) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 地域冷房の世界市場:生産技術別、原料別、用途別、地域別 - 2029年までの予測 |

|

出版日: 2024年08月01日

発行: MarketsandMarkets

ページ情報: 英文 271 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

地域冷房の市場規模は、2024年の11億米ドルから3.6%のCAGRで拡大し、2029年には13億米ドルに達すると予測されています。

地域冷房の成長を促進している要因は、急速な都市化、世界の気温の上昇、エネルギー効率の高い持続可能な冷房ソリューションへの需要です。エネルギー使用と温室効果ガス排出を抑制するため、政府や産業界は厳しい環境規制に合わせて地域冷房システムへの投資を増やしています。さらに、技術の進歩や再生可能エネルギー源の導入が、これらのシステムの魅力を高め、さまざまな分野での普及を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(米ドル)、数量(KRT)、 |

| セグメント別 | 生産技術別、原料別、用途別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、南米、中東・アフリカ |

予測期間中、化石燃料は、地域冷房市場において、金額ベースでも最大の原料別セグメントとして際立っています。これは、インフラが確立されており、一般的に利用可能であるためです。化石燃料は、大規模な冷房運転に必要な安定した信頼できるエネルギー源です。さらに、化石燃料はエネルギー密度が高いため、地域冷房システムに必要な大型機械を動かすための効果的なエネルギー源です。しかし、持続可能性を向上させ、環境への影響を軽減するために、再生可能エネルギー源を統合する傾向が強まっています。

フリークーリングは、地域冷房市場で最も急成長している生産技術分野です。フリークーリングは、地域冷房システム用の水を冷却するために低い外部温度を活用する、費用対効果が高く持続可能な方法です。このプロセスでは、周囲の空気や、湖、海、川などの自然源からの冷たい水を利用します。熱交換器によって地域冷房ネットワークを循環する水を冷却し、温まった水は自然の水源に戻されます。フリークーリングを取り入れることで、新築または既存の建物のエネルギー効率を大幅に向上させることができます。この方法は、地域冷房やヒートポンプとともに、吸着式や電気式冷凍機だけに頼ったシステムと比べて消費電力が少なくなります。

当レポートでは、世界の地域冷房市場について調査し、生産技術別、原料別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- バリューチェーン分析

- エコシステム分析

- ケーススタディ分析

- 技術分析

- 貿易分析

- 特許分析

- 2024年の主な会議とイベント

- 価格分析

- 投資と資金調達のシナリオ

- 関税と規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 生成AI/AIが地域冷房市場に与える影響

第6章 地域冷房市場(生産技術別)

- イントロダクション

- フリークーリング

- 吸収冷却

- 電気チラー

第7章 地域冷房市場(原料別)

- イントロダクション

- 化石燃料

- 再生可能エネルギー

- その他

第8章 地域冷房市場(用途別)

- イントロダクション

- 住宅

- 工業

- 商業

第9章 地域冷房市場(地域別)

- イントロダクション

- 北米

- アジア太平洋

- 欧州

- 中東・アフリカ

- 南米

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2019年~2024年

- 市場シェア分析、2023年

- 収益分析、2019-2023

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオと動向

- 企業価値評価と財務指標

- ブランド/製品比較

第11章 企業プロファイル

- 設計・調達・建設企業

- EMIRATES CENTRAL COOLING SYSTEMS CORPORATION PJSC

- TABREED

- EMICOOL

- SHINRYO CORPORATION

- ADC ENERGY SYSTEMS

- KEPPEL

- RAMBOLL GROUP A/S

- STELLAR ENERGY INTERNATIONAL

- 製造企業

- JOHNSON CONTROLS INC.

- DAIKIN INDUSTRIES, LTD.

- TRANE TECHNOLOGIES PLC

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- DANFOSS A/S

- ATKINSREALIS

- FORTUM

- SIEMENS

- VEOLIA

- LOGSTOR DENMARK HOLDING APS

- その他の参入企業

- MULTIPLY GROUP

- DC PRO ENGINEERING

- MARAFEQ QATAR

- SP GROUP

- VATTENFALL AB

- HELEN OY

- CETETHERM

- ENGIE

- DALKIA

- ENWAVE ENERGY CORPORATION

第12章 付録

List of Tables

- TABLE 1 DISTRICT COOLING MARKET: RISK ANALYSIS

- TABLE 2 DISTRICT COOLING MARKET SNAPSHOT

- TABLE 3 ROLE OF COMPANIES IN DISTRICT COOLING ECOSYSTEM

- TABLE 4 EXPORT DATA FOR HS CODE 841989-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2022 (USD THOUSAND)

- TABLE 5 IMPORT DATA FOR HS CODE 841989-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2023 (USD THOUSAND)

- TABLE 6 LIST OF PATENTS, 2021-2023

- TABLE 7 DISTRICT COOLING MARKET: LIST OF CONFERENCES AND EVENTS, 2024

- TABLE 8 INDICATIVE PRICING TREND OF DISTRICT COOLING SYSTEMS, BY APPLICATION, 2021-2023 (USD/RT)

- TABLE 9 AVERAGE SELLING PRICE TREND OF DISTRICT COOLING SYSTEMS, BY REGION, 2021-2023 (USD/RT)

- TABLE 10 IMPORT TARIFF DATA FOR HS 841989-COMPLIANT PRODUCTS, 2023

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: CODES AND REGULATIONS

- TABLE 17 ASIA PACIFIC: CODES AND REGULATIONS

- TABLE 18 GLOBAL: CODES AND REGULATIONS

- TABLE 19 PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 21 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 22 DISTRICT COOLING MARKET, BY PRODUCTION TECHNIQUE, 2021-2023 (USD MILLION)

- TABLE 23 DISTRICT COOLING MARKET, BY PRODUCTION TECHNIQUE, 2024-2029 (USD MILLION)

- TABLE 24 FREE COOLING: DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 25 FREE COOLING: DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 26 ABSORPTION COOLING: DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 27 ABSORPTION COOLING: DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 28 ELECTRIC CHILLERS: DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 29 ELECTRIC CHILLERS: DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 30 DISTRICT COOLING MARKET, BY SOURCE, 2021-2023 (USD MILLION)

- TABLE 31 DISTRICT COOLING MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 32 FOSSIL FUELS: DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 33 FOSSIL FUELS: DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 34 RENEWABLE ENERGY: DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 35 RENEWABLE ENERGY: DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 36 OTHER SOURCES: DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 37 OTHER SOURCES: DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 38 DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 39 DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 40 DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 41 DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 42 RESIDENTIAL: DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 43 RESIDENTIAL: DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 44 INDUSTRIAL: DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 45 INDUSTRIAL: DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 46 COMMERCIAL: DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 47 COMMERCIAL: DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 48 HOSPITALS: DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 49 HOSPITALS: DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 50 EDUCATIONAL INSTITUTES: DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 51 EDUCATIONAL INSTITUTES: DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 GOVERNMENT BUILDINGS: DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 53 GOVERNMENT BUILDINGS: DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 54 OFFICES: DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 55 OFFICES: DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 AIRPORTS: DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 57 AIRPORTS: DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 58 RETAIL STORES: DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 59 RETAIL STORES: DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 60 DISTRICT COOLING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 61 DISTRICT COOLING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 62 DISTRICT COOLING MARKET, BY REGION, 2021-2023 (THOUSAND RT)

- TABLE 63 DISTRICT COOLING MARKET, BY REGION, 2024-2029 (THOUSAND RT)

- TABLE 64 NORTH AMERICA: DISTRICT COOLING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 65 NORTH AMERICA: DISTRICT COOLING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 66 NORTH AMERICA: DISTRICT COOLING MARKET, BY PRODUCTION TECHNIQUE, 2021-2023 (USD MILLION)

- TABLE 67 NORTH AMERICA: DISTRICT COOLING MARKET, BY PRODUCTION TECHNIQUE, 2024-2029 (USD MILLION)

- TABLE 68 NORTH AMERICA: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 69 NORTH AMERICA: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 70 NORTH AMERICA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 71 NORTH AMERICA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 72 NORTH AMERICA: DISTRICT COOLING MARKET, BY SOURCE, 2021-2023 (USD MILLION)

- TABLE 73 NORTH AMERICA: DISTRICT COOLING MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 74 US: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 75 US: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 76 US: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 77 US: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 78 CANADA: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 79 CANADA: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 80 CANADA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 81 CANADA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 82 ASIA PACIFIC: DISTRICT COOLING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 83 ASIA PACIFIC: DISTRICT COOLING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 84 ASIA PACIFIC: DISTRICT COOLING MARKET, BY PRODUCTION TECHNIQUE, 2021-2023 (USD MILLION)

- TABLE 85 ASIA PACIFIC: DISTRICT COOLING MARKET, BY PRODUCTION TECHNIQUE, 2024-2029 (USD MILLION)

- TABLE 86 ASIA PACIFIC: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 87 ASIA PACIFIC: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 88 ASIA PACIFIC: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 89 ASIA PACIFIC: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 90 ASIA PACIFIC: DISTRICT COOLING MARKET, BY SOURCE, 2021-2023 (USD MILLION)

- TABLE 91 ASIA PACIFIC: DISTRICT COOLING MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 92 CHINA: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 93 CHINA: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 94 CHINA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 95 CHINA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 96 JAPAN: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 97 JAPAN: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 98 JAPAN: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 99 JAPAN: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 100 SOUTH KOREA: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 101 SOUTH KOREA: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 102 SOUTH KOREA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 103 SOUTH KOREA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 104 SINGAPORE: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 105 SINGAPORE: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 106 SINGAPORE: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 107 SINGAPORE: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 108 MALAYSIA: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 109 MALAYSIA: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 110 MALAYSIA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 111 MALAYSIA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 114 REST OF ASIA PACIFIC: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 115 REST OF ASIA PACIFIC: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 116 EUROPE: DISTRICT COOLING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 117 EUROPE: DISTRICT COOLING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 118 EUROPE: DISTRICT COOLING MARKET, BY PRODUCTION TECHNIQUE, 2021-2023 (USD MILLION)

- TABLE 119 EUROPE: DISTRICT COOLING MARKET, BY PRODUCTION TECHNIQUE, 2024-2029 (USD MILLION)

- TABLE 120 EUROPE: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 121 EUROPE: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 122 EUROPE: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 123 EUROPE: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 124 EUROPE: DISTRICT COOLING MARKET, BY SOURCE, 2021-2023 (USD MILLION)

- TABLE 125 EUROPE: DISTRICT COOLING MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 126 SWEDEN: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 127 SWEDEN: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 128 SWEDEN: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 129 SWEDEN: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 130 FRANCE: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 131 FRANCE: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 132 FRANCE: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 133 FRANCE: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 134 GERMANY: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 135 GERMANY: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 136 GERMANY: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 137 GERMANY: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 138 FINLAND: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 139 FINLAND: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 140 FINLAND: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 141 FINLAND: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 142 NORWAY: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 143 NORWAY: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 144 NORWAY: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 145 NORWAY: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 146 ITALY: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 147 ITALY: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 148 ITALY: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 149 ITALY: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 150 REST OF EUROPE: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 151 REST OF EUROPE: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 152 REST OF EUROPE: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 153 REST OF EUROPE: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: DISTRICT COOLING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: DISTRICT COOLING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 156 GCC: DISTRICT COOLING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 157 GCC: DISTRICT COOLING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: DISTRICT COOLING MARKET, BY PRODUCTION TECHNIQUE, 2021-2023 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: DISTRICT COOLING MARKET, BY PRODUCTION TECHNIQUE, 2024-2029 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: DISTRICT COOLING MARKET, BY SOURCE, 2021-2023 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: DISTRICT COOLING MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 166 SAUDI ARABIA: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 167 SAUDI ARABIA: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 168 SAUDI ARABIA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 169 SAUDI ARABIA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 170 UAE: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 171 UAE: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 172 UAE: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 173 UAE: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 174 QATAR: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 175 QATAR: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 176 QATAR: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 177 QATAR: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 178 BAHRAIN: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 179 BAHRAIN: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 180 BAHRAIN: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 181 BAHRAIN: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 182 OMAN: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 183 OMAN: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 184 OMAN: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 185 OMAN: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 186 KUWAIT: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 187 KUWAIT: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 188 KUWAIT: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 189 KUWAIT: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 190 EGYPT: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 191 EGYPT: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 192 EGYPT: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 193 EGYPT: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 194 AFRICA & REST OF MIDDLE EAST: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 195 AFRICA & REST OF MIDDLE EAST: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 196 AFRICA & REST OF MIDDLE EAST: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 197 AFRICA & REST OF MIDDLE EAST: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 198 SOUTH AMERICA: DISTRICT COOLING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 199 SOUTH AMERICA: DISTRICT COOLING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 200 SOUTH AMERICA: DISTRICT COOLING MARKET, BY PRODUCTION TECHNIQUE, 2021-2023 (USD MILLION)

- TABLE 201 SOUTH AMERICA: DISTRICT COOLING MARKET, BY PRODUCTION TECHNIQUE, 2024-2029 (USD MILLION)

- TABLE 202 SOUTH AMERICA: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 203 SOUTH AMERICA: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 204 SOUTH AMERICA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 205 SOUTH AMERICA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 206 SOUTH AMERICA: DISTRICT COOLING MARKET, BY SOURCE, 2021-2023 (USD MILLION)

- TABLE 207 SOUTH AMERICA: DISTRICT COOLING MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 208 BRAZIL: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 209 BRAZIL: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 210 BRAZIL: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 211 BRAZIL: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 212 ARGENTINA: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 213 ARGENTINA: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 214 ARGENTINA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 215 ARGENTINA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 216 REST OF SOUTH AMERICA: DISTRICT COOLING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 217 REST OF SOUTH AMERICA: DISTRICT COOLING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 218 REST OF SOUTH AMERICA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2021-2023 (USD MILLION)

- TABLE 219 REST OF SOUTH AMERICA: DISTRICT COOLING MARKET, BY COMMERCIAL APPLICATION, 2024-2029 (USD MILLION)

- TABLE 220 DISTRICT COOLING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2019-2024

- TABLE 221 DISTRICT COOLING MARKET: DEGREE OF COMPETITION, 2023

- TABLE 222 DISTRICT COOLING MARKET: PRODUCTION TECHNIQUE FOOTPRINT

- TABLE 223 DISTRICT COOLING MARKET: APPLICATION FOOTPRINT

- TABLE 224 DISTRICT COOLING MARKET: REGION FOOTPRINT

- TABLE 225 DISTRICT COOLING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 226 DISTRICT COOLING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 227 DISTRICT COOLING MARKET: PRODUCT LAUNCHES, JANUARY 2019-JUNE 2024

- TABLE 228 DISTRICT COOLING MARKET: DEALS, JANUARY 2019-JUNE 2024

- TABLE 229 DISTRICT COOLING MARKET: EXPANSIONS, JANUARY 2019-JUNE 2024

- TABLE 230 DISTRICT COOLING MARKET: OTHERS, JANUARY 2019-JUNE 2024

- TABLE 231 EMIRATES CENTRAL COOLING SYSTEMS CORPORATION PJSC: COMPANY OVERVIEW

- TABLE 232 EMIRATES CENTRAL COOLING SYSTEMS CORPORATION PJSC: DISTRICT COOLING PROJECTS

- TABLE 233 EMIRATES CENTRAL COOLING SYSTEMS CORPORATION PJSC: DEALS

- TABLE 234 EMIRATES CENTRAL COOLING SYSTEMS CORPORATION PJSC: EXPANSIONS

- TABLE 235 EMIRATES CENTRAL COOLING SYSTEMS CORPORATION PJSC: OTHERS

- TABLE 236 TABREED: COMPANY OVERVIEW

- TABLE 237 TABREED: DISTRICT COOLING PROJECTS

- TABLE 238 TABREED: DEALS

- TABLE 239 TABREED: EXPANSIONS

- TABLE 240 TABREED: OTHERS

- TABLE 241 EMICOOL: COMPANY OVERVIEW

- TABLE 242 EMICOOL: DISTRICT COOLING PROJECTS

- TABLE 243 EMICOOL: DEALS

- TABLE 244 EMICOOL: EXPANSIONS

- TABLE 245 SHINRYO CORPORATION: COMPANY OVERVIEW

- TABLE 246 SHINRYO CORPORATION: DISTRICT COOLING PROJECTS

- TABLE 247 ADC ENERGY SYSTEMS: COMPANY OVERVIEW

- TABLE 248 ADC ENERGY SYSTEMS: DISTRICT COOLING PROJECTS

- TABLE 249 KEPPEL: COMPANY OVERVIEW

- TABLE 250 KEPPEL: DISTRICT COOLING PROJECTS

- TABLE 251 KEPPEL: DEALS

- TABLE 252 KEPPEL: EXPANSIONS

- TABLE 253 RAMBOLL GROUP A/S: COMPANY OVERVIEW

- TABLE 254 RAMBOLL GROUP A/S: DISTRICT COOLING PROJECTS

- TABLE 255 RAMBOLL GROUP A/S: CONSULTING SERVICES

- TABLE 256 STELLAR ENERGY INTERNATIONAL: COMPANY OVERVIEW

- TABLE 257 STELLAR ENERGY INTERNATIONAL: DISTRICT COOLING PROJECTS

- TABLE 258 JOHNSON CONTROLS INC.: COMPANY OVERVIEW

- TABLE 259 JOHNSON CONTROLS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 260 DAIKIN INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 261 DAIKIN INDUSTRIES, LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 262 TRANE TECHNOLOGIES PLC: COMPANY OVERVIEW

- TABLE 263 TRANE TECHNOLOGIES PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 264 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 265 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 266 DANFOSS A/S: COMPANY OVERVIEW

- TABLE 267 DANFOSS A/S: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 268 DANFOSS A/S: PRODUCT LAUNCHES

- TABLE 269 DANFOSS A/S: DEALS

- TABLE 270 ATKINSREALIS: COMPANY OVERVIEW

- TABLE 271 ATKINSREALIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 FORTUM: COMPANY OVERVIEW

- TABLE 273 FORTUM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 274 SIEMENS: COMPANY OVERVIEW

- TABLE 275 SIEMENS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 276 VEOLIA: COMPANY OVERVIEW

- TABLE 277 VEOLIA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 278 LOGSTOR DENMARK HOLDING APS: COMPANY OVERVIEW

- TABLE 279 LOGSTOR DENMARK HOLDING APS: DISTRICT COOLING PROJECTS

- TABLE 280 LOGSTOR DENMARK HOLDING APS: DISTRICT COOLING PIPE NETWORKS

- TABLE 281 LOGSTOR DENMARK HOLDING APS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 282 LOGSTOR DENMARK HOLDING APS: DEALS

- TABLE 283 MULTIPLY GROUP: COMPANY OVERVIEW

- TABLE 284 DC PRO ENGINEERING: COMPANY OVERVIEW

- TABLE 285 MARAFEQ QATAR: COMPANY OVERVIEW

- TABLE 286 SP GROUP: COMPANY OVERVIEW

- TABLE 287 VATTENFALL AB: COMPANY OVERVIEW

- TABLE 288 HELEN OY: COMPANY OVERVIEW

- TABLE 289 CETETHERM: COMPANY OVERVIEW

- TABLE 290 ENGIE: COMPANY OVERVIEW

- TABLE 291 DALKIA: COMPANY OVERVIEW

- TABLE 292 ENWAVE ENERGY CORPORATION: COMPANY OVERVIEW

List of Figures

- FIGURE 1 DISTRICT COOLING MARKET SEGMENTATION

- FIGURE 2 DISTRICT COOLING MARKET: RESEARCH DESIGN

- FIGURE 3 DISTRICT COOLING MARKET: DATA TRIANGULATION

- FIGURE 4 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR DISTRICT COOLING SYSTEMS

- FIGURE 5 DISTRICT COOLING MARKET: BOTTOM-UP APPROACH

- FIGURE 6 DISTRICT COOLING MARKET: TOP-DOWN APPROACH

- FIGURE 7 KEY STEPS CONSIDERED TO ANALYZE SUPPLY OF DISTRICT COOLING SYSTEMS

- FIGURE 8 DISTRICT COOLING MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 9 DISTRICT COOLING MARKET: RESEARCH ASSUMPTIONS

- FIGURE 10 DISTRICT COOLING MARKET: RESEARCH LIMITATIONS

- FIGURE 11 FOSSIL FUELS SEGMENT TO DOMINATE DISTRICT COOLING MARKET BETWEEN 2024 AND 2029

- FIGURE 12 ELECTRIC CHILLERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 13 COMMERCIAL SEGMENT TO RECORD HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 14 MIDDLE EAST & AFRICA ACCOUNTED FOR LARGEST SHARE OF GLOBAL DISTRICT COOLING MARKET IN 2023

- FIGURE 15 GOVERNMENT-LED INITIATIVES TO PROMOTE ENERGY EFFICIENCY AND SUSTAINABILITY TO DRIVE MARKET

- FIGURE 16 COMMERCIAL SEGMENT AND CHINA TO HOLD LARGEST SHARES OF DISTRICT COOLING MARKET IN ASIA PACIFIC IN 2024

- FIGURE 17 COMMERCIAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 18 ELECTRIC CHILLERS SEGMENT TO HOLD LARGEST SHARE OF DISTRICT COOLING MARKET IN 2029

- FIGURE 19 FOSSIL FUELS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 20 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN DISTRICT COOLING MARKET BETWEEN 2024 AND 2029

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 INCREASE IN URBAN POPULATION, 2013-2022 (BILLION)

- FIGURE 23 PERCENTAGE OF POPULATION LIVING IN HOT CLIMATE AND NEEDING COOLING SYSTEMS, BY REGION, 2021

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 25 DISTRICT COOLING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 DISTRICT COOLING MARKET ECOSYSTEM

- FIGURE 27 EXPORT DATA FOR HS CODE 841989-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2021-2023 (USD THOUSAND)

- FIGURE 28 IMPORT DATA FOR HS CODE 841989-COMPLIANT PRODUCTS TOR TOP 5 COUNTRIES, 2021-2023 (USD THOUSAND)

- FIGURE 29 PATENTS APPLIED AND GRANTED, 2013-2023

- FIGURE 30 AVERAGE SELLING PRICE TREND OF DISTRICT COOLING SYSTEMS, BY REGION, 2021-2023 (USD/RT)

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO (USD MILLION)

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 34 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 35 IMPACT OF GEN AI/AI ON DISTRICT COOLING APPLICATIONS, BY REGION

- FIGURE 36 DISTRICT COOLING MARKET SHARE, BY PRODUCTION TECHNIQUE, 2023

- FIGURE 37 DISTRICT COOLING MARKET SHARE, BY SOURCE, 2023

- FIGURE 38 DISTRICT COOLING MARKET SHARE, BY APPLICATION, 2023

- FIGURE 39 ASIA PACIFIC TO RECORD HIGHEST CAGR IN GLOBAL DISTRICT COOLING MARKET DURING FORECAST PERIOD

- FIGURE 40 DISTRICT COOLING MARKET SHARE, BY REGION, 2023

- FIGURE 41 ASIA PACIFIC: DISTRICT COOLING MARKET SNAPSHOT

- FIGURE 42 MIDDLE EAST & AFRICA: DISTRICT COOLING MARKET SNAPSHOT

- FIGURE 43 MARKET SHARE ANALYSIS OF KEY PLAYERS OFFERING DISTRICT COOLING SYSTEMS AND SERVICES, 2023

- FIGURE 44 DISTRICT COOLING MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2019-2023 (USD MILLION)

- FIGURE 45 DISTRICT COOLING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 46 DISTRICT COOLING MARKET: COMPANY FOOTPRINT

- FIGURE 47 DISTRICT COOLING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 48 COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 49 FINANCIAL METRICS, 2024 (EV/EBITDA)

- FIGURE 50 BRAND/PRODUCT COMPARISON

- FIGURE 51 EMIRATES CENTRAL COOLING SYSTEMS CORPORATION PJSC: COMPANY SNAPSHOT

- FIGURE 52 TABREED: COMPANY SNAPSHOT

- FIGURE 53 SHINRYO CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 KEPPEL: COMPANY SNAPSHOT

- FIGURE 55 RAMBOLL GROUP A/S: COMPANY SNAPSHOT

- FIGURE 56 JOHNSON CONTROLS INC.: COMPANY SNAPSHOT

- FIGURE 57 DAIKIN INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 58 TRANE TECHNOLOGIES PLC: COMPANY SNAPSHOT

- FIGURE 59 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 60 DANFOSS A/S: COMPANY SNAPSHOT

- FIGURE 61 ATKINSREALIS: COMPANY SNAPSHOT

- FIGURE 62 FORTUM: COMPANY SNAPSHOT

- FIGURE 63 SIEMENS: COMPANY SNAPSHOT

- FIGURE 64 VEOLIA: COMPANY SNAPSHOT

- FIGURE 65 LOGSTOR DENMARK HOLDING APS: COMPANY SNAPSHOT

The district cooling market size is projected to reach USD 1.3 billion by 2029 at a CAGR of 3.6% from USD 1.1 billion in 2024. The factors fueling the growth of district cooling are rapid urbanization, escalating global temperatures, and the demand for energy-efficient, sustainable cooling solutions. To curtail energy use and greenhouse gas emissions, governments and industries are increasingly investing in district cooling systems, aligning with stringent environmental regulations. Furthermore, advancements in technology and the incorporation of renewable energy sources are boosting the attractiveness of these systems, promoting their widespread adoption across different sectors.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) Volume (KRT), |

| Segments | By Source By Production Technique By Application By Region |

| Regions covered | Asia Pacific, Europe, North America, South America, Middle East & Africa |

"Fossil Fuels is likely to account for the largest share of district cooling market."

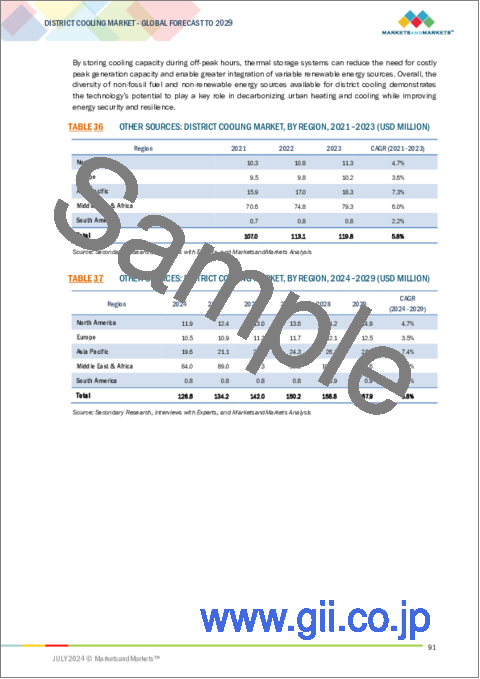

During the forecast period, fossil fuels stands out as the largest by source segment in the district cooling market, both in terms of value. This is because of their well-established infrastructure and general availability. They offer a steady and dependable energy source that is required for extensive cooling operations. Furthermore, fossil fuels are an effective source of energy for running the large machinery needed for district cooling systems due to their high energy density. However, in order to improve sustainability and lessen environmental effect, there is an increasing trend toward the integration of renewable energy sources.

"Free cooling is the fastest growing production technique in district cooling market."

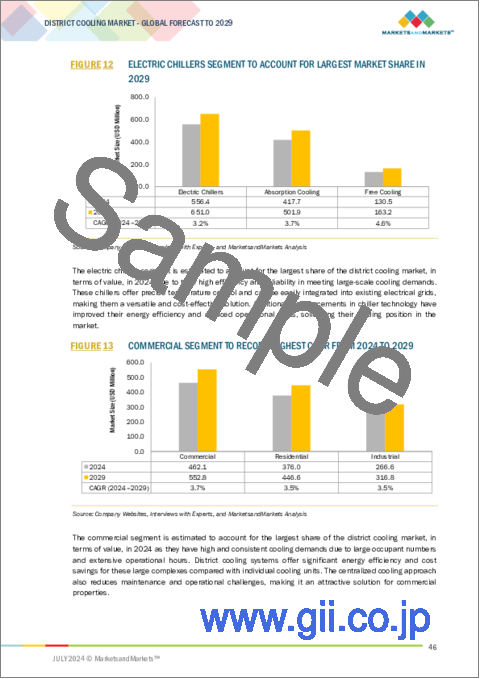

Free cooling represented the fastest growing production technique segment in the district cooling market. Free cooling is a cost-effective and sustainable method that leverages low external temperatures to cool water for district cooling systems. This process utilizes ambient air or cold water from natural sources like lakes, seas, or rivers. Heat exchangers cool the water circulating through district cooling networks, and the now-warm water is released back into the natural source. By incorporating free cooling, the energy efficiency of new or existing buildings can be significantly enhanced. This method, along with district cooling and heat pumps, consumes less electricity compared to systems relying solely on adsorption or electrical chillers.

"Middle East & Africa, by region is forecasted to be the fastest segment of district cooling market during the forecast period."

The Middle East & Africa region is the fastest-growing market for district cooling due to its hot climate, which drives substantial demand for cooling solutions. Countries like the UAE, Saudi Arabia, and Qatar have aggressively adopted district cooling to efficiently meet the cooling needs of their rapidly growing urban populations and extensive commercial developments. The region's investment in large-scale infrastructure projects and commitment to sustainable urban planning further support the growth of district cooling systems, making it a dominant market globally.

The break-up of the profile of primary participants in the district cooling market:

- By Company Type: Tier 1 - 46%, Tier 2 - 36%, and Tier 3 - 18%

- By Designation: C Level - 35%, D Level - 25%, and Others - 40%

- By Region: North America - 50%, Europe -30%, Asia Pacific - 20%, South America- 12%, the Middle East & Africa - 8%.

The key companies profiled in this report are Johnson Controls Inc. (US), Daikin Industries, Ltd. (Japan), Trane Technologies plc (Ireland), Mistubishi Heavy Industries, Ltd. (Japan), and Danfoss A/S (Denmark).

Research Coverage:

The district cooling market has been segmented based on Source (Fossil Fuels, Renewables, and Others), Production Technique (Free Cooling, Absorption Cooling, and Electric Chillers), Application (Commercial, Residential, and Industrial), and by Region (Asia Pacific, Europe, North America, South America, and Middle East & Africa).

Reasons to Buy the Report

From an insight perspective, this research report focuses on various levels of analyses - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together comprise and discuss the basic views on the competitive landscape; emerging and high-growth segments of the market; high growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (enhanced energy efficiency requirement), restraints (high initial infrastructure costs and investments for district cooling systems), opportunities (technological advancements in smart grid integration and IoT), challenges (difficulties faced during implementation of district cooling systems)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the market for district cooling across regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 List of primary interview participants

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Demand-side analysis

- 2.3.1.1.1 Regional analysis

- 2.3.1.1.2 Country-level analysis

- 2.3.1.1.3 Demand-side assumptions

- 2.3.1.1.4 Demand-side calculations

- 2.3.1.1 Demand-side analysis

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Supply-side analysis

- 2.3.2.1.1 Supply-side assumptions

- 2.3.2.1.2 Supply-side calculations

- 2.3.2.1 Supply-side analysis

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 FORECAST

- 2.5 RISK ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DISTRICT COOLING MARKET

- 4.2 DISTRICT COOLING MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

- 4.3 DISTRICT COOLING MARKET, BY APPLICATION

- 4.4 DISTRICT COOLING MARKET, BY PRODUCTION TECHNIQUE

- 4.5 DISTRICT COOLING MARKET, BY SOURCE

- 4.6 DISTRICT COOLING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing focus on achieving sustainability goals

- 5.2.1.2 Rapid urbanization and population growth

- 5.2.1.3 Mounting demand for air conditioning units

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial infrastructure development costs

- 5.2.2.2 Limited financial support and inconsistent policies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advances in IoT and smart grid technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Space constraints and operational issues

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 ARANER IMPLEMENTS WATER-FREE DISTRICT COOLING SOLUTIONS AS PART OF SAUDI ARABIA'S VISION 2030 TOURISM PROJECTS

- 5.6.2 CONCESSION AGREEMENTS HELP OVERCOME CHALLENGES ASSOCIATED WITH IMPLEMENTING DISTRICT COOLING SYSTEMS

- 5.6.3 SOOKE SCHOOL DISTRICT 62 ADOPTS HCMA'S DISTRICT COOLING SYSTEMS TO PROMOTE ENERGY EFFICIENCY AND SUSTAINABILITY

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Absorption chillers

- 5.7.2 ADJACENT TECHNOLOGIES

- 5.7.2.1 Thermal energy storage

- 5.7.1 KEY TECHNOLOGIES

- 5.8 TRADE ANALYSIS

- 5.8.1 EXPORT SCENARIO (HS CODE 841989)

- 5.8.2 IMPORT SCENARIO (HS CODE 841989)

- 5.9 PATENT ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS, 2024

- 5.11 PRICING ANALYSIS

- 5.11.1 INDICATIVE PRICING TREND, BY APPLICATION

- 5.11.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 CODES AND REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF GEN AI/AI ON DISTRICT COOLING MARKET

6 DISTRICT COOLING MARKET, BY PRODUCTION TECHNIQUE

- 6.1 INTRODUCTION

- 6.2 FREE COOLING

- 6.2.1 COST-EFFECTIVENESS AND SUSTAINABILITY TO CONTRIBUTE TO SEGMENTAL GROWTH

- 6.3 ABSORPTION COOLING

- 6.3.1 NEED TO ADHERE TO NOISE STANDARDS TO FOSTER SEGMENTAL GROWTH

- 6.4 ELECTRIC CHILLERS

- 6.4.1 REQUIREMENT FOR CENTRALIZED SOLUTIONS TO MEET URBAN COOLING NEEDS TO BOOST SEGMENTAL GROWTH

7 DISTRICT COOLING MARKET, BY SOURCE

- 7.1 INTRODUCTION

- 7.2 FOSSIL FUELS

- 7.2.1 INCREASING RELIANCE ON NATURAL GAS TO ADDRESS COOLING NEEDS TO AUGMENT SEGMENTAL GROWTH

- 7.3 RENEWABLE ENERGY

- 7.3.1 RISING GOVERNMENT INITIATIVES TO PROMOTE ENERGY-EFFICIENT BUILDINGS TO FOSTER SEGMENTAL GROWTH

- 7.4 OTHER SOURCES

8 DISTRICT COOLING MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 RESIDENTIAL

- 8.2.1 INCREASING DEPLOYMENT OF GREEN BUILDING TECHNOLOGIES TO EXPEDITE SEGMENTAL GROWTH

- 8.3 INDUSTRIAL

- 8.3.1 RISING NEED FOR PRECISE TEMPERATURE AND HUMIDITY CONTROL IN WAREHOUSES TO AUGMENT SEGMENTAL GROWTH

- 8.4 COMMERCIAL

- 8.4.1 HOSPITALS

- 8.4.1.1 Increasing requirement for maintaining optimal indoor air quality and temperature to boost segmental growth

- 8.4.2 EDUCATIONAL INSTITUTES

- 8.4.2.1 Rising emphasis on effective ventilation to contribute to segmental growth

- 8.4.3 GOVERNMENT BUILDINGS

- 8.4.3.1 Growing focus on meeting strict energy-efficiency standards to accelerate segmental growth

- 8.4.4 OFFICES

- 8.4.4.1 Increasing awareness about energy conservation to boost segmental growth

- 8.4.5 AIRPORTS

- 8.4.5.1 Rising emphasis on reducing energy consumption in western countries to fuel segmental growth

- 8.4.6 RETAIL STORES

- 8.4.6.1 Growing focus on enhancing customer satisfaction to augment segmental growth

- 8.4.1 HOSPITALS

9 DISTRICT COOLING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 US

- 9.2.1.1 Growing reliance on renewable energy in educational institutes to foster market growth

- 9.2.2 CANADA

- 9.2.2.1 Rapid transition toward sustainable energy future to boost market growth

- 9.2.1 US

- 9.3 ASIA PACIFIC

- 9.3.1 CHINA

- 9.3.1.1 Increasing government initiatives to promote renewable energy consumption to drive market

- 9.3.2 JAPAN

- 9.3.2.1 Rising adoption of decarbonization strategies to accelerate market growth

- 9.3.3 SOUTH KOREA

- 9.3.3.1 Growing demand for cooling systems in manufacturing facilities to expedite market growth

- 9.3.4 SINGAPORE

- 9.3.4.1 Increasing installation of air conditioners in commercial buildings to augment market growth

- 9.3.5 MALAYSIA

- 9.3.5.1 Rising focus on reducing energy consumption and carbon emissions to boost market growth

- 9.3.6 REST OF ASIA PACIFIC

- 9.3.1 CHINA

- 9.4 EUROPE

- 9.4.1 SWEDEN

- 9.4.1.1 Mounting adoption of sustainable energy practices to drive market

- 9.4.2 FRANCE

- 9.4.2.1 Growing commitment to low-carbon energy future to expedite market growth

- 9.4.3 GERMANY

- 9.4.3.1 Increasing investment in renewable energy sources to contribute to market growth

- 9.4.4 FINLAND

- 9.4.4.1 Expansion of high-density commercial infrastructure to fuel market growth

- 9.4.5 NORWAY

- 9.4.5.1 Increasing implementation of strict emission standards to accelerate market growth

- 9.4.6 ITALY

- 9.4.6.1 Rising emphasis on meeting energy security objectives to boost market growth

- 9.4.7 REST OF EUROPE

- 9.4.1 SWEDEN

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC

- 9.5.1.1 Saudi Arabia

- 9.5.1.1.1 Expanding industrial base and population growth to drive market

- 9.5.1.2 UAE

- 9.5.1.2.1 Rising initiatives to curb carbon emissions to augment market growth

- 9.5.1.3 Qatar

- 9.5.1.3.1 Growing demand for energy-efficient cooling systems to accelerate market growth

- 9.5.1.4 Bahrain

- 9.5.1.4.1 Rising emphasis on promoting sustainable energy practices to boost market growth

- 9.5.1.5 Oman

- 9.5.1.5.1 Increasing focus on reducing dependence on hydrocarbons to contribute to market growth

- 9.5.1.6 Kuwait

- 9.5.1.6.1 Rising installation of air conditioning units to expedite market growth

- 9.5.1.1 Saudi Arabia

- 9.5.2 EGYPT

- 9.5.2.1 Growing investment in construction projects to drive market

- 9.5.3 AFRICA & REST OF MIDDLE EAST

- 9.5.1 GCC

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Increasing reliance on renewable energy sources to foster market growth

- 9.6.2 ARGENTINA

- 9.6.2.1 Shifting preference from fossil fuels to clean energy sources to accelerate market growth

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019-2024

- 10.3 MARKET SHARE ANALYSIS, 2023

- 10.4 REVENUE ANALYSIS, 2019-2023

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.5.5.1 Company footprint

- 10.5.5.2 Production technique footprint

- 10.5.5.3 Application footprint

- 10.5.5.4 Region footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPETITIVE SCENARIO AND TRENDS

- 10.7.1 PRODUCT LAUNCHES

- 10.7.2 DEALS

- 10.7.3 EXPANSIONS

- 10.7.4 OTHERS

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 BRAND/PRODUCT COMPARISON

11 COMPANY PROFILES

- 11.1 ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) COMPANIES

- 11.1.1 EMIRATES CENTRAL COOLING SYSTEMS CORPORATION PJSC

- 11.1.1.1 Business overview

- 11.1.1.2 District cooling projects

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.3.2 Expansions

- 11.1.1.3.3 Others

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 TABREED

- 11.1.2.1 Business overview

- 11.1.2.2 District cooling projects

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Expansions

- 11.1.2.3.3 Others

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 EMICOOL

- 11.1.3.1 Business overview

- 11.1.3.2 District cooling projects

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 SHINRYO CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 District cooling projects

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths/Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses/Competitive threats

- 11.1.5 ADC ENERGY SYSTEMS

- 11.1.5.1 Business overview

- 11.1.5.2 District cooling projects

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths/Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses/Competitive threats

- 11.1.6 KEPPEL

- 11.1.6.1 Business overview

- 11.1.6.2 District cooling projects

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.6.3.2 Expansions

- 11.1.7 RAMBOLL GROUP A/S

- 11.1.7.1 Business overview

- 11.1.7.2 District cooling projects

- 11.1.7.3 Consulting services

- 11.1.8 STELLAR ENERGY INTERNATIONAL

- 11.1.8.1 Business overview

- 11.1.8.2 District cooling projects

- 11.1.1 EMIRATES CENTRAL COOLING SYSTEMS CORPORATION PJSC

- 11.2 MANUFACTURING COMPANIES

- 11.2.1 JOHNSON CONTROLS INC.

- 11.2.1.1 Business overview

- 11.2.1.2 Products/Services/Solutions offered

- 11.2.2 DAIKIN INDUSTRIES, LTD.

- 11.2.2.1 Business overview

- 11.2.2.2 Products/Services/Solutions offered

- 11.2.3 TRANE TECHNOLOGIES PLC

- 11.2.3.1 Business overview

- 11.2.3.2 Products/Services/Solutions offered

- 11.2.4 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 11.2.4.1 Business overview

- 11.2.4.2 Products/Services/Solutions offered

- 11.2.5 DANFOSS A/S

- 11.2.5.1 Business overview

- 11.2.5.2 Products/Services/Solutions offered

- 11.2.5.3 Recent development

- 11.2.5.3.1 Product launches

- 11.2.5.3.2 Deals

- 11.2.6 ATKINSREALIS

- 11.2.6.1 Business overview

- 11.2.6.2 Products/Services/Solutions offered

- 11.2.7 FORTUM

- 11.2.7.1 Business overview

- 11.2.7.2 Products/Services/Solutions offered

- 11.2.8 SIEMENS

- 11.2.8.1 Business overview

- 11.2.8.2 Products/Services/Solutions offered

- 11.2.9 VEOLIA

- 11.2.9.1 Business overview

- 11.2.9.2 Products/Services/Solutions offered

- 11.2.10 LOGSTOR DENMARK HOLDING APS

- 11.2.10.1 Business overview

- 11.2.10.2 District cooling projects

- 11.2.10.3 District cooling pipe networks

- 11.2.10.4 Products/Services/Solutions offered

- 11.2.10.5 Recent developments

- 11.2.10.5.1 Deals

- 11.2.1 JOHNSON CONTROLS INC.

- 11.3 OTHER PLAYERS

- 11.3.1 MULTIPLY GROUP

- 11.3.2 DC PRO ENGINEERING

- 11.3.3 MARAFEQ QATAR

- 11.3.4 SP GROUP

- 11.3.5 VATTENFALL AB

- 11.3.6 HELEN OY

- 11.3.7 CETETHERM

- 11.3.8 ENGIE

- 11.3.9 DALKIA

- 11.3.10 ENWAVE ENERGY CORPORATION

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS