|

|

市場調査レポート

商品コード

1854900

レーザー干渉計の世界市場 (~2030年):技術 (ホモダイン・ヘテロダイン)・タイプ (マイケルソン・ファブリペロー・フィゾー・マッハツェンダー・サニャック・トゥイマングリーン)・コンポーネント (レーザー・光検出器・光学)・用途 (表面トポロジー・バイオメディカル) 別Laser Interferometer Market by Technique (Homodyne, Heterodyne), Type (Michelson, Fabry-Perot, Fizeau, Mach-Zehnder, Sagnac, Twyman-green), Component (Laser, Photodetector, Optical), Application (Surface Topology, Biomedical) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| レーザー干渉計の世界市場 (~2030年):技術 (ホモダイン・ヘテロダイン)・タイプ (マイケルソン・ファブリペロー・フィゾー・マッハツェンダー・サニャック・トゥイマングリーン)・コンポーネント (レーザー・光検出器・光学)・用途 (表面トポロジー・バイオメディカル) 別 |

|

出版日: 2025年10月15日

発行: MarketsandMarkets

ページ情報: 英文 247 Pages

納期: 即納可能

|

概要

レーザー干渉計の市場規模は、予測期間中にCAGR 6.7%で推移し、2025年の3億4,000万米ドルから、2030年には4億7,000万米ドルに成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 検討単位 | 金額 (米ドル) |

| セグメント | 技術、タイプ、コンポーネント、用途、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

半導体デバイスの小型化の進展は、レーザー干渉計の需要を大幅に押し上げています。ナノメートルレベルまで微細化が進むことで、極めて高精度かつ信頼性の高い計測技術が不可欠となっているためです。レーザー干渉計はサブナノメートル精度を実現し、半導体メーカーがウエハ表面の平坦度・均一性・欠陥を高精度で測定・検査・制御することを可能にします。これらはデバイス性能を確保する上で欠かせない要素です。また、レーザー干渉計はMEMSの開発にも重要な役割を果たしており、表面形状の正確な測定によって微細部品の信頼性を保証しています。さらに、半導体業界が3Dスタッキングやシステムインパッケージ (SiP) といった先進的なパッケージ技術へと移行する中で、高精度な位置合わせと寸法計測の必要性は一層高まっています。多層構造デバイスでは、各層の厚み・位置・整合性を干渉計で確認することが効率と機能性に直結するためです。

さらに、新たな半導体材料、プロセス、アーキテクチャが次々と登場する中で、干渉計メーカーは半導体業界との協業を通じて技術革新を進め、システム機能を継続的に進化させています。この相乗効果により、進化し続ける生産課題に対応する、オーダーメイドの計測ソリューションの創造が可能になります。レーザー干渉計の非接触・高分解能測定能力は、半導体の品質を保証し、次世代エレクトロニクス開発を推進し、世界のレーザー干渉計市場の成長を促進するために不可欠なツールとして位置づけられています。

"ヘテロダインの部門が2025年から2030年にかけて大きなシェアを占める見通し"

この理由は優れた測定精度と多用途性にあります。ヘテロダイン干渉計は、高解像度の変位・速度測定を実現し、航空宇宙、自動車、半導体、精密工学などの産業で不可欠なツールです。特に、位相ノイズの低減やリアルタイムでの安定したデータ取得能力が、ウエハ露光装置の位置合わせやMEMS試験といった超高精度を要する環境で重視されています。製造業では、工作機械のキャリブレーション、ロボットのアライメント、動的振動解析などにも活用が拡大しており、生産性向上と誤差低減に貢献しています。また、ナノテクノロジーや微細部品の活用拡大により、サブナノメートルスケールでの測定が可能なヘテロダイン干渉計の需要が増加しています。さらに、研究機関や大学でも、光学実験や材料研究への導入が進んでいます。レーザーの安定性の向上と小型・低コスト化の進展も普及を後押ししており、今後、高精度化、高自動化、高信頼性を求める産業において、ヘテロダイン方式は引き続き主流の地位を維持するとみられます。

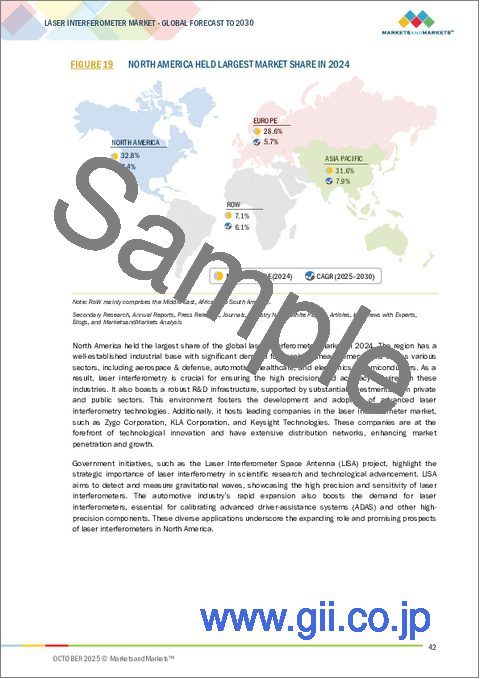

"北米地域が2024年に最大シェアを占める"

この背景には、先進製造業の集積、高い研究開発投資、精密測定技術の広範な採用があります。この地域の優位性は主に、航空宇宙、自動車、半導体、医療といった分野でのリーダーシップによるものであり、これらの産業では高精度な検査・試験装置が不可欠です。米国の半導体メーカーや大手航空宇宙企業は、厳格な品質・性能基準を満たすため、干渉計ソリューションの早期導入者として知られています。また、電気自動車 (EV) や自動運転技術への需要拡大により、キャリブレーション、部品試験、表面トポロジー測定といった用途でレーザー干渉計のニーズが一段と高まっています。北米には技術プロバイダーや研究機関の強力なエコシステムが存在し、干渉計技術の継続的な革新を促進しています。さらに、政府による先進製造イニシアティブや計測および産業オートメーションへの投資も市場成長を後押ししています。加えて、光学・レーザーシステム分野の世界的リーダー企業が米国に拠点を置いていることも、供給体制と技術発展を強化する要因です。こうした革新力、強固な産業基盤、早期導入の文化により、北米は2024年もレーザー干渉計市場の首位のポジションを維持しました。

当レポートでは、世界のレーザー干渉計の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 顧客の事業に影響を与える動向/混乱

- 価格分析

- 技術分析

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 2025-2026年の主な会議とイベント

- 関税と規制状況

- AI/生成AIがレーザー干渉計市場に与える影響

- 2025年の米国関税がレーザー干渉計市場に与える影響

第6章 レーザー干渉計のコンポーネント

- レーザー光源

- 光検出器

- 光学素子

- 制御システム

- ソフトウェア

第7章 レーザー干渉計の測定技術

- 位相測定

- 周波数測定

- 振幅測定

- 飛行時間測定

第8章 レーザー干渉計の設計

- ベンチトップシステム

- ポータブル/ハンドヘルドシステム

- インライン/プロセスシステム

- モジュラーシステム

- 飛行時間型システム

第9章 レーザー干渉計市場:タイプ別

- マイケルソン干渉計

- ファブリペロー干渉計

- フィゾー干渉計

- マッハツェンダー干渉計

- サニャック干渉計

- トゥイマングリーン干渉

第10章 レーザー干渉計市場:技術別

- ホモダイン

- ヘテロダイン

第11章 レーザー干渉計市場:用途別

- 表面トポロジー

- エンジニアリング

- 応用科学

- バイオメディカル

- 半導体検出

第12章 レーザー干渉計市場:産業別

- 自動車

- 航空宇宙・防衛

- 工業

- 医療

- エレクトロニクス・半導体

- 電気通信

第13章 レーザー干渉計市場:地域別

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- アジア太平洋地域のマクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第14章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- 製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- RENISHAW PLC

- KEYSIGHT TECHNOLOGIES

- ZEISS GROUP

- ZYGO CORPORATION

- BRUKER

- MAHR GMBH

- MOLLER-WEDEL OPTICAL GMBH

- QED TECHNOLOGIES

- SIOS MEBTECHNIK GMBH

- TOSEI ENGINEERING CORP.

- AUTOMATED PRECISION INC (API)

- その他の企業

- PRATT AND WHITNEY MEASUREMENT SYSTEMS, INC.

- SMARACT GMBH

- LASERTEX

- LUNA

- 4D TECHNOLOGY CORP.

- APRE INSTRUMENTS

- ADLOPTICA OPTICAL SYSTEMS GMBH

- LOGITECH

- HOLMARC OPTO-MECHATRONICS LTD.

- ATTOCUBE SYSTEMS GMBH

- HIGHFINESSE GMBH

- XONOX TECHNOLOGY GMBH

- THORLABS, INC.

- LASERTEC CORPORATION

- FUJIFILM HOLDINGS CORPORATION

- OLYMPUS CORPORATION