|

|

市場調査レポート

商品コード

1652655

両面受光型太陽電池市場:発電容量別、タイプ別、パネルタイプ別、フレームタイプ別、セル技術別、用途別、地域別 - 2029年までの予測Bifacial Solar Market by Type, Frame Type, Cell Technology, Application - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 両面受光型太陽電池市場:発電容量別、タイプ別、パネルタイプ別、フレームタイプ別、セル技術別、用途別、地域別 - 2029年までの予測 |

|

出版日: 2025年02月14日

発行: MarketsandMarkets

ページ情報: 英文 337 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の両面受光型太陽電池の市場規模は、2024年の185億米ドルから2029年には376億米ドルに成長すると予測されており、予測期間中のCAGRは15.2%になると見込まれています。

両面受光型ソーラーパネルは、さまざまな世界市場でグリッド・パリティを達成しつつあり、従来型エネルギー源の有力な競争相手として位置づけられています。このパリティは、生産コストを大幅に引き下げた技術や製造効率の進歩によってもたらされています。政府による支援政策やインセンティブと相まって、これらのパネルは双方からのエネルギー捕捉を強化するだけでなく、全体的な経済性の向上も実現しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 対象台数 | 金額(100万米ドル)/数量(台) |

| セグメント別 | 発電容量別、タイプ別、パネルタイプ別、フレームタイプ別、セル技術別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

セル技術別では、両面受光型太陽電池市場はPERC(Passivated Emitter Rear Contact)、TOPCon、HJT(Heterojunction)に区分されます。予測期間中、PERC(Passivated Emitter Rear Contact)セグメントが最大セグメントになると予想されます。PERCセルは、ハーフカットセルやマルチバスバー設計といった最先端の進歩と強固な互換性を示し、パネル全体の性能を大幅に増幅します。この相乗効果により、エネルギー生成効率と耐久性が向上し、従来型と二面型ソーラーパネル構成の両方で太陽光の利用が最適化されます。この統合は、出力を高めるだけでなく、太陽エネルギーシステムの拡張性とコスト効率にも貢献し、PERC技術が進化する太陽電池市場において極めて重要な原動力となっていることを裏付けています。

両面受光型太陽電池市場は、タイプ別にガラスバックシートとデュアルガラスに区分されます。予測期間中、ガラスバックシート分野は同市場の2番目に大きな分野になると予想されます。メーカーがガラスバックシート材料のラミネーションや二面セル技術の応用などのプロセスを改良するにつれて、生産効率は向上します。こうした進歩は、二面パネルの全体的な性能と耐久性を高めるだけでなく、長期的には大幅なコスト削減にも寄与します。さらに、材料科学と工学の革新は、ガラス・バックシート・パネルの信頼性と寿命を向上させ、メンテナンスコストを削減し、全体的な耐用年数を向上させることにより、コスト削減に貢献します。このようなコスト削減努力は、規制の枠組みや再生可能エネルギー技術に対する投資家の信頼の高まりと相まって、住宅用と公共施設用の両面でガラスバックシート両面受光型ソーラーパネルの普及に有利な環境となっています。

アジア太平洋は、予測期間中、両面受光型太陽電池市場で最大の地域になると予想されます。系統連系機能の強化と系統安定性の向上は、アジア太平洋地域全体で両面受光型ソーラープロジェクトを展開する実現可能性と魅力を高めている極めて重要な要因です。この地域の国々が再生可能エネルギー容量を拡大し続けているため、既存の送電網への両面受光型太陽光発電の統合はますますシームレスになっています。この進歩は、電力供給の信頼性を支えるだけでなく、変動する再生可能エネルギーの効率的な管理を促進します。さらに、地域の気候条件やエネルギー消費パターンに合わせた送電網技術の進歩は、両面受光型太陽光発電設備の性能をさらに最適化し、アジア太平洋地域における持続可能なエネルギー・ソリューションとしての普及を促進しています。

当レポートでは、世界の両面受光型太陽電池市場について調査し、発電容量別、タイプ別、パネルタイプ別、フレームタイプ別、セル技術別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- サプライチェーン分析

- エコシステム分析

- 技術分析

- ケーススタディ分析

- 特許分析

- 貿易分析

- 主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 投資と資金調達のシナリオ

第6章 両面受光型太陽電池市場、発電容量別

- イントロダクション

- 200 WP未満

- 200~400 WP

- 400 WP以上

第7章 両面受光型太陽電池市場、タイプ別

- イントロダクション

- デュアルガラス型

- ガラスバックシート型

第8章 両面受光型太陽電池市場、パネルタイプ別

- イントロダクション

- 単結晶

- 多結晶

第9章 両面受光型太陽電池市場、フレームタイプ別

- イントロダクション

- フレーム付き

- フレームレス

第10章 両面受光型太陽電池市場、セル技術別

- イントロダクション

- パッシベートエミッタとリアコンタクト(PERC)

- ヘテロ接合(HJT)

- TOPCON

- その他

第11章 両面受光型太陽電池市場、用途別

- イントロダクション

- 住宅

- 商業・工業

- ユーティリティ

第12章 両面受光型太陽電池市場、地域別

- イントロダクション

- アジア太平洋

- 景気後退の影響:アジア太平洋

- タイプ別

- フレームタイプ別

- セル技術別

- 用途別

- 国別

- 北米

- 景気後退の影響:北米

- タイプ別

- フレームタイプ別

- セル技術別

- 用途別

- 国別

- 欧州

- 景気後退の影響:欧州

- タイプ別

- フレームタイプ別

- セル技術別

- 用途別

- 国別

- その他の地域

- 景気後退の影響:北米

- タイプ別

- フレームタイプ別

- セル技術別

- 用途別

- 国別

第13章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 市場シェア分析

- 市場評価フレームワーク

- 主要市場参入企業のセグメント収益分析

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオと動向

第14章 企業プロファイル

- 主要参入企業

- LONGI

- CANADIAN SOLAR

- TRINASOLAR

- SHARP CORPORATION

- JA SOLAR TECHNOLOGY CO., LTD.

- JINKO SOLAR

- ADANI GROUP

- FIRST SOLAR

- RENEWSYS INDIA PVT. LTD.

- HANWHA QCELLS

- TALESUN SOLAR CO., LTD.

- HD HYUNDAI ENERGY SOLUTIONS., LTD.

- CHINT GROUP

- SOLAREDGE

- TATA POWER SOLAR SYSTEMS LTD.

- その他の企業

- ZNSHINE PV-TECH CO., LTD.

- YINGLI SOLAR

- WUXI SUNTECH POWER CO., LTD.

- CROSSROADS SOLAR

- SEG SOLAR

- NEOSUN INC.

- AUXIN SOLAR INC.

- SOLITEK

- SAATVIK SOLAR

- SILFAB SOLAR INC.

第15章 付録

List of Tables

- TABLE 1 BIFACIAL SOLAR MARKET SNAPSHOT

- TABLE 2 AVERAGE PRICE TREND OF BIFACIAL SOLAR, BY REGION, 2023-2029 (USD/WP)

- TABLE 3 INDICATIVE PRICE TREND OF BIFACIAL SOLAR, BY CELL TECHNOLOGY, 2023-2029 (USD/WP)

- TABLE 4 BIFACIAL SOLAR MARKET: COMPANIES AND THEIR ROLES IN ECOSYSTEM

- TABLE 5 BIFACIAL SOLAR MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2020-2024

- TABLE 6 EXPORT DATA FOR HS CODE 854143, BY COUNTRY, 2022-2023 (USD THOUSAND)

- TABLE 7 IMPORT SCENARIO FOR HS CODE 854143, BY COUNTRY, 2022-2023 (USD THOUSAND)

- TABLE 8 EXPORT DATA FOR HS CODE 854142, BY COUNTRY, 2022-2023 (USD THOUSAND)

- TABLE 9 IMPORT SCENARIO FOR HS CODE 854142, BY COUNTRY, 2022-2023 (USD THOUSAND)

- TABLE 10 BIFACIAL SOLAR MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 BIFACIAL SOLAR MARKET: REGULATIONS

- TABLE 16 BIFACIAL SOLAR MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TYPE

- TABLE 18 KEY BUYING CRITERIA IN TOP 3 APPLICATIONS

- TABLE 19 COMPANIES OFFERING BIFACIAL MODULES UP TO 200 WP

- TABLE 20 COMPANIES OFFERING 200-400 WP BIFACIAL MODULES

- TABLE 21 COMPANIES OFFERING ABOVE 400 WP BIFACIAL MODULES

- TABLE 22 BIFACIAL SOLAR MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 23 BIFACIAL SOLAR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 24 DUAL-GLASS BIFACIAL SOLAR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 25 DUAL-GLASS BIFACIAL SOLAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 26 GLASS-BACKSHEET BIFACIAL SOLAR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 27 GLASS-BACKSHEET BIFACIAL SOLAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 28 BIFACIAL SOLAR MARKET, BY FRAME TYPE, 2019-2023 (USD MILLION)

- TABLE 29 BIFACIAL SOLAR MARKET, BY FRAME TYPE, 2024-2029 (USD MILLION)

- TABLE 30 FRAMED BIFACIAL SOLAR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 31 FRAMED BIFACIAL SOLAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 32 FRAMELESS BIFACIAL SOLAR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 33 FRAMELESS BIFACIAL SOLAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 34 BIFACIAL SOLAR MARKET, BY CELL TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 35 BIFACIAL SOLAR MARKET, BY CELL TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 36 PASSIVATED EMITTER AND REAR CELL (PERC): BIFACIAL SOLAR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 37 PASSIVATED EMITTER AND REAR CELL (PERC): BIFACIAL SOLAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 38 HETEROJUNCTION (HJT): BIFACIAL SOLAR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 39 HETEROJUNCTION (HJT): BIFACIAL SOLAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 40 TOPCON: BIFACIAL SOLAR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 41 TOPCON: BIFACIAL SOLAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 42 BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 43 BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 44 RESIDENTIAL: BIFACIAL SOLAR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 45 RESIDENTIAL: BIFACIAL SOLAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 46 COMMERCIAL & INDUSTRIAL: BIFACIAL SOLAR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 47 COMMERCIAL & INDUSTRIAL: BIFACIAL SOLAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 48 UTILITIES: BIFACIAL SOLAR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 49 UTILITIES: BIFACIAL SOLAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 50 BIFACIAL SOLAR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 51 BIFACIAL SOLAR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 BIFACIAL SOLAR MARKET, BY REGION, 2019-2023 (MW)

- TABLE 53 BIFACIAL SOLAR MARKET, BY REGION, 2024-2029 (MW)

- TABLE 54 ASIA PACIFIC: BIFACIAL SOLAR MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 55 ASIA PACIFIC: BIFACIAL SOLAR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 56 ASIA PACIFIC: BIFACIAL SOLAR MARKET, BY FRAME TYPE, 2019-2023 (USD MILLION)

- TABLE 57 ASIA PACIFIC: BIFACIAL SOLAR MARKET, BY FRAME TYPE, 2024-2029 (USD MILLION)

- TABLE 58 ASIA PACIFIC: BIFACIAL SOLAR MARKET, BY CELL TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 59 ASIA PACIFIC: BIFACIAL SOLAR MARKET, BY CELL TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 60 ASIA PACIFIC: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 61 ASIA PACIFIC: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 62 ASIA PACIFIC: BIFACIAL SOLAR MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 63 ASIA PACIFIC: BIFACIAL SOLAR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 64 ASIA PACIFIC: BIFACIAL SOLAR MARKET, BY COUNTRY, 2019-2023 (MW)

- TABLE 65 ASIA PACIFIC: BIFACIAL SOLAR MARKET, BY COUNTRY, 2024-2029 (MW)

- TABLE 66 CHINA: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 67 CHINA: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 68 JAPAN: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 69 JAPAN: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 70 SOUTH KOREA: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 71 SOUTH KOREA: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 72 AUSTRALIA: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 73 AUSTRALIA: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 74 INDIA: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 75 INDIA: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 76 REST OF ASIA PACIFIC: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 78 NORTH AMERICA: BIFACIAL SOLAR MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 79 NORTH AMERICA: BIFACIAL SOLAR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 80 NORTH AMERICA: BIFACIAL SOLAR MARKET, BY FRAME TYPE, 2019-2023 (USD MILLION)

- TABLE 81 NORTH AMERICA: BIFACIAL SOLAR MARKET, BY FRAME TYPE, 2024-2029 (USD MILLION)

- TABLE 82 NORTH AMERICA: BIFACIAL SOLAR MARKET, BY CELL TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 83 NORTH AMERICA: BIFACIAL SOLAR MARKET, BY CELL TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 84 NORTH AMERICA: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 85 NORTH AMERICA: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 86 NORTH AMERICA: BIFACIAL SOLAR MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 87 NORTH AMERICA: BIFACIAL SOLAR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 88 NORTH AMERICA: BIFACIAL SOLAR MARKET, BY COUNTRY, 2019-2023 (MW)

- TABLE 89 NORTH AMERICA: BIFACIAL SOLAR MARKET, BY COUNTRY, 2024-2029 (MW)

- TABLE 90 US: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 91 US: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 92 CANADA: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 93 CANADA: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 94 MEXICO: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 95 MEXICO: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 96 EUROPE: BIFACIAL SOLAR MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 97 EUROPE: BIFACIAL SOLAR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 98 EUROPE: BIFACIAL SOLAR MARKET, BY FRAME TYPE, 2019-2023 (USD MILLION)

- TABLE 99 EUROPE: BIFACIAL SOLAR MARKET, BY FRAME TYPE, 2024-2029 (USD MILLION)

- TABLE 100 EUROPE: BIFACIAL SOLAR MARKET, BY CELL TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 101 EUROPE: BIFACIAL SOLAR MARKET, BY CELL TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 102 EUROPE: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 103 EUROPE: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 104 EUROPE: BIFACIAL SOLAR MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 105 EUROPE: BIFACIAL SOLAR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 106 EUROPE: BIFACIAL SOLAR MARKET, BY COUNTRY, 2019-2023 (MW)

- TABLE 107 EUROPE: BIFACIAL SOLAR MARKET, BY COUNTRY, 2024-2029 (MW)

- TABLE 108 GERMANY: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 109 GERMANY: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 110 ITALY: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 111 ITALY: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 112 NETHERLANDS: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 113 NETHERLANDS: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 114 SPAIN: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 115 SPAIN: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 116 FRANCE: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 117 FRANCE: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 118 REST OF EUROPE: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 119 REST OF EUROPE: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 120 REST OF THE WORLD: BIFACIAL SOLAR MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 121 REST OF THE WORLD: BIFACIAL SOLAR MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 122 REST OF THE WORLD: BIFACIAL SOLAR MARKET, BY FRAME TYPE, 2019-2023 (USD MILLION)

- TABLE 123 REST OF THE WORLD: BIFACIAL SOLAR MARKET, BY FRAME TYPE, 2024-2029 (USD MILLION)

- TABLE 124 REST OF THE WORLD: BIFACIAL SOLAR MARKET, BY CELL TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 125 REST OF THE WORLD: BIFACIAL SOLAR MARKET, BY CELL TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 126 REST OF THE WORLD: BIFACIAL SOLAR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 127 REST OF THE WORLD: BIFACIAL SOLAR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 128 REST OF THE WORLD: BIFACIAL SOLAR MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 129 REST OF THE WORLD: BIFACIAL SOLAR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 130 REST OF THE WORLD: BIFACIAL SOLAR MARKET, BY COUNTRY, 2019-2023 (MW)

- TABLE 131 REST OF THE WORLD: BIFACIAL SOLAR MARKET, BY COUNTRY, 2024-2029 (MW)

- TABLE 132 BIFACIAL SOLAR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2019-2024

- TABLE 133 BIFACIAL SOLAR MARKET: DEGREE OF COMPETITION, 2023

- TABLE 134 MARKET EVALUATION FRAMEWORK, 2019-2023

- TABLE 135 BIFACIAL SOLAR MARKET: REGIONAL FOOTPRINT, 2023

- TABLE 136 BIFACIAL SOLAR MARKET: TYPE FOOTPRINT, 2023

- TABLE 137 BIFACIAL SOLAR MARKET: FRAME TYPE FOOTPRINT, 2023

- TABLE 138 BIFACIAL SOLAR MARKET: CELL TECHNOLOGY FOOTPRINT

- TABLE 139 BIFACIAL SOLAR MARKET: PANEL TYPE FOOTPRINT

- TABLE 140 BIFACIAL SOLAR MARKET: APPLICATION FOOTPRINT

- TABLE 141 BIFACIAL SOLAR MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 142 BIFACIAL SOLAR MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 143 BIFACIAL SOLAR MARKET: PRODUCT LAUNCHES, JANUARY 2019- DECEMBER 2024

- TABLE 144 BIFACIAL SOLAR MARKET: DEALS, JANUARY 2019-DECEMBER 2024

- TABLE 145 BIFACIAL SOLAR MARKET: EXPANSIONS, JANUARY 2019-DECEMBER 2024

- TABLE 146 BIFACIAL SOLAR MARKET: OTHERS, JANUARY 2019-DECEMBER 2024

- TABLE 147 LONGI: COMPANY OVERVIEW

- TABLE 148 LONGI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 LONGI: PRODUCT LAUNCHES

- TABLE 150 LONGI: DEALS

- TABLE 151 LONGI: OTHER DEVELOPMENTS

- TABLE 152 CANADIAN SOLAR: COMPANY OVERVIEW

- TABLE 153 CANADIAN SOLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 CANADIAN SOLAR: PRODUCT LAUNCHES

- TABLE 155 CANADIAN SOLAR: DEALS

- TABLE 156 CANADIAN SOLAR: EXPANSIONS

- TABLE 157 CANADIAN SOLAR: OTHER DEVELOPMENTS

- TABLE 158 TRINASOLAR: COMPANY OVERVIEW

- TABLE 159 TRINASOLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 TRINASOLAR: PRODUCT LAUNCHES

- TABLE 161 TRINASOLAR: DEALS

- TABLE 162 TRINASOLAR: EXPANSIONS

- TABLE 163 TRINASOLAR: OTHER DEVELOPMENTS

- TABLE 164 SHARP CORPORATION: COMPANY OVERVIEW

- TABLE 165 SHARP CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 SHARP CORPORATION: PRODUCT LAUNCHES

- TABLE 167 SHARP CORPORATION: DEALS

- TABLE 168 SHARP CORPORATION: OTHER DEVELOPMENTS

- TABLE 169 JA SOLAR TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 170 JA SOLAR TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 JA SOLAR TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 172 JA SOLAR TECHNOLOGY CO., LTD.: DEALS

- TABLE 173 JA SOLAR TECHNOLOGY CO., LTD.: OTHER DEVELOPMENTS

- TABLE 174 JINKO SOLAR: COMPANY OVERVIEW

- TABLE 175 JINKO SOLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 JINKO SOLAR: PRODUCT LAUNCHES

- TABLE 177 JINKO SOLAR: DEALS

- TABLE 178 JINKO SOLAR: EXPANSIONS

- TABLE 179 JINKO SOLAR: OTHER DEVELOPMENTS

- TABLE 180 ADANI GROUP: COMPANY OVERVIEW

- TABLE 181 ADANI GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 ADANI GROUP: PRODUCT LAUNCHES

- TABLE 183 ADANI GROUP: DEALS

- TABLE 184 FIRST SOLAR: COMPANY OVERVIEW

- TABLE 185 FIRST SOLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 FIRST SOLAR: DEALS

- TABLE 187 FIRST SOLAR: EXPANSIONS

- TABLE 188 FIRST SOLAR: OTHER DEVELOPMENTS

- TABLE 189 RENEWSYS INDIA PVT. LTD.: BUSINESS OVERVIEW

- TABLE 190 RENEWSYS INDIA PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 RENEWSYS INDIA PVT. LTD.: PRODUCT LAUNCHES

- TABLE 192 RENEWSYS INDIA PVT. LTD.: DEALS

- TABLE 193 RENEWSYS INDIA PVT. LTD.: EXPANSIONS

- TABLE 194 HANWHA QCELLS: COMPANY OVERVIEW

- TABLE 195 HANWHA QCELLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 HANWHA QCELLS: DEALS

- TABLE 197 HANWHA QCELLS: EXPANSIONS

- TABLE 198 HANWHA QCELLS: OTHER DEVELOPMENTS

- TABLE 199 TALESUN SOLAR CO., LTD.: COMPANY OVERVIEW

- TABLE 200 TALESUN SOLAR CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 TALESUN SOLAR CO., LTD.: DEALS

- TABLE 202 TALESUN SOLAR CO., LTD.: EXPANSIONS

- TABLE 203 TALESUN SOLAR CO., LTD.: OTHER DEVELOPMENTS

- TABLE 204 HD HYUNDAI ENERGY SOLUTIONS., LTD.: COMPANY OVERVIEW

- TABLE 205 HYUNDAI ENERGY SOLUTIONS., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 HD HYUNDAI ENERGY SSOLUTIONS., LTD.: EXPANSIONS

- TABLE 207 CHINT GROUP: COMPANY OVERVIEW

- TABLE 208 CHINT GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 CHINT GROUP: DEALS

- TABLE 210 CHINT GROUP: OTHER DEVELOPMENTS

- TABLE 211 SOLAREDGE: COMPANY OVERVIEW

- TABLE 212 SOLAREDGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 TATA POWER SOLAR SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 214 TATA POWER SOLAR SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 TATA POWER SOLAR SYSTEMS LTD.: PRODUCT LAUNCHES

- TABLE 216 TATA POWER SOLAR SYSTEMS LTD.: DEALS

- TABLE 217 TATA POWER SOLAR SYSTEMS LTD.: EXPANSIONS

- TABLE 218 TATA POWER SOLAR SYSTEMS LTD.: OTHER DEVELOPMENTS

List of Figures

- FIGURE 1 BIFACIAL SOLAR MARKET: RESEARCH DESIGN

- FIGURE 2 BIFACIAL SOLAR MARKET: DATA TRIANGULATION

- FIGURE 3 BIFACIAL SOLAR MARKET: BOTTOM-UP APPROACH

- FIGURE 4 BIFACIAL SOLAR MARKET: TOP-DOWN APPROACH

- FIGURE 5 BIFACIAL SOLAR MARKET: DEMAND-SIDE ANALYSIS

- FIGURE 6 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF BIFACIAL SOLAR PANELS

- FIGURE 7 BIFACIAL SOLAR MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SHARE ANALYSIS OF BIFACIAL SOLAR MARKET, 2023

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE IN BIFACIAL SOLAR MARKET IN 2023

- FIGURE 10 DUAL-GLASS SEGMENT TO LEAD BIFACIAL SOLAR MARKET DURING FORECAST PERIOD

- FIGURE 11 FRAMED SEGMENT TO REGISTER HIGHER GROWTH IN BIFACIAL SOLAR MARKET DURING FORECAST PERIOD

- FIGURE 12 PASSIVATED EMITTER REAR CONTACT (PERC) SEGMENT TO DOMINATE BIFACIAL SOLAR MARKET

- FIGURE 13 UTILITIES SEGMENT TO BE LARGEST APPLICATION OF BIFACIAL SOLAR DURING FORECAST PERIOD

- FIGURE 14 DECREASING COST OF SOLAR SYSTEMS TO BOOST MARKET GROWTH BETWEEN 2023 AND 2029

- FIGURE 15 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 DUAL-GLASS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE

- FIGURE 17 FRAMED SEGMENT TO ACCOUNT FOR DOMINANT SHARE DURING FORECAST PERIOD

- FIGURE 18 PASSIVATED EMITTER REAR CONTACT (PERC) SEGMENT TO ACCOUNT FOR LARGEST SHARE IN BIFACIAL SOLAR MARKET

- FIGURE 19 UTILITIES SEGMENT TO BE LARGEST APPLICATION OF BIFACIAL SOLAR

- FIGURE 20 BIFACIAL SOLAR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 REMUNERATION SETTINGS FOR UTILITY-SCALE RENEWABLE PROJECTS

- FIGURE 22 RENEWABLE ELECTRICITY CAPACITY ADDITION

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 AVERAGE PRICE TREND OF BIFACIAL SOLAR, BY REGION, 2023-2029 (USD/WP)

- FIGURE 25 INDICATIVE PRICE TREND OF BIFACIAL SOLAR, BY CELL TECHNOLOGY, 2023-2029 (USD/WP)

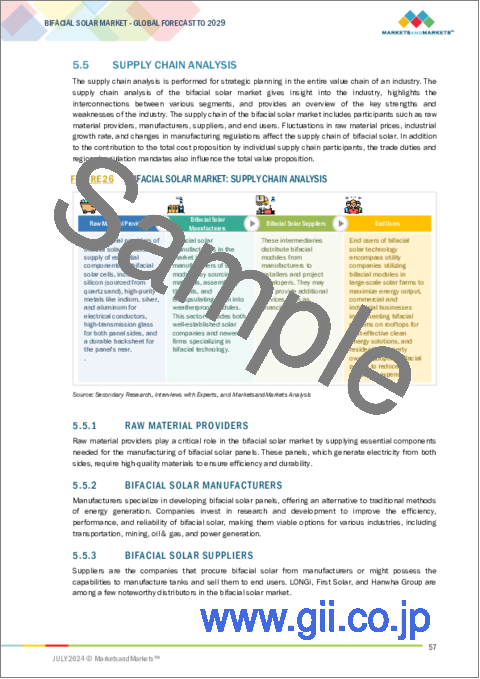

- FIGURE 26 BIFACIAL SOLAR MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 ECOSYSTEM MAP

- FIGURE 28 BIFACIAL SOLAR MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2014-2024

- FIGURE 29 EXPORT DATA FOR HS CODE 854143 FOR TOP FIVE COUNTRIES, 2022-2023 (USD THOUSAND)

- FIGURE 30 IMPORT DATA FOR HS CODE 854143 FOR TOP FIVE COUNTRIES, 2022-2023 (USD THOUSAND)

- FIGURE 31 EXPORT DATA FOR HS CODE 854142 FOR TOP FIVE COUNTRIES, 2022-2023 (USD THOUSAND)

- FIGURE 32 IMPORT DATA FOR HS CODE 854142 FOR TOP FIVE COUNTRIES, 2022-2023 (USD THOUSAND)

- FIGURE 33 BIFACIAL SOLAR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS, BY TYPE

- FIGURE 35 KEY BUYING CRITERIA FOR BIFACIAL SOLAR

- FIGURE 36 INVESTMENT AND FUNDING SCENARIO (USD MILLION)

- FIGURE 37 BIFACIAL SOLAR MARKET, BY TYPE, 2023

- FIGURE 38 BIFACIAL SOLAR MARKET, BY FRAME TYPE (2023)

- FIGURE 39 BIFACIAL SOLAR MARKET, BY CELL TECHNOLOGY (2023)

- FIGURE 40 BIFACIAL SOLAR MARKET, BY APPLICATION (2023)

- FIGURE 41 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN BIFACIAL SOLAR MARKET DURING FORECAST PERIOD

- FIGURE 42 BIFACIAL SOLAR MARKET SHARE, BY REGION (2023)

- FIGURE 43 ASIA PACIFIC: BIFACIAL SOLAR MARKET SNAPSHOT

- FIGURE 44 NORTH AMERICA: BIFACIAL SOLAR MARKET SNAPSHOT

- FIGURE 45 BIFACIAL SOLAR MARKET SHARE ANALYSIS, 2023

- FIGURE 46 BIFACIAL SOLAR MARKET: SEGMENTAL REVENUE ANALYSIS, 2019-2023

- FIGURE 47 BIFACIAL SOLAR MARKET: COMPANY VALUATION, 2024

- FIGURE 48 BIFACIAL SOLAR MARKET: FINANCIAL METRICS, 2024

- FIGURE 49 BIFACIAL SOLAR MARKET: COMPARATIVE ANALYSIS OF BRAND/PRODUCT

- FIGURE 50 BIFACIAL SOLAR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 51 BIFACIAL SOLAR MARKET: PRODUCT FOOTPRINT, 2023

- FIGURE 52 BIFACIAL SOLAR MARKET: MARKET FOOTPRINT, 2023

- FIGURE 53 BIFACIAL SOLAR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 54 LONGI: COMPANY SNAPSHOT

- FIGURE 55 CANDIAN SOLAR: COMPANY SNAPSHOT

- FIGURE 56 TRINASOLAR: COMPANY SNAPSHOT

- FIGURE 57 SHARP CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 JA SOLAR TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 59 JINKO SOLAR: COMPANY SNAPSHOT

- FIGURE 60 ADANI GROUP: COMPANY SNAPSHOT

- FIGURE 61 FIRST SOLAR: COMPANY SNAPSHOT

- FIGURE 62 SOLAR EDGE: COMPANY SNAPSHOT

The global bifacial solar market is estimated to grow from USD 18.5 billion in 2024 to USD 37.6 billion by 2029; it is expected to record a CAGR of 15.2% during the forecast period. Bifacial solar panels are increasingly achieving grid parity across various global markets, positioning them as viable competitors to conventional energy sources. This parity is driven by advancements in technology and manufacturing efficiencies, which have lowered production costs significantly. Coupled with supportive policies and incentives from governments, these panels offer not only enhanced energy capture from both sides but also improved overall economic feasibility.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million)/ Volume (Units) |

| Segments | Bifacial Solar Market by type, frame type, cell technology, application and region. |

| Regions covered | North America, Europe, Asia Pacific, and RoW. |

"Passivated Emitter Rear Contact (PERC)": The largest segment of the bifacial solar market, by cell technology"

Based on cell technology, the bifacial solar market has been segmented into Passivated Emitter Rear Contact (PERC), TOPCon, and Heterojunction (HJT). The Passivated Emitter Rear Contact (PERC) segment is expected to be the largest segment during the forecast period. PERC cells demonstrate robust compatibility with cutting-edge advancements such as half-cut cells and multi-busbar designs, significantly amplifying overall panel performance. This synergy enhances energy generation efficiency and durability, optimizing the utilization of sunlight in both conventional and bifacial solar panel configurations. This integration not only boosts power output but also contributes to the scalability and cost-effectiveness of solar energy systems, reinforcing PERC technology's position as a pivotal driver in the evolving solar market landscape.

"By type, the Glass-backsheet Bifacial Solar segment is expected to be the second largest segment during the forecast period."

Based on type, the bifacial solar market is segmented into glass-backsheet bifacial solar, and dual-glass bifacial solar. The glass-backsheet bifacial solar segment is expected to be the second largest segment of the bifacial solar market during the forecast period. As manufacturers refine their processes, such as the lamination of glass backsheet materials and the application of bifacial cell technology, production efficiencies improve. These advancements not only enhance the overall performance and durability of bifacial panels but also contribute to significant cost reductions over time. Moreover, innovations in materials science and engineering contribute to cost savings by improving the reliability and longevity of glass-backsheet panels, reducing maintenance costs and enhancing their overall lifetime value. Combined with supportive regulatory frameworks and increasing investor confidence in renewable energy technologies, these cost reduction efforts foster a favorable environment for the widespread adoption of glass-backsheet bifacial solar panels in both residential and utility-scale solar installations.

"Asia Pacific" is expected to be the largest region in the bifacial solar market."

Asia pacific is expected to be the largest region in the bifacial solar market during the forecast period. Enhanced grid integration capabilities and improved grid stability are pivotal factors bolstering the feasibility and attractiveness of deploying bifacial solar projects across the Asia-Pacific region. As countries in this region continue to expand their renewable energy capacities, the integration of bifacial solar into existing grids becomes increasingly seamless. This advancement not only supports the reliability of electricity supply but also facilitates the efficient management of fluctuating renewable energy sources. Furthermore, advancements in grid technology tailored to regional climatic conditions and energy consumption patterns further optimize the performance of bifacial solar installations, promoting their widespread adoption as a sustainable energy solution in the Asia-Pacific context.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 65%, Tier 2- 24%, and Tier 3- 11%

By Designation: C-Level- 30%, Director Level- 25%, and Others- 45%

By Region: North America- 10%, Europe- 25%, Asia Pacific- 35%, Middle East - 5%, Africa - 15%, South America - 10%

Note: Others include sales managers, engineers, and regional managers.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2022. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The bifacial solar market is dominated by a few major players that have a wide regional presence. The leading players in the bifacial solar market are LONGi (China), Trinasolar (China), Canadian Solar (Canada), JA SOLAR Technology Co., Ltd. (China), and SHARP CORPORATION (Japan). The major strategy adopted by the players includes new product launches, contracts, agreements, partnerships, joint ventures, acquisitions, and investments & expansions.

Research Coverage:

The report defines, describes, and forecasts the global bifacial solar Market based on type, frame type, cell technology, application, and region. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the bifacial solar market.

Key Benefits of Buying the Report

- Government initiatives at the national and international levels amplify the impact of investment on the bifacial solar market. Robust policy frameworks, often accompanied by financial incentives, subsidies, and regulatory support, encourage widespread adoption of bifacial solar. Factors such as high initial cost and lack of infrastructure restrain the growth of the market. The growing energy transition towards renewable energy sources and rapid urbanization are expected to present lucrative opportunities for the players operating in the bifacial solar.

- Product Development/ Innovation: The bifacial solar market is witnessing significant product development and innovation, driven by the growing demand for environmentally friendly, safe and sustainable products. Companies are investing in developing advanced bifacial solar for various applications.

- Market Development: Canadian Solar has announced a multi-year agreement with Lightsource BP to supply 1.2 GW of high-efficiency polycrystalline solar modules for projects in the US and Australia. The projects will utilize Canadian Solar's polycrystalline bifacial BiHiKu (CS3W-PB-AG) and HiKu (CS3W-P) modules. Canadian Solar, known globally for its solar cell and module innovations, specializes in bifacial modules that generate power from both the front and rear sides, increasing output compared to standard monofacial modules. The BiHiKu bifacial modules, noted for their high output, are expected to maximize power generation within limited plant areas.

- Market Diversification: Canadian Solar has announced the establishment of a new 5 GW solar PV cell manufacturing facility at the River Ridge Commerce Center in Jeffersonville, Indiana. This state-of-the-art plant will produce approximately 20,000 high-power modules daily, contributing significantly to solar energy production. Representing an investment exceeding $800 million, the facility is projected to generate about 1,200 skilled high-tech jobs once fully operational. The solar cells manufactured here will support Canadian Solar's module assembly plant in Mesquite, Texas, with production set to commence by the end of 2025.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, like include LONGi (China), Trinasolar (China), Canadian Solar (Canada), JA SOLAR Technology Co., Ltd. (China), and SHARP CORPORATION (Japan) among others in the bifacial solar market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 BIFACIAL SOLAR MARKET SEGMENTATION

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 SECONDARY AND PRIMARY RESEARCH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of major secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 List of primary interview participants

- 2.2.2.2 Key industry insights

- 2.2.2.3 Breakdown of primary interviews

- 2.2.2.4 Key data from primary sources

- 2.2.1 SECONDARY DATA

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Calculations for demand-side analysis

- 2.4.4 SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Assumptions for supply-side analysis

- 2.4.4.2 Calculations for supply-side analysis

- 2.5 GROWTH FORECAST ASSUMPTIONS

- 2.5.1 RESEARCH LIMITATIONS

- 2.5.2 RISK ASSESSMENT

- 2.5.3 IMPACT OF RECESSION ON BIFACIAL SOLAR MARKET

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BIFACIAL SOLAR MARKET

- 4.2 BIFACIAL SOLAR MARKET, BY REGION

- 4.3 BIFACIAL SOLAR MARKET, BY TYPE

- 4.4 BIFACIAL SOLAR MARKET, BY FRAME TYPE

- 4.5 BIFACIAL SOLAR MARKET, BY CELL TECHNOLOGY

- 4.6 BIFACIAL SOLAR MARKET, BY APPLICATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Declining costs of bifacial solar panels

- 5.2.1.2 Higher efficiency and durability

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complexity of installations

- 5.2.2.2 Dependence on albedo

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Government initiatives on bifacial solar technology

- 5.2.3.2 Emergence of advanced technologies such as TOPCon and IBC

- 5.2.4 CHALLENGES

- 5.2.4.1 Grid injection challenges

- 5.2.4.2 Competition from other energy sources

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE PRICE TREND OF BIFACIAL SOLAR, BY REGION

- 5.4.2 INDICATIVE PRICE TREND OF BIFACIAL SOLAR, BY CELL TECHNOLOGY

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL PROVIDERS

- 5.5.2 BIFACIAL SOLAR MANUFACTURERS

- 5.5.3 BIFACIAL SOLAR SUPPLIERS

- 5.5.4 END USERS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Monocrystalline

- 5.7.1.2 Polycrystalline

- 5.7.1.3 Nanocrystalline

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 P-Type solar panels

- 5.7.2.2 N-Type solar panels

- 5.7.2.3 P-N Type solar panels

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Monofacial solar panel

- 5.7.3.2 Perovskite solar cells

- 5.7.1 KEY TECHNOLOGIES

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 SHARP HELPED BIG C SUPERMARKET (THAILAND) IN INSTALLATION OF ROOFTOP SOLAR PANELS

- 5.8.2 HEWLETT PACKARD (HP) INSTALLED SOLAR PANELS ON ITS ROOFTOPS WITH HELP OF SHARP (JAPAN)

- 5.8.3 ASHOK TEXTILES' STRATEGIES FOR TERRAIN-DRIVEN EFFICIENCY

- 5.9 PATENT ANALYSIS

- 5.9.1 LIST OF MAJOR PATENTS

- 5.10 TRADE ANALYSIS

- 5.10.1 HS CODE 854143

- 5.10.1.1 Export scenario

- 5.10.1.2 Import scenario

- 5.10.2 HS CODE 854142

- 5.10.2.1 Export scenario

- 5.10.2.2 Import scenario

- 5.10.1 HS CODE 854143

- 5.11 KEY CONFERENCES AND EVENTS

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 BIFACIAL SOLAR MARKET: REGULATORY FRAMEWORK

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 INVESTMENT AND FUNDING SCENARIO

6 BIFACIAL SOLAR MARKET, BY POWER CAPACITY

- 6.1 INTRODUCTION

- 6.2 UPTO 200 WP

- 6.3 200-400 WP

- 6.4 ABOVE 400 WP

7 BIFACIAL SOLAR MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 DUAL-GLASS BIFACIAL SOLAR

- 7.2.1 ENHANCED DURABILITY TO DRIVE DEMAND FOR DUAL-GLASS SEGMENT

- 7.3 GLASS-BACKSHEET BIFACIAL SOLAR

- 7.3.1 GOVERNMENT POLICIES TO BOOST ADOPTION OF GLASS-BACKSHEET BIFACIAL SOLAR TECHNOLOGY

8 BIFACIAL SOLAR MARKET, BY PANEL TYPE

- 8.1 INTRODUCTION

- 8.2 MONOCRYSTALLINE

- 8.2.1 LONGEVITY AND EFFICIENCY OF MONOCRYSTALLINE SOLAR PANELS T0 DRIVE MARKET

- 8.3 POLYCRYSTALLINE

- 8.3.1 LOWERING INVESTMENT BARRIERS IN POLYSILICON MANUFACTURING TO FUEL MARKET GROWTH

9 BIFACIAL SOLAR MARKET, BY FRAME TYPE

- 9.1 INTRODUCTION

- 9.2 FRAMED BIFACIAL SOLAR

- 9.2.1 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR FRAMED BIFACIAL SOLAR

- 9.3 FRAMELESS BIFACIAL SOLAR

- 9.3.1 LOWER MAINTENANCE REQUIREMENTS IN EXTREME WEATHER CONDITIONS TO FUEL MARKET

10 BIFACIAL SOLAR MARKET, BY CELL TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 PASSIVATED EMITTER AND REAR CONTACT (PERC)

- 10.2.1 STRENGTHENING GRID STABILITY WITH COMMUNITY SOLAR AND PERC PANELS TO DRIVE MARKET

- 10.3 HETEROJUNCTION (HJT)

- 10.3.1 INNOVATIONS IN LID RESISTANCE WITH HJT SOLAR CELLS TO FUEL MARKET GROWTH

- 10.4 TOPCON

- 10.4.1 OPTIMAL PERFORMANCE OF TOPCON CELLS IN FREEZING CLIMATES TO SUPPORT MARKET GROWTH

- 10.5 OTHER CELL TECHNOLOGIES

- 10.5.1 PASSIVATED EMITTER REAR LOCALLY-DIFFUSED (PERL)

- 10.5.2 INTERDIGITATED BACK CONTACT (IBC)

- 10.5.3 PASSIVATED EMITTER REAR TOTALLY DIFFUSED (PERT)

11 BIFACIAL SOLAR MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 RESIDENTIAL

- 11.2.1 ASIA PACIFIC TO BE LARGEST MARKET FOR BIFACIAL SOLAR IN RESIDENTIAL SECTOR

- 11.3 COMMERCIAL & INDUSTRIAL

- 11.3.1 RISING ELECTRICITY COSTS AND SHIFT TOWARDS SOLAR POWER TECHNOLOGY TO FUEL MARKET

- 11.4 UTILITIES

- 11.4.1 ENVIRONMENTAL BENEFITS OF SOLAR POWER PLANTS TO SUPPORT MARKET GROWTH

12 BIFACIAL SOLAR MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 RECESSION IMPACT: ASIA PACIFIC

- 12.2.2 BY TYPE

- 12.2.3 BY FRAME TYPE

- 12.2.4 BY CELL TECHNOLOGY

- 12.2.5 BY APPLICATION

- 12.2.6 BY COUNTRY

- 12.2.6.1 China

- 12.2.6.1.1 China to remain dominant market in Asia Pacific

- 12.2.6.2 Japan

- 12.2.6.2.1 Government initiatives to drive market growth

- 12.2.6.3 South Korea

- 12.2.6.3.1 Utilities segment to be largest end user of bifacial solar

- 12.2.6.4 Australia

- 12.2.6.4.1 Commercial & industrial application to register highest CAGR during forecast period

- 12.2.6.5 India

- 12.2.6.5.1 Strong government initiatives for renewable energy to drive market

- 12.2.6.6 Rest of Asia Pacific

- 12.2.6.1 China

- 12.3 NORTH AMERICA

- 12.3.1 RECESSION IMPACT: NORTH AMERICA

- 12.3.2 BY TYPE

- 12.3.3 BY FRAME TYPE

- 12.3.4 BY CELL TECHNOLOGY

- 12.3.5 BY APPLICATION

- 12.3.6 BY COUNTRY

- 12.3.6.1 US

- 12.3.6.1.1 Federal policies boosting solar energy integration to support market growth

- 12.3.6.2 Canada

- 12.3.6.2.1 Canada to witness scalable production and innovation in solar modules

- 12.3.6.3 Mexico

- 12.3.6.3.1 Utilities segment to be largest end user of bifacial solar

- 12.3.6.1 US

- 12.4 EUROPE

- 12.4.1 RECESSION IMPACT: EUROPE

- 12.4.2 BY TYPE

- 12.4.3 BY FRAME TYPE

- 12.4.4 BY CELL TECHNOLOGY

- 12.4.5 BY APPLICATION

- 12.4.6 BY COUNTRY

- 12.4.6.1 Germany

- 12.4.6.1.1 Government initiatives to support market growth

- 12.4.6.2 Italy

- 12.4.6.2.1 Utilities to be fastest-growing application of bifacial solar in Italy

- 12.4.6.3 Netherlands

- 12.4.6.3.1 Investments and clean energy initiatives fueling market growth

- 12.4.6.4 Spain

- 12.4.6.4.1 Energy transformation targets to support market growth

- 12.4.6.5 France

- 12.4.6.5.1 Supportive legislation to drive market growth in France

- 12.4.6.6 Rest of Europe

- 12.4.6.1 Germany

- 12.5 REST OF THE WORLD

- 12.5.1 RECESSION IMPACT: NORTH AMERICA

- 12.5.2 BY TYPE

- 12.5.3 BY FRAME TYPE

- 12.5.4 BY CELL TECHNOLOGY

- 12.5.5 BY APPLICATION

- 12.5.6 BY COUNTRY

- 12.5.6.1 Middle East & Africa

- 12.5.6.1.1 Increased investments in renewable energy to drive market

- 12.5.6.2 South America

- 12.5.6.2.1 Brazil to be major driver of bifacial solar market in South America

- 12.5.6.1 Middle East & Africa

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.3 MARKET SHARE ANALYSIS

- 13.4 MARKET EVALUATION FRAMEWORK

- 13.5 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS

- 13.6 COMPANY VALUATION AND FINANCIAL METRICS

- 13.7 BRAND/PRODUCT COMPARISON

- 13.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.8.1 STARS

- 13.8.2 EMERGING LEADERS

- 13.8.3 PERVASIVE PLAYERS

- 13.8.4 PARTICIPANTS

- 13.8.5 COMPANY FOOTPRINT, KEY PLAYERS

- 13.8.5.1 Overall footprint

- 13.8.5.2 Region footprint

- 13.8.5.3 Type footprint

- 13.8.5.4 Frame type footprint

- 13.8.5.5 Cell technology footprint

- 13.8.5.6 Panel type footprint

- 13.8.5.7 Application footprint

- 13.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.9.1 PROGRESSIVE COMPANIES

- 13.9.2 RESPONSIVE COMPANIES

- 13.9.3 DYNAMIC COMPANIES

- 13.9.4 STARTING BLOCKS

- 13.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 13.9.5.1 List of key startups/SMEs

- 13.9.5.2 Competitive benchmarking of key startups/SMEs

- 13.10 COMPETITIVE SCENARIO AND TRENDS

- 13.10.1 PRODUCT LAUNCHES

- 13.10.2 DEALS

- 13.10.3 EXPANSIONS

- 13.10.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 LONGI

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Other developments

- 14.1.1.4 MnM View

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 CANADIAN SOLAR

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Expansions

- 14.1.2.3.4 Other developments

- 14.1.2.4 MnM View

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 TRINASOLAR

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.3.4 Other developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 SHARP CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Other developments

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 JA SOLAR TECHNOLOGY CO., LTD.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Other developments

- 14.1.5.4 MnM View

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 JINKO SOLAR

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Expansions

- 14.1.6.3.4 Other developments

- 14.1.7 ADANI GROUP

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.2.1 Product launches

- 14.1.7.2.2 Deals

- 14.1.8 FIRST SOLAR

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.3.2 Expansions

- 14.1.8.3.3 Other developments

- 14.1.9 RENEWSYS INDIA PVT. LTD.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Deals

- 14.1.9.3.3 Expansions

- 14.1.10 HANWHA QCELLS

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Services/Solutions offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Deals

- 14.1.10.3.2 Expansions

- 14.1.10.3.3 Other developments

- 14.1.11 TALESUN SOLAR CO., LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.3.2 Expansions

- 14.1.11.3.3 Other developments

- 14.1.12 HD HYUNDAI ENERGY SOLUTIONS., LTD.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Expansions

- 14.1.13 CHINT GROUP

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Services/Solutions offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.13.3.2 Other developments

- 14.1.14 SOLAREDGE

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Services/Solutions offered

- 14.1.15 TATA POWER SOLAR SYSTEMS LTD.

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Services/Solutions offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Product launches

- 14.1.15.3.2 Deals

- 14.1.15.3.3 Expansions

- 14.1.15.3.4 Other developments

- 14.1.1 LONGI

- 14.2 OTHER PLAYERS

- 14.2.1 ZNSHINE PV-TECH CO., LTD.

- 14.2.2 YINGLI SOLAR

- 14.2.3 WUXI SUNTECH POWER CO., LTD.

- 14.2.4 CROSSROADS SOLAR

- 14.2.5 SEG SOLAR

- 14.2.6 NEOSUN INC.

- 14.2.7 AUXIN SOLAR INC.

- 14.2.8 SOLITEK

- 14.2.9 SAATVIK SOLAR

- 14.2.10 SILFAB SOLAR INC.

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS