|

|

市場調査レポート

商品コード

1503250

流量計の世界市場:タイプ (差圧・容積式・磁気式・超音波式・コリオリ・タービン・ボルテックス)別、最終用途産業別、地域別 - 予測(~2029年)Flow Meter Market by Type (Differential Pressure, Positive Displacement, Magnetic (In-line, Insertion, Low Flow), Ultrasonic (Spool piece, Clamp-on, Insertion), Coriolis, Turbine, Vortex), End-use Industry, and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 流量計の世界市場:タイプ (差圧・容積式・磁気式・超音波式・コリオリ・タービン・ボルテックス)別、最終用途産業別、地域別 - 予測(~2029年) |

|

出版日: 2024年06月21日

発行: MarketsandMarkets

ページ情報: 英文 257 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

流量計の市場規模は、2024年の91億米ドルから、予測期間中はCAGR 6.7%で堅調に推移し、2029年には126億米ドルの規模に成長すると予測されています。

流量計の市場は、主に2つの要因によって大幅な成長を遂げています。産業活動の拡大と上下水道管理への注目の高まりです。石油・ガス、化学、製造などの産業が成長を続ける中、正確な流量計測の必要性は、プロセスの最適化、安全性の確保、規制基準の遵守のために不可欠となっています。流量計は、液体や気体の流れを監視・制御し、作業効率と製品品質を向上させる上で重要な役割を果たしています。同時に、持続可能な水管理と環境保護が世界的に重視されるようになったことで、配水と廃水処理のインフラに多額の投資が行われるようになりました。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額(米ドル) |

| セグメント | タイプ・エンドユーザー・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・南米 |

コリオリ部門は予測期間中に2番目に急成長する見通し:

コリオリ流量計は、液体と気体の両方の質量流量と密度を測定する際の比類のない精度と汎用性により、2024年から2029年にかけて2番目に急成長するタイプになると予測されています。これらのメーターは、石油・ガス、化学、食品・飲料など、正確な流量測定がプロセスの最適化と品質管理に不可欠な産業で高く評価されています。効率と規制遵守の重視の高まりが、コリオリメーターの採用をさらに後押ししています。コリオリメーターは、温度や圧力の補正を必要とせず、直接質量流量計測を行うことができるため、特に信頼性が高くなっています。その高度な診断能力と最小限のメンテナンス要件も、堅牢で正確な流量測定ソリューションを求める産業界の急速な成長に貢献しています。

最終用途産業別では、精製・石油化学の部門が2023年の金額ベースでが第3位の部門に:

精製・石油化学産業は、最適なプロセス制御、製品品質、安全性を確保する必要性から、精密で信頼性の高い流量計測に対する需要が高まっています。流量計は、流体の移動、混合、反応制御を含む精製と化学処理のさまざまな段階を監視する上で重要です。精製された石油製品や石油化学製品に対する世界の需要が続いていることに加え、既存施設の近代化や生産能力の拡大への投資が、先進的な流量計の採用を大幅に後押ししています。さらに、石油精製と石油化学産業における厳しい環境規制と安全規制により、正確な流量計測が必要とされており、同部門の地位をさらに強固なものとしています。

当レポートでは、世界の流量計の市場を調査し、市場概要、市場影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要・業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- マクロ経済指標

- サプライチェーン分析

- 主なステークホルダーと購入基準

- 価格分析

- 顧客のビジネスに影響を与える動向/ディスラプション

- エコシステム分析/市場マップ

- 技術分析

- ケーススタディ分析

- 貿易分析

- 規制状況

- 主な会議とイベント

- 投資と資金調達のシナリオ

- 特許分析

第6章 流量計市場:流体タイプ別

- 液体

- ガス

- 蒸気

第7章 流量計市場:技術別

- アナログ流量計

- デジタル流量計

第8章 流量計市場:タイプ別

- 差圧

- 容積式

- 超音波

- スプールピース

- クランプオン超音波流量計

- 挿入超音波流量計

- タービン

- 磁気

- インライン磁気

- 挿入磁気

- 低流量磁気

- コリオリ

- ボルテックス

- その他

- 熱流量計

- 多相流量計

第9章 流量計市場:最終用途産業別

- 水・廃水

- 精製・石油化学

- 石油・ガス

- 化学薬品

- 発電

- パルプ・紙

- 食品・飲料

- 医薬品

- 金属・鉱業

- その他

第10章 流量計市場:地域別

- アジア太平洋

- 北米

- 欧州

- 南米

- 中東・アフリカ

第11章 競合情勢

- 主要企業の戦略/有力企業

- 市場シェア分析

- 主要企業の収益分析

- 企業評価マトリックス:主要主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 企業価値評価と財務指標

- ブランド/製品比較分析

- 競合状況・動向

第12章 企業プロファイル

- 主要企業

- HONEYWELL INTERNATIONAL INC.

- SIEMENS AG

- EMERSON ELECTRIC CO.

- ABB LTD.

- YOKOGAWA ELECTRIC CORPORATION

- AZBIL CORPORATION

- BADGER METER, INC.

- ENDRESS+HAUSER MANAGEMENT AG

- KROHNE MESSTECHNIK GMBH

- SCHNEIDER ELECTRIC SE

- スタートアップ/中小企業

- BROOKS INSTRUMENTS LLC

- FUJI ELECTRIC CO., LTD.

- KEM KUPPERS ELEKTROMECHANIK GMBH

- MAX MACHINERY, INC.

- PARKER HANNIFIN CORP.

- TASI GROUP

- SENSIRION AG

- SICK AG

- THERMAL INSTRUMENT CO.

- KATRONIC TECHNOLOGIES LTD.

- FLOW METER GROUP

- OMNI FLOW COMPUTERS, INC.

- HENAN DAFANG DINGSHENG FLOW INSTRUMENT CO., LTD.

- FLOW-TRONIC S.A.

- MCCROMETER

第13章 隣接市場と関連市場

第14章 付録

The flow meters market is poised for significant growth, with a projected value of USD 12.6 billion by 2029, exhibiting a robust CAGR of 6.7% from its 2024 value of USD 9.1 billion. The flow meters market is witnessing substantial growth, primarily driven by two key factors. The expansion of industrial activities and the increasing focus on water and wastewater management. As industries such as oil and gas, chemicals, and manufacturing continue to grow, the need for precise flow measurement becomes critical for optimizing processes, ensuring safety, and meeting regulatory standards. Flow meters play a vital role in monitoring and controlling the flow of liquids and gases, enhancing operational efficiency and product quality. Simultaneously, the rising global emphasis on sustainable water management and environmental protection has led to significant investments in water distribution and wastewater treatment infrastructure.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Segments | Type, End-User, Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

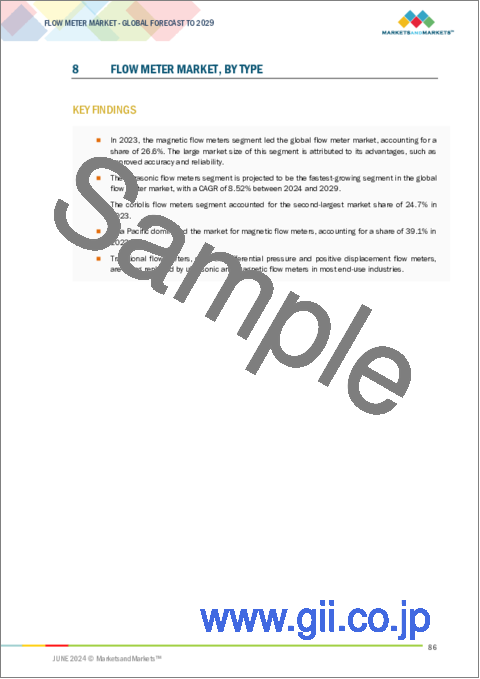

"Coriolis segment is estimated to be the second fastest-growing type for flow meter market during the forecast period 2024 to 2029."

Coriolis flow meters are projected to be the second fastest-growing type from 2024 to 2029 due to their unparalleled accuracy and versatility in measuring mass flow and density of both liquids and gases. These meters are highly valued in industries such as oil and gas, chemicals, and food and beverage, where precise flow measurement is critical for process optimization and quality control. The growing emphasis on efficiency and regulatory compliance further boosts their adoption. Coriolis meters' ability to provide direct mass flow measurements without the need for additional temperature and pressure compensation makes them especially reliable. Their advanced diagnostic capabilities and minimal maintenance requirements also contribute to their rapid growth, as industries seek robust and accurate flow measurement solutions.

"Refining & petrochemical was the third largest segment in flow meters market in 2023, in terms of value."

The refining and petrochemical segment was the third largest end-use industry for the flow meter market. This sector's demand for precise and reliable flow measurement is driven by the need to ensure optimal process control, product quality, and safety. Flow meters are critical in monitoring various stages of refining and chemical processing, including fluid movement, mixing, and reaction control. The ongoing global demand for refined petroleum products and petrochemicals, coupled with investments in modernizing existing facilities and expanding capacity, has significantly boosted the adoption of advanced flow meters. Additionally, stringent environmental and safety regulations in the refining and petrochemical industries necessitate accurate flow measurement, further solidifying this segment's position in the market.

"Middle East & Africa is estimated to be the second fastest growing segment of flow meters market during forecasted year from 2024 to 2029, in terms of value."

The Middle East & Africa is projected to be the second fastest-growing region for the flow meter market from 2024 to 2029 due to significant investments in the oil and gas sector and the expansion of water and wastewater infrastructure. The region's abundant hydrocarbon resources drive continuous exploration and production activities, necessitating accurate flow measurement for efficiency and regulatory compliance. Additionally, rapid urbanization and population growth are increasing the demand for improved water management solutions, prompting investments in modern water distribution and wastewater treatment facilities. These developments, coupled with the adoption of advanced technologies and smart infrastructure, are fueling the demand for sophisticated flow meters, making the Middle East & Africa a key growth region during the forecast period.

In the meticulous process of determining and verifying market sizes for multiple segments and subsegments, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees are as follows:

- By Company Type: Tier 1 - 69%, Tier 2 - 23%, and Tier 3 - 8%

- By Designation: - Director Level - 27%, C-Level - 25%, and Others - 48%

- By Region: North America - 32%, Europe - 28%, Asia Pacific - 21%, South America - 12%, and Middle East & Africa - 7%

The key market players illustrated in the report include Honeywell International Inc. (US), Siemens AG (Germany), Emerson Electric Co. (US), ABB Ltd. (Switzerland), Yokogawa Electric Corporation (Japan), Azbil Corporation (Japan), Badger Meter, Inc. (US), Endress+Hauser Management AG (Switzerland), Krohne Messtechnik GmbH (Germany), and Schneider Electric (France).

Research Coverage

This report segments the market for flow meters market based on type, end-use industry, and region, and provides estimations for the overall value (USD Million) of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisition associated with the market for flow meters.

Reasons to buy this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the flow meters market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing use in oil & gas and water & wastewater industries, rising demand for smart and intelligent flow meters in high-end applications, stringent regulations for wastewater treatment and increasing capacity additions, increasing pharmaceuticals production capacity in asia pacific), restraints (complexity and maintenance, compatibility and integration issue), opportunities (increased investments in process automation from india and china, increasing capacity expansions and joint venture activities by end users in high-growth markets), and challenges (high initial cost of coriolis and magnetic flow meters, fit for purpose flow meters lacking in the industrial end-use industry).

- Market Penetration: Comprehensive information on flow meters market offered by top players in the global flow meters market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the flow meters market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for flow meters market across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global flow meters market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the flow meters market

- Impact of recession on flow meters market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 FLOW METER MARKET: INCLUSIONS & EXCLUSIONS

- 1.2.2 FLOW METER MARKET: MARKET DEFINITION AND INCLUSIONS, BY TYPE

- 1.2.3 FLOW METER MARKET: MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 FLOW METER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews: demand side and supply side

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 2 MARKET SIZE ESTIMATION - APPROACH 1 (SUPPLY-SIDE): COMBINED MARKET SHARE OF KEY PLAYERS

- FIGURE 3 MARKET SIZE ESTIMATION - BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM SALE OF FLOW METERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 2 - BOTTOM-UP (DEMAND-SIDE): PRODUCTS SOLD AND THEIR AVERAGE SELLING PRICE

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 6 FLOW METER MARKET: DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS

- 2.4.1 SUPPLY SIDE

- FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- 2.4.2 DEMAND-SIDE

- FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

- 2.5 IMPACT OF RECESSION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

- TABLE 1 FLOW METER MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 9 WATER & WASTEWATER TO BE LARGEST END-USE INDUSTRY OF FLOW METERS DURING FORECAST PERIOD

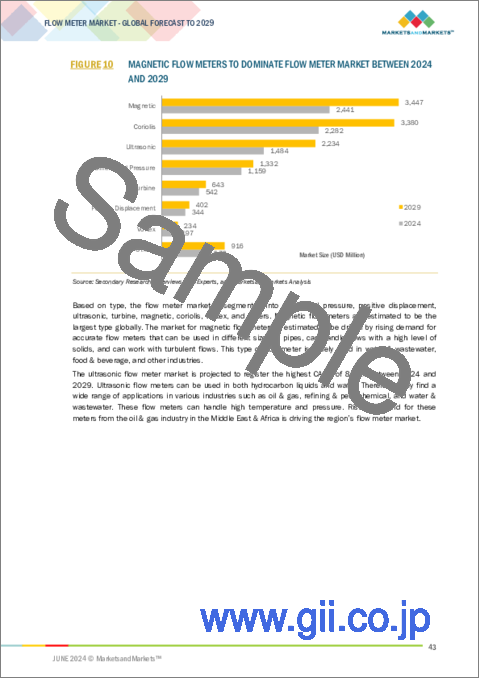

- FIGURE 10 MAGNETIC FLOW METERS TO DOMINATE FLOW METER MARKET BETWEEN 2024 AND 2029

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FLOW METER MARKET

- FIGURE 12 GROWING DEMAND FROM OIL & GAS END-USE INDUSTRY TO DRIVE FLOW METER MARKET DURING FORECAST PERIOD

- 4.2 FLOW METER MARKET, BY END-USE INDUSTRY

- FIGURE 13 OIL & GAS TO BE FASTEST-GROWING END-USE INDUSTRY DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: FLOW METER MARKET, BY TYPE AND COUNTRY

- FIGURE 14 CHINA ACCOUNTED FOR LARGEST SHARE OF FLOW METER MARKET IN 2023

- 4.4 FLOW METER MARKET, REGION VS. END-USE INDUSTRY

- FIGURE 15 WATER & WASTEWATER ACCOUNTED FOR LARGEST SHARE IN 2023

- 4.5 FLOW METER MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC TO BE LARGEST MARKET FOR FLOW METERS DURING FORECAST PERIOD

- 4.6 FLOW METER MARKET, BY KEY COUNTRY

- FIGURE 17 CHINA TO REGISTER HIGHEST CAGR IN FLOW METER MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FLOW METER MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use in oil & gas and water & wastewater industries

- 5.2.1.2 Rising demand for smart and intelligent flow meters in high-end applications

- 5.2.1.3 Stringent regulations on wastewater treatment and increasing capacity additions

- TABLE 2 INDUSTRIAL DEMAND FOR WATER, BY CONTINENT

- 5.2.1.4 Increasing pharmaceuticals production capacity in Asia Pacific

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complexity and maintenance

- 5.2.2.2 Compatibility and integration issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased investments in process automation in India and China

- TABLE 3 GDP CONTRIBUTION OF TOP TEN LARGEST ECONOMIES, IN TERMS OF PURCHASING POWER PARITY, 2023

- 5.2.3.2 Increasing capacity expansions and joint venture activities in high-growth markets

- 5.2.4 CHALLENGES

- 5.2.4.1 High initial cost of coriolis and magnetic flow meters

- 5.2.4.2 Fit for purpose flow meters lacking in industrial end-use industry

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 FLOW METER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 4 FLOW METER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GDP TRENDS AND FORECAST OF MOST PROMINENT ECONOMIES

- TABLE 5 GDP TRENDS AND FORECAST, BY MOST PROMINENT ECONOMIES, 2021-2029 (USD BILLION)

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 20 FLOW METER MARKET: SUPPLY CHAIN ANALYSIS

- 5.5.1 RAW MATERIALS

- 5.5.2 MANUFACTURING

- 5.5.3 DISTRIBUTION NETWORK

- 5.5.4 END-USE INDUSTRY

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN TOP 3 END-USE INDUSTRIES

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN TOP 3 END-USE INDUSTRIES (%)

- 5.6.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 7 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- 5.7 PRICING ANALYSIS

- 5.7.1 INDICATIVE SELLING PRICE TREND, BY REGION

- FIGURE 23 INDICATIVE SELLING PRICE TREND, BY REGION (USD/UNIT)

- TABLE 8 INDICATIVE AVERAGE SELLING PRICE TREND OF FLOW METER, BY REGION (USD/UNIT)

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.8.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR FLOW METER

- FIGURE 24 REVENUE SHIFT FOR FLOW METER MARKET

- 5.9 ECOSYSTEM ANALYSIS/MARKET MAP

- FIGURE 25 FLOW METER MARKET: ECOSYSTEM

- TABLE 9 FLOW METER MARKET: ECOSYSTEM

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Electromagnetic flow meter technology

- 5.10.2 COMPLIMENTARY TECHNOLOGIES

- 5.10.2.1 Coriolis flow meter technology

- 5.10.1 KEY TECHNOLOGIES

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 CASE STUDY ON ELECTROMAGNETIC AND ULTRASONIC FLOW METERS USED IN HVAC SYSTEM AND STP

- 5.11.2 UTILIZATION OF ULTRASONIC FLOW METERS FOR SAURASHTRA NARMADA AVTARAN IRRIGATION YOJANA (SAUNI YOJANA)

- 5.11.3 GRUPO SUZANO USES MAGNETIC FLOW METER TO SOLVE WATER INTAKE PROBLEM AT PULP & PAPER PLANT

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO

- FIGURE 26 IMPORT OF FLOW METERS, BY KEY COUNTRY

- TABLE 10 IMPORT OF FLOW METERS, BY REGION, 2017-2022 (USD MILLION)

- 5.12.2 EXPORT SCENARIO

- FIGURE 27 EXPORT OF FLOW METERS, BY KEY COUNTRY

- TABLE 11 EXPORT OF FLOW METERS, BY REGION, 2017-2022 (USD MILLION)

- 5.13 REGULATORY LANDSCAPE

- TABLE 12 NORTH AMERICA: REGULATIONS RELATED TO FLOW METERS

- TABLE 13 EUROPE: REGULATIONS RELATED TO FLOW METERS

- TABLE 14 ASIA PACIFIC: REGULATIONS RELATED TO FLOW METER S

- TABLE 15 SOUTH AMERICA: REGULATIONS RELATED TO FLOW METERS

- TABLE 16 MIDDLE EAST & AFRICA: REGULATIONS RELATED TO FLOW METERS

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 FLOW METER: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS IN 2024-2025

- TABLE 18 FLOW METER MARKET: KEY CONFERENCES AND EVENTS, 2024-2025

- 5.15 INVESTMENT AND FUNDING SCENARIO

- TABLE 19 FLOW METER MARKET: FUNDING/INVESTMENT

- 5.16 PATENT ANALYSIS

- 5.16.1 APPROACH

- 5.16.2 PATENT TYPES

- TABLE 20 FLOW METER MARKET: PATENT STATUS

- FIGURE 28 PATENTS REGISTERED FOR FLOW METERS, 2013-2023

- FIGURE 29 TOP PATENT OWNERS IN LAST 10 YEARS

- TABLE 21 MAJOR PATENTS FOR FLOW METERS

- 5.16.3 TOP APPLICANTS

- TABLE 22 PATENTS BY MICRO MOTION, INC.

- TABLE 23 PATENTS BY ENDRESS+HAUSER FLOWTEC AG

- TABLE 24 PATENTS BY HITACHI AUTOMOTIVE SYSTEMS LTD.

- TABLE 25 TOP 10 PATENT OWNERS IN US, 2013-2023

- FIGURE 30 LEGAL STATUS OF PATENTS FILED FOR FLOW METERS

- 5.16.4 JURISDICTION ANALYSIS

- FIGURE 31 MAXIMUM PATENTS FILED IN JURISDICTION OF CHINA

6 FLOW METER MARKET, BY FLUID TYPE

- 6.1 INTRODUCTION

- 6.2 LIQUID

- 6.3 GAS

- 6.4 STEAM

7 FLOW METER MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 ANALOG FLOW METER

- 7.3 DIGITAL FLOW METER

8 FLOW METER MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 32 ULTRASONIC FLOW METERS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- TABLE 26 FLOW METER MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 27 FLOW METER MARKET, BY TYPE, 2023-2029 (USD MILLION)

- 8.2 DIFFERENTIAL PRESSURE

- 8.2.1 HIGH RELIABILITY AND ACCURACY OF DIFFERENTIAL PRESSURE TO DRIVE MARKET

- TABLE 28 DIFFERENTIAL PRESSURE: FLOW METER MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 DIFFERENTIAL PRESSURE: FLOW METER MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 30 DIFFERENTIAL PRESSURE: ADVANTAGES AND DISADVANTAGES

- TABLE 31 ORIFICES: ADVANTAGES AND DISADVANTAGES

- TABLE 32 VENTURI TUBES: ADVANTAGES AND DISADVANTAGES

- TABLE 33 CONE METERS: ADVANTAGES AND DISADVANTAGES

- TABLE 34 VARIABLE AREA METERS: ADVANTAGES AND DISADVANTAGES

- TABLE 35 AVERAGING PITOTS: ADVANTAGES AND DISADVANTAGES

- 8.3 POSITIVE DISPLACEMENT

- 8.3.1 GROWING DEMAND IN VARIOUS INDUSTRIES TO DRIVE MARKET

- TABLE 36 POSITIVE DISPLACEMENT: FLOW METER MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 37 POSITIVE DISPLACEMENT: FLOW METER MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 38 POSITIVE DISPLACEMENT: ADVANTAGES AND DISADVANTAGES

- 8.4 ULTRASONIC

- 8.4.1 GROWING NEED FOR EFFICIENT WATER AND ENERGY MANAGEMENT TO DRIVE MARKET

- TABLE 39 ULTRASONIC: FLOW METER MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 40 ULTRASONIC: FLOW METER MARKET, BY REGION, 2023-2029 (USD MILLION)

- 8.4.2 SPOOL PIECES

- 8.4.3 CLAMP-ON ULTRASONIC FLOW METERS

- 8.4.4 INSERTION ULTRASONIC FLOW METERS

- TABLE 41 ULTRASONIC: FLOW METER MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 42 ULTRASONIC: FLOW METER MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 43 ULTRASONIC: ADVANTAGES AND DISADVANTAGES

- 8.5 TURBINE

- 8.5.1 INDUSTRIAL AUTOMATION AND PROCESS OPTIMIZATION TO DRIVE MARKET

- TABLE 44 TURBINE: FLOW METER MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 45 TURBINE: FLOW METER MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 46 TURBINE: ADVANTAGES AND DISADVANTAGES

- 8.6 MAGNETIC

- 8.6.1 INCREASING DEMAND FOR CLEAN WATER AND WASTEWATER TREATMENT TO DRIVE MARKET

- TABLE 47 MAGNETIC: FLOW METER MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 48 MAGNETIC: FLOW METER MARKET, BY REGION, 2023-2029 (USD MILLION)

- 8.6.2 IN-LINE MAGNETIC

- 8.6.3 INSERTION MAGNETIC

- 8.6.4 LOW FLOW MAGNETIC

- TABLE 49 MAGNETIC: FLOW METER MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 50 MAGNETIC: FLOW METER MARKET, BY TYPE, 2023-2029 (USD MILLION)

- TABLE 51 MAGNETIC: ADVANTAGES AND DISADVANTAGES

- 8.7 CORIOLIS

- 8.7.1 BROAD RANGE OF APPLICATIONS IN VARIOUS INDUSTRIES TO DRIVE MARKET

- TABLE 52 CORIOLIS: FLOW METER MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 CORIOLIS: FLOW METER MARKET, BY REGION, 2023-2029 (USD MILLION)

- 8.8 VORTEX

- 8.8.1 LOW INITIAL SET-UP COST TO DRIVE MARKET

- TABLE 54 VORTEX: FLOW METER MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 55 VORTEX: FLOW METER MARKET, BY REGION, 2023-2029 (USD MILLION)

- TABLE 56 VORTEX: ADVANTAGES AND DISADVANTAGES

- 8.9 OTHER TYPES

- 8.9.1 THERMAL FLOW METERS

- TABLE 57 THERMAL: ADVANTAGES AND DISADVANTAGES

- 8.9.2 MULTIPHASE FLOW METERS

- TABLE 58 OTHER TYPES: FLOW METER MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 59 OTHER TYPES: FLOW METER MARKET, BY REGION, 2023-2029 (USD MILLION)

9 FLOW METER MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- TABLE 60 APPLICATIONS OF FLOW METERS IN END-USE INDUSTRIES

- FIGURE 33 OIL & GAS INDUSTRY TO REGISTER HIGHEST CAGR IN FLOW METER MARKET

- TABLE 61 FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 62 FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 9.2 WATER & WASTEWATER

- 9.2.1 RISING DEMAND FOR HIGH WATER QUALITY TO DRIVE MARKET

- TABLE 63 FLOW METER MARKET IN WATER & WASTEWATER INDUSTRY, BY REGION, 2018-2022 (USD MILLION)

- TABLE 64 FLOW METER MARKET IN WATER & WASTEWATER INDUSTRY, BY REGION, 2023-2029 (USD MILLION)

- 9.3 REFINING & PETROCHEMICAL

- 9.3.1 DEMAND FOR ACCURATE FLOW MEASUREMENT TO DRIVE MARKET

- TABLE 65 FLOW METER MARKET IN REFINING & PETROCHEMICAL INDUSTRY, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 FLOW METER MARKET IN REFINING & PETROCHEMICAL INDUSTRY, BY REGION, 2023-2029 (USD MILLION)

- 9.4 OIL & GAS

- 9.4.1 EXPANSION OF INFRASTRUCTURE AND DIGITALIZING OF PROCESSES TO DRIVE DEMAND

- TABLE 67 FLOW METER MARKET IN OIL & GAS INDUSTRY, BY REGION, 2018-2022 (USD MILLION)

- TABLE 68 FLOW METER MARKET IN OIL & GAS INDUSTRY, BY REGION, 2023-2029 (USD MILLION)

- 9.5 CHEMICAL

- 9.5.1 GROWING DEMAND FOR SPECIALTY CHEMICALS TO DRIVE MARKET

- TABLE 69 FLOW METER MARKET IN CHEMICAL INDUSTRY, BY REGION, 2018-2022 (USD MILLION)

- TABLE 70 FLOW METER MARKET IN CHEMICAL INDUSTRY, BY REGION, 2023-2029 (USD MILLION)

- 9.6 POWER GENERATION

- 9.6.1 NEED TO MEASURE NON-CONDUCTIVE LIQUIDS USED IN POWER GENERATION TO DRIVE MARKET

- TABLE 71 FLOW METER MARKET IN POWER GENERATION INDUSTRY, BY REGION, 2018-2022 (USD MILLION)

- TABLE 72 FLOW METER MARKET IN POWER GENERATION INDUSTRY, BY REGION, 2023-2029 (USD MILLION)

- 9.7 PULP & PAPER

- 9.7.1 NEED FOR PRESSURE & TEMPERATURE AND PROCESS & INVENTORY LEVEL MEASUREMENTS TO DRIVE MARKET

- TABLE 73 FLOW METER MARKET IN PULP & PAPER INDUSTRY, BY REGION, 2018-2022 (USD MILLION)

- TABLE 74 FLOW METER MARKET IN PULP & PAPER INDUSTRY, BY REGION, 2023-2029 (USD MILLION)

- 9.8 FOOD & BEVERAGE

- 9.8.1 NECESSITY TO COMPLY WITH ENVIRONMENTAL REGULATIONS TO DRIVE DEMAND

- TABLE 75 FLOW METER MARKET IN FOOD & BEVERAGE INDUSTRY, BY REGION, 2018-2022 (USD MILLION)

- TABLE 76 FLOW METER MARKET IN FOOD & BEVERAGE INDUSTRY, BY REGION, 2023-2029 (USD MILLION)

- 9.9 PHARMACEUTICAL

- 9.9.1 SIGNIFICANT RISE IN PRODUCTION OF PHARMACEUTICALS TO DRIVE DEMAND

- TABLE 77 FLOW METER MARKET IN PHARMACEUTICAL INDUSTRY, BY REGION, 2018-2022 (USD MILLION)

- TABLE 78 FLOW METER MARKET IN PHARMACEUTICAL, BY REGION, 2023-2029 (USD MILLION)

- 9.10 METALS & MINING

- 9.10.1 WIDE APPLICATIONS IN METALS & MINING INDUSTRY TO DRIVE DEMAND

- TABLE 79 FLOW METER MARKET IN METALS & MINING INDUSTRY, BY REGION, 2018-2022 (USD MILLION)

- TABLE 80 FLOW METER MARKET IN METALS & MINING INDUSTRY, BY REGION, 2023-2029 (USD MILLION)

- 9.11 OTHER END-USE INDUSTRIES

- TABLE 81 FLOW METER MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018-2022 (USD MILLION)

- TABLE 82 FLOW METER MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2023-2029 (USD MILLION)

10 FLOW METER MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 34 ASIA PACIFIC TO REGISTER HIGHEST CAGR BETWEEN 2024 AND 2029

- TABLE 83 FLOW METER MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 84 FLOW METER MARKET, BY REGION, 2023-2029 (USD MILLION)

- 10.2 ASIA PACIFIC

- FIGURE 35 ASIA PACIFIC: FLOW METER MARKET SNAPSHOT

- 10.2.1 RECESSION IMPACT

- 10.2.2 ASIA PACIFIC: FLOW METER MARKET, BY TYPE

- TABLE 85 ASIA PACIFIC: FLOW METER MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 86 ASIA PACIFIC: FLOW METER MARKET, BY TYPE, 2023-2029 (USD MILLION)

- 10.2.3 ASIA PACIFIC: FLOW METER MARKET, BY END-USE INDUSTRY

- TABLE 87 ASIA PACIFIC: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 88 ASIA PACIFIC: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.2.4 ASIA PACIFIC: FLOW METER MARKET, BY COUNTRY

- TABLE 89 ASIA PACIFIC: FLOW METER MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 90 ASIA PACIFIC: FLOW METER MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- 10.2.4.1 China

- 10.2.4.1.1 Strong growth of manufacturing sector to drive market

- 10.2.4.1 China

- TABLE 91 CHINA: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 92 CHINA: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.2.4.2 Japan

- 10.2.4.2.1 Growing investment in chemical and power generation industries to support market growth

- 10.2.4.2 Japan

- TABLE 93 JAPAN: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 94 JAPAN: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.2.4.3 India

- 10.2.4.3.1 Growing FDI investments in manufacturing industry to support market growth

- 10.2.4.3 India

- TABLE 95 INDIA: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 96 INDIA: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.2.4.4 South Korea

- 10.2.4.4.1 Investments in water & wastewater treatment industry to play key role in market growth

- 10.2.4.4 South Korea

- TABLE 97 SOUTH KOREA: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 98 SOUTH KOREA: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.2.4.5 Malaysia

- 10.2.4.5.1 Oil & gas industry to play key role in market growth

- 10.2.4.5 Malaysia

- TABLE 99 MALAYSIA: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 100 MALAYSIA: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.2.4.6 Australia & New Zealand

- 10.2.4.6.1 Fuel industry to drive demand

- 10.2.4.6 Australia & New Zealand

- TABLE 101 AUSTRALIA & NEW ZEALAND: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 102 AUSTRALIA & NEW ZEALAND: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.3 NORTH AMERICA

- FIGURE 36 NORTH AMERICA: FLOW METER MARKET SNAPSHOT

- 10.3.1 RECESSION IMPACT

- 10.3.2 NORTH AMERICA: FLOW METER MARKET, BY TYPE

- TABLE 103 NORTH AMERICA: FLOW METER MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: FLOW METER MARKET, BY TYPE, 2023-2029 (USD MILLION)

- 10.3.3 NORTH AMERICA: FLOW METER MARKET, BY END-USE INDUSTRY

- TABLE 105 NORTH AMERICA: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 106 NORTH AMERICA: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.3.4 NORTH AMERICA: FLOW METER MARKET, BY COUNTRY

- TABLE 107 NORTH AMERICA: FLOW METER MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 108 NORTH AMERICA: FLOW METER MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- 10.3.4.1 US

- 10.3.4.1.1 Slump in oil & gas and chemical production to have significant impact on market

- 10.3.4.1 US

- TABLE 109 US: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 110 US: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.3.4.2 Canada

- 10.3.4.2.1 Growing government investments in water & wastewater industry to boost market

- 10.3.4.2 Canada

- TABLE 111 CANADA: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 112 CANADA: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.3.4.3 Mexico

- 10.3.4.3.1 Increasing investments in oil & gas and growing food & beverage industry to drive market

- 10.3.4.3 Mexico

- TABLE 113 MEXICO: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 114 MEXICO: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.4 EUROPE

- FIGURE 37 EUROPE: FLOW METER MARKET SNAPSHOT

- 10.4.1 RECESSION IMPACT

- 10.4.2 EUROPE: FLOW METER MARKET, BY TYPE

- TABLE 115 EUROPE: FLOW METER MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 116 EUROPE: FLOW METER MARKET, BY TYPE, 2023-2029 (USD MILLION)

- 10.4.3 EUROPE: FLOW METER MARKET, BY END-USE INDUSTRY

- TABLE 117 EUROPE: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 118 EUROPE: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.4.4 EUROPE: FLOW METER MARKET, BY COUNTRY

- TABLE 119 EUROPE: FLOW METER MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 120 EUROPE: FLOW METER MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- 10.4.4.1 Germany

- 10.4.4.1.1 Strong economic recovery post-COVID-19 pandemic to favor market growth

- 10.4.4.1 Germany

- TABLE 121 GERMANY: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 122 GERMANY: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.4.4.2 France

- 10.4.4.2.1 Government initiatives to boost manufacturing sector to support market

- 10.4.4.2 France

- TABLE 123 FRANCE: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 124 FRANCE: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.4.4.3 UK

- 10.4.4.3.1 Growing water treatment and chemical industries to drive demand

- 10.4.4.3 UK

- TABLE 125 UK: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 126 UK: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.4.4.4 Italy

- 10.4.4.4.1 Industrial sector to drive flow meter market

- 10.4.4.4 Italy

- TABLE 127 ITALY: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 128 ITALY: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.4.4.5 Spain

- 10.4.4.5.1 Strong focus on revival of economy to propel market

- 10.4.4.5 Spain

- TABLE 129 SPAIN: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 130 SPAIN: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.4.4.6 Scandinavia

- 10.4.4.6.1 Export-oriented economy to drive market

- 10.4.4.6 Scandinavia

- TABLE 131 SCANDINAVIA: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 132 SCANDINAVIA: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.5 SOUTH AMERICA

- 10.5.1 RECESSION IMPACT

- 10.5.2 SOUTH AMERICA: FLOW METER MARKET, BY TYPE

- TABLE 133 SOUTH AMERICA: FLOW METER MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 134 SOUTH AMERICA: FLOW METER MARKET, BY TYPE, 2023-2029 (USD MILLION)

- 10.5.3 SOUTH AMERICA: FLOW METER MARKET, BY END-USE INDUSTRY

- TABLE 135 SOUTH AMERICA: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 136 SOUTH AMERICA: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.5.4 SOUTH AMERICA: FLOW METER MARKET, BY COUNTRY

- TABLE 137 SOUTH AMERICA: FLOW METER MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 138 SOUTH AMERICA: FLOW METER MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- 10.5.4.1 Brazil

- 10.5.4.1.1 Rising demand from chemical and oil & gas industries to support market growth

- 10.5.4.1 Brazil

- TABLE 139 BRAZIL: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 140 BRAZIL: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.5.4.2 Argentina

- 10.5.4.2.1 Oil & natural gas sector to drive flow meter market

- 10.5.4.2 Argentina

- TABLE 141 ARGENTINA: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 142 ARGENTINA: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 RECESSION IMPACT

- 10.6.2 MIDDLE EAST & AFRICA: FLOW METER MARKET, BY TYPE

- TABLE 143 MIDDLE EAST & AFRICA: FLOW METER MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: FLOW METER MARKET, BY TYPE, 2023-2029 (USD MILLION)

- 10.6.3 MIDDLE EAST & AFRICA: FLOW METER MARKET, BY END-USE INDUSTRY

- TABLE 145 MIDDLE EAST & AFRICA: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.6.4 MIDDLE EAST & AFRICA: FLOW METER MARKET, BY COUNTRY

- TABLE 147 MIDDLE EAST & AFRICA: FLOW METER MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: FLOW METER MARKET, BY COUNTRY, 2023-2029 (USD MILLION)

- 10.6.4.1 GCC Countries

- 10.6.4.1.1 Expansion of oil & gas industry to support market growth

- 10.6.4.1.2 Saudi Arabia

- 10.6.4.1.2.1 Growing investment in expansion of desalination capacity to support market growth

- 10.6.4.1 GCC Countries

- TABLE 149 SAUDI ARABIA: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 150 SAUDI ARABIA: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

- 10.6.4.2 Iran

- 10.6.4.2.1 Doubling of oil production to significantly impact flow meter market

- 10.6.4.2 Iran

- TABLE 151 IRAN: FLOW METER MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 152 IRAN: FLOW METER MARKET, BY END-USE INDUSTRY, 2023-2029 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/ RIGHT TO WIN

- TABLE 153 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS OF FLOW METERS

- 11.3 MARKET SHARE ANALYSIS

- TABLE 154 FLOW METER MARKET: DEGREE OF COMPETITION

- FIGURE 38 EMERSON ELECTRIC CO. LED FLOW METER MARKET IN 2023

- 11.3.1 RANKING OF KEY MARKET PLAYERS, 2023

- FIGURE 39 RANKING OF KEY MARKET PLAYERS OF FLOW METERS, 2023

- 11.4 REVENUE ANALYSIS OF MAJOR PLAYERS (2019-2023)

- FIGURE 40 REVENUE ANALYSIS OF KEY COMPANIES IN LAST 5 YEARS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 41 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.5.5.1 Company footprint

- FIGURE 42 FLOW METER MARKET: COMPANY FOOTPRINT

- 11.5.5.2 Region footprint

- TABLE 155 FLOW METER MARKET: REGION FOOTPRINT

- 11.5.5.3 Type footprint

- TABLE 156 FLOW METER MARKET: TYPE FOOTPRINT

- 11.5.5.4 End-use industry footprint

- TABLE 157 FLOW METER MARKET: END-USE INDUSTRY FOOTPRINT

- 11.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 43 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 11.6.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- 11.6.5.1 Flow meter market: key start-ups/SMES

- 11.6.5.2 Flow meter market: competitive benchmarking of key start-ups/SMES

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 44 COMPANY VALUATION OF KEY PLAYERS

- FIGURE 45 EV/EBITDA OF KEY PLAYERS

- 11.8 BRAND/PRODUCT COMPARISON ANALYSIS

- 11.9 COMPETITIVE SITUATIONS AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- TABLE 158 FLOW METER MARKET: PRODUCT LAUNCHES (JANUARY 2018- DECEMBER 2023)

- 11.9.2 DEALS

- TABLE 159 FLOW METER MARKET: DEALS (JANUARY 2018- DECEMBER 2023)

- 11.9.3 EXPANSIONS

- TABLE 160 FLOW METER MARKET: EXPANSIONS (JANUARY 2018- DECEMBER 2023)

- 11.9.4 OTHER DEVELOPMENTS

- TABLE 161 FLOW METER MARKET: OTHER DEVELOPMENTS (JANUARY 2018- DECEMBER 2023)

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1.1 HONEYWELL INTERNATIONAL INC.

- TABLE 162 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 46 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 163 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.2 SIEMENS AG

- TABLE 164 SIEMENS AG: COMPANY OVERVIEW

- FIGURE 47 SIEMENS AG: COMPANY SNAPSHOT

- TABLE 165 SIEMENS AG : PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.3 EMERSON ELECTRIC CO.

- TABLE 166 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- FIGURE 48 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- TABLE 167 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 169 EMERSON ELECTRIC CO.: OTHER DEVELOPMENTS

- 12.1.4 ABB LTD.

- TABLE 170 ABB LTD.: COMPANY OVERVIEW

- FIGURE 49 ABB LTD.: COMPANY SNAPSHOT

- TABLE 171 ABB LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.5 YOKOGAWA ELECTRIC CORPORATION

- TABLE 172 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- FIGURE 50 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 173 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 YOKOGAWA ELECTRIC CORPORATION: DEALS

- TABLE 175 YOKOGAWA ELECTRIC CORPORATION: EXPANSIONS

- 12.1.6 AZBIL CORPORATION

- TABLE 176 AZBIL CORPORATION: COMPANY OVERVIEW

- FIGURE 51 AZBIL CORPORATION: COMPANY SNAPSHOT

- TABLE 177 AZBIL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 AZBIL CORPORATION: DEALS

- TABLE 179 AZBIL CORPORATION: EXPANSIONS

- 12.1.7 BADGER METER, INC.

- TABLE 180 BADGER METER, INC.: COMPANY OVERVIEW

- FIGURE 52 BADGER METER, INC.: COMPANY SNAPSHOT

- TABLE 181 BADGER METER, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 BADGER METER, INC.: DEALS

- TABLE 183 BADGER METER, INC.: EXPANSIONS

- 12.1.8 ENDRESS+HAUSER MANAGEMENT AG

- TABLE 184 ENDRESS+HAUSER MANAGEMENT AG: COMPANY OVERVIEW

- FIGURE 53 ENDRESS+HAUSER MANAGEMENT AG: COMPANY SNAPSHOT

- TABLE 185 ENDRESS+HAUSER MANAGEMENT AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 ENDRESS+HAUSER MANAGEMENT AG: DEALS

- TABLE 187 ENDRESS+HAUSER MANAGEMENT AG: EXPANSIONS

- 12.1.9 KROHNE MESSTECHNIK GMBH

- TABLE 188 KROHNE MESSTECHNIK GMBH: COMPANY OVERVIEW

- TABLE 189 KROHNE MESSTECHNIK GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 KROHNE MESSTECHNIK GMBH: PRODUCT LAUNCHES

- 12.1.10 SCHNEIDER ELECTRIC SE

- TABLE 191 SCHNEIDER ELECTRIC SE: COMPANY OVERVIEW

- FIGURE 54 SCHNEIDER ELECTRIC SE: COMPANY SNAPSHOT

- TABLE 192 SCHNEIDER ELECTRIC SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 SCHNEIDER ELECTRIC SE: EXPANSIONS

- 12.2 START-UPS/SMES

- 12.2.1 BROOKS INSTRUMENTS LLC

- TABLE 194 BROOKS INSTRUMENTS LLC: COMPANY OVERVIEW

- 12.2.2 FUJI ELECTRIC CO., LTD.

- TABLE 195 FUJI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- 12.2.3 KEM KUPPERS ELEKTROMECHANIK GMBH

- TABLE 196 KEM KUPPERS ELEKTROMECHANIK GMBH: COMPANY OVERVIEW

- 12.2.4 MAX MACHINERY, INC.

- TABLE 197 MAX MACHINERY, INC.: COMPANY OVERVIEW

- 12.2.5 PARKER HANNIFIN CORP.

- TABLE 198 PARKER HANNIFIN CORP.: COMPANY OVERVIEW

- 12.2.6 TASI GROUP

- TABLE 199 TASI GROUP: COMPANY OVERVIEW

- 12.2.7 SENSIRION AG

- TABLE 200 SENSIRION AG: COMPANY OVERVIEW

- 12.2.8 SICK AG

- TABLE 201 SICK AG: COMPANY OVERVIEW

- 12.2.9 THERMAL INSTRUMENT CO.

- TABLE 202 THERMAL INSTRUMENT CO.: COMPANY OVERVIEW

- 12.2.10 KATRONIC TECHNOLOGIES LTD.

- TABLE 203 KATRONIC TECHNOLOGIES LTD.: COMPANY OVERVIEW

- 12.2.11 FLOW METER GROUP

- TABLE 204 FLOW METER GROUP: COMPANY OVERVIEW

- 12.2.12 OMNI FLOW COMPUTERS, INC.

- TABLE 205 OMNI FLOW COMPUTERS, INC.: COMPANY OVERVIEW

- 12.2.13 HENAN DAFANG DINGSHENG FLOW INSTRUMENT CO., LTD.

- TABLE 206 HENAN DAFANG DINGSHENG FLOW INSTRUMENT CO., LTD.: COMPANY OVERVIEW

- 12.2.14 FLOW-TRONIC S.A.

- TABLE 207 FLOW-TRONIC S.A.: COMPANY OVERVIEW

- 12.2.15 MCCROMETER

- TABLE 208 MCCROMETER: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 INTELLIGENT FLOW METER MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 INTELLIGENT FLOW METER MARKET, BY REGION

- TABLE 209 INTELLIGENT FLOW METER MARKET, BY REGION, 2017-2025 (USD MILLION)

- 13.4.1 NORTH AMERICA

- TABLE 210 INTELLIGENT FLOW METER MARKET IN NORTH AMERICA, BY COUNTRY, 2017-2025 (USD MILLION)

- 13.4.2 EUROPE

- TABLE 211 INTELLIGENT FLOW METER MARKET IN EUROPE, BY COUNTRY, 2017-2025 (USD MILLION)

- 13.4.3 ASIA PACIFIC

- TABLE 212 INTELLIGENT FLOW METER MARKET IN ASIA PACIFIC, BY COUNTRY, 2017-2025 (USD MILLION)

- 13.4.4 ROW

- TABLE 213 INTELLIGENT FLOW METER MARKET IN ROW, BY REGION, 2017-2025 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS