|

|

市場調査レポート

商品コード

1481485

ポリカーボネート樹脂の世界市場:用途別、地域別 - 予測(~2029年)Polycarbonate Resin Market by Application (Electrical & Electronics, Optical Media, Construction, Consumer, Automotive, Packaging, Medical), and Region (Asia Pacific, Europe, North America, Middle East & Africa) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ポリカーボネート樹脂の世界市場:用途別、地域別 - 予測(~2029年) |

|

出版日: 2024年05月16日

発行: MarketsandMarkets

ページ情報: 英文 194 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のポリカーボネート樹脂の市場規模は、2024年に153億米ドル、2029年までに201億米ドルに達すると予測され、2024年~2029年にCAGRで5.5%の成長が見込まれます。

市場の成長は、自動車産業、特にグレージング用途での需要の増加によって促進されています。また、消費者セグメントからの需要の拡大も、市場の主な促進要因の1つです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 数量(キロトン)、金額(10億米ドル) |

| セグメント | 用途、地域 |

| 対象地域 | 北米、アジア太平洋、欧州、中東・アフリカ、南米 |

「用途別では、建設産業が予測期間に第3位の市場規模を占めました。」

建設産業は、その幅広い用途と有利な特性により、ポリカーボネート樹脂の重大な市場となっています。建設産業におけるポリカーボネートの主な用途は、天窓および屋根板です。ポリカーボネートは軽量であるため、取り扱いや施工が容易であり、また高い耐衝撃性と紫外線安定性により、屋外環境での性能が長持ちします。ポリカーボネートの屋根板は優れた耐候性を持ち、自然光を建物内に取り入れると同時に、人工照明の必要性を低減します。

「欧州が予測期間に市場で第2位の市場規模を占める見込みです。」

西欧におけるポリカーボネート樹脂の需要の主な促進要因は、自動車産業における需要の増加です。欧州では燃費に関する厳しい規制が適用されているため、自動車メーカーは自動車の製造に用いる、より軽量で耐久性のある材料を探しています。ポリカーボネート樹脂は軽量で強靭であり、光透過性に優れています。欧州におけるポリカーボネート樹脂市場の成長は、建築・建設や包装などの主な最終用途産業からの需要の増加によるものと考えられます。主要メーカーには、SABIC、Covestro AG、TRINSEO S.A.、TEIJIN LIMITED、Mitsubishi Gas Chemical Company, Inc.などが含まれます。

当レポートでは、世界のポリカーボネート樹脂市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- ポリカーボネート樹脂市場の企業にとっての機会

- ポリカーボネート樹脂市場:用途別

- ポリカーボネート樹脂市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 原材料サプライヤー

- 樹脂メーカー

- 配合業者

- 成形業者/コンポーネントメーカー

- エンドユーザー

- ポーターのファイブフォース分析

- 特許分析

- エコシステム/市場マップ

- 貿易分析

- ポリカーボネートの輸入シナリオ

- ポリカーボネートの輸出シナリオ

- マクロ経済の概要と主要動向

- 技術分析

- バイオベースポリカーボネート樹脂

- ナノテクノロジー

- 主な会議とイベント(2024年~2025年)

- 価格分析

- 平均販売価格の動向:地域別

- 主要企業の平均販売価格の動向:用途別

第6章 ポリカーボネート樹脂市場:用途別

- イントロダクション

- 電気・電子

- 光学メディア

- 消費財

- 自動車

- フィルム・シート

- 建設

- 包装

- 医療

- その他の用途

第7章 ポリカーボネート樹脂市場:地域別

- イントロダクション

- 北米

- 不況の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 不況の影響

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 不況の影響

- 中国

- 台湾

- 日本

- インド

- 韓国

- その他のアジア太平洋

- 中東・アフリカ

- 不況の影響

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- 南米

- 不況の影響

- ブラジル

- アルゼンチン

- その他の南米

第8章 競合情勢

- 主要企業戦略/有力企業

- 主要企業の収益分析(2021年~2023年)

- 主要市場企業のランキング(2023年)

- 市場シェア分析

- 企業評価マトリクス:主要企業(2023年)

- 競合シナリオ

第9章 企業プロファイル

- 主要企業

- COVESTRO AG

- SABIC

- MITSUBISHI ENGINEERING-PLASTICS CORPORATION

- LOTTE CHEMICAL CORPORATION

- TEIJIN LIMITED

- LG CHEM

- FORMOSA CHEMICALS & FIBRE CORPORATION

- TRINSEO PLC

- CHIMEI

- IDEMITSU KOSAN CO., LTD.

- その他の企業

- CHINA PETROLEUM CORPORATION (SINOPEC)

- SAMYANG (ADVANCED MATERIALS)

- RTP COMPANY

- SUMIKA STYRON POLYCARBONATE LIMITED

- SRF

- KAZANORGSINTEZ (SIBUR HOLDING PJSC)

- XIAMEN KEYUAN PLASTIC CO., LTD.

- THAI POLYCARBONATE CO., LTD.

- EMCO INDUSTRIAL PLASTICS, LLC

- WANHUA CHEMICAL GROUP

- LUXI GROUP

- NAHATA PLASTICS

- CELANESE CORPORATION

- ENSINGER

- FOREVER CO., LTD.

第10章 付録

The polycarbonate resin market size was estimated to be USD 15.3 billion in 2024 and is projected to reach USD 20.1 billion by 2029 at a CAGR of 5.5% between 2024 and 2029. The growth of the polycarbonate resin market is boosted by its increased demand in applications in the automotive industry, especially in the glazing application. The growing demand from the consumer sector is also one of the key drivers of the polycarbonate resin market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Volume (Kilo Tons), Value (USD Billion) |

| Segments | Application and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

"By application, construction industry accounted for the third largest market during the forecast period."

The construction industry represents a significant market for polycarbonate resin due to its wide-ranging applications and advantageous properties. One of the primary applications of polycarbonate in construction is in skylights and roofing panels. The lightweight nature of polycarbonate makes it easy to handle and install, while its high impact resistance and UV stability ensure long-lasting performance in outdoor environments. Polycarbonate roofing panels provide excellent weather protection, allowing natural light to enter buildings while reducing the need f bor artificial lighting.

"Europe is projected to account for the second largest market in the polycarbonate resin market during the forecast period."

The countries considered for the market in Europe include Germany, France, Italy, UK, and Spain, among others. The major factors driving demand for polycarbonate resin in Western Europe include the increased demand in the automotive industry. Stringent regulations regarding fuel efficiency are applicable in Europe, which drives manufacturers to search for more lightweight and durable materials for manufacturing vehicles. Polycarbonate resin is lightweight, tough, and has excellent optical transparency. The growth of the polycarbonate resin market in Europe can be attributed to the rising demand from key end-use industries such as building & construction and packaging. Major manufacturers include SABIC, Covestro AG, TRINSEO S.A., TEIJIN LIMITED, and Mitsubishi Gas Chemical Company, Inc.

By Company Type: Tier 1: 30%, Tier 2: 35%, and Tier 3: 35%

By Designation: C-level Executives: 20%, Directors: 40%, and Others: 40%

By Region: North America: 20%, Europe: 30%, Asia Pacific: 40%, South America: 5%, and Middle East & Africa: 5%

Companies Covered: The top market players involved in the polycarbonate resin business are SABIC Innovative Plastics (US), Covestro (Germany), TEIJIN LTD. (Japan), Mitsubishi Engineering-Plastics Corporation (Japan), and LG Chem (South Korea)..

Research Coverage

The market study covers the Plastics market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on application, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the polycarbonate resin market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall polycarbonate resin market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies.

The report provides insights on the following pointers:

- Analysis of drivers (Growing demand from automotive industry, Rapid urbanization and infrastructure development), restraints (Residual BPA in food packaging and medical applications), opportunities (High applicability in electronics) and challenges (Intense competition from alternative materials) influencing the growth of polycarbonate resin market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and mergers & acquisitions in the polycarbonate resin market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for polycarbonate resin market across regions.

- Market Diversification: Exhaustive information about new products % services, untapped geographies, recent developments and investments in the polycarbonate resin market

- Market Penetration: Comprehensive information on the polycarbonate resin market offered by top players in the global market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the polycarbonate resin

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 POLYCARBONATE RESIN MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Interviews with experts - demand and supply side

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 2 POLYCARBONATE RESIN MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 3 POLYCARBONATE RESIN MARKET: TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- FIGURE 4 DEMAND-SIDE FORECAST PROJECTIONS

- 2.4 DATA TRIANGULATION

- FIGURE 5 POLYCARBONATE RESIN MARKET: DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS & RISKS

- 2.8 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- FIGURE 6 ELECTRICAL & ELECTRONICS TO BE LARGEST APPLICATION, IN TERMS OF VALUE, DURING FORECAST PERIOD

- FIGURE 7 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN POLYCARBONATE RESIN MARKET

- FIGURE 8 ASIA PACIFIC TO LEAD MARKET, IN TERMS OF VOLUME, DURING FORECAST PERIOD

- 4.2 POLYCARBONATE RESIN MARKET, BY APPLICATION

- FIGURE 9 MEDICAL APPLICATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 POLYCARBONATE RESIN MARKET, BY COUNTRY

- FIGURE 10 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN POLYCARBONATE RESIN MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand from automotive industry

- TABLE 1 ASIA PACIFIC, VEHICLE PRODUCTION STATISTICS, BY COUNTRY, 2021-2022 (UNIT)

- 5.2.1.2 Rapid urbanization and infrastructure development

- 5.2.2 RESTRAINTS

- 5.2.2.1 Residual BPA in food packaging and medical applications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High applicability in electronics

- 5.2.3.2 Growth in emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 High competition and globalization

- 5.2.4.2 Intense competition from alternative materials

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 12 VALUE CHAIN ANALYSIS

- 5.3.1 RAW MATERIAL SUPPLIERS

- 5.3.2 RESIN MANUFACTURERS

- 5.3.3 COMPOUNDERS/FORMULATORS

- 5.3.4 MOLDER/COMPONENT MANUFACTURERS

- 5.3.5 END USERS

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 13 POLYCARBONATE RESIN MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREAT OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 2 PORTER'S FIVE FORCES ANALYSIS

- 5.5 PATENT ANALYSIS

- 5.5.1 METHODOLOGY

- 5.5.2 DOCUMENT TYPES

- FIGURE 14 GRANTED PATENTS

- 5.5.3 PUBLICATION TRENDS IN LAST 10 YEARS

- 5.5.4 INSIGHTS

- 5.5.5 JURISDICTION ANALYSIS

- 5.5.6 TOP 10 APPLICANTS

- 5.5.7 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- 5.6 ECOSYSTEM/MARKET MAP

- FIGURE 15 POLYCARBONATE RESIN MARKET ECOSYSTEM

- TABLE 3 POLYCARBONATE RESIN ECOSYSTEM

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO OF POLYCARBONATE

- FIGURE 16 IMPORT OF POLYCARBONATE, BY KEY COUNTRY, 2019-2023

- 5.7.2 EXPORT SCENARIO OF POLYCARBONATE

- FIGURE 17 EXPORT OF POLYCARBONATE, BY KEY COUNTRY, 2019-2023

- 5.8 MACROECONOMIC OVERVIEW AND KEY TRENDS

- 5.8.1 PLASTIC PRODUCTION

- TABLE 4 PLASTIC PRODUCTION (MILLION TONS)

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 BIOBASED POLYCARBONATE RESIN

- 5.9.2 NANOTECHNOLOGY

- 5.10 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 5 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 18 AVERAGE SELLING PRICE, BY REGION (USD)/KG)

- 5.11.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

- FIGURE 19 AVERAGE SELLING PRICE, BY MARKET PLAYER (USD/KG)

- TABLE 6 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP 3 APPLICATIONS (USD/KG)

6 POLYCARBONATE RESIN MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- FIGURE 20 ELECTRICAL & ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF POLYCARBONATE RESIN MARKET DURING FORECAST PERIOD

- TABLE 7 POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 8 POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 9 POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 10 POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 6.2 ELECTRICAL & ELECTRONICS

- 6.2.1 HIGH IMPACT RESISTANCE AND TRANSPARENCY TO DRIVE MARKET

- 6.3 OPTICAL MEDIA

- 6.3.1 SHIFT TOWARD DIGITAL STREAMING TO LEAD TO DECLINING MARKET SHARE

- 6.4 CONSUMER GOODS

- 6.4.1 INCREASING DEMAND FOR RIGID CONTAINERS TO DRIVE MARKET

- 6.5 AUTOMOTIVE

- 6.5.1 WEIGHT REDUCTION AND ENHANCEMENT OF FUEL EFFICIENCY AND PERFORMANCE TO DRIVE MARKET

- 6.6 FILMS & SHEETS

- 6.6.1 LIGHTWEIGHT AND EXCELLENT THERMAL INSULATION TO DRIVE MARKET

- 6.7 CONSTRUCTION

- 6.7.1 INCREASING DEMAND FOR SKYLIGHTS AND ROOFING PANELS TO DRIVE MARKET

- 6.8 PACKAGING

- 6.8.1 SHATTERPROOF AND WATER AND CHEMICAL RESISTANCE QUALITIES TO DRIVE MARKET

- 6.9 MEDICAL

- 6.9.1 BIOCOMPATIBILITY FOR SURGICAL INSTRUMENTS AND MEDICAL EQUIPMENT TO BOOST MARKET

- 6.10 OTHER APPLICATIONS

7 POLYCARBONATE RESIN MARKET, BY REGION

- 7.1 INTRODUCTION

- FIGURE 21 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 11 POLYCARBONATE RESIN MARKET, BY REGION 2021-2023 (USD MILLION)

- TABLE 12 POLYCARBONATE RESIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 13 POLYCARBONATE RESIN MARKET, BY REGION 2021-2023 (KILOTON)

- TABLE 14 POLYCARBONATE RESIN MARKET, BY REGION, 2024-2029 (KILOTON)

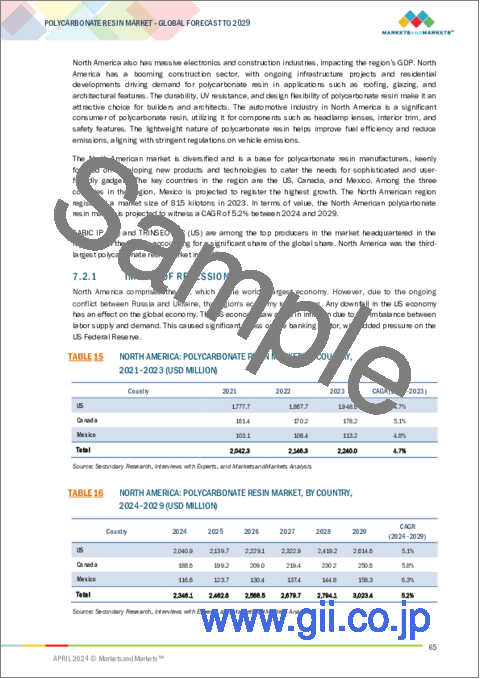

- 7.2 NORTH AMERICA

- 7.2.1 IMPACT OF RECESSION

- TABLE 15 NORTH AMERICA: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 16 NORTH AMERICA: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 17 NORTH AMERICA: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 18 NORTH AMERICA: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 19 NORTH AMERICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 20 NORTH AMERICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 21 NORTH AMERICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 22 NORTH AMERICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.2.2 US

- 7.2.2.1 Growth of electrical and automotive sectors to drive market

- TABLE 23 US: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 24 US: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 25 US: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 26 US: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.2.3 CANADA

- 7.2.3.1 Increasing demand for electronic devices to boost market

- TABLE 27 CANADA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 28 CANADA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 29 CANADA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 30 CANADA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.2.4 MEXICO

- 7.2.4.1 Growth of construction industry to drive market

- TABLE 31 MEXICO: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 32 MEXICO: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 33 MEXICO: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 34 MEXICO: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.3 EUROPE

- 7.3.1 IMPACT OF RECESSION

- FIGURE 22 EUROPE: POLYCARBONATE RESIN MARKET SNAPSHOT

- TABLE 35 EUROPE: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 36 EUROPE: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 37 EUROPE: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 38 EUROPE: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 39 EUROPE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 40 EUROPE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 41 EUROPE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 42 EUROPE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON )

- 7.3.2 GERMANY

- 7.3.2.1 Increasing demand for safety equipment in automotive to drive market

- TABLE 43 GERMANY: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 44 GERMANY: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 45 GERMANY: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 46 GERMANY: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON )

- 7.3.3 FRANCE

- 7.3.3.1 Rising automotive sector to drive market

- TABLE 47 FRANCE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 48 FRANCE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 49 FRANCE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 50 FRANCE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.3.4 UK

- 7.3.4.1 Growing construction industry to drive growth

- TABLE 51 UK: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 52 UK: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 53 UK: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 54 UK: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.3.5 ITALY

- 7.3.5.1 Transparency, durability, and lightweight properties to drive consumer electronics market

- TABLE 55 ITALY: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 56 ITALY: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 57 ITALY: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 58 ITALY: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON )

- 7.3.6 SPAIN

- 7.3.6.1 Increasing investments in renewable energy sector to drive market

- TABLE 59 SPAIN: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 60 SPAIN: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 61 SPAIN: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON )

- TABLE 62 SPAIN: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.3.7 REST OF EUROPE

- TABLE 63 REST OF EUROPE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 64 REST OF EUROPE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 65 REST OF EUROPE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 66 REST OF EUROPE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.4 ASIA PACIFIC

- 7.4.1 IMPACT OF RECESSION

- FIGURE 23 ASIA PACIFIC: POLYCARBONATE RESIN MARKET SNAPSHOT

- TABLE 67 ASIA PACIFIC: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 68 ASIA PACIFIC: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 69 ASIA PACIFIC: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 70 ASIA PACIFIC: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 71 ASIA PACIFIC: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 72 ASIA PACIFIC: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 73 ASIA PACIFIC: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 74 ASIA PACIFIC: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.4.2 CHINA

- 7.4.2.1 Stringent regulatory framework and open economy to drive market

- TABLE 75 CHINA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 76 CHINA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 77 CHINA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 78 CHINA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.4.2.2 Eastern China

- 7.4.2.3 Central China

- 7.4.2.4 Western China

- 7.4.2.5 Northeast China

- 7.4.2.6 South China

- 7.4.2.7 Key players in China

- TABLE 79 KEY PLAYERS IN CHINA

- TABLE 80 CHINA: POLYCARBONATE RESIN MARKET, BY TERRITORY, 2021-2023 (USD MILLION)

- TABLE 81 CHINA: POLYCARBONATE RESIN MARKET, BY TERRITORY, 2024-2029 (USD MILLION)

- TABLE 82 CHINA: POLYCARBONATE RESIN MARKET, BY TERRITORY, 2021-2023 (KILOTON)

- TABLE 83 CHINA: POLYCARBONATE RESIN MARKET, BY TERRITORY, 2024-2029 (KILOTON)

- 7.4.3 TAIWAN

- 7.4.3.1 Strong electronics industry to drive market

- TABLE 84 TAIWAN: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 85 TAIWAN: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 86 TAIWAN: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 87 TAIWAN: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.4.4 JAPAN

- 7.4.4.1 Large automotive industry to drive market

- TABLE 88 JAPAN: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 89 JAPAN: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 90 JAPAN: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 91 JAPAN: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.4.5 INDIA

- 7.4.5.1 Government initiatives and strong outlook to drive market

- TABLE 92 INDIA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 93 INDIA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 94 INDIA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 95 INDIA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.4.6 SOUTH KOREA

- 7.4.6.1 Strong growth of electronics industry to drive market

- TABLE 96 SOUTH KOREA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 97 SOUTH KOREA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 98 SOUTH KOREA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 99 SOUTH KOREA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.4.7 REST OF ASIA PACIFIC

- TABLE 100 REST OF ASIA PACIFIC: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 101 REST OF ASIA PACIFIC: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 103 REST OF ASIA PACIFIC: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.5 MIDDLE EAST & AFRICA

- 7.5.1 IMPACT OF RECESSION

- TABLE 104 MIDDLE EAST & AFRICA: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 107 MIDDLE EAST & AFRICA: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 108 MIDDLE EAST & AFRICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 111 MIDDLE EAST & AFRICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.5.2 GCC COUNTRIES

- 7.5.2.1 Saudi Arabia

- 7.5.2.1.1 Government initiatives to drive demand

- 7.5.2.1 Saudi Arabia

- TABLE 112 SAUDI ARABIA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 113 SAUDI ARABIA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 114 SAUDI ARABIA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 115 SAUDI ARABIA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.5.2.2 UAE

- 7.5.2.2.1 Investments in technology sector to drive market

- 7.5.2.2 UAE

- TABLE 116 UAE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 117 UAE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 118 UAE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 119 UAE: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.5.2.3 Rest of GCC Countries

- TABLE 120 REST OF GCC COUNTRIES: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 121 REST OF GCC COUNTRIES: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 122 REST OF GCC COUNTRIES: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 123 REST OF GCC COUNTRIES: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.5.3 SOUTH AFRICA

- 7.5.3.1 Growing construction industry to propel market

- TABLE 124 SOUTH AFRICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 125 SOUTH AFRICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 126 SOUTH AFRICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 127 SOUTH AFRICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 128 REST OF MIDDLE EAST & AFRICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 129 REST OF MIDDLE EAST & AFRICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 130 REST OF MIDDLE EAST & AFRICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 131 REST OF MIDDLE EAST & AFRICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.6 SOUTH AMERICA

- 7.6.1 IMPACT OF RECESSION

- TABLE 132 SOUTH AMERICA: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 133 SOUTH AMERICA: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 134 SOUTH AMERICA: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 135 SOUTH AMERICA: POLYCARBONATE RESIN MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 136 SOUTH AMERICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 137 SOUTH AMERICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 138 SOUTH AMERICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 139 SOUTH AMERICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.6.2 BRAZIL

- 7.6.2.1 Favorable business environment to drive market

- TABLE 140 BRAZIL: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 141 BRAZIL: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 142 BRAZIL: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 143 BRAZIL: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.6.3 ARGENTINA

- 7.6.3.1 Rising automotive industry to drive demand

- TABLE 144 ARGENTINA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 145 ARGENTINA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 146 ARGENTINA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 147 ARGENTINA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 7.6.4 REST OF SOUTH AMERICA

- TABLE 148 REST OF SOUTH AMERICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 149 REST OF SOUTH AMERICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 150 REST OF SOUTH AMERICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 151 REST OF SOUTH AMERICA: POLYCARBONATE RESIN MARKET, BY APPLICATION, 2024-2029 (KILOTON)

8 COMPETITIVE LANDSCAPE

- 8.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- FIGURE 24 COMPANIES ADOPTED EXPANSIONS AND PARTNERSHIPS AS KEY GROWTH STRATEGIES BETWEEN 2019 AND 2023

- 8.2 REVENUE ANALYSIS OF KEY PLAYERS (2021-2023)

- FIGURE 25 REVENUE ANALYSIS OF KEY PLAYERS IN POLYCARBONATE RESIN MARKET

- 8.3 RANKING OF KEY MARKET PLAYERS, 2023

- FIGURE 26 RANKING OF KEY MARKET PLAYERS, 2023

- 8.4 MARKET SHARE ANALYSIS

- FIGURE 27 MARKET SHARE OF KEY PLAYERS, 2023

- TABLE 152 POLYCARBONATE RESIN MARKET: DEGREE OF COMPETITION

- 8.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 8.5.1 STARS

- 8.5.2 EMERGING LEADERS

- 8.5.3 PERVASIVE PLAYERS

- 8.5.4 PARTICIPANTS

- FIGURE 28 POLYCARBONATE RESIN MARKET: COMPANY EVALUATION MATRIX, 2023

- 8.5.5 COMPANY FOOTPRINT, KEY PLAYERS, 2023

- 8.5.5.1 Application footprint

- TABLE 153 APPLICATION: COMPANY FOOTPRINT

- 8.5.5.2 Region footprint

- TABLE 154 REGION: COMPANY FOOTPRINT

- 8.5.5.3 Company footprint

- TABLE 155 COMPANY FOOTPRINT

- 8.6 COMPETITIVE SCENARIO

- 8.6.1 PRODUCT LAUNCHES

- TABLE 156 POLYCARBONATE RESIN MARKET: PRODUCT LAUNCHES, JANUARY 2019- DECEMBER 2023

- 8.6.2 DEALS

- TABLE 157 POLYCARBONATE RESIN MARKET: DEALS, JANUARY 2019-DECEMBER 2023

- 8.6.3 EXPANSIONS

- TABLE 158 POLYCARBONATE RESIN MARKET: EXPANSIONS, JANUARY 2019-DECEMBER 2023

9 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 9.1 MAJOR PLAYERS

- 9.1.1 COVESTRO AG

- TABLE 159 COVESTRO AG: COMPANY OVERVIEW

- FIGURE 29 COVESTRO AG: COMPANY SNAPSHOT

- TABLE 160 COVESTRO AG: PRODUCTS OFFERED

- TABLE 161 COVESTRO AG: PRODUCT LAUNCHES

- TABLE 162 COVESTRO AG: DEALS

- TABLE 163 COVESTRO AG: EXPANSIONS

- 9.1.2 SABIC

- TABLE 164 SABIC: COMPANY OVERVIEW

- FIGURE 30 SABIC: COMPANY SNAPSHOT

- TABLE 165 SABIC: PRODUCTS OFFERED

- TABLE 166 SABIC: PRODUCT LAUNCHES

- TABLE 167 SABIC: DEALS

- 9.1.3 MITSUBISHI ENGINEERING-PLASTICS CORPORATION

- TABLE 168 MITSUBISHI ENGINEERING-PLASTICS CORPORATION: COMPANY OVERVIEW

- TABLE 169 MITSUBISHI ENGINEERING-PLASTICS CORPORATION: PRODUCTS OFFERED

- TABLE 170 MITSUBISHI ENGINEERING-PLASTICS CORPORATION: DEALS

- 9.1.4 LOTTE CHEMICAL CORPORATION

- TABLE 171 LOTTE CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 172 LOTTE CHEMICAL CORPORATION: PRODUCTS OFFERED

- TABLE 173 LOTTE CHEMICAL CORPORATION: DEALS

- 9.1.5 TEIJIN LIMITED

- TABLE 174 TEIJIN LIMITED: COMPANY OVERVIEW

- FIGURE 31 TEIJIN LIMITED: COMPANY SNAPSHOT

- TABLE 175 TEIJIN LIMITED: PRODUCTS OFFERED

- TABLE 176 TEIJIN LIMITED: PRODUCT LAUNCHES

- TABLE 177 TEIJIN LIMITED: DEALS

- 9.1.6 LG CHEM

- TABLE 178 LG CHEM: COMPANY OVERVIEW

- FIGURE 32 LG CHEM: COMPANY SNAPSHOT

- TABLE 179 LG CHEM.: PRODUCTS OFFERED

- TABLE 180 LG CHEM: DEALS

- 9.1.7 FORMOSA CHEMICALS & FIBRE CORPORATION

- TABLE 181 FORMOSA CHEMICALS & FIBRE CORPORATION: COMPANY OVERVIEW

- TABLE 182 FORMOSA CHEMICALS & FIBRE CORPORATION: PRODUCTS OFFERED

- 9.1.8 TRINSEO PLC

- TABLE 183 TRINSEO PLC: COMPANY OVERVIEW

- FIGURE 33 TRINSEO PLC: COMPANY SNAPSHOT

- TABLE 184 TRINSEO PLC: PRODUCTS OFFERED

- TABLE 185 TRINSEO PLC: EXPANSIONS

- 9.1.9 CHIMEI

- TABLE 186 CHIMEI: COMPANY OVERVIEW

- TABLE 187 CHIMEI: PRODUCTS OFFERED

- TABLE 188 CHIMEI: PRODUCT LAUNCHES

- TABLE 189 CHIMEI: EXPANSIONS

- 9.1.10 IDEMITSU KOSAN CO., LTD.

- TABLE 190 IDEMITSU KOSAN CO., LTD.: COMPANY OVERVIEW

- FIGURE 34 IDEMITSU KOSAN CO., LTD: COMPANY SNAPSHOT

- TABLE 191 IDEMITSU KOSAN CO., LTD.: PRODUCTS OFFERED

- 9.2 OTHER PLAYERS

- 9.2.1 CHINA PETROLEUM CORPORATION (SINOPEC)

- TABLE 192 CHINA PETROLEUM CORPORATION (SINOPEC): COMPANY OVERVIEW

- 9.2.2 SAMYANG (ADVANCED MATERIALS)

- TABLE 193 SAMYANG (ADVANCED MATERIALS): COMPANY OVERVIEW

- 9.2.3 RTP COMPANY

- TABLE 194 RTP COMPANY.: COMPANY OVERVIEW

- 9.2.4 SUMIKA STYRON POLYCARBONATE LIMITED

- TABLE 195 SUMIKA STYRON POLYCARBONATE LIMITED.: COMPANY OVERVIEW

- 9.2.5 SRF

- TABLE 196 SRF: COMPANY OVERVIEW

- 9.2.6 KAZANORGSINTEZ (SIBUR HOLDING PJSC)

- TABLE 197 KAZANORGSINTEZ (SIBUR HOLDING PJSC).: COMPANY OVERVIEW

- 9.2.7 XIAMEN KEYUAN PLASTIC CO., LTD.

- TABLE 198 XIAMEN KEYUAN PLASTIC CO., LTD.: COMPANY OVERVIEW

- 9.2.8 THAI POLYCARBONATE CO., LTD.

- TABLE 199 THAI POLYCARBONATE CO., LTD.: COMPANY OVERVIEW

- 9.2.9 EMCO INDUSTRIAL PLASTICS, LLC

- TABLE 200 EMCO INDUSTRIAL PLASTICS, LLC: COMPANY OVERVIEW

- 9.2.10 WANHUA CHEMICAL GROUP

- TABLE 201 WANHUA CHEMICAL GROUP: COMPANY OVERVIEW

- 9.2.11 LUXI GROUP

- TABLE 202 LUXI GROUP: COMPANY OVERVIEW

- 9.2.12 NAHATA PLASTICS

- TABLE 203 NAHATA PLASTICS: COMPANY OVERVIEW

- 9.2.13 CELANESE CORPORATION

- TABLE 204 CELANESE CORPORATION: COMPANY OVERVIEW

- 9.2.14 ENSINGER

- TABLE 205 ENSINGER: COMPANY OVERVIEW

- 9.2.15 FOREVER CO., LTD.

- TABLE 206 FOREVER CO., LTD.: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

10 APPENDIX

- 10.1 DISCUSSION GUIDE

- 10.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 10.3 CUSTOMIZATION OPTIONS

- 10.4 RELATED REPORTS

- 10.5 AUTHOR DETAILS