|

|

市場調査レポート

商品コード

1479080

物理セキュリティ情報管理(PSIM)の世界市場:提供別、ソフトウェアタイプ別、展開方式別、組織規模別、業界別、地域別 - 予測(~2029年)Physical Security Information Management (PSIM) Market by Offering (Software and Services), Software Type, Deployment Mode, Organization Size, Vertical (BFSI, IT & ITES, and Healthcare) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 物理セキュリティ情報管理(PSIM)の世界市場:提供別、ソフトウェアタイプ別、展開方式別、組織規模別、業界別、地域別 - 予測(~2029年) |

|

出版日: 2024年05月09日

発行: MarketsandMarkets

ページ情報: 英文 294 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の物理セキュリティ情報管理(PSIM)の市場規模は、2024年の35億米ドルから2029年までに43億米ドルに達し、予測期間にCAGRで4.6%の成長が見込まれます。

PSIMシステムへのAI、ML、ブロックチェーン技術の到来は、セキュリティプロセスの自動化と脅威検出能力の強化によって大きな成長を促進します。例えば、CalipsaのAIは誤警報を最大95%削減し、業務を効率化します。このことに加え、業界全体のセキュリティシステムの複雑性が、PSIMの採用を促進しています。CCTVや入退室管理のような多様なセキュリティコンポーネントを一元化されたインターフェースに統合することで、PSIMはリアルタイムモニタリングとインシデント対応を強化します。企業が統合セキュリティ戦略を優先するにつれ、PSIMは効果的な資産保護に不可欠なものとなり、さまざまな部門における継続的な成長と採用に拍車をかけています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 提供、ソフトウェアタイプ、展開方式、組織規模、業界、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

「業界別では、輸送・ロジスティクス部門が大きな市場シェアを占めます。」

輸送・ロジスティクス部門は、世界の商取引における重要な役割と、それが直面する独自のセキュリティ課題により、市場で最大の市場シェアを占めています。空路、海路、鉄道、道路などのさまざまな輸送手段でモノや人の移動を促進するこの部門は、効率性、信頼性、安全性を優先しています。しかし、大量のセキュリティ機器やシステムの管理、状況認識の向上、規制遵守の確保は大きな課題となっています。PSIMは、多様なセキュリティシステムを統一プラットフォームに統合し、進化する脅威と運用ニーズに対応することで、これらの課題に対処します。テロやサイバー脅威など、セキュリティに対する懸念の高まりが、重要インフラを保護し、中断のない経営を確保するPSIMのような包括的なセキュリティソリューションの採用をさらに促進しています。

「提供別では、ソフトウェアセグメントが大きなシェアを占めています。」

ソフトウェアセグメントは、さまざまなセキュリティシステムを統合し管理できることから、PSIM市場を独占しています。PSIMソフトウェアには、入退室管理、ビデオ監視、侵入検知、火災安全、さらには施設管理ツールなども含まれます。GenetecやAvigilonなどの企業は、これらの機能を単一のプラットフォームに統合した包括的なPSIMソフトウェアスイートを提供しています。このような一元的なアプローチにより、セキュリティ経営が合理化され、状況認識が向上し、管理が単純化されるため、PSIM市場ではソフトウェアがもっとも価値の高い求められる製品となっています。

当レポートでは、世界の物理セキュリティ情報管理(PSIM)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 物理セキュリティ情報管理(PSIM)市場の企業にとって魅力的な機会

- 物理セキュリティ情報管理(PSIM)市場:提供別

- 物理セキュリティ情報管理(PSIM)市場:ソフトウェアタイプ別

- 物理セキュリティ情報管理(PSIM)市場:展開方式別

- 物理セキュリティ情報管理(PSIM)市場:組織規模別

- 物理セキュリティ情報管理(PSIM)市場:業界別、地域別

- 市場投資シナリオ

第5章 市場の概要と産業動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- バリューチェーン分析

- 研究開発

- 計画、設計

- テスト、品質保証

- システム統合

- 販売業者/再販業者

- エンドユーザー

- エコシステム

- ポーターのファイブフォース分析

- 価格分析

- 市場企業の平均販売価格の動向:ソフトウェア統合タイプ別

- 参考価格分析:ベンダー別

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 顧客のビジネスに影響を与える動向と混乱

- 主なステークホルダーと購入基準

- 規制情勢

- 主な会議とイベント

- ビジネスモデル分析

- 投資と資金調達のシナリオ

第6章 物理セキュリティ情報管理(PSIM)市場:用途別

- 集中管理

- コンプライアンス

- レポート、アナリティクス

- ビル管理

第7章 物理セキュリティ情報管理(PSIM)市場:提供別

- イントロダクション

- ソフトウェア

- サービス

第8章 物理セキュリティ情報管理(PSIM)市場:展開方式別

- イントロダクション

- オンプレミス

- クラウド

第9章 物理セキュリティ情報管理(PSIM)市場:組織規模別

- イントロダクション

- 中小企業

- 大企業

第10章 物理セキュリティ情報管理(PSIM)市場:業界別

- イントロダクション

- BFSI

- IT・ITES

- 政府

- 医療

- 小売・eコマース

- 住宅

- 輸送・ロジスティクス

- その他の業界

第11章 物理セキュリティ情報管理(PSIM)市場:地域別

- イントロダクション

- 北米

- 北米の物理セキュリティ情報管理(PSIM)市場の促進要因

- 北米に対する不況の影響

- 米国

- カナダ

- 欧州

- 欧州の物理セキュリティ情報管理(PSIM)市場の促進要因

- 欧州に対する不況の影響

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋の物理セキュリティ情報管理(PSIM)市場の促進要因

- アジア太平洋に対する不況の影響

- 中国

- 日本

- インド

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカの物理セキュリティ情報管理(PSIM)市場の促進要因

- 中東・アフリカに対する不況の影響

- GCC諸国

- トルコ

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカの物理セキュリティ情報管理(PSIM)市場の促進要因

- ラテンアメリカに対する不況の影響

- ブラジル

- メキシコ

- その他のラテンアメリカ

第12章 競合情勢

- 主要企業の戦略/有力企業

- ブランドの比較

- 企業評価と財務指標

- 収益分析

- 市場シェア分析

- 企業評価マトリクス:主要企業

- 企業評価マトリクス:スタートアップ/中小企業

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- HEXAGON AB

- HONEYWELL

- HIKVISION

- EVERBRIDGE

- AXXONSOFT

- VERINT

- GENETEC

- ENTELEC

- VIDSYS

- ADVANCIS

- その他の企業

- NANODEMS

- EAGLE EYE NETWORKS

- BOLD GROUP

- PRIMION

- PERSISTENT SENTINEL

- PRYSM SOFTWARE

- SUREVIEW

- EASYPSIM

- VERACITY

- AARMTECH

- OCTOPUS

- NETWORK HARBOR, INC.

- FAST SYSTEMS

- INTEGRATED SECURITY SYSTEMS

- GRETSCH-UNITAS

第14章 隣接市場と関連市場

- 隣接市場

- 制限事項

- 境界セキュリティ市場

- 物理セキュリティ市場

第15章 付録

The global physical security information management market size is projected to grow from USD 3.5 billion in 2024 to USD 4.3 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 4.6% during the forecast period. The emergence of AI, ML, and blockchain technologies into PSIM systems drives significant growth by automating security processes and enhancing threat detection capabilities. For example, Calipsa's AI reduces false alarms by up to 95%, streamlining operations. This, coupled with the complexity of security systems across industries, propels PSIM adoption. By unifying diverse security components like CCTV and access control into centralized interfaces, PSIM enhances real-time monitoring and incident response. As companies prioritize integrated security strategies, PSIM becomes indispensable for effective asset protection, fueling its continued growth and adoption in various sectors.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | USD (Billion) |

| Segments | Offering, Software Type, Deployment Mode, Organization Size, Vertical, And Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"By vertical, the Transportation & Logistics segment accounts for a larger market share."

The transportation and logistics sector commands the largest market share in the PSIM market due to its critical role in global commerce and the unique security challenges it faces. Facilitating the movement of goods and people across various transportation modes, including air, sea, rail, and road, this sector prioritizes efficiency, reliability, and safety. However, managing large numbers of security devices and systems, improving situational awareness, and ensuring regulatory compliance pose significant challenges. PSIM addresses these challenges by integrating diverse security systems into a unified platform, accommodating evolving threats and operational needs. The sector's heightened security concerns, such as terrorism and cyber threats, further drive the adoption of comprehensive security solutions like PSIM to safeguard critical infrastructure and ensure uninterrupted operations.

"By Offering, the software segment accounts for a larger market share."

The software segment dominates the PSIM market due to its ability to integrate and manage various security systems. PSIM software encompasses access control, video surveillance, intrusion detection, fire safety, and even facility management tools. Companies like Genetec and Avigilon offer comprehensive PSIM software suites that unify these functionalities under a single platform. This centralized approach streamlines security operations, improves situational awareness, and simplifies management, making software the most valuable and sought-after offering within the PSIM market.

Breakdown of primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 45%, Tier 2 - 35%, and Tier 3 - 20%

- By Designation: C-level Executives- 56% , Directors - 32%, and Others - 12%

- By Region: North America - 55%, Europe - 19%, Asia Pacific - 12%, Middle East & Africa - 9%, Latin America - 5%

Major vendors in the global physical security information management market include Hexagon AB (Sweden), Honeywell (US), Hikvision (China), Evergreen (US), Axxonsoft (Ireland), Genetec (Canada), Advancis (Germany), Entelec (Belgium), Verint (US), Vidsys (US), Nanodems (US), Eagle Eye Network (US), Bold Group (US), Primion (Germany), Persistent Sentinel (US), Prysm Software (France), Sureview Systems (US), easypsim (Switzerland), Veracity Solutions (Scotland), AARMTech (India), Octopus (Israel), Network Harbor (US), Fast Systems (Switzerland), Integrated Security Systems (ISS) (US), and Gretsch-Unitas Deutschland (Germany) are the key players and other players in the physical security information management market.

The study includes an in-depth competitive analysis of the key players in the physical security information management market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the physical security information management market and forecasts its size by Offering (Software and Services), Software Type (Access Control, Video Management, Intrusion Detection Management, Fire Safety and Alarms, GIS Mapping System, HVAC), Deployment Mode (On-Premises and Cloud), Organization Size (SMEs and Large Enterprises), Vertical (BFSI, IT and ITeS, Government, Healthcare, Retail and Ecommerce, Residential, Transport and Logistics, and Other Verticals), and Region (North America, Latin America, Europe, Asia-Pacific, Middle East, and Africa).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall physical security information management market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising concerns over security threats and need for integrating multiple security systems), restraints (complexity in integrating security systems with PSIM and absence of standardization), opportunities (emergence of cloud-based PSIM solutions, integration with advanced technologies like video analytics, and AI/ML and blockchain, and rise in smart cities), and challenges (High costs related to deployment of PSIM solutions and shortage of skilled professionals)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the physical security information management market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the physical security information management market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the physical security information management market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players Hexagon AB (Sweden), Honeywell (US), Hikvision (China), Evergreen (US), Axxonsoft (Ireland), among others, in the physical security information management market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2023

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 REVENUE ESTIMATES

- FIGURE 2 APPROACH 1 (SUPPLY SIDE): REVENUE OF PSIM VENDORS FROM SOLUTIONS/SERVICES

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1, SUPPLY-SIDE ANALYSIS

- FIGURE 4 APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOFTWARE AND SERVICES OF PSIM VENDORS

- 2.2.2 DEMAND-SIDE ANALYSIS

- FIGURE 5 APPROACH 3, TOP-DOWN (DEMAND SIDE)

- 2.3 MARKET FORECAST

- TABLE 2 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: FACTOR ANALYSIS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- TABLE 3 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET AND GROWTH RATE, 2018-2023 (USD MILLION, Y-O-Y%)

- TABLE 4 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET AND GROWTH RATE, 2024-2029 (USD MILLION, Y-O-Y%)

- FIGURE 6 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET SIZE AND Y-O-Y GROWTH RATE, 2022-2029 (USD MILLION

- FIGURE 7 SEGMENTS WITH HIGH GROWTH RATES DURING FORECAST PERIOD

- FIGURE 8 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2024

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET

- FIGURE 9 RISE IN TERRORIST ACTIVITIES AND NEED TO SECURE CRITICAL INFRASTRUCTURE TO DRIVE MARKET GROWTH

- 4.2 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING

- FIGURE 10 SOFTWARE SEGMENT TO ACCOUNT FOR HIGHER MARKET DURING FORECAST PERIOD

- 4.3 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE

- FIGURE 11 VIDEO MANAGEMENT SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- 4.4 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE

- FIGURE 12 CLOUD SEGMENT TO ACCOUNT FOR GREATER SHARE DURING FORECAST PERIOD

- 4.5 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE

- FIGURE 13 SMES TO GROW AT HIGHER RATE DURING FORECAST PERIOD

- 4.6 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL AND REGION

- FIGURE 14 TRANSPORT & LOGISTICS AND NORTH AMERICA TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2024

- 4.7 MARKET INVESTMENT SCENARIO

- FIGURE 15 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising concerns over security threats

- FIGURE 17 CRITICAL INFRASTRUCTURE SECTORS IMPACTED BY RANSOMWARE

- 5.2.1.2 Need for integrating multiple security systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complexity in integrating security systems with PSIM

- 5.2.2.2 Absence of standardization

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of cloud-based PSIM solutions

- 5.2.3.2 Integration with advanced technologies like video analytics, AI/ML, and blockchain

- 5.2.3.3 Increase in smart cities

- 5.2.4 CHALLENGES

- 5.2.4.1 High costs related to deployment of PSIM solutions

- 5.2.4.2 Shortage of skilled professionals

- 5.3 CASE STUDY ANALYSIS:

- 5.3.1 AXXONSOFT'S INTEGRATED SECURITY SOLUTION HELPED RAIFFEISEN BANK AVAL TRANSFORM SECURITY

- 5.3.2 SDI'S SITUATIONAL AWARENESS MANAGEMENT SOLUTION HELPED DEPARTMENT OF AIRPORTS ENHANCE SITUATIONAL AWARENESS AND RESPONSE EFFICIENCY

- 5.3.3 VA HEALTHCARE FACILITY OPTIMIZED SECURITY COMPLIANCE WITH PSIM INTEGRATION

- 5.3.4 GENETEC SECURITY CENTER HELPED UNIBAIL-RODAMCO-WESTFIELD OPTIMIZE SECURITY AND OPERATIONS SEAMLESSLY

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 18 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

- 5.4.1 RESEARCH AND DEVELOPMENT

- 5.4.2 PLANNING AND DESIGNING

- 5.4.3 TESTING AND QUALITY INSURANCE

- 5.4.4 SYSTEM INTEGRATION

- 5.4.5 DISTRIBUTORS/RESELLERS

- 5.4.6 END USERS

- 5.5 ECOSYSTEM

- FIGURE 19 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: ECOSYSTEM

- TABLE 5 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 PORTER'S FIVE FORCES ANALYSIS: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET

- TABLE 6 IMPACT OF PORTER'S FIVE FORCES ON PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF MARKET PLAYERS, BY SOFTWARE INTEGRATION TYPE

- FIGURE 21 AVERAGE SELLING PRICE TREND OF MARKET PLAYERS, BY SOFTWARE INTEGRATION TYPE

- TABLE 7 AVERAGE SELLING PRICE TREND OF MARKET PLAYERS, BY SOFTWARE INTEGRATION TYPE

- 5.7.2 INDICATIVE PRICING ANALYSIS, BY VENDOR

- TABLE 8 PRICING MODELS OF MILESTONE SYSTEMS FOR XPROTECT

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Artificial Intelligence (AI) and Machine Learning (ML)

- 5.8.1.2 Cloud Computing

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Video Analytics

- 5.8.2.2 Internet of Things (IoT)

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Real-time monitoring and analysis

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- FIGURE 22 NUMBER OF PATENTS GRANTED FOR PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, 2014-2024

- FIGURE 23 REGIONAL ANALYSIS OF PATENTS GRANTED FOR PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET

- TABLE 9 LIST OF TOP PATENTS IN PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, 2023-2024

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 REVENUE SHIFT FOR PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET VENDORS

- 5.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY VERTICALS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY VERTICALS

- 5.11.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY CONFERENCES & EVENTS

- TABLE 17 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: LIST OF CONFERENCES & EVENTS, 2024-2025

- 5.14 BUSINESS MODEL ANALYSIS

- TABLE 18 BUSINESS MODEL

- 5.15 INVESTMENT AND FUNDING SCENARIO

- FIGURE 27 LEADING GLOBAL PHYSICAL SECURITY INFORMATION SYSTEM STARTUPS AND SMES, BY NUMBER OF INVESTORS AND FUNDING AMOUNT

6 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY APPLICATION

- 6.1 CENTRALIZED MANAGEMENT

- 6.2 COMPLIANCE

- 6.3 REPORTING AND ANALYTICS

- 6.4 BUILDING MANAGEMENT

7 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING

- 7.1 INTRODUCTION

- FIGURE 28 SOFTWARE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 7.1.1 OFFERING: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET DRIVERS

- TABLE 19 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 20 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- 7.2 SOFTWARE

- 7.2.1 TRANSFORMATIVE SOFTWARE SOLUTIONS TO ENHANCE PHYSICAL SECURITY OPERATIONS

- TABLE 21 SOFTWARE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 22 SOFTWARE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 23 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 24 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- 7.2.2 ACCESS CONTROL

- TABLE 25 ACCESS CONTROL: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 26 ACCESS CONTROL: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.2.3 VIDEO MANAGEMENT

- TABLE 27 VIDEO MANAGEMENT: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 28 VIDEO MANAGEMENT: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.2.4 INTRUSION DETECTION MANAGEMENT

- TABLE 29 INTRUSION DETECTION MANAGEMENT: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 30 INTRUSION DETECTION MANAGEMENT: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.2.5 FIRE SAFETY & ALARMS

- TABLE 31 FIRE SAFETY & ALARMS: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 32 FIRE SAFETY & ALARMS: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.2.6 GIS MAPPING SYSTEMS

- TABLE 33 GIS MAPPING SYSTEMS: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 34 GIS MAPPING SYSTEMS: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

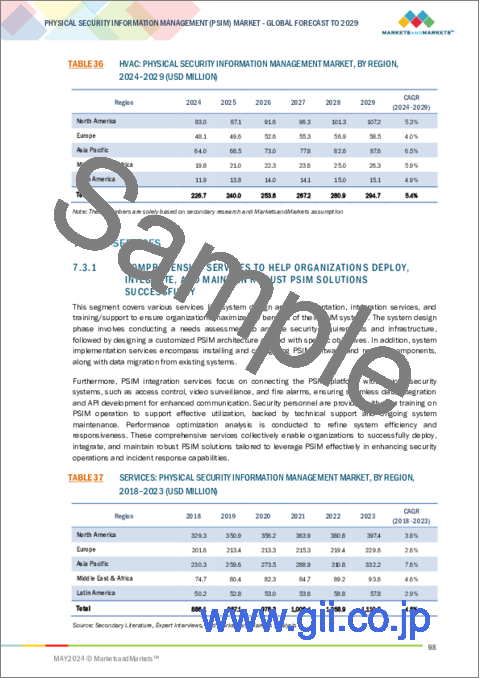

- 7.2.7 HVAC

- TABLE 35 HVAC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 36 HVAC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 7.3 SERVICES

- 7.3.1 COMPREHENSIVE SERVICES TO HELP ORGANIZATIONS DEPLOY, INTEGRATE, AND MAINTAIN ROBUST PSIM SOLUTIONS SUCCESSFULLY

- TABLE 37 SERVICES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 38 SERVICES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

8 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE

- 8.1 INTRODUCTION

- FIGURE 29 CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET BY 2029

- 8.1.1 DEPLOYMENT MODE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET DRIVERS

- TABLE 39 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 40 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 8.2 ON-PREMISES

- 8.2.1 CONTROL OVER PHYSICAL SECURITY DATA TO DRIVE ON-PREMISE PSIM ADOPTION

- TABLE 41 ON-PREMISES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 42 ON-PREMISES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3 CLOUD

- 8.3.1 OPTIMIZATION OF SECURITY OPERATIONS TO DRIVE DEMAND FOR CLOUD-BASED PSIM DEPLOYMENTS

- TABLE 43 CLOUD: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 44 CLOUD: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

9 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- FIGURE 30 LARGE ENTERPRISES SEGMENT TO DOMINATE MARKET BY 2029

- 9.1.1 ORGANIZATION SIZE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET DRIVERS

- TABLE 45 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 46 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 9.2.1 AFFORDABILITY, SCALABILITY, AND EASE OF DEPLOYMENT TO DRIVE DEMAND FOR PSIM SOLUTIONS

- TABLE 47 SMES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 48 SMES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3 LARGE ENTERPRISES

- 9.3.1 ADVANCED CUSTOMIZATION AND INTEGRATION CAPABILITIES TO DRIVE MARKET

- TABLE 49 LARGE ENTERPRISES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 50 LARGE ENTERPRISES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

10 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- FIGURE 31 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- 10.1.1 VERTICAL: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET DRIVERS

- TABLE 51 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 52 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- 10.2.1 PRECISE SUSPECT IDENTIFICATION AND RAPID RESPONSE CAPABILITIES TO DRIVE PSIM ADOPTION

- TABLE 53 BFSI: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 54 BFSI: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.3 IT & ITES

- 10.3.1 PROACTIVE THREAT DETECTION AND PREVENTION TO FUEL DEMAND FOR PSIM SOLUTIONS

- TABLE 55 IT & ITES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 56 IT & ITES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.4 GOVERNMENT

- 10.4.1 UNIFIED INTEGRATION TO DRIVE PSIM ADOPTION IN GOVERNMENT SECTOR

- TABLE 57 GOVERNMENT: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 58 GOVERNMENT: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.5 HEALTHCARE

- 10.5.1 ESCALATING SECURITY CHALLENGES TO DRIVE PSIM INTEGRATION

- TABLE 59 HEALTHCARE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 60 HEALTHCARE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.6 RETAIL & ECOMMERCE

- 10.6.1 INTEGRATING CENTRALIZED SECURITY SOLUTIONS TO ENHANCE OPERATIONAL EFFICIENCY

- TABLE 61 RETAIL & ECOMMERCE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 62 RETAIL & ECOMMERCE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.7 RESIDENTIAL

- 10.7.1 INTEGRATED MANAGEMENT SOLUTIONS TAILORED SPECIFICALLY FOR RESIDENTIAL ENVIRONMENTS TO SPUR DEMAND FOR PSIM SOLUTIONS

- TABLE 63 RESIDENTIAL: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 64 RESIDENTIAL: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.8 TRANSPORTATION & LOGISTICS

- 10.8.1 SURGING DEMAND FOR COMPREHENSIVE AND INTELLIGENT SECURITY MANAGEMENT SOLUTIONS TO DRIVE MARKET

- TABLE 65 TRANSPORTATION & LOGISTICS: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 66 TRANSPORTATION & LOGISTICS: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.9 OTHER VERTICALS

- TABLE 67 OTHER VERTICALS: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 68 OTHER VERTICALS: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

11 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 32 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 69 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 70 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET DRIVERS

- 11.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 33 NORTH AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET SNAPSHOT

- TABLE 71 NORTH AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 72 NORTH AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 73 NORTH AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 74 NORTH AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 75 NORTH AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 76 NORTH AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 77 NORTH AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 78 NORTH AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 79 NORTH AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 80 NORTH AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 81 NORTH AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 82 NORTH AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.2.3 US

- 11.2.3.1 Advancements in intelligence integration to boost market growth

- TABLE 83 US: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 84 US: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 85 US: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 86 US: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 87 US: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 88 US: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 89 US: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 90 US: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 91 US: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 92 US: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.2.4 CANADA

- 11.2.4.1 Rising cyber threats to drive adoption of cloud-based PSIM solutions

- TABLE 93 CANADA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 94 CANADA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 95 CANADA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 96 CANADA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 97 CANADA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 98 CANADA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 99 CANADA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 100 CANADA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 101 CANADA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 102 CANADA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET DRIVERS

- 11.3.2 EUROPE: RECESSION IMPACT

- TABLE 103 EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 104 EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 105 EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 106 EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 107 EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 108 EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 109 EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 110 EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 111 EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 112 EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 113 EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 114 EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Seamless integration of diverse security technologies through PSIM to drive market

- TABLE 115 UK: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 116 UK: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 117 UK: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 118 UK: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 119 UK: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 120 UK: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 121 UK: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 122 UK: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 123 UK: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 124 UK: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.3.4 GERMANY

- 11.3.4.1 Vendor-neutral integration and heightened flexibility to propel market

- TABLE 125 GERMANY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 126 GERMANY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 127 GERMANY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 128 GERMANY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 129 GERMANY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 130 GERMANY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 131 GERMANY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 132 GERMANY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 133 GERMANY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 134 GERMANY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.3.5 FRANCE

- 11.3.5.1 Rising need for effective centralized management system to present growth opportunities

- TABLE 135 FRANCE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 136 FRANCE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 137 FRANCE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 138 FRANCE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 139 FRANCE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 140 FRANCE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 141 FRANCE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 142 FRANCE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 143 FRANCE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 144 FRANCE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.3.6 ITALY

- 11.3.6.1 Strategic partnerships and innovative solutions offered by companies to bolster market growth

- TABLE 145 ITALY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 146 ITALY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 147 ITALY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 148 ITALY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 149 ITALY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 150 ITALY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 151 ITALY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 152 ITALY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 153 ITALY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 154 ITALY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.3.7 REST OF EUROPE

- TABLE 155 REST OF EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 156 REST OF EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 157 REST OF EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 158 REST OF EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 159 REST OF EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 160 REST OF EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 161 REST OF EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 162 REST OF EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 163 REST OF EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 164 REST OF EUROPE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 34 ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET SNAPSHOT

- TABLE 165 ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 166 ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 167 ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 168 ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 169 ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 170 ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 171 ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 172 ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 173 ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 174 ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 175 ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 176 ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.4.3 CHINA

- 11.4.3.1 Urbanization and government initiatives to boost market

- TABLE 177 CHINA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 178 CHINA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 179 CHINA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 180 CHINA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 181 CHINA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 182 CHINA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 183 CHINA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 184 CHINA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 185 CHINA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 186 CHINA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.4.4 JAPAN

- 11.4.4.1 Escalating security threats to prompt urgent security enhancements and drive market

- TABLE 187 JAPAN: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 188 JAPAN: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 189 JAPAN: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 190 JAPAN: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 191 JAPAN: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 192 JAPAN: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 193 JAPAN: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 194 JAPAN: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 195 JAPAN: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 196 JAPAN: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.4.5 INDIA

- 11.4.5.1 Substantial investments in infrastructure projects and digital transformation to spur market growth

- TABLE 197 INDIA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 198 INDIA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 199 INDIA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 200 INDIA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 201 INDIA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 202 INDIA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 203 INDIA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 204 INDIA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 205 INDIA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 206 INDIA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.4.6 REST OF ASIA PACIFIC

- TABLE 207 REST OF ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 214 REST OF ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 215 REST OF ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 216 REST OF ASIA PACIFIC: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 217 MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.5.3 GCC COUNTRIES

- TABLE 229 GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 230 GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 231 GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 232 GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 233 GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 234 GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 235 GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 236 GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 237 GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 238 GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 239 GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 240 GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.5.3.1 UAE

- 11.5.3.1.1 Growing PSIM adoption amid digital transformation to fuel market growth

- 11.5.3.1 UAE

- TABLE 241 UAE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 242 UAE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 243 UAE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 244 UAE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 245 UAE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 246 UAE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 247 UAE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 248 UAE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 249 UAE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 250 UAE: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.5.3.2 KSA

- 11.5.3.2.1 Strategic partnerships and innovative business models to accelerate market growth

- 11.5.3.2 KSA

- TABLE 251 KSA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 252 KSA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 253 KSA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 254 KSA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 255 KSA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 256 KSA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 257 KSA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 258 KSA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 259 KSA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 260 KSA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.5.3.3 Rest of GCC countries

- TABLE 261 REST OF GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 262 REST OF GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 263 REST OF GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 264 REST OF GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 265 REST OF GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 266 REST OF GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 267 REST OF GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 268 REST OF GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 269 REST OF GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 270 REST OF GCC COUNTRIES: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.5.4 TURKEY

- 11.5.4.1 Comprehensive network solutions to drive market growth

- TABLE 271 TURKEY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 272 TURKEY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 273 TURKEY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 274 TURKEY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 275 TURKEY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 276 TURKEY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 277 TURKEY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 278 TURKEY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 279 TURKEY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 280 TURKEY: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.5.5 SOUTH AFRICA

- 11.5.5.1 Need for holistic security management platforms to propel market

- TABLE 281 SOUTH AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 282 SOUTH AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 283 SOUTH AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 284 SOUTH AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 285 SOUTH AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 286 SOUTH AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 287 SOUTH AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 288 SOUTH AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 289 SOUTH AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 290 SOUTH AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.5.6 REST OF MIDDLE EAST & AFRICA

- TABLE 291 REST OF MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 292 REST OF MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 293 REST OF MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 294 REST OF MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 295 REST OF MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 296 REST OF MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 297 REST OF MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 298 REST OF MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 299 REST OF MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 300 REST OF MIDDLE EAST & AFRICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET DRIVERS

- 11.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 301 LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 302 LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 303 LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 304 LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 305 LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 306 LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 307 LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 308 LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 309 LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 310 LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 311 LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 312 LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.6.3 BRAZIL

- 11.6.3.1 Integration of advanced security technologies and surveillance systems to bolster market growth

- TABLE 313 BRAZIL: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 314 BRAZIL: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 315 BRAZIL: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 316 BRAZIL: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 317 BRAZIL: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 318 BRAZIL: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 319 BRAZIL: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 320 BRAZIL: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 321 BRAZIL: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 322 BRAZIL: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.6.4 MEXICO

- 11.6.4.1 Increasing adoption of sophisticated PSIM technologies to accelerate market growth

- TABLE 323 MEXICO: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 324 MEXICO: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 325 MEXICO: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 326 MEXICO: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 327 MEXICO: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 328 MEXICO: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 329 MEXICO: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 330 MEXICO: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 331 MEXICO: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 332 MEXICO: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.6.5 REST OF LATIN AMERICA

- TABLE 333 REST OF LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 334 REST OF LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 335 REST OF LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2018-2023 (USD MILLION)

- TABLE 336 REST OF LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY SOFTWARE TYPE, 2024-2029 (USD MILLION)

- TABLE 337 REST OF LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 338 REST OF LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 339 REST OF LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 340 REST OF LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 341 REST OF LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 342 REST OF LATIN AMERICA: PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2 BRAND COMPARISON

- FIGURE 35 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: COMPARISON OF VENDORS' BRANDS

- 12.3 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 36 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: COMPANY EVALUATION AND FINANCIAL METRICS

- 12.4 REVENUE ANALYSIS

- FIGURE 37 SEGMENTAL REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2020-2023 (USD MILLION)

- 12.5 MARKET SHARE ANALYSIS

- FIGURE 38 SHARE OF LEADING COMPANIES IN PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET

- TABLE 343 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: DEGREE OF COMPETITION

- FIGURE 39 RANKING OF KEY PLAYERS

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 40 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS

- 12.6.5.1 Company footprint

- FIGURE 41 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: COMPANY FOOTPRINT

- 12.6.5.2 Offering footprint

- TABLE 344 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: OFFERING FOOTPRINT

- 12.6.5.3 Software type footprint

- TABLE 345 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: SOFTWARE TYPE FOOTPRINT

- 12.6.5.4 Deployment mode footprint

- TABLE 346 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: DEPLOYMENT MODE FOOTPRINT

- 12.6.5.5 Vertical footprint

- TABLE 347 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: VERTICAL FOOTPRINT

- 12.6.5.6 Regional footprint

- TABLE 348 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: REGIONAL FOOTPRINT

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 42 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES

- 12.7.5.1 List of key startups/SMEs

- TABLE 349 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: KEY STARTUPS/SMES

- 12.7.5.2 Competitive benchmarking of key startups/SMEs

- TABLE 350 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: OFFERING FOOTPRINT OF KEY STARTUPS/SMES

- TABLE 351 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: VERTICAL FOOTPRINT OF KEY STARTUPS/SMES

- TABLE 352 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: REGIONAL FOOTPRINT OF KEY STARTUPS/SMES

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 PRODUCT LAUNCHES

- TABLE 353 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: PRODUCT LAUNCHES, JANUARY 2022-APRIL 2024

- 12.8.2 DEALS

- TABLE 354 PHYSICAL SECURITY INFORMATION MANAGEMENT MARKET: DEALS, JANUARY 2022- APRIL 2024

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 13.1.1 HEXAGON AB

- TABLE 355 HEXAGON AB: COMPANY OVERVIEW

- FIGURE 43 HEXAGON AB: COMPANY SNAPSHOT

- TABLE 356 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 357 HEXAGON AB: DEALS

- 13.1.2 HONEYWELL

- TABLE 358 HONEYWELL: COMPANY OVERVIEW

- FIGURE 44 HONEYWELL: COMPANY SNAPSHOT

- TABLE 359 HONEYWELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.3 HIKVISION

- TABLE 360 HIKVISION: COMPANY OVERVIEW

- FIGURE 45 HIKVISION: COMPANY SNAPSHOT

- TABLE 361 HIKVISION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 362 HIKVISION: PRODUCT LAUNCHES

- TABLE 363 HIKVISION: DEALS

- 13.1.4 EVERBRIDGE

- TABLE 364 EVERBRIDGE: COMPANY OVERVIEW

- FIGURE 46 EVERBRIDGE: COMPANY SNAPSHOT

- TABLE 365 EVERBRIDGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.5 AXXONSOFT

- TABLE 366 AXXONSOFT: COMPANY OVERVIEW

- TABLE 367 AXXONSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 368 AXXONSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- 13.1.6 VERINT

- TABLE 369 VERINT: COMPANY OVERVIEW

- FIGURE 47 VERINT: COMPANY SNAPSHOT

- TABLE 370 VERINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.7 GENETEC

- TABLE 371 GENETEC: COMPANY OVERVIEW

- TABLE 372 GENETEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 373 GENETEC: PRODUCT LAUNCHES AND ENHANCEMENTS

- 13.1.8 ENTELEC

- TABLE 374 ENTELEC: COMPANY OVERVIEW

- TABLE 375 ENTELEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.9 VIDSYS

- TABLE 376 VIDSYS: BUSINESS OVERVIEW

- TABLE 377 VIDSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.10 ADVANCIS

- TABLE 378 ADVANCIS: COMPANY OVERVIEW

- TABLE 379 ADVANCIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 380 ADVANCIS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 381 ADVANCIS: DEALS

- 13.2 OTHER PLAYERS

- 13.2.1 NANODEMS

- 13.2.2 EAGLE EYE NETWORKS

- 13.2.3 BOLD GROUP

- 13.2.4 PRIMION

- 13.2.5 PERSISTENT SENTINEL

- 13.2.6 PRYSM SOFTWARE

- 13.2.7 SUREVIEW

- 13.2.8 EASYPSIM

- 13.2.9 VERACITY

- 13.2.10 AARMTECH

- 13.2.11 OCTOPUS

- 13.2.12 NETWORK HARBOR, INC.

- 13.2.13 FAST SYSTEMS

- 13.2.14 INTEGRATED SECURITY SYSTEMS

- 13.2.15 GRETSCH-UNITAS

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 ADJACENT MARKETS

- TABLE 382 ADJACENT MARKETS AND FORECASTS

- 14.2 LIMITATIONS

- 14.3 PERIMETER SECURITY MARKET

- TABLE 383 PERIMETER SECURITY MARKET, BY COMPONENT, 2018-2023 (USD MILLION)

- TABLE 384 PERIMETER SECURITY MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 385 SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 386 SYSTEMS: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 387 SERVICES: PERIMETER SECURITY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 388 SERVICES: PERIMETER SECURITY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 14.4 PHYSICAL SECURITY MARKET

- TABLE 389 PHYSICAL SECURITY MARKET, BY COMPONENT, 2017-2022 (USD BILLION)

- TABLE 390 PHYSICAL SECURITY MARKET, BY COMPONENT, 2023-2028 (USD BILLION)

- TABLE 391 SYSTEMS: PHYSICAL SECURITY MARKET, BY REGION, 2017-2022 (USD BILLION)

- TABLE 392 SYSTEMS: PHYSICAL SECURITY MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 393 SERVICES: PHYSICAL SECURITY MARKET, BY REGION, 2017-2022 (USD BILLION)

- TABLE 394 SERVICES: PHYSICAL SECURITY MARKET, BY REGION, 2023-2028 (USD BILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS