|

|

市場調査レポート

商品コード

1811735

医療用ポリマーの世界市場:タイプ別、製造技術別、用途別、地域別 - 2030年までの予測Medical Polymer Market by Type (Medical Plastics, Medical Elastomers), Application (Medical Disposables, Medical Instruments and Devices, Prosthetics, Diagnostics Instruments and Tools), Manufacturing Technology, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 医療用ポリマーの世界市場:タイプ別、製造技術別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年09月05日

発行: MarketsandMarkets

ページ情報: 英文 451 Pages

納期: 即納可能

|

概要

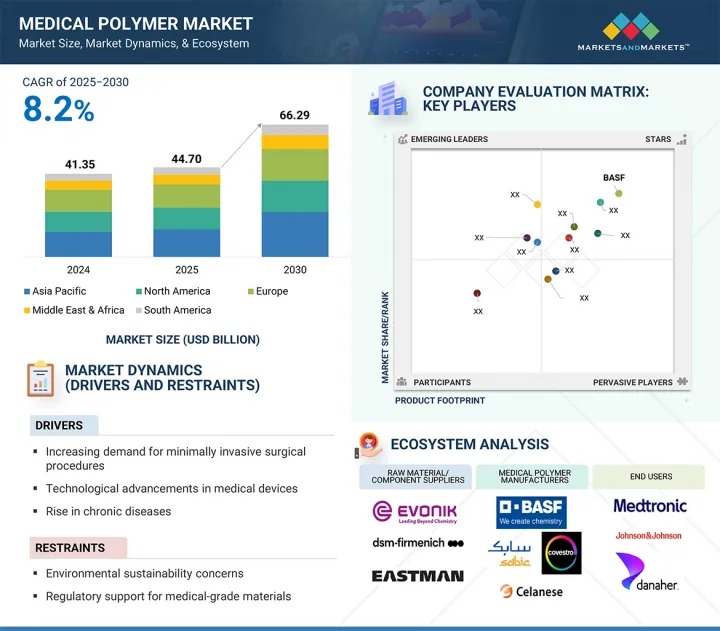

医療用ポリマーの市場規模は、予測期間中に8.2%のCAGRで拡大し、2025年の447億米ドルから2030年には662億9,000万米ドルに達すると予測されています。

医療用ポリマー市場は、ヘルスケア、材料工学、患者中心の技術革新の継続的な進歩の結果、急速な成長を遂げています。主な促進要因としては、軽量で耐久性があり、インプラントやカテーテル、診断機器、さらには手術器具のような生体適合材料が関係する状況での使用に適した材料へのニーズが挙げられます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)、数量(キロトン) |

| セグメント | タイプ別、製造技術別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

慢性疾患の増加、高齢化、低侵襲手術の必要性により、柔軟性、安全性、正確性を提供する先端ポリマーへの嗜好が高まっています。可能な限り衛生的で汚染物質の少ない使い捨て医療製品の使用が大幅にシフトしていることも、ポリマー製部品の普及に寄与しています。ポリマーの科学は、優れた機械的強度、耐久性、抗菌特性、活性滅菌技術との適合性を持つポリマーや材料を作り出すために進歩しています。知識と開発の進歩により、形状を保持できるポリマー、すなわち生体吸収性ポリマーは画期的な進歩を遂げ、ドラッグデリバリーデバイスや組織工学の分野で機会をもたらしています。医療用3Dプリンターの普及は、カスタムデザインのインプラントや器具を迅速に開発できるようになったため、この分野に革命をもたらしました。また、持続可能性への関心が高まり、リサイクル可能なポリマーや生分解性ポリマーへの関心が高まっています。

医療用エラストマーは、柔軟性、耐久性、生体適合性などのユニークな特性の組み合わせに基づき、医療用ポリマー市場で2番目に大きな種類を占めており、重要なヘルスケア用の何百もの精密な用途に使用することができます。医療用エラストマーの用途の多くは、シール、ガスケット、チューブ、シリンジ、プランジャー、カテーテル部品など、流体を封じ込める製品や、常に動いたり、伸ばしたり、圧縮したりする必要がある製品です。医療用エラストマー製品は、耐薬品性、温度変化への耐性、滅菌技術への耐性が最もよく知られており、高負荷のかかる医療用途で信頼性の高い製品を実現します。シリコーンエラストマー、熱可塑性エラストマー(TPE)、ゴム材料は、従来のポリマーや硬質ポリマーよりも快適性が向上しているため、文献で特に言及されることが多いため、ウェアラブル医療機器や皮膚に接触する用途に好まれています。さらに、ドラッグデリバリーシステム、自動封入検査システム、ライフスタイル診断機器に影響を与える高度な設計の側面と同様に、最小化の影響が引き続きエラストマー材料の性能を牽引しています。さらに、エラストマー材料は特に、E弾性率や引張強度が低下する自動製造や成形に適しており、かなり大量のコスト効率の良い生産が可能です。現代のヘルスケアにおける技術革新と安全性を支え、可能にすることと相まって、これらは最終的に、医療用ポリマー市場における医療用エラストマーの急成長と極めて重要なカテゴリーに貢献しています。

医療用ディスポーザブルは、医療現場における清潔さ、患者の安全性、感染対策において重要であるため、医療用ポリマー市場で2番目に大きな用途となっています。注射器、手袋、点滴バッグ、チューブと接続部、手術用ドレープ、マスクなどは、二次汚染を防ぎ、滅菌環境を維持するために使い捨てに設計されています。感染予防が重視され、感染管理をサポートする規制があるため、使い捨て医療用品の需要が高まっています。優れた加工性、低コスト、滅菌プロセスとの適合性から、医療用使い捨て品に使用されるポリマーは、主にポリプロピレン、ポリエチレン、PVCです。入院日数の増加、外科手術の強化、外来患者の増加などが、特に新興地域における良質なディスポーザブルの需要を牽引しています。すぐに使用できる滅菌済みアイテムの利便性は、多忙な医療現場での効率性を高める。ヘルスケアが安全性、費用対効果、効率性を重視し続ける中、ポリマー医療用使い捨て製品は今後も重要な成長分野となると思われます。

射出成形が医療用ポリマー分野で2番目に大きな製造技術であるのは、高精度で複雑な部品を優れた信頼性と効率で大規模に生産できるからです。射出成形は、診断機器のハウジング、手術器具のハンドル、注射器、コネクター、植え込み型器具の部品など、多種多様な医療製品の製造に使用されています。射出成形は、多くの医療グレードのポリマーと互換性があり、例えば、ポリカーボネート、ポリプロピレン、ABSから作ることができます。射出成形では、強度、生体適合性、耐薬品性、洗浄性が求められる部品の製造が可能です。射出成形は、複雑な形状を厳しい公差で製造することが可能であり、これらはすべて医療機器業界の安全性と性能の要件を満たすために関連するものです。射出成形は自動化にも対応しており、高品質な製品をコスト効率よく大量生産することができます。最近のマルチショットやマイクロファブリケーションの進歩は、さらに応用範囲を広げています。これらの利点により、射出成形が医療用ポリマー市場でいかに重要な役割を果たし、製品の技術革新を支え、洗練された信頼性の高い医療製品への需要を支え続けているかがよくわかります。

北米は医療用ポリマー市場において2番目に急成長している地域ですが、その主な理由は強力なヘルスケア力学と革新的な需要です。米国では保険適用が拡大し、カナダでは公的・私的医療投資が堅調であることから、一人当たりのヘルスケア費用が増加しています。北米ではヘルスケアの進歩に伴い、医療機器、パッケージング、創傷ケアのカテゴリーが他のどの地域よりも大きな成長を占めると予測されています。しかし米国は、整備された医療インフラ、強力な研究開発(R&D)エコシステム、ポリマー産業との強力なパートナーシップを基盤に、世界で最も革新的な医療環境を有しており、その結果、高性能ポリマーの数々が幅広く生み出され、拡大しています。これらのポリマーの多くは、手術器具、診断薬、ドラッグデリバリー・システム向けに生体適合性、さらには生分解性(樹脂や繊維)の特性を有しています。ヘルスケア業界は、使い捨て、低侵襲、在宅ケアといった患者の嗜好に合った製品導入を成功させるため、新製品開発(PEEKやその他のエンジニアリングプラスチックなど)の使用に関する新しい製品設計と革新的なアイデアに依存しています。アジア太平洋が最も高いCAGRでリードしている一方、北米は2番目に急速に成長している地域です。その理由は、規制の強さ(および米国の規制革新)、確立された医療制度、ポリマー技術開発の革新性を犠牲にすることなく患者や医療部門にサービスを提供するポリマーメーカーを擁する主要地域だからです。

当レポートでは、世界の医療用ポリマー市場について調査し、タイプ別、製造技術別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- マクロ経済指標

第6章 業界動向

- イントロダクション

- 主要な利害関係者と購入基準

- バリューチェーン分析

- エコシステム分析

- ケーススタディ分析

- 規制状況

- 技術分析

- 顧客ビジネスに影響を与える動向/混乱

- 貿易分析

- 2025年~2026年の主な会議とイベント

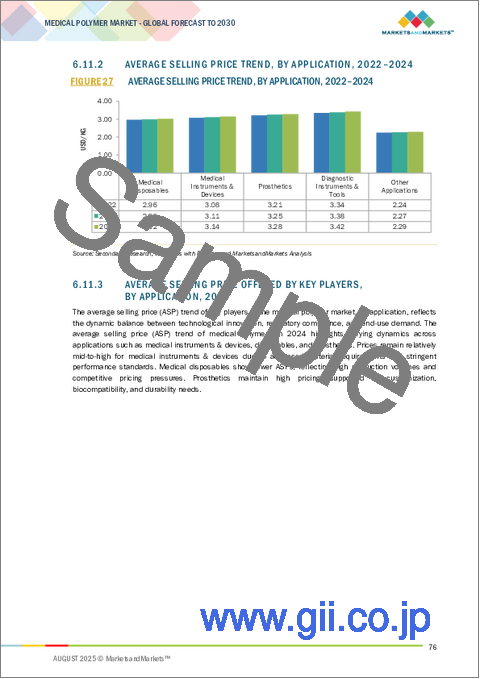

- 価格分析

- 投資と資金調達のシナリオ

- 特許分析

- AI/生成AIが医療用ポリマー市場に与える影響

- 2025年の米国関税が医療用ポリマー市場に与える影響

第7章 医療用ポリマー市場(タイプ別)

- イントロダクション

- 医療用プラスチック

- 医療用エラストマー

- その他

第8章 医療用ポリマー市場(製造技術別)

- イントロダクション

- 押出チューブ

- 圧縮成形

- 射出成形

- その他

第9章 医療用ポリマー市場(用途別)

- イントロダクション

- 医療用ディスポーザブル

- 医療機器

- 義肢

- 診断機器およびツール

- その他

第10章 医療用ポリマー市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

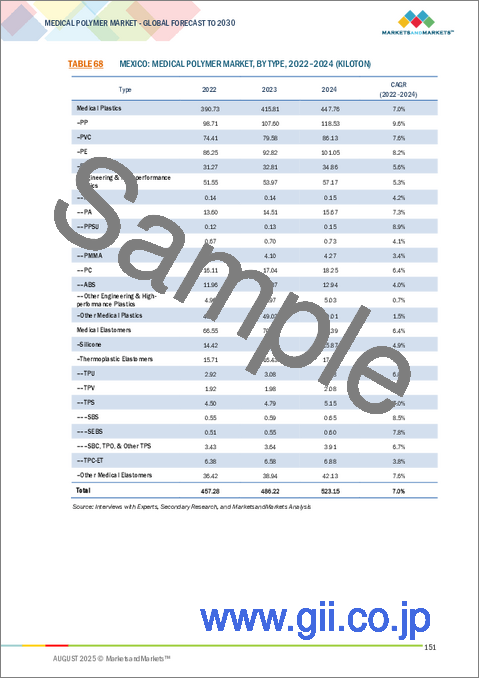

- メキシコ

- アジア太平洋

- 中国

- インド

- 韓国

- 日本

- オーストラリア

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略

- 収益分析、2022年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- BASF

- SABIC

- COVESTRO AG

- CELANESE CORPORATION

- EVONIK INDUSTRIES

- ARKEMA

- SOLVAY

- KURARAY CO., LTD.

- MOMENTIVE PERFORMANCE MATERIALS INC.

- DUPONT

- その他の企業

- TRINSEO

- KRATON CORPORATION

- TOTAL PLASTICS

- SIMONA AMERICA

- DSM

- INVIBIO

- AVIENT CORPORATION

- RTP COMPANY

- TEKNIPLEX

- TEKNOR APEX

- MITSUBISHI CHEMICALS ADVANCED MATERIALS

- WACKER CHIMIE

- HARDIE POLYMERS

- ELIX POLYMERS

- INNOVATIVE POLYMER COMPOUNDS