|

|

市場調査レポート

商品コード

1893724

鉄道管理システムの世界市場:オファリング別、鉄道タイプ別、地域別 - 2030年までの予測Railway Management System Market By Offering (Solution, Service), Railway Type - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 鉄道管理システムの世界市場:オファリング別、鉄道タイプ別、地域別 - 2030年までの予測 |

|

出版日: 2025年12月01日

発行: MarketsandMarkets

ページ情報: 英文 273 Pages

納期: 即納可能

|

概要

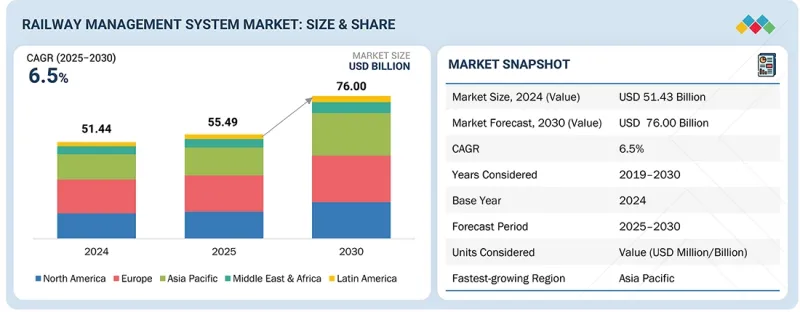

鉄道管理システムの市場規模は、2025年の554億9,000万米ドルから2030年までに760億米ドルへ成長し、予測期間中のCAGRは6.5%と予測されています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象単位 | 価値(100万/10億米ドル) |

| セグメント | オファリング別、鉄道タイプ別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、南米、中東・アフリカ |

旅客の期待が変化する中、鉄道事業者はシームレスで快適な旅行体験を提供することが求められています。統合型発券システム、リアルタイム旅客情報、Wi-Fi接続、エンターテインメントサービスは、現代の鉄道管理システムにおける標準機能となりつつあります。

鉄道管理システム市場におけるサービス分野は、鉄道運営の複雑化とエンドツーエンドの専門知識に対する需要の高まりにより、予測期間中に最も高いCAGRを記録すると見込まれています。コンサルティングサービスは、デジタルトランスフォーメーションや規制順守に向けた運営会社の取り組みを支援し、先行的な需要を生み出します。システム統合と導入は、従来の信号システム、車両テレメトリー、新たなクラウドベースの交通管理プラットフォームを連携させるため、専門的なインテグレーターを必要とします。サポートおよび保守サービスは、鉄道事業者が稼働時間、安全性、サイバーセキュリティ、予知保全を優先する中で継続的な収益源となり、長期サービス契約を促進します。さらに、電化、高速路線、都市モビリティプロジェクトへの官民投資の増加は、外部サービスに依存する大規模導入プログラムを後押ししています。包括的なサービスバンドルとパフォーマンスベースのSLAを提供するベンダーは、価値獲得において優位な立場にあり、単独のハードウェアやソフトウェアよりも迅速にサービス成長を加速させます。

サポート・保守セグメントが最大の市場シェアを占めると推定される背景には、鉄道管理システムが安全で効率的かつ中断のない運用を確保するため、継続的な監視、アップグレード、技術的介入を必要とする点が挙げられます。鉄道ネットワークが高度な信号システム、リアルタイム監視、予知保全、統合交通管理プラットフォームを導入するにつれ、これらのシステムの複雑性は増大し、専門的なサポートサービスへの長期的な依存が生じています。事業者は、パフォーマンス維持と規制順守のため、ソフトウェア更新、システム健全性監視、遠隔診断、予備部品管理、修正保全をベンダーに依存しています。老朽化したインフラは、資産寿命の延長と高額なダウンタイム回避のため、持続的な保守の必要性をさらに増幅させています。ベンダー各社は、複数年保守契約、遠隔運用サポート、IoTやAIと統合された状態監視型保守ソリューションの提供により、この分野を強化しています。旅客・貨物サービス双方において運用信頼性と稼働時間はミッションクリティカルであるため、継続的なサポートと保守は不可欠な経常経費となり、予測期間を通じてこの分野が市場シェアを支配する見込みです。

アジア太平洋は、集中的な公共投資、急速な都市化、大規模な容量拡張プロジェクトが信号システム、交通管理、デジタル運用プラットフォームへの強い需要を牽引するため、最高CAGRを達成する態勢にあります。インドの国家マスタープランと回廊計画は、信号システムの更新とマルチモーダル接続性への投資を加速させています。キウイレール向けアルストム社ICONISの導入など、大規模な展開と制御センターの近代化は、運行計画とネットワーク可視性を向上させる交通管理システムに対する地域の需要の高さを示しています。オーストラリアでは、複数路線の地下鉄拡張と新空港連絡線の建設により、統合制御・自動化プラットフォームの需要が高まっています。シンガポールでは、MRTの信頼性向上と更新プログラムが継続されており、高密度都市ネットワークにおける都市交通の近代化ニーズが浮き彫りとなっています。中国における持続的な鉄道近代化とネットワーク拡張は、デジタル信号システム、予知保全、ライフサイクルサービスにおける潜在市場をさらに拡大しています。政策支援、資金調達環境、大規模な新規・既存プロジェクトが相まって、アジア太平洋は鉄道管理システム分野で最も急速に成長する地域となっています。

鉄道管理システム市場の主要企業は、Alstom SA (フランス)、Huawei Technologies (中国)、Siemens AG (ドイツ)、Hitachi, Ltd. (日本)、Wabtec Corporation (米国)、Cisco Systems, Inc. (米国)、ABB (スイス)、Indra Sistemas, S.A. (スペイン)、IBM (米国)、Honeywell International Inc. (米国)、CAF, Construcciones y Auxiliar de Ferrocarriles, S.A. (スペイン)、WSP (カナダ)、Kyosan Electric Mfg. Co., (日本)、Advantech (台湾)、Thales (フランス)、Amadeus IT Group SA (スペイン)、AtkinsRealis (英国)、DXC Technology Company (米国)、Fujitsu Limited (日本)、Railroad Software (米国)、Railcube (オランダ)、Praedico (オランダ)、NWAY Technologies Private Limited (インド)、Eurotech S.p.A. (イタリア)、Frequentis (オーストリア), Railinc Corporation (米国)、Arcadis Gen Holdings Limited (英国)、 Telegraph (米国)、Tracis (英国)、Rail-Flow(ドイツ)です。これらの企業は、鉄道管理システム市場における事業拡大を図るため、パートナーシップ、契約、協業、新製品発売、製品改良、買収など、様々な成長戦略を採用しています。

調査範囲

当レポートの主な利点

当レポートは、市場リーダーや新規参入企業に対し、鉄道管理システム市場全体およびサブセグメントの収益規模に関する最も正確な推定値を提供します。これにより、利害関係者は競合情勢を理解し、自社のポジショニング強化や適切な市場参入戦略の立案に役立つ知見を得られます。また、市場の動向を把握し、主要な市場促進要因、抑制要因、課題、機会に関する情報を提供します。

当レポートは以下のポイントに関する洞察を提供します:

主要促進要因(政府の積極的な施策と官民連携、世界の都市化と旅客需要の増加、予知保全とリアルタイム資産管理)の分析、抑制要因(初期ハードウェア・統合コストの高さ、分断されたレガシーインフラ)、機会(交通インフラへのインテリジェントソリューション統合、リアルタイムデータ分析とビジネスインテリジェンスサービス)、課題(データセキュリティとプライバシー問題、厳格な安全・規制基準)の分析。

- 製品開発/イノベーション:鉄道管理システム市場における今後の技術動向、研究開発、新製品・サービス投入に関する詳細な分析。

- 市場開発:収益性の高い市場に関する包括的な情報-当レポートでは、様々な地域における鉄道管理システム市場を分析しています。

- 市場の多様化:鉄道管理システム市場における新製品・サービス、未開拓の地域、最近の動向、投資に関する包括的な情報。

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要考察

第4章 市場概要

- 市場力学

- 相互接続された市場と分野横断的な機会

- ティア1/2/3企業の戦略的動き

第5章 業界動向

- ポーターのファイブフォース分析

- マクロ経済見通し

- サプライチェーン分析

- エコシステム分析

- 価格分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 2025年の米国関税の影響- 鉄道管理システム市場

第6章 技術、特許、デジタル、AIの導入別戦略的破壊

- 主要な新興技術

- 補完的技術

- 技術ロードマップ

- 特許分析

- AI/生成AIが鉄道管理システム市場に与える影響

- 成功事例と実世界への応用

第7章 規制状況

- 地域の規制とコンプライアンス

- 業界標準

第8章 顧客情勢と購買行動

- 意思決定プロセス

- 購入者の利害関係者と購入評価基準

- さまざまな最終用途産業からのアンメットニーズ

第9章 鉄道管理システム市場(オファリング別)

- ソリューション

- サービス

第10章 鉄道管理システム市場(鉄道タイプ別)

- 旅客

- 貨物

第11章 鉄道管理システム市場(地域別)

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリアとニュージーランド

- その他

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他

- ラテンアメリカ

- ブラジル

- アルゼンチン

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略

- 収益分析

- 市場シェア分析

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- 競争シナリオと動向

第13章 企業プロファイル

- 主要参入企業

- ALSTOM SA

- HUAWEI TECHNOLOGIES CO., LTD.

- SIEMENS

- HITACHI, LTD.

- WABTEC CORPORATION

- CISCO SYSTEMS, INC.

- ABB

- INDRA SISTEMAS, S.A.

- IBM CORPORATION

- HONEYWELL INTERNATIONAL INC.

- その他の企業

- CAF

- WSP

- KYOSAN ELECTRIC MFG. CO., LTD.

- ADVANTECH CO., LTD.

- THALES

- AMADEUS IT GROUP SA

- ATKINSREALIS

- DXC TECHNOLOGY COMPANY

- FUJITSU

- スタートアップ/中小企業

- RAILROAD SOFTWARE

- RAILCUBE

- PRAEDICO

- NWAY TECHNOLOGIES

- EUROTECH S.P.A.

- FREQUENTIS

- RAILINC CORPORATION

- ARCADIS GEN HOLDINGS LIMITED

- TELEGRAPH

- TRACSIS PLC

- RAIL-FLOW