|

|

市場調査レポート

商品コード

1462800

酸化エチレンとエチレングリコールの世界市場:製品タイプ別、用途別、最終用途産業別、地域別 - 2029年までの予測Ethylene oxide and Ethylene Glycol Market by Product Type (Ethylene Glycol, Ethoxylates, Ethanolamines, Glycol Ethers), Application (Polyester Fibers, Antifreeze & Coolants, PET Resins), End-Use Industries, and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 酸化エチレンとエチレングリコールの世界市場:製品タイプ別、用途別、最終用途産業別、地域別 - 2029年までの予測 |

|

出版日: 2024年04月08日

発行: MarketsandMarkets

ページ情報: 英文 253 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の酸化エチレンとエチレングリコールの市場規模は、2024年に397億米ドル、2029年には519億米ドルとなるとみられ、予測期間中に5.5%のCAGRで拡大すると予測されています。

酸化エチレンとエチレングリコールの需要は、さまざまな産業で多用途に使用されているため増加しています。エチレングリコールは、PET樹脂、ポリエステル繊維、不凍液、その他自動車、繊維、プラスチック、包装分野の製品の生産に幅広く使用されています。さらに、酸化エチレンはヘルスケアの滅菌目的にも欠かせないです。生産技術の進歩、持続可能性の実践、新興経済国での消費拡大が、これらの化学品の需要増加にさらに貢献しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル)、数量(キロトン) |

| セグメント | 製品タイプ別、用途別、最終用途産業別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

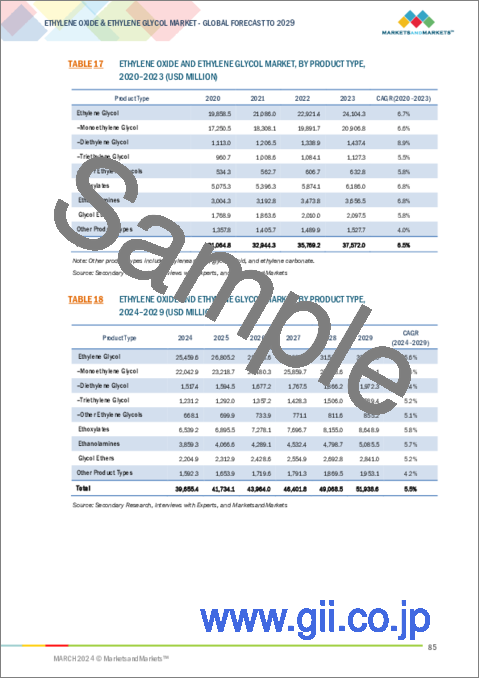

エチレングリコールは、その広範な使用と複数の産業にわたる多目的な用途により、酸化エチレンおよびエチレングリコール市場の製品タイプセグメントで最大のシェアを占めています。主要原料として、エチレングリコールはペットボトル、包装材料、繊維用繊維、ポリエステルフィルムの製造に広く利用されているPET樹脂の製造において極めて重要な役割を果たしています。優れた熱安定性、吸湿性、安定した溶液を形成する能力などの特性により、さまざまな分野のメーカーに選ばれています。さらに、エチレングリコールは自動車エンジンやHVACシステム用の不凍剤に一般的に使用されており、その需要をさらに高めています。急速な工業化と都市化を背景に、新興経済圏でエチレングリコールの採用が拡大していることも、酸化エチレンおよびエチレングリコール・セグメントにおけるエチレングリコールの圧倒的な市場地位に大きく寄与しています。

ポリエステル繊維は、その汎用性と様々な産業での広範な使用により、酸化エチレンとエチレングリコール市場の用途分野で最大のシェアを占めています。重合プロセスを通じてエチレングリコールから得られるこれらの繊維は、強度、耐久性、耐シワ性、手入れのしやすさといった優れた特性を持っています。そのため、繊維製品、アパレル、家庭用家具、工業用繊維、不織布などの用途に非常に適しています。さらに、ポリエステル繊維は他の繊維との混紡が可能なため、さまざまな分野での性能と適用性が向上します。特に新興経済圏における繊維製品に対する需要の高まりは、生産技術や持続可能性に関する継続的な技術革新と相まって、酸化エチレンおよびエチレングリコール市場の用途別セグメントにおけるポリエステル繊維の優位性をさらに強めています。

当レポートでは、世界の酸化エチレンとエチレングリコール市場について調査し、製品タイプ別、用途別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

第6章 業界の動向

- イントロダクション

- 主な利害関係者と購入基準

- サプライチェーン分析

- 規制状況

- 技術分析

- 顧客ビジネスに影響を与える動向/混乱

- 貿易分析

- 2024年~2025年の主な会議とイベント

- 価格分析

- 特許分析

第7章 酸化エチレンとエチレングリコール市場、最終用途産業別

- イントロダクション

- 自動車

- 包装

- 繊維

- 化学製造

- 医療・医薬品

- その他

第8章 酸化エチレンとエチレングリコール市場、製品タイプ別

- イントロダクション

- エチレングリコール

- エトキシレート

- エタノールアミン

- グリコールエーテル

- その他

第9章 酸化エチレンとエチレングリコール市場、用途別

- イントロダクション

- ポリエステル繊維

- PET樹脂

- その他

第10章 酸化エチレンとエチレングリコール市場、地域別

- イントロダクション

- 北米

- アジア太平洋

- 欧州

- 南米

- 中東・アフリカ

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略

- 市場シェア分析

- 収益分析

- 企業評価マトリックス:主要参入企業、2023年

- スタートアップ/中小企業評価マトリックス

- 競合シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- BASF SE

- SABIC

- SHELL PLC

- DOW CHEMICAL COMPANY

- EXXONMOBIL CORPORATION

- CLARIANT AG

- LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- HUNTSMAN CORPORATION

- NIPPON SHOKUBAI CO., LTD.

- INEOS GROUP

- THERMO FISHER SCIENTIFIC INC.

- RELIANCE INDUSTRIES LIMITED

- その他の企業

- INDIA GLYCOLS LIMITED

- RESTEK CORPORATION

- ADVANCED AIR TECHNOLOGIES, INC.

- ENVIRONMENTAL TECTONICS CORPORATION(ETC)

- GJ CHEMICAL

- COOLANTS PLUS INC.

- CATALYNT SOLUTIONS, INC.

- VIZAG CHEMICAL INTERNATIONAL

- SAE MANUFACTURING SPECIALTIES CORP.

- NOURYON

- SYNTHOKEM LABS PRIVATE LIMITED

- TOKYO ENGINEERING KOREA LTD.

- FARSA CHIMIE PETROCHEMICAL CO.

第13章 付録

The global ethylene oxide and ethylene glycol market is expected to grow at a CAGR of 5.5% during the forecast period, from an estimated USD 39.7 Billion in 2024 to USD 51.9 Billion by 2029. The demand for ethylene oxide and ethylene glycol is increasing due to their versatile applications across various industries. Ethylene glycol is extensively used in the production of PET resins, polyester fibers, antifreeze solutions, and other products in automotive, textiles, plastics, and packaging sectors. Additionally, ethylene oxide is crucial for healthcare sterilization purposes. Advancements in production technologies, sustainability practices, and growing consumption in emerging economies further contribute to the rising demand for these chemicals.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Product Type, Application, End-use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East and Africa, and South America |

"Ethylene Glycol accounted for the largest share in product type segment of ethylene oxide and ethylene glycol market in terms of value."

Ethylene glycol commands the largest share in the product type segment of the ethylene oxide and ethylene glycol market due to its extensive use and versatile applications across multiple industries. As a key raw material, ethylene glycol plays a pivotal role in the production of PET resins, which are widely utilized in the manufacturing of plastic bottles, packaging materials, fibers for textiles, and polyester films. Its properties, including excellent thermal stability, hygroscopic nature, and the ability to form stable solutions, make it a preferred choice for manufacturers in various sectors. Moreover, ethylene glycol is commonly used in antifreeze formulations for automotive engines and HVAC systems, further increasing its demand. The growing adoption of ethylene glycol in emerging economies, driven by rapid industrialization and urbanization, also contributes significantly to its dominant market position within the ethylene oxide and ethylene glycol segment.

"Polyester fibers accounted for the largest share in application segment of ethylene oxide and ethylene glycol market in terms of value."

Polyester fibers hold the largest share in the application segment of the ethylene oxide and ethylene glycol market due to their versatility and widespread use in various industries. These fibers, derived from ethylene glycol through polymerization processes, possess excellent properties such as strength, durability, resistance to wrinkles, and ease of care. This makes them highly desirable for applications in textiles, apparel, home furnishings, industrial fabrics, and non-woven materials. Additionally, polyester fibers are favored for their ability to be blended with other fibers, enhancing their performance and applicability across different sectors. The growing demand for textiles, especially in emerging economies, coupled with continuous innovations in production techniques and sustainability practices, further reinforces polyester fibers' dominance in the ethylene oxide and ethylene glycol market's application segment.

"Textile accounted for the largest share in the end-use industry segment of ethylene oxide and ethylene glycol market in terms of value."

The textile industry commands the largest share in the end-use industry segment of the ethylene oxide and ethylene glycol market due to its extensive utilization of ethylene glycol in polyester fiber production. Polyester fibers, derived from ethylene glycol through polymerization processes, offer exceptional properties such as strength, durability, wrinkle resistance, and ease of care. These qualities make polyester fibers highly sought-after for a wide range of applications, including apparel, home textiles, industrial fabrics, and non-woven materials. Moreover, the versatility of polyester fibers allows for the creation of innovative and high-performance textiles suitable for various sectors such as fashion, sportswear, automotive, and furnishings. The growing demand for textiles in emerging economies, coupled with advancements in textile technologies and sustainability practices, further strengthens the textile industry's dominant position in the ethylene oxide and ethylene glycol market's end-use segment.

"Asia-Pacific is the largest market for ethylene oxide and ethylene glycol."

The Asia Pacific region holds the largest share in the ethylene oxide and ethylene glycol market due to several key factors. Firstly, the region's rapid industrialization, particularly in countries like China, India, and Southeast Asian nations, fuels substantial demand for ethylene glycol across various industries such as automotive, textiles, plastics, and packaging. Additionally, the burgeoning population and rising disposable incomes in these economies lead to increased consumption of ethylene glycol-based products like PET resins, polyester fibers, and antifreeze solutions. Furthermore, Asia Pacific benefits from supportive government policies, investments in infrastructure, and technological advancements, creating a conducive environment for market growth. The strategic geographical location of the region, its access to raw materials, and expanding export opportunities further contribute to Asia Pacific's dominance in the ethylene oxide and ethylene glycol market.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the ethylene oxide and ethylene glycol market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives- 20%, Directors - 10%, and Others - 70%

- By Region: North America - 20%, Europe - 30%, APAC - 30%, South America- 10% , and

the Middle East & Africa -10%

The ethylene oxide and ethylene glycol market comprises major players such as BASF SE (Germany), SABIC (Saudi Arabia), Shell Plc (UK), Dow Chemical Company (US), ExxonMobil Corporation (US), Clariant AG (Switzerland), LyondellBasell Industries Holding B.V (US), Huntsman Corporation (US), Nippon Shokubai Co., Ltd. (Japan), INEOS Group (UK), Thermo Fisher Scientific Inc. (US), Reliance Industries Limited (India) and others. The study includes in-depth competitive analysis of these key players in the ethylene oxide and ethylene glycol market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for ethylene oxide and ethylene glycol market on the basis of product type, application, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisition associated with the market for ethylene oxide and ethylene glycol market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the ethylene oxide and ethylene glycol market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the ethylene oxide and ethylene glycol market offered by top players in the global ethylene oxide and ethylene glycol market.

- Analysis of drivers: (Strong demand for polyester fibers and PET resins, Growing demand for antifreeze, Technological advancements in production processes, Increasing demand for household and personal care products), restraints (Rising crude oil prices. Regulatory scenario, Geopolitical factors affecting supply chain), opportunities (Growing Asia-Pacific market, Growing non-ionic surfactant demand, Development of bio-based ethylene oxide and glycol production technologies, Integration of ethylene oxide derivatives in pharmaceutical and personal care products), and challenges (Price volatility and fluctuations in raw material costs, Stringent environmental regulations impacting production processes) influencing the growth of ethylene oxide and ethylene glycol market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the ethylene oxide and ethylene glycol market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for ethylene oxide and ethylene glycol market across regions.

- Market Capacity: Production capacities of companies producing ethylene oxide and ethylene glycol are provided wherever available with upcoming capacities for the ethylene oxide and ethylene glycol market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the ethylene oxide and ethylene glycol market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Interviews with experts-demand and supply side

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION: APPROACH

- 2.2.1 BOTTOM UP APPROACH

- 2.2.1.1 Approach for arriving at market size using bottom up analysis

- FIGURE 4 BOTTOM UP APPROACH

- 2.2.2 TOP DOWN APPROACH

- 2.2.2.1 Approach for arriving at market size using top down analysis

- FIGURE 5 TOP DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 FORECAST ESTIMATION

- FIGURE 7 DEMAND SIDE FORECAST PROJECTIONS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- TABLE 1 ETHYLENE OXIDE AND ETHYLENE GLYCOL: MARKET SNAPSHOT

- FIGURE 8 ASIA PACIFIC ESTIMATED TO LEAD ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET IN 2024

- FIGURE 9 ETHYLENE GLYCOL TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 POLYESTER FIBERS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 11 TEXTILES SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET

- FIGURE 12 INCREASING DEMAND FROM POLYESTER FIBER APPLICATION TO DRIVE MARKET DURING FORECAST PERIOD

- 4.2 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, REGIONAL ANALYSIS

- FIGURE 13 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE BY 2029, IN TERMS OF VOLUME

- 4.3 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY

- FIGURE 14 CHINA TO BE FASTEST-GROWING ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET DURING FORECAST PERIOD, IN TERMS OF VOLUME

- 4.4 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY PRODUCT TYPE

- FIGURE 15 ETHYLENE GLYCOL SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2029

- 4.5 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION

- FIGURE 16 POLYESTER FIBERS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2029

- 4.6 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY

- FIGURE 17 TEXTILES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2029

- 4.7 ASIA PACIFIC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION AND COUNTRY

- FIGURE 18 CHINA ACCOUNTS FOR LARGEST SHARE IN ASIA PACIFIC MARKET IN 2024

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Strong demand for polyester fibers and PET resins

- 5.2.1.2 Growing demand for antifreeze

- 5.2.1.3 Technological advancements in production processes

- 5.2.1.4 Increasing demand for household and personal care products

- 5.2.2 RESTRAINTS

- 5.2.2.1 Rising crude oil prices

- 5.2.2.2 Regulatory scenario

- 5.2.2.3 Geopolitical factors affecting supply chain

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing Asia Pacific market

- 5.2.3.2 Increasing demand for non-ionic surfactants

- 5.2.3.3 Development of bio-based ethylene oxide and glycol production technologies

- 5.2.3.4 Integration of ethylene oxide derivatives in pharmaceutical and personal care products

- 5.2.4 CHALLENGES

- 5.2.4.1 Price volatility and fluctuations in raw material costs

- 5.2.4.2 Stringent environmental regulations impacting production processes

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FOUR END-USE INDUSTRIES

- TABLE 3 INFLUENCE OF BUYERS ON BUYING PROCESS FOR TOP FOUR END-USE INDUSTRIES

- 6.2.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR TOP FOUR END-USE INDUSTRIES

- TABLE 4 KEY BUYING CRITERIA FOR TOP FOUR END-USE INDUSTRIES

- 6.3 SUPPLY CHAIN ANALYSIS

- FIGURE 23 OVERVIEW OF ETHYLENE OXIDE AND ETHYLENE GLYCOL VALUE CHAIN

- 6.3.1 RAW MATERIAL

- 6.3.2 MANUFACTURER

- 6.3.3 DISTRIBUTION

- 6.3.4 END USER

- 6.4 REGULATORY LANDSCAPE

- TABLE 5 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.5 TECHNOLOGY ANALYSIS

- TABLE 9 TECHNOLOGIES OFFERED IN ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET

- 6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ETHYLENE OXIDE AND ETHYLENE GLYCOL MANUFACTURERS

- FIGURE 24 REVENUE SHIFT OF ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO

- FIGURE 25 IMPORT OF ETHYLENE OXIDE AND ETHYLENE GLYCOLS, BY COUNTRY, 2019-2022 (USD MILLION)

- 6.7.2 EXPORT SCENARIO

- FIGURE 26 EXPORT OF ETHYLENE OXIDE AND ETHYLENE GLYCOLS, BY COUNTRY, 2019-2022 (USD MILLION)

- 6.8 KEY CONFERENCES & EVENTS IN 2024-2025

- TABLE 10 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- 6.9 PRICING ANALYSIS

- 6.9.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, FOR TOP 3 APPLICATIONS (USD/KG)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF KEY PLAYERS FOR TOP 3 APPLICATIONS (USD/KG)

- FIGURE 28 AVERAGE SELLING PRICE TREND, BY REGION

- 6.10 PATENT ANALYSIS

- 6.10.1 METHODOLOGY

- 6.10.2 PATENTS GRANTED WORLDWIDE, 2013-2023

- TABLE 11 TOTAL NUMBER OF PATENTS

- 6.10.3 PATENT PUBLICATION TRENDS

- FIGURE 29 TOTAL NUMBER OF PATENTS DURING LAST 11 YEARS

- 6.10.4 INSIGHTS

- 6.10.5 LEGAL STATUS OF PATENTS

- FIGURE 30 PATENT ANALYSIS, BY LEGAL STATUS

- 6.10.6 JURISDICTION-WISE PATENT ANALYSIS

- FIGURE 31 TOP JURISDICTIONS FOR ETHYLENE OXIDE AND ETHYLENE GLYCOL PATENTS

- 6.10.7 TOP COMPANIES/APPLICANTS

- FIGURE 32 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- 6.10.8 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 12 TOP TEN PATENT OWNERS

7 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY

- 7.1 INTRODUCTION

- FIGURE 33 TEXTILE END-USE INDUSTRY TO LEAD ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET DURING FORECAST PERIOD

- TABLE 13 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 14 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 15 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 16 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 7.2 AUTOMOTIVE

- 7.2.1 INNOVATION AND FOCUS ON PERFORMANCE, EFFICIENCY, AND SUSTAINABILITY TO DRIVE MARKET

- 7.3 PACKAGING

- 7.3.1 EXTENSION OF SHELF LIFE OF PACKAGED GOODS TO DRIVE MARKET

- 7.4 TEXTILES

- 7.4.1 DEMAND FOR PERFORMANCE-DRIVEN TEXTILES AND SUSTAINABILITY TO DRIVE MARKET

- 7.5 CHEMICAL MANUFACTURING

- 7.5.1 TECHNOLOGICAL ADVANCEMENTS, PRODUCT INNOVATION, AND REGULATORY REQUIREMENTS TO DRIVE MARKET

- 7.6 MEDICAL & PHARMACEUTICALS

- 7.6.1 STRINGENT REGULATORY REQUIREMENTS FOR PRODUCT SAFETY AND EFFICACY TO DRIVE MARKET

- 7.7 OTHER END-USE INDUSTRIES

8 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- FIGURE 34 ETHYLENE GLYCOL SEGMENT TO LEAD ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET DURING FORECAST PERIOD

- TABLE 17 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 18 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 19 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY PRODUCT TYPE, 2020-2023 (KILOTON)

- TABLE 20 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY PRODUCT TYPE, 2024-2029 (KILOTON)

- 8.2 ETHYLENE GLYCOL

- 8.2.1 VERSATILITY, PERFORMANCE-ENHANCING PROPERTIES, AND WIDE-RANGING APPLICATIONS TO DRIVE MARKET

- 8.2.2 MONOETHYLENE GLYCOL

- 8.2.3 DIETHYLENE GLYCOL

- 8.2.4 TRIETHYLENE GLYCOL

- 8.2.5 OTHER ETHYLENE GLYCOLS

- 8.3 ETHOXYLATES

- 8.3.1 INCREASING CONSUMER AWARENESS REGARDING HYGIENE AND CLEANLINESS TO DRIVE MARKET

- 8.4 ETHANOLAMINES

- 8.4.1 WIDE DEMAND IN PERSONAL CARE, AGRICULTURE, GAS TREATMENT, AND INDUSTRIAL PROCESSES TO DRIVE MARKET

- 8.5 GLYCOL ETHERS

- 8.5.1 RISING INDUSTRIAL MANUFACTURING, CONSTRUCTION PROJECTS, AND AUTOMOTIVE PRODUCTION TO DRIVE MARKET

- 8.6 OTHER PRODUCT TYPES

9 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 35 POLYESTER FIBERS SEGMENT TO LEAD ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET DURING FORECAST PERIOD

- TABLE 21 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 22 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 23 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 24 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 9.2 POLYESTER FIBERS

- 9.2.1 RISING DEMAND FROM TEXTILE AND PACKAGING END-USE INDUSTRIES TO DRIVE MARKET

- 9.2.2 RISING DEMAND FROM AUTOMOTIVE END-USE INDUSTRY TO DRAW HEAT FROM HOT ENGINE PARTS TO DRIVE MARKET

- 9.3 PET RESINS

- 9.3.1 WIDE USAGE IN PACKAGING END-USE INDUSTRY TO DRIVE MARKET

- 9.4 OTHER APPLICATIONS

10 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 36 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET REGIONAL SNAPSHOT

- TABLE 25 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 26 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 27 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 28 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY REGION, 2024-2029 (KILOTON)

- 10.2 NORTH AMERICA

- 10.2.1 RECESSION IMPACT

- FIGURE 37 NORTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET SNAPSHOT

- TABLE 29 NORTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 30 NORTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 31 NORTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 32 NORTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 33 NORTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 34 NORTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 35 NORTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 36 NORTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 37 NORTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 38 NORTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 39 NORTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 40 NORTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.2.2 US

- 10.2.2.1 Continuous innovations in automotive technology and materials to drive market

- TABLE 41 US: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 42 US: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 43 US: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 44 US: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.2.3 MEXICO

- 10.2.3.1 Rising demand from consumer goods industry to drive market

- TABLE 45 MEXICO: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 46 MEXICO: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 47 MEXICO: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 48 MEXICO: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.2.4 CANADA

- 10.2.4.1 Rigorous R&D activities in automotive sector to drive market

- TABLE 49 CANADA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 50 CANADA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 51 CANADA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 52 CANADA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3 ASIA PACIFIC

- 10.3.1 RECESSION IMPACT

- FIGURE 38 ASIA PACIFIC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET SNAPSHOT

- TABLE 53 ASIA PACIFIC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 54 ASIA PACIFIC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 55 ASIA PACIFIC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 56 ASIA PACIFIC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 57 ASIA PACIFIC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 58 ASIA PACIFIC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 59 ASIA PACIFIC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 60 ASIA PACIFIC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 61 ASIA PACIFIC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 62 ASIA PACIFIC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 63 ASIA PACIFIC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 64 ASIA PACIFIC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.3.2 CHINA

- 10.3.2.1 Expanding industrial base and robust manufacturing sector to fuel market

- TABLE 65 CHINA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 66 CHINA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 67 CHINA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 68 CHINA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.3 INDIA

- 10.3.3.1 Rising disposable incomes, growing population, and urbanization to drive market

- TABLE 69 INDIA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 70 INDIA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 71 INDIA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 72 INDIA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.4 SOUTH KOREA

- 10.3.4.1 Rapid industrialization, globalization, and technological advancements to propel market

- TABLE 73 SOUTH KOREA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 74 SOUTH KOREA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 75 SOUTH KOREA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 76 SOUTH KOREA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.5 JAPAN

- 10.3.5.1 Rising demand from automotive industry to propel market

- TABLE 77 JAPAN: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 78 JAPAN: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 79 JAPAN: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 80 JAPAN: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.6 THAILAND

- 10.3.6.1 Supportive government policies and well-established infrastructure to drive market

- TABLE 81 THAILAND: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 82 THAILAND: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 83 THAILAND: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 84 THAILAND: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.7 REST OF APAC

- TABLE 85 REST OF APAC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 86 REST OF APAC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 87 REST OF APAC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 88 REST OF APAC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.4 EUROPE

- 10.4.1 RECESSION IMPACT

- FIGURE 39 EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET SNAPSHOT

- TABLE 89 EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 90 EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 91 EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 92 EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 93 EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 94 EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 95 EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 96 EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 97 EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 98 EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 99 EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 100 EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.4.2 GERMANY

- 10.4.2.1 Increasing research & development activities to drive market

- TABLE 101 GERMANY: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 102 GERMANY: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 103 GERMANY: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 104 GERMANY: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.4.3 FRANCE

- 10.4.3.1 Increasing eco-friendly practices and reduced emissions to drive market

- TABLE 105 FRANCE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 106 FRANCE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 107 FRANCE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 108 FRANCE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.4.4 UK

- 10.4.4.1 Rising demand from pharmaceutical and personal care industries to drive market

- TABLE 109 UK: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 110 UK: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 111 UK: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 112 UK: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.4.5 ITALY

- 10.4.5.1 Growing demand for advanced technologies in automobiles to propel market

- TABLE 113 ITALY: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 114 ITALY: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 115 ITALY: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 116 ITALY: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.4.6 SPAIN

- 10.4.6.1 Rising demand from construction end-use industry to drive market

- TABLE 117 SPAIN: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 118 SPAIN: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 119 SPAIN: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 120 SPAIN: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.4.7 REST OF EUROPE

- TABLE 121 REST OF EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 122 REST OF EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 123 REST OF EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 124 REST OF EUROPE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.5 SOUTH AMERICA

- 10.5.1 RECESSION IMPACT

- TABLE 125 SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 126 SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 127 SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 128 SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 129 SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 130 SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 131 SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 132 SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 133 SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 134 SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 135 SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 136 SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.5.2 BRAZIL

- 10.5.2.1 Rising demand from antifreeze and coolant applications to drive market

- TABLE 137 BRAZIL: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 138 BRAZIL: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 139 BRAZIL: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 140 BRAZIL: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.5.3 ARGENTINA

- 10.5.3.1 Rising demand from chemical manufacturing end-use industry to drive market

- TABLE 141 ARGENTINA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 142 ARGENTINA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 143 ARGENTINA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 144 ARGENTINA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.5.4 REST OF SOUTH AMERICA

- TABLE 145 REST OF SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 146 REST OF SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 147 REST OF SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 148 REST OF SOUTH AMERICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 RECESSION IMPACT

- TABLE 149 MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 152 MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 153 MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 156 MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- TABLE 157 MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 160 MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Rising demand from medical & pharmaceuticals end-use industry to drive market

- 10.6.2.2 Saudi Arabia

- 10.6.2.2.1 Abundant oil & gas reserves to drive market

- TABLE 161 SAUDI ARABIA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 162 SAUDI ARABIA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 163 SAUDI ARABIA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 164 SAUDI ARABIA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.6.2.3 UAE

- 10.6.2.3.1 Rise in sustainable practices to drive market

- 10.6.2.3 UAE

- TABLE 165 UAE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 166 UAE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 167 UAE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 168 UAE: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.6.2.4 Rest of GCC

- TABLE 169 REST OF GCC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 170 REST OF GCC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 171 REST OF GCC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 172 REST OF GCC: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.6.3 SOUTH AFRICA

- 10.6.3.1 Technological advancements in petrochemical sector to drive market

- TABLE 173 SOUTH AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 174 SOUTH AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 175 SOUTH AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 176 SOUTH AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.6.4 REST OF MIDDLE EAST & AFRICA

- TABLE 177 REST OF MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 178 REST OF MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 179 REST OF MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2020-2023 (KILOTON)

- TABLE 180 REST OF MIDDLE EAST & AFRICA: ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES

- FIGURE 40 OVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR COMPANIES

- 11.3 MARKET SHARE ANALYSIS

- 11.3.1 RANKING OF KEY MARKET PLAYERS, 2023

- FIGURE 41 RANKING OF TOP FIVE PLAYERS IN ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET, 2023

- 11.3.2 MARKET SHARE ANALYSIS OF KEY PLAYERS

- TABLE 181 DEGREE OF COMPETITION

- FIGURE 42 SHARE OF KEY PLAYERS

- 11.4 REVENUE ANALYSIS

- FIGURE 43 REVENUE ANALYSIS OF KEY COMPANIES (2021-2024)

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 44 COMPANY EVALUATION MATRIX, 2023

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- TABLE 182 COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 183 REGION: COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 184 PRODUCT TYPE: COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 185 APPLICATION: COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 186 END-USE INDUSTRY: COMPANY FOOTPRINT (25 COMPANIES)

- 11.6 STARTUP/SME EVALUATION MATRIX

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 45 STARTUP/SME EVALUATION MATRIX, 2023

- 11.6.5 COMPETITIVE BENCHMARKING

- TABLE 187 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 188 COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

- 11.7 COMPETITIVE SCENARIO & TRENDS

- 11.7.1 DEALS

- TABLE 189 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET: DEALS, JANUARY 2021-FEBRUARY 2024

- 11.7.2 EXPANSIONS

- TABLE 190 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET: EXPANSIONS, JANUARY 2021-FEBRUARY 2024

- 11.7.3 OTHERS

- TABLE 191 ETHYLENE OXIDE AND ETHYLENE GLYCOL MARKET: OTHERS, JANUARY 2021-FEBRUARY 2024

12 COMPANY PROFILES

(Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats) **

- 12.1 MAJOR PLAYERS

- 12.1.1 BASF SE

- TABLE 192 BASF SE: COMPANY OVERVIEW

- FIGURE 46 BASF SE: COMPANY SNAPSHOT

- TABLE 193 BASF SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 194 BASF SE: EXPANSIONS, JANUARY 2021-FEBRUARY 2024

- 12.1.2 SABIC

- TABLE 195 SABIC: COMPANY OVERVIEW

- FIGURE 47 SABIC: COMPANY SNAPSHOT

- TABLE 196 SABIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 197 SABIC: DEALS, JANUARY 2021-FEBRUARY 2024

- TABLE 198 SABIC: EXPANSIONS

- 12.1.3 SHELL PLC

- TABLE 199 SHELL PLC: COMPANY OVERVIEW

- FIGURE 48 SHELL PLC: COMPANY SNAPSHOT

- TABLE 200 SHELL PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 201 SHELL PLC: DEALS, JANUARY 2021-FEBRUARY 2024

- TABLE 202 SHELL PLC: EXPANSIONS, JANUARY 2021-FEBRUARY 2024

- 12.1.4 DOW CHEMICAL COMPANY

- TABLE 203 DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 49 DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- TABLE 204 DOW CHEMICAL COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 205 DOW CHEMICAL COMPANY: OTHERS, JANUARY 2021-FEBRUARY 2024

- 12.1.5 EXXONMOBIL CORPORATION

- TABLE 206 EXXONMOBIL CORPORATION: COMPANY OVERVIEW

- FIGURE 50 EXXONMOBIL CORPORATION: COMPANY SNAPSHOT

- TABLE 207 EXXONMOBIL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 208 EXXONMOBIL CORPORATION: EXPANSIONS, JANUARY 2021-FEBRUARY 2024

- 12.1.6 CLARIANT AG

- TABLE 209 CLARIANT AG: COMPANY OVERVIEW

- FIGURE 51 CLARIANT AG: COMPANY SNAPSHOT

- TABLE 210 CLARIANT AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 211 CLARIANT AG: DEALS, JANUARY 2021-FEBRUARY 2024

- TABLE 212 CLARIANT AG: EXPANSION, JANUARY 2021-FEBRUARY 2024

- 12.1.7 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- TABLE 213 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: COMPANY OVERVIEW

- FIGURE 52 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: COMPANY SNAPSHOT

- TABLE 214 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 215 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: DEALS, JANUARY 2021-FEBRUARY 2024

- TABLE 216 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: EXPANSIONS, JANUARY 2021-FEBRUARY 2024

- 12.1.8 HUNTSMAN CORPORATION

- TABLE 217 HUNTSMAN CORPORATION: COMPANY OVERVIEW

- FIGURE 53 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

- TABLE 218 HUNTSMAN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 219 HUNTSMAN CORPORATION: EXPANSIONS, JANUARY 2021-FEBRUARY 2024

- 12.1.9 NIPPON SHOKUBAI CO., LTD.

- TABLE 220 NIPPON SHOKUBAI CO., LTD.: COMPANY OVERVIEW

- FIGURE 54 NIPPON SHOKUBAI CO., LTD.: COMPANY SNAPSHOT

- TABLE 221 NIPPON SHOKUBAI CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 222 NIPPON SHOKUBAI CO., LTD.: OTHERS, JANUARY 2021-FEBRUARY 2024

- 12.1.10 INEOS GROUP

- TABLE 223 INEOS GROUP: COMPANY OVERVIEW

- FIGURE 55 INEOS GROUP: COMPANY SNAPSHOT

- TABLE 224 INEOS GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 225 INEOS GROUP: DEALS, JANUARY 2021-FEBRUARY 2024

- 12.1.11 THERMO FISHER SCIENTIFIC INC.

- TABLE 226 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- FIGURE 56 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- TABLE 227 THERMO SCIENTIFIC FISHER INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 12.1.12 RELIANCE INDUSTRIES LIMITED

- TABLE 228 RELIANCE INDUSTRIES LIMITED: COMPANY OVERVIEW

- FIGURE 57 RELIANCE INDUSTRIES LIMITED: COMPANY SNAPSHOT

- TABLE 229 RELIANCE INDUSTRIES LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 INDIA GLYCOLS LIMITED

- TABLE 230 INDIA GLYCOLS LIMITED: COMPANY OVERVIEW

- 12.2.2 RESTEK CORPORATION

- TABLE 231 RESTEK CORPORATION: COMPANY OVERVIEW

- 12.2.3 ADVANCED AIR TECHNOLOGIES, INC.

- TABLE 232 ADVANCED AIR TECHNOLOGIES, INC.: COMPANY OVERVIEW

- 12.2.4 ENVIRONMENTAL TECTONICS CORPORATION (ETC)

- TABLE 233 ENVIRONMENTAL TECTONICS CORPORATION (ETC): COMPANY OVERVIEW

- 12.2.5 GJ CHEMICAL

- TABLE 234 GJ CHEMICAL: COMPANY OVERVIEW

- 12.2.6 COOLANTS PLUS INC.

- TABLE 235 COOLANTS PLUS INC.: COMPANY OVERVIEW

- 12.2.7 CATALYNT SOLUTIONS, INC.

- TABLE 236 CATALYNT SOLUTIONS, INC.: COMPANY OVERVIEW

- 12.2.8 VIZAG CHEMICAL INTERNATIONAL

- TABLE 237 VIZAG CHEMICAL INTERNATIONAL: COMPANY OVERVIEW

- 12.2.9 SAE MANUFACTURING SPECIALTIES CORP.

- TABLE 238 SAE MANUFACTURING SPECIALTIES CORP.: COMPANY OVERVIEW

- 12.2.10 NOURYON

- TABLE 239 NOURYON: COMPANY OVERVIEW

- 12.2.11 SYNTHOKEM LABS PRIVATE LIMITED

- TABLE 240 SYNTHOKEM LABS PRIVATE LIMITED: COMPANY OVERVIEW

- 12.2.12 TOKYO ENGINEERING KOREA LTD.

- TABLE 241 TOKYO ENGINEERING KOREA LTD.: COMPANY OVERVIEW

- 12.2.13 FARSA CHIMIE PETROCHEMICAL CO.

- TABLE 242 FARSA CHIMIE PETROCHEMICAL CO.: COMPANY OVERVIEW

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS