|

|

市場調査レポート

商品コード

1462413

3Dプリント衛星の世界市場- 製造技術別、コンポーネント別、衛星質量別、用途別、地域別 - 2030年までの予測3D Printed Satellite Market by Component (Antenna, Bracket, Shield, Housing and Propulsion), Satellite Mass (Nano and microsatellite, small satellite, medium and large satellite), Application and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 3Dプリント衛星の世界市場- 製造技術別、コンポーネント別、衛星質量別、用途別、地域別 - 2030年までの予測 |

|

出版日: 2024年04月05日

発行: MarketsandMarkets

ページ情報: 英文 188 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

衛星業界は、3Dプリント衛星の将来を形作る技術進歩の融合によって、激しい変革を遂げています。

3Dプリント衛星は、急速な技術進歩によって推進され、世界のサプライチェーンの脆弱性と変化する地政学的状況によって激化している重要な岐路に立っています。積極的な3Dプリント衛星、3Dプリント衛星コンポーネントのアウトソーシング、戦略的パートナーシップに重点が置かれるようになり、業界は急速に変化する環境において3Dプリント衛星の持続可能性と即応性を確保するために進化しています。

| 調査範囲 | |

|---|---|

| 調査対象年数 | 2024年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 対象単位 | 価値(100万米ドル) |

| セグメント | 製造技術別、コンポーネント別、衛星質量別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

3Dプリント衛の市場規模は、2024年の1億1,200万米ドルから2030年には4億8,700万米ドルに成長し、2024年から2030年にかけて年CAGR27.7%で成長すると予測されています。3Dプリント衛星市場は、宇宙探査をより身近で手頃な価格にする可能性があります。衛星製造のコストと複雑さを軽減することで、3Dプリントはより多くの国と企業が宇宙産業に参加できるようにします。衛星の重量は衛星に使用される部品の製造にかかるコストに直接影響するため、物理的重量が軽い衛星は宇宙ミッションでも優先されます。Maxar Space Systems(米国)、Boeing(米国)、3D Systems(米国)、Northrop Grumman Corporation(米国)、Fleet Space Technologies Pty Ltd(オーストラリア)は、3Dプリント衛星市場で活動している大手企業の一部です。

当レポートでは、世界の3Dプリント衛星市場について調査し、製造技術別、コンポーネント別、衛星質量別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向と混乱

- バリューチェーン分析

- 価格分析

- 運用データ

- 数量データ

- エコシステムマップ

- 使用事例分析

- 技術ー分析

- 3Dプリント衛星市場の技術ロードマップ

- 規制状況

- 貿易データ分析

- 2024年~2025年の主な会議とイベント

- 主な利害関係者と購入基準

- 衛星製造のビジネスモデル

- 総所有コスト

- 従来の印刷方法と比較した3D印刷の利点

- 3Dプリント衛星アウトソーシング

- 投資と資金調達のシナリオ

第6章 業界の動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- サプライチェーン分析

- 特許分析

第7章 3Dプリント衛星市場、製造技術別

- イントロダクション

- 熱溶解積層法(FDM)

- 選択的レーザー焼結(SLS)

- 電子ビーム溶解法(EBM)

- 直接金属レーザー焼結(DMLS)

- その他

第8章 3Dプリント衛星市場、衛星質量別

- イントロダクション

- ナノ・マイクロ衛星

- 小型衛星

- 中型・大型衛星

第9章 3Dプリント衛星市場、コンポーネント別

- イントロダクション

- アンテナ

- ブラケット

- シールド

- ハウジング

- 推進

第10章 3Dプリント衛星市場、用途別

- イントロダクション

- 技術開発

- 通信

- ナビゲーション

- 地球観測とリモートセンシング

第11章 3Dプリント衛星市場、地域別

- イントロダクション

- 地域別景気後退影響分析

- 北米

- 欧州

- アジア太平洋

- その他の地域

第12章 競合情勢

- イントロダクション

- 主要参入企業が採用した戦略

- 市場ランキング分析、2023年

- 収益分析、2020-2023

- 市場シェア分析、2023年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- MAXAR SPACE SYSTEMS

- NORTHROP GRUMMAN

- FLEET SPACE TECHNOLOGIES PTY LTD

- 3D SYSTEMS, INC.

- BOEING

- THALES ALENIA SPACE

- LOCKHEED MARTIN CORPORATION

- MITSUBISHI ELECTRIC CORPORATION

- CRP TECHNOLOGY S.R.L

- SWISSto12 SA

- REDWIRE CORPORATION

- RUAG GROUP

- MOOG INC.

- RENISHAW PLC

- ZENITH TECNICA

- その他の企業

- OC OERLIKON MANAGEMENT AG

- STRATASYS

- SIDUS SPACE

- EXONE

- HEXCEL CORPORATION

- NANO DIMENSION

- OPTOMEC INC

- OPTISYS INC

- TRUMPF

- ANYWAVES

- DAWN AEROSPACE

第14章 付録

The satellite industry is undergoing an intense transformation, driven by a convergence of technological advancements that are shaping the future of 3D-printed satellites. The 3D-printed satellite is at a critical juncture, driven by rapid technological advancements and intensified by global supply chain vulnerabilities and shifting geopolitical landscapes. With a growing emphasis on proactive 3D printed satellites, outsourcing 3D printed satellite components, and strategic partnerships, the industry is evolving to ensure the sustainability and readiness of 3D printed satellites in a rapidly changing environment.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Component, Satellite Mass, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

The 3D printed satellite market is projected to grow from USD 112 million in 2024 to USD 487 million by 2030, at a CAGR of 27.7% from 2024 to 2030. The 3D-printed satellite market has the potential to make space exploration more accessible and affordable. By reducing the cost and complexity of satellite manufacturing, 3D printing could enable more countries and companies to participate in the space industry. Satellites that have less physical weight are also given higher preference in space missions as their weight directly affects the costs involved in the manufacturing of components used in satellites. Maxar Space Systems (US), Boeing (US), 3D Systems (US), Northrop Grumman Corporation (US), and Fleet Space Technologies Pty Ltd (Australia) are some of the leading players operating in the 3D printed satellite market.

"The small satellite segment will account for the highest growth in the 3D printed satellite market during the forecast period."

Based on satellite mass, the 3D Printed Satellite Market has been classified into nano and microsatellites, small satellites, and Medium and Large Satellites. The miniaturization of satellites, driven by advances in component and system miniaturization, has been a transformative trend in the space industry. One key enabler of this trend is 3D printing technology, which facilitates the creation of intricate, lightweight structures perfectly suited for smaller satellites.

"The housing segment to account for largest market share in the 3D Printed Satellite market during the forecast period."

Based on the components, the 3D Printed Satellite Market has been classified into antenna, bracket, shield, housing, and propulsion. The housing segment has the largest market share during the forecast period. This is because 3D-printed housing ensures a precise fit for the satellite's components while reducing weight and optimizing performance.

"The North America market is projected to lead the market during the forecast period."

North America takes the lead in this market because of its significant space spending, innovative technology, and strong industrial foundation. The region boasts a robust ecosystem of technology companies and research institutions, fostering innovation and expertise in additive manufacturing techniques. Additionally, North America is home to a significant portion of the global space industry, providing ample opportunities for collaboration and adoption of 3D printing in satellite production. Furthermore, the supportive regulatory environment and favorable investment in the region contribute to the growth of this emerging market segment. These factors collectively position North America at the forefront of the 3D printed satellite market, offering a competitive edge in terms of technological advancement and market leadership.

Maxar Space Systems (US), Boeing (US), 3D Systems (US), Northrop Grumman Corporation (US), and Fleet Space Technologies Pty Ltd (Australia) are some of the leading players operating in the 3D printed satellite market.

.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-35%; Tier 2-45%; and Tier 3-20%

- By Designation: C Level-35%; Directors-25%; and Others-40%

- By Region: North America-40%; Europe-30%; Asia Pacific-20%; and Rest of the World-10%

Research Coverage

The study covers the 3D-printed satellite market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on satellite mass, application, components, manufacturing technique, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall 3D printed satellite market and its subsegments. The report covers the entire ecosystem of the 3D-printed satellite market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rise in Development of Customized Products, Cost efficiencies in satellite production, Increasing demand for lightweight components from space industry, Government investments in 3D printing projects), restraints (High Initial cost, Stringent industry certifications and lack of process control), opportunities (Development of new 3D printing technologies requiring less production time, Advancements in printing technologies), and challenges (Product quality compliance, Limited availability and high costs of raw materials) influencing the growth in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the 3D Printed satellite market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the 3D Printed satellite market across varied regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in 3D Printed satellite market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Maxar Space Systems (US), Boeing (US), 3D Systems, Inc (US), Northrop Grumman (US), and Fleet Space Technologies Pty Ltd (Australia) among others in the 3D Printed satellite market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 3D PRINTED SATELLITE MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.5 STAKEHOLDERS

- 1.6 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary respondents

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Insights from industry experts

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.4 RECESSION IMPACT ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology (demand-side)

- FIGURE 4 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 7 SMALL SATELLITES TO BE FASTEST-GROWING SEGMENT DURING FORECAST MARKET

- FIGURE 8 BRACKET SEGMENT TO EXHIBIT HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 9 COMMUNICATION TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2024

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN 3D PRINTED SATELLITE MARKET

- FIGURE 11 INCREASED GOVERNMENT INVESTMENTS IN 3D PRINTING TECHNOLOGY TO DRIVE MARKET

- 4.2 3D PRINTED SATELLITE MARKET, BY SATELLITE MASS

- FIGURE 12 SMALL SATELLITES TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 3D PRINTED SATELLITE MARKET, BY COMPONENT

- FIGURE 13 HOUSING TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- 4.4 3D PRINTED SATELLITE MARKET, BY APPLICATION

- FIGURE 14 COMMUNICATION SEGMENT TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 3D PRINTED SATELLITE MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Need for customized functional parts in satellite manufacturing

- 5.2.1.2 Cost efficiencies in satellite production

- 5.2.1.3 Increasing demand for lightweight components from space industry

- FIGURE 16 MAXAR'S 3D PRINTED SATELLITE COMPONENTS IN ORBIT, 2016-2019

- 5.2.1.4 Government investments in 3D printing projects

- TABLE 3 GOVERNMENT FUNDING FOR 3D PRINTING PROJECTS

- 5.2.1.5 Short supply chain of space components

- FIGURE 17 SUPPLY CHAIN FLOW OF SPACE COMPONENTS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of 3D printing equipment

- 5.2.2.2 Stringent industry certifications and lack of process control

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of new 3D printing technologies requiring less production time

- FIGURE 18 CLIP VS. OTHER 3D PRINTING TECHNOLOGIES

- 5.2.3.2 Advancements in printing technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Product quality compliance

- 5.2.4.2 Limited availability and high costs of raw materials

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 19 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 20 VALUE CHAIN ANALYSIS

- 5.4.1 RESEARCH AND DEVELOPMENT

- 5.4.2 RAW MATERIALS

- 5.4.3 COMPONENT/PRODUCT MANUFACTURERS (OEMS)

- 5.4.4 INTEGRATORS AND SYSTEM PROVIDERS

- 5.4.5 END USERS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF 3D PRINTED SATELLITES, BY KEY PLAYER

- FIGURE 21 AVERAGE SELLING PRICE OF 3D PRINTED SATELLITES, BY KEY PLAYER

- TABLE 4 AVERAGE SELLING PRICE OF 3D PRINTED SATELLITES, BY KEY PLAYER (USD MILLION)

- 5.5.2 AVERAGE SELLING PRICE OF 3D PRINTED SATELLITES, BY SATELLITE MASS

- TABLE 5 AVERAGE SELLING PRICE OF 3D PRINTED SATELLITES, BY SATELLITE MASS (USD MILLION)

- 5.5.3 INDICATIVE PRICING ANALYSIS, BY REGION

- TABLE 6 INDICATIVE PRICING ANALYSIS, BY REGION

- 5.6 OPERATIONAL DATA

- TABLE 7 OPERATIONAL DATA FOR 3D PRINTED SATELLITE COMPONENTS, BY SATELLITE MASS, 2021-2023

- TABLE 8 OPERATIONAL DATA FOR 3D PRINTED SATELLITE COMPONENTS, BY REGION, 2021-2023

- 5.7 VOLUME DATA

- TABLE 9 VOLUME DATA FOR 3D PRINTED SATELLITE COMPONENTS, BY REGION, 2021-2030

- 5.8 ECOSYSTEM MAP

- 5.8.1 PROMINENT COMPANIES

- 5.8.2 PRIVATE AND SMALL ENTERPRISES

- 5.8.3 END USERS

- FIGURE 22 ECOSYSTEM MAP

- TABLE 10 ROLE OF COMPANIES IN ECOSYSTEM

- 5.9 USE CASE ANALYSIS

- 5.9.1 REDESIGN OF TITANIUM INSERTS WITH ADDITIVE MANUFACTURING

- 5.9.2 3D PRINTING IN SATELLITE MOUNTING STRUCTURES

- 5.9.3 ENGINE OPTIMIZATION WITH 3D PRINTING

- 5.9.4 ENGINE BLADE REPAIR WITH LASER METAL DEPOSITION

- 5.9.5 3D PRINTING IN FLUID SYSTEMS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 INNOVATIVE 3D PRINTING TECHNOLOGIES

- TABLE 11 INNOVATIVE 3D PRINTED TECHNOLOGIES

- 5.10.2 4D PRINTING

- FIGURE 23 4D PRINTING

- 5.10.3 ARTIFICIAL INTELLIGENCE

- 5.11 TECHNOLOGY ROADMAP OF 3D PRINTED SATELLITE MARKET

- FIGURE 24 INTRODUCTION TO TECHNOLOGY ROADMAP

- FIGURE 25 EVOLUTION OF 3D PRINTED SATELLITE TECHNOLOGY, 2020-2030

- FIGURE 26 TECHNOLOGY TRENDS RELATED TO 3D PRINTED SATELLITES

- 5.12 REGULATORY LANDSCAPE

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 TRADE DATA ANALYSIS

- 5.13.1 IMPORT VALUE OF SPACECRAFT, INCLUDING SATELLITES AND SUBORBITAL & SPACECRAFT LAUNCH VEHICLES (HS CODE: 880260)

- FIGURE 27 IMPORT DATA, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 15 IMPORT DATA, BY COUNTRY, 2018-2022 (USD THOUSAND)

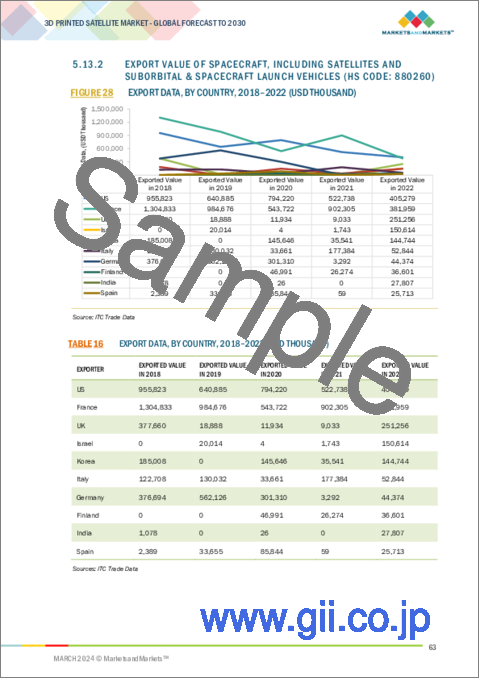

- 5.13.2 EXPORT VALUE OF SPACECRAFT, INCLUDING SATELLITES AND SUBORBITAL & SPACECRAFT LAUNCH VEHICLES (HS CODE: 880260)

- FIGURE 28 EXPORT DATA, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 16 EXPORT DATA, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.14 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 17 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF 3D PRINTED SATELLITES, BY SATELLITE MASS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF 3D PRINTED SATELLITES, BY SATELLITE MASS (%)

- 5.15.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR 3D PRINTED SATELLITES, BY SATELLITE MASS

- TABLE 19 KEY BUYING CRITERIA FOR 3D PRINTED SATELLITES, BY SATELLITE MASS

- 5.16 BUSINESS MODELS OF SATELLITE MANUFACTURING

- FIGURE 31 BUSINESS MODELS OF SATELLITE MANUFACTURING

- 5.16.1 BUILD-TO-ORDER

- 5.16.2 STANDARDIZED PLATFORM

- 5.16.3 CONSTELLATION MANUFACTURING

- 5.17 TOTAL COST OF OWNERSHIP

- TABLE 20 TOTAL COST OF OWNERSHIP

- 5.18 BENEFITS OF 3D PRINTING OVER CONVENTIONAL PRINTING METHODS

- TABLE 21 3D PRINTING VS. CONVENTIONAL PRINTING

- TABLE 22 ATTRIBUTE COMPARISON BETWEEN 3D PRINTING AND CONVENTION PRINTING

- 5.19 3D PRINTED SATELLITE OUTSOURCING

- FIGURE 32 MAKERSPACES AND OUTSOURCED SERVICES IN 3D PRINTED SATELLITE MANUFACTURING

- 5.20 INVESTMENT AND FUNDING SCENARIO

- FIGURE 33 INVESTMENT IN START-UP SPACE COMPANIES, BY INVESTOR TYPE, 2022

- FIGURE 34 VENTURE CAPITAL FUNDING, 2017-2022

- FIGURE 35 VENTURE CAPITAL FUNDING FOR TOP 10 COUNTRIES, 2022

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- FIGURE 36 TECHNOLOGY TRENDS

- 6.2.1 MINIATURIZATION OF SATELLITES

- 6.2.2 ADVANCED MATERIALS

- 6.2.3 INTEGRATION OF ELECTRONICS

- 6.2.4 HYBRID MANUFACTURING

- 6.2.5 LARGE-SCALE SPACE 3D PRINTING

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 GLOBAL CONNECTIVITY AND COMMUNICATION

- 6.3.2 SPACE EXPLORATION AND COMMERCIALIZATION

- 6.3.3 SUSTAINABILITY

- 6.4 SUPPLY CHAIN ANALYSIS

- FIGURE 37 SUPPLY CHAIN ANALYSIS

- 6.5 PATENT ANALYSIS

- FIGURE 38 PATENT ANALYSIS

- TABLE 23 PATENT ANALYSIS

7 3D PRINTED SATELLITE MARKET, BY MANUFACTURING TECHNIQUE

- 7.1 INTRODUCTION

- 7.2 FUSED DEPOSITION MODELING (FDM)

- 7.3 SELECTIVE LASER SINTERING (SLS)

- 7.4 ELECTRON BEAM MELTING (EBM)

- 7.5 DIRECT METAL LASER SINTERING (DMLS)

- 7.6 OTHER TECHNIQUES

8 3D PRINTED SATELLITE MARKET, BY SATELLITE MASS

- 8.1 INTRODUCTION

- FIGURE 39 3D PRINTED SATELLITE MARKET, BY SATELLITE MASS, 2024-2030

- TABLE 24 3D PRINTED SATELLITE MARKET, BY SATELLITE MASS, 2021-2023 (USD MILLION)

- TABLE 25 3D PRINTED SATELLITE MARKET, BY SATELLITE MASS, 2024-2030 (USD MILLION)

- 8.2 NANO & MICRO SATELLITES

- 8.2.1 WIDE SCOPE IN TACTICAL COMMUNICATION DEVICES TO DRIVE MARKET

- 8.3 SMALL SATELLITES

- 8.3.1 DEPLOYMENT IN CONSTELLATION ARCHITECTURE TO GATHER SCIENTIFIC DATA TO DRIVE MARKET

- 8.4 MEDIUM & LARGE SATELLITES

- 8.4.1 COST ADVANTAGES ASSOCIATED WITH LIGHTWEIGHT STRUCTURES TO DRIVE MARKET

9 3D PRINTED SATELLITE MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- FIGURE 40 3D PRINTED SATELLITE MARKET, BY COMPONENT, 2024-2030

- TABLE 26 3D PRINTED SATELLITE MARKET, BY COMPONENT, 2021-2023 (USD MILLION)

- TABLE 27 3D PRINTED SATELLITE MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- 9.2 ANTENNA

- 9.2.1 INNOVATIONS IN ANTENNA DESIGN TO DRIVE MARKET

- 9.3 BRACKET

- 9.3.1 EXCELLENT STRUCTURAL INTEGRITY TO DRIVE MARKET

- 9.4 SHIELD

- 9.4.1 PROTECTION AGAINST RADIATION-INDUCED DAMAGE TO DRIVE MARKET

- 9.5 HOUSING

- 9.5.1 OPTIMIZED SATELLITE PERFORMANCE TO DRIVE MARKET

- 9.6 PROPULSION

- 9.6.1 EFFICIENT COMBUSTION AND HEAT TRANSFER TO DRIVE MARKET

10 3D PRINTED SATELLITE MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 41 3D PRINTED SATELLITE MARKET, BY APPLICATION, 2024-2030

- TABLE 28 3D PRINTED SATELLITE MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 29 3D PRINTED SATELLITE MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- 10.2 TECHNOLOGY DEVELOPMENT

- 10.2.1 RAPID ITERATION AND PROTOTYPING OF SATELLITE COMPONENTS TO DRIVE MARKET

- 10.3 COMMUNICATION

- 10.3.1 RISING ADOPTION OF LEO SATELLITES IN MODERN COMMUNICATION TO DRIVE MARKET

- 10.4 NAVIGATION

- 10.4.1 IMPROVED ACCURACY AND PERFORMANCE TO DRIVE MARKET

- 10.5 EARTH OBSERVATION & REMOTE SENSING

- 10.5.1 EASE OF DESIGNING COMPLEX COMPONENTS TO DRIVE MARKET

11 3D PRINTED SATELLITE MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 42 3D PRINTED SATELLITE MARKET, BY REGION, 2024-2030

- TABLE 30 3D PRINTED SATELLITE MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 31 3D PRINTED SATELLITE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 11.2 REGIONAL RECESSION IMPACT ANALYSIS

- 11.3 NORTH AMERICA

- 11.3.1 PESTLE ANALYSIS

- 11.3.2 RECESSION IMPACT ANALYSIS

- 11.3.3 3D PRINTED SATELLITE PROGRAMS

- FIGURE 43 NORTH AMERICA: 3D PRINTED SATELLITE PROGRAMS

- 11.3.4 US

- 11.3.4.1 Expertise in space exploration and advanced printing technology to drive market

- 11.3.5 CANADA

- 11.3.5.1 Collaborative initiatives and ambitious space agendas to drive market

- 11.4 EUROPE

- 11.4.1 PESTLE ANALYSIS

- 11.4.2 RECESSION IMPACT ANALYSIS

- 11.4.3 3D PRINTED SATELLITE PROGRAMS

- FIGURE 44 EUROPE: 3D PRINTED SATELLITE PROGRAMS

- 11.4.4 UK

- 11.4.4.1 Rising adoption of 3D printing technology by prominent players to drive market

- 11.4.5 FRANCE

- 11.4.5.1 Increasing satellite launches with 3D printed components to drive market

- 11.4.6 ITALY

- 11.4.6.1 Focus on developing specialized 3D printing materials to drive market

- 11.4.7 SPAIN

- 11.4.7.1 Strategic collaborations between domestic research institutions and private firms to drive market

- 11.4.8 REST OF EUROPE

- 11.5 ASIA PACIFIC

- 11.5.1 PESTLE ANALYSIS

- 11.5.2 RECESSION IMPACT ANALYSIS

- 11.5.3 3D PRINTED SATELLITE PROGRAMS

- FIGURE 45 ASIA PACIFIC: 3D PRINTED SATELLITE PROGRAMS

- 11.5.4 CHINA

- 11.5.4.1 Escalating demand for reduced production costs to drive market

- 11.5.5 JAPAN

- 11.5.5.1 Shift toward smaller satellite constellations to drive market

- 11.5.6 INDIA

- 11.5.6.1 Rapid integration of 3D printing technology in space missions to drive market

- 11.5.7 AUSTRALIA

- 11.5.7.1 Government investments in space technologies to drive market

- 11.5.8 REST OF ASIA PACIFIC

- 11.6 REST OF THE WORLD

- 11.6.1 PESTLE ANALYSIS

- 11.6.2 RECESSION IMPACT ANALYSIS

- 11.6.3 3D PRINTED SATELLITE PROGRAMS

- FIGURE 46 REST OF THE WORLD: 3D PRINTED SATELLITE PROGRAMS

- 11.6.4 MIDDLE EAST & AFRICA

- 11.6.4.1 Booming IT industry to drive market

- 11.6.5 LATIN AMERICA

- 11.6.5.1 Ongoing collaborations and technological advancements to drive market

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 32 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 MARKET RANKING ANALYSIS, 2023

- FIGURE 47 MARKET RANKING OF KEY PLAYERS, 2023

- 12.4 REVENUE ANALYSIS, 2020-2023

- FIGURE 48 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2023

- 12.5 MARKET SHARE ANALYSIS, 2023

- FIGURE 49 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- TABLE 33 DEGREE OF COMPETITION

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 50 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 12.6.5 COMPANY FOOTPRINT

- FIGURE 51 COMPANY FOOTPRINT, 2023

- TABLE 34 APPLICATION FOOTPRINT, 2023

- TABLE 35 COMPONENT FOOTPRINT, 2023

- TABLE 36 REGION FOOTPRINT, 2023

- 12.7 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 52 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- 12.7.5 COMPETITIVE BENCHMARKING

- TABLE 37 KEY START-UPS/SMES

- TABLE 38 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 53 COMPANY VALUATION OF KEY PLAYERS

- FIGURE 54 EV/EBITDA OF KEY PLAYERS

- FIGURE 55 COMPANY VALUATION OF START-UPS/SMES

- FIGURE 56 EV/EBITDA OF START-UPS/SMES

- 12.9 BRAND/PRODUCT COMPARISON

- FIGURE 57 BRAND/PRODUCT COMPARISON

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 MARKET EVALUATION FRAMEWORK

- 12.10.2 PRODUCT LAUNCHES

- TABLE 39 3D PRINTED SATELLITE MARKET: PRODUCT LAUNCHES, 2020-2024

- 12.10.3 DEALS

- TABLE 40 3D PRINTED SATELLITE MARKET: DEALS, 2020-2024

- 12.10.4 OTHERS

- TABLE 41 3D PRINTED SATELLITE MARKET: OTHERS, 2020-2024

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 13.1.1 MAXAR SPACE SYSTEMS

- TABLE 42 MAXAR SPACE SYSTEMS: COMPANY OVERVIEW

- FIGURE 58 MAXAR SPACE SYSTEMS: COMPANY SNAPSHOT

- TABLE 43 MAXAR SPACE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 44 MAXAR SPACE SYSTEMS: DEALS

- 13.1.2 NORTHROP GRUMMAN

- TABLE 45 NORTHROP GRUMMAN: COMPANY OVERVIEW

- FIGURE 59 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- TABLE 46 NORTHROP GRUMMAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.3 FLEET SPACE TECHNOLOGIES PTY LTD

- TABLE 47 FLEET SPACE TECHNOLOGIES PTY LTD: COMPANY OVERVIEW

- TABLE 48 FLEET SPACE TECHNOLOGIES PTY LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 49 FLEET SPACE TECHNOLOGIES PTY LTD: DEALS

- 13.1.4 3D SYSTEMS, INC.

- TABLE 50 3D SYSTEMS, INC.: COMPANY OVERVIEW

- FIGURE 60 3D SYSTEMS, INC.: COMPANY SNAPSHOT

- TABLE 51 3D SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 52 3D SYSTEMS, INC.: DEALS

- 13.1.5 BOEING

- TABLE 53 BOEING: COMPANY OVERVIEW

- FIGURE 61 BOEING: COMPANY SNAPSHOT

- TABLE 54 BOEING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 55 BOEING: OTHERS

- 13.1.6 THALES ALENIA SPACE

- TABLE 56 THALES ALENIA SPACE: COMPANY OVERVIEW

- FIGURE 62 THALES ALENIA SPACE: COMPANY SNAPSHOT

- TABLE 57 THALES ALENIA SPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 58 THALES ALENIA SPACE: PRODUCT LAUNCHES

- 13.1.7 LOCKHEED MARTIN CORPORATION

- TABLE 59 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- FIGURE 63 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- TABLE 60 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 61 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- 13.1.8 MITSUBISHI ELECTRIC CORPORATION

- TABLE 62 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- FIGURE 64 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- TABLE 63 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 64 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

- 13.1.9 CRP TECHNOLOGY S.R.L

- TABLE 65 CRP TECHNOLOGY S.R.L: COMPANY OVERVIEW

- TABLE 66 CRP TECHNOLOGY S.R.L: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 67 CRP TECHNOLOGY S.R.L: PRODUCT LAUNCHES

- 13.1.10 SWISSTO12

- TABLE 68 SWISSTO12: COMPANY OVERVIEW

- TABLE 69 SWISSTO12: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 70 SWISSTO12: DEALS

- TABLE 71 SWISSTO12: OTHERS

- 13.1.11 REDWIRE CORPORATION

- TABLE 72 REDWIRE CORPORATION: COMPANY OVERVIEW

- FIGURE 65 REDWIRE CORPORATION: COMPANY SNAPSHOT

- TABLE 73 REDWIRE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.12 RUAG GROUP

- TABLE 74 RUAG GROUP: COMPANY OVERVIEW

- FIGURE 66 RUAG GROUP: COMPANY SNAPSHOT

- TABLE 75 RUAG GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 76 RUAG GROUP: OTHERS

- 13.1.13 MOOG INC.

- TABLE 77 MOOG INC.: COMPANY OVERVIEW

- FIGURE 67 MOOG INC.: COMPANY SNAPSHOT

- TABLE 78 MOOG INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.14 RENISHAW PLC

- TABLE 79 RENISHAW PLC: COMPANY OVERVIEW

- FIGURE 68 RENISHAW PLC: COMPANY SNAPSHOT

- TABLE 80 RENISHAW PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.15 ZENITH TECNICA

- TABLE 81 ZENITH TECNICA: COMPANY OVERVIEW

- TABLE 82 ZENITH TECNICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 83 ZENITH TECNICA: OTHERS

- 13.2 OTHER PLAYERS

- 13.2.1 OC OERLIKON MANAGEMENT AG

- TABLE 84 OC OERLIKON MANAGEMENT AG: COMPANY OVERVIEW

- 13.2.2 STRATASYS

- TABLE 85 STRATASYS: COMPANY OVERVIEW

- 13.2.3 SIDUS SPACE

- TABLE 86 SIDUS SPACE: COMPANY OVERVIEW

- 13.2.4 EXONE

- TABLE 87 EXONE: COMPANY OVERVIEW

- 13.2.5 HEXCEL CORPORATION

- TABLE 88 HEXCEL CORPORATION: COMPANY OVERVIEW

- 13.2.6 NANO DIMENSION

- TABLE 89 NANO DIMENSION: COMPANY OVERVIEW

- 13.2.7 OPTOMEC INC

- TABLE 90 OPTOMEC INC: COMPANY OVERVIEW

- 13.2.8 OPTISYS INC

- TABLE 91 OPTISYS INC: COMPANY OVERVIEW

- 13.2.9 TRUMPF

- TABLE 92 TRUMPF: COMPANY OVERVIEW

- 13.2.10 ANYWAVES

- TABLE 93 ANYWAVES: COMPANY OVERVIEW

- 13.2.11 DAWN AEROSPACE

- TABLE 94 DAWN AEROSPACE: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS