|

|

市場調査レポート

商品コード

1459459

アクチュエータの世界市場:アクチュエーション別、用途別、タイプ別、業界別、地域別 - 2029年までの予測Actuators Market by Actuation (Electric, Hydraulic, Pneumatic), Application (Industrial Automation, Robotics, Vehicle Equipment), Type (Linear Actuator, Rotary Actuator), Vertical (FnB, Oil & Gas, Mining) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| アクチュエータの世界市場:アクチュエーション別、用途別、タイプ別、業界別、地域別 - 2029年までの予測 |

|

出版日: 2024年03月29日

発行: MarketsandMarkets

ページ情報: 英文 341 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

アクチュエータの市場規模は、2024年の677億米ドルから2029年には948億米ドルに成長すると予測され、予測期間中のCAGRは7.0%になるとみられています。

アクチュエータの技術的進歩や複数の業界におけるアクチュエータ需要の増加、自律化が進む機器の採用、アクチュエータの新たな応用分野の台頭などは、市場の成長を促進する要因の一部です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | アクチュエーション別、用途別、タイプ別、業界別、地域別 |

| 対象地域 | 欧州、北米、アジア太平洋、その他の地域 |

空気圧アクチュエータは、空気圧を利用して動きを生み出します。これらのアクチュエーターは主に、シリンダー内に密閉されたピストンと、シリンダー内への圧縮空気の流れを制御するバルブで構成されています。空気圧シリンダーには単動式と複動式があります。単動式空気圧アクチュエータは、圧縮空気を使用して一方向の動きを作り出します。スプリングがピストンを元の位置に戻します。これらのアクチュエータは、飲食業や石油・ガス業界などで最も一般的に使用されているオートメーション用アクチュエータです。空気圧アクチュエータは、比較的小さな圧力変化で大きな力を発生させます。この力を利用してダイヤフラムを動かし、バルブに液体を流すことができます。空気圧アクチュエータは、クレーンやホイスト、パレタイザーやデパレタイザー、コンベア、自動保管システム、検索システムなどに使用されています。

このセグメントは、さまざまなプロセスを実行するためにさまざまな業界分野で採用されている業界用ロボットに使用されるアクチュエータをカバーしています。アクチュエータ市場の業界用ロボットセグメントは、多関節ロボット、直交ロボット、SCARA(Selective Compliance Assembly Robot Arm)ロボット、平行ロボット、協働ロボット、その他(円筒ロボット、球体/極座標ロボット)にさらに分類されています。

アクチュエータは自動車制御システムの不可欠な部分を形成し、その信頼性と耐久性を向上させることで車両性能の最適化に役立っています。アクチュエータは、オープンループまたはクローズドループ制御システムの一部であり、電子ユニットと自動車のプロセスシステムを接続します。アクチュエータは、トランスと最終制御エレメントで構成されています。アクチュエータが受信した各位置決め信号は、自動車の機械的出力に変換されます。自動車の制御システムには、ソレノイド、DCモーター、ステッピングモーター、圧電アクチュエーターなど、さまざまなアクチュエーターが使用されています。空気圧アクチュエータは、テールゲートの昇降システムなど、自動車の様々な用途に使用されています。油圧アクチュエータは、可変サスペンションシステムのバルブなど、大きな力を必要とする用途に使用されています。アクチュエータは、自動車の主要な機能システムだけでなく、自動車の車体や内装にも使用されています。

当レポートでは、世界のアクチュエータ市場について調査し、アクチュエーション別、用途別、タイプ別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 運用データ

- 不況の影響

- エコシステム分析

- バリューチェーン分析

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術ロードマップ

- 技術分析

- 使用事例分析:アクチュエータ

- 貿易分析

- 関税と規制状況

- 2024年の主な会議とイベント

- 投資と資金調達のシナリオ

- 主な利害関係者と購入基準

- アクチュエータの部品表

- 業界用アクチュエータの総所有コスト

第6章 業界の動向

- イントロダクション

- サプライチェーン分析

- 技術動向

- メガトレンドの影響

- 特許分析

第7章 顧客分析

- 目的

- イントロダクション

- 顧客アクチュエータ選択基準

- 検査

- 食品・飲料業界

- 化学業界

- 金属・鉱業

- 製造業・建設業

- 医薬品・ヘルスケア業界

- パルプ・製紙業界

- 水処理業界

- 石油・ガス

- 航空宇宙業界

- 防衛業界

- 発電業界

- 自動車業界

第8章 アクチュエータ市場、アクチュエーション別

- イントロダクション

- 電気式

- 油圧式

- 空気圧式

- その他

第9章 アクチュエータ市場、用途別

- イントロダクション

- 業界自動化

- ロボット工学

- 車両装備

第10章 アクチュエータ市場、タイプ別

- イントロダクション

- リニアアクチュエータ

- ロータリーアクチュエータ

第11章 アクチュエータ市場、業界別

- イントロダクション

- 食品・飲料

- 石油・ガス

- 金属、鉱業、機械

- 発電

- 化学薬品、紙、プラスチック

- 医薬品・ヘルスケア

- 自動車

- 航空宇宙・防衛

- 船舶

- 電子・&電気

- 建設

- ユーティリティ

- 家庭・娯楽

- 農業

第12章 地域分析

- イントロダクション

- 地域別景気後退影響分析

- 北米

- 欧州

- アジア太平洋

- 中東

- その他の地域

第13章 競合情勢

- 主要参入企業の戦略/強み

- 2022年のトップ企業ランキング

- 収益分析、2018-2022

- 主要企業の市場シェア分析、2022年

- 企業価値評価と財務指標

- 企業評価マトリックス:2022年

- アクチュエータ市場スタートアップ/中小企業評価マトリックス

- 製品/ブランド比較

- 競合シナリオ

第14章 企業プロファイル

- イントロダクション

- 主要参入企業

- EMERSON ELECTRIC

- ROCKWELL AUTOMATION

- PARKER HANNIFIN CORPORATION

- ABB LTD.

- SMC CORPORATION

- MOOG INC.

- CURTISS-WRIGHT CORPORATION

- REGAL REXNORD

- ROTORK GROUP

- SKF GROUP

- MISUMI GROUP INC.

- IMI PLC

- EATON CORPORATION

- TOLOMATIC

- VENTURE MFG. CO.

- その他の企業

- INTELLIGENT ACTUATOR, INC.

- HARMONIC DRIVE LLC

- NOOK INDUSTRIES, INC.

- SHOGHI COMMUNICATION LTD.

- DVG AUTOMATION SPA

- MACRON DYNAMICS

- ROTOMATION INC.

- PEGASUS ACTUATORS GMBH

- KINITICS AUTOMATION

- FESTO

第15章 付録

The Actuators market is projected to grow from USD 67.7 Billion in 2024 to USD 94.8 Billion by 2029, at a CAGR of 7.0 % during the forecast period. Technological advancements and increasing demand for actuation across several industries, adoption of increasingly autonomous equipment, and the rise of new application areas for actuators are some of the factors driving the growth of the market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million) |

| Segments | By Actuation, Application, Type, Vertical, and Region |

| Regions covered | Europe, North America, Asia Pacific, and Rest of the World |

"Pneumatic Actuators segment is projected to grow at a second-highest CAGR, by Industry during the forecast period."

Pneumatic actuators use air pressure to produce motion. These actuators primarily consist of a piston sealed within a cylinder and valves to control the flow of compressed air into the cylinder. Pneumatic cylinders can be single or double-acting actuators. Single-acting pneumatic actuators use compressed air to create motion in one direction. A spring serves to return the piston to its original position. These are the most commonly used automation actuators in F&B and oil & gas, among other industries. Pneumatic actuators generate high force with relatively small pressure changes. This force is used to move diaphragms to enable the flow of liquid through valves. Pneumatic actuators are used in cranes and hoists, palletizers and de-palletizers, conveyors, automated storage systems, and retrieval systems.

"Industrial Robots segment is projected to grow at highest CAGR by Robotics Application."

This segment covers actuators used in industrial robots that are employed in different industrial verticals to carry out different processes. The industrial robots segment of the actuators market has been further classified into articulated robots, Cartesian robots, Selective Compliance Assembly Robot Arm (SCARA) robots, parallel robots, collaborative robots, and others (cylindrical and spherical/polar robots).

"Automotive vertical accounts for the largest market share in 2024."

Actuators form an integral part of automotive control systems and help in optimizing vehicle performance by improving their reliability and durability. Actuators are part of open-loop or closed-loop control systems, which connect electronic units with process systems of automobiles. They consist of transformers and final control elements. Each positioning signal received by actuators is converted into mechanical output in automobiles. A wide variety of actuators such as solenoids, DC motors, stepper motors, and piezoelectric actuators are used in control systems of automobiles. Pneumatic actuators are used for various applications in automobiles such as in the systems of tailgate lifting. Hydraulic actuators are used in high force requirement applications such as valves of variable suspension systems. Actuators are not only used in major functional systems of an automobile but also in the bodywork and the interior of an automobile.

The break-up of the profile of primary participants in the ACTUATORS market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Managers - 25%, Others-40%

- By Region: North America -40%, Asia Pacific - 30%, Europe - 20%, Middle East & Africa - 5%, Latin America - 5%

Prominent companies include Rockwell Automation (US), Emersion Electric Co (US), Parker Hennifin Corporation (US), ABB Ltd (Switzerlands), and SMC Corporation (Japan) and among others.

Research Coverage:

This research report categorizes the Actuators Market by Vertical (Automotive, Aerospace & Defense, Automotive, Agriculture, Oil & Gas, metals, Mining & materials, Food & beverages, Power Generation, Construction, Electronics & Electrical, Pharmaceutical & Healthcare, Utilities, Chemical, Paper, & Plastics, , Household & Entertainment), Actuation (Electric, Hydraulic, Pneumatic, others), Application (Industrial Automation, Robotics, Vehicle Equipment), Type (Linear Actuator, Rotary Actuator) and region (North America, Europe, Asia Pacific, Middle East, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the Actuators market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, services; key strategies; Contracts, partnerships, and agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the Actuators market. Competitive analysis of upcoming startups in the Actuators market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Actuators market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers restraints opportunities and challenges

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Actuators market

- Market Development: Comprehensive information about lucrative markets - the report analyses the Actuators market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Actuators market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the Actuators market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 ACTUATORS MARKET SEGMENTATION

- FIGURE 1 MARKETS COVERED

- 1.2.2 REGIONAL SCOPE

- 1.2.3 YEARS CONSIDERED

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH INDUSTRY FLOW

- FIGURE 3 ACTUATORS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key primary insights

- 2.1.2.4 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE ANALYSIS

- 2.2.4 RECESSION IMPACT

- 2.3 MARKET SCOPE

- 2.3.1 SEGMENTS AND SUBSEGMENTS

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Regional actuators market

- 2.4.1.2 General approach for actuators market

- 2.4.1.3 Actuators market, by actuation

- 2.4.1.4 Actuators market, by type

- 2.4.1.5 Actuators market, by application

- 2.4.1.6 Actuators market, by vertical

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 DATA TRIANGULATION AND VALIDATION

- 2.5.1 DATA TRIANGULATION THROUGH SECONDARY RESEARCH

- 2.5.2 DATA TRIANGULATION THROUGH PRIMARY INTERVIEWS

- FIGURE 7 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.6.1 MARKET SIZING

- 2.6.2 MARKET GROWTH FORECASTING

- FIGURE 8 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 9 ELECTRONICS & ELECTRICAL SEGMENT TO GROW AT HIGHEST CAGR

- FIGURE 10 LINEAR ACTUATORS TYPE TO GROW AT HIGHER CAGR FROM 2024 TO 2029

- FIGURE 11 ELECTRIC ACTUATION SEGMENT TO LEAD ACTUATORS MARKET DURING FORECAST PERIOD

- FIGURE 12 ROBOTICS APPLICATION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO LEAD ACTUATORS MARKET IN 2024

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ACTUATORS MARKET

- FIGURE 14 INCREASED GLOBAL DEMAND FOR ELECTRIC ACTUATORS TO DRIVE MARKET

- 4.2 ACTUATORS MARKET, BY ACTUATION

- FIGURE 15 ELECTRIC ACTUATION SEGMENT TO WITNESS HIGHEST CAGR FROM 2024 TO 2029

- 4.3 ACTUATORS MARKET, BY TYPE

- FIGURE 16 LINEAR ACTUATOR SEGMENT TO LEAD MARKET FROM 2024 TO 2029

- 4.4 ACTUATORS MARKET, BY APPLICATION

- FIGURE 17 VEHICLE EQUIPMENT APPLICATION SEGMENT TO LEAD MARKET FROM 2024 TO 2029

- 4.5 ACTUATORS MARKET, BY VERTICAL

- FIGURE 18 AUTOMOTIVE VERTICAL SEGMENT TO LEAD ACTUATORS MARKET FROM 2024 TO 2029

- 4.6 ACTUATORS MARKET, BY COUNTRY

- FIGURE 19 UK TO WITNESS HIGHEST MARKET GROWTH FROM 2024 TO 2029

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand from automotive industry

- 5.2.1.2 Rapid industrialization and utilization of robotics

- FIGURE 21 GROWTH EXPECTATION IN ROBOTICS AND AUTOMATION ACROSS INDUSTRIES

- 5.2.1.3 Rising demand from healthcare

- 5.2.1.4 Revival of space travel

- 5.2.2 RESTRAINTS

- 5.2.2.1 Low oil prices and economic slowdown

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Wide range of applications for linear actuators

- 5.2.3.2 Growth of luxury, electric, and driverless cars

- 5.2.3.3 Increased spending on renewable sources of energy for power generation

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues of leakage in pneumatic and hydraulic actuators

- 5.3 OPERATIONAL DATA

- TABLE 2 NEW COMMERCIAL AUTOMOTIVE VEHICLE DELIVERIES, BY TYPE, 2018-2022 (MILLION UNITS)

- TABLE 3 NEW AIRCRAFT DELIVERIES, BY TYPE, 2019-2022 (UNITS)

- TABLE 4 NEW SHIP DELIVERIES, BY TYPE, 2019-2022 (UNITS)

- 5.4 IMPACT OF RECESSION

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 APPLICATIONS

- FIGURE 22 ECOSYSTEM ANALYSIS/MAP: ACTUATORS MARKET

- TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 23 VALUE CHAIN ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF ACTUATOR, BY COMPONENT

- TABLE 6 AVERAGE SELLING PRICE OF ACTUATORS AND THEIR COMPONENTS (2023)

- 5.7.2 AVERAGE SELLING PRICE OF ACTUATOR, BY TYPE

- TABLE 7 AVERAGE SELLING PRICE OF AUTOMOTIVE ACTUATORS, BY TYPE (USD) (2023)

- TABLE 8 AVERAGE SELLING PRICE OF AIRCRAFT ACTUATORS, BY TYPE (USD) (2023)

- TABLE 9 AVERAGE SELLING PRICE OF MARINE ACTUATORS, BY TYPE (USD) (2023)

- TABLE 10 AVERAGE SELLING PRICE OF INDUSTRIAL ACTUATORS, BY TYPE (USD) (2023)

- 5.7.3 AVERAGE SELLING PRICE TREND OF ACTUATORS, BY REGION

- FIGURE 24 AVERAGE SELLING PRICE TREND OF ACTUATORS, BY REGION

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 TECHNOLOGY ROADMAP

- FIGURE 26 TECHNOLOGY ROADMAP OF ACTUATORS MARKET, 2000-2030

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGY

- 5.10.1.1 SMART ACTUATORS FOR INDUSTRY 4.0

- 5.10.2 SUPPORTING TECHNOLOGY

- 5.10.2.1 ARTIFICIAL MUSCLES

- 5.10.1 KEY TECHNOLOGY

- 5.11 USE CASE ANALYSIS: ACTUATORS

- 5.11.1 LIFT ASSIST TECHNOLOGY TO ELIMINATE WORKPLACE-RELATED INJURIES

- 5.11.2 USE OF ACTUATORS IN HOME DECOR APPLICATIONS

- 5.12 TRADE ANALYSIS

- 5.12.1 TRADE DATA

- TABLE 11 IMPORT DATA (HS CODE: 841229), BY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 27 IMPORT DATA (HS CODE: 841229), BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 12 EXPORT DATA (HS CODE: 841229), BY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 28 EXPORT DATA (HS CODE: 841229), BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- TABLE 13 LIST OF INTERNATIONAL SOCIETY OF AUTOMATION STANDARDS FOR ACTUATORS

- TABLE 14 NORTH AMERICA: TARIFFS

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES AND EVENTS, 2024

- TABLE 18 KEY CONFERENCES AND EVENTS, 2024

- 5.15 INVESTMENT AND FUNDING SCENARIO

- TABLE 19 VENTURE CAPITAL AND DEALS, 2019-2022

- FIGURE 29 VENTURE CAPITAL AND DEALS, 2019-2022

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ACTUATORS, BY END USER

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ACTUATORS, BY TOP VERTICALS (%)

- 5.16.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR ACTUATORS, BY APPLICATION

- TABLE 21 KEY BUYING CRITERIA FOR ACTUATORS, BY APPLICATION

- 5.17 BILL OF MATERIALS FOR ACTUATORS

- FIGURE 32 BILL OF MATERIALS FOR ACTUATORS

- 5.18 TOTAL COST OF OWNERSHIP FOR INDUSTRIAL ACTUATORS

- FIGURE 33 TOTAL COST OF OWNERSHIP FOR INDUSTRIAL ACTUATORS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 34 SUPPLY CHAIN ANALYSIS

- 6.2.1 MAJOR COMPANIES

- 6.2.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 6.2.3 END USERS/CUSTOMERS

- 6.3 TECHNOLOGY TRENDS

- 6.3.1 SMART ACTUATORS

- 6.3.2 HYBRID ACTUATORS

- 6.3.3 MEMS-ELECTROTHERMAL ACTUATORS

- 6.3.4 AMPLIFIED PIEZOELECTRIC ACTUATORS

- 6.4 IMPACT OF MEGATRENDS

- 6.4.1 ACTUATORS IN UNMANNED SYSTEMS, AIRCRAFT, AND SPACECRAFT

- 6.4.2 AUTOMATIC DOOR ACTUATORS

- 6.5 PATENT ANALYSIS

- FIGURE 35 PATENT ANALYSIS

7 CUSTOMER ANALYSIS

- 7.1 OBJECTIVES

- 7.2 INTRODUCTION

- 7.2.1 FOURTH INDUSTRIAL REVOLUTION (INDUSTRY 4.0)

- 7.2.2 CONSUMER BUYING PROCESS

- 7.2.3 PROMINENT COMPANIES

- 7.2.4 SMALL AND MEDIUM-SIZED ENTERPRISES

- 7.3 CUSTOMER ACTUATOR SELECTION CRITERIA

- 7.4 TESTING

- 7.4.1 SELECTION CRITERIA

- 7.4.2 PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN TESTING INDUSTRY

- 7.4.3 MAJOR BUYERS OF ACTUATOR/ACTUATION SYSTEM IN TESTING INDUSTRY

- 7.4.4 MAJOR ACTUATOR SUPPLIERS FOR TESTING INDUSTRY

- 7.5 FOOD & BEVERAGE INDUSTRY

- 7.5.1 SELECTION CRITERIA

- 7.5.2 MAJOR PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN FOOD & BEVERAGES INDUSTRY

- 7.5.3 APPLICATION AREAS OF ACTUATORS IN FOOD & BEVERAGES INDUSTRY

- 7.5.4 FACTORS EXPECTED TO AFFECT DEMAND FOR ACTUATORS IN NEXT THREE TO FIVE YEARS

- 7.5.5 MAJOR BUYERS OF ACTUATOR/ACTUATION SYSTEM IN FOOD & BEVERAGE INDUSTRY

- 7.5.6 MAJOR ACTUATOR SUPPLIERS FOR FOOD & BEVERAGE INDUSTRY

- 7.6 CHEMICALS INDUSTRY

- 7.6.1 SELECTION CRITERIA

- 7.6.2 APPLICATION AREAS OF ACTUATORS IN CHEMICAL INDUSTRY

- 7.6.3 PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN CHEMICAL INDUSTRY

- 7.6.4 FACTORS EXPECTED TO AFFECT DEMAND FOR ACTUATORS IN NEXT THREE TO FIVE YEARS

- 7.6.5 MAJOR BUYERS OF ACTUATOR/ACTUATION SYSTEM IN CHEMICAL INDUSTRY

- 7.6.6 MAJOR ACTUATOR SUPPLIERS IN THIS INDUSTRY

- 7.7 METALS & MINING INDUSTRY

- 7.7.1 SELECTION CRITERIA

- 7.7.2 APPLICATION AREAS OF ACTUATORS IN METALS & MINING INDUSTRY

- 7.7.3 FACTORS EXPECTED TO AFFECT DEMAND FOR ACTUATORS IN NEXT THREE TO FIVE YEARS

- 7.7.4 MAJOR ACTUATOR/ACTUATION SYSTEM BUYERS IN METALS & MINING INDUSTRY

- 7.7.5 MAJOR ACTUATOR SUPPLIERS FOR METALS & MINING INDUSTRY

- 7.8 MANUFACTURING & CONSTRUCTION INDUSTRY

- 7.8.1 SELECTION CRITERIA

- 7.8.2 MAJOR PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN MANUFACTURING & CONSTRUCTION INDUSTRY

- 7.8.3 APPLICATION AREAS OF ACTUATORS IN MANUFACTURING & CONSTRUCTION INDUSTRY

- 7.8.4 FACTORS EXPECTED TO AFFECT DEMAND FOR ACTUATORS IN THREE TO FIVE YEARS

- 7.8.5 MAJOR ACTUATOR/ACTUATION SYSTEM BUYERS IN MANUFACTURING & CONSTRUCTION INDUSTRY

- 7.8.6 MAJOR ACTUATOR SUPPLIERS FOR MANUFACTURING & CONSTRUCTION INDUSTRY

- 7.9 PHARMACEUTICALS & HEALTHCARE INDUSTRY

- 7.9.1 SELECTION CRITERIA

- 7.9.2 ACTUATOR/ACTUATION SYSTEM ISSUES FACED BY CUSTOMERS IN PHARMACEUTICALS & HEALTHCARE INDUSTRY

- 7.9.3 APPLICATION AREAS OF ACTUATORS IN PHARMACEUTICALS INDUSTRY

- 7.9.4 FACTORS EXPECTED TO AFFECT DEMAND FOR ACTUATORS IN NEXT THREE TO FIVE YEARS

- 7.9.5 MAJOR ACTUATOR/SYSTEM BUYERS IN PHARMACEUTICALS INDUSTRY

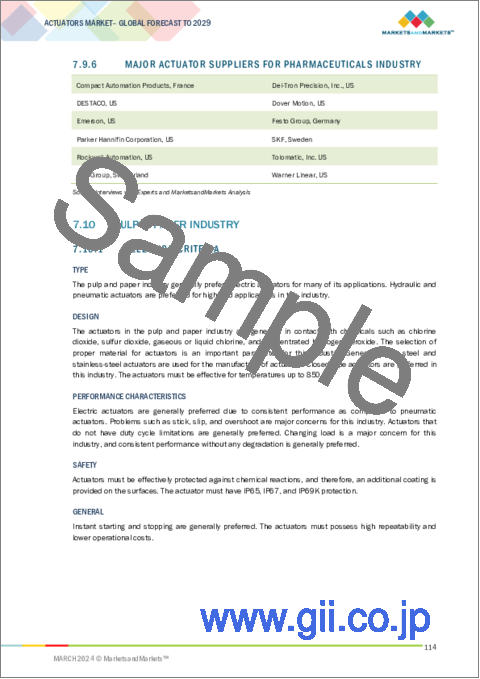

- 7.9.6 MAJOR ACTUATOR SUPPLIERS FOR PHARMACEUTICALS INDUSTRY

- 7.10 PULP & PAPER INDUSTRY

- 7.10.1 SELECTION CRITERIA

- 7.10.2 MAJOR PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN PULP & PAPER INDUSTRY

- 7.10.3 DIFFERENT APPLICATION AREAS OF ACTUATORS IN PULP & PAPER INDUSTRY

- 7.10.4 FACTORS EXPECTED TO AFFECT DEMAND FOR ACTUATORS IN NEXT THREE TO FIVE YEARS

- 7.10.5 MAJOR ACTUATOR/ACTUATION SYSTEM BUYERS IN PULP & PAPER INDUSTRY

- 7.10.6 MAJOR ACTUATOR SUPPLIERS FOR PULP & PAPER INDUSTRY

- 7.11 WATER TREATMENT

- 7.11.1 SELECTION CRITERIA

- 7.11.2 MAJOR PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN WATER TREATMENT INDUSTRY

- 7.11.3 APPLICATIONS OF ACTUATORS IN WATER TREATMENT INDUSTRY

- 7.11.4 FACTORS AFFECTING DEMAND FOR ACTUATORS IN WATER TREATMENT INDUSTRY IN NEXT THREE TO FIVE YEARS

- 7.11.5 MAJOR BUYERS OF ACTUATORS/ACTUATION SYSTEMS IN WATER TREATMENT INDUSTRY

- 7.11.6 MAJOR ACTUATOR SUPPLIERS FOR WATER TREATMENT INDUSTRY

- 7.12 OIL & GAS

- 7.12.1 SELECTION CRITERIA

- 7.12.2 APPLICATION AREAS FOR ACTUATORS IN OIL & GAS INDUSTRY

- 7.12.3 MAJOR PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN OIL & GAS INDUSTRY

- 7.12.4 FACTORS AFFECTING DEMAND FOR ACTUATORS IN OIL & GAS INDUSTRY IN NEXT THREE TO FIVE YEARS

- 7.12.5 MAJOR CERTIFICATIONS REQUIRED FOR ACTUATORS FOR OIL & GAS INDUSTRY

- 7.12.6 MAJOR BUYERS OF ACTUATORS/ACTUATION SYSTEMS IN OIL & GAS INDUSTRY

- 7.12.7 MAJOR ACTUATOR SUPPLIERS FOR OIL & GAS INDUSTRY

- 7.13 AEROSPACE INDUSTRY

- 7.13.1 SELECTION CRITERIA

- 7.13.2 MAJOR PROBLEMS RELATED TO ACTUATOR/ACTUATION SYSTEMS FACED BY CUSTOMERS IN AEROSPACE INDUSTRY

- 7.13.3 APPLICATION AREAS OF ACTUATORS IN AEROSPACE INDUSTRY

- 7.13.4 DIFFERENT APPLICATION AREAS OF ACTUATORS IN FLIGHT CONTROLS

- 7.13.5 APPLICATION AREAS OF LINEAR ACTUATORS IN FLIGHT CONTROLS

- 7.13.6 CHANGING ACTUATOR REQUIREMENTS IN FUTURE

- 7.13.7 MAJOR BUYERS OF ACTUATORS/ACTUATION SYSTEMS IN AEROSPACE INDUSTRY

- 7.13.8 MAJOR ACTUATOR SUPPLIERS IN AEROSPACE INDUSTRY

- 7.14 DEFENSE INDUSTRY

- 7.14.1 SELECTION CRITERIA

- 7.14.2 ADVANTAGES OF ACTUATORS IN DEFENSE

- 7.14.3 PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN DEFENSE INDUSTRY

- 7.14.4 MAJOR BUYERS OF ACTUATORS/ACTUATION SYSTEMS IN DEFENSE INDUSTRY

- 7.14.5 MAJOR ACTUATOR SUPPLIERS IN DEFENSE INDUSTRY

- 7.15 POWER GENERATION INDUSTRY

- 7.15.1 SELECTION CRITERIA

- 7.15.2 APPLICATIONS FOR WHICH ACTUATORS ARE USED

- 7.15.3 APPLICATION AREAS FOR ACTUATORS IN POWER GENERATION INDUSTRY

- 7.15.4 FACTORS AFFECTING DEMAND FOR ACTUATORS IN POWER GENERATION INDUSTRY IN NEXT THREE TO FIVE YEARS

- 7.15.5 CUSTOMER EXPECTATIONS FOR ACTUATORS AND RELATED SYSTEMS SUPPLIERS REGARDING MAINTENANCE AND SUPPORT

- 7.15.6 MAJOR BUYERS OF ACTUATORS/ACTUATION SYSTEMS IN POWER GENERATION INDUSTRY

- 7.15.7 MAJOR ACTUATOR SUPPLIERS IN POWER GENERATION INDUSTRY

- 7.16 AUTOMOTIVE INDUSTRY

- 7.16.1 SELECTION CRITERIA

- 7.16.2 APPLICATION AREAS OF ACTUATORS IN AUTOMOTIVE INDUSTRY

- 7.16.3 PROBLEMS RELATED TO ACTUATORS/ACTUATION SYSTEMS FACED BY CUSTOMERS IN AUTOMOTIVE INDUSTRY

- 7.16.4 FACTORS AFFECTING DEMAND FOR ACTUATORS IN AUTOMOTIVE INDUSTRY IN NEXT THREE TO FIVE YEARS

- 7.16.5 MAJOR BUYERS OF ACTUATORS/ACTUATION SYSTEMS IN AUTOMOTIVE INDUSTRY

- 7.16.6 MAJOR ACTUATOR SUPPLIERS IN AUTOMOTIVE INDUSTRY

8 ACTUATORS MARKET, BY ACTUATION

- 8.1 INTRODUCTION

- FIGURE 36 ELECTRIC SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 22 ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 23 ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- 8.2 ELECTRIC

- 8.2.1 INCREASED USE OF ELECTRICAL ACTUATORS IN DIFFERENT INDUSTRIES TO DRIVE DEMAND

- 8.3 HYDRAULIC

- 8.3.1 DEMAND IN HIGH-FORCE APPLICATIONS TO DRIVE MARKET

- 8.4 PNEUMATIC

- 8.4.1 USE IN FOOD & BEVERAGES AND OIL & GAS INDUSTRIES TO DRIVE DEMAND

- 8.5 OTHERS

- 8.5.1 RECENT DEVELOPMENTS IN THERMAL, PIEZOELECTRIC, AND HYBRID ACTUATORS TO DRIVE DEMAND

9 ACTUATORS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 37 VEHICLE EQUIPMENT APPLICATION TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- TABLE 24 ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 25 ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 9.2 INDUSTRIAL AUTOMATION

- 9.2.1 ENHANCING QUALITY AND INCREASING FLEXIBILITY OF MANUFACTURING PROCESS TO DRIVE MARKET

- 9.3 ROBOTICS

- 9.3.1 INCREASING ADOPTION OF ROBOTICS ACROSS AUTOMOTIVE AND ELECTRONICS & ELECTRICAL INDUSTRIES TO DRIVE GROWTH

- FIGURE 38 INDUSTRIAL ROBOTS SEGMENT TO LEAD ACTUATORS MARKET IN ROBOTICS

- TABLE 26 ACTUATORS MARKET IN ROBOTICS, BY ROBOT TYPE, 2020-2023 (USD MILLION)

- TABLE 27 ACTUATORS MARKET IN ROBOTICS, BY ROBOT TYPE, 2024-2029 (USD MILLION)

- 9.3.2 INDUSTRIAL ROBOTS

- 9.3.3 SERVICE ROBOTS

- 9.4 VEHICLE EQUIPMENT

- 9.4.1 INCREASING AUTONOMY LEVELS AND REQUIREMENTS FOR AUTOMATED VALE CONTROLS AND SUSPENSION MECHANISMS TO DRIVE MARKET

10 ACTUATORS MARKET, BY TYPE

- 10.1 INTRODUCTION

- FIGURE 39 ACTUATORS MARKET, BY TYPE, 2024 VS. 2029 (USD BILLION)

- TABLE 28 ACTUATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 29 ACTUATORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 10.2 LINEAR ACTUATORS

- 10.2.1 ROD TYPE

- 10.2.1.1 Increasing use of rod-less type linear actuators in aircraft structures to drive demand

- 10.2.2 SCREW TYPE

- 10.2.2.1 Growing use of servomotors in drive and control hardware to fuel demand

- 10.2.3 BELT TYPE

- 10.2.3.1 Rising use to increase operational efficiency of process automation to drive demand

- 10.2.1 ROD TYPE

- 10.3 ROTARY ACTUATORS

- 10.3.1 MOTORS

- 10.3.1.1 Surging sales of industrial robots to drive demand

- 10.3.2 BLADDER & VANE

- 10.3.2.1 Increasing use in gates and valves in process industry to drive demand

- 10.3.3 PISTON TYPE

- 10.3.3.1 Growing use for precision control applications in electronics industry to drive demand

- 10.3.1 MOTORS

11 ACTUATORS MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- FIGURE 40 ACTUATORS MARKET, BY VERTICAL, 2024 VS. 2029 (USD BILLION)

- TABLE 30 ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 31 ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.2 FOOD & BEVERAGES

- 11.2.1 REQUIREMENT FOR INCREASED AUTOMATION AND CAPACITY ENHANCEMENT TO DRIVE SEGMENT

- 11.3 OIL & GAS

- 11.3.1 INCREASE IN OIL & GAS EXPLORATION ACTIVITIES IN ASIA PACIFIC TO DRIVE SEGMENT

- 11.4 METALS, MINING & MACHINERY

- 11.4.1 REQUIREMENT FOR ROBUST ACTUATORS IN MINING INDUSTRY TO DRIVE SEGMENT

- 11.5 POWER GENERATION

- 11.5.1 INCREASED SPENDING ON RENEWABLE SOURCES TO DRIVE SEGMENT

- 11.6 CHEMICALS, PAPER & PLASTICS

- 11.6.1 RAPID INDUSTRIALIZATION AND STRINGENT IMPLEMENTATION OF ENVIRONMENTAL REGULATIONS TO DRIVE SEGMENT

- 11.7 PHARMACEUTICALS & HEALTHCARE

- 11.7.1 STRINGENT REGULATIONS FOR HYGIENE AND INCREASED DEMAND FOR SURGICAL ROBOTS TO DRIVE SEGMENT

- 11.8 AUTOMOTIVE

- 11.8.1 INCREASED DEMAND FOR INDUSTRIAL ROBOTS TO DRIVE SEGMENT

- TABLE 32 AUTOMOTIVE ACTUATORS VOLUME, BY VEHICLE TYPE, 2020-2029 (MILLION UNITS)

- 11.9 AEROSPACE & DEFENSE

- 11.9.1 RISE IN DEFENSE EXPENDITURE, COMMERCIAL AVIATION, AND MILITARY MODERNIZATION PROGRAMS TO DRIVE SEGMENT

- TABLE 33 AIRCRAFT ACTUATORS VOLUME, BY AIRCRAFT TYPE, 2020-2029 (THOUSAND UNITS)

- 11.10 MARINE

- 11.10.1 INCREASED USE IN COMMERCIAL SHIPBUILDING TO DRIVE SEGMENT

- TABLE 34 MARINE ACTUATORS VOLUME, BY VESSEL TYPE, 2020-2029 (THOUSAND UNITS)

- 11.11 ELECTRONICS & ELECTRICAL

- 11.11.1 GROWING DEMAND FOR BATTERIES, CHIPS, AND DISPLAYS TO DRIVE SEGMENT

- 11.12 CONSTRUCTION

- 11.12.1 INCREASED DEMAND FOR ELECTRICAL LINEAR ACTUATORS IN LIFTING AND MATERIAL HANDLING APPLICATIONS TO DRIVE SEGMENT

- 11.13 UTILITIES

- 11.13.1 INCREASED DEMAND FOR LOGISTICS, AGRICULTURE, AND FIELD ROBOTS TO DRIVE SEGMENT

- 11.14 HOUSEHOLD & ENTERTAINMENT

- 11.14.1 INCREASED DEMAND FOR SERVICE ROBOTS IN DOMESTIC APPLICATIONS TO BOOST DEMAND

- 11.15 AGRICULTURE

- 11.15.1 GROWING ADOPTION OF MECHANIZATION AND INCREASING GOVERNMENT SUPPORT TO DRIVE SEGMENT

12 REGIONAL ANALYSIS

- 12.1 INTRODUCTION

- FIGURE 41 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF ACTUATORS MARKET IN 2024

- TABLE 35 ACTUATORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 ACTUATORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- 12.2 REGIONAL RECESSION IMPACT ANALYSIS

- 12.3 NORTH AMERICA

- 12.3.1 PESTLE ANALYSIS: NORTH AMERICA

- 12.3.2 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 42 NORTH AMERICA: ACTUATORS MARKET SNAPSHOT

- TABLE 37 NORTH AMERICA: ACTUATORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 38 NORTH AMERICA: ACTUATORS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 39 NORTH AMERICA: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 40 NORTH AMERICA: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 41 NORTH AMERICA: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 42 NORTH AMERICA: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 43 NORTH AMERICA: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 44 NORTH AMERICA: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 45 NORTH AMERICA ACTUATORS MARKET IN ROBOTICS, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 46 NORTH AMERICA: ACTUATORS MARKET IN ROBOTICS, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 47 NORTH AMERICA: ACTUATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 48 NORTH AMERICA: ACTUATORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.3.3 US

- 12.3.3.1 Increase adoption of Industry 4.0 to drive market

- TABLE 49 US: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 50 US: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 51 US: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 52 US: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 53 US: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 54 US: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.3.4 CANADA

- 12.3.4.1 Rising demand for linear actuators to drive market

- TABLE 55 CANADA: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 56 CANADA: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 57 CANADA: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 58 CANADA: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 59 CANADA: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 60 CANADA: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.4 EUROPE

- 12.4.1 PESTLE ANALYSIS: EUROPE

- 12.4.2 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 43 EUROPE: ACTUATORS MARKET SNAPSHOT

- TABLE 61 EUROPE: ACTUATORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 62 EUROPE: ACTUATORS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 63 EUROPE: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 64 EUROPE: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 65 EUROPE: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 66 EUROPE: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 67 EUROPE: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 68 EUROPE: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 69 EUROPE: ACTUATORS MARKET IN ROBOTICS, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 70 EUROPE: ACTUATORS MARKET IN ROBOTICS, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 71 EUROPE: ACTUATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 72 EUROPE: ACTUATORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.4.3 GERMANY

- 12.4.3.1 Thriving automotive and manufacturing industries to drive market

- TABLE 73 GERMANY: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 74 GERMANY: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 75 GERMANY: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 76 GERMANY: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 77 GERMANY: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 78 GERMANY: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.4.4 UK

- 12.4.4.1 Increasing demand from oil & gas industry to drive market

- TABLE 79 UK: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 80 UK: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 81 UK: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 82 UK: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 83 UK: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 84 UK: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.4.5 FRANCE

- 12.4.5.1 Presence of major aerospace & defense manufacturers to drive market

- TABLE 85 FRANCE: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 86 FRANCE: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 87 FRANCE: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 88 FRANCE: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 89 FRANCE: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 90 FRANCE: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.4.6 ITALY

- 12.4.6.1 Presence of major automobile and food & beverages manufacturers to drive market

- TABLE 91 ITALY: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 92 ITALY: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 93 ITALY: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 94 ITALY: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 95 ITALY: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 96 ITALY: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.4.7 RUSSIA

- 12.4.7.1 Diverse industrial landscape to boost demand

- TABLE 97 RUSSIA: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 98 RUSSIA: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 99 RUSSIA: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 100 RUSSIA: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 101 RUSSIA: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 102 RUSSIA: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.4.8 REST OF EUROPE

- TABLE 103 REST OF EUROPE: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 104 REST OF EUROPE: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 105 REST OF EUROPE: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 106 REST OF EUROPE: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 107 REST OF EUROPE: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 108 REST OF EUROPE: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.5 ASIA PACIFIC

- 12.5.1 PESTLE ANALYSIS: ASIA PACIFIC

- 12.5.2 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 44 ASIA PACIFIC: ACTUATORS MARKET SNAPSHOT

- TABLE 109 ASIA PACIFIC: ACTUATORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 110 ASIA PACIFIC: ACTUATORS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 111 ASIA PACIFIC: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 112 ASIA PACIFIC: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 113 ASIA PACIFIC: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 114 ASIA PACIFIC: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 115 ASIA PACIFIC: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 116 ASIA PACIFIC: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 117 ASIA PACIFIC: ACTUATORS MARKET IN ROBOTICS, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 118 ASIA PACIFIC: ACTUATORS MARKET IN ROBOTICS, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 119 ASIA PACIFIC: ACTUATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 120 ASIA PACIFIC: ACTUATORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.5.3 CHINA

- 12.5.3.1 Presence of major industries to drive market

- TABLE 121 CHINA: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 122 CHINA: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 123 CHINA: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 124 CHINA: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 125 CHINA: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 126 CHINA: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.5.4 INDIA

- 12.5.4.1 Presence of flourishing steel and textile industries to drive market

- TABLE 127 INDIA: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 128 INDIA: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 129 INDIA: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 130 INDIA: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 131 INDIA: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 132 INDIA: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.5.5 JAPAN

- 12.5.5.1 Increasing demand across major industries to drive market

- TABLE 133 JAPAN: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 134 JAPAN: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 135 JAPAN: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 136 JAPAN: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 137 JAPAN: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 138 JAPAN: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.5.6 SOUTH KOREA

- 12.5.6.1 Presence of major automotive and electronics manufacturers to drive market

- TABLE 139 SOUTH KOREA: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 140 SOUTH KOREA: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 141 SOUTH KOREA: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 142 SOUTH KOREA: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 143 SOUTH KOREA: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 144 SOUTH KOREA: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.5.7 AUSTRALIA

- 12.5.7.1 Advancements in automation technologies across industries to boost demand

- TABLE 145 AUSTRALIA: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 146 AUSTRALIA: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 147 AUSTRALIA: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 148 AUSTRALIA: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 149 AUSTRALIA: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 150 AUSTRALIA: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.5.8 REST OF ASIA PACIFIC

- TABLE 151 REST OF ASIA PACIFIC: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.6 MIDDLE EAST

- 12.6.1 PESTLE ANALYSIS: MIDDLE EAST

- 12.6.2 MIDDLE EAST: RECESSION IMPACT ANALYSIS

- FIGURE 45 MIDDLE EAST: ACTUATORS MARKET SNAPSHOT

- TABLE 157 MIDDLE EAST: ACTUATORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 158 MIDDLE EAST: ACTUATORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 159 MIDDLE EAST: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 160 MIDDLE EAST: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 161 MIDDLE EAST: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 162 MIDDLE EAST: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 163 MIDDLE EAST: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 164 MIDDLE EAST: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 165 MIDDLE EAST: ACTUATORS MARKET IN ROBOTICS, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 166 MIDDLE EAST: ACTUATORS MARKET IN ROBOTICS, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 167 MIDDLE EAST: ACTUATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 168 MIDDLE EAST: ACTUATORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.6.3 GCC COUNTRIES

- 12.6.3.1 Industrialization and infrastructure development to drive growth

- TABLE 169 GCC COUNTRIES: ACTUATORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 170 GCC COUNTRIES: ACTUATORS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 171 GCC COUNTRIES: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 172 GCC COUNTRIES: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 173 GCC COUNTRIES: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 174 GCC COUNTRIES: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 175 GCC COUNTRIES: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 176 GCC COUNTRIES: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.6.3.2 Saudi Arabia

- 12.6.3.2.1 Economic diversification efforts to drive market

- 12.6.3.2 Saudi Arabia

- TABLE 177 SAUDI ARABIA: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 178 SAUDI ARABIA: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 179 SAUDI ARABIA: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 180 SAUDI ARABIA: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 181 SAUDI ARABIA: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 182 SAUDI ARABIA: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.6.3.3 UAE

- 12.6.3.3.1 Technological advancement and infrastructure development to drive market

- 12.6.3.3 UAE

- TABLE 183 UAE: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 184 UAE: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 185 UAE: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 186 UAE: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 187 UAE: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 188 UAE: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.6.4 REST OF MIDDLE EAST

- TABLE 189 REST OF MIDDLE EAST: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 190 REST OF MIDDLE EAST: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 191 REST OF MIDDLE EAST: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 192 REST OF MIDDLE EAST: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 193 REST OF MIDDLE EAST: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 194 REST OF MIDDLE EAST: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.7 REST OF THE WORLD (ROW)

- 12.7.1 ROW: RECESSION IMPACT ANALYSIS

- 12.7.2 PESTLE ANALYSIS

- FIGURE 46 ROW: ACTUATORS MARKET SNAPSHOT

- TABLE 195 ROW: ACTUATORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 196 ROW: ACTUATORS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 197 ROW: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 198 ROW: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 199 ROW: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 200 ROW: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 201 ROW: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 202 ROW: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 203 ROW: ACTUATORS MARKET IN ROBOTICS, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 204 ROW: ACTUATORS MARKET IN ROBOTICS, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 205 ROW: ACTUATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 206 ROW: ACTUATORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 12.7.3 LATIN AMERICA

- TABLE 207 LATIN AMERICA: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 208 LATIN AMERICA: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 209 LATIN AMERICA: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 210 LATIN AMERICA: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 211 LATIN AMERICA: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 212 LATIN AMERICA: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 12.7.4 AFRICA

- TABLE 213 AFRICA: ACTUATORS MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 214 AFRICA: ACTUATORS MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 215 AFRICA: ACTUATORS MARKET, BY ACTUATION, 2020-2023 (USD MILLION)

- TABLE 216 AFRICA: ACTUATORS MARKET, BY ACTUATION, 2024-2029 (USD MILLION)

- TABLE 217 AFRICA: ACTUATORS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 218 AFRICA: ACTUATORS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 219 STRATEGIES ADOPTED BY KEY PLAYERS, 2023-2024

- 13.2 RANKING OF LEADING PLAYERS, 2022

- FIGURE 47 RANKING OF LEADING PLAYERS IN ACTUATORS MARKET, 2022

- 13.3 REVENUE ANALYSIS, 2018-2022

- FIGURE 48 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2022

- 13.4 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2022

- FIGURE 49 SHARE ANALYSIS OF LEADING PLAYERS IN ACTUATORS MARKET, 2022

- TABLE 220 ACTUATORS MARKET: DEGREE OF COMPETITION

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 50 COMPANY VALUATION (USD BILLION), 2022

- FIGURE 51 FINANCIAL METRICS (ENTERPRISE VALUE/EBITDA), 2022

- 13.6 COMPANY EVALUATION MATRIX, 2022

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- FIGURE 52 ACTUATORS MARKET: COMPANY EVALUATION MATRIX, 2022

- 13.6.5 COMPANY FOOTPRINT

- FIGURE 53 COMPANY FOOTPRINT

- TABLE 221 ACTUATION FOOTPRINT

- TABLE 222 ACTUATOR TYPE FOOTPRINT

- TABLE 223 COMPANY REGION FOOTPRINT

- 13.7 ACTUATORS MARKET STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISE EVALUATION MATRIX

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- FIGURE 54 ACTUATORS MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 13.7.5 COMPETITIVE BENCHMARKING

- TABLE 224 KEY STARTUPS/SMES

- TABLE 225 ACTUATORS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.8 PRODUCT/BRAND COMPARISON

- TABLE 226 PRODUCT COMPARISON OF DIFFERENT ACTUATOR MANUFACTURERS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- TABLE 227 ACTUATORS MARKET: PRODUCT LAUNCHES, JANUARY 2020-MARCH 2024

- 13.9.2 DEALS

- TABLE 228 ACTUATORS MARKET: DEALS, JANUARY 2020-MARCH 2024

- 13.9.3 OTHER DEVELOPMENTS

- TABLE 229 ACTUATORS MARKET: OTHER DEVELOPMENTS, JANUARY 2020-MARCH 2024

14 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 EMERSON ELECTRIC

- TABLE 230 EMERSON ELECTRIC: BUSINESS OVERVIEW

- FIGURE 55 EMERSON ELECTRIC: COMPANY SNAPSHOT

- TABLE 231 EMERSON ELECTRIC: PRODUCTS OFFERED

- TABLE 232 EMERSON ELECTRIC: PRODUCT LAUNCHES

- TABLE 233 EMERSON ELECTRIC.: DEALS

- 14.2.2 ROCKWELL AUTOMATION

- TABLE 234 ROCKWELL AUTOMATION: BUSINESS OVERVIEW

- FIGURE 56 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- TABLE 235 ROCKWELL AUTOMATION: PRODUCTS OFFERED

- 14.2.3 PARKER HANNIFIN CORPORATION

- TABLE 236 PARKER HANNIFIN CORPORATION: BUSINESS OVERVIEW

- FIGURE 57 PARKER HANNIFIN CORPORATION: COMPANY SNAPSHOT

- TABLE 237 PARKER HANNIFIN CORPORATION: PRODUCTS OFFERED

- 14.2.4 ABB LTD.

- TABLE 238 ABB: BUSINESS OVERVIEW

- FIGURE 58 ABB: COMPANY SNAPSHOT

- TABLE 239 ABB: PRODUCTS OFFERED

- 14.2.5 SMC CORPORATION

- TABLE 240 SMC CORPORATION: BUSINESS OVERVIEW

- FIGURE 59 SMC CORPORATION: COMPANY SNAPSHOT

- TABLE 241 SMC CORPORATION: PRODUCTS OFFERED

- TABLE 242 SMC CORPORATION: PRODUCT LAUNCHES

- 14.2.6 MOOG INC.

- TABLE 243 MOOG INC.: BUSINESS OVERVIEW

- FIGURE 60 MOOG INC.: COMPANY SNAPSHOT

- TABLE 244 MOOG INC.: PRODUCTS OFFERED

- 14.2.7 CURTISS-WRIGHT CORPORATION

- TABLE 245 CURTISS-WRIGHT CORPORATION: BUSINESS OVERVIEW

- FIGURE 61 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- TABLE 246 CURTISS-WRIGHT CORPORATION: PRODUCTS OFFERED

- TABLE 247 CURTISS-WRIGHT CORPORATION: DEALS

- TABLE 248 CURTISS-WRIGHT CORPORATION: OTHER DEVELOPMENTS

- 14.2.8 REGAL REXNORD

- TABLE 249 REGAL REXNORD: BUSINESS OVERVIEW

- FIGURE 62 REGAL REXNORD: COMPANY SNAPSHOT

- TABLE 250 REGAL REXNORD: PRODUCTS OFFERED

- TABLE 251 REGAL REXNORD: PRODUCT LAUNCHES

- TABLE 252 REGAL REXNORD: DEALS

- 14.2.9 ROTORK GROUP

- TABLE 253 ROTORK GROUP: BUSINESS OVERVIEW

- FIGURE 63 ROTORK GROUP: COMPANY SNAPSHOT

- TABLE 254 ROTORK GROUP: PRODUCTS OFFERED

- TABLE 255 ROTORK GROUP: DEALS

- 14.2.10 SKF GROUP

- TABLE 256 SKF GROUP: BUSINESS OVERVIEW

- FIGURE 64 SKF GROUP: COMPANY SNAPSHOT

- TABLE 257 SKF GROUP: PRODUCTS OFFERED

- 14.2.11 MISUMI GROUP INC.

- TABLE 258 MISUMI GROUP INC.: BUSINESS OVERVIEW

- FIGURE 65 MISUMI GROUP INC.: COMPANY SNAPSHOT

- TABLE 259 MISUMI GROUP INC.: PRODUCTS OFFERED

- 14.2.12 IMI PLC

- TABLE 260 IMI PLC: BUSINESS OVERVIEW

- FIGURE 66 IMI PLC: COMPANY SNAPSHOT

- TABLE 261 IMI PLC: PRODUCTS OFFERED

- TABLE 262 IMI PLC: DEALS

- 14.2.13 EATON CORPORATION

- TABLE 263 EATON CORPORATION: BUSINESS OVERVIEW

- FIGURE 67 EATON CORPORATION: COMPANY SNAPSHOT

- TABLE 264 EATON CORPORATION: PRODUCTS OFFERED

- 14.2.14 TOLOMATIC

- TABLE 265 TOLOMATIC: BUSINESS OVERVIEW

- TABLE 266 TOLOMATIC: PRODUCTS OFFERED

- TABLE 267 TOLOMATIC: PRODUCT LAUNCHES

- 14.2.15 VENTURE MFG. CO.

- TABLE 268 VENTURE MFG. CO.: BUSINESS OVERVIEW

- TABLE 269 VENTURE MFG. CO.: PRODUCTS OFFERED

- 14.3 OTHER PLAYERS

- 14.3.1 INTELLIGENT ACTUATOR, INC.

- TABLE 270 INTELLIGENT ACTUATOR, INC.: COMPANY OVERVIEW

- 14.3.2 HARMONIC DRIVE LLC

- TABLE 271 HARMONIC DRIVE LLC: COMPANY OVERVIEW

- 14.3.3 NOOK INDUSTRIES, INC.

- TABLE 272 NOOK INDUSTRIES, INC.: COMPANY OVERVIEW

- 14.3.4 SHOGHI COMMUNICATION LTD.

- TABLE 273 SHOGHI COMMUNICATION LTD.: COMPANY OVERVIEW

- 14.3.5 DVG AUTOMATION SPA

- TABLE 274 DVG AUTOMATION SPA: COMPANY OVERVIEW

- 14.3.6 MACRON DYNAMICS

- TABLE 275 MACRON DYNAMICS: COMPANY OVERVIEW

- 14.3.7 ROTOMATION INC.

- TABLE 276 ROTOMATION INC.: COMPANY OVERVIEW

- 14.3.8 PEGASUS ACTUATORS GMBH

- TABLE 277 PEGASUS ACTUATORS GMBH: COMPANY OVERVIEW

- 14.3.9 KINITICS AUTOMATION

- TABLE 278 KINITICS AUTOMATION: COMPANY OVERVIEW

- 14.3.10 FESTO

- TABLE 279 FESTO: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS