|

|

市場調査レポート

商品コード

1459458

鉄道用複合材料の世界市場:繊維タイプ別、樹脂タイプ別、製造プロセス別、用途別、地域別-2028年までの予測Rail Composites Market by Fiber Type (Glass Fiber, Carbon Fiber), Resin Type (Polyester, Phenolic, Epoxy, Vinyl Ester), Manufacturing Process (Lay-up, Injection Molding, Compression Molding, RTM), Application, & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 鉄道用複合材料の世界市場:繊維タイプ別、樹脂タイプ別、製造プロセス別、用途別、地域別-2028年までの予測 |

|

出版日: 2024年03月29日

発行: MarketsandMarkets

ページ情報: 英文 209 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

鉄道用複合材料の市場規模は、予測期間中に7.2%のCAGRで拡大し、2023年の17億米ドルから2028年には24億米ドルに成長すると予測されています。

鉄道産業で使用されるほぼすべての複合材料は、高温に対する耐性が高いため、熱硬化性樹脂を使用して製造されます。フェノール樹脂はフェノールとアルデヒドの反応によって得られます。フェノール樹脂は耐火性、耐煙性、耐毒性(FST)に優れているため、レール用途に広く使用されています。フェノール樹脂は、天井、床、隔壁、階段などの製造に使用されます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 対象ユニット | 金額(100万米ドル)、数量(キロトン) |

| セグメント別 | 繊維タイプ別、樹脂タイプ別、製造プロセス別、用途別、地域別 |

| 対象地域 | 欧州、北米、アジア太平洋、その他の地域 |

フィラメントワインディングは、回転するマンドレルを金型として使用し、製品の内面と外面にラミネート面を製造する自動オープン成形プロセスです。この工程では繊維の負荷が高く、強度重量比の高いラミネートができます。レール用複合材料の製造には、迅速で経済的な方法です。この工程は自動化されており、人工構造物の製造に使用されます。中空または円形の部品ができます。

複合材料は、鉄道産業におけるダクト、シート、パネル、その他多くの内外装部品の製造に広く使用されています。ヘッドレストの背もたれパネル、座席、荷物入れはガラス繊維複合材料から製造できます。トレイ、グラブ・ハンドル、シート・ホルダーなどの複合モジュールは、天然繊維複合材料から製造することができ、低コストであるだけでなく、美的な外観と感触を与えることができます。換気扇ファンブレード、バットブレード付き冷却ファン、バーブレード付き冷却換気扇などの冷却ファンブレードは、複合材料で製造できます。

予測期間中、欧州は鉄道用複合材料市場で2番目に急成長する地域と予測されています。欧州の政府系鉄道会社のほとんどが高速鉄道(HSR)サービスを提供しています。欧州の多くの国では、国間のHSRネットワークが稼動しています。EU委員会は、欧州横断ネットワーク内のHSR開発に共同体資金の一部を充てることを計画しています。このようなHSRネットワークの拡大計画は、鉄道用途における複合材料の需要を増大させると予測されています。

当レポートでは、世界の鉄道用複合材料市場について調査し、繊維タイプ別、樹脂タイプ別、製造プロセス別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- エコシステム分析/市場マップ

- 価格分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- 主な利害関係者と購入基準

- 特許分析

- 規制状況

- 主な会議とイベント

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向と混乱

- 投資と資金調達のシナリオ

第6章 鉄道用複合材料市場、繊維タイプ別

- イントロダクション

- ガラス繊維複合材

- 炭素繊維複合材

- その他

第7章 鉄道用複合材料市場、樹脂タイプ別

- イントロダクション

- ポリエステル

- フェノール

- エポキシ

- ビニルエステル

第8章 鉄道用複合材料市場、製造プロセス別

- イントロダクション

- レイアッププロセス

- フィラメントワインディングプロセス

- 射出成形プロセス

- プルトルージョンプロセス

- 圧縮成形プロセス

- 樹脂トランスファー成形(RTM)プロセス

第9章 鉄道用複合材料市場、用途別

- イントロダクション

- 外装部品

- 内装部品

- その他

第10章 鉄道用複合材料市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- ブランド/製品比較分析

- 企業評価マトリックス

- スタートアップ/中小企業評価マトリックス

- 鉄道複合材メーカーの評価と財務指標

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- GURIT HOLDINGS AG

- HEXCEL CORPORATION SOLVAY

- TEIJIN LIMITED

- 3A COMPOSITES

- TORAY INDUSTRIES, INC.

- PREMIER COMPOSITE TECHNOLOGIES

- DARTFORD COMPOSITES LTD.

- EXEL COMPOSITES

- AVIENT CORPORATION

- KINECO LIMITED

- BASF SE

- AVIC CABIN SYSTEMS (UK)

- BFG INTERNATIONAL

- RELIANCE INDUSTRIES LTD.

- その他の企業

- TRB

- LANXESS

- CELANESE CORPORATION

- LAMERA AB

- ADAMANT COMPOSITES LTD.

- MADER

- FDC COMPOSITES INC.

- VICTALL

- PROLONG COMPOSITES

第13章 付録

The rail composites market is projected to grow from USD 1.7 billion in 2023 to USD 2.4 billion by 2028, at a CAGR of 7.2% during the forecast period. Almost all composites used in the rail industry are manufactured using thermosetting resin due to their high resistance to high temperature. Phenolic resin obtained by the reaction of phenols and aldehydes. Phenolic resins have good fire, smoke, and toxic (FST) resistant properties; hence, used widely in the rail applications. Phenolic resin is used in the manufacturing of ceilings, floors, bulkheads, and stairs among other applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | By Fiber Type, Resin Type, Manufacturing Process, Application, and Region |

| Regions covered | Europe, North America, Asia Pacific, and Rest of the World |

"Filament winding manufacturing process is expected to register highest CAGR in rail composites market during forecasted period."

Filament winding is an automated open molding process in which a rotating mandrel is used as a mold to produce an inner surface and a laminate surface on the outside of the product. This process offers high fiber loading and produces high strength-to-weight ratio laminates. It is a quick and economical method for manufacturing rail composites. This process is automated and used to make engineered structures. It produces hollow or circular components.

''In terms of value, interior components application accounted for the largest share of the overall rail composites market.''

Composites get widely used in manufacturing ducts, seats, panels, and many other interior and exterior components in the rail industry. Headrest back panels, seats, luggage bins can be produced from glass fiber composites. Composite modules, such as trays, grabs handles, and seat holders can be manufactured from natural fiber composites, which can give them an aesthetic look and feel, apart from being low cost. Cooling fan blades, such as ventilator fan blades, cooling fan with butt blades, cooling ventilators with bar blades can be manufactured with composites.

"During the forecast period, the rail composites market in Europe region is projected to register second-highest CAGR."

Europe is projected to be the second-fastest-growing region the rail composites market during forecasted years. Most of the European government owned rail companies provides high-speed rail (HSR) service. In many European countries inter-country HSR network is operational. The EU commission is planning to allocate some part of community funds for the development of HSR within the trans-Europe network. This expansion plan of HSR network is estimated to increasing the demand for composites in rail applications.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 40%, Tier 2- 33%, and Tier 3- 27%

- By Designation- C Level- 50%, Director Level- 30%, and Others- 20%

- By Region- North America- 15%, Europe- 50%, Asia Pacific (APAC) - 20%, RoW-15

The report provides a comprehensive analysis of company profiles:

Prominent companies include Gurit Holdings AG (Switzerland), Hexcel Corporation (US), 3A Composites (Switzerland), Toray Industries, Inc. (Japan), Solvay (Belgium), Teijin Limited (Japan), Premier Composite Technologies (UAE), Dartford Composites Ltd. (UK), Exel Composites (Finland), Avient Corporation (US), Kineco Limited (India), BASF SE (Germany), AVIC Cabin Systems (UK), BFG International (Bahrain), and Reliance Industries Ltd. (India).

Research Coverage

This research report categorizes the rail composites Market by Fiber Type (Carbon Fiber, Glass Fiber, and Others), Resin Type (Polyester, Phenolic, Epoxy, Vinyl Ester, and Others), Manufacturing Process (Lay-up, Filament Winding, Injection Molding, Pultrusion, RTM, Compression Molding, And Others), Application (Exterior Components, Interior Components, and Others), and Region (North America, Europe, Asia Pacific, and Rest of the World). The scope of the report includes detailed information about the major factors influencing the growth of the rail composites market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions, and services, key strategies, contracts, partnerships, and agreements. New product and service launches, mergers and acquisitions, and recent developments in the rail composites market are all covered. This report includes a competitive analysis of upcoming startups in the rail composites market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall rail composites market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand for high-speed rails, aesthetic properties and safety), restraints (High processing cost, concerns about recyclability), opportunities (Increasing demand from emerging countries, high adoption in rail ties, sleeper and composite bridges), and challenges (Development of low-cost manufacturing technologies) influencing the growth of the rail composites market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the rail composites market

- Market Development: Comprehensive information about lucrative markets - the report analyses the rail composites market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the rail composites market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Gurit Holdings AG (Switzerland), Hexcel Corporation (US), 3A Composites (Switzerland), Toray Industries, Inc. (Japan), Solvay (Belgium), Teijin Limited (Japan), Premier Composite Technologies (UAE), Dartford Composites Ltd. (UK), Exel Composites (Finland), Avient Corporation (US), Kineco Limited (India), BASF SE (Germany), AVIC Cabin Systems (UK), BFG International (Bahrain), and Reliance Industries Ltd. (India). among others in the rail composites market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 RAIL COMPOSITES MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY

- 1.6 UNITS CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

- 1.9.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RAIL COMPOSITES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key industry insights

- 2.2 IMPACT OF RECESSION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4 BASE NUMBER CALCULATION

- 2.4.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- FIGURE 5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF RAIL COMPOSITES MARKET

- 2.4.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- FIGURE 6 METHODOLOGY FOR DEMAND-SIDE SIZING OF RAIL COMPOSITES MARKET

- 2.5 MARKET FORECAST APPROACH

- 2.5.1 SUPPLY SIDE

- 2.5.2 DEMAND SIDE

- 2.6 DATA TRIANGULATION

- FIGURE 7 RAIL COMPOSITES MARKET: DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH ASSUMPTIONS

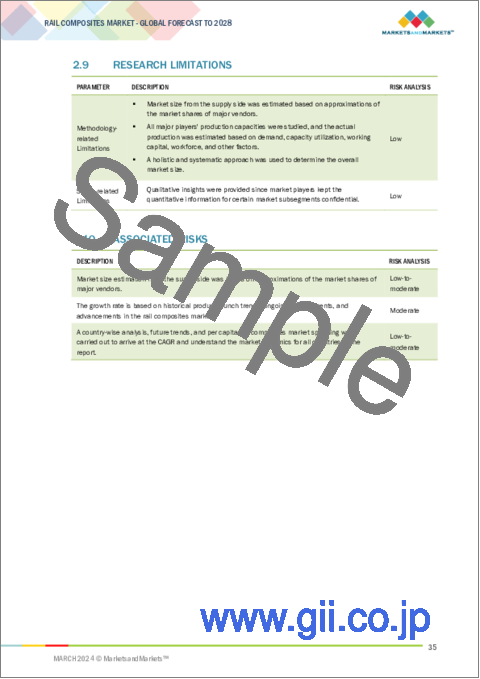

- 2.9 RESEARCH LIMITATIONS

- 2.10 ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- FIGURE 8 GLASS FIBER COMPOSITES LED OVERALL RAIL COMPOSITES MARKET IN 2022

- FIGURE 9 PHENOLIC RESIN ACCOUNTED FOR LARGEST SHARE OF RAIL COMPOSITES MARKET IN 2022

- FIGURE 10 LAY-UP MANUFACTURING PROCESS ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 11 INTERIOR COMPONENTS SEGMENT DOMINATED RAIL COMPOSITES MARKET IN 2022

- FIGURE 12 ASIA PACIFIC LED RAIL COMPOSITES MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RAIL COMPOSITES MARKET

- FIGURE 13 SIGNIFICANT GROWTH EXPECTED IN RAIL COMPOSITES MARKET BETWEEN 2023 AND 2028

- 4.2 RAIL COMPOSITES MARKET, BY APPLICATION AND REGION

- FIGURE 14 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF RAIL COMPOSITES MARKET

- 4.3 RAIL COMPOSITES MARKET, BY FIBER TYPE

- FIGURE 15 GLASS FIBER RAIL COMPOSITES DOMINATED MARKET IN 2022

- 4.4 RAIL COMPOSITES MARKET, BY RESIN TYPE

- FIGURE 16 PHENOLIC RESIN SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.5 RAIL COMPOSITES MARKET, BY MANUFACTURING PROCESS

- FIGURE 17 LAY-UP MANUFACTURING PROCESS ACCOUNTED FOR LARGEST SHARE IN 2022

- 4.6 RAIL COMPOSITES MARKET, BY KEY COUNTRIES

- FIGURE 18 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN RAIL COMPOSITES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Weight reduction and parts consolidation

- 5.2.1.2 Increasing demand for high-speed rail (HSR)

- TABLE 1 HSR MILEAGE IN OPERATION & UNDER CONSTRUCTION, BY COUNTRY

- 5.2.1.3 Improved esthetics and safety

- 5.2.2 RESTRAINTS

- 5.2.2.1 High processing & manufacturing costs

- 5.2.2.2 Difficulty of recycling composites

- 5.2.2.3 Lack of standardization in manufacturing technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand from emerging countries

- 5.2.3.2 Growing adoption of composites in rail ties, sleeper, and composite bridges

- 5.2.4 CHALLENGES

- 5.2.4.1 Development of low-cost technologies to manufacture composites

- 5.2.4.2 Reduction of process cycle time

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 RAIL COMPOSITES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 2 RAIL COMPOSITES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS/MARKET MAP

- TABLE 3 RAIL COMPOSITES MARKET: ROLE IN ECOSYSTEM

- FIGURE 21 RAIL COMPOSITES MARKET: ECOSYSTEM MAP

- FIGURE 22 RAIL COMPOSITES MARKET: KEY STAKEHOLDERS IN ECOSYSTEM

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE, BY APPLICATION (KEY PLAYERS)

- FIGURE 23 AVERAGE SELLING PRICES FOR TOP THREE APPLICATIONS (USD/KG)

- 5.5.2 AVERAGE SELLING PRICE, BY FIBER TYPE

- FIGURE 24 AVERAGE SELLING PRICE OF RAIL COMPOSITES, BY FIBER TYPE (USD/KG)

- 5.5.3 AVERAGE SELLING PRICE, BY RESIN TYPE

- FIGURE 25 AVERAGE SELLING PRICE OF RAIL COMPOSITES, BY RESIN TYPE (USD/KG)

- 5.5.4 AVERAGE SELLING PRICE, BY REGION

- TABLE 4 AVERAGE SELLING PRICE OF RAIL COMPOSITES, BY REGION

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 26 RAIL COMPOSITES MARKET: VALUE CHAIN ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 EXPORT SCENARIO FOR HS CODE 7019

- FIGURE 27 EXPORT OF GLASS FIBERS, BY KEY COUNTRIES, 2018-2022 (USD THOUSAND)

- TABLE 5 TOP 10 EXPORTING COUNTRIES IN 2022

- 5.7.2 IMPORT SCENARIO FOR HS CODE 7019

- FIGURE 28 IMPORT OF GLASS FIBERS, BY KEY COUNTRIES, 2018-2022 (USD THOUSAND)

- TABLE 6 TOP 10 IMPORTING COUNTRIES IN 2022

- 5.7.3 EXPORT SCENARIO FOR HS CODE 681511

- TABLE 7 TOP 15 EXPORTING COUNTRIES IN 2022

- 5.7.4 IMPORT SCENARIO FOR HS CODE 681511

- TABLE 8 TOP 15 IMPORTING COUNTRIES IN 2022

- 5.8 TECHNOLOGY ANALYSIS

- TABLE 9 COMPARATIVE STUDY OF MAJOR COMPOSITE MANUFACTURING PROCESSES

- 5.8.1 TECHNOLOGY ANALYSIS FOR GLASS FIBER COMPOSITES

- 5.8.2 TECHNOLOGY ANALYSIS FOR CARBON FIBER COMPOSITES

- 5.8.3 COMPLEMENTARY TECHNOLOGIES FOR LATEST MANUFACTURING PROCESS OF CARBON FIBERS

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- 5.9.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.10 PATENT ANALYSIS

- 5.10.1 INTRODUCTION

- 5.10.2 METHODOLOGY

- 5.10.3 DOCUMENT TYPE

- TABLE 12 RAIL COMPOSITES MARKET: TOTAL NUMBER OF PATENTS

- FIGURE 31 PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 32 PATENT PUBLICATION TRENDS, 2018-2023

- 5.10.4 INSIGHTS

- 5.10.5 LEGAL STATUS OF PATENTS

- FIGURE 33 RAIL COMPOSITES MARKET: LEGAL STATUS OF PATENTS

- 5.10.6 JURISDICTION ANALYSIS

- FIGURE 34 CHINA JURISDICTION REGISTERED HIGHEST NUMBER OF PATENTS

- 5.10.7 TOP APPLICANTS' ANALYSIS

- FIGURE 35 CRRC QINGDAO SIFANG CO., LTD. REGISTERED HIGHEST NUMBER OF PATENTS

- 5.10.8 PATENTS BY CRRC QINGDAO SIFANG CO., LTD.

- 5.10.9 PATENTS BY UNIV JILIN

- 5.10.10 PATENTS BY NEWTRY CO., LTD.

- 5.10.11 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 STANDARDS IN COMPOSITES MARKET

- TABLE 17 CURRENT STANDARD CODES FOR AUTOMOTIVE AND TRANSPORTATION COMPOSITES

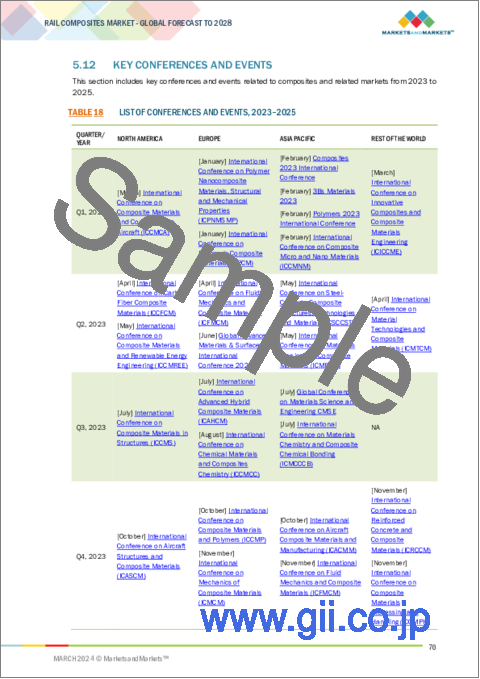

- 5.12 KEY CONFERENCES AND EVENTS

- TABLE 18 LIST OF CONFERENCES AND EVENTS, 2023-2025

- 5.13 CASE STUDY ANALYSIS

- 5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 36 REVENUE SHIFT AND NEW REVENUE POCKETS IN COMPOSITES MARKET

- 5.15 INVESTMENT AND FUNDING SCENARIO

- FIGURE 37 DEALS AND FUNDING IN COMPOSITES MARKET SOARED IN 2023

- FIGURE 38 MOST VALUED COMPOSITES FIRMS IN 2023 (USD BILLION)

6 RAIL COMPOSITES MARKET, BY FIBER TYPE

- 6.1 INTRODUCTION

- FIGURE 39 GLASS FIBER COMPOSITES TO DOMINATE RAIL COMPOSITES MARKET

- TABLE 19 RAIL COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (USD MILLION)

- TABLE 20 RAIL COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (KILOTON)

- TABLE 21 RAIL COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (USD MILLION)

- TABLE 22 RAIL COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (KILOTON)

- 6.2 GLASS FIBER COMPOSITES

- 6.2.1 GLASS FIBER RAIL COMPOSITES MARKET, BY REGION

- TABLE 23 GLASS FIBER RAIL COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 24 GLASS FIBER RAIL COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 25 GLASS FIBER RAIL COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 26 GLASS FIBER RAIL COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.3 CARBON FIBER COMPOSITES

- 6.3.1 CARBON FIBER RAIL COMPOSITES MARKET, BY REGION

- TABLE 27 CARBON FIBER RAIL COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 28 CARBON FIBER RAIL COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 29 CARBON FIBER RAIL COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 30 CARBON FIBER RAIL COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.4 OTHER FIBER COMPOSITES

- 6.4.1 NATURAL FIBER COMPOSITES

- 6.4.2 BASALT FIBER COMPOSITES

- 6.4.3 ARAMID FIBER COMPOSITES

- 6.4.4 HYBRID FIBER COMPOSITES

- 6.4.5 ULTRA-HIGH-MOLECULAR-WEIGHT POLYETHYLENE (UHMWPE) FIBER COMPOSITES

- 6.4.6 OTHER FIBER RAIL COMPOSITES MARKET, BY REGION

- TABLE 31 OTHER FIBER RAIL COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 32 OTHER FIBER RAIL COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 33 OTHER FIBER RAIL COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 34 OTHER FIBER RAIL COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

7 RAIL COMPOSITES MARKET, BY RESIN TYPE

- 7.1 INTRODUCTION

- 7.1.1 POLYESTER

- 7.1.2 PHENOLIC

- 7.1.3 EPOXY

- 7.1.4 VINYL ESTER

- FIGURE 40 PHENOLIC RESIN TO DOMINATE OVERALL RAIL COMPOSITES MARKET

- TABLE 35 RAIL COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (USD MILLION)

- TABLE 36 RAIL COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (KILOTON)

- TABLE 37 RAIL COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 38 RAIL COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (KILOTON)

8 RAIL COMPOSITES MARKET, BY MANUFACTURING PROCESS

- 8.1 INTRODUCTION

- 8.1.1 LAY-UP PROCESS

- 8.1.2 FILAMENT WINDING PROCESS

- 8.1.3 INJECTION MOLDING PROCESS

- 8.1.4 PULTRUSION PROCESS

- 8.1.5 COMPRESSION MOLDING PROCESS

- 8.1.6 RESIN TRANSFER MOLDING (RTM) PROCESS

- FIGURE 41 LAY-UP MANUFACTURING PROCESS TO ACCOUNT FOR LARGEST SHARE OF RAIL COMPOSITES MARKET

- TABLE 39 RAIL COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (USD MILLION)

- TABLE 40 RAIL COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (KILOTON)

- TABLE 41 RAIL COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (USD MILLION)

- TABLE 42 RAIL COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (KILOTON)

9 RAIL COMPOSITES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 42 INTERIOR COMPONENTS APPLICATION TO DOMINATE RAIL COMPOSITES MARKET

- TABLE 43 RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 44 RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 45 RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 46 RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 9.2 EXTERIOR COMPONENTS

- 9.2.1 RAIL COMPOSITES MARKET IN EXTERIOR COMPONENTS APPLICATION, BY REGION

- TABLE 47 RAIL COMPOSITES MARKET IN EXTERIOR COMPONENTS, BY REGION, 2020-2022 (USD MILLION)

- TABLE 48 RAIL COMPOSITES MARKET IN EXTERIOR COMPONENTS, BY REGION, 2020-2022 (KILOTON)

- TABLE 49 RAIL COMPOSITES MARKET IN EXTERIOR COMPONENTS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 50 RAIL COMPOSITES MARKET IN EXTERIOR COMPONENTS, BY REGION, 2023-2028 (KILOTON)

- 9.3 INTERIOR COMPONENTS APPLICATION

- 9.3.1 RAIL COMPOSITES MARKET IN INTERIOR COMPONENTS APPLICATION, BY REGION

- TABLE 51 RAIL COMPOSITES MARKET IN INTERIOR COMPONENTS, BY REGION, 2020-2022 (USD MILLION)

- TABLE 52 RAIL COMPOSITES MARKET IN INTERIOR COMPONENTS, BY REGION, 2020-2022 (KILOTON)

- TABLE 53 RAIL COMPOSITES MARKET IN INTERIOR COMPONENTS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 54 RAIL COMPOSITES MARKET IN INTERIOR COMPONENTS, BY REGION, 2023-2028 (KILOTON)

- 9.4 OTHER APPLICATIONS

- 9.4.1 RAIL COMPOSITES MARKET IN OTHER APPLICATIONS, BY REGION

- TABLE 55 RAIL COMPOSITES MARKET IN OTHER APPLICATIONS, BY REGION, 2020-2022 (USD MILLION)

- TABLE 56 RAIL COMPOSITES MARKET IN OTHER APPLICATIONS, BY REGION, 2020-2022 (KILOTON)

- TABLE 57 RAIL COMPOSITES MARKET IN OTHER APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 58 RAIL COMPOSITES MARKET IN OTHER APPLICATIONS, BY REGION, 2023-2028 (KILOTON)

10 RAIL COMPOSITES MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 43 CHINA TO BE FASTEST-GROWING RAIL COMPOSITES MARKET

- TABLE 59 RAIL COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 60 RAIL COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 61 RAIL COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 62 RAIL COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

- 10.2 NORTH AMERICA

- 10.2.1 IMPACT OF RECESSION

- FIGURE 44 NORTH AMERICA: RAIL COMPOSITES MARKET SNAPSHOT

- 10.2.2 NORTH AMERICA RAIL COMPOSITES MARKET, BY FIBER TYPE

- TABLE 63 NORTH AMERICA: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (KILOTON)

- TABLE 65 NORTH AMERICA: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (KILOTON)

- 10.2.3 NORTH AMERICA RAIL COMPOSITES MARKET, BY APPLICATION

- TABLE 67 NORTH AMERICA: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 69 NORTH AMERICA: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.2.4 NORTH AMERICA RAIL COMPOSITES MARKET, BY COUNTRY

- TABLE 71 NORTH AMERICA: RAIL COMPOSITES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: RAIL COMPOSITES MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 73 NORTH AMERICA: RAIL COMPOSITES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: RAIL COMPOSITES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 10.2.4.1 US

- 10.2.4.1.1 Increasing spending on rail sector to drive demand

- 10.2.4.1 US

- TABLE 75 US: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 76 US: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 77 US: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 78 US: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.2.4.2 Canada

- 10.2.4.2.1 Interior application to account for largest market share

- 10.2.4.2 Canada

- TABLE 79 CANADA: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 80 CANADA: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 81 CANADA: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 82 CANADA: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.3 EUROPE

- 10.3.1 IMPACT OF RECESSION

- FIGURE 45 EUROPE: RAIL COMPOSITES MARKET SNAPSHOT

- 10.3.2 EUROPE RAIL COMPOSITES MARKET, BY FIBER TYPE

- TABLE 83 EUROPE: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (USD MILLION)

- TABLE 84 EUROPE: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (KILOTON)

- TABLE 85 EUROPE: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (USD MILLION)

- TABLE 86 EUROPE: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (KILOTON)

- 10.3.3 EUROPE RAIL COMPOSITES MARKET, BY APPLICATION

- TABLE 87 EUROPE: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 88 EUROPE: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 89 EUROPE: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 90 EUROPE: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.3.4 EUROPE RAIL COMPOSITES MARKET, BY COUNTRY

- TABLE 91 EUROPE: RAIL COMPOSITES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 92 EUROPE: RAIL COMPOSITES MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 93 EUROPE: RAIL COMPOSITES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 94 EUROPE: RAIL COMPOSITES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 10.3.4.1 Germany

- 10.3.4.1.1 Presence of large rail manufacturing industry to drive demand

- 10.3.4.1 Germany

- TABLE 95 GERMANY: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 96 GERMANY: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 97 GERMANY: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 98 GERMANY: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.3.4.2 France

- 10.3.4.2.1 Presence of large network of high-speed rail driving demand

- 10.3.4.2 France

- TABLE 99 FRANCE: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 100 FRANCE: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 101 FRANCE: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 102 FRANCE: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.3.4.3 UK

- 10.3.4.3.1 Significant investments in HSR to support market growth

- 10.3.4.3 UK

- TABLE 103 UK: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 104 UK: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 105 UK: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 106 UK: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.3.4.4 Spain

- 10.3.4.4.1 Interior components application dominates market in Spain

- 10.3.4.4 Spain

- TABLE 107 SPAIN: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 108 SPAIN: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 109 SPAIN: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 110 SPAIN: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.3.4.5 Italy

- 10.3.4.5.1 Large rail network to drive market in Italy

- 10.3.4.5 Italy

- TABLE 111 ITALY: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 112 ITALY: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 113 ITALY: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 114 ITALY: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.3.4.6 Turkey

- 10.3.4.6.1 Enhancements of rail services to drive market

- 10.3.4.6 Turkey

- TABLE 115 TURKEY: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 116 TURKEY: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 117 TURKEY: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 118 TURKEY: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.3.4.7 Rest of Europe

- TABLE 119 REST OF EUROPE: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 120 REST OF EUROPE: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 121 REST OF EUROPE: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 122 REST OF EUROPE: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.4 ASIA PACIFIC

- 10.4.1 IMPACT OF RECESSION

- FIGURE 46 ASIA PACIFIC: RAIL COMPOSITES MARKET SNAPSHOT

- 10.4.2 ASIA PACIFIC RAIL COMPOSITES MARKET, BY FIBER TYPE

- TABLE 123 ASIA PACIFIC: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (USD MILLION)

- TABLE 124 ASIA PACIFIC: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (KILOTON)

- TABLE 125 ASIA PACIFIC: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (KILOTON)

- 10.4.3 ASIA PACIFIC RAIL COMPOSITES MARKET, BY APPLICATION

- TABLE 127 ASIA PACIFIC: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 128 ASIA PACIFIC: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 129 ASIA PACIFIC: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.4.4 ASIA PACIFIC RAIL COMPOSITES MARKET, BY COUNTRY

- TABLE 131 ASIA PACIFIC: RAIL COMPOSITES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: RAIL COMPOSITES MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 133 ASIA PACIFIC: RAIL COMPOSITES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: RAIL COMPOSITES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 10.4.4.1 China

- 10.4.4.1.1 Presence of large-scale manufacturing facilities to increase demand for composites

- 10.4.4.1 China

- TABLE 135 CHINA: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 136 CHINA: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 137 CHINA: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 138 CHINA: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.4.4.2 Japan

- 10.4.4.2.1 Increasing demand from various applications to drive market

- 10.4.4.2 Japan

- TABLE 139 JAPAN: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 140 JAPAN: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 141 JAPAN: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 142 JAPAN: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.4.4.3 India

- 10.4.4.3.1 Availability of inexpensive labor and raw materials to drive market

- 10.4.4.3 India

- TABLE 143 INDIA: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 144 INDIA: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 145 INDIA: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 146 INDIA: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.4.4.4 Australia

- 10.4.4.4.1 Interior components application to dominate market

- 10.4.4.4 Australia

- TABLE 147 AUSTRALIA: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 148 AUSTRALIA: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 149 AUSTRALIA: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 150 AUSTRALIA: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.4.4.5 Rest of Asia Pacific

- TABLE 151 REST OF ASIA PACIFIC: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 153 REST OF ASIA PACIFIC: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.5 REST OF WORLD

- 10.5.1 IMPACT OF RECESSION

- 10.5.2 REST OF WORLD RAIL COMPOSITES MARKET, BY FIBER TYPE

- TABLE 155 REST OF WORLD: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (USD MILLION)

- TABLE 156 REST OF WORLD: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (KILOTON)

- TABLE 157 REST OF WORLD: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (USD MILLION)

- TABLE 158 REST OF WORLD: RAIL COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (KILOTON)

- 10.5.3 REST OF WORLD RAIL COMPOSITES MARKET, BY APPLICATION

- TABLE 159 REST OF WORLD: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 160 REST OF WORLD: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 161 REST OF WORLD: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 162 REST OF WORLD: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.5.4 REST OF WORLD RAIL COMPOSITES MARKET, BY COUNTRY

- TABLE 163 REST OF WORLD: RAIL COMPOSITES MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 164 REST OF WORLD: RAIL COMPOSITES MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 165 REST OF WORLD: RAIL COMPOSITES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 166 REST OF WORLD: RAIL COMPOSITES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 10.5.4.1 Brazil

- 10.5.4.1.1 Development in rail sector to drive demand for composites

- 10.5.4.1 Brazil

- TABLE 167 BRAZIL: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 168 BRAZIL: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 169 BRAZIL: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 170 BRAZIL: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.5.4.2 Mexico

- 10.5.4.2.1 Growing demand in internal components application to drive market

- 10.5.4.2 Mexico

- TABLE 171 MEXICO: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 172 MEXICO: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 173 MEXICO: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 174 MEXICO: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 10.5.4.3 Others in Rest of World

- TABLE 175 OTHERS IN ROW: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 176 OTHERS IN ROW: RAIL COMPOSITES MARKET, BY APPLICATION, 2020-2022 (KILOTON)

- TABLE 177 OTHERS IN ROW: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 178 OTHERS IN ROW: RAIL COMPOSITES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- TABLE 179 STRATEGIES ADOPTED BY RAIL COMPOSITE MANUFACTURERS

- 11.3 REVENUE ANALYSIS

- FIGURE 47 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 48 SHARES OF KEY PLAYERS IN RAIL COMPOSITES MARKET

- TABLE 180 RAIL COMPOSITES MARKET: DEGREE OF COMPETITION

- 11.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 49 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 11.6 COMPANY EVALUATION MATRIX

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 50 RAIL COMPOSITES MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.6.5 COMPANY FOOTPRINT

- FIGURE 51 COMPANY OVERALL FOOTPRINT

- TABLE 181 COMPANY FIBER TYPE FOOTPRINT

- TABLE 182 COMPANY RESIN TYPE FOOTPRINT

- TABLE 183 COMPANY APPLICATION FOOTPRINT

- TABLE 184 COMPANY REGION FOOTPRINT

- 11.7 START-UP/SME EVALUATION MATRIX

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 52 RAIL COMPOSITES MARKET: START-UPS/SMES EVALUATION MATRIX, 2022

- 11.7.5 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 185 RAIL COMPOSITES MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 186 RAIL COMPOSITES MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 11.8 VALUATION AND FINANCIAL METRICS OF RAIL COMPOSITE MANUFACTURERS

- FIGURE 53 EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 54 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY MANUFACTURERS

- 11.9 COMPETITIVE SCENARIO AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- TABLE 187 RAIL COMPOSITES MARKET: PRODUCT LAUNCHES, JANUARY 2020-FEBRUARY 2024

- 11.9.2 DEALS

- TABLE 188 RAIL COMPOSITES MARKET: DEALS, JANUARY 2020-FEBRUARY 2024

- 11.9.3 EXPANSIONS

- TABLE 189 RAIL COMPOSITES MARKET: EXPANSIONS, JANUARY 2020-FEBRUARY 2024

12 COMPANY PROFILE

- (Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats) **

- 12.1 KEY COMPANIES

- 12.1.1 GURIT HOLDINGS AG

- TABLE 190 GURIT HOLDING AG: COMPANY OVERVIEW

- FIGURE 55 GURIT HOLDING AG: COMPANY SNAPSHOT

- TABLE 191 GURIT HOLDING AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.2 HEXCEL CORPORATION

- TABLE 192 HEXCEL CORPORATION: COMPANY OVERVIEW

- FIGURE 56 HEXCEL CORPORATION: COMPANY SNAPSHOT

- TABLE 193 HEXCEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 HEXCEL CORPORATION: EXPANSIONS, JANUARY 2020-FEBRUARY 2024

- 12.1.3 SOLVAY

- TABLE 195 SOLVAY: COMPANY OVERVIEW

- FIGURE 57 SOLVAY: COMPANY SNAPSHOT

- TABLE 196 SOLVAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 SOLVAY: PRODUCT LAUNCHES, JANUARY 2020-FEBRUARY 2024

- TABLE 198 SOLVAY: DEALS, JANUARY 2020-FEBRUARY 2024

- 12.1.4 TEIJIN LIMITED

- TABLE 199 TEIJIN LIMITED: COMPANY OVERVIEW

- FIGURE 58 TEIJIN LIMITED: COMPANY SNAPSHOT

- TABLE 200 TEIJIN LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 TEIJIN LIMITED: PRODUCT LAUNCHES, JANUARY 2020-FEBRUARY 2024

- 12.1.5 3A COMPOSITES

- TABLE 202 3A COMPOSITES: COMPANY OVERVIEW

- FIGURE 59 3A COMPOSITES: COMPANY SNAPSHOT

- TABLE 203 3A COMPOSITES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.6 TORAY INDUSTRIES, INC.

- TABLE 204 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 60 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 205 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES, JANUARY 2020-FEBRUARY 2024

- TABLE 207 TORAY INDUSTRIES, INC.: DEALS, JANUARY 2020-FEBRUARY 2024

- TABLE 208 TORAY INDUSTRIES, INC.: EXPANSIONS, JANUARY 2020-FEBRUARY 2024

- 12.1.7 PREMIER COMPOSITE TECHNOLOGIES

- TABLE 209 PREMIER COMPOSITE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 210 PREMIER COMPOSITE TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 PREMIER COMPOSITE TECHNOLOGIES: DEALS, JANUARY 2020-FEBRUARY 2024

- 12.1.8 DARTFORD COMPOSITES LTD.

- TABLE 212 DARTFORD COMPOSITES LTD.: COMPANY OVERVIEW

- TABLE 213 DARTFORD COMPOSITES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.9 EXEL COMPOSITES

- TABLE 214 EXEL COMPOSITES: COMPANY OVERVIEW

- FIGURE 61 EXEL COMPOSITES: COMPANY SNAPSHOT

- TABLE 215 EXEL COMPOSITES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 EXEL COMPOSITES: PRODUCT LAUNCHES, JANUARY 2020-FEBRUARY 2024

- 12.1.10 AVIENT CORPORATION

- TABLE 217 AVIENT CORPORATION: COMPANY OVERVIEW

- FIGURE 62 AVIENT CORPORATION: COMPANY SNAPSHOT

- TABLE 218 AVIENT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.11 KINECO LIMITED

- TABLE 219 KINECO LIMITED: COMPANY OVERVIEW

- TABLE 220 KINECO LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 KINECO LIMITED: EXPANSIONS, JANUARY 2020-FEBRUARY 2024

- 12.1.12 BASF SE

- TABLE 222 BASF SE: COMPANY OVERVIEW

- FIGURE 63 BASF SE: COMPANY SNAPSHOT

- TABLE 223 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.13 AVIC CABIN SYSTEMS (UK)

- TABLE 224 AVIC CABIN SYSTEMS (UK): COMPANY OVERVIEW

- TABLE 225 AVIC CABIN SYSTEMS (UK): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.14 BFG INTERNATIONAL

- TABLE 226 BFG INTERNATIONAL: COMPANY OVERVIEW

- TABLE 227 BFG INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 BFG INTERNATIONAL: DEALS, JANUARY 2020-FEBRUARY 2024

- 12.1.15 RELIANCE INDUSTRIES LTD.

- TABLE 229 RELIANCE INDUSTRIES LTD.: COMPANY OVERVIEW

- FIGURE 64 RELIANCE INDUSTRIES LTD.: COMPANY SNAPSHOT

- TABLE 230 RELIANCE INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

- 12.2 OTHER COMPANIES

- 12.2.1 TRB

- TABLE 231 TRB: COMPANY OVERVIEW

- 12.2.2 LANXESS

- TABLE 232 LANXESS: COMPANY OVERVIEW

- 12.2.3 CELANESE CORPORATION

- TABLE 233 CELANESE CORPORATION: COMPANY OVERVIEW

- 12.2.4 LAMERA AB

- TABLE 234 LAMERA AB: COMPANY OVERVIEW

- 12.2.5 ADAMANT COMPOSITES LTD.

- TABLE 235 ADAMANT COMPOSITES LTD.: COMPANY OVERVIEW

- 12.2.6 MADER

- TABLE 236 MADER: COMPANY OVERVIEW

- 12.2.7 FDC COMPOSITES INC.

- TABLE 237 FDC COMPOSITES INC.: COMPANY OVERVIEW

- 12.2.8 VICTALL

- TABLE 238 VICTALL: COMPANY OVERVIEW

- 12.2.9 PROLONG COMPOSITES

- TABLE 239 PROLONG COMPOSITES: COMPANY OVERVIEW

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORT

- 13.5 AUTHOR DETAILS