|

|

市場調査レポート

商品コード

1458403

コア材の世界市場:タイプ別、最終用途産業別、地域別 - 2028年までの予測Core Materials Market by Type (Foam, Balsa, and Honeycomb), End- use Industry (Wind Energy, Marine, Aerospace & Defense, Automotive & Transportation, Construction & Industrial), and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| コア材の世界市場:タイプ別、最終用途産業別、地域別 - 2028年までの予測 |

|

出版日: 2024年03月26日

発行: MarketsandMarkets

ページ情報: 英文 260 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

コア材の市場規模は、2023年に16億米ドルとなりました。

同市場は、予測期間中に13.5%のCAGRで拡大し、2028年には30億米ドルに達すると予測されています。厚さ、高剛性、低密度などの重要な特性を持つコア材は、サンドイッチ構造複合材料の不可欠な部品です。これらの主要部品を取り囲む複合材料層は、構造全体の強度を高める。コア材は、軽量かつ高強度という顕著な組み合わせにより、様々な最終用途分野で広く受け入れられています。さまざまな産業でコア材の需要が伸びているのは、その利点に対する認識が高まっているためです。風力エネルギー分野で大きな成長が見られ、予測期間中にコア材市場を押し上げるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 対象単位 | 金額(100万米ドル)、数量(キロトン) |

| セグメント別 | タイプ別、最終用途産業別、地域別 |

| 対象地域 | 欧州、北米、アジア太平洋、その他の地域 |

発泡コア材がコア材市場を独占し、同種の中で最大のシェアを獲得しています。発泡コア材は、その適応性、耐久性、手頃な価格から、多くの異なる産業で選択されている材料です。低密度で厚みと高い剛性を与えることができるため、サンドイッチ複合構造には欠かせません。PET、PVC、SAN、PMI、PEIなど、さまざまな種類の発泡体が、この市場セグメントにおける特定の用途要件を満たすためにカスタマイズされたソリューションを提供しています。その中でもPETフォームは、再生PETボトルから作られ、その優れた性能と環境に優しい性質の両方で有名であるため、特に注目されています。発泡芯材の卓越した品質と幅広い用途は、芯材業界の技術革新を促進し、現代産業の変化するニーズを満たすのに役立っています。

風力エネルギー部門は、金額と数量の両面で、コア素材市場の中で最大かつ最も急成長しているセグメントとして浮上しています。風力発電は、再生可能エネルギー源の世界の推進により、多くの支持を得ており、必須部品の需要が増加しています。風力タービン部品、特にローターブレード、ナセル、スピナーの構造は、その軽量かつ堅牢な性質により、エネルギー抽出を最大化し、構造的完全性を確保するため、コア材料に大きく依存しています。世界中の政府が二酸化炭素排出量を削減し、よりクリーンなエネルギー源にシフトするための措置を講じる中、風力エネルギーインフラへの支出が増加していることが、コア材料の需要をさらに押し上げています。この力強い成長軌道は、より環境に優しく持続可能な未来への移行を推進する風力エネルギー産業が、中核素材市場にとっていかに重要であるかを浮き彫りにしています。

当レポートでは、世界のコア材市場について調査し、タイプ別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- エコシステム分析

- 価格分析

- 貿易分析

- サプライチェーン分析

- バリューチェーン分析

- 流通経路

- 技術分析

- 主な利害関係者と購入基準

- 特許分析

- 規制状況

- 2024年~2025年の主な会議とイベント

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

第6章 コア材市場、タイプ別

- イントロダクション

- 発泡剤

- ハニカム

- バルサ

第7章 コア材市場、最終用途産業別

- イントロダクション

- 風力エネルギー

- 航空宇宙・防衛

- 船舶

- 自動車・輸送

- 建設

- 工業

- その他

第8章 コア材市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第9章 競合情勢

- イントロダクション

- 主要参入企業の戦略

- 収益分析

- 市場シェア分析

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2022年

- 評価と財務指標

- 競合シナリオと動向

第10章 企業プロファイル

- 主要参入企業

- GURIT HOLDINGS AG

- HEXCEL CORPORATION

- 3A COMPOSITES

- EVONIK INDUSTRIES AG

- ARMACELL

- DIAB GROUP

- THE GILL CORPORATION

- EURO-COMPOSITES

- CHANGZHOU TIANSHENG NEW MATERIALS CO., LTD.

- PLASCORE INC.

- TORAY INDUSTRIES, INC.

- CORELITE

- SICOMIN

- I-CORE COMPOSITES

- MARICELL CORE COMPOSITES

- SHOWA AIRCRAFT INDUSTRY CO., LTD

- TCCORE APPLIED HONEYCOMB TECHNOLOGY CO., LTD.

- SAERTEX GMBH & CO.KG

- その他の企業

- RELCORE COMPOSITES INC.

- POLYUMAC USA, LLC

- CARBON-CORE CORP.

- TASUNS COMPOSITE TECHNOLOGY CO., LTD

- DONGYING HORIZON COMPOSITE CO., LTD.

- ZHEJIANG YOUWEI NEW MATERIALS CO., LTD.

- NMG EUROPE SRL

- NAGOYA CORE CO., LTD.

- ARGOSY INTERNATIONAL INC.

- ECONCORE

第11章 付録

The core materials market size is 1.6 billion in 2023 and is estimated to reach USD 3.0 billion by 2028, at a CAGR of 13.5%, during the forecast period. With important properties including thickness, high stiffness, and low density, core materials are integral parts of sandwich structure composites. Composite layers that encircle these key components provide the construction more strength overall. The remarkable combination of low weight and high strength of core materials has led to their broad acceptance in a variety of end-use sectors. The growing demand for core materials across a range of industries is fueled by the growing awareness of their advantages. The major growth observed in the wind energy segment to boost the market for core materials during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | By Type, End-use Industry, and Region |

| Regions covered | Europe, North America, APAC, and RoW |

"Foam core materials holds the largest share in core materials market in 2022."

Foam core materials dominate the core materials market, capturing the largest share among its counterparts. Foam core materials are the material of choice in many different industries because of its adaptability, durability, and affordability. They are essential in sandwich composite constructions because they can give thickness and high stiffness with low density. Different varieties of foam, including PET, PVC, SAN, PMI, and PEI, provide customized solutions to fulfill specific application requirements within this market segment. Of them, PET foam is especially notable because it is made from recycled PET bottles and is renowned for both its outstanding performance and its environmentally friendly qualities. Foam core materials' remarkable qualities and wide range of uses help to drive innovation in the core materials industry and satisfy the changing needs of contemporary industries.

"Wind energy is the largest and the fastest growing end-use industry of core materials market, in terms of value and volume both."

The wind energy sector emerges as the largest and fastest-growing segment within the core materials market in terms of value and volume. Wind power has gained a lot of traction because of the global push for renewable energy sources, which has increased demand for essential components. The construction of wind turbine components, especially rotor blades, nacelles, and spinners, depends heavily on core materials because of their lightweight, robust nature, which maximizes energy extraction and ensures structural integrity. The demand for core materials is being further driven by the increasing expenditures made in wind energy infrastructure as governments across the world undertake steps to cut carbon emissions and shift to cleaner energy sources. This strong growth trajectory highlights how important the wind energy industry is to the core materials market as it drives the transition to a more ecologically friendly and sustainable future.

"Asia Pacific region to dominate the core materials market during forecasted period."

During the forecasted period, the Asia Pacific region emerges as the largest market in the core material industry. The adoption of renewable energy is being driven by nations like China, India, and Japan, which is driving an unprecedented increase in the region's need for core materials. Because of aggressive goals for producing clean energy and initiatives to allay environmental worries, wind energy in particular has drawn the attention of both governments and investors. The construction of wind farms throughout the Asia-Pacific area is driving up demand for core materials, particularly for the manufacturing of wind turbine components such as rotor blades.

This study has been validated through primary interviews conducted with various industry experts, globally. These primary sources have been divided into the following three categories:

- By Company Type - Tier 1- 40%, Tier 2- 33%, and Tier 3- 27%

- By Designation - C Level- 50%, Director Level- 30%, and Executives- 20%

- By Region - North America- 15%, Europe- 50%, Asia Pacific- 20%, Middle East & Africa (MEA)-10%, Latin America-10%

The report provides a comprehensive analysis of company profiles listed below:

- 3A Composites (Switzerland)

- Diab Group (Sweden)

- Gurit (Switzerland)

- Hexcel Corporation (US)

- Armacell International S.A. (Luxembourg)

- Euro-Composites S.A. (Luxembourg)

- Changzhou Tiansheng New Materials Co. Ltd. (China)

- Evonik Industries AG (Germany)

- The Gill Corporation(US)

- Plascore Inc. (US)

Research Coverage

This report covers the global core materials market and forecasts the market size until 2028. The report includes the following market segmentation: Type (foam, honeycomb, and balsa), End-use Industry (wind energy, aerospace & defense, marine, automotive & transportation, construction, and industrial), and Region (Europe, North America, Asia Pacific, and Rest of the world). Porter's Five Forces analysis, along with the drivers, restraints, opportunities, and challenges, have been discussed in the report. It also provides company profiles and competitive strategies adopted by the major players in the global core materials market.

Key benefits of buying the report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall core material market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of factors influencing the growth of the core material market key drivers (Demand for core materials in wind turbine blades and solar panels, increasing demand of core materials in aerospace sector, Imperative to improve fuel efficiency, Need for end-use industries to lower carbon emissions)

- Restraints (High cost of materials in cost-sensitive industries, Difficulty in recycling core materials)

- Opportunities (Growing demand for core materials in medical industry and 3D printing, Evolving industrial requirements)

- Challenges (Developing low-cost technologies, High R&D cost)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the core material market

- Market Development: Comprehensive information about lucrative markets - the report analyses the core material market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the core material market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like 3A Composites (Switzerland), Diab Group (Sweden), Gurit (Switzerland), Hexcel Corporation (US), Armacell (Luxembourg), Euro-Composites S.A. (Luxembourg), Changzhou Tiansheng New Materials Co. Ltd. (China), and The Gill Corporation (US). among others in the core material market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS & EXCLUSIONS

- FIGURE 1 CORE MATERIAL MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 CORE MATERIAL MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.2 RECESSION IMPACT

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4 BASE NUMBER CALCULATION

- 2.4.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- FIGURE 5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF CORE MATERIAL MARKET

- 2.4.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- FIGURE 6 METHODOLOGY FOR DEMAND-SIDE SIZING OF CORE MATERIAL MARKET

- 2.5 MARKET FORECAST

- 2.5.1 SUPPLY SIDE

- 2.5.2 DEMAND SIDE

- 2.6 DATA TRIANGULATION

- FIGURE 7 CORE MATERIAL MARKET: DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 WIND ENERGY INDUSTRY DOMINATED MARKET IN 2022

- FIGURE 9 FOAM SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 10 ASIA PACIFIC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CORE MATERIAL MARKET

- FIGURE 11 SIGNIFICANT GROWTH EXPECTED IN CORE MATERIAL MARKET BETWEEN 2023 AND 2028

- 4.2 CORE MATERIAL MARKET, BY TYPE

- FIGURE 12 FOAM TYPE DOMINATED MARKET IN 2022

- 4.3 CORE MATERIAL MARKET, BY END-USE INDUSTRY AND REGION

- FIGURE 13 ASIA PACIFIC AND WIND ENERGY DOMINATED MARKET IN 2022

- 4.4 CORE MATERIAL MARKET, BY KEY COUNTRY

- FIGURE 14 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CORE MATERIAL MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for core materials in aerospace sector

- FIGURE 16 DELIVERY OF TOP CORE MATERIAL UTILIZING BOEING PLANES, 2022-2024

- 5.2.1.2 Imperative to improve fuel efficiency

- 5.2.1.3 Need for end-use industries to lower carbon emissions

- 5.2.1.4 Rising demand for core materials in wind turbine blades and solar panels

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of materials in end-use industries

- 5.2.2.2 Difficulty in recycling core materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Pressing need for core materials in medical industry and 3D printing

- 5.2.3.2 Evolving industrial requirements

- 5.2.4 CHALLENGES

- 5.2.4.1 Development of low-cost technologies

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 CORE MATERIAL MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 1 CORE MATERIAL MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 18 CORE MATERIAL MARKET: ECOSYSTEM

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY

- FIGURE 19 AVERAGE SELLING PRICES OF CORE MATERIALS OFFERED BY KEY PLAYERS FOR TOP THREE END-USE INDUSTRIES (USD/KG)

- 5.5.2 AVERAGE SELLING PRICE TREND, BY TYPE

- FIGURE 20 AVERAGE SELLING PRICE OF CORE MATERIALS, BY TYPE

- TABLE 2 AVERAGE SELLING PRICE OF CORE MATERIALS, BY TYPE

- 5.5.3 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 3 AVERAGE SELLING PRICE OF CORE MATERIALS, BY REGION

- 5.6 TRADE ANALYSIS

- 5.6.1 EXPORT SCENARIO FOR HS CODE 761699

- FIGURE 21 EXPORT FOR HS CODE 761699, BY KEY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 4 TOP 10 EXPORTING COUNTRIES FOR HS CODE 761699 IN 2022

- 5.6.2 IMPORT SCENARIO FOR HS CODE 761699

- FIGURE 22 IMPORT FOR HS CODE 761699, BY KEY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 5 TOP 10 IMPORTING COUNTRIES FOR HS CODE 761699 IN 2022

- 5.6.3 EXPORT SCENARIO FOR HS CODE 392690

- FIGURE 23 EXPORT FOR HS CODE 392690, BY KEY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 6 TOP 10 EXPORTING COUNTRIES FOR HS CODE 392690 IN 2022

- 5.6.4 IMPORT SCENARIO FOR HS CODE 392690

- FIGURE 24 IMPORT FOR HS CODE 392690, BY KEY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 7 TOP 10 IMPORTING COUNTRIES FOR HS CODE 392690 IN 2022

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.7.1 RAW MATERIALS

- FIGURE 25 LEADING CORE MATERIAL RAW MATERIAL MANUFACTURERS AND SUPPLIERS

- 5.7.2 PRODUCT MANUFACTURERS

- FIGURE 26 LEADING PRODUCT MANUFACTURERS

- 5.7.3 END USERS

- FIGURE 27 MAJOR END USERS OF CORE MATERIALS

- 5.8 VALUE CHAIN ANALYSIS

- FIGURE 28 CORE MATERIAL MARKET: VALUE CHAIN ANALYSIS

- 5.9 DISTRIBUTION CHANNEL

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGY

- 5.10.1.1 Foam core material manufacturing process

- 5.10.2 COMPLEMENTARY TECHNOLOGY

- 5.10.2.1 Honeycomb and balsa core material manufacturing process

- 5.10.1 KEY TECHNOLOGY

- 5.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- 5.11.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- 5.12 PATENT ANALYSIS

- 5.12.1 INTRODUCTION

- 5.12.2 METHODOLOGY

- 5.12.3 DOCUMENT TYPES

- TABLE 10 CORE MATERIAL MARKET: GLOBAL PATENTS

- FIGURE 31 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 32 GLOBAL PATENT PUBLICATION TREND ANALYSIS IN LAST 10 YEARS

- 5.12.4 INSIGHTS

- 5.12.5 LEGAL STATUS

- FIGURE 33 CORE MATERIAL MARKET: LEGAL STATUS OF PATENTS

- 5.12.6 JURISDICTION ANALYSIS

- FIGURE 34 GLOBAL JURISDICTION ANALYSIS

- 5.12.7 TOP APPLICANTS

- FIGURE 35 TOP PATENT APPLICANT COMPANIES

- 5.12.8 PATENTS BY UACJ CORPORATION

- 5.12.9 PATENTS BY NIPPON MICROMETAL CORPORATION

- 5.12.10 PATENTS BY NIPPON STEEL CHEMICAL & MATERIAL CO. LTD.

- 5.12.11 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATIONS IN CORE MATERIAL MARKET

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 KEY CONFERENCES & EVENTS IN 2024-2025

- TABLE 15 CORE MATERIAL MARKET: CONFERENCES & EVENTS, 2024-2025

- 5.15 CASE STUDY ANALYSIS

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 36 REVENUE SHIFT OF CORE MATERIALS

- 5.17 INVESTMENT AND FUNDING SCENARIO

- FIGURE 37 INVESTOR DEALS AND FUNDING IN CORE MATERIALS

- FIGURE 38 KEY CORE MATERIAL MANUFACTURERS IN 2024 (USD BILLION)

6 CORE MATERIAL MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 39 FOAM TYPE TO DOMINATE CORE MATERIAL MARKET DURING FORECAST PERIOD

- TABLE 16 CORE MATERIAL MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 17 CORE MATERIAL MARKET, BY TYPE, 2020-2022 (KILOTON)

- TABLE 18 CORE MATERIAL MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 19 CORE MATERIAL MARKET, BY TYPE, 2023-2028 (KILOTON)

- 6.2 FOAM

- 6.2.1 INCREASING DEMAND IN WIND ENERGY BLADES AND TURBINES TO DRIVE MARKET

- FIGURE 40 ASIA PACIFIC TO BE LARGEST FOAM MARKET DURING FORECAST PERIOD

- TABLE 20 FOAM: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 21 FOAM: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 22 FOAM: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 23 FOAM: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 24 FOAM: CORE MATERIAL MARKET, BY FOAM TYPE, 2020-2022 (USD MILLION)

- TABLE 25 FOAM: CORE MATERIAL MARKET, BY FOAM TYPE, 2020-2022 (KILOTON)

- TABLE 26 FOAM: CORE MATERIAL MARKET, BY FOAM TYPE, 2023-2028 (USD MILLION)

- TABLE 27 FOAM: CORE MATERIAL MARKET, BY FOAM TYPE, 2023-2028 (KILOTON)

- 6.2.2 PET FOAM

- TABLE 28 PET FOAM: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 29 PET FOAM: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 30 PET FOAM: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 31 PET FOAM: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.2.3 PVC FOAM

- TABLE 32 PVC FOAM: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 33 PVC FOAM: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 34 PVC FOAM: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 35 PVC FOAM: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

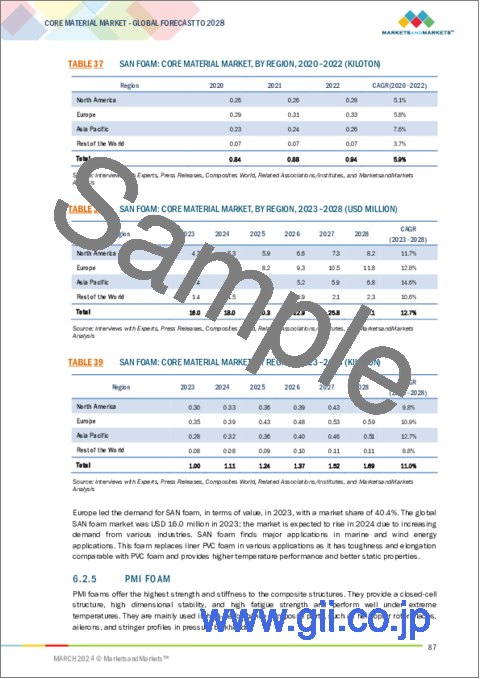

- 6.2.4 SAN FOAM

- TABLE 36 SAN FOAM: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 37 SAN FOAM: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 38 SAN FOAM: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 39 SAN FOAM: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.2.5 PMI FOAM

- TABLE 40 PMI FOAM: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 41 PMI FOAM: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 42 PMI FOAM: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 43 PMI FOAM: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.2.6 PEI FOAM

- TABLE 44 PEI FOAM: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 45 PEI FOAM: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 46 PEI FOAM: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 47 PEI FOAM: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.2.7 OTHER FOAMS

- TABLE 48 OTHER FOAMS: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 49 OTHER FOAMS: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 50 OTHER FOAMS: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 51 OTHER FOAMS: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.3 HONEYCOMB

- 6.3.1 WIDE APPLICATIONS IN AEROSPACE SECTOR TO BOOST MARKET

- FIGURE 41 ASIA PACIFIC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- 6.3.2 ALUMINUM

- 6.3.3 ARAMID

- 6.3.4 THERMOPLASTIC

- TABLE 52 HONEYCOMB: CORE MATERIAL MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 53 HONEYCOMB: CORE MATERIAL MARKET, BY TYPE, 2020-2022 (KILOTON)

- TABLE 54 HONEYCOMB: CORE MATERIAL MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 55 HONEYCOMB: CORE MATERIAL MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 56 HONEYCOMB: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 57 HONEYCOMB: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 58 HONEYCOMB: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 59 HONEYCOMB: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

- 6.4 BALSA

- 6.4.1 INCREASING USE IN MARINE AND TRANSPORTATION INDUSTRIES TO DRIVE MARKET

- FIGURE 42 ASIA PACIFIC TO BE FASTEST-GROWING BALSA MARKET DURING FORECAST PERIOD

- TABLE 60 BALSA: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 61 BALSA: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 62 BALSA: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 63 BALSA: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

7 CORE MATERIAL MARKET, BY END-USE INDUSTRY

- 7.1 INTRODUCTION

- FIGURE 43 WIND ENERGY TO BE FASTEST-GROWING END-USE INDUSTRY DURING FORECAST PERIOD

- TABLE 64 CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 65 CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 66 CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 67 CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 7.2 WIND ENERGY

- 7.2.1 INCREASING DEMAND FOR BALSA TO DRIVE MARKET

- FIGURE 44 ASIA PACIFIC TO LEAD GLOBAL CORE MATERIAL MARKET IN WIND ENERGY SEGMENT

- TABLE 68 WIND ENERGY: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 69 WIND ENERGY: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 70 WIND ENERGY: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 71 WIND ENERGY: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.3 AEROSPACE & DEFENSE

- 7.3.1 RISING DEMAND FOR HONEYCOMB MATERIAL TO BOOST MARKET

- TABLE 72 AEROSPACE & DEFENSE: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 73 AEROSPACE & DEFENSE: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 74 AEROSPACE & DEFENSE: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 75 AEROSPACE & DEFENSE: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.4 MARINE

- 7.4.1 WIDE DEPLOYMENT OF PVC FOAM IN MARINE INDUSTRY TO DRIVE MARKET

- TABLE 76 MARINE INDUSTRY: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 77 MARINE INDUSTRY: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 78 MARINE INDUSTRY: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 79 MARINE INDUSTRY: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.5 AUTOMOTIVE & TRANSPORTATION

- 7.5.1 PRESSING NEED FOR LIGHTWEIGHT FOAMS TO BOOST MARKET

- TABLE 80 AUTOMOTIVE & TRANSPORTATION: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 81 AUTOMOTIVE & TRANSPORTATION: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 82 AUTOMOTIVE & TRANSPORTATION: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 83 AUTOMOTIVE & TRANSPORTATION: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.6 CONSTRUCTION

- 7.6.1 INCREASING DEMAND FOR PREFABRICATED MATERIAL TO DRIVE MARKET

- TABLE 84 CONSTRUCTION: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 85 CONSTRUCTION: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 86 CONSTRUCTION: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 87 CONSTRUCTION: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.7 INDUSTRIAL

- 7.7.1 RISING NEED FOR FOAM CORES IN INDUSTRIAL APPLICATIONS TO BOOST MARKET

- TABLE 88 INDUSTRIAL: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 89 INDUSTRIAL: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 90 INDUSTRIAL: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 91 INDUSTRIAL: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.8 OTHER END-USE INDUSTRIES

- TABLE 92 OTHER END-USE INDUSTRIES: CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 93 OTHER END-USE INDUSTRIES: CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 94 OTHER END-USE INDUSTRIES: CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 95 OTHER END-USE INDUSTRIES: CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

8 CORE MATERIAL MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 45 CHINA TO RECORD FASTEST MARKET GROWTH DURING FORECAST PERIOD

- TABLE 96 CORE MATERIAL MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 97 CORE MATERIAL MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 98 CORE MATERIAL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 99 CORE MATERIAL MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.2 NORTH AMERICA

- 8.2.1 IMPACT OF RECESSION

- FIGURE 46 NORTH AMERICA: CORE MATERIAL MARKET SNAPSHOT

- 8.2.2 NORTH AMERICA, BY END-USE INDUSTRY

- TABLE 100 NORTH AMERICA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 102 NORTH AMERICA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.2.3 NORTH AMERICA, BY TYPE

- TABLE 104 NORTH AMERICA: CORE MATERIAL MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: CORE MATERIAL MARKET, BY TYPE, 2020-2022 (KILOTON)

- TABLE 106 NORTH AMERICA: CORE MATERIAL MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: CORE MATERIAL MARKET, BY TYPE, 2023-2028 (KILOTON)

- 8.2.4 NORTH AMERICA, BY COUNTRY

- TABLE 108 NORTH AMERICA: CORE MATERIAL MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: CORE MATERIAL MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 110 NORTH AMERICA: CORE MATERIAL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: CORE MATERIAL MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 8.2.4.1 US

- 8.2.4.1.1 High demand from aerospace & defense industry to drive market

- 8.2.4.1 US

- TABLE 112 US: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 113 US: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 114 US: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 115 US: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.2.4.2 Canada

- 8.2.4.2.1 Surge in wind energy installations to boost market

- 8.2.4.2 Canada

- TABLE 116 CANADA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 117 CANADA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 118 CANADA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 119 CANADA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.3 EUROPE

- 8.3.1 IMPACT OF RECESSION

- FIGURE 47 EUROPE: CORE MATERIAL MARKET SNAPSHOT

- 8.3.2 EUROPE, BY END-USE INDUSTRY

- TABLE 120 EUROPE: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 121 EUROPE: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 122 EUROPE: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 123 EUROPE: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.3.3 EUROPE, BY TYPE

- TABLE 124 EUROPE: CORE MATERIAL MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 125 EUROPE: CORE MATERIAL MARKET, BY TYPE, 2020-2022 (KILOTON)

- TABLE 126 EUROPE: CORE MATERIAL MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 127 EUROPE: CORE MATERIAL MARKET, BY TYPE, 2023-2028 (KILOTON)

- 8.3.4 EUROPE, BY COUNTRY

- TABLE 128 EUROPE: CORE MATERIAL MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 129 EUROPE: CORE MATERIAL MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 130 EUROPE: CORE MATERIAL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 131 EUROPE: CORE MATERIAL MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 8.3.4.1 Germany

- 8.3.4.1.1 Strong presence of wind energy industries to drive market

- 8.3.4.1 Germany

- TABLE 132 GERMANY: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 133 GERMANY: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 134 GERMANY: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 135 GERMANY: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.3.4.2 France

- 8.3.4.2.1 Increasing demand for windmills to boost market

- 8.3.4.2 France

- TABLE 136 FRANCE: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 137 FRANCE: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 138 FRANCE: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 139 FRANCE: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.3.4.3 UK

- 8.3.4.3.1 Pressing need for core materials in wind turbines to fuel market

- 8.3.4.3 UK

- TABLE 140 UK: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 141 UK: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 142 UK: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 143 UK: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.3.4.4 Italy

- 8.3.4.4.1 Rising demand for balsa in marine industry to boost market

- 8.3.4.4 Italy

- TABLE 144 ITALY: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 145 ITALY: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 146 ITALY: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 147 ITALY: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.3.4.5 Spain

- 8.3.4.5.1 Wide applications of composite cores in wind energy and aerospace industries to drive market

- 8.3.4.5 Spain

- TABLE 148 SPAIN: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 149 SPAIN: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 150 SPAIN: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 151 SPAIN: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.3.4.6 Turkey

- 8.3.4.6.1 Rising demand for foam in automobiles to drive market

- 8.3.4.6 Turkey

- TABLE 152 TURKEY: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 153 TURKEY: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 154 TURKEY: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 155 TURKEY: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.3.4.7 Rest of Europe

- TABLE 156 REST OF EUROPE: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 157 REST OF EUROPE: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 158 REST OF EUROPE: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 159 REST OF EUROPE: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.4 ASIA PACIFIC

- 8.4.1 IMPACT OF RECESSION

- FIGURE 48 ASIA PACIFIC: CORE MATERIAL MARKET SNAPSHOT

- 8.4.2 ASIA PACIFIC: CORE MATERIAL MARKET, BY TYPE

- TABLE 160 ASIA PACIFIC: CORE MATERIAL MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 161 ASIA PACIFIC: CORE MATERIAL MARKET, BY TYPE, 2020-2022 (KILOTON)

- TABLE 162 ASIA PACIFIC: CORE MATERIAL MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 163 ASIA PACIFIC: CORE MATERIAL MARKET, BY TYPE, 2023-2028 (KILOTON)

- 8.4.3 ASIA PACIFIC: CORE MATERIAL MARKET, BY END-USE INDUSTRY

- TABLE 164 ASIA PACIFIC: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 165 ASIA PACIFIC: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 166 ASIA PACIFIC: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 167 ASIA PACIFIC: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.4.4 ASIA PACIFIC: CORE MATERIAL MARKET, BY COUNTRY

- TABLE 168 ASIA PACIFIC: CORE MATERIAL MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 169 ASIA PACIFIC: CORE MATERIAL MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 170 ASIA PACIFIC: CORE MATERIAL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 171 ASIA PACIFIC: CORE MATERIAL MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 8.4.4.1 China

- 8.4.4.1.1 Increasing demand for foam and balsa to drive market

- 8.4.4.1 China

- TABLE 172 CHINA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 173 CHINA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 174 CHINA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 175 CHINA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.4.4.2 Japan

- 8.4.4.2.1 High demand for small passenger cars to drive market

- 8.4.4.2 Japan

- TABLE 176 JAPAN: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 177 JAPAN: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 178 JAPAN: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 179 JAPAN: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.4.4.3 India

- 8.4.4.3.1 Rising adoption of renewable energy to boost market

- 8.4.4.3 India

- TABLE 180 INDIA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 181 INDIA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 182 INDIA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 183 INDIA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.4.4.4 Australia

- 8.4.4.4.1 Immense need for fuel-efficient and sustainable materials to drive market

- 8.4.4.4 Australia

- TABLE 184 AUSTRALIA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 185 AUSTRALIA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 186 AUSTRALIA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 187 AUSTRALIA: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.4.4.5 Rest of Asia Pacific

- TABLE 188 REST OF ASIA PACIFIC: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 189 REST OF ASIA PACIFIC: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 190 REST OF ASIA PACIFIC: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 191 REST OF ASIA PACIFIC: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.5 REST OF WORLD

- 8.5.1 IMPACT OF RECESSION

- FIGURE 49 REST OF WORLD: CORE MATERIAL MARKET SNAPSHOT

- 8.5.2 REST OF WORLD: CORE MATERIAL MARKET, BY TYPE

- TABLE 192 REST OF WORLD: CORE MATERIAL MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 193 REST OF WORLD: CORE MATERIAL MARKET, BY TYPE, 2020-2022 (KILOTON)

- TABLE 194 REST OF WORLD: CORE MATERIAL MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 195 REST OF WORLD: CORE MATERIAL MARKET, BY TYPE, 2023-2028 (KILOTON)

- 8.5.3 REST OF WORLD: CORE MATERIAL MARKET, BY END-USE INDUSTRY

- TABLE 196 REST OF WORLD: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 197 REST OF WORLD: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 198 REST OF WORLD: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 199 REST OF WORLD: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.5.4 REST OF WORLD: CORE MATERIAL MARKET, BY COUNTRY

- TABLE 200 REST OF WORLD: CORE MATERIAL MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 201 REST OF WORLD: CORE MATERIAL MARKET, BY COUNTRY, 2020-2022 (KILOTON)

- TABLE 202 REST OF WORLD: CORE MATERIAL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 203 REST OF WORLD: CORE MATERIAL MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 8.5.4.1 Brazil

- 8.5.4.1.1 High number of wind power installations to boost market

- 8.5.4.1 Brazil

- TABLE 204 BRAZIL: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 205 BRAZIL: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 206 BRAZIL: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 207 BRAZIL: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.5.4.2 Mexico

- 8.5.4.2.1 Surge in demand for wind turbines to drive market

- 8.5.4.2 Mexico

- TABLE 208 MEXICO: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 209 MEXICO: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 210 MEXICO: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 211 MEXICO: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.5.4.3 Rest of ROW countries

- TABLE 212 REST OF ROW COUNTRIES: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022(USD MILLION)

- TABLE 213 REST OF ROW COUNTRIES: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 214 REST OF ROW COUNTRIES: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 215 REST OF ROW COUNTRIES: CORE MATERIAL MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 KEY PLAYER STRATEGIES

- TABLE 216 STRATEGIES ADOPTED BY CORE MATERIAL MANUFACTURERS

- 9.3 REVENUE ANALYSIS

- FIGURE 50 CORE MATERIAL MARKET: REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- 9.4 MARKET SHARE ANALYSIS

- FIGURE 51 SHARES OF TOP COMPANIES IN CORE MATERIAL MARKET

- TABLE 217 DEGREE OF COMPETITION: CORE MATERIAL MARKET

- 9.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 52 BRAND/PRODUCT COMPARISON

- 9.5.1 GURIT KERDYN

- 9.5.2 HEXWEB HONEYCOMB

- 9.5.3 AIREX

- 9.5.4 ROHACELL

- 9.5.5 DIVINYCELL

- 9.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2022

- 9.6.1 STARS

- 9.6.2 EMERGING LEADERS

- 9.6.3 PERVASIVE PLAYERS

- 9.6.4 PARTICIPANTS

- FIGURE 53 CORE MATERIAL MARKET: COMPANY EVALUATION MATRIX, 2022

- 9.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2022

- 9.6.5.1 Company footprint

- FIGURE 54 CORE MATERIAL MARKET: COMPANY FOOTPRINT (18 COMPANIES)

- 9.6.5.2 Company type footprint

- TABLE 218 CORE MATERIAL MARKET: COMPANY TYPE FOOTPRINT (18 COMPANIES)

- 9.6.5.3 Company subtype (foam) footprint

- TABLE 219 CORE MATERIAL MARKET: COMPANY SUBTYPE (FOAM) FOOTPRINT (18 COMPANIES)

- 9.6.5.4 Company subtype (honeycomb) footprint

- TABLE 220 CORE MATERIAL MARKET: COMPANY SUBTYPE (HONEYCOMB) FOOTPRINT (18 COMPANIES)

- 9.6.5.5 Company end-use industry footprint

- TABLE 221 CORE MATERIAL MARKET: COMPANY END-USE INDUSTRY FOOTPRINT (18 COMPANIES)

- 9.6.5.6 Company region footprint

- TABLE 222 CORE MATERIAL MARKET: COMPANY REGION FOOTPRINT (18 COMPANIES)

- 9.7 VALUATION AND FINANCIAL METRICS

- FIGURE 55 EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 56 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY MANUFACTURERS

- 9.8 COMPETITIVE SCENARIO AND TRENDS

- 9.8.1 PRODUCT LAUNCHES

- TABLE 223 CORE MATERIAL MARKET: PRODUCT LAUNCHES, JANUARY 2020-JANUARY 2024

- 9.8.2 DEALS

- TABLE 224 CORE MATERIAL MARKET: DEALS, JANUARY 2020-JANUARY 2024

- 9.8.3 EXPANSIONS

- TABLE 225 CORE MATERIAL MARKET: EXPANSIONS, JANUARY 2020-JANUARY 2024

10 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 10.1 KEY COMPANIES

- 10.1.1 GURIT HOLDINGS AG

- TABLE 226 GURIT HOLDING AG: COMPANY OVERVIEW

- FIGURE 57 GURIT HOLDING AG: COMPANY SNAPSHOT

- TABLE 227 GURIT HOLDING AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 GURIT HOLDING AG: PRODUCT LAUNCHES

- TABLE 229 GURIT HOLDINGS AG: DEALS

- 10.1.2 HEXCEL CORPORATION

- TABLE 230 HEXCEL CORPORATION: COMPANY OVERVIEW

- FIGURE 58 HEXCEL CORPORATION: COMPANY SNAPSHOT

- TABLE 231 HEXCEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 HEXCEL CORPORATION: DEALS

- TABLE 233 HEXCEL CORPORATION: EXPANSIONS

- 10.1.3 3A COMPOSITES

- TABLE 234 3A COMPOSITES: COMPANY OVERVIEW

- FIGURE 59 3A COMPOSITES: COMPANY SNAPSHOT

- TABLE 235 3A COMPOSITES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 3A COMPOSITES: PRODUCT LAUNCHES

- TABLE 237 3A COMPOSITES: DEALS

- 10.1.4 EVONIK INDUSTRIES AG

- TABLE 238 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- FIGURE 60 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- TABLE 239 EVONIK INDUSTRIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 EVONIK INDUSTRIES AG: PRODUCT LAUNCHES

- TABLE 241 EVONIK INDUSTRIES AG: EXPANSIONS

- 10.1.5 ARMACELL

- TABLE 242 ARMACELL: COMPANY OVERVIEW

- FIGURE 61 ARMACELL: COMPANY SNAPSHOT

- TABLE 243 ARMACELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 ARMACELL: PRODUCT LAUNCHES

- TABLE 245 ARMACELL: DEALS

- TABLE 246 ARMACELL: EXPANSIONS

- 10.1.6 DIAB GROUP

- TABLE 247 DIAB GROUP: COMPANY OVERVIEW

- TABLE 248 DIAB GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 DIAB GROUP: PRODUCT LAUNCHES

- TABLE 250 DIAB GROUP: DEALS

- TABLE 251 DIAB GROUP: EXPANSIONS

- 10.1.7 THE GILL CORPORATION

- TABLE 252 THE GILL CORPORATION: COMPANY OVERVIEW

- TABLE 253 THE GILL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 THE GILL CORPORATION: PRODUCT LAUNCHES

- TABLE 255 THE GILL CORPORATION: DEALS

- 10.1.8 EURO-COMPOSITES

- TABLE 256 EURO-COMPOSITES: COMPANY OVERVIEW

- TABLE 257 EURO-COMPOSITES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 EURO-COMPOSITES: PRODUCT LAUNCHES

- 10.1.9 CHANGZHOU TIANSHENG NEW MATERIALS CO., LTD.

- TABLE 259 CHANGZHOU TIANSHENG NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 260 CHANGZHOU TIANSHENG NEW MATERIALS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.10 PLASCORE INC.

- TABLE 261 PLASCORE INC.: COMPANY OVERVIEW

- TABLE 262 PLASCORE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.11 TORAY INDUSTRIES, INC.

- TABLE 263 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 62 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 264 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 TORAY INDUSTRIES, INC.: EXPANSIONS

- 10.1.12 CORELITE

- TABLE 266 CORELITE: COMPANY OVERVIEW

- TABLE 267 CORELITE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.13 SICOMIN

- TABLE 268 SICOMIN: COMPANY OVERVIEW

- TABLE 269 SICOMIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.14 I-CORE COMPOSITES

- TABLE 270 I-CORE COMPOSITES: COMPANY OVERVIEW

- TABLE 271 I-CORE COMPOSITES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.15 MARICELL CORE COMPOSITES

- TABLE 272 MARICELL CORE COMPOSITES: COMPANY OVERVIEW

- TABLE 273 MARICELL CORE COMPOSITES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.16 SHOWA AIRCRAFT INDUSTRY CO., LTD

- TABLE 274 SHOWA AIRCRAFT INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 275 SHOWA AIRCRAFT INDUSTRY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.17 TCCORE APPLIED HONEYCOMB TECHNOLOGY CO., LTD.

- TABLE 276 TCCORE APPLIED HONEYCOMB TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 277 TCCORE APPLIED HONEYCOMB TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.18 SAERTEX GMBH & CO.KG

- TABLE 278 SAERTEX GMBH & CO.KG: COMPANY OVERVIEW

- TABLE 279 SAERTEX GMBH & CO.KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 SAERTEX GMBH & CO.KG: PRODUCT LAUNCHES

- 10.2 OTHER PLAYERS

- 10.2.1 RELCORE COMPOSITES INC.

- TABLE 281 RELCORE COMPOSITES INC.: COMPANY OVERVIEW

- 10.2.2 POLYUMAC USA, LLC

- TABLE 282 POLYUMAC USA, LLC.: COMPANY OVERVIEW

- 10.2.3 CARBON-CORE CORP.

- TABLE 283 CARBON-CORE CORP.: COMPANY OVERVIEW

- 10.2.4 TASUNS COMPOSITE TECHNOLOGY CO., LTD

- TABLE 284 TASUNS COMPOSITE TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- 10.2.5 DONGYING HORIZON COMPOSITE CO., LTD.

- TABLE 285 DONGYING HORIZON COMPOSITE CO., LTD.: COMPANY OVERVIEW

- 10.2.6 ZHEJIANG YOUWEI NEW MATERIALS CO., LTD.

- TABLE 286 ZHEJIANG YOUWEI NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

- 10.2.7 NMG EUROPE SRL

- TABLE 287 NMG EUROPE SRL: COMPANY OVERVIEW

- 10.2.8 NAGOYA CORE CO., LTD.

- TABLE 288 NAGOYA CORE CO., LTD.: COMPANY OVERVIEW

- 10.2.9 ARGOSY INTERNATIONAL INC.

- TABLE 289 ARGOSY INTERNATIONAL INC.: COMPANY OVERVIEW

- 10.2.10 ECONCORE

- TABLE 290 ECONCORE: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS