|

|

市場調査レポート

商品コード

1443443

デジタル嗅覚技術の世界市場:ハードウェアデバイス、最終用途製品、用途、地域別 - 予測(~2029年)Digital Scent Technology Market by Hardware Device, End-Use Product, Application and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| デジタル嗅覚技術の世界市場:ハードウェアデバイス、最終用途製品、用途、地域別 - 予測(~2029年) |

|

出版日: 2024年02月27日

発行: MarketsandMarkets

ページ情報: 英文 277 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のデジタル嗅覚技術の市場規模は、2024年の12億米ドルから、予測期間中は10.5%のCAGRで推移し、2029年には20億米ドルの規模に成長すると予測されています。

空港や軍の検問所における爆発物検知への需要の高まり、AIアルゴリズムを組み込んだ高感度で耐久性のあるセンサーの開発、ゲームにおけるe-nose技術の統合、AR/VRアプリケーションにおけるe-noseの人気の高まりが、デジタル嗅覚技術市場の成長を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント | ハードウェアデバイス・最終用途製品・用途・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

ハードウェアデバイス別では、予測期間中、e-noseの部門が最大のシェアを占める見通しです。電気化学ノーズは、e-nose、電子ノーズ、マイクロノーズとも呼ばれ、化学ガスセンサーのアレイ、信号処理ユニット、サンプリングシステム、ガス、蒸気、臭気の分析に使用されるパターン分類アルゴリズムを備えたシステムを統合した人工嗅覚デバイスです。臭気を検出する電子ノーズは、圧電センサー、ポリマーセンサー、光ファイバーセンサー、MOSFETセンサーなど、さまざまなセンサー技術を統合しています。ポリマーセンサーは、高感度で検出範囲が広いなど、多くの利点があるため、e-noseに多く採用されています。これらのセンサーは、低消費電力、室温での動作能力、カスタマイズ可能な選択性が優れており、ポータブル機器やカスタマイズされたアプリケーションに最適です。

最終用途製品別では、品質管理製品の部門が予測期間中に第2位のシェアを占める見通しです。デジタル嗅覚は、腐敗の早期発見や精度の向上に役立つため、品質管理製品への採用が大幅に増えています。目視検査、物理的操作、化学分析に頼る従来の鶏肉品質管理方法は、課題に直面していおり、デジタルスキャンの技術が有望な選択肢として浮上しています。この技術は、鶏肉製品から放出される揮発性化合物を検出するセンサーを利用することで、客観的かつ非破壊的な分析を保証します。例えば、2021年1月、Skoltechの研究者は、厨房での品質管理を自動化し、一貫性と安全性を向上させることを目的として、グリルチキンの焼き上がりを検知するe-noseとコンピュータービジョンシステムを開発しました。

用途別では、医療の部門が予測期間中に最大のシェアを示す見通しです。e-nose技術は、人の呼気の臭いを感知することで、病気の早期発見に役立ちます。さらに、e-noseは結核やさまざまな種類の癌などの疾患の検出に広く使われています。2023年3月、ニュージーランドを拠点とするスタートアップ企業であるScentian Bioは、結核やマラリアを含む人の病気を検出できる画期的なバイオe-noseの開発に成功しました。

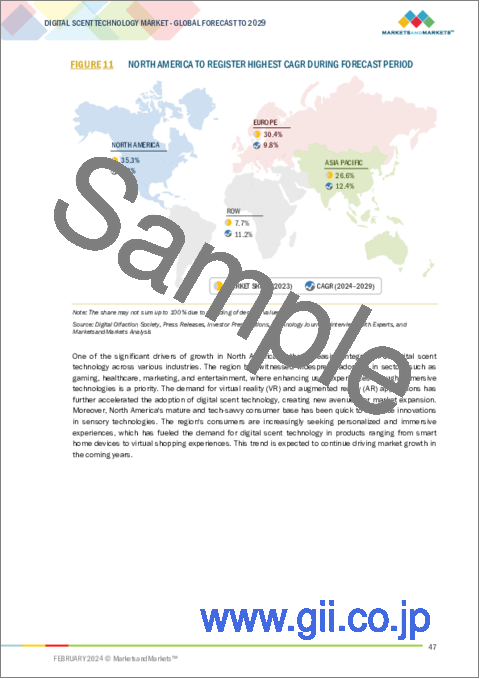

地域別では、北米地域が予測期間中に最大のシェアを示す見通しです。北米のシェアが大きい理由は、食品・飲料、医療、マーケティング、エンターテイメント産業などのエンドユーザーからの需要が高まっているためです。これらのエンドユーザー産業は北米で大きな存在感を示しており、デジタル嗅覚技術の需要を牽引しています。米国とカナダは技術強化が進み、AIの導入が進んでいることから、北米市場をリードしています。さらに、北米の技術に精通した消費者層は、感覚面の技術の革新を素早く受け入れています。同地域の消費者は、パーソナライズされた没入型体験を求める傾向が強まっており、スマートホームデバイスからバーチャルショッピング体験まで、幅広い製品でデジタル嗅覚技術の需要を促進しています。この動向は、今後数年間の市場成長を促進すると予想されています。

当レポートでは、世界のデジタル嗅覚技術の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/ディスラプション

- 価格分析

- バリューチェーン分析

- エコシステムマッピング

- デジタル嗅覚技術への投資と資金調達の情勢

- 技術分析

- 特許分析

- 貿易分析

- 主な会議とイベント

- ケーススタディ分析

- 関税、基準、規制状況

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 デジタル嗅覚技術市場:ハードウェアデバイス別

- e-nose

- 香り合成装置

- カートリッジ

第7章 デジタル嗅覚技術市場:最終用途製品別

- スマートフォン

- スメリングスクリーン

- 音楽・ビデオゲーム

- 爆発物探知機

- 品質管理製品

- 医療診断製品

- 癌検出

- 呼吸器疾患

- 尿路感染症

- その他

- その他

- プロジェクター

- 劇場

- Eメール

- 学習教材

- ホテル・レストラン

- スマートホームシステム

- ウェアラブル

第8章 デジタル嗅覚技術市場:用途別

- 食品・飲料

- 軍事・防衛

- 医療

- マーケティング

- 環境モニタリング

- エンターテインメント

- その他

第9章 地域分析

- 北米

- 欧州

- アジア太平洋

- その他の地域

第10章 競合情勢

- 概要

- 主要企業の採用戦略

- 収益分析

- 市場シェア分析

- 主要なデジタル嗅覚技術ベンダーの評価と財務指標

- ブランド/製品の比較分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- SIEMENS

- AMPHENOL CORPORATION

- SENSIRION AG

- HONEYWELL INTERNATIONAL INC.

- RENESAS ELECTRONICS CORPORATION

- FIGARO ENGINEERING INC.

- BOSCH SENSORTEC GMBH

- ALPHASENSE

- ENVIROSUITE LTD

- ALPHA MOS

- ELECTRONIC SENSOR TECHNOLOGY

- AROMAJOIN CORPORATION

- その他の企業

- SENSIGENT LLC

- AIRSENSE ANALYTICS GMBH

- SCENTSATIONAL TECHNOLOGIES LLC

- SCENT SCIENCES

- THE ENOSE COMPANY

- COMON INVENT B.V.

- ARYBALLE TECHNOLOGIES

- PLASMION

- NOZE

- SMELLDECT GMBH

- ROBOSCIENTIFIC

- AERNOS, INC.

- CDX, INC. (SUBSIDIARY OF MYDX, INC.)

- GERSTEL

- BREATHOMIX

- OLORAMA TECHNOLOGY LTD.

- SMARTNANOTUBES TECHNOLOGIES GMBH

- FLAVORACTIV.

- MUI-ROBOTICS

- CHROMATOTEC GROUP

第12章 付録

The Digital Scent Technology market is projected to grow from USD 1.2 billion in 2024 and is projected to reach USD 2.0 billion by 2029; it is expected to grow at a CAGR of 10.5% from 2024 to 2029. Heightened demand to detect explosives in airports and military checkpoints, development of sensitive and durable sensors embedded with AI algorithms, integration of e-nose technology in gaming, and rising popularity of e-nose in AR/VR applications to fuel the growth of Digital Scent Technology market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Hardware Device, End-Use Product, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Market for e-nose to hold the largest share during the forecast period."

An electrochemical nose, also called an e-nose or, electronic nose, or micro nose, is an artificial olfaction device integrated with an array of chemical gas sensors, a signal processing unit, a sampling system, and a system with a pattern classification algorithm used for the analysis of gases, vapours, or Odors. Simply put, it is an array made up of chemical gas sensors housed in a device that uses pattern recognition to recognize, identify, and compare Odors. Electronic nose to detect Odor integrates various sensor technologies, such as piezoelectric sensor, polymer sensors, optical fiber sensor, and MOSFET sensors. Polymer sensors are gaining significant adoption in e-nose due to numerous advantages such as they offer high sensitivity and broad detection range. These sensors are ideal for portable devices and customized applications, their low lower consumption, ability to operate at room temperature, and customizable selectivity set them apart.

"Market for quality control products holds for second-largest market share during the forecast period."

Digital scent technology is gaining significant adoption for quality control products, as it helps in early spoilage detection and improve accuracy to boost demand. Traditional methods of poultry quality control, relying on visual inspection, physical manipulation, and chemical analysis, face challenges such as subjectivity, destructiveness, and limited scope. In response, digital scent technology emerges as a promising alternative. This technology ensures objective and non- destructive analysis by utilizing sensors to detect volatile compounds emitted by poultry products. The benefits include improved accuracy and consistency, early spoilage detection, identification of specific contaminants, and rapid, non-destructive analysis. For instance, in January 2021, researchers from Skoltech developed an 'e-nose' and computer vision system to detect the readiness of grilled chicken, aiming to automate quality control in kitchens, potentially improving consistency and safety. Already implemented in some poultry processing plants, ongoing research aims to enhance detection capabilities. The potential of digital scent technology spans the entire poultry supply chain, offering a comprehensive solution for consistent, high-quality control from farm to fork, addressing food safety and authenticity concerns.

"Market for Medical segment is projected to hold for largest share during the forecast timeline."

E-nose technology helps in the early detection of diseases by sensing the odor of human breath. Early detection of diseases can save a patient's life and reduce the cost of treatment. Moreover, e-nose is widely used for the detection of diseases such as TB and different types of cancers. In March 2023, New Zealand-based start-up Scentian Bio successfully developed a groundbreaking biological electronic nose capable of detecting human diseases, including tuberculosis and malaria. The company's Chief Technology Officer utilized insect smell receptors to create a biosensor for identifying odors. E-noses, by analyzing volatile organic compounds in a patient's breath, offer a quick and patient-friendly approach to diagnosis, potentially contributing to the goal of detecting lung cancer at earlier stages when interventions are more effective.

"North America is expected to have the largest market share during the forecast period."

The digital scent technology market in North America has been studied in the US, Canada, and Mexico. The larger share of North America in the global digital scent technology market is driven by the rising demand from end users such as the food & beverage, medical, marketing, and entertainment industries. These end-user industries have a large presence within North America, which consequently drives the demand for digital scent technology. The US and Canada are leading the market in North America due to rising technological enhancements and the growing adoption of AI in these countries. Moreover, North America's mature and tech-savvy consumer base has quickly embraced sensory technology innovations. The region's consumers are increasingly seeking personalized and immersive experiences, which has fueled the demand for digital scent technology in products ranging from smart home devices to virtual shopping experiences. This trend is expected to propel the market growth in the coming years.

Extensive primary interviews were conducted with key industry experts in the Digital Scent Technology market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The break-up of primary participants for the report has been shown below:

The break-up of the profile of primary participants in the Digital Scent Technology market:

- By Company Type: Tier 1 - 45%, Tier 2 - 30%, and Tier 3 - 25%

- By Designation: C Level - 40%, Director Level - 35%, Others-25%

- By Region: North America - 30%, Europe - 22%, Asia Pacific - 40%, ROW- 8%

The report profiles key players in the Digital Scent Technology market with their respective market ranking analysis. Prominent players profiled in this report are Siemens (Germany), Amphenol Corporation (US), Sensirion AG (Switzerland), Honeywell International Inc. (US), Renesas Electronics Corporation (Japan), Envirosuite Ltd (Australia), Alpha MOS (France), Electronic Sensor Technology (US), Aromajoin Corporation (Japan), Figaro Engineering Inc. (US), Bosch Sensortec GmbH (Germany), and Alphasense (UK) among others.

Apart from this, Sensigent LLC (US), AIRSENSE Analytics GmbH (Germany), ScentSational Technologies LLC (UK), Scent Sciences (US), The eNose Company (Netherlands), COMON INVENT B.V. (Netherlands), Aryballe technologies (France), Plasmion (Germany), Noze (Canada), SMELLDECT GmbH (Germany), RoboScientific (UK), AerNos, Inc. (US), CDx, Inc., (subsidiary of MyDx, Inc.) (US), GERSTEL (Germany), Breathomix (Netherlands), Olorama Technology Ltd. (Spain), SmartNanotubes Technologies GmbH (Germany), FlavorActiV. (UK), mui-robotics (Singapore), CROMATOTEC GROUP (France) are among a few emerging companies in the Digital Scent Technology market.

Research Coverage: This research report categorizes the Digital Scent Technology market based on hardware device, en-use product, application and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the Digital Scent Technology market and forecasts the same till 2029. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the Digital Scent Technology ecosystem.

Key Benefits of Buying the Report The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Digital Scent Technologymarket and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing adoption of e-noses in food industry for process monitoring freshness evaluation, and authenticity assessment, rising adoption of compact, portable, and loT-enabled e-noses, growing deployment of e-nose devices for diagnosing diseases, integration of e-noses and synthesizers into smart homes) influencing the growth of the Digital Scent Technology market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Digital Scent Technologymarket.

- Market Development: Comprehensive information about lucrative markets - the report analysis the Digital Scent Technologymarket across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Digital Scent Technologymarket

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Siemens (Germany), Amphenol Corporation (US), Sensirion AG (Switzerland), Honeywell International Inc. (US), and Renesas Electronics Corporation (Japan) among others in the Digital Scent Technologymarket.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 IMPACT OF RECESSION

- FIGURE 1 GDP GROWTH PROJECTION DATA FOR MAJOR ECONOMIES, 2021-2023

- 1.10 GDP GROWTH PROJECTION UNTIL 2024 FOR MAJOR ECONOMIES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 DIGITAL SCENT TECHNOLOGY MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 RESEARCH FLOW: DIGITAL SCENT TECHNOLOGY MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY SENSOR MANUFACTURERS FOR DIGITAL SCENT TECHNOLOGY

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON STUDIED MARKET

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 E-NOSES SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 MEDICAL DIAGNOSTIC PRODUCTS SEGMENT TO SECURE LARGEST MARKET SHARE IN 2029

- FIGURE 10 ENVIRONMENTAL MONITORING SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DIGITAL SCENT TECHNOLOGY MARKET

- FIGURE 12 INCREASING APPLICATIONS OF E-NOSES IN FOOD & BEVERAGES INDUSTRY FOR QUALITY ASSURANCE TO DRIVE MARKET

- 4.2 DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE

- FIGURE 13 E-NOSES SEGMENT TO DOMINATE MARKET FROM 2024 TO 2029

- 4.3 DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION

- FIGURE 14 MEDICAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT

- FIGURE 15 SMARTPHONES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.5 DIGITAL SCENT TECHNOLOGY MARKET, BY COUNTRY

- FIGURE 16 MEXICO TO REGISTER HIGHEST CAGR IN GLOBAL DIGITAL SCENT TECHNOLOGY MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DIGITAL SCENT TECHNOLOGY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of e-noses in food industry for process monitoring, freshness evaluation, and authenticity assessment

- 5.2.1.2 Rising adoption of compact, portable, and IoT-enabled e-noses

- 5.2.1.3 Growing deployment of e-nose devices for diagnosing diseases

- 5.2.1.4 Integration of e-noses and scent synthesizers into smart homes

- FIGURE 18 IMPACT ANALYSIS OF DRIVERS IN DIGITAL SCENT TECHNOLOGY MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited adoption due to high cost of digital scent technology

- 5.2.2.2 Delays between successive tests

- FIGURE 19 IMPACT ANALYSIS OF RESTRAINTS IN DIGITAL SCENT TECHNOLOGY MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Heightened demand to detect explosives at airports and military checkpoints

- 5.2.3.2 Development of more sensitive and durable sensors embedded with AI algorithms

- 5.2.3.3 Deployment of e-nose technology in gaming industry

- 5.2.3.4 Rising popularity of e-noses in AR/VR applications

- FIGURE 20 IMPACT ANALYSIS OF OPPORTUNITIES IN DIGITAL SCENT TECHNOLOGY MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Application of hazardous chemicals in scent synthesizers

- 5.2.4.2 Issues associated with unpredictable airflow

- FIGURE 21 IMPACT ANALYSIS OF CHALLENGES IN DIGITAL SCENT TECHNOLOGY MARKET

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE PRICING ANALYSIS OF E-NOSES, BY KEY PLAYER

- TABLE 1 INDICATIVE PRICING ANALYSIS OF E-NOSES, BY KEY PLAYER, 2023 (USD)

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 23 DIGITAL SCENT TECHNOLOGY MARKET: VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM MAPPING

- FIGURE 24 DIGITAL SCENT TECHNOLOGY MARKET: ECOSYSTEM MAPPING

- TABLE 2 COMPANIES AND THEIR ROLES IN DIGITAL SCENT TECHNOLOGY ECOSYSTEM

- 5.7 DIGITAL SCENT TECHNOLOGY INVESTMENT AND FUNDING LANDSCAPE

- FIGURE 25 INVESTMENT AND FUNDING LANDSCAPE FOR STARTUPS/SMES

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 AI-ENABLED PORTABLE E-NOSE

- 5.8.2 MICROBIAL NANOWIRES FOR NEXT-GEN DIGITAL SCENT TECHNOLOGY

- 5.9 PATENT ANALYSIS

- FIGURE 26 DIGITAL SCENT TECHNOLOGY MARKET: PATENTS GRANTED, 2013-2023

- FIGURE 27 TOP 10 PATENT OWNERS IN LAST 10 YEARS, 2013-2023

- TABLE 3 TOP PATENT OWNERS IN DIGITAL SCENT TECHNOLOGY MARKET IN LAST 10 YEARS

- TABLE 4 DIGITAL SCENT TECHNOLOGY MARKET: INNOVATIONS AND PATENT REGISTRATIONS

- 5.10 TRADE ANALYSIS

- FIGURE 28 IMPORT DATA FOR HS CODE 902710-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 29 EXPORT DATA FOR 902710-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 5 DIGITAL SCENT TECHNOLOGY MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 FUJAIRAH MUNICIPALITY MITIGATES ODOR DISTURBANCES THROUGH E-NOSE MONITORING NETWORK SYSTEMS

- 5.12.2 TAL TRIESTE IMPLEMENTS NETWORK OF 12 E-NOSES THAT OFFER REAL-TIME DATA

- 5.12.3 UNIVERSITY OF MARYLAND, BALTIMORE COUNTY'S TEAM DEPLOYS SMITHS DETECTION'S BIOFLASH IDENTIFIER THAT OFFERS REAL-TIME SARS-COV-2 DETECTION

- 5.12.4 HEALTHCARE PROFESSIONALS RECEIVE ASSISTANCE WITH NON-INVASIVE SOLUTIONS FOR PERSONALIZED HEALTH STATE MONITORING

- 5.12.5 RESTAURANTS AND HOUSEHOLDS IMPLEMENT SMART E-NOSE FOOD WASTE MANAGEMENT THAT USES LOW-COST AND WEIGHT SENSORS

- 5.13 TARIFFS, STANDARDS, AND REGULATORY LANDSCAPE

- TABLE 6 MFN TARIFF FOR HS CODE 902710-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 7 MFN TARIFF FOR HS CODE 902710-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 8 MFN TARIFF FOR HS CODE 902710-COMPLIANT PRODUCTS EXPORTED BY GERMANY

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.13.2.1 IEC 62368-1

- 5.13.2.2 FCC Part 15 (Radio Frequency Devices)

- 5.13.2.3 EN 13779

- 5.13.2.4 EU Regulation 1907/2006 (REACH)

- 5.13.2.5 US Food and Drug Administration (FDA)

- 5.13.2.6 ASTM E2927-12

- 5.13.2.7 ISO 16000 Series

- 5.13.2.8 CENELEC EN 13707

- 5.13.2.9 NIOSH Occupational Exposure Limits (OELs)

- 5.13.2.10 Local Building Codes and Fire Regulations

- 5.13.3 GOVERNMENT REGULATIONS

- 5.13.3.1 US

- 5.13.3.2 Europe

- 5.13.3.3 China

- 5.13.3.4 Japan

- 5.13.3.5 India

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 DIGITAL SCENT TECHNOLOGY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 DIGITAL SCENT TECHNOLOGY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 BARGAINING POWER OF SUPPLIERS

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

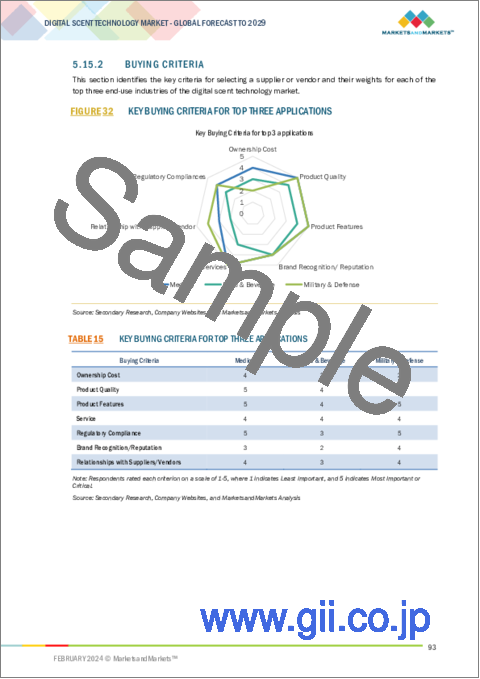

- 5.15.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6 DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE

- 6.1 INTRODUCTION

- FIGURE 33 DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE

- FIGURE 34 E-NOSES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 16 DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 17 DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- TABLE 18 DIGITAL SCENT TECHNOLOGY MARKET, BY E-NOSE, 2020-2023 (THOUSAND UNITS)

- TABLE 19 DIGITAL SCENT TECHNOLOGY MARKET, BY E-NOSE, 2024-2029 (THOUSAND UNITS)

- 6.2 E-NOSES

- FIGURE 35 FUNCTIONING OF E-NOSE

- FIGURE 36 FEATURES OF E-NOSE

- 6.2.1 E-NOSE, BY SENSOR TYPE

- 6.2.1.1 Polymer sensors

- 6.2.1.1.1 Low power consumption and fast response time to boost demand

- 6.2.1.2 Piezoelectric sensors

- 6.2.1.2.1 Ability to detect wide range of chemicals to drive market

- 6.2.1.3 MOSFET sensors

- 6.2.1.3.1 Seamless integration with CMOS technology to foster segmental growth

- 6.2.1.4 Optical fiber sensors

- 6.2.1.4.1 Ability to detect subtle changes in optical properties to accelerate demand

- 6.2.1.1 Polymer sensors

- TABLE 20 DIGITAL SCENT TECHNOLOGY: GAS SENSING METHODS

- TABLE 21 E-NOSES: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 22 E-NOSES: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 23 E-NOSES: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 24 E-NOSES: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 6.3 SCENT SYNTHESIZERS

- 6.3.1 CARTRIDGES

- 6.3.1.1 Increasing applications in households due to low fire risks to drive demand

- TABLE 25 SCENT SYNTHESIZERS: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 26 SCENT SYNTHESIZERS: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 27 SCENT SYNTHESIZERS: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 28 SCENT SYNTHESIZERS: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 6.3.1 CARTRIDGES

7 DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT

- 7.1 INTRODUCTION

- FIGURE 37 DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT

- FIGURE 38 MEDICAL DIAGNOSTIC PRODUCTS SEGMENT TO CLAIM LARGEST MARKET SHARE IN 2024

- TABLE 29 DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2020-2023 (USD MILLION)

- TABLE 30 DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2024-2029 (USD MILLION)

- 7.2 SMARTPHONES

- 7.2.1 CAPABILITY TO RELIEF STRESS BY DIFFUSING CALMING OR UPLIFTING SCENTS TO ACCELERATE DEMAND

- TABLE 31 SMARTPHONES: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 32 SMARTPHONES: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 33 SMARTPHONES: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 34 SMARTPHONES: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- 7.3 SMELLING SCREENS

- 7.3.1 INTRODUCTION OF IMMERSIVE OLFACTORY DIMENSION TO BOOST DEMAND

- TABLE 35 SMELLING SCREENS: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 36 SMELLING SCREENS: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 37 SMELLING SCREENS: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 38 SMELLING SCREENS: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- 7.4 MUSIC AND VIDEO GAMES

- 7.4.1 ENHANCED EMOTIONAL CONNECTION WITH MUSICAL COMPOSITIONS AND SYNCHRONIZED SCENTS TO DRIVE MARKET

- TABLE 39 MUSIC AND VIDEO GAMES: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 40 MUSIC AND VIDEO GAMES: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 41 MUSIC AND VIDEO GAMES: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 42 MUSIC AND VIDEO GAMES: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- 7.5 EXPLOSIVE DETECTORS

- 7.5.1 EMERGENCE OF NANOSENSORS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR PLAYERS

- TABLE 43 EXPLOSIVE DETECTORS: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 44 EXPLOSIVE DETECTORS: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 45 EXPLOSIVE DETECTORS: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 46 EXPLOSIVE DETECTORS: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- 7.6 QUALITY CONTROL PRODUCTS

- 7.6.1 EARLY SPOILAGE DETECTION AND IMPROVED ACCURACY TO BOOST DEMAND

- TABLE 47 QUALITY CONTROL PRODUCTS: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 48 QUALITY CONTROL PRODUCTS: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 49 QUALITY CONTROL PRODUCTS: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 50 QUALITY CONTROL PRODUCTS: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- 7.7 MEDICAL DIAGNOSTIC PRODUCTS

- 7.7.1 CANCER DETECTION

- 7.7.1.1 Ability to detect cancer early and perform non-invasive screening to drive market

- 7.7.2 RESPIRATORY DISEASES

- 7.7.2.1 Painless and cost-effective approach to detect respiratory diseases to foster segmental growth

- 7.7.3 URINARY TRACT INFECTIONS

- 7.7.3.1 Rapid diagnosis and potential point-of-care testing to boost demand

- 7.7.4 OTHER DISEASES

- TABLE 51 MEDICAL DIAGNOSTIC PRODUCTS: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 52 MEDICAL DIAGNOSTIC PRODUCTS: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 53 MEDICAL DIAGNOSTIC PRODUCTS: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 54 MEDICAL DIAGNOSTIC PRODUCTS: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- 7.7.1 CANCER DETECTION

- 7.8 OTHER END-USE PRODUCTS

- 7.8.1 PROJECTORS

- 7.8.1.1 Ability to mitigate discomfort due to unpleasant scents to drive market

- 7.8.2 THEATRES

- 7.8.2.1 Penetration of VR technology in infotainment industry to drive market

- 7.8.3 EMAILS

- 7.8.3.1 Transmission of aromas through emails to foster segmental growth

- 7.8.4 STUDY MATERIALS

- 7.8.4.1 Use of e-noses into science labs to learn about different chemicals to drive market

- 7.8.5 HOTELS AND RESTAURANTS

- 7.8.5.1 Ability to replicate aromas of various food items alongside menu to foster segmental growth

- 7.8.6 SMART HOME SYSTEMS

- 7.8.6.1 Ability to detect smoke and carbon monoxide to boost demand

- 7.8.7 WEARABLES

- 7.8.7.1 integration of e-noses into wearables to provide personalized and comprehensive user experience to boost demand

- TABLE 55 OTHER END-USE PRODUCTS: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 56 OTHER END-USE PRODUCTS: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 57 OTHER END-USE PRODUCTS: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 58 OTHER END-USE PRODUCTS: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- 7.8.1 PROJECTORS

8 DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 39 DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION

- FIGURE 40 MEDICAL SEGMENT TO HOLD LARGEST MARKET SHARE FROM 2024 TO 2029

- TABLE 59 DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 60 DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 8.2 FOOD & BEVERAGES

- 8.2.1 INCREASING APPLICATIONS IN QUALITY CONTROL, PRODUCT DEVELOPMENT, AND OPTIMIZATION OF FERMENTATION PROCESSES TO DRIVE MARKET

- FIGURE 41 E-NOSE SYSTEM FOR DETECTING RIPENING STAGE OF CITRUS FRUITS

- TABLE 61 FOOD & BEVERAGES: DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2020-2023 (USD MILLION)

- TABLE 62 FOOD & BEVERAGES: DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2024-2029 (USD MILLION)

- TABLE 63 FOOD & BEVERAGES: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 64 FOOD & BEVERAGES: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- TABLE 65 FOOD & BEVERAGES: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 66 FOOD & BEVERAGES: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3 MILITARY & DEFENSE

- 8.3.1 GROWING USE OF NANOTECHNOLOGY-BASED E-NOSES TO DETECT CHEMICAL AND BIOLOGICAL WARFARE AGENTS TO BOOST DEMAND

- TABLE 67 MILITARY & DEFENSE: DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2020-2023 (USD MILLION)

- TABLE 68 MILITARY & DEFENSE: DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2024-2029 (USD MILLION)

- TABLE 69 MILITARY & DEFENSE: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 70 MILITARY & DEFENSE: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- TABLE 71 MILITARY & DEFENSE: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 72 MILITARY & DEFENSE: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.4 MEDICAL

- 8.4.1 ABILITY TO OFFER NON-INVASIVE AND EARLY STAGE LUNG CANCER DIAGNOSIS TO BOOST DEMAND

- TABLE 73 DESCRIPTIVE AROMAS PREVIOUSLY USED FOR DIAGNOSING HUMAN DISEASES

- TABLE 74 MEDICAL: DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2020-2023 (USD MILLION)

- TABLE 75 MEDICAL: DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2024-2029 (USD MILLION)

- TABLE 76 MEDICAL: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 77 MEDICAL: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- TABLE 78 MEDICAL: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 79 APPLICATION: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.5 MARKETING

- 8.5.1 GROWING DEMAND IN COSMETICS INDUSTRY TO DRIVE MARKET

- TABLE 80 MARKETING: DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2020-2023 (USD MILLION)

- TABLE 81 MARKETING: DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2024-2029 (USD MILLION)

- TABLE 82 MARKETING: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 83 MARKETING: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- TABLE 84 MARKETING: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 85 MARKETING: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.6 ENVIRONMENTAL MONITORING

- 8.6.1 ABILITY TO RECOGNIZE AND DIFFERENTIATE VARIOUS GAS AND ODORS TO DRIVE MARKET

- FIGURE 42 E-NOSE APPLICATIONS IN ENVIRONMENTAL MONITORING

- TABLE 86 ENVIRONMENTAL MONITORING: DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2020-2023 (USD MILLION)

- TABLE 87 ENVIRONMENTAL MONITORING: DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2024-2029 (USD MILLION)

- TABLE 88 ENVIRONMENTAL MONITORING: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 89 ENVIRONMENTAL MONITORING: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- TABLE 90 ENVIRONMENTAL MONITORING: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 91 ENVIRONMENTAL MONITORING: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.7 ENTERTAINMENT

- 8.7.1 ADOPTION IN VISUAL THEATRES TO FOSTER SEGMENTAL GROWTH

- TABLE 92 ENTERTAINMENT: DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2020-2023 (USD MILLION)

- TABLE 93 ENTERTAINMENT: DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2024-2029 (USD MILLION)

- TABLE 94 ENTERTAINMENT: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 95 ENTERTAINMENT: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- TABLE 96 APPLICATION: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 97 ENTERTAINMENT: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.8 OTHER APPLICATIONS

- TABLE 98 OTHER APPLICATIONS: DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2020-2023 (USD MILLION)

- TABLE 99 OTHER APPLICATIONS: DIGITAL SCENT TECHNOLOGY MARKET, BY END-USE PRODUCT, 2024-2029 (USD MILLION)

- TABLE 100 OTHER APPLICATIONS: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 101 OTHER APPLICATIONS: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- TABLE 102 OTHER APPLICATIONS: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 103 OTHER APPLICATIONS: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

9 REGIONAL ANALYSIS

- 9.1 INTRODUCTION

- FIGURE 43 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2029

- TABLE 104 DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 105 DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 44 NORTH AMERICA: DIGITAL SCENT TECHNOLOGY MARKET SNAPSHOT

- FIGURE 45 US TO DOMINATE NORTH AMERICAN DIGITAL SCENT TECHNOLOGY MARKET IN 2029

- TABLE 106 NORTH AMERICA: DIGITAL SCENT TECHNOLOGY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 107 NORTH AMERICA: DIGITAL SCENT TECHNOLOGY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 108 NORTH AMERICA: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 109 NORTH AMERICA: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 110 NORTH AMERICA: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 111 NORTH AMERICA: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- 9.2.1 NORTH AMERICA: RECESSION IMPACT

- 9.2.2 US

- 9.2.2.1 Expanding medical sector to offer lucrative opportunities for market players

- 9.2.3 CANADA

- 9.2.3.1 Increasing demand from agriculture and food & beverages industries to drive market

- 9.2.4 MEXICO

- 9.2.4.1 Growing use to enhance quality control processes in pharmaceutical manufacturing to boost market growth

- 9.3 EUROPE

- FIGURE 46 EUROPE: DIGITAL SCENT TECHNOLOGY MARKET SNAPSHOT

- FIGURE 47 GERMANY TO DOMINATE EUROPEAN DIGITAL SCENT TECHNOLOGY MARKET DURING FORECAST PERIOD

- TABLE 112 EUROPE: DIGITAL SCENT TECHNOLOGY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 113 EUROPE: DIGITAL SCENT TECHNOLOGY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 114 EUROPE: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 115 EUROPE: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 116 EUROPE: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 117 EUROPE: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- 9.3.1 EUROPE: RECESSION IMPACT

- 9.3.2 UK

- 9.3.2.1 Integration of aromatherapy with e-noses to offer lucrative growth opportunities for market players

- 9.3.3 GERMANY

- 9.3.3.1 Expansion of military & defense industry to boost demand

- 9.3.4 FRANCE

- 9.3.4.1 Growing focus on developing portable electronic noses to drive market

- 9.3.5 REST OF EUROPE

- 9.4 ASIA PACIFIC

- FIGURE 48 ASIA PACIFIC: DIGITAL SCENT TECHNOLOGY MARKET SNAPSHOT

- FIGURE 49 CHINA TO DOMINATE ASIA PACIFIC DIGITAL SCENT TECHNOLOGY MARKET THROUGHOUT FORECAST PERIOD

- TABLE 118 ASIA PACIFIC: DIGITAL SCENT TECHNOLOGY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 119 ASIA PACIFIC: DIGITAL SCENT TECHNOLOGY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 120 ASIA PACIFIC: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 121 ASIA PACIFIC: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 122 ASIA PACIFIC: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 123 ASIA PACIFIC: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- 9.4.1 ASIA PACIFIC: RECESSION IMPACT

- 9.4.2 CHINA

- 9.4.2.1 Growing focus on technological innovation to drive market

- 9.4.3 JAPAN

- 9.4.3.1 Increasing collaborations and partnerships with international players to drive market

- 9.4.4 INDIA

- 9.4.4.1 Collaborative efforts in research and innovation with other countries to drive market

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 ROW

- FIGURE 50 ROW: DIGITAL SCENT TECHNOLOGY MARKET SNAPSHOT

- FIGURE 51 SOUTH AMERICA TO DOMINATE ROW DIGITAL SCENT TECHNOLOGY MARKET DURING FORECAST PERIOD

- TABLE 124 ROW: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 125 ROW: DIGITAL SCENT TECHNOLOGY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 126 ROW: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 127 ROW: DIGITAL SCENT TECHNOLOGY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 128 ROW: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2020-2023 (USD MILLION)

- TABLE 129 ROW: DIGITAL SCENT TECHNOLOGY MARKET, BY HARDWARE DEVICE, 2024-2029 (USD MILLION)

- 9.5.1 ROW: RECESSION IMPACT

- 9.5.2 SOUTH AMERICA

- 9.5.2.1 High investments in medical sector to accelerate market growth

- 9.5.3 GCC

- 9.5.3.1 Growing government support for boosting adoption of e-noses to drive market

- 9.5.4 REST OF MIDDLE EAST & AFRICA

- 9.5.4.1 Presence of entrepreneurial ecosystem to drive demand

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY MAJOR PLAYERS, 2020-2024

- TABLE 130 DIGITAL SCENT TECHNOLOGY MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2024

- 10.3 REVENUE ANALYSIS, 2019-2023

- FIGURE 52 DIGITAL SCENT TECHNOLOGY MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019-2023

- 10.4 MARKET SHARE ANALYSIS, 2023

- FIGURE 53 DIGITAL SCENT TECHNOLOGY MARKET SHARE ANALYSIS, 2023

- TABLE 131 DIGITAL SCENT TECHNOLOGY MARKET: DEGREE OF COMPETITION

- 10.5 VALUATION AND FINANCIAL METRICS OF KEY DIGITAL SCENT TECHNOLOGY VENDORS

- FIGURE 54 EV/EBITDA OF KEY VENDORS

- 10.6 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 55 DIGITAL SCENT TECHNOLOGY MARKET: TOP TRENDING BRANDS/PRODUCTS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- FIGURE 56 DIGITAL SCENT TECHNOLOGY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 10.7.5 COMPANY FOOTPRINT

- 10.7.5.1 Overall footprint

- TABLE 132 COMPANY OVERALL FOOTPRINT

- 10.7.5.2 Application footprint

- TABLE 133 COMPANY APPLICATION FOOTPRINT

- 10.7.5.3 End-use product footprint

- TABLE 134 COMPANY END-USE PRODUCT FOOTPRINT

- 10.7.5.4 Regional footprint

- TABLE 135 COMPANY REGIONAL FOOTPRINT

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES), 2023

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- FIGURE 57 DIGITAL SCENT TECHNOLOGY MARKET: STARTUPS/SMES EVALUATION MATRIX, 2023

- 10.8.5 COMPETITIVE BENCHMARKING

- 10.8.5.1 Competitive benchmarking of key startups/SMEs

- TABLE 136 DIGITAL SCENT TECHNOLOGY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.8.5.2 Detailed list of key startups/SMEs

- TABLE 137 DIGITAL SCENT TECHNOLOGY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 10.9 COMPETITIVE SCENARIOS AND TRENDS

- 10.9.1 PRODUCT LAUNCHES

- TABLE 138 DIGITAL SCENT TECHNOLOGY MARKET: PRODUCT LAUNCHES, FEBRUARY 2022-APRIL 2023

- 10.9.2 DEALS

- TABLE 139 DIGITAL SCENT TECHNOLOGY MARKET: DEALS, OCTOBER 2021-FEBRUARY 2024

11 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1 KEY PLAYERS

- 11.1.1 SIEMENS

- TABLE 140 SIEMENS: COMPANY OVERVIEW

- FIGURE 58 SIEMENS: COMPANY SNAPSHOT

- TABLE 141 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 SIEMENS: PRODUCT LAUNCHES

- TABLE 143 SIEMENS: DEALS

- 11.1.2 AMPHENOL CORPORATION

- TABLE 144 AMPHENOL CORPORATION: COMPANY OVERVIEW

- FIGURE 59 AMPHENOL CORPORATION: COMPANY SNAPSHOT

- TABLE 145 AMPHENOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 AMPHENOL CORPORATION: DEALS

- 11.1.3 SENSIRION AG

- TABLE 147 SENSIRION AG: COMPANY OVERVIEW

- FIGURE 60 SENSIRION AG: COMPANY SNAPSHOT

- TABLE 148 SENSIRION AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 SENSIRION AG: PRODUCT LAUNCHES

- TABLE 150 SENSIRION AG: DEALS

- TABLE 151 SENSIRION AG: OTHERS

- 11.1.4 HONEYWELL INTERNATIONAL INC.

- TABLE 152 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 61 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 153 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 155 HONEYWELL INTERNATIONAL INC.: DEALS

- 11.1.5 RENESAS ELECTRONICS CORPORATION

- TABLE 156 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- FIGURE 62 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- TABLE 157 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 RENESAS ELECTRONICS CORPORATION: PRODUCT LAUNCHES

- 11.1.6 FIGARO ENGINEERING INC.

- TABLE 159 FIGARO ENGINEERING INC.: COMPANY OVERVIEW

- TABLE 160 FIGARO ENGINEERING INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 FIGARO ENGINEERING INC.: PRODUCT LAUNCHES

- TABLE 162 FIGARO ENGINEERING INC.: OTHERS

- 11.1.7 BOSCH SENSORTEC GMBH

- TABLE 163 BOSCH SENSORTEC GMBH: COMPANY OVERVIEW

- TABLE 164 BOSCH SENSORTEC GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 BOSCH SENSORTEC GMBH: DEALS

- 11.1.8 ALPHASENSE

- TABLE 166 ALPHASENSE: COMPANY OVERVIEW

- TABLE 167 ALPHASENSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 ALPHASENSE: DEALS

- 11.1.9 ENVIROSUITE LTD

- TABLE 169 ENVIROSUITE LTD: BUSINESS OVERVIEW

- FIGURE 63 ENVIROSUITE LTD: COMPANY SNAPSHOT

- TABLE 170 ENVIROSUITE LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 ENVIROSUITE LTD: DEALS

- 11.1.10 ALPHA MOS

- TABLE 172 ALPHA MOS: COMPANY OVERVIEW

- TABLE 173 ALPHA MOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 ALPHA MOS: DEALS

- TABLE 175 ALPHA MOS: OTHERS

- 11.1.11 ELECTRONIC SENSOR TECHNOLOGY

- TABLE 176 ELECTRONIC SENSOR TECHNOLOGY: COMPANY OVERVIEW

- TABLE 177 ELECTRONIC SENSOR TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.12 AROMAJOIN CORPORATION

- TABLE 178 AROMAJOIN CORPORATION: COMPANY OVERVIEW

- TABLE 179 AROMAJOIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 AROMAJOIN CORPORATION: PRODUCT LAUNCHES

- 11.2 OTHER PLAYERS

- 11.2.1 SENSIGENT LLC

- 11.2.2 AIRSENSE ANALYTICS GMBH

- 11.2.3 SCENTSATIONAL TECHNOLOGIES LLC

- 11.2.4 SCENT SCIENCES

- 11.2.5 THE ENOSE COMPANY

- 11.2.6 COMON INVENT B.V.

- 11.2.7 ARYBALLE TECHNOLOGIES

- 11.2.8 PLASMION

- 11.2.9 NOZE

- 11.2.10 SMELLDECT GMBH

- 11.2.11 ROBOSCIENTIFIC

- 11.2.12 AERNOS, INC.

- 11.2.13 CDX, INC. (SUBSIDIARY OF MYDX, INC.)

- 11.2.14 GERSTEL

- 11.2.15 BREATHOMIX

- 11.2.16 OLORAMA TECHNOLOGY LTD.

- 11.2.17 SMARTNANOTUBES TECHNOLOGIES GMBH

- 11.2.18 FLAVORACTIV.

- 11.2.19 MUI-ROBOTICS

- 11.2.20 CHROMATOTEC GROUP

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS