|

|

市場調査レポート

商品コード

1442025

EMCシールドおよび試験装置の世界市場:材料別、試験装置別、手法別 - 予測(~2029年)EMC Shielding and Test Equipment Market by Material, Test Equipment Method - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| EMCシールドおよび試験装置の世界市場:材料別、試験装置別、手法別 - 予測(~2029年) |

|

出版日: 2024年02月21日

発行: MarketsandMarkets

ページ情報: 英文 271 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のEMCシールドおよび試験装置の市場規模は、2024年の84億米ドルから、予測期間中に6.2%のCAGRで推移し、2029年には113億米ドルの規模に成長すると予測されています。

世界のEMCシールドおよび試験装置の市場は、急速な工業化と電磁波汚染に対する懸念の高まりによって牽引されています。産業が急速に拡大し、技術が進歩するにつれて、電子機器の普及が電磁干渉の増加につながっています。この干渉の影響を緩和し、電子システムの信頼性を確保するために、堅牢なEMCシールドと試験装置の必要性が高まっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 検討単位 | 金額 (米ドル) |

| セグメント別 | 材料・試験装置・手法・地域別 |

| 対象地域 | アジア太平洋・欧州・北米・その他の地域 |

材料別では、EMCシールドテープ&ラミネートの部門がもっとも高いCAGRを示すと予測されています。これは主にその優れた汎用性と電磁干渉対策における有効性によるものです。これらの材料は、電子部品やシステムをシールドするための柔軟で適応性のあるソリューションを提供し、さまざまな用途に最適です。コンパクトで相互接続された電子機器の需要が急増する中、EMCシールドテープ&ラミネートは効率的で導入が容易なソリューションを提供します。そのEMI防止効果は、優れたシールド性能を確保するテープ技術の進歩と相まって、急速に進化する電磁両立性ソリューションの重要な一翼を担っています。これらの材料は継続的な技術革新により、特にCE製品や通信などさまざまな産業で採用されており、EMCシールド市場の著しいCAGRを牽引しています。

手法別では、放射線の部門が最大のCAGRを示す見通しです。放射線は、電磁干渉を緩和する効果が広く知られているため、EMCシールド市場で支配的な手法として位置付けられています。この手法は、敏感な電子部品を保護するために電磁信号の方向転換や吸収が必要な用途で特に有利です。CE製品、通信、自動車、ヘルスケア、航空宇宙などの業界では、電子機器のシームレスな動作を保証するために、放射線ベースのEMCシールドソリューションに大きく依存しています。放射線ベースの手法は、多様な材料に適応できることと、幅広い周波数範囲に対応できることから、さまざまな産業用途の電磁波シールドとして好まれており、市場における優位性と最大シェアを牽引しています。

当レポートでは、世界のEMCシールドおよび試験装置の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 顧客のビジネスに影響を与える動向/ディスラプション

- 価格分析

- 技術分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 関税と規制状況

- 特許分析

- 主な会議とイベント

第6章 EMCシールドおよび試験装置市場:タイプ別

第7章 EMCシールド市場:材料別

- 導電性コーティングおよびペイント

- 導電性ポリマー

- 金属シールド

- EMCフィルター

- EMCフィルター:負荷タイプ別

- EMCフィルター:挿入損失別

- EMCシールドテープ&ラミネート

第8章 EMCシールド市場:手法別

- 放射線

- 伝導

第9章 EMCシールド市場:エンドユーザー産業別

- CE製品

- 電気通信

- 自動車

- ヘルスケア

- 航空宇宙

- その他

第10章 EMC試験装置市場:装置タイプ別

- スペクトラムアナライザー

- EMI受信機

- EMCアンプ

- 静電気放電 (ESD) 発生器

- RF信号発生器

- ネットワークカップリング/デカップリング (CDNS)

- 回線インピーダンス安定化ネットワーク (LISNS)

- その他

第11章 EMC試験手法

- さまざまな種類の試験でのEMC試験装置の使用

- 製品およびコンポーネントのテストにおけるEMC試験装置の重要性

第12章 EMC試験装置市場:エンドユーザー産業別

- CE製品

- 電気通信

- 自動車

- ヘルスケア

- 航空宇宙

- その他

第13章 EMCシールドおよび試験装置市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第14章 競合情勢

- 概要

- 主要企業の採用戦略:概要

- 市場シェア分析

- 企業収益分析

- 企業評価と財務指標

- 製品/ブランドの比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオと動向

第15章 企業プロファイル

- 主要企業

- PARKER HANNIFIN CORP

- PPG INDUSTRIES, INC.

- 3M

- HENKEL AG & CO. KGAA

- AMETEK, INC.

- KEYSIGHT TECHNOLOGIES

- LAIRD TECHNOLOGIES, INC.

- NOLATO AB

- MG CHEMICALS

- ROHDE & SCHWARZ

- その他の企業

- SCHAFFNER HOLDING AG

- KITAGAWA INDUSTRIES CO., LTD.

- LITTELFUSE, INC.

- ESCO TECHNOLOGIES INC.

- LEADER TECH INC.

- TECH ETCH, INC.

- RTP COMPANY

- EAST COAST SHIELDING

- EFFECTIVE SHIELDING CO. INC.

- ATLANTA METAL COATING, INC.

- E-SONG EMC

- HOLLAND SHIELDING SYSTEMS BV

- ICOTEK

- INTEGRATED POLYMER SOLUTIONS

- INTERSTATE SPECIALTY PRODUCTS

- KEMTRON LTD

- MARIAN, INC.

- ENTRIUM CO., LTD

- OMEGA SHIELDING PRODUCTS

- SEAL SCIENCE, INC.

- SPIRA MANUFACTURING

- COM-POWER CORPORATION

- SCHWARZBECK-MESS-ELEKTRONIK

- FISCHER CUSTOM COMMUNICATIONS

- A.H. SYSTEMS, INC.

第16章 付録

The global EMC shielding and test equipment market is expected to be valued at USD 8.4 billion in 2024 and is projected to reach USD 11.3 billion by 2029; it is expected to grow at a CAGR of 6.2% from 2024 to 2029. The global EMC shielding and test equipment market is driven by rapid industrialization, coupled with heightened concerns regarding electromagnetic pollution. As industries undergo rapid expansion and technological advancements, the proliferation of electronic devices leads to increased electromagnetic interference. To mitigate the impact of this interference and ensure the reliability of electronic systems, there is a growing need for robust EMC shielding and test equipment. This demand is further accentuated by the escalating awareness and concerns regarding electromagnetic pollution, urging industries worldwide to invest in comprehensive solutions for electromagnetic compatibility, making the EMC shielding and test equipment market a critical player in maintaining the integrity of electronic components on a global scale.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Material, Test Equipment, Method and Region |

| Regions covered | Asia Pacific, Europe, North America and Rest of the World |

"Based on EMC shielding materials EMC shielding tapes & laminates accounts highest CAGR in the EMC shielding and test equipment market"

EMC Shielding Tapes & Laminates showcase the highest growth rate in the EMC shielding market, primarily due to their exceptional versatility and effectiveness in combating electromagnetic interference (EMI). These materials offer a flexible and adaptable solution for shielding electronic components and systems, making them ideal for various applications. As industries witness a surge in demand for compact and interconnected electronic devices, EMC Shielding Tapes & Laminates provide an efficient and easy-to-implement solution. Their effectiveness in preventing EMI, combined with advancements in tape technologies to ensure superior shielding performance, positions them as key contributors to the rapidly evolving landscape of electromagnetic compatibility solutions. These materials' continuous innovation and adoption across various industries, especially in consumer electronics and telecommunications, drive their remarkable CAGR in the EMC shielding market.

"Radiation method to exhibit highest CAGR in EMC shielding market."

Radiation emerges as the dominant method in the EMC shielding market due to its widespread effectiveness in mitigating electromagnetic interference (EMI). Radiation-based shielding methods involve absorbing or reflecting electromagnetic waves, offering a versatile and reliable solution across a broad spectrum of frequencies. This method is particularly advantageous in applications where electromagnetic signals need redirection or absorption to safeguard sensitive electronic components. Industries such as consumer electronics, telecommunications, automotive, healthcare, and aerospace rely heavily on radiation-based EMC shielding solutions to ensure the seamless operation of electronic devices. The adaptability of radiation-based methods to diverse materials, coupled with their ability to address a wide frequency range, makes them the preferred choice for shielding against electromagnetic interference in various industrial applications, driving their dominance and largest share in the market.

"Automotive end-user industry to exhibit highest growth rate in EMC shielding and test equipment market."

The automotive sector showcases the highest CAGR in the EMC shielding and test equipment market due to the transformative changes in the automotive landscape. As vehicles increasingly rely on electronic components and systems, including advanced driver-assistance systems (ADAS), connectivity features, and electric powertrains, the susceptibility to electromagnetic interference (EMI) rises substantially. Automotive manufacturers are investing significantly in EMC shielding and testing to ensure the reliability and performance of these intricate electronic systems, meeting stringent industry standards and regulations. The growing emphasis on electric vehicles and autonomous driving further amplifies the complexity of electronic systems, reinforcing the demand for robust EMC solutions. With the automotive industry at the forefront of technological innovation, the need for advanced EMC shielding and testing equipment experiences unparalleled growth, contributing to the sector's highest CAGR in the market.

"Asia Pacific region holds for largest share in EMC shielding and test equipment market."

Asia Pacific commands the largest EMC shielding and test equipment market share due to the region's burgeoning electronics manufacturing ecosystem. Countries such as China, Japan, South Korea, and Taiwan are pivotal hubs for consumer electronics, automotive manufacturing, and technological advancements. The rapid expansion of these industries, coupled with the increasing demand for sophisticated electronic devices, propels the need for effective electromagnetic compatibility (EMC) solutions. The region's robust manufacturing infrastructure and the relentless adoption of cutting-edge technologies fuel the demand for EMC shielding and test equipment. Additionally, stringent regulatory requirements drive the integration of EMC solutions across diverse industries. As Asia Pacific remains a global leader in electronics production and innovation, it secures the largest market share in the EMC shielding and test equipment market.

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 26%, Tier 2 - 32%, and Tier 3 - 42%

- By Designation: C-level Executives - 40%, Directors - 30%, and Others - 30%

- By Region: North America - 35%, Europe - 30%, Asia Pacific - 25%, and RoW - 10%

The key players operating in the smart glass market are PARKER HANNIFIN CORP (US), PPG Industries, Inc. (US), 3M (US), Henkel AG & Co. KGaA (Germany), and AMETEK.Inc. (US) among others.

Research Coverage:

The research reports the EMC Shielding and Test Equipment Market, By Type (EMC Shielding, EMC Test Equipment), By End-user Industry (Consumer Electronics, Telecommunications, Automotive, Healthcare, Aerospace, and Others), and Region (North America, Europe, Asia Pacific, and Rest of the world (RoW)). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the smart glass market. A detailed analysis of the key industry players has been done to provide insights into their business overviews, products, key strategies, Contracts, partnerships, and agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the smart glass market. Competitive analysis of upcoming startups in the EMC shielding and test equipment market ecosystem is covered in this report.

Key Benefits of Buying the Report

Analysis of key drivers (Stringent regulations for prevention of malfunctioning in electronic equipment, Increasing demand for compact electronic devices, Increasing adoption of reliable electrical systems with growing consumer electronics industry, Rapid industrialization along with growing concerns over electromagnetic pollution, Integration of smart grid technologies in the energy sector), restraints (High costs of EMI shielding metals coupled with susceptibility to environmental degradation, High cost of EMC test equipment, Low effectiveness of traditional materials used in EMC shielding), opportunities (Rising adoption of electric vehicles to fuel market growth in automotive EMC applications, Increasing adoption of digital healthcare solutions, Need of effective interoperability of connected devices, Increasing technological developments through research and development in EMC test equipment), and challenges (Concerns about signal interference within compact devices, Challenges in meeting complex EMC testing requirements) influencing the growth of the EMC shielding and test equipment market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the smart glass market

- Market Development: Comprehensive information about lucrative markets - the report analyses the smart glass market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the smart glass market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like PARKER HANNIFIN CORP (US), PPG Industries, Inc. (US), 3M (US), Henkel AG & Co. KGaA (Germany), and AMETEK.Inc. (US), among others in the EMC shielding and test equipment market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED

- FIGURE 1 EMC SHIELDING AND TEST EQUIPMENT MARKET: MARKET SEGMENTATION

- 1.3.3 REGIONAL SCOPE

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 EMC SHIELDING AND TEST EQUIPMENT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 List of primary interview participants

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 3 EMC SHIELDING AND TEST EQUIPMENT MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- FIGURE 5 EMC SHIELDING AND TEST EQUIPMENT MARKET: TOP-DOWN APPROACH

- FIGURE 6 EMC SHIELDING AND TEST EQUIPMENT MARKET: SUPPLY-SIDE ANALYSIS

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 EMC SHIELDING AND TEST EQUIPMENT MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 8 EMC SHIELDING AND TEST EQUIPMENT MARKET: RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- FIGURE 9 EMC SHIELDING AND TEST EQUIPMENT MARKET: RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

- TABLE 1 EMC SHIELDING AND TEST EQUIPMENT MARKET: RISK ASSESSMENT

- 2.7 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON EMC SHIELDING AND TEST EQUIPMENT MARKET

- TABLE 2 EMC SHIELDING AND TEST EQUIPMENT MARKET: PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON EMC SHIELDING AND TEST EQUIPMENT MARKET

3 EXECUTIVE SUMMARY

- FIGURE 10 EMC SHIELDING SEGMENT TO ACCOUNT FOR LARGER SHARE OF EMC SHIELDING AND TEST EQUIPMENT MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 11 CONDUCTIVE POLYMERS SEGMENT TO CAPTURE LARGEST SHARE OF EMC SHIELDING MARKET IN 2029

- FIGURE 12 RADIATION SEGMENT TO ACCOUNT FOR LARGER SHARE OF EMC SHIELDING MARKET IN 2029

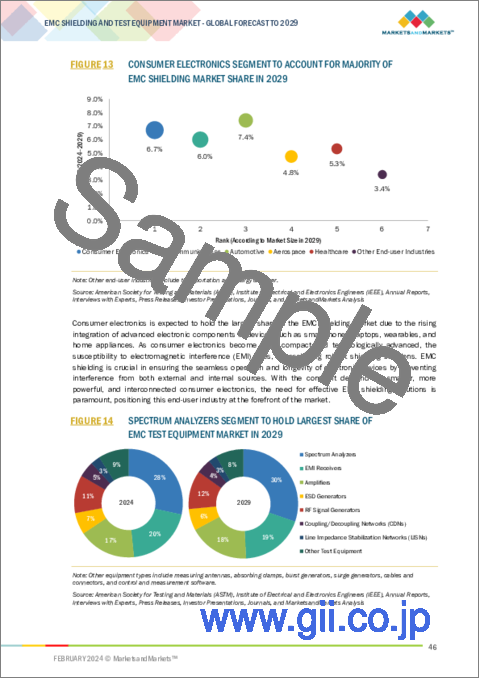

- FIGURE 13 CONSUMER ELECTRONICS SEGMENT TO ACCOUNT FOR MAJORITY OF EMC SHIELDING MARKET SHARE IN 2029

- FIGURE 14 SPECTRUM ANALYZERS SEGMENT TO HOLD LARGEST SHARE OF EMC TEST EQUIPMENT MARKET IN 2029

- FIGURE 15 ASIA PACIFIC HELD LARGEST SHARE OF EMC SHIELDING AND TEST EQUIPMENT MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EMC SHIELDING AND TEST EQUIPMENT MARKET

- FIGURE 16 RISING ADOPTION OF ADVANCED EMC SOLUTIONS BY CONSUMER ELECTRONICS COMPANIES TO CREATE SIGNIFICANT GROWTH OPPORTUNITIES FOR MARKET PLAYERS

- 4.2 EMC SHIELDING MARKET IN ASIA PACIFIC, BY COUNTRY AND END-USER INDUSTRY

- FIGURE 17 CHINA AND CONSUMER ELECTRONICS TO HOLD LARGEST SHARES OF EMC SHIELDING MARKET IN ASIA PACIFIC IN 2024

- 4.3 EMC SHIELDING MARKET, BY MATERIAL

- FIGURE 18 CONDUCTIVE POLYMERS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- 4.4 EMC SHIELDING AND TEST EQUIPMENT MARKET, BY REGION

- FIGURE 19 INDIA TO RECORD HIGHEST CAGR IN EMC SHIELDING AND TEST EQUIPMENT MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 EMC SHIELDING AND TEST EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 21 EMC SHIELDING AND TEST EQUIPMENT MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.1.1 Stringent regulations to ensure reliable performance of electronic equipment

- 5.2.1.2 Elevating demand for compact and wireless electronic devices

- 5.2.1.3 Increasing electromagnetic pollution with rapid industrialization

- 5.2.1.4 Growing deployment of smart grids in energy sector

- 5.2.2 RESTRAINTS

- FIGURE 22 EMC SHIELDING AND TEST EQUIPMENT MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.2.1 High cost of EMC shielding solutions and test equipment

- 5.2.2.2 Limitations of traditional EMC shielding solutions

- 5.2.3 OPPORTUNITIES

- FIGURE 23 EMC SHIELDING AND TEST EQUIPMENT MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.3.1 Rising adoption of electric vehicles

- 5.2.3.2 Increasing demand for digital healthcare solutions

- 5.2.3.3 Growing demand for interoperability in connected devices and networks

- 5.2.3.4 Constant technological developments through investments in R&D activities

- 5.2.4 CHALLENGES

- FIGURE 24 EMC SHIELDING AND TEST EQUIPMENT MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.2.4.1 Difficulties in meeting complex EMC testing requirements

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 25 EMC SHIELDING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 EMC TEST EQUIPMENT MARKET: VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 27 EMC SHIELDING AND TEST EQUIPMENT ECOSYSTEM

- TABLE 3 COMPANIES AND THEIR ROLES IN EMC SHIELDING AND TEST EQUIPMENT ECOSYSTEM

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 EMC SHIELDING AND TEST EQUIPMENT MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND

- FIGURE 29 AVERAGE SELLING PRICE OF EMC SHIELDING TAPES PROVIDED BY THREE KEY PLAYERS, BY THICKNESS (USD)

- TABLE 4 AVERAGE SELLING PRICE OF EMC SHIELDING TAPES PROVIDED BY THREE KEY PLAYERS, BY THICKNESS (USD)

- TABLE 5 AVERAGE SELLING PRICE OF EMC SHIELDING SOLUTIONS, BY MATERIAL (USD)

- TABLE 6 AVERAGE SELLING PRICE OF CONDUCTIVE COATINGS & PAINTS PER GALLON, BY TYPE (USD)

- FIGURE 30 AVERAGE SELLING PRICE TREND, BY REGION (USD)

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Conductive materials

- 5.7.1.2 Ferrites and magnetic materials

- 5.7.1.3 EMC test chambers

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Antenna design and placement

- 5.7.2.2 EMC simulation software

- 5.7.2.3 Nanotechnology

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 IoT and sensor

- 5.7.3.2 5G

- FIGURE 31 5G INFRASTRUCTURE VALUE CHAIN ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 EMC SHIELDING AND TEST EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 EMC SHIELDING AND TEST EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.8.2 BARGAINING POWER OF SUPPLIERS

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 THREAT OF NEW ENTRANTS

- 5.8.5 THREAT OF SUBSTITUTES

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRIES

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRIES

- 5.9.2 BUYING CRITERIA

- FIGURE 34 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- TABLE 9 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 PARKER CHOMERICS OFFERED CUSTOM FOIL/FILM SHIELDING SOLUTION TO DESKTOP COMPUTER PROVIDER FOR MECHANICAL AND EMI PROTECTION

- 5.10.2 SSD POLYMERS UTILIZED CONDUCTIVE ELASTOMER GASKETS TO ENHANCE EFFECTIVENESS OF EMI SHIELDING SOLUTION

- 5.10.3 PARKER CHOMERICS CREATED EMI-SHIELDED AIR VENTS TAILORED FOR MILITARY RADAR SYSTEM MANUFACTURERS

- 5.10.4 HPE REDUCED TROUBLESHOOTING TIME BY ADOPTING ADVANCED EMC TESTING SOLUTIONS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO

- FIGURE 35 IMPORT DATA FOR HS CODE 853630-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.11.2 EXPORT SCENARIO

- FIGURE 36 EXPORT DATA FOR HS CODE 853630-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF ANALYSIS

- TABLE 10 MFN TARIFF FOR HS CODE 853630-COMPLIANT PRODUCTS EXPORTED BY JAPAN

- TABLE 11 MFN TARIFF FOR HS CODE 853630-COMPLIANT PRODUCTS EXPORTED BY CHINA

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.3 STANDARDS

- TABLE 16 NORTH AMERICA: LIST OF STANDARDS

- TABLE 17 EUROPE: LIST OF STANDARDS

- 5.13 PATENT ANALYSIS

- FIGURE 37 EMC SHIELDING AND TEST EQUIPMENT MARKET: PATENTS APPLIED AND GRANTED, 2013-2022

- TABLE 18 EMC SHIELDING AND TEST EQUIPMENT MARKET: LIST OF PATENTS, 2020-2023

- 5.14 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 19 EMC SHIELDING AND TEST EQUIPMENT MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

6 EMC SHIELDING AND TEST EQUIPMENT MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 38 EMC SHIELDING TO DOMINATE EMC SHIELDING AND TEST EQUIPMENT MARKET DURING FORECAST PERIOD

- TABLE 20 EMC SHIELDING AND TEST EQUIPMENT MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 21 EMC SHIELDING AND TEST EQUIPMENT MARKET, BY TYPE, 2024-2029 (USD MILLION)

7 EMC SHIELDING MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- FIGURE 39 EMC SHIELDING MARKET, BY MATERIAL

- FIGURE 40 EMC SHIELDING TAPES & LAMINATES SEGMENT TO WITNESS HIGHEST CAGR IN EMC SHIELDING MARKET, BY MATERIAL, DURING FORECAST PERIOD

- TABLE 22 EMC SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 23 EMC SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 24 EMC SHIELDING MARKET FOR EMC SHIELDING TAPES, 2020-2023 (MILLION UNITS)

- TABLE 25 EMC SHIELDING MARKET FOR EMC SHIELDING TAPES & LAMINATES, 2024-2029 (MILLION UNITS)

- 7.2 CONDUCTIVE COATINGS & PAINTS

- 7.2.1 SURGING NEED FOR COMPACT ELECTRONIC DEVICES TO ACCELERATE SEGMENTAL GROWTH

- TABLE 26 CONDUCTIVE COATINGS & PAINTS: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 27 CONDUCTIVE COATINGS & PAINTS: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- FIGURE 41 FILLERS & BINDERS USED IN CONDUCTIVE COATINGS

- 7.3 CONDUCTIVE POLYMERS

- TABLE 28 SHELF LIFE OF CONDUCTIVE ELASTOMERS

- TABLE 29 CONDUCTIVE POLYMERS: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 30 CONDUCTIVE POLYMERS: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 7.3.1 CONDUCTIVE POLYMERS, BY TYPE

- TABLE 31 CONDUCTIVE POLYMERS: EMC SHIELDING MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 32 CONDUCTIVE POLYMERS: EMC SHIELDING MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 33 SHIELDING RANGE OF CONDUCTIVE POLYMERS, BY TYPE

- 7.3.1.1 Conductive elastomers

- TABLE 34 CONDUCTIVE POLYMERS: EMC SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 35 CONDUCTIVE POLYMERS: EMC SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 7.3.1.1.1 Conductive elastomers, by chemistry

- TABLE 36 CONDUCTIVE POLYMERS: EMC SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2020-2023 (USD MILLION)

- TABLE 37 CONDUCTIVE POLYMERS: EMC SHIELDING MARKET FOR CONDUCTIVE ELASTOMERS, BY CHEMISTRY, 2024-2029 (USD MILLION)

- 7.3.1.1.1.1 Silicone & fluorosilicone

- 7.3.1.1.1.2 EPDM rubber

- 7.3.1.2 Conductive plastics

- TABLE 38 CONDUCTIVE POLYMERS: EMC SHIELDING MARKET FOR CONDUCTIVE PLASTICS, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 39 CONDUCTIVE POLYMERS: EMC SHIELDING MARKET FOR CONDUCTIVE PLASTICS, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 7.4 METAL SHIELDING

- 7.4.1 GROWING DEMAND FROM AEROSPACE, DEFENSE, TELECOMMUNICATIONS, AUTOMOTIVE, AND MEDICAL DEVICES TO CONTRIBUTE TO MARKET GROWTH

- TABLE 40 METAL SHIELDING: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 41 METAL SHIELDING: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 7.5 EMC FILTERS

- TABLE 42 EMC FILTERS: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 43 EMC FILTERS: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- FIGURE 42 CLASSIFICATION OF EMC FILTERS

- 7.5.1 EMC FILTERS, BY LOAD TYPE

- TABLE 44 EMC FILTERS: EMC SHIELDING MARKET, BY LOAD TYPE, 2020-2023 (USD MILLION)

- TABLE 45 EMC FILTERS: EMC SHIELDING MARKET, BY LOAD TYPE, 2024-2029 (USD MILLION)

- 7.5.1.1 AC

- TABLE 46 EMC SHIELDING MARKET FOR AC EMC FILTERS, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 47 EMC SHIELDING MARKET FOR AC EMC FILTERS, BY TYPE, 2024-2029 (USD MILLION)

- 7.5.1.1.1 Single-phase

- 7.5.1.1.1.1 Integration into power supplies and test and measurement equipment to foster segmental growth

- 7.5.1.1.2 Three-phase

- 7.5.1.1.2.1 Deployment in HVAC systems, medical equipment, and industrial automation equipment to fuel market growth

- 7.5.1.2 DC

- 7.5.1.2.1 Rising demand for photovoltaic systems to drive market

- 7.5.1.1.1 Single-phase

- 7.5.2 EMC FILTERS, BY INSERTION LOSS

- TABLE 48 EMC FILTERS: EMC SHIELDING MARKET, BY INSERTION LOSS, 2020-2023 (USD MILLION)

- TABLE 49 EMC FILTERS: EMC SHIELDING MARKET, BY INSERTION LOSS, 2024-2029 (USD MILLION)

- 7.5.2.1 Common-mode

- 7.5.2.1.1 Implementation in high-speed data transmission applications to fuel market growth

- 7.5.2.2 Differential-mode

- 7.5.2.2.1 Integration of X-capacitors into EMC filters to mitigate differential-mode EMI to drive market

- 7.5.2.1 Common-mode

- 7.6 EMC SHIELDING TAPES & LAMINATES

- 7.6.1 ELEVATING DEMAND FROM CONSUMER ELECTRONICS COMPANIES TO STIMULATE MARKET GROWTH

- TABLE 50 EMC SHIELDING TAPES & LAMINATES: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 51 EMC SHIELDING TAPES & LAMINATES: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

8 EMC SHIELDING MARKET, BY METHOD

- 8.1 INTRODUCTION

- FIGURE 43 EMC SHIELDING MARKET, BY METHOD

- FIGURE 44 RADIATION SEGMENT TO ACCOUNT FOR LARGER SHARE OF EMC SHIELDING MARKET, BY METHOD, THROUGHOUT FORECAST PERIOD

- TABLE 52 EMC SHIELDING MARKET, BY METHOD, 2020-2023 (USD MILLION)

- TABLE 53 EMC SHIELDING MARKET, BY METHOD, 2024-2029 (USD MILLION)

- 8.2 RADIATION

- 8.2.1 INCREASING FOCUS ON SAFEGUARDING CONSUMER ELECTRONICS AND HEALTHCARE EQUIPMENT FROM HARMFUL EMI RADIATION TO DRIVE MARKET

- 8.3 CONDUCTION

- 8.3.1 GROWING RISK OF CONDUCTED EMI WITH RISING ADOPTION OF SWITCH-MODE POWER SUPPLIES ACROSS INDUSTRIES TO BOOST DEMAND FOR EMC FILTERS

9 EMC SHIELDING MARKET, BY END-USER INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 45 AUTOMOTIVE INDUSTRY TO EXHIBIT HIGHEST CAGR IN EMC SHIELDING MARKET DURING FORECAST PERIOD

- TABLE 54 EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 55 EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 9.2 CONSUMER ELECTRONICS

- 9.2.1 INTEGRATION OF ADVANCED SENSOR TECHNOLOGIES IN CONSUMER ELECTRONICS TO DRIVE MARKET

- TABLE 56 CONSUMER ELECTRONICS: EMC SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 57 CONSUMER ELECTRONICS: EMC SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 58 CONSUMER ELECTRONICS: EMC SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 59 CONSUMER ELECTRONICS: EMC SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 60 CONSUMER ELECTRONICS: EMC SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 61 CONSUMER ELECTRONICS: EMC SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3 TELECOMMUNICATIONS

- 9.3.1 RAPID ADVANCEMENTS IN WIRELESS COMMUNICATION TECHNOLOGIES TO BOOST DEMAND

- TABLE 62 TELECOMMUNICATIONS: EMC SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 63 TELECOMMUNICATIONS: EMC SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 64 TELECOMMUNICATIONS: EMC SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 65 TELECOMMUNICATIONS: EMC SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 66 TELECOMMUNICATIONS: EMC SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 67 TELECOMMUNICATIONS: EMC SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4 AUTOMOTIVE

- 9.4.1 SUBSTANTIAL INVESTMENTS IN EV PROJECTS BY GOVERNMENTS WORLDWIDE TO FOSTER MARKET GROWTH

- TABLE 68 AUTOMOTIVE: EMC SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 69 AUTOMOTIVE: EMC SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 70 AUTOMOTIVE: EMC SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 71 AUTOMOTIVE: EMC SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 72 AUTOMOTIVE: EMC SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 73 AUTOMOTIVE: EMC SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.5 HEALTHCARE

- 9.5.1 STRINGENT REGULATIONS TO ENSURE SMOOTH OPERATION AND RELIABILITY OF MEDICAL DEVICES TO DRIVE MARKET

- TABLE 74 HEALTHCARE: EMC SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 75 HEALTHCARE: EMC SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 76 HEALTHCARE: EMC SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 77 HEALTHCARE: EMC SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 78 HEALTHCARE: EMC SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 79 HEALTHCARE: EMC SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.6 AEROSPACE

- 9.6.1 NEED FOR EFFECTIVE COMMUNICATION AND DATA MANAGEMENT SYSTEMS FOR SMOOTH AIRCRAFT OPERATIONS TO FUEL MARKET GROWTH

- TABLE 80 AEROSPACE: EMC SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 81 AEROSPACE: EMC SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 82 AEROSPACE: EMC SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 83 AEROSPACE: EMC SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 84 AEROSPACE: EMC SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 85 AEROSPACE: EMC SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.7 OTHER END-USER INDUSTRIES

- TABLE 86 OTHER END-USER INDUSTRIES: EMC SHIELDING MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 87 OTHER END-USER INDUSTRIES: EMC SHIELDING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 88 OTHER END-USER INDUSTRIES: EMC SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 89 OTHER END-USER INDUSTRIES: EMC SHIELDING MARKET FOR CONDUCTIVE POLYMERS, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 90 OTHER END-USER INDUSTRIES: EMC SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 91 OTHER END-USER INDUSTRIES: EMC SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

10 EMC TEST EQUIPMENT MARKET, EQUIPMENT TYPE

- 10.1 INTRODUCTION

- FIGURE 46 SPECTRUM ANALYZERS TO DOMINATE EMC TEST EQUIPMENT MARKET THROUGHOUT FORECAST PERIOD

- TABLE 92 EMC TEST EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020-2023 (USD MILLION)

- TABLE 93 EMC TEST EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024-2029 (USD MILLION)

- 10.2 SPECTRUM ANALYZERS

- 10.2.1 INCREASING COMPLEXITY OF ELECTRONIC DEVICES AND RISING USE OF WIRELESS TECHNOLOGIES TO DRIVE MARKET

- 10.3 EMI RECEIVERS

- 10.3.1 SURGING USE OF CONDUCTED AND RADIATED EMISSION TESTING TO CREATE LUCRATIVE OPPORTUNITIES FOR EMC TEST EQUIPMENT PROVIDERS

- 10.4 EMC AMPLIFIERS

- 10.4.1 GROWING DEMAND FOR EMC AMPLIFIERS WITH HIGH OUTPUT POWER AND LOW NOISE AND LINEARITY TO DRIVE MARKET

- 10.5 ELECTROSTATIC DISCHARGE (ESD) GENERATORS

- 10.5.1 INCREASING FOCUS ON MITIGATING IMPACT OF ELECTROSTATIC DISCHARGES ON ELECTRONIC DEVICES TO BOOST DEMAND

- 10.6 RF SIGNAL GENERATORS

- 10.6.1 GROWING IMPORTANCE OF GENERATING PRECISE AND CONSISTENT FREQUENCY SIGNALS IN EMC TESTING TO INCREASE DEMAND

- 10.7 COUPLING/DECOUPLING NETWORKS (CDNS)

- 10.7.1 RISING USE OF CDNS IN EMC IMMUNITY TESTING TO FUEL MARKET GROWTH

- 10.8 LINE IMPEDANCE STABILIZATION NETWORKS (LISNS)

- 10.8.1 INCREASING DEMAND FOR CONDUCTED EMISSION TESTING TO PROPEL MARKET GROWTH

- 10.9 OTHER EQUIPMENT TYPES

11 EMC TESTING METHODS

- 11.1 INTRODUCTION

- FIGURE 47 EMC TESTING METHODS

- 11.2 USE OF EMC TEST EQUIPMENT IN DIFFERENT TYPES OF TESTING

- 11.2.1 EMC EMISSIONS AND IMMUNITY TESTING

- FIGURE 48 TESTING METHODS IN EMC TESTING

- 11.2.2 ELECTROSTATIC DISCHARGE TESTING

- FIGURE 49 COMMON MODELS OF ESD TESTING

- TABLE 94 DIFFERENCES BETWEEN ESD TESTING MODELS

- 11.2.3 CONDUCTED IMMUNITY TESTING

- 11.2.4 RADIOFREQUENCY COMPATIBILITY TESTING

- 11.3 IMPORTANCE OF EMC TEST EQUIPMENT IN PRODUCT AND COMPONENT TESTING

- 11.3.1 INTRODUCTION

- 11.3.2 PRODUCT TESTING

- 11.3.3 COMPONENT TESTING

12 EMC TEST EQUIPMENT MARKET, BY END-USER INDUSTRY

- 12.1 INTRODUCTION

- FIGURE 50 TELECOMMUNICATIONS INDUSTRY TO HOLD LARGEST SHARE OF EMC TEST EQUIPMENT MARKET THROUGHOUT FORECAST PERIOD

- TABLE 95 EMC TEST EQUIPMENT MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 96 EMC TEST EQUIPMENT MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 12.2 CONSUMER ELECTRONICS

- 12.2.1 INCREASING FOCUS ON ELECTRICAL SAFETY OF ELECTRONIC PRODUCTS TO PROPEL MARKET GROWTH

- TABLE 97 CONSUMER ELECTRONICS: EMC TEST EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 98 CONSUMER ELECTRONICS: EMC TEST EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 12.3 TELECOMMUNICATIONS

- 12.3.1 ROLLOUT OF 5G PILOT PROJECTS TO CREATE NEED FOR EMC TESTING

- TABLE 99 TELECOMMUNICATIONS: EMC TEST EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 100 TELECOMMUNICATIONS: EMC TEST EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 12.4 AUTOMOTIVE

- 12.4.1 DEPLOYMENT OF ADVANCED ELECTRONIC SYSTEMS IN SPORTS UTILITY VEHICLES TO ACCELERATE MARKET GROWTH

- TABLE 101 AUTOMOTIVE: EMC TEST EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 102 AUTOMOTIVE: EMC TEST EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 12.5 HEALTHCARE

- 12.5.1 STRINGENT SAFETY AND PERFORMANCE STANDARDS IN US, EUROPE, AND AUSTRALIA FOR MEDICAL DEVICES TO CONTRIBUTE TO MARKET GROWTH

- TABLE 103 HEALTHCARE: EMC TEST EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 104 HEALTHCARE: EMC TEST EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 12.6 AEROSPACE

- 12.6.1 SURGING DEMAND FOR HIGH-PERFORMANCE AND RELIABLE AVIONICS SYSTEMS TO DRIVE MARKET

- TABLE 105 AEROSPACE: EMC TEST EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 106 AEROSPACE: EMC TEST EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 12.7 OTHER END-USER INDUSTRIES

- TABLE 107 OTHER END-USER INDUSTRIES: EMC TEST EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 108 OTHER END-USER INDUSTRIES: EMC TEST EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

13 EMC SHIELDING AND TEST EQUIPMENT MARKET, BY REGION

- 13.1 INTRODUCTION

- FIGURE 51 ASIA PACIFIC TO LEAD EMC SHIELDING AND TEST EQUIPMENT MARKET DURING FORECAST PERIOD

- TABLE 109 EMC SHIELDING AND TEST EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 110 EMC SHIELDING AND TEST EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 111 EMC SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 112 EMC SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 113 EMC TEST EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 114 EMC TEST EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- 13.2 NORTH AMERICA

- FIGURE 52 NORTH AMERICA: EMC SHIELDING AND TEST EQUIPMENT MARKET SNAPSHOT

- TABLE 115 NORTH AMERICA: EMC SHIELDING AND TEST EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 116 NORTH AMERICA: EMC SHIELDING AND TEST EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 117 NORTH AMERICA: EMC SHIELDING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 118 NORTH AMERICA: EMC SHIELDING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 119 NORTH AMERICA: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 120 NORTH AMERICA: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 121 NORTH AMERICA: EMC TEST EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 122 NORTH AMERICA: EMC TEST EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 123 NORTH AMERICA: EMC TEST EQUIPMENT MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 124 NORTH AMERICA: EMC TEST EQUIPMENT MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 13.2.1 US

- 13.2.1.1 Constant flow of product innovations due to ongoing investments in R&D activities to boost demand

- 13.2.2 CANADA

- 13.2.2.1 Booming automotive industry to drive market

- 13.2.3 MEXICO

- 13.2.3.1 Heavy investments by automobile companies in establishing manufacturing and assembly plants to fuel market growth

- 13.2.4 RECESSION IMPACT ON MARKET IN NORTH AMERICA

- 13.3 EUROPE

- FIGURE 53 EUROPE: EMC SHIELDING AND TEST EQUIPMENT MARKET SNAPSHOT

- TABLE 125 EUROPE: EMC SHIELDING AND TEST EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 126 EUROPE: EMC SHIELDING AND TEST EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 127 EUROPE: EMC SHIELDING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 128 EUROPE: EMC SHIELDING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 129 EUROPE: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 130 EUROPE: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 131 EUROPE: EMC TEST EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 132 EUROPE: EMC TEST EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 133 EUROPE: EMC TEST EQUIPMENT MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 134 EUROPE: EMC TEST EQUIPMENT MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 13.3.1 FRANCE

- 13.3.1.1 Thriving aviation industry to foster market growth

- 13.3.2 GERMANY

- 13.3.2.1 Prominent presence of well-known automobile brands such as BMW and Audi to fuel market growth

- 13.3.3 UK

- 13.3.3.1 Rising adoption of electric and plug-in hybrid vehicles to stimulate market growth

- 13.3.4 REST OF EUROPE

- 13.3.5 RECESSION IMPACT ON MARKET IN EUROPE

- 13.4 ASIA PACIFIC

- FIGURE 54 ASIA PACIFIC: EMC SHIELDING AND TEST EQUIPMENT MARKET SNAPSHOT

- TABLE 135 ASIA PACIFIC: EMC SHIELDING AND TEST EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 136 ASIA PACIFIC: EMC SHIELDING AND TEST EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 137 ASIA PACIFIC: EMC SHIELDING MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 138 ASIA PACIFIC: EMC SHIELDING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 139 ASIA PACIFIC: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 140 ASIA PACIFIC: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 141 ASIA PACIFIC: EMC TEST EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 142 ASIA PACIFIC: EMC TEST EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 143 ASIA PACIFIC: EMC TEST EQUIPMENT MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 144 ASIA PACIFIC: EMC TEST EQUIPMENT MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 13.4.1 CHINA

- 13.4.1.1 Significant increase in automobile production to foster market growth

- 13.4.2 JAPAN

- 13.4.2.1 Growing use of automation and robotics by automotive, manufacturing, and aerospace companies to create opportunities for market players

- 13.4.3 INDIA

- 13.4.3.1 Implementation of e-health and e-governance projects to boost demand

- 13.4.4 REST OF ASIA PACIFIC

- 13.4.5 RECESSION IMPACT ON MARKET IN ASIA PACIFIC

- 13.5 ROW

- TABLE 145 ROW: EMC SHIELDING AND TEST EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 146 ROW: EMC SHIELDING AND TEST EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 147 ROW: EMC SHIELDING MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 148 ROW: EMC SHIELDING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 149 ROW: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 150 ROW: EMC SHIELDING MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 151 ROW: EMC TEST EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 152 ROW: EMC TEST EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 153 ROW: EMC TEST EQUIPMENT MARKET, BY END-USER INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 154 ROW: EMC TEST EQUIPMENT MARKET, BY END-USER INDUSTRY, 2024-2029 (USD MILLION)

- 13.5.1 MIDDLE EAST & AFRICA

- 13.5.1.1 Growing focus on improving telecommunications infrastructure to drive market

- 13.5.2 SOUTH AMERICA

- 13.5.2.1 Rapidly growing consumer electronics and telecom industries to propel market growth

- 13.5.3 RECESSION IMPACT ON MARKET IN ROW

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2023

- TABLE 155 EMC SHIELDING AND TEST EQUIPMENT MARKET: STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2023

- 14.3 MARKET SHARE ANALYSIS, 2023

- FIGURE 55 EMC SHIELDING AND TEST EQUIPMENT MARKET SHARE ANALYSIS, 2023

- TABLE 156 EMC SHIELDING AND TEST EQUIPMENT MARKET: DEGREE OF COMPETITION, 2023

- 14.4 COMPANY REVENUE ANALYSIS, 2018-2022

- FIGURE 56 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2018-2022

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 57 COMPANY VALUATION, 2022 (USD BILLION)

- FIGURE 58 FINANCIAL METRICS (EV/EBITDA), 2022

- 14.6 PRODUCT/BRAND COMPARISON

- FIGURE 59 PRODUCT/BRAND COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- FIGURE 60 EMC SHIELDING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 14.7.5.1 Company footprint (20 key players)

- FIGURE 61 COMPANY FOOTPRINT (20 KEY PLAYERS)

- 14.7.5.2 Region footprint (20 key players)

- TABLE 157 REGION FOOTPRINT (20 KEY PLAYERS)

- 14.7.5.3 Material footprint (20 key players)

- TABLE 158 MATERIAL FOOTPRINT (20 KEY PLAYERS)

- 14.7.5.4 End-user industry footprint (20 key players)

- TABLE 159 END-USER INDUSTRY FOOTPRINT (20 KEY PLAYERS)

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- FIGURE 62 EMC SHIELDING MARKET: COMPANY EVALUATION MATRIX (STARTUS/SMES EVALUATION MATRIX), 2023

- 14.8.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2023

- 14.8.5.1 Detailed list of startups/SMEs

- TABLE 160 EMC SHIELDING MARKET: LIST OF KEY STARTUPS/SMES

- 14.8.5.2 Competitive benchmarking of startups/SMEs.

- TABLE 161 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 14.9 COMPETITIVE SCENARIOS AND TRENDS

- 14.9.1 PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 162 EMC SHIELDING AND TEST EQUIPMENT MARKET: PRODUCT LAUNCHES, JANUARY 2020-DECEMBER 2023

- 14.9.2 DEALS

- TABLE 163 EMC SHIELDING AND TEST EQUIPMENT MARKET: DEALS, JANUARY 2020-DECEMBER 2023

- 14.9.3 EXPANSIONS

- TABLE 164 EMC SHIELDING AND TEST EQUIPMENT MARKET: EXPANSIONS, JANUARY 2020-DECEMBER 2023

- 14.9.4 OTHERS

- TABLE 165 EMC SHIELDING AND TEST EQUIPMENT MARKET: OTHERS, JANUARY 2020-DECEMBER 2023

15 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 15.1 KEY PLAYERS

- 15.1.1 PARKER HANNIFIN CORP

- TABLE 166 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- FIGURE 63 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- TABLE 167 PARKER HANNIFIN CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 PARKER HANNIFIN CORP: PRODUCT LAUNCHES

- 15.1.2 PPG INDUSTRIES, INC.

- TABLE 169 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 64 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 170 PPG INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 PPG INDUSTRIES, INC.: DEALS

- TABLE 172 PPG INDUSTRIES, INC.: EXPANSIONS

- TABLE 173 PPG INDUSTRIES, INC.: OTHERS

- 15.1.3 3M

- TABLE 174 3M: COMPANY OVERVIEW

- FIGURE 65 3M: COMPANY SNAPSHOT

- TABLE 175 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.1.4 HENKEL AG & CO. KGAA

- TABLE 176 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- FIGURE 66 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- TABLE 177 HENKEL AG & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 HENKEL AG & CO. KGAA: PRODUCT LAUNCHES

- TABLE 179 HENKEL AG & CO. KGAA: EXPANSIONS

- 15.1.5 AMETEK, INC.

- TABLE 180 AMETEK, INC.: COMPANY OVERVIEW

- FIGURE 67 AMETEK, INC.: COMPANY SNAPSHOT

- TABLE 181 AMETEK, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 AMETEK, INC.: PRODUCT LAUNCHES

- TABLE 183 AMETEK, INC.: EXPANSIONS

- 15.1.6 KEYSIGHT TECHNOLOGIES

- TABLE 184 KEYSIGHT TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 68 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 185 KEYSIGHT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 KEYSIGHT TECHNOLOGIES: EXPANSIONS

- 15.1.7 LAIRD TECHNOLOGIES, INC.

- TABLE 187 LAIRD TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 188 LAIRD TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 LAIRD TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 190 LAIRD TECHNOLOGIES, INC.: DEALS

- 15.1.8 NOLATO AB

- TABLE 191 NOLATO AB: COMPANY OVERVIEW

- FIGURE 69 NOLATO AB: COMPANY SNAPSHOT

- TABLE 192 NOLATO AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 NOLATO AB: DEALS

- TABLE 194 NOLATO AB: OTHERS

- 15.1.9 MG CHEMICALS

- TABLE 195 MG CHEMICALS: COMPANY OVERVIEW

- TABLE 196 MG CHEMICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 15.1.10 ROHDE & SCHWARZ

- TABLE 197 ROHDE & SCHWARZ: COMPANY OVERVIEW

- FIGURE 70 ROHDE & SCHWARZ: COMPANY SNAPSHOT

- TABLE 198 ROHDE & SCHWARZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 ROHDE & SCHWARZ: PRODUCT LAUNCHES

- TABLE 200 ROHDE & SCHWARZ: DEALS

- 15.2 OTHER PLAYERS

- 15.2.1 SCHAFFNER HOLDING AG

- 15.2.2 KITAGAWA INDUSTRIES CO., LTD.

- 15.2.3 LITTELFUSE, INC.

- 15.2.4 ESCO TECHNOLOGIES INC.

- 15.2.5 LEADER TECH INC.

- 15.2.6 TECH ETCH, INC.

- 15.2.7 RTP COMPANY

- 15.2.8 EAST COAST SHIELDING

- 15.2.9 EFFECTIVE SHIELDING CO. INC.

- 15.2.10 ATLANTA METAL COATING, INC.

- 15.2.11 E-SONG EMC

- 15.2.12 HOLLAND SHIELDING SYSTEMS BV

- 15.2.13 ICOTEK

- 15.2.14 INTEGRATED POLYMER SOLUTIONS

- 15.2.15 INTERSTATE SPECIALTY PRODUCTS

- 15.2.16 KEMTRON LTD

- 15.2.17 MARIAN, INC.

- 15.2.18 ENTRIUM CO., LTD

- 15.2.19 OMEGA SHIELDING PRODUCTS

- 15.2.20 SEAL SCIENCE, INC.

- 15.2.21 SPIRA MANUFACTURING

- 15.2.22 COM-POWER CORPORATION

- 15.2.23 SCHWARZBECK - MESS-ELEKTRONIK

- 15.2.24 FISCHER CUSTOM COMMUNICATIONS

- 15.2.25 A.H. SYSTEMS, INC.

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS