|

|

市場調査レポート

商品コード

1432257

網状フォームの世界市場:タイプ別、気孔率別、用途別、地域別-2028年までの予測Reticulated Foam Market by Type, Porosity, Application, and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 網状フォームの世界市場:タイプ別、気孔率別、用途別、地域別-2028年までの予測 |

|

出版日: 2024年02月16日

発行: MarketsandMarkets

ページ情報: 英文 178 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の網状フォームの市場規模は、2023年の5億600万米ドルから2028年には6,830億米ドルに拡大し、2023年から2028年までのCAGRは6.2%になると予測されています。

空気の質が重視されるようになったことで、室内の空気質の改善に貢献するろ過機能で知られる網状フォームの需要が高まっています。同時に、耐久性のある屋外用家具を求める動向の高まりは、網状フォームの弾力性と一致し、屋外用途での採用を促進しています。これらの2つの要因が、網状フォーム市場の成長を促進する主な要因となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 単位 | 金額(100万米ドル/10億米ドル)、数量(トン) |

| セグメント | タイプ別、気孔率別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

濾過セグメントは、フォームのユニークなオープンセル構造により、2022年に網状フォーム業界で最大のシェアを占めました。網状フォームの高い気孔率と通気性により、空気や液体のろ過に非常に効果的です。多様な濾過要件への適応性とカスタマイズ能力により、様々な産業で好まれる選択肢となっており、網状フォーム市場の濾過分野での優位性を牽引しています。

網状ポリエーテルフォーム発泡体セグメントは、高い気孔率、柔軟性、弾力性などの優れた特質により、量的に最大になると予想されています。これらの特性により、濾過や吸音など様々な用途に使用できるため、自動車、ヘルスケア、エレクトロニクスなど多様な産業で普及しています。網状化プロセスの効率性は、市場での優位性をさらに強固なものにしています。

用途別では、主にこのフォームの特徴的なオープンセル構造のため、ろ過分野が2022年の網状フォーム市場で数量ベースで最大のシェアを占めると推定されます。網状フォーム固有の特徴である高い気孔率や通気性は、空気や液体のろ過に非常に適しています。汎用性が高く、特定のろ過ニーズに合わせてカスタマイズできることから、さまざまな産業で選ばれています。これらの要因が、網状フォーム市場における濾過用途の支配的な地位につながっています。

アジア太平洋は、人口動態の変化、自動車産業とヘルスケア支出の増加により、網状フォームにとって魅力的な市場となっています。Sheela Foam LimitedやArjun Enterprisesのような業界の主要企業は、アジア太平洋地域に製造工場、流通網、営業所を設立し、網状フォームの安定供給を確保しています。これらの企業はまた、この地域の小規模企業や網状フォーム製造業者を買収しており、市場成長に貢献しています。さらに、北米や欧州の網状フォームメーカーはアジアでのプレゼンスを拡大し、様々なフォーラムへの積極的な参加を通じて先進国と新興国の知識交流を促進しています。

当レポートでは、世界の網状フォーム市場について調査し、タイプ別、気孔率別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 関税と規制状況

- 特許分析

- ケーススタディ

- 2024年と2025年の主要な会議とイベント

- 主要な利害関係者と購入基準

- 技術分析

- エコシステム分析

- 顧客のビジネスに影響を与える動向と混乱

第6章 網状フォーム市場、用途別

- イントロダクション

- 濾過

- 吸音

- 流体管理

- クリーニング製品

- その他

第7章 網状フォーム市場、気孔率別

- イントロダクション

- 超多孔質(75 PPI超)

- 中程度(50~75 PPI)

- 多孔質度(50 PPI未満)

第8章 網状フォーム市場、タイプ別

- イントロダクション

- 網状ポリエステルフォーム

第9章 網状フォーム市場、地域別

- イントロダクション

- アジア太平洋

- 欧州

- 南米

- 北米

- 中東・アフリカ

第10章 競合情勢

- イントロダクション

- 主要参入企業が採用した戦略

- 収益分析

- 市場シェア分析

- 企業評価マトリックス(Tier 1)

- スタートアップ/中小企業の評価マトリックス

- 網状フォーム市場:最近の動向、2019年~2022年

第11章 企業プロファイル

- 主要参入企業

- ROGERS FOAM CORPORATION

- SHEELA FOAM

- ARJUN ENTERPRISES

- LAMATEK INC.

- GB FOAM

- AMERICAN FOAM PRODUCTS

- FOAMCRAFT USA

- FILSONFILTER

- FLEXTECH

- WORLDWIDE FOAM

- W. DIMER GMBH

- SOUTHERN FILTERS

- THE RUBBER COMPANY

- FXI

- FOAMTECH WELLINGTON LTD.

- WINFUN FOAM

- CARPENTER CO.

- NEVEON

- WOODBRIDGE FOAM CORPORATION

- POLYMER TECHNOLOGIES INC.

第12章 隣接市場および関連市場

第13章 付録

The global reticulated foam market will rise from USD 506 million in 2023 to USD 683 billion by 2028 at a CAGR of 6.2% from 2023 to 2028. The increasing emphasis on air quality has led to a growing demand for reticulated foam, known for its filtration capabilities that contribute to improved indoor air quality. Simultaneously, the rising trend towards durable outdoor furnishings aligns with the resilience of reticulated foam, driving its adoption in outdoor applications. These dual factors are key drivers fueling the growth of the reticulated foam market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million/Billion), Volume (Tons) |

| Segments | Type, Porosity, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

"The filtration segment is expected to hold the largest share of the reticulated foam market during the forecast period."

The filtration segment accounted for the largest share of the reticulated foam industry in 2022 due to the foam's unique open-cell structure. Reticulated foam's high porosity and permeability make it exceptionally effective for filtering air and liquids. Its adaptability to diverse filtration requirements and customization capabilities position it as a preferred choice for various industries, driving its dominance in the filtration segment of the reticulated foam market.

"Reticulated polyether foam is expected to be the largest segment of the reticulated foam market during the forecast period."

The reticulated polyether foam foam segment is expected to be the largest in volume due to its superior qualities like high porosity, flexibility, and resilience. These attributes make it a versatile choice for a range of applications, including filtration and sound absorption, leading to its prevalence across diverse industries such as automotive, healthcare, electronics, and more. The efficiency of the reticulation process further solidifies its dominance in the market.

"Filtration segment is expected to lead the reticulated foam market during the forecast period."

Based on application, the filtration segment is estimated to account for the largest share of the reticulated foam market in 2022 in terms of volume, primarily because of the foam's distinctive open-cell structure. Reticulated foam's inherent features, such as high porosity and permeability, make it exceptionally well-suited for filtering air and liquids. Its versatility and the ability to customize for specific filtration needs establish it as the preferred choice across different industries. These factors contribute to the dominant position of filtration applications in the reticulated foam market.

"Asia Pacific is projected to grow at the highest CAGR of the reticulated foam market during the forecast period."

The Asia Pacific reticulated foam industry has been studied for China, Japan, India, South Korea, and the Rest of Asia Pacific. The Asia Pacific region presents an attractive market for reticulated foam due to shifting demographics and the rise in the automotive industry and healthcare spending. Key industry leaders like Sheela Foam Limited and Arjun Enterprises have established manufacturing plants, distribution networks, and sales offices in the Asia Pacific, ensuring a steady supply of reticulated foam. These companies are also acquiring smaller firms and fabricators of reticulated foam in the region, contributing to market growth. Additionally, reticulated foam manufacturers from North America and Europe are expanding their presence in Asia, fostering knowledge exchange between developed and emerging nations through active participation in various forums.

Breakdown of primary interviews for the report on the reticulated foam market

- By Company Type - Tier 1 - 16%, Tier 2 -36%, and Tier 3 - 48%

- By Designation - C-Level - 16%, D-Level Executives - 24%, and Others - 60%

- By Region - North America - 20%, Europe - 24%, Asia Pacific - 36%, Middle East & Africa - 12% South America - 8%,

Some of the leading manufacturers of reticulated foam profiled in this report include Rogers Foam Corporation (US), Sheela Foam (India), WinFun Foam (China), Woodbridge Foam Corporation (Canada), Carpenter Co. (US), Neveon (Austria), Polymer Technologies, Inc. (US), and FXI (US).

Research Coverage

This report covers the reticulated foam market by foam, material, application, and region. It aims to estimate the market's size and future growth potential across various segments. The report also includes an in-depth competitive analysis of the key market players, their profiles, and key growth strategies.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the reticulated foam market and its segments. This report is also expected to help stakeholders understand the market's competitive landscape better, gain insights to improve the position of their businesses and make suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of critical drivers (Growing demand for durable outdoor furnishings and increasing focus on air quality), restraints (Cost constraints in mass adoption), opportunities (Advancements in filtration technologies), and challenges (Limited standardization and industry guidelines) influencing the growth of the reticulated foam market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research &

development activities in the reticulated foam market.

- Market Development: Comprehensive information about lucrative markets - the report analyses

the reticulated foam market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped

geographies, recent developments, and investments in the reticulated foam market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service

offerings of leading players like Rogers Foam Corporation (US), Sheela Foam (India), WinFun Foam (China), Woodbridge Foam Corporation (Canada), Carpenter Co. (US), Neveon (Austria), Polymer Technologies, Inc. (US), and FXI (US), and among others in the reticulated foam market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 INCLUSIONS & EXCLUSIONS

- 1.4.1 RETICULATED FOAM MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

- 1.4.2 RETICULATED FOAM MARKET, BY POROSITY: INCLUSIONS & EXCLUSIONS

- 1.4.3 RETICULATED FOAM MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

- 1.4.4 YEARS CONSIDERED

- 1.5 CURRENCY

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 RESEARCH LIMITATIONS

- 1.9 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RETICULATED FOAM MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 List of participating companies for primary research

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.3 BASE NUMBER CALCULATION

- FIGURE 4 BASE NUMBER CALCULATION: APPROACH 1

- FIGURE 5 BASE NUMBER CALCULATION: APPROACH 2

- 2.3.1 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION: RETICULATED FOAM MARKET

- 2.5 RECESSION IMPACT

- 2.6 ASSUMPTIONS & LIMITATIONS

- 2.6.1 RESEARCH ASSUMPTIONS

- 2.6.2 LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 1 RETICULATED FOAM MARKET SNAPSHOT, 2023 AND 2028

- FIGURE 7 RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028

- FIGURE 8 ASIA PACIFIC RETICULATED FOAM MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RETICULATED FOAM MARKET

- FIGURE 9 AUTOMOTIVE AND FURNISHING INDUSTRIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 4.2 RETICULATED FOAM MARKET, BY APPLICATION

- FIGURE 10 FILTRATION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 NORTH AMERICA RETICULATED FOAM MARKET, BY TYPE AND KEY COUNTRIES

- FIGURE 11 US ACCOUNTED FOR LARGEST MARKET SHARE IN NORTH AMERICA

- 4.4 RETICULATED FOAM MARKET, BY MAJOR COUNTRIES

- FIGURE 12 CHINA TO REGISTER HIGHEST CAGR IN RETICULATED FOAM MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN RETICULATED FOAM MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing focus on air quality

- 5.2.1.2 Growing demand for durable outdoor furnishings

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost restraining mass adoption

- 5.2.2.2 Lack of awareness

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing emphasis on sustainable products

- 5.2.3.2 Advancements in filtration technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardization and industry guidelines

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 14 PORTER'S FIVE FORCES ANALYSIS: RETICULATED FOAM MARKET

- TABLE 2 PORTER'S FIVE FORCES ANALYSIS: RETICULATED FOAM MARKET

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 15 RETICULATED FOAM MARKET: SUPPLY CHAIN ANALYSIS

- 5.4.1 RETICULATED FOAM RAW MATERIAL SOURCING

- 5.4.2 RETICULATED FOAM MANUFACTURING

- 5.4.3 PRODUCT DESIGN AND CUSTOMIZATION

- 5.4.4 DISTRIBUTION AND LOGISTICS

- 5.4.5 MARKETING AND SALES

- 5.4.6 END USERS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- FIGURE 16 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

- TABLE 3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE (USD/KG)

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 17 AVERAGE SELLING PRICE TREND OF RETICULATED FOAM, BY REGION

- TABLE 4 AVERAGE SELLING PRICE TREND OF RETICULATED FOAM, BY REGION (USD/KG)

- 5.6 TARIFF AND REGULATORY LANDSCAPE

- 5.6.1 INTRODUCTION

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.3 STANDARDS AND GUIDELINES FOR RETICULATED FOAM

- 5.6.3.1 American National Standards Institute

- 5.6.3.2 Environment Protection Agency

- 5.6.3.3 Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH)

- 5.6.3.4 ASTM International Standards

- 5.6.3.5 Organization for Emergency Services Management

- 5.7 PATENT ANALYSIS

- FIGURE 18 LIST OF MAJOR PATENTS FOR RETICULATED FOAM

- 5.7.1 MAJOR PATENTS

- 5.8 CASE STUDY

- 5.8.1 CASE STUDY 1: HIGH PERFORMANCE OF RETICULATED FOAM FILTERS

- 5.9 KEY CONFERENCES & EVENTS IN 2024 & 2025

- TABLE 5 RETICULATED FOAM MARKET: CONFERENCES & EVENTS

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 20 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 7 KEY BUYING CRITERIA, BY TOP 3 END-USE INDUSTRIES

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 ZAPPING

- 5.11.2 QUENCHING

- 5.12 ECOSYSTEM ANALYSIS

- FIGURE 21 RETICULATED FOAM MARKET: ECOSYSTEM MAPPING

- TABLE 8 RETICULATED FOAM MARKET: ROLE IN ECOSYSTEM

- 5.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 REVENUE SHIFT AND NEW REVENUE POCKETS IN RETICULATED FOAM MARKET

6 RETICULATED FOAM MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- FIGURE 23 RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 9 RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 10 RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 11 RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 12 RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- 6.2 FILTRATION

- 6.2.1 HIGHLY POROUS NATURE, GOOD PERMEABILITY, AND HIGH CHEMICAL RESISTANCE PROPERTIES TO DRIVE MARKET

- TABLE 13 RETICULATED FOAM MARKET IN FILTRATION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 14 RETICULATED FOAM MARKET IN FILTRATION, BY REGION, 2023-2028 (USD MILLION)

- TABLE 15 RETICULATED FOAM MARKET IN FILTRATION, BY REGION, 2019-2022 (TON)

- TABLE 16 RETICULATED FOAM MARKET IN FILTRATION, BY REGION, 2023-2028 (TON)

- 6.3 SOUND ABSORPTION

- 6.3.1 INCREASING USE IN CONSTRUCTION, AUTOMOTIVE, AND MANUFACTURING INDUSTRIES TO DRIVE MARKET

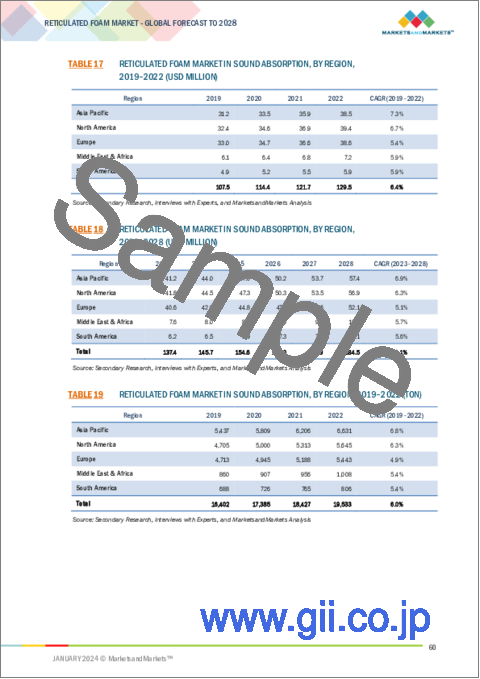

- TABLE 17 RETICULATED FOAM MARKET IN SOUND ABSORPTION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 18 RETICULATED FOAM MARKET IN SOUND ABSORPTION, BY REGION, 2023-2028 (USD MILLION)

- TABLE 19 RETICULATED FOAM MARKET IN SOUND ABSORPTION, BY REGION, 2019-2022 (TON)

- TABLE 20 RETICULATED FOAM MARKET IN SOUND ABSORPTION, BY REGION, 2023-2028 (TON)

- 6.4 FLUID MANAGEMENT

- 6.4.1 APPLICATIONS IN HEALTHCARE AND CONSTRUCTION INDUSTRIES TO DRIVE DEMAND

- TABLE 21 RETICULATED FOAM MARKET IN FLUID MANAGEMENT, BY REGION, 2019-2022 (USD MILLION)

- TABLE 22 RETICULATED FOAM MARKET IN FLUID MANAGEMENT, BY REGION, 2023-2028 (USD MILLION)

- TABLE 23 RETICULATED FOAM MARKET IN FLUID MANAGEMENT, BY REGION, 2019-2022 (TON)

- TABLE 24 RETICULATED FOAM MARKET IN FLUID MANAGEMENT, BY REGION, 2023-2028 (TON)

- 6.5 CLEANING PRODUCTS

- 6.5.1 AFFORDABILITY AND WIDE VARIETY OF CUSTOMIZATIONS TO DRIVE MARKET

- TABLE 25 RETICULATED FOAM MARKET IN CLEANING PRODUCTS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 26 RETICULATED FOAM MARKET IN CLEANING PRODUCTS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 27 RETICULATED FOAM MARKET IN CLEANING PRODUCTS, BY REGION, 2019-2022 (TON)

- TABLE 28 RETICULATED FOAM MARKET IN CLEANING PRODUCTS, BY REGION, 2023-2028 (TON)

- 6.6 OTHER APPLICATIONS

- 6.6.1 RISING USE IN AUTOMOTIVE AND FURNITURE INDUSTRIES TO DRIVE MARKET

- TABLE 29 RETICULATED FOAM MARKET IN OTHER APPLICATIONS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 30 RETICULATED FOAM MARKET IN OTHER APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 31 RETICULATED FOAM MARKET IN OTHER APPLICATIONS, BY REGION, 2019-2022 (TON)

- TABLE 32 RETICULATED FOAM MARKET IN OTHER APPLICATIONS, BY REGION, 2023-2028 (TON)

7 RETICULATED FOAM MARKET, BY POROSITY

- 7.1 INTRODUCTION

- 7.2 HIGHLY POROUS (>75 PPI)

- 7.3 MODERATELY POROUS (50-75 PPI)

- 7.4 LESS POROUS (<50 PPI)

8 RETICULATED FOAM MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 24 RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 33 RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 34 RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 8.2 RETICULATED POLYESTER FOAM

- 8.2.1 WIDE USE IN FURNITURE, PACKAGING, CUSHIONING TO DRIVE MARKET

- TABLE 35 RETICULATED POLYESTER FOAM MARKET, BY REGION, 2019-2022 (TON)

- TABLE 36 RETICULATED POLYESTER FOAM MARKET, BY REGION, 2023-2028 (TON)

- 8.3 RETICULATED POLYETHER FOAM

- 8.3.1 HIGH VERSATILITY AND AFFORDABILITY TO DRIVE MARKET

- TABLE 37 RETICULATED POLYETHER FOAM MARKET, BY REGION, 2019-2022 (TON)

- TABLE 38 RETICULATED POLYETHER FOAM MARKET, BY REGION, 2023-2028 (TON)

9 RETICULATED FOAM MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 25 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 39 RETICULATED FOAM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 40 RETICULATED FOAM MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 41 RETICULATED FOAM MARKET, BY REGION, 2019-2022 (TON)

- TABLE 42 RETICULATED FOAM MARKET, BY REGION, 2023-2028 (TON)

- 9.2 ASIA PACIFIC

- 9.2.1 IMPACT OF RECESSION

- FIGURE 26 ASIA PACIFIC: RETICULATED FOAM MARKET SNAPSHOT

- TABLE 43 ASIA PACIFIC: RETICULATED FOAM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 44 ASIA PACIFIC: RETICULATED FOAM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: RETICULATED FOAM MARKET, BY COUNTRY, 2019-2022 (TON)

- TABLE 46 ASIA PACIFIC: RETICULATED FOAM MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 47 ASIA PACIFIC: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 48 ASIA PACIFIC: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 50 ASIA PACIFIC: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 51 ASIA PACIFIC: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 52 ASIA PACIFIC: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.2.2 CHINA

- 9.2.2.1 Rapid industrialization and manufacturing growth to drive market

- TABLE 53 CHINA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 54 CHINA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 55 CHINA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 56 CHINA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 57 CHINA: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 58 CHINA: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.2.3 INDIA

- 9.2.3.1 Filtration to be largest end user of reticulated foam in India

- TABLE 59 INDIA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 60 INDIA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 61 INDIA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 62 INDIA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 63 INDIA: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 64 INDIA: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.2.4 JAPAN

- 9.2.4.1 High demand in automotive sector to drive market

- TABLE 65 JAPAN: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 66 JAPAN: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 67 JAPAN: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 68 JAPAN: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 69 JAPAN: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 70 JAPAN: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.2.5 SOUTH KOREA

- 9.2.5.1 Focus on technological innovation to drive market

- TABLE 71 SOUTH KOREA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 72 SOUTH KOREA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 73 SOUTH KOREA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 74 SOUTH KOREA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 75 SOUTH KOREA: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 76 SOUTH KOREA: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.2.6 REST OF ASIA PACIFIC

- TABLE 77 REST OF ASIA PACIFIC: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 78 REST OF ASIA PACIFIC: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 79 REST OF ASIA PACIFIC: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 80 REST OF ASIA PACIFIC: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 81 REST OF ASIA PACIFIC: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 82 REST OF ASIA PACIFIC: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.3 EUROPE

- 9.3.1 RECESSION IMPACT

- FIGURE 27 EUROPE: RETICULATED FOAM MARKET SNAPSHOT

- TABLE 83 EUROPE: RETICULATED FOAM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 84 EUROPE: RETICULATED FOAM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 85 EUROPE: RETICULATED FOAM MARKET, BY COUNTRY, 2019-2022 (TON)

- TABLE 86 EUROPE: RETICULATED FOAM MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 87 EUROPE: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 88 EUROPE: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 89 EUROPE: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 90 EUROPE: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 91 EUROPE: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 92 EUROPE: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.3.2 GERMANY

- 9.3.2.1 Growth of medical and automotive sectors to drive market

- TABLE 93 GERMANY: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 94 GERMANY: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 95 GERMANY: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 96 GERMANY: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 97 GERMANY: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 98 GERMANY: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.3.3 UK

- 9.3.3.1 High demand for foam in automobiles to drive market

- TABLE 99 UK: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 100 UK: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 101 UK: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 102 UK: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 103 UK: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 104 UK: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.3.4 FRANCE

- 9.3.4.1 Growth in innovation and environmental focus to drive market

- TABLE 105 FRANCE: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 106 FRANCE: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 107 FRANCE: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 108 FRANCE: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 109 FRANCE: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 110 FRANCE: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.3.5 ITALY

- 9.3.5.1 Rising demand in industrial applications to drive market

- TABLE 111 ITALY: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 112 ITALY: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 113 ITALY: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 114 ITALY: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 115 ITALY: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 116 ITALY: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.3.6 SPAIN

- 9.3.6.1 Strong automotive industry and focus on energy efficiency to drive market

- TABLE 117 SPAIN: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 118 SPAIN: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 119 SPAIN: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 120 SPAIN: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 121 SPAIN: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 122 SPAIN: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.3.7 REST OF EUROPE

- TABLE 123 REST OF EUROPE: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 124 REST OF EUROPE: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 125 REST OF EUROPE: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 126 REST OF EUROPE: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 127 REST OF EUROPE: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 128 REST OF EUROPE: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.4 SOUTH AMERICA

- 9.4.1 RECESSION IMPACT

- TABLE 129 SOUTH AMERICA: RETICULATED FOAM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 130 SOUTH AMERICA: RETICULATED FOAM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 131 SOUTH AMERICA: RETICULATED FOAM MARKET, BY COUNTRY, 2019-2022 (TON)

- TABLE 132 SOUTH AMERICA: RETICULATED FOAM MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 133 SOUTH AMERICA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 134 SOUTH AMERICA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 135 SOUTH AMERICA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 136 SOUTH AMERICA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 137 SOUTH AMERICA: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 138 SOUTH AMERICA: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.4.2 BRAZIL

- 9.4.2.1 Growth of consumer goods and healthcare sectors to drive market

- TABLE 139 BRAZIL: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 140 BRAZIL: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 141 BRAZIL: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 142 BRAZIL: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 143 BRAZIL: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 144 BRAZIL: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.4.3 ARGENTINA

- 9.4.3.1 Government infrastructure projects and private investment to drive market

- TABLE 145 ARGENTINA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 146 ARGENTINA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 147 ARGENTINA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 148 ARGENTINA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 149 ARGENTINA: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 150 ARGENTINA: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.4.4 REST OF SOUTH AMERICA

- TABLE 151 REST OF SOUTH AMERICA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 152 REST OF SOUTH AMERICA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 153 REST OF SOUTH AMERICA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 154 REST OF SOUTH AMERICA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 155 REST OF SOUTH AMERICA: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 156 REST OF SOUTH AMERICA: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.5 NORTH AMERICA

- 9.5.1 RECESSION IMPACT

- FIGURE 28 NORTH AMERICA: RETICULATED FOAM MARKET SNAPSHOT

- TABLE 157 NORTH AMERICA: RETICULATED FOAM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 158 NORTH AMERICA: RETICULATED FOAM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 159 NORTH AMERICA: RETICULATED FOAM MARKET, BY COUNTRY, 2019-2022 (TON)

- TABLE 160 NORTH AMERICA: RETICULATED FOAM MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 161 NORTH AMERICA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 162 NORTH AMERICA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 163 NORTH AMERICA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 164 NORTH AMERICA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 165 NORTH AMERICA: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 166 NORTH AMERICA: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.5.2 US

- 9.5.2.1 Presence of automobile giants to drive market

- TABLE 167 US: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 168 US: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 169 US: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 170 US: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 171 US: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 172 US: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.5.3 CANADA

- 9.5.3.1 Increasing demand from medical, automotive manufacturing, and electronics sectors to drive market

- TABLE 173 CANADA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 174 CANADA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 175 CANADA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 176 CANADA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 177 CANADA: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 178 CANADA: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.5.4 MEXICO

- 9.5.4.1 Burgeoning medical sector and increasing automotive projects to drive market

- TABLE 179 MEXICO: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 180 MEXICO: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 181 MEXICO: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 182 MEXICO: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 183 MEXICO: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 184 MEXICO: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 RECESSION IMPACT

- TABLE 185 MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY COUNTRY, 2019-2022 (TON)

- TABLE 188 MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 189 MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 192 MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 193 MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 194 MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 UAE

- 9.6.2.1.1 Increasing demand for open-cell structures and unique properties in construction to drive market

- 9.6.2.1 UAE

- TABLE 195 UAE: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 196 UAE: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 197 UAE: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 198 UAE: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 199 UAE: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 200 UAE: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.6.2.2 Saudi arabia

- 9.6.2.2.1 Demand for insulation and soundproofing in construction sector to drive market

- 9.6.2.2 Saudi arabia

- TABLE 201 SAUDI ARABIA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 202 SAUDI ARABIA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 203 SAUDI ARABIA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 204 SAUDI ARABIA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 205 SAUDI ARABIA: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 206 SAUDI ARABIA: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.6.2.3 Rest of GCC countries

- TABLE 207 REST OF THE GCC: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 208 REST OF THE GCC: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 209 REST OF THE GCC: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 210 REST OF THE GCC: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 211 REST OF THE GCC: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 212 REST OF THE GCC: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- TABLE 213 REST OF MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 214 REST OF MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 215 REST OF MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 216 REST OF MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 217 REST OF MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY TYPE, 2019-2022 (TON)

- TABLE 218 REST OF MIDDLE EAST & AFRICA: RETICULATED FOAM MARKET, BY TYPE, 2023-2028 (TON)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

- 10.3 REVENUE ANALYSIS

- FIGURE 29 REVENUE ANALYSIS OF KEY COMPANIES (2019-2022)

- 10.4 MARKET SHARE ANALYSIS

- 10.4.1 RANKING OF KEY MARKET PLAYERS

- FIGURE 30 RANKING OF TOP FIVE PLAYERS IN RETICULATED FOAM MARKET, 2022

- 10.4.2 MARKET SHARE OF KEY PLAYERS

- FIGURE 31 RETICULATED FOAM MARKET SHARE ANALYSIS

- TABLE 219 RETICULATED FOAM MARKET: DEGREE OF COMPETITION

- 10.4.2.1 ROGERS FOAM CORPORATION

- 10.4.2.2 WOODBRIDGE FOAM

- 10.4.2.3 SHEELA FOAM

- 10.4.2.4 WINFUN FOAM

- 10.4.2.5 CARPENTER CO.

- 10.5 COMPANY EVALUATION MATRIX (TIER 1)

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 32 COMPANY EVALUATION MATRIX: RETICULATED FOAM MARKET (TIER 1 COMPANIES)

- 10.5.5 COMPANY FOOTPRINT

- FIGURE 33 RETICULATED FOAM MARKET: COMPANY OVERALL FOOTPRINT

- TABLE 220 RETICULATED FOAM MARKET: COMPANY FOOTPRINT, BY TYPE

- TABLE 221 RETICULATED FOAM MARKET: COMPANY FOOTPRINT, BY POROSITY

- TABLE 222 RETICULATED FOAM MARKET: COMPANY FOOTPRINT, BY APPLICATION

- TABLE 223 RETICULATED FOAM MARKET: COMPANY FOOTPRINT, BY REGION

- 10.6 STARTUP/SME EVALUATION MATRIX

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 34 STARTUP/SME EVALUATION MATRIX: RETICULATED FOAM MARKET

- 10.6.5 COMPETITIVE BENCHMARKING

- TABLE 224 RETICULATED FOAM MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 225 RETICULATED FOAM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.7 RETICULATED FOAM MARKET: RECENT DEVELOPMENTS, 2019-2022

11 COMPANY PROFILES

- 11.1 KEY COMPANIES

- (Business overview, Products offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and Competitive threats)**

- 11.1.1 ROGERS FOAM CORPORATION

- TABLE 226 ROGERS FOAM CORPORATION: COMPANY OVERVIEW

- FIGURE 35 ROGERS FOAM CORPORATION: COMPANY SNAPSHOT

- 11.1.2 SHEELA FOAM

- TABLE 227 SHEELA FOAM: COMPANY OVERVIEW

- FIGURE 36 SHEELA FOAM: COMPANY SNAPSHOT

- 11.1.3 ARJUN ENTERPRISES

- TABLE 228 ARJUN ENTERPRISES: COMPANY OVERVIEW

- 11.1.4 LAMATEK INC.

- TABLE 229 LAMATEK INC.: COMPANY OVERVIEW

- 11.1.5 GB FOAM

- TABLE 230 GB FOAM: COMPANY OVERVIEW

- 11.1.6 AMERICAN FOAM PRODUCTS

- TABLE 231 AMERICAN FOAM PRODUCTS: COMPANY OVERVIEW

- 11.1.7 FOAMCRAFT USA

- TABLE 232 FOAMCRAFT USA: COMPANY OVERVIEW

- 11.1.8 FILSONFILTER

- TABLE 233 FILSONFILTER: COMPANY OVERVIEW

- 11.1.9 FLEXTECH

- TABLE 234 FLEXTECH: COMPANY OVERVIEW

- 11.1.10 WORLDWIDE FOAM

- TABLE 235 WORLDWIDE FOAM: COMPANY OVERVIEW

- 11.1.11 W. DIMER GMBH

- TABLE 236 W. DIMER GMBH: COMPANY OVERVIEW

- 11.1.12 SOUTHERN FILTERS

- TABLE 237 SOUTHERN FILTERS: COMPANY OVERVIEW

- 11.1.13 THE RUBBER COMPANY

- TABLE 238 THE RUBBER COMPANY: COMPANY OVERVIEW

- 11.1.14 FXI

- TABLE 239 FXI: COMPANY OVERVIEW

- 11.1.15 FOAMTECH WELLINGTON LTD.

- TABLE 240 FOAMTECH WELLINGTON LTD.: COMPANY OVERVIEW

- 11.1.16 WINFUN FOAM

- TABLE 241 WINFUN FOAM: COMPANY OVERVIEW

- 11.1.17 CARPENTER CO.

- TABLE 242 CARPENTER CO.: COMPANY OVERVIEW

- 11.1.18 NEVEON

- TABLE 243 NEVEON: COMPANY OVERVIEW

- 11.1.19 WOODBRIDGE FOAM CORPORATION

- TABLE 244 WOODBRIDGE FOAM: COMPANY OVERVIEW

- 11.1.20 POLYMER TECHNOLOGIES INC.

- TABLE 245 POLYMER TECHNOLOGIES INC.: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and Competitive threats might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 RETICULATED FOAM: INTERCONNECTED MARKETS

- 12.3.1 POLYURETHANE FOAM MARKET

- 12.3.1.1 Market definition

- 12.3.1.2 Market overview

- 12.3.1.3 Polyurethane foam market, by type

- 12.3.1 POLYURETHANE FOAM MARKET

- 12.4 FLEXIBLE FOAM

- 12.4.1 INCREASING POPULATION LEADING TO GROWTH OF FLEXIBLE FOAM SEGMENT

- 12.4.2 KEY APPLICATIONS OF FLEXIBLE FOAMS

- 12.4.2.1 Cushioning

- 12.4.2.2 Apparel padding

- 12.4.2.3 Filtration

- 12.4.2.4 Other applications

- 12.5 RIGID FOAM

- 12.5.1 SURGING DEMAND FOR INSULATION IN RESIDENTIAL AND COMMERCIAL BUILDINGS FUELING GROWTH

- 12.5.2 KEY APPLICATIONS OF RIGID FOAMS

- 12.5.2.1 Building and transport insulation

- 12.5.2.2 Appliances insulation (refrigerators and freezers)

- 12.5.2.3 Buoyancy and in-fill

- 12.6 SPRAY FOAMS

- 12.6.1 EXCELLENT HEAT, SOUND, AND WATER INSULATION PROPERTIES OF SPRAY FOAMS TO DRIVE CONSUMPTION

- 12.6.2 KEY APPLICATIONS OF SPRAY FOAMS

- 12.6.2.1 Building insulation

- 12.6.2.2 Attics

- 12.6.2.3 Roofing

- 12.6.2.4 Interior wall cavities

- 12.6.2.5 Industrial cool stores

- 12.6.2.6 Marine

- TABLE 246 POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018-2022 (KILOTON)

- TABLE 247 POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2023-2028 (KILOTON)

- TABLE 248 POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 249 POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2023-2028 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS