|

|

市場調査レポート

商品コード

1426524

ブライン濃縮鉱物の世界市場:タイプ (ナトリウム誘導体・マグネシウム誘導体・カルシウム誘導体・脱カリウム誘導体)・技術 (太陽熱蒸発・NF-RO-MF・浸透圧アシストRO)・用途・地域別- 予測(~2029年)Brine Concentration Minerals Market by Type (Sodium derivatives, Magnesium derivatives, Calcium derivatives, Potassium dereivatives), Technology (Solar evaporation, NF-RO-MF, Osmotically assisted RO), Application, and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ブライン濃縮鉱物の世界市場:タイプ (ナトリウム誘導体・マグネシウム誘導体・カルシウム誘導体・脱カリウム誘導体)・技術 (太陽熱蒸発・NF-RO-MF・浸透圧アシストRO)・用途・地域別- 予測(~2029年) |

|

出版日: 2024年02月15日

発行: MarketsandMarkets

ページ情報: 英文 243 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

ブライン濃縮鉱物の市場規模は、2024年の11億米ドルから、予測期間中はCAGR 8.1%で推移し、2029年には17億米ドルに達すると予測されます。

ブライン濃縮鉱物の市場は、極めて重要な促進要因によって推進されており、2つの主な要因がその軌道に大きく影響しています。第一に、リチウムイオン電池の需要の高まりが主要な推進力として際立っています。世界が再生可能エネルギーと電動モビリティに移行するにつれ、リチウムイオン電池はクリーンエネルギーの貯蔵と電気自動車の動力源として不可欠なものとなっています。このような需要の急増、特に自動車とエネルギー貯蔵部門からの需要は、ブライン濃縮鉱物から供給される重要な成分であるリチウムの必要性を大幅に押し上げています。持続可能性を重視する傾向が強まっていることも、インパクトのある原動力となっています。世界の産業界は、環境に優しく持続可能な資源採掘方法をますます優先するようになっており、ブライン濃縮は、従来の採掘方法と比較して、より環境に配慮した選択肢を提供します。このプロセスは、太陽熱蒸発技術を利用することでエコロジカルフットプリントを最小化し、エネルギー集約的な手順の必要性を減らし、化学試薬の使用を回避します。このことは、持続可能性に向けた世界の推進力と一致し、ブライン濃縮鉱物を、増大する需要を満たしながら環境に配慮した慣行を遵守するという2つの目的を満たす、求められるソリューションとして位置づけています。これらの要因が合わさり、ブライン濃縮鉱物の重要性が強調されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額(米ドル) |

| セグメント | タイプ・用途・技術・地域別 |

| 対象地域 | アジア太平洋・北米・欧州・中東&アフリカ・南米 |

技術別では、NF-RO-MFが予測期間中に金額ベースで最も急成長する技術になると予想されています。NF-RO-MFプロセスは、ブラインからイオンと汚染物質を分離する効率が高いため、ブラインの濃縮とミネラルの抽出において最も急成長している技術であると考えられています。ナノろ過、逆浸透、精密ろ過を組み合わせることで、多段階の精製プロセスが可能になり、高品質のブラインと濃縮されたミネラルが得られます。このプロセスは、環境への影響を最小限に抑えながら、鉱物の選択的分離を達成する能力で評価されています。NF-RO-MF技術の潜在的成長の要因には、高純度鉱物の生産における有効性、さまざまなブライン組成への適応性、鉱業・鉱物産業における持続可能で効率的な抽出方法の重視などがあります。

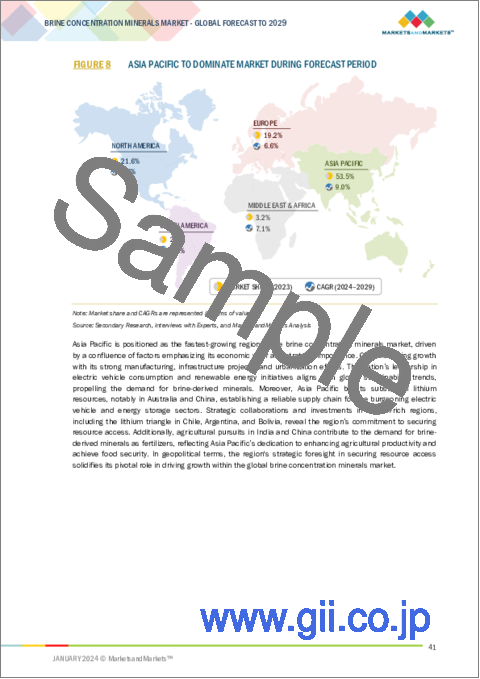

地域別では、北米地域がアジア太平洋に次いで2023年に第2位の市場になる見通しです。北米地域の優位性は、経済活動と資源利用のダイナミックな性質を反映した多面的なものです。主な原動力のひとつは、北米の先端産業部門における鉱物の大きな需要です。特に米国は、強固な製造基盤、技術革新、盛んな自動車産業を有しています。電気自動車や再生可能エネルギーが重視されるようになるにつれ、電池や軽量素材の製造用に、ブライン由来のリチウム、カリウム、マグネシウムなどの鉱物の必要性が高まっています。よりクリーンなエネルギー源と持続可能な技術への移行が、この地域におけるブライン濃縮鉱物の重要性を高めています。

当レポートでは、世界のブライン濃縮鉱物の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界の動向

- 顧客のビジネスに影響を与える動向/ディスラプション

- バリューチェーン分析

- 価格分析

- エコシステムマップ

- 技術分析

- 特許分析

- 貿易分析

- 主な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- マクロ経済指標

- ケーススタディ分析

第7章 ブライン濃縮鉱物市場:技術別

- 太陽蒸発

- NF-RO-MF

- 浸透圧補助型RO

- その他

- 膜蒸留・ナノ濾過

- 順浸透・膜容量性脱イオン化

第8章 ブライン濃縮鉱物市場:用途別

- 冶金

- 医薬品・食品・飲料

- 水処理

- 肥料

- 建設

- その他

- 紙パルプ

- プラスチック

- パワーエレクトロニクス/エネルギー

第9章 ブライン濃縮鉱物市場:タイプ別

- ナトリウム誘導体

- マグネシウム誘導体

- カルシウム誘導体

- カリウム誘導体

- その他

- 臭素

- ボロン

- リチウム誘導体

第10章 ブライン濃縮鉱物市場:地域別

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- 南米

第11章 競合情勢

- 主要企業の戦略/有力企業

- 市場シェア分析

- 収益分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- MAGRATHEA

- OLOKUN MINERALS

- ALBEMARLE CORPORATION

- GANFENG LITHIUM GROUP CO., LTD.

- ARCADIUM LITHIUM

- ICL INDUSTRIAL PRODUCTS

- SQM S.A.

- SOLVAY

- SEALEAU

- KONOSHIMA CHEMICALS CO., LTD.

- その他の企業

- KMX TECHNOLOGIES

- SALTWORKS TECHNOLOGIES INC.

- CONDUCTIVE ENERGY INC.

- MINERVA LITHIUM

- ADIONICS

- LILAC SOLUTIONS

- AQUAFORTUS

- STANDARD LITHIUM LTD.

- ROCK TECH LITHIUM INC.

- ENERGY EXPLORATION TECHNOLOGIES

- ESPIKU LLC

- KAZAN SODA ELEKTRIK

第13章 付録

The Brine concentration minerals Market is projected to reach USD 1.7 billion by 2029, at a CAGR of 8.1% from USD 1.1 billion in 2024. The brine concentration minerals market is propelled by pivotal drivers, with two key factors prominently influencing its trajectory. Firstly, the escalating demand for lithium-ion batteries stands out as a major driver. As the world transitions towards renewable energy and electric mobility, lithium-ion batteries have become indispensable in storing clean energy and powering electric vehicles. This surge in demand, particularly from the automotive and energy storage sectors, significantly boosts the need for lithium, a crucial component sourced from brine concentration minerals. The growing emphasis on sustainable practices constitutes another impactful driver. Industries worldwide are increasingly prioritizing eco-friendly and sustainable methods for resource extraction, and brine concentration offers a more environmentally conscious alternative compared to traditional mining practices. The process minimizes the ecological footprint by utilizing solar evaporation techniques, reducing the need for energy-intensive procedures and avoiding the use of chemical reagents. This aligns with the global push towards sustainability and positions brine concentration minerals as a sought-after solution that meets the dual objectives of fulfilling growing demand while adhering to environmentally responsible practices. Together, these drivers underscore the significance of brine concentration minerals in a rapidly evolving and sustainable global industrial landscape.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion/Million) |

| Segments | Type, Application, Technology, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Pharmaceutical and food & beverages, by application, accounts for the second-largest market share in 2023."

The Pharmaceutical and food & beverages segment accounts for the second largest market share in the brine concentration minerals market due to the diverse applications of certain minerals in pharmaceuticals, food production, and beverage manufacturing. For example, minerals like sodium, potassium, magnesium, and calcium derived from brine can be used as food additives, processing aids, or supplements. These minerals play essential roles in various biological processes and are crucial for human health. In the pharmaceutical industry, brine-derived minerals may be utilized in the formulation of medications and dietary supplements. The pharmaceutical sector often requires high-purity materials, and brine concentration minerals can provide a source of such minerals for pharmaceutical applications. The Food & beverages industry, which includes the production of processed foods, beverages, and other consumables, utilizes brine-derived minerals as additives or ingredients in food processing. These minerals can contribute to flavor enhancement, preservation, and nutritional fortification.

"NF-RO-MF is expected to be the fastest growing technology for brine concentration minerals market during the forecast period, in terms of value."

The NF-RO-MF process is considered to bee the fastest growing technology in context of brine concentration and mineral extraction due to its efficiency in separating ions and contaminants from the brine. The combination of nanofiltration, reverse osmosis, and microfiltration allows for a multi-stage purification process, resulting in high-quality brine and concentrated minerals. This process is valued for its ability to achieve selective separation of minerals while minimizing environmental impact. Factors contributing to the potential growth of NF-RO-MF technology includes its effectiveness in producing high-purity minerals, its adaptability to various brine compositions, and the increasing emphasis on sustainable and efficient extraction methods in the mining and minerals industry.

"Based on region, North America was the second largest market for brine concentration minerals market in 2023."

North America holds the position as the second-largest market for brine concentration minerals after Asia Pacific, driven by a combination of economic, industrial, and strategic factors. The region's prominence in the brine concentration minerals market is multifaceted, reflecting the dynamic nature of its economic activities and resource utilization. One of the primary drivers is the significant demand for minerals in North America's advanced industrial sectors. The United States, in particular, has a robust manufacturing base, technological innovation, and a thriving automotive industry. With the growing emphasis on electric vehicles (EVs) and renewable energy, there is an increasing need for minerals like lithium, potassium, and magnesium derived from brine for the production of batteries and lightweight materials. The transition towards cleaner energy sources and sustainable technologies amplifies the importance of brine concentration minerals in the region. Moreover, North America is home to substantial lithium resources, with lithium deposits in countries like the United States and Canada. The strategic significance of lithium, a crucial component in batteries for EVs and energy storage, positions North America as a key player in meeting the global demand for these minerals. Additionally, the region's focus on water treatment and environmental sustainability contributes to the demand for brine concentration minerals. The extraction and processing of minerals from brine offer environmentally friendly alternatives compared to traditional mining practices, aligning with North America's commitment to sustainable resource management. Furthermore, geopolitical factors and strategic alliances play a role in shaping North America's position in the brine concentration minerals market. The region actively engages in partnerships, investments, and resource exploration to secure a stable supply chain for critical minerals, ensuring resilience in the face of global market dynamics.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-Level - 20%, Director Level - 10%, and Others - 70%

- By Region: North America - 20%, Europe -30%, Asia Pacific - 30%, Middle East & Africa - 10%, and South America-10%

The key players in this market are Magrathea (US), Olokun Minerals (US), Albemarle Corporation (US), Ganfeng Lithium Group Co., Ltd. (China), Arcadium Lithium (US), ICL Industrial Products (Israel), SQM S.A. (Chile), Solvay (Belgium), SEALEAU (Netherlands), and Konoshima Chemical Co., Ltd. (Japan) etc.

Research Coverage

This report segments the market for the brine concentration minerals market on the basis of type, application, technology and region. It provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisitions associated with the market for the brine concentration minerals market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the brine concentration minerals market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers: Growing demand for lithium-ion batteries coupled with the global emphasis on sustainable practices.

- Market Penetration: Comprehensive information on the brine concentration minerals market offered by top players in the global brine concentration minerals market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the brine concentration minerals market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for the brine concentration minerals market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global brine concentration minerals market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the brine concentration minerals market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 BRINE CONCENTRATION MINERALS MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 BRINE CONCENTRATION MINERALS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key brine concentration mineral manufacturers

- 2.1.2.2 Breakdown of interviews with experts

- 2.1.2.3 Key industry insights

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.2.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- FIGURE 4 BRINE CONCENTRATION MINERALS MARKET: DATA TRIANGULATION

- 2.6 ASSUMPTIONS

- 2.7 RECESSION IMPACT

- 2.8 GROWTH FORECAST

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 5 METALLURGICAL APPLICATION TO DOMINATE MARKET BETWEEN 2024 AND 2029

- FIGURE 6 SOLAR EVAPORATION TECHNOLOGY TO LEAD MARKET BETWEEN 2024 AND 2029

- FIGURE 7 MAGNESIUM DERIVATIVES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BRINE CONCENTRATION MINERALS MARKET

- FIGURE 9 GROWING DEMAND FOR LITHIUM-ION BATTERIES TO DRIVE MARKET

- 4.2 BRINE CONCENTRATION MINERALS MARKET, BY TYPE

- FIGURE 10 MAGNESIUM DERIVATIVES TO BE FASTEST-GROWING TYPE DURING FORECAST PERIOD

- 4.3 BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION

- FIGURE 11 WATER TREATMENT TO BE FASTEST-GROWING APPLICATION DURING FORECAST PERIOD

- 4.4 BRINE CONCENTRATION MINERALS MARKET, BY TECHNOLOGY

- FIGURE 12 NF-RO-MF TO BE FASTEST-GROWING TECHNOLOGY DURING FORECAST PERIOD

- 4.5 BRINE CONCENTRATION MINERALS MARKET, BY REGION

- FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 BRINE CONCENTRATION MINERALS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for lithium-ion batteries

- 5.2.1.2 Global emphasis on sustainable practices

- 5.2.2 RESTRAINTS

- 5.2.2.1 Low mineral concentrations and selective mineral recovery

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Wide deployment of minerals in industrial processes and power generation

- 5.2.3.2 Technological advancements in brine concentration methods

- 5.2.4 CHALLENGES

- 5.2.4.1 Variability in mineral composition and product quality

- 5.2.4.2 Volatility in mineral prices

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR BRINE CONCENTRATION MINERAL MANUFACTURERS

- FIGURE 15 REVENUE SHIFT OF BRINE CONCENTRATION MINERALS MARKET

- 6.3 VALUE CHAIN ANALYSIS

- FIGURE 16 OVERVIEW OF BRINE CONCENTRATION MINERALS MARKET VALUE CHAIN

- 6.3.1 INBOUND LOGISTICS

- 6.3.2 MANUFACTURING

- 6.3.3 STORAGE & DISTRIBUTION

- 6.3.4 END-USE INDUSTRIES

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 1 AVERAGE SELLING PRICE, BY REGION, 2020-2029 (USD/TON)

- FIGURE 17 BRINE CONCENTRATION MINERALS MARKET: AVERAGE SELLING PRICE TREND, BY REGION

- 6.4.2 AVERAGE SELLING PRICE TREND, BY TYPE

- TABLE 2 AVERAGE SELLING PRICE, BY TYPE, 2020-2029 (USD/TON)

- 6.4.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP THREE TYPES

- TABLE 3 AVERAGE SELLING PRICE, BY TOP THREE TYPES, 2020-2029 (USD/TON)

- FIGURE 18 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 TYPES

- 6.4.4 AVERAGE SELLING PRICE TREND, BY TECHNOLOGY

- TABLE 4 AVERAGE SELLING PRICE, BY TECHNOLOGY, 2020-2029 (USD/TON)

- 6.4.5 AVERAGE SELLING PRICE TREND, BY APPLICATION

- TABLE 5 AVERAGE SELLING PRICE, BY APPLICATION, 2020-2029 (USD/TON)

- 6.5 ECOSYSTEM MAP

- TABLE 6 BRINE CONCENTRATION MINERALS MARKET: ECOSYSTEM

- 6.6 TECHNOLOGY ANALYSIS

- TABLE 7 TECHNOLOGIES OFFERED IN BRINE CONCENTRATION MINERALS MARKET

- 6.7 PATENT ANALYSIS

- 6.7.1 METHODOLOGY

- 6.7.2 GRANTED PATENTS

- TABLE 8 TOTAL NUMBER OF PATENTS, 2014-2023

- 6.7.2.1 Publication trend over last ten years

- FIGURE 19 PATENTS GRANTED OVER LAST TEN YEARS

- 6.7.3 INSIGHTS

- 6.7.4 LEGAL STATUS

- FIGURE 20 PATENT ANALYSIS, BY LEGAL STATUS

- 6.7.5 JURISDICTION ANALYSIS

- FIGURE 21 REGIONAL ANALYSIS OF PATENTS GRANTED FOR BRINE CONCENTRATION MINERALS MARKET, 2023

- 6.7.6 TOP APPLICANTS

- FIGURE 22 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST TEN YEARS

- TABLE 9 MAJOR PATENT OWNERS FOR BRINE CONCENTRATION MINERALS

- 6.7.7 KEY PATENTS FOR BRINE CONCENTRATION MINERALS

- TABLE 10 BRINE CONCENTRATION MINERALS MARKET: MAJOR PATENTS

- 6.8 TRADE ANALYSIS

- 6.8.1 IMPORT SCENARIO

- FIGURE 23 IMPORTS OF BRINE CONCENTRATION MINERALS, BY COUNTRY, 2022 (USD MILLION)

- 6.8.2 EXPORT SCENARIO

- FIGURE 24 EXPORTS OF BRINE CONCENTRATION MINERALS, BY COUNTRY, 2022 (USD MILLION)

- 6.9 KEY CONFERENCES & EVENTS IN 2024-2025

- TABLE 11 BRINE CONCENTRATION MINERALS MARKET: KEY CONFERENCES AND EVENTS, 2024-2025

- 6.10 TARIFF AND REGULATORY LANDSCAPE

- 6.10.1 TARIFFS RELATED TO BRINE CONCENTRATION MINERALS MARKET

- TABLE 12 TARIFFS FOR BRINE CONCENTRATION MINERALS MARKET

- 6.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.3 REGULATIONS RELATED TO BRINE CONCENTRATION MINERALS MARKET

- TABLE 18 REGULATIONS FOR BRINE CONCENTRATION MINERALS MARKET

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 19 IMPACT OF PORTER'S FIVE FORCES ON BRINE CONCENTRATION MINERALS MARKET

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS: BRINE CONCENTRATION MINERALS MARKET

- 6.11.1 THREAT OF NEW ENTRANTS

- 6.11.2 THREAT OF SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 20 INFLUENCE OF INSTITUTIONAL BUYERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- 6.12.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 6.13 MACROECONOMIC INDICATORS

- 6.13.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 INCREASING GLOBAL DESALINATION ACTIVITIES AND SUSTAINABLE BRINE MANAGEMENT

- 6.14.2 ENVIRONMENTAL IMPACT OF DIRECT LITHIUM EXTRACTION FROM BRINES

- 6.14.3 EXTRACTING MINERALS BY DESALINATING BRINE USING INNOVATIVE CAPACITIVE PHOTO ELECTROCATALYTIC DESALINATION CELLS

7 BRINE CONCENTRATION MINERALS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 28 SOLAR EVAPORATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 23 BRINE CONCENTRATION MINERALS MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 24 BRINE CONCENTRATION MINERALS MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 25 BRINE CONCENTRATION MINERALS MARKET, BY TECHNOLOGY, 2020-2023 (KILOTON)

- TABLE 26 BRINE CONCENTRATION MINERALS MARKET, BY TECHNOLOGY, 2024-2029 (KILOTON)

- 7.2 SOLAR EVAPORATION

- 7.2.1 EFFICIENT MINERAL EXTRACTION FROM SEAWATER DISTILLATION BRINE TO DRIVE MARKET

- 7.3 NANOFILTRATION-REVERSE OSMOSIS-MICROFILTRATION

- 7.3.1 GROWING DEMAND FOR EFFECTIVE MINERAL EXTRACTION METHODS TO BOOST MARKET

- 7.4 OSMOTICALLY ASSISTED RO

- 7.4.1 INCREASING NEED FOR HIGH WATER RECOVERY AND MINERAL CONCENTRATION TO DRIVE MARKET

- 7.5 OTHER TECHNOLOGIES

- 7.5.1 MEMBRANE DISTILLATION AND NANOFILTRATION

- 7.5.2 FORWARD OSMOSIS AND MEMBRANE CAPACITIVE DEIONIZATION

8 BRINE CONCENTRATION MINERALS, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 29 METALLURGICAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 27 BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 28 BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 29 BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 30 BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 8.2 METALLURGICAL

- 8.2.1 RESISTANCE TO EXTREME TEMPERATURES AND ENVIRONMENTAL SUSTAINABILITY TO FUEL MARKET

- 8.3 PHARMACEUTICAL AND FOOD & BEVERAGES

- 8.3.1 WIDE USE OF ESSENTIAL MINERALS IN PHARMACEUTICAL AND FOOD INDUSTRIES TO DRIVE MARKET

- 8.4 WATER TREATMENT

- 8.4.1 HIGH EFFICACY OF BRINE MINERALS IN WATER PURIFICATION TO DRIVE MARKET

- 8.5 FERTILIZERS

- 8.5.1 WIDE DEPLOYMENT IN SPECIFIC FORMULATIONS TO FUEL MARKET

- 8.6 CONSTRUCTION

- 8.6.1 EXTENSIVE USE IN WALL CLADDING AND CEILING SYSTEMS TO DRIVE MARKET

- 8.7 OTHER APPLICATIONS

- 8.7.1 PULP & PAPER

- 8.7.2 PLASTICS

- 8.7.3 POWER ELECTRONICS/ENERGY

9 BRINE CONCENTRATION MINERALS MARKET, BY TYPE

- 9.1 INTRODUCTION

- FIGURE 30 MAGNESIUM DERIVATIVES TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 31 BRINE CONCENTRATION MINERALS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 32 BRINE CONCENTRATION MINERALS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 33 BRINE CONCENTRATION MINERALS MARKET, BY TYPE, 2020-2023 (KILOTON)

- TABLE 34 BRINE CONCENTRATION MINERALS MARKET, BY TYPE, 2024-2029 (KILOTON)

- 9.2 SODIUM DERIVATIVES

- 9.2.1 WIDE APPLICATION IN AGRICULTURAL AND CONSUMER GOODS INDUSTRIES TO DRIVE MARKET

- 9.3 MAGNESIUM DERIVATIVES

- 9.3.1 RISING DEMAND FROM CONSTRUCTION SECTOR TO BOOST MARKET

- 9.4 CALCIUM DERIVATIVES

- 9.4.1 EXTENSIVE USE IN FOOD PRESERVATION TECHNIQUES TO DRIVE MARKET

- 9.5 POTASSIUM DERIVATIVES

- 9.5.1 INCREASING DEMAND IN CRYSTALLIZATION TECHNIQUES TO FUEL MARKET

- 9.6 OTHER TYPES

- 9.6.1 BROMINE

- 9.6.2 BORON

- 9.6.3 LITHIUM DERIVATIVES

10 BRINE CONCENTRATION MINERALS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 31 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 35 BRINE CONCENTRATION MINERALS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 36 BRINE CONCENTRATION MINERALS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 37 BRINE CONCENTRATION MINERALS MARKET, BY REGION, 2020-2023 (KILOTON)

- TABLE 38 BRINE CONCENTRATION MINERALS MARKET, BY REGION, 2024-2029 (KILOTON)

- 10.2 ASIA PACIFIC

- 10.2.1 RECESSION IMPACT

- FIGURE 32 ASIA PACIFIC: BRINE CONCENTRATION MINERALS MARKET SNAPSHOT

- TABLE 39 ASIA PACIFIC: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 40 ASIA PACIFIC: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 41 ASIA PACIFIC: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 42 ASIA PACIFIC: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 43 ASIA PACIFIC: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 44 ASIA PACIFIC: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 45 ASIA PACIFIC: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 46 ASIA PACIFIC: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.2.2 CHINA

- 10.2.2.1 Advancements in mineral extraction technology to drive market

- TABLE 47 CHINA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 48 CHINA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 49 CHINA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 50 CHINA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.2.3 JAPAN

- 10.2.3.1 Well-established automotive and electronics sectors to drive market

- TABLE 51 JAPAN: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 52 JAPAN: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 53 JAPAN: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 54 JAPAN: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.2.4 INDIA

- 10.2.4.1 Economic development and adoption of sustainable technologies to drive market

- TABLE 55 INDIA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 56 INDIA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 57 INDIA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 58 INDIA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.2.5 SOUTH KOREA

- 10.2.5.1 Rising demand for electric vehicles and renewable energy technology to drive market

- TABLE 59 SOUTH KOREA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 60 SOUTH KOREA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 61 SOUTH KOREA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 62 SOUTH KOREA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.2.6 REST OF ASIA PACIFIC

- TABLE 63 REST OF ASIA PACIFIC: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 64 REST OF ASIA PACIFIC: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 65 REST OF ASIA PACIFIC: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 66 REST OF ASIA PACIFIC: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.3 NORTH AMERICA

- 10.3.1 RECESSION IMPACT

- FIGURE 33 NORTH AMERICA: BRINE CONCENTRATION MINERALS MARKET SNAPSHOT

- TABLE 67 NORTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 68 NORTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 69 NORTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 70 NORTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 71 NORTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 72 NORTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 73 NORTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 74 NORTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.3.2 US

- 10.3.2.1 Growth of manufacturing sector to drive market

- TABLE 75 US: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 76 US: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 77 US: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 78 US: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.3.3 CANADA

- 10.3.3.1 Increasing demand for lithium-ion batteries to fuel market

- TABLE 79 CANADA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 80 CANADA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 81 CANADA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 82 CANADA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.3.4 MEXICO

- 10.3.4.1 Thriving mining and automotive sectors to drive market

- TABLE 83 MEXICO: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 84 MEXICO: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 85 MEXICO: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 86 MEXICO: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.4 EUROPE

- 10.4.1 RECESSION IMPACT

- FIGURE 34 EUROPE: BRINE CONCENTRATION MINERALS MARKET SNAPSHOT

- TABLE 87 EUROPE: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 88 EUROPE: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 89 EUROPE: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 90 EUROPE: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 91 EUROPE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 92 EUROPE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 93 EUROPE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 94 EUROPE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.4.2 GERMANY

- 10.4.2.1 Wide establishment of chemical industries to drive market

- TABLE 95 GERMANY: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 96 GERMANY: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 97 GERMANY: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 98 GERMANY: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.4.3 ITALY

- 10.4.3.1 Increased adoption of desalination systems to fuel market

- TABLE 99 ITALY: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 100 ITALY: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 101 ITALY: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 102 ITALY: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.4.4 FRANCE

- 10.4.4.1 Increased lithium extraction and rapid expansion of electric vehicles to drive market

- TABLE 103 FRANCE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 104 FRANCE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 105 FRANCE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 106 FRANCE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.4.5 UK

- 10.4.5.1 Rising environmental consciousness and deployment of desalination plants to drive market

- TABLE 107 UK: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 108 UK: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 109 UK: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 110 UK: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.4.6 SPAIN

- 10.4.6.1 Infrastructure development and investments in renewable energy projects to drive market

- TABLE 111 SPAIN: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 112 SPAIN: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 113 SPAIN: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 114 SPAIN: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.4.7 REST OF EUROPE

- TABLE 115 REST OF EUROPE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 116 REST OF EUROPE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 117 REST OF EUROPE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 118 REST OF EUROPE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 RECESSION IMPACT

- TABLE 119 MIDDLE EAST & AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 122 MIDDLE EAST & AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 123 MIDDLE EAST & AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 126 MIDDLE EAST & AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.5.2 GCC COUNTRIES

- TABLE 127 GCC COUNTRIES: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 128 GCC COUNTRIES: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 129 GCC COUNTRIES: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 130 GCC COUNTRIES: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.5.2.1 SAUDI ARABIA

- 10.5.2.1.1 Economic diversification and increasing infrastructure development projects to drive market

- 10.5.2.1 SAUDI ARABIA

- TABLE 131 SAUDI ARABIA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 132 SAUDI ARABIA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 133 SAUDI ARABIA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 134 SAUDI ARABIA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.5.2.2 UAE

- 10.5.2.2.1 Strategic diversification and focus on renewable energy projects to drive market

- 10.5.2.2 UAE

- TABLE 135 UAE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 136 UAE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 137 UAE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 138 UAE: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.5.2.3 REST OF GCC COUNTRIES

- TABLE 139 REST OF GCC COUNTRIES: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 140 REST OF GCC COUNTRIES: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 141 REST OF GCC COUNTRIES: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 142 REST OF GCC COUNTRIES: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.5.3 SOUTH AFRICA

- 10.5.3.1 Industrialization and technological advancements to drive market

- TABLE 143 SOUTH AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 144 SOUTH AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 145 SOUTH AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 146 SOUTH AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 147 REST OF MIDDLE EAST & AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 148 REST OF MIDDLE EAST & AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 149 REST OF MIDDLE EAST & AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 150 REST OF MIDDLE EAST & AFRICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.6 SOUTH AMERICA

- 10.6.1 RECESSION IMPACT

- TABLE 151 SOUTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 152 SOUTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 153 SOUTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2020-2023 (KILOTON)

- TABLE 154 SOUTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 155 SOUTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 156 SOUTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 157 SOUTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 158 SOUTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.6.2 ARGENTINA

- 10.6.2.1 Government incentives and foreign investments to drive market

- TABLE 159 ARGENTINA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 160 ARGENTINA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 161 ARGENTINA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 162 ARGENTINA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.6.3 BRAZIL

- 10.6.3.1 Growth of agricultural sector to drive market

- TABLE 163 BRAZIL: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 164 BRAZIL: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 165 BRAZIL: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 166 BRAZIL: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

- 10.6.4 REST OF SOUTH AMERICA

- TABLE 167 REST OF SOUTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 168 REST OF SOUTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 169 REST OF SOUTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2020-2023 (KILOTON)

- TABLE 170 REST OF SOUTH AMERICA: BRINE CONCENTRATION MINERALS MARKET, BY APPLICATION, 2024-2029 (KILOTON)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY BRINE CONCENTRATION MINERAL MANUFACTURERS

- 11.3 MARKET SHARE ANALYSIS

- 11.3.1 RANKING OF KEY MARKET PLAYERS, 2022

- FIGURE 35 RANKING OF TOP FIVE PLAYERS IN BRINE CONCENTRATION MINERALS MARKET, 2022

- 11.3.2 MARKET SHARE OF KEY PLAYERS

- TABLE 171 BRINE CONCENTRATION MINERALS MARKET: DEGREE OF COMPETITION

- FIGURE 36 BRINE CONCENTRATION MINERALS MARKET: SHARE OF KEY PLAYERS

- 11.3.2.1 Albemarle Corporation

- 11.3.2.2 Ganfeng Lithium Group Co., Ltd.

- 11.3.2.3 ICL Industrial Products

- 11.3.2.4 SQM S.A.

- 11.3.2.5 Arcadium Lithium

- 11.4 REVENUE ANALYSIS

- FIGURE 37 REVENUE OF KEY PLAYERS, 2020-2024

- 11.5 COMPANY EVALUATION MATRIX

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 38 BRINE CONCENTRATION MINERALS MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.5.5 COMPANY FOOTPRINT ANALYSIS

- TABLE 172 KEY COMPANY TYPE FOOTPRINT (10 COMPANIES)

- TABLE 173 KEY COMPANY APPLICATION FOOTPRINT (10 COMPANIES)

- TABLE 174 KEY COMPANY TECHNOLOGIES FOOTPRINT (10 COMPANIES)

- TABLE 175 KEY COMPANY REGIONAL FOOTPRINT (10 COMPANIES)

- 11.6 STARTUP/SME EVALUATION MATRIX

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 39 BRINE CONCENTRATION MINERALS MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 11.6.5 COMPETITIVE BENCHMARKING

- TABLE 176 BRINE CONCENTRATION MINERALS MARKET: KEY STARTUPS/SMES

- FIGURE 40 BRINE CONCENTRATION MINERALS MARKET: BUSINESS STRATEGY FOOTPRINT

- FIGURE 41 BRINE CONCENTRATION MINERALS MARKET: PRODUCT OFFERING STRATEGY

- 11.6.5.1 Brine concentration minerals market: Competitive benchmarking of key startups/SMEs

- TABLE 177 TYPE FOOTPRINT OF SME PLAYERS (15 COMPANIES)

- TABLE 178 KEY COMPANY APPLICATION FOOTPRINT OF SME PLAYERS (15 COMPANIES)

- TABLE 179 TECHNOLOGIES FOOTPRINT OF SME PLAYERS (15 COMPANIES)

- TABLE 180 REGION FOOTPRINT OF SME PLAYERS (15 COMPANIES)

- 11.7 COMPETITIVE SCENARIOS AND TRENDS

- 11.7.1 DEALS

- TABLE 181 BRINE CONCENTRATION MINERALS MARKET: DEALS (2020-2023)

- 11.7.2 OTHER DEVELOPMENTS

- TABLE 182 BRINE CONCENTRATION MINERALS MARKET: OTHER DEVELOPMENTS (2019-2023)

12 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 12.1 KEY PLAYERS

- 12.1.1 MAGRATHEA

- TABLE 183 MAGRATHEA: COMPANY OVERVIEW

- TABLE 184 MAGRATHEA: PRODUCT OFFERINGS

- 12.1.2 OLOKUN MINERALS

- TABLE 185 OLOKUN MINERALS: COMPANY OVERVIEW

- TABLE 186 OLOKUN MINERALS: PRODUCT OFFERINGS

- 12.1.3 ALBEMARLE CORPORATION

- TABLE 187 ALBEMARLE CORPORATION: COMPANY OVERVIEW

- FIGURE 42 ALBEMARLE CORPORATION: COMPANY SNAPSHOT

- TABLE 188 ALBEMARLE CORPORATION: PRODUCT OFFERINGS

- TABLE 189 ALBEMARLE CORPORATION: DEALS

- TABLE 190 ALBEMARLE CORPORATION: OTHER DEVELOPMENTS

- 12.1.4 GANFENG LITHIUM GROUP CO., LTD.

- TABLE 191 GANFENG LITHIUM GROUP CO., LTD.: COMPANY OVERVIEW

- FIGURE 43 GANFENG LITHIUM GROUP CO., LTD.: COMPANY SNAPSHOT

- TABLE 192 GANFENG LITHIUM GROUP CO., LTD.: PRODUCT OFFERINGS

- TABLE 193 GANFENG LITHIUM GROUP CO., LTD.: DEALS

- TABLE 194 GANFENG LITHIUM GROUP CO., LTD.: OTHER DEVELOPMENTS

- 12.1.5 ARCADIUM LITHIUM

- TABLE 195 ARCADIUM LITHIUM: COMPANY OVERVIEW

- FIGURE 44 ARCADIUM LITHIUM: COMPANY SNAPSHOT

- TABLE 196 ARCADIUM LITHIUM: PRODUCT OFFERINGS

- 12.1.6 ICL INDUSTRIAL PRODUCTS

- TABLE 197 ICL INDUSTRIAL PRODUCTS: COMPANY OVERVIEW

- FIGURE 45 ICL INDUSTRIAL PRODUCTS: COMPANY SNAPSHOT

- TABLE 198 ICL INDUSTRIAL PRODUCTS: PRODUCT OFFERINGS

- TABLE 199 ICL INDUSTRIAL PRODUCTS: DEALS

- TABLE 200 ICL INDUSTRIAL PRODUCTS: OTHER DEVELOPMENTS

- 12.1.7 SQM S.A.

- TABLE 201 SQM S.A.: COMPANY OVERVIEW

- FIGURE 46 SQM S.A.: COMPANY SNAPSHOT

- TABLE 202 SQM S. A.: PRODUCT OFFERINGS

- TABLE 203 SQM S. A.: DEALS

- TABLE 204 SQM S.A.: OTHER DEVELOPMENTS

- 12.1.8 SOLVAY

- TABLE 205 SOLVAY: COMPANY OVERVIEW

- FIGURE 47 SOLVAY: COMPANY SNAPSHOT

- TABLE 206 SOLVAY: PRODUCT OFFERINGS

- 12.1.9 SEALEAU

- TABLE 207 SEALEAU: COMPANY OVERVIEW

- TABLE 208 SEALEAU: PRODUCT OFFERINGS

- 12.1.10 KONOSHIMA CHEMICALS CO., LTD.

- TABLE 209 KONOSHIMA CHEMICALS CO., LTD.: COMPANY OVERVIEW

- FIGURE 48 KONOSHIMA CHEMICALS CO., LTD.: COMPANY SNAPSHOT

- TABLE 210 KONOSHIMA CHEMICALS CO., LTD.: PRODUCT OFFERINGS

- 12.2 OTHER PLAYERS

- 12.2.1 KMX TECHNOLOGIES

- TABLE 211 KMX TECHNOLOGIES: COMPANY OVERVIEW

- 12.2.2 SALTWORKS TECHNOLOGIES INC.

- TABLE 212 SALTWORKS TECHNOLOGIES INC.: COMPANY OVERVIEW

- 12.2.3 CONDUCTIVE ENERGY INC.

- TABLE 213 CONDUCTIVE ENERGY INC.: COMPANY OVERVIEW

- 12.2.4 MINERVA LITHIUM

- TABLE 214 MINERVA LITHIUM: COMPANY OVERVIEW

- 12.2.5 ADIONICS

- TABLE 215 ADIONICS: COMPANY OVERVIEW

- 12.2.6 LILAC SOLUTIONS

- TABLE 216 LILAC SOLUTIONS: COMPANY OVERVIEW

- 12.2.7 AQUAFORTUS

- TABLE 217 AQUAFORTUS: COMPANY OVERVIEW

- 12.2.8 STANDARD LITHIUM LTD.

- TABLE 218 STANDARD LITHIUM LTD.: COMPANY OVERVIEW

- 12.2.9 ROCK TECH LITHIUM INC.

- TABLE 219 ROCK TECH LITHIUM INC.: COMPANY OVERVIEW

- 12.2.10 ENERGY EXPLORATION TECHNOLOGIES

- TABLE 220 ENERGY EXPLORATION TECHNOLOGIES: COMPANY OVERVIEW

- 12.2.11 ESPIKU LLC

- TABLE 221 ESPIKU LLC: COMPANY OVERVIEW

- 12.2.12 KAZAN SODA ELEKTRIK

- TABLE 222 KAZAN SODA ELEKTRIK: COMPANY OVERVIEW

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS