|

|

市場調査レポート

商品コード

1752395

電子濾過の世界市場:製品タイプ別、濾過技術別、フィルター材料別、用途別、最終用途産業別、地域別 - 2030年までの予測Electronic Filtration Market by Type (Gas Filter, Liquid Filter, Air Filter), Filter Material, Filtration Technology, Application, End-use Industry (Consumer Electronics, Industrial Electronics, Semiconductors), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 電子濾過の世界市場:製品タイプ別、濾過技術別、フィルター材料別、用途別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月14日

発行: MarketsandMarkets

ページ情報: 英文 246 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

電子濾過の市場規模は、8.5%のCAGRで拡大し、2025年の47億米ドルから2030年には70億6,000万米ドルに増加すると予測されています。

この市場成長の背景には、消費財、産業、電子機器、人工知能など、さまざまな分野や産業におけるエレクトロニクス需要の高まりによる半導体需要の拡大があります。この動向は、エレクトロニクスフィルター市場の成長の重要な触媒として機能しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象単位 | 金額(100万米ドル)および数量(単位) |

| セグメント | 製品タイプ別、濾過技術別、フィルター材料別、用途別、最終用途産業別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、中東・アフリカ、南米 |

電子濾過市場におけるエアフィルター分野の拡大は、データセンター、通信インフラ、半導体製造施設など、機密性の高い環境における高い空気品質の必要性が大きな要因となっています。高効率微粒子空気(HEPA)および超低浸透空気(ULPA)フィルターは、微粒子汚染物質を軽減し、電子システムのピーク性能に不可欠な制御された大気環境を確保する上で重要な役割を果たしています。規制基準の厳格化、システムの信頼性強化の必要性、厳格な空気品質ベンチマークを維持する必要性の高まりは、エレクトロニクス業界における最先端の空気濾過ソリューションの需要を煽る主な要因となっています。

半導体製造における精密さへの要求の高まりが、主にウェットエッチング&洗浄セグメントの成長を牽引しています。このようなウェットプロセスでは、半導体デバイスの完全性を維持するために超クリーンな環境が必要となります。洗浄液やエッチング液から汚染物質を除去するには、ケミカルフィルターやポイント・オブ・ユースフィルターなどの高度な濾過技術が不可欠です。微粒子状の不純物を効果的に除去することで、これらの濾過システムは、マイクロエレクトロニクスデバイスの性能を損なう可能性のある汚染から保護します。半導体製造におけるウェットプロセス技術の採用の増加は、高度な半導体アプリケーションに要求される厳格な清浄度基準を達成する上で、高度な濾過技術の重要な機能を浮き彫りにしています。

アジア太平洋地域は現在、電子濾過市場において最も大きな拡大を経験しています。この成長の原動力となっているのは、エレクトロニクス製品に対する需要の増加と急速な産業開発であり、製造工程における厳格な汚染管理対策が必要とされています。技術進歩を目指した政府の積極的な取り組みと好調なエレクトロニクス産業が、半導体フィルター技術の成長を後押ししています。中国と台湾がこの市場での優位性を固めつつあり、高度な濾過技術への多額の投資は、半導体の高品質生産を確保するために不可欠です。

企業タイプ別 - ティア1 25%、ティア2 42%、ティア3 33%

役職別 - Cレベル:20%、取締役30%、その他50%

地域別 - 北米20%、欧州10%、アジア太平洋40%、南米10%、中東・アフリカ20%

備考 - その他の役職には、セールス、マーケティング、プロダクトマネージャーなどが含まれます。

ティア1 10億米ドル以上、ティア2 5億米ドル~10億米ドル、ティア3 5億米ドル未満

対象企業Pall Corporation(米国)、Entegris, Inc.(米国)、3M(米国)、Cobetter Filtration(中国)、Parker Hannifin(米国)、Donaldson Company, inc.(米国)、Mott Corporation(米国)、Porvair PLC(英国)、Mann+Hummel(ドイツ)、Critical Process Filtration, Inc.

調査対象

この調査レポートは、さまざまなセグメントにまたがるエレクトロニクス濾過市場を対象としています。用途、フィルター材料、濾過技術、製品タイプ、最終用途産業、地域など、さまざまなセグメントにわたる市場規模と成長の可能性を推定することを目的としています。また、主要企業プロファイル、製品や事業内容に関する主な考察、最近の動向、成長戦略などにハイライトを当て、市場における主要企業の詳細な競合分析も行っています。これらの戦略は、エレクトロニクス濾過市場における地位を強化し、プレゼンスを拡大することを目的としています。

当レポートは、市場リーダー/新規参入者に、電子濾過市場全体とサブセグメントの収益数の最も近い近似値に関する情報を提供します。当レポートは、利害関係者が競合情勢を理解し、事業をより良く位置づけるための考察を深め、適切な市場参入戦略を計画するのに役立ちます。当レポートは、利害関係者が市場の鼓動を理解し、主要市場促進要因・抑制要因・課題・機会に関する情報を提供するのに役立ちます。

当レポートでは、世界の電子濾過市場について調査し、製品タイプ別、ろ過技術別、フィルター材料別、用途別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- バリューチェーン分析

- 規制状況

- 貿易分析

- 投資と資金調達のシナリオ

- 価格分析

- エコシステム/市場マップ

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 2025年~2026年の主な会議とイベント

- 特許分析

- AI/生成AIが電子濾過市場に与える影響

- マクロ経済分析

- 2025年の米国関税が電子濾過市場に与える影響

第7章 電子濾過市場(製品タイプ別)

- イントロダクション

- エアフィルター

- ガスフィルター

- 液体フィルター

- その他

第8章 電子濾過市場(濾過技術別)

- イントロダクション

- 機械濾過

- 吸着濾過

- 深層濾過

- 膜濾過

- 静電濾過

- その他

第9章 電子濾過市場(フィルター材料別)

- イントロダクション

- ポリプロピレン(PP)

- ポリテトラフルオロエチレン(PTFE)

- ナイロン

- ポリエーテルスルホン(PES)

- セルロース

- セラミック

- ガラス繊維

- ステンレス鋼/金属

- その他

第10章 電子濾過市場(用途別)

- イントロダクション

- クリーンルーム環境

- フォトリソグラフィ

- ウェットエッチングおよび洗浄プロセス

- 化学蒸着法(CVD)と物理蒸着法(PVD)

- ガス供給システム

- 浄水プロセス

- その他

第11章 電子濾過市場(最終用途産業別)

- イントロダクション

- 家電

- 半導体

- 通信機器

- 産業用電子機器

- その他

第12章 電子濾過市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- 台湾

- 日本

- インド

- 韓国

- その他

- 欧州

- ドイツ

- フランス

- スペイン

- 英国

- イタリア

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- PALL CORPORATION

- ENTEGRIS

- 3M

- COBETTER

- PARKER HANNIFIN CORP

- DONALDSON COMPANY, INC.

- MOTT

- PORVAIR PLC

- MANN+HUMMEL

- CRITICAL PROCESS FILTRATION, INC.

- その他の企業

- CAMFIL

- PULLNER FILTERS

- W.L. GORE & ASSOCIATES, INC.

- GRAVER TECHNOLOGIES

- HONGTEK FILTRATION CO., LTD.

- FREUDENBERG FILTRATION TECHNOLOGIES GMBH & CO. KG

- FIL-TREK CORPORATION

- GUANGZHOU KLC CLEANTECH CO., LTD. ALL

- DYNA FILTERS PRIVATE LIMITED

- VALIN CORPORATION

- GLOBAL FILTER

- LENZING FILTRATION

- ALFA CHEMISTRY

- ROKI TECHNO CO.,LTD.

- D&D FILTRATION

- AMERICAN AIR FILTER COMPANY, INC.

第15章 付録

List of Tables

- TABLE 1 LIST OF ENVIRONMENTAL REGULATIONS BOOSTING DEMAND FOR FILTRATION

- TABLE 2 ENTERPRISES BUYING CLOUD COMPUTING SERVICES, BY ECONOMIC ACTIVITY, 2014-2023

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 INDICATIVE PRICING ANALYSIS OF ELECTRONIC FILTRATION SYSTEMS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/UNIT)

- TABLE 7 AVERAGE SELLING PRICE TREND OF ELECTRONIC FILTRATION SYSTEMS, BY REGION, 2023-2030 (USD/UNIT)

- TABLE 8 ROLES OF COMPANIES IN ELECTRONIC FILTRATION ECOSYSTEM

- TABLE 9 ELECTRONIC FILTRATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 11 KEY BUYING CRITERIA FOR THREE MAJOR END-USE INDUSTRIES

- TABLE 12 ELECTRONIC FILTRATION MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 TOP 10 PATENT OWNERS DURING LAST 11 YEARS, 2015-2024

- TABLE 14 GLOBAL GDP GROWTH PROJECTIONS, BY REGION, 2021-2028 (USD TRILLION)

- TABLE 15 ELECTRONIC FILTRATION MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

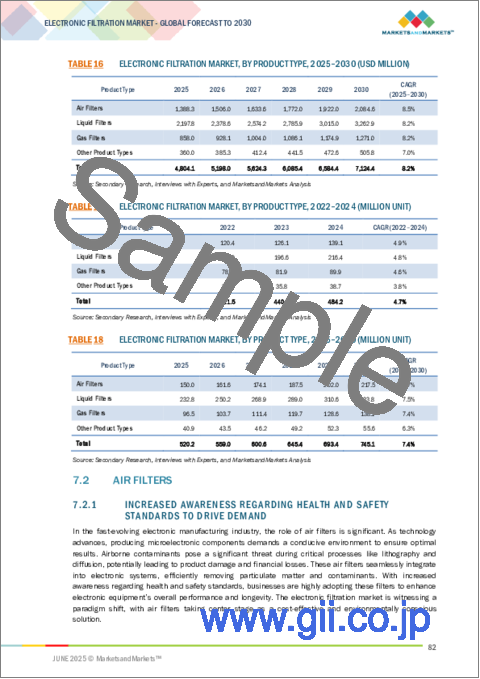

- TABLE 16 ELECTRONIC FILTRATION MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 17 ELECTRONIC FILTRATION MARKET, BY PRODUCT TYPE, 2022-2024 (MILLION UNIT)

- TABLE 18 ELECTRONIC FILTRATION MARKET, BY PRODUCT TYPE, 2025-2030 (MILLION UNIT)

- TABLE 19 ELECTRONIC FILTRATION MARKET, BY FILTRATION TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 20 ELECTRONIC FILTRATION MARKET, BY FILTRATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 21 ELECTRONIC FILTRATION MARKET, BY FILTER MATERIAL, 2022-2024 (USD MILLION)

- TABLE 22 ELECTRONIC FILTRATION MARKET, BY FILTER MATERIAL, 2025-2030 (USD MILLION)

- TABLE 23 ELECTRONIC FILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 24 ELECTRONIC FILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 25 ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 26 ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 27 ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION UNIT)

- TABLE 28 ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION UNIT)

- TABLE 29 ELECTRONIC FILTRATION MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 30 ELECTRONIC FILTRATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 ELECTRONIC FILTRATION MARKET, BY REGION, 2022-2024 (MILLION UNIT)

- TABLE 32 ELECTRONIC FILTRATION MARKET, BY REGION, 2025-2030 (MILLION UNIT)

- TABLE 33 NORTH AMERICA: ELECTRONIC FILTRATION MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 34 NORTH AMERICA: ELECTRONIC FILTRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: ELECTRONIC FILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 36 NORTH AMERICA: ELECTRONIC FILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 38 NORTH AMERICA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 39 US: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 40 US: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 41 CANADA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 42 CANADA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 43 MEXICO: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 44 MEXICO: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: ELECTRONIC FILTRATION MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 46 ASIA PACIFIC: ELECTRONIC FILTRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: ELECTRONIC FILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 48 ASIA PACIFIC: ELECTRONIC FILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 49 ASIA PACIFIC: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 50 ASIA PACIFIC: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 51 CHINA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 52 CHINA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 53 TAIWAN: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 54 TAIWAN: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 55 JAPAN: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 56 JAPAN: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 57 INDIA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 58 INDIA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 59 SOUTH KOREA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 60 SOUTH KOREA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 61 REST OF ASIA PACIFIC: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 62 REST OF ASIA PACIFIC: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 63 EUROPE: ELECTRONIC FILTRATION MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 64 EUROPE: ELECTRONIC FILTRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65 EUROPE: ELECTRONIC FILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 66 EUROPE: ELECTRONIC FILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 67 EUROPE: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 68 EUROPE: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 69 GERMANY: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 70 GERMANY: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 71 FRANCE: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 72 FRANCE: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 73 SPAIN: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 74 SPAIN: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 75 UK: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 76 UK: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 77 ITALY: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 78 ITALY: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 79 REST OF EUROPE: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 80 REST OF EUROPE: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 81 MIDDLE EAST & AFRICA: ELECTRONIC FILTRATION MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 82 MIDDLE EAST & AFRICA: ELECTRONIC FILTRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 MIDDLE EAST & AFRICA: ELECTRONIC FILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 84 MIDDLE EAST & AFRICA: ELECTRONIC FILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 85 MIDDLE EAST & AFRICA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 86 MIDDLE EAST & AFRICA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 87 GCC COUNTRIES: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 88 GCC COUNTRIES: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 89 SAUDI ARABIA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 90 SAUDI ARABIA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 91 UAE: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 92 UAE: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 93 REST OF GCC COUNTRIES: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 94 REST OF GCC COUNTRIES: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 95 SOUTH AFRICA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 96 SOUTH AFRICA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 97 REST OF MIDDLE EAST & AFRICA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 98 REST OF MIDDLE EAST & AFRICA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 99 SOUTH AMERICA: ELECTRONIC FILTRATION MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 100 SOUTH AMERICA: ELECTRONIC FILTRATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 101 SOUTH AMERICA: ELECTRONIC FILTRATION MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 102 SOUTH AMERICA: ELECTRONIC FILTRATION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 103 SOUTH AMERICA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 104 SOUTH AMERICA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 105 BRAZIL: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 106 BRAZIL: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 107 ARGENTINA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 108 ARGENTINA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 109 REST OF SOUTH AMERICA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 110 REST OF SOUTH AMERICA: ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 111 ELECTRONIC FILTRATION MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS BETWEEN 2023 AND 2025

- TABLE 112 ELECTRONIC FILTRATION MARKET: DEGREE OF COMPETITION, 2024

- TABLE 113 ELECTRONIC FILTRATION MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 114 ELECTRONIC FILTRATION MARKET: APPLICATION FOOTPRINT

- TABLE 115 ELECTRONIC FILTRATION MARKET: FILTRATION RATING FOOTPRINT

- TABLE 116 ELECTRONIC FILTRATION MARKET: FILTER MATERIAL FOOTPRINT

- TABLE 117 ELECTRONIC FILTRATION MARKET: FILTRATION TECHNOLOGY FOOTPRINT

- TABLE 118 ELECTRONIC FILTRATION MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 119 ELECTRONIC FILTRATION MARKET: REGION FOOTPRINT

- TABLE 120 ELECTRONIC FILTRATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 121 ELECTRONIC FILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 122 ELECTRONIC FILTRATION MARKET: PRODUCT LAUNCHES, JANUARY 2020-MAY 2025

- TABLE 123 ELECTRONIC FILTRATION MARKET: DEALS, JANUARY 2020-MAY 2025

- TABLE 124 ELECTRONIC FILTRATION MARKET: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 125 PALL CORPORATION: COMPANY OVERVIEW

- TABLE 126 PALL CORPORATION: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 127 PALL CORPORATION: DEALS

- TABLE 128 PALL CORPORATION: EXPANSIONS

- TABLE 129 ENTEGRIS: COMPANY OVERVIEW

- TABLE 130 ENTEGRIS: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 131 ENTEGRIS: DEALS

- TABLE 132 ENTEGRIS: EXPANSIONS

- TABLE 133 3M: COMPANY OVERVIEW

- TABLE 134 3M: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 135 COBETTER: COMPANY OVERVIEW

- TABLE 136 COBETTER: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 137 COBETTER: EXPANSIONS

- TABLE 138 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 139 PARKER HANNIFIN CORP: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 140 DONALDSON COMPANY, INC.: COMPANY OVERVIEW

- TABLE 141 DONALDSON COMPANY, INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 142 DONALDSON COMPANY, INC.: PRODUCT LAUNCHES

- TABLE 143 DONALDSON COMPANY, INC.: EXPANSIONS

- TABLE 144 MOTT: COMPANY OVERVIEW

- TABLE 145 MOTT: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 146 MOTT: PRODUCT LAUNCHES

- TABLE 147 MOTT: DEALS

- TABLE 148 MOTT: EXPANSIONS

- TABLE 149 PORVAIR PLC: COMPANY OVERVIEW

- TABLE 150 PORVAIR PLC: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 151 PORVAIR PLC: PRODUCT LAUNCHES

- TABLE 152 PORVAIR PLC: EXPANSIONS

- TABLE 153 MANN+HUMMEL: COMPANY OVERVIEW

- TABLE 154 MANN+HUMMEL: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 155 CRITICAL PROCESS FILTRATION, INC.: COMPANY OVERVIEW

- TABLE 156 CRITICAL PROCESS FILTRATION, INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 157 CAMFIL: COMPANY OVERVIEW

- TABLE 158 PULLNER FILTERS: COMPANY OVERVIEW

- TABLE 159 W.L. GORE & ASSOCIATES, INC.: COMPANY OVERVIEW

- TABLE 160 GRAVER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 161 HONGTEK FILTRATION CO., LTD.: COMPANY OVERVIEW

- TABLE 162 FREUDENBERG FILTRATION TECHNOLOGIES GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 163 FIL-TREK CORPORATION: COMPANY OVERVIEW

- TABLE 164 GUANGZHOU KLC CLEANTECH CO., LTD.: COMPANY OVERVIEW

- TABLE 165 DYNA FILTERS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 166 VALIN CORPORATION: COMPANY OVERVIEW

- TABLE 167 GLOBAL FILTER: COMPANY OVERVIEW

- TABLE 168 LENZING FILTRATION: COMPANY OVERVIEW

- TABLE 169 ALFA CHEMISTRY: COMPANY OVERVIEW

- TABLE 170 ROKI TECHNO CO., LTD.: COMPANY OVERVIEW

- TABLE 171 D&D FILTRATION: COMPANY OVERVIEW

- TABLE 172 AMERICAN AIR FILTER COMPANY, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ELECTRONIC FILTRATION MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 ELECTRONIC FILTRATION MARKET: RESEARCH DESIGN

- FIGURE 3 ELECTRONIC FILTRATION MARKET: TOP-DOWN APPROACH

- FIGURE 4 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 5 ELECTRONIC FILTRATION MARKET: APPROACH 1

- FIGURE 6 ELECTRONIC FILTRATION MARKET: APPROACH 2

- FIGURE 7 ELECTRONIC FILTRATION MARKET: DATA TRIANGULATION

- FIGURE 8 LIQUID FILTERS TO BE LARGEST PRODUCT TYPE SEGMENT BETWEEN 2025 AND 2030

- FIGURE 9 CLEANROOM ENVIRONMENT SEGMENT TO LEAD ELECTRONIC FILTRATION MARKET BETWEEN 2025 AND 2030

- FIGURE 10 CONSUMER ELECTRONICS SEGMENT TO LEAD ELECTRONIC FILTRATION MARKET BETWEEN 2025 AND 2030

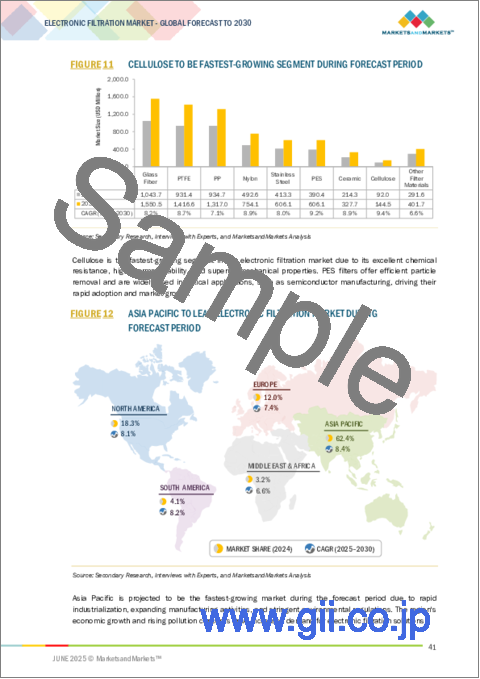

- FIGURE 11 CELLULOSE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO LEAD ELECTRONIC FILTRATION MARKET DURING FORECAST PERIOD

- FIGURE 13 RISING DEMAND IN ASIA PACIFIC TO CREATE LUCRATIVE OPPORTUNTIES FOR MARKET PLAYERS

- FIGURE 14 LIQUID FILTERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 CONSUMER ELECTRONICS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 ELECTRONIC FILTRATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 GLOBAL SEMICONDUCTOR SALES, 2020-2025 (USD BILLION)

- FIGURE 19 ELECTRONIC FILTRATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 IMPORT DATA RELATED TO HS CODE 842121-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 21 EXPORT DATA RELATED TO HS CODE 842121-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 22 ELECTRONIC FILTRATION MARKET: INVESTMENT AND FUNDING SCENARIO, 2019-2024 (USD MILLION)

- FIGURE 23 AVERAGE SELLING PRICE TREND OF ELECTRONIC FILTRATION SYSTEMS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/UNIT)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF ELECTRONIC FILTRATION SYSTEMS, BY REGION, 2023-2030 (USD/UNITS)

- FIGURE 25 ELECTRONIC FILTRATION MARKET: ECOSYSTEM/MARKET MAP

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 ELECTRONIC FILTRATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 29 KEY BUYING CRITERIA FOR THREE MAJOR END-USE INDUSTRIES

- FIGURE 30 ELECTRONIC FILTRATION MARKET: GRANTED PATENTS, 2015-2024

- FIGURE 32 LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 33 TOP JURISDICTION, BY DOCUMENT, 2015-2024

- FIGURE 34 TOP 10 PATENT APPLICANTS, 2015-2024

- FIGURE 35 AIR FILTERS TO BE FASTEST-GROWING PRODUCT TYPE SEGMENT DURING FORECAST PERIOD

- FIGURE 36 MECHANICAL FILTRATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 37 GLASS FIBER SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 38 CLEANROOM ENVIRONMENT SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 39 CONSUMER ELECTRONICS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 40 SOUTH KOREA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF ELECTRONIC FILTRATION MARKET IN 2030

- FIGURE 42 NORTH AMERICA: ELECTRONIC FILTRATION MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: ELECTRONIC FILTRATION MARKET SNAPSHOT

- FIGURE 44 ELECTRONIC FILTRATION MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024 (USD BILLION)

- FIGURE 45 ELECTRONIC FILTRATION MARKET SHARE ANALYSIS, 2024

- FIGURE 46 ELECTRONIC FILTRATION MARKET: FINANCIAL METRICS OF LEADING COMPANIES, 2024

- FIGURE 47 ELECTRONIC FILTRATION MARKET: COMPANY VALUATION OF LEADING COMPANIES, 2024 (USD BILLION)

- FIGURE 48 ELECTRONIC FILTRATION MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 49 ELECTRONIC FILTRATION: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 ELECTRONIC FILTRATION MARKET: COMPANY FOOTPRINT

- FIGURE 51 ELECTRONIC FILTRATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 ENTEGRIS: COMPANY SNAPSHOT

- FIGURE 53 3M: COMPANY SNAPSHOT

- FIGURE 54 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- FIGURE 55 DONALDSON COMPANY, INC.: COMPANY SNAPSHOT

- FIGURE 56 PORVAIR PLC: COMPANY SNAPSHOT

- FIGURE 57 MANN+HUMMEL: COMPANY SNAPSHOT

The market for electronic filters is projected to increase from USD 4.70 billion in 2025 to USD 7.06 billion in 2030, at a CAGR of 8.5%. The market growth can be attributed to the escalating demand for semiconductors, driven by rising demand for electronics across multiple sectors and industries, such as consumer goods, industrial, electronics, and artificial intelligence. This trend serves as a significant catalyst for the growth of the electronics filter market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Unit) |

| Segments | Product Type, Filter Material, Application, End-use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

"Air filters segment to register highest CAGR in electronic filtration market during forecast period"

The expansion of the air filter segment in the electronic filtration market is largely driven by the necessity for high air quality in sensitive environments, including data centers, telecommunications infrastructure, and semiconductor fabrication facilities. High-Efficiency Particulate Air (HEPA) and Ultra-Low Penetration Air (ULPA) filters play a crucial role in mitigating particulate pollutants, ensuring a controlled atmospheric context, which is vital for electronic systems' peak performance. The increasing stringency of regulatory standards, the imperative for enhanced system reliability, and the escalating necessity to uphold stringent air quality benchmarks are key factors fueling the demand for cutting-edge air filtration solutions within the electronics industry.

"Wet etching & cleaning to be second fastest-growing segment in electronic filtration market during forecast period"

The escalating demand for precision in semiconductor fabrication primarily drives the growth of the wet etching & cleaning segment. These wet processes necessitate ultra-clean environments to preserve the integrity of semiconductor devices. Advanced filtration technologies, including chemical filters and point-of-use filters, are essential for eliminating contaminants from cleaning and etching solutions. By effectively removing particulate impurities, these filtration systems safeguard against contamination that could compromise microelectronic device performance. The increased adoption of wet processing techniques in semiconductor manufacturing highlights the critical function of sophisticated filtration technologies in achieving the rigorous cleanliness standards required for advanced semiconductor applications.

"Asia Pacific to record highest CAGR during forecast period"

Asia Pacific is currently experiencing the most significant expansion in the electronics filtration market. This growth is driven by the increasing demand for electronic products and rapid industrial development, which necessitate stringent contamination control measures during manufacturing processes. Supportive government initiatives aimed at technological advancements and a strong electronics industry are propelling the growth of semiconductor filtration technologies. With China and Taiwan solidifying their dominance in this market, substantial investments in advanced filtration technologies are critical to ensuring the high-quality production of semiconductors.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: Pall Corporation (US), Entegris, Inc. (US), 3M (US), Cobetter Filtration (China), Parker Hannifin (US), Donaldson Company, inc. (US), Mott Corporation (US), Porvair PLC (UK), Mann+Hummel (Germany), and Critical Process Filtration, Inc. (US).

Research Coverage

The study covers the electronics filtration market across various segments. It aims to estimate the market size and growth potential across different segments, including application, filter material, filtration technology, product type, end-use industry, and region. The study also provides an in-depth competitive analysis of key players in the market, highlighting their company profiles, key observations related to their products and business offerings, recent developments, and growth strategies. These strategies aim to enhance their position and expand their presence in the electronics filtration market. Reasons to Buy Report

The report will offer the market leaders/new entrants information on the closest approximations of the revenue numbers for the overall electronic filtration market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of drivers (Growing demand for semiconductors in various end-use industries and Increasing demand for ultra-pure water in microelectronics), restraints (High costs associated with advanced filtration solutions), opportunities (Usage of nanocomposite membranes), and challenges (Lack of standardized filtration solutions due to diverse nature of electronic components) influencing the growth of electronics filtration market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the electronic filtration market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the electronic filtration market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the electronic filtration market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Pall Corporation (US), Entegris, Inc. (US), 3M (US), Cobetter Filtration (China), Parker Hannifin (US), Donaldson Company, inc. (US), Mott Corporation (US), Porvair PLC (UK), Mann+Hummel (Germany) and Critical Process Filtration, Inc. (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Interviews with experts - demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 BASE NUMBER CALCULATION

- 2.4.1 DEMAND-SIDE APPROACH

- 2.4.2 SUPPLY-SIDE APPROACH

- 2.5 MARKET FORECAST APPROACH

- 2.5.1 SUPPLY SIDE

- 2.5.2 DEMAND SIDE

- 2.6 DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNTIES FOR PLAYERS IN ELECTRONIC FILTRATION MARKET

- 4.2 ELECTRONIC FILTRATION MARKET, BY PRODUCT TYPE

- 4.3 ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY

- 4.4 ELECTRONIC FILTRATION MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding semiconductor industry

- 5.2.1.2 Increasing demand for ultra-pure water in microelectronics manufacturing

- 5.2.1.3 Need for clean room environment in semiconductor and microelectronics production

- 5.2.1.4 Innovations in electronic filtration with rising stringent environmental regulations

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of advanced filtration technologies

- 5.2.2.2 Environmental issues associated with waste disposal from membrane filtration

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of Internet of Things (IoT) technology into electronic filtration systems

- 5.2.3.2 Demand for customized filtration solutions for emerging applications

- 5.2.3.3 Innovations in nanofiber and PTFE membrane technologies

- 5.2.3.4 Growth of data centers and cloud computing services

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardized filtration solutions

- 5.2.4.2 Prolonged validation cycles

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 VALUE CHAIN ANALYSIS

- 6.2 REGULATORY LANDSCAPE

- 6.2.1 REGULATIONS

- 6.2.1.1 North America

- 6.2.1.2 Europe

- 6.2.1.3 South America

- 6.2.1.4 Asia Pacific

- 6.2.2 STANDARDS

- 6.2.2.1 ISO 16890

- 6.2.2.2 ANSI/ASHRAE 52.1

- 6.2.2.3 China's GB/T 38899-2020 Standard

- 6.2.2.4 ISO 14001 Environmental Management System

- 6.2.2.5 EN 12952

- 6.2.2.6 ASTM D6803-19

- 6.2.2.7 IEDA Standards

- 6.2.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.2.1 REGULATIONS

- 6.3 TRADE ANALYSIS

- 6.3.1 IMPORT SCENARIO (HS CODE 842121)

- 6.3.2 EXPORT SCENARIO (HS CODE 842121)

- 6.4 INVESTMENT AND FUNDING SCENARIO

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 6.5.2 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2030

- 6.6 ECOSYSTEM/MARKET MAP

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.1.1 Mechanical filtration

- 6.8.1.2 Membrane filtration

- 6.8.1.3 Electrostatic filtration

- 6.8.1.4 Coalescing filtration

- 6.8.1.5 Adsorption filtration

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.2.1 Pre-filtration systems

- 6.8.2.2 Filter monitoring and control systems

- 6.8.2.3 Modular filter housing and skid systems

- 6.8.3 ADJACENT TECHNOLOGIES

- 6.8.3.1 Ultrapure water (UPW) generation

- 6.8.3.2 Gas purification and delivery systems

- 6.8.3.3 Cleanroom environmental controls

- 6.8.1 KEY TECHNOLOGIES

- 6.9 PORTER'S FIVE FORCES ANALYSIS

- 6.9.1 THREAT OF NEW ENTRANTS

- 6.9.2 THREATS OF SUBSTITUTES

- 6.9.3 BARGAINING POWER OF SUPPLIERS

- 6.9.4 BARGAINING POWER OF BUYERS

- 6.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.10.2 BUYING CRITERIA

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 R.P. FEDDER - HIGH VOLUME FLEXIBILITY AND QUALITY FOR INDUSTRIAL EQUIPMENT FILTERS

- 6.11.2 PORVAIR PLC - DISPOSABLE FILTERS FOR HIGH-PERFORMANCE INKJET INKS AND FLUIDS

- 6.11.3 GLOBAL FILTER - EXCEPTIONAL RESPONSE TIME AND LEAD TIMES

- 6.11.4 NX FILTRATION - REVOLUTIONIZING MANUFACTURING WITH INNOVATIVE FILTRATION TECHNOLOGY

- 6.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.13 PATENT ANALYSIS

- 6.13.1 METHODOLOGY

- 6.13.2 DOCUMENT TYPES

- 6.13.3 PUBLICATION TRENDS IN LAST 11 YEARS

- 6.13.4 INSIGHTS

- 6.13.5 LEGAL STATUS OF PATENTS

- 6.13.6 JURISDICTION ANALYSIS

- 6.13.7 TOP APPLICANTS

- 6.14 IMPACT OF AI/GEN AI ON ELECTRONIC FILTRATION MARKET

- 6.15 MACROECONOMIC ANALYSIS

- 6.15.1 INTRODUCTION

- 6.15.2 GDP TRENDS AND FORECASTS

- 6.16 IMPACT OF 2025 US TARIFF ON ELECTRONIC FILTRATION MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 IMPACT ON KEY COUNTRY/REGION

- 6.16.4.1 US

- 6.16.4.2 China

- 6.16.4.3 Germany

- 6.16.5 END-USE INDUSTRY IMPACT

7 ELECTRONIC FILTRATION MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 AIR FILTERS

- 7.2.1 INCREASED AWARENESS REGARDING HEALTH AND SAFETY STANDARDS TO DRIVE DEMAND

- 7.2.1.1 High-efficiency particulate air (HEPA) filters

- 7.2.1.2 Ultra-low penetration air (ULPA) filters

- 7.2.1.3 Other air filters

- 7.2.1 INCREASED AWARENESS REGARDING HEALTH AND SAFETY STANDARDS TO DRIVE DEMAND

- 7.3 GAS FILTERS

- 7.3.1 ADVANCEMENTS IN CONSUMER ELECTRONICS INDUSTRY TO DRIVE DEMAND

- 7.3.1.1 Particulate filters

- 7.3.1.2 In-line filters

- 7.3.1.3 Other gas filters

- 7.3.1 ADVANCEMENTS IN CONSUMER ELECTRONICS INDUSTRY TO DRIVE DEMAND

- 7.4 LIQUID FILTERS

- 7.4.1 ABILITY TO MITIGATE ADVERSE IMPACT OF PARTICULATE MATTER AND ENSURE LONGEVITY AND RELIABILITY OF ELECTRONIC COMPONENTS TO DRIVE DEMAND

- 7.4.1.1 Depth filters

- 7.4.1.2 Membrane filters

- 7.4.1.3 Cartridge filters

- 7.4.1.4 Bag filters

- 7.4.1.5 String wound filters

- 7.4.1.6 Pleated filters

- 7.4.1 ABILITY TO MITIGATE ADVERSE IMPACT OF PARTICULATE MATTER AND ENSURE LONGEVITY AND RELIABILITY OF ELECTRONIC COMPONENTS TO DRIVE DEMAND

- 7.5 OTHER PRODUCT TYPES

8 ELECTRONIC FILTRATION MARKET, BY FILTRATION TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 MECHANICAL FILTRATION

- 8.2.1 EXTENSIVE USE FOR SAFEGUARDING MICROELECTRONICS MANUFACTURING PROCESSES TO DRIVE MARKET

- 8.3 ADSORPTION FILTRATION

- 8.3.1 WIDE APPLICATION SCOPE IN GAS PURIFICATION AND REMOVAL OF VOCS TO DRIVE MARKET

- 8.4 DEPTH FILTRATION

- 8.4.1 SURGE IN DEMAND FOR PURIFICATION OF PROCESS CHEMICALS TO DRIVE MARKET

- 8.5 MEMBRANE FILTRATION

- 8.5.1 USE FOR SELECTIVE REMOVAL OF IONS, SALTS, AND ORGANIC MOLECULES TO DRIVE MARKET

- 8.6 ELECTROSTATIC FILTRATION

- 8.6.1 HIGH USE IN CLEANROOM APPLICATIONS IN SEMICONDUCTOR INDUSTRY TO DRIVE MARKET

- 8.7 OTHER FILTRATION TECHNOLOGIES

9 ELECTRONIC FILTRATION MARKET, BY FILTER MATERIAL

- 9.1 INTRODUCTION

- 9.2 POLYPROPYLENE (PP)

- 9.2.1 HIGH CHEMICAL AND THERMAL RESISTANCE TO DRIVE MARKET

- 9.3 POLYTETRAFLUOROETHYLENE (PTFE)

- 9.3.1 EXCEPTIONAL PROPERTIES TO INCREASE DEMAND

- 9.4 NYLON

- 9.4.1 SUPERIOR CHEMICAL COMPATIBILITY TO DRIVE DEMAND

- 9.5 POLYETHERSULFONE (PES)

- 9.5.1 CRUCIAL ROLE IN HIGH-PURITY CHEMICAL MIXING TO SUPPORT MARKET GROWTH

- 9.6 CELLULOSE

- 9.6.1 SUPERIOR FILTERING CAPABILITIES AND COST-EFFECTIVENESS TO DRIVE DEMAND

- 9.7 CERAMIC

- 9.7.1 HIGH CHEMICAL RESISTANCE, THERMAL STABILITY, AND EXCEPTIONAL FILTRATION EFFICIENCY TO DRIVE MARKET

- 9.8 GLASS FIBER

- 9.8.1 STRENGTH, DURABILITY, AND THERMAL STABILITY TO INCREASE USE

- 9.9 STAINLESS STEEL/METALS

- 9.9.1 SMOOTH SURFACE FACILITATING EASY CLEANING AND STERILIZATION TO DRIVE MARKET

- 9.10 OTHER FILTER MATERIALS

10 ELECTRONIC FILTRATION MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 CLEANROOM ENVIRONMENTS

- 10.2.1 RISING DEMAND FOR PRECISION AND EFFICIENCY TO DRIVE MARKET

- 10.3 PHOTOLITHOGRAPHY

- 10.3.1 HIGH PRECISION THROUGH ADVANCED ELECTRONIC FILTRATION SOLUTIONS IN SEMICONDUCTOR MANUFACTURING TO DRIVE DEMAND

- 10.4 WET ETCHING AND CLEANING PROCESSES

- 10.4.1 ABILITY TO ENHANCE EFFICIENCY IN WET ETCHING AND POST-ETCH CLEANING OPERATIONS TO FUEL DEMAND

- 10.5 CHEMICAL VAPOR DEPOSITION (CVD) AND PHYSICAL VAPOR DEPOSITION (PVD)

- 10.5.1 EXTENSIVE USE IN HIGH-QUALITY DEVICE PRODUCTION TO DRIVE MARKET

- 10.6 GAS DELIVERY SYSTEMS

- 10.6.1 RISING USE OF GAS DELIVERY SYSTEMS WITH INTEGRATED FILTRATION TECHNOLOGIES FOR PRECISION ELECTRONICS MANUFACTURING TO DRIVE MARKET

- 10.7 WATER PURIFICATION PROCESS

- 10.7.1 DEMAND FOR HIGH PURITY AND QUALITY OF WATER IN VARIOUS CHIP MANUFACTURING STAGES TO DRIVE MARKET

- 10.8 OTHER APPLICATIONS

11 ELECTRONIC FILTRATION MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 CONSUMER ELECTRONICS

- 11.2.1 HIGH DEMAND FOR MINIATURIZED DEVICES TO DRIVE MARKET

- 11.3 SEMICONDUCTOR

- 11.3.1 EXTENSIVE USE OF FILTRATION AND PURIFICATION PRODUCTS TO DRIVE MARKET

- 11.4 TELECOMMUNICATIONS EQUIPMENT

- 11.4.1 SURGE IN DEMAND FOR HIGH-SPEED DATA TRANSMISSION AND SEAMLESS CONNECTIVITY TO DRIVE MARKET

- 11.5 INDUSTRIAL ELECTRONICS

- 11.5.1 RISING DEMAND FOR PRECISE FILTRATION FOR OPTIMAL FUNCTIONALITY TO DRIVE MARKET

- 11.6 OTHER END-USE INDUSTRIES

12 ELECTRONIC FILTRATION MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Advancing semiconductor excellence and innovations in electronic filtration industry to drive market

- 12.2.2 CANADA

- 12.2.2.1 Growing semiconductor manufacturing industry to boost market

- 12.2.3 MEXICO

- 12.2.3.1 Government-led collaborations with semiconductor manufacturing companies to drive market

- 12.2.1 US

- 12.3 ASIA PACIFIC

- 12.3.1 CHINA

- 12.3.1.1 Growing semiconductor industry to drive market

- 12.3.2 TAIWAN

- 12.3.2.1 Growing demand for semiconductor foundries to boost market

- 12.3.3 JAPAN

- 12.3.3.1 Government-led investments in semiconductor industry to drive market

- 12.3.4 INDIA

- 12.3.4.1 Increasing demand from consumer electronics industry to boost market

- 12.3.5 SOUTH KOREA

- 12.3.5.1 Growing demand from industrial electronics industry to drive market

- 12.3.6 REST OF ASIA PACIFIC

- 12.3.1 CHINA

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Booming consumer electronics industry to drive market

- 12.4.2 FRANCE

- 12.4.2.1 Growing semiconductor industry to drive market

- 12.4.3 SPAIN

- 12.4.3.1 Advancing Industry 4.0 with precision and innovation to fuel market growth

- 12.4.4 UK

- 12.4.4.1 UK's Electronic Filtration Market Poised for Growth Amidst Semiconductor and Telecom Sector Advancements in 2025

- 12.4.5 ITALY

- 12.4.5.1 Reliance on advanced filtration technologies in microelectronics sector to drive market

- 12.4.6 REST OF EUROPE

- 12.4.1 GERMANY

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.5.1.1 Saudi Arabia

- 12.5.1.1.1 Surge in demand for miniaturization and complex chip architectures to drive market

- 12.5.1.2 UAE

- 12.5.1.2.1 Government-led initiatives to develop electronics industry to propel market

- 12.5.1.3 Rest of GCC Countries

- 12.5.1.1 Saudi Arabia

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Expanding consumer electronics industry to boost market

- 12.5.3 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Rising industrial and digital transformation to fuel market growth

- 12.6.2 ARGENTINA

- 12.6.2.1 Industrial growth and advancements in electronic filtration industry to drive market

- 12.6.3 REST OF SOUTH AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

- 13.4.1 PALL CORPORATION

- 13.4.2 ENTEGRIS

- 13.4.3 3M

- 13.4.4 PARKER HANNIFIN CORP

- 13.4.5 COBETTER

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Product type footprint

- 13.7.5.3 Application footprint

- 13.7.5.4 Filtration rating footprint

- 13.7.5.5 Filter material footprint

- 13.7.5.6 Filtration technology footprint

- 13.7.5.7 End-use industry footprint

- 13.7.5.8 Region footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 PALL CORPORATION

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 ENTEGRIS

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 3M

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Key strengths/Right to win

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses/Competitive threats

- 14.1.4 COBETTER

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 PARKER HANNIFIN CORP

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Key strengths/Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses/Competitive threats

- 14.1.6 DONALDSON COMPANY, INC.

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Expansions

- 14.1.6.4 MnM view

- 14.1.6.4.1 Key strengths/Right to win

- 14.1.6.4.2 Strategic choices

- 14.1.6.4.3 Weaknesses/Competitive threats

- 14.1.7 MOTT

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.7.3.3 Expansions

- 14.1.7.4 MnM view

- 14.1.7.4.1 Key strengths/Right to win

- 14.1.7.4.2 Strategic choices

- 14.1.7.4.3 Weaknesses/Competitive threats

- 14.1.8 PORVAIR PLC

- 14.1.8.1 Business Overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Expansions

- 14.1.8.4 MnM view

- 14.1.8.4.1 Key strengths/Right to win

- 14.1.8.4.2 Strategic choices

- 14.1.8.4.3 Weaknesses/Competitive threats

- 14.1.9 MANN+HUMMEL

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 MnM view

- 14.1.10 CRITICAL PROCESS FILTRATION, INC.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 MnM view

- 14.1.1 PALL CORPORATION

- 14.2 OTHER PLAYERS

- 14.2.1 CAMFIL

- 14.2.2 PULLNER FILTERS

- 14.2.3 W.L. GORE & ASSOCIATES, INC.

- 14.2.4 GRAVER TECHNOLOGIES

- 14.2.5 HONGTEK FILTRATION CO., LTD.

- 14.2.6 FREUDENBERG FILTRATION TECHNOLOGIES GMBH & CO. KG

- 14.2.7 FIL-TREK CORPORATION

- 14.2.8 GUANGZHOU KLC CLEANTECH CO., LTD. ALL

- 14.2.9 DYNA FILTERS PRIVATE LIMITED

- 14.2.10 VALIN CORPORATION

- 14.2.11 GLOBAL FILTER

- 14.2.12 LENZING FILTRATION

- 14.2.13 ALFA CHEMISTRY

- 14.2.14 ROKI TECHNO CO.,LTD.

- 14.2.15 D&D FILTRATION

- 14.2.16 AMERICAN AIR FILTER COMPANY, INC.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS