|

|

市場調査レポート

商品コード

1423543

医療用レーザーの世界市場:技術別、用途別、エンドユーザー別、アンメットニーズ - 予測(~2028年)Medical Lasers Market by Technology (Solid [ER:YAG, ND:YAG, HO:YAG, Alexandrite], Gas [CO2, Argon, Excimer], Pulsed Dye, Diode), Application (Aesthetics, Dermatology, Urology), End User (Hospital, Clinic, Home), Unmet Needs - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 医療用レーザーの世界市場:技術別、用途別、エンドユーザー別、アンメットニーズ - 予測(~2028年) |

|

出版日: 2024年02月01日

発行: MarketsandMarkets

ページ情報: 英文 268 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の医療用レーザーの市場規模は、2023年の48億米ドルから2028年までに83億米ドルに達し、2023年~2028年にCAGRで11.5%の成長が予測されています。

医療用レーザー市場の拡大は、タトゥー除去や脱毛治療などの処置に対する強い需要によって大きく形作られています。この需要は、肥満率の上昇に伴うタトゥー除去ソリューションへのニーズの高まりに対応する医療用レーザー技術の進歩と、老年人口の肌の欠陥に対処するためのスキンリサーフェシングの要求という2つの要因によって促進されており、市場全体の成長に寄与しています。これらの要素は、美容と加齢に関連する懸念の双方への対処における医療用レーザー治療の根強い人気を明示しており、市場の拡大に拍車をかけています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 単位 | 10億米ドル |

| セグメント | 技術、用途、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

「固体レーザー用途セグメントが2023年に市場で最大のシェアを占めました。」

市場は、家庭環境で実施される美容処置への需要の増加により成長が見込まれています。

「用途別では、脱毛セグメントが予測期間に美容/化粧品の中でもっとも高いCAGRを記録する見込みです。」

脱毛セグメントが2023年~2028年に美容/化粧品市場でもっとも高いCAGRを記録すると予測されています。化粧品に関連する医薬品に対する消費者の支出が増加しています。

「アジア太平洋市場が予測期間に最高の成長を示す見込みです。」

アジア太平洋の医療用レーザー市場が、予測期間に最高のCAGRを記録すると予測されており、これは主に進化している医療インフラと、この地域の主要企業の注目の高まりによるものです。インドや中国などの新興経済国の医療インフラは急速なペースで進化しており、病院や手術センターによる先進の医療用レーザーシステムへの大規模な投資につながっています。これらの要因が、この地域の医療用レーザー市場の成長を促進すると予測されています。

当レポートでは、世界の医療用レーザー市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 医療用レーザー市場の概要

- 固体医療用レーザーシステム市場:タイプ別(2023年・2028年)

- 地域の分析:医療用レーザー市場、エンドユーザー別(2022年)

- 医療用レーザー市場:地理的な成長機会

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 規制分析

- 主な規制ガイドライン

- 米国

- カナダ

- 英国

- フランス

- ドイツ

- 中国

- インド

- ブラジル

- アラブ首長国連邦

- 償還シナリオ

- サプライチェーン分析

- 有名企業

- 中小企業

- エンドユーザー

- エコシステム市場マップ

- 価格分析

- 貿易分析

- 特許分析

- ポーターのファイブフォース分析

- 主な会議とイベント(2024年~2025年)

- ケーススタディ分析

- 技術分析

- 顧客のビジネスに影響を与える動向/混乱

- 新技術

- 主なステークホルダーと購入基準

- 主な購入基準の影響の分析

- 顧客のアンメットニーズと主な悩み

第6章 医療用レーザー市場:技術別

- イントロダクション

- 固体レーザーシステム

- ER:YAGレーザーシステム

- ND:YAGレーザーシステム

- HO:YAGレーザーシステム

- アレキサンドライトレーザーシステム

- その他の固体レーザーシステム

- ガスレーザーシステム

- CO2レーザーシステム

- アルゴンレーザーシステム

- クリプトンレーザーシステム

- エキシマレーザーシステム

- その他のガスレーザーシステム

- パルス色素レーザーシステム

- ダイオードレーザーシステム

- その他の技術

第7章 医療用レーザー市場:用途別

- イントロダクション

- 美容/化粧品用途

- 脱毛

- タトゥー除去

- ニキビと傷跡の除去

- その他の美容用途

- 皮膚科用途

- 歯科用途

- 泌尿器科用途

- 眼科用途

- 産婦人科用途

- 腫瘍用途

- 心血管用途

- その他の用途

第8章 医療用レーザー市場:エンドユーザー別

- イントロダクション

- 病院、外科センター

- 皮膚科、歯科クリニック

- メディカルスパ、美容スパ

- 家庭使用、セルフケア

- その他のエンドユーザー

第9章 医療用レーザー市場:地域別

- イントロダクション

- 北米

- 北米の医療用レーザー市場に対する景気後退の影響

- 米国

- カナダ

- 欧州

- 欧州の医療用レーザー市場に対する景気後退の影響

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋の医療用レーザー市場に対する景気後退の影響

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカの医療用レーザー市場に対する景気後退の影響

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

- 市場を牽引する美容治療への需要の増大

- 中東・アフリカの医療用レーザー市場に対する不況の影響

第10章 競合情勢

- 概要

- 主要企業が採用した戦略

- 収益シェア分析

- 市場シェア分析

- 歯科製品の市場シェア

- 美容、皮膚科製品の市場シェア

- 眼科製品の市場シェア

- 企業の評価マトリクス

- スタートアップ/中小企業の評価マトリクス

- 競合ベンチマーキング

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- BOSTON SCIENTIFIC CORPORATION

- JOHNSON & JOHNSON VISION CARE, INC.

- ALCON INC.

- CYNOSURE

- CARL ZEISS MEDITEC AG

- CANDELA CORPORATION

- LUMENIS BE LTD.

- CUTERA, INC.

- BAUSCH HEALTH COMPANIES INC.

- EL.EN. S.P.A.

- ALMA LASERS

- FOTONA

- AEROLASE CORP.

- SCITON

- LUTRONIC

- IPG PHOTONICS CORPORATION

- BISON MEDICAL.

- AMD LASERS

- その他の企業

- ZOLAR TECHNOLOGY & MFG. CO. INC.

- IRIDEX CORPORATION

- SHARPLIGHT TECHNOLOGIES INC.

- EUFOTON S.R.L.

- A.R.C. LASER GMBH

- OMNIGUIDE HOLDINGS, INC.

- AMPLITUDE LASER

- AKELA LASER CORPORATION

- LASOS LASERTECHNIK GMBH

- LIGHT INSTRUMENTS LTD.

第12章 付録

The medical lasers market is projected to reach USD 8.3 billion by 2028 from USD 4.8 billion in 2023, at a CAGR of 11.5% from 2023 to 2028. The expansion of the medical lasers market is greatly shaped by the strong demand for procedures such as tattoo removal and hair removal treatment. Two key factors drive this demand: technological advancements in medical laser technology, which addresses the increasing need for tattoo removal solutions as obesity rates rise, and the aging demographic's desire for skin resurfacing to counter imperfections, contributing to the overall growth of the market. These elements underscore the enduring popularity of medical laser treatments in addressing both cosmetic and age-related concerns, fueling the market's expansion.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Billion |

| Segments | Technology, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

"The solid- state laser application segment held the largest share of the market in 2023."

Based on technology, the medical lasers market is segmented into solid-state laser systems, gas laser systems, pulsed dye laser systems, diode laser systems, other technologies. the solid-state laser systems application segment held the largest market share in 2023. The market is expected to experience growth due to an increasing demand for aesthetic procedures conducted in home settings.

"The hair removal segment is projected to register the highest CAGR of the aesthetic/cosmetics by application during the forecast period."

Based on Application, the medical lasers market is segmented into aesthetic/cosmetic applications, dermatology applications, urology applications, ophthalmology applications, dental applications, ob/gyn applications, oncology applications, cardiovascular applications and other applications. The hair removal segment is projected to register the highest CAGR of the aesthetics/cosmetic market from 2023 to 2028. The rising expenditure by consumers on pharmaceuticals related to cosmetics.

"The market in the Asia Pacific region is expected to witness the highest growth during the forecast period."

The medical lasers market in the APAC region is expected to register the highest CAGR during the forecast period, primarily due to evolving healthcare infrastructure and the increasing focus of major players in the region. The healthcare infrastructure in emerging economies, such as India and China, is evolving at a rapid pace, leading to major investments in advanced medical lasers systems by hospitals and surgical centers. these factors are anticipated to fuel the growth of the medical lasers market in this region.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-40%, Tier 2-34%, and Tier 3-26%

- By Designation: Director-level-20%, C-level-20%, and Others-60%

- By Region: North America-30%, Europe-40%, Asia Pacific-20%, Latin America-08%, Middle East and Africa-02%

The prominent players in the medical lasers market are Cynosure (US), Candela Medical (US), Cutera (US), and amongs others.

Research Coverage

This report studies the medical lasers market based on technology, application, end user, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their growth trends and forecasts the revenue of the market segments with respect to three main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall medical lasers market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This report provides insights on the following pointers:

Analysis of key drivers (technological advancement in the medical laser technology, increase in the number of non surgical cosmetic procedures, rising demand for minimally invasive surgical procedures, reimbursement scenario and increase incidence and prevalence of targeted diseases), restraints (high cost of medical laser, stringent safety regulation), opportunities (growth of medical tourism, extended use of laser in diverse clinical fields), challenges (risk associated with lasers) influencing the growth of the medical lasers market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the medical lasers market

- Market Development: Comprehensive information about lucrative markets-the report analyses the medical lasers market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the medical lasers market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Inmode (Israel), Alma Lasers (Israel), Cynosure (US), and Cutera (US), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 RESEARCH LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RECESSION IMPACT

- 2.3 RESEARCH DESIGN

- 2.3.1 SECONDARY RESEARCH

- 2.3.2 PRIMARY RESEARCH

- 2.3.2.1 Primary sources

- 2.3.2.2 Key industry insights

- 2.3.2.3 Breakdown of primaries

- FIGURE 1 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.4 MARKET SIZE ESTIMATION

- FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Approach 1: Company revenue estimation approach

- 2.4.1.2 Approach 2: Customer-based market estimation

- FIGURE 4 MEDICAL LASERS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.4.1.3 CAGR projections

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.5 DATA VALIDATION APPROACH

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- 2.6 MARKET SHARE ASSESSMENT

- 2.7 STUDY ASSUMPTIONS

- 2.8 RISK ASSESSMENT

- 2.8.1 MEDICAL LASERS MARKET: RISK ASSESSMENT

- 2.9 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 MEDICAL LASERS MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 8 MEDICAL LASERS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 MEDICAL LASERS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 GEOGRAPHICAL SNAPSHOT OF MEDICAL LASERS MARKET

4 PREMIUM INSIGHTS

- 4.1 MEDICAL LASERS MARKET OVERVIEW

- FIGURE 11 RISING NUMBER OF NON-SURGICAL COSMETIC PROCEDURES TO DRIVE MARKET

- 4.2 SOLID-STATE MEDICAL LASER SYSTEMS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 ND:YAG LASER SYSTEMS TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.3 REGIONAL ANALYSIS: MEDICAL LASERS MARKET, BY END USER (2022)

- FIGURE 13 NORTH AMERICA DOMINATED MEDICAL LASERS MARKET FOR ALL END-USER SEGMENTS IN 2022

- 4.4 MEDICAL LASERS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 14 INDIA TO REGISTER HIGHEST GROWTH FOR MEDICAL LASER PRODUCTS DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 MEDICAL LASERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements in medical laser technology

- 5.2.1.2 Increasing number of non-surgical cosmetic procedures

- FIGURE 16 NUMBER OF NON-SURGICAL PROCEDURES PERFORMED GLOBALLY, 2018 VS. 2022

- 5.2.1.3 Rising demand for minimally invasive surgical procedures

- 5.2.1.4 Increasing incidence and prevalence of target diseases

- 5.2.1.5 Favorable reimbursement scenario

- TABLE 1 REIMBURSEMENT SCENARIO IN US

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of medical laser products and treatment

- TABLE 2 SURGEON FEES FOR NON-SURGICAL PROCEDURES WITH MEDICAL LASERS

- TABLE 3 SURGEON FEES FOR SURGICAL PROCEDURES WITH MEDICAL LASERS

- 5.2.2.2 Stringent safety regulations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth of medical tourism

- 5.2.3.2 Growing applications of laser-based devices in diverse clinical areas

- 5.2.4 CHALLENGES

- 5.2.4.1 Risks associated with lasers

- 5.3 REGULATORY ANALYSIS

- 5.3.1 KEY REGULATORY BODIES AND GOVERNMENT AGENCIES

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4 KEY REGULATORY GUIDELINES

- 5.4.1 US

- 5.4.2 CANADA

- 5.4.3 UK

- 5.4.4 FRANCE

- 5.4.5 GERMANY

- 5.4.6 CHINA

- 5.4.7 INDIA

- 5.4.8 BRAZIL

- 5.4.9 UAE

- 5.5 REIMBURSEMENT SCENARIO

- TABLE 8 MAJOR CPT CODES FOR LASER PROCEDURES IN THE US

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 5.6.3 END USERS

- FIGURE 17 SUPPLY CHAIN ANALYSIS: MEDICAL LASERS MARKET

- 5.7 ECOSYSTEM MARKET MAP

- TABLE 9 MEDICAL LASERS MARKET: ROLE IN ECOSYSTEM

- 5.8 PRICING ANALYSIS

- FIGURE 18 AVERAGE SELLING PRICE TREND OF MEDICAL LASER SYSTEMS, BY TECHNOLOGY

- FIGURE 19 AVERAGE SELLING PRICE TREND OF MEDICAL LASER SYSTEMS, BY REGION

- 5.9 TRADE ANALYSIS

- 5.9.1 TRADE ANALYSIS OF MEDICAL LASER SYSTEMS

- TABLE 10 IMPORT DATA FOR LASER DEVICES (HS CODE 854370), BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 11 EXPORT DATA FOR LASER DEVICES (HS CODE 854370), BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 12 IMPORT DATA FOR LASERS (EXCLUDING DIODES) (HS CODE 901320), BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 13 EXPORT DATA FOR LASERS (EXCLUDING DIODES) (HS CODE 901320), BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.10 PATENT ANALYSIS

- FIGURE 20 PATENT DETAILS FOR MEDICAL LASERS (JANUARY 2013-NOVEMBER 2023)

- 5.11 PORTER'S FIVE FORCE ANALYSIS

- TABLE 14 PORTER'S FIVE FORCES ANALYSIS: MEDICAL LASERS MARKET

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY CONFERENCES AND EVENTS IN 2024-2025

- TABLE 15 LIST OF MAJOR CONFERENCES AND EVENTS IN MEDICAL LASERS MARKET IN 2023-2024

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 CASE 1: IMPROVED PLATFORMS AND HIGHLY EFFECTIVE SUPPLY CHANNELS

- 5.13.2 CASE 2: REVOLUTIONIZING DENTAL CARE - HARNESSING DIODE LASERS FOR MINIMALLY INVASIVE PRECISION

- 5.14 TECHNOLOGY ANALYSIS

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.16 EMERGING TECHNOLOGIES

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS

- TABLE 16 CRITICAL STAKEHOLDER REQUIREMENT IN PURCHASE CRITERIA FOR MEDICAL LASER SYSTEMS

- 5.18 IMPACT ANALYSIS OF KEY BUYING CRITERIA

- TABLE 17 KEY REQUIREMENTS OF STAKEHOLDERS ON BUYING CRITERIA AND THEIR IMPACT ON PURCHASE DECISION

- 5.19 CUSTOMER UNMET NEEDS AND KEY PAIN POINTS

6 MEDICAL LASERS MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- TABLE 18 MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 6.2 SOLID-STATE LASER SYSTEMS

- TABLE 19 SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 20 SOLID-STATE LASER SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 21 SOLID-STATE LASER SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 6.2.1 ER:YAG LASER SYSTEMS

- 6.2.1.1 Increasing demand for Er:YAG laser systems in medicine to propel market

- TABLE 22 ER:YAG LASER SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2 ND:YAG LASER SYSTEMS

- 6.2.2.1 Exhibit versatility across various disciplines

- TABLE 23 ND:YAG LASER SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.3 HO:YAG LASER SYSTEMS

- 6.2.3.1 Highly versatile tool in endourology

- TABLE 24 HO:YAG LASER SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.4 ALEXANDRITE LASER SYSTEMS

- 6.2.4.1 Effective in dermatological procedures to treat pigmented lesions and tattoos

- TABLE 25 ALEXANDRITE LASER SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.5 OTHER SOLID-STATE LASER SYSTEMS

- TABLE 26 OTHER SOLID-STATE LASER SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3 GAS LASER SYSTEMS

- TABLE 27 GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 28 GAS LASER SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 29 GAS LASER SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 6.3.1 CO2 LASER SYSTEMS

- 6.3.1.1 Minimal postoperative swelling and reduced risk of tissue scarring to support market growth

- TABLE 30 CO2 LASER SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.2 ARGON LASER SYSTEMS

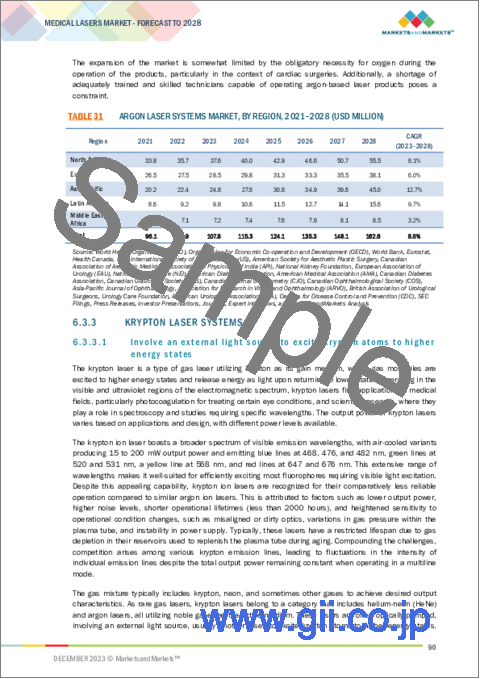

- 6.3.2.1 Rising popularity of argon-based laser systems in medical field to favor market growth

- TABLE 31 ARGON LASER SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.3 KRYPTON LASER SYSTEMS

- 6.3.3.1 Involve an external light source to excite krypton atoms to higher energy states

- TABLE 32 KRYPTON LASER SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.4 EXCIMER LASER SYSTEMS

- 6.3.4.1 Expansion and advancements in industrial applications to drive growth

- TABLE 33 EXCIMER LASER SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.5 OTHER GAS LASER SYSTEMS

- TABLE 34 OTHER GAS LASER SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.4 PULSED DYE LASER SYSTEMS

- 6.4.1 INCREASING NUMBER OF DERMATOLOGY AND COSMETIC SURGERY TREATMENT PROCEDURES TO DRIVE MARKET

- TABLE 35 PULSED DYE LASER SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 36 PULSED DYE LASER SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 6.5 DIODE LASER SYSTEMS

- 6.5.1 TECHNOLOGICAL ADVANCEMENTS IN SEMICONDUCTOR DIODES TO SUPPORT MARKET GROWTH

- TABLE 37 DIODE LASER SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 38 DIODE LASER SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 6.6 OTHER TECHNOLOGIES

- TABLE 39 MEDICAL LASERS MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 40 MEDICAL LASERS MARKET FOR OTHER TECHNOLOGIES, BY END USER, 2021-2028 (USD MILLION)

7 MEDICAL LASERS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 41 MEDICAL LASERS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 7.2 AESTHETIC/COSMETIC APPLICATIONS

- TABLE 42 MEDICAL LASERS MARKET FOR AESTHETIC/COSMETIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- 7.2.1 HAIR REMOVAL

- 7.2.1.1 Laser hair removal gained traction in emerging economies

- TABLE 43 TOP FIVE COUNTRIES PERFORMING HAIR REMOVAL TREATMENT

- TABLE 44 MEDICAL LASERS MARKET FOR HAIR REMOVAL, BY REGION, 2021-2028 (USD MILLION)

- 7.2.2 TATTOO REMOVAL

- 7.2.2.1 Improved safety and efficacy of tattoo removal procedures to drive market

- TABLE 45 MEDICAL LASERS MARKET FOR TATTOO REMOVAL, BY REGION, 2021-2028 (USD MILLION)

- 7.2.3 ACNE AND SCAR REMOVAL

- 7.2.3.1 Rising population and expanded portfolio of acne and scar removal devices to drive market

- TABLE 46 MEDICAL LASERS MARKET FOR ACNE AND SCAR REMOVAL, BY REGION, 2021-2028 (USD MILLION)

- 7.2.4 OTHER AESTHETIC APPLICATIONS

- TABLE 47 MEDICAL LASERS MARKET FOR OTHER AESTHETIC APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 7.3 DERMATOLOGY APPLICATIONS

- 7.3.1 GROWING ADOPTION OF LASER ABLATION IN AESTHETIC APPLICATIONS TO SUPPORT MARKET GROWTH

- TABLE 48 MEDICAL LASERS MARKET FOR DERMATOLOGY APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 7.4 DENTAL APPLICATIONS

- 7.4.1 TECHNOLOGICAL ADVANTAGES IN LASER-ASSISTED DENTAL SURGERIES TO SUPPORT MARKET GROWTH

- TABLE 49 MEDICAL LASERS MARKET FOR DENTAL APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 7.5 UROLOGY APPLICATIONS

- 7.5.1 INCREASING INCIDENCE OF UROLOGICAL DISORDERS TO DRIVE MARKET

- TABLE 50 MEDICAL LASERS MARKET FOR UROLOGY APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 7.6 OPHTHALMOLOGY APPLICATIONS

- 7.6.1 RISING DEMAND IN LASER-ASSISTED OPHTHALMIC SURGERIES TO DRIVE MARKET

- TABLE 51 MEDICAL LASERS MARKET FOR OPHTHALMOLOGY APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 7.7 OB/GYN APPLICATIONS

- 7.7.1 RISING INCIDENCE OF GYNECOLOGICAL DISORDERS TO DRIVE MARKET

- TABLE 52 MAJOR LASER TECHNOLOGIES USED FOR GYNECOLOGICAL APPLICATIONS

- TABLE 53 MEDICAL LASERS MARKET FOR OB/GYN APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 7.8 ONCOLOGY APPLICATIONS

- 7.8.1 RISING PREVALENCE OF CANCER TO DRIVE MARKET

- FIGURE 21 NUMBER OF NEW CANCER CASES, 2023

- FIGURE 22 NUMBER OF CANCER DEATHS, 2023

- TABLE 54 MEDICAL LASERS MARKET FOR ONCOLOGY APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 7.9 CARDIOVASCULAR APPLICATIONS

- 7.9.1 RISING INCLINATION AMONG PATIENTS TOWARD MINIMALLY INVASIVE PROCEDURES TO SUPPORT MARKET GROWTH

- TABLE 55 MEDICAL LASERS MARKET FOR CARDIOVASCULAR APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 7.10 OTHER APPLICATIONS

- TABLE 56 MEDICAL LASERS MARKET FOR OTHER APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

8 MEDICAL LASERS MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 57 MEDICAL LASERS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2 HOSPITALS AND SURGICAL CENTERS

- 8.2.1 INCREASING OUTSOURCING OF MEDICAL LASER TREATMENT TO HOSPITALS AND SURGICAL CENTERS TO DRIVE GROWTH

- TABLE 58 MEDICAL LASERS MARKET FOR HOSPITALS AND SURGICAL CENTERS, BY REGION, 2021-2028 (USD MILLION)

- 8.3 DERMATOLOGY AND DENTAL CLINICS

- 8.3.1 INCREASING NUMBER OF DERMATOLOGY AND DENTAL CLINICS TO SUPPORT MARKET GROWTH

- TABLE 59 MEDICAL LASERS MARKET FOR DERMATOLOGY AND DENTAL CLINICS, BY REGION, 2021-2028 (USD MILLION)

- 8.4 MEDICAL AND BEAUTY SPAS

- 8.4.1 INCREASING DEMAND FOR COSMETIC AND AESTHETIC TREATMENTS TO DRIVE ADOPTION

- TABLE 60 MEDICAL LASERS MARKET FOR MEDICAL AND BEAUTY SPAS, BY REGION, 2021-2028 (USD MILLION)

- 8.5 HOME USE AND SELF-CARE

- 8.5.1 GROWING FOCUS ON INNOVATIVE MEDICAL AESTHETICS TREATMENT TO DRIVE MARKET

- TABLE 61 MEDICAL LASERS MARKET FOR HOME USE AND SELF-CARE, BY REGION, 2021-2028 (USD MILLION)

- 8.6 OTHER END USERS

- TABLE 62 MEDICAL LASERS MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

9 MEDICAL LASERS MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 63 MEDICAL LASERS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 RECESSION IMPACT ON NORTH AMERICAN MEDICAL LASERS MARKET

- FIGURE 23 NORTH AMERICA: MEDICAL LASERS MARKET SNAPSHOT

- TABLE 64 NORTH AMERICA: MEDICAL LASERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: MEDICAL LASERS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: MEDICAL LASERS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 Presence of developed healthcare system and numerous established medical laser companies to drive market

- TABLE 70 US: NUMBER OF MEDICAL LASER PROCEDURES, 2018-2022

- TABLE 71 US: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 72 US: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 73 US: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Increased awareness about noninvasive laser procedures to drive market

- TABLE 74 CANADA: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 75 CANADA: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 76 CANADA: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 RECESSION IMPACT ON EUROPEAN MEDICAL LASERS MARKET

- TABLE 77 EUROPE: MEDICAL LASERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 78 EUROPE: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 79 EUROPE: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 80 EUROPE: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 81 EUROPE: MEDICAL LASERS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 82 EUROPE: MEDICAL LASERS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.2 GERMANY

- 9.3.2.1 Increasing research on laser-assisted surgical procedures to propel market

- TABLE 83 GERMANY: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 84 GERMANY: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 85 GERMANY: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Stringent government regulations related to cosmetic surgeries to limit market

- TABLE 86 FRANCE: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 87 FRANCE: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 88 FRANCE: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.4 UK

- 9.3.4.1 Increasing number of cosmetic surgeries to support market growth

- TABLE 89 UK: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 90 UK: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 91 UK: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.5 ITALY

- 9.3.5.1 Growing medical tourism to drive market

- TABLE 92 ITALY: NUMBER OF MEDICAL LASER PROCEDURES, 2018-2022

- TABLE 93 ITALY: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 94 ITALY: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 95 ITALY: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.6 SPAIN

- 9.3.6.1 Growing demand for cosmetic procedures and rising availability of safe, minimally invasive treatment procedures to drive market

- TABLE 96 SPAIN: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 97 SPAIN: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 98 SPAIN: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.7 REST OF EUROPE

- TABLE 99 REST OF EUROPE: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 100 REST OF EUROPE: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 101 REST OF EUROPE: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4 ASIA PACIFIC

- TABLE 102 ASIA PACIFIC: NUMBER OF MEDICAL PROCEDURES, BY COUNTRY, 2022

- 9.4.1 RECESSION IMPACT ON ASIA PACIFIC MEDICAL LASERS MARKET

- FIGURE 24 ASIA PACIFIC: MEDICAL LASERS MARKET SNAPSHOT

- TABLE 103 ASIA PACIFIC: MEDICAL LASERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MEDICAL LASERS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MEDICAL LASERS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Faster implementation of innovative technologies to drive market

- TABLE 109 JAPAN: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 110 JAPAN: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 111 JAPAN: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.3 CHINA

- 9.4.3.1 Rise in accessibility of laser surgery apps and online services to support market growth

- TABLE 112 CHINA: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 113 CHINA: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 114 CHINA: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.4 INDIA

- 9.4.4.1 Increasing incidence of target diseases to drive demand

- TABLE 115 INDIA: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 116 INDIA: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 117 INDIA: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.5 AUSTRALIA

- 9.4.5.1 Rising demand for noninvasive procedures to propel market

- TABLE 118 AUSTRALIA: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 119 AUSTRALIA: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 120 AUSTRALIA: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Increasing demand for medical laser treatments to drive market

- TABLE 121 SOUTH KOREA: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 122 SOUTH KOREA: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 123 SOUTH KOREA: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.4.7 REST OF ASIA PACIFIC

- TABLE 124 REST OF ASIA PACIFIC: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 126 REST OF ASIA PACIFIC: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.5 LATIN AMERICA

- 9.5.1 RECESSION IMPACT ON LATIN AMERICAN MEDICAL LASERS MARKET

- TABLE 127 LATIN AMERICA: MEDICAL LASERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 128 LATIN AMERICA: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 129 LATIN AMERICA: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 130 LATIN AMERICA: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 131 LATIN AMERICA: MEDICAL LASERS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 132 LATIN AMERICA: MEDICAL LASERS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.2 BRAZIL

- 9.5.2.1 Increased awareness of advanced laser procedures to drive market

- TABLE 133 BRAZIL: NUMBER OF MEDICAL AESTHETIC PROCEDURES, 2022

- TABLE 134 BRAZIL: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 135 BRAZIL: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 BRAZIL: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.5.3 MEXICO

- 9.5.3.1 Increase in patient inflow for laser treatment procedures to drive market

- TABLE 137 MEXICO: NUMBER OF MEDICAL PROCEDURES, 2022

- TABLE 138 MEXICO: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 139 MEXICO: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 140 MEXICO: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.5.4 REST OF LATIN AMERICA

- TABLE 141 REST OF LATIN AMERICA: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 142 REST OF LATIN AMERICA: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 143 REST OF LATIN AMERICA: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GROWING DEMAND FOR AESTHETIC TREATMENTS TO DRIVE MARKET

- 9.6.2 RECESSION IMPACT ON MIDDLE EAST & AFRICAN MEDICAL LASERS MARKET

- TABLE 144 MIDDLE EAST & AFRICA: MEDICAL LASERS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: SOLID-STATE LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: GAS LASER SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: MEDICAL LASERS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: MEDICAL LASERS MARKET, BY END USER, 2021-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN MEDICAL LASERS MARKET

- TABLE 149 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MANUFACTURING COMPANIES

- 10.3 REVENUE SHARE ANALYSIS

- FIGURE 25 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN MEDICAL LASERS MARKET, 2020-2022 (USD MILLION)

- 10.4 MARKET SHARE ANALYSIS

- 10.4.1 DENTAL PRODUCTS MARKET SHARE

- FIGURE 26 DENTAL PRODUCTS MARKET SHARE, BY KEY PLAYER, 2022

- 10.4.2 AESTHETIC AND DERMATOLOGY PRODUCTS MARKET SHARE

- FIGURE 27 AESTHETIC AND DERMATOLOGY PRODUCTS MARKET SHARE, BY KEY PLAYER, 2022

- 10.4.3 OPHTHALMOLOGY PRODUCTS MARKET SHARE

- FIGURE 28 OPHTHALMOLOGY PRODUCTS MARKET SHARE, BY KEY PLAYER, 2022

- TABLE 150 MEDICAL LASERS MARKET: DEGREE OF COMPETITION

- 10.5 COMPANY EVALUATION MATRIX

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 29 MEDICAL LASERS MARKET: COMPANY EVALUATION MATRIX, 2022

- 10.6 STARTUP/SME EVALUATION MATRIX

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 30 MEDICAL LASERS MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 10.7 COMPETITIVE BENCHMARKING

- 10.7.1 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS

- TABLE 151 TECHNOLOGY AND REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS IN MEDICAL LASERS MARKET

- TABLE 152 TECHNOLOGY FOOTPRINT

- TABLE 153 REGIONAL FOOTPRINT

- 10.8 COMPETITIVE SCENARIO AND TRENDS

- 10.8.1 PRODUCT LAUNCHES & APPROVALS (JANUARY 2020-NOVEMBER 2023)

- 10.8.2 DEALS (JANUARY 2020-NOVEMBER 2023)

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 11.1.1 BOSTON SCIENTIFIC CORPORATION

- TABLE 154 BOSTON SCIENTIFIC CORPORATION: COMPANY OVERVIEW

- FIGURE 31 BOSTON SCIENTIFIC CORPORATION: COMPANY SNAPSHOT (2022)

- 11.1.2 JOHNSON & JOHNSON VISION CARE, INC.

- TABLE 155 JOHNSON & JOHNSON VISION CARE, INC.: COMPANY OVERVIEW

- FIGURE 32 JOHNSON & JOHNSON SERVICES, INC.: COMPANY SNAPSHOT (2022)

- 11.1.3 ALCON INC.

- TABLE 156 ALCON INC.: COMPANY OVERVIEW

- FIGURE 33 ALCON INC.: COMPANY SNAPSHOT (2022)

- 11.1.4 CYNOSURE

- TABLE 157 CYNOSURE: COMPANY OVERVIEW

- 11.1.5 CARL ZEISS MEDITEC AG

- TABLE 158 CARL ZEISS MEDITEC AG: COMPANY OVERVIEW

- FIGURE 34 CARL ZEISS MEDITEC AG: COMPANY SNAPSHOT (2022)

- 11.1.6 CANDELA CORPORATION

- TABLE 159 CANDELA CORPORATION: COMPANY OVERVIEW

- 11.1.7 LUMENIS BE LTD.

- TABLE 160 LUMENIS BE LTD.: COMPANY OVERVIEW

- 11.1.8 CUTERA, INC.

- TABLE 161 CUTERA, INC.: COMPANY OVERVIEW

- FIGURE 35 CUTERA, INC: COMPANY SNAPSHOT (2022)

- 11.1.9 BAUSCH HEALTH COMPANIES INC.

- TABLE 162 BAUSCH HEALTH COMPANIES INC.: COMPANY OVERVIEW

- FIGURE 36 BAUSCH HEALTH COMPANIES INC.: COMPANY SNAPSHOT (2022)

- 11.1.10 EL.EN. S.P.A.

- TABLE 163 EL.EN. S.P.A.: COMPANY OVERVIEW

- FIGURE 37 EL.EN. S.P.A.: COMPANY SNAPSHOT (2022)

- 11.1.11 ALMA LASERS

- TABLE 164 ALMA LASERS: COMPANY OVERVIEW

- FIGURE 38 SISRAM MEDICAL LTD.: COMPANY SNAPSHOT (2022)

- 11.1.12 FOTONA

- TABLE 165 FOTONA: COMPANY OVERVIEW

- 11.1.13 AEROLASE CORP.

- TABLE 166 AEROLASE CORP.: COMPANY OVERVIEW

- 11.1.14 SCITON

- TABLE 167 SCITON: COMPANY OVERVIEW

- 11.1.15 LUTRONIC

- TABLE 168 LUTRONIC: COMPANY OVERVIEW

- 11.1.16 IPG PHOTONICS CORPORATION

- TABLE 169 IPG PHOTONICS CORPORATION: COMPANY OVERVIEW

- FIGURE 39 IPG PHOTONICS CORPORATION: COMPANY SNAPSHOT (2022)

- 11.1.17 BISON MEDICAL.

- TABLE 170 BISON MEDICAL: COMPANY OVERVIEW

- 11.1.18 AMD LASERS

- TABLE 171 AMD LASERS: COMPANY OVERVIEW

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 ZOLAR TECHNOLOGY & MFG. CO. INC.

- 11.2.2 IRIDEX CORPORATION

- 11.2.3 SHARPLIGHT TECHNOLOGIES INC.

- 11.2.4 EUFOTON S.R.L.

- 11.2.5 A.R.C. LASER GMBH

- 11.2.6 OMNIGUIDE HOLDINGS, INC.

- 11.2.7 AMPLITUDE LASER

- 11.2.8 AKELA LASER CORPORATION

- 11.2.9 LASOS LASERTECHNIK GMBH

- 11.2.10 LIGHT INSTRUMENTS LTD.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS