|

|

市場調査レポート

商品コード

1415820

低体温治療システムの世界市場:製品別(冷却装置、冷却カテーテル、クールキャップ)、用途別(神経科、循環器科、新生児ケア)、地域別- 2028年までの予測Therapeutic Hypothermia Systems Market by Product (Cooling Devices, Cooling Catheters, Cool Caps), Application (Neurology, Cardiology, Neonatal Care), and Region (North America, Europe, Asia- Pacific, RoW) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 低体温治療システムの世界市場:製品別(冷却装置、冷却カテーテル、クールキャップ)、用途別(神経科、循環器科、新生児ケア)、地域別- 2028年までの予測 |

|

出版日: 2024年01月19日

発行: MarketsandMarkets

ページ情報: 英文 168 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント | 製品別、用途別、エンドユーザー別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

世界の低体温治療システムの市場規模は、予測期間中にCAGR 6.3%で拡大し、2023年の2億9,100万米ドルから2028年には3億9,600万米ドルに達すると予測されています。

同市場の成長の主な原動力は、感染症や慢性疾患の有病率の増加と、低侵襲的な冷却方法の使用の増加です。しかし、代替方法の存在や発展途上国における認知度の低さが、治療用低体温システム市場の成長を抑制する可能性があります。

製品別では、2022年には冷却装置セグメントが市場を独占しました。このセグメントの大きなシェアは、使いやすさ、利用可能な労働集約的なデバイスの少なさ、制御ユニットによるシンプルで効果的な温度調整システムの存在に起因しています。

用途別では、2022年の低体温治療システム市場で最もCAGRが高かったのは循環器分野でした。このセグメントのCAGRが最も高いのは、主に心停止患者の治療に低体温療法を使用する潜在的なメリットがあるためです。

地域別に見ると、北米は予測期間中、高い市場シェアが見込まれます。技術的に高度な治療用低体温システム製品の存在と医療機器産業における進歩の増加が、治療用低体温システム市場の成長を支えています。

当レポートでは、世界の低体温治療システム市場について調査し、製品別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- サプライチェーン分析

- ポーターのファイブフォース分析

- 規制分析

- 貿易分析

- 技術分析

- エコシステム分析

- 特許分析

- 2024年~2025年の主要な会議とイベント

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- 主要な利害関係者と購入基準

第6章 低体温治療システム市場、製品別

- イントロダクション

- 冷却装置

- 冷却カテーテル

- クールキャップ

第7章 低体温治療システム市場、用途別

- イントロダクション

- 神経科

- 循環器科

- 新生児ケア

- その他

第8章 低体温治療システム市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第9章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオと動向

第10章 企業プロファイル

- 主要参入企業

- ASAHI KASEI CORPORATION(ZOLL MEDICAL CORPORATION)

- BECTON, DICKINSON AND COMPANY

- GENTHERM INCORPORATED

- STRYKER CORPORATION

- BELMONT MEDICAL TECHNOLOGIES

- INTERNATIONAL BIOMEDICAL LTD.

- EM-MED

- PHOENIX MEDICAL SYSTEMS

- LIFE RECOVERY SYSTEMS

- SHENZHEN COMEN MEDICAL INSTRUMENTS CO., LTD.

- MIRACRADLE(PLUSS ADVANCED TECHNOLOGIES PVT. LTD.)

- その他の企業

- TERUMO CARDIOVASCULAR SYSTEMS CORPORATION

- PFM MEDICAL HICO GMBH

- VNG MEDICAL INNOVATION SYSTEM PVT. LTD.

- ASPEN SYSTEMS

- COOLTECH MEDICAL

- GLOBAL HEALTHCARE SG

- CRYOTHERMIC SYSTEMS INCORPORATED

- PAXMAN COOLERS LTD.

- DIGNITANA AB

- WISHCAPS

第11章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Million |

| Segments | Product, Application, and End User |

| Regions covered | North America, Europe, Asia Pacific, Rest of the World |

The global therapeutic hypothermia systems market is projected to reach USD 396 million by 2028 from USD 291 million in 2023, at a CAGR of 6.3% during the forecast period. The growth of this market is majorly driven by the growing prevalence of infectious and chronic diseases and the rise in the use of minimally invasive cooling methods. However, the presence of alternative methods and less awareness in developing countries could restrain the growth of the therapeutic hypothermia systems market.

"Cooling devices segment accounted for the highest market share in the therapeutic hypothermia systems market, by product, during the forecast period."

Based on product, the therapeutic hypothermia systems market is classified into Cooling Catheters, Cooling devices and Cool Caps. The cooling devices segment dominated the market in 2022. The large share of the segment can be attributed to the ease of use, fewer labor-intensive devices available, and the presence of a simple and effective thermal regulating system with the control unit.

"Cardiology accounted for the highest CAGR during the forecast period."

Based on the application, the therapeutic hypothermia systems market is segmented into Neurology, Cardiology, Neonatal care, and other applications. The cardiology segment accounted for the highest CAGR of the therapeutic hypothermia systems market in 2022. The highest CAGR of this segment can be primarily attributed to the potential benefit of using hypothermia for treating cardiac arrest patients.

"The North America segment accounted for the highest market share in the therapeutic hypothermia systems market, by region, during the forecast period."

Based on the region, the global therapeutic hypothermia systems market is categorized into North America, Asia Pacific, Europe, and the Rest of the World. North America is expected to witness a high market share during the forecast period. The presence of technologically advanced therapeutic hypothermia systems products and the increasing advancement in the medical device industries are supporting the growth of the therapeutic hypothermia systems market.

Breakdown of supply-side primary interviews by company type, designation, and region:

- By Company Type: Tier 1 (30%), Tier 2 (48%), and Tier 3 (22%)

- By Designation: C-level (28%), Director-level (33%), and Others (39%)

- By Region: North America (21%), Europe (30%), Asia-Pacific (34%), and RoW (15%)

Prominent companies include ZOLL Medical Corporation (Japan), Becton, Dickinson and Company (US), Stryker Corporation (US), Gentherm Incorporated (US), Belmont Medical Technologies (US), International Biomedical Ltd. (US), EM-MED (Poland), Phoenix Medical Systems (India), Life Recovery Systems (US), Shenzhen Comen Medical Instruments Co., Ltd. (China), MiraCradle (India), Terumo Cardiovascular Systems Corporation (US), pfm medical hico gmbh (Germany), VNG Medical Innovation System Pvt. Ltd. (India), Aspen Systems (US), CoolTech Medical (US), Global Healthcare SG (Singapore), Cryothermic Systems Incorporated (US), Paxman Coolers Ltd. (UK), Dignitana AB (Italy), and Wishcaps (US).

Research Coverage

This research report categorizes the therapeutic hypothermia systems market by product, application, and region. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the therapeutic hypothermia systems market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, services; key strategies; Contracts, partnerships, and agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the therapeutic hypothermia systems market. Competitive analysis of upcoming startups in the therapeutic hypothermia systems market ecosystem is covered in this report.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall therapeutic hypothermia systems market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers, restraints, opportunities, and challenges influencing the growth of the therapeutic hypothermia systems market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the therapeutic hypothermia systems market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the therapeutic hypothermia systems market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the therapeutic hypothermia systems market

- Competitive Assessment: In-depth assessment of market ranking, growth strategies, and service offerings of leading players like ZOLL Medical Corporation (Japan), Becton, Dickinson and Company (US), Stryker Corporation (US), among others in the therapeutic hypothermia systems market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 STAKEHOLDERS

- 1.6 LIMITATIONS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 3 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY END USER, DESIGNATION, AND REGION

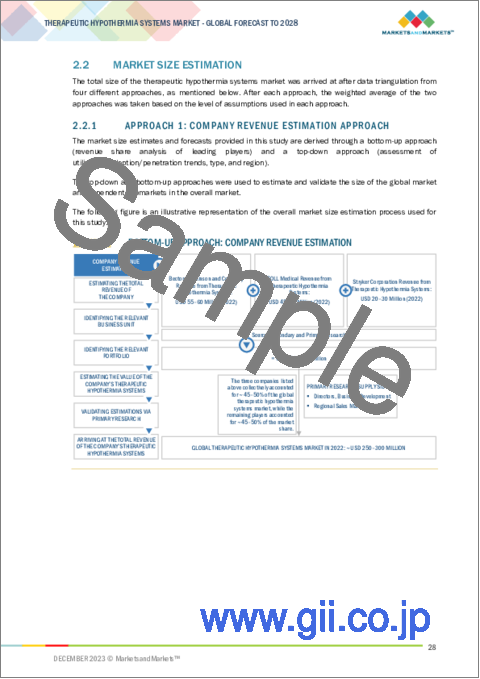

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH 1: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 6 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION

- 2.2.2 APPROACH 2: NUMBER OF THERAPEUTIC HYPOTHERMIA SYSTEMS

- TABLE 1 REVENUE ESTIMATION APPROACH BY CALCULATING MARKET SIZE OF THERAPEUTIC HYPOTHERMIA SYSTEMS

- 2.2.3 APPROACH 3: PRESENTATIONS OF COMPANIES AND PRIMARY INTERVIEWS

- 2.2.4 APPROACH 4: PRIMARY INTERVIEWS

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 8 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ANALYSIS

- 2.5 MARKET ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT

- 2.7 RECESSION IMPACT ON THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET

3 EXECUTIVE SUMMARY

- FIGURE 10 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 GEOGRAPHICAL SNAPSHOT OF THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET

4 PREMIUM INSIGHTS

- 4.1 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET OVERVIEW

- FIGURE 13 RISING NUMBER OF SURGICAL PROCEDURES TO DRIVE THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET

- 4.2 ASIA PACIFIC: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT AND COUNTRY (2022)

- FIGURE 14 COOLING DEVICES SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2022

- 4.3 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 15 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.4 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET: REGIONAL MIX

- FIGURE 16 ASIA PACIFIC MARKET TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- 4.5 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET: DEVELOPED VS. EMERGING ECONOMIES

- FIGURE 17 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising population and increasing prevalence of chronic and infectious diseases

- 5.2.1.2 Increasing number of surgical procedures

- 5.2.1.3 Rising number of hypothermia cases

- 5.2.1.4 Growing number of trauma cases

- 5.2.1.5 Rising adoption of minimally invasive cooling methods

- 5.2.1.6 Growing demand for targeted temperature management in cardiac arrest

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of awareness regarding therapeutic hypothermia systems in developing countries

- 5.2.2.2 Availability of alternative methods

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing growth opportunities in emerging economies

- 5.2.3.2 Developing healthcare infrastructure

- 5.2.3.3 Growing number of contracts and agreements between market players

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of skilled healthcare professionals

- 5.2.4.2 Lack of proper supply chain management

- 5.2.4.3 Product recalls

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 19 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED DURING MANUFACTURING PHASE

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 20 DISTRIBUTION-STRATEGY PREFERRED BY PROMINENT COMPANIES

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 PORTER'S FIVE FORCES ANALYSIS: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET

- 5.5.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.5.2 BARGAINING POWER OF SUPPLIERS

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 THREAT OF SUBSTITUTES

- 5.5.5 THREAT OF NEW ENTRANTS

- 5.6 REGULATORY ANALYSIS

- TABLE 4 INDICATIVE LIST OF REGULATORY AUTHORITIES GOVERNING THERAPEUTIC HYPOTHERMIA SYSTEMS

- 5.6.1 NORTH AMERICA

- 5.6.1.1 US

- TABLE 5 CLASSIFICATION OF MEDICAL DEVICES BY US FDA

- FIGURE 21 PREMARKET NOTIFICATION: 510(K) APPROVAL FOR MEDICAL DEVICES

- 5.6.1.2 Canada

- FIGURE 22 CANADA: APPROVAL PROCESS FOR MEDICAL DEVICES

- 5.6.2 EUROPE

- FIGURE 23 CE APPROVAL PROCESS FOR THERAPEUTIC HYPOTHERMIA SYSTEMS

- 5.6.3 ASIA PACIFIC

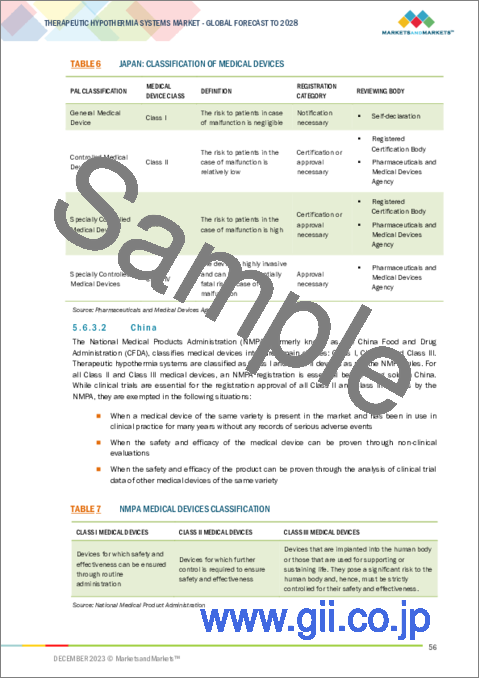

- 5.6.3.1 Japan

- TABLE 6 JAPAN: CLASSIFICATION OF MEDICAL DEVICES

- 5.6.3.2 China

- TABLE 7 NMPA MEDICAL DEVICES CLASSIFICATION

- 5.6.3.3 India

- 5.7 TRADE ANALYSIS

- 5.7.1 TRADE ANALYSIS FOR THERAPEUTIC HYPOTHERMIA SYSTEMS

- TABLE 8 IMPORT DATA FOR HS CODE 901890, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 901890, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.8 TECHNOLOGY ANALYSIS

- 5.9 ECOSYSTEM ANALYSIS

- FIGURE 24 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET: ECOSYSTEM ANALYSIS

- 5.9.1 ROLE IN ECOSYSTEM

- FIGURE 25 KEY PLAYERS IN THERAPEUTIC HYPOTHERMIA SYSTEMS ECOSYSTEM

- 5.10 PATENT ANALYSIS

- FIGURE 26 PATENT ANALYSIS FOR THERAPEUTIC HYPOTHERMIA SYSTEMS

- 5.11 KEY CONFERENCES AND EVENTS IN 2024-2025

- TABLE 10 LIST OF CONFERENCES AND EVENTS IN 2024-2025

- 5.12 PRICING ANALYSIS

- TABLE 11 AVERAGE SELLING PRICE OF KEY PRODUCTS IN THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET (2019-2022)

- TABLE 12 AVERAGE SELLING PRICE TRENDS, BY REGION, 2019-2022

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.13.1 REVENUE SHIFT & REVENUE POCKETS FOR THERAPEUTIC HYPOTHERMIA SYSTEM MANUFACTURERS

- FIGURE 27 REVENUE SHIFT FOR THERAPEUTIC HYPOTHERMIA SYSTEMS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR HOSPITALS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR HOSPITALS

- 5.14.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR TOP END USERS

- TABLE 14 KEY BUYING CRITERIA, BY TOP END USER

6 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 15 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2 COOLING DEVICES

- 6.2.1 INCREASING PREVALENCE OF CARDIOVASCULAR DISEASES TO DRIVE DEMAND

- TABLE 16 THERAPEUTIC HYPOTHERMIA COOLING DEVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 17 NORTH AMERICA: THERAPEUTIC HYPOTHERMIA COOLING DEVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 18 EUROPE: THERAPEUTIC HYPOTHERMIA COOLING DEVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 19 ASIA PACIFIC: THERAPEUTIC HYPOTHERMIA COOLING DEVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 20 REST OF THE WORLD: THERAPEUTIC HYPOTHERMIA COOLING DEVICES MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3 COOLING CATHETERS

- 6.3.1 ABILITY TO COOL SPECIFIC AREAS EFFICIENTLY TO SUPPORT MARKET GROWTH

- TABLE 21 THERAPEUTIC HYPOTHERMIA COOLING CATHETERS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 22 NORTH AMERICA: THERAPEUTIC HYPOTHERMIA COOLING CATHETERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 23 EUROPE: THERAPEUTIC HYPOTHERMIA COOLING CATHETERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 24 ASIA PACIFIC: THERAPEUTIC HYPOTHERMIA COOLING CATHETERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 25 REST OF THE WORLD: THERAPEUTIC HYPOTHERMIA COOLING CATHETERS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.4 COOL CAPS

- 6.4.1 INCREASING NUMBER OF CHEMOTHERAPY PROCEDURES TO DRIVE DEMAND

- TABLE 26 THERAPEUTIC HYPOTHERMIA COOL CAPS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 27 NORTH AMERICA: THERAPEUTIC HYPOTHERMIA COOL CAPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 28 EUROPE: THERAPEUTIC HYPOTHERMIA COOL CAPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: THERAPEUTIC HYPOTHERMIA COOL CAPS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 30 REST OF THE WORLD: THERAPEUTIC HYPOTHERMIA COOL CAPS MARKET, BY REGION, 2021-2028 (USD MILLION)

7 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 31 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 7.2 NEUROLOGY

- 7.2.1 GROWING PREVALENCE OF TBI AND OTHER NEUROLOGICAL DISEASES TO DRIVE MARKET

- TABLE 32 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR NEUROLOGY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR NEUROLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 34 EUROPE: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR NEUROLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR NEUROLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 36 REST OF THE WORLD: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR NEUROLOGY, BY REGION, 2021-2028 (USD MILLION)

- 7.3 CARDIOLOGY

- 7.3.1 HIGH INCIDENCE OF CARDIAC ARRESTS TO SUPPORT MARKET GROWTH

- TABLE 37 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR CARDIOLOGY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR CARDIOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 39 EUROPE: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR CARDIOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 40 ASIA PACIFIC: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR CARDIOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 41 REST OF THE WORLD: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR CARDIOLOGY, BY REGION, 2021-2028 (USD MILLION)

- 7.4 NEONATAL CARE

- 7.4.1 INCREASING NUMBER OF PRETERM BIRTHS TO SUPPORT MARKET GROWTH

- TABLE 42 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR NEONATAL CARE, BY REGION, 2021-2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR NEONATAL CARE, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 44 EUROPE: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR NEONATAL CARE, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR NEONATAL CARE, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 46 REST OF THE WORLD: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR NEONATAL CARE, BY REGION, 2021-2028 (USD MILLION)

- 7.5 OTHER APPLICATIONS

- TABLE 47 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR OTHER APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 49 EUROPE: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 51 REST OF THE WORLD: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET FOR OTHER APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

8 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY REGION

- 8.1 INTRODUCTION

- TABLE 52 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.2 NORTH AMERICA

- FIGURE 30 NORTH AMERICA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET SNAPSHOT

- 8.2.1 NORTH AMERICA: RECESSION IMPACT

- TABLE 53 NORTH AMERICA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.2.2 US

- 8.2.2.1 Growing number of cardiac arrest and brain injury cases to support market growth

- TABLE 56 US: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 57 US: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 58 US: THERAPEUTIC HYPOTHERMIA COOLING DEVICES MARKET, BY VOLUME, 2021-2028 (THOUSAND UNITS)

- 8.2.3 CANADA

- 8.2.3.1 Increasing incidence of various chronic diseases to drive market

- TABLE 59 CANADA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 60 CANADA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.3 EUROPE

- 8.3.1 EUROPE: RECESSION IMPACT

- TABLE 61 EUROPE: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 62 EUROPE: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 63 EUROPE: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.3.2 GERMANY

- 8.3.2.1 High demand for patient cooling devices for cardiology procedures to drive market

- TABLE 64 GERMANY: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 65 GERMANY: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 66 GERMANY: THERAPEUTIC HYPOTHERMIA COOLING DEVICES MARKET, BY VOLUME, 2021-2028 (THOUSAND UNITS)

- 8.3.3 UK

- 8.3.3.1 Rising number of sports injuries and accident & emergency procedures to drive market

- TABLE 67 UK: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 68 UK: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 69 UK: THERAPEUTIC HYPOTHERMIA COOLING DEVICES MARKET, BY VOLUME, 2021-2028 (THOUSAND UNITS)

- 8.3.4 FRANCE

- 8.3.4.1 Strong healthcare system to support market growth

- TABLE 70 FRANCE: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 71 FRANCE: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 72 FRANCE: THERAPEUTIC HYPOTHERMIA COOLING DEVICES MARKET, BY VOLUME, 2021-2028 (THOUSAND UNITS)

- 8.3.5 ITALY

- 8.3.5.1 Growing demand for therapeutic hypothermia systems in traumatic brain injury treatment to support market growth

- TABLE 73 ITALY: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 74 ITALY: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.3.6 SPAIN

- 8.3.6.1 Growing geriatric population and subsequent increase in prevalence of target conditions to drive market

- TABLE 75 SPAIN: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 76 SPAIN: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.3.7 REST OF EUROPE

- TABLE 77 REST OF EUROPE: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 78 REST OF EUROPE: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.4 ASIA PACIFIC

- FIGURE 31 ASIA PACIFIC: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET SNAPSHOT

- 8.4.1 ASIA PACIFIC: RECESSION IMPACT

- TABLE 79 ASIA PACIFIC: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.4.2 CHINA

- 8.4.2.1 Increasing disposable income of middle-class population to drive market

- TABLE 82 CHINA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 83 CHINA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 84 CHINA: THERAPEUTIC HYPOTHERMIA COOLING DEVICES MARKET, BY VOLUME, 2021-2028 (THOUSAND UNITS)

- 8.4.3 JAPAN

- 8.4.3.1 Rapidly increasing geriatric population to drive market

- TABLE 85 JAPAN: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 86 JAPAN: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 87 JAPAN: THERAPEUTIC HYPOTHERMIA COOLING DEVICES MARKET, BY VOLUME, 2021-2028 (THOUSAND UNITS)

- 8.4.4 INDIA

- 8.4.4.1 Growing target patient population to support market growth

- TABLE 88 INDIA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 89 INDIA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.4.5 REST OF ASIA PACIFIC

- TABLE 90 REST OF ASIA PACIFIC: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.5 REST OF THE WORLD

- 8.5.1 REST OF THE WORLD: RECESSION IMPACT

- TABLE 92 REST OF THE WORLD: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 93 REST OF THE WORLD: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 94 REST OF THE WORLD: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.5.2 LATIN AMERICA

- 8.5.2.1 Rising prevalence of chronic diseases to drive market

- TABLE 95 LATIN AMERICA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 96 LATIN AMERICA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.5.3 MIDDLE EAST & AFRICA

- 8.5.3.1 High prevalence of chronic conditions to support market growth

- TABLE 97 MIDDLE EAST & AFRICA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.5.4 GCC COUNTRIES

- 8.5.4.1 Rise in road accident injuries and TBI to drive market

- TABLE 99 GCC COUNTRIES: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 100 GCC COUNTRIES: THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 101 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET

- 9.3 REVENUE ANALYSIS

- FIGURE 32 REVENUE ANALYSIS FOR KEY COMPANIES IN THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET, 2018-2022 (USD MILLION)

- 9.4 MARKET SHARE ANALYSIS

- FIGURE 33 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET RANKING ANALYSIS, BY KEY PLAYER (2022)

- TABLE 102 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET: DEGREE OF COMPETITION

- 9.5 COMPANY EVALUATION MATRIX

- 9.5.1 STARS

- 9.5.2 EMERGING LEADERS

- 9.5.3 PERVASIVE PLAYERS

- 9.5.4 PARTICIPANTS

- FIGURE 34 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET: COMPANY EVALUATION MATRIX, 2022

- 9.5.5 COMPANY FOOTPRINT

- TABLE 103 PRODUCT FOOTPRINT (11 PLAYERS)

- TABLE 104 REGIONAL FOOTPRINT (11 PLAYERS)

- TABLE 105 OVERALL COMPANY FOOTPRINT (11 PLAYERS)

- 9.6 STARTUP/SME EVALUATION MATRIX

- 9.6.1 PROGRESSIVE COMPANIES

- 9.6.2 STARTING BLOCKS

- 9.6.3 RESPONSIVE COMPANIES

- 9.6.4 DYNAMIC COMPANIES

- FIGURE 35 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 9.6.5 COMPETITIVE BENCHMARKING

- TABLE 106 THERAPEUTIC HYPOTHERMIA SYSTEMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 107 PRODUCT & SERVICE FOOTPRINT (STARTUPS/SMES)

- TABLE 108 REGIONAL FOOTPRINT (STARTUPS/SMES)

- TABLE 109 OVERALL COMPANY FOOTPRINT (STARTUPS/SMES)

- 9.7 COMPETITIVE SCENARIO AND TRENDS

- 9.7.1 DEALS

- TABLE 110 THERAPEUTIC HYPOTHERMIA SYSTEMS: DEALS, JANUARY 2020-NOVEMBER 2023

- 9.7.2 OTHER DEVELOPMENTS

- TABLE 111 THERAPEUTIC HYPOTHERMIA SYSTEMS: OTHER DEVELOPMENTS, JANUARY 2020-NOVEMBER 2023

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 10.1.1 ASAHI KASEI CORPORATION (ZOLL MEDICAL CORPORATION)

- TABLE 112 ASAHI KASEI CORPORATION: BUSINESS OVERVIEW

- FIGURE 36 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT (2022)

- 10.1.2 BECTON, DICKINSON AND COMPANY

- TABLE 113 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- FIGURE 37 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- 10.1.3 GENTHERM INCORPORATED

- TABLE 114 GENTHERM INCORPORATED: BUSINESS OVERVIEW

- FIGURE 38 GENTHERM INCORPORATED: COMPANY SNAPSHOT (2022)

- 10.1.4 STRYKER CORPORATION

- TABLE 115 STRYKER CORPORATION: BUSINESS OVERVIEW

- FIGURE 39 STRYKER CORPORATION: COMPANY SNAPSHOT (2022)

- 10.1.5 BELMONT MEDICAL TECHNOLOGIES

- TABLE 116 BELMONT MEDICAL TECHNOLOGIES: BUSINESS OVERVIEW

- 10.1.6 INTERNATIONAL BIOMEDICAL LTD.

- TABLE 117 INTERNATIONAL BIOMEDICAL LTD.: BUSINESS OVERVIEW

- 10.1.7 EM-MED

- TABLE 118 EM-MED: BUSINESS OVERVIEW

- 10.1.8 PHOENIX MEDICAL SYSTEMS

- TABLE 119 PHOENIX MEDICAL SYSTEMS: BUSINESS OVERVIEW

- 10.1.9 LIFE RECOVERY SYSTEMS

- TABLE 120 LIFE RECOVERY SYSTEMS: BUSINESS OVERVIEW

- 10.1.10 SHENZHEN COMEN MEDICAL INSTRUMENTS CO., LTD.

- TABLE 121 SHENZHEN COMEN MEDICAL INSTRUMENTS CO., LTD.: BUSINESS OVERVIEW

- 10.1.11 MIRACRADLE (PLUSS ADVANCED TECHNOLOGIES PVT. LTD.)

- TABLE 122 MIRACRADLE: BUSINESS OVERVIEW

- 10.2 OTHER PLAYERS

- 10.2.1 TERUMO CARDIOVASCULAR SYSTEMS CORPORATION

- TABLE 123 TERUMO CARDIOVASCULAR SYSTEMS CORPORATION: COMPANY OVERVIEW

- 10.2.2 PFM MEDICAL HICO GMBH

- TABLE 124 PFM MEDICAL HICO GMBH: COMPANY OVERVIEW

- 10.2.3 VNG MEDICAL INNOVATION SYSTEM PVT. LTD.

- TABLE 125 VNG MEDICAL INNOVATION SYSTEM PVT. LTD.: COMPANY OVERVIEW

- 10.2.4 ASPEN SYSTEMS

- TABLE 126 ASPEN SYSTEMS: COMPANY OVERVIEW

- 10.2.5 COOLTECH MEDICAL

- TABLE 127 COOLTECH MEDICAL: COMPANY OVERVIEW

- 10.2.6 GLOBAL HEALTHCARE SG

- TABLE 128 GLOBAL HEALTHCARE SG: COMPANY OVERVIEW

- 10.2.7 CRYOTHERMIC SYSTEMS INCORPORATED

- TABLE 129 CRYOTHERMIC SYSTEMS INCORPORATED: COMPANY OVERVIEW

- 10.2.8 PAXMAN COOLERS LTD.

- TABLE 130 PAXMAN COOLERS LTD.: COMPANY OVERVIEW

- 10.2.9 DIGNITANA AB

- TABLE 131 DIGNITANA AB: COMPANY OVERVIEW

- 10.2.10 WISHCAPS

- TABLE 132 WISHCAPS: COMPANY OVERVIEW

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS