|

|

市場調査レポート

商品コード

1415817

AIデータ管理の世界市場:オファリング別(プラットフォーム、ソフトウェアツール、サービス)、データタイプ別、技術別(ML、NLP、コンピュータビジョン、コンテキスト認識)、用途別(プロセス自動化、データ増強)、業界別、地域別-2028年までの予測AI Data Management Market by Offering (Platform, Software tools, and Services), Data Type, Technology (ML, NLP, Computer Vision, Context Awareness), Application (Process Automation, Data Augmentation), Vertical and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| AIデータ管理の世界市場:オファリング別(プラットフォーム、ソフトウェアツール、サービス)、データタイプ別、技術別(ML、NLP、コンピュータビジョン、コンテキスト認識)、用途別(プロセス自動化、データ増強)、業界別、地域別-2028年までの予測 |

|

出版日: 2024年01月17日

発行: MarketsandMarkets

ページ情報: 英文 424 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2017年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント別 | オファリング別、データタイプ別、技術別、用途別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

世界のAIデータ管理の市場規模は2023年に251億米ドルとなり、2028年には702億米ドルに達すると予測され、予測期間中のCAGRは22.8%になると予測されています。

クラウドコンピューティングの登場と普及は、組織がデータを保存、処理、アクセスする方法を再定義しました。クラウド技術はスケーラブルで柔軟な基盤を提供するため、企業は従来のオンプレミスインフラの制約を受けることなく、増え続けるデータを効率的に管理できます。クラウドベースのプラットフォームへのシフトは、AIデータ管理ソリューションの需要を促進する上で重要な役割を果たしています。クラウド環境は、ダイナミックなビジネスニーズに適応するために必要な俊敏性を提供するため、企業はデータ管理機能をシームレスに拡張することができます。クラウド向けに設計されたAI主導のデータ管理ツールは、本質的に拡張性が高く、企業は多様なデータセットと増加するワークロードを効率的に処理できます。データの量と種類が飛躍的に拡大し続ける中、この拡張性は特に重要です。

AIデータ管理におけるプラットフォームは、人工知能技術を用いたデータの収集、保存、処理、分析、活用を促進する包括的なエコシステムとして機能します。これらのプラットフォームは、組織がデータを効率的に管理し、実用的な洞察を導き出すことを可能にする様々なツール、アルゴリズム、機能性を統合しています。多くの場合、データの取り込み、クレンジング、変換のためのコンポーネントと、複雑なデータセットから貴重なパターンや傾向を抽出するのに役立つAI主導の分析・可視化ツールを備えています。

テキストデータのAIデータ管理には、人工知能技術を用いた非構造化テキスト情報の構造化された整理、分析、活用が含まれます。テキストデータは、その非構造化という性質、さまざまなフォーマット、言語のニュアンスの違いにより、独自の課題を抱えています。AIベースの自然言語処理(NLP)とテキスト分析は、この分野で極めて重要であり、システムが膨大な量のテキストを理解し、分類し、洞察を抽出し、意味を導き出すことを可能にします。センチメント分析、名前付きエンティティ認識、トピックモデリング、言語翻訳などの技術は、テキストデータから価値ある情報、センチメント傾向、文脈理解を抽出することを可能にします。AI主導のテキストデータ管理は、顧客フィードバック分析、コンテンツ分類、文書要約、チャットボット、情報検索システムなどに応用され、組織が豊富な非構造化テキスト情報を活用して情報に基づいた意思決定を行い、ユーザー体験を向上させる方法に革命をもたらしています。

当レポートでは、世界のAIデータ管理市場について調査し、オファリング別、データタイプ別、技術別、用途別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- AIデータ管理市場:アーキテクチャ

- AIデータ管理市場:進化

- サプライチェーン分析

- 生態系/市場マップ

- ケーススタディ分析

- 関税と規制状況

- 特許分析

- AIデータ管理ソフトウェアのための貿易分析

- 技術分析

- 価格分析

- ポーターのファイブフォース分析

- 顧客のビジネスに影響を与える動向/混乱

- 2023年から2025年の主要な会議とイベント

- 主要な利害関係者と購入基準

- AIデータ管理市場の技術ロードマップ

- AIデータ管理市場のベストプラクティス

- AIデータ管理市場のビジネスモデル

第6章 AIデータ管理市場、オファリング別

- イントロダクション

- タイプ別

- プラットフォーム

- ソフトウェアツール

- サービス

- 導入モード別

- クラウド

- オンプレミス

第7章 AIデータ管理市場、データタイプ別

- イントロダクション

- オーディオデータ

- 音声データ

- 画像データ

- テキストデータ

- ビデオデータ

第8章 AIデータ管理市場、技術別

- イントロダクション

- 機械学習

- 自然言語処理

- コンピュータビジョン

- コンテキスト認識

第9章 AIデータ管理市場、用途別

- イントロダクション

- プロセス自動化

- データ検証とノイズ低減

- データ増強

- 探索的データ分析

- 代入と予測モデリング

- データの匿名化と圧縮

- その他

第10章 AIデータ管理市場、業界別

- イントロダクション

- 銀行、金融サービス、保険

- 小売と電子商取引

- 電気通信

- ヘルスケアとライフサイエンス

- 製造業

- ITとITES

- 政府と防衛

- メディアとエンターテイメント

- エネルギーと公共事業

- その他

第11章 AIデータ管理市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- ブランド/製品の比較分析

- 企業評価マトリックス

- スタートアップ/中小企業評価マトリックス、2022年

- 競合シナリオと動向

- 主要ベンダーの評価と財務指標

- 主要ベンダーの年初来価格の総収益と5年間の株価ベータ

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- MICROSOFT

- IBM

- AWS

- ORACLE

- SALESFORCE

- SAP

- SAS INSTITUTE

- HPE

- SNOWFLAKE

- TERADATA

- INFORMATICA

- DATABRICKS

- TIBCO SOFTWARE

- QLIK

- COLLIBRA

- DATAIKU

- ALTERYX

- DATAMATICS BUSINESS SOLUTIONS

- ACCENTURE

- スタートアップ/中小企業

- ATACCAMA CORPORATION

- RELTIO

- TAMR

- THOUGHTSPOT

- ATSCALE

- ALATION

- CLARIFAI

- DDN STORAGE

- DATALOOP AI

- ASTERA SOFTWARE

第14章 隣接市場および関連市場

第15章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | USD (Billion) |

| Segments | By Offering by Type Offering by Deployment mode, Data Type, Technology, Application, Vertical, and Region. |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The global AI data management market is valued at USD 25.1 billion in 2023 and is estimated to reach USD 70.2 billion by 2028, registering a CAGR of 22.8% during the forecast period. The advent and widespread adoption of cloud computing have redefined the way organizations store, process, and access data. Cloud technologies provide a scalable and flexible foundation, enabling businesses to efficiently manage their ever-growing volumes of data without the constraints of traditional on-premises infrastructure. The shift towards cloud-based platforms is instrumental in driving the demand for AI data management solutions. Cloud environments offer the agility required to adapt to dynamic business needs, allowing organizations to scale their data management capabilities seamlessly. AI-driven data management tools designed for the cloud are inherently more scalable, enabling businesses to handle diverse datasets and increasing workloads effectively. This scalability is particularly crucial as the sheer volume and variety of data continue to expand exponentially.

"By offering, the platform segment is projected to hold the largest market size during the forecast period."

Platforms in AI data management serve as comprehensive ecosystems that facilitate the collection, storage, processing, analysis, and utilization of data using artificial intelligence technologies. These platforms integrate various tools, algorithms, and functionalities that enable organizations to manage their data efficiently and derive actionable insights. They often feature components for data ingestion, cleansing, and transformation, along with AI-driven analytics and visualization tools that help in extracting valuable patterns and trends from complex datasets.

"By data type, Text Data segment is registered to grow at the highest CAGR during the forecast period."

AI data management for text data involves the structured organization, analysis, and utilization of unstructured textual information using artificial intelligence techniques. Text data presents unique challenges due to its unstructured nature, varying formats, and nuances in language. AI-based natural language processing (NLP) and text analytics are pivotal in this domain, allowing systems to comprehend, categorize, extract insights, and derive meaning from vast volumes of text. Techniques like sentiment analysis, named entity recognition, topic modeling, and language translation enable the extraction of valuable information, sentiment trends, and contextual understanding from text data. AI-driven text data management finds applications in customer feedback analysis, content categorization, document summarization, chatbots, and information retrieval systems, revolutionizing how organizations harness the wealth of unstructured textual information to make informed decisions and enhance user experiences.

"Asia Pacific is projected to witness the highest CAGR during the forecast period."

Asia Pacific region has witnessed remarkable growth and evolution in AI data management. With a surge in technological advancements, increased digitalization, and a burgeoning tech ecosystem, countries within the APAC region have been actively embracing AI-driven data management solutions. Countries like China, India, Japan, South Korea, and Singapore have emerged as key players in advancing AI technologies for data management. China, for instance, has heavily invested in AI research and development, fostering innovation in data-driven technologies. India, known for its IT expertise, has been rapidly adopting AI in various sectors, especially in data-intensive industries like finance, healthcare, and e-commerce. Japan and South Korea have been focusing on leveraging AI for precision manufacturing and robotics, while Singapore has been actively promoting itself as a hub for AI development and deployment in the region. The diverse economies and industries across the APAC region have driven a growing demand for AI data management solutions.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the AI data management market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, Directors: 25%, and Others: 40%

- By Region: North America: 45%, Europe: 20%, Asia Pacific: 30%, RoW: 5%

Major vendors offering AI data management platform, software/tools and services across the globe are Microsoft (US), AWS (US), IBM (US), Google (US), Oracle (US), Salesforce (US), SAP (Germany), SAS Institute (US), HPE (US), Snowflake (US), Teradata (US), Informatica (US), Databricks (US), TIBCO Software (US), Qlik (US), Collibra (US), Dataiku (US), Alteryx (US), Datamatics Business Solutions (US), Accenture (Ireland), Ataccama (Canada), Reltio (US), Tamr (US), ThoughtSpot (US), AtScale (US), Alation (US), Clarifai (US), DDN Storage (US), Dataloop AI (US) Astera Software (US).

Research Coverage

The market study covers AI data management across segments. It aims at estimating the market size and the growth potential across different segments, such as offering by type, offering by deployment mode, data type, application, technology, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market for AI data management and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (AI-powered data fabric solutions and automated integration fueling market expansion, the evolution in cloud technology to drive the AI Data Management market growth, Rapid advancements in AI and ML to propel the adoption of transformative data management solutions), restraints (Issues related to data availability and quality and susceptibility to bias and inaccuracies), opportunities (Automated data cleaning to revolutionize data preparation for better insights, enhanced predictive analytics to empower businesses to anticipate future trends, personalized and adaptive systems to emerge as a significant opportunity in the market), and challenges (Training AI on large and diverse datasets to enhance data quality poses market challenges, acquiring skilled AI experts in data management to challenge the market, limitations in bridging the educational gap for a skilled workforce) influencing the growth of the AI data management market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AI data management market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the AI data management market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in AI data management market strategies; the report also helps stakeholders understand the pulse of the AI data management market and provides them with information on key market drivers, restraints, challenges, and opportunities.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as Microsoft (US), IBM (US), AWS (US), Google (US), Oracle (US) among others in the AI data management market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 AI DATA MANAGEMENT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- TABLE 1 AI DATA MANAGEMENT MARKET: PRIMARY INTERVIEWS

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key insights from industry experts

- 2.2 DATA TRIANGULATION AND MARKET BREAKUP

- FIGURE 2 AI DATA MANAGEMENT MARKET: DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 AI DATA MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE FROM AI DATA MANAGEMENT/SERVICES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL AI DATA MANAGEMENT/SERVICE COMPANIES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY SIDE): REVENUES OF TOP PLAYERS AND SOURCES OF DATA

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND SIDE): SHARE OF OVERALL AI DATA MANAGEMENT SPENDING

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 IMPACT OF RECESSION

- TABLE 3 IMPACT OF RECESSION ON GLOBAL AI DATA MANAGEMENT MARKET

3 EXECUTIVE SUMMARY

- TABLE 4 AI DATA MANAGEMENT MARKET SIZE AND GROWTH RATE, 2017-2022 (USD MILLION, Y-O-Y)

- TABLE 5 AI DATA MANAGEMENT MARKET SIZE AND GROWTH RATE, 2023-2028 (USD MILLION, Y-O-Y)

- FIGURE 8 PLATFORM SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 9 DATA WAREHOUSING SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 10 CLOUD DEPLOYMENT MODE TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 DATA INTEGRATION & ETL SOFTWARE TOOLS SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 12 CONSULTING SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 13 IMAGE DATA SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 14 MACHINE LEARNING TECHNOLOGY SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 15 PROCESS AUTOMATION SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 16 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN AI DATA MANAGEMENT MARKET

- FIGURE 18 EXPONENTIAL GROWTH OF DIVERSE AND VOLUMINOUS DATASETS TO FUEL ACCURATE MODEL TRAINING AND ENHANCE ALGORITHMIC PERFORMANCE

- 4.2 AI DATA MANAGEMENT MARKET, BY APPLICATION

- FIGURE 19 PROCESS AUTOMATION SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 AI DATA MANAGEMENT MARKET, BY OFFERING & KEY VERTICAL

- FIGURE 20 PLATFORM SEGMENT AND BFSI VERTICAL TO ACCOUNT FOR LARGEST SHARES IN 2023

- 4.4 AI DATA MANAGEMENT MARKET, BY REGION

- FIGURE 21 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 AI DATA MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Adoption of AI-powered data fabric solutions and automated integration

- 5.2.1.2 Emergence and widespread adoption of cloud computing and evolution in cloud technology

- 5.2.1.3 Rapid advancements in AI and ML and adoption of transformative data management solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Scarcity of relevant, comprehensive, and high-quality data

- 5.2.2.2 Susceptibility to biases and inaccuracies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Automated data cleaning to revolutionize data preparation for better insights

- 5.2.3.2 Enhanced predictive analytics to empower businesses to anticipate future trends

- 5.2.3.3 Rise of personalized and adaptive systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Acquiring and curating large datasets leading to need for substantial resources

- 5.2.4.2 Lack of professional knowledge and scarcity of skilled AI experts

- 5.2.4.3 Limited access to specialized education and training programs tailored to AI data management

- 5.3 AI DATA MANAGEMENT MARKET: ARCHITECTURE

- FIGURE 23 ARCHITECTURE OF AI DATA MANAGEMENT SOLUTIONS

- 5.4 AI DATA MANAGEMENT MARKET: EVOLUTION

- FIGURE 24 EVOLUTION OF AI DATA MANAGEMENT SOLUTIONS

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 25 AI DATA MANAGEMENT MARKET: SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM/MARKET MAP

- FIGURE 26 KEY PLAYERS IN AI DATA MANAGEMENT MARKET ECOSYSTEM

- TABLE 6 AI DATA MANAGEMENT MARKET: ECOSYSTEM

- 5.6.1 PLATFORM PROVIDERS

- 5.6.2 SOFTWARE PROVIDERS

- 5.6.3 SERVICE PROVIDERS

- 5.6.4 REGULATORY BODIES

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 CASE STUDY 1: TAMR'S HEALTHCARE PROVIDERS DATA PRODUCT UNIFIED VAST DATA SOURCES AND CREATED RELIABLE RECORDS FOR P360

- 5.7.2 CASE STUDY 2: ALATION EMPOWERED AUSTRALIAN ENERGY COMPANY'S DIGITAL TRANSFORMATION THROUGH DATA GOVERNANCE AND CURATED INSIGHTS

- 5.7.3 CASE STUDY 3: VIACOM18 DEPLOYED AZURE DATABRICKS TO ACCELERATE VIEWER PERSONALIZATION, BOOST PRODUCTIVITY, AND ENHANCE INSIGHTS

- 5.7.4 CASE STUDY 4: CNP ASSURANCES DEPLOYED INFORMATICA MDM TO FACILITATE REAL-TIME AND BATCH-PROCESSING UPDATES TO MANAGE EVOLVING RISK PROFILES EFFECTIVELY

- 5.7.5 CASE STUDY 5: COGNIWARE ADOPTED ARGOS PLATFORM INTEGRATED WITH IBM WATSONX.DATA TO STREAMLINE DATA COLLECTION PROCESS AND EMPOWER USERS TO VISUALIZE CONNECTIONS

- 5.8 TARIFF AND REGULATORY LANDSCAPE

- TABLE 7 TARIFF RELATED TO AI DATA MANAGEMENT SOFTWARE AS A SERVICE SOLUTIONS

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 NORTH AMERICA

- 5.8.2.1 US

- 5.8.2.2 Canada

- 5.8.3 EUROPE

- 5.8.4 ASIA PACIFIC

- 5.8.4.1 South Korea

- 5.8.4.2 China

- 5.8.4.3 India

- 5.8.5 MIDDLE EAST & AFRICA

- 5.8.5.1 UAE

- 5.8.5.2 KSA

- 5.8.5.3 Bahrain

- 5.8.6 LATIN AMERICA

- 5.8.6.1 Brazil

- 5.8.6.2 Mexico

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- 5.9.2 PATENTS FILED, BY DOCUMENT TYPE

- TABLE 13 PATENTS FILED, 2013-2023

- 5.9.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 27 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2013-2023

- 5.9.3.1 Top 10 applicants in AI data management market

- FIGURE 28 TOP APPLICANTS IN AI DATA MANAGEMENT MARKET, 2013-2023

- FIGURE 29 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013-2023

- TABLE 14 TOP 20 PATENT OWNERS IN AI DATA MANAGEMENT MARKET, 2013-2023

- TABLE 15 LIST OF PATENTS GRANTED IN AI DATA MANAGEMENT MARKET, 2023

- 5.10 TRADE ANALYSIS FOR AI DATA MANAGEMENT SOFTWARE

- 5.10.1 IMPORT SCENARIO OF COMPUTER SOFTWARE

- FIGURE 30 COMPUTER SOFTWARE IMPORTS, BY KEY COUNTRY, 2015-2022 (USD BILLION)

- 5.10.2 EXPORT SCENARIO OF COMPUTER SOFTWARE

- FIGURE 31 COMPUTER SOFTWARE EXPORTS, BY KEY COUNTRY, 2015-2022 (USD BILLION)

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 AI DATA MANAGEMENT MARKET: TECHNOLOGY ANALYSIS

- 5.11.1.1 Key Technologies

- 5.11.1.1.1 ML

- 5.11.1.1.2 NLP

- 5.11.1.1.3 Computer Vision

- 5.11.1.1.4 Edge AI

- 5.11.1.2 Complementary Technologies

- 5.11.1.2.1 Big Data

- 5.11.1.2.2 Cloud Computing

- 5.11.1.2.3 5G

- 5.11.1.2.4 Predictive Analytics

- 5.11.1.3 Adjacent Technologies

- 5.11.1.3.1 IoT

- 5.11.1.3.2 Edge Computing

- 5.11.1.3.3 Blockchain

- 5.11.1.3.4 Digital Twins

- 5.11.1.1 Key Technologies

- 5.11.1 AI DATA MANAGEMENT MARKET: TECHNOLOGY ANALYSIS

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, TOP 3 SOFTWARE TOOLS

- FIGURE 32 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, TOP 3 SOFTWARE TOOLS

- 5.12.2 INDICATIVE PRICING ANALYSIS OF AI DATA MANAGEMENT, BY OFFERING

- TABLE 16 INDICATIVE PRICING LEVELS OF AI DATA MANAGEMENT SOLUTIONS, BY OFFERING

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 AI DATA MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 IMPACT OF PORTER'S FIVE FORCES ON AI DATA MANAGEMENT MARKET

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 34 REVENUE SHIFT FOR AI DATA MANAGEMENT MARKET

- 5.15 KEY CONFERENCES & EVENTS, 2023-2025

- TABLE 18 AI DATA MANAGEMENT MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023-2025

- 5.16 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.16.2 BUYING CRITERIA

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 20 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.17 TECHNOLOGY ROADMAP OF AI DATA MANAGEMENT MARKET

- TABLE 21 SHORT-TERM ROADMAP, 2023-2025

- TABLE 22 MID-TERM ROADMAP, 2026-2028

- TABLE 23 LONG-TERM ROADMAP, 2029-2030

- 5.18 BEST PRACTICES IN AI DATA MANAGEMENT MARKET

- 5.19 BUSINESS MODELS OF AI DATA MANAGEMENT MARKET

- 5.19.1 DATA AS A SERVICE (DAAS)

- 5.19.2 AI-POWERED ANALYTICS AND INSIGHTS

- 5.19.3 DATA GOVERNANCE AND COMPLIANCE SOLUTIONS

- 5.19.4 PERSONALIZATION AND RECOMMENDATION ENGINES

- 5.19.5 AI INFRASTRUCTURE AND TOOLING

6 AI DATA MANAGEMENT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: AI DATA MANAGEMENT MARKET DRIVERS

- FIGURE 37 SERVICES SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 24 AI DATA MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 25 AI DATA MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 OFFERING, BY TYPE

- 6.2.1 PLATFORM

- 6.2.1.1 AI data management platforms to provide end-to-end solutions that streamline data handling across AI lifecycle

- FIGURE 38 DATA WAREHOUSING SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- TABLE 26 AI DATA MANAGEMENT MARKET, BY PLATFORM, 2017-2022 (USD MILLION)

- TABLE 27 AI DATA MANAGEMENT MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 28 PLATFORM: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 29 PLATFORM: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.1.2 Data collection & ingestion

- 6.2.1.3 Data preparation & processing

- 6.2.1.4 Data warehousing

- 6.2.1.5 Data analytics

- 6.2.1.6 Data governance

- 6.2.1.7 Data quality management

- 6.2.1.8 Data lifecycle management

- 6.2.1.9 Other platforms

- 6.2.2 SOFTWARE TOOLS

- 6.2.2.1 AI data management software tools to streamline data handling and analysis within AI ecosystems

- FIGURE 39 DATA INTEGRATION & ETL SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- TABLE 30 AI DATA MANAGEMENT MARKET, BY SOFTWARE TOOL, 2017-2022 (USD MILLION)

- TABLE 31 AI DATA MANAGEMENT MARKET, BY SOFTWARE TOOL, 2023-2028 (USD MILLION)

- TABLE 32 SOFTWARE TOOLS: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 33 SOFTWARE TOOLS: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.2 Data integration & ETL

- 6.2.2.3 Data visualization & reporting

- 6.2.2.4 Data modeling

- 6.2.2.5 Data security & privacy

- 6.2.2.6 Data labeling & annotation

- 6.2.2.7 Data cleaning & normalization

- 6.2.2.8 Data versioning

- 6.2.3 SERVICES

- 6.2.3.1 Need for expertise in data governance, data quality, and AI-driven analytics to drive demand for AI data management services

- FIGURE 40 CONSULTING SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- TABLE 34 AI DATA MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 35 AI DATA MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 6.2.3.2 Consulting

- 6.2.3.3 System integration & implementation

- 6.2.3.4 Support & maintenance

- 6.2.3.5 Data migration

- 6.2.3.6 AI change management & adoption

- 6.2.3.7 AI platform administration

- 6.2.1 PLATFORM

- 6.3 OFFERING, BY DEPLOYMENT MODE

- FIGURE 41 CLOUD DEPLOYMENT MODE TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- TABLE 36 AI DATA MANAGEMENT OFFERING MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 37 AI DATA MANAGEMENT OFFERING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 6.3.1 CLOUD

- 6.3.1.1 Scalability and accessibility of cloud-based AI data management solutions to fuel its demand

- TABLE 38 CLOUD: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 39 CLOUD: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 ON-PREMISES

- 6.3.2.1 Stringent data governance and security requirements to propel demand for on-premises AI data management solutions

- TABLE 40 ON-PREMISES: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 41 ON-PREMISES: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

7 AI DATA MANAGEMENT MARKET, BY DATA TYPE

- 7.1 INTRODUCTION

- 7.1.1 DATA TYPE: AI DATA MANAGEMENT MARKET DRIVERS

- FIGURE 42 TEXT DATA SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 42 AI DATA MANAGEMENT MARKET, BY DATA TYPE, 2017-2022 (USD MILLION)

- TABLE 43 AI DATA MANAGEMENT MARKET, BY DATA TYPE, 2023-2028 (USD MILLION)

- 7.2 AUDIO DATA

- 7.2.1 RISING ADOPTION OF VOICE-ENABLED DEVICES AND PERSONALIZED AUDIO EXPERIENCES TO PROPEL MARKET

- TABLE 44 AUDIO DATA: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 45 AUDIO DATA: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 SPEECH & VOICE DATA

- 7.3.1 RISE OF VOICE-CONTROLLED DEVICES AND DEMAND FOR SEAMLESS SPEECH RECOGNITION TECHNOLOGIES TO DRIVE MARKET

- TABLE 46 SPEECH & VOICE DATA: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 47 SPEECH & VOICE DATA: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 IMAGE DATA

- 7.4.1 NEED FOR IMAGE RECOGNITION TECHNOLOGIES ACROSS INDUSTRIES TO BOOST DEMAND FOR AI DATA MANAGEMENT FOR IMAGE DATA

- TABLE 48 IMAGE DATA: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 49 IMAGE DATA: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 TEXT DATA

- 7.5.1 REQUIREMENT FOR SENTIMENT ANALYSIS AND LANGUAGE PROCESSING TECHNOLOGIES TO DRIVE MARKET

- TABLE 50 TEXT DATA: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 51 TEXT DATA: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 VIDEO DATA

- 7.6.1 NEED FOR VIDEO ANALYTICS IN VARIOUS VERTICALS TO FUEL GROWTH OF AI DATA MANAGEMENT FOR VIDEO DATA

- TABLE 52 VIDEO DATA: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 53 VIDEO DATA: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

8 AI DATA MANAGEMENT MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.1.1 TECHNOLOGY: AI DATA MANAGEMENT MARKET DRIVERS

- FIGURE 43 MACHINE LEARNING TECHNOLOGY SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- TABLE 54 AI DATA MANAGEMENT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 55 AI DATA MANAGEMENT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 8.2 MACHINE LEARNING

- 8.2.1 NEED FOR ACCURATE AND PREDICTIVE MACHINE LEARNING MODELS TO FUEL DEMAND FOR ROBUST AI DATA MANAGEMENT

- TABLE 56 MACHINE LEARNING: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 57 MACHINE LEARNING: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.2 DEEP LEARNING

- 8.2.2.1 CNNs

- 8.2.2.2 RNNs

- 8.2.2.3 Generative AI

- 8.3 NATURAL LANGUAGE PROCESSING

- 8.3.1 INCREASING DEMAND FOR ADVANCED LANGUAGE UNDERSTANDING AND COMMUNICATION CAPABILITIES TO DRIVE MARKET

- TABLE 58 NATURAL LANGUAGE PROCESSING: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 59 NATURAL LANGUAGE PROCESSING: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 COMPUTER VISION

- 8.4.1 GROWING NEED FOR ACCURATE IMAGE AND VIDEO ANALYSIS ACROSS INDUSTRIES TO PROPEL DEMAND FOR COMPUTER VISION TECHNOLOGY

- TABLE 60 COMPUTER VISION: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 61 COMPUTER VISION: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

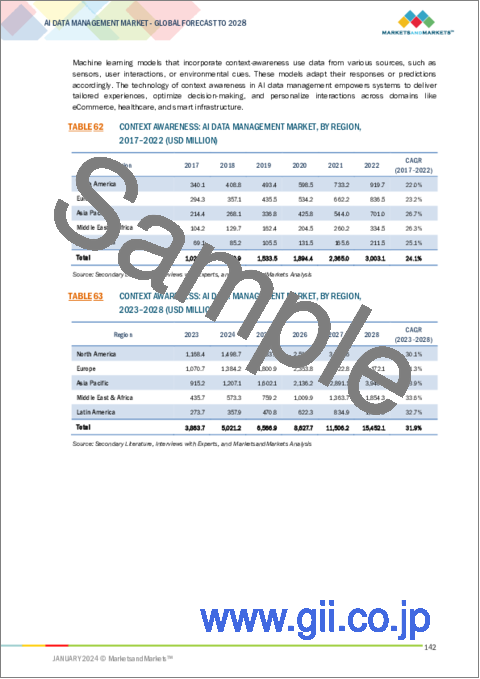

- 8.5 CONTEXT AWARENESS

- 8.5.1 CONTEXT AWARENESS IN AI DATA MANAGEMENT TO DELIVER TAILORED EXPERIENCES, OPTIMIZE DECISION-MAKING, AND PERSONALIZE INTERACTIONS

- TABLE 62 CONTEXT AWARENESS: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 63 CONTEXT AWARENESS: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

9 AI DATA MANAGEMENT MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.1.1 APPLICATION: AI DATA MANAGEMENT MARKET DRIVERS

- FIGURE 44 IMPUTATION PREDICTIVE MODELING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 64 AI DATA MANAGEMENT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 65 AI DATA MANAGEMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 PROCESS AUTOMATION

- 9.2.1 INCREASED OPERATIONAL EFFICIENCY AND REDUCED MANUAL INTERVENTION TO FUEL DEMAND FOR PROCESS AUTOMATION

- TABLE 66 PROCESS AUTOMATION: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 67 PROCESS AUTOMATION: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 DATA VALIDATION & NOISE REDUCTION

- 9.3.1 NEED TO ENSURE DATA ACCURACY AND RELIABILITY AND REDUCE UNWANTED DISTORTIONS TO PROPEL MARKET

- TABLE 68 DATA VALIDATION & NOISE REDUCTION: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 69 DATA VALIDATION & NOISE REDUCTION: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 DATA AUGMENTATION

- 9.4.1 NEED TO ENHANCE MODEL GENERALIZATION AND PERFORMANCE BY ARTIFICIALLY EXPANDING DATASETS TO DRIVE MARKET

- TABLE 70 DATA AUGMENTATION: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 71 DATA AUGMENTATION: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 EXPLORATORY DATA ANALYSIS

- 9.5.1 NECESSITY OF UNCOVERING VALUABLE INSIGHTS, UNDERSTANDING DATA DISTRIBUTIONS, AND PREPARING DATA FOR SUBSEQUENT MODELING OR ANALYSIS TO DRIVE MARKET

- TABLE 72 EXPLORATORY DATA ANALYSIS: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 73 EXPLORATORY DATA ANALYSIS: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 IMPUTATION & PREDICTIVE MODELING

- 9.6.1 NEED TO HANDLE MISSING DATA EFFECTIVELY AND GENERATE ACCURATE PREDICTIONS TO PROPEL MARKET

- TABLE 74 IMPUTATION & PREDICTIVE MODELING: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 75 IMPUTATION & PREDICTIVE MODELING: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7 DATA ANONYMIZATION & COMPRESSION

- 9.7.1 NEED TO ENSURE PRIVACY, REDUCE STORAGE REQUIREMENTS, AND OPTIMIZE DATA PROCESSING TO DRIVE MARKET

- TABLE 76 DATA ANONYMIZATION & COMPRESSION: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 77 DATA ANONYMIZATION & COMPRESSION: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8 OTHER APPLICATIONS

- TABLE 78 OTHER APPLICATIONS: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 79 OTHER APPLICATIONS: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

10 AI DATA MANAGEMENT MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICAL: AI DATA MANAGEMENT MARKET DRIVERS

- FIGURE 45 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- TABLE 80 AI DATA MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 81 AI DATA MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- TABLE 82 BFSI: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 83 BFSI: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2.1 FRAUD DETECTION

- 10.2.2 CUSTOMER CHURN PREDICTION

- 10.2.3 CREDIT RISK ASSESSMENT

- 10.2.4 ANTI-MONEY LAUNDERING (AML) COMPLIANCE

- 10.2.5 OTHER BFSI APPLICATION TYPES

- 10.3 RETAIL & ECOMMERCE

- TABLE 84 RETAIL & ECOMMERCE: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 85 RETAIL & ECOMMERCE: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.1 PERSONALIZED PRODUCT RECOMMENDATION

- 10.3.2 INVENTORY MANAGEMENT

- 10.3.3 DYNAMIC PRICING

- 10.3.4 CUSTOMER SENTIMENT ANALYSIS

- 10.3.5 OTHER RETAIL & ECOMMERCE APPLICATION TYPES

- 10.4 TELECOMMUNICATIONS

- TABLE 86 TELECOMMUNICATIONS: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 87 TELECOMMUNICATIONS: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4.1 NETWORK PERFORMANCE OPTIMIZATION

- 10.4.2 NETWORK SECURITY

- 10.4.3 QUALITY OF SERVICE MONITORING

- 10.4.4 CUSTOMER SUPPORT CHATBOTS

- 10.4.5 OTHER TELECOMMUNICATIONS APPLICATION TYPES

- 10.5 HEALTHCARE & LIFE SCIENCES

- TABLE 88 HEALTHCARE & LIFE SCIENCES: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 89 HEALTHCARE & LIFE SCIENCES: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5.1 DISEASE DIAGNOSIS

- 10.5.2 DRUG DISCOVERY

- 10.5.3 PATIENT MONITORING

- 10.5.4 CLINICAL TRAILS OPTIMIZATION

- 10.5.5 OTHER HEALTHCARE & LIFE SCIENCES APPLICATION TYPES

- 10.6 MANUFACTURING

- TABLE 90 MANUFACTURING: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 91 MANUFACTURING: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.6.1 QUALITY CONTROL

- 10.6.2 ROBOTIC PROCESS AUTOMATION

- 10.6.3 DEMAND FORECASTING

- 10.6.4 PRODUCTION OPTIMIZATION

- 10.6.5 OTHER MANUFACTURING APPLICATION TYPES

- 10.7 IT & ITES

- TABLE 92 IT & ITES: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 93 IT & ITES: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7.1 IT SERVICE MANAGEMENT

- 10.7.2 PREDICTIVE MAINTENANCE

- 10.7.3 CAPACITY PLANNING

- 10.7.4 DATA BACKUP RECOVERY

- 10.7.5 OTHER IT & ITES APPLICATION TYPES

- 10.8 GOVERNMENT & DEFENSE

- TABLE 94 GOVERNMENT & DEFENSE: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 95 GOVERNMENT & DEFENSE: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.8.1 NATURAL DISASTER RESPONSE

- 10.8.2 PREDICTIVE POLICING

- 10.8.3 BORDER CONTROL & IMMIGRATION

- 10.8.4 PUBLIC HEALTH MONITORING

- 10.8.5 OTHER GOVERNMENT & DEFENSE APPLICATION TYPES

- 10.9 MEDIA & ENTERTAINMENT

- TABLE 96 MEDIA & ENTERTAINMENT: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 97 MEDIA & ENTERTAINMENT: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.9.1 CONTENT RECOMMENDATION

- 10.9.2 CONTENT CREATION

- 10.9.3 AUDIENCE ENGAGEMENT ANALYSIS

- 10.9.4 REAL-TIME STREAMING OPTIMIZATION

- 10.9.5 OTHER MEDIA & ENTERTAINMENT APPLICATION TYPES

- 10.10 ENERGY & UTILITIES

- TABLE 98 ENERGY & UTILITIES: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 99 ENERGY & UTILITIES: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.10.1 GRID MANAGEMENT

- 10.10.2 ENERGY CONSUMPTION ANALYSIS

- 10.10.3 RENEWABLE ENERGY FORECASTING

- 10.10.4 ENVIRONMENTAL IMPACT ASSESSMENT

- 10.10.5 OTHER ENERGY & UTILITIES APPLICATION TYPES

- 10.11 OTHER VERTICALS

- TABLE 100 OTHER VERTICALS: AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 101 OTHER VERTICALS: AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

11 AI DATA MANAGEMENT MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 46 SOUTH AFRICA TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 102 AI DATA MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 103 AI DATA MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: AI DATA MANAGEMENT MARKET DRIVERS

- 11.2.2 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 48 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 104 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 107 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 108 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY PLATFORM, 2017-2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY SOFTWARE TOOL, 2017-2022 (USD MILLION)

- TABLE 111 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY SOFTWARE TOOL, 2023-2028 (USD MILLION)

- TABLE 112 NORTH AMERICA: AI DATA MANAGEMENT OFFERING MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 113 NORTH AMERICA: AI DATA MANAGEMENT OFFERING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 115 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 116 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY DATA TYPE, 2017-2022 (USD MILLION)

- TABLE 117 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY DATA TYPE, 2023-2028 (USD MILLION)

- TABLE 118 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 119 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 120 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 121 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 122 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 123 NORTH AMERICA: AI DATA MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.2.3 US

- 11.2.3.1 Robust innovation ecosystem, collaborative efforts, and government initiatives to drive market

- 11.2.4 CANADA

- 11.2.4.1 Demand for tech infrastructure, skilled workforce, well-established ecosystems, and National AI Strategy to propel market

- 11.3 EUROPE

- 11.3.1 EUROPE: AI DATA MANAGEMENT MARKET DRIVERS

- 11.3.2 EUROPE: RECESSION IMPACT ANALYSIS

- TABLE 124 EUROPE: AI DATA MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 125 EUROPE: AI DATA MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 126 EUROPE: AI DATA MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 127 EUROPE: AI DATA MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 128 EUROPE: AI DATA MANAGEMENT MARKET, BY PLATFORM, 2017-2022 (USD MILLION)

- TABLE 129 EUROPE: AI DATA MANAGEMENT MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 130 EUROPE: AI DATA MANAGEMENT MARKET, BY SOFTWARE TOOL, 2017-2022 (USD MILLION)

- TABLE 131 EUROPE: AI DATA MANAGEMENT MARKET, BY SOFTWARE TOOL, 2023-2028 (USD MILLION)

- TABLE 132 EUROPE: AI DATA MANAGEMENT OFFERING MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 133 EUROPE: AI DATA MANAGEMENT OFFERING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 134 EUROPE: AI DATA MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 135 EUROPE: AI DATA MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 136 EUROPE: AI DATA MANAGEMENT MARKET, BY DATA TYPE, 2017-2022 (USD MILLION)

- TABLE 137 EUROPE: AI DATA MANAGEMENT MARKET, BY DATA TYPE, 2023-2028 (USD MILLION)

- TABLE 138 EUROPE: AI DATA MANAGEMENT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 139 EUROPE: AI DATA MANAGEMENT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 140 EUROPE: AI DATA MANAGEMENT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 141 EUROPE: AI DATA MANAGEMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 142 EUROPE: AI DATA MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 143 EUROPE: AI DATA MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Need for diverse and talented workforce, thriving ecosystem, and strategic initiatives taken by government to drive market

- 11.3.4 GERMANY

- 11.3.4.1 Rising focus on AI research and implementation and skilled labor force to propel market

- 11.3.5 FRANCE

- 11.3.5.1 Strategic focus on open-source AI initiatives to transform AI data management market

- 11.3.6 SPAIN

- 11.3.6.1 Spanish government's active support and initiatives to accelerate growth of AI to boost demand for AI data management market

- 11.3.7 ITALY

- 11.3.7.1 Well-established technology industry and strategic government initiatives to fuel demand for AI data management solutions

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: AI DATA MANAGEMENT MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 49 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 144 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY COUNTRY/REGION, 2017-2022 (USD MILLION)

- TABLE 145 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY COUNTRY/REGION, 2023-2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY PLATFORM, 2017-2022 (USD MILLION)

- TABLE 149 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY SOFTWARE TOOL, 2017-2022 (USD MILLION)

- TABLE 151 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY SOFTWARE TOOL, 2023-2028 (USD MILLION)

- TABLE 152 ASIA PACIFIC: AI DATA MANAGEMENT OFFERING MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 153 ASIA PACIFIC: AI DATA MANAGEMENT OFFERING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 155 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY DATA TYPE, 2017-2022 (USD MILLION)

- TABLE 157 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY DATA TYPE, 2023-2028 (USD MILLION)

- TABLE 158 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 159 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 160 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 161 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 165 ASIA PACIFIC: AI DATA MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4.3 CHINA

- 11.4.3.1 Substantial investments in AI research and development and rising government initiatives for R&D to drive market

- 11.4.4 JAPAN

- 11.4.4.1 AI-driven healthcare industry and strategic government support to fuel demand for AI data management solutions

- 11.4.5 INDIA

- 11.4.5.1 Increasing investment in AI-driven R&D and establishment of National Program on AI to propel market

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Robust ICT industry, high production of semiconductors, and AI patent dominance to accelerate market

- 11.4.7 AUSTRALIA & NEW ZEALAND

- 11.4.7.1 Increasing reliance on software solutions and rising awareness regarding strategic value of AI to propel market

- 11.4.8 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT ANALYSIS

- TABLE 166 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY PLATFORM, 2017-2022 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY SOFTWARE TOOL, 2017-2022 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY SOFTWARE TOOL, 2023-2028 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT OFFERING MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT OFFERING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY DATA TYPE, 2017-2022 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY DATA TYPE, 2023-2028 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: AI DATA MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.5.3 UAE

- 11.5.3.1 Implementation of National Artificial Intelligence Strategy 2031 and investment in innovative technologies to propel market

- 11.5.4 KSA

- 11.5.4.1 Saudi Arabia's Vision 2030 commitment to AI to fuel demand for AI data management solutions

- 11.5.5 SOUTH AFRICA

- 11.5.5.1 Growing ICT sector and adoption of AI technologies to fuel demand for diverse AI-driven solutions

- 11.5.6 TURKEY

- 11.5.6.1 Rapid growth of cloud and online services driving demand for high-speed data delivery to propel market

- 11.5.7 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: AI DATA MANAGEMENT MARKET DRIVERS

- 11.6.2 LATIN AMERICA: RECESSION IMPACT ANALYSIS

- TABLE 186 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 187 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 188 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY PLATFORM, 2017-2022 (USD MILLION)

- TABLE 189 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 190 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY SOFTWARE TOOL, 2017-2022 (USD MILLION)

- TABLE 191 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY SOFTWARE TOOL, 2023-2028 (USD MILLION)

- TABLE 192 LATIN AMERICA: AI DATA MANAGEMENT OFFERING MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 193 LATIN AMERICA: AI DATA MANAGEMENT OFFERING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 194 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 195 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 196 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY DATA TYPE, 2017-2022 (USD MILLION)

- TABLE 197 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY DATA TYPE, 2023-2028 (USD MILLION)

- TABLE 198 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 199 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 200 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 201 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 202 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 203 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 204 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 205 LATIN AMERICA: AI DATA MANAGEMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.6.3 BRAZIL

- 11.6.3.1 Robust software development and implementation of stringent regulations to create favorable environment for AI data management to drive market

- 11.6.4 MEXICO

- 11.6.4.1 Burgeoning IT industry and adoption of comprehensive national AI strategy to drive market

- 11.6.5 ARGENTINA

- 11.6.5.1 Increasing tech-savvy population, significant broadband penetration rates, and rising development of new technologies to propel market

- 11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 206 OVERVIEW OF STRATEGIES ADOPTED BY KEY AI DATA MANAGEMENT VENDORS

- 12.3 REVENUE ANALYSIS

- FIGURE 50 TOP 5 PLAYERS TO DOMINATE MARKET IN LAST 5 YEARS

- 12.4 MARKET SHARE ANALYSIS

- FIGURE 51 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2022

- TABLE 207 AI DATA MANAGEMENT MARKET: DEGREE OF COMPETITION

- 12.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 52 AI DATA MANAGEMENT MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- 12.6 COMPANY EVALUATION MATRIX

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 53 AI DATA MANAGEMENT MARKET: COMPANY EVALUATION MATRIX, 2022

- 12.6.5 COMPANY FOOTPRINT OF KEY PLAYERS

- TABLE 208 PRODUCT FOOTPRINT (20 COMPANIES)

- TABLE 209 VERTICAL FOOTPRINT (20 COMPANIES)

- TABLE 210 REGION FOOTPRINT (20 COMPANIES)

- TABLE 211 OVERALL COMPANY FOOTPRINT (20 COMPANIES)

- 12.7 START-UP/SME EVALUATION MATRIX, 2022

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 54 AI DATA MANAGEMENT MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 12.7.5 COMPETITIVE BENCHMARKING

- TABLE 212 AI DATA MANAGEMENT MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 213 AI DATA MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 12.8 COMPETITIVE SCENARIO AND TRENDS

- 12.8.1 PRODUCT LAUNCHES

- TABLE 214 AI DATA MANAGEMENT MARKET: PRODUCT LAUNCHES, MAY 2021-DECEMBER 2023

- 12.8.2 DEALS

- TABLE 215 AI DATA MANAGEMENT MARKET: DEALS, FEBRUARY 2021-NOVEMBER 2023

- 12.8.3 OTHERS

- TABLE 216 AI DATA MANAGEMENT MARKET: OTHERS, JULY 2021-NOVEMBER 2023

- 12.9 VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 55 VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 12.10 YTD PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 56 YTD PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- (Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 13.2 KEY PLAYERS

- 13.2.1 MICROSOFT

- FIGURE 57 MICROSOFT: COMPANY SNAPSHOT

- TABLE 218 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 220 MICROSOFT: DEALS

- 13.2.2 IBM

- TABLE 222 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 224 IBM: DEALS

- TABLE 225 IBM: OTHERS

- 13.2.3 AWS

- TABLE 226 AWS: COMPANY OVERVIEW

- FIGURE 59 AWS: COMPANY SNAPSHOT

- TABLE 230 AWS: OTHERS

- 13.2.4 GOOGLE

- FIGURE 60 GOOGLE: COMPANY SNAPSHOT

- 13.2.5 ORACLE

- TABLE 237 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 ORACLE: DEALS

- 13.2.6 SALESFORCE

- TABLE 240 SALESFORCE: COMPANY OVERVIEW

- FIGURE 62 SALESFORCE: COMPANY SNAPSHOT

- TABLE 241 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 243 SALESFORCE: DEALS

- 13.2.7 SAP

- TABLE 244 SAP: COMPANY OVERVIEW

- FIGURE 63 SAP: COMPANY SNAPSHOT

- TABLE 245 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 247 SAP: DEALS

- TABLE 248 SAP: OTHERS

- 13.2.8 SAS INSTITUTE

- 13.2.9 HPE

- TABLE 253 HPE: COMPANY OVERVIEW

- FIGURE 64 HPE: COMPANY SNAPSHOT

- TABLE 254 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 HPE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 256 HPE: DEALS

- 13.2.10 SNOWFLAKE

- TABLE 257 SNOWFLAKE: COMPANY OVERVIEW

- FIGURE 65 SNOWFLAKE: COMPANY SNAPSHOT

- TABLE 258 SNOWFLAKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 SNOWFLAKE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 260 SNOWFLAKE: DEALS

- TABLE 261 SNOWFLAKE: OTHERS

- 13.2.11 TERADATA

- TABLE 262 TERADATA: COMPANY OVERVIEW

- FIGURE 66 TERADATA: COMPANY SNAPSHOT

- TABLE 263 TERADATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 TERADATA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 265 TERADATA: DEALS

- TABLE 266 TERADATA: OTHERS

- 13.2.12 INFORMATICA

- TABLE 267 INFORMATICA: COMPANY OVERVIEW

- FIGURE 67 INFORMATICA: COMPANY SNAPSHOT

- TABLE 268 INFORMATICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 INFORMATICA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 270 INFORMATICA: DEALS

- TABLE 271 INFORMATICA: OTHERS

- 13.2.13 DATABRICKS

- 13.2.14 TIBCO SOFTWARE

- 13.2.15 QLIK

- TABLE 285 QLIK: OTHERS

- 13.2.16 COLLIBRA

- 13.2.17 DATAIKU

- 13.2.18 ALTERYX

- 13.2.19 DATAMATICS BUSINESS SOLUTIONS

- 13.2.20 ACCENTURE

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 13.3 START-UPS/SMES

- 13.3.1 ATACCAMA CORPORATION

- 13.3.2 RELTIO

- 13.3.3 TAMR

- 13.3.4 THOUGHTSPOT

- 13.3.5 ATSCALE

- 13.3.6 ALATION

- 13.3.7 CLARIFAI

- 13.3.8 DDN STORAGE

- 13.3.9 DATALOOP AI

- 13.3.10 ASTERA SOFTWARE

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 MASTER DATA MANAGEMENT MARKET

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- TABLE 286 MASTER DATA MANAGEMENT MARKET SIZE AND GROWTH RATE, 2016-2021 (USD MILLION, Y-O-Y %)

- TABLE 287 MASTER DATA MANAGEMENT MARKET SIZE AND GROWTH RATE, 2022-2027 (USD MILLION, Y-O-Y %)

- 14.2.2.1 Master data management market, by component

- TABLE 288 MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 289 MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 14.2.2.2 Master data management market, by deployment type

- TABLE 290 MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 291 MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- 14.2.2.3 Master data management market, by organization size

- TABLE 292 MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 293 MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 14.2.2.4 Master data management market, by vertical

- TABLE 294 MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 295 MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 14.2.2.5 Master data management market, by region

- TABLE 296 MASTER DATA MANAGEMENT MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 297 MASTER DATA MANAGEMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 14.3 METADATA MANAGEMENT TOOLS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- TABLE 298 GLOBAL METADATA MANAGEMENT TOOLS MARKET SIZE AND GROWTH RATE, 2015-2020 (USD MILLION, Y-O-Y%)

- TABLE 299 GLOBAL METADATA MANAGEMENT TOOLS MARKET SIZE AND GROWTH RATE, 2021-2026 (USD MILLION, Y-O-Y%)

- 14.3.2.1 Metadata management tools market, by application

- TABLE 300 METADATA MANAGEMENT TOOLS MARKET, BY APPLICATION, 2015-2020 (USD MILLION)

- TABLE 301 METADATA MANAGEMENT TOOLS MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- 14.3.2.2 Metadata management tools market, by business function

- TABLE 302 METADATA MANAGEMENT TOOLS MARKET, BY BUSINESS FUNCTION, 2015-2020 (USD MILLION)

- TABLE 303 METADATA MANAGEMENT TOOLS MARKET, BY BUSINESS FUNCTION, 2021-2026 (USD MILLION)

- 14.3.2.3 Metadata management tools market, by organization size

- TABLE 304 METADATA MANAGEMENT TOOLS MARKET, BY ORGANIZATION SIZE, 2015-2020 (USD MILLION)

- TABLE 305 METADATA MANAGEMENT TOOLS MARKET, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- 14.3.2.4 Metadata management tools market, by vertical

- TABLE 306 METADATA MANAGEMENT TOOLS MARKET, BY VERTICAL, 2015-2020 (USD MILLION)

- TABLE 307 METADATA MANAGEMENT TOOLS MARKET, BY VERTICAL, 2021-2026 (USD MILLION)

- 14.3.2.5 Metadata management tools market, by component

- TABLE 308 METADATA MANAGEMENT TOOLS MARKET, BY COMPONENT, 2015-2020 (USD MILLION)

- TABLE 309 METADATA MANAGEMENT TOOLS MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- 14.3.2.6 Metadata management tools market, by metadata type

- TABLE 310 METADATA MANAGEMENT TOOLS MARKET, BY METADATA TYPE, 2015-2020 (USD MILLION)

- TABLE 311 METADATA MANAGEMENT TOOLS MARKET, BY METADATA TYPE, 2021-2026 (USD MILLION)

- 14.3.2.7 Metadata management tools market, by deployment mode

- TABLE 312 METADATA MANAGEMENT TOOLS MARKET, BY DEPLOYMENT MODE, 2015-2020 (USD MILLION)

- TABLE 313 METADATA MANAGEMENT TOOLS MARKET, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- 14.3.2.8 Metadata management tools market, by region

- TABLE 314 METADATA MANAGEMENT MARKET, BY REGION, 2015-2020 (USD MILLION)

- TABLE 315 METADATA MANAGEMENT MARKET, BY REGION, 2021-2026 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS