|

|

市場調査レポート

商品コード

1804845

エレベーター・エスカレーターの世界市場:タイプ別、サービス別、エレベーター技術別、最終用途産業別、地域別 - 予測(~2030年)Elevators & Escalators Market by Type (Elevators, Escalators, Moving Walkways), Service (New Installation, Maintenance & Repair), Elevator Technology (Traction, Machine-Room-Less, & Hydraulic), End-use Industry, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| エレベーター・エスカレーターの世界市場:タイプ別、サービス別、エレベーター技術別、最終用途産業別、地域別 - 予測(~2030年) |

|

出版日: 2025年08月27日

発行: MarketsandMarkets

ページ情報: 英文 296 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

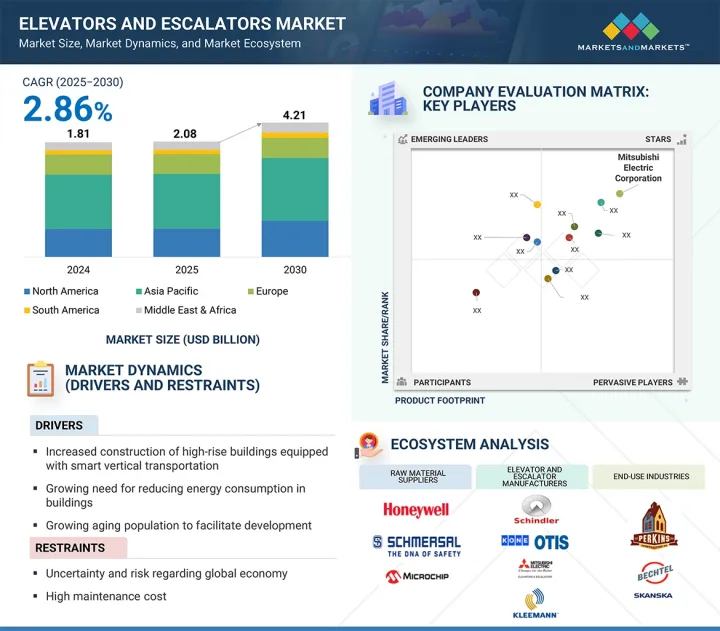

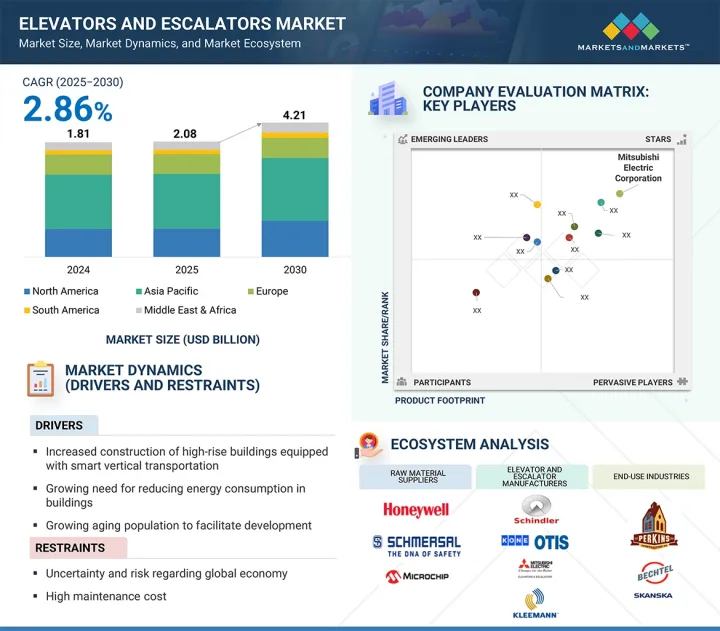

世界のエレベーター・エスカレーターの市場規模は、2025年の988億4,220万米ドルから2030年までに1,138億1,380万米ドルに達すると予測され、予測期間にCAGRで2.86%の成長が見込まれます。

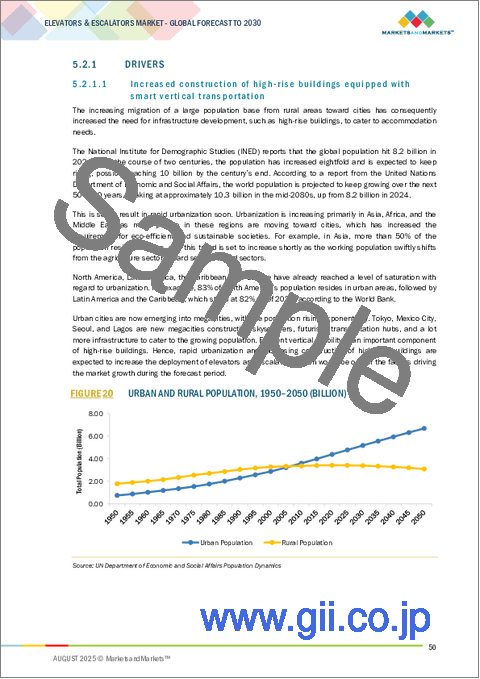

農村部から都市部への大移動の動向が高まり、大規模なインフラ開発、特に増加する住宅需要を満たすための高層ビル建設の必要性が高まっています。このため、都市部はメガシティへと進化し、東京、メキシコシティ、ソウル、ラゴスなどの都市で顕著な人口増加が見られます。これらのメガシティでは、人口増加を支えるため、超高層ビルや高度交通ハブ、その他のさまざまなインフラプロジェクトの建設に積極的に取り組んでいます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル、千台 |

| セグメント | タイプ、サービス、エレベーター技術、最終用途産業、地域 |

| 対象地域 | 北米、アジア太平洋、欧州、南米、中東・アフリカ |

高層構造物の重要な構成要素は、効率的な垂直移動を促進することであり、エレベーター・エスカレーターの必要性を際立たせています。その結果、急速な都市化と高層建築プロジェクトの増加が、エレベーター・エスカレーターの需要を押し上げると予測されます。このような使用の増加は、予測期間の市場成長に大きく寄与する見込みです。

「金額と数量の両面で、エレベーターが予測期間にもっとも速い成長を記録する見込みです。」

エレベーターは、建物の異なるフロア間で人や物を運ぶために使用されるオープンプラットフォームであれ、密閉されたプラットフォームであれ、規制機関が定めた厳格な安全基準に従わなければなりません。米国では、エレベーターメーカーはAmerican National Standards Institute(ANSI)とAmerican Society of Mechanical Engineers(ASME)が定めた安全規制を遵守することが義務付けられています。エレベーター産業は、世界中で住宅や商業施設の新規プロジェクトが開発され続けているため、大きな成長が見込まれています。この成長は、CAGRがもっとも高いと予測されるエレベーターセグメントでもっとも顕著になる見込みです。

サービス別では、近代化セグメントが予測期間にもっとも高いCAGRを記録すると推定されます。"

エスカレーターやエレベーターの更新は、より信頼性が高く、より速く、より安全になるため一般的です。古いエレベーターはメンテナンスコストが高く、乗り心地が悪く、故障が頻発し、忙しいビルの日常業務に支障をきたすことが多いです。近代化によって主要部品がアップグレードされ、効率が向上し、エネルギー使用が削減されます。これは経費削減につながり、環境にも有益です。また、最新の安全規制への準拠を保証し、これらのシステムの外観を改良し、ユーザーエクスペリエンスを向上させます。全体として、近代化は建物の価値を高め、設備の寿命を延ばし、今日のスマートで持続可能なインフラのニーズを満たします。

「マシンルームレストラクションエレベーターセグメントが予測期間にもっとも速い成長を記録します。」

技術の進歩により、マシンルームを必要としないエレベーターがエレベーター・エスカレーター市場で最速の成長を記録すると予測されます。絶え間ない進歩に由来するこの最先端技術は、従来のエレベーター産業を一変させました。重要な進歩は、新たに設計された永久磁石モーター(PMM)の使用によって実現された、トラクションシステムに使用される電気モーターの大幅な小型化です。この技術の主な特徴は、昇降路の上にマシンルームを設ける必要がなくなったことです。この設計は世界的な人気を博し、エレベーター技術の新たな規範となりつつあります。

「商業最終用途セグメントが予測期間にもっとも速い成長を記録します。」

複数の重要な理由により、商業部門がエレベーター・エスカレーターの高い需要を示しています。要因の1つは、都市の急速な発展と高層商業ビルの登場です。これらの構造物では、効率的で安全かつ確実な移動手段が必要とされ、垂直搬送システムが不可欠となっています。さらに、特に高齢者と障がい者のためのアクセシビリティの向上が重視されています。この重視が、商業環境において、先進の包括的なエレベーター・エスカレーターのソリューションに対する需要を促進しています。さらに、今日のエレベーター・エスカレーターはただの単純な機械ではなく、革新的な機能を備えた精巧でエネルギー効率の高いシステムとなっています。商業空間は、現代の設計動向に対応し、持続可能性目標を達成するために、こうした技術的進歩を積極的に求めています。

当レポートでは、世界のエレベーター・エスカレーター市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- エレベーター・エスカレーター市場の企業にとって魅力的な機会

- エレベーター・エスカレーター市場:エレベーター技術別

- エレベーター・エスカレーター市場:タイプ別

- エレベーター・エスカレーター市場:サービス別

- エレベーター・エスカレーター市場:最終用途産業別

- アジア太平洋のエレベーター・エスカレーター市場:タイプ別、国別

- エレベーター・エスカレーター市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業動向

- カスタマービジネスに影響を与える動向と混乱

- 価格設定の分析

- エレベーター・エスカレーターの平均販売価格帯:タイプ別

- 住宅用エレベーター(平均価格帯)

- 商業用エレベーターの価格に影響を与える要因

- バリューチェーン分析

- 研究開発

- コンポーネントメーカー

- メーカー

- ソフトウェア・サービス

- インテグレーター

- 最終用途用途

- エコシステム分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- エレベーター・エスカレーター市場におけるAI世代の影響

- 特許分析

- イントロダクション

- 調査手法

- 特許分析

- 管轄分析

- 貿易分析

- 主な会議とイベント

- 規制機関と政府機関

- ポーターのファイブフォース分析

- マクロ経済指標

- イントロダクション

- GDPの動向と予測

- 主なステークホルダーと購入基準

- ケーススタディ分析

- ケーススタディ1:ELEVATORS GURGAON MEDANTA

- ケーススタディ2:ルビーの先進エレベーターシステムによる高層ビルの効率向上

- ケーススタディ3:HONEYWELL - 企業オフィスの改装

- ケーススタディ4:KONE CORPORATION-180 BRISBANE商業オフィス、オーストラリア

- 投資と資金調達のシナリオ

- エレベーター・エスカレーター市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

第7章 エレベーター・エスカレーター市場:タイプ別

- イントロダクション

- エレベーター

- エスカレーター

- 動く歩道

第8章 エレベーター・エスカレーター市場:サービス別

- イントロダクション

- 新設

- メンテナンス・修理

- 近代化

第9章 エレベーター・エスカレーター市場:エレベーター技術別

- イントロダクション

- トラクションエレベーター

- マシンルームレストラクションエレベーター

- 油圧式エレベーター

第10章 エレベーター・エスカレーター市場:最終用途産業別

- イントロダクション

- 住宅

- 商業

- 機関

- インフラ

- その他の最終用途産業

第11章 エレベーター・エスカレーター市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- GCC諸国

- その他の中東・アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 主要企業の収益分析

- 市場シェア分析

- 企業の評価と財務指標

- 製品/ブランドの比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- SCHINDLER GROUP

- OTIS WORLDWIDE CORPORATION

- KONE CORPORATION

- HITACHI LTD.

- HYUNDAI ELEVATOR CO., LTD.

- FUJITEC CO., LTD.

- TOSHIBA ELEVATORS AND BUILDING SYSTEMS CORPORATION

- MITSUBISHI ELECTRIC CORPORATION

- TK ELEVATOR

- SJEC CORPORATION

- その他の企業

- KLEEMANN

- SIGMA ELEVATORS

- WEMAINTAIN

- ESCON ELEVATORS

- SHENYANG YUANDA INTELLECTUAL INDUSTRY GROUP CO., LTD.

- ORONA

- EITA ELEVATOR

- GLARIE ELEVATOR

- AARON INDUSTRIES LTD.

- LEO ELEVATORS

- TRIO ELEVATORS CO (INDIA) PRIVATE LIMITED

- STANNAH GROUP

- CIBES LIFT

- WALTON GROUP

- EXPEDITE AUTOMATION LLP

- LIFT AI VENTURES INC.

第14章 隣接市場と関連市場

- イントロダクション

- 制限事項

第15章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE OF ELEVATORS, BY TYPE (PER UNIT)

- TABLE 2 ELEVATORS AND ESCALATORS MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 3 LIST OF KEY PATENTS, 2022-2024

- TABLE 4 EXPORT DATA FOR HS CODE 8428-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 5 IMPORT DATA FOR HS CODE 8428-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 6 ELEVATORS AND ESCALATORS MARKET: CONFERENCES & EVENTS, 2025-2026

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 CONTAINER COMPLIANCE OPTIONS FOR SAFETY AND ACCESSIBILITY IN EUROPE

- TABLE 13 LIFT/ELEVATOR STANDARDS IN INDIA

- TABLE 14 ELEVATORS AND ESCALATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 WORLD GDP ANNUAL PERCENTAGE CHANGE OF ADVANCED ECONOMIES, 2024-2026

- TABLE 16 WORLD GDP ANNUAL PERCENTAGE CHANGE OF ADVANCED ECONOMIES, 2024-2026

- TABLE 17 WORLD GDP ANNUAL PERCENTAGE CHANGE OF EMERGING MARKET AND DEVELOPING ECONOMIES, 2024-2026

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 19 KEY BUYING CRITERIA FOR ELEVATORS AND ESCALATORS INDUSTRY

- TABLE 20 ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 21 ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 22 ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 23 ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 24 ELEVATORS AND ESCALATORS MARKET, BY SERVICE, 2020-2023 (USD MILLION)

- TABLE 25 ELEVATORS AND ESCALATORS MARKET, BY SERVICE, 2024-2030 (USD MILLION)

- TABLE 26 ELEVATORS AND ESCALATORS MARKET, BY SERVICE, 2020-2023 (THOUSAND UNITS)

- TABLE 27 ELEVATORS AND ESCALATORS MARKET, BY SERVICE, 2024-2030 (THOUSAND UNITS)

- TABLE 28 ELEVATORS AND ESCALATORS MARKET, BY ELEVATOR TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 29 ELEVATORS AND ESCALATORS MARKET, BY ELEVATOR TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 30 ELEVATORS AND ESCALATORS MARKET, BY ELEVATOR TECHNOLOGY, 2020-2023 (THOUSAND UNITS)

- TABLE 31 ELEVATORS AND ESCALATORS MARKET, BY ELEVATOR TECHNOLOGY, 2024-2030 (THOUSAND UNITS)

- TABLE 32 ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 33 ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 34 ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 35 ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 36 ELEVATORS AND ESCALATORS MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 37 ELEVATORS AND ESCALATORS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 38 ELEVATORS AND ESCALATORS MARKET, BY REGION, 2020-2023 (THOUSAND UNITS)

- TABLE 39 ELEVATORS AND ESCALATORS MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- TABLE 40 NORTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 41 NORTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 43 NORTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 44 NORTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 45 NORTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 47 NORTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 48 NORTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 49 NORTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 51 NORTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 52 US: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 53 US: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 54 US: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 55 US: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 56 US: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 57 US: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 58 US: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 59 US: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 60 CANADA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 61 CANADA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 62 CANADA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 63 CANADA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 64 CANADA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 65 CANADA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 66 CANADA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 67 CANADA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 68 MEXICO: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 69 MEXICO: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 70 MEXICO: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 71 MEXICO: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 72 MEXICO: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 73 MEXICO: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 74 MEXICO: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 75 MEXICO: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 76 ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 77 ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 78 ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 79 ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 80 ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 81 ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 82 ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 83 ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 84 ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 85 ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 86 ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 87 ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 88 CHINA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 89 CHINA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 90 CHINA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 91 CHINA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 92 CHINA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 93 CHINA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 94 CHINA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 95 CHINA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 96 INDIA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 97 INDIA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 98 INDIA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 99 INDIA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 100 INDIA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 101 INDIA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 102 INDIA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 103 INDIA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 104 JAPAN: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 105 JAPAN: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 106 JAPAN: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 107 JAPAN: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 108 JAPAN: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 109 JAPAN: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 110 JAPAN: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 111 JAPAN: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 112 SOUTH KOREA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 113 SOUTH KOREA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 114 SOUTH KOREA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 115 SOUTH KOREA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 116 SOUTH KOREA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 117 SOUTH KOREA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 118 SOUTH KOREA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 119 SOUTH KOREA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 120 REST OF ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 123 REST OF ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 124 REST OF ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 126 REST OF ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 127 REST OF ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 128 EUROPE: ELEVATORS AND ESCALATORS, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 129 EUROPE: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 130 EUROPE: ELEVATORS AND ESCALATORS, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 131 EUROPE: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 132 EUROPE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 133 EUROPE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 134 EUROPE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 135 EUROPE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 136 EUROPE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 137 EUROPE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 138 EUROPE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 139 EUROPE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 140 GERMANY: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 141 GERMANY: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 142 GERMANY: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 143 GERMANY: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 144 GERMANY: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 145 GERMANY: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 146 GERMANY: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 147 GERMANY: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 148 FRANCE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 149 FRANCE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 150 FRANCE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 151 FRANCE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 152 FRANCE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 153 FRANCE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 154 FRANCE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 155 FRANCE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 156 UK: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 157 UK: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 158 UK: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 159 UK: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 160 UK: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 161 UK: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 162 UK: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 163 UK: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 164 ITALY: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 165 ITALY: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 166 ITALY: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 167 ITALY: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 168 ITALY: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 169 ITALY: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 170 ITALY: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 171 ITALY: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 172 SPAIN: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 173 SPAIN: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 174 SPAIN: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 175 SPAIN: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 176 SPAIN: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 177 SPAIN: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 178 SPAIN: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 179 SPAIN: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 180 REST OF EUROPE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 181 REST OF EUROPE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 182 REST OF EUROPE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 183 REST OF EUROPE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 184 REST OF EUROPE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 185 REST OF EUROPE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 186 REST OF EUROPE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 187 REST OF EUROPE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 188 SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 189 SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 190 SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 191 SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 192 SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 193 SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 194 SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 195 SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 196 SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 197 SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 198 SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 199 SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 200 BRAZIL: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 201 BRAZIL: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 202 BRAZIL: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 203 BRAZIL: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 204 BRAZIL: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 205 BRAZIL: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 206 BRAZIL: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 207 BRAZIL: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 208 ARGENTINA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 209 ARGENTINA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 210 ARGENTINA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 211 ARGENTINA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 212 ARGENTINA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 213 ARGENTINA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 214 ARGENTINA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 215 ARGENTINA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 216 REST OF SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 217 REST OF SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 218 REST OF SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 219 REST OF SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 220 REST OF SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 221 REST OF SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 222 REST OF SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 223 REST OF SOUTH AMERICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 224 MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 227 MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 228 MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 231 MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 232 MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 235 MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 236 GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 237 GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 238 GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 239 GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 240 GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 241 GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 242 GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 243 GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 244 UAE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 245 UAE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 246 UAE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 247 UAE: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 248 UAE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 249 UAE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 250 UAE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 251 UAE: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 252 SAUDI ARABIA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 253 SAUDI ARABIA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 254 SAUDI ARABIA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 255 SAUDI ARABIA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 256 SAUDI ARABIA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 257 SAUDI ARABIA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 258 SAUDI ARABIA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 259 SAUDI ARABIA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 260 REST OF GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 261 REST OF GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 262 REST OF GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 263 REST OF GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 264 REST OF GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 265 REST OF GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 266 REST OF GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 267 REST OF GCC COUNTRIES: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 268 REST OF MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 269 REST OF MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 270 REST OF MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 271 REST OF MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY TYPE, 2024-2030 (THOUSAND UNITS)

- TABLE 272 REST OF MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 273 REST OF MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 274 REST OF MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2020-2023 (THOUSAND UNITS)

- TABLE 275 REST OF MIDDLE EAST & AFRICA: ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY, 2024-2030 (THOUSAND UNITS)

- TABLE 276 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS BETWEEN JANUARY 2021 AND JUNE 2025

- TABLE 277 ELEVATORS AND ESCALATORS MARKET: DEGREE OF COMPETITION

- TABLE 278 ELEVATORS AND ESCALATORS MARKET: REGION FOOTPRINT

- TABLE 279 ELEVATORS AND ESCALATORS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 280 ELEVATORS AND ESCALATORS MARKET: TYPE FOOTPRINT

- TABLE 281 ELEVATORS AND ESCALATORS MARKET: SERVICE FOOTPRINT

- TABLE 282 ELEVATORS AND ESCALATORS MARKET: ELEVATOR TECHNOLOGY FOOTPRINT

- TABLE 283 ELEVATORS AND ESCALATORS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 284 ELEVATORS AND ESCALATORS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 285 ELEVATORS AND ESCALATORS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 286 ELEVATORS AND ESCALATORS MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 287 ELEVATORS AND ESCALATORS MARKET: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 288 ELEVATORS AND ESCALATORS MARKET: DEALS, JANUARY 2021-JUNE 2025

- TABLE 289 ELEVATORS AND ESCALATORS MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 290 SCHINDLER GROUP: COMPANY OVERVIEW

- TABLE 291 SCHINDLER GROUP: PRODUCTS OFFERED

- TABLE 292 SCHINDLER GROUP: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 293 SCHINDLER GROUP: DEALS, JANUARY 2021-JUNE 2025

- TABLE 294 SCHINDLER GROUP: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 295 OTIS WORLDWIDE CORPORATION: COMPANY OVERVIEW

- TABLE 296 OTIS WORLDWIDE CORPORATION: PRODUCTS OFFERED

- TABLE 297 OTIS WORLDWIDE CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 298 OTIS WORLDWIDE CORPORATION: DEALS, JANUARY 2021-JUNE 2025

- TABLE 299 OTIS WORLDWIDE CORPORATION: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 300 OTIS WORLDWIDE CORPORATION: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 301 KONE CORPORATION: COMPANY OVERVIEW

- TABLE 302 KONE CORPORATION: PRODUCTS OFFERED

- TABLE 303 KONE CORPORATION: DEALS, JANUARY 2021-JUNE 2025

- TABLE 304 KONE CORPORATION: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 305 HITACHI LTD.: COMPANY OVERVIEW

- TABLE 306 HITACHI LTD.: PRODUCTS OFFERED

- TABLE 307 HITACHI LTD.: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 308 HITACHI LTD.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 309 HITACHI LTD.: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 310 HITACHI LTD.: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 311 HYUNDAI ELEVATOR CO., LTD.: COMPANY OVERVIEW

- TABLE 312 HYUNDAI ELEVATOR CO., LTD.: PRODUCTS OFFERED

- TABLE 313 HYUNDAI ELEVATOR CO., LTD.: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 314 HYUNDAI ELEVATOR CO., LTD.: DEALS, JANUARY 2021-JUNE 2025

- TABLE 315 HYUNDAI ELEVATOR CO., LTD.: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 316 HYUNDAI ELEVATOR CO., LTD.: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 317 FUJITEC CO., LTD.: COMPANY OVERVIEW

- TABLE 318 FUJITEC CO., LTD.: PRODUCTS OFFERED

- TABLE 319 FUJITEC CO., LTD.: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 320 FUJITEC CO., LTD.: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 321 FUJITEC CO., LTD.: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 322 TOSHIBA ELEVATORS AND BUILDING SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 323 TOSHIBA ELEVATORS AND BUILDING SYSTEMS CORPORATION: PRODUCTS OFFERED

- TABLE 324 TOSHIBA ELEVATORS AND BUILDING SYSTEMS CORPORATION: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 325 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 326 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS OFFERED

- TABLE 327 MITSUBISHI ELECTRIC CORPORATION: DEALS, JANUARY 2021-JUNE 2025

- TABLE 328 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 329 MITSUBISHI ELECTRIC CORPORATION: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 330 TK ELEVATOR: COMPANY OVERVIEW

- TABLE 331 TK ELEVATOR: PRODUCTS OFFERED

- TABLE 332 TK ELEVATOR: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 333 TK ELEVATOR: DEALS, JANUARY 2021-JUNE 2025

- TABLE 334 TK ELEVATOR: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 335 TK ELEVATOR: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 336 SJEC CORPORATION: COMPANY OVERVIEW

- TABLE 337 SJEC CORPORATION: PRODUCTS OFFERED

- TABLE 338 KLEEMANN: COMPANY OVERVIEW

- TABLE 339 SIGMA ELEVATORS: COMPANY OVERVIEW

- TABLE 340 WEMAINTAIN: COMPANY OVERVIEW

- TABLE 341 ESCON ELEVATORS: COMPANY OVERVIEW

- TABLE 342 SHENYANG YUANDA INTELLECTUAL INDUSTRY GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 343 ORONA: COMPANY OVERVIEW

- TABLE 344 EITA ELEVATOR: COMPANY OVERVIEW

- TABLE 345 GLARIE ELEVATOR: COMPANY OVERVIEW

- TABLE 346 AARON INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 347 LEO ELEVATORS: COMPANY OVERVIEW

- TABLE 348 TRIO ELEVATORS CO (INDIA) PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 349 STANNAH GROUP: COMPANY OVERVIEW

- TABLE 350 CIBES LIFT: COMPANY OVERVIEW

- TABLE 351 WALTON GROUP: COMPANY OVERVIEW

- TABLE 352 EXPEDITE AUTOMATION LLP: COMPANY OVERVIEW

- TABLE 353 LIFT AI VENTURES INC.: COMPANY OVERVIEW

- TABLE 354 SMART ELEVATOR MARKET, BY COMPONENT, 2017-2020 (USD MILLION)

- TABLE 355 SMART ELEVATOR MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- TABLE 356 SMART ELEVATOR MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 357 SMART ELEVATOR MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- TABLE 358 SMART ELEVATOR MARKET, BY SERVICE, 2017-2020 (USD MILLION)

- TABLE 359 SMART ELEVATOR MARKET, BY SERVICE, 2021-2026 (USD MILLION)

- TABLE 360 SMART ELEVATOR MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 361 SMART ELEVATOR MARKET, BY REGION, 2021-2026 (USD MILLION)

List of Figures

- FIGURE 1 ELEVATORS AND ESCALATORS MARKET: RESEARCH DESIGN

- FIGURE 2 STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY-SIDE

- FIGURE 6 ELEVATORS AND ESCALATORS MARKET: DATA TRIANGULATION

- FIGURE 7 NEW INSTALLATION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 MACHINE-ROOM-LESS TRACTION ELEVATORS SEGMENT TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 9 ELEVATORS SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 10 RESIDENTIAL SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 11 ASIA PACIFIC DOMINATED ELEVATORS AND ESCALATORS MARKET IN 2024

- FIGURE 12 INCREASED CONSTRUCTION OF HIGH-RISE BUILDINGS EQUIPPED WITH SMART VERTICAL TRANSPORTATION OFFERS LUCRATIVE GROWTH OPPORTUNITIES

- FIGURE 13 MACHINE-ROOM-LESS TRACTION ELEVATORS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 14 ELEVATORS SEGMENT TO DOMINATE MARKET IN TERMS OF VOLUME

- FIGURE 15 MODERNIZATION SEGMENT TO REGISTER HIGHEST GROWTH IN TERMS OF VOLUME

- FIGURE 16 COMMERCIAL SEGMENT TO WITNESS HIGH GROWTH IN MARKET, BY VOLUME, DURING FORECAST PERIOD

- FIGURE 17 ELEVATORS SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2024

- FIGURE 18 US TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 ELEVATORS AND ESCALATORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 URBAN AND RURAL POPULATION, 1950-2050 (BILLION)

- FIGURE 21 ENERGY CONSUMPTION: RESIDENTIAL, COMMERCIAL, AND INDUSTRIAL SECTORS, 1950-2024

- FIGURE 22 GLOBAL AGING POPULATION (% INCREASE), 1970-2024

- FIGURE 23 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 ELEVATORS AND ESCALATORS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 ELEVATORS AND ESCALATORS MARKET: ECOSYSTEM

- FIGURE 26 GEN AI USE IN ELEVATORS AND ESCALATORS MARKET

- FIGURE 27 ELEVATORS AND ESCALATORS MARKET: MAJOR PATENTS, 2015-2024

- FIGURE 28 JURISDICTION ANALYSIS, 2015-2024

- FIGURE 29 EXPORT DATA FOR HS CODE 8428-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 30 IMPORT DATA FOR HS CODE 8428-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 31 ELEVATORS AND ESCALATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 33 KEY BUYING CRITERIA OF ELEVATORS AND ESCALATORS MARKET

- FIGURE 34 INVESTOR DEALS AND FUNDING SOARED IN 2022

- FIGURE 35 ELEVATORS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 36 NEW INSTALLATION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 37 MACHINE-ROOM-LESS TRACTION ELEVATORS SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 38 RESIDENTIAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 39 US TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO LEAD ELEVATORS AND ESCALATORS MARKET IN 2024

- FIGURE 41 NORTH AMERICA: ELEVATORS AND ESCALATORS MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF KEY COMPANIES IN ELEVATORS AND ESCALATORS MARKET, 2020-2024 (USD BILLION)

- FIGURE 44 ELEVATORS AND ESCALATORS MARKET SHARE ANALYSIS, 2024

- FIGURE 45 COMPANY VALUATION (USD BILLION)

- FIGURE 46 FINANCIAL MATRIX: EV/EBITDA RATIO

- FIGURE 47 YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA

- FIGURE 48 PRODUCT/BRAND COMPARISON

- FIGURE 49 ELEVATORS AND ESCALATORS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 ELEVATORS AND ESCALATORS MARKET: COMPANY FOOTPRINT

- FIGURE 51 ELEVATORS AND ESCALATORS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 SCHINDLER GROUP: COMPANY SNAPSHOT

- FIGURE 53 OTIS WORLDWIDE CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 KONE CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 HITACHI LTD.: COMPANY SNAPSHOT

- FIGURE 56 HYUNDAI ELEVATOR CO., LTD.: COMPANY SNAPSHOT

- FIGURE 57 FUJITEC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 58 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

The global elevators and escalators market is projected to grow from USD 98,842.2 million in 2025 to USD 113,813.8 million by 2030, at a CAGR of 2.86% during the forecast period. The rising trend of mass movement from rural regions to urban areas has created a greater need for significant infrastructure development, particularly in constructing high-rise buildings to satisfy the increasing housing demands. This has led to the evolution of urban areas into megacities, with notable population surges in cities such as Tokyo, Mexico City, Seoul, and Lagos. These megacities are actively involved in the construction of skyscrapers, advanced transportation hubs, and various other infrastructure projects to support their growing populations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Thousand Units) |

| Segments | Type, Service, Elevator Technology, End-use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, South America, and the Middle East & Africa. |

A critical component of high-rise structures is facilitating efficient vertical mobility, highlighting the necessity for elevators and escalators. As a result, the rapid urbanization and the increase in high-rise building projects are expected to drive the demand for elevators and escalators. This heightened usage is anticipated to be a significant contributor to market growth during the forecast period.

"In terms of both value and volume, elevators are projected to register the fastest growth during the forecast period."

Elevators, whether they are open or enclosed platforms used to transport people or goods between different floors in a building, must follow strict safety standards established by regulatory bodies. In the US, elevator manufacturers are required to comply with safety regulations set by the American National Standards Institute (ANSI) and the American Society of Mechanical Engineers (ASME). The elevator industry is expected to experience significant growth due to the ongoing development of new residential and commercial projects worldwide. This growth is projected to be most pronounced in the elevators segment, which is anticipated to achieve the highest CAGR.

By service, the modernization segment is estimated to register the highest CAGR during the forecast period."

Updating escalators and elevators is common because it makes them more reliable, faster, and safer. Older elevators often have higher maintenance costs, slow rides, and frequent breakdowns, which disrupt the daily operations of busy buildings. Modernization upgrades key parts, boosting efficiency and reducing energy use. This leads to lower expenses and benefits the environment. It also ensures compliance with the latest safety regulations and improves the look and feel of these systems, enhancing the user experience. Overall, modernization increases a building's value, extends the life of the equipment, and meets the needs of today's smart and sustainable infrastructure.

"Machine-room-less traction elevator segment to register the fastest growth during the forecast period."

Elevators that do not need a machine room are expected to register the fastest growth in the elevators and escalators market due to advancements in technology. This cutting-edge technology, stemming from continuous advancements, has transformed the traditional elevator industry. A significant advancement is the major decrease in the size of electrical motors used in traction systems, achieved through the use of newly designed permanent magnet motors (PMM). A key characteristic of this technology is the removal of the necessity for a machine room above the hoistway. This design has gained global popularity and is quickly becoming the new norm in elevator technology.

"Commercial end-use segment to register the fastest growth during the forecast period."

The commercial sector showcases high demand for elevators and escalators for several key reasons. One major factor is the rapid growth of cities and the emergence of tall commercial buildings. These structures require efficient, safe, and secure methods for people to move around, making vertical transportation systems essential. Additionally, there is a strong focus on improving accessibility, particularly for the aging population and individuals with disabilities. This emphasis is driving the demand for more advanced and inclusive elevator and escalator solutions in commercial environments. Furthermore, today's elevators and escalators are not just simple machines; they have become sophisticated, energy-efficient systems equipped with innovative features. Commercial spaces are actively seeking these technological advancements to keep up with modern design trends and achieve their sustainability goals.

"In terms of value, the Asia Pacific elevators and escalators market is projected to account for the largest share during the forecast period."

The Asia Pacific region is anticipated to hold the largest share in terms of value. This increase is linked to greater investments in construction, improved living standards, and rapid urban growth. Countries in the Asia Pacific are actively working on projects to improve commercial and institutional buildings. In the past few years, numerous nations in the region have initiated efforts to create smart cities utilizing low-carbon and Internet of Things (IoT) technologies. As a result, this trend offers promising prospects for the growth of the elevators and escalators market.

In-depth interviews were conducted with chief executive officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the elevators and escalators market.

- By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

- By Designation: C-level Executives: 20%, Directors: 30%, and Others: 50%

- By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, Middle East & Africa: 20%, and South America: 20%

Schindler Group (Switzerland), Otis (US), KONE Corporation (Finland), Hitachi Ltd. (Japan), Hyundai Elevator Co. Ltd. (South Korea), Fujitec Co., Ltd. (Japan), Toshiba Elevators and Building Systems Corporation (Japan), Mitsubishi Electric Corporation (Japan), TK Elevator (Germany), and SJEC Corporation (China) are some of the key players in the elevators and escalators market.

Research Coverage

The market study covers the elevators and escalators market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on type (elevators, escalators, and moving walkways), service (new installations, maintenance & repair, and modernization), elevator technology (traction elevators, machine-room-less traction elevators, and hydraulic elevators), end-use industry (residential, commercial, institutional, infrastructure, and other end-use industries), and region (Asia Pacific, North America, Europe, South America, and the Middle East & Africa). The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the elevators and escalators market.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall hydrofluoric acid market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following points:

- Analysis of key drivers (Increased construction of high-rise buildings equipped with smart vertical transportation systems due to rapid urbanization, growing need for reducing energy consumption in buildings, and growing aging population to facilitate development of better infrastructure within buildings), restraints (uncertainty and risk regarding global economy and high maintenance costs), opportunities (adoption of green building codes and energy-efficient products, development of innovative technologies, and rising demand for smart elevators), and challenges (compliance with standards and regulations) influencing the growth of the elevators and escalators market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the elevators and escalators market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the elevators and escalators market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the elevators and escalators market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Schindler Group (Switzerland), Otis Elevator (US), Thyssenkrupp AG (Germany), KONE Corporation (Finland), Hitachi Ltd. (Japan), Hyundai Elevator Co. Ltd. (South Korea), Fujitec Co., Ltd. (Japan), Toshiba Elevators and Building System Corporation (Japan), Mitsubishi Electric Corporation (Japan), TK Elevator (Germany), and SJEC Corporation (China), among others, in the elevators and escalators market. The report also helps stakeholders understand the pulse of the elevators and escalators market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELEVATORS AND ESCALATORS MARKET

- 4.2 ELEVATORS AND ESCALATORS MARKET, BY ELEVATOR TECHNOLOGY

- 4.3 ELEVATORS AND ESCALATORS MARKET, BY TYPE

- 4.4 ELEVATORS AND ESCALATORS MARKET, BY SERVICE

- 4.5 ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY

- 4.6 ASIA PACIFIC: ELEVATORS AND ESCALATORS MARKET, BY TYPE AND COUNTRY

- 4.7 ELEVATORS AND ESCALATORS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increased construction of high-rise buildings equipped with smart vertical transportation

- 5.2.1.2 Growing need for reducing energy consumption in buildings

- 5.2.1.3 Growing aging population to facilitate development

- 5.2.2 RESTRAINTS

- 5.2.2.1 Uncertainty and risk regarding global economy

- 5.2.2.2 High maintenance cost

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of green building codes and energy-efficient products

- 5.2.3.2 Development of innovative technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Compliance with standards and regulations

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE RANGE OF ELEVATORS AND ESCALATORS, BY TYPE

- 6.2.2 RESIDENTIAL ELEVATORS (AVERAGE PRICE RANGE)

- 6.2.3 FACTORS AFFECTING PRICE OF COMMERCIAL ELEVATORS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & DEVELOPMENT

- 6.3.2 COMPONENT MANUFACTURERS

- 6.3.3 MANUFACTURERS

- 6.3.4 SOFTWARE & SERVICES

- 6.3.5 INTEGRATORS

- 6.3.6 END-USE APPLICATIONS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Intuitive elevator technology

- 6.5.1.2 Cable-free smart elevators

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Touchless interface

- 6.5.2.2 Internet of Things (IoT) and 5G technology

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 AI for traffic management

- 6.5.3.2 Augmented reality for maintenance

- 6.5.1 KEY TECHNOLOGIES

- 6.6 IMPACT OF GEN AI ON ELEVATORS & ESCALATORS MARKET

- 6.7 PATENT ANALYSIS

- 6.7.1 INTRODUCTION

- 6.7.2 METHODOLOGY

- 6.7.3 PATENT ANALYSIS

- 6.7.4 JURISDICTION ANALYSIS

- 6.8 TRADE ANALYSIS

- 6.9 KEY CONFERENCES AND EVENTS

- 6.10 REGULATORY BODIES AND GOVERNMENT AGENCIES

- 6.10.1 REGULATORY FRAMEWORK

- 6.10.1.1 ASME A17.7-2007/CSA B44.7-07 (R2021)

- 6.10.1.2 EN 81-20:2014 and EN 81-50:2020

- 6.10.1.3 IS 14665 Part 2 and IS 15259

- 6.10.1 REGULATORY FRAMEWORK

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 THREAT OF NEW ENTRANTS

- 6.11.2 THREAT OF SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 MACROECONOMIC INDICATORS

- 6.12.1 INTRODUCTION

- 6.12.2 GDP TRENDS AND FORECASTS

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 CASE STUDY 1: ELEVATORS GURGAON MEDANTA

- 6.14.2 CASE STUDY 2: ENHANCING HIGH-RISE EFFICIENCY WITH ADVANCED ELEVATOR SYSTEMS AT RUBY

- 6.14.3 CASE STUDY 3: HONEYWELL - CORPORATE OFFICE RENOVATIONS

- 6.14.4 CASE STUDY 4: KONE CORPORATION- 180 BRISBANE COMMERCIAL OFFICES, AUSTRALIA

- 6.15 INVESTMENT AND FUNDING SCENARIO

- 6.16 IMPACT OF 2025 US TARIFF ON ELEVATORS AND ESCALATORS MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 IMPACT ON COUNTRY/REGION

- 6.16.4.1 US

- 6.16.4.2 Europe

- 6.16.4.3 Asia Pacific

- 6.16.5 END-USE INDUSTRY IMPACT

7 ELEVATORS AND ESCALATORS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 ELEVATORS

- 7.2.1 DEVELOPMENT OF NEW RESIDENTIAL AND COMMERCIAL PROJECTS TO DRIVE MARKET

- 7.2.2 PASSENGER ELEVATORS

- 7.2.2.1 Bed elevators

- 7.2.2.2 Service elevators

- 7.2.2.3 Observation elevators

- 7.2.2.4 Residential elevators

- 7.2.3 FREIGHT ELEVATORS

- 7.2.3.1 Dumbwaiters

- 7.2.3.2 Vehicle elevators

- 7.2.4 OTHER ELEVATOR TYPES

- 7.3 ESCALATORS

- 7.3.1 BOOM IN REAL ESTATE SECTOR AND NEED FOR EFFICIENT & RAPID TRANSIT SYSTEMS TO DRIVE MARKET

- 7.4 MOVING WALKWAYS

- 7.4.1 INCREASING NUMBER OF AIRPORTS AND SHOPPING MALLS TO DRIVE MARKET

8 ELEVATORS AND ESCALATORS MARKET, BY SERVICE

- 8.1 INTRODUCTION

- 8.2 NEW INSTALLATION

- 8.2.1 RISING CONSTRUCTION ACTIVITIES TO DRIVE MARKET

- 8.3 MAINTENANCE & REPAIR

- 8.3.1 GROWING CONCERNS REGARDING AGING ELEVATORS TO DRIVE MARKET

- 8.4 MODERNIZATION

- 8.4.1 NEED TO REPLACE AGING AND OBSOLETE SYSTEMS TO DRIVE MARKET

9 ELEVATORS AND ESCALATORS MARKET, BY ELEVATOR TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 TRACTION ELEVATORS

- 9.2.1 LIGHTWEIGHT PROPERTY TO DRIVE MARKET

- 9.3 MACHINE-ROOM-LESS TRACTION ELEVATORS

- 9.3.1 COST-EFFECTIVENESS AND SUPERIOR PERFORMANCE OF TECHNOLOGY TO DRIVE MARKET

- 9.4 HYDRAULIC ELEVATORS

- 9.4.1 TECHNICAL SPECIALTIES OF TECHNOLOGY TO DRIVE MARKET

10 ELEVATORS AND ESCALATORS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 RESIDENTIAL

- 10.2.1 GROWTH IN HIGH-RISE RESIDENTIAL BUILDING CONSTRUCTION TO DRIVE MARKET

- 10.3 COMMERCIAL

- 10.3.1 NEED TO OPTIMIZE TRAFFIC FLOW IN ELEVATORS IN COMMERCIAL SPACES TO DRIVE MARKET

- 10.4 INSTITUTIONAL

- 10.4.1 RISING DEMAND FOR NEW INSTITUTIONS TO DRIVE MARKET

- 10.5 INFRASTRUCTURE

- 10.5.1 RAPID URBANIZATION TO DRIVE MARKET

- 10.6 OTHER END-USE INDUSTRIES

11 ELEVATORS AND ESCALATORS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Government investments in infrastructure projects to drive market

- 11.2.2 CANADA

- 11.2.2.1 Increased investment in residential sector to drive market

- 11.2.3 MEXICO

- 11.2.3.1 Growth in commercial construction to drive market

- 11.2.1 US

- 11.3 ASIA PACIFIC

- 11.3.1 CHINA

- 11.3.1.1 Rapid industrialization and urbanization to drive market

- 11.3.2 INDIA

- 11.3.2.1 Government initiatives for smart cities to drive market

- 11.3.3 JAPAN

- 11.3.3.1 Increasing adoption of smart technologies to drive market

- 11.3.4 SOUTH KOREA

- 11.3.4.1 Changing lifestyles and increasing government initiatives to drive market

- 11.3.5 REST OF ASIA PACIFIC

- 11.3.1 CHINA

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Emphasis on modernization, infrastructure development, and stringent safety standards to drive market

- 11.4.2 FRANCE

- 11.4.2.1 Regulatory frameworks and architectural needs to drive market

- 11.4.3 UK

- 11.4.3.1 Development of smart cities and new technologies to drive market

- 11.4.4 ITALY

- 11.4.4.1 Growing investment in construction industry to drive market

- 11.4.5 SPAIN

- 11.4.5.1 Sustainability in construction and real estate sectors to drive market

- 11.4.6 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Increasing demand for residential & nonresidential construction to drive market

- 11.5.2 ARGENTINA

- 11.5.2.1 Investment in construction sector to drive market

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

- 11.6.1.1 UAE

- 11.6.1.1.1 Industrial growth and rise in tourism to drive market

- 11.6.1.2 Saudi Arabia

- 11.6.1.2.1 Growing non-oil economy to drive market

- 11.6.1.3 Rest of GCC countries

- 11.6.1.1 UAE

- 11.6.2 REST OF MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS OF KEY PLAYERS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 PRODUCT/BRAND COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 End-use industry footprint

- 12.7.5.4 Type footprint

- 12.7.5.5 Service footprint

- 12.7.5.6 Elevator technology footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 EXPANSIONS

- 12.9.3 DEALS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SCHINDLER GROUP

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 OTIS WORLDWIDE CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.3.4 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 KONE CORPORATION

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Ke strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 HITACHI LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.3.4 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 HYUNDAI ELEVATOR CO., LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Expansions

- 13.1.5.3.4 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 FUJITEC CO., LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Expansions

- 13.1.6.3.3 Other developments

- 13.1.6.4 MnM view

- 13.1.7 TOSHIBA ELEVATORS AND BUILDING SYSTEMS CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Other developments

- 13.1.7.4 MnM view

- 13.1.8 MITSUBISHI ELECTRIC CORPORATION

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Product launches

- 13.1.8.3.3 Other developments

- 13.1.8.4 MnM view

- 13.1.9 TK ELEVATOR

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.9.3.3 Expansions

- 13.1.9.3.4 Other developments

- 13.1.9.4 MnM view

- 13.1.10 SJEC CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 MnM view

- 13.1.1 SCHINDLER GROUP

- 13.2 OTHER PLAYERS

- 13.2.1 KLEEMANN

- 13.2.2 SIGMA ELEVATORS

- 13.2.3 WEMAINTAIN

- 13.2.4 ESCON ELEVATORS

- 13.2.5 SHENYANG YUANDA INTELLECTUAL INDUSTRY GROUP CO., LTD.

- 13.2.6 ORONA

- 13.2.7 EITA ELEVATOR

- 13.2.8 GLARIE ELEVATOR

- 13.2.9 AARON INDUSTRIES LTD.

- 13.2.10 LEO ELEVATORS

- 13.2.11 TRIO ELEVATORS CO (INDIA) PRIVATE LIMITED

- 13.2.12 STANNAH GROUP

- 13.2.13 CIBES LIFT

- 13.2.14 WALTON GROUP

- 13.2.15 EXPEDITE AUTOMATION LLP

- 13.2.16 LIFT AI VENTURES INC.

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.2.1 SMART ELEVATOR MARKET

- 14.2.1.1 Market definition

- 14.2.1.2 Smart elevator market, by component

- 14.2.1.3 Smart elevator market, by application

- 14.2.1.4 Smart elevator market, by service

- 14.2.1.5 Smart elevator market, by region

- 14.2.1 SMART ELEVATOR MARKET

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS