|

|

市場調査レポート

商品コード

1643943

合成皮革市場:タイプ別、最終用途産業別、地域別 - 2029年までの予測Synthetic Leather Market by Type (PU based, PVC based, and Bio based), End-use Industry (Footwear, Furnishing, Automotive, Clothing, Bags, Purses, & Wallets), and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 合成皮革市場:タイプ別、最終用途産業別、地域別 - 2029年までの予測 |

|

出版日: 2025年01月23日

発行: MarketsandMarkets

ページ情報: 英文 245 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

合成皮革の市場規模は、2024年から2029年の間に5.3%のCAGRで拡大すると予測され、2024年の719億3,000万米ドルから2029年には932億5,000万米ドルに達すると予測されています。

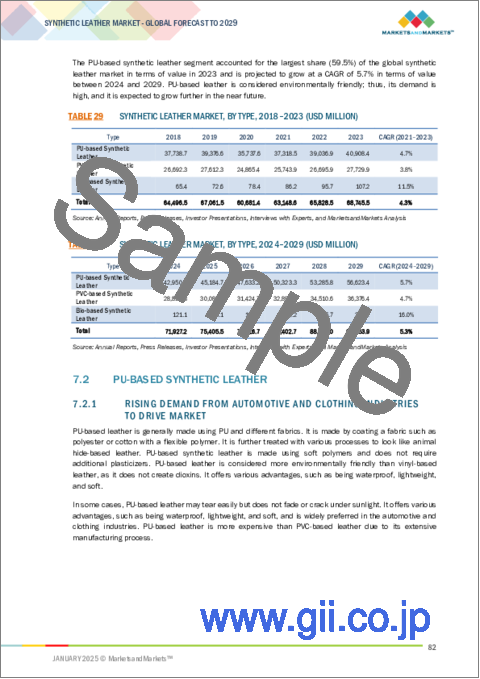

タイプ別セグメントではPUベースの合成皮革が、2023年に市場の最大のシェアを占めると推定されます。バイオベースは、合成皮革市場において金額ベースで最も急成長するタイプである可能性が高いとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント別 | タイプ別、最終用途産業別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

人工PVCレザーは、レザーに似せた合成皮革です。PVC原料の層が作られ、それが圧力や熱を加えることによって適切な布の裏地に接着され、ビニールレザーが作られます。合成皮革は、長持ちし、防水性があり、手入れが簡単なことで知られ、椅子張り、ファッション、車の内装などによく使われる素材です。PVC合成皮革は天然皮革に比べ通気性は劣りますが、様々な質感や仕上げがあり、一般的に同等の本革よりも安価で環境に優しい素材です。

バイオベース合成皮革の環境に優しい魅力と持続可能な生産方法によって、最も急成長しているタイプの一つとなっています。バイオベースの合成皮革は、コルク、藻類、植物ベースのポリマーなどの再生可能な資源を使用することで、従来の合成皮革に多く含まれる石油ベースの成分への依存を減らしています。環境に配慮した選択肢は、環境問題への関心の高まりとともに、企業や顧客の間で人気が高まっています。さらに、バイオベースの合成皮革は、非バイオベースの合成皮革よりも二酸化炭素への影響が少なく、しかもゴージャスで長持ちします。バイオベースの合成皮革は、持続可能な家具、ファッション、車の内装を求めるバイヤーが増えているため、環境に優しい代替品として人気が高まっています。

合成皮革市場のフットウェア分野は、ファッショナブルで長持ちし、リーズナブルな価格の本革代替品へのニーズの高まりにより、最も速いペースで拡大しています。合成皮革は非常に順応性が高く、新しいデザインの創造を可能にし、多様な質感と仕上げでシンプルに維持されているように見えます。一方、環境に優しい合成皮革は、消費者の環境維持と動物愛護への理解が深まるにつれ、代用品として人気を博しました。さらに、合成皮革は従来の皮革よりも製造コストが低いという事実も、サンダル、ブーツ、靴にこの素材を採用するという世界の開発動向に拍車をかけています。

アジア太平洋は、工業化の進展、都市化、可処分所得の増加により、合成皮革市場にて最も急成長しています。中国、インド、ベトナムの低い労働コストと広範な産業基盤は、合成皮革アイテムの主要な生産拠点となっています。さらに、顧客は本革よりも経済的で耐久性があり、環境に優しい代替品に移行しており、ファッション、靴、自動車を含む分野における合成皮革の需要を押し上げています。さらに、政府の持続可能性への取り組みや、小売業やeコマース産業の拡大により、この分野は合成皮革市場の拡大において大きな役割を果たすことになるとみられています。

当レポートでは、世界の合成皮革市場について調査し、タイプ別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- マクロ経済指標

第6章 業界の動向

- サプライチェーン分析

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- 技術分析

- ケーススタディ分析

- 貿易分析

- 規制状況

- 2025年の主な会議とイベント

- 投資と資金調達のシナリオ

- 特許分析

- AI/生成AIが合成皮革市場に与える影響

第7章 合成皮革市場、タイプ別

- イントロダクション

- PUベースの合成皮革

- PVCベースの合成皮革

- バイオベース合成皮革

第8章 合成皮革市場、最終用途産業別

- イントロダクション

- フットウェア

- 服飾品

- 自動車

- 衣類

- バッグ、財布

- その他

第9章 合成皮革市場、地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- 台湾

- タイ

- マレーシア

- インドネシア

- 欧州

- ドイツ

- イタリア

- フランス

- 英国

- スペイン

- ロシア

- ポーランド

- スウェーデン

- ポルトガル

- 北米

- 米国

- メキシコ

- カナダ

- 南米

- ブラジル

- アルゼンチン

- 中東・アフリカ

- 中東

- アフリカ

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- ブランド/製品比較

- 企業価値評価と財務指標

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- KURARAY CO., LTD.

- SAN FANG CHEMICAL INDUSTRY CO., LTD.

- TEIJIN LIMITED

- MAYUR UNIQUOTERS LIMITED

- NAN YA PLASTICS CORPORATION

- FILWEL CO., LTD.

- ZHEJIANG HEXIN HOLDINGS CO., LTD.

- WANHUA CHEMICAL GROUP CO., LTD.

- ALFATEX ITALIA SRL

- H.R. POLYCOATS PRIVATE LIMITED

- その他の企業

- KOLON INDUSTRIES, INC.

- MARVEL VINYLS LIMITED

- TORAY INDUSTRIES, INC.

- ANHUI ANLI MATERIAL TECHNOLOGY CO., LTD.

- SHANDONG JINFENG ARTIFICIAL LEATHER CO., LTD.

- ECOLORICA MICROFIBER S.R.L.

- KONUS KONEX D.O.O.

- UNITED DECORATIVES PRIVATE LIMITED(JINDAL)

- ARORA POLYFAB PVT. LTD.

- ZHEJIANG YONGFA SYNTHETIC LEATHER CO., LTD.

- POLITEKS SUNI DERI TEKSTIL SAN. LTD.

- LEO VINYLS

- PRIMO(PVT)LTD

- NIRMAL FIBRES(P)LTD.

- SHAKTI TEX COATERS PRIVATE LIMITED

第12章 隣接市場と関連市場

第13章 付録

List of Tables

- TABLE 1 SYNTHETIC LEATHER MARKET: DEFINITION AND INCLUSIONS, BY TYPE

- TABLE 2 SYNTHETIC LEATHER MARKET: DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- TABLE 3 USD EXCHANGE RATE, 2020-2024

- TABLE 4 SYNTHETIC LEATHER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 6 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 7 GDP TRENDS AND FORECAST, BY KEY COUNTRY, 2021-2029 (USD BILLION)

- TABLE 8 INDICATIVE PRICING ANALYSIS OF SYNTHETIC LEATHER OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2023 (USD/SQ. METER)

- TABLE 9 AVERAGE SELLING PRICE TREND OF SYNTHETIC LEATHER, BY REGION, 2021-2029 (USD/SQ. METER)

- TABLE 10 ROLES OF COMPANIES IN SYNTHETIC LEATHER ECOSYSTEM

- TABLE 11 IMPORT DATA FOR HS CODE 590320-COMPLIANT PRODUCTS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 12 EXPORT DATA FOR HS CODE 590320-COMPLIANT PRODUCTS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 13 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 SYNTHETIC LEATHER MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025

- TABLE 20 SYNTHETIC LEATHER MARKET: FUNDING/INVESTMENT SCENARIO

- TABLE 21 SYNTHETIC LEATHER MARKET: PATENT STATUS, 2014-2024

- TABLE 22 LIST OF MAJOR PATENTS RELATED TO SYNTHETIC LEATHER, 2014-2024

- TABLE 23 PATENTS BY NIKE INC., 2014-2024

- TABLE 24 PATENTS BY BASF SE, 2014-2024

- TABLE 25 PATENTS BY NOVOZYMES A/S, 2014-2024

- TABLE 26 TOP 10 PATENT OWNERS IN US, 2014-2024

- TABLE 27 SYNTHETIC LEATHER MARKET, BY TYPE, 2018-2023 (MILLION SQ. METER)

- TABLE 28 SYNTHETIC LEATHER MARKET, BY TYPE, 2024-2029 (MILLION SQ. METER)

- TABLE 29 SYNTHETIC LEATHER MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 30 SYNTHETIC LEATHER MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 31 PU-BASED SYNTHETIC LEATHER: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (MILLION SQ. METER)

- TABLE 32 PU-BASED SYNTHETIC LEATHER: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (MILLION SQ. METER)

- TABLE 33 PU-BASED SYNTHETIC LEATHER: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 34 PU-BASED SYNTHETIC LEATHER: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 35 PVC-BASED SYNTHETIC LEATHER: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (MILLION SQ. METER)

- TABLE 36 PVC-BASED SYNTHETIC LEATHER: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (MILLION SQ. METER)

- TABLE 37 PVC-BASED SYNTHETIC LEATHER: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 38 PVC-BASED SYNTHETIC LEATHER: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 BIO-BASED SYNTHETIC LEATHER: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (MILLION SQ. METER)

- TABLE 40 BIO-BASED SYNTHETIC LEATHER: SYNTHETIC LEATHER MARKET, 2024-2029 (MILLION SQ. METER)

- TABLE 41 BIO-BASED SYNTHETIC LEATHER: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 42 BIO-BASED SYNTHETIC LEATHER: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 43 SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 44 SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 45 SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 46 SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 47 FOOTWEAR: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (MILLION SQ. METER)

- TABLE 48 FOOTWEAR: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (MILLION SQ. METER)

- TABLE 49 FOOTWEAR: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 50 FOOTWEAR: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 51 FURNISHING: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (MILLION SQ. METER)

- TABLE 52 FURNISHING: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (MILLION SQ. METER)

- TABLE 53 FURNISHING: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 54 FURNISHING: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 55 AUTOMOTIVE: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (MILLION SQ. METER)

- TABLE 56 AUTOMOTIVE: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (MILLION SQ. METER)

- TABLE 57 AUTOMOTIVE: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 58 AUTOMOTIVE: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 59 CLOTHING: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (MILLION SQ. METER)

- TABLE 60 CLOTHING: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (MILLION SQ. METER)

- TABLE 61 CLOTHING: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 62 CLOTHING: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 63 BAGS, PURSES & WALLETS: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (MILLION SQ. METER)

- TABLE 64 BAGS, PURSES & WALLETS: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (MILLION SQ. METER)

- TABLE 65 BAGS, PURSES & WALLETS: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 66 BAGS, PURSES & WALLETS: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 67 OTHER END-USE INDUSTRIES: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (MILLION SQ. METER)

- TABLE 68 OTHER END-USE INDUSTRIES: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (MILLION SQ. METER)

- TABLE 69 OTHER END-USE INDUSTRIES: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 70 OTHER END-USE INDUSTRIES: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 71 SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (MILLION SQ. METER)

- TABLE 72 SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (MILLION SQ. METER)

- TABLE 73 SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 74 SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 75 ASIA PACIFIC: SYNTHETIC LEATHER MARKET, BY TYPE, 2018-2023 (MILLION SQ. METER)

- TABLE 76 ASIA PACIFIC: SYNTHETIC LEATHER MARKET, BY TYPE, 2024-2029 (MILLION SQ. METER)

- TABLE 77 ASIA PACIFIC: SYNTHETIC LEATHER MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 78 ASIA PACIFIC: SYNTHETIC LEATHER MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 79 ASIA PACIFIC: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 80 ASIA PACIFIC: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 81 ASIA PACIFIC: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 82 ASIA PACIFIC: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 83 ASIA PACIFIC: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 84 ASIA PACIFIC: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 85 ASIA PACIFIC: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 86 ASIA PACIFIC: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 87 CHINA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 88 CHINA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 89 CHINA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 90 CHINA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 91 INDIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 92 INDIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 93 INDIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 94 INDIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 95 JAPAN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 96 JAPAN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 97 JAPAN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 98 JAPAN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 99 SOUTH KOREA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 100 SOUTH KOREA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 101 SOUTH KOREA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 102 SOUTH KOREA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 103 TAIWAN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 104 TAIWAN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 105 TAIWAN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 106 TAIWAN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 107 THAILAND: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 108 THAILAND: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 109 THAILAND: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 110 THAILAND: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 111 MALAYSIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 112 MALAYSIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 113 MALAYSIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 114 MALAYSIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 115 INDONESIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 116 INDONESIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 117 INDONESIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 118 INDONESIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 119 EUROPE: SYNTHETIC LEATHER MARKET, BY TYPE, 2018-2023 (MILLION SQ. METER)

- TABLE 120 EUROPE: SYNTHETIC LEATHER MARKET, BY TYPE, 2024-2029 (MILLION SQ. METER)

- TABLE 121 EUROPE: SYNTHETIC LEATHER MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 122 EUROPE: SYNTHETIC LEATHER MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 123 EUROPE: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 124 EUROPE: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 125 EUROPE: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 126 EUROPE: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 127 EUROPE: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 128 EUROPE: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 129 EUROPE: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 130 EUROPE: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 131 GERMANY: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 132 GERMANY: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 133 GERMANY: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 134 GERMANY: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 135 ITALY: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 136 ITALY: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 137 ITALY: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 138 ITALY: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 139 FRANCE: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 140 FRANCE: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 141 FRANCE: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 142 FRANCE: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 143 UK: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 144 UK: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 145 UK: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 146 UK: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 147 SPAIN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 148 SPAIN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 149 SPAIN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 150 SPAIN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 151 RUSSIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 152 RUSSIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 153 RUSSIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 154 RUSSIA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 155 POLAND: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 156 POLAND: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 157 POLAND: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 158 POLAND: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 159 SWEDEN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 160 SWEDEN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 161 SWEDEN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 162 SWEDEN: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 163 PORTUGAL: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 164 PORTUGAL: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 165 PORTUGAL: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 166 PORTUGAL: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 167 NORTH AMERICA: SYNTHETIC LEATHER MARKET, BY TYPE, 2018-2023 (MILLION SQ. METER)

- TABLE 168 NORTH AMERICA: SYNTHETIC LEATHER MARKET, BY TYPE, 2024-2029 (MILLION SQ. METER)

- TABLE 169 NORTH AMERICA: SYNTHETIC LEATHER MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 170 NORTH AMERICA: SYNTHETIC LEATHER MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 171 NORTH AMERICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 172 NORTH AMERICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 173 NORTH AMERICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 174 NORTH AMERICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 175 NORTH AMERICA: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 176 NORTH AMERICA: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 177 NORTH AMERICA: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 178 NORTH AMERICA: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 179 US: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 180 US: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 181 US: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 182 US: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 183 MEXICO: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 184 MEXICO: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 185 MEXICO: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 186 MEXICO: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 187 CANADA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 188 CANADA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 189 CANADA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 190 CANADA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 191 SOUTH AMERICA: SYNTHETIC LEATHER MARKET, BY TYPE, 2018-2023 (MILLION SQ. METER)

- TABLE 192 SOUTH AMERICA: SYNTHETIC LEATHER MARKET, BY TYPE, 2024-2029 (MILLION SQ. METER)

- TABLE 193 SOUTH AMERICA: SYNTHETIC LEATHER MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 194 SOUTH AMERICA: SYNTHETIC LEATHER MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 195 SOUTH AMERICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 196 SOUTH AMERICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 197 SOUTH AMERICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 198 SOUTH AMERICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 199 SOUTH AMERICA: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 200 SOUTH AMERICA: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 201 SOUTH AMERICA: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 202 SOUTH AMERICA: SYNTHETIC LEATHER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 203 BRAZIL: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 204 BRAZIL: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 205 BRAZIL: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 206 BRAZIL: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 207 ARGENTINA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 208 ARGENTINA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 209 ARGENTINA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 210 ARGENTINA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET, BY TYPE, 2018-2023 (MILLION SQ. METER)

- TABLE 212 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET, BY TYPE, 2024-2029 (MILLION SQ. METER)

- TABLE 213 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET, BY TYPE, 2018-2023 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 216 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 217 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (MILLION SQ. METER)

- TABLE 220 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (MILLION SQ. METER)

- TABLE 221 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: SYNTHETIC LEATHER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 223 MIDDLE EAST: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 224 MIDDLE EAST: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 225 MIDDLE EAST: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 226 MIDDLE EAST: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 227 AFRICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (MILLION SQ. METER)

- TABLE 228 AFRICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (MILLION SQ. METER)

- TABLE 229 AFRICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2018-2023 (USD MILLION)

- TABLE 230 AFRICA: SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 231 SYNTHETIC LEATHER MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, 2019-2024

- TABLE 232 SYNTHETIC LEATHER MARKET: DEGREE OF COMPETITION, 2023

- TABLE 233 SYNTHETIC LEATHER MARKET: TYPE FOOTPRINT

- TABLE 234 SYNTHETIC LEATHER MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 235 SYNTHETIC LEATHER MARKET: REGION FOOTPRINT

- TABLE 236 SYNTHETIC LEATHER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 237 SYNTHETIC LEATHER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 238 SYNTHETIC LEATHER MARKET: PRODUCT LAUNCHES, JANUARY 2020-OCTOBER 2024

- TABLE 239 SYNTHETIC LEATHER MARKET: DEALS, JANUARY 2020-OCTOBER 2024

- TABLE 240 SYNTHETIC LEATHER MARKET: EXPANSIONS, JANUARY 2020-OCTOBER 2024

- TABLE 241 KURARAY CO., LTD.: COMPANY OVERVIEW

- TABLE 242 KURARAY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 KURARAY CO., LTD.: DEALS

- TABLE 244 SAN FANG CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 245 SAN FANG CHEMICAL INDUSTRY CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 246 SAN FANG CHEMICAL INDUSTRY CO., LTD.: EXPANSIONS

- TABLE 247 TEIJIN LIMITED: COMPANY OVERVIEW

- TABLE 248 TEIJIN LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 TEIJIN LIMITED: PRODUCT LAUNCHES

- TABLE 250 MAYUR UNIQUOTERS LIMITED: COMPANY OVERVIEW

- TABLE 251 MAYUR UNIQUOTERS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 NAN YA PLASTICS CORPORATION: COMPANY OVERVIEW

- TABLE 253 NAN YA PLASTICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 FILWEL CO., LTD.: COMPANY OVERVIEW

- TABLE 255 FILWEL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 ZHEJIANG HEXIN HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 257 ZHEJIANG HEXIN HOLDINGS CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 258 WANHUA CHEMICAL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 259 WANHUA CHEMICAL GROUP CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 260 ALFATEX ITALIA SRL: COMPANY OVERVIEW

- TABLE 261 ALFATEX ITALIA SRL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 H.R. POLYCOATS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 263 H.R. POLYCOATS PRIVATE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 KOLON INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 265 MARVEL VINYLS LIMITED: COMPANY OVERVIEW

- TABLE 266 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 267 ANHUI ANLI MATERIAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 268 SHANDONG JINFENG ARTIFICIAL LEATHER CO., LTD.: COMPANY OVERVIEW

- TABLE 269 ECOLORICA MICROFIBER S.R.L.: COMPANY OVERVIEW

- TABLE 270 KONUS KONEX D.O.O.: COMPANY OVERVIEW

- TABLE 271 UNITED DECORATIVES PRIVATE LIMITED (JINDAL): COMPANY OVERVIEW

- TABLE 272 ARORA POLYFAB PVT. LTD.: COMPANY OVERVIEW

- TABLE 273 ZHEJIANG YONGFA SYNTHETIC LEATHER CO., LTD.: COMPANY OVERVIEW

- TABLE 274 POLITEKS SUNI DERI TEKSTIL SAN. LTD.: COMPANY OVERVIEW

- TABLE 275 LEO VINYLS: COMPANY OVERVIEW

- TABLE 276 PRIMO (PVT) LTD: COMPANY OVERVIEW

- TABLE 277 NIRMAL FIBRES (P) LTD.: COMPANY OVERVIEW

- TABLE 278 SHAKTI TEX COATERS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 279 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2016-2019 (KILOTON)

- TABLE 280 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2026 (KILOTON)

- TABLE 281 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 282 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION, 2020-2026 (USD MILLION)

- TABLE 283 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2016-2019 (KILOTON)

- TABLE 284 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2026 (KILOTON)

- TABLE 285 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 286 ASIA PACIFIC: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2026 (USD MILLION)

- TABLE 287 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2016-2019 (KILOTON)

- TABLE 288 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2026 (KILOTON)

- TABLE 289 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 290 NORTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2026 (USD MILLION)

- TABLE 291 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2016-2019 (KILOTON)

- TABLE 292 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2026 (KILOTON)

- TABLE 293 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 294 EUROPE: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2026 (USD MILLION)

- TABLE 295 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2016-2019 (KILOTON)

- TABLE 296 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2026 (KILOTON)

- TABLE 297 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 298 MIDDLE EAST & AFRICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2026 (USD MILLION)

- TABLE 299 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2016-2019 (KILOTON)

- TABLE 300 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2026 (KILOTON)

- TABLE 301 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2016-2019 (USD MILLION)

- TABLE 302 SOUTH AMERICA: AUTOMOTIVE INTERIOR MATERIALS MARKET, BY COUNTRY, 2020-2026 (USD MILLION)

List of Figures

- FIGURE 1 SYNTHETIC LEATHER MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SYNTHETIC LEATHER MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4 - TOP-DOWN

- FIGURE 4 SYNTHETIC LEATHER MARKET: DATA TRIANGULATION

- FIGURE 5 CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 6 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 7 PU-BASED SYNTHETIC LEATHER SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 FOOTWEAR TO BE LARGEST SEGMENT OF SYNTHETIC LEATHER MARKET BETWEEN 2024 AND 2029

- FIGURE 9 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 SEVERAL ADVANTAGES OFFERED BY SYNTHETIC LEATHER OVER GENUINE LEATHER TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 11 PU-BASED SYNTHETIC LEATHER SEGMENT AND CHINA DOMINATED ASIA PACIFIC SYNTHETIC LEATHER MARKET IN 2023

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST CAGR BETWEEN 2024 AND 2029

- FIGURE 13 FOOTWEAR SEGMENT LED SYNTHETIC LEATHER MARKET ACROSS ALL REGIONS IN 2023

- FIGURE 14 CHINA TO BE FASTEST-GROWING SYNTHETIC LEATHER MARKET DURING FORECAST PERIOD

- FIGURE 15 SYNTHETIC LEATHER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 GLOBAL AUTOMOBILE PRODUCTION, BY REGION, 2019-2023 (MILLION)

- FIGURE 17 SYNTHETIC LEATHER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 19 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 20 SYNTHETIC LEATHER MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 AVERAGE SELLING PRICE TREND OF SYNTHETIC LEATHER OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2023 (USD/SQ. METER)

- FIGURE 22 AVERAGE SELLING PRICE TREND OF SYNTHETIC LEATHER, BY REGION, 2021-2029 (USD/SQ. METER)

- FIGURE 23 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 24 SYNTHETIC LEATHER MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 IMPORT DATA RELATED TO HS CODE 590320-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 26 EXPORT DATA RELATED TO HS CODE 590320-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 27 PATENTS REGISTERED RELATED TO SYNTHETIC LEATHER, 2014-2024

- FIGURE 28 TOP PATENT OWNERS DURING LAST 10 YEARS, 2014-2024

- FIGURE 29 LEGAL STATUS OF PATENTS FILED FOR SYNTHETIC LEATHER, 2014-2024

- FIGURE 30 MAXIMUM PATENTS FILED IN US JURISDICTION, 2014-2024

- FIGURE 31 PU-BASED SYNTHETIC LEATHER SEGMENT TO DOMINATE SYNTHETIC LEATHER MARKET IN 2024

- FIGURE 32 FOOTWEAR SEGMENT TO DOMINATE SYNTHETIC LEATHER MARKET IN 2029

- FIGURE 33 ASIA PACIFIC TO BE LARGEST SYNTHETIC LEATHER MARKET IN 2029

- FIGURE 34 ASIA PACIFIC: SYNTHETIC LEATHER MARKET SNAPSHOT

- FIGURE 35 EUROPE: SYNTHETIC LEATHER MARKET SNAPSHOT

- FIGURE 36 NORTH AMERICA: SYNTHETIC LEATHER MARKET SNAPSHOT

- FIGURE 37 SYNTHETIC LEATHER MARKET SHARE ANALYSIS, 2023

- FIGURE 38 SYNTHETIC LEATHER MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD MILLION)

- FIGURE 39 SYNTHETIC LEATHER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 40 SYNTHETIC LEATHER MARKET: COMPANY FOOTPRINT

- FIGURE 41 SYNTHETIC LEATHER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 42 SYNTHETIC LEATHER MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 43 SYNTHETIC LEATHER MARKET: EV/EBITDA OF KEY PLAYERS, 2023

- FIGURE 44 SYNTHETIC LEATHER MARKET: ENTERPRISE VALUATION OF KEY PLAYERS, 2023 (USD BILLION)

- FIGURE 45 KURARAY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 46 SAN FANG CHEMICAL INDUSTRY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 47 TEIJIN LIMITED: COMPANY SNAPSHOT

- FIGURE 48 MAYUR UNIQUOTERS LIMITED: COMPANY SNAPSHOT

- FIGURE 49 NAN YA PLASTICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 WANHUA CHEMICAL GROUP CO., LTD.: COMPANY SNAPSHOT

The synthetic leather market is projected to register a CAGR of 5.3% between 2024 and 2029, in terms of value. The synthetic leather market size is projected to reach USD 93.25 billion by 2029 at a CAGR of 5.3% from USD 71.93 billion in 2024. The PU based, by type segment is estimated to account for the largest share in terms of value of the synthetic leather market in 2023. Biobased, by type likely to be the fastest growing type of synthetic leather market in terms of value.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By Type, By End use Industry, Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

Man-made PVC leather is synthetic leather that is intended to resemble leather. A layer of PVC raw material is created, and it is bonded to a suitable fabric backing by applying pressure and/or heat to create vinyl leather. Synthetic leather is known for its long-lasting, waterproof, and easy-to-maintain characteristics, making it a popular material for upholstery, fashion, and vehicle interiors. Although it is less breathable than natural leather, PVC synthetic leather comes in a variety of textures and finishes and is typically less expensive or more eco-friendly than comparable real leather.

The eco-friendly appeal and sustainable production practices of bio-based synthetic leather have made it one of the fastest-growing types. Bio-based synthetic leather reduces reliance on petroleum-based components often present in conventional synthetic leathers by using renewable resources for producing it, such as cork, algae, or plant-based polymers. Greener options are becoming more popular among businesses and customers alike in an environmentally concerned society. Additionally, bio-based synthetic leather has a lower carbon impact than non-bio-based synthetic leather while yet being just as gorgeous and long-lasting. Bio-based synthetic leather is becoming more and more popular as an eco-friendly alternative since more buyers are looking for sustainable furniture, fashion, and car interiors.

"Footwear, by end use industry is fastest growing end-use industry segment of synthetic leather market"

The footwear segment of the synthetic leather market is expanding at its fastest pace due to the growing need for fashionable, long-lasting, and reasonably priced substitutes for real leather. Synthetic leather is extremely adaptable, allowing for the creation of new designs and seeming to be simply maintained with diverse textures and finishes, from which many types of footwear styles may be constructed. Eco-friendly synthetic leather, on the other hand, gained popularity as a substitute as consumers' understanding of environmental sustainability and animal welfare increased. In addition, the fact that synthetic leather is less expensive to produce than traditional leather adds to the developing global trend of employing this material in sandals, boots, and shoes.

"Asia Pacific, by region is forecasted to be the fastest growing segment of synthetic leather market during the forecast period."

Asia Pacific has emerged as the fastest-growing synthetic leather market due to increased industrialization, urbanization, and rising disposable incomes. The low labor costs and extensive industrial bases in China, India, and Vietnam have made them key production hubs for synthetic leather items. In addition, customers are moving toward more economical, durable, and eco-friendly alternatives to real leather, which is driving up demand for synthetic leather in sectors including fashion, footwear, and automobiles. In addition, government sustainability initiatives and the expanding retail and e-commerce industries would enable this sector to play a major role in the expansion of the synthetic leather market.

Interviews:

- By Company Type: Tier 1 - 46%, Tier 2 - 36%, and Tier 3 - 18%

- By Designation: C Level - 21%, D Level - 23%, and Others - 56%

- By Region: North America - 37%, Europe - 26%, Asia Pacific - 23%, and South America - 4%, Middle East & Africa - 10%

The key companies profiled in this report are Kuraray Co., Ltd. (Japan), San Fang Chemical Industry Co., Ltd. (Taiwan), Teijin Limited (Japan), Mayur Uniquoters Limited (India), Nan Ya Plastics Corporation (Taiwan), Filwel Co., Ltd. (Japan), and Zhejiang Hexin Holdings Co., Ltd. (China) .

Research Coverage:

The synthetic leather market has been segmented based on Type (PU based, PVC based, and Bio based), End-use Industry (Fotwear, Furnishing, Automotive, Clothing, Bags, Purse, & wallets, and Others), and by Region (Asia Pacific, North America, Europe, South America, Middle East & Africa).

This report provides insights on the following pointers:

- Analysis of key drivers (Emerging demand from the APAC region, High growth of end-use industries,), restraints (Substitute for Synthetic leather in automotive industry), opportunities (Growth in emerging applications), and challenges (Recycling of synthetic leather) influencing the growth of the synthetic leather market.

- Product Development/Innovation: Detailed insight of upcoming technologies, research & development activities, and new product launch in the synthetic leather market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the synthetic leather market across varied regions.

- Market Diversification: Exclusive information about the new products & service untapped geographies, recent developments, and investments in synthetic leather market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like, Kuraray Co., Ltd. (Japan), San Fang Chemical Industry Co., Ltd. (Taiwan), Teijin Limited (Japan), Mayur Uniquoters Limited (India), Nan Ya Plastics Corporation (Taiwan), Filwel Co., Ltd. (Japan), and Zhejiang Hexin Holdings Co., Ltd. (China) among other in the synthetic leather market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Participants for primary interviews (demand and supply side)

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 BOTTOM-UP APPROACH

- 2.3.1 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) - COLLECTIVE MARKET SHARE OF KEY PLAYERS

- 2.3.2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM-UP (SUPPLY SIDE) - COLLECTIVE REVENUE OF ALL SYNTHETIC LEATHER TYPES

- 2.3.3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - BOTTOM-UP (DEMAND SIDE): PRODUCTS SOLD

- 2.4 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 GROWTH RATE ASSUMPTIONS/FORECAST

- 2.6.1 SUPPLY SIDE

- 2.6.2 DEMAND SIDE

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 RESEARCH LIMITATIONS

- 2.10 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SYNTHETIC LEATHER MARKET

- 4.2 ASIA PACIFIC SYNTHETIC LEATHER MARKET, BY TYPE AND COUNTRY

- 4.3 SYNTHETIC LEATHER MARKET, BY REGION

- 4.4 REGIONAL SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY

- 4.5 SYNTHETIC LEATHER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding footwear and apparel industries

- 5.2.1.2 Rising concerns about animal welfare and environmental impact

- 5.2.1.3 Advantages associated with synthetic leather

- 5.2.1.4 Booming automotive sector

- 5.2.2 RESTRAINTS

- 5.2.2.1 Environmental impacts related to use of PVC and PU in synthetic leather production

- 5.2.2.2 Availability of substitutes for synthetic leather in automotive industry

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for sustainable synthetic leather solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Challenges in waste management and recycling of synthetic leather

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST OF PROMINENT ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Polyurethane (PU) coating technology

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Water-based technology: Advancing sustainable synthetic leather production

- 6.5.1 KEY TECHNOLOGIES

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 DEVELOPMENT OF SYNTHETIC LEATHER VIA NATURAL MATERIALS

- 6.6.2 DURABILITY AND ABRASION RESISTANCE OF FAUX LEATHER FABRICS

- 6.6.3 DEVELOPMENT OF THERMOREGULATED PVC-BASED SYNTHETIC LEATHER FOR CAR SEATS

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 590320)

- 6.7.2 EXPORT SCENARIO (HS CODE 590320)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATIONS

- 6.8.2.1 European Chemicals Agency (ECHA)

- 6.8.2.2 Leather Working Group (LWG)

- 6.8.2.3 Saudi Standards, Metrology and Quality Organization (SASO)

- 6.8.2.4 American National Standards Institute (ANSI)

- 6.8.2.5 Central Pollution Control Board (CPCB) - India

- 6.8.2.6 European Committee for Standardization (CEN TC 289)

- 6.9 KEY CONFERENCES AND EVENTS, 2025

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 PATENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF AI/GEN AI ON SYNTHETIC LEATHER MARKET

7 SYNTHETIC LEATHER MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 PU-BASED SYNTHETIC LEATHER

- 7.2.1 RISING DEMAND FROM AUTOMOTIVE AND CLOTHING INDUSTRIES TO DRIVE MARKET

- 7.2.1.1 Microfiber leather

- 7.2.1.1.1 Smooth, soft, lightweight, good tensile strength, antibacterial, and excellent resistance to tear, scratch, and abrasion to drive market

- 7.2.1.1 Microfiber leather

- 7.2.1 RISING DEMAND FROM AUTOMOTIVE AND CLOTHING INDUSTRIES TO DRIVE MARKET

- 7.3 PVC-BASED SYNTHETIC LEATHER

- 7.3.1 HIGH STRENGTH, RESISTANCE TO VARIOUS CLIMATIC CONDITIONS, AND EASE OF MAINTENANCE TO DRIVE MARKET

- 7.4 BIO-BASED SYNTHETIC LEATHER

- 7.4.1 INCREASING GOVERNMENT REGULATIONS AND RISING ENVIRONMENTAL CONCERNS TO DRIVE MARKET

8 SYNTHETIC LEATHER MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 FOOTWEAR

- 8.2.1 EXCELLENT PROPERTIES AND HIGH DURABILITY TO DRIVE DEMAND

- 8.2.1.1 Sports shoes

- 8.2.1.2 Formal shoes & boots

- 8.2.1.3 Sandals & slippers

- 8.2.1 EXCELLENT PROPERTIES AND HIGH DURABILITY TO DRIVE DEMAND

- 8.3 FURNISHING

- 8.3.1 AFFORDABLE ALTERNATIVE TO PURE LEATHER TO DRIVE MARKET

- 8.3.1.1 Chairs

- 8.3.1.2 Sofas

- 8.3.1.3 Bean bags & others

- 8.3.1 AFFORDABLE ALTERNATIVE TO PURE LEATHER TO DRIVE MARKET

- 8.4 AUTOMOTIVE

- 8.4.1 COMFORTABLE SEAT UPHOLSTERY AND RESISTANCE TO COLD AND HOT TEMPERATURES TO DRIVE DEMAND

- 8.4.1.1 Seats

- 8.4.1.2 Steering wheel covers

- 8.4.1.3 Door trims, knobs & gear bot covers

- 8.4.1 COMFORTABLE SEAT UPHOLSTERY AND RESISTANCE TO COLD AND HOT TEMPERATURES TO DRIVE DEMAND

- 8.5 CLOTHING

- 8.5.1 GROWING GLOBAL FASHION INDUSTRY TO DRIVE MARKET

- 8.5.1.1 Jackets

- 8.5.1.2 Belts

- 8.5.1.3 Tops, trousers & others

- 8.5.1 GROWING GLOBAL FASHION INDUSTRY TO DRIVE MARKET

- 8.6 BAGS, PURSES & WALLETS

- 8.6.1 GROWING FASHION INDUSTRY, RISING DISPOSABLE INCOMES, AND CHANGING LIFESTYLES TO FUEL DEMAND

- 8.6.1.1 Bags

- 8.6.1.2 Purses

- 8.6.1.3 Wallets

- 8.6.1 GROWING FASHION INDUSTRY, RISING DISPOSABLE INCOMES, AND CHANGING LIFESTYLES TO FUEL DEMAND

- 8.7 OTHER END-USE INDUSTRIES

9 SYNTHETIC LEATHER MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Rising domestic demand for footwear and furnishing to fuel market growth

- 9.2.2 INDIA

- 9.2.2.1 Increased urbanization and industrialization to drive market

- 9.2.3 JAPAN

- 9.2.3.1 Increased demand for sports footwear to drive market

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Rising demand from automotive and footwear industries to drive market

- 9.2.5 TAIWAN

- 9.2.5.1 Growing industrialization and establishment of footwear OEMs to drive market

- 9.2.6 THAILAND

- 9.2.6.1 Growing demand from footwear OEMs to drive market

- 9.2.7 MALAYSIA

- 9.2.7.1 Presence of large footwear industry to drive demand

- 9.2.8 INDONESIA

- 9.2.8.1 Strong export-oriented manufacturing entities to drive market

- 9.2.1 CHINA

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Growing focus on sustainability and innovative product development to drive market

- 9.3.2 ITALY

- 9.3.2.1 Rising awareness regarding animal welfare to drive market

- 9.3.3 FRANCE

- 9.3.3.1 Excellent aesthetic appeal and easy maintenance to drive demand in footwear and furnishing industries

- 9.3.4 UK

- 9.3.4.1 Booming automotive sector to drive market

- 9.3.5 SPAIN

- 9.3.5.1 Significant car exports to drive market

- 9.3.6 RUSSIA

- 9.3.6.1 Fast-growing automotive and footwear industries to drive market

- 9.3.7 POLAND

- 9.3.7.1 Growing domestic and export markets for furniture to drive demand

- 9.3.8 SWEDEN

- 9.3.8.1 Growing clothing, footwear, and furniture industries to drive market

- 9.3.9 PORTUGAL

- 9.3.9.1 Rising demand from footwear, furnishing, and automotive industries to drive market

- 9.3.1 GERMANY

- 9.4 NORTH AMERICA

- 9.4.1 US

- 9.4.1.1 Technological advancements and capacity expansions to drive market

- 9.4.2 MEXICO

- 9.4.2.1 Increased footwear export to drive market

- 9.4.3 CANADA

- 9.4.3.1 Expanding end-use industries to drive market

- 9.4.1 US

- 9.5 SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.5.1.1 Growing footwear, automotive, and clothing industries to drive market

- 9.5.2 ARGENTINA

- 9.5.2.1 Increasing demand from automotive, furnishing, and footwear industries to drive market

- 9.5.1 BRAZIL

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MIDDLE EAST

- 9.6.1.1 Booming furnishing, automotive, and clothing industries to drive market

- 9.6.2 AFRICA

- 9.6.2.1 Thriving footwear and automotive industries to fuel market growth

- 9.6.1 MIDDLE EAST

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.5.5.1 Company footprint

- 10.5.5.2 Type footprint

- 10.5.5.3 End-use industry footprint

- 10.5.5.4 Region footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 BRAND/PRODUCT COMPARISON

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 KURARAY CO., LTD.

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 SAN FANG CHEMICAL INDUSTRY CO., LTD.

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 TEIJIN LIMITED

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses/Competitive threats

- 11.1.4 MAYUR UNIQUOTERS LIMITED

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths/Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses/Competitive threats

- 11.1.5 NAN YA PLASTICS CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths/Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses/Competitive threats

- 11.1.6 FILWEL CO., LTD.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.7 ZHEJIANG HEXIN HOLDINGS CO., LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.8 WANHUA CHEMICAL GROUP CO., LTD.

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.9 ALFATEX ITALIA SRL

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.10 H.R. POLYCOATS PRIVATE LIMITED

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.1 KURARAY CO., LTD.

- 11.2 OTHER PLAYERS

- 11.2.1 KOLON INDUSTRIES, INC.

- 11.2.2 MARVEL VINYLS LIMITED

- 11.2.3 TORAY INDUSTRIES, INC.

- 11.2.4 ANHUI ANLI MATERIAL TECHNOLOGY CO., LTD.

- 11.2.5 SHANDONG JINFENG ARTIFICIAL LEATHER CO., LTD.

- 11.2.6 ECOLORICA MICROFIBER S.R.L.

- 11.2.7 KONUS KONEX D.O.O.

- 11.2.8 UNITED DECORATIVES PRIVATE LIMITED (JINDAL)

- 11.2.9 ARORA POLYFAB PVT. LTD.

- 11.2.10 ZHEJIANG YONGFA SYNTHETIC LEATHER CO., LTD.

- 11.2.11 POLITEKS SUNI DERI TEKSTIL SAN. LTD.

- 11.2.12 LEO VINYLS

- 11.2.13 PRIMO (PVT) LTD

- 11.2.14 NIRMAL FIBRES (P) LTD.

- 11.2.15 SHAKTI TEX COATERS PRIVATE LIMITED

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 AUTOMOTIVE INTERIOR MATERIALS MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 AUTOMOTIVE INTERIOR MATERIALS MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS